Case Reports: 2019 Vol: 25 Issue: 6

What about Cynthia a Case Study Exploring Corporate Fiduciary Duties and Social Responsibility

Thomas J. Freeman, Creighton University

Abstract

This case is designed to highlight the difficulties corporate executives and managers face when seeking to balance their fiduciary duties with their human and ethical obligations. The case involves Save Shop, a fictional regional grocery chain that is considering replacing most of the cashiers in their stores with automated or self-checkouts. This switch would save the company money but would also cost hundreds of employees their jobs. Save Shop’s executives will have to decide how to balance their desire to do right by the company’s employees with their fiduciary duties to its shareholders. Many business students will at some point in their careers be faced with similar decisions.

Keywords

Fiduciary Duty, Social Responsibility, Technological Change, Shareholder Theory, Stakeholder Theory, Brand Identity, Business Law, Business Ethics, Shareholder Value, Corporate Citizenship

Introduction

Corporate America is quickly discovering that businesses can increase their profit margins by replacing some or even most of their employees with computers and other automation (Gasparo, 2019). Many restaurants are utilizing self-order kiosks customers can use to place their orders without the need for a cashier (Kelso, 2019). Many grocery stores are replacing their checkout clerks with self-checkouts, where customers scan and bag their own groceries, pay, and then leave the store (Andrews, 2018).

Save Shop’s larger and institutional shareholders have begun asking questions about why the company has not implemented that strategy. Several of Save Shop’s competitors have begun replacing cashiers with self-checkouts. Those companies that have done so have reduced their labor costs and increased their profitability.

The History of Save Shop

Save Shop was started in 1946 by Bill and Maude Fleming. Bill had returned from World War II the previous year and wanted to create a business that served his community and created a lasting legacy. Maude had memories of food rationing during the war and a desire to ensure her neighbors had access to quality food at low prices. Save Shop fulfilled both of those needs. The company started as a neighborhood market with the bare essentials and quickly grew into a regional chain, with 43 locations in 22 different cities across the Midwest. Save Shop has more than 1500 employees, many of whom work entry-level jobs as cashiers in their stores.

Save Shop has placed a great deal of emphasis on attempting to employ those others would not. The company has aggressively sought to find room for convicted felons, those on probation or parole, the elderly, the developmentally disabled, etc. The Fleming family’s philosophy on this is informed by their belief that there is a dignity in work that everyone should be able to experience. This mentality is built into Save Shop’s culture, where employees bend over backwards to accommodate their coworkers’ disabilities and limitations.

Bill Fleming passed away in 2006 and Maude Fleming died in 2013. At that point, the controlling interest in Save Shop was sold to Brunesco Holdings, an investment firm with an interest in retail. Pat Fleming, the oldest son of Bill and Maude Fleming, was left as the President of Save Shop, a role he currently holds.

Fiduciary Duties

The traditional view is that directors and managers of a company have a fiduciary duty to maximize shareholder value (Schecter, 2017). Brunesco Holdings has been increasingly vocal in reminding Pat Fleming about that, as it seeks to pressure him into introducing self-checkouts. Pat has resisted that pressure so far, largely due to his desire to defend the legacy and vision of his parents.

Corporate Social Responsibility

The fiduciary duties of directors and managers have evolved somewhat over time and now include an obligation to ensure the company acts in a socially responsible way (Smith, 2003). That creates a conundrum for business leaders when they are faced with decisions that force them to choose between what makes money and what seems right or between profits and people (Fairfax, 2002).

Shareholder Theory versus Stakeholder Theory

Does management run the company solely for the benefit of the shareholders (shareholder primacy) or should they seek to balance the interest of all people who have a stake in the company? (Fontaine, 2006). What are Pat and the management team’s fiduciary duties in this situation?

Save Shop’s Brand

Save Shop has made a concerted effort to improve the lives of developmentally disabled and other workers who face employment challenges. Customers who frequent the store appreciate that if Save Shop did not employ these people, many of them would have difficulty finding other employment. If Save Shop moves to replace its cashiers with self-checkouts, many of those employees would lose their jobs. That could cause significant backlash from Save Shop’s customers and prompt lawsuits from the affected employees. Save Shop has been following the response to Walmart’s decision to eliminate some greeter positions and fears a similar outcome (Selyukh, 2019).

In addition, Save Shop has run several advertising campaigns over the last few years which feature Cynthia, a developmentally disabled employee who works as a cashier in one of the stores. Cynthia is charming, hard-working, popular with customers, and in many ways synonymous with Save Shop’s brand. It takes her a little longer to do her job than some of her coworkers, but the customers are so taken with her they don’t care. It is not unusual for customers to ignore an open checkout line in order to wait for Cynthia to check them out. Cynthia loves her job and thrives on the conversations and interactions she has with her coworkers and the store’s customers. While Cynthia is the company’s most popular employee, she is hardly alone in that regard. Save Shop’s developmentally disabled employees are hard-working, great with customers, and generally beloved.

