Research Article: 2022 Vol: 26 Issue: 3

A Meta-Analysis of the Effect of Capital Structure on Profitability

Samuel Tabot Enow, The Iie Vega School

Citation Information: Enow, S.T. (2022). A meta-analysis of the effect of capital structure on profitability. Academy of Accounting and Financial Studies Journal, 26(3), 1-10

Abstract

Capital structure represents an essential managerial decision task because of its relative importance in assessing the risk of a firm. Large and multi-national business is constantly faced with the decision of analysing the appropriate mix of debt and equity/assets. This study aimed at investigating the effect of capital structure on profitability using a meta-analysis to ascertain what has been documented in prior literature. Using a Lilliefors test, a Kolmogorov Smirnov test, a Chi square test and a sample of 23 published journal articles, the results shows that profitability is independent of capital structure. Also, capital structure is not a good fit in explaining variations in profitability. The implication of this study is that policy makers, business support organisations, banks and academic institutions should not consider the effect of their capital structure decisions when analyzing their profitability. Although there might have been a positive or negative relationship between the two concepts, it is purely by chance. Also, articles that are titled “the effect of capital structure on profitability” should first establish the direction of impact, the effect size, a dependency relationship and a detailed coefficient of determination analysis.

Keywords

Capital Structure, Profitability, Meta-Analysis, Lilliefors Test, Kolmogorov Smirnov test, Chi Square Test.

Introduction

Capital structure is arguably among the most controversial topics in corporate finance and has gain recent recognition of its importance (Chakraborty, 2010). This is particularly true when considering that capital structure differs across industry and firms. Firms across various sectors have a different level debt-to equity mix, in other words, different leverage mix. When a firm finance it assets mostly with equity, it avoids leverage risk thereby reducing the potential of bankruptcy. However, debt financing allows a firm to pursue its growth strategy while maintaining ownership and control of the business (Chechet & Olayiwola, 2014). It is perceived that optimal capital structure can reduce the overall risk of company by adjusting the different sources of capital, debt and equity, to suit the company goals (Ejupi & Ferati, 2009). Poor capital structure decisions might result in increasing weighted average cost of capital which will cause the net present value of profitable projects to be negative which leverages a firm’s strategy and competitive behaviours.

However, considering the above importance of capital structure, there have been many contradictions on opinions with regards to the link between of capital structure and profitability of a firm. In particular, Modigliani & Miller (1963) contended that, in a competitive market capital structure has no impact on profitability. Modigliani & Miller (1963) are of the opinion that, the mix of debt and equity has no impact on the firm’s value. In their research, they pointed out that, if two identical firms have with the same asset value and identical operations then their value and profitability would be the same regardless of their capital structure. Modigliani & Miller (1963) illustrated that, if you two pies have the same shape, it doesn’t matter how the pie is sliced, in the context of finance the profitability of both firms must be the same. In line with the proposition of Modigliani & Miller (1963), Chung et al. (2013), also contends that the mix of debt and equity is also irrelevant when assessing the profitability of a firm. Chung et al. (2013) also point out that most firms increase their leverage when faced with attractive business opportunity which has no significant effect on their profitability in the short run, implying that equity financing is equally as good as debt financing relative to profitability. However, prior research by Chechet & Olayiwola (2014); Akeem et al. (2014); Zangiabadi et al. (2015); Vătavu (2015); Abata & Migiro (2016); Marandu & Sibindi (2016); Sakr & Bedeir (2019); Reschiwati et al. (2019); Almahadin & Oroud (2019); Otekunrin et al. (2020); Ullah et al. (2020); Dinh & Pham (2020); Wieczorek-Kosmala et al. (2021) have revealed that capital structure significantly affects a firm’s profitability and value. Specifically, these authors found a significant relationship between debt-to-equity (DTE) mix and return to equity (ROE), return to assets and profit after tax and other measures of profitability mainly using regression analysis. The implications of these studies are that an optimal capital structure should be implemented in a firm in other to maximise profitability in addition to other recommendations. Evidence gleaned from the above studies suggests that there have been mixed results in this research area which motivates the purpose of this study. There are three considerations of this study, firstly as clearly documented in the study of Rjoub et al. (2017), a regression analysis must first establish the direction of impact. This means there is either a two or one-way direction of impact which implies that does capital structure affects profitability and profitability affect capital structure (2 way) or capital structure only affects profitability (one way)? Studies with 2-way direction of impact should not be considered for publication as it is redundant for profitability to affect capital structure where all the above studies cited did not established this fact. Secondly, there coefficient of determination (R2) was not the bases of analysis and the main emphasis was on p-values and coefficients. Lastly, these studies (Chechet & Olayiwola 2014); Akeem et al. (2014); Zangiabadi et al. (2015); Vătavu (2015); Abata & Migiro (2016); Marandu & Sibindi (2016); Sakr & Bedeir (2019); Reschiwati et al. (2019); Almahadin & Oroud (2019); Otekunrin et al. (2020); Ullah et al. (2020); Dinh & Pham (2020); Wieczorek-Kosmala et al. (2021) did not present their findings in line with the effect size of capital structure on profitability and a dependency test analysis. Hence, the main aim of this study was to investigate how capital structure affects profitability using a meta-analysis constituting R2, effect size and dependency test of a sample of 23 published articles.

