Research Article: 2021 Vol: 13 Issue: 3S

The Role of Administrative Procedures In Enhancing the Quality of Integrated Reporting and Its Reflection In Financing Decisions

Ali Khalaf Gatea, Southern Technical University

Haider Ali Jarad, University of Karbala

Citation: Gatea, A.K., & Jarad, H.A. (2021). The role of administrative procedures in enhancing the quality of integrated reporting and its reflection in financing decisions. Business Studies Journal 13(S3), 1-19.

Abstract

Keywords

Quality, Integrated Reporting, Financing Decisions.

Introduction

It is clear that there is a clear compatibility between the objectives of the integrated reports, and the needs of stakeholders, in terms of how to identify successful investments, and that the integrated reports will improve the quality of the information available, which will enable them to allocate capital more efficiently and productively, as well as the increased demand for reporting Non-financial information, as the availability of non-financial information from the point of view of capital providers has become a necessity for decision-making, and as a result contribute to protecting the continuity of the Economic entity, especially with the disclosure of information related to environmental, social and governance issues.

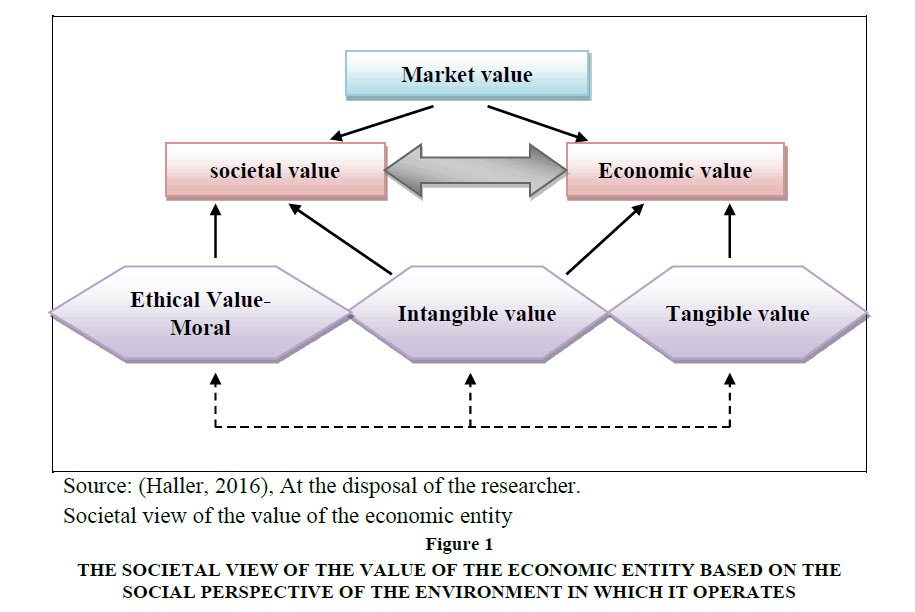

The modern concept of the value of the Economic Entity does not focus on achieving profits as much as it focuses on maximizing value, and that the Economic Entity is a special form of investment, which is expected to double the invested capital and increase the value of the project owned by investors, as a result of the Economic essence of ownership issues related to Closely related to the issues of utility, and the value associated with the specificity of the Economic Entity, the idea of "value" in general refers to the assessment of the benefit perceived by stakeholders or other beneficiaries, which can be tangible or intangible, as a result, the determination of the market value of the Economic Entity depends on internal factors. and external ones (cultural, religious, regional) related to the person performing the assessment, which can be stable or vary according to the situations surrounding the working environment (Haller, 2016). Despite this, the value of the Economic Entity is affected by other elements, which include intangible values often associated with knowledge and experience, whose value cannot be quantified or the beneficiaries of it, but may contribute to increasing the value of the Economic Entity more than physical assets (IIRC, 2013).

There are also other factors that control the value of the Economic Entity, which are moral and ethical factors, including societal beliefs or ideals, which are essential for individuals and societies and help them to interact and work collectively, and are related to religious or philosophical concepts and principles, such as trust, love, respect and others, which may be reflected In national laws relevant to the Economic environment, and often expressed in codes of ethics or professional conduct, as they reflect a moral rather than a quantitative assessment of market value; Being highly culturally influenced and having a strong influence on the societal value of the Economic Entity (Haller, 2016) which can be illustrated in Figure 1.

Figure 1: The Societal View of the Value of the Economic Entity Based on the Social Perspective of the Environment in which it Operates

The Relationship between Integrated Reporting and Economic Entity Value

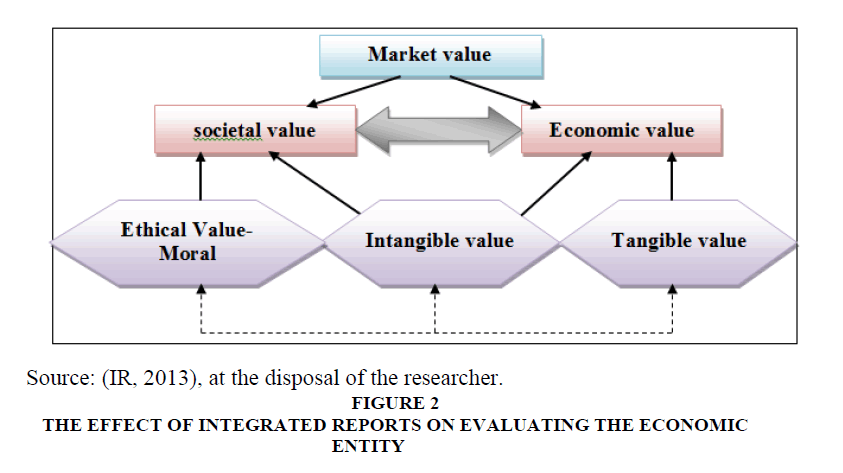

(Adam, 2015) Economic challenges in the business environment pose real threats, among other things, to management in evaluating business operations, which is reflected on workers and supply chains. Market, usually by a number of key performance indicators, or qualitative factors such as business opportunities, risks, strategies, and plans, all of which allow an assessment of the quality and diversity of cash flows and profits, and the meaning attributed to “value” is critical in determining the extent of business overlap. , society, and the environment in a way that is mutually beneficial (Krzus, 2011). The market value of the economic entity can also be attributed to decreasing tangible assets or intellectual capital, which depicts the percentage of market value attributed to tangible and intangible assets. As a result, economic, environmental, and societal factors are closely related to the reports issued by economic entities. Which called for a new concept of reporting, which is "integrated reports", which reflects the integrated strategic thinking, to create value in the short, medium and long term (IIRC, 2013). The creation of value is not limited to the interest of the economic entity, or is the product of the operations carried out alone, but is the result of interaction with other factors affecting value creation, namely stakeholders and society in general, and this is clear in the message of the conceptual framework of integrated reports, which clarified that Value creation manifests over time in increases, decreases, or shifts in capital, caused by activities to the value an organization creates for itself or others, when it relates to a social purpose that affects their assessments of the economic entity. The change in the presentation of the financial statements, and the need to find a new type of reporting resulted from shifts in the economic environment that were manifested in the following:

a. Globalization and the growing activity of economic policies in response to financial and governance crises.

b. Growing expectations of corporate transparency and accountability.

c. Scarcity of actual and foreseeable resources.

d. Population growth.

e. Environmental concerns.

