Research Article: 2021 Vol: 25 Issue: 6

Accountability And Internal Control Practices: A Study of Church Fund Management

Lexis Alexander Tetteh, University of Professional Studies, Accra

Paul Muda, University of Professional Studies, Accra

Isaac Kwafo Yawson, Wisconsin International University College, Ghana

Prince Sunu, University of Professional Studies, Accra

Timothy Azaa Ayamga, University of Professional Studies, Accra

Citation Information: Tetteh, L.A., Muda, P., Yawson, I.K., Sunu, P., & Ayamga, T.A. (2021). Accountability And Internal Control Practices: A Study of Church Fund Management. Academy of Accounting and Financial Studies Journal, 25(6), 1-15.

Abstract

The paper explores accountability and internal control practices within religious organisations in Ghana. The study used a qualitative interpretive approach as the methodological stance and purposive sampling was used to select thirty-two (32) key officials with in-depth understanding of the accountability and internal control practices of the congregations for interview. The findings suggest that many contingencies for successful implementation of internal control mechanisms were present in the Church, such as the answerability to congregation, approval of expenditures, segregation of duties, instant cash deposit, supporting of expenditure with receipt, and monitoring of finance system. The study further revealed that, even if many conditions for a successful implementation of the controls are in place, the practices of accountability may ultimately fail due to shortcomings in the application of the church’s control systems. The findings offer practical implication to the importance of separating accountability and internal controls mechanisms of religious organisations from spiritual belief. The study suggests that religious organisations need physical security to their assets and not only spiritual beings. This is the first qualitative study that offers rich insight into the study of accountability and internal controls practices within religious organisations through the lens of Resource-based View and Resource Dependence theory.

Keywords

Fund Management, Accountability, Internal Controls, Religion, Management Practices.

Introduction

Many at times people wonder what their monies are being used for in their local churches. This is due to the misappropriation of church funds among some churches that are springing up these days. In order to erode this negative disposition from the minds of congregants, churches would therefore like to have their accounts audited quarterly, semi-annually or annually. Like all other organizations, accountability and internal controls are integral part of any Non-Governmental Organization's rules, regulations, policies, and procedures. Internal controls refer to the whole system of controls, established by the management to carry out their tasks in an orderly manner, ensure adherence to organization policies, safeguard its assets and secure as far as possible the accuracy and reliability of its records (Gupta, 2011). Again, internal controls ensure accuracy and reliability in accounting and operating data, securing compliance with the policies of the organization and evaluating the level of performance in all units of the organization (Behn et al., 2010).

Churches are religious institutions which are founded primarily to serve the religious needs of the people but not for profit making. However, churches should be concerned about the management of their finances and the leadership must take pride in protecting the church, its membership and its workers. Religious organizations in Ghana have contributed immensely to the development of the country through the provision of social facilities as well as seeking the spiritual welfare of their members. A weak internal control system will increase the risk of managing the financial resources of these nonprofit organizations thus affecting the voluntary services provided by these organizations. When these religious organizations fail due to poor internal control and budgetary control practices, society will be the loser. These religious organizations have been entrusted with a lot of financial resources which are used to provide social services to communities where they operate. Despite the availability of these resources, there is always a lack of funds for the church to carry out its missionary work due to poor or lack of proper accountability and internal control systems (Ahiabor & Mensah, 2015). The success of any organization is not necessarily how much money comes into it but how well the organization manages the funds.

The management of ecclesiastical organizations is rarely researched due to the assumed sacred nature of their activities. This assumption has led to a distinct sense of the inferiority of accounting issues to any non-monetary issues, which often results in ignoring managerial control of churches' finances (Myers, 2012; Ahiabor & Mensah, 2015). Laughlin (2009) argues that the Church of England regards accounting as an activity that should not interfere with the more important spiritual endeavors of the Church of England. They are allowed to exist to assist the created internal resourcing units, but their role is limited. Thus, parish accounting systems are rudimentary, precisely because they have no part to play in this demarcated spiritual unit. Because of this belief, many churches do not see the need for internal controls in their organizations. This, therefore, means that organizations that fail to confront the reality of money to obtain an account mission resources, compromise the fulfillment of their mandate (Irvine, 2015). According to Irvin (2015), internal controls play an intervening role in ensuring the allocation and accountability of resources with a view of increasing performance. Abdulkadir, (2014) found that as far as internal control in religious organizations is concerned, there exist positive changes in performance for organizations with proper internal controls.

Most church leaders think that accountability and internal control are only instituted in order to identify and prevent fraud (Ahiabor & Mensah, 2013). This myth has also prevented Church leaders or religious groups to implement sound control polices, as they do not want to be seen to be distrustful. Laughlin, (2008) observes that the Church of England finds accounting to be an operation that should not conflict with the Church of England's spiritual efforts. In contrast to secular institutions, it seems that the use of internal controls in churches today is very far behind. At present, many churches do not use appropriate professional standards to carry out their administrative activities, particularly with regard to the management of funds (Tanui et al., 2016). Many Churches believe that all Christian staff should be trusted, and this has led to cases of theft and fraud. The donors often feel that they are donating to God and not to an individual, and all they want in return are "blessings from God," so they are less interested in knowing what their contributions are used for.

