Research Article: 2022 Vol: 26 Issue: 1

A Comparison of the Financial Performance of Islamic Vs Conventional Banks in the Mena Region

Ahmed Mohammed Debes, Mansoura University

Marim Alenezi, Prince Mohammad Bin Fahad University

Mohamed El Baradie, Hamdan Bin Mohammed Smart University

Citation Information: Debes, A.M., Alenezi, M., & Baradie, M.E. (2022). A comparison of the financial performance of islamic vs conventional banks in the mena region. Academy of Accounting and Financial Studies Journal, 26(1), 1-22.

Abstract

Purpose: This paper compares the financial performance of Islamic and conventional banks in the Middle East and North Africa (MENA) region. Approach: The comparison is undertaken through examining the influence of bank specific factors and macroeconomic factors on banks’ financial performance using data obtained from Bankscope and Worldbank Databank for 108 banks comprising 35 Islamic banks and 73 conventional banks from 15 countries (Algeria, Bahrain, Egypt, Jordan, Iran, Iraq, Kuwait, Libya, Morocco, Oman, Saudi Arabia, Tunisia, Qatar, Yemen, United Arab of Emirates) for the period 2004-2014. Multivariate linear regression and non-linear Artificial Neural Network models are employed. Findings: The study found that only credit risk was not statistically significant between Islamic banks and conventional banks in the MENA region suggesting that credit risk management approaches might be similar in both banking types. In addition, the study showed evidence of increased capitalisation, but declining financial performance, of Islamic banks after the 2008 financial instability. Conventional banks performed relatively better than Islamic banks in this period despite high fluctuations. Further, the study suggests that conventional banks were affected relatively more than Islamic banks by the 2008 global financial crisis. Also, a comparison of the results obtained using the artificial neural network to those obtained using the multivariate regression analysis showed that overall, the explanatory power obtained using the artificial neural network was relatively higher suggesting superiority of the methodological approach. Originality/value: The paper contributes to the literature that shows that differences in operational models of banks have an effect on their financial performance.

Keywords

MENA, Islamic Banks, Conventional Banks, Financial Performance, Artificial Neural Network, Multivariate Linear Regression.

Introduction

In 2018, there were predictions of another financial crisis to occur in 2020 similar or worse than the 2008 global financial crisis (Economist, 2018; Fortune, 2018; Guardian, 2018; Harrison, 1999). While the predictions did not specify the cause of the impending crisis, the outbreak of COVID-19 has made these predictions a reality in 2020. What was questioned, however, in these predictions was the ability of banks to withstand the crisis. The substantial losses and government bailouts raised questions of whether ‘enough’ lessons had been learnt from the 2008 global financial crisis (Economist, 2018). Lessons, for instance, could be learnt from other banking models that were more resilient.

Several sources appear to suggest that many Islamic banks suffered much lower losses and were more stable during the 2008 global financial crisis than many conventional banks (Ahmed, 2010; Al-Hamzani, 2008; IMF, 2010; Hassan et al., 2019; Parashar & Venkatesh, 2010; Zeitun, 2012). If this is the case, then there is the potential for the conventional banking system to develop strategies based on the strengths of the Islamic banking system in order to apply them to their operational procedures. This could allow conventional banks to have much more stable and sustainable strategies for dealing with potential financial crises in the future. The current financial crisis as a result of COVID-19, arguably, provides another resilience test opportunity for banks. The exponential growth in global Islamic banking of an average annual growth rate of over 6.9% reaching an estimated global value of over USD2.19 trillion in 2018 (IFSB, 2019), partly demonstrates the sector’s viability and sustainability.

There could be lessons drawn, in this respect, through examining financial performance of Islamic banks and conventional banks in periods of both financial and non-financial crises. This is of interest given the nature and operational model of Islamic banks which makes them distinct from conventional banks, and thus, the importance of investigating whether this distinctiveness gives an inherent advantage. Islamic banking is by nature more risk-averse (Azmat et al., 2020; Khediri et al., 2015; Prenzlin, 2009), and many of the Sharia laws (Islamic laws), intrinsic in the Islamic banking system, prevent certain behaviours which are believed to have been significant contributory factors in the 2008 financial crisis (Ahmed, 2010; Alexakis et al., 2018; Hasan, 2009; Karkal, 2010; Srairi, 2013). Excessive and imprudent lending, for instance, was an important cause of the 2008 banking crisis, coupled with factors that created a false sense of immunity from losses (Chapra, 2011). The ‘too big to fail’ concept, for example, tended to give assurance to big banks that the central bank, for fear of systemic disruption, would come to banks’ rescue and not allow them to fail.

This paper is aimed at comparing the financial performance of Islamic banks and conventional banks in the Middle East and North Africa (MENA) region for the period 2004 to 2014. In covering a longer period of 10 years, the study makes an empirical contribution as this period includes the period of financial instability of the 2008 global financial crisis as compared to other studies (Abedifar et al., 2013; Beck et al., 2013; Srairi, 2010) that concentrated on the pre-2008 global financial crisis period only or post-financial crisis period only. This study, therefore, covers the periods before, during and after the 2008 global financial crisis giving a much broader, and arguably richer, perspective that facilitates the understanding of financial performance of the two banking models. Further, in covering the MENA region, the study contributes to the Islamic banking literature in going beyond a one country analysis when compared to other studies that focus on one country (Al-Qudah & Jaradat, 2013; Ramlan & Adnan, 2016; Wasiuzzaman & Tarmizi, 2010) and also beyond the Cooperation Council for the Arab States of the Gulf (formerly Gulf Cooperation Council (GCC)) countries which have received considerable attention in the literature (Azmat et al., 2020; Khediri et al., 2015; Olson & Zoubi, 2008; Smaoui & Salah, 2012; Srairi, 2010). As such, the study makes an empirical contribution through giving a broader perspective to the comparative study of financial performance of Islamic and conventional banks.

Further, in making a comparison between Islamic and conventional banks’ financial performance, this study contributes to the crescent literature on Islamic finance giving more insight on how the “compliance to the Sharia’s principles may affect financial performance” (Wanke et al., 2016, p. 486). Therefore, this goes beyond the financial performance of the banking models to question the ideological foundations of the business operations. For instance, if Islamic banks are more profitable and where less affected by global financial instability, could this imply that more equality and fairness (social responsibility) should be promoted in the financial dealings of society? This study, therefore, has ideological contributions to thinking about social inequality and injustice in financial operations. In addition, the results obtained from this study contribute to the body of knowledge from prior studies that have revealed mixed results on the comparative financial performance of Islamic and conventional banks (Belanes & Hassiki, 2012; ElMassah, 2015; Ramlan & Adnan, 2016). For instance, ElMassah (2015) showed that conventional banks are more solvent, liquid and profitable and less risky than Islamic banks, similar to Hassan et al. (2019) study. On the contrary, Belanes & Hassiki (2012) did not find any significant differences between conventional and Islamic banks. This shows that the body of knowledge on performance comparison is still unclear.

This study also makes a methodological contribution in using two research methods: multivariate linear regression and artificial neural network (ANN) approach. The usage of non- linear models, the artificial neural network in particular, has rarely been used in evaluating banks’ financial performance. The benefit of employing this artificial neural network approach is that it improves the research results (Bakar & Tahir, 2009; Delen et al., 2005). Thus, through employing this research method, this study makes a methodological contribution in advancing the usage of non-linear models and providing empirical evidence to its explanatory power.

The next section reviews some selected literature on comparison of financial performance of Islamic and conventional banks.

