Research Article: 2021 Vol: 25 Issue: 6

A Study of Stock Performance of Select IPOS in India

Mohammed Arshad Khan, Department of Accountancy, College of Administrative and Financial Sciences, Saudi Electronic University, Saudi Arabia

Khudsiya Zeeshan, School of Business, Koneru Lakshmaiah Education Foundation, India

Md Faiz Ahmad, School of Management, Malla Reddy University, India Syed Azhar, ICBM-SBE, India

Abdullah A. Alakkas, Department of Accountancy, College of Administrative and Financial Sciences, Saudi Electronic University, Saudi Arabia

Md Rashid Farooqi, Department of Management and Commerce, Maulana Azad National Urdu University, India

Citation Information: Khan, M.A., Zeeshan, K., Ahmad, M.F., Alakkas, A.A., & Farooqi, M.R. (2021). A Study of Stock Performance of Select IPOS in India. Academy of Accounting and Financial Studies Journal, 25(6), 1- 11

Abstract

The government institutions and corporate companies raise finance through debt and/ or equity. The unlisted companies can issue shares through Initial Public Offering (IPO) from the primary market. It is an opportunity for these companies which are planning to expand, diversify, and grow with better future business prospects. For an investor holding shares issued through IPO can consider it as a mere speculative opportunity in short term or an opportunity to earn high dividends with capital appreciation in the long run. The study attempts to evaluate the value of share premium and pricing on listing day, assess progressive growth of IPO return. Further the study compares short-term performance with the long-term performance of IPO returns using Wilcoxon Signed Rank Test. The sample includes twenty-six companies issued IPOs that were successfully listed in the year 2016. The study considered a period of three years from the date of issue for analysis, i.e., 2016 to 2019. The study found that return on IPO fluctuated during the study period. Among the select sample, twenty IPOs have provided returns on the listing day. The IPOs traded on the stock exchange are found to be promising in long term when compared to short term period. It is also found that the companies that have overpriced issue price have failed to grow during the study period. This study acknowledges the fact that holding investment for a longer period provides an opportunity to earn higher returns. The study suggests the investors to hold investment for more than one year for better returns. Further the investors can sell the shares that are overpriced by the end of the listing day to minimize the losses.

IPO, Stock Performance, Stock Premium.

Introduction

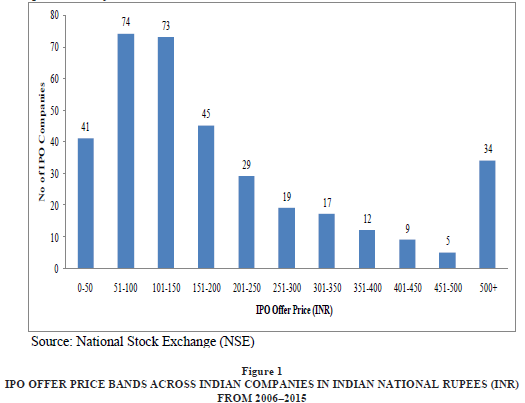

The liberalization reforms of 1991 have developed the Indian Capital markets to new heights. It is observed that since 1976 the United States (U.S) companies are maintaining their initial public offering prices between $15 to $20 (Weld et al., 2009). IPO is considered as a buzzword among the investors from decades and it is the largest source of funds with long or indefinite maturity (Birru & Wang, 2016). For the past few years, the number of companies issuing initial public offer is encouraging. This indicates that the capital market is strengthening its role in supporting funding needs of public companies (Birru & Wang, 2016) and it is also a motivating factor for small and unlisted companies and sometimes larger private companies preferring to issue IPO for the purpose of expansion, diversification, and acquisitions in the near future after converting to public company. There are many companies that have raised capital through markets have successfully led to growth and development. The following figure 1 shows the IPO offer price bands across Indian companies in Indian National Rupees (INR) for a period of 10 years from 2006-2015.

