Case Reports: 2024 Vol: 30 Issue: 3

Transforming Regulatory Compliance and Customer Service: A Saga of Innovation of BankIslami

Waqar Ahmed, Superior University

Waqar Ahmed, Superior University

Citation Information: Ahmed, W. & Rafiq, M. (2024). Transforming regulatory compliance and customer service: A saga of innovation of bankislami. Journal of the International Academy for Case Studies, 30(3), 1-9.

Abstract

This case study purpose is to find out how to overcome the issues/problems facing by a reputable bank and take it to the new heights of innovation. During this pivotal meeting, the leadership confronted a dilemma that transcended mere operational inefficiencies. The regulatory environment, particularly the ever-tightening grip of anti-money laundering (AML) and know your customer (KYC) regulations, loomed large. The intricate dance between compliance and customer satisfaction became the focal point of discussion, and the need for a transformative solution became evident. Mr. Sarim, the Digital Delivery Channel Team Lead, whose strategic mindset, operational prowess, and reflexive approach have propelled the bank to unprecedented heights. His visionary leadership has not only steered the institution through the complexities of regulatory compliance but has also redefined customer service excellence in the face of rapid digital evolution.

Keywords

Bank's financial strength, Regulatory Compliance, Customer Satisfaction, Digital Delivery Channel, Mr Sarim Team Lead.

Introduction

In the hushed confines of a high-stakes senior management meeting at Bankislami, the air was thick with tension. The digital age was in full swing, yet the bank struggled to provide the level of customer service expected in a rapidly evolving financial landscape. Customer queries lingered in a seemingly endless queue, eroding trust and challenging the bank's reputation.

During this pivotal meeting, the leadership confronted a dilemma that transcended mere operational inefficiencies. The regulatory environment, particularly the ever-tightening grip of anti-money laundering (AML)1 and know your customer (KYC) regulations, loomed large. The intricate dance between compliance and customer satisfaction became the focal point of discussion, and the need for a transformative solution became evident.

Background

One of the fundamental pillars of banking is regulatory compliance The bank, established in 2006 and celebrated as a paragon of financial excellence, found itself entangled in a web of challenges and in the case of this Islamic bank, the stakes were higher due to the intricacies of anti-money laundering (AML) and know your customer (KYC) regulations specific to Islamic finance. The bank had been finding it increasingly difficult to provide exceptional customer service and respond to customer queries promptly while adhering to these stringent regulations. As the financial landscape continued to shift and regulatory expectations became more stringent, the bank faced a daunting task.

The banking sector in Pakistan has undergone significant evolution since the country gained independence in 1947. Initially characterized by a few established banks inherited from the pre-partition era, the sector gradually expanded with the nationalization of banks in the 1970s. The 1990s witnessed a transformative phase marked by financial liberalization and the introduction of modern banking practices. This period saw the emergence of private banks, which brought competition and innovation to the industry. The State Bank of Pakistan, the central bank, played a crucial role in implementing reforms to enhance the sector's stability and efficiency. The banking landscape diversified with the introduction of Islamic banking, catering to a growing segment of the population seeking Sharia-compliant financial services. Over the years, technological advancements have further reshaped the sector, with online banking, mobile banking, and digital payment solutions becoming integral components. Despite facing challenges such as economic fluctuations and regulatory adjustments, the banking sector in Pakistan continues to play a pivotal role in fostering economic growth, facilitating trade, and promoting financial inclusion.

Since the establishment of the State Bank of Pakistan in 1948 as the country's central banking authority, the early years of the banking sector were marked by a predominantly state-controlled system.

This period saw the denationalization and privatization of several banks, encouraging the entry of private banks and foreign financial institutions. The move aimed to inject competition, efficiency, and innovation into the banking landscape.

The State Bank of Pakistan played a crucial role in overseeing these reforms, implementing policies to strengthen the regulatory framework, enhance risk management, and ensure the stability of the financial system. The establishment of the Securities and Exchange Commission of Pakistan (SECP)2 in 1997 further contributed to the regulatory environment, overseeing non-banking financial institutions and capital markets.

In addition to conventional banking, the late 1990s also witnessed the introduction of Islamic banking in Pakistan. Responding to the needs of a sizable population seeking financial products compliant with Islamic principles, Islamic banks and Islamic windows of conventional banks have since expanded, offering Sharia-compliant banking services.