Integrated reports can also affect the decisions of stakeholders in the following (IR, 2011):

a. The information reported is better integrated with the needs of the investors.

b. More accurate non-financial information.

c. Achieving high levels of trust with stakeholders.

d. Allocating resources more efficiently and effectively, including reducing costs.

e. Strengthening risk management.

f. Increasing participation with current and potential investors, including employees, which leads to attracting and retaining skills.

g. Lower cost of capital, and improved access to it due to improved disclosure.

h. Develop a common language and greater cooperation across different functions, within the organizational structure of the economic entity.

The evaluation process is often very complex, and it is related to the evaluation methodology and the scope of expertise enjoyed by the evaluator, and that the actual market value is rarely determined by the assets owned by it, but rather the actual evaluation of a number of surrounding factors, affecting the economic situation of the country, and the attractiveness of the market And the development strategy that the economic entity pursues in managing its business, as well as the human resources available to it, so it can be said that the value of the market entity often reflects the value of the assets and factors achieved by the economic entity and resulting from its effective management. , affect the evaluation method and investment decisions taken by stakeholders (Miciuła et al, 2020). As a result, the benefits of integrated reports and their effects on the value of the economic entity can be summarized in Figure 2.

The factors affecting the evaluation of the economic entity, taking into account future trends, and the requirements of stakeholders, with the presence of internal factors affecting the evaluation process represented in brevity, reliability and relative importance, which obscure their consideration in application of accounting standards and practices stipulated within the relevant laws and instructions.

(Arul et al, 2020) In order for integrated reports to achieve their main purpose in enhancing the value of the economic entity, the administration must rely on building integrated strategic thinking, within the organizational structure of the economic entity, which includes basic conditions that must be met as follows:

a. Integrated thinking should reflect how the types of capitals - financial, human, technical, intellectual, social and environmental - are used and their interrelationships.

b. How to consider that all capitals interact in generating activities within the economic entity and creating value in the past, present and future.

c. The economic entity needs to take into account the needs and material capacity of stakeholders, and whether it has sufficient capabilities to meet those needs.

d. Choosing a business model is a key part of the success of the economic entity in building integrated strategic thinking, to deal with external transformations in its environment, and to be able to respond to future risks or opportunities.

(Zhou & Green, 2017)The adoption of integrated reports as a mechanism to provide stakeholders with relevant information, came as a result of the need of administrations, investors and capital markets, to provide high-quality and value-related information, and to encourage a vibrant climate for investment, transparency and ethical practices. Despite the issuance of sustainability reports, one of the main criticisms is The sheer volume of information, without specifying the strategic or financial implications, which led to a low benefit to users of that information, especially to providers of capital.

(Miciuła et al, 2020)Also, careful preparation of the economic entity assessment, on the basis of the relevant information provided by the integrated reports, will lead to the achievement of advantages for stakeholders that can be mentioned in the following:

a. Decision-making: It consists in providing the necessary information about the value of the economic entity in relation to the intended implementation of certain transactions.

b. Negotiation: Refers to situations in which the opinions of the parties to a transaction on value vary widely.

c. Justifying: The skilful use of information obtained in the course of the evaluation, which is related to the selection of information that will enhance the beneficiary's bargaining power.

d. Security: Its essence is to provide information about the value of the economic entity, for the purposes of protecting against the negative effects of disputes arising in relation to value.

e. Information: Its essence is the availability of information obtained in the evaluation process for the purposes of managing the institution, and the recipients of this information are investors, banks, business partners, customers, financial analysts and authorities at different levels.

Stakeholders are very keen to know how the business is run, what are the potential risks of future business, and what are the effects on society. As a result, they also want to know the effects of business activities on the environment and the financial position together, as economic entities need to meet the increasing demand for financial and non-financial information. Financial, while demonstrating strategies that add value in the short, medium and long term, so traditional reports (annual report, environmental report, social report) are usually published and directed to shareholders and capital providers, so they fail to provide comprehensive information on business activities and their dilemma Lack of complete transparency for the rest of the beneficiaries who want comprehensive information with standardized reports that facilitate the comparison process and estimate the future value (Hoque, 2017).

Integrated Report Quality

Conceptually, Integrated Report Quality refers to the degree of compliance of integrated reports and their submission to the practice of governance, from those responsible for preparing integrated reports, as well as the environment for the organization to determine the essential matters, and how to disclose them in the integrated reports(IIRC, 2013). As a result, the management of the economic entity has discretion regarding what you choose to disclose, which will result in different levels of alignment between the integrated reporting and the conceptual framework (Moloi, 2020). Which seeks to produce integrated, high-quality, long-term reports as part of the prevailing business practices in the public and private sectors, with the aim of improving the quality of available information (Moloi, 2020) Disclosure of financial and non-financial information is of value to stakeholders and capital providers in particular, and to provide them with both forms of information in one comprehensive report, to create and enhance long-term value, and to disclose financial and non-financial information in a complementary way, enabling them to evaluate the available opportunities in a way More effective, and intensive capital investment control, and this is the goal that integrated reports seek to achieve, as a result, the benefits achieved from the quality of integrated reports include the following:

a. Presenting the economic entity's strategy, and how its business model responds to changes in the external environment and competitive landscape.

b. Presenting specific risks and opportunities that affect the ability of an economic entity to create value in the short, medium and long term.

c. What key risk mitigation is, and the governance structure needed to support value creation.

d. The focus is not on financial performance only, but includes non-financial performance, to meet the needs of management and other stakeholders.

e. Allocating the available resources on the basis of their connection with the external environment, and the extent to which they are utilized.

f. The participation of multiple departments in preparing integrated reports, and not limiting them to a specific party.

g. Improving and increasing the efficiency of internal processes and reducing costs, through the intersection of information between departments.

h. Lowering the cost of capital, and providing essential information in an integrated manner related to value creation.

i. Reducing the costs of obtaining and processing information for external stakeholders.

