Research Article: 2022 Vol: 26 Issue: 2S

A comparative performance appraisal of Islamic and conventional banking in Pakistan

Ahmad Ali, Punjab Vocational Training Council

Minhas Akbar, COMSATS University Islamabad (Sahiwal Campus) & University of Hradec Králové

Ing. Libuše Svobodová, University of Hradec Králové

Citation Information: Ali, A., Akbar, M., & Svobodová, I.L. (2022). A comparative performance appraisal of Islamic and conventional banking in Pakistan. Academy of Accounting and Financial Studies Journal, 26(S2), 1-13.

Abstract

Islamic banking has witnessed a phenomenal growth worldwide and has been at the forefront of academic discussion in recent years. The present research employs financial ratios to compare the performance indicators of liquidity, profitability, insolvency risk and asset composition in Islamic and conventional banks of Pakistan. We use diverse econometric approaches such as univariate analysis and logistic regression to analyze the financial ratios of Islamic and conventional banks. While neural network analysis is applied to uncover the most important ratios in the banking industry. The findings reveal that, on average profitability for conventional banks is higher than Islamic banks. In contrast, credit and insolvency risk is higher for Islamic banks than their conventional counterparts. Results of neural network analysis entail that deposit to assets ratio and return on equity are most important financial indicators in the banking industry. While, loans to deposits ratio is the least important indicator. Study has useful implications especially for Islamic banking industry. The policy makers of these banks should strive to optimize profitability and introduce new tools to curtail the credit and insolvency risk. Profitability can be increase by focusing on increasing turnover, efficiency, productivity, and decreasing costs. It can be overcome by thoroughly checking clients’ past credit history, limiting the credit level, insurance the credit risk, etc.

Keywords

Conventional Banking, Banking Industry, Global Financial Crises

Introduction

Islamic finance industry has witnessed exponential growth globally, surpassing the USD 2 trillion mark in 2017 (Alam, Seifzadeh & Management, 2020) and reaching at 2.4 trillion in 2019. The banking system plays a vital role in the economic progress of a nation. It supports in managing investments, channelize savings and funds in the financial market. While banks being a mainstay in the financial system, they provide numerous financial services to their customers. They perform an intermediate role between borrowers and depositors and also provide brokerage and cash management services. The banking sector distorted globally as a result of the Global Financial Crises (GFC) of 2007-2008. However, Islamic banking system not only sustained but also remained resilient than their conventional banking counterparts. During the financial crisis, the stability of Islamic banks arrested the attention of researchers and policymakers to contrast the operating mechanism of conventional and Islamic banking systems (Alexakis, Izzeldin, Johnes & Pappas, 2019). The primary difference between them is that Islamic banks are interest-free because it is strictly prohibited in Shariah,1 while the operations of conventional banks are based on interest also known as riba in Islam (Bhatti, 2020; Sorwar, Pappas, Pereira & Nurullah, 2016).

Islamic banking is growing rapidly around the globe, and Pakistan is no exception. Islamic institutions' total assets reached 2.4 trillion dollars in 2019, and around 1400 institutions are operating in 80 different countries (refinitiv, 2019). Islamic banking department of State Bank of Pakistan (SBP) is working with the vision to make it the priority of all users. Total assets of Islamic banks in Pakistan have reached PKR 2992 billion with an annual growth rate of 20.6%, while a total number of Islamic banking branches and sub-branches is reached at 2913 (SBP, 2019). Total five full-fledged Islamic banks are working in Pakistan with a market share of around 20%, expected in 2020 (Ullah, 2019).

As the Islamic financial system has got global attention, the literature has proliferated rapidly in this niche. A list of studies has described the instruments, Shariah principles, business model, stability and comparison between Islamic and conventional banks (Beck, Demirgüç-Kunt & Merrouche, 2010; Khediri, Charfeddine & Youssef, 2015b; Miah & Sharmeen, 2015; Pappas, Ongena, Izzeldin & Fuertes, 2017). Others have discussed the supervisory, management, institutional diversity, framework and regulatory roles of Islamic banking (Qorchi, 2005; Garas & Pierce, 2010; Karim, 2001; Rammal, 2006; Sarker, 2005; Sarker, 2000; Seibel, 2008), profitability and efficiency comparison using stochastic frontier analysis, data envelopment analysis, function approach, meta frontier analysis, camel analysis, assets growth, credit growth and systematic and unsystematic risk (Boubakri, Chen, Guedhami & Li, 2019; Hamdi, Abdouli, Ferhi, Aloui & Hammami, 2019; Nosheen & Rashid, 2019; Ullah, 2019) and either we can distinguish between Islamic and conventional banks or not (Al-Tamimi, Lafi & Uddin, 2016; Asad, Ahmad, Haider & Salman, 2018; Imran Khan, Khan & Tahir, 2017; Shawtari, Ariff & Abdul Razak, 2019).