Although religious organisations, practically churches, are considered one of the oldest organisations with a significant role in society, research on accountability and internal control systems in religious organisations has been generally under explored. Most of the researches on church accounting have been conducted in developed economies such as Australia, Canada, the UK, etc. (Agyei-Mensah, 2016). In the developing country context, scholars such as Duncan, Flesher & Stocks (1999), Ahiabor & Mensah, (2013), Agyei-Mensah, (2016) and Tanui et al., (2016) have made considerable effort to research into the phenomenon, however, all these studies employed quantitative approach to investigate the issues.

In addition, a number of the findings from current empirical research demonstrate clearly that research on internal control practices of church primarily evaluated the effectiveness of the control systems and neglected why the churches implemented the controls and how the controls systems operate to achieve desired outcomes (See, e.g. Ahiabor & Mensah, 2013; Agyei-Mensah, 2016). A study based on mathematical robotism does not give the participants the willingness to explain further, so we must reason on the inductivist's trajectory to achieve a profound understanding of the phenomenon under study. Therefore, this study is unique because the study employs the interpretivist approach to extend our knowledge in accountability and internal control practice in religious organisations in order to respond to calls made in the existing literature (Agyei-Mensah, 2016) and to also bring to light a developing country’s perspective of the issue using qualitative approach. In doing so, the study answers the following research questions.

RQ 1: What are the accountability and internal control procedures for the management of the Church Fund?

RQ2: What are the challenges facing the churches in enforcing internal controls to safeguard the funds of the churches?

The Presbyterian Church of Ghana was chosen as a study site for notable reasons. The focus of Presbyterian thinking on discipline and order led to the provision of formal manuals for the management of church resources and the manuals detail the roles and obligations of each leader in keeping proper records of church funds and properties for the advancement of the Kingdom of God. This position of stewardship has created a form of institutional accountability and internal control that is distinctive from other forms of accountability expectations in Protestant churches in Ghana. The reform came in the form of educating those in charge of managing church funds, which created extensive literacy, especially among the “middle class”. The above reasons explain why the Presbyterian Church was chosen as a study site rather than the other Orthodox Churches in Ghana.

Literature Review

Theoretical Lens

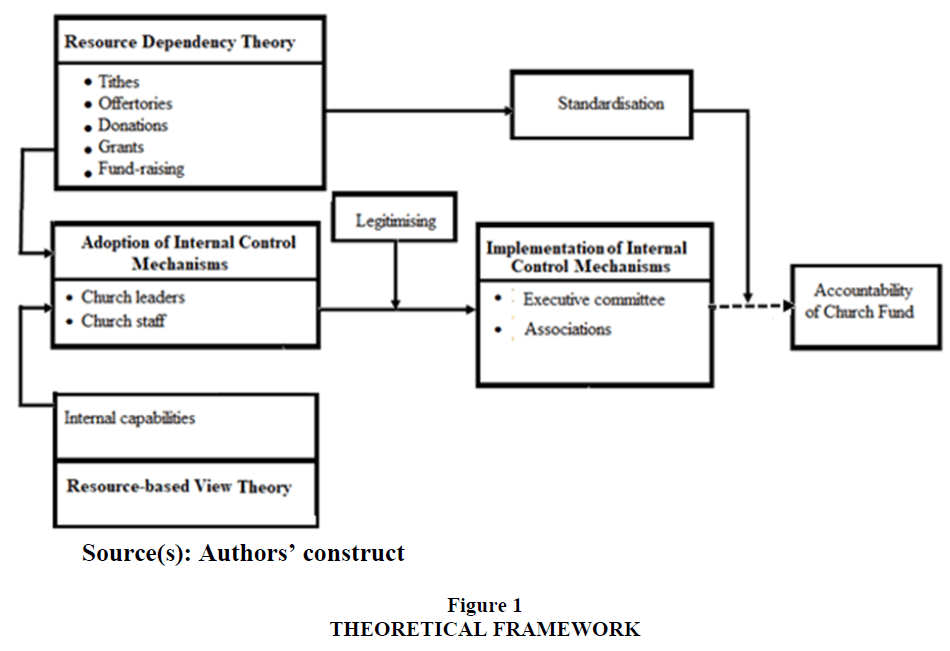

There are several theories that explain accountability and internal control practices. For the purpose of this study, the resource-based view and resource dependence theory were the emergent theories from this inductive study and they are discussed as below.

The Resource-based View Theory is one of the prominent theories in strategic management research. It focuses on how organisations link their strategies with their internal resources and capabilities to create and sustain competitive advantage (Grant, 1991). Grant, (1991) clarifies the distinction between resources and capabilities. Grant defines resources to include capital equipment items, finance, patent, brand names, skills of individual employees, in-house knowledge of technology, efficient procedures, trade contacts, which serve as inputs into the production process whiles capability is the ability of the firm to put these resources into productive activity. Grant, (1991) clarifies the distinction by hinting that while resources are the source of a firm’s capabilities, capabilities are the main sources of its competitive advantage (Grant, 1991). The author maintains that the competencies need to be rare, inimitable, and non-substitutable. The Church resources may be a critical factor in the effectiveness of any church accounting system, as indicated by Booth, (1993). Resources that are measured in terms of church membership may have a particular impact on the design of an internal control system (Duncan et al., 1999). Increased membership in the church usually leads to increased financial resources, increased church personnel and a greater potential for separation of financial duties. In addition, a large church is also more likely to recruit an individual with expertise in accounting and administration, thus increasing the likelihood of improved internal controls.

