Research Article: 2021 Vol: 24 Issue: 3

Accountability index for zakat management institutions in Indonesia

Rini Rini, Universitas Islam Negeri Syarif Hidayatullah Jakarta

Ari Purwanti, Universitas Islam Negeri Syarif Hidayatullah Jakarta

Wilda Farah, Universitas Islam Negeri Syarif Hidayatullah Jakarta

Citation Information: Rini, R., Purwanti, A., & Farah, W. (2021). Accountability index for zakat management institutions in Indonesia. Journal of management Information and Decision Sciences, 24(3), 1-10

Abstract

Zakat is an explicit obligation in the pillars of Islam. In recent years, research on the dimensions of accountability of financial statements has been carried out. However, the dimensions of accountability in financial statements, especially for Zakat management institutions (ZMI), have not yet been found. Therefore, the study seeks to investigate the purpose of the financial statements of ZMI and to rank based on the accountability dimension index by using a qualitative method of the critical paradigm approach. Data collection is carried out in a comprehensive convenience sampling. A series of research activities ranging from interviews with the financial department of zakat institutions, distributing questionnaires to people who pay zakat (muzakki), to conducting group discussion forums with experts and academics. The results show that the financial dimension is ranked first, followed by the dimensions of performance, governance, public information, observance based on sharia rules, and engagement/interaction being the smallest weights.

Keyword

Accountability; Zakat management institutions; Financial reporting; Indonesia.

Introduction

As a religious public sector organization, Zakat Management Institutions (ZMI) requires financial reporting in accordance with their objectives. Allah says in the Qur'an that "Allah commands you to restore your beliefs to those who are entitled to it; and when judging between people who judge fairly. This verse instructs Muslims to take responsibility for the beliefs imposed by related parties. The relationship between the organization and the community/stakeholders is carried out through various forms of formality accompanied by how to account for it is the main factors in accountability (Gray & Bebbington, 2006).

IFAC (2020) states that the purpose of accounting in public sector organizations is to: 1) manage information on the use of appropriate, efficient and economical resources in the organization's operational processes, and 2) report the responsibility of managers in the implementation of management of resources under their appropriately and effectively control. Accounting in the public sector focuses on three main points, namely the provision of information, management control, and accountability. Accounting expert, Parker (2001), at a future accounting seminar in Adelaide emphasized the need for accounting changes from an emphasis on decision making to an emphasis on accountability (Harahap, 2007). Parker (2001) revealed there are shifting paradigms in accounting.

Accounting in past years, more focused on prepare financial statement for decision making. In recent era, for realizing accountability and transparency, we need financial reporting as an accountability tool. Therefore, New Public Management (NPM), a public sector organization that aims to increase transparency and accountability. Transparency and accountability are interrelated. Transparency makes the breath of accountability important for financial management resilience (Cutt & Murray, 2000).

Accountability is very important and needs to be increased to reduce scandal and lawlessness (Keating & Frumkin, 2001). For this reason, good management will increase public trust in ZMI (Mukhlisin, 2015) through disclosures that ensure accountability and transparency (Saunah et al., 2014). Financial disclosures from zakat, infaq and waqf (LAZIS) or non-profit organizations (NPO) have an impact on the receipt of funding or organizational performance (Marudas, 2002; Zietlow et al., 2007).

The fact shows Bambang Sudibyo (Chairman of the National Education Agency) stated that collecting ZIS in 2016 was IDR 5.12 trillion. This number increased by 20% (Tempo, 2017). However, the achievement of the ZIS collection is only 2.36% of the potential ZIS released in 2012 (IDR 217 trillion) in Indonesia. In a recent study released by Gora (2016), the potential amount of zakat is IDR.286 trillion. The percentage of ZIS collection is still lower than the potential of ZIS. One of the factors that influence the collection of ZIS is financial reporting by zakat institutions. The better the reporting, the ZIS collection increases (Puskas Baznas, 2017).

