Research Article: 2020 Vol: 24 Issue: 1

What Influences Corporate Bond Issuing Decision and Value? The Role of Board of Director and Large Audit Firms in Vietnam

Pham Tien Manh, Banking Academy of Vietnam

Tran Thi Thu Huong, Banking Academy of Vietnam

Nguyen Thanh Phuong, Banking Academy of Vietnam

Abstract

This paper investigates the role that board of director and large auditing firms play in the firm’s decision to issue corporate bonds using data of listed firms on the Ho Chi Minh city stock exchange in the period 2011-2018. Board size, independent directors, foreign members on board and large auditing firm are core independent variables being considered. The results show positive correlations between independent directors, large auditing firms and firm’s decision to issue bonds. This paper could not find relationship between board size, foreign board members and bonds issuing decisions. The findings could be suggestion to build suitable solutions to develop the Vietnamese corporate bond market and further researches.

Keywords

Corporate Bond Issuing Decision, Corporate Governance, Large Auditing Firms, Vietnam.

Introduction

It is well known that there are many ways for a firm to raise capital, including internal and external finance. When a firm being larger, internal finance is not enough for the demand to develop and this firm need to find out external finance. Myers & Majluf (1984) said that firms often borrow money from banks before going to debt markets for debt finance. Pagano et al., (1998) argued that “The decision to go public is one of the most important and least studied question in corporate finance”. The decision to issue corporate bonds is made by managerial choice (Berger et al., (1997), Stulz (1990)). The choice is determined by many factors such as macroeconomic conditions, firm’s growth opportunities, leverage, profitability, firms’ size, corporate governance. Studies related to bond issuance are mainly included in the research on capital structure of enterprises (Mizen et al., 2011). Through factors affecting capital structure, managers and investors will have different opinions on whether businesses choose to issue stocks or bonds.

In fact, it can be seen that the development of Vietnamese corporate bond market is still limited with small market size and lack of liquidity. In the primary market, there are not many firms issuing bonds to raise capital. Corporate bonds outstanding per GDP is small compared to other countries in the Asian region such as Japan, Korea, Malaysia...Thus, it is necessary to find out factors that have influence on issuing bond decisions of a firm in order to suggest solutions to develop Vietnamese corporate bond market.

From the perspective of law, at present, there are provisions on debt repayment responsibility of firms and corporate bond issuing conditions. When firms decide to issue bonds to public, or to the international market, they are required to follow the principle of selfborrowing and self- repayment, ensure the solvency of its business. Moreover, conditions for issuing bonds in Vietnam are regulated by Decree 58/2012/ND-CP dated July 20, 2012, providing detailed regulations for implementation of a number of articles of the law on securities and Decree 163/2018/ND-CP dated December 04, 2018, providing regulations on the issuance of corporate bonds. In particular, to issue bonds, firms must meet the criteria such as conditions on equity, leverage, profit... In addition, financial statements of these firms must be audited by qualified auditing companies as required by law.

This paper will rely on the theoretical basis and the provisions of law to propose variables affecting the corporate bonds issuing decision of firms.

Literature Review and Hypotheses

Several macro and micro factors are considered to affect a firm’s decision to issue corporate bonds.

Macroeconomic Factors

Changes in macroeconomic variables could contain important information and affect financial market, leading to the influences on firms’ decision to issue bond (Chen et al. (1986), Pearce & Roley (1985)).

Level of National Economic Development

A small and underdeveloped economy could not support a firm to issue bonds due to the small surplus savings, ineffective financial market and week infrastructure. Pukthuanthong-Le, Elayan & Rose (2007) used data of 34 countries from 1990-2000 and found that an upgrade in the economic outlook of a country has positive effect on bond market returns, then effect on corporate bond issuing decisions.