Finally, while the church size is likely to enhance internal control systems is intuitively appealing, no empirical evidence exists to support this contention. What this suggests is that the resource-based view implicitly implies a role and function for internal audit as possibly being part of the bundle of valuable resources of an organisation. A proper system of control itself of a church will be one of these valuable resources to maintain a sustainable advantage towards other churches. Subsequently, internal audit can be viewed as valuable (i.e. contributory to efficiency and effectiveness) and as part of the overall control system of a church. Therefore, Resource-based View Theory is considered as a theoretical basis for understanding the accountability and internal control systems used in management of church funds.

The second theoretical lens within which this study was conducted is the Resource Dependence Theory. The theory indicates that firm’s survival depends crucially on the ability to acquire and maintain resources (Pfeffer & Salancik, 1978). For instance, many churches rely on tithes, offertory, donations, grants and fund-raising activities to perform their mission. Before supporting an organisation such as church, contributors are likely to assess whether the organisation will be able to use funds as intended (Agyei-Mensah, 2016). Therefore, the ability of religious entities to convince donors (members and non-member) to provide adequate financial resources to achieve their strategic objective depends on effective resource management. In order to maintain these resources, proper accountability and internal control practices are important.

Concept of Accountability and Internal Controls

The term 'accountability' has undergone a definitional change in time. Yuesti & Kepramareni, (2014) opine that the definition of accountability depends on the ideology, objectives and language of the day. In theory, the authors claimed further that accountability has a special meaning. For example, an auditor performing financial accountability appears to be rigidly tasked in financial matters. Again, a politician understands accountability as a constitutional statute. In the meantime, a philosopher sees accountability as part of ethics. These explanations suggest that accountability has different definitions depending on who defines it and in which perspectives. The International Organization of Supreme Audit Institutions (INTOSAI) as cited in Iyoha & Oyerinde, (2010) defines accountability as fiscal accountability of a person or an entity entrusted to manage resources, tasks, and programs. This definition implies that accountability is the responsibility of both individuals and institutions. In the context of religion, churches often collect large amounts of money as offerings on Sunday mornings (Ahiabor & Mensah, 2013). These offerings were a voluntary donation of money to support church organizations, buildings, and ministries (Duncan et al., 1999; Crawley, 2014). In addition to providing spiritual guidance, church leaders are expected to manage church funds and operations efficiently and effectively (Schneider, 2013). Church leaders should understand their responsibilities for the financial well-being of churches is in connection with their obligations to demonstrate good stewardship of church resources and assets (Schneider, 2013). Leithwood & Riehl, (2003) also assert that in addition to church leaders taking responsibility for their own actions, they must also learn how to hold others accountable. In support of Leithwood & Riehl’s, (2003) assertion, Heward-Mills, (2009) adds that leadership accountability means that each leader is accountable to his/her employer and to the structures and processes of the Church as a whole. Similarly, Millichamp, (2005) suggests that all transactions should be subject to authorisation or approval by the appropriate person as part of internal control of an accounting system. Millichamp, (2005) further opines that no one person should be allowed to carry a transaction through from the initiation to its completion.

In order to achieve this mandate effectively, church leaders must protect resources by implementing appropriate accounting and internal controls to prevent theft or misuse of the resources (Ekhomu, 2015; Peters, 2015). This is because many worshippers considered the church a place of refuge (Peters, 2015). Members are engaged in close relations with persons who work in such organizations and foster strong bonds of trust (Peters, 2015). As a result of these trusting relationships, members are often deceived into believing that churches are invulnerable to fraudulent activity, but religious entities, similar to other businesses, may be victimized by fraud (Peters, 2015). On this issue, Woodbine, (1997) put forward strategies that will help religious organisations to operate on sound and smooth cash management. suggested that there should be counting committee, individual offertory be envelopes, regular banking of cash and segregation of duties. In support of the Woodbine’s, (1997), Hauriasi, (2011) and Jayasinghe and Soobaroyen (2009) asserts that the scant attention being paid to internal controls in religious institutions could be attributed mainly to the fact that their primary purpose is spiritual and social rather than economic. The Figure 1 below depicts the theoretical framework of the study.

The logic behind Figure 1 is as follows: there are forces that come from members and other benevolent institutions that donate to religious bodies, as well as internal capabilities of a religious body that influence the adoption of internal control mechanisms to promote efficiency in all aspects of a religious organization. The building blocks in this figure also imply that the presence of expertise in accounting and administration in a religious organisation increases the likelihood of improved internal controls. The adoption of the internal control mechanisms leads to actual implementation in the church. Therefore, for leaders to establish, preserve and retain legitimacy in order to receive continued support and to sustain funding from their members and benevolent institutions, they put in place control mechanisms to curb wasteful spending and mismanagement of church funds to legitimize the collection of the donations and other form of receipts. Figure 1 also implicates that the givers of the resources, may strive, through standardized policies and procedures to ensure the continued reliability of accounting systems to protect their donation. However, if church leaders do not see the financial well-being of the church as their responsibilities, they are likely not to demonstrate good stewardship of church resources and assets and this may impair on the accountability of church fund.

Empirical Review

The phenomenon of internal control systems has been embraced and implemented by churches in developing countries. Moreover, evidence in extant literature shows that researches on churches that have implemented the internal controls report of mixed results (Ahiabor & Mensah, 2013; Agyei-Mensah, 2016). For instance, the study of Ahiabor & Mensah, (2013) revealed that churches have embraced some form of internal control system and that the independence of the internal audit functions has a positive relationship with the finances of the churches. Similarly, a study carried out by Agyei-Mensah, (2016) on the financial accountability and internal control practices of societies within the Dioceses of the Methodist church in Ghana show that the Dioceses of the Methodist church in Ghana has strengthen its internal control system with respect to documentation of receipts and distribution of funds.

