Research Article: 2018 Vol: 22 Issue: 2

A Behavioural Finance Discourse: AAA-Treasury Bond Spread Drift Theory

Armand Picou, Texas A&M Univ-Corpus Christi

Keywords

Investor Behaviour, Bond Spreads, Discontinuous Trading, Bond Downgrades, Bond Market Crisis.

Introduction

From the early 1920’s to 2000 the spread between both the 10 year Treasury and AAA securities; primarily attributed to premium differences in liquidity and default risk, has averaged less than 100 Basis Points (BP). From the 1950’s to the 1970’s spreads were well below 50 BP. Since early 2000, the AAA-Treasury spread has several times reached above 200 BP and averages 150 BP. These wide gyrations are a significant drift from the typical AAA-Treasury spread.

The accuracy of ratings for AAA bonds underwent extreme scrutiny following the financial turmoil of 2008. In Table 1, a 2010 study conducted by the Fitch rating agency shows the percentage of firms with downgrades in 2009. Note the differences across ratings. Nearly 28% of AAA bonds were eventually downgraded, evidence that investors trusted the default risk premiums prior to 2008.

| Table 1: Bond Rating, Default Risk and Yield (Study from Fitch Rating Agency March 2010) | |||||||

| % Default | Median Ratios | % Upgraded or Downgraded in 2009 |

|||||

|---|---|---|---|---|---|---|---|

| Rating | 1 year | 5 year | Return on Capital | Debt Ratio | Down | Up | Yield |

| Investment-grade bonds | |||||||

| AAA | 0.0 % | 0.0 % | 27.6 % | 12.4 % | 27.8 % | - | 3.92 % |

| AA | 0.0 | 0.1 | 27.0 | 28.3 | 25.8 | 0.0 | 4.45 |

| A | 0.1 | 0.7 | 17.5 | 37.5 | 18.4 | 0.9 | 4.48 |

| BBB | 0.3 | 2.8 | 13.4 | 42.5 | 9.5 | 1.2 | 5.13 |

| Junk bonds | |||||||

| BB | 1.5 | 7.5 | 11.3 | 53.7 | 15.2 | 6.4 | 5.87 |

| B | 2.7 | 9.3 | 8.7 | 75.9 | 14.6 | 5.4 | 7.38 |

| CCC | 26.4 | 35.3 | 3.2 | 113.5 | 59.3 | 1.9 | 10.09 |

Downgrades of AAA’s reached nearly 28 % in 2009. However, AAA downgrades today are below 1 % and have been so for several years. Lower spreads would suggest confidence in ratings while higher spreads would suggest a loss of confidence in AAA securities over Treasuries. With the population of AAA securities having been repeatedly scoured to reduce questionable securities, the persistence of heightened spreads is questioned.

With uncertainty in 2009 from rating downgrades it is reasonable to see Treasury-AAA spreads increase, especially as quantitative easing is instituted to stabilize financial markets. But nearly four years later Treasury-AAA spreads remained high even as AAA downgrades have returned to normal: Below 1 %. Clearly, AAA bondholders did not resolve confidence issues quickly as the markets rebounded.

The focus of this study on a single corporate security is predicated on reducing confounding influences apparent in lower graded securities (Heck et al. (2015)). As indicated in Table 1, the 5-year default rates remain at zero for AAA securities. Default rates for bonds retaining the AAA rating were essentially zero and remain so even today, appearing essentially default proof. For the investor with very high-risk aversion AAA securities thus remain attractive. It is the preferred security for a certain type of investor, one who values safety more than yield. Thus if an AAA rating prior to 2008 is the primary factor in the investment decision with yield being a secondary consideration, this could lead to complacency; meaning investors buy AAA regardless of yield, which would explain both persistent high and low Treasury-AAA spreads.

While neither a <100 BP and a >150 BP spread perhaps is not unique, in rational markets such extremes usually are quickly resolved with a shift in the yield curve. Herd behaviour explains the reactions seen during the 2008 crisis, i.e., spread changes due to fear reactions in the crisis. However, herd behaviour does not explain the persistent disregard for lower risk in AAA bonds since 2009.