Based on the Analytical Framework, this study will propose an accountability framework within ZMI by (1) providing information about decisions and actions taken during the entity's operations; (2) asking internal parties to review information, and (3) taking corrective action if necessary. Therefore, this study aims to reduce the gap in previous ZMI topic research through dimensions of ZMI financial reporting, the dimensions of accountability in ZMI into index, and then what should stakeholders need about financial reporting requirements for zakat institutions.

Literature Review

The meaning of Surah Al-Tawbah: 60 directs that in fact the zakat must only be given to: people in need who have nothing, the poor who do not have something to satisfy them and cover their needs, officials who are busy collecting it, people who softened his heart so that his Islam is expected, or is expected to strengthen his faith, or people who are expected to benefit Muslims, or you can dismiss with him the badness of someone against the Muslims, to free slaves and slaves who want to redeem themselves, those who affected by debt demands in order to improve disputes, or people who are burdened by debts that are not used for damage or scattered, then they find it difficult to pay it off, fighters in the way of Allah, and travelers who run out of supplies. This division is an obligation obliged by God and determined by Him. Allah knows well the benefits of His servants, all-wise in the regulation and teachings of His Shari'a.

Zakat is one of religion duties from Allah to Moslem, which is equivalent to prayer, fasting, and hajj. However, it is recognized as wealth worship through one’s properties instead of as physical worship through one’s body (BAZIS DKI Jakarta, 1999). Zakat means "purifying", purifying wealth and soul. Purifying wealth is done by distributing assets for the purpose of growing prosperity. Meanwhile, it purifies the soul by freeing humans from greed, selfishness, jealousy, hatred, and various forms of discomfort, and includes forgiveness of sins.

The principle of zakat governs two types of zakat, namely zakat-ul maal which regulates the purification of wealth or property, and zakat-al-fitr, is inherent in human beings and is obligatory on every Muslim, without exception being paid at Ramadan before the Eid Al-Fitr prayer. In zakat there is Muzakki, who is obliged to pay zakat and Mustahiq, the rightful recipient of zakat (8 groups/asnaf in Al Quran). The rules of zakat are based on nisab (minimum amount) and haul (annually paid). Nisab is a calculation of the minimum value based on the fair price of 85 grams of gold/595 grams of pure silver. Haul is the period in which the property is obliged to pay zakat.

The benefits of Islamic accounting, relating to zakat, seek to avoid doubts in zakat justice disputes (Chapter/Sura Hud verses 84-85; Al-An’am verse 152) and equal distribution of rights (Al-Qur'an An- Nisa verse 29). The nature of Islamic accounting is to determine the proper income and promote and assess the efficiency of leadership, compliance to Sharia law, attachment to justice and change in the financial reporting and accounting practice (Afifuddin & Siti-Nahzia, 2010). Circulation of wealth, prohibition of interest, and forbidden transaction and contracts are Islamic accounting purpose, in terms from the economic objectives of sharia law (Hameed, 2005).

Islam has a Shari'a that must be obeyed by Muslims, so it is natural that Muslims must have financial and accounting institutions in accordance with the basics of religion. Accounting is important in Islam because of the importance of emphasis on social aspects and the need for the implementation of the zakat and baitul mal system (Gambling et al., 1993).

Ikatan Akuntansi Indonesia (IAI/Indonesian Accountants Association) in Sharia Financial Reporting Conceptual Framework describes that financial statements have general purpose objective. More detailed in Article 30, the objectives of financial statement are:

1. To increase the obedience on sharia principles for all transactions and activities

2. To inform the obedience sharia entities on sharia principles, including their assets, liabilities, incomes and expenses that are not comply with sharia principles if any, and how to get and use them.

3. To inform and assess responsibility compliance sharia entity on trustworthiness in fund protection, investing in fair profitability.

4. To inform return on investment to capital provider and temporary syirkah fund owner; and to inform related to pay obligation sharia entity social function, including manage and distribute zakat, infaq, sadaqa (voluntary donations), and waqf.