Stability of Macro-Economy

Macroeconomic stability affects a firm’s decision to issue bonds. Uncertainty about macro conditions in the future could cause a concern for firms as well as for investors when issuing and investing in bonds about interest rate and inflation fluctuations. In a difficult economic condition, the pressure to repay principal and interest makes firms hesitant when deciding to borrow money (Lorca et al., 2011). Moreover, an unreasonable inflation rate could lead to difficulties to production and business activities, affecting firms’ ability to repay obligations to bondholders. Besides, in this context, investors also consider investing in corporates’ bond or saving money at banks.

Micro-Conditions

There is not much research on factors that affect the bond issuing decision of a firm. Little researches have shown some key micro- factors such as internal factors (operating efficiency, financial leverage, cash ratio), or corporate governance factors (members of the board of directors), or external factors (firms’ choice of audit services). These factors could affect the capital demand, ability to repay bond principal and interests of a firm.

Internal Factors

In a research on Korea, Indonesia, Malaysia and Thailand over period 1995-2004, Mizen & Tsoukas (2012) suggested that firm’ size, growth prospects, financial conditions and the development of the bond market have influences on decision to issue bond of a firm. The empirical results showed that firm’s size and growth are major factors affecting decision to issue bonds, while financial conditions have an influence as indicators of creditworthiness. In detail, large firms tend to issue securities while small firms tend to borrow money from banks, so firm’s size is an important factor affecting to the probability of a bond issue (Datta et al., 2000).

Financial conditions of a firm could be considered as a determinant of bond issuing decision (Leland & Pyle, 1977); Rajan (1992); Bougheasm et al., (2006). Mizen et al. (2008), using panel data of 939 US firms operated between 1995-2004 in variety of sectors, showed that financial variables have significant effect on bond issuing decision of firms. There are some dimensions of financial health of a firm that should be examined like leverage, profitability, cash ratio. The leverage ratio of a firm could be important factors that influences on issuing bond decisions. Cantor (1990), Bougheas et al., (2006) suggested that high leverage firms could be more difficult to issue corporate bonds due to an unhealthy balance sheet. Leverage ratio has negative relationship with bonds issuance. However, other researches demonstrated the positive correlations between leverage and the probability to issue bonds (Pagano et al., 1998), Datta et al. (2000), Denis &Mihov (2003), Faulkender and Petersen (2006)). It could be explained that high leverage can be seen as a good indicator reflecting good credit standing and capacity of a firm.

It is also argued that firms with high profit have high probability to issue bonds (Denis & Mihov, 2003). So there is a positive relationship between profitability and the probability to issue corporate bonds.

Several studies showed that firms with high cash ratio often have low financial leverage. Due to the abundance of cash, corporates tend to use available capital rather than external borrowing (Lorca et al., 2011). Acharya et al. (2007) has pointed out the inverse relationship between the cash ratio and the corporate bond issuance. However, when the corporation cannot predict the future cash flow, this relationship cannot be determined. Gamba & Triantis (2008) argued that the different combination of cash ratio and bond capital in firm’s capital structure has different impact on operating efficiency, reputation and value of a firm.

Corporate Governance Factors

Many studies have pointed out the impact of the director board on corporate bond issuance such as Anderson et al. (2004).

Anderson et al. (2004), Piot & Missonier-Piera (2007) said that there is relationship between independent board members and corporate bond issuance. The yields of new issued bonds have a negative effect on the number of independent board members (Bhojraj & Sengupta, 2003). Meanwhile, the corporate bonds’ credit rating has a positive relationship with the number of independent board members, thereby impacting yields of new issued bonds (Ashbaugh-Skaife et al., 2006). In contrast, Lorca et al. (2011) studied the companies listed on the Spanish Stock Exchange in the period 2004-2007 to find out the impact of board members on the issuance of corporate’s bonds. The result shows that independent members of the director board have no effect on the debt capital structure of enterprises, especially for the issuance of corporate bonds. It could be explained that the independent board members in Spain may not really be independent, depend on large investors and other board members’ opinions.

