Research Article: 2021 Vol: 25 Issue: 5

A Critical Analysis of the Tax Systems on Artisanal Miners and Small-Scale Miners in Zimbabwe

Wadesango N, University of Limpopo, Polokwane

Malatji S, Tshwane University of Technology, Pretoria

Rumbidzai P Mutare, Midlands State university, Zimbabwe

Sitsha L Sitsha L, Midlands State university, Zimbabwe

Abstract

Artisanal mining activities play a major role in contributing to our national GDP. In Zimbabwe the mining sector is said to be the backbone of the economy accounting for over 50% of national forex in the past decade. However, it has been said that Zimbabwe Revenue Authority (ZIMRA) is failing to collect revenue from this sector as the participants are not willing to comply with the tax laws. Artisanal mining’s poor methods of mining are leading to environment degradation and other negative factor therefore they are required to pay to the government for these damages caused. This research was carried out in order to critically analyse the tax systems on artisanal miners in Zimbabwe. The researchers used quantitative research methodology. Questionnaires were used for data collection. The study used a sample of 50 artisanal mining participants and 20 ZIMRA officials who completed the questionnaires. The results showed that paying of taxes affect the artisanal miners negatively on their operations. It also emerged that the tax systems have failed to bring all the informal miners into the tax net, hence there is need to restructure the tax systems. The study also concludes that ZIMRA does not carry out awareness campaigns to remind the miners to pay their taxes.

Keywords

Tax Systems, Artisanal Miners, Small-Scale Miners, Developing Country.

Introduction

According to Gutu (2017), African Mining Vision recognises small-scale mining activities as important in encouraging sustainable livelihoods and in the reduction of poverty in countries that are mineral rich on the continent. In the past decade, Zimbabwe’s mining sector has become the main support of the economy earning above 50% of the national forex. Takavasha (2013) identifies artisanal miners as the main producers of most precious minerals and other semi-precious stones, indicating that above 70% of the small scale miners are into mineral production. Since independence ASM activities were difficult to understand as the country had a partially strong economy and the majority of the labour employed in industries and other commercial entities. During the period between 2000 to 2008 Zimbabwe suffered an economic recession which led to the closure of many companies and some were forced into reducing their operating capacity.

An artisanal or a small scale miner is a miner who is not formally employed by a mining company but rather works on his own, mining different types of minerals or gold panning using his or her own resources (Landu, 2014). Small-scale mining conducts its activities differently from large scale miners hence activities are conducted individually and in small groups. Small scale mining is permitted in Zimbabwe unlike in other countries. The CEO of the Zimbabwe Miners Federation at a meeting held in Kadoma in 2013 cited that Zimbabwe has been taking part in artisanal mining since the era of Munhumutapa Empire in 15th century. This involved the trading of gold between Shona people and Portuguese people. He went on to say that the economic contributions by these miners has been large with the international statistics demonstrating that gold contributions add up to 5% and tin contributions by this sector are 25 percent. Nyahwa (2017) postulated that Zimbabwe’s mining law is administered by the Mines and Minerals Act of 1961, which allows Zimbabwean citizens who are permanent residents to obtain a mining license. Due to the significant contributions of the small mining sector in the economy Zimbabwe has permitted and tolerated these activities. Gutu (2017) cited that more than five hundred thousand individuals are taking part in the operations of small-scale mining which contributed to almost half of the of gold which was produced in Zimbabwe in 2017. She went on to say, in 2016, artisanal miners also contributed a large percent of the nation’s gold production, which contributed a greater amount of revenue for the country. She also wrote that artisanal mining form part of the small and medium enterprises (SMEs). Presently, the SMEs sector constitutes of 60 percent of Zimbabwe’s labour force and also contributes more than 50 percent to the gross domestic product (GDP) (Ministry of Finance 2013). ASM contributes 8 percent of the total of SMEs. Therefore, it becomes clear that ASM is an important source of income which reduces poverty in the country. The ZIMASSET from 2013 to 2018 acknowledged that ASM sector is playing an important role in the economy’s growth.