Islamic finance industry is growing rapidly in Pakistan due to an increased public demand for Islamic financial products (Akbar & Akbar, 2016; Akbar, Akbar & Draz, 2021). In the context of Pakistan, a list of studies have been conducted on the comparison between Islamic and conventional banks; some compare the feature of both banks (Jaffar & Manarvi, 2011), differentiation between Islamic and conventional banks using camel analysis (Hanif, 2014), discussed differences and similarities (Ahmad, Saif & Safwan, 2010) and explored the service quality in Pakistani banks (Tara, Irshad, Khan, Yamin & Rizwan, 2014). Some recent studies in Pakistan discussed lending structure, risk management, and cost and benefit analysis (Asad et al., 2018). CAMEL analysis compares banks in terms of management capabilities, liquidity and assets management (Khan, Rizwan, Akhtar, Naqvi & Waqar, 2017), credit risk (Khan, Saeed & Alam, 2018) and deposits determinants in Pakistan (Ishtiaq Khan, Rahman, Jan & Khan, 2017). However, considering the breadth and depth of these studies, they have ignored an important aspect to be compared between Islamic and conventional banks. That is, the level of profitability, liquidity and insolvency risk in both types of banks.

The study contributes to the Islamic finance literature in at least two ways. First, by using financial ratios, it compares the Islamic and conventional banks in multiple aspects. (Profitability, liquidity, credit risk and insolvency risk). Second, most of the studies in the literature focus only on descriptive statistics to compare Islamic and conventional banks. This study used the most sophisticated techniques, such as logistic regression and neural network analysis. Thus, this study endeavors to contribute to the literature on Islamic finance by likening Islamic and conventional banks to their profitability, liquidity and risk measured by using different financial ratios.

Literature Review and Hypotheses Development

Literature Review

Majority of the studies focused on the internal and external characteristics and comparison of performance between Islamic and Conventional banks. So for based on previous studies we concluded four features that supports both banks performance. First, the marks up agreements of Islamic banks are based on real assets that represent actual economy, making them less risky in speculative environment which actually became the cause of financial crisis in 2008 (Alexakis et al., 2019). Second, most often, to compete with conventional banks and attract new customers, Islamic banks have to offer higher returns to their customers. If the returns are not reasonable, customers start to invest in other available alternatives and may withdraw their investments from Islamic banks; this push makes Islamic banks' performance more efficient (Farooq & Zaheer, 2015). Third, in some macroeconomic factors such as; increase in banking foreign competition, the progress of the private banking sector, oil revenues, and the latest reforms, adoption creates pressure on Islamic banks for better performance to change the policies and make positive financial changes (Bitar, Hassan & Walker, 2017). Finally, Islamic banks' capability of managing has also increased by providing awareness to their customers to cope with the disadvantage of the lack of knowledge about Shariah products. Islamic banks are using effective marketing strategies to increase the awareness of Islamic financial products as well they are providing training to employees to enhance the positive experience and all these steps promote the effectiveness of Islamic banks (Albaity & Rahman, 2019; Zin, Noordin, Rahman & Faisal, 2019).

In contrast, conventional banks are more efficient than Islamic banks for four key reasons. First, Islamic banks' dependency on the real economy somehow becomes a disadvantage for Islamic banks if the financial situation disturbs the actual economy (Bourkhis & Nabi, 2013). Nakheel properties, an investment business in Dubai, rescheduled the Sukuk of Islamic banks worth 4 billion dollars considering the bankruptcy risk, may land the banking system in crisis (gulfnews, 2009). Therefore, it raised the question in Islamic finance report that whether or not Islamic banks are dependent on the real economy? (Standard & Poor's, 2017). Second, Islamic banking is based on Shariah principles and it only deals in the products and tools which comply Shariah principles. Hence, the products used in Islamic banks have different investment and risk management tools; some are not homogeneous. Furthermore, prior to introducing new products in Islamic banks, Shariah board’s approval is mandatory which is often time consuming (Abedifar, Molyneux & Tarazi, 2013; Johnes, Izzeldin & Pappas, 2014). Nevertheless, Islamic banks have to follow both international and Islamic accounting standards which escalates the operational cost of Islamic banks (Bitar, Hassan & Hippler, 2018). Finally, as per (Beck et al., 2010) Islamic banking system is still at it infancy stage, relatively small and less experienced than the conventional banking system. The industry’s contribution to the economy is also meager than conventional peers.

Hypothesis Development

This study mainly focuses on the comparison between Islamic and conventional banks based on their financial characteristics. Our study examined the differences according to financial position between Islamic and conventional banking. Our first hypothesis is about the profitability.