Technological advancements have significantly impacted the sector in recent years. The widespread adoption of online banking, mobile banking apps, and digital payment solutions has transformed the way customers interact with financial institutions. This digitization has not only improved accessibility for urban areas but also extended financial services to remote regions, contributing to the goal of financial inclusion.

Despite these positive developments, challenges such as non-performing loans, regulatory compliance, and economic instability persist. The banking sector in Pakistan remains dynamic, adapting to global trends and local challenges while continuing to serve as a critical engine for economic development and financial stability in the country.

Key Success Factors

Customer Service Implications

The bank's struggle to provide exceptional customer service indicates the impact of regulatory compliance on the customer experience. Lengthy KYC processes and enhanced due diligence measures result in delays and frustrations for customers, potentially affecting customer satisfaction and retention.

Customer Dissatisfaction

The bank's struggle to balance regulatory compliance with customer service results delays in processing customer requests, account openings, and transactions. Customers become frustrated with the extended timelines, impacting their overall satisfaction.

Competitive Disadvantage

Other banks in the market that manage to strike a better balance between regulatory compliance and efficient customer service has got a competitive edge. Customers has drawn to banks that offer smoother services while still adhering to necessary regulations.

Reputation Damage

News of delays, inefficiencies, or complications related to compliance issues harms the bank's reputation. In the age of social media and instant communication, negative publicity spread quickly, leading to a loss of trust among existing and potential customers.

Increased Operational Costs

To meet evolving regulatory expectations, the bank has to invest heavily in sophisticated compliance infrastructure, leading to increased operational costs. This has affected the bank's profitability and, in turn, its market competitiveness.

Customer Attrition

Dissatisfied customers seek alternatives, leading to customer attrition. If competing banks offer similar Islamic financial products and services with more efficient processes, customers may be inclined to switch, further eroding the bank's market share.

Mr. Sarim, the new Team Lead of the Digital Delivery Channel. A seasoned professional with a penchant for innovation, this leader stepped into the fray with a determination to untangle the complexities and redefine the narrative for Bankislami.

Tactical Handlings

The appointment of the Digital Delivery Channel Team Lead marked the genesis of a strategic revolution. Recognizing the symbiotic relationship between regulatory compliance and customer service, the leadership envisioned a future where technology would be the linchpin for success. The objective is to not merely to meet regulatory expectations but to transcend them, delivering an unparalleled customer experience.

Mr. Sarim initiated a meticulous audit of existing systems, uncovering the chasms in regulatory compliance protocols. A strategic alliance with technology firms specializing in identity verification solutions was forged, laying the groundwork for a streamlined and foolproof KYC process. The decision to allocate a dedicated budget for technology investments underscored the bank's commitment to navigating the intricate regulatory landscape.

Operational Level

With the strategic blueprint in hand, the Digital Delivery Channel Team Lead orchestrated a symphony of operational changes. Cutting-edge AML monitoring systems, powered by artificial intelligence and machine learning, were introduced to fortify the bank's defences against illicit transactions. Simultaneously, the customer service infrastructure underwent a radical transformation, embracing AI-powered chatbots to deliver instantaneous responses and liberate human representatives for more nuanced interactions.

A dedicated compliance team within the Digital Delivery Channel emerged as the linchpin,3 ensuring constant vigilance over regulatory changes. Regular audits became the norm, swiftly followed by corrective actions to rectify any identified shortcomings. The decisions made at this level were not just about compliance but about redefining the very essence of customer service in a digital age (Bolton, 1998).

Reflexive Level

As the operational changes took root, a reflexive approach became paramount to ensure sustained success. Feedback sessions evolved into vibrant forums where insights from compliance and customer service teams merged to form a nexus of innovation. The culture of adaptability and innovation was nurtured, with employees encouraged to contribute ideas for improving both compliance and customer service.

The reflexive decisions were visionary. Gamified training modules injected a sense of excitement into compliance education, while a dynamic customer feedback loop provided real-time insights for service enhancement. A cross-functional task force, a brain trust comprised of compliance, customer service, and technology experts, was established to foresee regulatory shifts and proactively mould the bank's systems to meet future challenges (Cadotte et al., 1987).