The Recommendation

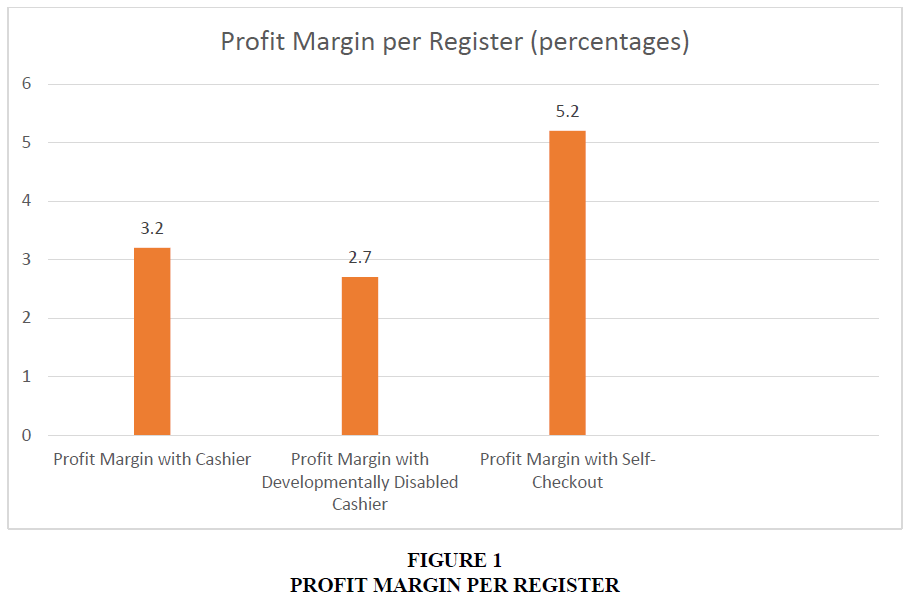

Pat Fleming has been asked to make a recommendation to the Board of Directors about whether to start replacing the company’s cashiers with self-checkouts. In terms of raw numbers, cashiers simply cost more than self-checkouts, and cashiers who have developmental disabilities cost more than other cashiers. As a result of their disabilities, some cashiers are able to move less customers through their lines. In addition, the developmentally disabled cashiers are so popular that customers spend more time talking to them, which also reduces their efficiency. Pat has run the numbers that measure productivity for all of the company’s cashiers. The average profit margins of the checkouts they operate, expressed as percentages, are illustrated in the chart which follows in Figure 1.

There is little doubt that these raw numbers are accurate. There are studies that indicate however that some customers do not like and will not use self-checkout registers and that self-checkouts encourage theft (Tiffany, 2018).

Save Shop has realized for years that there is some additional business cost involved in hiring and training employees with employment challenges. Like his parents, Pat passionately believes that there is a tremendous amount of intangible value that having a diverse group of employees brings to the company. Pat realizes that defending their jobs will be a difficult and uphill battle. The people that run Brunesco Holdings acquired Save Shop to make money and likely could not care less about Cynthia and Save Shop’s other developmentally disabled employees. Pat is convinced that he has to do whatever he can to protect his employees and defend his family’s legacy.

Legal Issues

1. If Pat chooses people over profits and refuses to replace cashiers with self-checkouts, could he face the possibility shareholders will sue him for violating his fiduciary duties to Save Shop? Could he be fired?

2. With respect to Save Shop’s employees with employment challenges, particularly those with disabilities, could Save Shop face liability if it chooses to terminate their employment? Specifically, would Save Shop face the possibility of lawsuits under the Americans with Disabilities Act?

Ethical Issues

1. Does the company have a greater ethical obligation to its shareholders or to its employees?

2. Does a company have a greater ethical obligation to continue to employ someone who if terminated, might not be able to find another job? Similarly, does such an obligation exist when the job provides the employee with dignity and a feeling of purpose that she might otherwise not be able to find?

Practical Issue

If the decision is made to replace cashiers with self-checkouts, the process would be a gradual one, implemented over a period of 12-18 months. During such a transition period, with less staff, and with any issues with the self-checkout system being worked out, it would be even more important that the remaining cashiers be as productive as possible. On the surface, it would make economic sense then to start the layoffs with the developmentally disabled cashiers. The decision to do so would be a public relations nightmare for Save Shop. It would also be devastating to the company’s morale. Pat is of the opinion that such a decision would result in many of the company’s longest serving and most valuable personnel leaving the company. There is already a sense that the company has drifted from its purpose under Brunesco’s management. If Save Shop engaged in wholesale firings of its employees with employment challenges, Pat fears there might be a wholesale revolt.

Assignment:

1) How can Pat make the best business case possible for saving the jobs of the company’s cashiers, particularly those with employment challenges? Make the case for the moral and ethical obligations Save Shop owes to those employees and to the legacy of the Fleming family, but the focus of your argument will need to be on profits. How would firing beloved employees affect customer attitudes about the brand and their loyalty to the company? What value do those employees add? Construct the best argument possible that continuing to employ Cynthia and those with similar employment challenges will benefit the company’s bottom line.