Literature Review

As already alluded, several factors affect a firm’s value and it is perceived that capital structure might be one of the factors that have a significant impact. As propose by the traditional theory of capital structure, optimal capital mix minimises the weighted average cost of capital which in turn increases the market value per share. Usually, Capital structure is made up of debt and equity and changes to the level of debt or equity will also alter the firm’s value. From the tax benefits perspective, most firms are expected to borrow more in order to obtain a higher performance under the tax burden. In this case, using debt and equity ratios to assess a firm’s performance may not be a viable assessing tool as there are multiple factors interfering in these relationships. Several empirical research has been conducted to investigate the relationship between a firm s performance and capital structure in which contradictory results where obtain. The Table 1 below presents the findings.

| Table 1 Summary Of Prior Studies On The Effect Of Capital Structure On Profitability |

|||||

|---|---|---|---|---|---|

| Study (Author & year of study) | Country | Period | Dependent variables used for profitability |

Independent variables used for capital structure |

Summary of findings |

| Abor (2005) | Ghana | 1998-2002 | ROE | SDA, LDA and DA | Profitability depends on debt than the other components of capital structure. Firms should carefully manage their debt ratios |

| Salawu (2009) | Nigeria | 1990 to 2004 |

profitability | TLR, LTD and STD | Firms should manage their capital structure effectively to improve on their performance. |

| Gill, Biger & Mathur (2011) | USA | 2005 – 2007 |

ROE | STD, LTD and TD | Capital structure positively affects profitability, firms should increase their the use of debt to improve their profitability. |

| Ferati & Ejupi (2012) | Macedonia | ROE | STDL, TETL and LTDE | Capital structure positively affects profitability with exception of long term debt | |

| Salim & Yadav (2012) | Malaysia | 1995-2011 | ROA, ROE and EPS |

STD, LTD and TD | Significant positive relationship between STD and LTD but negative relationship with TD. Capital structure positively affects profitability |

| Shubita & alsawalhah (2012) | Jordan | 2004-2009 | ROE | STD, LTD and TD | Negative relationship between debt components and probability hence firms should focus on measure of equity to finance their projects |

| Taani (2013) | Jordan | 2007-2011 | ROIC, NP, ROE and NIM |

TDTF, TDTE | Bank performance is directly positively related to all capital measures except ROE Banks can improve their performance by managing their ROIC, NP and NIM effectively |

| Moghadas et al. (2013) | Iran | 2006-2010 | Market value | DR, RG, firm size, asset growth | DR and RG significantly positively affects profitability |

| Ebrati et al. (2013) | Iran | 2006 to 2011 |

ROE, market value and ROA | SDTA, LDTA, TDTA and TDTQ | Capital structure significantly affects ROE and market value while negatively affects ROA. |

| Hasan et al. (2014) | Bangladesh | 2007–2012 | ROE,ROA and EPS | STD,LTD and TDR | Capital structure significantly affects profitability and firms should use internal source of funds before considering external sources |

| Chechet & Olayiwola (2014) | Nigeria | 2000-2009 | profitability | DR and Equity | DR is negatively related to profitability while equity is positively related to profitability. This explains the concept of agency cost. |

| Akeem, Edwin, Kiyanjui & Kayode (2014) |

Nigeria | 2003 - 2012 |

ROE and ROA | DT and DE | Capital structure is negatively related to profitability, should use more equity to increase their profitability. |

