Research Article: 2021 Vol: 24 Issue: 1S

A Structural Equation Model of Factors Affecting Financial Technology Acceptance Components of Commercial Banks in Thailand

Ong-art Chanprasitchai, Mahasarakham Business School, Mahasarakham University

Citation Information: Chanprasitchai, O. (2021). A Structural Equation Model of Factors Affecting Financial Technology Acceptance Components of Commercial Banks in Thailand. Journal of Management Information and Decision Sciences 24(S1), 1-17.

Keywords

Financial Technology, Commercial Bank, Technology Acceptance

Abstract

This research aims to study the factors affecting the financial technology acceptance of commercial banks in Thailand based on the conceptual framework of applied research from the technology acceptance model theory and the survey method. 388 cases from people who have used financial technology services of commercial banks in Thailand answered the questionnaire and data was analyzed by using a linear regression model (Regression Model) and Structural Equation Model Analysis: SEM) The results showed that the relationship structure model that the researcher built according to the theory was consistent with the empirical data. The causal structure relationship found that the norm factors of social references (Subjective Norm) and Attitude Toward Technology (ATT) factors positively affects the intention to use financial technology of commercial banks (BI) and positively affects the factor affecting the behavior of Thai commercial banks in using financial technology (Usage Behavior : UB), which had a positive effect on the decision to use the financial technology services of Thai commercial banks (Purchase Decision : PD).

Introduction

The rapid development of innovation and financial technology has resulted in various types of financial institutions. Throughout the world, products and service models have been developed and innovations have resulted in technological developments that have made leaps and bounds. Furthermore, adjustments to work processes, personnel potential development, the introduction of modern tools, and technologies in conjunction with operations of personnel and services to customers whose current financial technology services in addition to Internet Banking and Mobile Banking have been integrated into a financial service guidance system. This affects the willingness of the Iranian people to use financial technology and is a key element in the adoption of financial technology (Bashir, Irfan & Madhavaiah, 2014), where commercial banks and financial institutions need to plan for further technological development. Systematic finance takes into account technological advances and the availability of service users as well as corporate earnings because financial technology has both positive and negative impacts on the organization, such as customer deposits made online. Online banking transactions have a significant relationship with a commercial bank's ROA, while fees and commissions for internet banking and internet banking charges are negatively correlated with the commercial banks' ROA (Wadesango & Magaya, 2020).

development of financial technology is therefore a challenge for each country in laying the foundation and driving a digital financial ecosystem that allows all sectors to adapt to the world of digital finance in a timely manner with appropriate competition. Diversified players take full advantage of digital financial services. The key point, besides the advancement of technology, is customer acceptance of the financial technology, as each customer segment may have different levels of acceptance in each technological aspect, such as perceived benefit and social influence (Singh et al., 2020), especially if the technology is associated with perceptions, attitudes, lifestyles and changes in service use behaviors. Therefore, the researchers are aware of the important changes and adjustments of financial institutions in Thailand during this time of change. The researchers therefore proceeded to study the structural factors affecting the financial technology acceptance of commercial banks in Thailand. This will lead to a guideline for commercial banks to develop their operational potential in order to be aligned with the level of technology acceptance of users, and applied for further developments and applications in academic work, as well as being served as a guideline for future research on financial technology

Literature Review

Concepts, Theories and Related Research

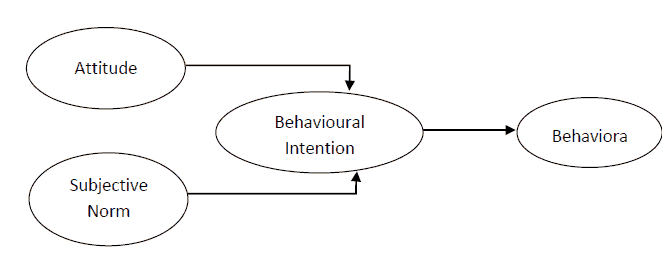

Theories of Reasoned Action: TRA. Fishbein & Ajzen (1975) proposed a theory of rational action based on the social psychology theory used in the study of human behavior, explaining how the relationship between beliefs and attitudes affects human behavioral changes. Changes in beliefs and behaviors by some people think that they are appropriate because people always consider principles and reasons before acting. Davis, et al., (1989) applied the principles of TRA theory to study the behavior of technology acceptance of individuals according to the principles of TRA theory: suggesting that although individual behavior is caused by individual decision-making, the direct determinant of behavior is the intention to exhibit a strong behavior. The theory is driven by two main factors: attitudes towards behavior and individual norms related to behavior, which can be modeled on the relationship between factors according to the above TRA theory as follows Figure 1:

