Case Reports: 2020 Vol: 26 Issue: 1

Together We Can Do Great Things An Inclusive Business Model

Wamalwa Lucy Simani, KCA University

Abstract

"Doing business in developing economies like Kenya is difficult because of resource scarcity, weak institutions, poor market infrastructure and lower purchasing power of consumers especially in rural areas. In the past, most multinational corporations have repeatedly failed to penetrate this market, acquire relevant and valuable resources, to create value for these consumers, launch, and grow a sustainable business. The challenges in designing a business model in this market is how to combine and maintain a balance between low cost, quality products, sustainability, profitability, and integrate all stakeholders in value creation. Safaricom Kenya offers a viable business model for this market, as they are socially and culturally appropriate and environmentally sustainable building value off local resources and capabilities. The company harnesses customer competencies by engaging with them beyond the mere buyer-seller relationship to innovate products with them. Their strength and survival largely depend on how they understand consumers' needs and how they create, enhance, retain, and, most importantly, utilize and preserving the existing social capital."

Keywords

The Bottom of the Pyramid, Inclusive Business Model, Safaricom Kenya

Introduction

Globalization has reduced government roles in the economy and increased economic interdependence among different nations. This interdependence is beneficial mainly to the advanced countries, with sufficient export capabilities with similar low-cost production. However, it is not effective in third world countries to address their fundamental economic challenges such as massive poverty, increasing unemployment, multidimensional human deprivations, starvation, inequality, and environmental degradation (Sharma, 2014). In the face of hunger and social injustice, climate change, technological changes, and changes in markets, companies are asked to use their corporate ingenuity to provide innovative solutions to this problem (Ansari, et al., 2012). Traditional solutions of CSR are questioned (Tonelli & Cristoni, 2013); they only scratch on the surface of the problem. Hence the need to explore new avenues to poverty alleviation. Market-based approaches that is economically sustainable. Where markets work for the poor and the poor participate in the market and value chain as producers and consumers. Creating a new community consisting of diverse people working together to create and sustain interdependent lives (Simanis & Hart, 2009).

The decisions as to whether to serve these markets or not have always been divisive. Some researchers (Karnani, 2007) argue that the size of the Bottom Of the Pyramid (BOP) market is small; the consumer purchasing power is low; there is no fortune specifically for large companies, and the cost of serving the market can be high and recommends stripped-down products. Alternatively, other academicians and practitioners see these markets as opportunities who's strength is dependent on; the aggregated purchasing power of low-income consumers (Prahalad & Hammond, 2002); social capital (Ansari et al., 2012) and the role of innovation and alliances Simanis & Hart, (2009); Pels & Sheth, (2017). However, doing business successfully in BOP markets have not been easy for MNC, the unique characteristics of consumers demand in BOP markets, combined with the inadequacy of the marketing and distribution infrastructure (Samuel Craig & Douglas, 2011). Demands that companies innovate new strategies and business models for the BOP markets to achieve the price points and cost position required to reach the poor (BOP) (Simanis & Hart, 2008). Faced with high cost and low revenues (Simanis & Duke, 2014) most Multinational Corporations (MNC) have repeatedly failed to penetrate the BOP market because of their inability to rearrange their business model to fit into this market (Tonelli & Cristoni, 2013). A review of BOP literature (Kolk, Rivera-Santos, & Rufín, 2014) shows a variation of models ranging from initiative resembling traditional low-end market entry to initiatives emphasising BOP specific co-invention hence the need to conceptualize a business model for these markets. Contrasting with the original idea that large MNCs had a central role to play in BOP initiatives MNCs lead only a small number of the initiatives. More of these cases are from India and other economies (Kolk et al., 2014) broadening literature in Africa seems necessary.

This study will further research on inclusive development by examining business models adopted by Safaricom. One of the MNC that has been successful working with the poor in slum areas, refugees in camps and developing the Kenyan economy through job creation, infrastructure development and creating opportunities for the youth, innovating solutions for social issues. The research study focuses explicitly on the effect of social capital on the performance of MNCs in BOP Markets, examining the tradeoff that exists between profitability, social impact, and the impact on the environment. Using social capital and network theory the paper conceptualises a viable business model for general business in Kenya.

Significance of the Case

Most MNCs that have ventured into BOP markets have failed either because of the high cost of doing business in these markets or the inability to modify the business models to enable them to attain sustainability in these markets (Simanis & Duke, 2014; Simanis & Hart, 2008; Tonelli & Cristoni, 2013). This study examines a business model adopted by Safaricom a multinational that has been successful in doing business in Kenyan rural areas. Identifying conditions and factors that have led to their success in this market examining the challenges they have faced doing business in the rural area and integrating them into a business model. This will create guidance knowledge that will enable other MNCs to learn from their past success and failure. By understanding challenges faced by MNCs in rural areas, the study will provide direction and provide policy recommendations that will help Kenya and other less developed countries, in promoting their business environment to not only makes their countries an attractive location for MNC investments but also facilitates the creation of economic and social development from inclusiveness in business practices. Some of the critical success factors examined in this study are the role of social capital, networking, partnerships and understanding national culture as a means of a reduction in marketing costs, enabling acceptance by the local community. Safaricom business incorporate the Kenyan communism culture, the firm enables consumers to share resources that includes, monthly income earned by young Kenyans in urban areas send to rural areas, it also enables Kenyans to share airtime, data bundles and internet services. Most Kenyans have low income the corporation enables them to buy airtime with prices as low as Kshs.5, and send kshs 100 at no expense.

Trade and competition are critical drivers of growth, increased living standards, and job creation. One way to alleviate poverty is to incorporate the poor in less developed countries in the global trade as producers, innovators, and consumers through partnerships with MNCs as this provides opportunities to stimulate the local economy. MNCs often enjoy the technologically superior position. Technology transfer has a significant influence on improving the health and livelihoods of people living in rural areas. The spread of knowledge and ideas helps close the gap between rich countries and developing countries, boost productivity in rural areas, lead to Skill development and improve the rural community access to technology and improve their innovativeness and management practices. Safaricom presents a unique case that highlights the role of MNC in creating inclusiveness business socially through technology transfer. Safaricom innovation mobile money transfer (Mpesa) has been a source of livelihood for many Kenyans by engaging them as agents and retailers along its value chain. Mpesa has also enhanced SME performance by enabling them to access banking services and credit services. The company has also succeeded in working with Kenyan citizens to develop an application that has improved access to health care, education, and agriculture. hence stimulating the country economy:

Learning Objectives

1. Understand the business environment that affects operating in developing economies, the barriers to growth, remove regulatory and other barriers to growth, entry, and scaling of MNC in rural areas

2. To deepen learners, understanding of BOP consumers, how to develop and market products for these markets

3. Business models give a system-level, holistic approach to explaining how firms do business in emerging economies.

4. Explain how MNC can create and captured value for firms doing business in BOP markets

5. Explain and discuss the effect of MNC in Stimulating economic growth (through taxation and engraining the poor into the global value chain as entrepreneurs and consumers).