Studies on the impact of the size of director boards on corporate bonds issuance are still limited. The size of the board of directors could have impact on managing and controlling the bond issuance activities through corporate governance activities. A large number of board members has benefit to firms through leadership skills sharing, relationship expansion (Chan & Heang, 2010). On the other hand, John & Senbet (1998) believed that there is negative correlation between size of director board and the firms ‘performance because of the dilution in the contribution to the business, the increase in operating costs and time-consuming in making decisions within the company. Anderson et al. (2004) pointed out that board size has the negative impact on corporate bond issuance because the increase in number of board members leads to the increase in controlling firms’ capital structure and debt issues. Poitevin (2006) also studied the issue of corporate bonds but could not find any relationship between the number of board members and the corporate bond issue. Similarly, Lorca et al. (2011) showed that there is no relationship between the number of board members and decision to choose to issue bonds or not. Although there has been no study on the impact of foreign board members on corporate bond issuance, in this study, authors suggest that foreign board members affect to firm’s performance, leading to the effect on the enterprise’s choice of bond issuance. Regarding business performance, Choi & Hasan (2005); Choi et al. (2007) showed that foreign member would require strict control of business activities, so it is advisable to encourage enterprises have at least one foreign member on the Board in order to improve the firm performance. In addition, board members who are foreigners often do not harm the interests of shareholders to get benefit (Stulz, 1999). Therefore, the addition of foreign board members will enhance the ability of enterprises to cross-list, attract foreign investors, and improve the company’s transparency.

External Factors

Studies that related to the impact of audit quality on firms’ performance in general and on raising capital via stocks and bonds issuance in particular usually focus on the two main roles of audit firms, namely the role of providing information and the role of ensuring accurate information.

Auditing firms provide their independent opinions on the financial statements of the firm based on defined standards. Therefore, auditing companies who adhere to the principles and ethics could save information searching costs and improve investment efficiency of investors (Jensen & Meckling, 1976).

Mansi et al. (2004) stated that the corporate bond market is sensitive to negative information about business, so auditing firms’ opinions plays the most important role when investors make decision to invest in corporate bonds. Meanwhile, Blackwell (1998) argues that firms using the services of large audit firms could pay lower interest rates when issuing bonds, compared to other companies. Similarly, when doing research on new public companies, Pittman & Fortin (2004) pointed out that large audit firms support companies to raise capital with lower interest rates on bank loans or lower interest rates on corporate bonds compared to others. Large audit firms often provide high quality services because they have ability to control and process information better based on size, network and operational experience advantages (Watts & Zimmerman, 1981). They focus on quality of service since they have a lot to lose if their report are problematic (DeAngelo, 1981).

Research Hypotheses

To find out the relationship between corporate bond issuance matters, the role of board of directors and using large audit services, this paper is going based on two hypotheses:

Hypothesis 1: Board of director influences to corporate bond issuance decisions

H1a. The size of director board influence to corporate bond issuance decisions.

H1b. The foreign member on board of director influence to corporate bond issuance decisions.

H1c. The independent board of director influence to corporate bond issuance decisions.

Hypothesis 2: There is significant relationship between board of directors and corporate bond issuance value

H2a. The size of director board influence to corporate bond issuance value.

H2b. The foreign member on board of director influence to corporate bond issuance value.

H2c. The independent board of director influence to corporate bond issuance value.

Hypothesis 3: Firms using services from large audit firm do impact to corporate bond issuance decisions and value.

H3a. Firms using services from large audit firm influence to corporate bond issuance decisions.

H3b. Firms using services from large audit firm influence to corporate bond issuance value.

Methodology, Data and Research Models

This research uses data of listed firms on Ho Chi Minh Stock Exchange (HOSE) in Vietnam, in 2011-2018 period times. At the end of 2018, there are 380 listed firms on HOSE. However, with the full data requirement from 2011 to 2018, there are only 221 satisfied firms, dividing in 10 industries according to industry standard of HOSE. In this research, the data is collected from Ho Chi Minh City Stock Exchange website (www.hsx.vn), financial reports, balance sheets, cashflow statements and annual reports of listed firms. Regarding to corporate issuing bond information, we accumulate them yearly, which based on announcement reports of the target firms (Table 1).