Figure 1. IPO Offer Price Bands Across Indian Companies in Indian National Rupees (Inr) From 2006–2015

IPO issue in a year indicates the risk appetite of investors. The sentiments of investors can influence the market performance (Barberis et al., 1998; Daniel et al., 1998), which can cause stock prices to rise or fall (Clarke et al., 2016, Gompers & Metrick, 2001; Daniel et al., 1998). The investor sentiments can affect the issue of IPO and it can also be affecting by the firms age, issue size, subscription rate (Sahoo & Rajib, 2012), reputation of issue manager, market condition and, promoters holding, returns of the firms, market cycle and IPO grading etc.

Among the factors, issue price is one of the most important factors influencing IPO performance (Yong & Isa, 2003; Rock, 1986; Fung et al., 2005; Ljungqvist & Wilhelm, 2006; Fernando et al., 2004; Sahoo & Rajib, 2012). It is the price at which the IPO is issued in the market. The companies can either under-price or over-price IPOs, but few studies have proved that IPOs which are over-priced led to initial losses and on the other hand, under-pricing leads to small gains for investors by the end of the listing day (Purnanandam & Swaminathan, 2004; Chowdhry & Sherman, 1996; Rock, 1986). Further in the long-term, an IPOs price will settle into a steady value which can be followed by traditional stock price metrics like moving averages (Cai, 2008; Carter et al., 1998).

The retail investors commonly subscribe and sell it in the stock market to earn short term gains with a speculative interest (Clarke et al., 2016; Neupane & Poshakwale, 2012). According to Prithvi Haldea Managing Director of Prime Database, “the investors invest in IPO with the sole purpose of making listing gains rather than investing for long term” (Weld et al., 2009).

Material and Methods

Literature Review

The Initial public offering has always regarded as an opportunity for short term gains or long- term gain (Ritter, 1991; Carter et al., 1998; Choi & Nam, 1998; Jain & Kini, 1999). The study enquired if IPO can be a long-term investment tool or a speculative opportunity to earn booming profits (Fadah et al., 2019) whereas a study concluded that investors cannot earn abnormal returns from IPOs in the post-listing period (Jaleel, 2018). The IPO returns in the short-term and long-term returns can have either positive or negative relationship (Levis, 1993, Jain & Kini 1999; Chan et al., 2004, Poornima et al., 2016), whereas the other study has demonstrated negative or least returns in the short-run and higher return in the long-run (Hawaldar et al., 2018). Few studies have focused on the magnitude of returns in short and long term.

The day on which the IPO is issued plays an important role in assessing the performance. The shares issued on certain days may be more fruitful compared to issue on other days. Durukan (2002) observed that the volume of issue on Monday yield higher returns than IPO issued on other days. The underwriter also plays a vital role in the pre and post listing of IPOs (Dong et al., 2011). It is reported that IPOs marketed by prestigious underwriters provide significantly higher and positive aftermarket returns (Upadhyay & Tripathi, 2016). Jones & Ligon (2009) and Menyah & Paudyal (2006) suggested that IPOs are under-priced on the listing day but missed out the pricing phenomenon after a certain period of the listing, i.e., 1 year, 2 years, 3 years etc. from the date of listing. Further (Omran, 2005), the under-pricing of business group companies is higher than that of stand-alone companies.

Need for the Study

There have been two major differences concerning IPO literature worldwide - listing day under-pricing, post listing under-performance in the medium to long run (Jain & Kini, 1999). Therefore, the present study identifies the return on IPOs which is a multiple of its issue price and further to analyse the progressive performance of IPO to suggest opportunities in terms of significant gains to the investors in capital market.

Objectives of the Study

1. To evaluate the rate of premium on IPOs.

2. To evaluate the performance of IPOs on listing day.

3. To analyse and compare short run and long run performance of IPOs.

Research Methodology

This research study is descriptive and analytical in nature. A total of 27 companies issued IPOs in the year 2016 but one company failed to receive full subscription and hence eliminated from the sample size. The study considered data for a period of three years from the date of issue. Therefore, the sample size of the study is limited to 26 companies issuing IPOs and listed in National Stock Exchange (NSE) in India. The progressive growth of select sample was based on the data of returns on the first day, one month, three months, six months, one year, two years and three years. Wilcoxon Signed Rank Test was performed using MS Excel and SPSS to evaluate the difference in the short-term and long-term performance.