| Vătavu (2015) | Romania | 2003- 2010 | ROA, ROE | TOTD, LGTD, SHTD and TE |

Debt significantly affects profitability. Firms should use less debt and more equity to finance their operations. |

| Zangiabadi, Rahimzade & Taboli (2015) | Iran | 2001- 2011 | ROA and ROE | DTNW, DTAR | DR affects ROE but not ROA. Capital structure positively affects the profitability |

| Abata & Migiro (2016) | Nigeria | 2005 - 2014 |

ROE and ROA | DTE and TDTA | Firms should use long term debt to finance their projects |

| Marandu & Sibindi (2016) | South African | 2002- 2013 | ROE and ROA | Firm size, credit risk and capital | Evidence of strong relationship between capital structure and bank profitability |

| Almahadin & Oroud (2019) | Jordan | 2013-2017 | EBIT-TA | DR | The value of the firm is negatively correlated to profitability, firms should carefully consider their capital structure decisions |

| Reschiwati et al. (2019) | Indonesia | 2014-2018 | ROA and CR | DR, log of total asset | Capital structure affects the value of a firm and the firm size. Capital structure should be managed effectively. |

| Sakr & Bedeir (2019) | Egypt | 2003-2016 | ROE, ROA | STD, LTD and TD | Significant negative relationship between ROA and STD, LTD and TD while ROE positively impacts LTD and TD. |

| Otekunrin, Nwanji et al. (2020) | Nigeria | 2003- 2018 | ROE | DE and leverage ratio | Significant negative relationship between capital structure and profitability. There is a need to properly manage the mix of debt to equity ratio. |

| Dinh & Pham (2020) | Vietnam | 2015 - 2019 |

ROE | Leverage ratio and DR | Firms should increase the proportion of debt in their capital structures so as to increase profitability. |

| Ullah et al. (2020) | Pakistan | 2008 – 2017 |

ROE | DE and TD | Debt to equity in capital structure has a negative relationship with profitability. Managers should reduce their leveraging to increase the financial performance. |

| Wieczorek- Kosmala, Błach & Gorze ´n- Mitka (2021) | Czech Republic | 2015–2019 | ROE and ROA | DA, LTD and STD | Negative relationship between capital structure and profitability, firms should apply the pecking order theory of financing their operations |

ROA= retrun on asset, ROE=return on equity, TOTD = total debt to total asset, LGTD= long term debt to total asset, SHTD= short term debt to total debt, TE=total equity, EPS=earnings per share, STD= short term debt, LTD=long term debt, TD=total debt, DR= debt ratio, RG=real growth, DTNW=debt to net worth, DTAR=debt to asset ratio, SDTA=short term debt to total asset, LDTA=long term debt to total asset, TDTA=total debt to asset, TDTQ= total debt to total equity, SDA=short term debt to total capital, LDA=long term debt to capital, DA=total debt to capital, STDL= short term debt to liability, TETL=total equity to total liability and LTDE=long term debt to equity, ROIC= return on invested capital, NP=net profit, NIM= net interest margin, TLR=total liability ratio, EBIT-TA=earnings before interest and tax to total asset.

Research Methodology

This study made use of 3 techniques namely, the Lilliefors test, the Kolmogorov Smirnov test and Chi square test to determine the distribution, goodness of fit and dependency between the effect of capital structure on profitability. More specifically, the Lilliefors test and Kolmogorov smirnov tests were used to investigate the distribution of R2 and how measures of independent variable which in the case of this study is capital structure can be used to account for variability in profitability and the effect size (Massey, 1951). A small effect size means that measures of capital structure can adequately account for profitability. Also, the Chi square test is relevant in assessing the whether profitability is dependent on capital structure. Using the R2 values for a sample of 23 published articles the following hypothesis where examined.

H0: The values of R2 are normally distributed and measures of capital structure can be used to explain the variability in profitability and the effect size is small.

H1: The values of R2 are not normally distributed and measures of capital structure cannot be used to explain the variability in profitability and the effect size is large.

H2: The Chi square test value is more than the critical value; therefore capital structure is related and dependent of profitability.

H3: The Chi square test value is less than the critical value; therefore capital structure is not related and independent of profitability.

