Research Article: 2022 Vol: 26 Issue: 1

The role of company ability, supply chain respon and supply chain management on company competitiveness and performance regional owned enterprises (bumd) in Indonesia

Ismail Nurdin, Institut Pemerintahan Dalam Negeri

Sri Hartati, Institut Pemerintahan Dalam Negeri

Citation Information: Nurdin I., Hartati S. (2022).The role of company ability, supply chain respon and supply chain management on company competitiveness and performance regional owned enterprises (bumd) in Indonesia. International Journal of Entrepreneurship, 26(1), 1-13

Abstract

The purpose of this study is to analyze the effect of company ability on company competitiveness, the effect of Supply Chain Response has an effect on company competitiveness, the effect of Supply Chain Management on company competitiveness and company competitiveness on company performance. In this study using quantitative methods and data analysis techniques Structural Equation Modeling Equation Modeling using SmartPLS 3.0 software. The sample selection method used the snowball sampling method. An online questionnaire was sent to 230 Regional Owned Enterprises (BUMD) respondents in Banten Province. Based on the results of data analysis, it is concluded that company Ability has a significant effect on company competitiveness, Supply Chain Response has a significant effect on company competitiveness, Supply Chain Management has a significant effect on company competitiveness, and company competitiveness has a significant effect on company performance.

Keywords

company Ability, Supply Chain Respon, Supply Chain Management, company performance

Introduction

According to Fantazy et al. (2019) In an era of increasingly fierce business competition, companies are very important to increase their strategic competitiveness. Companies must be able to take advantage of several possibilities to become more competitive and productive so as to improve company performance. According to Farahani et al. (2014), Fantazy et al. (2019) Company performance is a benchmark indicator of the development of a company. Competitive business is focused on how to increase value to consumers, namely providing products and services that are more valuable than competitors. According to Acar et al. (2014), Awaysheh et al. (2010) In order for a company to compete and develop, the company must have a competitive advantage. This encourages companies to be able to compete on how to provide products to consumers but at low prices and products and services to the right place and the right time. Many companies also realize that it is not enough to increase efficiency in a company organization, they must make the entire supply chain more competitive and efficient. According to Awaysheh et al. (2010) With the rapid increase in consumer demand and some disruptions that can occur in the supply process, supply chain management is very necessary in adjusting the existing business environment. This will directly be a competitive advantage for the company.

No less important factor in creating a company's competitive advantage is the company's ability. According to Tracey et al. (2005) that to create a company's competitive advantage requires individual resources who work together to create an integrated organizational capability. Yusuf et al. (2014) the company's organizational ability has a positive effect on the company's competitive advantage. According to Wang et al. (2013), Wong et al. (2011), Yusuf et al. (2014) shows that the company's ability has a significant positive effect on competitive advantage, meaning that a good company's ability is able to increase the company's competitive advantage. According to Wong et al. (2011), Yusuf et al. (2014) show that supply chain management practices have a significant positive effect on competitive advantage, meaning that good supply chain management practices can increase competitive advantage. Meanwhile, Singh et al. (2010) show that supply chain management practices have a significant negative effect on competitive advantage. According to Wong et al. (2011), Yusuf et al. (2014) shows that supply chain management practices have no significant effect on competitive advantage, meaning that improving supply chain management practices does not affect competitive advantage. Based on the studies that have been carried out, most of the studies argue that supply chain factors and company capabilities cannot be denied to be the main things that play a role in improving company performance, although there are still some researchers who have different opinions from the conclusions of the research results obtained.

The Influence of Company Capability on Competitive Advantage

The strategic importance of the company's capabilities lies in its contribution to creating a competitive advantage and superior profitability. According to Ortas et al. (2014), Rao et al. (2005) The company's competitive advantage must be consistent with the relative value generated by the company's relative resources in producing that value. According to Silvestre et al. (2015), Storey et al. (2006) The higher the company's ability, the more it will increase the company's competitive advantage. According to Tarigan et al. (2021) There are three sources that will form a competitive advantage, namely financial capabilities, strategic capabilities and technological capabilities. With the company's high ability, it will have a positive effect in creating company excellence. Based on some of the results of these studies, the researchers took a hypothesis:

H1: The company's ability has a positive effect on the company's competitive advantage

The Influence of Supply Chain Management Practices on Competitive Advantage

Supply chain management practices have a relationship in creating a company's competitive advantage. According to Montshiwa et al. (2018) Supply chain management practices empirically have a positive influence on competitive advantage. According to Likumahwa et al. (2019), Montshiwa et al. (2018) Strategic relationship with suppliers, the close relationship between the company and suppliers can affect the company's competitive advantage. According to Harrison et al. (2019), Likumahwa et al. (2019), Montshiwa et al. (2018)S the closer the relationship between the company and its suppliers and the exchange of information runs smoothly, the more competitive the company will be.

In the study of Likumahwa et al. (2019),Montshiwa et al. (2018) identified that Supply Chain Management Practice has a significant positive effect on Competitive Advantage. Based on some of the results of these studies, the researchers took a hypothesis:

H2: Supply chain management practices have a positive effect on competitive advantage

The Influence of Supply Chain Responsiveness on Competitive Advantage

The responsiveness of the company to its supply chain practices, the responsiveness of the supply chain has a positive influence on establishment of the company's competitive advantage. According to Marwah et al. (2014), Mitra et al. (2014) found that there was a positive influence between indicators of operational system responsiveness, logistics process responsiveness and supplier network responsiveness that had a positive relationship to competitive advantage. By running responsive operations, companies will be able to compete with advantages in cost, time to market, and dependence on supply from consumers. Responsive logistics processes can also be a company advantage. According to Yusuf et al. (2014), Yang et al. (2013) The company's ability to respond to changes in the volume of customer demand can increase the company's competitive advantage in terms of product supply. According to Mitra et al. (2014), Neely et al. (2001) The higher the level of responsiveness of a company's supply chain, the significantly positive effect on the company's competitive advantage. According to Yang et al. (2013) Based on some of the results of these studies, the researchers took a hypothesis:

H3: Supply chain responsiveness has a positive effect on competitive advantage

The Effect of Competitive Advantage on Company Performance

The competitive advantage of a company describes that a company has one or more advantages compared to other competitors. According to Marwah et al. (2014) Competitive advantage can lead companies to achieve higher levels of economic performance, customer satisfaction and loyalty and effective customer relationships. Brand companies with high customer loyalty will tend to avoid competition in switching brands according to the targeted market segments which can directly increase sales and profitability. According to Yusuf et al. (2014), Yang et al. (2013) A company that offers high quality products can be offered at high prices and at the same time increase the company's profit margin and return on investment. According to Marwah et al. (2014) Competitive advantage has a significant positive effect on company performance. Based on this research, it can be seen that there is a positive relationship between competitive advantage and company performance. Then the researcher can formulate the following hypothesis:

H4: Competitive advantage has a positive effect on company performance

In this study using quantitative methods and data analysis techniques Structural Equation Modeling Equation Modeling using SmartPLS 3.0 software. The sample selection method used the snowball sampling method. An online questionnaire was sent to 230 BUMD respondents in Banten Province. Based on theoretical studies and previous studies, the research model is structured as follows:

In this study there are 4 hypotheses as follows:

H1: The company's ability has a positive effect on the company's competitive advantage

H2: Supply chain management practices have a positive effect on competitive advantage

H3: Supply chain responsiveness has a positive effect on competitive advantage

H4: Competitive advantage has a positive effect on company performance

Data Processing Stages

Reliability Test:

To test the reliability of the construct in this study used the value of composite reliability. A variable is said to meet construct reliability if it has a composite reliability value > 0.7 and Cronbach's Alpha value > 0.7 has a good level of reliability for a variable (Purwanto et al, 2019).

Validity Test:

According to Purwanto et al. (2020) The validity test is intended to measure the extent to which the accuracy and accuracy of a measuring instrument performs the function of its measuring instrument or provides appropriate measurement results by calculating the correlation between each statement with a total score. In this study, the measurement validity test consisted of convergent validity and discriminant validity.