Our study differentiates the Islamic and conventional banks in terms of financial perspective by using financial ratios. Halkos & Salamouris (2004) Investigate the efficiency of conventional banks in Greek by using the financial ratios. They use the Data Envelopment analysis. Our First hypothesis is about profitability. Hassoune (2002) Examine the profitability of Islamic banks. He concludes that the profitability of Islamic banks is more than conventional peers. Islamic banks outperforming is due to rely on the current account which are nonprofit or interest free accounts. The income of conventional banks is the bank spread while in case of Islamic banks the income of Islamic bank increases because of the interest free current accounts deposits. Islamic banks utilize these funds for more profitable investments and on average more profitable than conventional banks. In a similar fashion (Malim, 2020) show that Islamic bank has safe edge in profit and loss sharing accounts. The depositors in Islamic banks are mostly are religious, so they are more loyal than others. Depositors are happy on lower returns. Islamic banks are on safe side and less volatility than conventional banks. Further Bananuka (2019) explains that religious factor influences the depositors to fulfill the loan obligations as per the Islam principles. Customers prefer Islamic banks due to the religious beliefs and are ready to pay rents on the financial services received by their banks. That is the reason; Islamic banks charged high rent from their borrower and pay less than to their depositors. Further they extra charged by their clients in the name of providing the Shariah Base services to customers (Abedifar et al., 2013). Another part of literature shows that higher capital ratios of banks needs less external debts as well as have solvency risk reduce due higher capital ratio. Monitory returns of banks increased due to increase in equity and risk taking capacity of banks also increase in this way (Abedifar et al., 2013). The capital of bank and the profitability have a positive relationship as per the previous literature (Ben Khediri, 2009; Hassan, 2003; Luarn, 2005). We use the Return on Assets (ROA) and Return on Equity (ROE) as a measurement of profitability. These measures largely use in literature to measure profitability of banks (Bourkhis, 2013; Iqbal, 2001; Olson, 2008).Hence, base of the above discussion we formulate our first hypothesis as follows:

H1: Islamic banks are more profitable than conventional banks.

The second hypothesis is for liquidity in banks. Liquidity is the banks position to meet its obligation when it comes to due. Generally, banks face liquidity problem due to excess withdraw from savings and current accounts. Cash ratio is used to measure the ability of banks in short term obligation. Islamic banks are bound to invest only into Sharia based investment which is interest free. So, banks need to take capital for a longer time period to safe themselves from liquidity risk. Therefor to safe themselves from such risks, Islamic banks offer Sharia base higher return in bank accounts to collect more capital while the return for these investment is uncertain (Hasan, 2011). As per the previous studies Islamic banks holds more liquidity than conventional banks (Alqahtani, 2018; Bourkhis, 2013; Olson, 2008; Olson, 2017). In this study we examine the liquidity ratio through Cash to deposit ratio and cash to assets ratio and these ratios are largely used in the previous studies (Haddad, 2019; Khediri, 2015; Noman, 2015; Rashid, 2018). Higher level of ratios shows that banks have higher liquidity risk. So, we formulate our second hypothesis.

H2: Islamic banks are more liquid than conventional banks.

Our third research hypothesis is about insolvency and credit risk. If the borrower or the other party, who takes loans from bank fail to repay its obligations than banks face credit risk problems. This failure to repay is the loss for borrower and a risk for bank. Moreover, if the liabilities of bank become higher than the total assets, bank becomes insolvent. Assumptions that Islamic banks are lower risky than conventional banks are because of the Shariah base contracts (Khan, 2017; Olson, 2017; Toumi, 2019) In profit and loss sharing agreement banks maintain their risk in difficult financial position because banks have no guaranteed for fix return and on principle amount. Therefor PLS agreement allow Islamic banks to move the credit risk to its liability side from its assets side and in case of decreasing its assets, its liability also decrease. Olson, (Olson, 2017) further examines that under the profit and loss sharing agreement the risk of paying the return to borrowers reduce. This shows that comparatively than conventional banks, Islamic banks have more chances to sustain in loss condition (Abedifar et al., 2013). Islamic agreement reduced credit risk because of the moral responsibility shared between both parties. Further Islam prohibits the excessive uncertainty investments as well as gambling is also prohibited in Islamic (Siddiqi, 2006). So, comparatively Islamic banks are lower or less risk than conventional banks. Literature shows that Islamic and conventional banks may be different in terms of risk (Metwally, 1997) and studies show that the risk in Islamic banks are lower than conventional banks (Abedifar, 2013; Beck, 2013). We use two financial ratios as a credit risk proxy. While we use four financial ratios for insolvency risk calculations. Loans to Assets ratios (LTA) and Loans to Deposits (LTD) as proxy for measuring credit risk. While, Debt To Assets (DTA), Debt To Equity (DTE), Deposits To Equity (DE) and Deposits To Assets (DA) these are the proxy for insolvency risk (Khan, 2017; Olson, 2017; Toumi, 2019; Khan, 2017; Olson, 2017; Toumi, 2019). These ratios are previously used in literature to measure and compare the Islamic and conventional banking.