The years of heightened spread drift represents a loss of confidence in the historical long-term spread level. As proposed, Spread Drift theory is primarily attributed to a market-wide under and/or overconfident estimation of default risk premium brought on by economic forces, AAA bond investor complacency and the discontinuous trading common to AAA bond markets.

Discussion/Literature Review

One could easily argue that the bonds of a company are safer than the shares of the same company. As residual claimants, stockholders accept more risk in the hopes of more return. Yet there are well defined human behaviours that often attenuate the apparent risks associated with stock investing (Overconfidence, self-attribution and anchoring to name a few) Shiller (2002); Baker & Nofsinger (2002). The priority bonds have in the payments arising from income increases the safety of bonds over stocks. Investors should have more confidence in returns from holding the bonds over the stock of individual firms. The stability of bonds due to having a superior claim to cash flows when compared to stocks should enable accurate yield estimation at time of the offering. When cash flows are partially deficient, the stock is the first to be impacted and only later when a systemic problem occurs do the seasoned bonds of a firm undergo pressure.

It can be reasoned the behaviours of bond investors have unique differences not applicable to stockholders. The support starts with the risk/return relationships being more rigorously defined for bonds than for stocks. Categories of bonds, from AAA to below investment grade; are clearly demarcated with the current risk rating systems. Correspondingly, bond yields are nearly uniform across single bond classifications (AAA, AA, etc.) bridging industries and sectors.

Trading volume also supports a behavioural difference. The daily volume of individual stock trades far exceeds the volume of individual bond trades. Stocks change hands frequently. However, many AAA bond investors advocate buy and hold strategies and attractive issues (AAAs) trade infrequently after the initial offering. For a security with potentially a 30-year life to all but disappear from the secondary markets would invite the potential mispricing evident in the less travelled end of the OTC stock markets (penny stocks, pink sheets) where discontinuous trading abounds. Furthermore, the discontinuous trading in AAA bond markets supports a possible deviation or drift in default risk premium when intense scrutiny is lacking.

No proposed theory would be complete without a comparison to existing behavioural theories. Beginning with the founding document by Thaler (1993), behavioural finance is simply defined as open-minded finance. He defines behavioural finance as substituting normal people for rational people. Purely rational mathematical relationships do not predict the behaviour of normal individuals. A huge body of study resulted from that seminal paper.

Behavioural theories examined in this study fall into two broad categories (1) behaviour potentially influencing a change in rating class (upgrades or downgrade) by influencing a single firm or industry/sector and (2) behaviour that could cause a change in interest rates having the potential to impact all market yields. Behaviour affecting industries or sectors does not explain the broader effect seen across all AAA securities and are excluded from the discussion.

Broad forces that impact an entire market; for example increased risk aversion or changes in inflation expectations, can move not only stocks but also the interest rates on debt. Bond yield changes begin with Treasury markets and spill over into corporate bonds. Normally, when Treasury rates move in a sustained direction, the corporate bond yields follow. We examine three primarily stock behaviour theories; Availability Drift, Herd Behaviour and Hindsight Drift, for an explanation of the spread data.

Availability Drift contends decisions are based on the most recent data (Chiodo et al., 2003). The authors’ theory predicts overreactions should erode over time to revert to the mean as new information quells uncertainty. This is the opposite of the observable AAA trend. As spreads rose with increased uncertainty in 2008, the persistent lower rates of Treasuries as well as the removal of questionable AAA securities should have had a persuasive effect on rates over the next few quarters. Instead we see nearly multiple years of heightened rates.

Herd Behaviour is the natural desire to follow the majority (sometimes referred to as Communal reinforcement) (Christie & Huang, 1995; Hirshleifer et al., 1994); Tvede, 1999). This theory does not explain why spreads maintain the increase from 2009 and resist the downward pull of historical norms. Of the three Federal Reserve rate increases prior to 2018, two had no immediate impact on the herd, but one rate increase (12/2016) appeared to have a speedy effect. It is plausible; due to discontinuous trading, the herd behaviour common to the stock market does not translate to the AAA bond markets broader spread measurements spanning sectors.