The following data was collected from the journal articles, only studies with R2 values where considered Table 2.

| Table 2 R2 Values |

||

|---|---|---|

| Study (Author & year of study) | R2 value | Sample size |

| Abor (2005) | 64.% | 22 |

| Salawu (2009) | 7.8% | 50 |

| Gill, Biger & Mathur (2011) | 9% | 272 |

| Salim & Yadav (2012) | 11.8% | 237 |

| Ferati & Ejupi (2012) | 10.5% | 150 |

| Shubita & alsawalhah (2012) | 30.6% | 39 |

| Moghadas, Pouraghajan & Bazugir (2013) | 4.0% | 290 |

| Taani (2013) | 31.1% | 12 |

| Ebrati, Emadi, Balasang & Safari (2013) | 38% | 85 |

| Hasan, Ahsan, Rahaman & Alam (2014) | 42% | 36 |

| Chechet & Olayiwola (2014) | 60% | 70 |

| Akeem, Edwin, Kiyanjui & Kayode (2014) | 10.7% | 10 |

| Zangiabadi, Rahimzade & Taboli (2015) | 7.8% | All listed firms |

| Vătavu (2015) | 11.6% | 196 |

| Abata & Migiro (2016) | 32.3% | 297 |

| Marandu & Sibindi (2016) | 0.1% | 28 |

| Sakr & Bedeir (2019) | 34% | 62 |

| Reschiwati et al. (2019) | 96.4% | 15 |

| Almahadin & Oroud (2019) | 33.2% | N/A |

| Otekunrin et al. (2020) | 79.8% | 8 |

| Ullah et al. (2020) | 73% | 90 |

| Dinh & Pham (2020) | 48.2% | 30 |

| Wieczorek-Kosmala et al., (2021) | 44.9% | 1977 |

Data Results

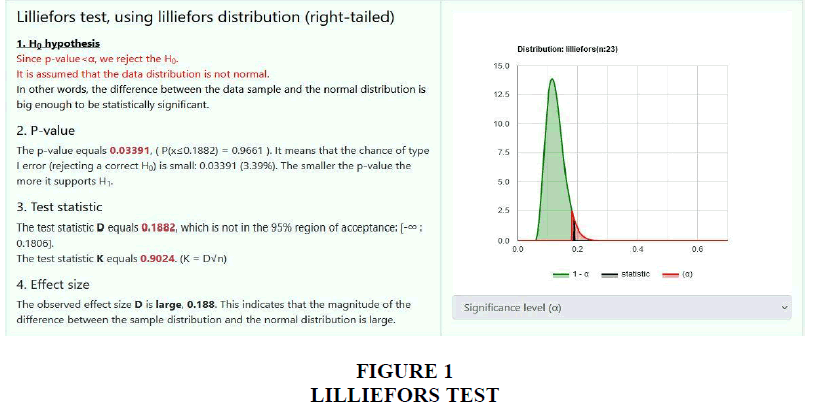

The following results were obtained from Lilliefors test, the Kolmogorov smirnov test and chi square test respectively Figure 1.

The results of the Lilliefors test indicate that the data is skewed to the right indicating assuming a right tail distribution. This is evident in the p-value that is less than 5% (0.03391) supporting that alternate hypothesis should be accepted. To establish the validity of this finding, a Kolmogorov smirnov test was also conducted. The results of the analysis are presented below Table 3 and Table 4.

