Research Article: 2020 Vol: 24 Issue: 3

Abnormal Audit Fees and Audit Quality, The Impact of Business Context on Auditors' Priorities

Felice Matozza, University of Roma Tre

Anna Maria Biscotti, University of Foggia

Eugenio D’Amico, University of Roma Tre

Alberto Dello Strologo, European University of Rome

Abstract

Companies facing serious financial distress are more likely to engage in income-increasing earnings management than healthy firms in order to mask poor performance. In these contexts, audit firms might increase substantive tests, that should constrain discretionary accruals, as well as charging risk premiums, both resulting in growing audit fees. The different components of audit fees, namely a fee premium for auditors’ efforts or risk premium, however, have an opposing impact on audit quality. This paper aims thus to investigate how the business context status of a client might differently affect the auditors’ pricing policies and commitments in the audit process. We address our research questions adopting a matched sample consisting of bankrupt and healthy US firms in the post-SOX period, between 2005 and 2015. Consistent with our predictions, the results show a significant propensity of ex-post bankrupt firms to adopt upward earnings management. In these critical contexts, it reveals that auditors are primarily concerned about obtaining a risk premium, especially in the first year of an engagement, rather than extending the audit efforts to constrain earnings manipulation. By contrast, the higher audit fees charged to healthy companies by the newly appointed auditors result in effective audit efforts, therefore improving the earnings quality. This study thus provides evidence that in riskier business contexts auditors prefer conservative approaches to pro-active commitments by primarily adjusting risk premiums in response to a higher litigation risk. The paper contributes to the extant literature by documenting the existence of a component in the audit fees that results in low audit quality.

Keywords

Audit Quality, Earnings Management, Abnormal Audit Fees, Bankruptcy, Risk Premium, Audit Pricing.

JEL Classifications

G33, M41, M42

Introduction

Companies facing serious financial distress are more likely to engage in incomeincreasing earnings management than healthy firms in order to mask poor performance (Kallunki & Martikainen, 1999). Previous studies have documented income-increasing accruals within firms experiencing financial difficulties, i.e., in the years prior to the bankruptcy process for firms that receive clean audit opinions (Charitou et al., 2007) or in non-going-concern years (Rosner, 2003), prior to debt-covenant violations (DeFond & Jiambalvo, 1994; Sweeney, 1994), before technical default (Beneish et al., 2012), or during economic downturns (Trombetta & Imperatore, 2014). In this context, audit firms of riskier clients might increase substantive tests, that should constrain discretionary accruals, as well as charging risk premiums, both resulting in growing audit fees. A recent study conducted by Cenciarelli et al. (2018) documented that auditors charged higher fees to ex-post bankrupt companies. However, the higher audit fees could represent both extended audit efforts and/or higher risk premiums (Lobo & Zhao, 2013), but Cenciarelli et al. (2018) did not distinguish between them. Thus, the purpose of our study is to fill this gap in the literature by investigating the earnings management behavior of ex-post bankrupt firms and analyzing whether the higher audit fees charged reflect the auditors’ efforts in constraining corporate earnings management or risk premium. We address our research questions adopting a sample of 184 matched bankrupt and healthy US firms in the post-SOX period.

The US environment is an interesting setting to investigate auditors’ behaviors because in the aftermath of SOX implementation they are subject to stricter regulation, with the Public Company Accounting Oversight Board inspection when auditing SEC registrants and restrictions to sell non-audit services. Besides, owing to the demise of Arthur Andersen, auditors would be more aware of the risk related to audit failure (Blankley et al., 2012). Moreover, failing firms are often associated with lower earnings quality which, in turn, increases litigation risk against auditors (Heninger, 2001) that is substantial in the US context (Wingate, 1997).

In line with prior studies, we measure audit efforts and/or risk premium by computing abnormal audit fees (Lobo & Zhao, 2013) and audit quality by calculating discretionary accruals (Heninger, 2001; Gul et al., 2003).

Consistent with our predictions, the results show a significant propensity of ex-post bankrupt firms to adopt upward earnings management. Furthermore, in these critical contexts we reveal that auditors are primarily concerned about obtaining a risk premium, especially in the first year of an engagement, rather than extending the audit efforts to constrain earnings manipulation. By contrast, the higher audit fees charged to healthy companies by the newly appointed auditors result in effective audit efforts, therefore improving the earnings quality. Overall, our results signal that abnormal audit fees in a highly risky context might be indicative of other prevailing conditions besides extra-audit efforts, i.e., an attempt to recoup moneys from sanctions that could have been imposed by national enforcers, or reputational or legal costs which the auditors could incur when reviewing the financial statements of ex-post bankrupt companies (Hribar et al., 2014).

Our paper makes several contributions.

In primis, this study improves upon the findings of Cenciarelli et al. (2018) by arguing and finding that the higher audit fees related to a bankruptcy event may be attributable to the presence of risk premium rather than higher audit efforts. In particular, the risk premium component is more pronounced for firms which change the auditor.

Moreover, we complement the work of Niemi (2002), Houston et al. (1999) and Jiang and Son (2015) who encourage new studies and call for a deeper understanding of risk premiums in audit fees, testing whether ex-post bankrupt US clients, charged with larger audit fees, exhibit higher earnings management given that the authors expected to find risk premiums in more litigious settings.

Finally, our work extends research on the effects of auditor changes on audit pricing (Fleischer et al., 2017) by demonstrating that the higher fees requested by newly appointed auditors represent a fee premium for healthy firms, resulting in quality improvements in earnings.

Our study also presents practical implications. In particularly, the identification of the factors that compromise audit quality is an important issue for investors and regulators. Our results highlight how in riskier organizational settings, such as financially distressed firms, auditors tend to prefer a conservative approach instead of concentrating the audit efforts on higher earnings quality (Francis & Krishnan, 1999; Abbott et al., 2006). However, while receiving a modified audit opinion (i.e., not receiving a clean opinion) warns financial statement users of impending problems and represents a visible indicator of client-firm risk, risk premium is a deadweight loss, unrelated to audit quality (DeFond & Zhang, 2014), that could hide critical information from the principal stakeholders. In this way, the auditors engage in a strategy to mitigate litigation risk by shifting expected losses to the client without reducing earnings management.

The remainder of this work follows the outline given below. The second section reviews existing literature and outlines the development of the three hypotheses tested in our study. The third section describes the empirical research: the statistical models and the sample adopted. Lastly, the fourth section reports and discusses the results and the fifth section concludes the paper.