Figure.1 shows that attitudes affect behaviors are factors that occur within the individual. Individuals assess the overall picture of behavior based on personal beliefs, whether it’s positive or negative that is associated with a certain behavior. The person who evaluates the behavior and believes positively will have a positive attitude towards the behavior. On the contrary, if the assessment results are negative, the person will have a negative attitude towards the behavior, which becomes the norm of the people who they are associated with. Perseverance is the perception of an individual in relation to the expectations or needs of a group of people in a society, which is considered important to an individual to show or not perform any behavior. It is the motivation that motivates the individual to comply with the needs of the individual groups in that society, especially with those who are close to them such as family members, colleagues, or people who want to show a certain behavior. However, TRA still has its limitations because individual behavior may not be realized if the behavior is too complex and difficult for the person's ability to control. It is used to describe behavior in general, but it can also be applied to predict technology adoption behavior by looking at usage attitudes and subjective norms as factors that contribute to the intention of technological use and will ultimately affect the person's behavior of technology acceptance (Yahyapour, 2008).

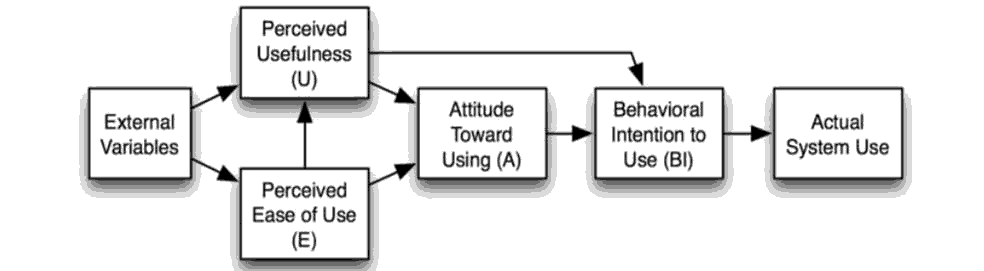

Technology Acceptance Model: TAM. Davis, et al., (1989) presented the innovation and technology adoption model, which is an accepted theory and an indicator of the success of the use of customized technology in addition to the theory. TRA shows the key factors influencing innovation and technology adoption. The five factors are perceived usefulness of technology, perceived ease of use, attitude towards technology, intent to use and behavior in service use, as shown in below figure 2.

This technology adoption model explains that external variables create perceived usability and perceived ease of use, which in turn influences intentional usage attitudes. In the end use of the technology, there will be practical use followed, where the perceived usefulness also drives the intention for applying it and making use on its practicality.

The composition of the technology adoption model consists of five factors:

1. Perceived usability refers to the degree to which users believe that the usefulness of a technology can enhance their work efficiency that is directly related to user attitudes and behaviors.

2. Perceived ease-of-use refers to the degree to which the user believes the technology being used is easy to use and can be used without much effort, which is directly related to perceived usefulness and attitude towards the user.

3. Attitude towards usability refers to user opinions on a particular technology. This is due to the perception of usability and perception on ease of use, which will directly affect the intention of use.

4. Intent to use refers to the behavior of using technology influenced by perceived usefulness and attitude towards the use of that technology.

5. Practical use refers to the adoption of the technology by its practical application, with usability being the variable that affects the actual use of the user.

