Research Article: 2019 Vol: 23 Issue: 1

A Study of Capital Structure Decisions by SMES: Empirical Evidence from Jordan

Mohammad O. Al-Smadi, Philadelphia University, Jordan

Abstract

Although of the important role for SMEs in promoting economic growth, as well as in combating poverty and unemployment, the determinants of their capital structure have not been studied sufficiently. Using a panel data of (77) SMEs in Jordan, this study examines factors that affect choices of capital structure. Two models were developed, the long-term debt model and the short-term debt model. The regression results of the long-term model show that assets structure, growth, size, and liquidity have a beneficial impact on the long-term debt ratio, while profitability has a negative effect. The results of the short-term model show that assets structure, size, and profitability have a negative impact, while growth has a positive impact. The results of the study can be used by the management of SMEs and government entities, which develop policies that aim to support and foster the emergence of SMEs in the Jordanian economy.

Keywords

SMEs, Long Term Debt, Short Term Debt, Jordan.

Introduction

A key decision made by firms is the selection of the components of their capital structure which is defined as “the mix of debt and equity maintained by the firm” (Gitman & Zutter, 2012). Capital structure influences the profitability, cost of the capital, and the firm’s liquidity, and thus the value of the firm (Ross et al., 2013). Selecting the capital structure of the firm is affected by different factors. However, understanding how factors influence the capital structure can assist the management of the firm in taking the right decisions that enhance the stability and sustainability of the firm (Mokhova & Zinecker, 2014). Since Modigliani and Miller proposed their irrelevance proposition in 1958, researchers have been more interested in capital structure. Hence, a group of theories that explain financing sources has been advanced; they include the trade-off theory, Modigliani and Miller’s theory, and the pecking order theory. According to these theories, a number of studies were carried out in the stock market-listed firms because of the availability of data for these firms, while a few studies concentrated on Small and Medium-Sized Enterprises (SMEs) (Balios et al., 2016; Kumar, 2014; Napompech, 2013; Pr?dkiewicz & Pr?dkiewicz, 2015). Kumar (2014) stressed the importance of understanding the finance choices of SMEs. This is because the inability to obtain appropriate sources of funding is one of the leading causes of SME failure.

During recent decades, decision-makers and academics have realized the important role of SMEs on the economies of both developed and developing countries. SMEs contribute significantly in economic growth and the lowering of poverty and unemployment. Nevertheless, a little attention was paid to the elements that influence the choices of capital structure in SMEs (Balios et al., 2016). On another hand, Palacín-Sánchez et al. (2013) suggested that financing alternatives of SMEs are affected by the characteristics of their working environment such as financial, macroeconomic, and legal factors. Hence, the results of the studies that were carried out in the developed countries are not applicable to the developing countries. This raises the question of whether the theories of a capital structure are useful to understand capital structure choices for SMEs, and factors that affect these choices in the developing counties.

Motivated by the previous issues, this paper proposes to study how selected factors influence the capital structure of SMEs in Jordan. SMEs in Jordan contribute significantly to economic development, innovation and employment (AL-Mahrouq, 2010; Siam & Rahahleh, 2010). In Jordan, around 95 percent of enterprises are small and medium-sized, and they contribute by 40 percent in the Jordanian GDP. In addition, SMEs in Jordan employ around 40 percent of the labor force (Central Bank of Jordan, 2017). However, Jordan as a developing country has faced financial and economic obstacles, such as an economic slowdown and high rate of unemployment. One of the reasons behind these obstacles is the significant increase in the population as a result of the forced migrations from neighboring countries. Hence, the authorities in Jordan, such as the Ministry of Planning and the Central Bank of Jordan, have developed programs aimed at supporting SMEs because of their role in supporting production capacity and reducing unemployment. The definition of SMEs differs from one country to another. Table 1 presents the definition of SMEs in Jordan categorized based on total assets or sales and total number of employees.

However, few studies have been carried out on the factors influencing SMEs’ capital structure in Jordan. Thus, this study enriches the existence knowledge in this area. The result from the study would help the owner of SMEs to make the right capital structure decisions appropriate to the characteristics of these enterprises. Moreover, the results of the study would benefit the relevant authorities seeking to adopt policies supportive for this important sector, which is considered one of the engines of the Jordanian economy and an effective instrument to reduce poverty and unemployment rates.