| Table 3 Kolmogorov Smirnov Test Results |

||||||

|---|---|---|---|---|---|---|

| R-square value |

Cummulative | Expected | Rank | NORM.S.INV | Actual | Difference |

| 64.0% | 1 | 0.043478 | -0.04348 | -1.712 | 0.870 | 0.914 |

| 7.8% | 2 | 0.086957 | 0 | -1.360 | 0.163 | 0.163 |

| 9% | 3 | 0.130435 | 0.043478 | -1.124 | 0.175 | 0.131 |

| 11.8% | 4 | 0.173913 | 0.086957 | -0.939 | 0.203 | 0.116 |

| 10.5% | 5 | 0.217391 | 0.130435 | -0.781 | 0.190 | 0.059 |

| 30.6% | 6 | 0.26087 | 0.173913 | -0.641 | 0.450 | 0.276 |

| 4.0% | 7 | 0.304348 | 0.217391 | -0.512 | 0.131 | 0.086 |

| 31% | 8 | 0.347826 | 0.26087 | -0.391 | 0.457 | 0.196 |

| 38.0% | 9 | 0.391304 | 0.304348 | -0.276 | 0.561 | 0.256 |

| 42% | 10 | 0.434783 | 0.347826 | -0.164 | 0.619 | 0.271 |

| 60% | 11 | 0.478261 | 0.391304 | -0.055 | 0.836 | 0.444 |

| 10.7% | 12 | 0.521739 | 0.434783 | 0.055 | 0.192 | 0.243 |

| 7.8% | 13 | 0.565217 | 0.478261 | 0.164 | 0.163 | 0.315 |

| 11.6% | 14 | 0.608696 | 0.521739 | 0.276 | 0.201 | 0.321 |

| 32.3% | 15 | 0.652174 | 0.565217 | 0.391 | 0.475 | 0.090 |

| 0.1% | 16 | 0.695652 | 0.608696 | 0.512 | 0.102 | 0.507 |

| 34.0% | 17 | 0.73913 | 0.652174 | 0.641 | 0.501 | 0.151 |

| 96.4% | 18 | 0.782609 | 0.695652 | 0.781 | 0.990 | 0.295 |

| 33.2% | 19 | 0.826087 | 0.73913 | 0.939 | 0.488 | 0.251 |

| 79.8% | 20 | 0.869565 | 0.782609 | 1.124 | 0.957 | 0.175 |

| 73% | 21 | 0.913043 | 0.826087 | 1.360 | 0.928 | 0.102 |

| 48.2% | 22 | 0.956522 | 0.869565 | 1.712 | 0.704 | 0.166 |

| 44.9% | 23 | 1 | 0.913043 | 0.659 | 0.254 | |

| Table 4 Actual And Normal Distribution Value |

|

|---|---|

| Count | 23 |

| Mean | 33.93% |

| Standard deviation | 26.7% |

| Maximum | 0.914 |

| Test statistics (5%, n=23) | 0.279 |

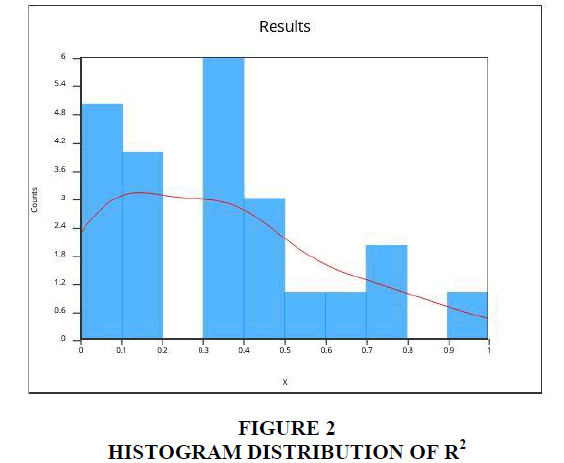

The maximum value of the difference between the actual and normal distribution value is 0.914 which is greater than the test statistics values. This means the maximum values falls in the area of rejection in which the hypothesis that the R2 is normally distributed is rejected at 5% confidence level. Therefore, results of Kolmogorov smirnov test and the Lilliefors test is in tandem. A R2 histogram was also computed where it also concurs with the Lilliefors distribution as shown below Figure 2.

Finally, the chi square dependency test was also conducted to have a vivid idea of the level of dependency between the two concepts of analysis in this study. The results are presented below in table 5.

| Table 5 Chi Square Test Results |

||

|---|---|---|

| Observed R- squarevalues | Expected R squarevalues | (Observed- Expected)^2 /Expected |