Overall impact on the bank

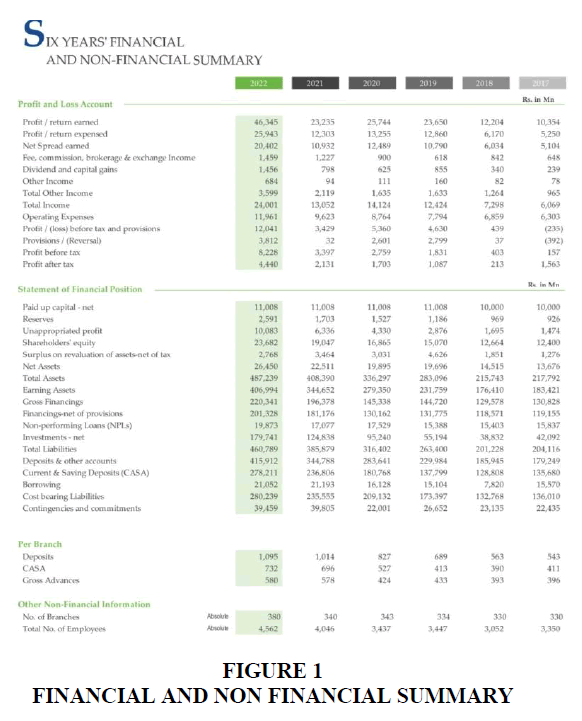

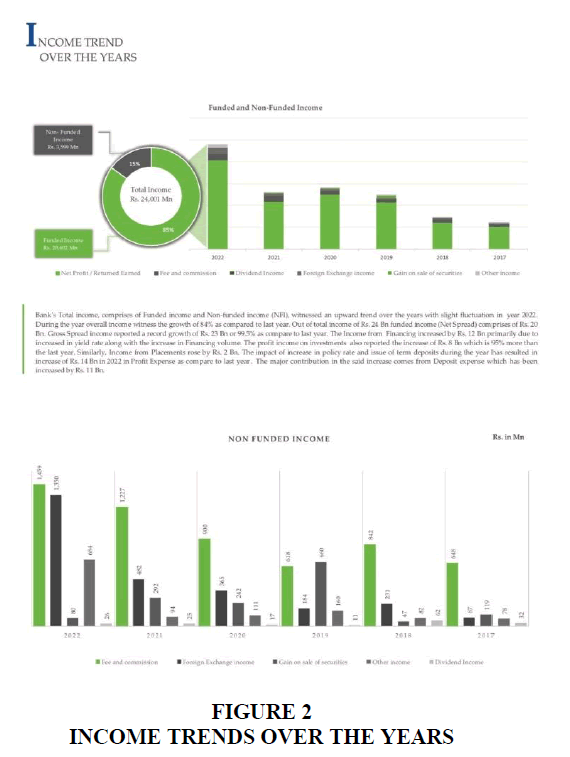

BankIslami Pakistan Limited announced its financial results for the year ended December 31, 2022 declaring a remarkable growth of 142% in profit before tax i.e. Rs. 8.23 billion as compared to Rs. 3.39 billion during last year. Profit after tax closed at Rs. 4.44 billion as compared to Rs. 2.13 billion closed during last year i.e. growth of Rs. 108% despite significant increase in tax rates. Year 2022 has been a great success for BankIslami, where it not only achieved the highest ever profitability, but also announced its first ever dividend of 10% to its shareholders. This is a result of all round performance of the Bank where almost all of its segments have contributed very well. These deposits surpassed the Rs. 400 billion landmarks and closed at Rs. 415.91 billion, depicting a prominent rise of Rs. 71.1 billion and growth of 20.63%. 9 (Figure 1).

Despite increase in policy rates, around 50% of the increase in deposits was contributed by the Current Account. This was the outcome of the Bank’s all out efforts in introducing new and innovative products, expanding its sales team across the country and pursuing aggressive marketing initiatives. The Bank also seized the opportunity of rising policy rate scenarios by offering attractive term deposit products which enabled healthy growth of 27.5% (Rs. 29.72 billion) in term deposits.