Accounting and Auditing Organization for Islamic Financial (AAOIFI, 2015) and IAI (2016) state the purpose of financial reporting is for decision making and stewardship (accountability). Accountability influences the behavior of zakat payers (Saxton & Guo, 2011; Sloan, 2009).

IAI mentioned in PSAK 109, that the financial statement for ZMI contains of Statement of Financial Position; Statement of Changes in Fund; Statement of Changes in Asset under management; Statement of Cash Flows, and Notes to The Financial Statement.

The presence of regulations will increase the accountability of NPOs thereby increasing the ability to serve the community (Chisolm, 1995). NPO accountability consists of three categories, namely: economic and financial dimensions, mission-related dimensions, and socialrelated dimensions (Andreaus & Costa, 2014). For example, accountability in faith-based charitable organizations consisting of process accountability, performance accountability, program accountability, policy accountability (Yasmin et al., 2014).

Unfortunately, few academic studies have investigated the urgency of accountability mechanisms in Non-Government Organizations (O'Dwyer & Unerman, 2008). Rini (2016) found there are accountability issues at ZMI and there is a lack of financial reporting at ZMI. There are eight recommendations regarding the management of Zakat Institutions, four of which improve financial management, prepare financial reporting standards and timely reports, transparency of zakat institutions and efficient disbursement of Amil funds.

Accountability in social and complete disclosure is the basis for the correct use of accountability in Islam (Baydoun & Willet, 1998). Adequate accountability information contains information about fulfilling the obligations of Allah's rules and information in economic and environmental decision making (Haniffa & Hudaib, 2002). The presence of 19 verses in the Koran related to accountability shows the importance of accountability (Maali et al., 2006; Haniffa & Hudaib, 2007) for all organizations, including zakat institutions. The roots of accountability in management, accounting practices and reporting appear to be within the waqf entity under study, significant improvements are still needed to ensure accountability can be continuously improved and enforced (Nahar & Yaacob, 2011). Understanding religion in financial reporting is important because social norms based on religious understanding are known to have a strong influence on how humans will act (Perrin, 1985; Sunstein, 1996; Cialdini and Goldstein, 2004).