The conceptual framework of integrated reports (IIRC) is also integrated with the general framework for management ethics issued by the Institute of Management Accountants (IMA), regarding the need to achieve a high level of quality of the information disclosed, and that the administration adhere to a number of standards that lead to enhancing efficiency and confidentiality , integrity, and credibility, (IMA, 2017) which includes the following:

a. Competence: means maintaining an appropriate level of professional leadership and experience, by enhancing knowledge and skills, to carry out professional duties in accordance with relevant laws, regulations and technical standards, to provide accurate, clear, concise and timely information that contributes to risk detection and assistance in its management.

b. Confidentiality: Maintaining the confidentiality of information must be in accordance with the laws and regulations that allow this, as a result of maintaining market competitiveness, and to be declared as part of compliance with governance requirements.

c. Integrity: It means the necessity of achieving the principle of non-conflict of interest, and not refraining from using confidential information for unethical or illegal advantages, or any behavior that would lead to material or moral harm to others.

d. Credibility: The fair and objective communication of information is one of the most important priorities of the administration that can be expected from stakeholders, including reporting restrictions that would affect the decision taken as a result of the lack of clarity of information.

The reports provided by the economic entity represent the link with other parties. Through the information provided in the various reports, stakeholders make their decisions based on this information, and in order to be able to make decisions, the information contained therein must be accurate and reliable. However, most economic entities nowadays are increasingly resorting to smoothing financial statements, in order to present a more attractive picture to the largest possible number of investors (Remenaric et al, 2019). Also, providing information in a transparent manner to stakeholders helps them make informed decisions, so any event that is likely to affect the current financial position of the economic entity, or future risks, must be indicated in those reports.

Integration of Integrated Quality Reports

Information is nowadays the engine of global markets and their rapid development. The more detailed information provided by economic entities, the better the markets work. Therefore, the amount of information disclosed by economic entities has increased significantly during the past decades, and the preparation of reports that include financial statements, governance and social responsibility of the entities. Economic (Von,2014).

But in fact, these reports are not connected, and it is difficult to integrate them to the extent that it can undermine the representative credibility of the disclosure, and as a result the purpose of it is not achieved, and this leads to the existence of information gaps among the beneficiaries, as well as impeding optimal decision-making, so there was a need to compile Data and information in integrated reports, with the aim of enhancing transparency and reliability of stakeholders, providing more accuracy and homogeneous information, and an in-depth and comprehensive vision of how value is created and the factors contributing to it, and as a result of the need shown by stakeholders, to explain business models and how to create value (Cortesi & Vena 2019).

Parallel to financial reporting, integrated reporting focuses on non-financial information and data, which creates an incentive for long-term investments related to environmental, social, governance and financial factors, as a result of providing high quality data to make safer investment decisions (Pavlopoulos et al, 2019).

The conceptual framework of integrated reports (IIRC) aims to provide an integrated systematic representation of the performance of the economic entity, which includes the presentation, evaluation and control of all potential financial and non-financial risks (Guthrie et al, 2020; Piston et al, 2018), which could harm the activities of the economic entity, as a result, the quality of the data contained in the integrated reports, depends on A broad concept of integration, and better alignment of information, as it includes the following:

a. Interpreting the performance of the economic entity as a result of the joint use of different types of capital provided by different stakeholders, which includes monetary, human, technical, intellectual, social and environmental capital.

b. Clarify the relationship between the economic entity's strategy and its performance.

c. Follow up the integration between production, administrative and functional processes and organizational procedures.

d. Promote a framework of integrated thinking and interdepartmental cooperation in order to improve long-term value creation for the company.

e. The value generated is not only as a result of the internal activities of the firm but also as a result of the quality of relations with the external environment.

The increase in global competition, technological progress and the requirements of international organizations for disclosure, led to a change in the business environment, in addition, the crisis resulting from (COVID-19), which shed light on the shortcomings of traditional financial reports, including the lack of information With a future dimension, and the failure to predict potential liabilities resulting from social or environmental conditions, despite the fact that economic entities provide independent social and environmental reports, and this information is provided in separate sections in their annual reports, separately from financial disclosures, which led to the difficulty of assessing Its impact on decision-making, therefore, the preparation of integrated reports (IR) will be able to meet these challenges, in response to the increasing demands of stakeholders, for a broader and more useful information in decision-making, and that the reported information allows to provide specific strategies and long-term prospects for Economic entity, for investors, stakeholders and other beneficiaries (Adhariani & Villiers, 2019).

Despite this, there are still challenges facing integrated reports, which must be faced in order to achieve integrated thinking, which can be summarized in Table 1.

| Table 1 Challenges |

|

| Challenges | Details |

|---|---|

| Understanding the information | Understanding the information is a critical component of integrated reporting. |

| Flexibility in application | Information delivery must be consistent with accounting applications. |

| integrated thinking applications | Mature integrated thinking, demonstrated by effective communication, can improve decision-making. |

| Form and content | There must be a link with the content of other reports to achieve effective communication and effective decision-making. |

| Trust and credibility | Fulfilling the wishes of stakeholders, in obtaining reliable and timely information, is a basis for integrated reporting. |

Source: (La Torre et al, 2019), At the disposal of the researcher.

Challenges facing the implementation of integrated reports

Table 1 shows summarizes the most important challenges that the economic entity may face, when applying the concept of integrated thinking in reporting financial and non-financial activities, which must be faced within the internal environment and to achieve maximum compatibility between the conceptual framework of integrated reports, and the foundations that govern the financial disclosure process including national standards and laws.

Factors affecting the Quality of Integrated Reports

(Owen, 2013) There is a historical fact that proves that the preparation of reports evolves directly with the changing information needs of decision makers, and to realize the shortcomings in meeting the needs for data and information, economic units adapt themselves to modernize their reporting system, and the effects of the surrounding environment have a role in determining how to disclose Information, country-specific factors, influence reporting preferences using the perspective of institutional theory which states that organizations are embedded in a comprehensive system of political, financial, educational, cultural, and economic institutions that pressure departments to disclose information? The adequacy of reports in meeting the information needs of beneficiaries is questionable to disclose risks, reduce uncertainty, improve regulatory transparency, and the decision-making processes of stakeholders, and financial reports overlook types of risks that pose a threat to organizational sustainability and society (Guthrie et al, 2020). As a result, integrated reports emerged, as a more comprehensive and updated reporting system, aimed at meeting the needs of all stakeholders, instead of preparing stand-alone reports with a targeted goal, such as sustainability reports, financial reports, and other reports produced by management to disclose specific information with a context-focused focus on A specific goal, which means that economic entities adopt integrated reports, not just to reform the quality of disclosure in them (Vitolla et al, 2019).