Literature and Hypotheses Development

The US audit market is characterized by unique institutional features that allow this setting to differentiate from others, namely the greater public enforcement (Files, 2012), the greater auditors’ exposure to legal liability (Krauß et al., 2015; Ghosh & Pawlewicz, 2009) and the higher litigation risk (Bronson et al., 2017; Gu & Hu, 2015) that are expected to affect audit quality and risk premium. Furthermore, the new regulation introduced in the aftermath of SOX implementation, which caused the overall increase in audit fees (Ghosh & Pawlewicz, 2009), may have changed the audit fees determination and the auditors related behavior.

Prior research on earnings management has often focused on firms showing signs of financial distress; the most common proxy utilized was debt covenant violation.

Sweeney (1994) and DeFond and Jiambalvo (1994) found evidence of firms making income-increasing accounting choices when approaching covenant violations, in order to avoid costly associated activities (Beneish & Press, 1993), and Franz et al. (2014) reported that the use of income-increasing accruals for firms close to technical default or violation of their debt covenant are primarily observed in the case of firms experiencing financial difficulties.

Gupta et al. (2008) argued that firms with bad news are more likely to conceal that news using accruals and Chen et al. (2010) found that financially distressed firms in China manage earnings upwards to avoid being de-listed. Firms with debt covenant problems and persistent losses, however, are undoubtedly less distressed than those filing for Chapter 11 (Charitou et al., 2007).

Chapter 11 allows a troubled firm to propose a reorganization plan to its creditors, as well as to the court, with the aim of convincing them to support reorganization over liquidation by reorganizing the firm’s activities and changing its capital structure (Fisher et al., 2019).

Further incentives for positive earnings management include, among others, going for IPO (Alhadab et al., 2015), increasing compensation for CEOs (Bergstresser & Philippon, 2006), reducing interest rates (Cassar et al., 2015) and avoiding a decrease in or loss of earnings (Burgstahler & Dichev, 1997).

However, Argenti (1976) argues that earnings manipulation or “creative accounting” are mainly aimed at hiding distress and postponing failure. Managers might thus manipulate discretionary accruals to increase earnings so as to avoid or postpone the process of filing for bankruptcy. To this end, Du Jardin et al. (2019) found that the inclusion of earnings management measures in bankruptcy prediction models improves their predictive ability by providing specific information that helps discriminate between bankrupt and non-bankrupt firms.

The first studies regarding earnings management and bankruptcy were mainly carried out in Anglo-Saxon countries before SOX implementation. In this regard, Rosner (2003), investigating the accruals manipulation of failed US companies, documented that in the years before bankruptcy firms without going-concern opinion reported higher earnings management due to lower audit scrutiny. Similarly, García Lara et al. (2009), examining a sample of publicly quoted UK firms, showed that accruals manipulation was more pronounced in the case of ex-post bankrupt firms that did not show signs of financial difficulties.

The investigation of the relationship between company failure and earnings management behavior has been explored thoroughly within small-medium firms (Campa & Camacho-Miñano, 2015) and in diverse institutional contexts outside Anglo-Saxon countries, (Kallunki & Martikainen (1999), for Finland; Campa & Camacho-Miñano (2014), for Spain; Li et al. (2011), for China), evidencing that failed firms manage reported earnings upwards prior to bankruptcy. Earnings manipulation before failure also results in reducing conditional conservatism (García Lara et al., 2009). Similarly, existing literature also sheds light on the fact that asset capitalizations can be exploited by opportunistic managers in failing firms. Jones (2011) found that failing firms in Australia, where permissive national accounting standards previously implemented allowed opportunistic managers to exert significant discretion in capitalizing a wide range of intangible, capitalized intangible assets more aggressively than non-failed firms to reduce net income losses.

Research has also indicated that distressed firms face substantial costs in terms of bankruptcy. More specifically, these costs include not only direct bankruptcy costs, such as professional fees and internal administrative expenses, but also the indirect costs associated with bankruptcy, such as loss of market share and discounted asset sales (Branch, 2002). Lastly, corporate bankruptcy also imposes personal costs on the firm’s managers (Gilson, 1989) and damages their reputation. A recent study by Eckbo et al. (2016) found that the CEOs of bankrupt firms are highly likely to lose their jobs, have reduced employment prospects and experience reduced compensation.

Therefore, based on previous empirical evidence and the aforementioned arguments relating to bankruptcy costs, we expect that failing firms will be strongly motivated to materially overstate earnings. We thus hypothesize opportunistic earnings management behavior, as follows:

H1 Failing firms manage earnings upwards more than healthy companies

Prior studies suggested that auditors respond to client-specific business risk by increasing audit effort, highlighting that auditors charge high-risk clients higher fees (Bell et al., 2001; Schelleman & Knechel, 2010). Raghunandan & Rama (2006), Hoitash et al. (2008) and Feldmann et al. (2009) documented that firms which disclosed internal control material weaknesses and accounting errors, respectively, are charged higher audit fees. However, while much of the prior work in this area consistently found higher audit fees in the presence of higher audit risk, there is contrasting evidence as to whether such fees reflect additional auditing effort and/or a higher risk premium. On the one hand, Blankley et al. (2012) reported that the auditors of restating firms in the year of misstatement received low abnormal audit fees, Eshleman and Guo (2014) and Mendiratta (2019) found that firms paying higher abnormal audit fees were significantly less likely to use discretionary accruals to meet or beat the consensus analyst forecast and Ettredge et al. (2014) documented that lower fee pressure during the 2008 financial crisis resulted in a higher number of misstatements. This evidence is consistent with higher audit fees improving auditor effort and, ultimately, audit quality.

On the other hand, Niemi (2002), Houston et al. (1999) and Jiang and Son (2015) reported the existence of risk premiums in audit fees for listed firms, clients characterized by a higher than average business risk, in the presence of irregularities and when companies’ internal controls deteriorated, respectively. Gul et al. (2003) found a positive association between discretionary accruals and audit fees with accounting-based management compensation which strengthens this relationship. Moreover, Simunic & Stein (1996) identified increasing audit fees in the case of firms facing a higher litigation risk and Abbott et al. (2006) documented that audit fees for firm clients with income-increasing discretionary accruals are larger, and that this relationship is strengthened in the case of high price-earnings ratio firms that have incentives to improve earnings in order to meet forecasts.