6. In the technology adoption model, attitude factor is emphasized because it is the factor that can have enough influence directly on the acceptance decision or use behavior only as an intermediary between belief and intention. Negative aspects of the technology, however, may be behavioral use because those individuals have been considered to perceive the maximum benefits that technology can provide. In the Davis study, it was found that the perceived usefulness factor had a strong influence on the initiation of intent to use, while the perceived ease of use factor had a lesser influence, but was still a significant part of what could be as it affects the intention of using (Davis et al., 1989).

However, the study of research related to technology adoption theory shows the need to increase variables to better understand how to explain individual adoption of new technology more clearly. Thus, the technology acceptance model theory was developed, which is an extension of the Extension of the Technology Acceptance Model or TAM++ theory of innovation. Venkatesh & Davis (2000) has improved the external variables and pre-existing factors by developing on the influence on perceptions of the benefits that information technology has to offer. Moreover, the modern perception that it is easier to apply more, such as social norms, voluntary image throughout the cognitive process, is related to the work, quality of outcomes where results can be demonstrated beforehand, and being recognized as an easy-to-use system.

Network Externalities: NE. An external network or NE is the value or utility that a consumer receives when using a product/technology. If NE is high, it means that the product/technology it has can create utility or value for more than one user (Shapiro & Hal, 1999). They are divided into (1) Direct Network Effects, which are products or technologies that can be used by more than one person, such as social networking services like Facebook, Twitter, Airbnb, Tiktok, Uber, and Agoda; or telecommunications devices like instant messaging services such as Line, MSN, or QQ, and (2) Indirect Network Effects, which is how a particular product or technology can be made more useful, or have more users and more benefits when it comes to other products or technologies. Involvement such as computers, telephones and various hardware will be more useful if the software is developed to be more usable.

Related Research

Behavioral intentions are a good predictor of true behavior, and the results of the Technology Acceptance Model study have been found to be applicable to psychological theories such as rational action theory (Fishbein & Ajzen, 1975). According to the Plan (Ajzen, 1991), innovation diffusion theory (Rogers, 1995), which concludes that intention is the main factor determining the use behavior, i.e., the action or expression or response to something. For example, if a person intends to use the Internet to make a purchase, it will directly affect the actual behavior of that person showing the actual behavior of searching for the desired product, such as using the Internet to Purchase of goods (Bashir, Irfan & Madhavaiah, 2014). In addition, a variety of variables, such as social norms, social influence (Yousafzai et al., 2007), have also been proposed in the model accepting technology.

In addition, Bashir, Irfan & Madhavaiah (2014) found that the willingness to use financial technology of an Iranian sample using a referral system is a key element in the adoption of financial technology. The trend of financial technology (Fin Tech) that affects the lifestyles of financial service users in the digital era (Pichai & Montana, 2019) found that the sample group had perceptions and attitudes towards financial technology. Finances were high but there was a moderate level of perception, attitudes and trends towards financial technology in lifestyle, followed by mobile financial technology services (54.75%). These are electronic money cards (24.73%) and Prompt Pay (23.81%), and most of them want financial institutions to improve their security to create more confidence for their users.

Shaikh, et al., (2020) found that the key elements affecting the adoption of Islamic banking technology for the Malaysian sample were the ease of use of financial technology and the benefits of using financial technology. It did not affect the acceptance of financial technology among the sample group.

Research Methodology

This research is a quantitative research in which the researcher uses data collection by using a specific random sampling from Thai people who have used at least one of the financial technology services or transactions of commercial banks. With a total of 388 online questionnaires and research steps, each step is detailed as follows.

1. Studying documents and research related to research synthesis.

2. Create and test questionnaires by experts to be used as research tools.

3. Collection by random sampling of a specific sample from Thai people who have used or performed financial technology transactions of commercial banks. So far, a total of 388 people have arrived.