It was also found that establishment of segregation of duties, coordination among accounting staff, recording of financial transactions and authorising the disbursement of funds greatly improved the internal controls procedures of the Dioceses. These findings indicate that assets of the churches are secured against waste, fraud and inefficiency, and that accounting and operational records have been correct and reliable; and the policies have been complied with. In addition, the results of both studies indicate that the size and hierarchical structure enhance the effectiveness of a church's system of internal control, since the larger the congregation, the more the members begin to hold church leaders more accountable to the use of the funds.

In Kenya et al., (2016) undertook a study to promote the effectiveness of financial management through internal control systems in Protestant churches. Like previous studies, their study was motivated by the unending church scandals and misconception that church leaders could not commit crimes. As corruption has crept into the church and is gradually increasing, the adoption of internal controls acts as the first line of defense for the church. Surprisingly, the findings of their study revealed that only control activities out of the five components of internal control were evident in the churches’ control procedures. To respond to the call of Tanui et al., (2016), another study was carried out by Gachoka et al., (2018) to examine the intervening effect of internal control on the relationship between budgeting process and performance of churches. The study found that internal controls have intervening effects on the relationship between budgeting process and the performance of churches in Kenya. The study further found that budgeting process and internal controls are adequately practiced in Kenyan Churches resulting to a positive effect on their performance. The evidence implies that churches need to make their control environment, risk assessment and control activities strong since it is key in financial accountability of churches.

Based on the above review, this study explores accountability and internal control practices in a number of Presbyterian churches in Ghana. The aim is to uncover the various forms of accountability in the churches and the different types of internal control mechanisms developed by the churches. This research is intended to add to the accounting literature that the Church also needs a good accounting system to enhance the well-being of the society.

Research Methodology

Based on the interpretivist research paradigm, this study adopted a purely qualitative approach to research in terms of research method, data collection and analysis. Interpretivist approaches to research have the intention of understanding “the world of human experience” (Walsham, 2006). The interpretivist researcher tends to rely upon the ‘participants’ views of the situation being studied (Creswell & Creswell, 2017) and recognises the impact on the research of their own background and experiences. The study adopted a case study design to serve as an effective means of gaining in-depth understanding of the emerging issues. The study specifically focused on the presbyters, pastors, society leaders, accountants as well as treasures of the Presbyterian Church of Ghana. Thirty-two (32) participants were identified through purposive sampling and that involved locating people with in-depth understanding of the accountability and internal control practices of the churches. The study also gathered data from church bulletins and other archival documents on financial management reforms of the churches. Probing techniques were used to gain further clarification and to induce respondents to expand and explain their answers, and focus on the specific content of the interview (Creswell, 2014).

On the average, formal interviews took between 30 to 60 minutes. Depending on the agreement with the participants, the interviews were recorded through a combination of tape-recording and note-taking and subsequently transcribed after each session as soon as possible. The interview was brought to an end after information were saturated and no new issues were emerging anymore. This was achieved after interviewing the 28th participant. In addition to the interview responses, the study also requested formal manuals for the management of church resources and a document detailing the roles and obligations of each leader in keeping proper records of church funds and properties in order to confirm and further explore the validity of the answers to the interview questions.

In line with the interpretive approach, data was analyzed using thematic techniques by pulling the central themes from the interviews. Thematic analysis is a method for identifying, analyzing, and reporting patterns (themes) within data (Creswell, 2014). Braun & Clarke, (2006) also suggest that one of the benefits of thematic analysis is its flexibility. Audiotape details and field notes were transcribed. The transcribed interviews were read and compared with the audio recordings and field notes to determine similarities. Codes that may be relevant were then generated to answer the research questions (Miles & Huberman, 1994). After identifying the codes, we began to categorize the codes into corresponding themes. This process produced two emerging themes. In addition, we reviewed the themes to establish whether they answer the research questions (Thomas, 2012). The themes were then reviewed to determine whether the research questions were answered (Thomas, 2012). Finally, we merged the analytical narrative, data extracts, and contextualized the analysis in relation to existing literature. The emergent themes were then used to structure the research findings presented in the next section.

Findings and Discussion

The aim of this study is to understand the experience of churches in the context of a developing country with regard to their accountability and internal control practices. During the analysis of the data, the findings below emerged in relation to the research objectives.

Accountability and Internal Control Practices at the Church

This section discusses the existence of the accountability and internal control practices at the Presbyterian Church of Ghana. The subsequent paragraphs provide detailed analysis of the emergent sub themes.

Answerable to the congregations was discovered as the first accountability practices of the Church. The respondents clarified that, as a way of being responsible to their congregation, when there were issues resulting from the decisions they made, they often took joint responsibility rather than blamed one of them for such a mistake. A representative from one of the churches gave an example of a time they procured materials for construction from one of the members who failed to supply the agreed quality. The respondents commented that:

As church leaders, we believe every man is rewarded for duties performed and punished for duties neglected, the rewards and punishments being received partly in this world and partly in the next world. For instance, one of our leaders was as asked to procure materials for a church project and ended up procuring low-quality materials. Although, he was unable to discharge his duties as required by the congregation, we own the mistake as a team, and resigned from the procurement commitment.

