Research Article: 2023 Vol: 26 Issue: 5S

A Study of the Impact of Demographic Factors on Customers′ Awareness of Banking Services

Ashwitha Shetty, Bharathidasan University

Suresh G, Bharathidasan University

Citation Information: Shetty, A., & Suresh, G. (2023). A study of the impact of demographic factors on customers' awareness of banking services. Journal of Entrepreneurship Education, 26(S5), 1-12.

Abstract

This study is having the goal of investigate the impact of demographic factors customers' awareness of banking services. The research was conducted using a quantitative survey method, which involved a sample of 120 respondents from various age groups, gender, education, and income levels. The data collected were analyzed using descriptive statistics, correlation analysis, and regression analysis. The results of the study revealed that demographic factors significantly influenced customers' awareness of banking services. Age, education, and income level were found to have a positive impact on customers' awareness, while gender had no significant impact. Furthermore, the study found that the level of awareness of banking services varied among different demographic groups, with younger, more educated, and higher-income customers having higher levels of awareness. The study provides insights into the importance of considering demographic factors when developing marketing strategies for banking services. The findings suggest that banks should tailor their marketing efforts to target specific demographic groups based on their level of awareness of banking services. Moreover, banks should focus on educating customers about the benefits of using banking services, particularly those in lower-income and less-educated demographic groups, to increase their awareness and usage of banking services.

Keywords

Awareness, Demographic, Banking Service.

Introduction

The economy is growing in India. For the growth and development of economy various factors contributing. Banking is one of the industries, which have contributed for the economy growth and development. Banks performance main roles in the development of country as well as to develop the growth of the economy. Banking operations have aided in the growth of the economy and the fulfillment of customer demands. To meet the dynamic needs of customer’s banks will provide the different kinds of Investment products to its customers. A healthy relationship between the banker and the consumer is essential for the development of any country's banking system. Mutual trust and confidence are required between customers and banks. Customers should assume increasing responsibility for their financial affairs as financial products and services become more sophisticated.

This paper examines the awareness level of people of Mangalore about the Deposits and Loans facilities provided by the banks. Results of the study suggest that respondent’s level of awareness about the products.

Literature Review

Tiwari et al. (2021) Mobile banking has significantly improved the electronic banking system and has the potential to increase customer demand for online banking services. Although information technology (IT) in banking has grown quickly and offers a variety of options on the worldwide market, India's m-banking adoption has not experienced a significant growth. India has a lot of potential for m-banking, according to several types of study on the adoption of mobile banking that have been undertaken in different nations

Inegbedion et al. (2020) studies on e-banking have placed a strong emphasis on its adoption drivers, adoption barriers, and the degree to which client awareness drives adoption. "Exposure to/use of e-banking channels: Implications for customer awareness and attitude in Nigeria" was the topic of this study. This study aims to assess how consumers' exposure to and use of e-banking channels affects their awareness of and attitudes regarding e-banking in Nigeria.

Elavarasi & Surulivel (2014) aims to raise customer awareness and identify their top preferred bank e-banking services. The study was conducted in KumbakonamCity with a 200- person sample size. Following the data collection, the researcher determined which commercial bank offers better customer service with relation to e-banking services, as well as the degree to which consumers are satisfied with the banks' websites for internet banking.

Chawla & Sehgal (2012), Investors preferences towards mutual funds-a study on Silk City securities at Berhampur Town-Odisha, India the study explore that Because of the lack of confidentiality, many people are afraid of mutual funds. He also indicated that investors need the knowledge and conditions of Mutual Funds. Owing to lack of Understanding, many of the individuals have not invested in Mutual funds while they have money to invest. THE Investment platforms, such as researchers, industrialists, financial intermediaries, investors and regulators, attract the interest of different sectors of society.