Literature Review

Defining Islamic and Conventional Banks

Despite the global growth in Islamic banking, no universal definition seems to encapsulate this banking model (Zarrouk et al., 2016). Warde (2000) argued that “no definition of Islamic finance is entirely satisfactory. To every general criterion - a financial institution owned by Muslims, catering to Muslims, supervised by a Sharia Board, belonging to the International Association of Islamic Banks (IAIB), etc” would be classified as an Islamic bank. This essentially means that any financial institution organised on the basic elements of Islam is an Islamic bank. Nonetheless, a formal definition has been provided by the Organisation of the Islamic Conference (OIC) which define an Islamic bank as “a financial institution whose statutes, rules and procedures expressly state its commitment to the principles of Islamic Sharia and to the banning of the receipt and payment of interest on any of its operations” (stated in Ali & Sarkar, 1995, p. 20). In other words, Islamic banks are those banks that comply to the Sharia law.

Given the definition of an Islamic bank as that which provides financial services that meet the requirements of the Sharia or Islamic law, by default, a conventional bank is any non- Islamic bank. This is the operational definition adopted in this study.

Comparison of Islamic Banking to Conventional Banking

Islamic and conventional banking have both similarities and differences. Chong & Liu (2009) highlight that Islamic banks are similar to conventional banks except for the four principles that they follow according to Sharia law. These are with regard to the prohibition of uncertainty (gharar), the prohibition of interest (riba), money is not a commodity and the prevalence of justice (Caporale et al., 2017). The underlying feature of Islamic banking is the promotion of risk sharing, co-operation, mutual assistance, and the sharing of profits (losses) between the investors and the users of funds (Parsa, 2020; Wanke et al., 2016). As such, a key feature of the Islamic banking model is that its nature and structure promote social responsibility (Warde, 2000). The driving aim for Islamic banking is the provision of socio-economic benefits to the wider society rather than the primacy of profit maximisation (Wasiuzzaman & Tarmizi, 2010). The argument is that the foundations of the Islamic banking model is the promotion of equality and fairness in the financial dealings of society. This results from the attachment of the financial dealings to Sharia principles that emphasize ethical, moral and social aspects (Wanke et al., 2016).

Thus, one of the significant differences between Islamic and conventional banks relates to this focus on the equality and fairness in financial dealings. Conventional banking system, on the other hand, has the primary objective of profit maximization (Abedifar et al., 2013; Cerović et al., 2017). The difference, therefore, is on their relative emphasis of profit.

Nonetheless, profitability is an important aspect in both conventional and Islamic banking systems (Parsa, 2020; Zarrouk et al., 2016). Shareholders/Investors and managers (directors) are particularly interested in profitability as both Islamic and conventional banks are profitable institutions. As such, the evaluation of profits is important in both banking types. Profitability enhances a bank’s performance and stability (Zarrouk et al., 2016) and can also act as a signal to both investors and depositors (Azmat et al., 2020; Cerović et al., 2017). To depositors, for instance, profitability and stability concerns influence the decisions of whether to keep or withdraw their funds.

Put simply, Islamic banks, despite their prioritisation of ethical and social objectives are not charitable organisations but have to offer returns to their shareholders and depositors (Warde, 2000). Islamic banks also have to compete (whether direct or indirect) with conventional banks, investing in product innovation and technology (Hassan et al., 2019; Parsa, 2020). However, whilst profit is important to Islamic banks, this is not their primary goal as compared to conventional banks (Wanke et al., 2016). Further, being Sharia based organizations, they are expected to achieve only a reasonable rate of return (Haron & Azmi, 2009). Determining the reasonable rate of return, however, is subjective and depends on interpretations (Haron & Azmi, 2009; Wanke et al., 2016; Warde, 2000).

Further, besides profitability, both Islamic and conventional banks share the underlying objective of a financial institution, which is the provision of an efficient system of money management, as well as the facilitation of finance for business (Cerović et al., 2017). The acceptance of deposits and the provision of financing to individuals and businesses remains the fundamental role of a financial institution. The difference, however, lies in the approach to how this is done.

Both conventional and Islamic banks accept deposits and use these deposits to provide funding to individuals and businesses. The difference, however, is that in conventional banking, the banks pay a rate of interest to depositors, and charge a rate of interest to debtors (Abedifar et al., 2013). The payment of interest on credit deposits and the charging of interest on debt is fundamental in the conventional banking style (Cerović et al., 2017). However, such interest payments to the depositors would not be prohibited in a Sharia-compliant banks (Obaidullah, 2005; Wanke et al., 2016).

The most fundamental difference between the conventional and Islamic banks revolves around the payment and levying of interest. On the surface, this would raise the question of how an Islamic banking system could possibly be conventionally sustainable. This is based on the fact that traditional forms of conventional or retail banking rely on interest as their primary source of revenue, with a conventional bank profiting from the differential between the level of interest it pays for deposits and other sources of funds, and the level of interest it charges on its lending activities (Bessis, 2015; Freixas & Rochet, 2008). This is because, while different rates of interest are used for different activities or products (for example, savers would normally expect better rates of interest in exchange for tying their money in to a longer deposit period, using instruments such as term deposits or bonds, and borrowers would expect to pay a lower percentage rate of interest on large secured loans than they would on small unsecured loans or credit card balances), a lower rate of interest is always paid to savers than is charged to borrowers (Bessis, 2015; Karkal, 2010; Mishkin, 2007).

Further, a central concept in Islamic banking, as with many aspects of Islamic society, culture and legislation, is justice. In Islamic banking, justice is achieved predominantly through risk sharing, co-operation and mutual assistance (Azmat et al., 2020; Haron & Azmi, 2009; Wanke et al., 2016; Warde, 2000). Thus, the principle of profit/loss sharing forms a cornerstone of Islamic banking (Abedifar et al., 2013; Warde, 2000). In respect to how Islamic banks generate revenue, deposits are made by investors and then invested in a manner similar to a conventional investment bank. Those who have deposited their savings then share the profits or losses resulting from the investment. While outright speculation is not permitted within Sharia law, this type of co-operative venture capitalism is seen as enabling enterprise and, as such, is permissible (Prenzlin, 2009).

As such, riba, the prohibition of interest, essentially provides the theoretical concept to the Islamic banking system which is based on profit/loss sharing (Abedifar et al., 2013; Cerović et al., 2017). Further, concepts of mudaraba (trustee financing) and musharakah (equity participation) are all forms of profit/loss sharing (Farooq & Zaheer, 2015; Zarrouk et al., 2016). An example would help illustrate the similarities and differences between the two banking systems. Mortgage is a prime example of one of the most common lending products within contemporary retail banking practice from a consumer perspective. In such a product, the risks are shared between the bank and the borrower in Islamic banking. This frequently happens under a diminishing musharakah, or partnership contract (Farooq & Zaheer, 2015). The applicant and the bank form an effective partnership, with the bank providing the bulk of the equity and the borrower a percentage which in a conventional banking scenario would be classed as a deposit. The borrower then buys out the bank’s share of the partnership over a pre-defined period, through profits made on rental income for the property, although the borrower is usually the rental customer. In most cases, the borrower is effectively paying rent to him or herself, and then paying a proportion of that rent back to the bank in accordance with the bank’s percentage capital share of the partnership at the time (Hassan et al., 2017; Khediri et al., 2015).

The bank (and therefore the depositors who have entrusted their money to the bank, who are effectively partners of the bank in the purchase of the house) makes revenue/gains through the profit from the rent, which is usually effectively paid by the borrower, as they normally live in the home they are purchasing through the bank (Farooq & Zaheer, 2015). Should the borrower default on either the agreed rent or the principal partnership agreement itself, then the bank may elect to provide the borrower with an interest-free loan to enable him or her to continue making the agreed payments on the understanding that they will pay in full when they are able to do so (Prenzlin, 2009; Zarrouk et al., 2016). This does not mean that Islamic banks do not assess credit risk. In fact, they are usually more risk-averse than many conventional banks when making lending decisions (Khediri et al., 2015; Miah & Uddin, 2017; Prenzlin, 2009).