Literature Review And Hypotheses Development

Theories of Capital Structure

The first theory on capital structure, as proposed by Modigliani & Miller (1958), is the irrelevance theory. They assumed the existence of a perfect capital market where rational investors can exchange securities freely and borrow money at the same cost as corporations and there are no taxes and transaction costs. Based on these unrealistic assumptions, they argued that capital structure has no influence on the value of the firm. In a consequent study, Modigliani & Miller (1963) simplified their assumptions, and extended the theory to include tax of corporations. They argued that the use of debt by the firm leads to a reduction in the tax paid by the firm. This is because interest expenses are deducted from tax. Hence, a firm’s value depends on the debt used to finance it.

The trade-off theory was suggested by DeAngelo & Masulis (1980). This theory sees the firm’s optimal capital structure as the structure that is traded off between debt’s cost and benefit. The benefit derivable from debt funding is the tax shield of interest, while the costs of debt are the marginal costs of bankruptcy and costs of agency between owners and lenders of the firm. Accordingly, the firm’s market value increases when the tax-saving offsets the cost associated with debt. In contrast, the pecking order theory proposed by Myers (1984) and Myers & Majluf (1984) assumes that the optimal capital structure is not exist. Instead, the need for external finance by the firm determines the debt-to-equity ratio. This theory argued that the firm’s management has more information about the firm than external investors, which leads to the problem of information asymmetry. To avoid this problem, firm uses its internal funds like retained earnings. When the firm exhausts its internal sources, it seeks funds from external financing through the issuance of debt or equity. However, between external sources, firms rely first on debt because of their low cost and low risk compared with equity.

Determinants of Capital Structure

Assets structure is one of the determinants of the choices of the capital structure for SMEs. Fixed assets increase the firm’s ability to obtain debt financing because they can be used as collateral. However, SMEs are less transparent with information compared with large listed firms, which often causes the problem of asymmetry of information between firms and suppliers of funds. Therefore, using fixed assets as collaterals by SMEs overcomes this problem (Balios et al., 2016). Based on the trade-off theory, tangible assets minimize the cost of bankruptcy by increasing the liquidation value of the firm (Napompech, 2013). In addition, the existence of tangible assets such as land, building, and equipment reduces financial distress costs for the firm (Daskalakis & Psillaki, 2008). The results of previous studies have shown a significant effect of asset structure on the debt ratios of the firms. Proença et al. (2014), who studied factors that affect SMEs’ capital structure in Portugal, found a beneficial impact of assets structure assessed using the ratio of tangible fixed assets to total assets and long-term debt ratio, as well as the disadvantage of assets structure and short-term debt ratio. Similar results were found by Mateev & Ivanov (2011), who examined the role played by firm and country factors on the capital structure of SMEs in Central and Eastern Europe. Thus, the following hypotheses were developed:

H1a: Assets structure of SMEs and their long-term debt are positively related.

H1b: Assets structure of SMEs and their short-term debt are negatively related.

The size of the enterprise also has an impact on SMEs financing options. Big firms have more opportunities for diversification compared to small firms, and their earnings are less volatile. Palacín-Sánchez et al. (2013) mentioned that large firms have the benefit of lower funding costs and better access to credit. In addition, they argued that large firms are less affected by the asymmetric information problem. This is due to the idea that large firms are more transparent, and thus, the information transferred to outside investors is more qualitative and reliable. However, the empirical results are inconsistent. Sarlija & Harc (2016) examined the capital structure of 500 SMEs in Croatia. They concluded there was a correlation between the size of SMEs measured by sales revenue and by long-term leverage. A similar result was found by Saarani & Shahadan (2013) who analyzed the capital structure of the top 50 Malaysian SMEs during the period from 2005 to 2009. In addition, they found a negative correlation between size of enterprise and short-term debt. In contrast, Napompech (2013) found a negative impact of the size of SMEs on long-term debt in Thailand, while no significance is found in the relationship with short-term debt. It is expected to find that the size of SMEs is advantageous to long-term debt and conversely detrimental to short-term debt. Therefore, the following hypotheses were developed:

H2a: Size of SMEs and their long-term debt are positively related.

