Research Article: 2020 Vol: 24 Issue: 3

Accounting Model of Human Capital Assessment Within the Information Space of the Enterprise

Tetiana Hilorme, Oles Honchar Dnipro National University

Iryna Perevozova, Ivano-Frankivsk National Technical University of Oil and Gas

Alina Sakun, Kherson State Agricultural University

Oleg Reznik, Sumy State University

Yevheniia Khaustova, Kyiv National University of Technologies and Design

Abstract

The article deals with the peculiarities of human capital as specific intangible capital in terms of energy saving, methods of human capital assessment, calculation of life cycle costs (LCC) (project) and cost of deferred decision (CoD) indicators according to alternative cost theory, justification of the choice of accounting model on human capital, depending on the scope of powers and responsibilities of managers, the peculiarities of choosing a model of accounting for human capital costs, depending on the classification of centers of responsibility. The algorithm for deciding on alternative costs for the staff of the enterprise has been determined. An algorithm for determining the social factor as a dominant of human capital development in accordance with the ESG methodology according to social indicators (staff rights, labor standards, state of corporate governance, social and psychological climate in the workforce, staff satisfaction as alpha-stakeholders) has been proposed. At the same time, the dependence of the staff accounting process, depending on the phase of the career cycle, requires in-depth theoretical substantiation, which will allow to investigate the features of adaptation and development of staff as the main factors of an employee's career growth.

Keywords

Balanced Scorecard, Strategic Budgeting, Strategic Management Accounting, Information Space, Management Decisions.

JEL Classifications

M5, Q2

Introduction

A person in consumer society seeks to consume so that, on the one hand, not to be worse than others, and on the other - not to merge with the crowd. Individual consumption reflects not only the social characteristics of the consumer (as a demonstration of their social status), but also the characteristics of the individual lifestyle. All these features change the staff of the enterprise, thus changing the characteristics (properties) of the staff itself, appearing specific depending on economic activity.

All this requires a change in the company's outlook on staff as a special, priority resource the transformation of the entire enterprise resource management system, its constituent elements (accounting, analysis, planning, organization, control, etc). The manifestation of the concept of human capital in the theory of economic thought necessitates the creation of effective information support. It has become a prerequisite for the creation of the concept of accounting for human resources (human capital, staff).

The purpose of the study is to develop theoretical, methodological provisions and practical recommendations for introducing a model of accounting and assessment of human resources (capital, personnel) to formulate a strategy for enterprise development in the context of preventive anti-crisis management.

In accordance with the stated purpose, the following tasks are set in the work: to analyze the personnel as a priority asset of the enterprise in accordance with the Conceptual basis of financial statements; to explore the features of two models of accounting and assessment of human resources (capital, staff): assets (“cost”, chronological) and usefulness of the resource; to identify the advantages and disadvantages of two models, to build an algorithm for implementing these two models in the internal management accounting system; to determine the need to introduce two additional life cycle costs (LCC) (project) and cost of deferred decision (CoD) indicators according to alternative cost theory in determining the effectiveness of implementing a staff development program (project).

Review of Previous Studies

One of the options for developing (improving) the human capital assessment system for covering all intangible assets and their expression as the sum of intellectual capital is the “Accounting for the future” accounting model (AFTF) (Bharadwaj et al., 2017). This model is designed as a special tool for generating financial statements on the value of an enterprise based on the use of enterprise budgeting techniques.

“Value added intellectual coefficient” (VAIC)) accounting model is a system of indicators for measuring the value added generated by the human capital of an enterprise. The development of this model is based on the hypothesis that value added is the main indicator of the transformation of intangible assets into market assets of an enterprise (Boudreau & Cascio, 2017).

The failure of the accounting system to aggregate objects of human capital, and the financial reporting of modern standardization to provide market institutions with a formalized assessment of it and, together with it, a worthwhile description of the company, leads to the use of poorly formalized information models Drobyazko et al. (2019).

In modern practice, Balanced Scorecard (Cuaresma, 2017), Enterprise Value Map (Bilan et al., 2017), Value Explorer (Hilorme et al., 2019a, Hilorme et al. 2019b) etc. are used; a concept has also been formulated (Tetiana et al. 2019).

Insufficient justification for accounting, formation and management, determining the efficiency of use, reflection of human capital as an element of intangible assets in the reporting makes it impossible to determine the market capitalization of the enterprise. The paradigm “human capital is the cost of the enterprise” provokes the company's management to reduce the cost of reproduction (primarily social and professional development) of staff when forming a strategy to minimize total costs, especially in times of crisis.

Methodology

Certainly, each of the methods of human capital assessment has its advantages, disadvantages and limitations. Thus, profit methods have special requirements for the composition of experts, experience, intuition, system of preferences of experts involved in determining the cost of personal care products, and the initial information on the basis of which the assessment has been made.