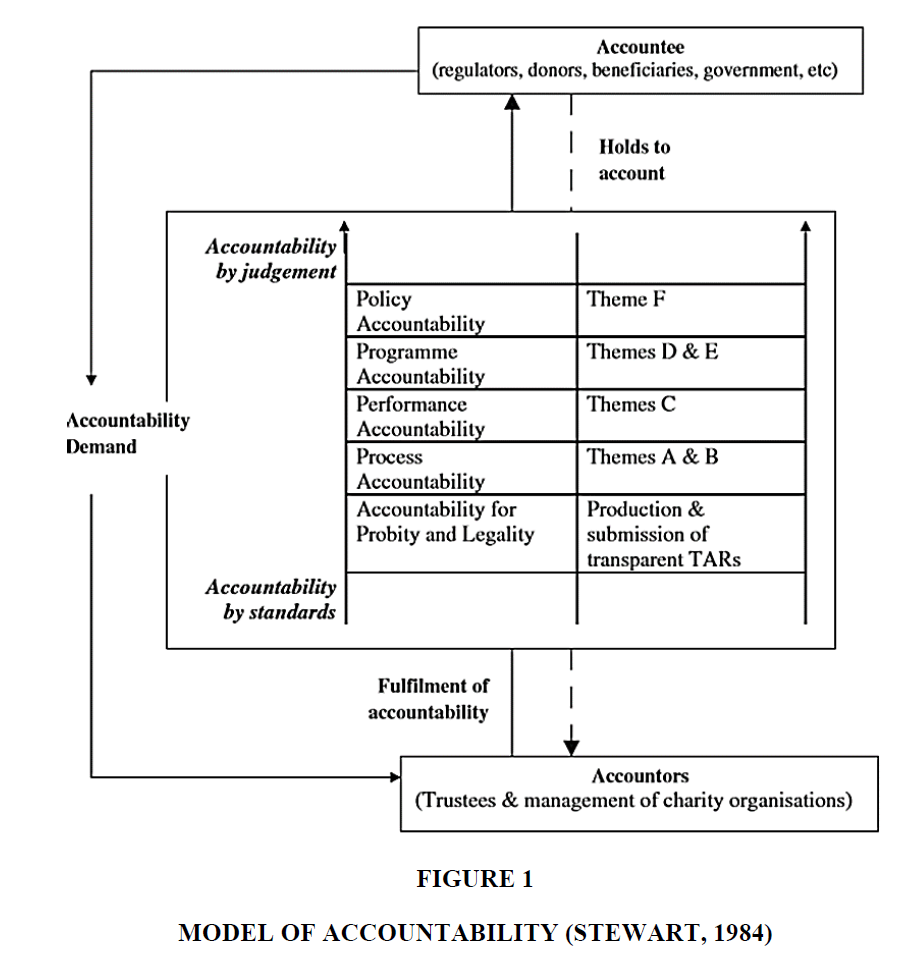

Yasmin et al. (2014) uses the five levels of accountability previously established by Stewart (1984) in Figure 1 which is a recommendation on the practice of charity organizations in the UK. This accountability assessment starts from operational information to strategic information. Process Accountability provide information about the administration, structure and governance of an organization in accordance with the goals and mission of the organization (Themes A and B). Program accountability provides information about the implementation of activities and their achievements (Themes D and E). Performance Accountability provides achievement and performance information (Theme C). Policy accountability provides information about monitoring policies on the suitability of activities taken with the goals/mission of the organization, both now and in the future (Theme F).

Research Methodology

Because of this study aims to reduce the gap in previous ZMI topic through formulate the dimensions of accountability in ZMI into index, then what should stakeholders need about financial reporting requirements for ZMI, this research has done in qualitative way by critic paradigm approach (Sekaran, 2016).

Data collection is obtained directly from the source through interviews to the financial section of ZMI, group discussion forums for experts and academics, plus the acquisition of information from filling in the questionnaire by muzakki. Therefore, the determination of sampling uses the convenience sampling method.

This research started to formulate operationalization method, and then held focus group discussion about operationalization method. To ensure the information that have been gathered, the next activity is to distribute questionnaire to muzakki. Again, focus group discussion about result is held, and the last is to hold meeting with regulator for recommendation and further action.

To conduct all the research activity, we took into 2 phases that explained step by step the process of operationalizing the four identified broad financial reporting for ZMI based on accountability approach into behavioral dimensions and measurable elements. Yasmin et al. (2014), proposed four level accountabilities (Process, Performance, Program, and Policy), and Siswantoro et al. (2018), have five concepts of financial reporting (Finance, Performance, Public, Engagement, and Islamic Aspect), the study has identified and summarized four broad ideal financial reporting for ZMI based on accountability approach, namely Process, Performance, Program and Policy accountability. Each of these four concepts would thereafter be broken down into broad characteristics or dimensions (D) and finally into measurable behaviors or elements (E).

The second phase is the process of identifying the stages of the dimensions, then identifying elements and turn into indicators of every concept of ZMI's financial reporting objectives likes in Table 1. Beginning with interpreting that refers to the Al-Quran and the Sunnah. Then, the application of the theory developed in a series of previous studies on the accountability of Islamic financial statements.

| Table 1 Zakat Management Institutions (ZMI) Accountability Aspects | ||||

| Dimension | Dimensional Weight (%) | Indicator | Indicator Weight (%) | Source of Data |

| D1. Finance | 29.38 | Audited financial statement | 23.44 | Questionnaire |

| Information on ZIS Fund Distribution (with details of category 8 asnaf) |

20.30 | Questionnaire | ||

| Information on receipt of ZIS funds | 14.98 | Questionnaire | ||

| Statements of financial position | 12.57 | Questionnaire | ||

| Sharia council activity and information | 10.59 | Questionnaire | ||

| Management records and structure | 8.97 | Questionnaire | ||

| Information that supports the Financial Statements | 9.15 | Questionnaire | ||

| D2. Performance | 16.17 | Funds change report (detailed deficit/surplus information) |