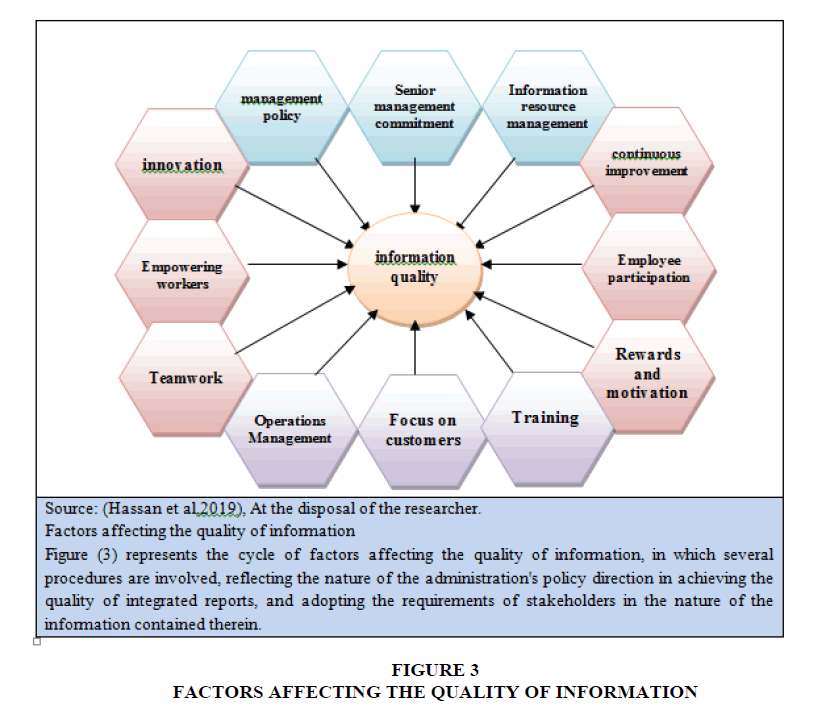

In order to understand the current reporting process, factors affecting the quality of integrated reports must be studied (Durak, 2013). As there are internal factors that affect the quality of disclosure in integrated reports, they are preferred by the management, which constitute the social, political and economic priorities from the point of view of the management and the controlling owners of the decision in the economic entity, and they include the following:

a. Ownership Structure: The ownership structure affects the preferences of the economic entity for information disclosure, as dominant shareholders can achieve their own goals at the expense of the minority of shareholders, and access to information directly related to decision-making, which will reduce the demand for integrated reports, As well as staying away from the risks of disclosure, loss of competitive advantage, and disclosure of information related to research and development activities or other information that could be used by parties outside the economic entity.

b. The Board of Directors (Characteristics of the Board): Since it is the responsibility of the Board of Directors to protect the interests of stakeholders, by alleviating information asymmetries and reducing problems related to them, the characteristics of the Board of Directors are important determinants in favoring integrated reports, which are affected As:

- Board Size: As the number of board members increases, so does the breadth and integrity of the information provided as a result of the diversity of experiences in the board.

- Board independence: The presence of non-executive board members on the board of directors will add objectivity, independence in management and oversight functions, and improve the quality and quantity of information, because their actions are less affected by competitors' actions compared to executives.

- Activity of the Board of Directors: Board members can monitor operations activities and gather information, which leads to a logical positive relationship between the activity of the Board of Directors and the volume of disclosure, which basically meets the need of the Board of Directors in making decisions.

- Diversity in the Board: Increasing diversity leads to enhancing problem solving with the help of the diverse experiences included in the Board of Directors, and the diversity of cultural values will affect the behavior of integrated reports in disclosure and meet the multiple needs of stakeholders, by pushing the collective behavior of cultural diversity in Board of Directors.

c. Corporate Governance: The effectiveness of the governance system applied in the economic entity aims to strengthen internal controls and reduce information asymmetry, and in return it can prevent or limit the disclosure of information, for reasons of security and reliability.

d. The size of the economic entity (Firm Size): The size of the economic entity is an influential factor in the way integrated reports are presented. The size of the economic entity is directly proportional to the need to reveal more information and enhance its quality.

e. Profitability and Growth Opportunities: Economic entities with high profitability usually tend to use information as a marketing tool, so it is expected that they will tend to provide high quality information in the form of integrated reports.

f. Industry: The industrial sectors, especially information technology and chemical industries, are expected to adapt to a similar pattern of information disclosure, and that the quantity and quality of the information disclosed is subject to the environment in which they operate. Economic entities may tend to disclose information More to reduce potential costs for stakeholders to acquire.

There are also many other factors, which can affect the quality of information shown in Figure 3.

As a result, the economic entity has to find some kind of communication between the economic entity and the relevant authorities that benefit from the integrated reports, to enhance their ability to maintain the distinct stereotype of the beneficiaries, as well as to link the current and future time horizons, and develop a strategy that promotes a connected mentality of integrated reporting, including responding to needs and the legitimate interests and expectations of stakeholders (Rivera, 2017).

The Methodology

The process of reporting the results of the business of the economic entity is tainted by various problems that prompted the emergence of an advanced type of reports, which aims to achieve a higher level of quality of accounting reporting, and on the other hand shows a set of dimensions that affect the behavioral aspects, to know the effects associated with the work of economic entities, whether they are These influences are social, environmental, or internal, related to how management deals with it and makes decisions, which appeared in the form of integrated reporting, and the extent to which management procedures affect the quality of reporting, and its reflection on financing decisions. Quality problems in reporting business results are one of the matters of importance to the beneficiaries of financial reports, and as a result of business expansion and the economic and financial overlap of various economic activities and sectors, financial information has become insufficient to take effective decisions with a future dimension. The research seeks to achieve objectives, including identifying the role of administrative procedures related to confirmation and planning and their impact on the quality of integrated reports and the selection of disclosure mechanisms in integrated reports.

The hypotheses presented by the researcher are related to the problems presented and the goals to be achieved, as they are answers or suggested solutions resulting from a study of the dimensions presented by the research problem, as the research assumes the following:

H1: There is a significant relationship with a statistical significance at the level of (0.005) between administrative procedures and the quality of reporting in the integrated reports. which includes:

H2: There is a significant relationship with statistical significance at the level (0.05) between the administration's assertions and the quality of reporting in the integrated reports.

H3: There is a significant relationship with statistical significance at the level (0.05) between the long-term strategic planning and the quality of reporting in the integrated reports.