Hindsight Drift is the belief that events are predictable, leading to overconfidence (Taleb, 2004). This theory would seem to invite purchases after a trend is noticed. While this might explain recent narrowing of the spread, it fails to clarify other time periods where spreads remained well over 150 Basis points. For hindsight drift to hold, yields perceived as higher than rational would cause an influx of investors and drive the price of AAA securities upward, lowering yields during 2010-2016. This did not occur.

Availability Drift, Herd Behaviour and Hindsight Drift do not explain the currently observed AAA-Treasury spread. Spread Drift theory is more inclusive than the three aforementioned behaviours. It allows for investor complacency brought on by discontinuous trading and allows for reduced upward and a downward drift in spread until significant economic forces provide clear incentives.

Several other lines of behavioural research lend some support for a potential spread drift theory. A brief coverage of the most relevant behavioural finance articles follows. Oliver (2010) concludes societal optimism and pessimism influences financial decisions leading to broad market encompassing events. His research tangentially supports the Spread Drift proposal. When pessimistic, investors are not willing to pay higher prices, thus receiving higher yields for accepting the risk. If the currently elevated spread drift is due to pessimism, then either the liquidity premium would be high or confidence in the default risk premium is lacking. But the bull market of 2010-2017 does not support a pessimistic investor perspective.

Risk attitudes as studied by Corter (2011) create a chain of events that lead to larger losses in market downturns. Investors will deny the outcome of reduced expectations by supporting the holding of flagging investments longer than is prudent. A bonds AAA rating is the quality standard placating highly risk-averse investor. The greater risk tolerance Corter found could well support the beginning of higher spread levels than reasonable. But after markets return to rationality, spreads should drop. Spread Drift theory allows for either persistent elevated or lowered AAA yields to continue due to investor preference for buy and hold.

Gordon (2013) compares institutional faults with human behaviour which inevitably leads to financial upheavals. He concludes prevention after the fact is likely to be at least short-term but unlikely to be permanent. In Metwally et.al (2015) herding behaviour is studied during both bull and bear markets. Specifically, their study concludes a market with slow dissemination of financial information changes the herding behaviour in bull and bear markets. However, the sophistication of bond portfolio managers does not support the retention of extreme spreads long-term if risk is quantifiable. We believe the Spread Drift theory allows more permanence in unreasonably high or low spreads in both bull and bear markets.

Existing Behavioural Finance Theories primarily affect an individual firms’ stock price behaviour and have less influence on overall bond spreads. Routine stock volatility usually does not portend a change in company’s bond rating; meaning the daily volatility in the stock market is not mirrored in the bond market to a great extent. Over the short-term, a single firm’s market return may change dramatically, resulting from a volatile stock price more influenced by supply and demand than by actual changes in sales or profits. While stocks reflect this day to day volatility, scant evidence exists to indicate the yield for a particular seasoned AAA bond is as influenced by short-term stock behaviour.

The security of AAA bond investments may be a principle attraction to certain investors. If these investors do not see investment grade bonds (AAA to BBB) in general and AAA in particular as risky, this class of securities may be viewed as safe and not speculative. Thus investors may trade bonds less frequently than stocks. The willingness to hold bonds can lead to overconfidence and potentially alter spreads if pervasive.

