Research Article: 2021 Vol: 25 Issue: 4

A Bibliometric Study of IFRS Adoption and Audit Quality

Emad Fallatah, Putra Business School, Universiti Putra Malaysia

Nur Ashikin Mohd Saat, School of Business and Economics, Universiti Putra Malaysia

Sabarina Mohammed Shah, School of Business and Economics, Universiti Putra Malaysia

Choo Wei Chong, School of Business and Economics, Universiti Putra Malaysia

Abstract

There is a growing concern of accounting and auditing regulative bodies around the world in enhancing financial reporting and auditing professions. This paper is among the first effort that aims to investigate the body of literature on IFRS adoption and audit quality by providing a quantitative overview of the academic as well as the professional literature constituting the field of accounting and auditing. Based on the Scopus database containing 1019 documents in IFRS and audit quality research domain between 2005-2019, a bibliometric analysis is conducted using Vosviewer and Microsoft excel tools. Following the adoption of IFRS by the majority of European Union countries and emerging markets and the financial crisis of 2008 that highlighted the importance of audit quality. Findings from the study show that IFRS adoption and audit quality have developed as a young discipline especially in recent years, but despite this fact, they still face some challenges to get a wider audience in accounting and auditing research.

Keywords

Audit Quality, Bibliometric, IFRS Adoption, Scopus, VOS Viewer.

Introduction

International Financial Reporting Standards (IFRS) as issued by IASB in 2001 are meant to provide high-quality accounting reporting and comparable accounting information across the globe. Recently, there are more than 120 countries are keyed into IFRS adoption seeking to enhance their accounting reporting and to be in line with developed practices. With the increased development in local and multinational business practices, IFRS have had sustainable developments and amendments that required multiple professional judgments. This situation has heightened the need to have a high level of audit quality that can meet this continuous development in the accounting profession and business environment. Moreover, it unleashes the powers of the international bodies of accounting and auditing such as Public Accounting Oversight Board (PCAOB), International Assurance Auditing Standards Board (IAASB), Center for Audit Quality (CAQ), and International Federation of Accountants (IFAC) to try persistently to improve the quality of audits around the world.

There have been many debates in the concept of audit quality among scholars and professional bodies that make ambiguity on what it means (e.g., IAASB 2014; CAQ 2016, 2019; PCAOB 2013, 2015a, 2018). Theoretically, yet, beyond the notion that claimed that better audit quality leads to better financial reporting quality under certain accounting standards, a little consensus emerges in the scant literature as to how best audit quality can be defined (Gaynor et al., 2016). DeAngelo (1981), the father of the audit quality concept, defines audit quality as the market-assessed joint probability that allows an auditor to both detect material misstatements of financial statements and report those material misstatements to the public. The concept of audit quality has become much extensive after differences audit quality practices that arise from different firms across the world including Enron (2001), WorldCom (2006), and Wels Fargo bank (2016) in the USA, Nortel in Canada (2011), Satyam Corporation in India (2015), and Al-Mojil Group in Saudi Arabia (2015). All these deficient audit quality practices occurred due to fraud allegations and auditing infidelity shortly after the report of external auditors that led to severe consequences to different stakeholders.

As financial statements prepared at either IFRS or any accounting standards, are meant to reflect accurately the underlining economic reality of firms, some professional bodies declared that the quality of the financial statements is conditioned by the quality of the accounting information and the quality of the system (either monitoring system or those who are engaging in preparing this information) at different clients (IFAC, 2014; CAQ, 2014). So, the audit system in this case would lend itself to increase the quality of the accounting information and the quality of the monitoring system within a certain organization for decision making (Knechel et al., 2013). In turn, if the underlying economic purpose is absent, the accounting information is deficient, and the system is weak, that could affect the adherence of a specific firm to the accounting standards such as IFRS. In this case, an audit firm needs to work hard in clarifying weaknesses to the management of the firm and in the audit report to the stakeholders of the organization.

In 2014, the International Auditing and Assurance Standards Board (IAASB) agreed with the difficulty of understanding audit quality and provided a framework guideline discussion on audit quality. The guideline declared that auditors, audit firms, other stakeholders, and regulators can do more to increase audit quality in their environments. Moreover, it stated that the responsibility for performing quality audits of financial statements does not rest only on auditors but also can be achieved through the appropriate interactions among participants in the financial reporting supply chain (IAASB, 2014). A continuous effort is made professionally as well by the Public Company Accounting Oversight Board (PCAOB) to improve the understanding of audit quality concepts through releasing a concept that identifies 28 possible audit quality indicators (AQIs) (PCAOB, 2015). The concept released seeks to identify the potential value to audit committees, audit firms, investors, and regulators. The PCAOB’s proposal recognizes the importance of the financial reporting quality as well (the quality of accounting standards such as IFRS) as effective measures in providing ultimately a meaningful understanding of audit quality.

To inform the sustained discussions surrounding the potential public dissemination of AQI, this study provides a comprehensive review in IFRS adoption and audit quality measures around the world from 2005-2019 using the effective bibliometric analytical technique to enhance the discussion of the PCAOB and other professional accounting and auditing bodies on the audit quality. To the best of our knowledge, this study is among the first efforts to carry out a bibliometric analysis on IFRS and audit quality research domain. Moreover, the study aims to understand the trends of academic efforts made in developed and emerging markets in IFRS adoption, as quality financial reporting standards that have been adopted widely, and audit quality as an extensively developed concept with different understanding around the globe.