4. Data analysis by linear regression model and Structural Equation Model Analysis (SEM).

Results

The results of the regression model estimation were used to study the relationship between variables when the variables were linearly correlated. The data was analyzed in correlation research according to the research objectives to study the factors affecting the variation patterns and correlation. Accepting the financial technology of commercial banks in Thailand by the researcher has set up a research conceptual framework consisting of 14 factors. (Table 1)

| Table 1 The Results Of The Linear Regression Model Estimation |

|||||

|---|---|---|---|---|---|

| -2 | -3 | -4 | -5 | -6 | |

| PNCP | PC | PEOU | PU | PS | |

| PNP | 0.1928*** | ||||

| PNCP | 0.0737 | ||||

| PC | 0.4604*** | ||||

| PEOU | 0.2358*** | 0.1096 | |||

| PU | 0.4905*** | ||||

| PS | 0.2077*** | ||||

| PA | 0.1614*** | ||||

| ATT | 0.4396*** | ||||

| ARI | 0.5152*** | ||||

| IRI | 0.4178*** | ||||

| SRI | 0.2804*** | ||||

| BI | 0.4237*** | ||||

| UB | |||||

| UD | 0.3254*** | ||||

| Constant | 0.0264 | 0.0046 | 0.0068 | 0.2530*** | 0.2451*** |

| N | 388 | 388 | 388 | 388 | 388 |

| rss | 9.7904 | 7.5959 | 5.9225 | 6.6771 | 3.7288 |

| F | 130.7154 | 185.2056 | 334.8172 | 256.5396 | 349.677 |

| r2 | 0.5772 | 0.6592 | 0.6349 | 0.5713 | 0.6449 |

| r2_a | 0.5728 | 0.6556 | 0.633 | 0.5691 | 0.6431 |

| * <0.1, ** p<0.05, *** p<0.01 Note: *Statistically significant 0.10, **Statistically significant 0.05, ***Statistically significant 0.01 | |||||

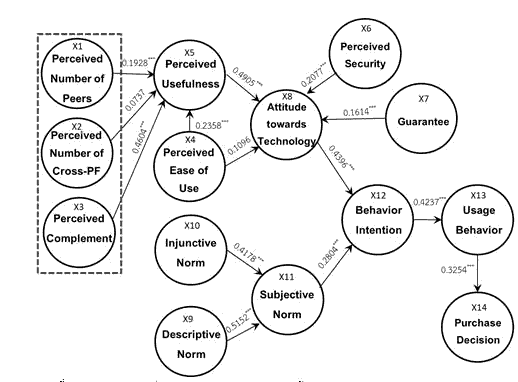

From Figure 3, the results of the study of factors that positively affect the changing patterns and acceptance of financial technology by commercial banks in Thailand can be described as follows:

The factor that had the highest positive effect on the Perceived Usefulness (PU) of Thai commercial banks' financial technology was the Perceived Complementarity (PC) factor of financial technology. The relationship was 0.4604 with a statistical significance of 0.01, followed by The Perceived Number of Peers (PNP) factor which was 0.1928 with a significance level of 0.01 and the Perceived Ease of Use (PEOU) factor of Thai commercial banks' financial technology was 0.2358, with a significance level of 0.01. However, it was found that the Perceived Number of Cross-Platform (PNCP) factor was not statistically related to the perceived factor, which was believed to benefit from the financial technology of commercial banks in Thailand.

The factor that had the highest positive effect on Thai commercial banks' Attitude Toward Technology (ATT) was the Perceived Usefulness (PU) coefficient of financial technology. The correlation was 0.4905 with a statistical significance of 0.01, followed by the Thai commercial bank's perceived security factor (PS) having a correlation coefficient of 0.2077 with a statistical significance of 0.01 and a correlation coefficient of 0.4905. Guarantee for the use of financial technology of Thai commercial banks (Guarantee) has a correlation coefficient of 0.1614 with a statistical significance of 0.01, while the factor of ease of use of financial technology of Thai commercial banks (Perceived Ease of Use: PEOU) did not have a statistically significant relationship with Thai commercial banks' Attitude Toward Technology (ATT).

The factor that had the highest positive effect on the norm of social reference (Subjective Norm) was the norm of the close person (Descriptive Norm) having a relationship coefficient of 0.5152 with a statistical significance of 0.01, followed by the norm of the person (Injunctive Norm) The correlation coefficient was 0.4178 with a statistical significance 0.01.