Several Islamic countries have adopted a dual banking system (comprising both Islamic and conventional banks). In the Cooperation Council for the Arab States of the Gulf (CCASG) region, for example, member countries enjoy a free market economy where customers are free to select from a range of banks – both Islamic and conventional (Alexakis et al., 2018; ElMassah, 2015). This has provided the ideal environment for the development of numerous innovative Sharia-compliant products, which are designed to compete with the products on offer in conventional banks in the region (Ali, 2012). These range from equity funds to bonds and insurance, as well as daily transaction services such as debit cards, internet, and telephone banking (Iqbal & Molyneux, 2016).

Comparing the Financial Performance of Islamic and Conventional Banks

The growth of global Islamic finance has given rise to an increase in research interest in Islamic banking (Alexakis et al., 2018; Caporale et al., 2017; Khokhar et al., 2020; Miah & Uddin, 2017; Ben Selma Mokni & Rachdi, 2014; Parashar & Venkatesh, 2010; Srairi, 2013). These have been undertaken from different country and regional perspectives and employing different methodological approaches.

One of the areas of focus has been on performance evaluation of the Islamic banks as compared to conventional banks (Abedifar et al., 2013; Belanes & Hassiki, 2012; Caporale et al., 2017; Hassan et al., 2019; Hussain & Al-Ajmi, 2012; Johnes et al., 2014; Zeitun, 2012). The interest to investigate banking performance has partly been fueled by the observable better performance of the Islamic banks as compared to conventional banks during the 2008 global financial crisis (Khediri et al., 2015; Parashar & Venkatesh, 2010; Zeitun, 2012). Thus, whilst the 2008 global financial crisis had a negative impact on both the Islamic and conventional banks, most studies showed that the losses sustained by the Islamic banks were lower than conventional banks (Hassan & Kayed, 2009; IMF, 2010). The nature or operational models of the Islamic banks are perceived to have contributed to more stability and better performance (Alexakis et al., 2018; Srairi, 2013). Hassan & Kayed (2009, p. 38) argued that the 2008 financial crisis gave “credence to the Islamic scholars and economists who pointed out the inherent frailty and faults of the financial system and who reaffirm that the root of the crisis was inadequate market discipline resulting from lack of profit-sharing models of financing, from expanded use of derivatives and from the policy of ‘too big to fail”. Wasiuzzaman & Tarmizi (2010) similarly argued that Islamic banks were not caught by toxic assets as Sharia law prohibits interest.

However, some studies (e.g. Parashar & Venkatesh, 2010) have shown different results with Islamic banks found to have suffered more losses from the 2008 financial crisis than conventional banks. Other studies, such as Boukhris & Nabi (2013) did not find any significant differences with respect to the effect of the 2008 financial crisis on Islamic banks and conventional banks contrary to most studies (e.g. Hassan & Kayed, 2009). As such, the empirical evidence is mixed.

Beyond the comparison of financial performance during periods of financial instability, several studies have investigated the comparative financial performance during period of relative financial stability (Belanes & Hassiki, 2012; ElMassah, 2015; Hassan et al., 2019; Ramlan & Adnan, 2016). For instance, Ramlan & Adnan (2016) found that Islamic banks are more profitable than conventional banks whilst ElMassah (2015) showed that conventional banks are more solvent, liquid and profitable and less risky than Islamic banks. Similarly, Hassan et al. (2019) found that Islamic banks are better than conventional banks in managing risks. Belanes & Hassiki (2012), on the other hand, did not find any significant differences between conventional and Islamic banks. This shows that the body of knowledge on performance comparison is still unclear. As the results of the comparative performance of Islamic banks vs conventional banks are still unclear, this paper contributes to the literature by investigating the following research questions:

1. Are there significant financial performance differences between conventional and Islamic banks?

2. How was the financial performance of Islamic banks when compared to conventional banks in the period 2004 to 2014?

3. Does the use of the artificial neural network (ANN) improve the explanatory power of the significant difference between Islamic and conventional banks?

The Context of the Study

The Middle East and North Africa (MENA) region is composed of 21 countries: Algeria, Bahrain, Djibouti, Egypt, Iran, Iraq, Israel, Jordan, Kuwait, Lebanon, Libya, Malta, Morocco, Oman, Qatar, Saudi Arabia, Syria, Tunisia, the United Arab Emirates (UAE), West Bank and Gaza and Yemen Bank, 2018. The MENA region can be separated into developing economies and emerging economies (World Bank, 2018), as it is composed of some oil rich countries and also poor countries. It is one of the world’s richest regions in terms of resources, since it includes the oil-rich countries of the Cooperation Council for the Arab States of the Gulf (CCASG) (Diop et al., 2012), holding more than 60 percent of the world’s proven oil reserves and about half of the global gas reserves (World Bank, 2018). A distinction, relevant to this study, can be made between oil exporting countries, comprising the CCASG countries and non-CCASG countries. The oil-exporters, CCASG countries, are Bahrain, Kuwait, Qatar, Saudi Arabia, and UAE.

The MENA region comprises the highest number of Islamic banks (Bourkhis & Nabi, 2013; Caporale et al., 2017) with the banking sector playing a major role in the developmental agendas of the economies (Ali, 2012). Importantly, Islamic banking in the region is a growing business as it satisfies the financial needs of the people in congruent to their social and religious values (Ali, 2012). The Islamic banking assets have recorded exponential growth over the last few years. The total Islamic finance assets is projected to reach US$3.8 trillion by 2022 after recording annual average growth of 7% to reach US$2.19 trillion in 2018 from 1.746 trillion in 2012 (IFSB, 2019).

In terms of distribution, the MENA region, which comprises also the CCASG (former GCC countries) accounts for over 67.4% of the global Islamic finance assets (IFSB, 2019). The 67.4% is comprised of 42.3% for the CCASG countries only and the remaining 25.1% for the non-CCASG countries within the MENA region. Table 1 below shows the global distribution of Islamic finance assets.

| Table 1 Distribution of Global Islamic Finance Assets by Sector and Region (US$ Billion) | ||||||

| Region | Banking Assets | Sukuk Outstanding | Islamic Funds Assets |

Takaful Contributions | Total | Share% |

| Asia | 266.1 | 323.2 | 24.2 | 4.1 | 617.6 | 28.2% |

| GCC | 704.8 | 187.9 | 22.7 | 11.7 | 927.1 | 42.3% |

| MENA (ex- GCC) |

540.2 | 0.3 | 0.1 | 10.3 | 550.9 | 25.1% |

| Africa (ex- North) |

13.2 | 2.5 | 1.5 | 0.01 | 17.2 | 0.8% |

| Others | 47.1 | 16.5 | 13.1 | -- | 76.7 | 3.5% |

| Total | 1,571.3 | 530.4 | 61.5 | 27.7 | 2,190 | 100.00% |

Several factors are contributing to this growth in Islamic finance. Among these factors include the increases in oil prices which lead to more surplus funds available in the region (National, 2017). Further, governments in the region have embarked on regulatory reforms which have strengthened the banking industry (Ali, 2012). There is also more public confidence in the Islamic banks following successful performance over the years, including during the 2008 global financial crisis (Al-Musali et al., 2014; Ali, 2012; Beck et al., 2013; Caporale et al., 2017). In addition, there has been a growing demand for Islamic system which is associated with Islamic finance in the region (Ali, 2012), arising from population growth. As such, the banking sector has had to develop to meet this demand. Another contributory factor to the exponential growth of Islamic banking in the region arises from some foreign hostile government policies in countries such as the USA following the wake of September 11, 2001 terrorist incident which reduced the incentive to invest in foreign countries (Ali, 2012). This resulted in more funds being available within the region coupled with rising oil prices resulting in higher investable (petrodollar) surplus (Ali, 2012; Olson & Zoubi, 2011).