| Table 1 The Number of Listed Firms in this Research | ||

| Order | Industry | The number of firms |

| 1 | Materials | 38 |

| 2 | Real Estate | 27 |

| 3 | Energy | 7 |

| 4 | Essential Services | 11 |

| 5 | Essential Consumer Goods | 26 |

| 6 | Health Care | 8 |

| 7 | Industry | 62 |

| 8 | Consumer Goods | 26 |

| 9 | Information Technology | 6 |

| 10 | Financial Services | 10 |

| Sources: www.hsx.vn | ||

The authors use ordinary least square regression model (OLS) to determine which factors influence to issuing bond decisions and logistic regression model to find out what factors impact on the value of bonds issuing in listed firms in Vietnam.

Research Models

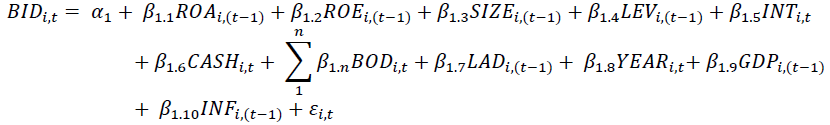

Model 1

Determinants of corporate bond issuing decision in listed firms in Vietnam (Logistic regression model)

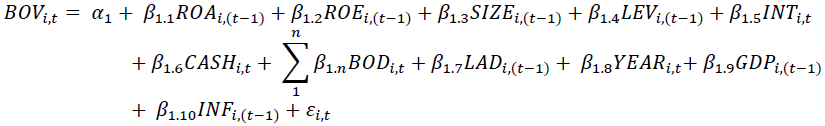

Model 2

Determinants of corporate bond issuing value in listed firms in Vietnam (ordinary least square regression model)

Where the dependent variables include bond issuing decision (BID) and bond issuing value (BOV). BID is a dummy variable that equals 1 if firm decided to issue a bond in year t, and it equals 0 otherwise. BOV is the value of a firm’s bond issuing in year t, it equals natural logarithm of total value of issued bond in year t.

Core independent variables reflect corporate governance and large auditing firms. The authors introduce board of director characteristics (BOD), which includes total board of directors (TBOD) in year t; total foreign board of directors (FBOD) in year t; total independent board of directors (IBOD) in year t. In addition, the dummy variable: large audit firm (LAD) is used. It equals 1 if that listed firms use services of top 10 largest audit firms in Vietnam in year t-1, otherwise, it equals 0.

Control independent variables include macro and micro variables. For macro variables, the authors select 2 representative variables GDP, reflecting the level of national economic development, and inflation index, showing the level of macro stability. Gross domestic product annual growth rate (GDP) in year t-1 is used with assumption that the higher the GDP growth rate, the more decisions and the higher value of issued corporate bonds in year t. Inflation rate (INF) in year t-1 is added to the model to determine whether or not this variable influences to corporate bond release in listed firms. The authors do not choose many macro variables to be included in the model due to concerns about the collinearity phenomenon.

For micro variables, the authors select variables showing firm’s performance, financial leverage, cash ratio, including ROA, ROE, SIZE, LEV, INT, CASH and YEAR. Return on assets (ROA) is defined as total net profit over total assets, where return on equity (ROE) is calculated as total net profit on total equity. Firm size (SIZE) equals natural logarithm of total assets, financial leverage (LEV) is defined as firm’s total debt on total assets. We introduce interest rate payment (INT) and cash holding ratio (CASH) as independent variables, where INT equals natural logarithm of total value of interest rate which a firm will have to be paid in year t; CASH equals natural logarithm of total cash that a firm keep in year t. The age of firms (YEAR) from the establishing time to year t, in 2018 is also used.