The factor that had the highest positive impact on the Thai commercial bank's Attitude Toward Technology (ATT) was their Attitude Toward Technology (ATT), which had a correlation coefficient of 0.4396 with a statistical significance 0.01, followed by the norm of social reference (Subjective Norm) having a correlation coefficient of 0.2804 with a statistical significance at the 0.01 level.

The positive factor affecting Thai commercial banks' use behavior (UB) was Behavior Intention (BI) having a significant correlation coefficient of 0.4237, statistically at 0.01 level The positive factor affecting the decision to use financial technology services of Thai commercial banks Purchase Decision (PD) was the usage behavior of Thai commercial banks (UB) which had a significant correlation coefficient of 0.3254, statistically at 0.01 level

Conclusion and Discussion of The Research Results

In this research, it was possible to discuss whether the changing patterns and adoption of commercial banks' financial technology in Thailand among the consumer groups depended on Attitude Toward Technology (ATT) and the subjective norm are consistent with the research results by (Pinsuk, 2014) which found that the perception of ease with the use of technology recognized the benefits of using the quality of service through electronic channels. The reliability of the application system and the privacy of its use are factors that affect online movie ticket booking through the application system, like those of (Phumlamchiek et al., 2013) found that attitudes towards e-books, perceptions of ease of use of e-books, perceptions of e-book benefits, and reliability of e-book service websites were important factors influencing the use of electronic books by people in Bangkok

The results showed that the sample group had a high level of attitude towards using Thai commercial banks' financial technology (Attitude Toward Technology (ATT) as good, smart and modern). This is consistent with the research by (Pichai & Montana, 2019) that found that the sample group had a high level of perception and attitude towards financial technology.

Factors that had the highest positive effect on Thai commercial banks' Attitude Toward Technology (ATT) were Perceived Usefulness of financial technology. Perceived security and assurance in the use of Thai commercial banks' financial technology (Assurance) were in line with the research done by (Fortesa & Rita, 2016) who found that privacy protection and trust risk should be factored into the study. The idea that technology, ease of use, and usability affect the attitudes and intentions of e-commerce users to shop online are in line with the research done by (Wasutida & Songwit, 2018) with regards to Perceived Security, Perceived Ease of Use and Perceived Usefulness factors. Thipol's intention were to use financial technology and payment services with QR code mobile applications for the next generation of consumers. A research conducted by (Wang, Lin & Luarn, 2006) found that the factors affecting the use of mobile technology are perceptions of a person's ability to use technology, benefits gained from utilizing it, perception of ease of use, and perception of reliability.

Factors benefiting from using financial technology of Thai commercial banks (Perceived Usefulness), with the opinion that Thai commercial banks' financial technology makes life more convenient, reducing restrictions on time and place and being able to manage finances better. This is consistent with the findings of (Jeong & Yoon, 2013) which found that perceived usefulness is the most influential factor in the use of mobile financial transactions and is consistent with the results of Worawut's research. Meechai (2012) found that users of financial transactions via mobile phones in Bangkok see the importance of use because it is comfortable, faster, and more time-saving than going to a bank. Zeithmal, et al., (2011) found that the most important factor in a customer's Indian banking experience is ease of use. Rungruangsak (2014) has found that the service user has identified the location. Location-Based Services (LBS) in Bangkok found that the perceived benefits, such as speed, accuracy and reliability factor of use, are factors that lead users to accept and decide to share the information they have in the system.

It is particularly interesting that in this study, the factor of commercial banks' ease of use of financial technology was not statistically related to Thai commercial banks' attitudes towards financial technology usage. This contradicts the researcher's research above, but is consistent with the findings of Jeong & Yoon (2013) which found that mobile financial transaction users perceived such transactions to be "inappropriate". To make thins simple and useful, while non-users find it difficult to use mobile banking services, bank staff are still required to advise their customers on how to use the system.