Joseph & Prakash (2014) has carried “A Study on Preferred Investment Avenues among the People and Factors Considered for Investment”. The aim of the study was to examine the investment choices of individuals in a few towns in Bangalore. The analysis depends on the use of a standardized questionnaire. The study concludes that investing in bank deposits and insurance is more important for all the age groups among the respondents. A respondent's income level is an important factor which affects the respondent's investment portfolio. Respondents are more conscious of different investment choices, such as insurance, bank deposits.

Berger & DeYoung (2001) the investment knowledge and attitude of investors to understand the degree of satisfaction with their investments have been examined. The study concluded that the demographic factors of the salaried class and their knowledge of investment policies are significantly linked. The findings also showed that a large percentage of Coimbatore's salaried investors know how to make good investment decisions, and that one-third of the salaried class does not choose the right financial plan because of the right financial plan.

West (2012), Explored the knowledge of investment and Investors' attitude towards knowing the level of satisfaction with their investments. The quest concluded that the demographic variables of the salaried class and their knowledge of investment policies are significantly related. The findings also showed that a large percentage of Coimbatore's salaried investors are capable of making good investment decisions and one-third of the salaried class do not opt for the correct financial strategy because of a lack of knowledge of the investment.

Thambiah et al. (2011). They concluded that different investment avenues emphasized that for safety reasons, high income and aged investors tend to invest only in post offices and bank deposits. It was noted that the perceptions among male and female investors, different investment avenues are equivalent. It is also shown that with the exception of gold and post office, the order of choice for different investment avenues is the same across the genders. This study concluded that among the different income levels of the respondents, the understanding of the order of investment towards the post office differs.

Objectives Of The Study

• To identify the demographic factors that has an impact on customers' awareness of banking services.

• To determine the level of awareness of banking services among different demographic groups.

• To analyze the association between demographic variables and customers' awareness on banking facilities.

• To examine the effectiveness of marketing strategies used by banks to promote their services to different demographic groups.

Research Methodology

This investigation is used both Primary and secondary data for the study. The questionnaire was used to collect the primary data, and the simple percentage approach was used to evaluate it. 120 people were selected at random from the Mangalore region using the convenience sampling method.

Analysis and Interpretation

H1: There is no latent factors’ loading on the measured indicators.

Interpretation: The correlation matrix shows that "Awareness" has the highest correlation with "Sources" (0.249) among the observed variables. "Social media" has a moderate positive correlation with "Sources" (0.668) and "friend family member" (0.518). "Television commercials" and "marketing campaign Social media" also have a moderate positive correlation (0.632) Table 1."Using" has negative correlations with all other variables, indicating an inverse relationship with the rest of the observed variables. This suggests that the variable "Using" may be measuring a different construct compared to the other variables. Significance values: The significance values indicate whether the correlations between variables are statistically significant or not. A value of 0.05 or less typically indicates statistical significance. In this case, many of the correlations are statistically significant, suggesting meaningful relationships between the variables. Determinant: The determinant of the correlation matrix (0.035) provides information about the overall strength of the relationships between the variables. A determinant close to zero indicates that the variables are highly correlated, suggesting the presence of redundancy or multi collinearity.

| Table 1 Analysis And Interpretation |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Awareness | Sources | Friend family m ember | Social media | Banking website | Using | Marketing campaign Social media | Television co mmercials | Direct mail | In person events | ||

| Correlation | Awareness | 1.000 | 249 | 0.191 | .114 | 157 | -121 | 0.112 | 0.080 | 0.010 | 0.109 |

| Sources | 0.249 | 1.000 | 0.587 | .668 | 0.552 | -0.067 | 0.473 | 497 | 256 | 338 | |

| Friend family member | 0.191 | 0.587 | 1.000 | .518 | 0.485 | -0.083 | 297 | 356 | 385 | 385 | |

| Social media | 0.114 | 0.668 | 0.518 | 1.000 | 0.492 | -0.104 | 0.603 | 464 | 193 | 310 | |

| Banking website | 0.157 | 0.552 | 485 | 0.492 | 1.000 | -0.050 | 253 | 358 | 0.417 | 312 | |