H3: Islamic banks are less risky comparatively than conventional banks.

Data and Methodology

Data and Variables

This study uses the annual reports to collect the financial data of both Islamic and conventional banks for 2011 to 2018. Some conventional banks and Islamic branches of conventional banks have been excluded from the final sample because of the non-availability of data on key variables. So, the final sample consists of 17 conventional and 4 full-fledged Islamic banks. ROA and ROE are the most commonly used measures of enterprise performance (Akbar, 2014a, 2014b, 2015; Wang, Akbar & Akbar, 2020). While liquidity ratios depict ability to pay short term obligations (Akbar, Jiang & Akbar, 2020; Khan, Akbar & Akbar, 2016). Likewise, insolvency ratios indicate bank’s ability to pay its long-term liabilities as they become due (A. Akbar, Akbar, Tang & Qureshi, 2019; Hussain et al., 2020). The structure ratios exhibit the proportion of fixed assets in the portfolio of total assets (Akbar & Akbar, 2015). The ratios used in this study are consistent with the prior studies (Khediri, Charfeddine & Youssef, 2015a; Pasiouras & Finance, 2008; Srairi, 2013). Table 1 presents the calculation and definition of variables used in this study.

| Table 1 Variables Calculation |

||

|---|---|---|

| Abbreviation | Variables | Definition |

| Profitability | ||

| ROA | Return-on-assets | Net Income/total assets |

| ROE | Return-on-equity | Net Income/total equity |

| Liquidity | ||

| CTA | Cash-to-Assets | Cash/Total Assets |

| CTD | Cash-to-deposits | Cash/Total deposits |

| Credit Risk/insolvency risk | ||

| LTA | Loan-to-Assets | Loan/Total Assets |

| LTD | Loan-to-Deposits | Loan/Total Deposits |

| DTA | Debt-to-assets | Total Debt/Total assets |

| ETA | Equity-to-assets | Total Equity/Total assets |

| DA | Deposits-to-assets | Total Deposits/Total assets |

| DE | Deposits-to-equity | Total Deposits/Total equity |

| Assets Structure | ||

| FAA | Fixed Assets-to-Assets | Fixed-Assets/Total-Assets |

Descriptive Statistics and Independent Sample t-test

Table 2 present the results for descriptive statistics and t-test for this study. Descriptive statistics provides the basic features of the data used in the study. It describes the magnitude of the study and helps us to present large data in a simplified form. Independent sample t-test, also called the two-sample t-test and student test is an inferential statistical test that explores a statistically significant difference based on mean values of two groups of data. The null and alternative hypothesis for independent sample t-test is that there is no statistically difference and mean values of populations are equal for two groups. There is a statistical difference in population mean values, respectively. In the second case, we can accept the alternative hypothesis and reject the null hypothesis. For instance, we need to set the level of significance that can be the benchmark to accept the null hypothesis and accept the alternative hypothesis normally. The value is used 0.05, and the same value is followed in this study. This study uses Islamic and conventional banks as dependent variables and financial ratios as independent variables. This methodology is previously used in literature to compare both kinds of banks (Khediri et al., 2015b).

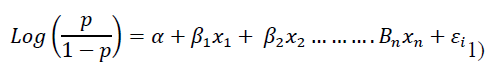

Logistic Regression

Logistic regression analysis is used to forecast the categorical dependent variables by using some explanatory variables. Discriminant analysis is also used for this purpose. Though, our data is not fulfilling its assumptions (large size of data, homogeneity in matrices, normal distribution and no outliers), while on the other hand, logistic regression needs no prior assumptions to fulfill (Pampel, 2000). The objective of logistic regression is to locate the best fitting and stingiest model to portray the connection between the result and by using a set of explanatory variables. We are using the banks (Islamic and conventional) as dependent variables and financial ratios as an independent variable to predict the variances, it presents in equations 1. The interpretation rule for the logit model is that if the coefficients beta value is positive, it supports the second group (conventional banks) performing well. In contrast, the negative beta value supports the first group (Islamic banks).

Omnibus tests used for goodness of model coefficients model significant value are good for this model. Hosmer and Lemeshow (Allen & Hevert) test show that either the predicted variables are significantly different or not. The insignificant value for this model shows the goodness of the fit model. The pseudo r2 is just like the value of r2 used in the ordinary least square regression. A classification table was used to determine the overall percentage of success for the model. The model explains the variation in dependent variable by using a set of independent variables in the following equation;

Here,

P=probability of the result of outcomes

Α=constant term

Β=represent the coefficients for independent variables

ei=error term.