Overall, based on the analysis of the aforementioned studies on abnormal audit fees, a fundamental discriminant affecting auditor pricing related to the riskiness of the business context emerged. These studies, in particular, suggested that in riskier settings auditors tend to charge higher audit fees due to the risk premium, while the auditors’ propensity to curb earnings management would prevail in heathier organizations. Therefore, it is expected that in highly risky contexts, such as those characterizing companies in serious financial distress (Carcello & Palmrose, 1994), the higher audit fees charged by auditors can primarily be explained by risk premium rather than fee premium related to a greater commitment to improving earnings quality. We thus formulate our second hypothesis as follows:

H2 Abnormal audit fees charged by auditors to failing firms reflect risk premium rather than greater audit efforts in constraining income-increasing earnings management

Previous findings supported the fact that failing firms are more likely to switch auditors than healthy firms (Schwartz & Menon, 1985). Companies voluntarily change audit firms to manage earnings and avoid receiving qualified audit reports (DeFond & Subramanyam, 1998; Lennox, 2000). Managers of failed firms are also incentivized to replace an auditor as this implies lowballing, favoring new clients who could benefit from fee discounts in the initial-year audits although substantial additional efforts characterize that period (Huang et al., 2009; Cameran et al., 2015).

However, such fee discounts offered to attract new clients are contingent upon a client’s financial health (Walker & Casterella, 2000), consistent with the idea that auditors require higher fees in response to increased client risk, and the regulatory environment, in fact stricter legislation enacted in the post-SOX impaired audit fee discounting for new engagements (Huang et al., 2009).

Furthermore, the incoming auditor of a firm in severe financial difficulties might not be able to constrain earnings management in the first engagement years due to learning curve effects (Cameran et al., 2015; Gul et al., 2009).

Owing to greater difficulty in improving the earnings quality of an unfamiliar organizational context, we expect that the newly appointed auditors of firms in serious financial distress will face a higher audit risk in the early years of an engagement (Carcello & Nagy, 2004; Lennox, 2014), thereby charging higher fees justified by the risk premium.

The third hypothesis is therefore formulated as follows:

H3 Abnormal audit fees charged by newly appointed auditors to failing firms reflect risk premium rather than greater audit efforts in constraining income-increasing earnings management

Research Design

Econometric Regression Models and Description of The Variables

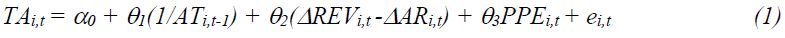

Discretionary Accruals Model

In line with prior literature on audit research (Heninger, 2001; Gul et al., 2003) we adopted the accruals model outlined by Dechow et al. (1995), which represents an extension of Jones’ (1991) model, which divides accruals into two components: discretionary and nondiscretionary. Discretionary accruals are computed by collecting residuals (e) from Equation (1) using ordinary least squares regressions. We regressed all observations separately with available data on the Compustat database for each two-digit US SIC industry year group, adopting the following equation:

where TA represents total accruals, calculated as net income minus cash flow from operations, AT constitutes total assets, ΔREV and ΔAR are the changes in revenue and net receivables from year t to year t-1, respectively, and PPE is gross property, plant and equipment. TA, ΔREV, ΔAR and PPE are scaled by lagged total assets.

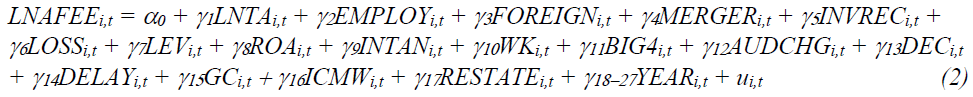

Audit Fee Model

To divide audit fees into two components, i.e., the expected component and the abnormal audit fees, in line with extensive research on audits (Blankley et al., 2012; Eshleman & Guo, 2014; Lobo & Zhao, 2013) we adopted the following model:

where LNAFEE constitutes logged audit fees. Consistent with prior research, we included several control variables (Eshleman & Guo, 2014; Ettredge et al., 2014; Hoitash et al., 2008; Kanakriyah, 2020). We included the natural logarithm of total assets (LNTA) and the number of employees in thousands (EMPLOY) as a control in terms of size (Eshleman & Guo, 2014). Complexity measures used by prior audit fee research included the following variables: a dummy variable equals one if the client audited has foreign operations (FOREIGN), an indicator variable equals one if the firm is engaged in a merger or acquisition (MERGER) and the total of the accounts receivable plus inventory scaled by total assets (INVREC) (Hoitash et al., 2008).

We included a binary variable to control whether a firm reported a loss (LOSS); the ratios of long term-debt (LEV), earnings before interest and tax (ROA), intangible assets (INTAN) and working capital (WK), are all scaled by total assets, to capture firm risk (Eshleman & Guo, 2014; Blankley et al., 2012).

We also included several variables related to the audit that affected audit fees: BIG4 is used as a control for audit quality, AUDCHG captures fee negotiation at initial audit engagements, DEC is a binary variable and equals one if the company’s fiscal year is December and DELAY represents the number of days between fiscal year-end and the signature date of audit opinion (Lobo & Zhao, 2013). We included three proxies for audit risk by adding binary variables for companies that received a going concern opinion (GC), disclosed internal control material weaknesses (ICMW) and restated their previously published financial statement (RESTATE) (Ettredge et al., 2014).

Finally, we included year (YEAR) fixed effects.

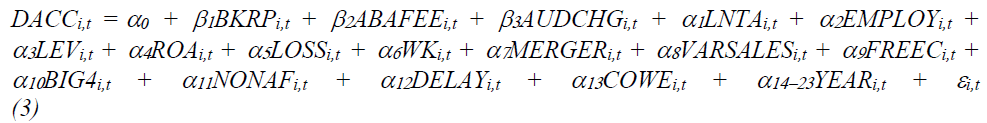

Main Model

Subsequently, to test whether ex-post bankrupt firms manage earnings upwards one year before filing for Chapter 11, we performed the following ordinary least squares regression:

where DACC constitutes signed discretionary accruals, calculated using the Dechow et al. (1995) model, as shown in Equation (1). To test Hypothesis 1, we adopted the explanatory variable BKRP in Equation (3), which is a dummy variable that equals 1 for ex-post bankrupt firms, and 0 otherwise. In line with Hypothesis 1, we expected a positive relationship between BKRP and DACC. To test Hypothesis 2, we developed the basic model shown in Equation (3) and added an interaction term (β4) between BKRP and ABAFEE, viz. residuals (u) from the audit fee model presented in Equation (2), to examine whether auditors’ abnormal audit fees in a bankruptcy setting translated into low earnings quality. In line with Hypothesis 2, we expected a positive relationship between the interaction term BKRP*ABAFEE and DACC.