Convergent Validity

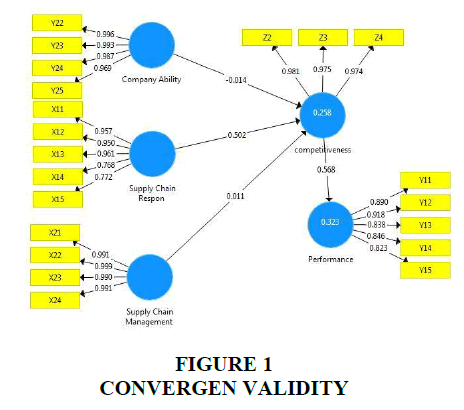

Measurement Measurement can be categorized as having convergent validity if the loading factor value is > 0.7 (Purwanto et al, 2021). If all loading factors have a value of > 0.7, it can be concluded that all indicators have met the criteria for convergent validity, because no indicators for all variables have been eliminated from the model

Discriminant Validity:

Discriminant validity is a test of construct validity by predicting the size of the indicator from each block (Purwanto et al, 2019). One of the discriminant validity can be seen by comparing the AVE value with the correlation between other constructs in the model. If the AVE root value is > 0.50, it means that discriminant validity is reached (Purwanto et al, 2020). In addition, discriminant validity is also carried out based on the Fornell Larcker criteria measurement with the construct. In addition to using the AVE value, another method that can be used to determine discriminant validity is to measure discriminant validity by using the cross loading value. An indicator is said to meet discriminant validity if the cross loading value is 0.70 or more (Purwanto, 2020).

Structural Model (Inner Model)

The structural model (inner model) is the pattern of the relationship between the research variables. Evaluation of the structural model is by looking at the coefficients between variables and the value of the coefficient of determination (R2). The coefficient of determination (R2) essentially measures how far the model's ability to explain variations in the dependent variable is. A value close to 1 means that the independent variables provide almost all the information needed to predict the variation of the dependent variable (Purwanto, 2021).

Hypothesis Testing

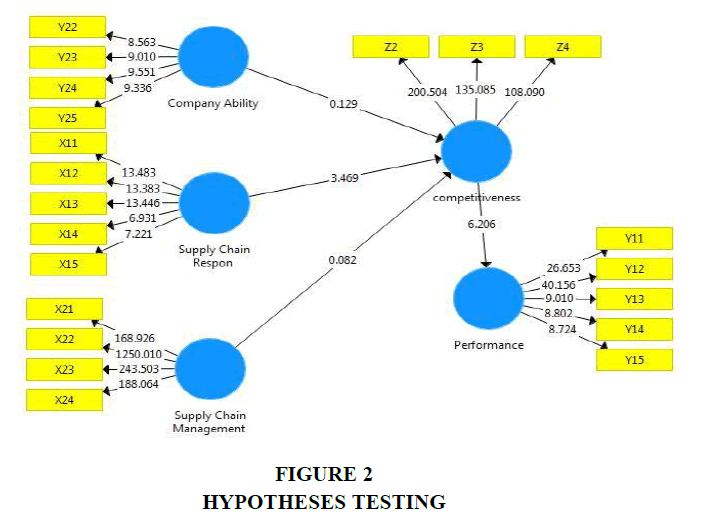

The last step of the test using the Smart Pls application is hypothesis testing and is carried out by looking at the results of the bootsrapping value. This test is done by selecting the calculate menu and after that the menu options appear, then select bootstrapping, then the desired data will appear. The following are the results of the data test using bootstrapping. Hypothesis testing in this study can be known through regression weight by comparing the p-value with a significance level of 5% (α=5%). The hypothesis is said to be significant if it has a probability value (p-value) < 5%.

Result and Discussion

Reliability Test

According to Purwanto et al. (2020) the reliability requirement is a measure of the stability and consistency of the results (data) at different times. To test the reliability of the construct in this study used the value of composite reliability. A variable is said to meet construct reliability if it has a composite reliability value > 0.7 and Cronbach's Alpha value > 0.6 has a good level of reliability for a variable (Purwanto et al, 2019). The composite reliability value of each indicator can be seen in Table 1 below.

| Table 1 Reliability |

||

|---|---|---|

| Variables | Cronbach’s Alpha | Composite Reliability |

| Company Ability | 0.976 | 0.984 |

| Supply Chain Respon | 0.994 | 0.993 |

| Supply Chain Management | 0.926 | 0.936 |

| Competitiveness | 0.994 | 0.996 |

| Performance | 0.937 | 0.948 |

In Table 1, it can be seen the results of the reliability test analysis using the SmartPLS tool which states that all composite reliability values are greater than 0.7, which means that all variables are reliable and have met the test criteria. Furthermore, the value of cronbanch's omission also shows that all cronbanch's 'alpa' values are more than 0.6 and this indicates the level of reliability of the variable has also met the criteria.