The Neural Network Analysis

The neural network technique is an algorithmic methodology for changing inputs into wanted outputs by utilizing exceptionally interconnected networks of comparatively simple processing units. The important element of a neural network is the nodes, the network design depicting the associations between the nodes. The nodes are associated with each other as the output from one node can be filled in as the inputs to another node. Every node changes a contribution to an output utilizing some predefined work that is typically monotone. This capacity relies upon boundaries whose qualities ought to be resolved with a preparation set of inputs and outputs. The network design is the association of nodes and the kinds of associations permitted. The nodes are organized in layers with associations between nodes in various layers, yet not between nodes in a similar layer.

The layer getting the inputs is known as the input layer. The last layer giving the objective output signal is the output layer. Any layers between the output and input layers are called hidden layers. The decision rule of the neural network is as per the following: if the output unit ≥0.5, the perception belongs with group 1 (Islamic banks). Interestingly, on the other hand, if the output unit ≤0.5, at that point, the perception belongs with group 2 (conventional banks). This technique is previously used in literature to compare Islamic and conventional banks by using a set of independent variables (Khediri et al., 2015b).

Results and Discussion

Independent Sample t-test

On the ground level, to differentiate between Islamic and conventional banks based on financial ratios, table 2 shows the descriptive statistics to compare Islamic and conventional banks. The last column of the table presents the independent sample t-test for equality of means for all Islamic and conventional banks for every 11 financial ratios used in this study. The finding is measured by assuming unequal variances instead of equal variances because the data set for both types of banks are not equal. Table 2 also shows the means differences and standard deviation to compare the means differences between Islamic and conventional banks. Among all 11 financial ratios, 5 ratios are statistically significant to differentiate between both types of banks. The results show that conventional banks are more profitable than Islamic banks when we use ROA to measure it.

The average mean values are higher for conventional banks as 0.1008 and 0.0819 respectively. Finding shows that conventional banks are better in managing profitability and second reason because conventional banks are dominant in Pakistan. The results support our first hypothesis about profitability. We reject the null hypothesis and accept the alternative hypothesis because the profitability is higher for conventional banks. The findings are in line with our second hypothesis about liquidity. Liquidity is measured by cash to assets and cash to deposit ratios. The results are statistically insignificant. As per the results, we cannot distinguish between Islamic and conventional banks in terms of liquidity. Credit risk measured by using LTA and LTD ratios, the findings are statistically insignificant, show no difference between the two groups. Insolvency is a very important variable among all financial ratios because all its components show statistically significant results.

| Table 2 Descriptive Statistics |

||||||||

|---|---|---|---|---|---|---|---|---|

| Variables | N | Means | Standard Deviation | T-test equalityof means | ||||

| IB | CB | IB | CB | IB | CB | T-value | P-Value | |

| ROE | 32 | 144 | 0.082 | 0.101 | 0.09 | 0.249 | -0.733 | 0.455 |

| ROA | 32 | 144 | 0.005 | 0.01 | 0.005 | 0.013 | -3.6 | 0.000* |

| CTA | 32 | 144 | 0.076 | 0.08 | 0.022 | 0.131 | -0.297 | 0.313 |

| CTD | 32 | 144 | 0.091 | 0.106 | 0.027 | 0.176 | -1 | 0.758 |

| LTD | 32 | 144 | 0.574 | 0.544 | 0.128 | 0.14 | 1.19 | 0.313 |

| LTA | 32 | 144 | 0.483 | 0.408 | 0.097 | 0.102 | 3.91 | 0.246 |

| DTA | 32 | 144 | 0.483 | 0.408 | 0.097 | 0.102 | 3.91 | 0.000* |

| ETA | 32 | 144 | 0.071 | 0.101 | 0.019 | 0.177 | -1.97 | 0.048** |

| DA | 32 | 144 | 0.845 | 0.753 | 0.027 | 0.061 | 13.22 | 0.000* |

| DE | 32 | 144 | 12.73 | 11.58 | 3.32 | 5.42 | 1.56 | 0.09*** |

| FAA | 32 | 144 | 0.025 | 0.039 | 0.01 | 0.12 | -1.42 | 0.164 |

The insolvency risk is higher for Islamic banks when we use DTA, DA, and DE, the results reveal a higher risk of insolvency, but when we use eta to calculate risk, it shows lower risk in Islamic banks. On average, higher risk is because Islamic banks are interest-free and have to follow Shariah compliance strictly. The findings are in line with our third hypothesis about risk. Based on findings, we reject the null hypothesis and accept the alternative hypothesis.