Literature Review

Bottom of the Pyramid Concept

Poverty, unemployment, and lack of basic needs make large parts of sub-Saharan Africa. In search of practical solutions, the World Bank, the UN, and bilateral donors are increasingly asking corporates to be resourceful and providing innovative solutions to this problem. Traditional solutions of CSR are questioned and seen as long outdated. International aid flows from north to south are probably over $150 billion annually, a third of which goes to Africa (Haan, 2010); however, often, little has been achieved because of the corruption of rulers of these countries. Development scholars argue that the reason why aid has failed in Africa is because they favor planners rather than searchers, planners have optimistic, overarching goals (eliminate poverty). They are insensitive to the cultural and political underpinning of long-term development. While searcher respects context and empowers individuals especially through markets (Lenz & Pinhanez, 2012). With the increase attention desired at improving the conditions of the world poor, aid agencies are facing greater scrutiny as to the effectiveness of their poverty alleviation efforts, hence the need to explore new approaches to poverty alleviation (London, 2007). Donation-based aid approaches have an impact on poverty alleviating, but they are inherently not economically sustainable; however, market-based approaches offer economically sustainable alternatives; the BOP is one of these approaches. A social, economic concept that segments a vast majority of consumers about four billion of the world's most impoverished population into a market segment that is invisible and unserved. Hindered by barriers which prevent them from realizing the human potential of their benefits, those of their family and that of society at large. Technically a member of the BOP is a part of the world poorest group of the populations that earns less than 2.50 dollars and is excluded from the modernity of globalized civilized society including consumption and choices as well as access to organize financial. The aggregate value of BOP consumption is estimated at up to five trillion dollars. Making it a desirable objective for creating and leading a visionary business throughout the world. This approach argues that businesses can do well by doing well. Social problems are also economic problems. A business can redirect its core operations in such a way that it alleviates poverty and also make profits. By tackling social sector problems, they are forced to stretch their capabilities to produce innovations that have business as well as community payoffs. Previous success and failure of companies from developed countries who lack experiences in BOP markets suggest that the most severe mistake such companies make is attempting to leverage strategies and experiences successful in developed markets to the BOP markets. To be successful, companies must adapt products and services to the needs of a local, low-income customer base while simultaneously achieving the efficiencies traditionally associated with large standardized operations (Fawcett & Waller, 2015).

Partnerships

In the past decades, many multinationals have come up short trying to make a profit by solving the pressing needs of BOP communities. Preoccupied with their social missions, companies have optimistically taken on challenging projects only to be surprised when weak consumer demands and obstacles such as bad roads keep revenue low and costs high (Simanis & Duke, 2014). Faced with these challenges and confronted with high levels of uncertainty and market failure in rural areas due to information asymmetry. MNCs have to look beyond the boundaries of the firms and build efficiency through partnerships, to complement the existing firm resources, knowledge, and competencies and also create value to the customer. Bringing different economic actors/partners with different assets, knowledge, and competencies together to create synergy and value for the customer. The Strength and reliability of the bond among them depend on trust, commitment, openness, and goodwill. Trust among partners leads to improved communication, a higher commitment of organization members, and reduced uncertainty regarding the opportunistic behavior of other person party involved. Also, accordingly reduce transactions and monitoring costs (Beugelsdijk Sjoerd & Smulders, 2003) and allows organization members to take risks, try new things, and boosts innovation. Each partner must understand that they are jointly and individually liable to customer value creation and their mutual survival is dependent on each other responsibly fulfilling their obligations.

Investment in a partnership should also pay off concerning innovation. A knowledge-intense business process that configures existing knowledge assets and resources and explores new knowledge (Jiménez-Jiménez, et al., 2014) to improve performance, solve problems, add value and create a competitive advantage for organizations. Maqsood & Finegan (2009) hypothesize that Knowledge management as an innovation. Its acceptance and application pave the way for other innovations to be useful. Performance differences between firms accrue because of the difference in stocks of knowledge and their differing capabilities in using and developing knowledge. The knowledge that is capable of enhancing innovation is rare and thus difficult to develop by private means alone. External knowledge acquisition is key to organizational imperatives for breaking through learning boundaries. Creating relations with BOPs increases its ability to gain access to a large amount of knowledge that is central and non-redundant. This ordinarily strengthens the ability to innovate. The partnership ability to builds adequate information and knowledge flow through inter-organizational routines among the partners is imperative. Increase in complexity of knowledge in today's dynamic environment has made it increasingly difficult for a single firm to contain and capitalize on all relevant knowledge; hence Inter-firm relationships are used to complement their knowledge (Perez, et al., 2013). Besides, different stakeholders will hoard different knowledge and information about markets and customer needs. MNCs aiming at producing superior products in Kenyan rural areas must then interact and learn from customers, Non-Governmental Organization (NGO), channel members, suppliers, and other external organizations on one on one basis. BOPs need to build a relationship that enables their business partners to share not only explicit knowledge but also store tacit knowledge in their routines created through long-term work experience and problem-solving through trial and error.

An organization has a better chance of making a difference if it knows how its agenda relates to specific social needs, and the community accepts it either for the propriety of the activity in general or their validity as practitioners. However, an organization often faces the daunting task of gaining legitimacy. This is a general perception or assumption that the actions of an entity are desirable, proper, and appropriate in a socially constructed system of norms and definitions (Suchman, 1995). Stronger partners committed to change are critical for the BOP venture gaining legitimacy and sequentially its success. When the community perceives the organization as legitimate, they are more likely to supply resources to the organization; however, an organization that is not perceived as legitimate is vulnerable to claims that they are negligent, irrational, or unnecessary (Tinsley & Agapitova, 2018). Analyzing POB markets suggests that; to successfully sell products in these markets, the consumers must have a common understanding about the product or service feel that it is worth paying for and be willing to develop habits about purchasing and reusing the product or service regularly. BOPS venture survival in rural areas is, therefore, dependent on their ability to gain legitimacy; the general perception that the action of this entity is desirable and appropriate, valuable, worthy of support, and reflects the values of the society. Strong support from partners enables the organization to create legitimacy and helps ensure that new solutions will create systematic change, not languish in separate projects. These partners help business to win legitimacy and access to underserved rural markets.

Multinational Corporation and Foreign Direct Investment in Africa

In Sub-Saharan countries, the resources to finance the optimal level of economic development are in short supply. Hence, as the economies face problems associated with the vicious cycle of poverty, low domestic savings, low tax revenue, low productivity, and limited foreign exchange earnings Mohammed & Ehikioya, (2015); Obayori, et al., (2018). To bridge the gap between the resources available and what is required to advance economic development. The Kenyan government introduced several policy stances to address the challenges of poverty, Corruption, and unemployment (Institute of Economic Affairs, 2017). Embedded in these policies is the need and means to attract more foreign investors with the view to enhance economic growth, create jobs, and supplement domestic expenditure (Masipa, 2018). Attracting foreign investment is, therefore, crucial from several standpoints. First, the consistent and regulated inflow of Foreign Direct Investment (FDI) provides an important source of foreign exchange earnings needed to supplement domestic savings and raise investment levels. Second, the import-substituting investment would serve to reduce the import bill as investments in export industries will directly increase the country’s foreign exchange earnings. It also has a means of transfer of technology (Tsagkanos, et al., 2019) through the participation of Multinational Companies (MNCs) or direct capital involvement in the economy.

The Potential drawbacks of FDI include a deterioration of the balance of payments as profits are repatriated, a lack of linkages with local communities, environmental degradation, social disruptions of accelerated commercialization in less developed countries, and the effects of increased competition on domestic markets (Bekmurodova, 2019). Moreover, some host country perceives an increasing dependence on MNCs as a loss of political sovereignty. And some expected benefits such as technology transfer may prove elusive if, the host economy, cannot take advantage of the technologies know-how transferred through FDI (OCED, 2002).