Results and Discussion

The data analysis comprises of three parts - evaluation of share premium, evaluation of performance on listing day and comparison of short-term and long-term performance.

Premium on Issue of Share

The Companies Act 2013 has defined Share premium as “the excess amount received by the company over and above the face value of its shares”. As per the Section 52 of the Companies Act, 2013, a company can issue shares at a premium. The excess amount received by the company over and above the face value of its shares is called as share premium. It is expressed in terms of the number of times premium received by the company in proportion to face value. It is expressed as;

The companies that are financially strong, well-managed and have a good reputation in the market issue shares at a premium. Indeed, investors are substantially interested in the company issuing an IPO with other intangible benefits that are not reflected in the finances of the company.

The table 1 shows the number of times, the shares are issued at premium over the face value by sample companies. The premium on shares indicates the value of the share price of the company in the market. The companies issuing IPOs with higher premium are considered as financially strong with better prospects in the market. Share premium is also an indicator for the investors to anticipate the growth of the company assuming that companies with high premium will perform better in the long-run.

| Table 1 Ranking Of IPO Based On Issue At Share Premium

|

|||||

| Issuer Name | Face Value | Issue price | Premium | No of Times | Rank |

| L&T Infotech Ltd | 1 | 710 | 709 | 709 | 1 |

| L&T Technology Services Ltd | 2 | 860 | 858 | 429 | 2 |

| Sheela Foam Ltd | 5 | 730 | 725 | 145 | 3 |

| Advanced Enzyme Technologies Ltd | 10 | 896 | 886 | 88.6 | 4 |

| Team Lease Services Ltd | 10 | 850 | 840 | 84 | 5 |

| PNB Housing Finance Ltd | 10 | 775 | 765 | 76.5 | 6 |

| Endurance Technologies Ltd | 10 | 472 | 462 | 46.2 | 7 |

| Thyrocare Technologies Ltd | 10 | 446 | 436 | 43.6 | 8 |

| Varun Beverages Ltd | 10 | 445 | 435 | 43.5 | 9 |

| Infibeam Incorporation Ltd | 10 | 432 | 422 | 42.2 | 10 |

| Laurus Labs Ltd | 10 | 428 | 418 | 41.8 | 11 |

| Mahanagar Gas Limited | 10 | 421 | 411 | 41.1 | 12 |

| ICICI Prudential Life Insurance Company Ltd | 10 | 334 | 324 | 32.4 | 13 |

| Quick Heal Technologies Ltd | 10 | 321 | 311 | 31.1 | 14 |

| Quess Corp Ltd | 10 | 317 | 307 | 30.7 | 15 |

| S P Apparels Ltd | 10 | 268 | 258 | 25.8 | 16 |

| RBL Bank Ltd | 10 | 225 | 215 | 21.5 | 17 |

| Dilip Buildcon Ltd | 10 | 219 | 209 | 20.9 | 18 |

| Healthcare Global Enterprises Ltd | 10 | 218 | 208 | 20.8 | 19 |

| Parag Milk Foods Ltd | 10 | 215 | 205 | 20.5 | 20 |

| Ujjivan Financial Services Ltd | 10 | 210 | 200 | 20 | 21 |

| GNA Alexies Ltd | 10 | 207 | 197 | 19.7 | 22 |

| HPL Electric & Power Ltd | 10 | 202 | 192 | 19.2 | 23 |

| Precision Camshafts Ltd | 10 | 186 | 176 | 17.6 | 24 |

| Equitas Holdings Limited | 10 | 110 | 100 | 10 | 25 |

| Bharat Wire RopesLtd | 10 | 45 | 35 | 3.5 | 26 |

For the purpose of study, the companies issuing IPOs are ranked based on the share premium received. Ranking of IPO reflects the ability of the company to repay principal. Better ranking attracts more investors to invest in prospective growth companies. The study ranked first L&T Infotech Ltd, followed by L&T Technology Services Ltd, Sheela Foam Ltd, Advanced Enzyme Technologies Ltd, Team Lease Services Ltd and PNB Housing Finance Ltd etc as an order of priority while issuing share at premium.

