Research Article: 2022 Vol: 28 Issue: 2S

Accounting Conservatism and Financial Crisis of Companies Accepted On the Tehran Stock Exchange

Ayad Adil Abdulhassan, AL-Furat Al-Awsat Techincal University

Salwan Kadhim Ojah, AL-Furat Al-Awsat Techincal University

Rabab Adnan Al-Ruba'ei, AL-Furat Al-Awsat Techincal University

Citation Information: Abdulhassan, A.A., Ojah, S.K., & Al-Ruba'ei, R.A. (2022). Accounting conservatism and financial crisis of companies accepted on the Tehran stock exchange. Academy of Entrepreneurship Journal, 28(S2), 1-23.

Keywords

Accounting Conservatism, Corporate Financial Crisis, Firm Size, Leverage Ratio and Profitability Index

Abstract

The purpose of this study is to investigate the accounting conservatism and financial crisis of companies accepted on the Tehran Stock Exchange. The statistical population of the study includes all companies accepted on the Tehran Stock Exchange between 1394-1398 (5-year time slicing). Among the companies, 103 of them were selected as a sample by systematic elimination sampling method. Regression method was used to analyze the information and test the hypotheses. The results showed that there is a significant relationship between accounting conservatism and financial crisis.

Introduction

One of the main arteries in the accounting and financial reporting system, is company’s information .This system has qualitative features affect the form and content of information, which is one of the qualitative features of accounting conservatism.

The appropriate tools to assess the financial condition of organizations, is one of the effective factors helps decision-making process. The most important tools are the models predicting companies’ financial distress and the bankrupt companies in different countries that are considered by researchers and capital market participants. Accordingly, in connection with the financial distress of companies, different theories proposed by researchers.

Dambulna & Khoury believe that company’s bankruptcy has occurred due to some internal and external factors. Internal factors occur due to the poor management performance, including lack of coordination with technological changes, unproper communication, fraud, inability to control costs and lack of financial knowledge of managers. (Farhadi, 1397)

According to John Su and Basu, conservatism in accounting practices has a 500 years history. Sterling believes that conservatism is the principle of assessing the influence of accounting, and in the United States, empirical researches about conservatism showed accounting practices are conservative, and they also become more conservative over the past thirty years. (Mehrani, Thani & Hallaj, 1396)

According to the literature of the research about helplessness and conservative crises, we will notice that studies will be done in these two areas, and the most important point is the impact of these two areas on each other which has been studied and how they effect on each other was explained. In order to explain the impact of the financial crisis on conservatism further analysis about the roots of financial crises is necessary. Securities markets closely monitor agency costs and stock price declines. This claims that declining shareholder and managerial prices motivate them to reduce asymmetry of information and agency costs (ibid, 112).

Problem Statement

In companies where managers meet financial crisis, due to declining profitability and lower stock prices and bonuses, they have high incentives to use optional accruals and profit manipulation. Such actions lead to lower profit quality and lower quality of financial information. Therefore in the context of the financial crisis, investors' trust on financial reporting system is weakened and determining the quality of accounting is crucial. (Shoorvarzi et al., 2016)

According to view of Olsons’ (1995), conservatism means the net worth expectation of a company's assets in the long time is less than its market value. In other words due to the utilization of accounting conservatism, the market value of the reported assets will be higher than their book value.

In order to take advantage of investment opportunities and better allocation of resources, anticipate financial distress suggested .Therefor, at first by providing the necessary warnings, companies will be aware of the occurrence of financial distress so they can response to these warnings, and second, investors and lenders distinguish favorable investment opportunities from unfavorable opportunities and invest their resources in appropriate investment opportunities. The Financial Accounting Board will define Conservatism in Accounting as a conservative response to ambiguity in Concept Statement number 2 in order to ensure the risks and ambiguities in the company are sufficiently addressed. Although conservatism has a long history in accounting, the joint Concept Framework draft for Financial Reporting, introduced in 2008, states that conservatism may lead to information asymmetries and that Investor insights into future cash flows will be diminished. In this research, we want to examine whether there is a significant relationship between accounting conservatism and the financial crisis of companies listed on the Tehran Stock Exchange?