Finally, to test Hypothesis 3, we included in Equation (3) a three-way interaction term (β7) between BKRP, ABAFEE and AUDCHG, which proxies audit change, jointly with the remaining two pairs of two-way interaction terms, i.e., BKRP*AUDCHG (β5) and ABAFEE*AUDCHG (β6), to examine whether in the case of failed firms that are charged with abnormally high audit fees DACC is sensitive to voluntary auditor changes. Prior research suggests reduced audit quality when auditor changes occur (Cameran et al., 2015; Gul et al., 2009).

Based on prior research into the determinants of earnings management (Chen et al., 2010; Choi et al., 2010), we included several firm- and audit-control variables in the model.

In Equation (3), we included LNTA and EMPLOY to control the size effect (Choi et al., 2010). We captured client-specific risk factors by adding LEV, ROA, LOSS, WK (Chen et al., 2010; Choi et al., 2010; Robinson, 2008) and MERGER (Lobo & Zhao, 2013). In line with Blankley et al. (2012), we added a variable relate to the demand for external financing, namely FREEC, which equals operating cash flow less average capital expenditures, scaled by lagged total assets. We included VARSALES, which equals the annual growth in sales, expected to be positively related to discretionary accruals (Asthana & Boone, 2012).

We also included four variables related to audit quality and audit risk: BIG4 acted as a control for audit quality, NONAF was the ratio of non-audit fees to total fees that acted as a control for a possible economic bonding effect (Hribar et al., 2014), DELAY partly controlled the extent of auditor effort on earnings quality (Asthana & Boone, 2012) and COWE represented the number of internal control weaknesses (Chan et al., 2008). Lastly, we included year fixed effects (YEAR).

Sample and Data Collection

We collected data on failed companies that filed for Chapter 11 between 2005 and 2015, with a bankruptcy end date before the close of 2016, from the Bankruptcy database (Corporate + Legal Module) provided by Audit Analytics.

We excluded failed firms operating in the financial and real estate industries (SIC 60-69) and limited the sample to firms whose financial statement data were available 18 months before the bankruptcy start date in CRSP/Compustat Merged Database.

This procedure yielded a sample of 92 firms. In addition, we selected a pair-matched sample of firms by identifying the non-failed firm that was closest in terms of total assets, operating within the same industry (had the same two-digit US SIC codes), and with data available in the CRSP/Compustat Merged Database, as a match for each failed firm. Furthermore, the data collected in relation to non-failed firms came from the same years as those of the bankrupt firms. Consequently, we obtained a final sample of 184 firms. Audit (and nonaudit) fee and auditor data were obtained from Audit Analytics (Audit + Compliance Module).

Results and Discussion

Table 1 presents the descriptive statistics for our sample observations, including the means, medians, standard deviations and Pearson’s correlations of the variables used in Equation (3).