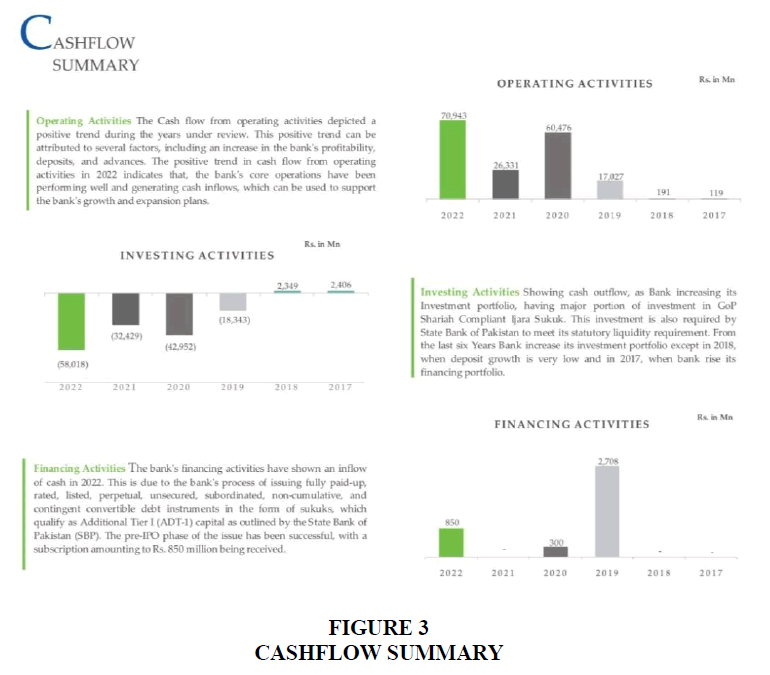

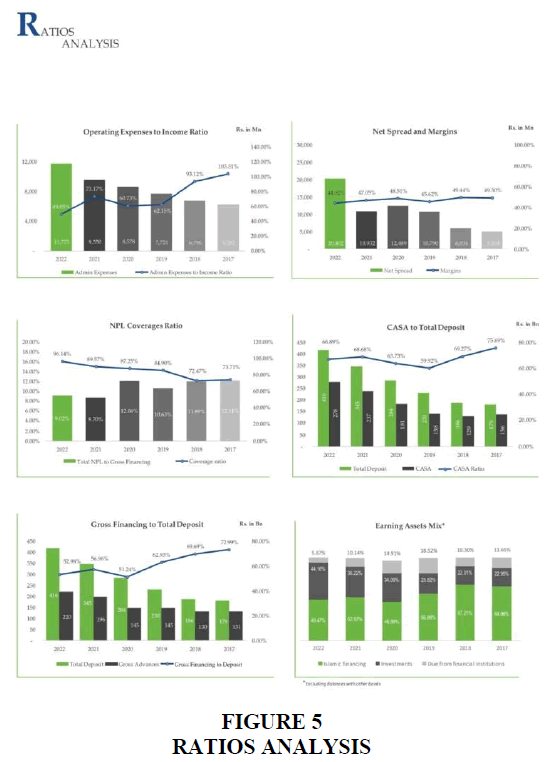

Despite a slowdown in economic activities at country level, the Bank was able to achieve growth of 12.20% in its Financing book (gross). Composition of Consumer financing in the overall financing portfolio remained at 23.19% despite regulatory measures to curb the demand of auto financing. Financing to deposit ratio (ADR – gross) plunged to 52.98% as at December 31, 2022. Infection ratio of the Bank as at December 31, 2022 increased to 9.02% from 8.7% as compared to last year due to classification of certain corporate accounts. In view of the prevailing economic situation, the Bank has recorded an additional general provision of Rs. 2.15 billion during the year, which improved the coverage ratio against delinquent accounts to 96.14% as compared to 89.57% at the end of last year (Figure 2 & Figure 3).

