Research Article: 2019 Vol: 23 Issue: 1

Ability of Earnings and Cash Flows in Forecasting Future Cash Flows: A Study in the Context of Saudi Arabia

Nabil Ahmed Mareai Senan, College of Business Administration, Prince Sattam bin Abdulaziz University

Abstract

We examine a capability of Current Earnings (CEs) and Cash Flows (CFs) and disaggregation of earnings to forecast the Future Operating Cash Flows (FOCF) for 45 Saudi Arabian companies belonging to different sectors from 2006 to 2015. We found significant positive relationship between the CEs and FOCF. Further, we found that the disaggregation of earnings into accruals has greater predictive ability of Forecasting Future Cash Flows (FFCF), while disaggregated earnings into other accrual components has decreased the predictive power. The results of the study are in contrast to the assertion of Financial Accounting Standards Board (FASB) that earnings have the better ability than CFs in FFCF.

Keywords

Current Earnings, Cash Flows, Forecasting Future Cash Flows.

Introduction

The prediction of Future Earnings (FEs) and CFs catches attention in the field of accounting and finance provided that the firms have capability to generate Future Cash Flows (FCFs). Several external parties to the firm are concerned with the prospects of firms’ CFs according to FASB. The accrual accounting provides a much better prediction of firm FCFs compared to the current CFs, since accrual accounting attempt to estimate the financial effects of various transactions on a firm’s CFs (FASB Statement of Concepts). International Accounting Standards Board (IASB) confirms that accrual accounting is a significant domain of financial reporting. A conceptual framework corroborates that accrual based financial reporting provides past and future data to the concerned stakeholders of financial statements.

The pronouncements of FASB assert the significance of accrual based earnings to predict the FCFs. Therefore, this statement has drawn the attention of many researchers from all over the world to investigate the superiority of CEs over current CFs to predict the FCFs. But unfortunately the literature is incomplete in providing concrete evidence on the superiority of earnings over CFs to predict FCFs. A large group of researchers directly examines the pronouncement of FASB that the CEs have good predictive power over current CFs to predict the FCFs. Even though these researchers examined the FASB assertion, they reported mixed results (Kim and Kross, 2005; Greenberg et al., 1986; Beaver, 1989; Barth et al., 2001; Dechow and Dichev, 2001; Ebaid, 2011; Jemaa et al., 2013; Dechow et al., 1998). They suggest the superiority of CEs over CFs, while Bowen et al. (1986) oppose this view along with the other researchers (Finger, 1994; Lorek and Willinger, 2009). The results of these researchers are based on the fact that, the accounting transactions are recognized upon their occurrence, rather than their receipt and payment. Further, Collins et al. (1997) circuitously investigate the FASB assertion of supremacy of CEs over CFs by establishing relationship in the stock market returns and earnings. This fact is also corroborated by Brown et al. (1999) and Ryan and Zarowin (2003). Moreover, they also reported that result of this relationship is not satisfactory over the time.

Firstly, there are always contrasting views by the researchers on whether the CEs or the CFs are superior to forecast the FCFs. Secondly, most of the previous research examining the forecasting abilities of CEs and CFs for FCFs has been undertaken in developed markets, such as USA, UK, etc., while it is meager in emerging markets and yet to be undertaken in the Kingdom of Saudi Arabia (KSA). Thirdly, there are changes taking place in financial reporting standards which might impact the accounting rules of most of the nations in the world. Therefore, the main objective of our research is to observe the forecasting power of earnings and CFs in predicting the FOCF in the context of Saudi Arabia.

The countries in Middle East have started economic reforms to attract investment and promote economic growth. The professional accounting bodies in the Middle East have experienced major reforms in their accounting system during the previous years. The KSA is an emerging economy, which carried out reforms in accounting system from 1930. Further, the official stock market index was established during early 80’s under central bank of KSA to protect the potential investors from adverse market effects. Moreover, Capital Market Authority has been established during a year 2003 to control administrative, legal, and financial regulations in the Kingdom. Furthermore, the current reforms in accounting that are taking place in the Kingdom due to convergence with international accounting regulations might impact the financial disclosure practices. Our current research is contributing to the literature in several ways. Firstly, it represents one of the major emerging countries in the Middle East, and that this is being undertaken for the first time in KSA. Secondly, the accounting practices in KSA are in a transition stage due to major reforms being undertaken by the accounting bodies. Thirdly, the current research might help the Saudi Arabian accounting regulators during this transition period.

The remaining part of this paper is alienated by following sections. The first section explains the related literature, while the second section details the data and methodology used for this research. Further, the third section discusses the empirical findings of the current research and lastly we conclude the study.