Data Collection & Simple Research

For the purpose of measuring the impact of cultural dimensions on the quality of integrated reports from the point of view of management, stakeholders and other beneficiaries, a questionnaire was designed that includes the nature of administrative procedures that are based on assurance and long-term strategic planning. The questionnaire included two main sections, each of which contains (10) main axis, which can affect the quality of the integrated reports, and the information contained therein. Simplicity and clarity were taken into account in its formulation as a tool for collecting the necessary data and information, as it was distributed to the research community Table 2.

| Table 2 Statistics |

||||||||||||||||||||||||

| degree | Job | sector | Experience | sex | ||||||||||||||||||||

| N | Valid | 184 | 184 | 184 | 184 | 184 | ||||||||||||||||||

| Missing | 0 | 0 | 0 | 0 | 0 | |||||||||||||||||||

| Degree | ||||||||||||||||||||||||

| Frequency | Percent | Valid Percent | Cumulative Percent | |||||||||||||||||||||

| Valid | other | 104 | 56.5 | 56.5 | 56.5 | |||||||||||||||||||

| Bch | 32 | 17.4 | 17.4 | 73.9 | ||||||||||||||||||||

| master | 22 | 12.0 | 12.0 | 85.9 | ||||||||||||||||||||

| Doc. | 26 | 14.1 | 14.1 | 100.0 | ||||||||||||||||||||

| Total | 184 | 100.0 | 100.0 | |||||||||||||||||||||

| Job | ||||||||||||||||||||||||

| Frequency | Percent | Valid Percent | Cumulative Percent | |||||||||||||||||||||

| Valid | academic | 72 | 39.1 | 39.1 | 39.1 | |||||||||||||||||||

| investment | 14 | 7.6 | 7.6 | 46.7 | ||||||||||||||||||||

| accounting | 66 | 35.9 | 35.9 | 82.6 | ||||||||||||||||||||

| management | 26 | 14.1 | 14.1 | 96.7 | ||||||||||||||||||||

| auditing | 6 | 3.3 | 3.3 | 100.0 | ||||||||||||||||||||

| Total | 184 | 100.0 | 100.0 | |||||||||||||||||||||

| Sector | ||||||||||||||||||||||||

| Frequency | Percent | Valid Percent | Cumulative Percent | |||||||||||||||||||||

| Valid | special sector | 136 | 73.9 | 73.9 | 73.9 | |||||||||||||||||||

| general sector | 48 | 26.1 | 26.1 | 100.0 | ||||||||||||||||||||

| Total | 184 | 100.0 | 100.0 | |||||||||||||||||||||

| Experience | ||||||||||||||||||||||||

| Frequency | Percent | Valid Percent | Cumulative Percent | |||||||||||||||||||||

| Valid | 1-5 year | 26 | 14.1 | 14.1 | 14.1 | |||||||||||||||||||

| 6-10 year | 102 | 55.4 | 55.4 | 69.6 | ||||||||||||||||||||

| 11-15 year | 24 | 13.0 | 13.0 | 82.6 | ||||||||||||||||||||

| 16 more year | 32 | 17.4 | 17.4 | 100.0 | ||||||||||||||||||||

| Total | 184 | 100.0 | 100.0 | |||||||||||||||||||||

| Sex | ||||||||||||||||||||||||

| Frequency | Percent | Valid Percent | Cumulative Percent | |||||||||||||||||||||

| Valid | male | 166 | 90.2 | 90.2 | 90.2 | |||||||||||||||||||

| female | 18 | 9.8 | 9.8 | 100.0 | ||||||||||||||||||||

| Total | 184 | 100.0 | 100.0 | |||||||||||||||||||||

For the purpose of measuring the stability of the internal consistency between the paragraphs of the axis, the stability index (Cronbach's Alpha) was used in Table 3.

| Table 3 Reliability Statistics |

|

| Cronbach's Alpha | N of Items |

|---|---|

| 0.842 | 20 |

The homogeneity of the axis paragraphs is also important in knowing the power of the questionnaire, which can be measured by the (Split-Half reliability) indicator in measuring the homogeneity and stability of the research sample Table 4.

| Table 4 Reliability Statistics |

|||

| Cronbach's Alpha | Part 1 | Value | .699 |

| N of Items | 10a | ||

| Part 2 | Value | .775 | |

| N of Items | 10b | ||

| Total N of Items | 20 | ||

| Correlation Between Forms | .669 | ||

| Spearman-Brown Coefficient | Equal Length | .802 | |

| Unequal Length | .802 | ||

| Guttmann Split-Half Coefficient | .799 | ||

Measuring the degree of pivot (management assertions about the quality of integrated reporting), as integrated reports must explain what are the specific risks and opportunities that affect the ability of the economic entity to create value in the short, medium and long term, and how the economic entity deals with them, which can reduce risks and enhance Opportunities by complying with the laws, and following the behavioral and ethical rules in publishing data that lead to moving away from uncertainty and making decisions based on confirmed facts Table 5.

| Table 5 Descriptive Statistics (Management Assertions) |

|||

| Paragraph. | N | Mean | Std. Deviation |

|---|---|---|---|

| Integrated reporting identifies risks and opportunities that affect the ability of an economic entity to create value. | 184 | 3.93 | .834 |

| The quality of integrated reports enhances the ability of stakeholders to reduce the risk of making decisions. | 184 | 3.90 | .755 |

| Integrated quality reporting helps stakeholders identify risks, opportunities, and the effectiveness of internal controls. | 184 | 3.76 | .939 |

| The quality of the integrated reports contributes to assessing the impacts and future expectations of risks from the point of view of stakeholders. | 184 | 3.72 | 1.017 |

| Management practices consistency in disclosing the relative importance of uncertainties in integrated reports. | 184 | 3.66 | .853 |

| Management procedures include identifying internal risks in a way that enhances the quality of integrated reports. | 184 | 3.74 | .873 |

| Management procedures in disclosure lead to increased clarity and lack of tolerance with cases of uncertainty in the integrated reports. | 184 | 3.88 | .766 |

| Management is keen to include the potential impact of expected risks in cases of uncertainty in the integrated reports. | 184 | 3.67 | .784 |

| Management assumes its responsibilities for internal controls to protect the interests of others in cases of uncertainty within the integrated reporting. | 184 | 3.97 | .842 |

| The inherent risk of uncertainty is an ongoing threat that cannot be completely eliminated in integrated reporting. | 184 | 3.64 | 1.082 |

| Valid N Listwise) | 184 | ||

Table 5 shows the results of the first axis (management assertions), as the highest value was in paragraph (7) with an arithmetic mean (3.88) and a good level, while the lowest value came at paragraph (10) with an arithmetic mean (3.64) and a good level, As for the arithmetic mean for the first axis, it was (3.78) and with a good answer level, which indicates the approval of the research sample on the paragraphs of the first axis, and in a way that enhances the quality of integrated reports, management assertions and their impact on the quality of integrated reporting.