26.44 | Questionnaire |

| Suggestions from beneficiaries | 18.44 | Questionnaire | ||

| Program effectiveness and evaluation |

21.68 | Questionnaire | ||

| Employee competency improvement program |

15.13 | Questionnaire | ||

| Performance indicator | 18.32 | Questionnaire | ||

| D3. Public Information | 14.73 | Information for the recipient and distributor of zakat funds |

29.27 | Questionnaire |

| Information on zakat institutions | 19.45 | Questionnaire | ||

| Information on the percentage of funds used for social empowerment | 21.88 | Questionnaire | ||

| Response to suggestions | 14.80 | Questionnaire | ||

| Description of programs and activities |

14.60 | Questionnaire | ||

| D4. Engagement | 10.84 | Access and availability of contacts | 32.82 | Questionnaire |

| official websites | 26.49 | Questionnaire | ||

| Updates and organization news | 21.22 | Questionnaire | ||

| FAQ | 19.48 | Questionnaire | ||

| D5. Governance | 14.87 | Code of ethics and regulations | 38.32 | Questionnaire |

| Sharia Supervisory Board | 35.07 | Questionnaire | ||

| Audit Committee | 26.61 | Questionnaire | ||

| D6. Compliance with Sharia Law and Other Regulations |

14.01 | Compliance with sharia law | 43.17 | Questionnaire |

| Compliance with regulations | 29.41 | Questionnaire | ||

| Basic policies followed | 27.43 | Questionnaire | ||

In a series of research activities, such as questionnaire filling, interviews and discussion group forums, there are several things that underlie these activities. This research builds a conceptual framework by exploring a number of basic things regarding the accountability of financial reporting theoretically and practically. The design is always based on how the accountability framework can be applied. Starting from what is the manifestation of accountability; when accountability is said to be relevant and at the level of position or organization; to whom accountability is responsible; why does accountability require information and what types of accountability are needed; how accountability information is generated, communicated, validated, used, until it is likely to be released (Saad et al., 2014; Afifuddin & Siti-Nahzia, 2010).

Results and Discussion

Research on the accountability index for nonprofits was investigated by Yasmin et al. (2014), Siswantoro et al. (2018), and Mohammed (2018) who show different accountability conceptual results. This research uses all the concepts that have been used from the three researchers. The most appropriate dimension in the context of ZMI is chosen. The results show the Islamic accountability index for zakat institutions consisting of six dimensions such as Finance, Performance, Public Information, Engagement, Governance, and Compliance with Sharia Law and Other Regulations.

Each dimension consists of various components which are also appropriate in the context of ZMI in theory and practice. Finance dimension has 29.39% weight of accountability information which is the biggest weight of accountability information. It consists of seven indicators, such as audited financial statement, information on ZIS Fund Distribution (with details of category 8 asnaf), information on receipt of ZIS funds, statements of financial position, sharia council activity and information, management records and structure, information that supports the Financial Statements.

Performance dimension has only 16.17% weight of accountability information consists of five indicators, such as funds change report (detailed deficit/surplus information), suggestions from beneficiaries, program effectiveness and evaluation, employee competency improvement program, and performance indicator.

Public information dimension has only 14.73% weight of accountability information consists of five indicators, such as information for the recipient and distributor of zakat funds, information on zakat institutions, information on the percentage of funds used for social empowerment, response to suggestions, and description of programs and activities.

Engagement dimension has only 10.84% weight of accountability information which is the lowest weight of accountability information. It consists of four indicators, such as access and availability of contacts, official websites, updates and organization news, and FAQ.

Governance dimension has only 14.87% weight of accountability information consists of three indicators, such as code of ethics and regulations, sharia Supervisory Board, and audit Committee.

Compliance with Sharia Law and Other Regulations dimension has only 14.01% weight of accountability information consists of three indicators, such as compliance with sharia law, compliance with regulations, and basic policies followed.