Research Results

According to the description results in the Table 2, the mean value of total board of directors in listed firms under the research is 7.85, with the minimum value is 5 and maximum value is 13. The maximum foreign board members in these firms are 8 members whereas some firms do not have any foreigner in board of director. In addition, some listed companies also do not have independent board of director, others have up to 9 independent members on board of director, and with mean value are 2.38.

| Table 2 Descriptive Statistics | |||||

| Variable | Obs | Mean | Std. Dev. | Min | Max |

| BID BOV |

1,765 104 |

0.021 26.870 |

0.143 1.305 |

0 24.167 |

1 29.220 |

| TBOD FBOD IBOD LAD ROA ROE SIZE LEV INT CASH YEAR |

1,765 1,765 1,765 1,765 1,764 1,765 1,764 1,764 1,461 1,764 1,765 |

7.848 0.403 0.963 0.834 0.132 0.293 27.95 2.862 10.093 0.332 15.908 |

1.368 1.094 1.275 7.810 0.907 2.244 1.349 6.296 0.930 4.483 6.813 |

5 0 1 0 -1.779 -2.334 20.685 0 5.524 0 4 |

13 8 9 1 14.108 93.658 34.630 185.191 12.634 83.815 66 |

| GPD INF |

1,766 1,765 |

0.061 0.094 |

0.006 0.056 |

0.048 0.035 |

0.069 0.184 |

Correlation Results

Table 3 shows the Pearson’s correlation results for all variables in this research, at the 5% significant level. It is clear that, there is a positive and significant correlation between corporate bond issuance decisions and firm size, interest payment, total board of director, foreign board of director, using services from large audit firms and the age of firms. However, inflation rate is negatively and significantly influence to BID.

| Table 3 Pearson Correlation Results for Main Variables | |||||||||||||||

| BID | BOV | ROA | ROE | SIZE | LEV | INT | CASH | TBOD | FBOD | IBOD | LAD | YEAR | GDP | INF | |

| BID | 1 | ||||||||||||||

| BOV | -0.009 | 1 | |||||||||||||

| ROA | 0.024 | 0.180 | 1 | ||||||||||||

| ROE | -0.009 | 0.230 | 0.007 | 1 | |||||||||||

| SIZE | 0.191* | 0.622* | -0.104* | 0.009 | 1 | ||||||||||

| LEV | 0.018 | 0.384* | -0.046 | 0.693* | 0.217* | 1 | |||||||||

| INT | 0.055* | 0.379 | -0.316* | -0.054* | 0.652* | 0.129* | 1 | ||||||||

| CASH | 0.004 | 0.193 | 0.570* | -0.003 | -0.099* | -0.034 | -0.316* | 1 | |||||||

| TBOD | 0.092* | 0.374* | 0.112* | -0.006 | 0.307* | 0.025 | 0.086* | 0.094* | 1 | ||||||

| FBOD | 0.087* | 0.388* | 0.032 | -0.008 | 0.161* | 0.006 | 0.018 | 0.017 | 0.312* | 1 | |||||

| IBOD | -0.002 | -0.343* | -0.016 | 0.058* | -0.075* | 0.007 | -0.023 | -0.013 | 0.090* | -0.027 | 1 | ||||

| LAD | 0.052* | 0.222 | 0.045 | 0.011 | 0.269* | 0.050* | 0.176* | 0.044 | 0.134* | 0.071* | -0.041 | 1 | |||

| YEAR | 0.086* | 0.126 | 0.010* | -0.014 | -0.002 | -0.024 | -0.163* | 0.093* | 0.124* | 0.027 | 0.040 | 0.160* | 1 | ||

| GDP | 0.025 | 0.013 | -0.012 | 0.031 | 0.008 | 0.016 | -0.056* | -0.010 | 0.009 | 0.027 | -0.050* | -0.222* | 0.059* | 1 | |

| INF | -0.077* | -0.079 | 0.034 | -0.009 | -0.061* | -0.010 | -0.001 | 0.027 | -0.034 | -0.026 | 0.012 | -0.056* | -0.097* | -0.092* | 1 |

| Note: (*) significant at 5% level. | |||||||||||||||

Regarding to bond issuing value, we can see that independent board of director and inflation rate negatively impact on the total bond value of these listed firms. On the other hand, there is a positive relationship between other variables with the value of corporate bond issuing under the research. It is clear to note that, the correlation coefficient between variables are low (<0.5), therefore it is least likely to have multi-collinear phenomena in the regression model.