Literature Review

The current literature review concentrates on findings concerning audit quality and its proxies to evaluate the degree of effectiveness of IFRS adoption. The quality possessed by an external auditor of financial statements act as a crucial mechanism to regulate the opportunistic conduct of officers and managers. It is believed that audit quality relies upon the competencies and independence of external auditors, which is typically associated with the size of the audit firm (Bouchareb, 2014). Hence, the size or magnitude of external audit firms can be utilized as a useful proxy to measure audit quality. The study of Hassan and Rehman (2019) explains this view that the core responsibility of the auditor is to detect errors in financial reports and record misstatements. Reputable or large audit companies remain relatively unlikely to engage themselves in producing low-quality audits as they remain equipped with qualified professionals. Findings conclude that IFRS adoption tends to reduce the degree of earnings management, hence improve audit quality, especially for firms that associate themselves with Big 8, now Big 4, audit companies to maximize the efficacy of their financial disclosures.

The auditor pricing decision is perceived as another measure for audit quality. Abu Risheh & Al-Saeed (2014) explains that different magnitude of audit firms’ charges varying audit fees, often based upon the degree of audit quality supplied to clients. Hence, a higher audit premium is likely to result in improved audit quality. Ball (2006) also agrees with this statement, further suggesting that the level of training, compensation, independence, along with auditor status are significant elements that influence the overall quality of financial inspection after IFRS adoption. In a similar context, Marden & Brackney (2009) report that reputable accounting companies are likely to deliver professional education required for accountants to undertake appropriate judgments and adequate compliance. In relation to the adoption of new standards, larger auditing firms are expected to invest more resources in improving audit quality relative to low-quality audit services. Cabal-García et al. (2019) highlight that the Big 4 auditing firms are specifically targeted by the public and members of authorities and therefore remain subject to more scrutinized checks than other auditors. Hence IFRS adoption, while being in contract with reputable auditors, tends to produce high-quality audits (Garrouch et al., 2014).

Abu Risheh & Al-Saeed (2014) reports that unlike previous local standards, IFRS proves to be more inclusive and efficient, reserving far more accuracy when it comes to supplying targeted and factual financial information to investors and other relevant parties. The factors of refined comparability, timeliness, understandability, and verifiability that the transition of IFRS yields enable auditors to improve what they do (Jung et al., 2016). Lahmar & Ali (2017) highlight that auditors must provide insights concerning the most efficient allocation of resources available at the disposable of the respective firm. The study supplied by Reid Carcello & Neal (2016) asserts these findings by undertaking research within the developed market of the UK and providing evidence that IFRS implementation improves the tendency to consider operations and activities that significantly enhance the allocation of available resources which eventually points towards the increased audit quality element.

The efficiency of audits can also be reviewed by Audit Report Lags, which can be defined as the duration of time demanded by a firm to generate financial statements in a particular, fiscal year indicating the timeliness of auditors and accountants (Shan et al., 2015). One can argue here that the quality of audit reports will positively improve with the reduction in audit report lags. Kawshalya & Srinath (2019) highlight that shorter audit report lags or timely disclosure of audited financial statements are associated with increased usefulness and benefits that investors, creditors, and shareholders can derive from such disclosures. The study concludes that adoption or switch to IFRS possess a significant negative link between audit report lag since a sudden change in accounting practices requires substantial efforts in educating auditors with the advanced principles and rules needed to comply with IFRS. Fodio et al. (2015) also support these findings highlighting that IFRS implementation extended the time duration required to disclose an audit report demonstrating the complexities and incremental costs associated with IFRS adoption in the case of Nigerian banks. Large intervals in financial information do not only aggravates uncertainty based on the decisions of market participants but additionally decrease the relevance of audit documents as they paint a picture of becoming outdated (Modugu et al., 2012).

Empirical research carried out by Fiona (2013) questions the relationship between IFRS adoption and the levels of trust between external auditors and internal management and whether this influences the quality of published audits. Findings prove that the implementation of IFRS holds the ability to improve client-auditor relationships enhancing the audit quality by generating inspected statements promptly. Improved audit quality is also examined under the perspective of enforcing goodwill accounting principles, as stated in the IFRS demanding auditors to measure accurate goodwill impairment and manage impairment losses against revenues earned in the same period. Since most previously adopted accounting practices did not necessarily accommodate impairment costs to reflect the company’s economic goodwill, the new regime, depending upon the degrees of its implementation and enforcement, caters to higher audit quality by revealing more credible accounting data (Strokes & Webster, 2010). In a similar context, Jarva (2014) agrees that implementing the advance impairment regime demands extensive professional expertise and judgment to be practiced by preparers, therefore welcoming opportunities for managerial bias and interpretation that requires additional auditing efforts. An increase in such efforts and diligence is thought to be associated with improved efficiency of audit reports (Abu Risheh & Al-Saeed, 2014)

Data and Methodology

The data used to achieve the study objectives were sourced from the Scopus database. The Scopus database is the largest collection of scholarly published works with over 41,000 titles. The database was launched in 2004 by Elsevier. First, the search query link was used. Specific keywords typed into the search query contained “IFRS” and “Audit Quality” were used to generate the data analyzed in this study. The result from the search query is shown as {ALL ("IFRS" AND "Audit Quality") AND PUBYEAR > 2004 AND PUBYEAR < 2020}. The search was performed on 29th June 2020, 10:22 am. The publication year start date is 2004. The justification for starting from the year 2004 is due to the adoption and implementation of IFRS by most developed countries.