Literature Review

Dechow (1994) studied a significance of accruals in predicting some measures of firm’s performance, such as earnings and CFs. He found earnings as a best measurement tool rather than CFs in examining the short-term performance, while the opposite is true in terms of longterm performance. Further, the CFs has some matching and timing problems in reflecting the firm performance compared to earnings. The study also assumes the cash flow approach to be more traditional in measuring the firm performance. Cheng et al. (1997) examined the importance of CFs to the investors at large by comparing SFAS 95 with changes in stock prices and estimates available from the financial statements. They found that the estimated CFs are more significant than earnings. Quirin et al. (1999) studied the supporting relation between the CFs and realized earnings. They reported a collateral effect to those firms with earnings and CFs being negative and unexpected. Their results found opposite to Philipich et al. (1994) and do not support the corroborative relationship between the CFs and realized earnings. Barth et al. (2001) investigated the accruals and their significance in FCF prediction. They incorporated distinct accruals into their model to predict the FCFs. They found that the earnings and their lags significantly explain the expected FCFs. They further reported that different accruals along with the earnings increase the ability of earnings prediction.

Ball et al. (2003) investigated an association among accounting standards and incentives of auditors and company managers for some East-Asian economies, such as Malaysia, Hong Kong, Thailand and Singapore. They evidenced that the incentives dominate the accounting standards in terms of financial reporting. Defond and Hung (2003) investigated the trends in analysts’ forecasts on operating CFs. They found that the financial analysts’ forecast those firms which have huge accruals, different accounting alternatives, excess capital, volatile earnings, and destitute financial position. They further found a lower relationship between earnings and stocks returns among the firms with Cash Flow Forecasts (CFFs). Barth et al. (2005) studied for disaggregation of earnings in forecasting the simultaneous equity values by using earnings, CFs and accruals. They suggested that, there is a concern of error related to prediction effort distribution, while predicting equity values, hence the separation of earning into CFs, four accruals’ components and entire accruals depend on the degree of prediction error. Richardson et al. (2005) explored an association between a persistence of earnings and a reliability of earnings. They reported that low reliability of accruals lowers the persistence in earnings and hence decreases the investors’ anticipation, which in turn leads to security mispricing. They further reported that the security miss-pricing because of lower accrual levels found higher than the previous research studies.

Yan (2005) studied the capability of different accounting’s estimates i.e. earnings, CFs and accruals in predicting the FCFs of listed companies in Hong Kong. They found that the FCF prediction by the current CFs is better than the earnings. Further, the separation of earnings into CFs and accruals and incorporating others accruals’ constituents lead to better forecasting of FCFs. Seng (2006) inspected a capability of different CFs’ measures and earnings to forecast FCFs. He reported that the CFs’ measures, such as CFs from operations and financial transactions are the better predictors rather than the earnings. The result of current study contradicts with the FASB’s assumption that earnings forecast FCFs better than the different cash flow measures. Sarkar et al. (2006) scrutinized an effect of board’s characteristics on a company’s management of earnings. They reported that, the earnings are more affected by the board quality and not the board dependence. They also found that, the hard working board’s members resulted in lower earnings. Conversely, a board consisted of multiple appointments exist are associated with higher earnings. Wasley and Wu (2006) studied the disclosure practices of CFFs by the management. They found that CFFs issued by the management sends signals of pleasant news of CF’s information which meet the demands of investors. Further, they also advised that management should flow the pleasant news to depress the effect of adverse news in earnings.

Farshadfar et al. (2008) tested the comparative predictive capability of earnings and different CF’s measures in forecasting the FCFs of Australian companies. They also included firm size to influence the predictive ability of earnings and CFs from operations and found that such CFs have more predictive ability to forecast the FCFs than that of earnings and different other CFs’ measures. Bandyopadhyay (2008) examined the trends of earnings’ ability to predict FCFs and earnings, and trade-off between reliability and relevance. They found a positive association with reliability but not with relevance. They reported an inverse relationship in reliability and relevance among other measures. Bratten (2009) examined the use of earnings’ components by Analysts’ in FEs’ prediction. He used the integrated financial statement framework to estimate the persistence of earnings’ components. He found that the disaggregation of earnings helps a lot in FEs’ prediction. He also found that even though the analysts’ consider the persistence of earnings’, but they will not integrate it into their forecasts. He concluded by saying that the relation between earnings’ persistence and analysts’ forecasts has declined. Call et al. (2009) examined an accurateness of forecasting of earnings, when accompanied by the CFFs. Their result was consistent with the assumption that the analysts’ earnings’ forecasts have greater accuracy when it is escorted by CFFs. They also reported that accurate CFFs by the analysts will increase the likelihood of their long existence.

Arthur et al. (2010) explored a disaggregation of CFs while forecasting FEs. Their assumption was that the prediction of earnings will be accurate by incorporating different cash flow components. They found that CFs with different components is better to an aggregate CFs’ model in FEs’ prediction. Lev et al. (2010) studied a significance of accountancy’s estimates in forecasting the FEs and CFs. They reported that the accounting estimates out of working capital are weak in predicting the FCFs, while they help in predicting the FEs’ of next year and not of subsequent year. Doukakis (2010) investigated that either earnings along with its components are diligence in post IFRS implementations. They found that disaggregation of earnings’ components helps to predict the future profitability. Further, the adoption of IFRS neither improves the diligence of earnings, nor the earnings’ components to predict the future profitability. Flint et al. (2010) studied the prediction of growth in FEs’ through dividend payout ratio. They rejected the assumption that the firms with large retained earnings have good growth in FEs, while they suggested that the large dividend payout ratios conform to higher growth in earnings, and they are positively associated to FEs growth.