| Table 1 Descriptive Statistics and Pearson’s Correlations | ||||||||||

| Variables | Mean | Median | S.D. | [1] | [2] | [3] | [4] | [5] | [6] | [7] |

| [1] DACC | 0.12 | 0.00 | 1.23 | |||||||

| [2] BKRP | 0.50 | 0.50 | 0.50 | 0.01 | ||||||

| [3] ABAFEE | 0.00 | -0.01 | 0.47 | 0.09 | 0.01 | |||||

| [4] AUDCHG | 0.06 | 0.00 | 0.24 | 0.02 | -0.02 | 0.00 | ||||

| [5] LNTA | 6.20 | 6.13 | 1.68 | -0.03 | 0.03 | 0.00 | -0.18 | |||

| [6] EMPLOY | 6.65 | 1.84 | 19.25 | -0.05 | -0.02 | 0.00 | -0.06 | 0.43 | ||

| [7] LEV | 0.24 | 0.10 | 0.37 | -0.01 | 0.25 | 0.00 | -0.04 | 0.18 | 0.05 | |

| [8] ROA | -0.12 | 0.02 | 0.49 | -0.01 | -0.21 | 0.00 | -0.06 | 0.51 | 0.12 | 0.05 |

| [9] LOSS | 0.63 | 1.00 | 0.49 | -0.01 | 0.55 | 0.00 | 0.05 | -0.18 | -0.10 | 0.14 |

| [10] WK | 2.29 | 1.46 | 3.04 | 0.09 | -0.34 | 0.00 | 0.28 | -0.32 | -0.11 | -0.20 |

| [11] MERGER | 0.07 | 0.00 | 0.26 | 0.07 | -0.02 | 0.00 | -0.07 | 0.03 | -0.06 | -0.07 |

| [12] VARSALES | 0.56 | 0.04 | 3.20 | 0.07 | -0.03 | -0.04 | 0.06 | -0.09 | -0.05 | -0.06 |

| [13] FREEC | -0.10 | -0.03 | 0.25 | -0.03 | -0.17 | -0.01 | -0.13 | 0.49 | 0.13 | -0.02 |

| [14] BIG4 | 0.80 | 1.00 | 0.40 | 0.01 | -0.09 | 0.00 | -0.33 | 0.39 | 0.15 | 0.06 |

| [15] NONAF | 0.15 | 0.11 | 0.14 | 0.13 | -0.11 | -0.14 | -0.08 | 0.00 | 0.06 | -0.08 |

| [16] DELAY | 80.13 | 72.00 | 47.79 | -0.05 | 0.25 | 0.00 | 0.25 | -0.11 | -0.09 | -0.01 |

| [17] COWE | 0.51 | 0.00 | 1.59 | -0.05 | 0.27 | 0.10 | 0.06 | -0.03 | -0.03 | -0.06 |

| Variables | [8] | [9] | [10] | [11] | [12] | [13] | [14] | [15] | [16] | |

| [9] LOSS | -0.36 | |||||||||

| [10] WK | -0.04 | -0.01 | ||||||||

| [11] MERGER | 0.05 | -0.01 | -0.03 | |||||||

| [12] VARSALES | -0.03 | 0.03 | 0.07 | -0.02 | ||||||

| [13] FREEC | 0.60 | -0.33 | -0.13 | 0.16 | -0.21 | |||||

| [14] BIG4 | 0.14 | -0.05 | -0.15 | -0.07 | -0.06 | 0.30 | ||||

| [15] NONAF | -0.13 | -0.05 | 0.13 | 0.13 | 0.07 | -0.06 | 0.06 | |||

| [16] DELAY | -0.04 | 0.24 | 0.01 | 0.00 | -0.03 | 0.01 | -0.07 | -0.12 | ||

| [17] COWE | -0.01 | 0.08 | -0.09 | 0.06 | -0.04 | -0.03 | -0.08 | -0.07 | 0.39 | |

As the table shows, on average, the firms in our sample are highly indebted (mean(LEV)=0.24) and have low profitability (mean(ROA)=-0.12). Besides, firms that reported negative earnings constituted 63% of our observations (mean(LOSS)=0.63), while 80% of the sample firms were audited by a Big 4 audit company (mean(BIG4)=0.80); finally, the average audit report lag was nearly 80 days (mean(DELAY)=80.13) and the number of internal control material weaknesses were contained, with a mean value of 0.51 (mean(COWE)=0.51).

In relation to Pearson correlations, BKRP was positively and significantly correlated to LEV (ρ=0.25), LOSS (ρ=0.55), DELAY (ρ=0.25) and COWE (ρ=0.27), providing evidence that bankrupt firms are more indebted, have a higher tendency to record negative earnings, have a lengthier audit report lag and report a higher number of internal control material weaknesses. Moreover, BKRP is negatively correlated with ROA (ρ=-0.21), WK (ρ=-0.34), and FREEC (ρ=- 0.17), indicating that failed firms have lower profitability, lower internally-generated funds and a higher need for external financing, respectively.

Table 2 reports the results of the regression analysis shown in Equation (3).

| Table 2 OLS Regression Models Of DACC | ||||

| Variables | Coeff. | (1) DACC | (2) DACC | (3) DACC |

| BKRP | b1 | 0.9904** (2.00) |

0.8260* (1.74) |

0.7924 (1.65) |

| ABAFEE | b2 | 0.7921 (1.37) |

-0.4214 (-0.91) |

-0.2943 (-0.64) |

| AUDCHG | b3 | 0.8355 (0.96) |

1.0411 (1.18) |

2.3590* (1.85) |

| BKRP*ABAFEE | b4 | - | 2.7039** (2.20) |

2.6945** (2.10) |

| BKRP*AUDCHG | b5 | - | - | -2.1607 (-1.58) |

| ABAFEE*AUDCHG | b6 | - | - | -5.9959*** (-4.44) |

| BKRP*ABAFEE* AUDCHG | b7 | - | - | 3.8419** (2.04) |

| LNTA | a1 | -0.1427 (-0.57) |

-0.1461 (-0.59) |

-0.1276 (-0.52) |

| EMPLOY | a2 | -0.0048 (-0.57) |

-0.0033 (-0.39) |

-0.0042 (-0.48) |

| LEV | a3 | 0.0431 (0.09) |

0.1746 (0.35) |

0.1881 (0.37) |

| ROA | a4 | 0.6122 (0.88) |

0.5217 (0.79) |

0.4516 (0.68) |

| LOSS | a5 | -0.4884 (-0.94) |

-0.3622 (-0.70) |

-0.1799 (-0.34) |

| WK | a6 | 0.0864 (0.61) |

0.0604 (0.41) |

0.0575 (0.37) |

| MERGER | a7 | 1.3811 (1.19) |

1.3155 (1.15) |

1.2876 (1.12) |

| VARSALES | a8 | 0.0435 (0.82) |

0.0336 (0.68) |

-0.0030 (-0.06) |

| FREEC | a9 | -0.6324 (-0.57) |

-0.4375 (-0.40) |

-0.2099 (-0.18) |

| BIG4 | a10 | 0.6643 (0.95) |

0.4310 (0.63) |

0.4616 (0.68) |

| NONAF | a11 | 3.9266 (1.60) |

4.0910* (1.66) |

4.1528* (1.69) |

| DELAY | a12 | -0.0034 (-1.40) |

-0.0022 (-0.76) |

-0.0023 (-0.84) |

| COWE | a13 | -0.1284 (-0.94) |

-0.1586 (-1.15) |

-0.1698 (-1.22) |

| Year dummies | Included | Included | Included | |

| R2 % | 8.34 | 11.63 | 12.89 | |

| Observations | 184 | 184 | 184 | |

*, **, and *** denote statistical significance at 0.10, 0.05 and 0.01 levels (two-sided), respectively.

Column (1) in Table 2 reports the estimation of Equation (3) which investigates the earnings management practices of ex-post bankrupt US firms compared with the matching sample of healthy firms. We found a positive and significant impact of BKRP on DACC (β1>0; p<0.05). This relationship validated Hypothesis 1, supporting the expectation that bankrupt firms exhibit more income-increasing abnormal accruals one year before filing for Chapter 11, by comparison with healthy companies, accounting for the effects of multiple firm- and auditcontrol variables identified by prior literature. Our findings are thus consistent with Argenti’s (1976) arguments in relation to the management tendency to manipulate discretionary accruals to increase earnings so as to postpone filing for bankruptcy. The results also strengthen the bankruptcy prediction model developed by Du Jardin et al. (2019) by demonstrating a greater resolve on the part of bankrupt firms to manage the earnings. To test Hypothesis 2, we added the interaction term between BKRP and ABAFEE (BKRP*ABAFEE), as we speculated that ex-post bankrupt firms that pay abnormally high audit fees one year before filing for Chapter 11 have a higher magnitude of discretionary accruals. While a negative association between BKRP*ABAFEE and DACC can be expected if the auditors, by exerting extra efforts on auditing activity, constrain the earnings management of failed firms, a positive association is explained by the presence of a risk premium component in audit fees.

Column (2) in Table 2 shows the results of the analysis from Equation (3) in which we added the aforementioned interaction term. Hypothesis 2 received empirical support with a positive and significant relationship between BKRP*ABAFEE and DACC (β4>0; p<0.05).

Consistent with the studies of Niemi (2002), Houston et al. (1999) and Jiang and Son (2015), we show that business risk substantially affects audit pricing. In particular, we demonstrate how the riskiness of organizational context, characterizing companies in serious financial distress, is strongly perceived by the auditors, influencing audit pricing by charging higher risk premiums. Indeed, the abnormal audit fees charged to ex-post failed firms do not result in greater efforts by auditors to improve earnings quality, thereby suggesting that the primary auditors’ concern is to preserve their profit margins from potential future litigation costs in high-risk contexts.