Methodology

The financial performance of banks is affected by both internal (bank specific) and external (macroeconomic) factors (Abedifar et al., 2013; Abid et al., 2018; Al-Musali et al., 2014; Ali & Puah, 2019; Daly & Frikha, 2017). Through investigating the relationship between these bank specific characteristics and macroeconomic factors on bank’s performance, a comparative financial performance analysis can be undertaken between Islamic and conventional banks.

Data was obtained from Bankscope and Worldbank’s DataBank for 108 banks comprising 35 Islamic banks and 73 conventional banks from 15 countries (Algeria, Bahrain, Egypt, Jordan, Iran, Iraq, Kuwait, Libya, Morocco, Oman, Saudi Arabia, Tunisia, Qatar, Yemen, United Arab of Emirates) in the MENA region for the period 2004-2014. The banks selected had to be identified as being operational within the MENA countries for the period under consideration. The Bankscope database provided the bank specific factors of bank size, capital risk, loan intensity, financial leverage, credit risk, operating ratio and Z-score, while the DataBank database was useful in capturing the macroeconomic factors of gross domestic product (GDP) and inflation. The bank specific factors and macroeconomic factors formed the independent variables.

The banks’ financial performance was captured by return on assets (ROA) and return on equity (ROE), obtained from Bankscope, forming the dependent variables. These accounting measurement variables have been widely used in the literature to compare financial performance of banks (Bilal & Amin, 2015; Caporale et al., 2017; Samad & Hassan, 2006; Van Horen, 2007; Zarrouk et al., 2016). The dependent and independent variables, including their measurement, are shown in Table 2 below.

| Table 2 Study Variables and Measures | ||

| Variable | Measure | |

| Dependent Variables | Return on assets | Net income over total assets ratio |

| Return on equity | Net income over equity ratio | |

| Bank specific factors - independent Variables | Bank size | The natural logarithm of total assets |

| Capital risk | The ratio of equity to total assets | |

| Loan intensity | Loans over total assets ratio | |

| Financial leverage | The ratio of total assets to equity | |

| Credit Risk | Loan loss provision over gross loans | |

| Operating ratio | The ratio of fixed assets to total assets | |

| Z-score | Logarithm of Z-score | |

| Capital ratio | (the loan loss provision (LLP) plus the equity and the total) divided by total loan |

|

| Macroeconomic factors - independent Variables | GDP | Logarithm of gross domestic production |

| Inflation | Inflation rates | |

In order to analyse the data collected from 108 banks comprised of 32.4% Islamic banks and 67.6% conventional banks, two research techniques were employed: the multivariate linear regression model and the artificial neural network (ANN) model. The application of the Artificial Neural Network (ANN) model enhances the results obtained from the multivariate linear regression model (Lam, 2004; Stergiou, 2014) and thus, the methodological contribution to the literature on comparative financial performance of banks. Very few studies have employed the ANN approach in evaluating financial performance (Arulsudar et al., 2005; Nghiep & Al, 2001; Wanke et al., 2016).

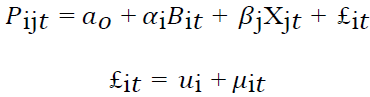

The multivariate linear regression model depicting the relationship between the independent variables and dependent variables is as follows:

Where Pijt is the measure of financial performance for bank i in country j at time t. Bit are the bank specific variables (bank size, capital risk, loan intensity, financial leverage, credit risk, operating ratio and Z-score) for bank i at time t. Xjt are macroeconomics variables for country j at time t while α0 is a constant term and αi and βj are coefficients. £it denotes to an error term, with μi is the unobserved bank-specific effect and μit is the idiosyncratic error in Table 2.

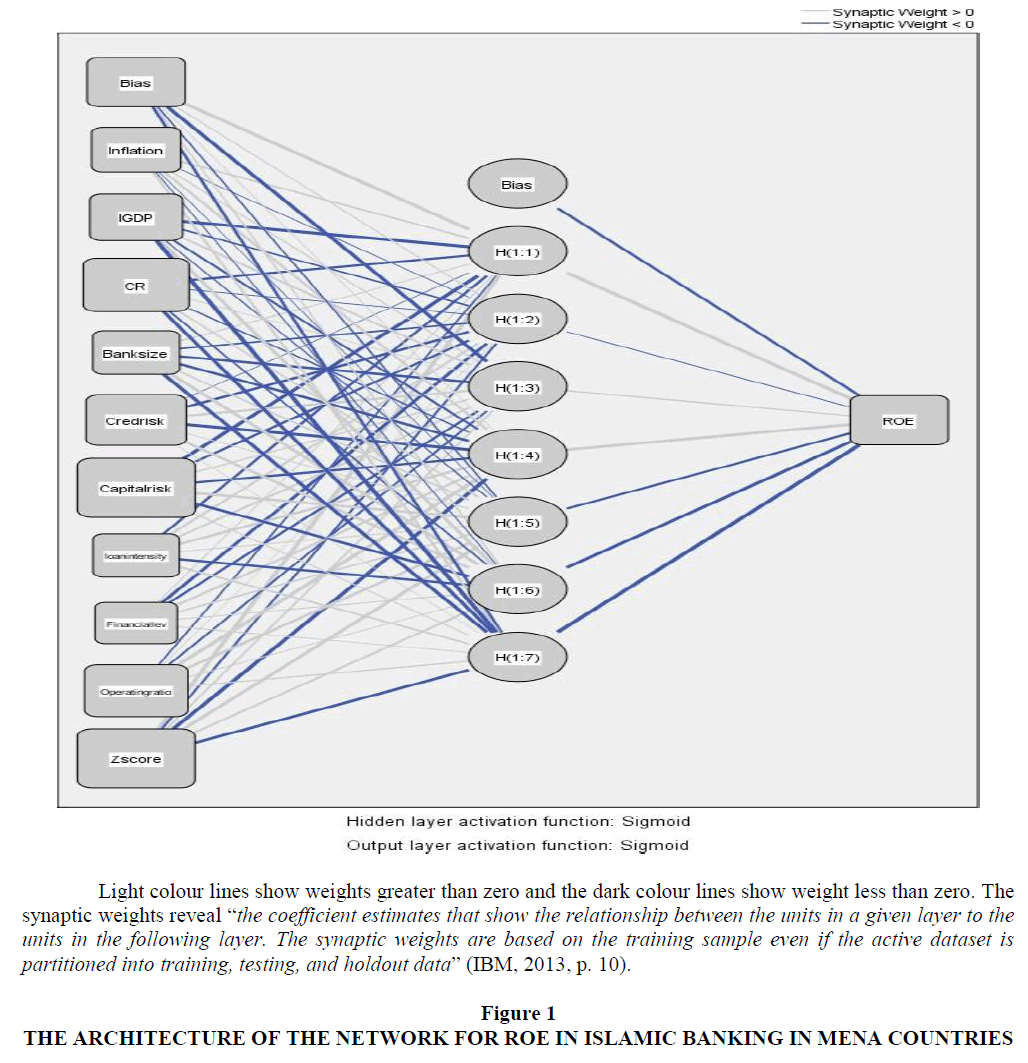

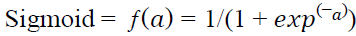

The artificial neural networks (ANN) is one of the powerful nonlinear regression techniques inspired by theories drawn from the operationalisation mechanism of the brain (Wanke et al., 2016). The behaviour of an artificial neural network depends on both the weights and the input-output function (transfer/activation function) that is specified for the units (Datt, 2012; Lam, 2004; Stergiou, 2014). The activation function links the weighted sums of units in a layer to the values of units in the succeeding layer (IBM, 2013). The activation function in this study is based on sigmoid which takes real-valued arguments and transforms them to the range (0,1). The sigmoid activation function used is:

In which the output boundaries are (0,1). f(a) is the function of observable variable while exp(-a) is the exponential values of variable (a). The multilayer perceptron (MLP) procedure was performed for each dependent variable with data divided into 3 sets: training, testing and excluded. The training set was used for the estimation of the synaptic weights in the neural network whilst the predictions were made in the testing set. On the basis of the errors observed in the training set, the weights of the neural network were adjusted in order to minimize the errors in the testing set and also correct any overtraining problems.