Based on the results of filling in the questionnaire by muzakki, it is seen that 57% of the sample are male and 43% of the sample are in the age of 41-50 years with the most education at postgraduate level. Most respondents are muzakki who have paid zakat for 10 to 15 years with income levels below 5 million rupiah. Data also shows that 45% of respondents are civil servants.

The results of filling in the accountability questionnaire by the muzakki for the financial dimension show the highest weighting among other accountability dimensions. Nearly 30% of accountability, the financial dimension takes an important role in which good ZMI accountability is by disclosing matters relating to finance. The muzakki really want that the financial statements of ZMI must be audited. This requirement ranks first among other financial elements. This shows that the public still needs audited financial statements to increase their confidence in ZMI. With the audited financial statements, the public can assess that ZMI's financial statements have no material misstatements and are in accordance with their presentations based on applicable standards. Although, there is need to disclose elements of the statements of financial position ranks fourth.

The information needs that muzakki really want to know are elements of Information on ZIS Fund Distribution (with details of category 8 asnaf). This shows that the muzakki want to know the zakat he paid will be distributed to any recipient and whether the distribution is in accordance with sharia targets and rules.

Meanwhile, the Information on receipt of ZIS funds element and the Sharia council activity and information element are at a dozen percent. About 30% of the difference is the highest elemental weight. The elements of Management records and structure and Information elements that support the Financial Statements are elements that only less than 10% of the information desired from the financial dimension by muzakki. This shows that muzakki don't really need information about how ZMI processes financial data.

The second biggest dimension of accountability is ZMI performance. The difference in the magnitude of the contribution of the financial dimension to the performance dimension of 30%. So that only 16.17% of ZMI's performance dimensions contributed to ZMI's financial reporting accountability. Funds change report (detailed deficit/surplus information) is the information most needed by muzakki, followed by the Program effectiveness and evaluation. This shows that the muzakki need information on the availability of zakat funds to be distributed along with information on the effectiveness of distribution and evaluation programs.

Meanwhile, Suggestions from beneficiaries, Performance indicators, and Employee competency improvement programs still need information, but not as much as Funds change report information (detailed deficit/surplus information). ZMI's internal performance conditions are not the most needed concern for muzakki. Meanwhile, the dimensions of governance, the dimensions of public information, and the dimensions of compliance with sharia law and other regulations are dimensions of accountability that have an almost equal weight rating, at 14%. On the governance dimension, the code of ethics and regulations element, the sharia supervisory board element, and the audit committee element have an almost equal role in contributing to the governance dimension. This result implies that governance mechanisms are expected to work effectively in supervising ZMI performance.

However, this is not the case for elements in the other two dimensions at the same weight level. In the public information dimension, the Information for the recipient and distributor of zakat funds elements are the elements that make the highest contribution from this dimension. That is, the muzakki need adequate information channels in the distribution of zakat. While in the dimensions of compliance with sharia law and other regulations, the element that gave the highest contribution was compliance with sharia law. This condition certainly shows that ZMI obedience to sharia rules has begun to be built on a reasonably reliable basis.

For the engagement dimension, this dimension contributed only 10.84% of financial reporting accountability, with the highest element being Access and availability of contacts.

Conclusion

In an effort to narrow gaps in understanding the objectives of financial reporting by ZMI, this study identified several measures that match the accountability dimensions sorted by weight. So stakeholders can have an understanding of the minimum requirements in ZMI financial reporting. The higher accountability dimension reflects the greater the needs of stakeholders to find out information from this dimension in the process of preparing ZMI financial statements.

Through a series of questionnaires filled out by muzakki and interviews with ZMI's finance department and experts and academics, the results of this study provide practical implications for ZMI to evaluate that financial reporting requires an accountability dimension that convinces stakeholders to fulfill their needs based on weights. Stakeholders feel that ZMI has been accountable if the financial dimensions have been disclosed. Nearly one third of ZMI's financial reporting accountability is contributed by the financial dimension. While the next dimension of stakeholder consideration is ZMI performance, how is ZMI governance, public information and adherence to the sharia principle. These dimensions have contributed to ZMI's financial reporting accountability in the range of dozens of percent. While the engagement/interaction dimension provided the smallest contribution to ZMI's financial reporting accountability.