But the significant disadvantages of the existing methods are mainly that the assessment indicators are not interconnected, and each intangible asset is considered in isolation from the combination of others. For a correct assessment of the impact of human capital on indicators of the value of enterprises, it is necessary to form a single cumulative intangible asset by consolidating several dissimilar intangible assets for the general purpose of their use by the enterprise.

An example of such an asset is a portfolio of human capital competencies, which should be defined as a specific cumulative intangible asset of an enterprise, which is a set of interconnected elements (qualities, properties of personal care products) that are used to develop an effective strategy for the innovative development of an enterprise, to increase the efficiency of financial and economic activity in connection with that the effectiveness of the use of human capital affects the creation of additional value - profit.

Results and Discussions

The future economic benefits of staff are viewed as a measurement of their added value, and cannot be included in the assets of the entities because they can only be controlled in the workplace. It is necessary to take into account the peculiarities of the staff as an object of management.

A special, priority type of resource, which, in combination with other resources of the enterprise (assets, information, knowledge, entrepreneurial abilities and other resources), their qualitative status, allows such an administrative unit to develop and apply strategies that lead to improving the rationality and efficiency of its activities.

This is the set of hired individuals who are the bearers of the corresponding properties (natural, acquired and systemic), used in employment and adapted in the existing conditions at the enterprise depending on the type of economic activity. That is, it is the ability to meet the requirements of the workplace at the enterprise, functional responsibilities in accordance with internal regulations, which allows to get as close as possible to achieving the goals of the enterprise.

This is the bearer of other special resources of the enterprise: information, knowledge, entrepreneurial abilities - it is necessary to take into account the specifics of personal goals of hired full-time, temporary, external associate’s employees, working owners of the enterprise.

This is an open system of social relations - formed and changed under the influence of external and internal factors. At the same time, this system is characterized by: integrity (labor collective (unified whole) and subsystem of individuals (personalities)); hierarchy of construction (interaction of two subsystems: managing (employer) and managed (labor collective and individuals); structuring (process of functioning of the system is caused not so much by the properties of its individual elements as by the properties of the structure itself); plurality (it is possible to use many cybernetic, economic, and mathematical models to describe individual elements and systems) and systematic (property of the object to possess all the features of the system).

In American practice, there are two fundamental approaches to accounting for personnel costs of an enterprise: the asset model (“cost”) and the usefulness model (Table 1).

| Table 1 Comparative Characteristics of Accounting Models and Cost Estimates for Company Staff in the USA (Systematized by the Author) | ||

| Features of staff accounting model | Advantages | Disadvantages |

| Asset Model (“cost”/chronological model) | ||

| Traditional scheme of accounting for fixed capital, taking into account the features of “human capital”. | Ability to define groups of staff costs for groups of long-term investments (staff capitalization) and current costs (cost for staff use), ability to assess the standard term for depreciation of funds spent on staff - a period when it is necessary to make additional investments | Cost of investing objects may differ significantly from its market price, since in practice there is no direct relationship between the costs and benefits of this object. |

| Accounts include staffing costs (long-term investments, recurrent costs) | ||

| Regulatory term of staff depreciation | ||

| Usefulness model | ||

| Assessment of the economic consequences of changes in the employment behavior of staff (the effect of staff investments) | Establishing a real connection between the amount of invested capital and the income from its use | Not tied to accounting, balance, or other accounting information |

| Estimated calculations of income expected from the realization of investment projects, their comparison with the necessary costs for realization of investments | Relation with accounting characteristics of income (accounting profit) | Indicators do not take into account changes in the value of money over time |

| Definition of indicators: term of return on investment (period during which the initial investment will be returned to the investor in the form of income from the project realization); rate of return on investment (ratio of the average annual amount of profit from the implementation of the project to the value of investments). | Simplicity of calculation, clarity, availability of information for its calculation, adaptability for comparative analysis of alternative projects | |

The assets of an entity are the result of past transactions or other events. Businesses typically obtain assets through their acquisition or production; however, other transactions or events also generate assets. It is the development of the personnel that allows to prolong the professional path of the staff, to develop properties under the influence of innovative technologies. Applying the concept of staff life cycle as a specific asset allows to take into account current trends in the formation of a new type of knowledge-based economy. Continuous staff development throughout life, the acquisition of new skills, knowledge, skills, support for health and a good standard of living are the prerequisites for the information society.

Such a technique can be applied in an enterprise when it is necessary to build a logical chain with all the factors that can form staff costs.