Convergent validity:

Measurement Measurement can be categorized as having convergent validity if the loading factor value is > 0.7 (Purwanto et al., 2021). Figure 1 shows that all loading factors have a value of > 0.7, so it can be concluded that all indicators have met the criteria for convergent validity, because indicators for all variables have not been eliminated from the model.

Discriminant validity:

Based on Table 2, the AVE value for all variables is > 0.50. So it can be said that the measurement model has been valid with discriminant validity. In addition, discriminant validity was also carried out based on the Fornell Larcker criteria measurement with the construct. If the construct correlation in each indicator is greater than the other constructs, it means that latent constructs can predict indicators better than other constructs (Purwanto et al., 2019).

| Table 2 Ave |

|

|---|---|

| Variables | AVE |

| Company Ability | 0.954 |

| Supply Chain Respon | 0.973 |

| Supply Chain Management | 0.746 |

| Competitiveness | 0.985 |

| Performance | 0.785 |

Structural Model (Inner Model)

The structural model (inner model) is the pattern of the relationship between the research variables. Evaluation of the structural model is by looking at the coefficients between variables and the value of the coefficient of determination (R2). The coefficient of determination (R2) essentially measures how far the model's ability to explain variations in the dependent variable is. In this study, the adjusted r-square value (adjusted R2) is used, because it has more than two independent variables.

In Table 3 it can be explained that the adjusted R2 value of the independent variables Company Ability, Supply Chain Response and Supply Chain Management on the dependent variable competitiveness is 0.258 This value is categorized as weak. Company Ability, Supply Chain Response and Supply Chain Management variables contribute to the dependent variable competitiveness by 25.8% while the remaining 74.2% is influenced by other variables not discussed in this study. The adjusted R2 value of the Company Ability, Supply Chain Response and Supply Chain Management and competitiveness variables on the dependent variable performance is 0.323. This value is categorized as weak. Company Ability, Supply Chain Response and Supply Chain Management variables and competitiveness contributed to the dependent variable performance by 32.3% while the remaining 67.7% was influenced by other variables not discussed in this study (Figure 2).

| Table 3 R-Square Adjusted |

|

|---|---|

| Variables | R-square adjusted |

| Competitiveness | 0.258 |

| Performance | 0.323 |

Hypothesis Test

According to Purwanto et al. (2021) After a research model is believed to be fit, a hypothesis test can be performed.The next step is to test the hypothesis that has been built in this study. The following are the results of the data test using bootstrapping. Hypothesis testing in this study can be known through regression weight by comparing the p-value with a significance level of 5% (α=5%). The hypothesis is said to be significant if it has a probability value (p-value) < 5% in Table 4.

| Table 4 Hypotheses Testing For Direct Effect |

||

|---|---|---|

| Hypotheses | P - Value | Result |

| Company Ability ->company competitiveness | 0.001 | Significant |

| Supply Chain Respon ->company competitiveness | 0.001 | Significant |

| Supply Chain Management ->company competitiveness | 0 | Significant |

| company competitiveness -> Performance | 0 | Significant |

The Relationship Between Company Ability And Company Competitiveness

Based on the results of data analysis using Smart PLS obtained p value of 0.001 < 0.050 so that it is concluded that Company Ability has a significant effect on company competitiveness, an increase in Company Ability variable will have a significant effect on increasing company competitiveness variable and decreasing Company Ability variable will have a significant effect on decreasing company variable. competitiveness. These results are not in line with the research conducted by According to Acar et al. (2014), Awaysheh et al. (2010), Bhatnagar et al. (2005), Farahani et al. (2014), Fantazy et al. (2019) that Company Ability has a positive and significant effect on company competitiveness. Competitive advantage can be defined as an organization's ability to create a defensive position above all its competitors. The approach to competitive advantage is centered on the company's ability to be a low cost producer in its industry or to be unique in its industry that will provide its own value for customers. The process of introducing products with lower prices or higher quality attracts the attention of customers. For that we need a unique product or service to be provided. This is the reason why there are some customers who have high brand loyalty for a product or service. The increasingly fierce competition climate, every company will try to find a position to survive by using competitive advantage.