H2b: Size of SMEs and their short-term debt are negatively related.

Previous studies stressed that profitability has an impact on the choices of SMEs’ capital structure. Theoretically, there are two arguments, depending upon the theory it is conferred with. According to the trade-off theory, firms that are doing well take advantage of debt to reap benefits from the tax shield. In contrast, according to the pecking order theory, firms that are doing well use the funds they generate from profit. Therefore, the need to raise external debt is decreased. Napompech (2013) mentioned that SMEs’ use of short-term funds because they are likely dependent on profitability rather than other firms’ characteristics. In addition, short-term financing is less susceptible to financial constraints compared to longterm financing. However, empirical findings from the prior literature show that the correlation between debt and profitability is negative (Balios et al., 2016; Napompech, 2013; Sarlija & Harc, 2016), which supports the pecking order theory. A negative impact of the profitability of SMEs on all types of debt is likely. Thus, the following hypotheses were developed:

H3a: Profitability of SMEs and their long-term debt are negatively related.

H3b: Profitability of SMEs and their short-term debt are negatively related.

Growth is another determinant of the debt level of SMEs. It refers to the growth of investment opportunities that generate profit. The influence of growth of SMEs on the level of debt is ambiguous. On the one hand, based on the pecking order theory, a firm depends on its internal resources to finance its needs resulting from growth opportunities. Then the firm moves to use an external source, preferably debt (Palacín-Sánchez et al., 2013). In addition, Proença et al. (2014) mentioned that high growth is a good signal for creditors. Hence, creditors grant credit to the firm easily. This implies that the relationship is positive. On the other hand, Mateev & Ivanov (2011) suggested that it was difficult to evaluate growth opportunities from outsiders, which leads to the asymmetric information problem. In addition, a higher growth rate firm is expected to face underinvestment problems (Proença et al., 2014). Therefore, creditors reduce fund supply to the firm, which implies a negative association between debt and growth. Empirical findings from past studies are also not consistent. In various areas of Spain, Palacín-Sánchez et al. (2013) examined SMEs’ capital structure. They found a positive impact of the growth of SMEs measured by an annual change of total assets on both short and long-term debts. Mateev & Ivanov (2011) reported a positive relationship between growth and only long-term debt. In contrary, Sarlija & Harc (2016) did not find a substantial effect of the growth of SMEs on long-term debt. However, it is expected that growth has a positive impact on long-term debt and the relationship being more positive with short-term debt because short-term debt is more attractive for SMEs. Thus, the following hypotheses were developed:

H4a: Growth of SMEs and their long-term debt are positively related.

H4b: Growth of SMEs and their short-term debt are positively related.

Liquidity is also affect capital structure choices of SMEs. It reflects the firm’s capability to repay its short-term obligations. There is a mixed impact of liquidity on the debt levels of SMEs. On the one hand, a liquid firm can use debt because of its ability to pay interest costs, while an illiquid firm avoids using debt because of its high bankruptcy cost. This implies that liquidity has a positive impact on debt, which is supported by the trade-off theory. On another hand, Proença et al. (2014) mentioned that a liquid firm uses its assets to finance its needs. In addition, Degryse et al. (2009) argued that firms prefer to use trade credits instead of debt financing. This might be due to the idea that suppliers know more about the firm than creditors. Therefore, they grant trade credit to their customers. This implies a negative association between debt and liquidity levels, which is supported by the pecking order theory. Empirically, Saarani & Shahadan (2013) found a negative effect of liquidity accessed by quick ratio on leverage. Mateev & Ivanov (2011) reported a positive correlation between liquidity and long-term debt, and a negative association with short-term debt. Proença et al. (2014) made similar findings. However, it is expected that the association between long-term debt and liquidity is positive, and the association with short-term debt is negative. Thus, the following hypotheses were developed:

H5a: Liquidity of SMEs and their long-term debt are positively related.

H5b: Liquidity of SMEs and their short-term debt are negatively related.

Research Methodology

Variables and Data of the Study

The dependent variable of the study is a debt level. To consider the characteristics of SMEs, and following previous studies, the author use two proxies of debt, which are Short- Term Debt ratio (STD) and Long-Term Debt ratio (LTD). All ratios are measured as a proportion of total assets. LTD is understood to be the debt that the firm has to repay in more than a year, while STD is defined as the debt that the firm has to repay in one year or less. Book values are used because SMEs are not listed firms, and market values are not available.