Habib (2010) examined the power of CEs and CFs in predicting the FEs and FCFs from operations. Their results reported that the models based on CFs are more accurate than the models based on earnings to predict the FOCF. Weis (2010) examined the influence of asymmetric behavior of costs on analysts’ forecasts on the forecasts of FEs. The results report that the cohesiveness of costs influences the analysts’ forecasts to forecasts of FEs. The earnings’ forecasts of analysts with high cost cohesiveness are less accurate, while the opposite is true with low cost cohesiveness. Lorek and Willinger (2010) estimated the models predicting the FCFs. They suggested that the models of predicting CFs using time periods is superior to estimation of models in cross-sections’ studies. They also reported that the accurateness of CFs’ forecasting is not affected either the CFs or the earnings are employed to the forecasting models. Zuch and Pronobis (2010) explored the forecasting power of comprehensive income and income’s components. They reported that they don’t find a confirmation on the superiority of a comprehensive-income over net-income in examining the firm performance. Further, they fail to find out the predictive ability of comprehensive income components.

Chen et al. (2011) studied audit-quality effects on management of earnings and equitycapital’s cost in state-owned business and private business. Their results report that the private business experience more reduction in earnings and equity-capital’s cost when auditors of high quality are appointed, while the case is opposite with the SOEs. McInnis and Collins (2011) studied the CFFs and its effect on quality of accruals and earnings benchmark. They reported that when accrual forecasts are presented by the analysts along with the earnings and CFFs, there is an increase in transparency of earnings management. This increases the accrual quality but decreases the firms’ inclination in terms of earnings benchmark. Ebaid (2011) examined the power of CEs and CFs to predict the FCFs, earnings and its components in emerging markets. They reported that the ability of aggregate earnings compare to CFs is more in FCF prediction. Further, the disaggregation of earnings into different components increases earnings ability of predicting FCFs. Debie (2011) studied comparative power of CEs and CFs in predicting the FCFs. He found that the ability of current CFs in predicting the FOCF is greater than that of CEs. Moreover, this ability is stronger in case of larger companies compared to smaller companies.

Seng and Hancock (2012) examined the influence of changes in current fundamental factors and contextual factors on FEs. They found that the ability of fundamental signals is much strong compared to contextual factors in predicting the changes in short-term and long-term FEs. Hammami (2012) studied the predictive power of current CFs compared to CEs in predicting FCFs in high growth rate economy. They found that the current CFs and earnings are not correlated with each other. They reported CFs as the best predictors of FCFs than earnings. Shen (2012) examined the future prediction of earnings with the neural networks with time-delay. They used CFs and accrual components in predicting the FCFs. They found that the addition of earnings components along with the current CFs helps in better prediction of FCFs. Takhtaei and Karimi (2013) investigated the relative power of CFs, earnings and operational working capital in predicting the FCFs. They reported that the earnings have better prediction ability of FCFs compared to current CFs and its different components.

Farshadfar and Monem (2013) examined the predictive power of current CFs and its disaggregation in to various components in forecasting the FCFs. Their results supported the evidence that disaggregation of current CFs improve the forecasting capability of aggregate CFs in envisaging the FCFs. Li et al. (2014) explored an effect of firm’s financial status on its attributes of earnings quality. The researchers found that accruals’ quality, earnings’ forecasting power, and smoothness of earnings are different between low and high performance firms. Bratten et al. (2015) studied the ability of fair value adjustments in predicting the FEs of banks. They found that some of the fair value adjustments have better ability to forecast FEs. They also found that reliable fair value measurements increase the predictive ability. Jemaa et al. (2015) examined the relative power of CEs and current CFs in predicting the FCFs of Tunisian companies. They found that the current CFs is good estimators of FCFs for one or two years than earnings, while the earnings have better predictive ability when FCFs are multi-year. Baranes and Palas (2016) investigated the usefulness of accounting information in forecasting the FEs’ movements. They found that the accounting information has more forecasting ability of tracking FEs’ movements. Li et al. (2017) examined the usefulness of accounting data after IFRS adoption in forecasting the FCFs. They found that the accuracy of prediction by accounting information is more after IFRS adoption. Further, they reported that the results are accurate in those countries where IFRS has been adopted.

As a whole, we found mixed results as to which of earnings or CFs is superior in forecasting the FOCF. Therefore, our study contributed in literature by examining the superiority of earnings over CFs in the largest market of Middle East, i.e. Saudi Arabia. The hypothesis for this study is formulated as follows:

H1: Earnings are superior to CFs in predicting the FOCF.

H2: Earnings disaggregation into CFs and accruals’ components increases the forecasting power of earnings in predicting FOCF.