A total of 1,019 documents met the search criteria and formed the data used for analysis performed in this study. The data for the 1019 documents included the following 4 key fields: citation information, bibliographical information, abstract and keywords, and funding details. The citation information consists of Authors’ name, document title, year of publication, source title (journal outlet), citation count, digital object identifier, volume, issues, and pages. The bibliographical information includes institutional affiliations, serial identifiers (ISSN), publisher, and correspondence address. The abstract and keywords field contains abstract, author keywords, and index keywords. Lastly, the funding details filed consists of funding numbers, acronym, and sponsor. The extracted data were exported as a Comma Separated Version (CSV) file format. The study made use of VOSViewer and MS Excel for data visualization and relevant statistical analysis. The CSV file was uploaded to the VOSViewer for network, overlay, and density visualization

Results and Discussion

Documents and Source Typeof Volatility

This section shows the different classification of 1019 documents used for this bibliometric study. This classification consists of document and source type. Table 1 present the classification based on the document type. Article publication has the highest percentage with 914 documents. This shows that majority of the authors' work is available as full-length article as oppose to conference papers where only abstracts are published.

| Table 1 Document Type | ||

| Document Type | Total Publications (TP) | Percentage (%) |

| Article | 914 | 89.7 |

| Review | 34 | 3.3 |

| Conference Paper | 21 | 2.1 |

| Book | 20 | 2.0 |

| Book Chapter | 16 | 1.5 |

| Editorial | 4 | 0.4 |

| Note | 4 | 0.4 |

| Undefined | 6 | 0.6 |

| Total | 1019 | 100.0 |

Table 2 shows the classification based on the source type. There are four types of sources where the 1019 documents are published. Among these four sources, Journal recorded the highest with 95.1%

| Table 2 Source Type | ||

| Document Type | Total Publications (TP) | Percentage (%) |

| Journal | 969 | 95.1 |

| Book | 32 | 3.1 |

| Conference Proceedings | 10 | 1.0 |

| Book Series | 8 | 0.8 |

| Total | 1019 | 100.0 |

Yearly publication distribution

The main objective is to highlight the ability of the transactions of purchases and sales in explaining the asymmetry of volatility. So, in order to determine the impact of transaction activity and exchange direction on volatility, we choose to regress to the following equations:

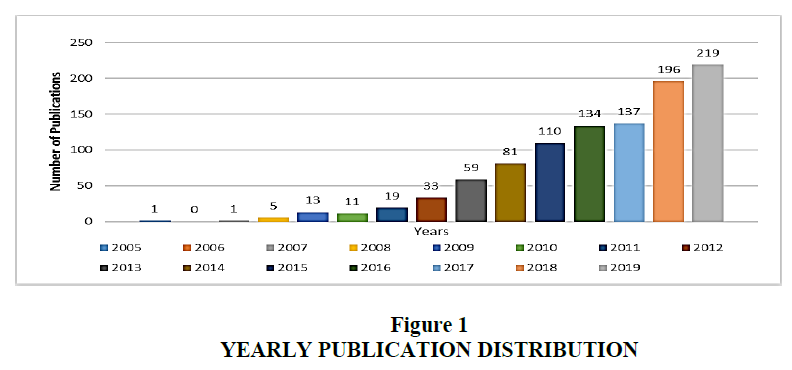

Based on the 1019 documents used for this study, figure 1 shows the yearly publication distribution from 2005-2019. In 2005, only one publication was related to IFRS and audit quality research. The article is titled “Earnings management under German GAAP versus IFRS” authored by Van Tendeloo & Vanstraelen (2005). Their paper addresses the question of whether voluntary adoption of International Financial Reporting Standards (IFRS) is associated with lower earnings management in Germany. They indicate that voluntary adopters of IFRS in Germany cannot be associated with lower earnings management. In 2006, no publication was recorded on the Scopus database using our search query. However, there has been a steady growth in the number of publications on the subject area from 2009 to 2019. The year 2019 recorded the highest number of publications with 219 documents as shown in figure 1.

Languages of Documents

The 1019 documents are published in seven different languages. This is presented in Table 3. Among these seven languages, English has the highest document with 98.1% followed by Portuguese with 0.7%. Korean and German language recorded the lowest publication with one document representing 0.1% each.

| Table 3 Document Type | ||

| Language | Total Publications (TP) | Percentage (%) |

| English | 1000 | 98.1 |

| Portuguese | 6 | 0.7 |

| Spanish | 5 | 0.5 |

| Chinese | 4 | 0.4 |

| French | 2 | 0.2 |

| German | 1 | 0.1 |

| Korean | 1 | 0.1 |

| Total | 1019 | 100.0 |

Publishing Activity by Country

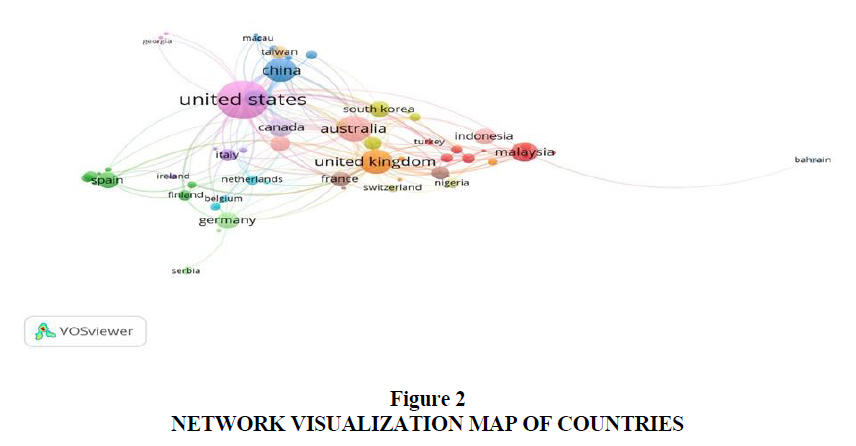

Authors from 83 countries have contributed at least one scholarly publication on IFRS and audit quality research. Figure 2 shows the co-authorship of countries from VOS Viewer. The country with the highest number of scholarly publications is the United States with total link strength of 118. The following countries recorded only one document Vietnam, Uruguay, Tanzania, Syria Arab Republic, Sri Lanka, Peru, Morocco, Mexico, Luxembourg, Israel, Hungary, Georgia, Estonia, Denmark, and Albania.