According to the relevant previous studies, the author selects five independent variables. First independent variable is assets structure (ASST). The author measure ASST using the ratio of total assets to net fixed assets (Balios et al., 2016; Saarani & Shahadan, 2013). The second independent variable is size (SZE), which is assessed as total assets’ logarithm (Muiru & Kamau, 2014; Napompech, 2013). Profitability (PROFT) is the third variable, which is assessed as the ratio of income before interest and tax to total assets (Palacín-Sánchez et al., 2013; Sarlija & Harc, 2016). The fourth independent variable is growth (GRWTH). It is measured as the growth rate of total sales (Napompech, 2013; Proença et al., 2014). The last independent variable is liquidity (LIQ). It is assessed as the ratio of total assets to total liabilities (Mateev & Ivanov, 2011; Napompech, 2013).

Financial statements of SMEs are the main source of data. However, these SMEs are not listed and are not obliged to disclose their financial statements. After direct contact with some SMEs, data of 77 SMEs were obtained during the period from 2013 to 2017. The sample covers all the sectors based on the classification of the Ministry of Industry and Trade and Supply in Jordan.

Econometric Model

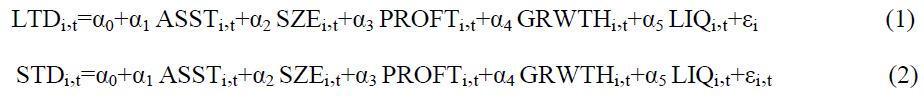

This study aims to investigate factors that impact capital structure choices of SMEs in Jordan, using Generalized Least Square (GLS) panel data regression analysis. This methodology considers the dynamic nature of the variables of the study. Based on the discussion in the previous section, the author developed the following models:

Where, i denote SME, and t denotes time ranging from 1 to 5. α0 is the intercept, and εi,t is the error term.

Results And Discussion

To test the existence of multicollinearity, a correlation analysis was conducted. The magnitude of the correlation between the variables indicates that multicollinearity does not exist as shown in Table 1.

| Table 1: Correlation Matrix Of The Independent Variables | |||||

| ASST | SZE | PROFT | GRWTH | LIQ | |

|---|---|---|---|---|---|

| ASST | 1.000 | ||||

| SZE | 0.423 | 1.000 | |||

| PROFT | 0.287 | 0.500 | 1.000 | ||

| GRWTH | 0.249 | 0.349 | 0.549 | 1.000 | |

| LIQ | 0.338 | 0.157 | 0.581 | 0.381 | 1.000 |

Since this study uses panel data, the Hausman test was used to appraise the panel data model. Hausman test results presented in Table 2 show that the null hypothesis that supposes the random effects are uncorrelated with the independent variables and so it is rejected. Thus, the fixed-effect model is appropriate in this study.

| Table 2: Results Of The Hausman Test | |||

| Dependent variable: Long-term debt | |||

|---|---|---|---|

| Test Summary | Chi2 Statistic | Chi2 df. | Prob. |

| Cross-section random | 37.2478 | 5 | 0.000 |

| Dependent variable: Short-term debt | |||

| Test Summary | Chi2 Statistic | Chi2 df. | Prob. |

| Cross-section random | 30.0412 | 5 | 0.000 |

In addition to the previous robustness tests, the presence of heteroskedasticity is examined using Levene’s test. The results show the absence of the heteroskedasticity problem. Autocorrelation is also tested using the Durbin-Watson statistics. The results show that the value of Durbin-Watson statistics is less than 2 for both models, which indicates that there is no autocorrelation. Table 3 summarizes the regression results.