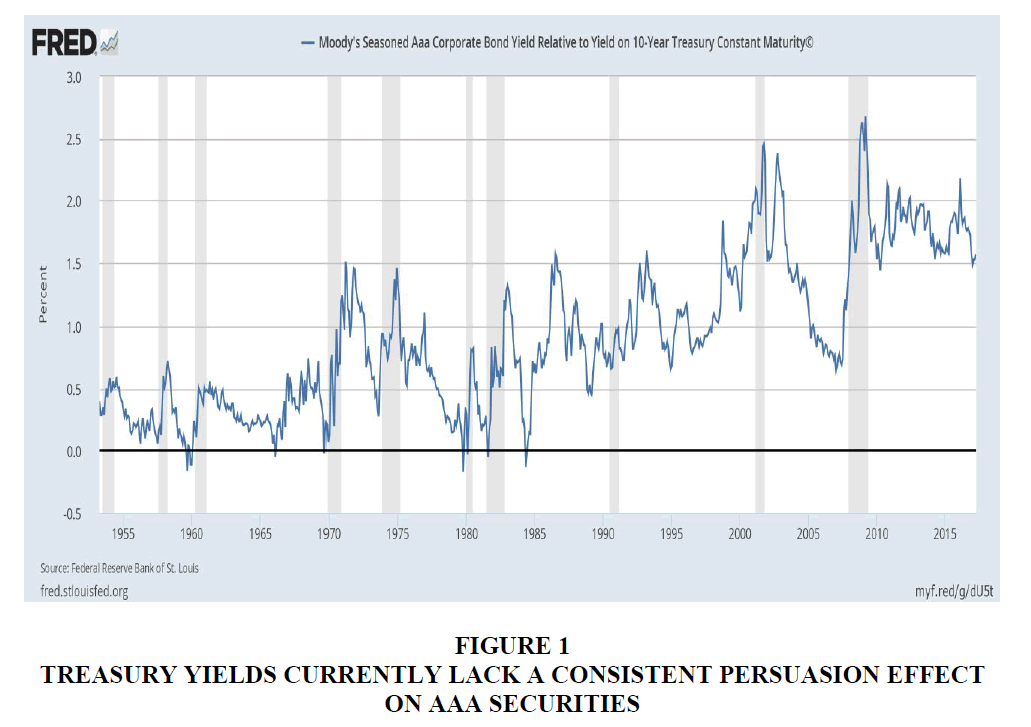

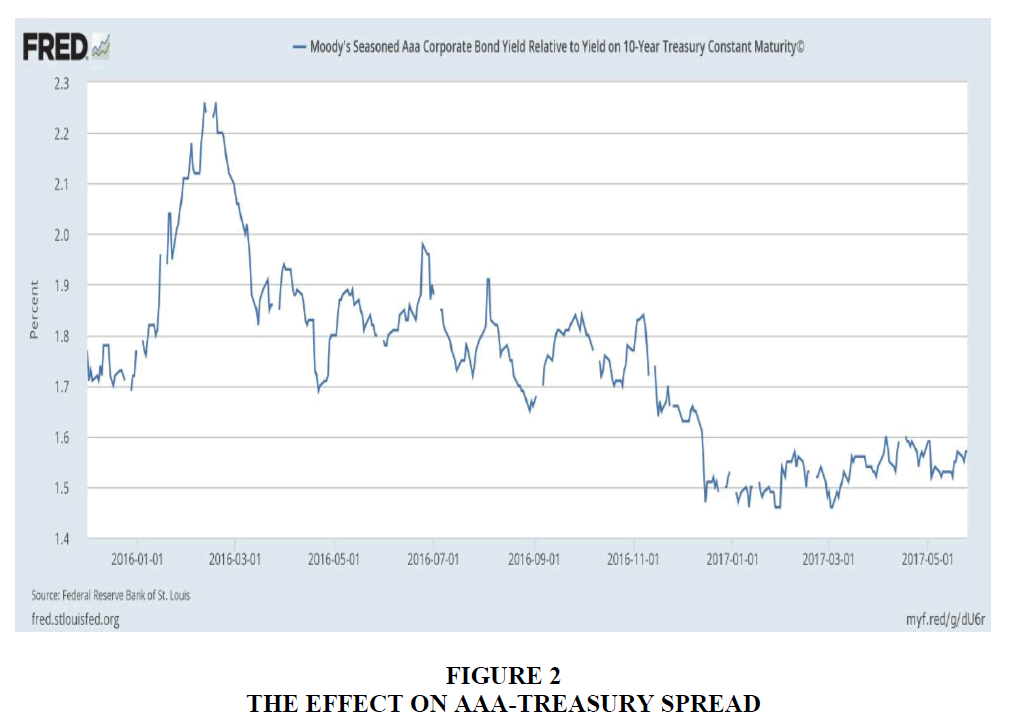

Treasury yields currently lack a consistent persuasion effect on AAA securities. Prior to 1999, Treasury yields had a strong influence on the overall yield for AAA securities (Figure 1). While quantitative easing coupled with low expectations of inflation since 2008 has resulted in a significant lowering of the risk-free rate, AAA securities are still far above levels that for generations have maintained a predictable spread. In the distant past when treasury securities have been in low yield territory, AAA bond rates have generally followed. Since 2008, the Federal Reserve has raised rates three times, December 2015, December 2016 and March 2017. The effect on AAA-Treasury spread can be seen below in Figure 2.

The AAA-Treasury spread is falling somewhat delayed following the recent increases made by the Federal Reserve (12/15, 12/16 & 5/17). In Figure 2, the spread over several years dropped from 2.25 to 1.55, a drop of 70 BP while the Federal Reserve has raised rates by 75 BP. Significant delays in all but the second rate increase are evident.

The first interest rate hike was met with a sharp increase in the spread. The second rate hike caused an immediate drop in the spread but the third increase has had little impact on the overall spread.

As evidence, risk-adjusted capital budgeting techniques generally have been quite sound from period to period. Prior to the year 2008, CE or Certainty Equivalents (Brigham & Ehrhardt 2013) produced answers similar to these risk-adjusted capital budgeting techniques. Recall that CE techniques scale back risky future cash flows to reflect only the cash flows earned without risk. Currently, using the risk-free rate of the 10 year Treasury bond to analyse the CE project cash flows does not compare in a two-period test (Picou 2014), meaning corporate AAA bond rates are higher than would otherwise be found.

Bond ratings are a unique attribute shared by a broad class of securities spanning multiple industries and sectors. Yields are relatively uniform across bonds of equivalent quality. In comparison, a stocks’ volatility is viewed as specific to the company and industry or sector. Many Behavioural Theories can be directly tied to how investors view a specific industry or individual sectors’ economic opportunities. However, when AAA bond yields are altered, the effect is similar across industries and across multiple sectors in line with rating class and maturity.