The benefits of FDI do not accrue automatically and evenly across countries, sectors, and local communities. Policies implemented by the host country to improve the ease of doing business in developing economies influence the level and number of FDI involvement in the host country. These policies aim to enhance the general macroeconomic and institutional frameworks, creation of a regulatory environment conducive to inward functions of FDI and upgrade technology, infrastructure, and human proficiencies to the level required by foreign corporations to realize their full potential. Foreign investors influenced the expected level of profitability and the ease at which subsidiaries’ operations in a host country can be integrated into their global strategies. However, for MNCs operating in BOP markets, local market size, and geographical access to the market location is a key hindrance to these markets. Moreover, in many cases, the profitability of individual investment projects in developing countries may be at least as high as elsewhere (OCED 2002). The measures available to host-country authorities fall into Effect developing countries.

Corruption in Kenya

Corruption refers to behavior that deviates from formal duties because of private gains. Corruption is the greatest obstacle to economic and social development (Papaconstantinou, et al., 2013) (Doh, et al., 2003). The World Bank estimates more than US$ 1 trillion is paid in bribes each year (Papaconstantinou et al., 2013). Transparency International's (2012) Corruption Perception Index shows Sub-Saharan Africa (SSA) has a regional average corruption score of 3.3 of a maximum possible score of ten (with one being highly corrupt) (Luiz & Stewart, 2014). The high levels of corruption in SSA markets present a challenge to MNC operating in these regions. MNC face the operational paradox that involves cost: either participate in corruption in host countries and incur the cost associated with corruption or sacrifice business opportunities (Spencer & Gomez 2011). This raises the issue of how organizations should engage competitors who may or may not share their vision for a corruption-free environment and competitors who gain access to markets based on their corruption. The weak institutional frameworks including inadequate regulatory systems, flawed judiciaries and political systems in these markets, provide settings ripe for corrupt behavior as companies either opportunistically try to exploit these weaknesses or out of frustration succumb to pressure to 'get things done.

Kenya faces a high level of corruption that has penetrated every sector of the economy. A weak judicial system and frequent demands for bribes by public officials lead to increased business costs for foreign investors (EACC, 2018). Widespread fraud in public procurement and tax evasion are rampant. A recent survey carried out by transparent international shows 67% of the Kenyans think corruption increased in the last 12 months, 45% of public service users paid a bribe in the previous 12 months, and 71% believe their government is doing a lousy job of tackling corruption (GCBR & AFRICA, 2019). A similar survey carried out by ethics and anti-corruption commission ranked corruption (43.6%) first as the major problem facing the country, Poverty (37%) was rated second followed by Unemployment (32.2%), Unfavorable economic conditions (22.2%) and political instability (21.8%) respectively (EACC,2018). Corruption is a disincentive for foreign direct investment, net capital inflows (Papaconstantinou et al., 2013), unproductive allocation of scarce resources and the under-provision of both public and private goods (Luiz & Stewart, 2014).

Consequently, corruption has led to overwhelming levels of poverty and inequality experienced in the country, attributed to unequal redistribution of resources, due to ethnic favoritism in resource allocation (Ngunjiri, 2010). The skewed distribution of resources has led to rural areas marginalized, poverty trapped and lagging in economic development. To MNC, the costs of corruption are much more than operational and direct costs (Doh et al., 2003). Merely operating in a country that is perceived to experience high levels of corruption can have a reputational effect on an organization and influence company value or performance (Spencer & Gomez 2011), (Agbiboa 2012). The perception is that they must somehow be complicit in perpetuating high levels of corruption if they can thrive there.

Business Model

Abraham Maslow identified five categories of needs physiological, safety, love, esteem, and self-actualization needs and proposed that physiological needs. One fulfills. Lower level needs to before higher-level needs. Poverty, malnutrition, poor sanitation, and lack of housing remain pressing issues in Kenyan rural economies. Rationally such needs must be fulfilled for consumers to purchase goods that fulfill high levels of needs. However, what BOPs need is not necessarily what they want. It is the responsibility of BOPs first to help consumers understand what they need but paradoxically not to take away their rights to make choices and hence sell to them what they want. According to (Prahalad & Hammond, 2002), it is incorrect to assume that the poor are too concern fulfilling their basic needs and can not waste money on non-essential goods; in fact, the poor often buy "luxury" items. However, selling to the poor can also lead to exploitation and worsening their poverty situation; this can result in poor spending money on luxury products spent on higher priority needs (Karnani, 2007). To successfully do business in Kenyan rural areas, one must understand the unique characteristics and needs of consumers in these markets. Moreover, adjust their business products and business models to meet their expectations. The business venture's product decisions should be driven by incorporating both the needs and wants of the BOPs into their products.

Selling for the poor requires constant interaction, empathy, and a deep understanding of local needs, culture, and habits (Tonelli & Cristoni, 2013). Achieving this requires changes in attitudes, behavior, and strategy. It requires companies to focus on the basics and start their venture with a rigorous understanding of the business environment in these markets, changing attitude behavior and changing the way products are made and delivered (Simanis & Duke, 2014). Companies that underestimate these hurdles miscalculate the resources, innovation capabilities, and the time involved, and the projects team end up poorly equipped to accomplish the task. Value creation is critical in these markets; usefulness and affordability are drivers that eventually determine the success or failure in these markets. As (Tinsley & Agapitova, 2018) notes, the critical challenge in this market is understanding the use of a product and if it is worth buying. Significant to the BOP practice are the principle of mutual value and co-creation. The significance of the company working in equal partnership with BOP communities to create value for BOP consumers, launch and grow a sustainable business and ensures the business model is socially and culturally-appropriate and environmentally sustainable by building off local resources and capabilities and creates value for all partners in terms importance to each. Co-creation a model with the BOPs lies on the principle that companies can harness their customer competencies by engaging with them and move beyond the mere buyer-seller relationship (Tonelli & Cristoni, 2013) to innovate products with them.

The literature on low-cost innovation shows that firms can innovate and market products and services in these markets and enjoy high demand (Winterhalter, et al., 2016). MNCs operating in rural areas, therefore, need to utilize the community to become more involved in the co-creation of value. This requires more collaborative approaches between MNCs, small enterprises, public sector entities, civil society, and the poor. Creating a balance between community interest and market efficiency but maintaining a focus on the brand and corporate mission. Co-creating a new community with a company embedded in its foundation (Simanis & Hart, 2009). One way to design this model is to open up traditionally closed models by engaging users, the poor, the NGOs, the local government, and other interested parties in innovative design, production, distribution, marketing, and sales of products. This provides sustainable solutions to social problems by mobilizing scarce resources (Bhatt & Altinay, 2013). Societal problems among the BOPs can serve as a basis for innovating business solutions and an opportunity to develop reverse innovations (Linna, 2011), leading to disruptive innovations deployed by companies (Schuster & Holtbrügge, 2014). BOP markets are a rich source of innovation and opportunities that need to be nurtured rather than exploited. A good model for business in the BOP markets is, therefore, not a tradeoff between community interest and business profitability (London, 2007) but an inclusive model that directly integrates low-income peoples as entrepreneurs, suppliers, distributors, retailers, employees and consumers (Linna, 2011). A blended value proposition that integrates and affirms the greatest maximization of social, environmental, and economic values within a single firm (Emerson, 2003).