Lastly, Column (3) in Table 2 shows the effects following auditor changes. The interaction term BKRP*ABAFEE*AUDCHG is positively and significantly related to DACC (β7>0; p<0.05). These findings validate our prediction under Hypothesis 3 by showing that the newly hired external auditors who charged ex-post bankrupt firms higher fees appeared less prone to constrain earnings management behavior, very different from healthy companies (β6<0; p<0.01). According to Cameran et al. (2015) and Gul et al. (2009), the audit pricing applied by newly appointed auditors would be affected by learning curve effects. Our results, in particular, shed light on the different approaches pursued by incoming auditors in defining the audit price for a new client, with the discriminant represented by the riskiness characterizing the business setting. While in new, healthy organizations, the abnormal fees charged tended to reflect a fee premium for greater auditors’ efforts, which were required as new auditors had little clientspecific knowledge, in unfamiliar, financially distressed contexts, the higher fees would primarily express the audit risk perceived. We thus demonstrate how limited client knowledge on the part of the incoming auditors lead them to apply abnormal audit fees, the latter reflecting a divergent auditors’ approach based on the financial position of the firm. Overall, our results interestingly reveal a significant moderating role of the riskiness associated with the business context in orienting the auditors’ activity and concerns, thereby affecting the audit pricing differently, especially with regard to new business clients.

The highest variance inflation factors value among the explanatory variables is 4.0392, which gives no indication that multicollinearity is a serious issue in the multivariate analyses (Neter et al., 1990).

Concluding Comments and Limitations

Our paper aimed to investigate how the business context status of a client might differently affects the auditors’ pricing policies and commitments in the audit process. Employing multivariate regressions analyses, we examined this issue adopting a matched sample of 184 US bankrupt and healthy firms in the years after the passage of the SOX. Our findings revealed that in critical business contexts, auditors appear primarily concerned about obtaining a risk premium rather than increasing the audit efforts to curb earnings management policies. Particularly, this tendency is strengthened when auditors address an unfamiliar, critical organizational context, whereas the higher audit fees applied to new, healthy business clients would reflect a fee premium for the greater auditor’ commitment in the audit process.

The different components of abnormal audit fees - as a fee premium for the auditor’ efforts or as a risk premium – produce an opposing impact on audit quality (Jiang & Son, 2015): while the auditor’s effort level, which is a beneficial input to the audit process, results in audit quality, risk premia arises in exchange for accepting higher engagement risk and it does not generate any beneficial impact for audit quality. Particularly, we document the existence of a component in the audit fees that compromises audit quality in a bankruptcy context, therefore identifying a new source of risk that auditors control through increased risk premiums. This complements existing literature on the relationship between audit fees and bankruptcy, indicating that in this setting abnormally high audit fees are explained by the presence of risk premium to cover potential future litigation costs.

Our study contributes to the literature in several ways.

Firstly, Cenciarelli et al. (2018) suggested that firms with higher audit fees are more likely to go bankrupt and questioned whether higher audit fees are due to extended audit effort or a higher risk premium. Our study, therefore, answers Cenciarelli et al.’s (2018) paper, evidencing that the riskiness of the business context plays a relevant role in orienting auditors’ activity and concerns, thereby influencing audit pricing. In particularly, we demonstrate how a critical organizational context, characterizing the ex-post bankrupt firms, leads the auditors to charge higher fees as compensation for their risk, without any apparent benefits for the clients. This approach represents a questionable practice, which exacerbates audit quality concerns primarily following an auditor change, since a certain time period is required to become familiar with the company structure.

Secondly, we respond to Niemi (2002), Houston et al. (1999) and Jiang & Son’s (2015) calls for further research within the US to provide consistent support for the pricing behavior of auditors within the bankruptcy context, so identifying a new source of risk that auditors must control through increased risk premiums.

Regarding the practical implications, previous literature reported that auditors could also issue a modified opinion when they perceive that a financial statement is of low quality (Francis & Krishnan, 1999), sending an earlier signal to the market. Charitou et al. (2007) and Rosner (2003) found that audit opinions drive managers of ex-post bankrupt firms to be more conservative in their financial reporting. Contrary to risk premiums, modified opinions play an important signaling role for stakeholders.

As a consequence, it is essential to examine in detail when auditors incorporate risk premiums due to pervasive earnings management in audit fees. The application of higher risk premiums requires that the client be willing to pay the incremental fees (DeFond & Zhang, 2014) and may influence the auditor’s independence or judgment through bonding between auditors and clients, hiding critical information from principal stakeholders. Consequently, an important implication of this study is that positive abnormal audit fees for firms close to bankruptcy could represent a proxy for low accounting quality, mainly in the case of audit change, probably because of the auditors’ inability to remediate low accounting quality by applying normal audit procedures (Hribar et al., 2014). Besides, when do the auditors issue a modified opinion? In our sample all the firms analyzed received an unqualified opinion.

Lastly, future research could investigate whether risk premium demand is related to auditors’ size; while Big 4 auditors are characterized by higher reputation concerns that should result in greater effort (Francis & Krishnan, 1999; Abbott et al., 2006), they have financial resources to afford potential future losses and could spread the risk premium equally across clients, which is obviously not possible in the case of auditors with a small client portfolio.

One limitation of this study is the unavailability of a variable that acts as a control for the extent of audit work to better isolate the risk premium in Equation (2). One method aimed at taking into account auditor effort is to obtain data on actual audit hours (Niemi, 2002), but this information is undisclosed in the financial statements produced by US firms.

References

- Abbott, L.J., Parker, S., & Peters, G.F. (2006). Earnings management, litigation risk, and asymmetric audit fee responses. Auditing: A Journal of Practice & Theory, 25(1), 85-98.

- Alhadab, M., Clacher, I., & Keasey, K. (2015). Real and accrual earnings management and IPO failure risk. Accounting and Business Research, 45(1), 55-92.

- Argenti, J. (1976). Corporate planning and corporate collapse. Long Range Planning, 9(6), 12-17.

- Asthana, S.C., & Boone, J.P. (2012). Abnormal audit fee and audit quality. Auditing: A Journal of Practice & Theory, 31(3), 1-22.