The Decision of Corporate Bond Issuance

To find out determinants of bond issuing decisions (BID) and bond value (BOV) of listed firms in Vietnam, regression models are run and reported in Table 4. Firstly, with dummy variable BID, the authors are going to use logistic regression model to assess the determinant of corporate bond issuing decisions. In the first step, we use the main variables in this research includes TBOD, FBOD, IBOD and LAD to check the probability of corporate bond issuance. The result show that firms with more members on board of director (TBOD) are more likely to decide to issue bond compared to firms with lower total number board members, with positive and significant at 1% level. In addition, there is positive and significant relationship between foreign board of director (FBOD) and bond issuing decision (BID), at 5% level. It means that firms with more foreign members on board of director have more probability in issuing bond chance. The influence of using large audit firm services (LAD) on firms’ decisions to issue bonds are positive, providing the evidence that firms which use the services from top ten audit firms in Vietnam have more chance to issues bond, significant at 10% level.

| Table 4 Regression Results | ||||

| -1 | -2 | -3 | -4 | |

| BOV-1 | BOV-2 | BID-2 | BID-1 | |

| TBOD | 0.198 | 0.204 | 0.132*** | 0.121** |

| -0.372 | -0.171 | -0.005 | -0.018 | |

| FBOD | 0.166 | -0.151 | 0.141** | 0.113** |

| -0.525 | -0.548 | -0.013 | -0.036 | |

| IBOD | -0.349*** | -0.419*** | 0.034 | 0.011 |

| -0.005 | -0.002 | -0.603 | -0.834 | |

| LAD | 0.631 | -0.671 | 0.122* | 0.235* |

| -0.182 | -0.117 | -0.075 | -0.08 | |

| ROA | -12.681 | 2.61 | ||

| -0.25 | -0.316 | |||

| ROE | 3.009 | -1.843 | ||

| -0.535 | -0.322 | |||

| SIZE | 0.535** | 0.396 | ||

| -0.048 | -0.422 | |||

| LEV | 0.123 | -0.017 | ||

| -0.584 | -0.67 | |||

| INT | 0.105*** | 0.160** | ||

| -0.005 | -0.026 | |||

| CASH | 2.210*** | 1.019 | ||

| -0.001 | -0.293 | |||

| YEAR | 0.014 | 0.221** | ||

| -0.421 | -0.035 | |||

| GDP | -42.526 | 3.135 | ||

| -0.277 | -0.825 | |||

| INF | 3.718* | -3.781 | ||

| -0.055 | -0.672 | |||

| _cons | 25.157*** | 13.635** | -12.061*** | -2.946*** |

| 0 | -0.027 | 0 | 0 | |

| N | 152 | 104 | 1460 | 1764 |

| adj. R2 | 0.258 | 0.332 | ||

| p-values in parentheses * p<0.1, ** p<0.05, *** p<0.01 |

||||

In the next step, we add full variables in the model, to find out the determinants of bond issuance decisions of firms. It is interesting to note that, there are significant and positive relationship between bond issuance decisions and TBOD (at 1% level), FBOD (at 5% level), LAD (at 10%), INT (at 5% level) and YEAR (at 5% level). Therefore, we are going to reject H1a, H1b and H3a and accept H1c. This result is consistent with the previous model when we use only board of directors and large audit firm variables. Furthermore, firms that have to pay more interest payment in year t would likely to issue bonds; and firms with long time in operation also have more chances to issue bond. By contrast, return on assets and inflation rate have negative and significant impact on bond issuing decisions, both at 5% level. In case of impact of total board of director, the research’s result is opposite to Anderson et al. (2004) when they reported that in firms with higher total member on board of director, the probability of issuing bonds is lower compared to others.