According to Maponga and Ngorima (2013) the ASM sector has since been an important activity complementing each other with small-scale farming. They however concluded that, Zimbabwe’s ASM sector has faced contests that affect product volume and individual compliance to the mining and environmental laws. Artisanal miners commonly depend on inexperienced labour in their mining activities. Due to absence of suitable geographical knowledge and planning skills, a lot of small scale mining activities are disordered and cause environmental damages. The ASM in Zimbabwe lacks financial support to equip the mining operations with suitable machinery due to lack of business plans which are viable or practical and they also lack collateral security which enables them to access bank loans. High-priced licence requirement makes it challenging for artisanal miners to stay legally compliant. Due to these challenges the Ministry of Mines Development saw it possible to remove the presumptive tax, which was being charged on artisanal miners. Presumptive tax on artisanal miners was removed in order to incentivise them. It was done to encourage artisanal miners to register so as to operate legally. The government wanted to make sure that all minerals are accounted for and not sold outside Zimbabwe. The tax was charged on the basis of presumed income by artisanal miners. Rushwaya (2019) said only 30000 of the estimated 1.5 million artisanal miners have regularised their operations owing to levies charged by the government. This has given the government a lot of problems in revenue collection as most of the artisanal miners are not registering for tax purposes. Taxes are the main sources of income in several developing countries the governmental authorities have thrived to collect revenue from most of the small-scale miners.

Methodology

The researchers adopted the quantitative research methodology. This study was carried out in Shurugwi mining area of Zimbabwe. It is a fairly small area with various mining cites. The researchers used stratified random sampling as it was much suitable for the data to be collected. Data collection was done using questionnaires. The data was arranged and presented making use of tables, bar graphs, pie charts and percentages calculated to show different responses from the respondents to all the questions. The researchers used excel to analyse and present data because of its simplicity.

Results

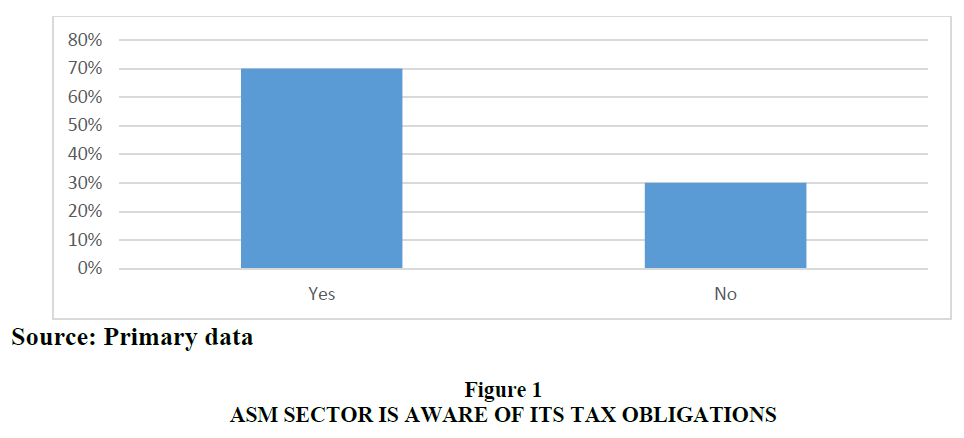

ASM Sector is Aware of the Tax Obligations

This question was to find out if this mining sector knows that it is supposed to pay tax since tax revenue collected from them is low compare to their number Figure 1.

The data collected showed that 70% of the targeted population is aware of its obligations of paying tax and 30% knew nothing about the tax system. Dalu et al. (2015) argued that the informal sector is unaware of the tax obligations but these results show that this part of the informal sector is aware of the existence of taxes.