| 64.00% | 0.339 | 0.266 |

| 7.75% | 0.339 | 0.202 |

| 9.00% | 0.339 | 0.183 |

| 11.77% | 0.339 | 0.145 |

| 10.50% | 0.339 | 0.162 |

| 30.60% | 0.339 | 0.003 |

| 4.00% | 0.339 | 0.264 |

| 31.05% | 0.339 | 0.002 |

| 38.00% | 0.339 | 0.005 |

| 42.00% | 0.339 | 0.019 |

| 60.00% | 0.339 | 0.200 |

| 10.70% | 0.339 | 0.159 |

| 7.78% | 0.339 | 0.202 |

| 11.56% | 0.339 | 0.147 |

| 32.28% | 0.339 | 0.001 |

| 0.07% | 0.339 | 0.338 |

| 34.00% | 0.339 | 0.000 |

| 96.37% | 0.339 | 1.149 |

| 33.15% | 0.339 | 0.000 |

| 79.80% | 0.339 | 0.620 |

| 73.00% | 0.339 | 0.450 |

| 48.20% | 0.339 | 0.060 |

| 44.90% | 0.339 | 0.035 |

| Chi-square test value | 4.61 | |

| Critical value | 33.92 | |

The Chi square test value (4.61) is far less than the critical value meaning profitability is independent of capital structure. This finding is in sharp contrast with the studies of Chechet & Olayiwola (2014); Akeem et al. (2014); Zangiabadi et al. (2015); Vătavu (2015); Abata & Migiro (2016); Marandu & Sibindi (2016); Sakr & Bedeir (2019); Reschiwati et al., (2019); Almahadin & Oroud (2019); Otekunrin et al. (2020); Ullah et al. (2020); Dinh & Pham (2020); Wieczorek-Kosmala et al., (2021) who found significant relationship either positive or negative. However, this finding supports the proposition of Modigliani & Miller (1963) which says capital structure is irrelevant and should not be used to access the profitability of a firm. Maybe findings that contradicts this principle should be carefully scrutinised before published. Also, the direction of impact and the effect size should be clearly stated in the abstract. Therefore, H0 and H2 are rejected while H1 and H3are accepted

Conclusion

The purpose of this study was to investigate the effect of capital structure on profitability using a meta-analysis. This study used a sample 23 published articles across different journals investigate this relationship with a Lilliefors, Kolmogorov smirnov and chi square test. From the analysis, it is evident that profitability is independent of capital structure and firms cannot increase their profitability by increasing their capital structures. However, increasing the debt-to-equity ratio beyond a certain level will negatively affect their businesses as it increases the level of risk in the business. Although a growing business will generally have an aggressive strategy in financing its growth with debt, this should not be analyzed in line with profitability.

Significance of the Study

The findings this study is of significant importance to the academic world publishers will be made aware of the effect of their capital structure decisions on profitability, as well as the various firms and academic institutions that have advanced the concept effectively managing capital structure to increase profitability. The feedback from this study is that capital structure is independent of profitability despite several publications that it’s significant effect.

References

Abata, M.A., & Migiro, S.O. (2016). Capital structure and firm performance in Nigerian-listed companies. Journal of Economics and Behavioral Studies, 8(3), 54-74.

Indexed at, Google Scholar, Cross Ref

Abor, J. (2005). The effect of capital structure on profitability: empirical analysis of listed firms in Ghana. Journal of Risk Finance 6(5), 438-47.

Indexed at, Google Scholar, Cross Ref

Akeem, L.B., Terer, E.K., Kiyanjui, M.W., & Kayode, A.M. (2014). Effects of capital structure on firm’s performance: Empirical study of manufacturing companies in Nigeria. Journal of Finance and Investment Analysis, 3(4), 39-57.

Chakraborty, I. (2010). Capital structure in an emerging stock market: The case of India. Research in International Business and Finance, 24(3), 295-314.

Indexed at, Google Scholar, Cross Ref

Chechet, I.L., & Olayiwola, B.A. (2014). Capital structure and profitability of Nigeria Quoted firms: The Agency Cost theory perspective. American International Journal of Social Science, 3(1), 139-158.

Chung, Y.P., Na, H.S., & Smith, R. (2013). How important is capital structure policy to firm survival?. Journal of Corporate Finance, 22, 83-103.

Indexed at, Google Scholar, Cross Ref

Ebrati, M.R., Emadi, F., Balasang, R.S., & Safari, G. (2013). The impact of capital structure on firm performance: Evidence from Tehran Stock Exchange. Australian Journal of Basic and Applied Sciences, 7(4), 1-8.

Ejupi, E., & Ferati, R. (2010). Capital structure and profitability: The Macedonian case. European Scientific Journal, 8(7), 51-58.

Indexed at, Google Scholar, Cross Ref

Gill, A., Biger, N., & Mathur, N. (2011). The effect of capital structure on profitability: Evidence from the United States. International Journal of Management, 28(4), 3.

Hasan, M.B., Ahsan, A.M., Rahaman, M.A., & Alam, M.N. (2014). Influence of capital structure on firm performance: Evidence from Bangladesh. International Journal of Business and Management, 9(5), 184.