And to measure the second axis (long-term strategic planning), which integrated reports must show, the future direction of the economic entity and how it intends to reach it, as well as the challenges it is likely to face in pursuing its strategy, and what are the potential effects of its business model and future performance, as well as the expected changes over time Table 6.

| Table 6 Descriptive Statistics (Long-Term Strategic Planning) |

|||

| Paragraph. | N | Mean | Std. Deviation |

|---|---|---|---|

| Management is concerned with defining short, medium and long-term strategic goals when presenting integrated reports. | 184 | 4.07 | .674 |

| Management adapts to the circumstances surrounding the work environment to create future value when presenting integrated reports. | 184 | 3.80 | .865 |

| The quality of integrated reports enhances management's ability to measure its success and link it with strategic future plans and the flow of value. | 184 | 3.96 | .835 |

| Management responds to external variables when presenting integrated reports in the short, medium and long term. | 184 | 3.78 | .885 |

| Management addresses the potential impacts of future challenges from its point of view, taking into account stakeholders' concerns. | 184 | 3.67 | .888 |

| The quality of integrated reports helps to achieve economic growth and achieve future goals. | 184 | 3.99 | .881 |

| The quality of integrated reports enhances the future competitive advantage when presenting the environmental and social issues surrounding them. | 184 | 3.82 | .934 |

| Stakeholders are interested in the quality of integrated reports to orient the future of the economic entity. | 184 | 3.83 | .987 |

| Stakeholders focus on the extent of the economic entity's ability to deal with the surrounding future conditions, which are disclosed in the integrated reports. | 184 | 3.72 | 1.059 |

| The quality of integrated reports contributes to creating the future value of the economic entity. | 184 | 4.00 | .810 |

| Valid N (Listwise) | 184 | ||

Table 6 shows the results of the second axis (long-term strategic planning), as the highest value was in paragraph (1) with an arithmetic mean (4.07) and a good level, while the lowest value came at paragraph (5) with an arithmetic mean (3.67) and a good level, As for the arithmetic mean for the third axis, it was (3.63) with a good answer level, which reflects the approval of the research sample on the paragraphs of the second axis, and in a manner that enhances the quality of the integrated reports within (long-term strategic planning). To test the validity of the second sub-hypothesis, which states (There is a significant relationship with statistical significance at the level (0.05) between the administration's assertions and the quality of reporting in the integrated reports.), in terms of the correlation between the items of the first axis, which is shown in the table 7 as follows.

| Table 7 The Relationship Between the Paragraphs of the First Axis |

|||||||||||

| Q1 | Q2 | Q3 | Q4 | Q5 | Q6 | Q7 | Q8 | Q9 | Q10 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Q1 | Pearson Correlation | 1 | .233** | .287** | .275** | .292* | .202** | .176* | .302** | .190* | .313** |

| Sig. (2-tailed) | .001 | .000 | .000 | .002 | .006 | .017 | .000 | .002 | .000 | ||

| N | 184 | 184 | 184 | 184 | 184 | 184 | 184 | 184 | 184 | 184 | |

| Q2 | Pearson Correlation | .233** | 1 | .368** | .277** | .169* | .061 | .282** | .241** | .167* | .278** |

| Sig. (2-tailed) | .001 | .000 | .000 | .022 | .414 | .000 | .001 | .024 | .000 | ||

| N | 184 | 184 | 184 | 184 | 184 | 184 | 184 | 184 | 184 | 184 | |

| Q3 | Pearson Correlation | .287** | .368** | 1 | .386** | .117 | .350** | .158* | .205** | .142 | .055 |

| Sig. (2-tailed) | .000 | .000 | .000 | .113 | .000 | .033 | .005 | .054 | .459 | ||

| N | 184 | 184 | 184 | 184 | 184 | 184 | 184 | 184 | 184 | 184 | |

| Q4 | Pearson Correlation | .275** | .277** | .386** | 1 | .293** | .126 | .069 | .185* | .283** | .195** |

| Sig. (2-tailed) | .000 | .000 | .000 | .000 | .089 | .355 | .012 | .000 | .008 | ||

| N | 184 | 184 | 184 | 184 | 184 | 184 | 184 | 184 | 184 | 184 | |

| Q5 | Pearson Correlation | .292* | .169* | .117 | .293** | 1 | .072 | .222** | .292** | .061 | .058 |

| Sig. (2-tailed) | .215 | .022 | .113 | .000 | .331 | .002 | .000 | .413 | .436 | ||

| N | 184 | 184 | 184 | 184 | 184 | 184 | 184 | 184 | 184 | 184 | |

| Q6 | Pearson Correlation | .202** | .061 | .350** | .126 | .072 | 1 | .198** | .178* | -.012- | .224** |

| Sig. (2-tailed) | .002 | .414 | .000 | .089 | .331 | .007 | .015 | .875 | .002 | ||

| N | 184 | 184 | 184 | 184 | 184 | 184 | 184 | 184 | 184 | 184 | |

| Q7 | Pearson Correlation | .176* | .282** | .158* | .069 | .222** | .198** | 1 | .153* | .028 | .053 |

| Sig. (2-tailed) | .017 | .000 | .033 | .355 | .002 | .007 | .038 | .708 | .471 | ||

| N | 184 | 184 | 184 | 184 | 184 | 184 | 184 | 184 | 184 | 184 | |

| Q8 | Pearson Correlation | .302** | .241** | .205** | .185* | .292** | .178* | .153* | 1 | .249** | .274** |

| Sig. (2-tailed) | .000 | .001 | .005 | .012 | .000 | .015 | .038 | .001 | .000 | ||

| N | 184 | 184 | 184 | 184 | 184 | 184 | 184 | 184 | 184 | 184 | |

| Q9 | Pearson Correlation | .190* | .167* | .142 | .283** | .061 | .012- | .028 | .249** | 1 | .155* |

| Sig. (2-tailed) | .002 | .024 | .054 | .000 | .413 | .875 | .708 | .001 | .036 | ||

| N | 184 | 184 | 184 | 184 | 184 | 184 | 184 | 184 | 184 | 184 | |

| Q10 | Pearson Correlation | .313** | .278** | .055 | .195** | .058 | .224** | .053 | .274** | .155* | 1 |

| Sig. (2-tailed) | .000 | .000 | .459 | .008 | .436 | .002 | .471 | .000 | .036 | ||

| N | 184 | 184 | 184 | 184 | 184 | 184 | 184 | 184 | 184 | 184 | |

**. Correlation is significant at the 0.01 level (2-tailed).

*. Correlation is significant at the 0.05 level (2-tailed).