Correlation Analysis

The Pearson correlation presented in Table 3 reveals the high association among most variables of the study. ROE is statistically positively correlated with ROA at a significance level of 1%, while a weak level positive correlation with CTD and de at 5% level. However, ROE is negatively correlated with LTA on a moderate level at 1%, and positively moderate level correlation with DA at the significance level of 1%. Likewise, ROE is negatively correlated on a moderate level with DTA and ETA at 1% and 5 %, respectively.

| Table 3 Pearson Correlation Analysis |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| ROE | ROA | CTA | CTD | LTD | LTA | DTA | ETA | DA | DE | FAA | |

| ROE | 1 | 0.139 | 0.187* | -0.117 | -0.535** | -0.220** | -.180* | .451** | .187* | -0.01 | |

| ROA | 0.876** | 1 | 0.059 | 0.053 | 0.018 | -.386** | -0.176* | -.182* | .171* | 0.053 | -0.013 |

| CTA | 0.139 | 0.059 | 1 | 0.966** | 0.205* | -0.132 | 0.168* | 0.078 | .224** | .966** | -0.151 |

| CTD | 0.187* | 0.053 | 0.966** | 1 | -0.052 | -0.277** | 0.153 | .159* | .369** | 1.000** | -0.127 |

| LTD | -0.117 | 0.018 | 0.205* | -0.052 | 1 | 0.419** | 0.132 | -.238** | -.306** | -0.052 | -0.152 |

| LTA | -0.535** | -0.386** | -0.132 | -0.277** | 0.419** | 1 | 0.083 | -0.07 | -.815** | -.277** | -0.044 |

| DTA | -0.220** | -0.176* | 0.168* | 0.153 | 0.132 | 0.083 | 1 | .928** | -0.016 | 0.153 | .264** |

| ETA | -.180* | -0.182* | 0.078 | .159* | -.238** | -0.07 | .928** | 1 | 0.092 | .159* | .330** |

| DA | 0.451** | 0.171* | 0.224** | .369** | -.306** | -.815** | -0.016 | 0.092 | 1 | .369** | -0.014 |

| DE | 0.187* | 0.053 | 0.966** | 1.00** | -0.052 | -.277** | 0.153 | .159* | .369** | 1 | -0.127 |

| FAA | -0.01 | -0.013 | -0.151 | -0.127 | -0.152 | -0.044 | .264** | .330** | -0.014 | -0.127 | 1 |

Logistic Regression

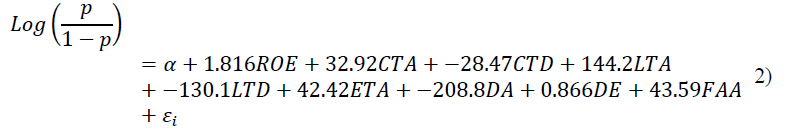

Our study dependent variables are dummy variables and we used 0 value for Islamic banks and 1 for conventional banks to explore the results using financial ratios. We have used 9 financial ratios to explore the results and exclude the two due to the problem of multicollinearity. In logistic regression, the omnibus test is used to find a significantly better model. The omnibus test uses the chi-square to see the statistically significant difference between the new and baseline models. Here we have chi-square value statistically significant (chi-square=129.21, df=10, p<0.000). Therefore, the new model is statistically better than the baseline model. Results for the logit model in equations form are presented in equation 2 with all coefficients values.

Table 4 shows the results for beta values, p-value, r2, chi-square, omnibus test, Hosmer test, and hit rate. Omnibus tests are used for goodness of model coefficients. Hosmer and Lemeshow (Allen & Hevert) test show that either the predicted variables are significantly different or not. The insignificant value for this test shows that explanatory variables are statistically different. In this study r2 shows that independent variables explain 84.90% to the dependent variables. A classification table was used to determine the overall percentage of success for the model, hit rate for this study is 94.90%.

Finally, total 4 ratios LTD, LTA, DA, and DE, are statistically significant that can be used to predict that Islamic banks perform well or conventional banks. Positive beta value for roe shows that conventional banks are better at utilizing equity to generate profit, but the results are not statistically significant. The findings are in use of our first hypothesis about profitability. Based on the results, we cannot differentiate between Islamic and conventional banking in terms of profitability. Our second hypothesis is about liquidity. CTA and CTD show statistically insignificant results that mean no difference in both banks in terms of liquidity. However, the positive beta value for CTA shows that conventional banks are better at utilizing cash in terms of total assets, while CTD shows that Islamic banks are managing cash well in terms of customer deposits.

The negative beta value of LTD is statistically significant, representing Islamic banks using more loans than conventional peers, which means higher credit risk for Islamic banks. However, positive beta value of LTA is statistically significant at 5%, which explores that Islamic banks have lower credit risk than conventional banks. Eta shows insignificant results which illustrate that we cannot use eta to distinguish between Islamic and conventional banks. The results for DA and DE are statistically significant at 5%, the negative beta value for DA predicts that Islamic banks are considered lower-level deposits to assets ratio than conventional banks and have higher insolvency risk. However, a positive DE ratio reveals a better deposit to equity ratio while less insolvency ratio. Fixed assets to assets ratio are statistically insignificant which suggests no difference in managing assets between these two groups.