Performance of IPOs on Listing Day

The study considered issue price and closing price of listing day to evaluate performance of IPO on the listing day. The performance can be categorized as under-pricing or over-pricing based upon the increase or decrease of stock prices on the listing day. Khurshed et al. (2008), Marisetty & Subrahmanyam (2010) and Michaely & Shaw (1994) have calculated the under-pricing of IPOs from the issue price and the closing price of the listing day;

Where,

IRi = IPO subscriber’s initial return from security i.

Pi1 = Closing price of the IPO on the first day of trading.

Pi0 = Offer/issue price of the IPO scrip.

The table 2 shows the performance of IPOs on the listing day issued in the year 2016. Technically, when the closing stock prices are above the issue price, it is labelled as under-priced. In our study, twenty companies have under-priced their issue on the listing day, enabling more investors to trade in the secondary market. It can lead to increase in stock prices in case of under-pricing which might result to positive return on the listing day.

| Table 2 Performance Of IPO On Listing Day | ||||

| Company Name | Issue Price | Closing Price on ListingDay |

IRi | Performance |

| Precision camshaft Ltd | 186 | 177.45 | -4.6 | Over-priced |

| Team Lease Services Ltd | 850 | 1032 | 21.41 | Under-priced |

| Quick Heal Technologies | 321 | 253.85 | -20.92 | Over-priced |

| Healthcare Global Enterprises Ltd | 218 | 171 | -21.56 | Over-priced |

| Bharat Wire Ropes Ltd | 45 | 45.55 | 1.22 | Under-priced |

| Infibeam Incorporation Ltd | 432 | 445.75 | 3.18 | Under-priced |

| Equitas Holdings Limited | 110 | 135.2 | 22.91 | Under-priced |

| Thyrocare Technologies Ltd | 446 | 618.8 | 38.74 | Under-priced |

| Ujjivan Financial Services Ltd | 210 | 231.55 | 10.26 | Under-priced |

| Parag Milk Foods Ltd | 215 | 247 | 14.88 | Under-priced |

| Mahanagar Gas Limited | 421 | 520.3 | 23.59 | Under-priced |

| Quess Corp Ltd july9 | 317 | 503.1 | 58.71 | Under-priced |

| L&T Infotech Ltd | 710 | 697.6 | -1.75 | Over-priced |

| Advanced Enzyme Techn. Ltd | 896 | 1178.1 | 31.48 | Under-priced |

| Dilip Buildcon Ltd | 219 | 251.75 | 14.95 | Under-priced |

| S P Apparels Ltd | 268 | 288.75 | 7.74 | Under-priced |

| RBL Bank Ltd | 225 | 299.4 | 33.07 | Under-priced |

| L&T Technology Services Ltd | 860 | 869 | 1.05 | Under-priced |

| G N A Alexies Ltd | 207 | 245.05 | 18.38 | Under-priced |

| ICICI Prudential Life Insurance Company | 334 | 297.55 | -10.91 | Over-priced |

| HPL Electric & Power Ltd | 202 | 189.3 | -6.29 | Over-priced |

| Endurance Technologies Ltd | 472 | 646.9 | 37.06 | Under-priced |

| PNB Housing Finance Ltd | 775 | 891.15 | 14.99 | Under-priced |

| Varun Beverages Ltd | 445 | 459.5 | 3.26 | Under-priced |

| Sheela Foam Ltd | 730 | 1032 | 41.37 | Under-priced |

| Laurus Labs Ltd | 428 | 480.4 | 12.24 | Under-priced |

On the other hand, six companies have over-priced. It indicates lower returns on the listing day. It shows a decrease in the closing price of share when compared with the issue price on the listing day. An over prices issue of a company's stock may fall on its first day and its IPO being blasted as a failure.