| Using | -121 | -067 | -083 | -0.104 | -050 | 1.000 | -0.042 | 0.114 | -0.005 | 0.015 | |

| Marketing campaign Social media | 0.112 | 473 | 297 | 0.603 | .253 | -0.042 | 1.000 | 0.632 | 180 | 330 | |

| Television commercials | 0.080 | 497 | 356 | 0.464 | .358 | 0.114 | 632 | 1.000 | 0.264 | 336 | |

| Direct mail | 0.010 | 0.256 | 385 | 0.193 | 417 | -0.005 | 0.180 | 0.264 | 1.000 | 386 | |

| In person events | 0.109 | 338 | 385 | 0.310 | .312 | 0.015 | 0.330 | 0.336 | 386 | 1.000 | |

| Sig. (1-tailed) | Awareness | 0.001 | 0.009 | 0.081 | .027 | 0.070 | 0.086 | 165 | 0.454 | 0.092 | |

| Sources | 0.001 | 0.000 | 0.000 | .000 | 0.208 | 0.000 | 0.000 | 0.001 | 0.000 | ||

| Friend family member | 0.009 | 0.000 | 0.000 | .000 | 156 | 0.000 | 0.000 | 0.000 | 0.000 | ||

| Social media | 0.081 | 0.000 | 0.000 | .000 | 101 | 0.000 | 0.000 | 0.009 | 0.000 | ||

| Banking website | 0.027 | 0.000 | 0.000 | 0.000 | 0.270 | 0.001 | 0.000 | 0.000 | 0.000 | ||

| Using | 0.070 | 208 | 0.156 | 0.101 | .270 | 0.306 | 0.081 | 0.478 | 0.430 | ||

| Marketing campaign Social media | 0.086 | 0.000 | 0.000 | 0.000 | .001 | 306 | 0.000 | 0.014 | 0.000 | ||

| Television commercials | 0.165 | 0.000 | 0.000 | 0.000 | .000 | 0.081 | 0.000 | 0.001 | 0.000 | ||

| Direct mail | 0.454 | 0.001 | 0.000 | 0.009 | .000 | 0.478 | 014 | 0.001 | 0.000 | ||

| In person events | 0.092 | 0.000 | 0.000 | 0.000 | .000 | 430 | 0.000 | 0.000 | 0.000 | ||

The KMO value ranges between 0 and 1, with higher values indicating better suitability for factor analysis. In your case, the KMO value is 0.808, which is considered good Table 2. It suggests that the variables in your dataset share a substantial amount of common variance and are appropriate for factor analysis.

| Table 2 KMO and Bartlett’s Test |

|

|---|---|

| Kaiser-Meyer-Olkin Measure of Sampling Adequacy | 0.808 |

| Approx. Chi-Square | 490.991 |

| Bartlett's Test of Sphericity df | 45 |

| Sig. | 0.000 |

From the extraction communalities, we can see that the variables "Awareness," "Banking website," and "Using" have relatively lower communalities compared to the other variables. This suggests that they are less strongly related to the underlying factors extracted from the data. On the other hand, variables such as "marketing campaign Social media," "Social media," "Direct mail and Television commercials" have relatively higher communalities, indicating a stronger association with the extracted factors Table 3.