Methodology

We examine the ability of CEs and CFs and disaggregation of earnings to forecast the FCFs for Saudi Arabian companies. We use earnings, CFs, accruals, account-receivables, account-payables, inventory, depreciation and amortization as variables. We obtain the data from Argaam Database Portal and Tadawul. Our sample consists of the companies from different sectors in the KSA. We select the company for our sample through selection criterion, such as a company might be listed with Tadawul (stock exchange of Saudi Arabia), it should not be from financial sector and it should have data for longer period. Initially, our sample consisted of 57 companies listed on Tadawul, but 12 companies were removed from the sample as per the sample selection criteria. Therefore, our final sample consists of 45 companies from 2006 to 2015. Our sample consists of firms from 12 sectors of KSA. Among these sectors in KSA, the Materials, Food & Beverages, Capital Goods, Retailing sectors together make up 66.67% of the sample, while the materials sector alone make up 40% of the sample. The sector-wise distribution of samples firms is shown in Table 1.

| Table 1 Sector-Wise Distribution Of Sample Firms |

||

| S.No. | Sector | Number of Companies |

| 1 | Materials | 18 |

| 2 | Food & Beverages | 4 |

| 3 | Telecommunications | 3 |

| 4 | Utilities | 1 |

| 5 | Food & Staples | 1 |

| 6 | Capital Goods | 4 |

| 7 | Health Care Equipment | 2 |

| 8 | Retailing | 4 |

| 9 | Energy | 2 |

| 10 | Transportation | 3 |

| 11 | Consumer Durables | 1 |

| 12 | Consumer Services | 2 |

To explore the capability of CEs and CFs in predicting the FCFs, we employ the Cash Flow from Operations (CFO) as an explained variable. The Net Income (EARN), Accruals (ACCR), Change in Accounts Receivable (ΔAR), Change in Accounts Payable (ΔAP), Change in Inventory (ΔINV), Amortization (AMR) as explanatory variables. Entire variables are scaled by Total Assets. We use net income as earnings to predict the FCFs as suggested by (Dechow, 1994; Fedhila, 2003). They are of the opinion that the net-income would be assumed as the best measure of business-performance. Further, we employ accruals and its components as suggested by Dechow and Dichev, 2001; Dumontier 1996) as the changes in CFs happens due to their impact. We estimate five forecasting models based on one year and two year lagged values. We employ fixed effect and random effect panel regression model for estimation of parameters. The results of Hausman test shall be used by us to determine the efficiency of above mentioned methods.

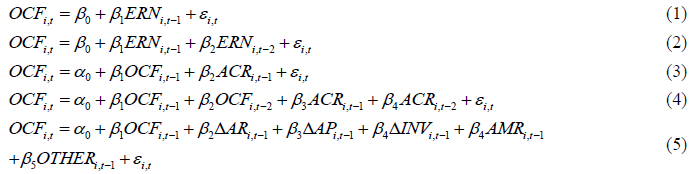

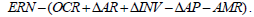

Forecasting Models

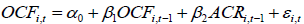

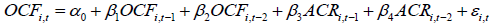

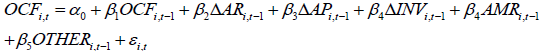

We scrutinize a capability of past earnings, CFs and total accruals for forecasting the FCFs. We estimate five forecasting models following (Greenberg et al., 1986; Jemaa et al., 2015; Eng and Vichitsarawong, 2017). The forecasting models are earnings, cash flow from operations, accruals and accrual components.

Where, OCF is net operating CFs, ERN is net-income, ACR is accruals (net income – CFs from operations) and OTHER represents other accruals calculated as  We evaluate the predictive power of these models by comparing the adjusted-R2 and F statistic.

We evaluate the predictive power of these models by comparing the adjusted-R2 and F statistic.

Descriptive Statistics

Table 2 displays the descriptive statistics. The results show that the mean CFO, earnings, ΔAR, ΔAP, ΔINV and amortization of assets are positive, while total accruals are negative. The negative result of total accruals might be due to the presence of amortization component which is described as an investment activity rather than operating activity under SFAC 95. Table 3 displays the correlation analysis. The correlation of cash from operations, earnings and amortization is significantly positive, while the individual components of accruals are negatively correlated. Further, the individual components are significantly and positively correlated.

| Table 2 Descriptive Statistics |

||||

| Variable | Mean | SD | Min | Max |

| OCF | 13.91 | 25.67 | 0.002 | 101.11 |

| ERN | 9.71 | 17.96 | -0.18 | 70.25 |

| ACR | -3.85 | 9.29 | -50.1 | 6.55 |

| DAR | 1.89 | 8.02 | -0.82 | 52.65 |

| DAP | 1.02 | 2.58 | -0.03 | 12.72 |

| DINV | 1.68 | 4.82 | -0.14 | 25.97 |

| AMR | 6.39 | 13.85 | 0.002 | 80.93 |

| OTHER | -0.47 | 7.03 | -25.69 | 24.4 |

| Table 3 Correlation Matrix |

||||||||

| Variable | OCF | ERN | ACR | ΔAR | ΔIN | ΔAP | AMR | OTHER |

| OCF | 1 | |||||||

| ERN | 0.639* | 1 | ||||||

| ACR | -0.124 | 0.077 | 1 | |||||

| DAR | -0.038* | -0.038 | -0.042 | 1 | ||||

| DINV | -0.0002 | 0.005 | 0.005 | 0.428* | 1 | |||

| DAP | -0.019 | -0.036 | -0.094* | 0.95* | 0.275* | 1 | ||

| AMR | 0.143* | 0.018 | -0.189 | -0.039 | 0.002 | -0.015 | 1 | |

| OTHER | 0.025 | -0.001 | -0.065 | -0.333 | -0.926* | -0.087 | 0.045 | 1 |

Note: *Significant at 0.05 level.