It is, therefore, essential to understand the multiple roles of BOPs both as consumers and producers. As producers, this consumer's key economic activity is agriculture. They face the following difficulties; limited markets and market access, lack of infrastructure, high cost and limited access to improved farm inputs and production technology, lack of access to agriculture credit facilities, and inadequate agriculture extension services. Most of the rural population depends entirely on rain with very little irrigation or modern animal husbandry. Poverty, malnutrition, poor sanitation and lack of housing remain pressing issues in Kenyan rural economies. Such needs must be fulfilled for consumers to purchase goods that fulfill high levels needs. To alleviate poverty in rural areas, the emphasis is to buy from the poor and create efficient markets that capture the full value of their products (Karnani, 2007). BOP literature emphasizes the need to co-create value for their product (Simanis & Hart, 2009); (London, 2007) (Prahalad, et al., 2012). However, the co-creating value for their products seems to be one-sided one must also look at the value of the product produced by the poor and consider co-creating value for their products too. This requires alliances with suppliers of agriculture equipment and buyers of agriculture produce as they venture into these markets. One must be able to stimulate their consumption capabilities by unlocking the rural economies and building the capabilities of the poor.

Therefore, at the foundation of any viable business model for the rural Kenyan markets should be a joint constructed vision of a better life and community and strategic community intent anchored around the new business. Fulfillment of this joint vision is tangled with the business success; business model intimacy instills a sense of responsibility in the community for growth and success of the new business enterprise (Simanis & Hart, 2009). To do so effectively, two interventions are critical, providing access to credit and increasing the earning potential of the poor. Though credit is not available to the poor because of lack of collateral, by harnessing on social capital, the poor should be able to access credit through microfinance institutions. There is a need for BOPs to partner with nontraditional partners. These partners are not the only NGO but must include microfinance enterprises. Microfinance, in general, also aims to overcome the barriers of missing securities, property rights, legal title, and personal documents of the borrower as well as a poor connection to infrastructure to create functioning business environment and investment climate (Hahn, 2012). The poor in rural areas, they have constrained resources, not only financial resources but also entrepreneurial skills for a company that needs to do business in rural areas they must partner with non-traditional partners such as business schools.

Critics of the BOP concepts argue that the cost of doing business in rural areas is incredibly high; for instance, developing environmentally sustainable products require significant research. Likewise, distribution channels and communication networks are inadequate, expensive to develop, and sustain with few local entrepreneurs that lack managerial skills to create this infrastructure (Kolk et al., 2014). The challenges faced by the BOP in rural areas are also entrepreneurial opportunities for the vast majority of the unemployed youth in Kenya. The youth in Kenya accounts for 35.4% of the population with 1,000,000 entering the labor market annually. They offer a dynamic and innovative workforce, have a high uptake of technological know-how, and the ability to take up a significant level of risks (Government of Kenya, 2017). MNCs that seek to enter into the rural Kenyan markets successfully must do so by first identifying the latent potential of the people in this setup and learn to incorporate with other stakeholders to achieve sustainable development (Salminen & Teixeira, 2013). The rural Kenyan youth are resources that cannot be left unutilized as entrepreneurs, consumers, innovators and distributors/marketers of their products.

Central to network theory is reciprocity. This involves a much less precise definition of equivalence, one that emphasizes indebtedness and obligation. This reciprocity is enhanced by taking a long-term perspective (Powell, 1990). Future expectations shape immediate payoff facing current players. For a new venture that wants to do business in rural areas, it takes time to build social capital, trust, and norms of cooperation, relationship stability, and durability for it to be engrained in the rural communities. However, as new ventures becoming part of a community allows people to reinvent themselves, it makes it possible for them to have a different vision of the future (Simanis & Hart, 2009). BOP should not focus on short time costs but focus on investing in their future survival. As western markets get saturated (Prahalad & Hammond, 2002) and have small prospects of economic growth since these markets have short product life cycles and almost completely satisfied needs (Tonelli & Cristoni, 2013). The key focus should be on the customer lifetime value of the youth and lifetime revenue streams for the MNCs. This will enable them to build customer and brand loyalty, and the ability to innovate, transmit and learn new knowledge and skills form them. This may imply lifetime revenue for the corporations. This will enable companies to allocate marketing costs to ideas that generate high customer value away from those that do not generate high customer value. Based on social capital and the value of reciprocity it is expected that the customer lifetime value for consumers in rural areas is going to be high.

Conceptual Model

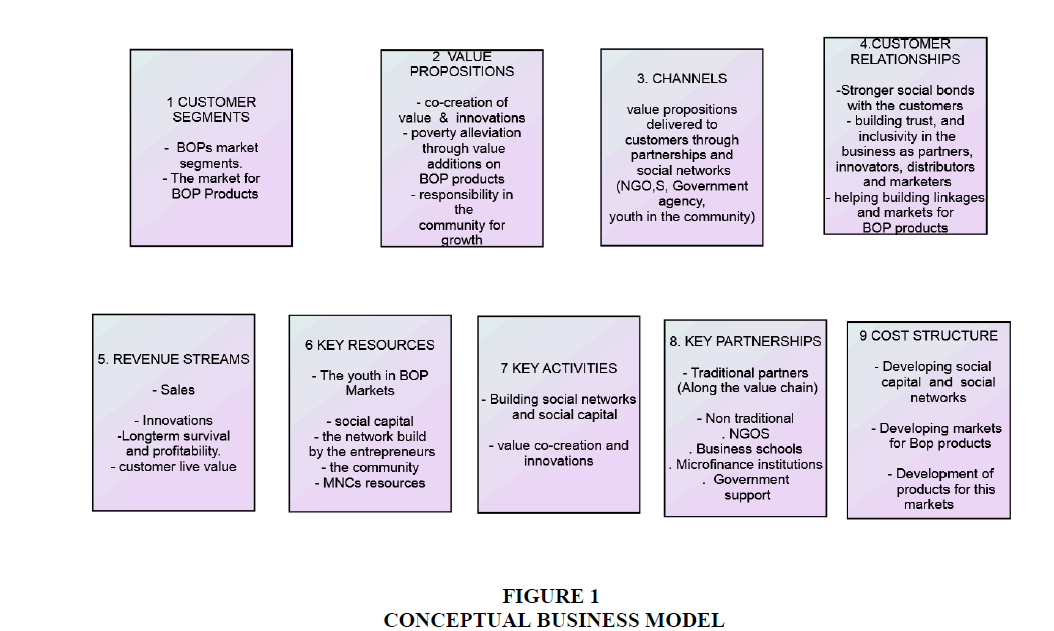

A business model describes an architect for how the firm creates and delivers value to customers and the mechanism employed to capture a share of that value. It is a matched set of elements encompassing the flow of costs, revenue, and profits (Teece, 2017). (Osterwalder, et al., 2010) Canvas model identifies nine building blocks for a business model; customer segments, value proposition, channels, customer relationships management, revenue streams, essential resources, key activities, key partnerships, and cost structure. The conceptual model used in the study is a replica of a canvas model with adjustments to fit into the rural markets.

This model conceptualizes the interdependence between the BOPs as Consumers, producers, and entrepreneurs carrying business in the rural area and MNC that work in this market as one business with a shared vision profitable MNC business and a better community for the BOP market. To carry out their business, profitably, MNC must stimulate economic growth in the rural markets. To attain these MNCs need to go beyond their business boundaries and consider BOPs as the needs of BOPs as their business partner (Figure 1).