The results of this study show the implication that the importance of financial reporting accountability of ZMI will encourage the general public to have adequate confidence and trust in relation to that zakat has been well managed by ZMI. While in terms of the development of research in the field of zakat, although there are still many weaknesses in the collection of insufficient data, this study provides implications for further research to consider including regulators in interviews to affirm the importance of considering dimensions to improve accountability of ZMI financial reporting in future.

References

- AAOIFI. (2016). Accounting, auditing and governance standards. Bahrain: AAOIFI

- Afifuddin, H. B., & Siti-Nabiha, A. K. (2010). Towards good accountability: The role of accounting in Islamic religious organisations. World Academy of Science, Engineering and Technology, 66(6), 1133-1139.

- Andreaus, M. & Costa, E. (2014). Toward an integrated accountability model for nonprofit organizations. In: Accountability and social accounting for social and non-profit organizations (Advances in public interest accounting, Vol. 17), Emerald Group Publishing Limited.

- Baydoun, N., & Willett, R. J. (1998). Islam and accounting: Ethical issues in the presentation of financial information. Accounting, Commerce & Finance: The Islamic Perspective, 12(1), 1-25.

- BAZIS DKI Jakarta. (1999). Pengelolaan Zakat dan Infaq/Shadaqah di DKI Jakarta. Jakarta: BAZIS DKI Jakarta.

- Chisolm, L. (1995). Accountability of nonprofit organizations and those who control them: The legal framework. Nonprofit Management and Leadership, 6(2), 141-156.

- Cialdini, R. B., & Goldstein, N. J. (2004). Social influence: compliance and conformity. Annual review of psychology, 55, 591-621.

- Cutt, J., & Murray, V. (2000). Accountability and effectiveness evaluation in non-profit organizations. New York: Routledge.

- Gambling, T., Jones, R., & Karim, R. A. A. (1993). Credible organizations: self?regulation v. external standard? setting in Islamic banks and British charities. Financial Accountability & Management, 9(3), 195-207.

- Gora, K. (2016). “Baznas: Potensi Zakat di Indonesia Capai Rp 286 Triliun.” Investor Daily, June 30, 2016. Retrieved form https://investor.id/archive/baznas-potensi-zakat-di-indonesia-capai-rp-286-triliun

- Gray, R., & Bebbington, J. (2006). NGO, civil society, and accountability: making the people accountable to capital. Accounting, Auditing & Accountability Journal, 19(3), 319-348.

- Hameed, S. (2005). A review of income and value measurement concepts in conventional accounting theory and their relevance to Islamic accounting. In B. Shanmugam, V. Perumal, & A. H. Ridzwa (Eds.), Issues in Islamic accounting. Selangor: Universiti Putra Malaysia Press.

- Haniffa, R. M., & Hudaib, M. A. (2002). A theoretical framework for the development of the Islamic perspective of accounting. Accounting, Commerce and Finance: The Islamic Perspective Journal, 6(1/2), 1-71.

- Haniffa, R. M., & Hudaib, M. A. (2007). Exploring the ethical identity of Islamic banks via communication in annual reports. Journal of business Ethics, 76(1), 97-116.

- Harahap, S. S. (2007). Krisis akuntansi kapitalis & peluang akuntansi syariah. Jakarta: Pustaka Quantum. IAI. (2016). Standar akuntansi keuangan syariah. Jakarta: IAI.

- IFAC. (2020). Public sector accounting-A discipline in its own right. Retrieved from https://www.ifac.org/knowledge-gateway/contributing-global-economy/discussion/public-sector-ccountingdiscipline-its-own-right

- Keating, E. K., & Frumkin, P. (2001). How to assess nonprofit financial performance. Harvard University and Kellogg Graduate School of Management at Northwestern University.