Results

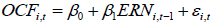

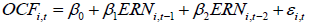

This section discusses the empirical findings. We examine the ability of past earnings, CFs and total accruals to forecast the FCFs by estimating five forecasting models. The CFO is assumed as explained variable for all models. We report the results of these models in Tables 4-8 below.

| Table 4 Results Showing The Forecasting Power Of Earnings |

|||||

Model 1:  |

|||||

| Variables | a | b | t-stat | P-value | |

| Constant | 0.0731 | - | 11.20 | 0.000*** | |

|

- | 0.486 | 7.18 | 0.000*** | |

| Adj. R2 | 0.38 | ||||

| F | 51.53*** | ||||

| Note: ***Significant at 0.01 level. | |||||

| Table 5 Results Showing The Forecasting Power Of Earnings |

|||||

Model 2:  |

|||||

| Variables | a | b | t-stat | P-value | |

| Constant | 0 .0767 | - | 11.06 | 0.000*** | |

|

- | 0.554 | 6.85 | 0.000*** | |

|

- | - 0.115 | 1.53 | 0.126 | |

| Adj. R2 | 0.37 | ||||

| F | 27.02*** | ||||

| Note: ***Significant at 0.01 level. | |||||

| Table 6 Results Showing The Forecasting Power Of Earnings |

|||||

Model 3:  |

|||||

| Variables | α | β | t-stat | P-value | |

| Constant | 0.0731 | - | 10.82 | 0.000*** | |

|

- | 0.486 | 7.17 | 0.000*** | |

|

- | 0.486 | 5.73 | 0.000*** | |

| Adj. R2 | 0.38 | ||||

| F | 25.71*** | ||||

| Note: ***Significant at 0.01 level. | |||||

| Table 7 Results Showing The Forecasting Power Of Earnings |

|||||

Model 4:  |

|||||

| Variables | α | β | t-stat | P-value | |

| Constant | 0.0752 | 0.545 | 10.43 | 0.000*** | |

|

- | -0.110 | 6.70 | 0.000*** | |

|

- | 0.486 | 1.47 | 0.141 | |

|

-0.177 | 5.73 | 0.000*** | ||

|

1.95 | 0.052*** | |||

| Adj. R2 | 0.36 | ||||

| F | 13.86*** | ||||

| Note: *Significant at 0.01 level. | |||||

| Table 8 Results Showing The Forecasting Power Of Earnings |

|||||

Model 5:  |

|||||

| Variables | α | β | t-stat | P-value | |

| Constant | 0.0752 | 10.25 | 0.000*** | ||

|

- | 0 .475 | 6.97 | 0.000*** | |

|

- | .482 | 5.66 | 0.000*** | |

|

-.482 | 5.67 | 0.000*** | ||

|

.483 | 5.68 | 0.000*** | ||

|

-.416 | 4.39 | 0.000*** | ||

|

.482 | 5.67 | 0.000*** | ||

| Adj. R2 | 0.33 | ||||

| F | 9.13*** | ||||

| Note: *Significant at 0.01 level. | |||||

Table 4 displays the estiamtes of model (1) where earnings with one-year lag are associated with CFO. The model’s estimates showed that the earnings are positive and significant at the 1% level. This shows that the earnings have greater predictive ability to forecast CFs for the following year. The model statistics show that adjusted-R2 is 0.38, while the Fstatistic is significant at the 1% level.

Table 5 presents the estimates of model (2) where earnings’ one-year and two-year lags are associated with CFO. The model estimates showed that the earnings with one-year lag are positive and significant at 1% level, while earnings with two-year lag are negative and insignificant. This shows that the earnings with one-year lag have great predictive ability to forecast CFs for the following year. The model statistics show that the adjusted-R2 is 0.37, while the F-statistic is significant at the 1% level. The comparison between models (1) and (2) shows that, the former is better in prediction than the latter, since the adjusted-R2 and F-statistic is of model (1) are better than model (2). The result provides an evidence of the statement related to FASB which describes CEs as better predictor of FCFs (Finger, 1994; Barth et al., 2001). A positive and significant relationship is found between CEs and FOCF (Takhtaei and Karimi, 2013). The result contrasts with the result reported by Lev et al. (2010) where current operating CFs are the best forecaster of future operating CFs than that of earnings. The past decades have experienced more conservative approach of earnings’ recognition due to the application of several FASB notifications (Givoly and Hayn, 2000), and this might be the reason of increase in the ability of CEs in FFCF (Kim and Kross, 2005). Our results are in line with the pronouncements of FASB which explains the ability of earnings in forecasting the FCFs. Greenberg et al. (1986) studied a capability of earnings and operating CFs to forecast the FOCF, and reported the superiority of earnings in prediction over the operating CFs.