Importance and Necessity of Research

Accounting conservatism is one of the fundamental concepts in accounting, defines conservatism requires a high degree of approval to recognize good news such as profit versus bad news such as loss. Discover accounting and other variables. Various studies have been conducted by researchers to discover the relationship between accounting conservatism and other variables. Examining variables such as accounting conservatism and corporate financial crisis as a new research can provide useful information to capital market participants compared to previous research. It is expected that the results of the research will have the following scientific achievement and value: (Eskandari & Farzaneh, 1390)

First, the results of this study can lead to the development of theoretical foundations related to the variables affecting the financial crisis of companies.

Second, results of research as a scientific achievement can provide useful information to investors, creditors and managers to achieve their goals.

Third, the results of this research suggest new ideas for further research on the subject of research.

Theoretical Foundations of Research

Accounting Conservatism

Accounting conservatism in accounting is the tendency to use a higher level of verifiability to identify favorable news than unfavorable news. Hendrix & Nobarda (2018) consider the reason for accounting conservatism, which is due to uncertainty, is two factors: the continuation of the business unit in the foreseeable future and the obligation to supply or estimate some amounts. They also bring reasons for the application of accounting conservatism; including pessimism stemming from the principle of accounting conservatism in the financial reporting process modulates optimism in management's major estimates of the entity's performance. Lafunds & Watts (2017) consider the use of accounting conservatism to be necessary because of the moderating over-management optimism in estimates. Basu (2016) defines accounting conservatism as the requirement to have a high degree of approval to recognize good news such as profit versus bad news such as loss. This definition describes accounting conservatism from a profit and loss perspective; but another definition is the definition of accounting conservatism from a balance sheet perspective. According to this view, in cases there is a real doubt in the choice or several reporting methods are considered, a method should be chosen that has the least desirable effect on equity. The third definition of accounting conservatism is based on the perspective of a combination of profit and loss and balance sheet. According to this concept, accounting conservatism means a reduction in the reported accumulated profit, a later income structure and a faster cost recognition, which leads to a lower valuation of assets and a higher valuation of debt. Ryan (2017) defines accounting conservatism as conditional accounting conservatism and unconditional accounting conservatism. Conditional accounting conservatism is accounting conservatism that is required by accounting standards; That is, recognizing losses in a timely manner in the presence of bad and undesirable news and not recognizing profits in the presence of good and desirable news. (Shahriari, 1396)

The Relationship between Accounting Conservatism and the Financial Crisis

In times of financial crisis, business unit managers tend to positively corporate profits by spreading good news, such as identifying unrealized profits (Biddle et al., 2017). Watts believes that if the company's contracts with various groups, such as investors and creditors, are based on accounting figures, then due to conflicts of interest between managers and those groups, company managers will try to behave in a biased manner. They will manipulate those figures that have increased profits or assets and reduced debts, for example, conservatism as an effective contractual mechanism by delaying the recognition of profits and assets and the recognition of At the time of losses and debts, they neutralized the managerial biased behavior, so it can be argued that there is a relationship between accounting conservatism and the financial crisis. (Talibnia, 2013)

Background of the Research.

Internal Research Background

Heidari & Tara (1398). The effect of accounting conservatism on the investment of companies listed on the Tehran Stock Exchange during the global financial crisis. The research method of the present study is applied and its research design is semi-empirical and using a post-event approach (through past information). The spatial scope of this research includes investment companies listed on the Tehran Stock Exchange and the time domain of this research was also from 1987 to 1991 that was selected by the systematic removal method and 71 companies were selected as the final sample by Cochran method. To prove this issue three hypotheses were also formulated. Corporate accounting conservatism before and after The financial crisis is significantly different. The level of corporate investment before and after the global financial crisis is significantly different. The relationship between accounting conservatism and corporate investment before and after the global financial crisis is significantly different. The results showed that conservatism there is a significant difference between corporate accounting before and after the financial crisis. The amount of investment of companies before and after the global financial crisis is significantly different. The relationship between accounting conservatism and corporate investment before and after the global financial crisis is significantly different. The results showed that the accounting conservatism of companies before and after the financial crisis is significantly different. The amount of investment of companies before and after the global financial crisis is significantly different. The relationship between accounting conservatism and corporate investment before and after the global financial crisis is significantly different.