2) Brunesco Holdings holds firm to the idea that Pat’s job as President is to maximize shareholder value, which is only reflected in quarterly and annual financial statements. Construct the best argument possible that a corporate director or manager also has a fiduciary obligation to ensure that the company is run ethically and in a socially responsible way. Find some specific examples.

Summary and Additional Discussion Points

Corporate directors and managers are told they have a fiduciary obligation to maximize shareholder value. Yet no one ever provides clear guidance about what that means. A decision that benefits the company in the short-term may cost it in the longer-term and vice versa (Stout, 2013). A company’s short-term success is often at the expense of shareholder wealth over the long term. When faced with such a decision, is the corporate director to make the decision that benefits the company now or that will pay off down the road?

“The problem with the term ‘maximize shareholder value’ is that it has been hijacked by those who incorrectly believe that the goal is to maximize short-term earnings to boost today’s stock price. Properly understood, maximizing shareholder value means allocating resources so as to maximize long-term cash flow. Because an organization’s success depends on long-term relationships with each of its stakeholders, lengthening the investment time horizon benefits not only shareholders but customers, employees, suppliers, creditors, and communities as well.” (Mauboussin, 2016).

Similarly, while the consensus seems to be that corporate directors have a fiduciary duty to ensure their companies behave in a socially responsible way; it is largely unclear how that obligation operates in the real world. There are certainly situations where a company will benefit financially by being a good corporate citizen. Companies like Patagonia have largely built their brands on that principle (Wilburn, 2014). But there will also be cases where a corporation will have to choose between what seems right and what will be profitable. Those situations are far more difficult to navigate, particularly if there is a lack of consensus among those who run the company as to what the company’s priorities should be. This exercise attempts to set up such a situation, which the students can then explore and work with.

References

- Andrews, C.K. (2018). The Overworked Consumer: Self-checkouts, Supermarkets, and the Do-it-yourself Economy. Rowman & Littlefield.

- Fairfax, L.M. (2002). Doing well while doing good: Reassessing the scope of directors' fiduciary obligations in for-profit corporations with non-shareholder beneficiaries. Wash. & Lee L. Rev., 59, 409.

- Fontaine, Charles, Haarman, Antoine, & Schmid, Stefan (2006). The Stakeholder Theory, Semantics Scholar. Retrieved on Dec. 11, 2019 from https://pdfs.semanticscholar.org/606a/828294dafd62aeda92a77bd7e5d0a39af56f.pdf

- Gasparo, Ilaria (2019). A-Retail. The automated future of shopping, from fashion to grocery stores. Medium, April 2, 2019. Retrieved on Dec. 11, 2019 from https://medium.com/gobeyond-ai/call-it-a-retail-call-it-retail-automation-call-it-automated-retail-whatever-308322bc5832

- Kelso, Alicia (2019). Self-Order Kiosks Are Finally Having a Moment in the Fast Food Space. Forbes, July 30, 2019. Retrieved on Dec. 11, 2019 from https://www.forbes.com/sites/aliciakelso/2019/07/30/self-order-kiosks-are-finally-having-a-moment-in-the-fast-food-space/#41bfad7f4275

- Mauboussin, Michael J. & Rappaport, Alfred (2016). Reclaiming the Idea of Shareholder Value. Harvard Business Review, Jul 1, 2016. Retrieved on December 11, 2019 from https://hbr.org/2016/07/reclaiming-the-idea-of-shareholder-value

- Schecter, Asher (2017). It’s time to rethink Milton Friedman’s ‘shareholder value’ argument. Chicago Booth Review, Dec. 7, 2017. Retrieved on Dec. 11, 2019 from https://review.chicagobooth.edu/economics/2017/article/it-s-time-rethink-milton-friedman-s-shareholder-value-argument

- Selyukh, Alina (2019). Walmart Is Eliminating Greeters. Workers With Disabilities Feel Targeted. NPR. Feb. 25, 2019. Retrieved on Dec. 11, 2019 from https://www.npr.org/2019/02/25/696718872/walmart-is-eliminating-greeters-workers-with-disabilities-feel-targeted

- Smith, H. Jeff (2003). The Shareholders vs. Stakeholders Debate. MIT Sloan Management Review, Jul. 15, 2003. Retrieved on Dec. 11, 2019 from https://sloanreview.mit.edu/article/the-shareholders-vs-stakeholders-debate/

- Stout, Lynn A. (2013). The Shareholder Value Myth. Cornell Law Faculty Publications. Paper 771. Retrieved on Dec. 11, 2019 from http://scholarship.law.cornell.edu/facpub/771

- Tiffany, Kaitlyn (2018). Wouldn’t it be better if self-checkout just died? Yes! Because you won’t like what it spawns next. Vox, Oct. 2, 2018. Retrieved on Dec. 11, 2019 from https://www.vox.com/the-goods/2018/10/2/17923050/self-checkout-amazon-walmart-automation-jobs-surveillance

- Wilburn, Kathleen, Wilburn, & Roger (2014). The double bottom line: Profit and social benefit, Business Horizons 57, 11-20 at p. 15. Retrieved on Dec. 11, 2019 from http://www.australianessay.com/wp-content/uploads/attachments/28474-article-7.pdf