Unit of analysis = Countries

Counting method: Fractional counting

Minimum number of documents of a country = 1

Minimum number of citations of a country = 0

Table 4 shows the top 10 countries that contributed to the publications in IFRS and audit quality research. The country topping the list is the United States with 248 documents, amounting to 29.2%. These documents have been cited 5356 times. Among the top 10 countries, South Korea has the lowest count with 41 documents amounting to 4.8%.

| Table 4 Top 10 Countries Contribution to the Publications | |||

| Country | Documents | Percentage (%) | Citations |

| United States | 248 | 29.2 | 5356 |

| Australia | 114 | 13.4 | 1377 |

| United Kingdom | 98 | 11.6 | 1187 |

| China | 93 | 11.0 | 714 |

| Malaysia | 65 | 7.7 | 416 |

| Canada | 55 | 6.5 | 736 |

| Germany | 47 | 5.5 | 443 |

| Hong Kong | 44 | 5.2 | 1181 |

| Spain | 43 | 5.1 | 260 |

| South Korea | 41 | 4.8 | 187 |

Authors and Co-Authorship

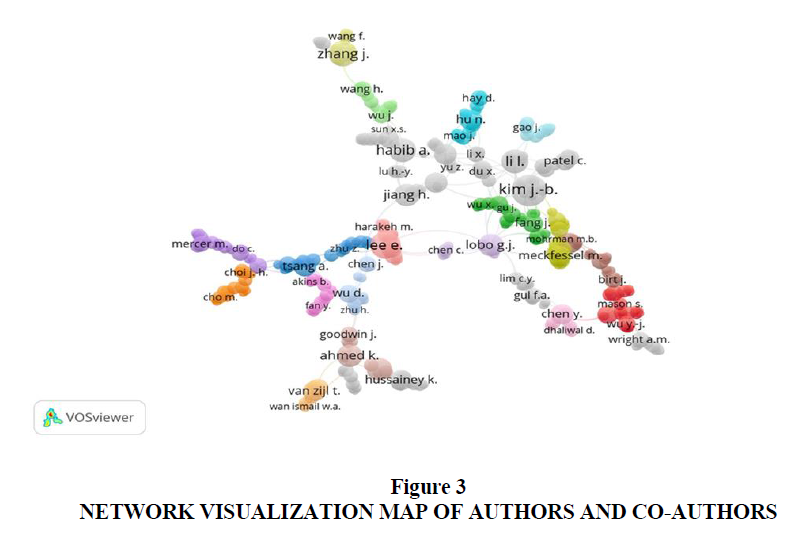

This section presents the prolific authors in IFRS and audit quality research domain in terms of the volume of scholarly outputs published. 2010 authors met the threshold selected in the VOSViewer. 376 out of 2010 authors have the largest set of connected items. Fig. 3 shows the network visualization map of authors and co-authors from VOS Viewer.

Unit of analysis = Authors

Counting method: Fractional counting

Minimum number of documents of an author = 1

Minimum number of citations of an author = 0

Table 5 present the top 10 most published authors in IFRS and audit quality research domain. The author with the highest number of publications is Kim, J.B of City University of Hong Kong, Hong Kong with 12 documents with 209 citations. Among these top 10 prolific authors, Zhang, J of Xi’an Jiaotong University, China recorded the highest number of citations (533 citations) with 8 documents. The author with the lowest number of documents among the top 10 most published authors is Ahmed, K. of La Trobe University in Australia with 6 documents and 125 citations

| Table 5 Top 10 Most Published Authors in IFRS and Audit Quality | |||||

| Author | Institutional Affiliation | Country | Documents | Percentage | Citations |

| Kim, J.-B. | City University of Hong Kong | Hong Kong | 12 | 14.5 | 209 |

| Lee, E. | University of Manchester | United Kingdom | 9 | 10.8 | 94 |

| Ozili, P.K. | University of Essex | United Kingdom | 9 | 10.8 | 63 |

| Uwuigbe, U. | Covenant University | Nigeria | 9 | 10.8 | 43 |

| Iatridis, G.E. | University of Thessaly | Greece | 8 | 9.6 | 84 |

| Uwuigbe, O.R. | Covenant University | Nigeria | 8 | 9.6 | 37 |

| Zhang, J. | Xi’an Jiaotong University | China | 8 | 9.6 | 533 |

| Habib, A. | Massey University | New Zealand | 7 | 8.4 | 101 |

| Li, L. | University of Pennsylvania | United States | 7 | 8.4 | 99 |

| Ahmed, K. | La Trobe University | Australia | 6 | 7.2 | 125 |

Most Active Source Titles

An analysis of the most active outlets where IFRS and audit quality research has been published is presented in this section in Table 6.

| Table 6 Top 20 Outlet of IFRS and Audit Quality Research (2005-2019) | ||||||

| Source | Publisher | TP | TC | SJR 2019 | SNIP 2019 | Cite Score 2019 |

| Accounting Review | American Accounting Association | 31 | 1981 | 5.446 | 3.729 | 7.1 |

| Auditing | American Accounting Association | 30 | 436 | 1.822 | 1.706 | 4.0 |

| Managerial Auditing Journal | Emerald | 28 | 214 | 0.468 | 1.271 | 2.7 |

| International Journal of Accounting | Elsevier | 23 | 350 | 0.450 | 1.259 | 2.9 |

| International Journal of Auditing | Wiley-Blackwell | 22 | 93 | 0.394 | 0.979 | 2.0 |

| Asian Review of Accounting | Emerald | 20 | 127 | 0.323 | 0.892 | 2.0 |

| Australian Accounting Review | Wiley-Blackwell | 20 | 189 | 0.386 | 1.023 | 2.2 |

| European Accounting Review | Taylor & Francis | 19 | 484 | 0.973 | 1.575 | 3.9 |

| Contemporary Accounting Research | Wiley-Blackwell | 18 | 174 | 2.207 | 2.274 | 4.3 |

| Journal of Accounting and Public Policy | Elsevier | 18 | 159 | 1.125 | 1.948 | 4.6 |