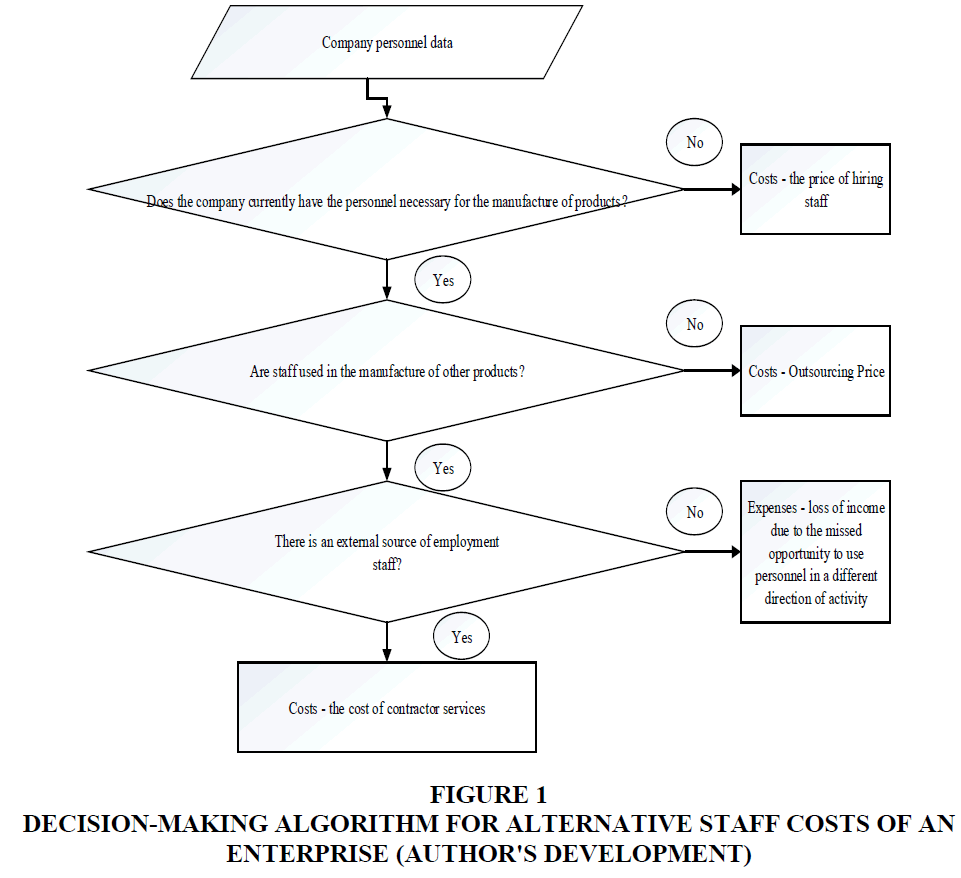

Alternative cost is an economic term that defines the lost profit from the alternative use of a particular resource. Moreover, its value is determined as the largest value of all possible alternatives. Such a technique can be applied in an enterprise when it is necessary to build a logical chain with all the factors that can form staff costs. The decision-making algorithm for alternative staff costs is presented in Figure 1.

Figure 1 Decision-Making Algorithm for Alternative Staff Costs of an Enterprise (Author's Development)

Along with alternative costs, there are also non-recoverable costs that cannot be returned and recoverable costs that can either be canceled or not paid. However, staff costs cannot be recoverable, they are non-recoverable.

Thus, based on the consideration of alternative staff costs, the company is able to make management decisions on the formation and use of staff - to hire external contractors, to use part-time employees, to use the services of contractors, outsourcing or outstaffing of personnel.

In modern management, outsourcing refers to the performance of certain functions production, service, information, financial, management, or business processes organizational, financial, economic, production and technological, marketing external organization with the necessary resources for this, on the basis of long-term agreements.

Recommendations

This is confirmed by the linear relation between the Corporate Social Responsibility Index and the reputation of the world's leading companies, as identified in the Global Reputation Pulse Study (2010). In recent years, many companies have published reports attempting to disclose ESG (environmental, social and governance) factors, i.e. environmental and social considerations, as well as corporate governance. It is the corporate social reporting that discloses the company's activities with ESG factors and is an additional source of financial information.

With this information, an entity's reporting users can determine how a company interacts with key stakeholders, and thus evaluate how stable the free cash flow is in the future. In this case, human capital is seen as a component of intellectual capital in the creation of market value added.

In order to manage the value of the company, management can use a balanced scorecard, which was proposed by Norton and Kaplan - decomposition of the strategy into 4 perspectives (finance, customers, business processes and training and growth), this allows to transfer the strategy to the operational level and determine KPI (key performance indicators). But, in our opinion, in order to take into account, the interests of all stakeholders, especially human capital, it is necessary to take into account the concept of stakeholders in developing strategies using the CPS method, which will maximize the value of the company.