Table 7 shows the correlation coefficient of the first axis paragraphs, and we note from the results received that the correlation coefficients for the questions of the second axis show the existence of a strong positive correlation, and it is statistically significant at the level of significance (0.05) in terms of P.Value (0.000), and it is also inferred from the results that the possibility of Modifying the moral relationship with a degree of freedom (0.01) due to the strength of the correlation reflected in the results, and as a result, the measurement tool has high credibility, and then it indicates a clear agreement in the answers of the research sample, which amounted to (184) respondents, about the paragraphs of the questionnaire for the study variables, As a result, the validity of the second sub-hypothesis was confirmed, which states that there is a significant statistically significant relationship between management assurances and the quality of integrated reports.

And to test the validity of the third hypothesis, which states that (there is a significant relationship with statistical significance at the level (0.05) between the long-term strategic planning and the quality of reporting in the integrated reports), in terms of the correlation between the paragraphs of the second axis, which is illustrated in the Table 8 as follows.

| Table 8 The Relationship Between the Paragraphs of the Second Axis |

|||||||||||

| Q1 | Q2 | Q3 | Q4 | Q5 | Q6 | Q7 | Q8 | Q9 | Q10 | ||

| Q1 | Pearson Correlation | 1 | .685** | .121 | .097 | .072 | .117 | .227** | .017 | .118 | .120 |

| Sig. (2-tailed) | .000 | .003 | .190 | .330 | .004 | .002 | .818 | .111 | .104 | ||

| N | 184 | 184 | 184 | 184 | 184 | 184 | 184 | 184 | 184 | 184 | |

| Q2 | Pearson Correlation | . 685** | 1 | .200** | .187* | .471** | .184* | .293** | .229** | .273** | .250** |

| Sig. (2-tailed) | .000 | .007 | .011 | .000 | .013 | .000 | .002 | .000 | .001 | ||

| N | 184 | 184 | 184 | 184 | 184 | 184 | 184 | 184 | 184 | 184 | |

| Q3 | Pearson Correlation | .121 | .200** | 1 | .342** | .334** | .207** | .242** | .137 | .468** | .210** |

| Sig. (2-tailed) | .003 | .007 | .000 | .000 | .005 | .001 | .065 | .000 | .004 | ||

| N | 184 | 184 | 184 | 184 | 184 | 184 | 184 | 184 | 184 | 184 | |

| Q4 | Pearson Correlation | .097 | .187* | .342** | 1 | .299** | .221** | .440** | .107 | .167* | .275** |

| Sig. (2-tailed) | .190 | .011 | .000 | .000 | .003 | .000 | .150 | .023 | .000 | ||

| N | 184 | 184 | 184 | 184 | 184 | 184 | 184 | 184 | 184 | 184 | |

| Q5 | Pearson Correlation | .072 | .471** | .334** | .299** | 1 | .414** | .256** | .346** | .262** | .517** |

| Sig. (2-tailed) | .330 | .000 | .000 | .000 | .000 | .000 | .000 | .000 | .000 | ||

| N | 184 | 184 | 184 | 184 | 184 | 184 | 184 | 184 | 184 | 184 | |

| Q6 | Pearson Correlation | .117 | .184* | .207** | .221** | .414** | 1 | .462** | .299** | .126 | .506** |

| Sig. (2-tailed) | .004 | .013 | .005 | .003 | .000 | .000 | .000 | .089 | .000 | ||

| N | 184 | 184 | 184 | 184 | 184 | 184 | 184 | 184 | 184 | 184 | |

| Q7 | Pearson Correlation | .227** | .293** | .242** | .440** | .256** | .462** | 1 | .391** | .245** | .347** |

| Sig. (2-tailed) | .002 | .000 | .001 | .000 | .000 | .000 | .000 | .001 | .000 | ||

| N | 184 | 184 | 184 | 184 | 184 | 184 | 184 | 184 | 184 | 184 | |

| Q8 | Pearson Correlation | .017 | .229** | .137 | .107 | .346** | .299** | .391** | 1 | .444** | .273** |

| Sig. (2-tailed) | .818 | .002 | .065 | .150 | .000 | .000 | .000 | .000 | .000 | ||

| N | 184 | 184 | 184 | 184 | 184 | 184 | 184 | 184 | 184 | 184 | |

| Q9 | Pearson Correlation | .118 | .273** | .468** | .167* | .262** | .126 | .245** | .444** | 1 | .051 |

| Sig. (2-tailed) | .111 | .000 | .000 | .023 | .000 | .089 | .001 | .000 | .492 | ||

| N | 184 | 184 | 184 | 184 | 184 | 184 | 184 | 184 | 184 | 184 | |

| Q10 | Pearson Correlation | -.120- | .250** | .210** | .275** | .517** | .506** | .347** | .273** | .051 | 1 |

| Sig. (2-tailed) | .104 | .001 | .004 | .000 | .000 | .000 | .000 | .000 | .492 | ||

| N | 184 | 184 | 184 | 184 | 184 | 184 | 184 | 184 | 184 | 184 | |

**. Correlation is significant at the 0.01 level (2-tailed).

*. Correlation is significant at the 0.05 level (2-tailed).

Table 8 shows the strength of the correlation coefficients for the paragraphs of the second axis, which whenever it approaches (1) the integer number, it reflects the existence of a positive correlation between the dimension (long-term strategic planning and the quality of integrated reports), for the correlation coefficients between the questions of the second axis, and it is statistically significant when Significance level (0.05) in terms of P.Value(0.000), whose degree of freedom can be adjusted to (0.01), which reached (.685**) as the highest degree and it shows that there is agreement and validity in the answers of the research sample, which amounted to (184) respondents, to the study variables Accordingly, the third hypothesis is validated, which states that there is a significant statistically significant relationship between long-term strategic planning and the quality of integrated reports.

To test the validity of the first hypothesis, which states (that administrative procedures affect the quality of integrated reporting), Table 9 shows the correlation between the axis of management assurances and strategic planning, as well as the business environment, as follows in Table 9.

| Table 9 Correlation Between the Axis of Management Assurances and Strategic Planning, as well as The Business Environment |

|||||

| Regulatory Assurance | strategic planning | management procedure | business environment | ||

|---|---|---|---|---|---|

| Regulatory Assurance | Pearson Correlation | 1 | .669** | .817** | .292** |

| Sig. (2-tailed) | .000 | .000 | .000 | ||

| N | 184 | 184 | 184 | 184 | |

| strategic planning | Pearson Correlation | .669** | 1 | .833** | .312** |

| Sig. (2-tailed) | .000 | .000 | .000 | ||

| N | 184 | 184 | 184 | 184 | |

| management procedure | Pearson Correlation | .817** | .833** | 1 | .231** |

| Sig. (2-tailed) | .000 | .000 | .002 | ||

| N | 184 | 184 | 184 | 184 | |

| business environment | Pearson Correlation | .292** | .312** | .231** | 1 |

| Sig. (2-tailed) | .000 | .000 | .002 | ||

| N | 184 | 184 | 184 | 184 | |

**. Correlation is significant at the 0.01 level (2-tailed).

To confirm the validity of the hypotheses, Table 10 presents the degree of influence and the correlation between the total variables.