| Advances in Accounting | Elsevier | 17 | 193 | 0.392 | 0.721 | 1.9 |

| International Journal of Accounting and Information Management |

Emerald | 17 | 144 | 0.494 | 1.565 | 2.7 |

| Journal of International Accounting, Auditing, and Taxation |

Elsevier | 16 | 148 | 0.421 | 1.203 | 2.0 |

| Corporate Governance (Bingley) | Emerald | 15 | 77 | 0.574 | 1.396 | 3.3 |

| Corporate Ownership and Control | Virtus Interpress | 15 | 12 | NA | NA | NA |

| Journal of Contemporary Accounting and Economics |

Elsevier | 15 | 148 | 0.581 | 1.286 | 2.5 |

| Accounting and Finance | Wiley-Blackwell | 13 | 95 | 0.43 | 1.36 | 2.5 |

| Journal of Applied Accounting Research | Emerald | 13 | 73 | 0.349 | 0.951 | 2.0 |

| Journal of Business Finance and Accounting | Wiley-Blackwell | 13 | 262 | 0.874 | 1.47 | 2.7 |

| Journal of International Accounting Research | American Accounting Association | 13 | 51 | 0.397 | 0.832 | 1.8 |

There are 298 outlets where authors have published their scholarly work on IFRS and audit quality. The top 20 outlets were presented in table 6. Accounting review published by the American Accounting Association is the source with the highest number of publications recording 31 scholarly output. These 31 publications have been cited in 1981 times. This journal is among the top 10% source with the highest cite score on the Scopus database. Following Accounting Review Journal, Auditing is the source with the second highest number of publications with 30 articles with a cite score of 4.0. The lowest source among the top 20 outlets presented above is the Journal of International Accounting Research published by American Accounting Association with a cite score of 1.8. There is 13 scholarly outputs in the Journal of International Accounting Research for the time frame considered in this bibliometric study.

Keywords Analysis

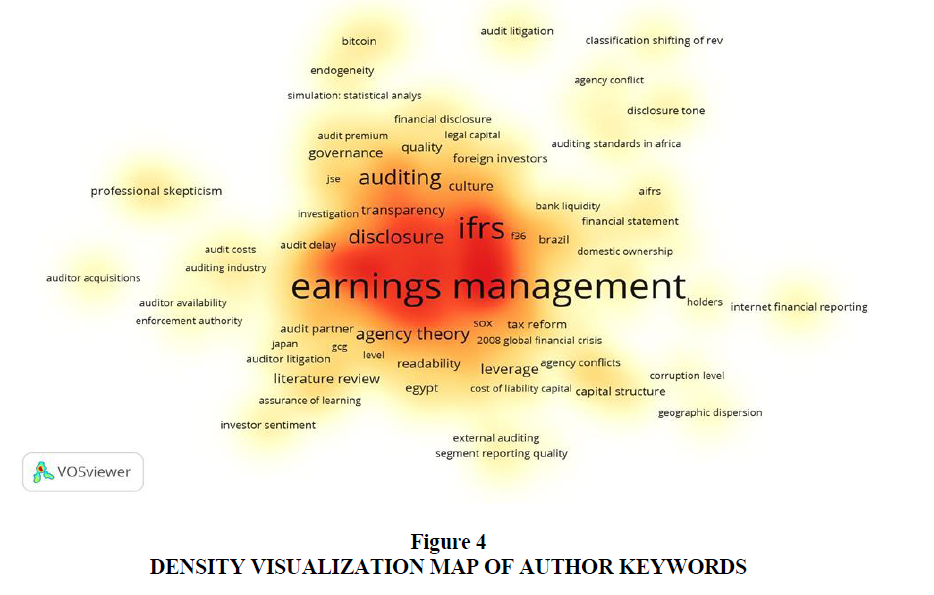

An analysis of author keywords used in IFRS and audit quality literature was performed to determine the trend of research in the domain. Figure 4 shows the density visualization map of author keywords.

Unit of analysis = Author Keywords

Counting method: Fractional counting

Minimum number of occurrence of a keyword = 1

There are 2137 keywords from scholarly publications in the research domain. From the density visualization map above, it is evidenced that earnings management and IFRS are two keywords with the highest publication count. This is further presented in table 7. Earnings management is the keyword with most publication count. 136 scholarly documents included earnings management as a keyword. Following earning management, corporate governance is the second among the top 10 keywords trend having 105 documents. Audit quality has 100 publications. The lowest keyword among the top 10 is financial reporting.

| Table 7 Top 10 Keywords Trend | ||

| Keyword | Total Publications | Percentage |

| Earnings Management | 136 | 20.2 |

| Corporate Governance | 105 | 15.6 |

| Audit Quality | 100 | 14.9 |

| IFRS | 93 | 13.8 |

| Audit Fees | 51 | 7.6 |

| Earnings Quality | 45 | 6.7 |

| Discretionary Accruals | 37 | 5.5 |

| China | 36 | 5.3 |

| Financial reporting quality | 36 | 5.3 |

| Financial reporting | 34 | 5.1 |

Most Influential Institutions

There are 1847 participating institutions for research in IFRS and audit quality. Table 8 presents the top 20 institutions with a minimum of 3 documents. The City University of Hong Kong is the most influential institution with 7 scholarly publications recording 99 citations. Following this, University of Thessaly, Greece has 6 documents with 64 citations. There are five institutions with 5 documents each. These are Ferdowsi University of Mashhad (Iran), Temple University (United States), University of Houston (United States), University of Kentucky (United States), University of South Florida (United States). The institutions with lowest documents recording 3 documents each are Xiamen University (Hong Kong), American University (United States), Arizona State University (United States), Chinese University of Hong Kong (Hong Kong), Covenant University (Nigeria), Deakin University (Australia).