Mehrani, Thani & Hallaj (1396) examined the size of the company and debt contracts with conservatism in the Tehran Stock Exchange in 85 companies between 1382-85. In this study, they found that there is a significant positive relationship between debt and conservatism in two criteria based on accruals and based on market value. Also, the negative relationship between firm size and conservatism was only confirmed in the criterion based on market value in their research. According to their conclusion, it cannot be inferred that there is a significant and negative relationship between firm size and conservatism.

Karami, et al., (2016) investigated the effect of the mechanisms of the company's management system on the level of accounting conservatism in companies accepted on the Tehran Stock Exchange. Findings indicate a positive relationship between the percentage of ownership of board members and institutional investors with accounting conservatism and a negative relationship between the ratio of financial crisis and accounting conservatism.

Hassanzadeh (2016). In a study entitled The effect of accounting conservatism on the relationship between retained cash and abnormal returns of companies in the Tehran Stock Exchange examines the effect of accounting conservatism on the relationship between retained cash and abnormal returns of companies. The results show that the market value of an additional retained cash rail increases with the introduction of accounting conservatism in companies and leads to efficient use of cash and reduces the loss of market value associated with retained cash.

Talibnia, et al., (2015) predicted the financial crisis based on providing a model consisting of macroeconomic variables and financial variables. In this study, four models of predicting financial crisis with a time interval of one year and two years were developed. The results of their research show that the Springate and Wallace models developed with cash flow ratios and macroeconomic variables have effective variables to predict the financial crisis.

Roodpashti, et al., (2014) compared the results of using Altman and Falmer models to predict the bankruptcy of companies during the years 1379 to 1383, in a research. The results indicate that in predicting a company, there is a significant difference between the results of the two models. The Altman model is also more conservative in predicting bankruptcy than the Falmer model.

Rezazadeh & Azad (2014). In a study, they examined the relationship between information asymmetry between investors and the degree of conservatism in financial reporting during the period 1381 to 1385. The results of this study indicate a positive and significant relationship between information asymmetry between investors and the level of conservatism applied in financial statements. In addition, the results show that the change in information asymmetry between investors causes a change in the level of conservatism, and following the increase in information asymmetry between investors, the demand for conservatism in financial reporting increases.

Foreign Research Background

A review of Rosilanda (2017) results indicates a weak correlation between corporate governance system and increased conservatism in financial statements. He found that the independence of the audit committee and the size of the board had no effect on increasing conservatism in the financial statements. The use of five large independent auditors also had little effect on increasing conservatism. Separating the tasks of chairman of the board from the CEO and the degree of independence of the board has had a limited effect on conservatism.

Bidel, et al., (2017) examined the bilateral causal relationship between accounting conservatism and bankruptcy risk and found that conditional and unconditional conservatism have a negative relationship with bankruptcy risk. They also found that the risk of bankruptcy was positively related to unconditional conservatism and negatively related to conditional conservatism. They introduced the use of conservative practices as an important principle in financial accounting In their research.

In a research, Wichit Sarah Wong & Ang (2016) showed in the financial crisis of 1997 in Hong Kong, Malaysia, Singapore and Thailand, the rate of conservatism was low and managers tended to provide good news early and bad news with delay. The findings indicate that the use of conservatism has increased since the Asian financial crisis. The results indicate that the effect of applying conservatism or conservative accounting practices has been beneficial after the financial crisis.

Daei and Ian (2016) in a study,examining the impact of conservatism on trade credit and monetary policy concluded that the level of bat conservatism in a strong monetary policy leads to a higher level of trade credit.

Garcia & Mirasogorb (2015) state that companies with financial constraints tend to invest their cash first to finance profitable projects and then in fixed assets or working capital. They invest their cash in a way that guarantees a new loan. Companies are more likely to increase tangible fixed assets because of the financial problems in the future.