As proposed, Spread Drift theory assumes investors can be influenced by confidence in economic expectations. Spreads revert to the recent mean unless economic confidence changes sufficiently. Like a simple moving average, the Spread Drift theory allows for slow changes reflecting yield trends. Thus the Spread Drift theory can reflect contentment with a single bonds’ yield when compared to the entire class of similarly rated bonds.

For example; if during a reasonably stable economy rigorous analysis indicates a rating of AAA is to be assigned and AAA securities are currently yielding 4 % with a 100 Basis point spread above Treasuries, the security may sell at prices closely yielding 4 %. As time passes and the bond becomes seasoned, the now seasoned bond tends to hold in the minds of the investor the current market yield associated with new AAA issues. As long as the economy changes at a glacial pace, meaning AAA bond yields rise or fall slowly, inactively traded bond are assumed to have a similar yield and spread. Unless a ratings agency announces a ratings review; little individual change is expected of the original seasoned AAA bonds, which now remain closely associated with the actual yields of new issues. If no event affects the investors’ confidence in seasoned AAA bonds, then yields will follow the historical relationship with Treasury bonds.

But when a significant economic change occurs, Spread Drift theory responds similarly to an exponential moving average which gives greater weight to more recent prices. When economic change moves the spread to new highs or lows, recent yields can become a continuing and customary expectation unless a new significant economic change changes the spread level again.

For example, the period 2008-2009 was a period of intense scrutiny for AAA bonds. Many securities lost the AAA rating, greatly reducing the ranks of the top corporate debt. Spreads were chaotic and investors were increasingly risk-averse. However, while markets have rebounded, the spread relationships of the past have not yet been restored. Observations of spreads in Figure 1 show that spreads have remained elevated since 2010-2017.