Methodology

Secondary data research included an exhaustive search of relevant publications. The primary source of information was Safaricom annual reports from 2015- 2019, company websites, related articles in newspapers and journals.

Safaricom Case Study

For over 19 years, Safaricom has built a company that has a vast impact on the Kenyan economy. Safaricom is, on average, annually contributes to 6.5% of Kenya's GDP. Over the years, the company has created 845,000 sustainable jobs. This includes over 156,000 agents who run MPESA as a standalone business or have incorporated it into their retail business. The total social impact of M-PESA in 2016 was estimated to be Shs185bn. Most of the value arose from Mobile money transfer (M-PESA) customers being able to receive, save, access credit, and send money freely and jobs created by M-PESA agents. Besides, an estimated amount of Shs0.66 was added to the Kenyan economy for every Shs1 invested in infrastructure money that developed over the past decade. Besides its usual business

Customer Segments

The first part of the model concerns about customer segment. This includes developing BOP markets and developing markets for BOP products. By enabling consumers to have access to a market. MNCs are in a better position to improve their livelihood. This leads to more profitable business as consumers are in a position to buy their products. Safaricom is one of the successful MNCs in less developed countries. Its survival, growth, and success depend on its ability to transform lives through strategies that touches the lives of shareholders, customers, and other stakeholders. Safaricom customer base encompasses the full spectrum of individuals and organizations across Kenya. They are divided into two segments consumer and business enterprise. The Consumer customers segment is individual purchasers of goods and services. While enterprise clientele includes business ranging from small-to-medium enterprises (SMEs) to large corporate firms. The company has 196,000 enterprise customers split into three major segments. Large Enterprises; Small and Medium Enterprises (SMEs); and Small Offices-Home Offices (SOHO).

Besides its regular business, Safaricom continues to provide life-changing solutions in health, education, agriculture, energy sector, and access to clean water in slum areas through products like M-TIBA, Eneza, and M-KOPA. For instance, beyond providing mobile money services, the company has entered into a partnership with SHOFCO, an NGO that aims to scale up the provision of clean water to the Kibera community in a slum in Nairobi, without disturbing life patterns in the settlement. Safaricom provides free data and highly subsidized internet connectivity to SHOFCO's satellite centers in Kibera and Mathare slums, enabling library users and the youth in the areas to access the internet. In refugee camps in northern Kenya, Safaricom, through Bamba Chakula, provides refugees with the opportunity to purchase their food courtesy of a mobile food voucher system.

Value Proposition

MNCs have to build a community of consumers anchored around their products; this requires that they co-create value with BOPs for their products. However, there is needed to relook at BOPs as producers hence the need to enhance their ability to add value to their product. MNCs must take the lead in solving community problems, climatic changes as they are better positioned and have the social capital to do so. Safaricom is a leading telecommunication services company in Kenya, providing a comprehensive range of integrated solutions including voice and data (both mobile and fixed), SMS, internet, and financial services. The company continues to tailor products to meet the ever-changing needs of Kenyan consumers. Its key product Mpesa is embedded in the Africa collective culture. A key to the success of M-Pesa is that it benefits from what is called ‘network effects.’ Kenya is categorized as a collective society community resources are effectively allocated as children, the elderly and the sick are collectively cared for. Individual’s members of a community internalize the norms, values, and goals of the community; they see themselves as psychologically intertwined with the fate of the community. Individuals expect their relatives, clan and the in-group to take care of them in exchange for unquestionable loyalty (Hofstede, 1984). Many Kenyans who work in cities use the system to send money back to relatives in their home villages and M-Pesa allows them to do this safely without the risks of robbery or the inconvenience of having to make the journey. These strong interpersonal relationships shared of norms, beliefs, values, trust, cooperation, and unquestionable reciprocity is the strength of this community and a critical economic resource that nurture the development of capabilities in a community (social capital). Apart from the financial enabling role, that M-PESA plays in the lives of more than 20 million Kenyans. To stimulate Kenyan economic growth, Safaricom has ventured into MFI micro-finance savings and loan service, which helps low-income Kenyans to access banking services and credit services. And the Lipa Na M-PESA merchant service, which entrepreneurial and SME to carry out receive cash payment through MPesa and also make payment through Mpesa services.

In addition to developing its products, the company continues to co-create value for the BOP markets products and help solve social problems. For instance, the Kenyan music industry struggled with copyright infringement and piracy major threats to Creativity. Recently it introduced Songa music-streaming app aimed at supporting local artists and offers consumers access to about 3 million songs, this application ensures content providers receive 65% of revenues generated through royalty payments. The company also launched a new Interactive Voice Recognition (IVR) M-PESA balance inquiry service for visually impaired people. To reduce cases of fraud when they transact on M-PESA, enabling them to stop their reliance on third parties in handling their cash deposits and withdrawals.

To improve its value proposition, the company has recently launched an innovation hub, Alpha. To enable it to come up with more innovative products focused on critical issues that affect Kenyans access to health services, education, agriculture, and payments, as well as capture insights that will help the business tap into the full range of opportunities offered by Big Data. Some of these innovations have successfully transitioned into commercial business units. These innovations include M-TIBA and Digifarm, two services that are successfully leveraging the power of mobile technology to drive sustainable growth while addressing local challenges in healthcare and agriculture. Safaricom Alpha, coupled with Safaricom Spark Venture Fund, has enabled techpreneurs to access to mentors, funds, and other resources to enable them to expand their businesses. Spark venture fund has invested in six Kenya-based startups in agriculture, education, logistics and E-Commerce. This includes Sendy; A successful logistics firm with population coverage of over 6 million is linked to e-commerce segment and deliver products to the consumer (home) and enterprise (office) deliveries using motorcycles, pickups, vans and 3-ton trucks.

Msurvey; provides a platform for conducting mobile-based surveys and seeks to simplify access to credible, on-demand, real-time customer data to their clients. The platform is a success and has over 17 million unique consumers have interacted with the platform to-date. The mSurvey platform is used regionally for first-hand customer intimacy surveys by Pan- African banks, hospitals, energy companies and others. Safaricom has also collaborated with mSurvey to offer Net Promoter Score to Lipa Na M-Pesa merchants Eneza an education platform; Many children in Kenya lack access to relevant learning materials which can affect performance in school. Eneza platform leverages simple SMS and USSD technology to provide primary and secondary school students with learning content for revision purposes. The platform, close to two million active users, offers learners unlimited lessons and assessments at Shs10 per week. The amount that users pay per week to access lessons. The platform enables learners to access 4.6 million exam questions, lessons, textbooks, and even ask questions to teachers.

Lynk 4; Provides an opportunity to link their customers with professionals in various fields, such as farmhands, house helps, waiters, chefs or carpenters Farmdrive; Agriculture is the most significant economic activity in Sub Saharan Africa. The application demystifying and lower lending risk by providing a model that helps small- scale farmers get access to financial services.

Channels

By building social capital, the model recommends that MNC must build and use social capital and building the capabilities of the local community to assist in the distribution and marketing of their products. To substitute and complement media in cases where media communication is not well developed.