- Maali, B., Casson, P., & Napier, C. (2006). Social reporting by Islamic banks. Abacus, 42(2), 266-289.

- Marudas, N. P. (2002). Effects of large non-profit organization financial disclosures on private donor giving. (Doctoral dissertation, Georgia State University).

- Mohammed, M. O. (2018). The Performance of Islamic Banking: A Maqasid Approach. Kulliyyah of Economics & Management Sciences (KENMS) International Islamic University Malaysia.

- Mukhlisin, M. (2015). “Kemana Zakat Kita?” Sakinah Finance, Retrieved from http://sakinah.mysharing.co/14745/kemana-zakat-kita/

- Nahar, H., & Yaacob, H. (2011). Accountability in the sacred context: The case of management, accounting, reporting of a Malaysian cash awqaf institution. Journal of Islamic Accounting and Business Research, 2(2), 87-113.

- O’Dwyer, B., & Unerman, J. (2008). The paradox of greater NGO accountability: A case study of Amnesty Ireland. Accounting, Organizations and Society, 33(7-8), 801-824.

- Parker, L. D. (2001). Reactive planning in a Christian bureaucracy. Management Accounting Research, 12(3), 321- 356.

- Perrin, J. R. (1985). Differentiating financial accountability and management in governments, public services and charities. Financial Accountability & Management, 1(1), 11-32.

- Puskas Baznas. (2017). Outlook zakat Indonesia 2017. Retrieved from https://www.puskasbaznas.com/images/outlook/outlook_zakat_2017_puskasbaznas.pdf

- Rini, R. (2016). Penerapan internet financial reporting untuk Meningkatkan Akuntabilitas organisasi pengelola zakat. Jurnal Akuntansi Multiparadigma, 7(2), 288-306.

- Saad, R. A. J., Aziz, N. M. A., & Sawandi, N. (2014). Islamic accountability framework in the zakat funds management. Procedia-Social and Behavioral Sciences, 164, 508-515.

- Saunah, Z., Atan, R., & Wah, Y. B. (2014). An empirical study on the determinants of information disclosure of Malaysian non-profit organizations. Asian Review of Accounting, 22(1), 35-55.

- Saxton, G., & Guo, C. (2011). Accountability online: understanding the web-based accountability practices of nonprofit organizations. Nonprofit and Voluntary Sector Quarterly, 40(2), 270-295.

- Sekaran, U. (2016). Research methods for business: A skill-building approach. London: Wiley.

- Siswantoro, D., Rosdiana, H., & Fathurahman, H. (2017). Islamic accountability index of cash waqf institution in Indonesia. In Gani, L., Gitaharie, B. Y., Husodo, Z., & Kuncoro, A. (Eds.), Competition and Cooperation in Economics and Business: Proceedings of the Asia-Pacific Research in Social Sciences and Humanities. Depok, Indonesia, Topics in Economics and Business. London: Taylor & Francis.

- Sloan, M. F. (2009). The effects of nonprofit accountability ratings on donor behavior. Nonprofit and voluntary sector quarterly, 38(2), 220-236.

- Stewart, J. D. (1984). The role of information in public accountability. In A. Hopwood & C. Tomkins (Eds.), Issues in public sector accounting. Oxford: Philip Allen.

- Sunstein, C. R. (1996). Social norms and social roles. Columbia law review, 96(4), 903-968.

- Tempo. (2017). Baznas: Penghimpunan Zakat Meningkat. Retrieved from https://bisnis.tempo.co/read/878771/baznas-penghimpunan-zakat-meningkat/full&view=ok.

- Yasmin, S., Haniffa, R., & Hudaib, M. (2014). Communicated accountability by faith-based charity organisations. Journal of Business Ethics, 122(1), 103-123.

- Zietlow, J., Hankin, J. A., & Seidner, A. (2007). Financial management for nonprofit organizations: policies and procedures. New Jersey: John Wiley & Sons.