| Table 3 Communalities |

||

|---|---|---|

| Initial | Extraction | |

| Awareness | 1.000 | 0.424 |

| Sources | 1.000 | 0.707 |

| Friend family member | 1.000 | 0.619 |

| Social media | 1.000 | 0.709 |

| Banking website | 1.000 | 0.588 |

| Using | 1.000 | 0.568 |

| Marketing campaign Social media | 1.000 | 0.747 |

| Television commercials | 1.000 | 0.704 |

| Direct mail | 1.000 | 0.721 |

| In person events | 1.000 | 0.463 |

| Awareness | 1.000 | |

| Extraction method: Principle component analysis | ||

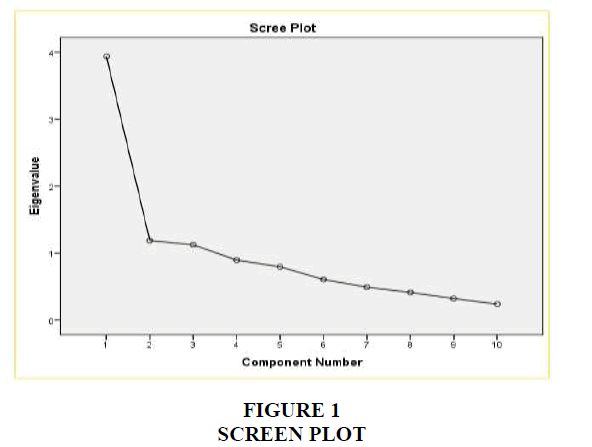

The first component (Component 1) explains 39.388% of the total variance. This component captures the largest amount of variability in the data and represents the most important underlying factor. The second component (Component 2) explains an additional 11.862% of the total variance. Together with Component 1, these two components explain a cumulative variance of 51.250%. Component 2 contributes significantly to the overall variance explained but to a lesser extent than Component 1.The third component (Component 3) explains 11.232% of the total variance, bringing the cumulative variance explained to 62.482% when combined with Components 1 and 2. Component 3 adds further information to the factor structure, but its contribution is smaller compared to the first two components Table 4. From the cumulative percentages, we can observe that the first three components capture a substantial portion of the variance in the data. As we move to the subsequent components (4 to 10), the amount of variance explained by each component decreases. Components 4 to 10 explain relatively smaller proportions of the total variance. Therefore, when interpreting the factor analysis results, it would be most meaningful to focus on the first three components, as they collectively account for a significant portion of the underlying structure in the data Figure 1.

| Table 4 Total Variance Explained |

||||||

|---|---|---|---|---|---|---|

| Initial Eigenvalues | Extraction Sums of Squared Loadings | |||||

| Component | Total | % of Variance | Cumulative % | Total | % of Variance | Cumulative % |

| 1 | 3,939 | 39.388 | 39,388 | 3,939 | 39,388 | 39.388 |

| 2 | 1.186 | 11.862 | 51.250 | 1.186 | 11.862 | 51.250 |

| 3 | 1.123 | 11.232 | 62,482 | 1.123 | 11.232 | 62.482 |

| 4 | 0.894 | 8,940 | 71,422 | |||

| 5 | 0.794 | 7,945 | 79,367 | |||

| 6 | 0.605 | 6,047 | 85,414 | |||

| 7 | 0.490 | 4,898 | 90.312 | |||

| 8 | 0.411 | 4.115 | 94.427 | |||

| 9 | 0.320 | 3.199 | 97.626 | |||

| 10 | 237 | 2.374 | 100.000 | |||

| Extraction method: Principle component analysis | ||||||

H2: There is no correlation between demographical factors and awareness level.

Interpretation: The interpretation of the correlations provided suggests that there is no significant correlation between demographical factors (age, gender, marital status, education, and employment) and awareness level Table 5. Specifically, the Spearman's rho correlation coefficients show that the correlations between awareness level and these demographical factors are weak and not statistically significant, except for a moderate correlation with education and a weak correlation with age, gender, marital status and employment Table 6, Table 7, Table 8, Table 9, Table 10, Table 11.

| Table 5 Correlations |

||||||

|---|---|---|---|---|---|---|

| Age | Gender | Marital status | Education | Employment | Awareness level | |

| Spearman's rho Age Correlation Coefficient | 1.000 | -0.076 | 0.771 | 0.616** | 0.575* | 0.124 |

| Sig .(2-tailed ) | 0.415 | 0.000 | 0.000 | 0.000 | 0.181 | |

| N | 118 | 118 | 118 | 118 | 118 | 118 |

| Gender Correlation Coefficient | -0.076 | 1.000 | .101 | 0.046 | -0.106 | -0.091 |