Relationship Between Supply Chain Response And Company Competitiveness

Based on the results of data analysis using SmartPLS obtained p value of 0.001 < 0.050 so it can be concluded that Supply Chain Response has a significant effect on company competitiveness, an increase in the Supply Chain Response variable will have a significant effect on increasing the company competitiveness variable and a decrease in the Supply Chain Response variable will have a significant effect on a decrease in the company competitiveness variable. These results are not in line with the research conducted by According to Geng et al. (2017), Harrison et al. (2019), Likumahwa et al. (2019), Montshiwa et al. (2018) that Supply Chain Response has a positive and significant effect on company competitiveness. According to Tarigan et al. (2021) Supply chain management is a network starting from producing raw materials, turning them into semi-finished goods and then final products, as well as delivering products to customers through the distribution system. According to Storey et al. (2006), Tarigan et al. (2021) The main reason and purpose of supply chain management is to provide a strategic weapon in building a sustainable competitive advantage by reducing costs without reducing the level of customer satisfaction. According to Ortas et al. (2014), Rao et al. (2005) explained that strategic supplier partnerships, customer relationships and information sharing are the keys to supply chain management. This study develops the measurement of supply chain management practices referring to several previous studies. According to Silvestre et al. (2015), Storey et al. (2006), Tarigan et al. (2021) The indicators that will be used to describe the variables of supply chain management practices are strategic relationships with suppliers, customer relations, information exchange, delay practices, use of technology and quality of information exchange.

Relationship Between Supply Chain Management And Company Competitiveness

Based on the results of data analysis using SmartPLS obtained p value 0.000 < 0.050 so it is concluded that Supply Chain Management has a significant effect on company competitiveness, an increase in the Supply Chain Management variable will have a significant effect on increasing the company competitiveness variable and a decrease in the Supply Chain Management variable will have a significant effect on a decrease in the company competitiveness variable. This result is not in line with the research conducted by According to Marwah et al. (2014), Mitra et al. (2014), Neely et al. (2001), Yusuf et al. (2014), Yang et al. (2013) that Supply Chain Management has a positive and significant effect on company competitiveness.Supply chain responsiveness is defined as the ability in speed with which the supply chain can anticipate changes in consumer demand. According to Rao et al. (2005), Silvestre et al. (2015). The responsiveness level is a combination of operational responsiveness, logistics process responsiveness and supplier network responsiveness. In a rapidly changing competitive world, the need for a flexible and responsive supply chain is indispensable. According to Ortas et al. (2014), Rao et al. (2005) explained that with a high level of speed and flexibility in the supply chain, the level of supply chain responsiveness increases. Based on several studies, it can be identified that there are three dimensions in supply chain responsiveness, including: operational responsiveness, logistics process responsiveness, and supplier network responsiveness.

The Relationship Between Company Competitiveness And Performance

Based on the results of data analysis using SmartPLS, the p value is 0.000 < 0.050 so it can be concluded that company competitiveness has a significant effect on company performance, an increase in the company competitiveness variable will have a significant effect on increasing the company competitiveness variable and a decrease in the Company Ability variable will have a significant effect on the decrease in the performance variable. These results are not in line with the research conducted by According to Ortas et al. (2014), Rao et al. (2005), Silvestre et al. (2015), Storey et al. (2006), Tarigan et al. (2021) that company competitiveness has a positive and significant effect on performance. According to Farahani et al. (2014), Fantazy et al. (2019) The company's performance reflects how well the company achieves its market goals and financial goals. The short-term goal of supply chain management is to increase productivity, reduce inventory and production cycles, while the long-term goal is to increase market share and profit for all partners involved in the organization's supply chain. According to Fantazy et al. (2019) argues that assets, capabilities, organizational processes, company attributes owned and controlled by the company have a role in increasing the company's effectiveness and efficiency in achieving superior company performance. According to Acar et al. (2014), Awaysheh et al. (2010) company performance can be described into two dimensions, namely financial and non-financial dimensions, where the main elements are described based on sales (sales-based) and organization (organizational-based). According to Acar et al. (2014) Company performance is an important benchmark for a company and can reflect whether a company has achieved competitive advantage or not. Approach in measuring Company Performance used indicators of operational performance and economic performance.