A rating review generally portends a potential upheaval of a specific corporation’s bonds. Historically, rating changes occur infrequently for AAA securities. A rating review when required typically is the result of a time-consuming process lasting several months. The decision to change the bond rating is influenced primarily by the bond indenture provisions, financial ratios and other qualitative factors. The most common financial ratios to consider are the interest coverage, the return on investment and the debt ratio. Bond indentures often have restrictive covenants that assign importance to maintain acceptable financial ratios. Violations of the covenants lead to rating reviews. Informed investors would be aware of the review and trade prior to the conclusion of the review. Rating changes occur far later after an extended review by the rating agencies, meaning bondholders can react to company-specific financial changes before agency rating evaluations are finished.

For individual companies, we recognize the bond investor can react ahead of rating agencies. However, for the entire family of AAA-rated bonds, we contend the average bondholder complacently accepts current market yields. Once accepted, Spread Drift theory allows high or low yields until a major economic event spanning industries and sectors warrants re-examination of the appropriate yield to risk. Spread Drift theory allows for yields to essentially remain outside normal spreads until market direction stabilizes significantly.

One potential cause of the Spread Drift theory stems from the tendency of investors to equate AAA bond rating with little or no risk. Over time, if rating agencies have earned the trust of investors then almost no one questions the yield-to-rating relationship. This encourages complacency and complacency can be misguided. Prior to 2018, AAA bond ratings and trust in default ratings were stable and normal spreads abounded. Once default risk premiums were determined to be misguided, yields changed to reflect the uncertainty. Spread Drift theory predicts that elevated (or lowered) AAA-Treasury spreads will persist until investors are sure the economic direction is sustainable.

It is reasonable to assume the passage of time will lead away from crisis induced fear to a return to normalcy, a reversion to the mean. With any drastic market event such as in 2008, it is normal investors will become cautious and more discerning for a period of time. Currently the AAA-Treasury spread has begun a march to 100 BP. One possible explanation is the 2017 economic growth indicators has finally convinced AAA bond investors that markets have fully recovered.

In today's’ robust market, Spread Drift theory also suggests two factors could lead us to another bout of diversion from the mean spread: Human nature and first-time bond investors. During prosperous times, human nature may have a general tendency toward lowering incentives to gather information and a return to an increasing reliance on bond rating agencies. Additionally, as each generation of new and inexperienced investors become first active in stock markets, their eventual entrance into the bond markets as they approach retirement could affect changes in attitudes toward yields assigned to a bond classification. As bond yields are generally lower than stock returns, new investors may associate bonds with lower risk potential, enabling a downward spread drift to persist over time.

To summarize, during reasonably stable markets and at the initial bond offering when analytical scrutiny is assumed highest, AAA bond yields should have default risk premiums commensurate with their bond classifications. After a time and partially due to discontinuous trading and further exacerbated by the slow ratings review process, seasoned AAA bonds are assumed to carry the yields of new issues. Until a financial crisis occurs causing a re-evaluation of yields and re-examination of default risk, spreads remain relatively uniform. However, once risk is perceived as higher (lower) in a crisis (period of relative calm), the elevated (lowered) premiums again persist beyond a return to a normal market. That elevated or lowered yields can continue indicates AAA bondholders require a clearer economic direction before reverting to historical spreads.

Methodology

Unlike other corporate bond categories, AAA securities are perceived as closer to Treasuries in safety yet can offer higher yield potential to investors. To reduce the likelihood of confounding influences, this study examines AAA securities in isolation. The AAA corporate bond represents the gold standard for more risk averse investors.

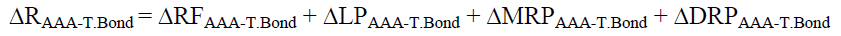

For an interpretation of Spread Drift theory, we examine the components of quoted returns for debt securities. The nominal or quoted pre-tax cost of debt is determined by several components. The generally accepted formula is:

R = RF + LP + MRP + DRP

Where RF is the risk-free rate generally defined as the 10 year Treasury bond yield, LP is the liquidity premium, MRP is the maturity risk premium and DRP is the default risk premium.