The returns earned by the companies issuing IPO are Sheela foam Ltd, Advanced Enzyme Techn Ltd, Team Lease Services Ltd, Thyrocare Technologies Ltd and Quess Corp Ltd. are 41.37%, 31.48%, 21.41%, 38.74% and 58.71% respectively. Among these, Quess Corp Ltd has recorded the highest positive returns. We can observe that the returns on the listing day is high. The investors can take this as an opportunity to purchase and sell IPO stock on closing price of listing day to generate the better profits. As the investors considers IPO as the exit strategy to invest and earn the returns in the short run. Therefore, it is suggested that the companies issuing share through IPOs adopt under-pricing to ensures better responses from the investors for significant gains during trading.

Progressive Growth of IPO Return’s in Short Term and Long-Term Period

The study attempts to evaluate the progressive growth in case of buy and hold strategy of investors. Buy and hold return is used to analyse progressive growth from the date of issue for next successive three years. The study collected data, such as change in stock returns over different time horizons like Listing Day, 1 month, 3 months, 6 months, 1 year, 2 years and 3 years considering issue price as a base.

Progressive growth is expressed in terms of increase in returns. It is calculated by considering the closing price at the end of the trading day divided by the issue price. It is expressed in terms of percentage. To standardize the data, the value of the issue price is converted to percentages. The issue price is base price for comparison purpose and fixed as 100. The changes in terms of increase or decrease in returns are recorded thereof. In case the value is below 100, it indicates fall in prices of stock and on the other hand, if the returns on IPO is recorded above 100 percent indicates increase in the price of stock.

Buy and hold for Six Months

The study attempts to evaluate the performance of buy and hold strategy of an investor holding investments for a period of six months from the date of issue. Among the 26 IPOs, 19 IPOs have generated positive returns. The performance of seven IPOs have decreased by the end of six months, namely Precision camshaft Ltd (78.39%), Quick Heal Technologies (74.67%), Bharat Wire Ropes Ltd (88.44%), L&T Infotech Ltd (95.51%), L&T Technology Services Ltd (78.85%), GNA Alexies Ltd (93.38%) and HPL Electric & Power Ltd (62.23%).

Buy and hold for One Year

The study attempts to evaluate the performance of buy and hold strategy of an investor holding investments for a period of one year. Twenty companies have demonstrated growth from the date of issue, except companies such as Precision camshaft Ltd (84.46%), Quick Heal Technologies (78.58%), HPL Electric & Power Ltd (73.24%) and Advanced Enzyme Techn. Ltd (34.55%) performance have declined by the end of one year from the date of issue.

Buy and hold for Two Years

The study attempts to evaluate the performance of buy and hold strategy of an investor holding investments for a period for two years from the date of issue of shares. Twenty-one companies have demonstrated growth in share price by the end of two years. On the other hand, the companies such as Precision camshaft Ltd (63.28%), Infibeam Incorporation Ltd (36.74%), Advanced Enzyme Tech. Ltd (23.13%), HPL Electric & Power Ltd (28.19%) and Laurus Labs Ltd (90.96%) have decline in the stock prices from the date of issue.

Buy and hold for Three Years

The study attempts to evaluate the performance of buy and hold strategy of an investor holding investments for a period of three years from the data of issue. The companies, namely TeamLease Services Ltd (334.16%), Bharat Wire Ropes Ltd (130.33%), Equitas Holdings Limited (123.50%), Ujjivan Financial Services Ltd (149%), Mahanagar Gas Limited (195.91%), Dilip Buildcon Ltd (195.68%), RBL Bank Ltd (278.87%), L&T Technology Services Ltd (186.12), GNA Alexies Ltd (120.05%), ICICI Prudential Life Insurance (114.17%), Endurance Technologies Ltd (211.89%), Varun Beverages Ltd (216.89%), and Sheela Foam Ltd (177.38%) have demonstrated growth from the date of initial public offer issue in Table 3.