| Sig .(2-tailed ) | 0.415 | 0.276 | 0.622 | 0.255 | 0.325 | |

| N | 118 | 118 | 118 | 118 | 118 | 118 |

| Marital status Correlation Coefficient | 0.771 | 0.101 | 1.000 | 0.494 | 0.424 | 0.152 |

| Sig .(2-tailed ) | 0.000 | 0.276 | 0.000 | 0.000 | 0.101 | |

| N | 118 | 118 | 118 | 118 | 118 | 118 |

| Education Correlation Coefficient | 0.616 | 0.046 | 0.494 | 1.000 | 0.567 | 0.243 |

| Sig .(2-tailed ) | 0.000 | 0.622 | 0.000 | 0.000 | 0.008 | |

| N | 118 | 118 | 118 | 118 | 118 | 118 |

| Employment Correlation Coefficient | 0.575 | -0.106 | **0.424 | 0.567** | 1.000 | 0.155 |

| Sig .(2-tailed ) | 0.000 | 0.255 | 0.000 | 0.000 | 0.094 | |

| N | 118 | 118 | 118 | 118 | 118 | 118 |

| Awareness level Correlation Coefficient | 0.124 | -0.091 | 0.152 | 0.243 | 155 | 1.000 |

| Sig .(2-tailed ) | 0.181 | 0.325 | 0.101 | 0.008 | 0.094 | |

| N | 118 | 118 | 118 | 118 | 118 | 118 |

| **.Correlation is significant at the 0.01level (2-tailed ). | ||||||

Therefore, based on these correlations, we cannot conclude that any of these demographical factors has a strong influence on the awareness level. Other factors, such as access to information, personal interest, and exposure to the topic, may have a more significant impact on awareness level than the demographic characteristics of an individual.

Age Awareness level

| Table 6 Crosstab |

||||||

|---|---|---|---|---|---|---|

| *Awareness level | ||||||

| Age | 1.0 | 2.0 | 3.0 | 4.0 | 5.0 | Total |

| 1.0 | 4 | 3 | 9 | 36 | 4 | 56 |

| 2.0 | 0 | 0 | 4 | 19 | 7 | 30 |

| 3.0 | 1 | 1 | 5 | 14 | 3 | 24 |

| 4.0 | 0 | 0 | 1 | 4 | 1 | 6 |

| 5.0 | 0 | 0 | 0 | 2 | 0 | 2 |

| Total | 5 | 4 | 19 | 75 | 15 | 118 |

| Table 7 Chi-square Tests |

|||

|---|---|---|---|

| Value | df | Asymp. Sig.(2-sided) | |

| Pearson Chi -Square | 10.389a | 16 | 0.846 |

| Likelihood Ratio | 13.212 | 16 | 0.657 |

| Linear-by-Linear Association | 1.792 | 1 | 0.181 |

| N of Valid Cases | 118 | ||

| a.20cells (80.0%) have expected countless than 5.The minimum expected count is 0.07. | |||

Gender Awareness level

| Table 8 Cross tab |

||||||

|---|---|---|---|---|---|---|

| *Awareness level | ||||||

| Gender | 1.0 | 2.0 | 3.0 | 4.0 | 5.0 | Total |

| 1.0 | 3 | 1 | 9 | 43 | 9 | 65 |

| 2.0 | 2 | 3 | 10 | 32 | 6 | 53 |

| Total | 5 | 4 | 19 | 75 | 15 | 118 |

| Table 9 Chi-square Tests |

|||

|---|---|---|---|

| Value | df | Asymp. Sig.(2-sided ) | |

| Pearson Chi -Square | 2.269a | 4 | 0.686 |

| Likelihood Ratio | 2.301 | 4 | 0.681 |

| Linear-by-Linear Association | 0.677 | 1 | 0.411 |

| N of Valid Cases | 118 | ||

| a.4 cells (40.0%) have expected countless than 5.The minimum expected count is 1.80. | |||