Table 6 presents the results of model 3 where past operating CFs and accruals with one year lag are associated with FCF from operations. The model estimates show that the operating CFs and accruals with one year lag are positive and significant at the 1% level. This shows that the operating CFs and accruals with one year lag have greater predictive ability to forecast CFs for the following year. The model statistics show that the adjusted-R2 is 0.38, while the F-statistic is significant at the 1% level. Further, earnings’ disaggregation into CFs and accrual lead in increasing predictive power of earnings, i.e. increase of adjusted R2 from 0.37 to 0.38. Finger (1994) examined a capability of earnings to forecast FOCF, and reported the superiority of operating CFs over earnings in prediction. Similarly, the operating CFs has greater power of prediction than that of earnings in forecasting the FOCF (Al Debie, 2011). Further, Lev et al. (2010) reported that the operating CFs significantly outperform the earnings to forecast the FOCF. Ebaid et al. (2011) reported that both the earnings and operating CFs have a capability to predict the FOCF, however the CEs are superior in prediction over operating CFs.

Table 7 presents the results of model 4 where past operating CFs and accruals with one and two year lags are associated with FCFs from operations. The model estimates show that the operating CFs and accruals with one year lag are positive and significant at the 1% level, while the operating CFs with two year lag are insignificant and accruals with two year lags are negatively significant at the 5% level. This shows that the operating CFs and accruals with one year lag have greater predictive ability to forecast CFs for the following year. The model statistics show that the adjusted R2 is 0.36, while the F-statistic is significant at the 1% level.

Table 8 presents the results of model (5) where past operating CFs and disaggregation of earnings with one year lag are associated with FCF from operations. The model estimates show that the operating CFs and individual accrual components  with one year lag are positive and significant at the 1% level, while the other independent variables are negatively significant at the 1% level. This shows that the operating CFs and disaggregation of earnings with one-year lag have greater predictive ability to forecast CFs for the following year. The model statistics show that the adjusted-R2 is 0.33, while the F-statistic is significant at the 1% level. This shows that, total accruals’ disaggregation into different components is leading to decrease the forecasting capability of earnings, i.e. the adjusted-R2 has decreased from 0.36 to 0.33. Our findings are in contrast to results of Dechow et al. (1998), Holister et al. (2002), Barth et al. (2001) and Al-Attar and Hussain (2004).

with one year lag are positive and significant at the 1% level, while the other independent variables are negatively significant at the 1% level. This shows that the operating CFs and disaggregation of earnings with one-year lag have greater predictive ability to forecast CFs for the following year. The model statistics show that the adjusted-R2 is 0.33, while the F-statistic is significant at the 1% level. This shows that, total accruals’ disaggregation into different components is leading to decrease the forecasting capability of earnings, i.e. the adjusted-R2 has decreased from 0.36 to 0.33. Our findings are in contrast to results of Dechow et al. (1998), Holister et al. (2002), Barth et al. (2001) and Al-Attar and Hussain (2004).

Discussion

We examine the ability of CEs and CFs and disaggregation of earnings to forecast the FOCF for Saudi Arabian companies. We employ CFO as an explained variable. EARN, ACCR, ΔAR, ΔAP, ΔINV, AMR as explanatory variables. The findings from model (1) show that the earnings have greater predictive ability to forecast CFs for the following year. The results of model (2) provides an evidence of the statement related to FASB which describes CEs as better predictor of FCFs (Finger, 1994; Barth et al., 2001) and a relationship between the CEs and FOCF (Takhtaei and Karimi, 2013). The result contrasts with the result reported by Lev et al (2010) where current operating CFs are the best forecaster of FOCF than earnings. The past decades have experienced more conservative approach of earnings’ recognition due to the application of several FASB notifications (Givoly and Hayn, 2000), and this might be the reason of increase in the ability of CEs in FFCF (Kim and Kross, 2005).

1. Our results of Models (1) and (2) are in line with the pronouncements of FASB which explains the ability of earnings in forecasting the FCFs. Greenberg et al. (1986) studied a capability of earnings and operating CFs to forecast the FOCF, and reported the superiority of earnings in prediction over the operating CFs.

2. Further, the results of Model (3) shows the disaggregation of earnings into CFs and accruals leading in increasing the forecasting power of earnings, i.e. an increased adjusted R2 from 0.37 to 0.38. Finger (1994) examined a capability of earnings in forecasting FOCF, and reported the superiority of operating CFs over earnings in prediction. Similarly, the operating CFs has greater power of prediction than that of earnings in forecasting the FOCF (Al Debie, 2011). Further, Lev et al. (2010) reported that the operating CFs significantly outperform the earnings to forecast the FOCF. Ebaid et al. (2011) reported that both the earnings and operating CFs are showing a capability in forecasting the FOCF, however the CEs are superior in prediction over operating CFs.

The results of Model (4) shows that the operating CFs and accruals with one-year lag have greater predictive ability to forecast CFs for the following year.