| Table 4 Result of Logit Regression Model |

||

|---|---|---|

| Ratios | Beta | P-Value |

| ROE | 1.816 | 0.4 |

| CTA | 32.924 | 0.93 |

| CTD | -28.474 | 0.92 |

| LTD | -130.198 | .02** |

| LTA | 144.243 | .03** |

| ETA | 42.421 | 0.24 |

| DA | -208.861 | .00* |

| DE | 0.866 | .00* |

| FAA | 43.598 | 0.28 |

| Constant | 164.497 | .00* |

| P-Value (Omnibus Test) | 0.00* | |

| Chi-Square | 129.21 | |

| Nagelkerke R-Squared | 84.90% | |

| P-Value (Hosmer Test) | 0.99 | |

| Hit Rate | 94.90% | |

Overall findings of logistic regression predict no differences in profitability and liquidity, which supports our first two hypotheses. As per logistic regression, we cannot differentiate Islamic and conventional banking by using the financial ratios used in this study in Pakistan. However, credit risk is higher for Islamic banks when using the LTD ratio and lower by using the LTA ratio. It demonstrates that Islamic banks are using more proportion of deposits to disburse loan and have lower capacity to cover urgent operational activities than conventional banks. Though, they are in better position in terms of assets. Insolvency risk is also higher by using deposit to assets ratio but lower when we use deposit to equity ratio that means Islamic banks are better managing deposits in terms of equity than conventional banks. The results support our third hypothesis about risk, we accept the null hypothesis when we use the LTA and DE ratios and accept the alternative hypothesis when we use the ltd and DA ratios.

Neural Network Analysis

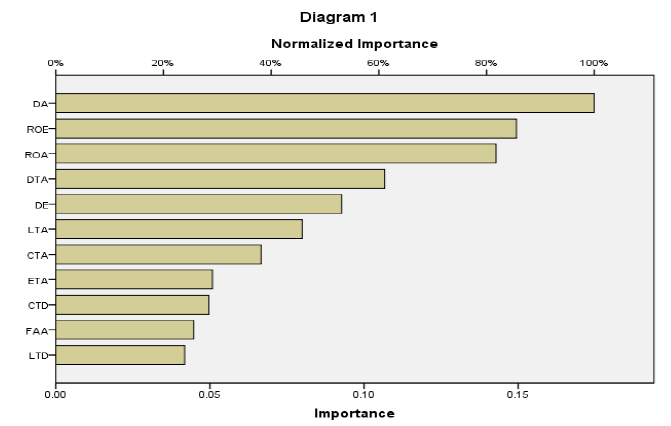

Figure 1 shows the normalized importance of all variables in the model. The importance

of explanatory variables show how much the predicted value differs in the neural network model compared to other independent variables. Table 5 shows the normalized importance values of neural network mode. Normalized importance shows the highest important value into a percentage. We use the importance table to predict that when we use neural network analysis, financial ratios are more important than Islamic and conventional banks. Figure 1 shows the graphical form for these variables.

| Table 5 Importance Score of Performance |

||

|---|---|---|

| Importance | NormalizedImportance | |

| ROE | 0.149 | 85.60% |

| ROA | 0.143 | 81.80% |

| CTA | 0.067 | 38.10% |

| CTD | 0.05 | 28.40% |

| LTD | 0.042 | 23.90% |

| LTA | 0.08 | 45.80% |

| DTA | 0.107 | 61.10% |

| ETA | 0.051 | 29.10% |

| DA | 0.175 | 100.00% |

| DE | 0.093 | 53.10% |

| FAA | 0.045 | 25.60% |

| Hit Rate | 92.30% | |

The most important variables to discriminate the banks in terms of importance are DA, ROE, ROA, DTA, DE, and LTA. Results demonstrate that DA is the highest importance scored, followed by return on equity and return on assets. DA scores 17.5%, which explores that the deposit to assets ratio intensely influences the predicted value of the model's predicted value. On the opposite side, the loan to deposit ratio has the lowest importance value of 0.42, showing no credit risk effects by using ltd on the model. The classification accuracy or success rate for neural network analysis is 92.3%.

Conclusion

Over the last three decades Islamic banking and finance witnessed a phenomenal growth worldwide. A rapid increase in demand for Islamic finance products arrested the interest of researchers and corporate practitioners alike. While literature on Islamic finance predominately centered on the Islamic instruments and principles used in Islamic banking. This study compared the performance features of conventional and Islamic banks by using selected financial indicators of profitability, liquidity, and credit risk and asset composition in Islamic and conventional banks in Pakistan. Moreover, this research employs independent t-test, logistic regression, and neural network analysis to outline a comprehensive empirical strategy.