| Table 10 ANOVAa |

||||||

| Model | Sum of Squares | df | Mean Square | F | Sig. | |

|---|---|---|---|---|---|---|

| 1 | Regression | 39.458 | 3 | 13.153 | 29.394 | .000b |

| Residual | 80.542 | 180 | .447 | |||

| Total | 120.000 | 183 | ||||

a. Dependent Variable: The quality of integrated reports.

b. Predictors: (Constant), management procedure, Regulatory Assurance, strategic planning

Discussion

The change in the business environment and its economic complexities, created a kind of deficiency in financial reports in meeting the needs of the renewed needs for information from stakeholders, and the inability to keep pace with developments, due to its focus on financial information only that pertains to operational and investment activities, and neglecting other activities that could To affect the overall activity result, which includes non-financial information regarding the social environment, health, climate and other information, related to enhancing the value of the economic entity over time, as a result integrated reporting (IR) has gained great interest in improving the quality of information provided to its users, in addition to enhancing Oversight and disclosure, allocating available resources in the decision-making process, and enabling the improvement of international relations between economic entities, most of which are directed to integrating financial and non-financial disclosures in their annual reports. Since the economic entity is part of a social environment, representing its business environment, it affects and is affected by the values of that community. The results show that management procedures play an important role in the integrated reporting of economic entities, due to the nature of the formation of the social personality of those responsible for their numbers. decision maker. Culture is a factor affecting human behavior in particular and society in general, and its values in general, and cannot be neglected or dispensed with, in the formation of personal or social and economic practices, and as a result, its impact on accounting practices cannot be neglected as it is part of society, it affects and is affected by cultural behaviors that reflect Personal characteristics of stakeholders. Societies are usually classified according to cultural concepts that reflect the level of awareness, development, and adherence to societal customs and values.

Recommendations

Understanding how the human mindset or behavior affects the success or failure of the business environment in achieving its goals is important to help the economic entity manage its resources more effectively, and reduce potential undesirable cultural biases, which can affect the course of decision-making, as The organizational culture of the administration (Management Assurances and planning) can affect the level of performance improvement and the effectiveness of communication at the organizational and personal level with the workers in the economic entity or the beneficiaries of its outputs, whether services or data intended to be used for decision-making. In general, integrated reports aim to bring about a fundamental change in the way economic entities are managed and report to stakeholders to make decisions, by creating relationships between the components of the economic entity, productivity, administrative and other functions, and linking them with the capital elements that use or influence them, to provide a vision Long-term, and part of the prevailing practices in the economic business environment, which lead to efficient and productive capital allocation, and support financial stability

Prospects and future studies

The International Integrated Reporting Council (IIRC) and the Sustainability Accounting Standards Board (SASB) have formally announced their merger to form the Value Reporting Foundation.

References

- Adhariani, D., & De Villiers, C. (2019). Integrated reporting: perspectives of corporate report preparers and other stakeholders. Sustainability Accounting, Management and Policy Journal, 10(1), 126-156.

- Arul, R., De Villiers, C., & Dimes, R. (2020). Insights from narrative disclosures regarding integrated thinking in integrated reports in South Africa and Japan. Meditari Accountancy Research, pp.1-29.

- Cortesi, A., & Vena, L. (2019). Disclosure quality under integrated reporting: a value relevance approach. Journal of cleaner production,pp.745-755.

- DURAK, M. G. (2013). Factors affecting the companies’ preferences on integrated reporting. International Journal of Contemporary Economics and Administrative Sciences, 3(3-4), 68-85.

- Guthrie, J., Rossi, F. M., Orelli, R. L., & Nicolò, G. (2020). Investigating risk disclosures in Italian integrated reports. Meditari Accountancy Research., pp.1-30.

- Haller, A. (2016). Value creation: a core concept of integrated reporting. In Integrated reporting (pp. 37-57). Palgrave Macmillan, London.

- Hoque, M.E. (2017). Why company should adopt integrated reporting?. International Journal of Economics and Financial Issues, 7(1), pp.241-248.

- IIRC. (2011) Integrated reporting, The International Integrated Reporting Council, UK, pp.1-6.

- IIRC. (2013) THE International <IR> Framework, The International Integrated Reporting Council, UK, pp.1-35.

- IMA, (2017) Statement of Ethical Professional Practice, Institute of Management Accountants, USA.

- Krzus, M.P. (2011). Integrated reporting: if not now, when. Zeitschrift für internationale Rechnungslegung, 6(6), 271-276.

- Miciuła, I., Kadłubek, M., & Stępień, P. (2020). Modern Methods of Business Valuation—Case Study and New Concepts. Sustainability, 12(7), 2699.

- Moloi, T,, & Iredele, O, (2020), Firm Value and Integrated Reporting Quality of South African Listed Firms, Academy of Strategic Management Journal, 19(1), 1-12.

- Owen, G. (2013). Integrated reporting: A review of developments and their implications for the accounting curriculum. Accounting Education, 22(4), 340-356.

- Pavlopoulos, A., Magnis, C., & Iatridis, G. E. (2019). Integrated reporting: An accounting disclosure tool for high quality financial reporting. Research in International Business and Finance, 49, 13-40.

- Pistoni, A., Songini, L., & Bavagnoli, F. (2018). Integrated reporting quality: An empirical analysis. Corporate Social Responsibility and Environmental Management, 25(4), 489-507.

- Remenarić, B., Kenfelja, I., & Mijoč, I. (2018). Creative accounting-motives, techniques and possibilities of prevention. Ekonomski vjesnik, 31(1), 193-199.

- Rivera-Arrubla, Y.A., Zorio-Grima, A., & García-Benau, M.A. (2017). Integrated reports: disclosure level and explanatory factors. Social Responsibility Journal, pp. 155-176.

- Vitolla, F., Raimo, N., Marrone, A., & Rubino, M. (2019). The role of board of directors in intellectual capital disclosure after the advent of integrated reporting. Corporate Social Responsibility and Environmental Management,pp.1-16.

- Von Ahsen, A. (2014). The integration of quality, environmental and health and safety management by car manufacturers–a long‐term empirical study. Business Strategy and the Environment, 23(6), 395-416.

- Zhou, S., Simnett, R., & Green, W. (2017). Does integrated reporting matter to the capital market?. Abacus, 53(1), 94-132.