4. The results of Model (5) shows that the operating CFs and disaggregation of earnings with one-year lag have greater predictive ability to forecast CFs for the following year. The model statistics show that adjusted-R2 is 0.33, while the F-statistic is significant at the 1% level. This shows that total accruals’ disaggregation in different components is leading to decrease the forecasting capability of earnings, i.e. adjusted-R2 has decreased from 0.36 to 0.33. The findings of our study found in contrast to results of Dechow et al. (1998), Barth et al. (2001), Holister et al. (2002) and Al-Attar and Hussain (2004).

The results reported by our study shows that earnings and CFs have equal predictive ability in forecasting the FCFs, while the disaggregation of earnings into different accrual components decreases the predictive ability. Therefore, our study rejects the two hypotheses, that earnings are superior to CFs and earnings disaggregation increases the predictive power of earnings in FFCF. Further, the results of our study are in contrast to the assertion of FASB that earnings have the better ability than CFs in FFCF.

Conclusion

We examine the ability of CEs and CFs and disaggregation of earnings to forecast the FOCF for 45 Saudi Arabian companies belonging to different sectors from 2006 to 2015. We employ the CFO as a explained variable and EARN, ACCR, ΔAR, ΔAP, ΔINV, AMR as explanatory variables. We estimate five forecasting models. We found a positive relationship in CEs and FOCF. Our results of models (1) and (2) are in line with the pronouncements of FASB which explains the ability of earnings in forecasting the FCFs. The disaggregation of earnings into accruals has greater predictive ability of FFCF, while the disaggregation of earnings into other accrual components has decreased the predictive power. The results reported by our study shows that earnings and CFs have equal predictive ability in forecasting the FCFs, while the disaggregation of earnings into different accrual components decreases the predictive ability. Further, the results of our study are in contrast to the assertion of FASB that earnings have the better ability than CFs in FFCF.

References

- Al-Attar, A., & Hussain, S. (2004). Corporate data and FCF. Journal of Business Finance and Accounting, 31(7-8), 861-903.

- Ball, R., Robin, A., & Wu, J.S. (2003). Incentives versus standards: Properties of accounting income in four East Asian countries. Journal of Accounting and Economics, 36, 235-270.

- Bandyopadhyay, S.P., Chen, C., Huang, A.G., & Jha, R. (2010). Accounting conservatism and the temporal trends in CEs’ ability to predict FCFs versus FEs: Evidence on the trade-off between relevance and reliability. Contemporary Accounting Research, 27(2), 413-460.

- Baranes, A., & Palas, R. (2016). The prediction of earnings movements using accounting data: Using XBRL. International Journal of Accounting Research, 5(1), 1-7.

- Barth, M.E., Cram, P.D., & Nelson, K.K. (2001). Accruals and the prediction of FCFs. The Accounting Review, 76(1), 27-58.

- Barth, M.E., Hand, J.R.M., & Landsman, W.R. (2005). Accruals, accounting-based valuation models, and the prediction of equity values. Working Paper. Retrieved from https://pdfs.semanticscholar.org/6544/ e34edfb70bdcbdcd6cf332040d987ee28280.pdf

- Beaver, W.H. (1989). Financial accounting: An accounting revolution. Prentice-Hall, Engle-wood Cliffs, N J.

- Bowen, R.M., Burgstahler, D., & Daley, L.A. (1986). Evidence on the relationships between earnings and various measures of cash flow. The Accounting Review, 61(4), 713-725.

- Bratten, B., Causholli, M., & Khan, U. (2016). Usefulness of fair values for predicting banks’ FEs: Evidence from other comprehensive income and its components. Review of Accounting Studies, 21, 280-315.

- Brown, L.D., & Pinello, A.S. (2007). To what extent does the financial reporting process curb earnings surprise games? Journal of Accounting Research, 45(5), 947-981.

- Call, A.C., Chen, S., & Tong, Y.H. (2009). Are analysts’ earnings forecasts more accurate when accompanied by cash-flow forecasts. Review of Accounting Studies, 14(2/3), 358-391.

- Chen, H., Chen, J.Z., Lobo, G.L., & Wang, Y. (2011). Effects of audit quality on earnings management and cost of equity capital: Evidence from China. Contemporary Accounting Research, 28(3), 892-925.

- Cheng, A.N., & Czernkowski, R. (2010). Cash flow disaggregation and the prediction of FEs. Accounting & Finance, 50(1), 1-30.

- Cheng, C.S., Agnes, Liu., & Chao-Shin. (1997). The value-relevance of SFAS N°95: Cash-flows from operations as assessed by security market effects. Accounting Horizons, 11, 15-18.

- Dechow, P.M. (1994). Accounting earnings and CFs as measures of firm performance: The role of accounting accruals. Journal of Accounting and Economics, 18, 3-42.

- Dechow, P.M., Kothari, S.P., & Watts, R.L. (1998). The relation between earnings and CFs. Journal of Accounting and Economics, 25, 133-168.

- Dechow, P.M., & Skinner, D.J. (2000). Earnings management: reconciling the views of accounting academics, practitioners, and regulators. Accounting Horizons, 14, 235-251.

- Dechow, P.M., & Dichev, I.D. (2001). The quality of accruals and earnings: The role of accruals estimation errors. The Accounting Review, 77, 35-59.