Safaricom has a network of 400 ‘active' dealers across Kenya that sell data, devices, and airtime on behalf of Safaricom. The company has focused on helping each dealer create successful businesses. This includes providing capital financing in times when the economy is not performing like after general elections to cushion them against these effects and decreased consumer purchasing power. Most BOPs lack skills to run a successful business the company offers country-wide training to its dealer outlet managers on basic finance skills and book-keeping, stock management and customer service skills. The company hosted an annual Dealer of the Year Awards (DOYA) to recognize and reward dealers who have performed well in different areas of the sales environment while maintaining high standards. The company also supported dealers in meeting the regulatory subscriber registrations requirements with software Applications. Other than dealers, the company has 156,000 M-PESA agents; the company expects an additional 14,000 agents in 2019 and 10,000 in 2020. Countrywide.

Customer Relationships

MNC Should builds strong bonds with the BOP markets and incorporates them into their business as consumers, producers, innovators, suppliers. Though revenue in this market may not be immediate, MNCs must consider the lifelong value of consumers in this market, most of these consumers in these markets are young by building loyalty and designing products for these markets they are likely to use their products for more than 20 years hence the firm will eventually reach its equilibrium.

Safaricom has built value through relationships with 29.6 million customers. The company continually meet the needs and expectations of Kenyan's by extending its core business to include partnering with government, communities, NGOs, and individuals to empower and uplift Kenyans, by enabling them to have access to health and education, and agricultural services; as well as providing access to transformative mobile communications solutions. The company continues to incorporate a large number of Kenyan youth in their products. The company continued to launch products one key product that targets the youth is BLAZE a network for the young by Safaricom that enables them to get access to mentorship programs; have access to finances to set up businesses, develop business plans, networking, and the embed in them the discipline they require to be successful entrepreneurs.

From the classroom to the boardroom, Safaricom believes in promoting technology among learners. Safaricom’s Women in Technology (WIT) have collaborated with Technovation to sponsor a three months app development and mentorship program aimed at cultivating women's interest in Science, Technology, and Engineering and Mathematics (STEM) studies.

Revenue Streams

The revenue streams for this market includes sales, innovations that a setup. Safaricom principal business is the provision of telecommunication services. Safaricom airtime can is bought as scratch cards or PIN-less top-ups through dealers, own-retail centers spread across the country. Customers can also purchase airtime through M-PESA, emergency top up and direct top up for bulk purchases. From the financial statement as indicates below, the key revenue sources are voice revenue and mobile money transfer, followed by data and SMS revenues.

Voice and SMS Revenue

Voice and SMS enable customers to make calls and send text respectively within and outside the network. Customers top up their phones buying prepay cards from dealers, retail outlets, by using M-PESA or borrowing credit. Customers can also borrow and receive airtime from (friends, relatives) other subscribers or subscribe to various tariffs billed monthly based on fixed charge or usage.

Data Revenue

Mobile data enables customers to access the Internet. Customers top up their lines by purchasing credit or data bundles in advance or get credit based on the tariff subscribed.

Other Service Revenue

This revenue stream includes access fees charged on emergency top-up services when a customer borrows airtime (Okoa Jahazi) or data bundles (Okoa Data) with the debt being repayable within five days and a rental fee charged for codes allocated to premium rate services providers. This also includes (sale of mobile phone handsets, starter packs, Sim swaps and other accessories sold through dealers and own-retail centers spread across the country (Table 1).

| Table 1: Safaricom Revenue Streams | |||||

| 2015 | 2016 | 2017 | 2018 | 2019 | |

|---|---|---|---|---|---|

| Voice revenue | 87,368 | 90,802 | 93,459 | 95,639 | 95,938 |

| M-Pesa revenue | 32,626 | 41,500 | 55,084 | 62,907 | 74,990 |

| Mobile data revenue | 14,823 | 21,154 | 29,289 | 36,357 | 38,687 |

| Fixed data revenue | 3,128 | 3,815 | 5,242 | 6,673 | 8,191 |

| SMS revenue | 15,671 | 17,328 | 16,679 | 17,721 | 17,496 |

| Other service revenue | 2,631 | 3,185 | 4,356 | 5,237 | 5,001 |

| Total Service revenue | 156,247 | 177,784 | 204,109 | 224,535 | 240,303 |

| Handset and other revenue | 7,117 | 8,621 | 8,700 | 8,980 | 9,584 |

| Construction revenue | 9,280 | 76 | 202 | 603 | |

| Other income | 576 | 232 | 2,511 | 510 | 464 |

| Total revenue | 163940 | 195,917 | 215,396 | 234,227 | 250,955 |

Key Resources

Critical resources for these markets include social capital, the youth, and innovations as discussed in value propositions. Safaricom key resources include; Mpesa platform

M-PESA is a mobile phone service platform that enables customers to deposit, transfer and withdraw money or pay for goods and services using a mobile phone. This service is available to all Safaricom Limited subscribers. The company has the leading mobile money transfer platform in the country, with 24,206,341 active customers 162,800 agents with 102,337 merchants accepting Mpesa transactions as a mean of payment countrywide. In twenty seventeen, the value of transactions carried out on Mpesa was Shs6.9trn.

Capital Resources

Safaricom shareholding structure comprised of the Government of Kenya (35 percent), Vodacom (35 percent), Vodafone (5 percent), and free float (25 percent). The majority of Safaricom's shareholders (96%) are local individuals who hold a maximum of 10,000.

Human Resources

Safaricom has Permanent 4,376 and 1,180, contract employees. These employees are of diverse skills, knowledge, and experience. The company has built a conducive working environment that ensures diversity and inclusion, enables talent and career growth, and promotes employee wellbeing, as well as providing equal status, rights and opportunities to all employees.

Key Activities

Marketing, building markets in BOP markets, and developing products for these markets. Safaricom continues to build social capital by empowering dealers through financial services and training. The company has also continuously come out with innovative solutions as discussed in value propositions and partnerships.

The company also engages in CSR activities as either sponsors or organizers this includes Safaricom International Jazz Festival is the most prominent jazz event in East and Central Africa; Safaricom Youth Orchestra; East Africa Safari Classic Rally, Safaricom Athletics Series, Chapa Dimba na Safaricom (football) and Safaricom Rugby Sevens and finally sponsoring sportsman of the Year Awards (SOYA). This has the company to unify Kenya's through sports and music and also reach a broadening the company's reach and allowing it to connect with a diverse audience.

Partnerships

Key partners include traditional partners along the organization value chain, but this also includes non-traditional partners. NGOs often know these markets hence the need to incorporate them in social marketing, to stimulate economic development in this region MNCs need partnerships with MFIs and Business school. To incorporate skills entrepreneurship skills among this consumer.

The company business partners include suppliers, dealers, and agents. This comprises of comprised of 1,164 suppliers, 440 ‘active' dealers and 156,000 M-PESA agents. The company relied heavily on them both an operational perspective and in terms of reputation as they are the interface with many relevant stakeholders. The company spent KES 85.6 billion on products and services in 2018. Local suppliers forming the majority of the suppliers, about 83 percent of providers remaining were from local companies hence stimulating the growth of the Kenyan economy.

Safaricom Data has collaborated with CCTV, to provide business owners access to information. In particular, SMEs that had in the past been locked out by high costs of installing and maintaining high-speed connectivity. Safaricom partnership with Craft Silicon led to the creation of little, a taxi app that brings customers and taxi drivers together. Little is a Kenyan innovation a competitor to the uber taxi.

Safaricom has also collaborated with NGO to provide services beyond mobile money services, M-PESA has partnered with SHOFCO to the provision of clean water to the Kibera community in Nairobi, without disturbing life patterns in the settlement.