The results are in accordance with Leithwood & Riehl, (2003), who suggest that, in addition to taking responsibility for their own actions, leaders must also learn how to hold others accountable. Expectations must be rational, consistent and well understood. Good performance needs to be acknowledged and performance gaps resolved quickly and fairly. As Heward-Mills, (2009) says, leadership accountability means that each leader is accountable to his/her employer and to the structures and processes of the church as a whole. The result also suggests that the mechanisms by which leaders are held responsible have been clearly defined to prevent conflicts of interest. This quotation describes the ideal perception of handling church tasks as services to humanity, through which the solution to church problems is to be found inside the leaders who caused it, through internal dialogue, rather than the leaders being forced to resign. This practice can be related to the vow of stability as a pledge to abide by church doctrine, regardless of what happened. From a more important point of view, this is an example of how leaders become personally accountable by self-reflection for handling church fund in order to give assurance to those the church depends on for resource.

The study again discovered that the Church always approved budgets before payments were made as an internal control strategy established in the church. The respondents were of the opinion that with the church’s payment system, for example, the Church ensures that the payment voucher passes through the Accounts Officer, who then forwards it to the two officers assigned to the church to make the appropriate approval, namely the District Minister and then the Treasurer of the Session, and then sends it for approval. The respondent explained that this is to ensure that the church does not make any payment outside the internal control system established by the church. This was what a respondent said:

And also, every payment that is made must have the prior approval of the treasurer and also of the district minister before the checks are written or any payment is made. I will say, for example, before the check is issued or before any payment is made, two people must approve it, the District Minister and the Treasurer of the Church.

This was reechoed by another respondent:

Yes, we have internal control measures in place in this church, one of the internal control measures is that if there is any payment that needs to be made, it must be approved by three people. That's the accountant, the treasurer, and myself.

As noted from the quotes, the Church is underpinned by a complex management structure dominated by clear preference for a consultive model of decision making when it comes to approval of budgets. At the district level, management approval of budget is undertaken by two interlocking members. These members are theoretically equal in status and are obliged to consult with one another prior to approval of budgets for payment. Such accountability practice is intended to facilitate the implementation of policies and culture that have the consensus of all parties affected by the decision, particularly, providers of church funds to continue to install assurance in them on the way church funds are appropriated. This is a good practice, as it avoids mismanagement of church funds. The findings are consistent with Millichamp, (2005) who suggests that all transactions should be subject to authorisation or approval by the appropriate person as part of internal control of an accounting system.

The interview response and reliance on archival document of the church revealed that there is a team of cash management who simply focuses on addressing the cash management framework employed by the church. This framework looks at the existence of a cash policy, qualified personnel, compliance with policy, management of cash sources and how these are disbursed. The study found that there is specific manual for cash management. For instance, we were made to understand that there are current conventions and generally accepted accounting principles that the church management team complies with. One of the respondents disclosed that:

The cash of the church is strictly guided by the budget and this is passionately adhered to. We have staff and volunteers in charge of this function and they are professionally qualified and trained by the church, that is in the case of volunteers. This function is not performed by just anyone and the church are those who monitor this activity.

In terms of banking of the cash, the study discovered that the Presbyterian Church of Ghana, depending on the location, operate local and foreign bank account (a cedi and dollar account). There are always four signatories to the account and all the four are members of the church. However, any two of the elders can sign a document or cheque at a time. A cheque beyond a threshold stipulated by the elders would have to be co-signed by at least one of the three presiding elders. An interviewee explained that:

Sunday is the usual ‘bank day’ for the church, therefore all receipts that are collected in the course of the week are kept until Sunday when it is banked together with the offertory. The counting team a sub-committee under the Church Administration Ministry is in charge of the offerings received on Sundays. So, immediately after the offerings are collected, two members of the team accompany the ushers to leave the monies in a secure room. Then after the services, the team then meets in a different secure room to count the money. We also have a counting machine to enhance the task and limit mistakes.

Another interviewee buttressed the above submission by adding that:

After we have countered the offertory and tithes, the monies are then immediately handed over to a team from the bank we save in exchange for a pay in slip. So once this is done, we the church elders consider the monies banked.

On the issue of mode of payments, the study found that the church uses cheque often than physical cash payment. One of the church administrators revealed that:

The use of actual cash in the church administration is limited. For instance, we make payment to vendors through the issue of cheque. Cheques are not pre-signed, no matter the situation and they are kept under lock and key.

The study also found that there is segregation of duties with respect to handling of offering and tithes. This was what the other respondent had to say:

Eerrmmm, alright, so there are internal control systems in this church and I will say that some of the internal control systems instituted at the church are errrrmmm. For instance, those who count the offerings and the tithes are not the same people who deposit the cash with our banks.

It can be deduced that the core rationale underlying the fund management practices is to facilitate a sacred mission that cannot be subject to questioning by auditors of the church. It can also be clearly inferred from the findings that there is high level of coordination, security and compliance as reported by Agyei-Mensah, (2016). The counting committee, individual offertory envelopes, regular banking of cash and segregation of duties were among Woodbine’s, (1997) strategies to ensure sound and smooth cash management. Also, contrary to the manual which stipulates that a member of the counting team is to go and deposit the funds at the bank, the bank officials rather go to the church premises to secure the funds under heavy security. The rationale is to increase the level of security the funds are under, and to minimize risk to the members of the church. It is also a more effective option, according to the church administrators since it serves as a form of insurance.