- Bell, T.B., Landsman, W.R., & Shackelford, D.A. (2001). Auditors’ perceived business risk and audit fees: Analysis and evidence. Journal of Accounting Research, 39(1), 35-43.

- Beneish, M.D., & Press, E. (1993). Costs of technical violation of accounting-based debt covenants. The Accounting Review, 68(2), 233-257.

- Beneish, M.D., Press, E., & Vargus, M.E. (2012). Insider trading and earnings management in distressed firms. Contemporary Accounting Research, 29(1), 191-220.

- Bergstresser, D., & Philippon, T. (2006). CEO incentives and earnings management. Journal of Financial Economics, 80(3), 511-529.

- Blankley, A.I., Hurtt, D.N., & MacGregor, J.E. (2012). Abnormal audit fees and restatements. Auditing: A Journal of Practice & Theory, 31(1), 79-96.

- Branch, B. (2002). The costs of bankruptcy: A review. International Review of Financial Analysis, 11(1), 39-57.

- Bronson, S.N., Ghosh, A., & Hogan, C.E. (2017). Audit fee differential, audit effort, and litigation risk: An examination of ADR firms. Contemporary Accounting Research, 34(1), 83-117.

- Burgstahler, D., & Dichev, I. (1997). Earnings management to avoid earnings decreases and losses. Journal of Accounting and Economics, 24(1), 99-126.

- Cameran, M., Francis, J.R., Marra, A., & Pettinicchio, A. (2015). Are there adverse consequences of mandatory auditor rotation? Evidence from the Italian experience. Auditing: A Journal of Practice & Theory, 34(1), 1-24.

- Campa, D., & Camacho-Miñano, M.D.M. (2014). Earnings management among bankrupt non-listed firms: evidence from Spain. Spanish Journal of Finance and Accounting/Revista Española de Financiación y Contabilidad, 43(1), 3-20.

- Campa, D., & Camacho-Miñano, M.D.M. (2015). The impact of SME’s pre-bankruptcy financial distress on earnings management tools. International Review of Financial Analysis, 42, 222-234.

- Carcello, J.V., & Nagy, A.L. (2004). Audit firm tenure and fraudulent financial reporting. Auditing: A Journal of Practice & Theory, 23(2), 55-69.

- Carcello, J.V., & Palmrose, Z.V. (1994). Auditor litigation and modified reporting on bankrupt clients. Journal of Accounting Research, 32, 1-30.

- Cassar, G., Ittner, C.D., & Cavalluzzo, K.S. (2015). Alternative information sources and information asymmetry reduction: Evidence from small business debt. Journal of Accounting and Economics, 59(2-3), 242-263.

- Cenciarelli, V.G., Greco, G., & Allegrini, M. (2018). External audit and bankruptcy prediction. Journal of Management and Governance, 22(4), 863-890.

- Chan, K.C., Farrell, B., & Lee, P. (2008). Earnings management of firms reporting material internal control weaknesses under Section 404 of the Sarbanes-Oxley Act. Auditing: A Journal of Practice & Theory, 27(2), 161-179.

- Charitou, A., Lambertides, N., & Trigeorgis, L. (2007). Managerial discretion in distressed firms. The British Accounting Review, 39(4), 323-346.

- Chen, Y., Chen, C.H., & Huang, S.L. (2010). An appraisal of financially distressed companies’ earnings management. Pacific Accounting Review, 22(1), 22-41.

- Choi, J.H., Kim, J.B., & Zang, Y. (2010). Do abnormally high audit fees impair audit quality? Auditing: A Journal of Practice & Theory, 29(2), 115-140.

- Dechow, P.M., Sloan, R.G., & Sweeney, A.P. (1995). Detecting earnings management. The Accounting Review, 70(2), 193-225.

- DeFond, M.L., & Jiambalvo, J. (1994). Debt covenant violation and manipulation of accruals. Journal of Accounting and Economics, 17(1-2), 145-176.

- DeFond, M.L., & Subramanyam, K.R. (1998). Auditor changes and discretionary accruals. Journal of Accounting and Economics, 25(1), 35-67.

- DeFond, M.L., & Zhang, J. (2014). A review of archival auditing research. Journal of Accounting and Economics, 58(2-3), 275-326.

- Du Jardin, P., Veganzones, D., & Séverin, E. (2019). Forecasting corporate bankruptcy using accrual-based models. Computational Economics, 54(1), 7-43.

- Eckbo, B.E., Thorburn, K.S., & Wang, W. (2016). How costly is corporate bankruptcy for the CEO?. Journal of Financial Economics, 121(1), 210-229.

- Eshleman, J.D., & Guo, P. (2014). Abnormal audit fees and audit quality: The importance of considering managerial incentives in tests of earnings management. Auditing: A Journal of Practice & Theory, 33(1), 117-138.

- Ettredge, M., Fuerherm, E.E., & Li, C. (2014). Fee pressure and audit quality. Accounting, Organizations and Society, 39(4), 247-263.

- Feldmann, D. A., Read, W. J., & Abdolmohammadi, M. J. (2009). Financial restatements, audit fees, and the moderating effect of CFO turnover. Auditing: A Journal of Practice & Theory, 28(1), 205-223.

- Files, R. (2012). SEC enforcement: Does forthright disclosure and cooperation really matter? Journal of Accounting and Economics, 53(1-2), 353-374.

- Fisher, T.C., Gavious, I., & Martel, J. (2019). Earnings management in Chapter 11 bankruptcy. Abacus, 55(2), 273-305.

- Fleischer, R., Goettsche, M., & Schauer, M. (2017). The Big 4 premium: Does it survive an auditor change? Evidence from Europe. Journal of International Accounting, Auditing and Taxation, 29, 103-117.

- Francis, J.R., & Krishnan, J. (1999). Accounting accruals and auditor reporting conservatism. Contemporary Accounting Research, 16(1), 135-165.

- Franz, D.R., HassabElnaby, H.R., & Lobo, G.J. (2014). Impact of proximity to debt covenant violation on earnings management. Review of Accounting Studies, 19(1), 473-505.

- García Lara, J.M., Osma, B.G., & Neophytou, E. (2009). Earnings quality in ex?post failed firms. Accounting and Business Research, 39(2), 119-138.

- Ghosh, A., & Pawlewicz, R. (2009). The impact of regulation on auditor fees: Evidence from the Sarbanes-Oxley Act. Auditing: A Journal of Practice & Theory, 28(2), 171-197.

- Gilson, S.C. (1989). Management turnover and financial distress. Journal of Financial Economics, 25(2), 241-262.