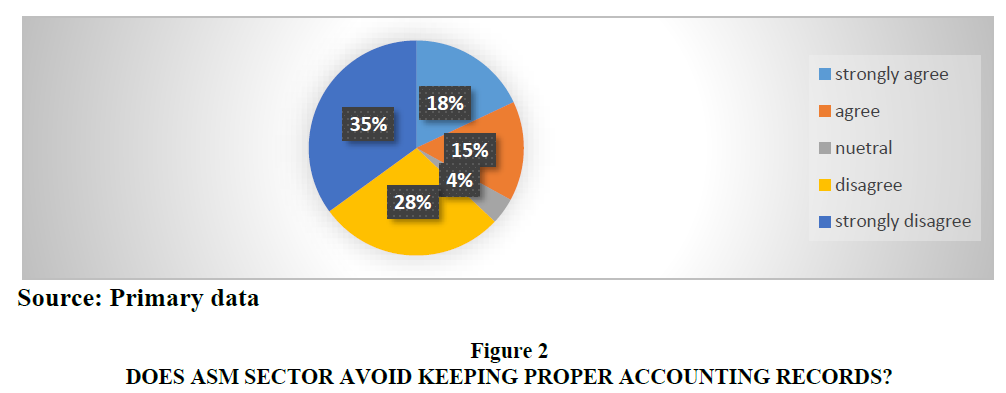

Asm Sector Avoids Keeping Proper Books of Accounting

Many of the informal sector businesses do not have proper accounting records. The main objective of this question was to find the reason why the ASMs do not possess proper accounting records in Figure 2.

35% of the participants strongly disagree that willingly avoid keeping proper books of accounting. Also 28% of the respondents disagree to the view that they deliberately avoid proper bookkeeping. However, 18% and 15% strongly agree and agree respectively that the ASM sector intentionally avoids keeping proper records. According to the responses 63% agree that they deliberately avoid keeping records which agrees with Kamuteku (2016) whose study reviewed that majority of the informal sector fail to keep proper accounting records. Maseko & Manyani (2011) also pointed out that informal sector businesses deliberately keep no books of accounts.

The Tax Systems are the Best Way of Taxing T\the ASM Sector?

This question was meant to uncover how the ASM sector perceived the tax systems on them. It turned out that 62% thought that the various taxing systems are not the best way of taxing the ASM sector. This is largely due to the fact that the taxes charged are too many for these subsistence miners thereby overcharging the taxpayers. 38% however viewed the tax systems as the best way of taxing the artisanal miners Table 1.

| Table 1 Are the Tax Systems the Best Way of Taxing the ASM? | ||||

| Frequency | Percent | Valid Percent | Cumulative Percent | |

| agree | 4 | 4.4 | 4.4 | 6.7 |

| disagree | 26 | 57.8 | 57.8 | 64.4 |

| strongly agree | 2 | 4.4 | 4.4 | 68.9 |

| strongly disagree | 14 | 31.1 | 31.1 | 100.0 |

| Total | 45 | 100.0 | 100.0 | |

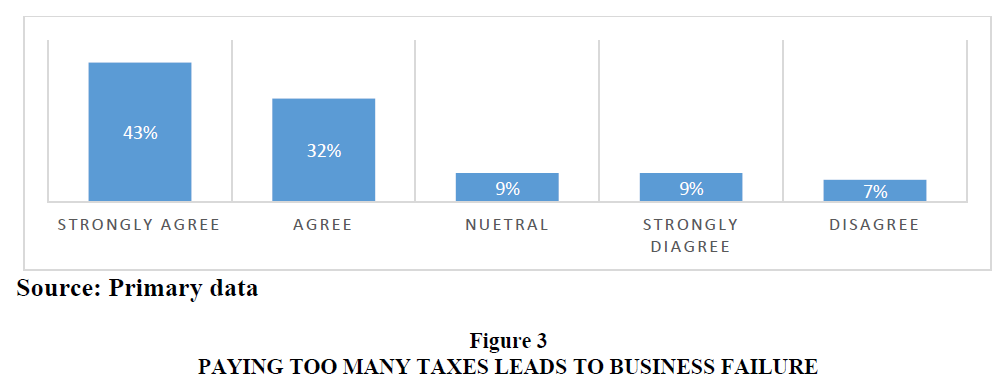

Paying too many taxes impacts negatively on the operations of a business.

The relationship between business survival and payment of taxes is of great importance. It has been an area of interest for a long time. This question was meant to clarify and answer the argument of business survival and taxation in the mining sector Figure 3.

The results obtained showed that 43% strongly agree, 32% agree and 9% are indifferent, 9% disagree and 7% agree that paying too much taxes and licenses has a negative impact on the business. This proves that the mining sector since they get low revenues has a huge burden of paying too much taxes.

Have You Ever Attended Any Workshop on Taxation?