The study also found that the congregations of the Church have professionally qualified and trained staff and volunteers in charge of the church financial management and internal controls. This finding is a clear manifestation of the Resource-based View Theory which holds the view that a large church is also more likely to employ an individual with expertise in accounting and administration, thus increasing the probability of improved internal controls (Duncan et al., 1999). Also, the findings on the segregation of duty is also consistent with Millichamp’s, (2005) view that no one person should be allowed to carry a transaction through from the initiation to its completion. Such a practice could be liable for fraudulent manipulations. Overall, it seems the cash control system is healthy as it has a management team of professionals who adhere to the international standards for management principles. The absence of any mismanagement also goes to say a lot about the efficiency of the practices employed and the effectiveness of the cash internal controls.

Furthermore, as a result of the responses, it was evident that the Church ensures that expenditure is supported by receipt. The respondent also explained that the Presbyterian Church of Ghana will always insist that every system is complied with and that any expenses incurred by any officer must be provided with a receipt to support it. The respondents further explained that where receipts are not available, the church ensure that the officer sign other certificates to ensure that the church has evidence of the transaction. All respondents were of the opinion that the Church has some control policies in place to ensure that the Church's offerings are not misused. This was what a respondent said:

Eerrrmmm we ensure that every system is complied with and every expenditure that you incur you have to get a receipt. Where receipts are not available, we ensure that you’ll sign other certificates to ensure that we have evidence of the transaction. And so that alone in this I can say that there is no expenditure here that does not have these two documents, either one of them should source.

Another respondent emphasized that:

We make sure that every single expenditure is supported by evidence. We must account to the church members for how we spent their offerings and donations so that they will continue to have faith in the Presbyterian church and give more when the church needs funds for development.

Another set of inferences from the study is the manifestation of the Resource Dependence Theory. The Presbyterian Church of Ghana depends on the resources of church members and other philanthropists, and therefore, if the resources entrusted to the care of the congregations are not properly managed, they will lose future resources to non-Presbyterian congregations, which will serve as a major blow to the entire Presbyterian ministry. Also, the attitude of the church in relation to supporting every expenditure with receipt is not in agreement with the assertion of Hauriasi, (2011) that scant attention is paid to internal controls in religious institutions which could be attributed mainly to the fact that their primary purpose is spiritual and social rather than economic.

In addition to the aforementioned controls and accountability practices of the Church, the study discovered that the monitoring of the church’s financial system was another control measure instituted at the Church. Few of the respondents were of the opinion that, at every stage, there is someone who monitors the church’s finance system. This is to ensure that the church’s financial system is sound. From the religious point of view, anyone who spends God's money indignantly will bring curses on themselves, and so leaders are very mindful of that. From this theoretical stance, a respondent had this to say:

Errrmmm we have someone who monitors the church accounting system frequently but the person is not an auditor. So, I will say that the person is chiefly responsible for following the funds to see if proper steps are being taken in handling them, and errmmm also reviewing the systems and controls to see if expenditure is within the approved limits.

Another staff also said that:

Although the systems are available the audit team doesn’t come every month to check the transactions so the transactions get palled up and tracing source documents becomes difficult sometimes. But the external auditors from the national audit unit of the Presbyterian church visit the church every quarter for their audit.

Inference from the findings on the system of internal controls put in place for accountability purpose clearly shows that the management of the church has a designed system of control to provide reasonable assurance regarding the achievement of the objectives of the church (Tanui et al., 2016). Therefore, the leaders of the churches perceived that in order to remain accountable to the provision of a sacred mission to God and humanity, they needed to actively adopt accountability and internal control strategies that will help maintain and protect the churches’ assets. In order to implement such core strategies, the leaders of the churches were seen to have advocated a number of subsidiary strategies, and all of which were seen to have contributed to the protection of the resource base by minimizing the chances of misappropriation of funds. The findings are not surprising, as the church has demonstrated on a number of occasions that it does not entertain corrupt practices and misappropriation of church or public funds. For example, when the leaders of the Presbyterian Church noticed that some church officials were engaged in corrupt practices, the Church either suspended or ordered them to repay any misappropriated money and called upon the auditors to put in place controls to prevent such a threat from occurring in the future (myjoyonline, 2011).

Also, in 2013, the Presbyterian Church held a press conference expressing concern over the increasing incidence of bribery and corruption, theft and misappropriation of state and private funds in the country and called on government to sit up (modernghana, 2013). Likewise, in August 2016, the main opposition presidential nominee, when he wanted the Church to rally behind him to fight corruption in the country, it was the Presbyterian Church of Ghana that he believed could play a major role in ensuring that society ends all acts of corruption (citifmonline, 2019). Although, the leaders of the church were criticized to have been in bed with the opposition party, when there was change in power, the Church again called on the authorities in the helm of managing the public resources of the country to stop lamenting on corruption and act decisively to save the nation from the curse (Daily Graphic, 2019). All these efforts have shown that the Presbyterian Church of Ghana does not condone acts of corruption and misappropriation of public funds.

Weaknesses of the Internal Controls Systems

Religious organisations, like profit-making entities, are also vulnerable to flaws in controls put in place to address issues of misappropriation of church assets. Following the responses, it was evident that some of the congregations were not proactive enough to detect and prevent errors in the management of funds. Some of the opinions expressed by the respondents were that a great deal of effort is not taken into account when it comes to preventing and detecting errors, because the Church sees the detection and prevention of errors in the Church’s accounting system as an activity that should not interfere with the Church's more important spiritual endeavors.