| Table 3 Progressive Performance Of IPO In Short And Long Term (In %) | ||||||||

| Company Names | Issue Price (In %) |

ListingDay | Months | Years | ||||

| 1 | 3 | 6 | 1 | 2 | 3 | |||

| Precision camshaft Ltd | 100 | 95.4 | 85.43 | 79.68 | 78.39 | 84.46 | 63.28 | 30.59 |

| TeamLease Services Ltd | 100 | 120.34 | 115.26 | 104.68 | 129.11 | 106.16 | 258.29 | 334.16 |

| Quick Heal Technologies | 100 | 79.08 | 68.44 | 80.22 | 74.67 | 78.58 | 95.23 | 54.1 |

| Healthcare Global Ent. Ltd | 100 | 78.44 | 84.08 | 84.24 | 101.4 | 103.23 | 132.64 | 100.92 |

| Bharat Wire Ropes Ltd | 100 | 101.22 | 90.33 | 99.89 | 88.44 | 220.22 | 258.56 | 130.33 |

| Infibeam Incorporation Ltd | 100 | 103.18 | 118.77 | 161.22 | 213.33 | 219.59 | 36.74 | 9.49 |

| Equitas Holdings Limited | 100 | 122.91 | 134.64 | 157.86 | 166.64 | 155.86 | 137.09 | 123.5 |

| Thyrocare Technologies | 100 | 138.74 | 134.6 | 124.46 | 141.67 | 159.98 | 142.93 | 117.04 |

| Ujjivan Financial Services | 100 | 110.26 | 174.14 | 205.81 | 204 | 165.12 | 192.19 | 149 |

| Parag Milk Foods Ltd | 100 | 114.88 | 117.07 | 147.81 | 123.72 | 112.51 | 163.05 | 113.26 |

| Mahanagar Gas Limited | 100 | 123.59 | 120.86 | 156.81 | 187.14 | 235.72 | 194.49 | 195.91 |

| Quess Corp Ltd | 100 | 158.71 | 167.13 | 194.59 | 213.97 | 289.83 | 337.73 | 135.14 |

| L&T Infotech Ltd | 100 | 98.25 | 93.61 | 87.83 | 95.51 | 108.21 | 246.61 | 44.36 |

| Advanced Enzyme Techn. | 100 | 131.48 | 152.51 | 248.91 | 202.04 | 34.55 | 23.13 | 18.25 |

| Dilip Buildcon Ltd | 100 | 114.95 | 105.11 | 94.45 | 124.82 | 238.11 | 386.51 | 195.68 |

| S P Apparels Ltd | 100 | 107.46 | 121.49 | 130.32 | 140.34 | 156.14 | 116.96 | 103.66 |

| RBL Bank Ltd | 100 | 133.07 | 129.42 | 161.67 | 211.87 | 242.04 | 278.78 | 278.87 |

| L&T Technology Services | 100 | 81.12 | 77.28 | 74.34 | 78.85 | 89.34 | 203.6 | 186.12 |

| G N A Alexies Ltd | 100 | 118.38 | 120.46 | 86.79 | 93.38 | 146.5 | 175.7 | 120.05 |

| ICICI Prudential Life Ins. | 100 | 89.09 | 92.39 | 89.85 | 111.05 | 116.41 | 99.93 | 114.17 |

| HPL Electric & Power Ltd | 100 | 93.71 | 80.97 | 49.73 | 62.23 | 73.24 | 28.19 | 28.42 |

| Endurance Technologies | 100 | 137.06 | 114.92 | 127.4 | 172.4 | 232.43 | 233.23 | 211.89 |

| PNB Housing Finance Ltd | 100 | 114.99 | 110.99 | 127.97 | 170.5 | 180.71 | 117.45 | 100.28 |

| Varun Beverages Ltd | 100 | 103.26 | 95 | 90.78 | 110.6 | 113.29 | 172.82 | 216.89 |

| Sheela Foam Ltd | 100 | 141.37 | 130.23 | 150.48 | 184.3 | 240.23 | 197.11 | 177.38 |

| Laurus Labs Ltd | 100 | 112.24 | 112.35 | 123.97 | 141.53 | 123.93 | 90.96 | 80.3 |

Comparison of Short Term and Long-Term Returns

Wilcoxon Signed Ranks Test is a non-parametric statistical test used to identify whether there is a significant difference in the short run and long run performance.