The results of the analysis of financial performance of Islamic banks vs conventional banks using both techniques are presented and discussed next.

Results

Descriptive Statistics

The descriptive statistics for both the independent variables and dependent variables are shown in Table 3. Among the variables, inflation (6.4%), financial leverage (5%), capital ratio (2.3%) and bank size (2.1%) fluctuated the most as captured by standard deviation. The average inflation among the 15 MENA countries in the period 2004 to 2014 was 5.906 with a recorded fluctuation of 6.419%. This is broken down further in appendix A which shows a high rate of inflation in Iran, where the mean inflation rate is 19.849% with standard deviation of 8.595%. This is followed by Yemen with a mean of 11.903% and a standard deviation of 4.237%. Of the 15 countries, Bahrain was the country with the least inflation where the mean inflation rate was 2.424% with a standard deviation of 1.087%.

| Table 3 Descriptive Statistics of Mena Banks (N=988) | ||||

| Mean | Std. Dev. | Skewness | Kurtosis | |

| Inflation | 5.906 | 6.419 | 3.996 | 36.046 |

| Log GDP | 11.013 | 0.479 | -0.061 | -1.033 |

| Capital ratio | 0.761 | 2.300 | 9.871 | 125.818 |

| Bank size | 8.073 | 2.114 | -0.841 | 1.868 |

| Credit risk | 0.071 | 0.102 | 4.539 | 29.117 |

| Capital risk | 0.186 | 0.176 | 2.951 | 9.051 |

| Loan intensity | 0.522 | 0.208 | -0.551 | -0.046 |

| Financial leverage | 8.263 | 5.041 | 1.903 | 6.245 |

| Operating ratio | 0.019 | 0.026 | 6.678 | 71.808 |

| Z-score | 1.013 | 0.370 | -0.474 | 0.096 |

| Return on equity (ROE) | 0.115 | 0.141 | -3.551 | 35.474 |

| Return on asset (ROA) | 0.017 | 0.030 | -2.792 | 34.126 |

With respect to bank performance in the sample, the average ROE was about 11.5%, with a standard deviation of 14.1% whilst the average ROA was lower at 1.7% with standard deviation of 3.0%.

Significant Difference in the Financial Variables

The test results for the financial variables of Islamic and conventional banks in the region are shown in Table 4 which revealed that there were significant differences between the Islamic and conventional banks in the financial variables examined during the period. Among the variables examined, only credit risk was not statistically significant between Islamic and conventional banks. This might suggest that credit risk management approaches might be similar in both banking types. Further, the study found that whilst bank performance (captured by ROE and ROA) was relatively higher in conventional banks, this fluctuated more. This might suggest some volatility in performance of conventional banks. The observed significant difference in the financial variables is largely consistent with Caporale et al. (2017) study on the 17 MENA countries but inconsistent with Belanes & Hassiki (2012) study that did not find significant differences among the 19 conventional banks and 13 Islamic banks in the MENA region.

| Table 4 Test Results for Financial Variables of Islamic Banks and Conventional Banks in Mena Countries in the Sample | ||||||

| Islamic Banking | Conventional Banking | T Test | ||||

| Mean | Std. Dev. | Mean | Std. Dev. | T | Sig. | |

| Inflation | 7.705 | 7.527 | 5.137 | 5.718 | 5.857 | .000** |

| log GDP | 11.133 | 0.534 | 10.961 | 0.445 | 5.256 | .000** |

| Capital ratio | 1.390 | 3.939 | 0.492 | 0.833 | 5.709 | .000** |

| Bank size | 7.387 | 2.583 | 8.367 | 1.803 | -6.823 | .000** |

| Credit risk | 0.065 | 0.127 | 0.073 | 0.089 | -1.031 | .303 |

| Capital risk | 0.229 | 0.241 | 0.168 | 0.135 | 5.060 | .000** |

| Loan intensity | 0.481 | 0.207 | 0.540 | 0.207 | -4.105 | .000** |

| Financial leverage | 8.701 | 6.358 | 8.076 | 4.349 | 1.787 | .074*** |

| Operating ratio | 0.028 | 0.040 | 0.015 | 0.015 | 7.452 | .000** |

| Z-score | 0.939 | 0.400 | 1.045 | 0.352 | -4.175 | .000** |

| Return on equity (ROE) | 0.102 | 0.139 | 0.120 | 0.141 | -1.890 | .059*** |

| Return on asset (ROA) | 0.014 | 0.038 | 0.018 | 0.026 | -1.838 | .066*** |

***Significant at a significant level of 10%

Significant differences in the Financial Variables of Banks before and after the 2008 financial crisis in the MENA Countries

The test results for financial variables of the Islamic and conventional banks before and after the 2008 global financial crisis in the MENA countries are shown in tables 5 and 6 respectively. The results for Islamic banks reveal a higher value of the capital ratio after 2008 compared to the period before 2008 with a value 1.402 for after 2008 and 1.143 for before 2008. This reflects an increased capitalisation of Islamic banks following the global financial crisis partly explained by regulatory requirement (Almanaseer, 2014; Farooq & Zaheer, 2015). Further, the performance of Islamic banks (reflected by ROE and ROA) after 2008 was low and seen to fluctuate more than before 2008 which suggests some responses to tougher economic conditions, reflected for instance, in the relatively unstable and low oil prices (National, 2017). In general, an insignificant difference on all financial variables except credit risk was found for Islamic banks.

| Table 5 Descriptive Statistic and Test Results for Financial Variables in Islamic Banking Before and After 2008 in Mena Countries | ||||||

| Before 2008 | After 2008 | T-Test | ||||

| Mean | Std. Dev. | Mean | Std. Dev. | t | Sig. | |

| Inflation | 7.212 | 5.068 | 7.040 | 8.387 | .179 | .858 |

| log GDP | 10.929 | 0.520 | 11.236 | 0.517 | -4.593 | .000** |

| Capital ratio | 1.143 | 2.762 | 1.402 | 4.125 | -.541 | .589 |

| Bank size | 7.196 | 2.574 | 7.460 | 2.545 | -.800 | .425 |

| Credit risk | 0.045 | 0.087 | 0.080 | 0.149 | -2.048 | .042* |

| Capital risk | 0.243 | 0.260 | 0.216 | 0.225 | .894 | .372 |

| Loan intensity | 0.476 | 0.195 | 0.480 | 0.213 | -.139 | .889 |

| Financial leverage | 8.850 | 7.370 | 8.733 | 5.830 | .143 | .887 |

| Operating ratio | 0.029 | 0.046 | 0.025 | 0.026 | .865 | .388 |

| Z-score | 0.955 | 0.390 | 0.929 | 0.405 | .509 | .611 |

| Return on equity (ROE) | 0.137 | 0.091 | 0.087 | 0.153 | 2.873 | .004** |

| Return on asset (ROA) | 0.027 | 0.028 | 0.008 | 0.041 | 3.938 | .000** |

* Significant at a significant level of 5%

| Table 6 Descriptive Statistic and Test Results for Financial Variables in Conventional Banking Before and After 2008 in Mena Countries | ||||||