The respondent also explained that the relationship between church stakeholders and management is complicated by non-contractual, and therefore, when dealing with financial issues, it is seen as more spiritual than monetary. A respondent had this to say:

Normally, we do not focus much on prevention and error detection when it comes to internal control practices. Because it's a church, so people are expected to be well behaved, and I'm also going to say that because it's a church, we get to work with people who are well behaved so we don’t envisage anything like they will mishandle our assets and our accounts.

A respondent also added:

…for now, we are not constantly checking for errors, so I'm going to say that detecting errors in the church isn't on a regular basis because this is the house of God. Although, it is expected that errors should be prevented all the time, I cannot do it, but all I want to say is that at the end of the day, we do it and the errors are corrected if there are any.

The responses gathered appear that the sampled respondents for the case study mix faith and belief of God in the performance of their routine duties. This implies that the workers see God as the main internal control system of the church and not what human has established and implemented.

It was also discovered that, in a church setting where truth is the basis of activities, fraud can be carried out undetected if the control system is spiritualized. In addition, where internal controls are not in place or ineffective, the propensity to defraud the church is high. A respondent expounds:

Frankly speaking, when internal controls are not in place or ineffective, there is a high tendency to defraud in the church. Integrity and ethical values, I'm going to say it's a little lower than the average rate, but all the same, I think the members and the workers here are God-fearing, so they won't do anything against the will of God.

Inference from the above findings indicates that although controls systems are in place it appears trust is used by the Church to complement the implementation of the controls. Donors usually react to internal control problems by decreasing the amount of their donations, which has been found to occur in general among the non-profits making organisations (Duncan et al., 1999; Tanui et al., 2016). The inability of some of the congregations to be proactive enough to detect and prevent errors provides opportunity for fraud to thrive for several months before detection, which hinders proper internal auditing practices in religious organisations.

Conclusion

Drawing on the ideas of Resource-based View and Resource Dependence theory, the study sought to explore how accountability and internal control practices in churches facilitate proper fund management in an emerging economy. The study further unearths the challenges that the churches face in implementing internal controls. This is a way to understand how physical and spiritual protections are blended to safeguard church’s assets. The results of the study revealed that the case study institution has a great deal of strength, such as the incorporation of corporate or secular standards that promote efficiency in all facets of its congregations in the country. The congregations have professionally trained staff and volunteers, as well as elders who guide and monitor all activities. Also, the congregations have a good record-keeping culture and a good brand name with respect to their integrity in all their dealings. Further, it emerged from the study that much focus is not placed on integrity and ethical issues in financial accountability, because the congregations believe that those at the front line dealing with church resources will do so with a high level of integrity, because Christ is the center of all things in the congregations.

Based on the findings, the study concludes that the congregations of the Presbyterian Church of Ghana have taken action to improve the effectiveness of their internal control systems. For instance, the congregations ensured that the payment vouchers are forwarded to the account officer, who shall then forward them to the two officers assigned by the churches for appropriate approval. Payment vouchers are then forwarded to the District Minister and then to the Treasurer of the Session for final approval. The study also concludes that all expenditures have supportive documents and receipts. However, the congregations seem to have left the monitoring of the controls in the hands of God and His Angels to handle them.

This study offers a number of implications for research, practice and policy. For research, the study shows that Resource-based View Theory complements Resource Dependency Theory to enhance accountability and internal control in religious organisations in emerging economies. For instance, the study unearths that the type of accountability and internal control practices offered by religious organizations is an important determinant of whether or not these organizations will succeed in maintaining the loyalty of their followers. This is because the churches rely largely on the offering, the tithe, the donation just to mention a few, to carry out their mandate, therefore, if the funds are not put to proper use, the contributors to the fund will be discouraged from continuing to give to the church. In addition, this is the first qualitative study that offers insight into the study of accountability and internal controls practices within religious organisations through the lens of Resource-based View and Resource Dependence theory.

The results of this study should inform the deliberations of regulators, standard-setters and policy makers. In addition, research findings are helpful to formulate policies, particularly by the church regulators, governments and the internal auditors, in order to resolve the challenges of internal controls among religious organisations.

One of the weaknesses of this study is that it was confined to congregations of the Presbyterian Church of Ghana in the Greater Accra Region. This makes it very difficult to generalize the findings. Therefore, the study suggests that other researchers take a broader sample into account. The entire Presbyterian Church of Ghana, for example, or the comparative study of Ghana’s Charismatic and Orthodox Churches.

References

- Abdulkadir, H. S. (2014). Challenges of implementing internal control systems in Non-Governmental Organizations (NGO) in Kenya: A case of Faith-Based Organizations (FBO) in Coast Region, Journal of Business and Management, 16 (3), 57-62.

- Agyei-Mensah, B. K. (2016). Accountability and internal control in religious organisations: a study of Methodist church Ghana, African Journal of Accounting, Auditing and Finance, 5(2), 95-112.

- Ahiabor, G., & Mensah, C. C. Y. (2013). Effectiveness of internal control on the finances of churches in Greater Accra, Ghana, Research Journal of Finance and Accounting, 4(13), 115-120.

- Apollo, O. (2020). Control Environment, Risks Assessment, Control Activities and Financial Accountability in Pentecostal Churches: Evidence of Lira Municipality, International Journal of Innovative Research and Advanced Studies, 7(6) 1-6.

- Behn, B. K., DeVries, D. D., & Lin, J. (2010). The determinants of transparency in nonprofit organizations: An exploratory study, Advances in Accounting, 26(1), 6-12.