The table 4 shows the result of Wilcoxon Signed Rank Test. The mean rank in short and long run period is categorized as positive and negative ranks. Positive ranks indicate that the return in the long run is better when compared to short run and vice-versa. The difference in performance in the short and long run is compared by using data of the IPO return before and after 1-year. It is found that 17 companies are performing better in the long run over short run whereas 9 companies are earning better returns in the short run over a long run period.

| Table 4 Ranks | ||||

| N | Mean Rank | Sum of Ranks | ||

| Returns in Long run | Negative Ranks | 9a | 9.67 | 87 |

| Returns in short run | Positive Ranks | 17b | 15.53 | 264 |

| Ties | 0c | |||

| Total | 26 | |||

The table 5 shows whether there is a significant difference between the short term and Long-term returns. The calculated p value is less at 5% level of significance, indicating that there is a significant difference between the short run and long run returns. Therefore, the research hypothesis is accepted at 5 % level of significance.

| Table 5 Results of Wilcoxon Signed Ranks Test | |||

| Hypothesis | Z | P-Value | Decision |

| H1: There is a significant difference between the short term and Long-term returns. | -2.248b | 0.025 | Accepted |

| a. Wilcoxon Signed Ranks Test | |||

| b. Based on negative ranks. | |||

Conclusion

The initial public is an opportunity for the company to procure capital from the primary market. Procurement of large capital is only possible by issuing shares through IPO. Risk of undersubscription has been reduced by intervention of underwriters by providing assurance to the companies issuing IPO and making it more successful. The success of IPO depends on various factors such as day of issue, price of share to be used, projected earnings, and cash flow, IPO grading, the goodwill of the underwriters etc.

The study found that IPO which are under-pricing are yielding higher returns. It is inferred that the closing price of the listing day is higher than the issue price on the listing day (Po >P1). It helps to boost demand and maintain price stability in the secondary market. Hence, under-pricing helps to boost demand and maintain price stability in the secondary market. In the initial period, the investors quit on the listing day to receive quick gains. Further the true price is can be discovered after listing shares in the stock exchange. As new information comes into the market through different sources other than the syndicate can establish a new fair and true price in the market.

Finally, the study suggests the investors to sell the shares that are overpriced by the end of the listing day to minimize the losses and further the investors can hold investment for more than one year for better returns that are under-priced. The long-term returns are more promising when compared with the short term. If the investors buy the shares of the companies on the listing day and hold them for long term, there is a high possibility of making good returns.

References

- Barberis. N., Shlifer. A., & Vishny. R. (1998). A model of investor sentiment. Journal of Financial Economics, 49, 307 -343.

- Birru, J., & Baolian, W. (2016). Nominal Price Illusion. Journal of Financial Economics, 119, 578–98.

- Cai, Xiaoqiong, L., Guy, S., & Mase, B. (2008). The long-run performance of initial public o?erings and its determinants: the case of China. Review of Quantitative Finance and Accounting, 30(4), 419–432.

- Carter, R., Dark, R., & Singh, A. (1998). Underwriter reputation, initial returns, and the lon-grun performance of initial public offering stocks. Journal of Finance, 53, 289-311.

- Chan, K., Wang, J., John Wei, K.C. (2004). Under-pricing and long-term performance of IPOs in China. J. Corp. Finan, 10(3), 409–430.

- Choi, S.D., & Nam, S.K. (1998). The short-run performance of IPOs of privately- and publicly owned firms: International evidence. Multinational Finance Journal, 2, 225–244.

- Chowdhry, B., & Ann, S. (1996). International differences in oversubscription and under-pricing of IPOs. Journal of Corporate Finance, 2, 359–81.

- Clarke, J., Arif, K., Alok, P., & Ajai, K.S. (2016). Sentiment traders & IPO initial returns: The indian evidence. Journal of Corporate Finance, 37, 24–37.

- Daniel, K., Hirshleifer, D., & Subrahmanyam, A. (1998). Investor psychology and stock market under- and over- reactions. Journal of Finance, 53, 1839-1886.

- Dong, M., Michel, Jean-Sébastien, & Ari Pandes, J. (2011). Underwriter quality and long-run IPO performance. Financ. Manag, 40(1), 219–251.