| Before 2008 | After 2008 | T Test | ||||

| Mean | Std. Dev. | Mean | Std. Dev. | t | Sig. | |

| Inflation | 5.761 | 5.272 | 3.825 | 5.413 | 4.290 | .000** |

| log GDP | 10.785 | 0.444 | 11.052 | 0.422 | -7.399 | .000** |

| Capital Ratio | 0.544 | 0.962 | 0.478 | 0.791 | .922 | .357 |

| Bank Size | 7.997 | 1.625 | 8.547 | 1.898 | -3.616 | .000** |

| Credit risk | 0.090 | 0.115 | 0.066 | 0.073 | 3.071 | .002** |

| Capital Risk | 0.169 | 0.141 | 0.171 | 0.134 | -.139 | .890 |

| Loan intensity | 0.501 | 0.202 | 0.558 | 0.205 | -3.351 | .001** |

| Financial leverage | 8.196 | 4.256 | 7.755 | 3.802 | 1.321 | .187 |

| Operating ratio | 0.012 | 0.009 | 0.016 | 0.017 | -3.172 | .002** |

| Z-score | 1.032 | 0.343 | 1.057 | 0.354 | -.836 | .403 |

| Return on Equity (ROE) | 0.168 | 0.155 | 0.093 | 0.126 | 6.545 | .000** |

| Return on Asset (ROA) | 0.027 | 0.028 | 0.014 | 0.022 | 6.056 | .000** |

Contrary to the Islamic banks, conventional banks recorded significant differences in the observed financial variables before and after the 2008 global financial crisis in the region. One observed change was high values in bank sizes which suggests some increase in cross-border mergers among conventional banks after the financial crisis (Sahut & Mili, 2011).

The Effect of the 2008 Financial Crisis on banks in the MENA Countries

The summary results of the impact of the 2008 global financial crisis on the Islamic and conventional banks in the region is shown in table 7. The results show that the financial crisis impacted the performance of Islamic and conventional banks weakly. This conclusion is reached because the global financial crisis variable is responsible for 5.6% of the changes that occurred in the dependent variable, ROA, for conventional banks in the region. Further, with respect to Islamic banks, the global financial crisis can be credited for 5.5% of the changes that occurred in the ROA. The relative difference in the impact of the financial crisis on the Islamic banks and conventional banks using the ROA as the dependent variable was insignificant.

| Table 7 Summary of Results on the Impact of Financial Crisis in the Mena Region | |||

| MENA | |||

| ROE | ROA | ||

| Islamic banks | r | -.174** | -.236** |

| R2 | 0.030 | 0.055 | |

| Conventional banks | r | -.254** | -.237** |

| R2 | 0.064 | 0.056 | |

Using the ROE as the dependent variable for bank performance, the global financial crisis can be credited for only 3.0% of the changes in the dependent variable of Islamic banks. On the other hand, the global financial crisis variable accounted for 6.4% of the changes in the ROE of conventional banks in the MENA countries. As such, these results show that whilst the effect of the global financial crisis were overall weak in the MENA region, the impact on conventional banks was relatively more than the impact on the Islamic banks. These results are inconsistent, for instance, with Bourkhis & Nabi (2013) study that showed no significant difference on the impact of the financial crisis on the two banking types in the MENA region.

The impact on the explanatory power of using the artificial neural network (ANN)

The multilayer perceptron (MLP) procedure was conducted for the ROE and ROA respectively. An example of the case processing summary, network information and architecture of the network for ROE in Islamic banks is shown in Appendix B.

The MLP procedure was performed first for all the independent variables for each respective dependent variable and then subsequently for only selected independent variable. An example of a model summary for all independent variables and then subsequently for five normalised importance variables is shown in Appendix C. The goodness of fit comparison based on coefficient of determination for both Islamic and conventional banks showed the results summarised in table 8.The results suggest that there is an increase in the value of the coefficients of determination (R2) when using artificial neural network model for almost all the observation. However, in the case of the estimating model for ROA in Islamic banks, the value of the coefficient of determination decreased from 0.191 to 0.164 when using the ANN. In general, nonetheless, the use of neural networks to determine the most important independent variables affecting the dependent variables has increased the explanatory power of the results. These results are largely consistent with several studies that have shown the improved explanatory power provided by the neural networks research method (Arulsudar et al., 2005; Delen et al., 2005; Leshno & Spector, 1996; Nghiep & Al, 2001).

| Table 8 Summary of Results From Multivariate Linear Regression (MLR) and Artificial Neural Network (ANN) for Both Islamic and Conventional Banks in the Mena Countries | ||||||||

| Islamic banks | Conventional banks | |||||||

| ROE | ROA | ROE | ROA | |||||

| MLR | ANN | MLR | ANN | MLR | ANN | MLR | ANN | |

| Inflation | Ö | Ö | ||||||

| Log GDP | Ö | Ö | ||||||

| Capital ratio | Ö | Ö | Ö | |||||

| Bank size | ||||||||

| Credit risk | Ö | Ö | Ö | Ö | Ö | Ö | Ö | |

| Capital risk | Ö | Ö | Ö | Ö | ||||

| Loan intensity | ||||||||

| Financial leverage | Ö | Ö | Ö | |||||

| Operating ratio | Ö | Ö | Ö | Ö | Ö | Ö | ||

| Z-score | Ö | Ö | Ö | Ö | Ö | Ö | Ö | |

| R2 | 0.258 | 0.490 | 0.191 | 0.164 | 0.138 | 0.664 | 0.242 | 0.502 |

Discussion

The study found that only credit risk was not statistically significant between Islamic and conventional banks in the MENA region suggesting that credit risk management approaches might be similar in both banking types. Being financial institutions, it makes credit risk management an integral aspect of the banking business strategy. The importance of credit risk management for banking performance has been widely acknowledged in the literature (Athanasoglou et al., 2008; Căpraru & Ihnatov, 2014; Kutan et al., 2012; Liang et al., 2013; Petria et al., 2015). Further, the study found that whilst bank performance (captured by ROE and ROA) was relatively higher in conventional banks, it fluctuated more.

The results of the study also showed evidence of increased capitalisation of Islamic banks with a higher value of the capital ratio after 2008 compared to the period before. This increased capitalisation reflects the regulatory requirement after the 2008 global financial crisis (Almanaseer, 2014; Farooq & Zaheer, 2015; PWC, 2018). However, whilst capitalisation in Islamic banks increased after the 2008 financial instability period, their financial performance as captured by ROE and ROA seems to have declined and fluctuated more. This can be partly attributed to the tougher economic conditions and recovery, reflected for instance, in the relatively unstable and low oil prices (National, 2017).

Some observable significant differences in the financial variables of conventional banks between pre and post 2008 global financial crisis were noted. In particular, high values in bank sizes were observed which suggests some increase in cross-border mergers among conventional banks after the financial crisis (Sahut & Mili, 2011).

This study makes a contribution to the growing but still crescent literature on comparative banking performance (Alexakis et al., 2018; Caporale et al., 2017; Wanke et al., 2016; Zarrouk et al., 2016). An examination of the effect of the 2008 global financial crisis in the region revealed that conventional banks were affected more than Islamic banks. This suggests that conventional banks are more vulnerable to the financial instability than the Islamic banks. This is partly explained by their relative cross border operations when compared to Islamic banks (Kosmidou et al., 2007; PWC, 2018). Investments to develop secure financial systems across the region have increased in order to be internationally competitive (Ali, 2012). The impact of globalisation coupled with liberalisation policies have enabled foreign banks to enter this region (World Bank, 2017). This has led to more efficiency and competition in the sector (Cull & Soledad Martinez Peria, 2010; Jeon et al., 2011). As such, the entrance of new actors in the financial sector has increased the sector’s competitiveness. This has resulted in more product offering and investment in financial technology (PWC, 2018). On the other hand, the openness of the sector to foreign entrants has exposed it more to external financial shocks (Ali, 2012). However, the World Bank (2017, p. 1) observed that the banking sector in spite of the gradual economic liberalisation, remains largely shielded from the pressures of globalization and competition in most of the region. In several countries, the state retains a dominant role in the sector. Even in countries where most banks are privately owned, competition remains low. The result is financial systems that, while stable, perform inefficiently, not reaching large segments of the population. Most MENA banks tend to lag behind in product innovation and the provision of new services to both savers and borrowers.