The Value of Corporate Bond Issuance

In this section, the authors are going to test the second models: what influence the value of corporate bond issuance. The results of this section are report in Table 4. As we can see from the results, independent member on board has negative and significant impact on value of bond issuance, at 1% level. This means the increase in independent member on board of director would lead to the decrease in the value of bond issuance by 0.419 points value. The results also show the positive and significant relationship between value of interest payment, cash holding ratio and inflation rate with the value of bond issuance. This suggest that when total interest rate payment increase 1% the value of bond issuance also increases 0.424% (significant at 1% level). Therefore, we accepted the entire hypothesis 2c.

Firms with higher cash holding ratio would likely have higher value of bond issuance. This result is inconsistent with Lorca, Sánchez-Ballesta and García-Meca (2011a) and Acharya et al. (2007) when they believe that firms with high cash ratio level would prefer using internal source of finance rather than using external capital. In addition, inflation rate also has impact on the value of bond issuing. With 1% growth in inflation rate, corporate bond issuance’s total value increases 6.676% (significant at 10% level).

Conclusions

This research uses the data from listed firms in Vietnam to find out the impact of (1) board of director and (2) large audit firms on corporate bond issuance decisions, by using two independent variables: bond issuing decisions and bond issuing value. The results show that total board of director, foreign member on board of director, using services from large audit firms, the value of interest payment and the age of firm impact on the decision of whether or not issuing corporate bond. In addition, independent member on board of director, interest payment, cash holding ratio and inflation rate are significantly influence to bond issuance value.

In fact, mobilizing investment capital throughout the stock market, particularly via the corporate bond market till has limited in Vietnam, while banks still play very important role in economy, the existent of institutions, especially venture capital fund is limited (Pham, 2019). Therefore, in order to improve the role of corporate bond in capital market, there are some suggestions to both policy makers as well as enterprise themselves such as stabilizing macroeconomics conditions to enhance economic development growth, developing reputable credit rating organizations. Until now, Vietnam does not have any official credit rating firms giving bond rating. Therefore, investors do not have enough official information to analyse before making their investments. It is essential to reinforce the transparency of the corporate bond market to make investors feel more secure when participating in the market. In addition, policy marker needs to improve the legal framework for the corporate bond market, especially tax incentives for corporate bond investors. Moreover, bond issuers need to improve their financial and governance capacity if they want to successfully issue corporate bonds at low cost. The limitation of this research is the data was only collected from listed firms in Ho Chi Minh City (HOSE) Stock Exchange. In the next research, when the authors have enough data from all listed firms in Vietnam, it will give the better overview of determinants influence to corporate bond issuance.

References

- Acharya, V.V., Almeida, H., & Campello, M. (2007). Is cash negative debt? A hedging perspective on corporate financial policies. Journal of Financial Intermediation.

- Anderson, R.C., Mansi, S.A., & Reeb, D.M. (2004). Board characteristics, accounting report integrity, and the cost of debt. Journal of Accounting and Economics.

- Ashbaugh-Skaife, H., Collins, D.W., & LaFond, R. (2006). The effects of corporate governance on firms credit ratings. Journal of Accounting and Economics, 42(2), 203-243.

- Berger, P.G., Ofek, E., & Yermack, D.L. (1997). Managerial entrenchment and capital structure decisions. Journal of Finance, 52(4), 1411-1438.

- Bhojraj, S., & Sengupta, P. (2003). Effect of corporate governance on bond ratings and yields: The role of institutional investors and outside directors. The Journal of Business, 76(3), 455-476.

- Bougheas, S., Mizen, P., & Yalcin, C. (2006). Access to external finance: Theory and evidence on the impact of monetary policy and firm-specific characteristics. Journal of Banking and Finance, 30(1), 199-227.

- Cantor, R. (1990). Effects of leverage on corporate investment and hiring decisions. Federal Reserve Bank of New York Quarterly Review, 15(2), 31-41.

- Chan, S., & Heang, L.T. (2010). Corporate governance, board diversity and bank efficiency: The case of commercial banks in Malaysia, in The Asian Business & Management Conference, 576–595.

- Chen, N.F., Roll, R., & Ross, S.A. (1986). Economic forces and the stock market. The Journal of Business, 59(3), 383.