- Durukan, B.K. (2002). The Relationship Between IPO Returns and Factors Influencing IPO Performance: Case of Istanbul Stock Exchange, Managerial Finance, 28(2), 18-38.

- Fernando, C.S., Krishnamurthy, S., & Spindt, P.A. (2004). Are share price levels informative? Evidence from the ownership, pricing, turnover and performance of IPO firms. Journal of Financial Markets, 7(4), 377- 403.

- Fung, J.K., Cheng, L.T., & Chan, K.C. (2004). The impact of the costs of subscription on measured IPO returns: the case of Asia. Journal of Corporate Finance, 10(3), 459-465.

- Gompers, P.A., & Metrick, A. (2001). Institutional investors and equity prices. The quarterly journal of Economics, 116(1), 229-259.

- Hawaldar, I.T., Naveen Kumar, K.R., & Mallikarjunappa, T. (2018). Pricing and performance of IPOs: Evidence from Indian stock market. Cogent Economics & Finance, 6(1), 1-20.

- Jain, B.A., & Kini, O. (1999). The life cycle of initial public offering firms. Journal of Business Finance & Accounting, 26(9-10), 1281-1307.

- Jaleel, T. (2018). Investing in IPOs? Here's how many gave positive returns since start of 2017, Economic Times, Retrieved from //economictimes.indiatimes.com/articleshow/65337349.cms?utm_source=contentofinterest&utm_medi um=text&utm_campaign=cppst

- Jones, T.L., & Ligon, J.A. (2009). The day of the week effect in IPO initial returns. The Quarterly Review of Economics and Finance, 49(1), 110-127.

- Khurshed, A., Paleari, S., Pande, A., & Vismara, S. (2008). IPO Grading in India: Does it Add Value to the Book Building Process?. Unpublished Working Paper accessed from www. unibg. it/dati/bacheca/530/36104. pdf.

- Levis, M. (1993). The long-run performance of initial public offerings: The UK experience 1980-1988. Financial Management, 28-41.

- Ljungqvist, A., & Wilhelm Jr, W.J. (2005). Does prospect theory explain IPO market behavior?. The Journal of Finance, 60(4), 1759-1790.

- Marisetty, V.B., & Subrahmanyam, M.G. (2010). Group affiliation and the performance of IPOs in the Indian stock market. Journal of Financial Markets, 13(1), 196-223.

- Menyah, K., & Paudyal, K. (2006). Returns to style investments in initial public offerings. In Initial Public Offerings (pp. 13-28). Butterworth-Heinemann.

- Michaely, R., & Shaw, W.H. (1994). The pricing of initial public offerings: Tests of adverse-selection and signaling theories. The Review of Financial Studies, 7(2), 279-319.

- Neupane, S., & Poshakwale, S.S. (2012). Transparency in IPO mechanism: Retail investors’ participation, IPO pricing and returns. Journal of banking & finance, 36(7), 2064-2076.

- Omran, M. (2005). Underpricing and long-run performance of share issue privatizations in the Egyptian stock market. Journal of Financial Research, 28(2), 215-234.

- Poornima, D., Haaji, A., & Deepha, B. (2016). Study on the performance of initial public offering of companies listed in NSE, India & Gulf Base GCC Index. International Journal of Research in Finance & Marketing, 6(11), 31-46.

- Purnanandam, A.K., & Swaminathan, B. (2004). Are IPOs really underpriced?. The Review of Financial Studies, 17(3), 811-848.

- Ritter, J.R. (1991). The long-run performance of initial public offerings. The Journal of Finance, 46(1), 3-27. Sahoo, S., & Rajib, P. (2012). Determinants of pricing IPOs: An empirical investigation. South Asian Journal of Management, 19(4), 59.

- Weld, W.C., Michaely, R., Thaler, R.H., & Benartzi, S. (2009). The nominal share price puzzle. Journal of Economic Perspectives, 23(2), 121-42.

- Yong, O., & Isa, Z. (2003). Initial performance of new issues of shares in Malaysia. Applied Economics, 35(8), 919-930.