| Table 8 Top 20 Influential Institutions | ||||

| Organization | Country | Documents | Percentage | Citations |

| City University of Hong Kong | Hong Kong | 7 | 8.3 | 99 |

| University of Thessaly | Greece | 6 | 7.1 | 64 |

| Ferdowsi University of Mashhad | Iran | 5 | 6.0 | 16 |

| Temple University | United States | 5 | 6.0 | 65 |

| University of Houston | United States | 5 | 6.0 | 69 |

| University of Kentucky | United States | 5 | 6.0 | 84 |

| University of South Florida | United States | 5 | 6.0 | 119 |

| Depaul University | United States | 4 | 4.8 | 100 |

| Emory University | United States | 4 | 4.8 | 84 |

| Georgia State University | United States | 4 | 4.8 | 189 |

| Michigan State University | United States | 4 | 4.8 | 89 |

| Monash University | Australia | 4 | 4.8 | 58 |

| University of Sydney | Australia | 4 | 4.8 | 15 |

| Wake Forest University | United States | 4 | 4.8 | 127 |

| Xiamen University | China | 3 | 3.6 | 50 |

| American University | United States | 3 | 3.6 | 39 |

| Arizona State University | United States | 3 | 3.6 | 29 |

| Chinese University of Hong Kong | Hong Kong | 3 | 3.6 | 463 |

| Covenant University | Nigeria | 3 | 3.6 | 9 |

| Deakin University | Australia | 3 | 3.6 | 11 |

Citation Analysis

An analysis of the top 20 most cited publications in the IFRS and audit quality domain is presented in table 9. The document with the highest citations is titled “a review of archival Auditing research” published by Defond & Zhang (2014). This article was published in the Journal of Accounting and Economics. In this article, they define higher audit quality as a greater assurance of high financial reporting quality. Researchers use many proxies for audit quality, with little guidance on choosing among them. They provided a framework for systematically evaluating the unique strengths and weaknesses of audit quality proxies. Because it is inextricably intertwined with financial reporting quality, audit quality also depends on firms' innate characteristics and financial reporting systems. Their review of the models commonly used to disentangle these constructs suggests the need for better conceptual guidance. Finally, they urge more research on the role of auditor and client competency in driving audit quality. The keywords used are Audit quality; Audit quality models; Audit quality proxies; Auditing; Auditor incentives; Client incentives; Competencies; Financial reporting quality

| Table 9 Highly Cited Articles |

||||

| S/N | Authors | Year | Titles | Citations |

| 1 | Defond, M., Zhang, J. | 2014 | A review of archival auditing research | 477 |

| 2 | Lennox, C.S., Francis, J.R., Wang, Z. | 2012 | Selection models in accounting research | 430 |

| 3 | Dhaliwal, D.S., Radhakrishnan, S., Tsang, A., Yang, Y.G. | 2012 | Nonfinancial disclosure and analyst forecast accuracy: International evidence on corporate social responsibility disclosure | 429 |

| 4 | Armstrong, C.S., Barth, M.E., Jagolinzer, A.D., Riedl, E.J. | 2010 | Market reaction to the adoption of IFRS in Europe | 298 |

| 5 | Dichev, I.D., Graham, J.R., Harvey, C.R., Rajgopal, S. | 2012 | Earnings quality: evidence from the field | 249 |

| 6 | Van Tendeloo, B., Vanstraelen, A. | 2005 | Earnings management under German GAAP versus IFRS | 222 |

| 7 | Leuz, C., Wysocki, P.D. | 2016 | The economics of disclosure and financial reporting regulation: evidence and suggestions for future research | 206 |

| 8 | Lang, M., Lins, K.V., Maffett, M. | 2012 | Transparency, liquidity, and valuation: international evidence on when transactions matters most | 174 |

| 9 | Leuz, C. | 2010 | Different approaches to corporate reporting regulation: how jurisdictions differ and why | 162 |

| 10 | Chen, H., Tang, Q., Jiang, Y., Lin, Z. | 2010 | The role of international financial reporting standards in accounting quality: evidence from the European Union | 161 |

| 11 | Shipman, J.E., Swanquist, Q.T., Whited, R.L. | 2017 | Propensity score matching in accounting research | 160 |

| 12 | Ball, R. | 2009 | Market and political/regulatory perspectives on the recent accounting scandals | 154 |

| 13 | Humphrey, C., Loft, A., Woods, M. | 2009 | The global audit profession and the international financial architecture: understanding regulatory relationships at a time of financial crisis | 134 |

| 14 | Brown, P. Preiato, J., Tarca, A. | 2014 | Measuring country differences in enforcement of accounting standards: an audit and enforcement proxy | 113 |

| 15 | Hope, O.K., Thomas, W.B., Vyas, D. | 2013 | Financial reporting quality of U.S private and public firms | 107 |

| 16 | Guedhami, O., Pittman, J.A., Saffar, W. | 2014 | Auditor choice in politically connected firms | 94 |

| 17 | Glaum, M., Schmidt, P., Street, D.L., Vogel, S. | 2013 | Compliance with IFRS 3 and IAS 36 required disclosures across 17 European countries: company and country-level determinants | 86 |

| 18 | Lang, M., Maffett, M. | 2011 | Transparency and liquidity uncertainty in crisis periods | 82 |

| 19 | Kathy Hurtt, R., Brown-Liburd, H., Earley, C.E., Krishnamoorthy, G. | 2013 | Research on auditor professional skepticism: literature synthesis and opportunities for future research | 79 |

| 20 | Marra, A., Mazzola, P., Prencipe, A. | 2011 | Board monitoring and earnings management pre and post IFRS | 79 |

Conclusion

This study offers a unique perspective on IFRS and audit quality as a subdomain of accounting research as it provides a holistic overview of different research themes that frequently occur within leading accounting and auditing journals. First, the descriptive part of this study reveals that IFRS and audit quality research domain has attracted growing attention in the leading accounting and auditing journals especially between 2009-2019. The adoption of IFRS by many developing countries can be linked to the increase in publications.