As such, deliberate government policy action and increased private investment is needed in order to enhance the sector’s efficiency and competitiveness. The study has also shown that the application of the artificial neural network technique produced better results than the linear regression results as it increased the results’ explanatory power. In this regard, this study makes a contribution to a growing number of studies that support the superiority of the artificial neural network approach in statistical analysis (Delen et al., 2005; Leshno & Spector, 1996; Nghiep & Al, 2001). Therefore, in employing this research method, this study makes a methodological contribution in advancing the usage of non-linear models in banking financial performance studies.

Conclusion and Future Research

This paper was aimed at comparing the financial performance of Islamic and conventional banks in the MENA region for the period 2004-2014. The MENA region represents one of the world’s fastest growing markets in the banking and capital markets sector (PWC, 2018). The financial services sector is undergoing a massive overhaul and both Islamic and conventional banking are key contributors to financial stability. In making a comparison between the two banking models, the study has shown that compliance to the Sharia’s principles may affect financial performance.

The subsequent paper will focus on the key determinants of the financial performance of both Islamic and conventional banks. Also, since the MENA region comprises some oil rich countries, further segregation of the region will be undertaken to highlight any significant differences in performance of the two banking models in the Cooperation Council for the Arab States of the Gulf (CCASG) and non-CCASG countries. Future research could extend the period covered and also employ other methodological approaches.

References

Al-Hamzani, M. (2008). Islamic banks unaffected by global financial crisis. Asharq Al-Awsat.

Al-Qudah, A. M., & Jaradat, M. A. (2013). The impact of macroeconomic variables and banks characteristics on Jordanian Islamic banks profitability: Empirical evidence. International Business Research, 6(10), 153.

Ali, M., & Sarkar, A. A. (1995). Islamic banking: Principles and operational methodology. Thoughts on Economics, 5(3), 20-25.

Almanaseer, M. (2014). The impact of the financial crisis on the Islamic banks profitability-Evidence from GCC. International Journal of Financial Research, 5(3), 176-187.

Athanasoglou, P. P., Brissimis, S. N., & Delis, M. D. (2008). Bank-specific, industry-specific and macroeconomic determinants of bank profitability. Journal of international financial Markets, Institutions and Money, 18(2), 121-136.

Bakar, N. M. A., & Tahir, I. M. (2009). Applying multiple linear regression and neural network to predict bank performance. International Business Research, 2(4), 176-183.

Belanes, A., & Hassiki, S. (2012). Efficiency in Islamic and conventional banks: A comparative analysis in the MENA region. Bank. Mark. Invest, 120, 36-49.

Bessis, J. (2015). Risk management in banking: John Wiley & Sons.

Bilal, M., & Amin, H. (2015). Financial performance of Islamic and conventional banks during and after US sub- prime crisis in Pakistan: A comparative study. Global Journal Al-Thaqafah, 5(2), 73-87.

Cerović, L., Suljić Nikolaj, S., & Maradin, D. (2017). Comparative analysis of conventional and islamic banking: Importance of market regulation. Ekonomska misao i praksa(1), 241-263.

Chong, B. S., & Liu, M.-H. (2009). Islamic banking: interest-free or interest-based? Pacific-Basin finance journal, 17(1), 125-144.

Datt, G. (2012). An evolutionary approach: analysis of artificial neural networks. International Journal of Emerging Technology and Advanced Engineering, 2(1).

Diop, N., Marotta, D., & de Melo, J. (2012). Natural resource abundance, growth, and diversification in the Middle East and North Africa: The effects of natural resources and the role of policies: The World Bank.

Fortune, (2018). J.P. Morgan Has a Date for the Next Financial Crisis—and It's Not Far Off (online). Available at: http://fortune.com/2018/09/13/jpmorgan-next-financial-crisis/. Accessed: 20/12/2019.

Freixas, X., & Rochet, J.C. (2008). Microeconomics of banking: MIT press.

The Guardian (2018). We are due a recession in 2020 – and we will lack the tools to fight it. (Online). Available at: https://www.theguardian.com/business/2018/sep/13/recession-2020-financial-crisis-nouriel-roubini. Accessed: 15/12/2019.

Haron, S., & Azmi, N. W. (2009). Islamic finance banking system: McGraw-Hill Singapore-Professional.

Harrison, F. (1999). Boom Bust: House Prices, Banking and the Depression of 2010. Shepheard-Walwyn (Publishers) Ltd.

Hasan, B. (2009). Mitigating risks during a financial crisis. Mimeo

Hassan, M. K., & Kayed, R. N. (2009). The global financial crisis, risk management and social justice in Islamic finance. ISRA International Journal of Islamic Finance, 1(1), 33-58.

IBM, (2013). IBM SPSS Neural Networks 22 (online). Available at: http://www.sussex.ac.uk/its/pdfs/SPSS_Neural_Network_22.pdf. Accessed: 01/12/2019.

Islamic Financial Services Board (IFSB), (2019). Islamic Financial Services Industry Stability Report (online). https://www.ifsb.org/sec03.php. Accessed: 11/11/2018.

International Monetary Fund (IMF), (2010). Islamic Banks: More Resilient to Crisis? (online). Available at: http://www.imf.org/external/pubs/ft/survey/so/2010/res100410a.htm. Accessed: 01/02/2020.

Iqbal, M., & Molyneux, P. (2016). Thirty years of Islamic banking: History, performance and prospects: Springer.

Karkal, S. (2010). How do banks work?, April 25 (online). Retrieved from http://banksimple.com/blog/2010/04/25/how-do-banks-work/. Assessed: 01/03/2020.

Khokhar, I., Hassan, M., Khan, M. N., Amin, M. F. B., & Center, I. B. (2020). Investigating the Efficiency of GCC Banking Sector: An Empirical Comparison of Islamic and Conventional Banks. International Journal of Financial Research, 11(1).

Mishkin, F. S. (2007). The economics of money, banking, and financial markets: Pearson education.

Obaidullah, M. (2005). Islamic Financial Services. Saudi Arabia Islamic Economics Research Center, King Abdul- Aziz University (online). Available at: http://islamiccenter.kau.edu.sa/english/Publications/Obaidullah/ifs/ifs.html. Accessed: 01/04/2020.

Olson, D., & Zoubi, T. A. (2008). Using accounting ratios to distinguish between Islamic and conventional banks in the GCC region. The International Journal of Accounting, 43(1), 45-65.

Petria, N., Capraru, B., & Ihnatov, I. (2015). Determinants of banks’ profitability: evidence from EU 27 banking systems. Procedia economics and Finance, 20(15), 518-524.

Prenzlin, R. (2009). How do Islamic Banks Make Money? (online). Available at: http://ezinearticles.com/?How-Do- Islamic-Banks-Make-Money?&id=2052742. Accessed: 01/03/2020.

PWC, (2018). Banking & Capital markets (online). Available at: https://www.pwc.com/m1/en/industries/banking- capital-markets.html. Accessed: 01/04/2020.

Ruxanda, G., & Badea, L. M. (2014). Configuring artificial neural networks for stock market predictions. Technological and Economic Development of Economy, 20(1), 116-132.