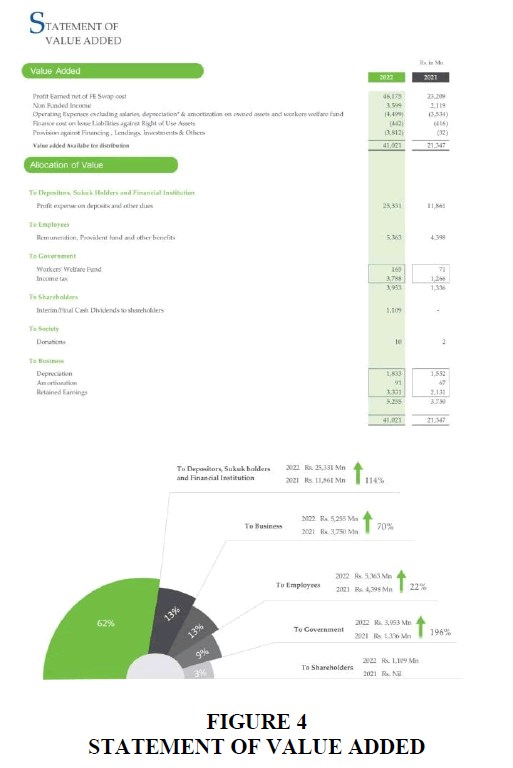

The Bank deployed its surplus liquidity mainly in GoP Ijarah Sukuks, which resulted in considerable growth of 43.98% in investment portfolio and closed investment book at Rs. 179.74 billion. Capital Adequacy Ratio (CAR)4 of the Bank improved to 17.92%, well above the regulatory threshold of 11.50%, while it stood at 14.15% at the end of last year. (Figure 4 & Figure 5).

The Bank has declared its first ever dividend to its shareholders of Re. 1 per share (10%) subject to approval of the shareholders in its upcoming Annual General Meeting.

Going forward, in order to continue this growth trajectory, the Bank will focus on increasing its branch network, improving the overall customer experience through leveraging technology, expanding its digital footprint and developing low-cost deposit products.

The reflexive level initiatives implemented in the bank have had a profound impact on various aspects of its operations. Here are some key impacts:

Sustained Success

The reflexive approach ensured that operational changes were deeply ingrained in the organization, contributing to sustained success. By fostering a culture of adaptability and innovation, the bank became better equipped to navigate challenges and capitalize on opportunities in the long term.

Innovative Insights

The transformation of feedback sessions into vibrant forums allowed for the merging of insights from compliance and customer service teams. This convergence formed a nexus of innovation, where diverse perspectives led to creative solutions. This collaborative approach likely resulted in more effective and innovative strategies for both compliance and customer service.

Employee Engagement and Contribution

Encouraging employees to contribute ideas for improvement signaled a shift towards a more inclusive and engaged workforce. The reflexive level initiatives empowered employees to actively participate in the enhancement of compliance and customer service, fostering a sense of ownership and pride in their contributions.

Exciting Learning Environments

The introduction of gamified training modules injected excitement into compliance education. This innovative approach likely led to increased engagement and retention of information among employees, making the learning process more effective and enjoyable (Bearden & Teel, 1983).

Real-time Service Enhancement

The establishment of a dynamic customer feedback loop provided real-time insights for service enhancement. This responsiveness to customer feedback is crucial in maintaining and improving service quality. It allows the bank to adapt quickly to changing customer needs and preferences.

Proactive Regulatory Adaptation

The creation of a cross-functional task force comprised of compliance, customer service, and technology experts demonstrates a proactive approach to regulatory shifts. By foreseeing potential changes in regulations, the bank can adapt its systems in advance, minimizing the impact of regulatory shifts and ensuring compliance with evolving requirements.

Holistic Approach

The reflexive decisions reflect a holistic approach to addressing challenges by involving multiple departments and areas of expertise. This integrated strategy ensures that the bank is well-prepared to meet complex challenges that may arise at the intersection of compliance, customer service, and technology.

The reflexive level initiatives have not only contributed to the immediate improvement of compliance and customer service but have also positioned the bank to navigate future challenges with agility and innovation. The impacts are seen not only in operational efficiency but also in the overall organizational culture and adaptability.

Forecast

Strategic Planning

Mr. Sarim has led the development of a strategic plan that aligns the bank's business goals with regulatory compliance requirements. This plan emphasizes the importance of customer satisfaction and market competitiveness (Anderson et al., 1994).

Cross-Functional Collaboration

Foster collaboration between different departments, including compliance, technology, and customer service. Mr. Sarim facilitate a cohesive approach to ensure that compliance measures are integrated seamlessly into customer service processes.

Training and Development

Mr Sarim has given an idea to oversee comprehensive training programs for staff, focusing on both regulatory compliance and customer service skills. A well-trained workforce is crucial for effectively managing compliance challenges while maintaining excellent customer service (Anderson et al., 1997).