Employment Awareness level

| Table 10 Crosstab |

||||||

|---|---|---|---|---|---|---|

| *Awareness level | ||||||

| Employment | 1.0 | 2.0 | 3.0 | 4.0 | 5.0 | Total |

| 1.0 | 0 | 0 | 0 | 1 | 0 | 1 |

| 2.0 | 0 | 0 | 2 | 1 | 1 | 4 |

| 3.0 | 2 | 3 | 7 | 29 | 2 | 43 |

| 4.0 | 0 | 0 | 0 | 2 | 0 | 2 |

| 5.0 | 3 | 1 | 10 | 42 | 12 | 68 |

| Total | 5 | 4 | 19 | 75 | 15 | 118 |

H3: There is a strong association is exist between education and awareness.

| Table 11 Chi-square Tests |

|||

|---|---|---|---|

| Value | df | Asymp. Sig. (2-sided) | |

| Pearson Chi -Square | 12.404ª | 16 | 0.716 |

| Likelihood Ratio | 13.238 | 16 | 0.655 |

| Linear-by-Linear Association | 1.709 | 1 | 0.191 |

| N of Valid Cases | 118 | ||

| a.4 cells (40.0%) have expected countless than 5.The minimum expected count is 1.80. | |||

Interpretation: Based on the statistical analysis, the model suggests that there is a positive relationship between education and awareness level. The coefficient for Education is positive (B=0.151), indicating that for every one unit increase in Education, there is an increase in the Awareness level by 0.151 units, holding all other variables constant Table 12. The Rsquared value of 0.037 indicates that only a small proportion of the variation in awareness level can be explained by education. However, the ANOVA results show that the regression model is significant (p<0.05), suggesting that education is a statistically significant predictor of awareness level Table 13.

| Table 12 Coefficients a |

|||||

|---|---|---|---|---|---|

| Model | Unstandardized Coefficients | Standardized Coefficients | |||

| B | Std .Error | Beta | t | Sig. | |

| 1(Constant ) | 3.295 | 0.238 | 0.193 | 13.843 | 0.000 |

| Education | 0.151 | 0.071 | 2.121 | 0.036 | |

| a .Dependent Variable :Awareness level | |||||

| Table 13 Anova2 |

|||||

|---|---|---|---|---|---|

| Model | Sum of Squares | df | Mean Square | F | Sig. |

| Regression | 1 | 3.315 | 4.497 | .036b | |

| Residual | 1 3.3151 | 116 | .737 | ||

| Total | 88.822 | 117 | |||

| a .Dependent Variable :Awarnesslevel b .Predictors :(Constant ),Education |

|||||

In summary, the statistical analysis specifies that there is a weak but important positive relationship between education and awareness level. This suggests that individuals with higher levels of education may have a greater awareness of various issues compared to those with lower levels of education. However, education alone may not be the only factor influencing awareness levels, as other variables may also play a role Table 14.

| Table 14 Model Summary |

||||

|---|---|---|---|---|

| Model | R | R Square | Adjusted R Square | Std .Error of |

| 0.193a | 0.037 | 0.029 | 0.8586 | |

| a.Predictors:(Constant),Education | ||||

H4: There is an association between age, gender, education and marital status on awareness of banking services.

Marital status Awareness level

Interpretation: The Chi-Square tests have been used to determine whether there is a significant association between age, gender, education, marital status, and awareness of banking services. The tests have been conducted on a sample of 118 valid cases Table 15, Table 16. The results indicate that there is no significant association between these variables and awareness of banking services. The p-values obtained from the Pearson Chi-Square, Likelihood Ratio, and Linear-by-Linear Association tests are all greater than the significance level of 0.05 (two-tailed), indicating that there is not enough evidence to reject the null hypothesis that there is no association.