To further drive financial inclusion, Safaricom partnered with Commercial Bank of Africa (CBA) and Kenya Commercial Bank (KCB) to offer microfinance services (Mshwari) and KCB-M-PESA services. These services users to save as little as one Kenyan shilling and get loans from K Shs50 to Shs1 million.

In camps in northern Kenya (Dadaab and Kakuma refugee camps), Safaricom has partnered with World food programs to provide refugees with the opportunity to purchase their food courtesy of a mobile food voucher system known as Bamba Chakula. This eliminated chances of corruption and saves refugees from having to endure the indignity of financial access levels in the country from and reduced the cost of distributing relief queuing for food rations. This has created jobs and business opportunities for people in refugee camps restoring dignity to thousands of refugees instead of lining up for food rations-digitalizing food distribution. Safaricom has also partnered with the Kenya Red Cross to develop Msalama a disaster management platform that sends early warning information on natural disaster alerts to subscribe. Msalama enables Kenyans to register as volunteers with the KRCS. Safaricom has also partnered with Strathmore business school to provide educational services to M-Pesa foundation school.

Cost Structure

Key cost structures include developing BOP markets and markets for BOP products and building social networks and social capital. In addition to these, it also includes costs involved in day to day running of the business (Table 2).

| Table 2: Safaricom Expenses From 2015-2019 | |||||

| 2015 | 2016 | 2017 | 2018 | 2019 | |

|---|---|---|---|---|---|

| Direct costs | (56,709) | (62,310) | (66,750 | (70,555) | (71,818) |

| Construction costs | (9,280) | (76) | (202) | (603) | |

| Operating expenses | (36,040) | (41,261) | (44,961) | (50,636) | (53,590) |

| Depreciation & amortisation costs | (25,570) | (27,943) | (33,234) | (33,568) | (35,331) |

From the financial records, the essential costs include direct costs which include M-PESA commissions; Airtime commissions; Licence fees (spectrum, M-PESA and link leases) Interconnect and roaming costs Handset costs; Customer acquisition and retention; Value-added services costs (Voice and SMS) Other direct costs. The main construction costs are the National Police Service contract costs.

The operating expenses costs include the following; Repairs and maintenance expenditure on property, plant, and equipment; Operating lease rentals – buildings; Operating lease rentals – sites; Warehousing costs; Employee benefits expense Auditor’s remuneration; Sales and advertising; Consultancy including legal fees Network operating costs; Travel and accommodation Computer maintenance Office upkeep; Bad debts; Net foreign exchange losses, other than on borrowings and cash and cash equivalents Other operating expenses Other significant costs include depreciation rates and impairment of property, plant, and equipment.

Taxation and regulatory environment

The company operates in a complex environment, heavily regulated environment, and must comply with a multitude of local and international laws. These include laws relating to data privacy, antimony laundering; competition; anti-bribery, and economic sanctions. Failure to comply with these laws could lead to reputational damage, financial penalties, or suspension of our license. The rundown success of the mobile money further exposes it to money laundering and terror financing related risks. Safaricom is licensed and operates under the Communications Authority of Kenya (CA). CA mandated to oversees and ensured mobile network operators are delivering services of adequate quality. And are adhering to the provisions of the Kenya Information and Communications Act, 1998 and the Kenya Communications Regulations, 2001. CA is responsible for policy and strategy development and implementation with regards to telecommunications services. Besides, the Authority reviews the sector to ensure that competition is fostered and to guard against anti-competitive behavior by licensed operators. Lastly, the commission provides pricing guidelines to ensure communication service affordability.

Taxation on mobile phone-based transactions and airtime continues to increase over time. As the subsector and has an increasing turnover of formal transactions by both formal and informal enterprises. In addition to 2003 excise tax on airtime, Kenya has increasingly introduced and increased taxes on mobile phones, computer hardware, and software. In 2018 Finance Act Kenya increased the excise tax from 10% on money transfer to 20 percent, on telephone services (airtime) to 15 percent, on mobile phone-based financial transactions to 12 percent, and introduced 15 percent excise tax on internet data services and fixed-line telephone services (Ndung' u, 2019). Hence the mobile communications industry is subject to unpredictable and higher direct and indirect taxes, as seen in the recent past years. The country's economic growth is affected by the general election; for instance, 2018 was on the rebound following the slow growth in 2017 after the general election. However, the country is still battling increased taxation and inflation as well, leading to a marginal weakening of the Kenyan currency the Shilling. The decline in economic growth has resulted in a reduction of disposable incomes and spending power of the people of the consumers. Kenyan main economic activity is agriculture; hence, a delayed rainfall leading to drought in some parts of the country further erodes the purchasing power of our consumers.

However, the company remains the most profitable telecommunications company in East Africa. In 2019 the company tax contributed to 6.5 percent to Kenya's GDP through direct and indirect taxes. The tax fee paid to the government from 2015 to 2019 is highlighted below. Safaricom has topped the list of the highest taxpayer in Kenya for seven consecutive years from 2007 to 2014. The company paid has paid a total of KSh 698.5 billion in fees, duties, and taxes to the government since its inception in 2000. The Table 3 highlights taxes paid to the government for the last five years.

| Table 3: Safaricom Tax Expenses From 2015-2019 | |

| Year | Tax paid in millions |

|---|---|

| 2015 | (14,278) |

| 2016 | (17,658) |

| 2017 | (22,188) |

| 2018 | (24,620) |

| 2019 | (28,460) |

Conclusion

Doing business in developing economies like Kenya is difficult because of resource scarcity especially in rural areas. In the past, most MNCs have found it challenging to acquire relevant and valuable resources, to create value for these consumers, launch and grow a sustainable business. A good model for business in the BOP markets is one that integrates and affirms the greatest maximization of social, environmental and economic values within a single firm. Therefore, the critical challenge in designing the model for this market is how to combine and maintain a balance between low cost, good quality, sustainability, and profitability and integrate all stakeholders in value creation Safaricom offers a viable business model for this market, as they are socially and culturally appropriate and environmentally sustainable building value off local resources and capabilities. The company is harnessing customer competencies by engaging with them beyond the mere buyer-seller relationship to innovate products with them. Their strength and survival largely depend on how they understand consumers' needs and how they create, enhance, retain and most importantly utilize social capital and preserving the existing social capital.

References

- Ansari, S., Munir, K., & Gregg, T. (2012). Impact at the “Bottom of the Pyramid”: The role of social capital in capability development and community empowerment. Journal of Management Studies, 49(4), 813–842. https://doi.org/10.1111/j.1467-6486.2012.01042.x

- Bekmurodova, G. (2019). Theoretical Features of FDI (Foreign Direct Investment) and its influence to Economic Growth. Journal of International Business Research and Marketing, 4(5), 13-18. https://doi.org/10.18775/jibrm.1849-8558.2015.45.3002

- Emerson, J. (2003). The Blended Value Proposition: Integrating Social and Financial Returns. California Management Review, 45(3), 32–52.