In computing the spread between 10 year AAA securities and 10 year Treasury Bonds, the formula is stated as follows:

Since the risk-free rate (RF) and the maturity risk premium (MRP) are assumed one and the same for both securities, these two components of interest rates drop from the formula leaving us with:

We look at the two factors as potential sources for rationalizing the Spread Drift theory. Technically, the AAA-Treasury spread can be primarily attributed to default risk and liquidity premiums. Granted supply/demand forces affect liquidity which does affect spread, yet AAA securities have the lowest liquidity premium relative to Treasuries and typically the impact of supply and demand on AAA-Treasury spread is usually minimal. There is no evidence that market liquidity has changed appreciably and if anything AAA bonds are increasingly popular since 2010 through today. The high liquidity should indicate confidence but the persistently high AAA-Treasury spreads do not. The answer lies in why apparent default risk has not diminished to realistic levels.

As the most popular security worldwide, Treasuries have extremely low liquidity risk, meaning bondholders can easily exit the position at the prevailing market price. This calls to question whether liquidity risk is substantial for AAA securities, a position we do not support. Additionally, since Treasuries have no default risk – they will pay interest and principal on time; the main difference in rates between AAA and Treasury Bonds should be attributed to the default risk premium. These assertions are supported by Friewald et al. (2012).

In their paper, the authors have several conclusions that indirectly support a spread drift theory by testing for AAA liquidity significance and bond default risk in general. First, the authors found strong evidence of a connection between liquidity risk and yields that vary significantly as bond rating decrease (Heck et al. (2015)). Second, the authors’ study found that the change in liquidity as part of yield spread significantly increased during a financial crisis for all but AAA securities. Third, the authors’ results indicate normally only 14 % of a BBB bond yield is due to the liquidity premium. This implies AAA liquidity premiums should be much lower than 14 % of yield. And finally in the two financial crises studied, the authors found only the AAAs respond in a significant and positive way while lower-rated securities (AA, A, BBB, etc.) responded in a negative fashion, with average liquidity rising from 14% of yield to almost 30% of yield. It should be noted that in a flight to quality during economic uncertainty, it is both Treasuries and AAA securities that are primarily purchased. This supports the argument that ΔRAAA-T.Bond are largely due to default risk and not due to differences in liquidity premium.

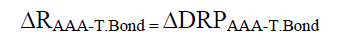

The results in Friewald et al. (2102) supports liquidity premiums for AAAs are small. Assuming the liquidity premium is near zero, the formula is reduced to:

Since The default risk premiums for the US. Treasury is zero, the formula is reduced to:

In summation, we assume AAA-Treasuries have insignificant differences in liquidity premium, share the same maturity risk premiums and differ primarily due to default risk. Support for our claim that LP and DRP are highly correlated for all but AAA securities was also found by Friewald et al. (2012).

Several qualitative factors are also associated with default and liquidity. Though not an exhaustive list, the most common influences are the sensitivity of earnings to the economy, the price elasticity of the product or service, concerns over the stability of labour and the changing regulatory environment. Should environmental regulations or economic stability have a direct impact on a firm, the current market yield may change in response to the threat or the potential investment opportunity. While it is unlikely all AAA bonds in the rating category would have a similar impact on the changing qualitative factors, most sectors move in tandem.

Conclusion

Existing Behavioural Finance Theories primarily affect an individual firms’ stock price behaviour and have less influence on overall bond spreads. Routine stock volatility usually does not portend a change in company’s bond rating; meaning the daily volatility in the stock market is not mirrored in the bond market to a great extent. Over the short-term, a single firm’s market return may change dramatically, resulting from a volatile stock price more influenced by supply and demand than by actual changes in sales or profits. While stocks reflect this day to day volatility, scant evidence exists to indicate the yield for a particular seasoned AAA bond is as influenced by short-term stock behaviour.