Empirical testing reveals that the profitability of conventional banks is significantly higher than Islamic banks. However, no statistically significant difference was observed in terms of liquidity and credit risk between these two groups. However, we did find that Islamic banks have a higher insolvency risk by employing DTA, DA, and DE but lower risk when using the ETA indicator. Subsequently, logistic regression predicts that Islamic and conventional banks may be differentiated in terms of credit risk and insolvency risk and results vary considerably for different financial indicators. Lastly, the neural network model provides the importance of independent variables and suggests that the deposit to assets ratio is the most important variable while fixed assets to total assets and loan to deposits ratios are the least important in the context of banking industry. Overall the study findings conjecture that Islamic banking industry is still at its growth stage and has a long way to go to surpass its conventional banking counterpart.

Based on the findings of this study, we recommend that Islamic banks need a better liquidity and risk management system to compete with conventional banks. Therefore, regulators of Islamic banks should implement effective control mechanisms to lower the insolvency risk, credit risk, and enhance the profitability of Islamic banks. However, this study is limited to the performance appraisal of banking industry. Future studies can extend this line of research by exploring the performance of other Islamic financial industries such as Islamic mutual funds, Islamic insurance (Takaful) and Islamic micro-finance. Besides, other aspects of banking may also be incorporated into the empirical model such as stability, business model, operational efficiency, and board composition to draw t a better comparison between Islamic and conventional banking industry. Nonetheless, it will be interesting to compare the performance of Islamic banking industry of different Islamic countries to unveil the global best practices in Islamic banking.

Author Contributions: Formal analysis, A.A.; funding acquisition, P.P.; methodology, A.A.; supervision, M.A. writing—original draft, T.S.; writing review and editing, A.A. and M.A. All authors have read and agreed to the published version of the manuscript.

Funding: This research is supported by the SPEV project 2021 at the faculty of informatics and management, University of Hradec Kralove, Czech Republic.

Institutional Review Board Statement: Not applicable.

Informed Consent Statement: Not applicable.

Data Availability Statement: Publicly available datasets were analyzed in this study. Data is available upon request.

References

Abedifar, P., Molyneux, P., & Tarazi, A. (2013). Risk in Islamic banking. Review of Finance, 17(6), 2035-2096.

Ahmad, A., Saif, I., & Safwan, N. (2010). An empirical investigation of Islamic banking in Pakistan based on perception of service quality. African journal of business management, 4(6), 1185-1193.

Akbar, A. (2014a). Corporate governance and firm performance: Evidence from textile sector of Pakistan. Journal of Asian business strategy, 4(12), 200-207.

Akbar, A. (2014b). Working capital management and corporate performance: Evidences from textile sector of China. European academic research, 2(9), 11440-11456.

Akbar, A. (2015). The role of corporate governance mechanism in optimizing firm performance: A conceptual model for corporate sector of Pakistan. Journal of Asian business strategy, 5(6), 109-115.

Crossref, GoogleScholar, Indexed at

Akbar, A., Akbar, M., Tang, W., & Qureshi, M.A. (2019). Is bankruptcy risk tied to corporate life-cycle? Evidence from Pakistan. Sustainability, 11(3), 678.

Crossref, GoogleScholar, Indexed at

Akbar, A., Jiang, X., & Akbar, M. (2020). Do working capital management practices influence investment and financing patterns of firms? Journal of Economic and Administrative Sciences.

Crossref, GoogleScholar, Indexed at

Akbar, M., & Akbar, A. (2015). Approaches to improving asset structure management in commercial banks. Oeconomics of Knowledge, 7(2).

Akbar, M., & Akbar, A. (2016). Working capital management and corporate performance in Shariah compliant firms. European Academic Research, 4(2), 1946-1965.

Akbar, M., Akbar, A., & Draz, M.U. (2021). Global financial crisis, working capital management, and firm performance: Evidence from an Islamic market index. SAGE Open, 11(2), 21582440211015705.

Crossref, GoogleScholar, Indexed at

Al-Tamimi, H.A.H., Lafi, A.S., & Uddin, M.H. (2016). Bank image in the UAE: Comparing Islamic and conventional banks. In Islamic Finance, 46-65. Springer.

Crossref, GoogleScholar, Indexed at

Alam, I., Seifzadeh, P.J.J.O.R., & Management, F. (2020). Marketing Islamic financial services: A review, critique, and agenda for future research, 13(1), 12.

Albaity, M., & Rahman, M. (2019). The intention to use Islamic banking: An exploratory study to measure Islamic financial literacy. International Journal of Emerging Markets.

Alexakis, C., Izzeldin, M., Johnes, J., & Pappas, V. (2019). Performance and productivity in Islamic and conventional banks: Evidence from the global financial crisis. Economic Modelling, 79, 1-14.

Allen, S.A., & Hevert, K.T.J.J.o.B.V. (2007). Venture capital investing by information technology companies: Did it pay?, 22(2), 262-282.

Asad, M., Ahmad, I., Haider, S.H., & Salman, R. (2018). A crystal review of Islamic and conventional banking in digital era: A case of Pakistan. International Journal of Engineering & Technology, 7(4), 57-59.