Indexed at, Google Scholar, Cross Ref

Marandu, K.R. Sibindi, A.B (2016). Capital structure and profitability: An empirical study of South African banks.Corporate Ownership & Control, 14(1), 8-19.

Indexed at, Google Scholar, Cross Ref

Massey Jr, F.J. (1951). The Kolmogorov-Smirnov test for goodness of fit. Journal of the American statistical Association, 46(253), 68-78.

Indexed at, Google Scholar, Cross Ref

Modigliani, F., & Miller, M.H. (1963). Corporate income taxes and the cost of capital: a correction. The American Economic Review, 53(3), 433-443.

Moghadas, A., Pouraghajan, A., & Bazugir, V. (2013). Impact of capital structure on firm value: Evidence from Tehran Stock Exchange. Management Science Letters, 3(6), 1535-1358.

Indexed at, Google Scholar, Cross Ref

Otekunrin, A.O., Nwanji, T.I., Eluyela, D., Olowookere, J.K., & Fagboro, D.G. (2020). Capital structure and profitability: the case of Nigerian deposit money banks. Banks and Bank Systems, 15(4), 221.

Indexed at, Google Scholar, Cross Ref

Pham, C.D., & Dinh. (2020). The effect of capital structure on financial performance of Vietnamese listing pharmaceutical enterprises. The Journal of Asian Finance, Economics, and Business, 7(9), 329-340.

Indexed at, Google Scholar, Cross Ref

Reschiwati, R., Syahdina, A., & Handayani, S. (2020). Effect of Liquidity, Profitability, and Size of Companies on Firm Value. Utopía y Praxis Latinoamericana, 25(6), 325-332.

Rjoub, H., Civcir, I., & Resatoglu, N.G. (2017). Micro and macroeconomic determinants of stock prices: the case of Turkish banking sector. Romanian Journal of Economic Forecasting, 20(1), 150-166.

Sakr, A., & Bedeir, A. (2019). Impact of Capital Structure on Firm¡¯ s Performance: Focusing on Non-financial Listed Egyptian Firms. International Journal of Financial Research, 10(6), 78-87.

Indexed at, Google Scholar, Cross Ref

Salawu, R.O., & Awolowo, O. (2009). The effect of capital structure on profitability: An empirical analysis of listed firms in Nigeria. The International Journal of Business and Finance Research, 3(2), 121-129.

Salim, M., & Yadav, R. (2012). Capital structure and firm performance: Evidence from Malaysian listed companies. Procedia-Social and Behavioral Sciences, 65, 156-166.

Indexed at, Google Scholar, Cross Ref

Shubita, M.F., & Alsawalhah, J.M. (2012). The relationship between capital structure and profitability. International Journal of Business and Social Science, 3(16).

Taani, K. (2013). Capital structure effects on banking performance: A case study of Jordan. International Journal of Economics, Finance and Management Sciences, 1(5), 227-233.

Indexed at, Google Scholar, Cross Ref

Ullah, A., Pinglu, C., Ullah, S., Zaman, M., & Hashmi, S.H. (2020). The nexus between capital structure, firm- specific factors, macroeconomic factors and financial performance in the textile sector of Pakistan. Heliyon, 6(8), e04741.

Indexed at, Google Scholar, Cross Ref

Vătavu, S. (2015). The impact of capital structure on financial performance in Romanian listed companies. Procedia Economics and Finance, 32, 1314-1322.

Indexed at, Google Scholar, Cross Ref

Wieczorek-Kosmala, M.J., Błach, & I. Gorze´ n-Mitka (2021). Does Capital Structure Drive Profitability in the Energy Sector?. Energies, 14, 1-15.

Indexed at, Google Scholar, Cross Ref

Zangiabadi, M., Rahimzade, A., & Taboli, M. (2015). Impact of the Capital Structure Tools on the Performance Indicators in the Listed Companies in Tehran Stock Exchange. Journal of Investment and Management, 4(5), 204-209.

Indexed at, Google Scholar, Cross Ref

Received: 24-Jan-2022, Manuscript No. AAFSJ-22-10972; Editor assigned: 27-Jan-2022, PreQC No. AAFSJ-22-10972(PQ); Reviewed: 09-Fab-2022, QC No. AAFSJ-22-10972; Revised: 16-Fab-2022, Manuscript No. AAFSJ-22-10972(R); Published: 23-Feb-2022