Some behavioural theories do allow for changes in spreads when we apply them to bond market reactions. However, the extended time of non-normal spreads is not explained by current behavioural theories. A reversion to the mean usually resolves itself within the short-term according to existing literature.

As proposed, Spread Drift theory is closely related to opinions on acceptable yields and decoupled from all but major shifts in the economy. As long as the AAA bond ratings appear stable, investors expend few efforts to adjust yields and only recent sales of the same security are likely monitored. Since many bonds are rarely traded beyond the IPO stage, few pricing opportunities to examine yields occur.

Characteristically, AAA bonds represent both discontinuous trading and the preferred habitat for risk adverse investors. We argue that Spread Drift theory allows for actual changes in default risk premiums to persist when they should revert back to normal levels. Under Spread Drift theory, AAA investors ignore Treasury rate changes for a time allowing for AAA-Treasury default risk spreads near zero or above 150 BP.

Three factors influence the Spread Drift Theory: New investors represented by retirees more familiar with stocks than bonds, the need for a strong economic certainty to precipitate a change in perceived default risk and the discontinuous trading prevalent to investors in the AAA bond market. Investors during periods of high stock market instability may not resolve confidence issues related to economic strength and direction. The investor uncertainty allows default risk premiums to remain higher or lower for extended periods until significant economic changes warrant a substantial change in yield.

References

- Baker, H.K. & Nofsinger, J.R. (2002). Psychological drifts of investors.Financial Services Review,11(2), 97-116.

- Brigham, E. & Ehrhardt, M. (2009). Financial Management: Theory and Practice (Thirteenth Edition). South-Western Cengage Learning, Web Extension 13-B, 1-7.

- Chiodo, A., Guidolin, M., Qwyang, M. & Shimiji, M. (2003). Subjective probabilities: Psychological evidence and economic applications. Working Paper 2003-2009, Federal Reserve Bank of St. Louis.

- Christie, W.G. & Huang, R.D. (1995). Following the pied piper: Do individual returns herd around the market?Financial Analysts Journal,51(4), 31.

- Corter, J. (2011). Does investment risk tolerance predict emotional and behavioural reactions to market turmoil? International Journal of Behavioural Accounting and Finance, 2(3-4), 225-237.

- Friewald, N., Jankowitsch, R. & Subrahmanyam, M. (2012). Illiquidity or credit deterioration: A study of liquidity in the US corporate bond market during financial crises. Journal of Financial Economics, 105, 18-36.

- Gordon, C. (2013). Two theories of the subprime crisis: Governance failure or mere greed? International Journal of Behavioural Accounting and Finance, 4(1), 3-17.

- Heck, S., Margaritis, D. & Muller, A. (2016). Liquidity patterns in the US corporate bond market. 28th Australian Finance and Banking Conference.

- Hirshleifer, D., Subrahmanyam, A. & Titman, S. (1994). Security analysis and trading patterns when some investors. Journal of Finance,49(5), 1665.

- Metwally, A., Eldomiaty, T. & Abdel-Wahab, L. (2016). Does herding behaviour vary in bull and bear markets? Perspectives from Egypt. International Journal of Behavioural Accounting and Finance, 6(1), 26-53.

- Oliver, B. (2010). The impact of market sentiment on capital structures in the USA. International Journal of Behavioural Accounting and Finance, 1(4), 335-348.

- Picou, A. (2014). Interest rates are sticky: Implications from the yield curve. Academy of Accounting and Financial StudiesJournal, 18(1), 1-10.

- Shiller, R.J. (2002). Bubbles, human judgment and expert opinion.Financial Analysts Journal,58(3), 18-26.

- Taleb, N.N. (2004). Bleed or blow-up? Why do we prefer asymmetric payoffs?Journal of Behavioural Finance,5(1), 2-7.

- Thaler, R.H. (1993). Advances in behavioural finance. Russell Sage foundation, New York.

- Tvede, L. (1999). The Psychology of Finance: Wiley. First edition published by Norwegian University Press in hardcover in 1990.