Theoretical Implications:

This presentation of theoretical implications is used to strengthen support for several previous studies that were used as references and their relationship to the theory used. Strategic relationships with suppliers can encourage better supply chain management practices. Strategic relationships with suppliers allow organizations to work more effectively with a few important suppliers who will share responsibility for the success of a product. Information exchange is an inseparable factor in the supply chain process. Partners in supply chain processes who exchange information regularly will be able to work together as one entity.

Together, they will be able to understand the needs of the end customer well and be able to respond to the market quickly. The responsiveness of the supplier network is the ability of the company's main suppliers to respond to customer requests. The better the responsiveness of the company's supply chain will have a positive impact on company performance. Service capability is the company's ability which is reflected in the provision of superior service so that it is able to retain customers for several periods of time. Service capabilities are needed in terms of building relationships with customers. Relationship management capability is the company's ability to manage relationships both with customers and suppliers, to create collaborative relationships so as to create competitive advantages and long-term trade relationships.

Policy Implication

From the research findings, the suggested policy implications for the company can be drawn up, namely that the company is expected to be able to build good relationships with suppliers and customers and the process of implementing supply chain management using the latest technology so that the information exchange process can run well and the information obtained becomes more accurate. in determining the direction of future business policies.

The company is expected to optimize operational and logistical processes as well as build personnel competence so that supply chain process activities within the company can be more responsive and flexible to the market. The company is expected to be able to develop the company's internal capabilities, including the ability to reduce operational costs, service capabilities to customers, ability to see existing market conditions, integration capabilities and relationship management capabilities both with suppliers and customers. The company is expected to apply competitive lubricant prices and service innovations, in order to create a certain uniqueness and contribute to the creation of the company's competitive advantage. The company is expected to optimize the potential of existing resources through accuracy in establishing relationships between suppliers and customers, optimizing operational costs, and optimizing the marketing function within the company in order to provide better company performance improvements.

Conclusion

Based on the results of data analysis, it is concluded that company Ability has a significant effect on company competitiveness, Supply Chain Response has a significant effect on company competitiveness, Supply Chain Management has a significant effect on company competitiveness, and company competitiveness has a significant effect on company performance. The company's ability has a positive effect on competitive advantage. Adequate company capabilities will have an impact on the company's competitive advantage. Supply chain management practices have no effect on competitive advantage. Good supply chain management practices may not necessarily contribute to competitive advantage. Supply chain responsiveness has no effect on competitive advantage. Good supply chain responsiveness may not necessarily contribute to competitive advantage. Competitive advantage has a positive effect on company performance. The higher the competitive advantage of the company, the better the company's performance will be. Supply chain management practices have a positive effect on company performance. The more adequate the supply chain management process is carried out, the better the company's performance will be. The results of this study and the limitations found in the study can be used as a source of ideas for research development, so the expansion of research suggested in this study is to add independent variables that affect competitive advantage. A wider sample is related to the relationship of these variables, especially in the lubricant retail industry sector. Not all respondents from the initial target respondents can be interviewed and return the questionnaire. The research area is quite large which requires a long time in research.

References

Harrison A, Skipworth H, van Hoek R., & Aitken J. (2019). Logistics management and strategy: competing through the supply chain. Pearson UK.

Likumahwa F.M, Purwaningsih R, & Handayani N.U. (2019). The Influence of Green Supply Chain management on Company’s Performance and Competitiveness in Wood Furniture Industry: An Overview of Conceptual Model. In IOP Conference Series: Materials Science and Engineering (Vol. 598, No. 1, p. 012076). IOP Publishing.

Marwah A.K, Jain S, & Thakar G. (2014). Implications of human resource variables on supply chain performance and competitiveness. International Journal of Engineering (IJE), 8(1), 11-21.