In conclusion, this paper specifically employs a bibliometric approach to quantitatively analyze the volume and impact of 1019 publications in IFRS and audit quality research domain. The study focused on determining the yearly distribution, national contributions, leading prolific authors, most productive institutions, publication outlets, authorship patterns, document types, the language of documents, and citation trends of IFRS and audit quality research publication from 2005-2019. The International Financial Reporting Standards (IFRS) have now been implemented and routinely practiced in over 120 jurisdictions, while some of these nations have partially shifted their accounting practices to those enlisted in IFRS, including China. Whereas a country like the United States yet remains reluctant to adopt such practices. In contrast, a few economies like Iran still find themselves examining the feasibility and utility of these standards (Mohammadrezaei et al., 2015). The worldwide implementation of IFRS has initiated theoretical and empirical research emphasizing on that probability that whether the quality and efficiency of financial reporting improves following IFRS adoption via enhanced value relevance, reduced discretionary accruals, improved analysts forecast accuracy and other measures (Clarkson et al., 2011; Houqe et al., 2012; Kim & Shi, 2012; Cordo? et al., 2020). However, Ahmed et al. (2013) report that this strand of research has produced mixed findings and therefore are unable to reach a conclusion.

References

- Abu Risheh, K.E., & Al-Saeed, M.T.A. (2014). The Impact of IFRS adoption on audit fees: evidence from Jordan. Accounting & Management Information Systems/Contabilitate si Informatica de Gestiune, 13(3), 1-12.

- Ahmed, K., Chalmers, K., & Khlif, H. (2013). A meta-analysis of IFRS adoption effects. The International Journal of Accounting, 48(2), 173-217.

- Armstrong, C.S., Barth, M.E., Jagolinzer, A.D., & Riedl, E.J. (2010). Market reaction to the adoption of IFRS in Europe. The Accounting Review, 85(1), 31-61.

- Ball, R. (2006). International Financial Reporting Standards (IFRS): pros and cons for investors. Accounting and Business Research, 36(1), 5-27.

- Ball, R. (2009). Market and political/regulatory perspectives on the recent accounting scandals. Journal of Accounting Research, 47(2), 277-323.

- Bouchareb, M. (2014). Does the Adoption of IAS/IFRS with a Strong Governance Mechanism Can Deter Earnings Management? International Journal of Academic Research in Economics and Management Sciences, 3(1), 264.

- Brown, P. Preiato, J., & Tarca, A. (2014). Measuring country differences in enforcement of accounting standards: an audit and enforcement proxy. Journal of Business Finance and Accounting, 41(1-2), 1-52.

- Cabal-García, E., De-Andrés-Suarez, J., & Fernández-Méndez, C. (2019). Analysis of the effects of changes in Spanish auditing regulation on audit quality and its differential effect depending on the type of auditor. Revista de Contabilidad-Spanish Accounting Review, 22(2), 171-186.

- Center for Audit Quality (CAQ). (2014). The CAQ approach to audit quality indicators. Available at: https://www.thecaq.org/caqapproach-audit-quality-indicators

- Center for Audit Quality (CAQ). (2016). Audit quality indicators: Journey and path ahead. Available at: https://www.thecaq.org/auditquality-indicators-journey-and-path-ahead

- Center for Audit Quality (CAQ). (2019). Audit quality disclosure framework. Available at: https://www.thecaq.org/audit-qualitydisclosure-framework/

- Chen, H., Tang, Q., Jiang, Y., Lin, Z. (2010). The role of international financial reporting standards in accounting quality: evidence from the European Union. Journal of International Financial Management and Accounting, 21(3), 220-278.

- Clarkson, P., Hanna, J.D., Richardson, G.D., & Thompson, R. (2011). The impact of IFRS adoption on the value relevance of book value and earnings. Journal of Contemporary Accounting & Economics, 7(1), 1-17.

- Cordo?, G.S., Fülöp, M.T., & M?gda?, N. (2020). The concept of corporate reporting and audit quality. In Management Accounting Standards for Sustainable Business Practices (pp. 251-271). IGI Global.

- Dhaliwal, D.S., Radhakrishnan, S., Tsang, A., & Yang, Y.G. (2012). Nonfinancial disclosure and analyst forecast accuracy: international evidence on corporate social responsibility disclosure. Accounting Review, 87(3), 727-759.

- DeFond, M.L., & Lennox, C.S. (2017). Do PCAOB inspections improve the quality of internal control audits? Journal of Accounting Research, 55(3), 591-627.

- Defond, M., & Zhang, J. (2014). A review of archival auditing research. Journal of Accounting and Economics, 58(3), 275-326.

- Dichev, I.D., Graham, J.R., Harvey, C.R., & Rajgopal, S. (2012). Earnings quality: evidence from the field. Journal of Accounting and Economics, 56(2-3), 1-33.

- Fodio, M.I., Oba, V.C., Olukoju, A.B., & Zik-rullahi, A.A. (2015). IFRS adoption, firm traits, and audit timeliness: Evidence from Nigeria. Acta Universitatis Danubius Economica, 11(3), 1-12.

- Garrouch, H., Hadriche, M., & Omri, A. (2014). Earnings management and corporate governance related to mandatory IFRS adoption: evidence from French–listed firms. International Journal of Managerial and Financial Accounting, 6(4), 322-340.

- Gaynor, L.M., Kelton, A.S., Mercer, M., & Yohn, T. L. (2016). Understanding the relation between financial reporting quality and audit quality. Auditing: A Journal of Practice & Theory, 35(4), 1-22.

- Glaum, M., Schmidt, P., Street, D.L. & Vogel, S. (2013). Compliance with IFRS 3 and IAS 36 required disclosures across 17 European countries: company and country-level determinants. Accounting and Business Research, 43(3), 163-204.

- Guedhami, O., Pittman, J.A., & Saffar, W. (2014). Auditor choice in politically connected firms. Journal of Accounting Research, 52(1), 107-162.

- Hope, O.K., Thomas, W.B., & Vyas, D. (2013). Financial reporting quality of U.S private and public firms. Accounting Review, 88(5), 1715-1742.