| Table 15 Crosstab |

||||||

|---|---|---|---|---|---|---|

| *Awareness level | ||||||

| Marital status | 1.0 | 2.0 | 3.0 | 4.0 | 5.0 | Total |

| 1.0 | 5 | 3 | 12 | 48 | 7 | 75 |

| 2.0 | 0 | 1 | 7 | 26 | 8 | 42 |

| 3.0 | 0 | 0 | 0 | 1 | 0 | 1 |

| Total | 5 | 4 | 19 | 75 | 15 | 118 |

| Table 16 Chi-square Tests |

|||

|---|---|---|---|

| Value | df | Asymp. Sig. (2-sided) | |

| Pearson Chi -Square | 5.635a | 8 | 0.688 |

| Likelihood Ratio | 7.493 | 8 | 0.485 |

| Linear-by-Linear Association | 3.660 | 1 | 0.056 |

| N of Valid Cases | 118 | ||

| a.9 cells (60.0%) have expected countless than 5.The minimum expected count is 0.03. | |||

H5: There is a significant difference between the awareness level based on gender, age and education level.

Interpretation: The hypothesis H5 states that there is a significant difference between the awareness level based on gender, age, and education level. To test this hypothesis, a Paired Samples Test was conducted on three pairs of variables: Age-Awareness level, Gender- Awareness level, and Education-Awareness level Table 17. The results of the test are presented in the table. The results indicate that there is a significant difference between the awareness level based on gender, age, and education level. The p-values for all three pairs are less than .05, which means that the null hypothesis (there is no significant difference) is rejected, and the alternative hypothesis (there is a significant difference) is accepted.

| Table 17 Paired Samples Test |

|||||||||

|---|---|---|---|---|---|---|---|---|---|

| Paired Difference | t | df | Sig .(2-tailed ) | ||||||

| Mean | Std .Deviation | Std .Error mean | 95%Confidence Interval of the Differences | ||||||

| Lower | Upper | ||||||||

| Pair 1 | Age-Awareness level | -1.8898 | 1.2526 | 0.1153 | -2.1182- | 1.6615 | -16.389 | 117 | 0.000 |

| Pair 2 | Gender-Awareness level | -2.3220 | 1.0368 | 0.0954 | -2.5111- | 2.1330 | -24.329 | 117 | 0.000 |

| Pair 3 | Education –Awareness level | -0.6271 | 1.2730 | 0.1172 | -0.8592 | -0.3950 | -5.351 | 117 | 0.000 |

The mean paired differences for age-awareness level and gender-awareness level are negative, which indicates that the awareness level is higher for the younger age group and females than the older age group and males. The mean paired difference for education-awareness level is also negative, which indicates that the awareness level is higher for the more educated group than the less educated group.

H6: There is a correlation between various sources of awareness and level of awareness.

Interpretation: Based on the correlation Table 18 matrix provided, it appears that there is a correlation between various sources of awareness and the level of awareness. The Pearson correlation coefficients range from 0.063 to 0.641, with all but one of the correlations being statistically significant at either the 0.05 or 0.01 level.

| Table 18 Correlations |

|||||

|---|---|---|---|---|---|

| Sources Advertisement | Friend family member | Social media | Banking website | Awareness level | |

| Sources Advertisement | |||||

| Pearson Correlation | 1 | **0.537 | 0.641** | 0.482 | 0.200* |

| Sig .(2-tailed ) | 0.000 | 0.000 | 0.000 | 0.030 | |

| N | 118 | 118 | 118 | 118 | 118 |

| Friend family member | |||||

| Pearson Correlation | 0.537** | 1 | 0.502 | 0.487 | 0.137 |

| Sig .(2-tailed ) | 0.000 | 0.000 | 0.000 | 0.138 | |

| N | 118 | 118 | 118 | 118 | 118 |

| Social media | |||||

| Pearson Correlation | 0.641 | 0.502 | 1 | 0.451 | 0.063 |

| Sig .(2-tailed ) | 0.000 | 0.000 | 0.000 | 0.498 | |

| N | 118 | 118 | 118 | 118 | 118 |

| Banking website | |||||

| Pearson Correlation | 0.482 | 0.487 | 0.451 | 1 | 0.098 |

| Sig .(2-tailed ) | 0.000 | 0.000 | 0.000 | 0.293 | |

| N | 118 | 118 | 118 | 118 | 118 |

| Awareness level | |||||

| Pearson Correlation | 0.200 | 0.137 | 0.063 | 0.098 | 1 |

| Sig .(2-tailed ) | 0.030 | 0.138 | 0.498 | 0.293 | |

| N | 118 | 118 | 118 | 118 | 118 |

| **Correlation is significant at the 0.01level (2-tailed). *Correlation is significant at the 0.05level (2-tailed). |