- Ethics and Anti-Corruption Commission. (EACC) (2018). National Ethics Review. In the National Ethics and Corruption survey,

- Fawcett, S.E., & Waller, M.A. (2015). Designing the Supply Chain for Success at the Bottom of the Pyramid. Journal of Business Logistics, 36(3), 233–239. https://doi.org/10.1111/jbl.12096

- GCBR, & AFRICA, G.C.B. (2019). GLOBAL CORRUPTION BAROMETER AFRICA 2019 CITIZENS ’ VIEWS

- Government of Kenya. (2017). Kenya Youth Agribusiness Strategy 2017-2021. REPUBLIC OF KENYA, 1–60. Retrievedfrom https://africa.ypard.net/sites/default/files/resources/kenya_youth_in_agribusiness_strategy_2017-2021_a.pdf

- Haan, A. de. (2010). Aid: The Drama, the Fiction, and Does it Work? Indian Journal of Human Development, 4(2), 233-252. https://doi.org/10.1177/0973703020100202

- Hahn, R. (2012). Inclusive business, human rights and the dignity of the poor: A glance beyond economic impacts of adapted business models. Business Ethics, 21(1), 47–63. https://doi.org/10.1111/j.1467-8608.2011.01640.x

- Hofstede, G. (1984). Cultural dimensions in management and planning. Asia Pacific J Manage, 1(2), 81–99. https://doi.org/10.1007/bf01733682

- Institute of Economic Affairs. (2017). Policy Debate on 5 Socio-economic Issues in Kenya : Elections 2017 Policy Debate on 5 Socio-economic Issues in Kenya : Elections 2017. Institute of Economic Affairs.

- Jiménez-Jiménez, D., Martínez-Costa, M., & Sanz-Valle, R. (2014). Knowledge management practices for innovation: a multinational corporation’s perspective. Journal of Knowledge Management, 18(5), 905–918. https://doi.org/10.1108/JKM-06-2014-0242

- Karnani, A.G. (2007). Fortune at the Bottom of the Pyramid: A Mirage. Working Papers (Faculty) -- University of Michigan Business School, (1035), 1–1. https://doi.org/10.2139/ssrn.914518

- Kolk, A., Rivera-Santos, M., & Rufín, C. (2014). Reviewing a Decade of Research on the " Base/ Bottom of the Pyramid " (BOP) Concept. Business & Society, 53(3), 338–377. https://doi.org/10.1177/0007650312474928

- Lenz, A., & Pinhanez, M. (2012). A business strategy contribution to poverty alleviation and sustainable development: the Base-of-the-Pyramid theorys validity and inadequacies. Transformare.Adm.Br. Retrieved from http://www.transformare.adm.br/anais/Anna-Katharine-Lenz-and-Monica-Pinhanez-A-business-strategy-contribution.pdf

- Linna, P. (2011). Community-level entrepreneurial activities : Case study from rural Kenya, 1(April), 8–15.

- London, T. (2007). A Base-of-the-Pyramid Perspective on Poverty Alleviation Working Paper. Development, (March), 1-46. https://doi.org/10.5465/AMBPP.2008.33716520

- Luiz, J.M., & Stewart, C. (2014). Corruption, South African Multinational Enterprises and Institutions in Africa. Journal of Business Ethics, 124(3), 383-398. https://doi.org/10.1007/s10551-013-1878-9

- Maqsood, T., & Finegan, A.D. (2009). A knowledge management approach to innovation and learning in the construction industry. International Journal of Managing Projects in Business, 2(2), 297-307. https://doi.org/10.1108/17538370910949310

- Masipa, T.S. (2018). The relationship between foreign direct investment and economic growth in South Africa: Vector error correction analysis. Acta Commercii, 18(1), 1–8. https://doi.org/10.4102/ac.v18i1.466

- Mohammed, I., & Ehikioya, I. L. (2015). Macroeconomic Determinants of Economic Growth in Nigeria: A Co-integration Approach. International Journal of Academic Research in Economics and Management Sciences, 4(1), 34–46. https://doi.org/10.6007/ijarems/v4-i1/1485

- Obayori, J.B., Chidinma, C., & Anokwuru, G. (2018). Determinants of Foreign Direct Investment Inflow in Tanzania. European Journal of Economic and Financial Research, 18(1), 53–65.

- OCED. (2002). Foreign direct investment - support for development. ORGANISATION FOR ECONOMIC CO-OPERATION AND DEVELOPMENT, 16(11), 95–97.

- Papaconstantinou, P., Tsagkanos, A. G., & Siriopoulos, C. (2013). How bureaucracy and corruption affect economic growth and convergence in the European Union: The case of Greece. Managerial Finance, 39(9), 837–847. https://doi.org/10.1108/MF-12-2009-0143

- Pels, J., & Sheth, J.N. (2017). Business models to serve low-income consumers in emerging markets. Marketing Theory, (April), 1–19. https://doi.org/10.1177/1470593117704262

- Perez, L., Whitelock, J., & Florin, J. (2013). Learning about customers: Managing B2B alliances between small technology startups and industry leaders. European Journal of Marketing, 47(3), 431–462. https://doi.org/10.1108/03090561311297409

- Powell, W.W. (1990). Neither market nor hierarchy. Research on Organizational Behavior (Vol. 12). https://doi.org/10.1007/BF03059442

- Prahalad, C.K., Di Benedetto, A., & Nakata, C. (2012). Bottom of the pyramid as a source of breakthrough innovations. Journal of Product Innovation Management, 29(1), 6–12. https://doi.org/10.1111/j.1540-5885.2011.00874.x

- Prahalad, C.K., & Hammond, A. (2002). Serving the world’s poor, profitably. Harvard Business Review, 80(9), 48. https://doi.org/10.1108/02756660710732611

- Salminen, J., & Teixeira, J. (2013). Critical Assessment of Value Propositions and Marketing of Technology Startups: Evidence from Finland, (March). Retrieved from http://www.absrc.org/index.php/proceedings-venice-2012

- Samuel Craig, C., & Douglas, S.P. (2011). Empowering rural consumers in emerging markets. International Journal of Emerging Markets, 6(4), 382–393. https://doi.org/10.1108/17468801111170374

- Sharma, N.K. (2014). Globalization and its Impact on the Third World Economy. Crossing the Border: International Journal of Interdisciplinary Studies, 1(1), 21–28.

- Simanis, E., & Duke, D. (2014). Profits at the bottom of the pyramid: A tool for assessing your opportunities. Harvard Business Review, 92(10), 86–93.

- Simanis, E., & Hart, S. (2008). The Base of the Pyramid Protocol: Toward Next Generation BoP Strategy. Innovations: Technology, Governance, Globalization, 3(1), 57–84. https://doi.org/10.1162/itgg.2008.3.1.57

- Simanis, E., & Hart, S. (2009). S U S T A I N A B I L I T Y & I N N O VAT I O N Innovation From the Inside Out THE LEADING. MIT Sloan Management Review, (50414).

- Tinsley, E., & Agapitova, N. (2018). Reaching the last mile: Social Enterprise Business Models for Inclusive Development. openknowledge.worldbank.org (Vol. 1978).

- Tonelli, M., & Cristoni, N. F. (2013). BoP and MNCs: Where is the Market and Where the Source of Innovation? Academic Journal of Interdisciplinary Studies, (October). https://doi.org/10.5901/ajis.2013.v2n8p184

- Tsagkanos, A., Siriopoulos, C., & Vartholomatou, K. (2019). Foreign direct investment and stock market development: Evidence from a “new” emerging market. Journal of Economic Studies, 46(1), 55-70. https://doi.org/10.1108/JES-06-2017-0154

- Winterhalter, S., Zeschky, M.B., & Gassmann, O. (2016). Managing dual business models in emerging markets: An ambidexterity perspective. R and D Management, 46(3), 464–479. https://doi.org/10.1111/radm.12151