- Doukakis, L.C. (2010). The persistence of earnings and earnings components after the adoption of IFRS. Managerial Finance, 36 (11), 969-980.

- Dumontier, P., & Labelle, R. (2010). Accounting earnings and firm valuation: The French case. European Accounting Review, 7(2), 163-183.

- Ebaid, I.E. (2011). Accruals and the prediction of FCFs: Empirical evidence from an emerging market. Management Research Review, 34(7), 1-32. 291.

- Eng, L.L., & Vichitsarawong, T. (2016). Usefulness of accounting estimates a tale of two countries (China and India). Journal of Accounting, Auditing & Finance, 32(1), 123-135.

- Farshadfar, S.,&Monem, R.(2013). The usefulness of operating cash flow and accrual components in improving the predictive ability of earnings: a re-examination and extension. Accounting & Finance, 53(4), 1061-1082.

- Farshadfar, S., Ng, C., & Brimble, M. (2008). The relative ability of earnings and cash flow data in FFCF. Pacific Accounting Review, 20(3), 251-268.

- Finger, C.A. (1994). The ability of earnings to predict FEs and cash flow. Journal of Accounting Research, 32(2), 210-23.

- Flint, A., Tan, A., & Tian, G. (2010). Predicting FEs growth: A test of the dividend payout ratio in the Australian market. The International Journal of Business and Finance Research, 4(2), 43-58.

- Givoly, D., & Hayn, C. (2000). The changing time-series properties of earnings, CFs and accruals: Has financial reporting become more conservative? Journal of Accounting and Economics, 29, 287-320.

- Greenberg, R.R., Johnson, J.L., & Ramesh, K. (1986). Earnings versus cash flow as a predictor of FCF measures. Journal of Accounting, Auditing & Finance, 1(4), 266-277.

- Habib, A. (2010). Prediction of operating CFs: Further evidence from Australia. Australian Accounting Review, 20(2), 134.

- Hammami, H. (2012). The use of reported cash-flows versus earnings to predict cash-flows: Preliminary evidence from Quatar. The Busines Sytems Review, 1, 103-121.

- Hollister, J., Shoaf, V., & Tully, G. (2008). The effect of accounting regime characteristics on the prediction of FCFs: An international comparison. International Business and Economics Research Journal, 7(5), 15-30.

- Jemaa, O.B., Toukabari, M., & Jilani, F. (2015). The examination of the ability of earnings and cash flow in predicting FCFs: Application to the Tunisian context. Accounting and Finance Research, 4(1), 1-16.

- Kim, M., & Kross, W. (2005). The ability of earnings to predict FOCF has been increasing-not decreasing. Journal of Accounting Research, 43(5), 753 -780.

- Lev, B.,Li, S.,&Sougiannis, T.(2010). The usefulness of accounting estimates for predicting CFs and earnings. Review of Accounting Studies, 15(4), 779-807.

- Li, F., Abeysekera, I., & Ma, S. (2014). The effect of financial status on earnings quality of Chinese-listed firms. Journal of Asia-Pacific Business, 15(1), 4-26.

- Li, S., Sougiannis, T., & Wang, I.L. (2017). Mandatory IFRS Adoption and the usefulness of accounting information in predicting FEs and CFs. Retrieved from http://dx.doi.org/10.2139/ssrn.2948775

- Lorek, K., &Willinger, G.(2009). New evidence pertaining to the prediction of operating CFs. Review of Quantitative Finance and Accounting, 32(1),1-15.

- Mcinnis, J., & Collins, D. (2011). The effect of cash-flow forecasts on accrual quality and benchmark beating. Journal of Accounting and Economics, 5(3), 219-239.

- Quirin, J.J., O'Bryan, D., Wilcox, W.E. & Berry, K.T. (1999). Forecasting cash flow from operations: Additional evidence. The Mid-Atlantic Journal of Business, 35(2-3), 135-42.

- Richardson, S.A.,Sloan, R.G.,Soliman, M.T., & Tuna, I.(2005). Accrual reliability, earnings persistence and stock prices. Journal of Accounting and Economics, 39(3),437-485.

- Ryan, S.G., & Zarowin, P.A. (2003). Why has the contemporaneous linear returns-earnings relation declined? The Accounting Review, 78(2), 523-553.

- Sarkar, J., Sarkar, S., & Sen, K. (2008). Board of directors and opportunistic earnings management: Evidence from India. Journal of Accounting, Auditing & Finance, 23(4), 517-551.

- Seng, D. (2006). Earnings versus CFs as predictors of FCFs: New Zealand evidence. Working Paper, University of Otago.

- Takhtaei, N., & Karimi, H. (2013). Relative ability of earnings data and cash flow in predicting FCFs. International Journal of Accounting and Financial Reporting, 3(1), 214-226.

- Wasley, C.E. & Wu, J.S. (2006). Why do managers voluntarily issue CFFs? Journal of Accounting Research, 44(2), 389-429.

- Weiss, D. (2010). Cost behavior and analysts’ earnings forecasts. The Accounting Review, 85(4), 1441-1471.