Samad, A., & Hassan, M. K. (2006). The performance of Malaysian Islamic bank during 1984–1997: An exploratory study. International journal of Islamic Financial Services, 1(3).

Smaoui, H., & Salah, I. B. (2012). Profitability of Islamic banks in the GCC region. Global Economy and Finance Journal, 5(1), 85-102.

Srairi, S., A. (2013). Ownership structure and risk-taking behaviour in conventional and Islamic banks: Evidence for MENA countries. Borsa Istanbul Review, 13(4), 115-127.

Stergiou, C., & Siganos, D. (2014). Neural Network (online). Available at: https://www.doc.ic.ac.uk/~nd/surprise_96/journal/vol4/cs11/report.html#Neural%20Networks%20in%20Pr actice.

The Economist (2018). The world has not learned the lessons of the financial crisis (online). Available at: https://www.economist.com/leaders/2018/09/06/the-world-has-not-learned-the-lessons-of-the-financial- crisis.

The National, (2017). Middle East Islamic banking (online). Available at: (https://www.thenational.ae/business/banking/middle-east-islamic-banking-to-grow-by-5-annually-says- governor-of-central-bank-of-bahrain-1.681770).

Van Horen, N. (2007). Foreign banking in developing countries; origin matters. Emerging Markets Review, 8(2), 81- 105.

Warde, I. (2000). Islamic finance in the global economy: Edinburgh University Press.

World Bank, (2017). Global Report on Islamic Finance: Islamic Finance - A Catalyst for Shared Prosperity? Washington, DC: World Bank.

WorldBank,(2018).DataBank (online). https://data.worldbank.org/region/middle-east-and-north- africa?view=chart.

Zeitun, R. (2012). Determinants of Islamic and conventional banks performance in GCC countries using panel data analysis. Global Economy and Finance Journal, 5(1), 53-72.

Ali, A. (2012). Predicting continuance intention to use accounting information systems among SMEs in Terengganu, Malaysia. International Journal of Economics and Management, 6(2), 295-320.

Bourkhis, K., & Nabi, M. S. (2013). Islamic and conventional banks' soundness during the 2007–2008 financial crisis. Review of Financial Economics, 22(2), 68-77.

Jeon, H. Y., Zhu, H., Derksen, R. C., Ozkan, H. E., Krause, C. R., & Fox, R. D. (2011). Performance evaluation of a newly developed variable-rate sprayer for nursery liner applications. Transactions of the ASABE, 54(6), 1997-2007.

Appendix

Appendix A. Economic Variables descriptive statistics in Table 9

| Table 9 Descriptive Statistic for Economic Variables on all Country (N=988) | |||

| Countries | Inflation | Log GDP | |

| Algeria | Mean | 10.347 | 11.247 |

| Std. Dev. | 20.027 | 0.074 | |

| Bahrain | Mean | 2.424 | 10.390 |

| Std. Dev. | 1.087 | 0.106 | |

| Egypt | Mean | 10.067 | 11.240 |

| Std. Dev. | 3.232 | 0.199 | |

| Emirates | Mean | 6.137 | 11.449 |

| Std. Dev. | 5.829 | 0.130 | |

| Iran | Mean | 19.849 | 11.610 |

| Std. Dev. | 8.595 | 0.153 | |

| Iraq | Mean | 6.526 | 11.213 |

| Std. Dev. | 12.107 | 0.164 | |

| Jordan | Mean | 5.059 | 10.354 |

| Std. Dev. | 3.471 | 0.162 | |

| Kuwait | Mean | 4.485 | 11.083 |

| Std. Dev. | 2.365 | 0.135 | |

| Libya | Mean | 6.181 | 10.791 |

| Std. Dev. | 4.569 | 0.120 | |

| Morocco | Mean | 1.500 | 10.981 |

| Std. Dev. | 0.957 | 0.050 | |

| Oman | Mean | 3.752 | 10.719 |

| Std. Dev. | 3.099 | 0.163 | |

| Qatar | Mean | 4.866 | 11.039 |

| Std. Dev. | 6.249 | 0.253 | |

| Saudi | Mean | 4.002 | 11.705 |

| Std. Dev. | 2.535 | 0.146 | |

| Tunisia | Mean | 4.167 | 10.611 |

| Std. Dev. | 1.033 | 0.066 | |

| Yemen | Mean | 11.903 | 10.397 |

| Std. Dev. | 4.237 | 0.145 | |

| Total | Mean | 5.906 | 11.012 |

| Std. Dev. | 6.419 | 0.479 | |

Appendix B. Case processing summary, network information and architecture of the network for ROE in Islamic banks in MENA region Table 10 & Table 11

| Table 10 Case Processing Summary for Roe in Islamic Banks | |||

| N | Percent | ||

| Sample | Training | 215 | 72.6% |

| Testing | 81 | 27.4% | |

| Valid | 296 | 100.0% | |

| Excluded | 0 | ||

| Total | 296 | ||

| Table 11 Network Information for Roe in Islamic Banks in the Mena Region | |||

| Input Layer | Covariates** | 1 | Inflation |

| 2 | Log GDP | ||

| 3 | Capital ratio | ||

| 4 | Bank size | ||

| 5 | Cred risk | ||

| 6 | Capital risk | ||

| 7 | Loan intensity | ||

| 8 | Financial leverage | ||

| 9 | Operating ratio | ||

| 10 | Z-score | ||

| Number of units a** | 10 | ||

| Rescaling method for covariates | Standardized | ||

| Hidden Layer(s) | Number of hidden layers | 1 | |

| Number of units in hidden layer 1 a** | 7 | ||

| Activation function | Sigmoid | ||

| Output Layer | Dependent variables | 1 | Return on equity** |

| Number of units | 1 | ||

| Rescaling method for scale dependents | Normalized | ||

| Activation function | Sigmoid | ||

| Error function | Sum of squares | ||

** Values that were changing in the subsequent test analysis.

Appendix B. Model summary of ROA for independent variables for Islamic Banks Model Summary for all Independent Variables Table 12 & Table 13

| Table 12 Model Summary for Roa in Islamic Banks in the Mena Countries | ||

| Training | Sum of Squares Error | .593 |

| Relative Error | .823 a |

|

| Stopping rule used | 1 consecutive step(s) with no decrease in error | |

| Training time | 0:00:00.03 | |

| Testing | Sum of Squares Error | .089 |

| Relative Error | .998 | |

| Dependent Variable: Return on Asset, a. Error computations are based on the testing sample. |

||

| Table 13 Model Summary for Roa in Islamic Banks in the Mena Countries | ||

| Training | Sum of Squares Error | .608 |

| Relative Error | .960 | |

| Stopping rule used | 1 consecutive step(s) with no decrease in errora | |

| Training time | 0:00:00.00 | |

| Testing | Sum of Squares Error | .181 |

| Relative Error | .946 | |

a. Error computations are based on the testing sample

The results show the Sum of Squares Error of 0.593 and Relative Error 0.823 in training stage. The Sum of Squares Error is 0.089 and Relative Error is 0.998 in testing stage. The sum of squares errors has reduced from the training phase at 0.593 to 0.089 in the testing stage reflecting the improvement in the fitness of the model. The sum of squared errors in the ANN basically measures the differences between the network outputs and the target (desired) outputs, which can be perceived as a ‘cost’ (Ruxanda & Badea, 2014).

Model summary for five selected independent variables

The goodness of fit of the neural network model has improved as depicted from the reduction in the Sum of Squares Error. This reduced from 0.608 in the training stage to 0.181 in the testing stage. Further, the percentage of incorrect predictions as shown by the relative errors is almost equal across the training and testing samples with values of 0.960 and 0.946 respectively.