Monitoring and Reporting

Implement a robust monitoring and reporting system under Mr. Sarim's leadership. Regular assessments of compliance processes and customer service metrics provide insights into areas that need improvement, allowing for timely adjustments.

Innovation and Efficiency

Encourage innovation within the team to find efficient solutions to compliance challenges. Mr. Sarim promote a culture of continuous improvement, where team members are empowered to propose and implement innovative approaches to enhance both compliance and customer service.

Customer Feedback Mechanism

Establish a feedback mechanism to capture customer sentiments and experiences. Mr. Sarim's team uses this feedback to identify areas of improvement and make necessary adjustments to ensure that customer satisfaction remains a priority (Anderson & Sullivan, 1993).

By implementing these solutions and leveraging Mr. Sarim's leadership, the Bankislami navigate the complexities of regulatory compliance while maintaining a strong focus on customer satisfaction and market competitiveness, ultimately preserving and enhancing its market share.

Way Forward

Bankislami's transformative journey is a compelling narrative that goes beyond mere triumph over challenges; it is a captivating saga of innovation, resilience, and foresight. At the helm of this remarkable transformation is Mr. Sarim, the Digital Delivery Channel Team Lead, whose strategic mindset, operational prowess, and reflexive approach have propelled the bank to unprecedented heights. His visionary leadership has not only steered the institution through the complexities of regulatory compliance but has also redefined customer service excellence in the face of rapid digital evolution. The case study of Bankislami stands as a testament to the potent combination of visionary leadership and adept management, showcasing how a financial institution can not only meet regulatory standards but also surpass them, setting a new standard for others in the industry. This success story serves as a beacon for financial institutions aspiring to not just comply with regulations but to excel in customer service within the dynamic landscape of digital advancements.

End Notes

1(AML) Anti-money laundering (AML) refers to the activities financial institutions perform to achieve compliance with legal requirements to actively monitor for and report suspicious activities.

2(SECP) It has investigative and enforcement powers. The current mandate of the SECP includes the following: Regulation of corporate sector and capital market. Supervision and regulation of insurance companies.

3Linchpin The most important member of a group or part of a system, that holds together the other members or parts or makes it possible for them to operate as intended.

4 (CAR) The capital adequacy ratio (CAR), also known as capital to risk-weighted assets ratio, measures a bank's financial strength by using its capital and assets.

Ijarah Sukuks:

Ijarah Sukuk are certificates of equal value which are issued by the owner of an existing property or asset either on his own or through a financial intermediary, for the purpose of leasing it against a rental from the subscription proceeds. Annexure 2.

References

Anderson, E. W., & Sullivan, M. W. (1993). The antecedents and consequences of customer satisfaction for firms. Marketing science, 12(2), 125-143.

Indexed at, Google Scholar, Cross Ref

Anderson, E. W., Fornell, C., & Rust, R. T. (1997). Customer satisfaction, productivity, and profitability: Differences between goods and services. Marketing science, 16(2), 129-145.

Indexed at, Google Scholar, Cross Ref

Anderson, E. W., Fornell, C., & Lehmann, D. R. (1994). Customer satisfaction, market share, and profitability: Findings from Sweden. Journal of marketing, 58(3), 53-66.

Indexed at, Google Scholar, Cross Ref

Bearden, W. O., & Teel, J. E. (1983). Selected determinants of consumer satisfaction and complaint reports. Journal of marketing Research, 20(1), 21-28.

Indexed at, Google Scholar, Cross Ref

Bolton, R. N. (1998). A dynamic model of the duration of the customer's relationship with a continuous service provider: The role of satisfaction. Marketing science, 17(1), 45-65.

Cadotte, E. R., Woodruff, R. B., & Jenkins, R. L. (1987). Expectations and norms in models of consumer satisfaction. Journal of marketing Research, 24(3), 305-314.

Indexed at, Google Scholar, Cross Ref

Received: 30-Jan-2024, Manuscript No. JIACS-24-14436; Editor assigned: 02-Feb-2024, Pre QC No. JIACS-24-14436 (PQ); Reviewed: 18-Feb-2024, QC No. JIACS-24-14436; Revised: 25-Feb-2024, Manuscript No. JIACS-24-14436 (R); Published: 01-Sep-2024