Workshops are vital as they educate people on the importance of paying taxes and the benefits one can enjoy by paying taxes. Also this can give platform for both the authority and the taxpayers to communicate on any grievances in order to ensure that they are on the same page. However, 100% of the miners revealed that they had never attended any tax workshop. Zivanai et al. (2015) pointed out that lack of awareness campaigns by ZIMRA including workshops is the reason why the taxpayers are not compliant. Nyamwanza et al. (2014) said that the educational level received by taxpayers is important as it contributes to the general understanding of taxation. As such these workshops are essential.

Why Do You Think That ASM Participants Avoid Paying Taxes?

Since revenue collected from ASM sector is very low compared to the number of ASM sector participants it was important to know why many participants skip paying their taxes. Many miners pointed out that the taxes were too high for them and could not afford to pay-out such amounts every month. Another answer as that ZIMRA does not do frequent compliance check-ups so peoples tend to be reluctant in paying their taxes.

What Methods are Used in Determining the Tax Rates for the Mining Sector?

It is important to know how ZIMRA comes up with the tax rates that it imposes on the small mining sector. 83% responded that they are taxed according to their output that is what they have produced for a certain period of time. 17% responded that the standard assessment is used in determining the tax rate

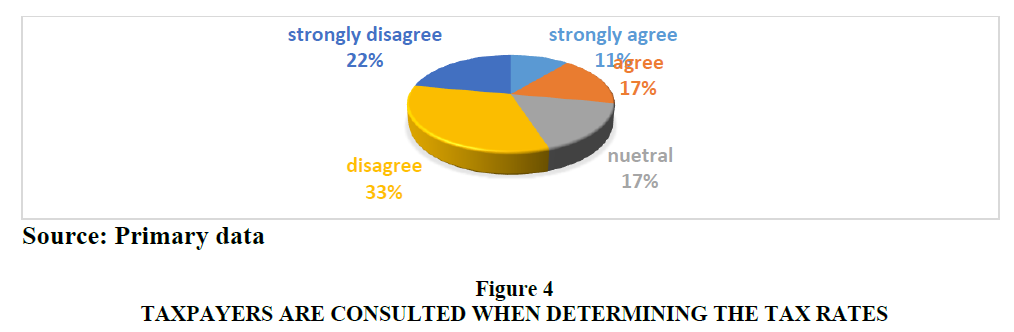

Are Taxpayers Consulted When Determining the Rate to Be Charged?

The authorities must be able to involve and consult the taxpayers when determining the tax rates as this will increase their participation. Involving the ASM will to help increase the efficiency of the tax systems. The main reason for this question was to see whether ZIMRA consulted the taxpayers before they set the tax rates in the artisanal mining sector Figure 4.

With reference to fig 4, 11% strongly agree, 17% agree, 17% was not sure, 33% disagree and 22% strongly disagree that ASM are consulted when determining the tax rates. These results show that 55% disagrees with the fact that the ASM sector is consulted when determining tax rates. Utaumire et al (2013) pointed out the lack of involvement of the informal sector in determining tax rates.

Are the Tax Rates Charged in the ASM Sector Affordable?

The main aim by the authorities is to charge reasonable tax rates which can be met by the payers. The main objective of the question was to find out if the payers were easily being able to meet their tax obligations. A huge rate of 65% of the participants responded that the rates are way much affordable to the ASM sector. This is shown by the low taxes paid in this sector. However, on the other hand 35% thought that the tax rates are too much for the ASM sector.

What methods are being implemented to collect the taxes? Are they effective?

Putting a tax system in place is one thing but making sure that it runs smoothly is another thing. The effective revenue collection must be enabled by a well-structured method which guarantees the collection as much as possible. 80% of the respondents pointed out that outsourcing the collection of taxes from other local authorities has proved to be more effective as most of the tax revenue collected during the year is from these authorities. This agrees with Colin and Loana (2015) who said in Ghana outsourcing of taxes has been a success. In Zimbabwe other local authorities take time to remit taxes they have collected. 20% said that remittance by individuals is also another method used to collect tax. However, it was pointed out that this is the most ineffective method as very few miners turn up to pay their dues. A lot of the miners do not bother to pay their taxes to ZIMRA as it is well documented that the informal sector avoids paying taxes.