- Gu, J., & Hu, D. (2015). Audit fees, earnings management, and litigation risk: Evidence from Japanese firms cross-listed on US Markets. Academy of Accounting and Financial Studies Journal, 19(3), 125-140.

- Gul, F.A., Chen, C.J., & Tsui, J.S. (2003). Discretionary accounting accruals, managers' incentives, and audit fees. Contemporary Accounting Research, 20(3), 441-464.

- Gul, F.A., Fung, S.Y.K., & Jaggi, B. (2009). Earnings quality: Some evidence on the role of auditor tenure and auditors’ industry expertise. Journal of Accounting and Economics, 47(3), 265-287.

- Gupta, M., Khurana, I.K., & Pereira, R. (2008). Legal inforcement, short maturity debt, and the incentive to manage earnings. Journal of Law and Economics, 51(4), 619-640

- Heninger, W.G. (2001). The association between auditor litigation and abnormal accruals. The Accounting Review, 76(1), 111-126.

- Hoitash, R., Hoitash, U., & Bedard, J.C. (2008). Internal control quality and audit pricing under the Sarbanes-Oxley Act. Auditing: A Journal of Practice & Theory, 27(1), 105-126.

- Houston, R.W., Peters, M.F., & Pratt, J.H. (1999). The audit risk model, business risk and audit-planning decisions. The Accounting Review, 74(3), 281-298.

- Hribar, P., Kravet, T., & Wilson, R. (2014). A new measure of accounting quality. Review of Accounting Studies, 19(1), 506-538.

- Huang, H.W., Raghunandan, K., & Rama, D. (2009). Audit fees for initial audit engagements before and after SOX. Auditing: A Journal of Practice & Theory, 28(1), 171-190.

- Jiang, W., & Son, M. (2015). Do audit fees reflect risk premiums for control risk? Journal of Accounting, Auditing & Finance, 30(3), 318-340.

- Jones, J.J. (1991). Earnings management during import relief investigations. Journal of Accounting Research, 29(2), 193-228.

- Jones, S. (2011). Does the capitalization of intangible assets increase the predictability of corporate failure? Accounting Horizons, 25(1), 41-70.

- Kallunki, J.P., & Martikainen, T. (1999). Financial failure and managers’ accounting responses: Finnish evidence. Journal of Multinational Financial Management, 9(1), 15-26.

- Kanakriyah, R. (2020). Model to determine main factors used to measure audit fees. Academy of Accounting and Financial Studies Journal, 24(2), 1-13.

- Krauß, P., Pronobis, P., & Zülch, H. (2015). Abnormal audit fees and audit quality: Initial evidence from the German audit market. Journal of Business Economics, 85(1), 45-84.

- Leach, R., & Newsom, P. (2007). Do firms manage their earnings prior to filing for bankruptcy? Academy of Accounting and Financial Studies Journal, 11(3), 125-137.

- Lennox, C. (2000). Do companies successfully engage in opinion-shopping? Evidence from the UK. Journal of Accounting and Economics, 29(3), 321-337.

- Lennox, C. (2014). Auditor tenure and rotation. In D. Hay, W.R. Knechel & M. Willekens (Eds), The Routledge Companion to Auditing (pp. 89-106). New York, NY: Routledge.

- Li, F., Abeysekera, I. & Ma, S. (2011). Earnings management and the effect of earnings quality in relation to stress level and bankruptcy level of Chinese listed firms. Corporate Ownership and Control, 9(1), 366-391.

- Lobo, G.J., & Zhao, Y. (2013). Relation between audit effort and financial report misstatements: Evidence from quarterly and annual restatements. The Accounting Review, 88(4), 1385-1412.

- Mendiratta, A. (2019). Abnormal audit fees and audit quality post PCAOB. Journal of Commerce & Accounting Research, 8(3), 47-63.

- Neter, J., Wasserman, W., & Kutner, M.H. (1990). Applied Linear Statistical Models: Regression, Analysis of Variance, and Experimental Designs. Homewood, IL: Irwin.

- Niemi, L. (2002). Do firms pay for audit risk? Evidence on risk premiums in audit fees after direct control for audit effort. International Journal of Auditing, 6(1), 37-51.

- Palmrose, Z.V. (1988). An analysis of auditor litigation and audit service quality. The Accounting Review, 63(1), 55-73.

- Raghunandan, K., & Rama, D.V. (2006). SOX Section 404 material weakness disclosures and audit fees. Auditing: A Journal of Practice & Theory, 25(1), 99-114.

- Robinson, D. (2008). Auditor independence and auditor-provided tax service: Evidence from going-concern audit opinions prior to bankruptcy filings. Auditing: A Journal of Practice & Theory, 27(2), 31-54.

- Rosner, R.L. (2003). Earnings manipulation in failing firms. Contemporary Accounting Research, 20(2), 361-408.

- Schelleman, C., & Knechel, W.R. (2010). Short-term accruals and the pricing and production of audit services. Auditing: A Journal of Practice & Theory, 29(1), 221-250.

- Schwartz, K.B., & Menon, K. (1985). Auditor switches by failing firms. The Accounting Review, 60(2), 248-261.

- Simunic, D.A., & Stein, M.T. (1996). Impact of litigation risk on audit pricing: A review of the economics and the evidence. Auditing: A Journal of Practice & Theory, 15(Supplemental), 119-134.

- Stanley, J.D., Brandon, D.M., & McMillan, J.J. (2015). Does lowballing impair audit quality? Evidence from client accruals surrounding analyst forecasts. Journal of Accounting and Public Policy, 34(6), 625-645.

- Sweeney, A.P. (1994). Debt-covenant violations and managers’ accounting responses. Journal of Accounting and Economics, 17(3), 281-308.

- Trombetta, M., & Imperatore, C. (2014). The dynamic of financial crises and its non-monotonic effects on earnings quality. Journal of Accounting and Public Policy, 33(3), 205-232.

- Walker, P.L., & Casterella, J.R. (2000). The role of auditee profitability in pricing new audit engagements. Auditing: A Journal of Practice & Theory, 19(1), 157-167.

- White, H. (1980). A heterokedasticity-consistent covariance matrix estimator and a direct test for heterokedasticity. Econometrica, 48(4), 817-838.

- Wingate, M. (1997). An examination of cultural influence on audit environment. Research in Accounting Regulation, 10(Supplement), 129-148.