- Blackbeard, L. (2011). Accounting for the church, Accounting Honours Journal, 2(59), 56-58.

- Boncondin, E. T. (2007). Citizen engagement in budgeting and public accountability. 6th Session of the United Nations Committee of Expert on Public Administration.

- Booth, P. (1993) Accounting in churches: research framework and agenda, Accounting, Auditing and Accountability Journal, 6(4),37–67.

- Braun, V., & Clarke, V. (2006). Using thematic analysis in psychology, Qualitative research in psychology, 3(2), 77-101.

- Crawley, S. L. (2014). A study of determinants of giving among churches affiliated with the Baptist Missionary Association of America. Dallas Baptist University.

- Creswell, J. W. (2014). Research design: Qualitative, quantitative, and mixed methods approaches (4th ed.). Thousand Oaks, CA: Sage Publication

- Creswell, J. W., & Clark, V. L. P. (2017). Designing and conducting mixed methods research. Sage publications.

- Duncan, J. B., Flesher, D. L., & Stocks, M. H. (1999). Internal control systems in US churches. Accounting, Auditing & Accountability Journal, 12(2) 142-164.

- Ekhomu, G. O. (2015). The impact of financial literacy competencies in faith-based organizations: A multiple case study of independent churches in mid-western USA, (Order No. 3741495). Available from ProQuest Dissertations & Theses Global. (1753915442). Retrieved from http://ezproxy.liberty.edu:2048/login?url=http://search.proquest.com /docview/ 1753915442?accountid=12085

- Gachoka, N., Aduda, J., Kaijage, E., & Okiro, K. (2018). The intervening effect of internal controls on the relationship between budgeting process and performance of churches in Kenya, Journal of Finance and Investment Analysis, 7(2), 53-79.

- Grant, R. M. (1996). Toward a knowledge?based theory of the firm, Strategic management journal, 17(2), 109-122.

- Gupta, K. (2011). Business unit strategy: The quest for competitive advantage. In L. Fahey and R. Randall (Eds.). The Portable MBA in Strategy (2nd ed.). New York: John Wiley.

- Hauriasi, A. (2011). The interaction of Western Budgeting and Solomon Islands Culture: A Case of the Budgeting Process of the Church of Melanesia [online] http://researchcommons.waikato.ac.nz/ (accessed 16 May 2020).

- Heward-Mills, D. (2009). Why Non-Tithing Christians Become Poor. Parchment House. Accra.

- https://www.modernghana.com/news/485409/presby-church-calls-for-action-on-corruption.html (accessed 7 February, 2021).

- https://www.graphic.com.gh/news/general-news/act-to-save-country-from-corruption-presbyterian-church-of-ghana-tells-leadership.html (accessed 7 February, 2021).

- https://citifmonline.com/2016/08/nana-addo-courts-presby-church-to-help-fight-corruption/

- https://www.myjoyonline.com/christian-council-of-ghana-holds-symposium-on-anti-corruption/(accessed 7 February, 2021).

- Irvine, H. J. (2015). Balancing money and mission in a local church budget, Accounting, Auditing & Accountability Journal, 18(2) 2, 211-237.

- Iyoha, F. O., & Oyerinde, D. (2010). Accounting infrastructure and accountability in the management of public expenditure in developing countries: A focus on Nigeria, Critical perspectives on Accounting, 21(5), 361-373.

- Jayasinghe, K. & Soobaroyen, T. (2009). Religious spirit and peoples' perceptions of accountability in Hindu and Buddhist religious organizations, Accounting, Auditing & Accountability Journal, 22(7), 997-1028.

- Laughlin, R. (2009). Accounting in its social context: an analysis of the accounting systems of the Church of England, Accounting, Auditing and Accountability Journal, 1(2), 19-42.

- Leithwood, K. A., & Riehl, C. (2003). What we know about successful school leadership. Nottingham: National College for School Leadership.

- Millichamp, A. H. (2005). Auditing, 8th ed., Thomson Learning, London.

- Myers, J. (2012). An effective performance measurement system: Developing an effective performance measurement system for city of Elmira sub-grantees, New York: Unpublished manuscript, Binghamton University, State University of New York.

- Peters, C. S. (2015). More than just good deeds: Fraud within religious organizations” (Order No. 1599154). Available from ProQuest Dissertations & Theses Global. (1728329488). Retrieved from http://ezproxy.liberty.edu:2048/login?url=http://search.proquest .com/docview/1728329488? accountid=12085

- Pfeffer, J. & Salancik, G. R. (1978). The External Control of Organizations: A Resource Dependence Perspective, Harper & Row, New York.

- Schneider, J. (2012). Comparing stewardship across faith-based organizations. Nonprofit and Voluntary Sector, Quarterly, 42(3), 517- 539.

- Tanui, P. J., Omare, D., & Bitange, J. B. (2016). Internal control system for financial management in the church: A case of protestant churches in Eldoret Municipality, Kenya, European Journal of Accounting, Auditing and Finance Research, 4(6), 29-46.

- Walsham, G. (2006). Doing interpretive research. European, Journal of information systems, 15(3), 320-330.

- Woodbine, G. (1997). Cash Controls Within Christian Churches: An Exploration of the Determinants, Asian Review of Accounting, 5(2), 21-37.

- Yuesti, A., & Kepramareni, P. (2014). Accountability and accounting infrastructure in several churches in Bali, Scientific Research Journal, 4(7), 23-30.