The factors positively affecting the norm of the subjective norm were the descriptive norm, followed by the norm of the person in contact (Injunctive Norm), which was consistent with the research of (Wasutida & Songwit, 2018), who found that word-of-mouth communication factors (Injunctive Norm and Descriptive Norm) influenced technology adoption and payment intent among the new generation of consumers with QR code applications and mainly use their smart phones to make the banking/business transactions.

Research Limitations

This research focuses on those who have used financial technology services of commercial banks in Thailand. Therefore, there is no information about the opinions of those who decided not to use the financial technology services of commercial banks. This is another interesting piece of information to see why they have decided not to use financial technology services of commercial banks and may lead to ways on attracting them to decide on using the financial technology services of commercial banks in the future.

Suggestions for applying the research results

The results showed that the sample group had the view that the financial technology of Thai commercial banks is beneficial when (1) the bank is enriching its financial technology with special offers, (2) the number of users of the bank's financial technology, and (3) the bank's financial technology is easy to use, so Thai commercial banks should consider developing the services to be easy to use. There are marketing activities by creating various special offers, as well as making them aware that there is a large number of Thai commercial banks' financial technology users.

In addition, the results showed that the sample group had a positive attitude towards Thai commercial banks' use of financial technology when (1) they felt it was useful (2) safe, and (3) the bank had a guarantee of use in the event of a mistake or error made. With errors or shortcomings of technology that can occur, Thai commercial banks should develop a service system to benefit users with a secure system and guarantee of service without any hidden fee.

Suggestions for the Next Research Study

This research focuses on those who have used financial technology services of commercial banks in Thailand. Therefore, in the future, research should be carried out to know the factors in deciding to use the financial technology services of commercial banks for the sample group who have decided not to use the service.

In addition, as more and more non-financial organizations are now offering financial technology services, especially through social media platforms such as Line-pay, Shopee Coin, and AirPay Wallet, they should study the factors of acceptance on the financial technology among non-bank or non-financial organizations.

Acknowledgement

This research is highly grateful to Mahasarakham University for the supported funds and promoting the entry into academic positions of teachers from the 2019 fiscal year.

References

- Ajzen, I. (1991). The theory of planned behaviors. Organizational behavior and human decision process, 50, 179-211.

- Pinsuk, A. (2014). Information technology acceptance, e-service quality, and marketing mix from the customer’s perspectives affecting the e-satisfaction toward e-ticket applications of users in Bangkok. Independent Study. Master of Business Administration. Bangkok University. Bangkok.

- Irfan, B., & Madhavaiah, C. (2014). Determinants of young consumers' intention to use internet banking services in India. Vision: The Journal of Business Perspective, 18, 153-163.

- Jeong, B.K., & Yoon, T.E. (2013). An empirical investigation on consumer acceptance of mobile banking services. Business and Management Research, 2(1), 31-40.

- Shapiro, C., & Hal, R. (1999). Varian. Information rules: A strategic guide to the network economy. Boston, Massachusetts: Harvard Business School Press, 173-226

- Davis, F.D., Bagozzi, R.P., &Warshaw, P.R. (1989). User acceptance of computer technology: A comparison of two theoretical models. Management Science, 35(8), 982–1003.

- Davis, F., Bagozzi, R., & Warshaw, P. (1992). Extrinsic and intrinsic motivation to use computers in the workplace. Journal of Applied Social Psychology, 22(14), 1111–1132

- Loiacono, E.T., Watson, R.T., & Goodhue, D.L. (2007). WebQual: An instrument for consumer evaluation of web sites. International Journal of Electronic Commerce, 11(3), 51-87.

- Fishbein, M., & Ajzen, I. (1975). Belief, attitude, intention, and behavior: An introduction to theory and research. Reading, Mass: Addison-Wesley Pub. Co.

- Davis, F.D. (1989). Perceived usefulness, perceived ease of use, and user acceptance of information technology. MIS Quarterly, 13(3), 319-339.

- Qasim, H., & Shanab, E.A. (2016). "Drivers of mobile payment acceptance: The impact of network externalities." Information Systems Frontiers, Springer, 18(5), 1021-1034

- Rungruangsak, J. (2557). The study of impact of technology acceptance and perceived risk on user’s trust perception of location-based services in Bangkok. Independent study, Master of Business Administration. Bangkok University. Bangkok.