|||||

The strongest positive correlation is between awareness from social media and awareness level, with a Pearson correlation coefficient of 0.641. This suggests that individuals who are more aware of financial matters through social media are also more likely to have a higher level of overall financial awareness.

Similarly, there is a significant positive correlation between awareness from advertisements and awareness level (0.537), as well as between awareness from friends or family members and awareness level (0.502). These findings suggest that exposure to financial information through these sources may also contribute to an individual's overall level of financial awareness.

Interestingly, there is a weaker but still statistically significant positive correlation between awareness from banking websites and awareness level (0.098). This suggests that utilizing banking websites may also contribute to an individual's financial awareness.

Conlcusion

The banking sector is under pressure to improve due to competition from both domestic and international banks. In India, there is no transparent pricing, and customer protection and awareness are lacking. Customers will have more trust in purchasing financial products and services if they have access to credible and objective information. People's saving habits are improved by investing in banking goods. People's saving habits will improve, and the economy will develop naturally as a result. When it comes to investment, though, people's knowledge of the items is critical. There will be no success until they have a thorough understanding of the investment options available through banks. Banks should take the necessary steps to make their products more marketable. Savings and investment are two important economic indicators that can be used to assess a person's physical well-being and standard of living. In a country like India, individuals only utilize banks for the traditional technique, which is to invest their money in stocks or bonds.

References

Berger, A.N., & DeYoung, R. (2001). The effects of geographic expansion on bank efficiency.Journal of Financial Services Research,19, 163-184.

Indexed at, Google Scholar, Cross Ref

Chawla, S., & Sehgal, R. (2012). An Empirical Analysis of the Awareness and Satisfaction Level of Internet Banking Users with Respect to Demographic Profile.IUP Journal of Marketing Management,11(1).

Elavarasi, R., & Surulivel, S.T. (2014). Customer awareness and preference towards e-banking services of banks (A study of SBI).International Research Journal of Business and Management,4(1), 59-67.

Inegbedion, H., Inegbedion, E.E., Osifo, S.J., Eze, S.C., Ayeni, A., & Akintimehin, O. (2020). Exposure to and usage of e-banking channels: Implications for bank customers’ awareness and attitude to e-banking in Nigeria.Journal of Science and Technology Policy Management,11(2), 133-148.

Indexed at, Google Scholar, Cross Ref

Joseph, A.L., & Prakash, M. (2014). A study on preferred investment avenues among the people and factors considered for investment.International Journal of Management and Commerce Innovations,2(1), 120.

Thambiah, S., Eze, U.C., & Ismail, H. (2011). Customer awareness and current usage of Islamic retail banking products and services in Malaysia.Australian Journal of Basic and Applied Sciences,5(10), 667-671.

Tiwari, P., Tiwari, S.K., & Gupta, A. (2021). Examining the impact of customers’ awareness, risk and trust in m-banking adoption.FIIB Business Review,10(4), 413-423.

Indexed at, Google Scholar, Cross Ref

West, J. (2012). Financial literacy education and behaviour unhinged: combating bias and poor product design.International Journal of Consumer Studies,36(5), 523-530.

Indexed at, Google Scholar, Cross Ref

Received: 09-Jun-2023, Manuscript No. AJEE-23-13718; Editor assigned: 12-Jun-2023, Pre QC No. AJEE-23-13718(PQ); Reviewed: 26- Jun-2023, QC No. AJEE-23-13718; Published: 30-Jun-2023