- Houqe, M.N., Monem, R.M., & van Zijl, T. (2012). Government quality, auditor choice, and adoption of IFRS: a cross country analysis. Advances in Accounting, 28(2), 307-316.

- Humphrey, C., Loft, A., & Woods, M. (2009). The global audit profession and the international financial architecture: understanding regulatory relationships at a time of financial crisis. Accounting, Organizations and Society, 34(6-7), 810-825.

- Ionela, I.V.A.N. (2016). The importance of professional judgement applied in the context of the International Financial Reporting Standards. The Audit Financiar Journal, 14(142), 1127-1127.

- Jarva, H. (2014). Economic consequences of SFAS 142 goodwill write?offs. Accounting & Finance, 54(1), 211-235.

- Jung, S.J., Kim, B.J., & Chung, J.R. (2016). The association between abnormal audit fees and audit quality after IFRS adoption. International Journal of Accounting and Information Management.

- Kang, Y.J., & Piercey, M.D. (2020). Would an audit judgment rule improve audit committee oversight and audit quality? Current Issues in Auditing, 14(1), P16-P25.

- Kathy Hurtt, R., Brown-Liburd, H., Earley, C.E., & Krishnamoorthy, G. (2013). Research on auditor professional skepticism: literature synthesis and opportunities for future research. Auditing, 32(1), 45-97.

- Kawshalya, P., & Srinath, N. (2019). The impact of company characteristics and IFRS adoption on audit report delay: evidence from a developing country. In Proceedings of the 3rd International Conference on Business and Information Management (pp. 87-91).

- Kim, J.B., & Shi, H. (2012). Voluntary IFRS adoption, analyst coverage, and information quality: International evidence. Journal of International Accounting Research, 11(1), 45-76.

- Krishnan, J., Krishnan, J., & Song, H. (2017). PCAOB international inspections and audit quality. The Accounting Review, 92(5), 143-166.

- Marques, R.P., & Santos, C. (2017). Research on continuous auditing: A bibliometric analysis. In 2017 12th Iberian Conference on Information Systems and Technologies (CISTI) (pp. 1-4). IEEE.

- Modugu, P.K., Eragbhe, E., & Ikhatua, O.J. (2012). Determinants of audit delay in Nigerian companies: Empirical evidence. Research Journal of Finance and Accounting, 3(6), 46-54.

- Mohammadrezaei, F., Mohd-Saleh, N., & Banimahd, B. (2015). The effects of mandatory IFRS adoption: A review of evidence-based on accounting standard setting criteria. International Journal of Disclosure and Governance, 12(1), 29-77.

- Lahmar, A.T., & Asbi, A. (2017). Factors influence the adoption of international financial reporting standards (IFRS) adoption in Libya. Global Journal of Accounting and Finance, 1, 18-32.

- Lang, M., Maffett, M. (2011). Transparency and liquidity uncertainty in crisis periods. Journal of Accounting and Economics, 52(2-3), 101-125.

- Lang, M., Lins, K.V., & Maffett, M. (2012). Transparency, liquidity, and valuation: international evidence on when transactions matters most. Journal of Accounting Research, 50(3), 729-774.

- Lennox, C.S., Francis, J.R., & Wang, Z. (2012). Selection models in accounting research. The Accounting Review, 87(2), 589-616.

- Leuz, C. (2010). Different approaches to corporate reporting regulation: how jurisdictions differ and why. Accounting and Business Research, 40(3), 229-256.

- Leuz, C., & Wysocki, P.D. (2012). The economics of disclosure and financial reporting regulation: evidence and suggestions for future research. Journal of Accounting Research, 54(2), 525-622.

- Marra, A., Mazzola, P., Prencipe, A. (2011). Board monitoring and earnings management pre and post IFRS. International Journal of Accounting, 46(2), 205-230.

- Public Company Accounting Oversight Board- PCAOB (2013). Briefing paper: Discussion—Audit quality indicators, SAG meeting, May 15-16. Available at: https://pcaobus.org/News/Events/Documents/10162013_IAGMeeting/AQI_Briefing_Paper.pdf

- Public Company Accounting Oversight Board- PCAOB. (2015a). Concept Release on Audit Quality Indicators. Release No. 2015-005. Available at:https://pcaobus.org/Rulemaking/Docket%20041/Release_2015_005.pdf

- Public Company Accounting Oversight Board- PCAOB. (2015b). Briefing paper: Audit quality indicators—Update and discussion, SAG meeting, November 12-13. Available at: https://pcaobus.org/News/Events/Documents/11-12-2015-SAG-Meeting/SAG AQIMemo.pdf

- Public Company Accounting Oversight Board- PCAOB. (2017a). The auditor’s report on an audit of financial statements when the auditor expresses an unqualified opinion. Available at: https://pcaobus.org/Rulemaking/Docket034/2017-001-auditors-report-finalrule.pdf

- Public Company Accounting Oversight Board- PCAOB. (2017b). Briefing paper: Audit quality indicators—Panel discussion, SAG meeting, November 29-30. Available at: https://pcaobus.org/News/Events/Documents/11292017-SAG-meeting/Audit-QualityIndicators-11-29-17.pdf

- Public Company Accounting Oversight Board- PCAOB. (2018). Strategic plan 2018–2022. Available at: https://pcaobus.org/About/ Administration/Documents/Strategic%20Plans/PCAOB-2018-2022-Strategic-Plan.pdf\

- Shan, Y.G., Troshani, I., & Richardson, G. (2015). An empirical comparison of the effect of XBRL on audit fees in the US and Japan. Journal of Contemporary Accounting & Economics, 11(2), 89-103.

- Shipman, J.E., Swanquist, Q.T., Whited, R.L. (2017). Propensity score matching in accounting research. Accounting Review, 92(1), 213-244.

- Van Tendeloo & Vanstraelen (2005). Earnings management under German GAAP versus IFRS. European Accounting Review, 14(1), 155-180.