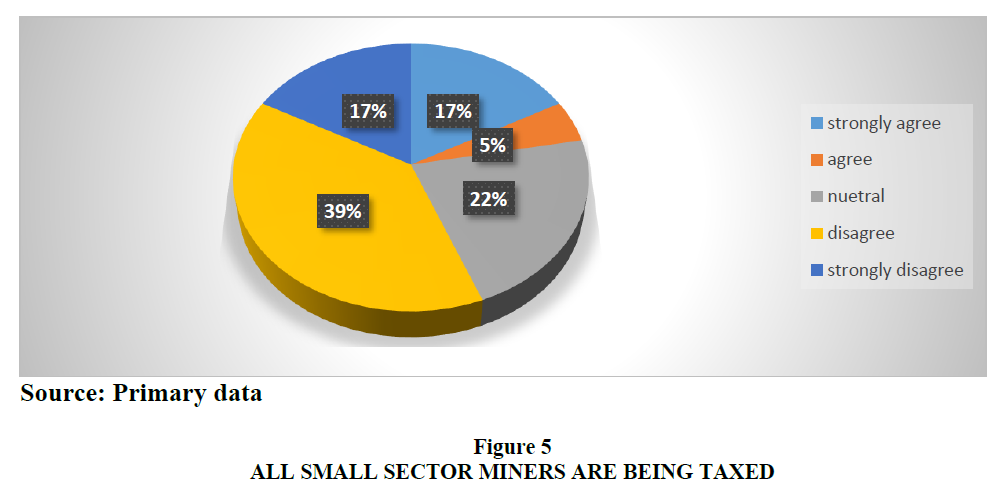

The Tax Systems Bring All the Asm into the Tax Net

The main objective of this question was to find out if the current tax regime on small scale miners is managing to tax all the eligible ASM both formalised and informal sector. The more the ASM in the tax net the more the tax revenue collected Figure 5.

In figure 5 above it is clearly shown that 5% agree, 17% strongly agree, 22% are not sure, 17% strongly disagree and 39% disagree that the whole ASM sector is being taxed. There is need for improvement when it comes to taxing small scale miners. Not all small scale miners are being taxed. As much as the government is trying to bring this sector into

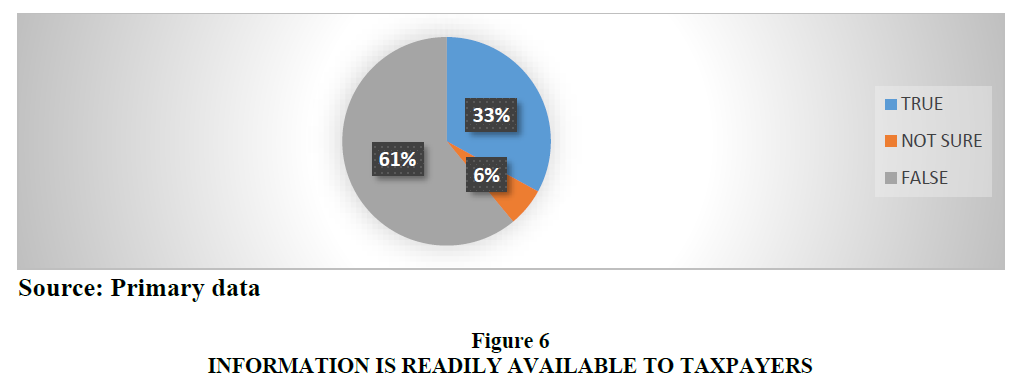

Information pertaining to the tax systems is readily available to tax payers.

Taxpayers must always be informed about any changes or any new developments concerning the tax rate. If they are given adequate information, they will always be up to date to any changes in rates and new agents Figure 6.

The results of the research showed that information about changes in tax regimes is not always readily available to tax payers which is not a satisfactory situation. 61% of the respondents said information is not readily available to the taxpayers.

Conclusion

The goal of the research was to scrutinize the tax systems on ASM in Zimbabwe. The results indicated that paying of these taxes impacts negatively on the possible survival of the small scale miners. The tax systems were condemned by the miners as unsuitable as they believe that they are being overtaxed. The study also concludes that not all small scale miners are being taxed by the tax system. The system is failing to bring ASM into the tax net.

References

- Ahmad S.E., & Stern, N.H. (1989). Taxation for developing countries. The London school of economics.

- Alm, J., Vazquez, J.M., & Schneider, F. (2004). Sizing the Problem of the Hard-ToTax. Atlanta: George State University.