- Juniwati. (2014). Influence of perceived usefulness, ease of use, risk on attitude and intention to shop online. European Journal of Business and Management, 6(27), 218-228.

- Fernando, M., & Surjandy. (2019). The influence of perceived risk and trust in adoption of fintech services in Indonesia. CommIT (Communication and Information Technology) Journal, 13(1), 31-37.

- Pichai, N., & Kongkaew, M. (2019). A study of trends in financial technology affecting the lifestyles of financial service users in the digital age. Report from the 4th National Academic Conference, Kanchanaburi Rajabhat University.

- Fortesa, N., & Rita, P. (2016). Privacy concerns and online purchasing behavior: Towards an integrated model. European Research on Management and Business Economics, 22, 67–176.

- Park, N. (2010). Adoption and use of computer-based voice over Internet protocol phone service: Toward an integrated model. Journal of Communication, 60(1), 40–72.

- Phumlamchiak, P. (2013). Factors affecting online usage behavior among eBook users in Bangkok. Master of Business Administration Degree. Marketing major. Faculty of Business Administration. Rajamangala University of Technology Thanyaburi. Pathumtani.

- Chunhachinda, P. (2019). Digital transformation and the progress of Thailand’s fintech. Suthiparithat, 33(106). 251-264

- PWC. (2017). PWC global fintech report 2017. Insights from PwC’s global asset and wealth management practice. Exploring the impact of FinTech. PwC AWM Insights January 2017. Price waterhouse Coopers.

- Everett, R.M. (1995). Diffusion of innovations, (Fourth edition). New York, Free Press.

- Shaikh, I.M., Qureshi, M.A., Noordin, K., Shaikh, J.M., Khan, A., & Shahbaz, M.S. (2020), "Acceptance of Islamic financial technology (FinTech) banking services by Malaysian users: an extension of technology acceptance model". Foresight, 22(3), 367-383.

- Singh, S., Sahni, M.M., & Kovid, R.K. (2020). "What drives FinTech adoption? A multi-method evaluation using an adapted technology acceptance model". Management Decision, 58(8), 1675-1697.

- Venkatesh, V., & Davis, F. (2000). A theoretical extension of the technology acceptance model: for longitudinal field studies. Management Science, 46(2), 186-204.

- Viswanath, V., Fred, D., & Morris, M.G. (2007). "Dead or alive? The development, trajectory and future of technology adoption research." Journal of the Association for Information Systems, 8(4), 269-285.

- Wadesango, N., & Magaya, B. (2020). The impact of digital banking services on performance of commercial banks. Journal of Management Information and Decision Sciences, 23(S1), 343-353.

- Nurittamont, W., & Charoenkitthanalap, S. (2018). The factors influence on technology acceptance and using service intention for payment of young consumers by QR code application trough smart phone. The journal of social communication innovation, 6(2), 40 - 50.

- Meechai, W. (2012). Factors affecting the decision to use mobile banking service in Bangkok. Master of Business Administration (Marketing). Faculty of Business Administration. Rajamangala University of Technology Thanyaburi. Pathumtani.

- Yahyapour, N. (2008). Determining factors affecting intention to adopt banking recommender system, case of Iran, Thesis, Lulea University of Technology Division of Industrial Marketing and E-commerce. Journal of Marketing and E-commerce, 9, 201-242.

- Shu-Ching, Y., & Chin-Hung, L. (2011). Factors affecting the intention to use Facebook to support problem-based learning among employees in a Taiwanese manufacturing company. African Journal of Business Management, 5(22), 9014-9022.

- Shumaila, Y., Robert, F.G., & Gordon, P.J. (2007). Technology acceptance: A meta-analysis of the TAM: Part 1. Journal of Modelling in Management, 2(3), 251-280

- Zeithmal, V.A., Bitner, M.J., Gremler, D.D., & Pandit, A. (2011). Service marketing: Integrating customer focus across the firm, (5th edition). McGraw-Hill, New York, NY.