- Choi, J.J., Park, S.W., & Yoo, S.S. (2007). The value of outside directors: Evidence from Corporate governance reform in korea. Journal of Financial and Quantitative Analysis, 42(4), 941.

- Choi, S., & Hasan, I. (2005). Ownership, governance, and bank performance: Korean experience. Financial Markets, Institutions and Instruments, 215-241.

- Datta, S., Iskandar-Datta, M., & Patel, A. (2000). Some evidence on the uniqueness of initial public debt offerings. Journal of Finance, 55(2), 715-743.

- DeAngelo, L.E. (1981). Auditor size and audit quality. Journal of Accounting and Economics.

- Denis, D.J., & Mihov, V.T. (2003). The choice among bank debt, non-bank private debt, and public debt: Evidence from new corporate borrowings. Journal of Financial Economics, 70(1), 3-28.

- Faulkender, M., & Petersen, M.A. (2006). Does the source of capital affect capital structure? Review of Financial Studies, 45-79.

- Gamba, A., & Triantis, A. (2008). The value of financial flexibility. Journal of Finance.

- Jensen, M., & Meckling, W. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 3, 305-360.

- Leland, H.E., & Pyle, D.H. (1977). Informational asymmetries, financial structure, and financial intermediation. The Journal of Finance, 32(2), 371.

- Lorca, C., Sánchez-Ballesta, J.P., & García-Meca, E. (2011). Board effectiveness and cost of debt. Journal of Business Ethics.

- Mansi, S.A., Maxwell, W.F., & Miller, D.P. (2004). Does auditor quality and tenure matter to investors? Evidence from the bond market. Journal of Accounting Research.

- Mizen, P., Tsoukalas, J.D., & Tsoukas, S. (2011). How does reputation influence a firm’s decision to issue corporate bonds? New evidence from initial and seasoned public debt offerings. SSRN Electronic Journal.

- Mizen, P., Tsoukalas, J., & Tsoukas, S. (2008). What influences a firm’s decision to issue corporate bonds?? The role of creditworthiness, reputation and incentives. Centre for Finance & Credit Markets.

- Mizen, P., & Tsoukas, S. (2012). What Effect has bond market development in emerging asia had on the issuance of corporate bonds? SSRN Electronic Journal.

- Myers, S.C., & Majluf, N.S. (1984). Corporate financing and investment decisions when firms have information that investors do not have. Journal of Financial Economics, 13(2), 187-221.

- Pagano, M., Panetta, F., & Zingales, L. (1998). Why do companies go public? An empirical analysis. Journal of Finance, 53(1), 27-64.

- Pearce, D.K., & Roley, V.V. (1985). Stock prices and economic news. The Journal of Business, 58(1), 49.

- Piot, C., & Missonier-Piera, F. (2007). Corporate governance, audit quality and the cost of debt financing of french listed companies. SSRN Working Paper Series.

- Pittman, J.A., & Fortin, S. (2004). Auditor choice and the cost of debt capital for newly public firms. Journal of Accounting and Economics.

- Poitevin, M. (2006). Collusion and the banking structure of a duopoly. The Canadian Journal of Economics.

- Pukthuanthong-Le, K., Elayan, F.A., & Rose, L.C. (2007). Equity and debt market responses to sovereign credit ratings announcement. Global Finance Journal, 18(1), 47-83.

- Rajan, R.G. (1992). Insiders and outsiders: The choice between informed and arm’s?length debt. The Journal of Finance, 47(4), 1367-1400.

- Stulz, R. (1999). Globalization, corporate finance, and the cost of capital. Journal of Applied Corporate Finance, 12(3), 8-25.

- Stulz, R.M. (1990). Managerial discretion and optimal financing policies. Journal of Financial Economics, 26(1), 3-27.

- Tien Manh, P. (2019). Venture capital worldwide trend and policy implications for Vietnam. International Journal of Advanced Engineering and Management Research, 4(02).

- Watts, R.L., & Zimmerman, J.L. (1981). The markets for independence and independent auditors. Researcher Gate.