| Table 3: Results Of Regression Results | ||||

| Long-term Debt | Short-term Debt | |||

|---|---|---|---|---|

| Variable | Coefficient | Prob. | Coefficient | Prob. |

| constant | 7.337 | 0.000 | 6.607 | 0.000 |

| ASST | 0.308*** | 0.000 | -0.265*** | 0.000 |

| SZE | 0.389*** | 0.000 | -0.335*** | 0.000 |

| PROFT | -0.598** | 0.035 | -0.973** | 0.005 |

| GRWTH | -0.165** | 0.010 | -0.590** | 0.016 |

| LIQ | 0.400** | 0.040 | 0.646 | 0.325 |

| Multiple R | 0.794 | 0.782 | ||

| R Square | 0.630 | 0.612 | ||

| Adjusted R Square | 0.611 | 0.526 | ||

| DW | 1.80 | 1.70 | ||

| F-statistics | 32.390 | 46.609 | ||

| Prob. (F-statistics) | 0.000 | 0.000 | ||

| Note: **, *** means significance at 5% and 1% respectively. | ||||

The regression results show that all independent variables are significant at 1% and 5% significance levels. A significant and positive association was found between assets structure and long-term debt, and a significant and negative association was found with shortterm debt, which supports H1a and H1b. This implies that an increase of fixed assets relative to total assets leads to a rise in the long-term debt and reduce the short-term debt of SMEs. This finding is similar with those of Palacín-Sánchez et al. (2013). As expected, the coefficient value of size of SMEs shows a significant and positive correlation with long-term debt, and a significant and negative correlation with short-term debt. Thus H2a and H2b are accepted. Large SMEs depend on long-term financing resources because of the advantages they gain due to their size. This result is similar to that of Saarani & Shahadan (2013). The coefficient value of profitability of SMEs shows a significant and negative relationship with both debt levels, which is in the line with the pecking order theory. Thus, H3a and H3b are accepted. Against expectations, the impact of the growth of SMEs on debt levels is found to be significant but negative, which supports the trade-off theory. The potential justification of this result is that SMEs avoid the risk of borrowing by using internal resources since this risk is not shared with more investors such as large firms. This finding is the same with those of Mateev & Ivanov (2011). Hence, H4a and H4b are rejected. In addition, the magnitude of regression coefficient shows that SMEs prefer to use short-term funds compared to long-term funds as was found by Palacín-Sánchez et al. (2013). Finally, liquidity is significant and beneficial for long-term debt. This means that SMEs with a high liquidity ratio depend on long-term debt. The potential interpretation of this result is that SMEs that have enough liquidity are less likely to default, which convinces an outside supplier of funds to lend to them at low cost. This result is in line with those of Saarani & Shahadan (2013). Thus, H5a is accepted, and H5b is rejected.

Conclusion And Recommendations

Recently, the world’s interest in SMEs has increased. This is due to the role of these enterprises in stimulating economic growth and combating poverty and unemployment. In response to this trend, the relevant authorities in Jordan have developed strategies and policies aimed at supporting this important sector. However, the decision to select a capital structure is important within the firm. This decision has an influence on the value of the firm and on the chances of growth and continuation in future. Despite the importance of this subject, it has not been studied sufficiently in Jordan. Thus, this study enriches the existence knowledge about this issue. The findings from this study can be used by SMEs to manage their capital structures efficiently. In addition, the outcome of this study is expected to assist banks, which target these firms, to design their credit policies. Government agencies, such as the Ministry of Planning, that seeks funds for these firms can also benefit from the results of the study.

Using a panel data of 77 SMEs, a significant link was found between assets structure, size, profitability, growth, and liquidity and the debt level of SMEs in Jordan. Two measures of debt were used to deal with debt maturity issue of SMEs and to compare the determinants of long and short-term debt. For a long-term debt level, a correlation exists between assets structure, size, growth, and liquidity and debt ratio of SMEs, while profitability has a negative effect. For a short-term debt level, a negative impact was found for assets structure, size, and profitability on the debt ratio of SMEs, while growth has a positive impact. However, liquidity does not impact significantly on the short-term debt of SMEs in Jordan. Among the significant factors, profitability has the highest impact on both debt levels, which implies its importance during the process of selecting SMEs’ capital structure. This study recommends that funding parties finance SMEs at a low-interest rate; it also recommends that government bodies encourage financing parties by granting them advantages such as tax exemption on profit earned from SME financing.

Although this study achieved its goals, and because of the lack of studies in this area, it is necessary to carry out more studies that deal with the capital structure of SMEs and the factors affecting it. In addition, it is worth establishing a comprehensive database at the country level that includes reliable and valid data since financial statements of SMEs are not audited in the most cases.