Basso (2014) defines conservatism as the accounting tendency to require a higher degree of verifiability to identify good news compared to the degree of verification required to identify bad news. This leads to a decrease in profits and consequently assets. The Technical Committee of the Auditing Organization of Iran (2007) states that the preparers of financial statements deal with ambiguities that inevitably throw over many events and circumstances. And the amount of claims related to the guarantee of the goods sold. Such cases are reviewed with caution in the financial statements and with disclosure of their nature and extent.

Research Hypotheses

1) The financial crisis has a significant effect on accounting conservatism.

2) Financial leverage has a significant effect on accounting conservatism.

3) It has a significant effect on accounting conservatism in advertising and marketing.

Research Method, Statistical Population and Sampling Method

The statistical population of the study includes all companies accepted on the Tehran Stock Exchange between 1394-1398 (5-year period).

Among the companies, 103 companies were selected as a sample by systematic elimination sampling method. The sample selection process is shown in the table 1:

| Table 1 Sample Selection Process |

|

|---|---|

| Total number of companies listed on the stock exchange at the end of 1398 | 652 |

| Criteria: | |

| Number of companies that have not been active in the stock exchange in the period 1394-1398. | 161 |

| Number of companies accepted on the stock exchange until 1398. | 57 |

| Number of companies other than holding companies, investments, financial intermediaries, banks or leasing companies. | 82 |

| The number of companies that have changed the fiscal year in the period 1394-1394 or the fiscal year does not finished until the end of March 2017. | 89 |

| The number of companies that had trading interruptions for more than three months between 1394-1394. | 160 |

| Number of sample companies after systematic removal | 103 |

Research Models and Variables

Test Model of the First Hypothesis

The financial crisis has a significant effect on accounting conservatism.

Test Pattern of the Second Hypothesis

Financial leverage has a significant effect on accounting conservatism.

Test Pattern of the Third Hypothesis

Has a significant effect on accounting conservatism in advertising and marketing.

Research Variables

In this study the variables include the following categories:

Independent Variable

Accounting Conservatism

The dependent variable in this study is accounting conservatism, which in the present study uses a multivariate regression model inspired by Basso?s (2013) model, and modified Basso?s model proposed by Roichudari & Watts (2012) to investigate the relationship between board composition and conservatism. The description of each model bring as follows:

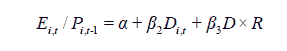

Basso model: The tendency to accelerate the recognition of losses and delay the recognition of profits is a conservatism from the perspective of profit and loss, and accordingly in 1997 Basso introduced the criterion of temporal asymmetry of profits. Basu model is as follows:

Ei, t = profit before unexpected items of company i in year t

Pi, t-1 = Value of the capital market of company i at the beginning of year t

Ri, t = annual stock return of company i in year t

Di, t: A virtual variable 0 and 1 in which if R≤0 It’s value is one and otherwise zero.

β = Measures the response of profit to positive returns.

β2+ β3= Measures the response of profit to negative returns.

Conservatism means β2 + β3 > β2 or β3 >0in other words.

Modified Basso Model: Basso model tested and evaluated in many studies, the results showed a negative relationship between this criterion and the B / M ratio (an old and well-known criterion for conservatism), therefore the mentioned results led to put the reputation of the Basso model to stake. After criticizing the Basu criterion, (Roichudari & Watts, 2006) in their experimental research showed that if the period of estimating the temporal asymmetry of profit increases from one period to several periods, the relationship between the temporal asymmetry of profit and the ratio B / M will be positive at the end of that long period. Therefore, Roichudari and Watts?s research (2006) led to the adjustment of Basso criterion in the form of time asymmetry of multi-cycle profit. In this study, using the following model, derived from the temporal asymmetry criterion of profit of a period (Basso model) and the criterion of multi-period temporal asymmetry (Roichudari & Watts model), the relationship between financial leverage and board composition in conservative Something will be examined.

Dependent Variable

Financial Crisis

The dependent variable in this study is the financial crisis. The control variables of this study areAttribkt = In the k hypothesis (second, third and fourth), respectively, is equivalent to the amount of financial crisis, financial leverage and advertising and marketing of the company in year t.

MBt = Control variable ratio of market value to book capital value of the company in year t

Levt = Company lever control variable in year t

Sizet = Company size control variable in year t

In the above model, in the second, third and fourth hypotheses, respectively (equivalent to the degree of financial crisis, financial leverage, km) and the company's advertising and marketing in year t.