- Bird, R., & Gendro, P. (2007). The Vat in Developing and Transitional Countries. Cambridge University Press: New York.

- Bird, R., & Wallace, S. (2003). Is It Really So Hard to Tax the Hard-to-Tax? The Context and Role of Presumptive Taxes, ITP Paper 0307, prepared for the International Tax Program Institute for International Business Joseph L. Rotuman School of Management University of Toronto, Toronto, Ontario.

- Bird, R.M., & Wallace, S. (2004). Is it really so hard to tax the hard-to-tax? The context and role of presumptive taxes, in Taxing the Hard-to-tax: Lessons from Theory and Practice Eds Alm, J, Martinez-Vazquez, J, Wallace, S (North-Holland, Amsterdam), 121–158.

- Bryman & Bell. (2007). The new role of the internal auditor: Implications for internal auditor Canada Perspective, The Canadian Economic Observer, 7(5).

- Caroll, E. (2011). Taxing Ghana's Informal Sector: The Experience of Women, Occasional Paper No.7, Christian Aid.

- Chidoko, C., Bemani, J., & Matungamire, P., (2011). Tax law and practice in Zimbabwe: Concepts and Perspectives. LAP LAMBERT Academic Publishing GmbH & Co.KG.

- Embuka, A. (2015). Presumptive tax: Equalizing the distribution of tax burden (11) in Finance News 15/06/15

- Emran, S., & Stiglitz, J. (2005). On selective indirect tax reform in developing countries.

- Engelschalk, M. (2005) Small business taxation in transition countries. The World Bank, Washington, D.C. 35109

- Feige, L. (1994). The Underground Economy and the Currency Enigma, Public Finances Publiques, 49, 119-136.

- Kirk, J., & Miller, M. (1986). Realiability and Validity in Qualitative Research. Qualitative Research Methods Series 1. Sage University Paper.

- Kuchta-Helbling, C., & Sullivan, J.D. (2000). Barriers to participation: the informal sector in emerging democracies. Centre for International Private Enterprise. Labaree, Robert.

- Loeprick, J. (2009). Small Business Taxation: Reform to Encourage Formality and Firms Growth, Investment Climate in Practice: Business Taxation No. 1, Washington DC: World Bank London: SAGE, 2001; Trochim, William M.K. 2006.

- Makochekanwa, A. (2013). An analysis of tourism contribution to economic growth in SADC Countries. Botswana Journal of Economics, 11(15), 42-56.

- Maloney, W.F. (2004). Informality revisited‚ in World Development, 32(7), 1159–1178.

- Maponga, O., & Mfote, D. (2001). Small scale chromite, gold and tantalite mining and environment in Zimbabwe. The environment of smallholder producers. University of Zimbabwe.

- Masarirambi, C. (2013). An investigation into Factors Associated with Tax evasion in the Zimbabwe informal sector: A survey of Mbare Magaba Informal Traders. Doctorate Thesis: Zimbabwe Open University.

- Rajaraman, I. (1995). Presumptive Direct Taxation: Lessons from Experience in Developing Countries. Economic and Political Weekly, 30(18/19): 1103-1124.

- Sadka, E., & Tanzi, V. (1993). A Tax on Gross Assets of Enterprises as a Form of Presumptive Taxation, Bulletin: International Bureau of Fiscal Documentation, 47(2), 66-73.

- Saunders, M., Lewis, P., & Thornhill, A. (2009). Research Business for Business Students: Fifth Edition. Harlow: Prentice Hall.

- Saunders, M., Lewis, P., & Thornhill, A. (2016). Research Business for Business Students: seventh edition. Harlow: Prentice Hall.

- Schneider, F., Buehn, A., & Montenegro, C. (2010). Shadow economies all over the world: new estimates for 162 countries from 1999 to 2007. World Bank Policy Research Working, 5356.

- Sethuraman, S.V. (1976). The Urban Informal Sector: Concept and Measurement. International Labour Review, 114(1), 69-81.

- Slemrod, J., & Yitzhaki, S. (1994). Analyzing the standard deduction as a presumptive tax. International Tax and Public Finance, 1(1), 25-34.

- Tendler, J. (2002). Small Firms, the Informal Sector and the Devil's Deal’, IDS B.