Acknowledgment

This paper is supported by the Deanship of Scientific Research and Graduate Studies at Philadelphia University in Jordan.

References

- AL-Mahrouq, M. (2010). Success factors of small and medium-sized enterprises (SMEs): The case of Jordan. Anadolu University Journal of Social Sciences, 10(1), 1-16.

- Balios, D., Daskalakis, N., Eriotis, N., & Vasiliou, D. (2016). SMEs capital structure determinants during severe economic crisis: The case of Greece. Cogent Economics & Finance, 4, 1-11.

- Central Bank of Jordan (2017). Financial stability report. Amman: Central Bank of Jordan.

- Daskalakis, N., & Psillaki, M. (2008). Do country or firm factors explain capital structure? Evidence from SMEs in France and Greece. Applied Financial Economics, 18(2), 87-97.

- DeAngelo, H., & Masulis, R.W. (1980). Optimal capital structure under corporate and personal taxation. Journal of Financial Economics, 8(1), 3-29.

- Degryse, H.A., de Goeij, P.C., & Kappert, P. (2009). The impact of firm and industry characteristics on small firms? capital structure: evidence from Dutch panel data. European Banking Center Discussion Paper.

- Gitman, L.J., & Zutter, C.J. (2012). Principles of managerial finance. Prentice Hall.

- Kumar, N.S. (2014). A study on capital structure pattern of small and medium enterprises (SMEs). Journal of Economics and Finance, 5(6), 19-23.

- Mateev, M., & Ivanov, K. (2011). How SME uniqueness affects capital structure: Evidence from central and eastern europe panel data. Quarterly Journal of Finance and Accounting, 50(1), 115-143.

- Modigliani, F., & Miller, M.H. (1958). The cost of capital, corporation finance and the theory of investment. The American Economic Review, 48(3), 261-297.

- Modigliani, F., & Miller, M.H. (1963). Corporate income taxes and the cost of capital: A correction. The American Economic Review, 53(3), 433-443.

- Mokhova, N., & Zinecker, M. (2014). Macroeconomic factors and corporate capital structure. Procedia-Social and Behavioral Sciences, 110, 530-540.

- Muiru, M., & Kamau, S.M. (2014). An assessment of capital structure decisions by small and medium enterprises in Kenya. Research Journal of Finance and Accounting, 5(12), 20-27.

- Myers, S.C. (1984). The capital structure puzzle. The Journal of Finance, 39(3), 574-592.

- Myers, S.C., & Majluf, N.S. (1984). Corporate financing and investment decisions when firms have information that investors do not have. Journal of Financial Economics, 13(2), 187-221.

- Napompech, K. (2013). Determinants of capital structure of small firms in Thailand. Trends in Applied Sciences Research, 8(2), 92-104.

- Palacín-Sánchez, M.J., Ramírez-Herrera, L.M., & Pietro, F.D. (2013). Capital structure of SMEs in Spanish regions. Small Business Economics, 41(2), 503-519.

- Predkiewicz, K., & Predkiewicz, P. (2015). Chosen determinants of capital structure in small and medium-sized enterprises: Evidence from Poland. Finanse, Rynki Finansowe, Ubezpieczenia, 17(2), 331-340.

- Proença, P., Laureano, R.M.S., & Laureano, L.M.S. (2014). Determinants of capital structure and the 2008 financial crisis: Evidence from Portuguese SMEs. Procedia-Social and Behavioral Sciences, 150, 182-191.

- Ross, S.A., Westerfiled, R.W., Jaffe, J., & Bley, J. (2013). Corporate finance. New York: McGrow-Hill Education.

- Saarani, A.N., & Shahadan, F. (2013). The determinant of capital structure of SMEs in Malaysia: Evidence from enterprise 50(e50) SMEs. Asian Social Science, 9(6), 64.

- Sarlija, N., & Harc, M. (2016). Capital structure determinants of small and medium enterprises in Croatia. Managing Global Transitions, 14(3), 251.

- Siam, W.Z., & Rahahleh, M.Y. (2010). Implications of applying the international financial reporting standards (IFRSs) for small and medium-sized enterprises on the accounting environment in Jordan. Journal of Accounting?Business & Management, 17(2), 21-33.