MBt = control variable ratio of market value to book capital value of the company in year t

Levt = company leverage control variable in year t

Size = Company size control variable in year t

The Researches shown in Table 2, 3, 4, 5, 6, 7, 8

Research Findings

Descriptive Statistics

Table 2ReferencesAli, E.K., & Shahriari, A. (2017). Investigating the relationship between political expenditures and conservatism (political hypothesis) in tehran stock exchange”. Accounting and Auditing Reviews, 57, 3-16. Basu, S. (2018). "Conservatism research: Historical development and future prospects". Chinese Journal of Accounting Research, 2, 1-20. Crossref, GoogleScholar, Indexed at Ghodratollah, T., Shad, A.J., & Zamani, Z.P. (2013). Evaluating the efficiency of financial variables and economic variables in predicting companies' financial crisis (Study of companies accepted on the Tehran Stock Exchange) ". Accounting and Auditing Reviews, 55 67-8. Gholamreza, K., & Omrani, H. (2015). The effect of company life cycle and conservatism on company value ". Accounting and Sensitive Studies, 59, 79-96. Gary, C., Mary, L.M., & Song, F.M. (2017). Accounting conservatism and bankruptcy risk. Financial Accounting and Reporting Section, www.ssrn.com, 1-20. Givoly, D., & Hayn, C.K. (2015). The changing time-series properties of earnings, cash flows and accruals: Has financial reporting become more conservative. Journal of Accounting and Economics, 29, 287-320. Karami (2016). The effect of the mechanisms of the company's management system on the level of accounting conservatism in companies accepted on the Tehran Stock Exchange. Consecutive Number 4, 122-103. Kothari, S.P., Ramanna, K., & Skinner, D.J. (2014). Implications for GAAP from an Analysis of Positive Research in Accounting. Journal of Accounting and Economics, 50, 246-248. LaFond, R., & Watts, R. (2016). The information role of conservatism. The accounting review (forthcoming). Mahd, B., Tahmineh, B. (2009). The effect of accounting conservatism, government ownership, company size and leverage ratio on corporate losses. Journal of Accounting and Auditing Reviews, 58, 53-70. Mehrani, Wafi Thani & Hallaj (1396). Size of Company and Debt Contracts with Conservatism in Tehran Stock Exchange. Scientific-Research (Ministry of Science / ISC) 16, 97-112. Reza, R.M., Mirfeiz, S., & Farzaneh, E. (2011). Assessing the financial distress of companies accepted on the Tehran Stock Exchange: A comparative study between data envelopment analysis and logistic regression. Quarterly Journal of Management Research in Iran, 15(3), 129-147. Shorvarzi, M. (n.d). Lack of information symmetry and information role of accounting conservatism. Accountant Quarterly, 210. Somayeh, F., & Mehdi, D.Q. (2015). Investigating the impact of financial crisis on company accounting conservatism in Tehran stock exchange, national conference on new and creative thoughts in management. Legal and Social accounting Studies, Urmia, 22. Sensitive, Y. (1396). Investigating the relationship between ownership concentration and accounting conservatism in Tehran stock exchange. Journal of Financial Accounting Research, 2(2), 77. Tara, H. (1398). The effect of accounting conservatism on the investment of companies accepted on the Tehran Stock Exchange during the global financial crisis, the 2th National Conference on Fundamental Research in Management and Accounting, Tehran. Watts, R., & Zimmerman, J. (1986). Positive accounting theory. Prentice Hall, Englewood Cliffs, NJ.PP.210-217. Watts, R. (2017). Conservatism in accounting part I: Explanations and implications. Accounting Horizons, 17, 207–221. Received: 25-Nov-2021, Manuscript No. AEJ-21-6469; Editor assigned: 27-Nov-2021, PreQC No. AEJ-21-6469 (PQ); Reviewed: 13-Dec-2021, QC No. AEJ-21-6469; Revised: 18-Dec-2021, Manuscript No. AEJ-21-6469 (R); Published: 04-Jan-2022. |

|---|