Consider in more detail the features of applying the FTSE4Good ESG Ratings methodology, while the ESG indicator can have a maximum score of 5. To obtain the digital value of the score, it is necessary to assess the risks and effectiveness of the company in the following areas of social indicators of human capital: rights of personnel in the company, labor standards, state of corporate social management, relations in the workforce (sociopsychological climate), satisfaction of staff as alpha-stakeholders.

According to the approach used in the FTSE4 Good ESG Ratings methodology, there are 3 levels of risk and indicators: topic level; pillar level; general level. For each company, theme risk is in the range of 0 to 3 (0 is no risk and 3 is high risk) and the theme indicator is 0 to 5 (0 is not disclosed, 5 is best practice).

Due to the fact that the total value of the social factor according to the ESG methodology is not more than 5, it is possible to estimate how much the social factor influences the development of the enterprise.

In our view, when implementing ESG calculations taking into account the stakeholder concept, the entity will be able to regularly monitor the dynamics of relations with stakeholders, especially alpha-stakeholders - human capital.

But despite which assessment method of human capital as an intangible asset will be chosen, it is necessary to be taken it into account in the statements of the enterprise: financial, managerial, statistical.

Undoubtedly, traditional accounting, which considers human capital only in terms of costs, does not allow to take into account the future economic benefits, the need to constantly update, prolong the quality of human capital - to consider the development of staff as a dominant development of the entity itself. In our opinion, it is necessary to evaluate human capital in the prism of each staff.

In our view, when implementing ESG calculations taking into account the stakeholder concept, the entity will be able to regularly monitor the dynamics of relations with stakeholders, especially alpha-stakeholders - human capital.

Conclusions

Organizational and methodological approach to accounting for staff costs as a special resource of the enterprise involves reforming the methodology of accounting - to bring it closer to international standards and principles, taking into account the experience of leading countries with a market economy, in particular the USA, in forming a model of accounting staff in the management accounting system, in assessing the efficiency of the formation, use and reproduction of enterprise staff. Due to the specific nature of its activity, the entity can form independently the model of accounting and assessment of human capital and on this basis to build the enterprise development strategies in crisis situations.

Human capital, as an aggregate of personalities, with their inherent personal qualities (properties), creates the market added value of each economic entity - a key priority factor for its development as the only opportunity for survival in today's changing environment. All this requires a change in the outlook to the definition of “human capital”, a change in the whole set of management functions, especially since the beginning of orthodox accounting. If changes in management accounting for accounting and assessment of human capital are ongoing: new models emerge on the basis of various concepts, as discussed in the article, the paradigm “human capital is the cost of the enterprise” remains in the domestic financial accounting.

In our opinion, it is necessary to create a special reserve, to which funds will be periodically deducted that relate to the costs of the enterprise throughout the life cycle of the employee, which will ensure the restoration of his/her socio-professional quality and the accumulation of funds for training and professional development in accordance with the requirements of the workplace.

The rate of transition to each stage depends on internal and external factors. Internal factors are the totality of the qualities of each person: susceptibility to innovations, degree of resistance to organizational changes, career ambitions, etc. External factors are ensured by the social policy of the enterprise: effective mechanism of motivation and stimulation, implementation of the principles of social responsibility to achieve social effectiveness. Interaction between the internal and external factors is necessary, in particular, by constructing maps of motivators and demotivators.

The prospect of further development is the study of accounting for the costs of personnel of an enterprise depending on the life cycles of staff and the enterprise, the development of theoretical and methodological foundations of corporate social reports regarding human capital, the improvement of the methodology.

References

- Bharadwaj, P., Gibson, M., Zivin, J.G., & Neilson, C. (2017). Gray matters: Fetal pollution exposure and human capital formation. Journal of the Association of Environmental and Resource Economists, 4(2), 505-542.

- Bilan, Y., Mishchuk, H., & Dzhyhar, T. (2017). Human capital factors and remuneration: Analysis of relations, modelling of influence. Business: Theory and Practice, 18, 208.

- Boudreau, J., & Cascio, W. (2017). Human capital analytics: Why are we not there? Journal of Organizational Effectiveness: People and Performance, 4(2), 119-126.

- Cuaresma, J.C. (2017). Income projections for climate change research: A framework based on human capital dynamics. Global Environmental Change, 42, 226-236.

- Drobyazko S., Shapovalova A., Bielova O., Nazarenko O., & Yunatskyi M. (2019). Formation of hybrid costing system accounting model at the enterprise. Academy of Accounting and Financial Studies Journal, 23(6).

- Drobyazko, S., Bondarevska, O., Klymenko, D., Pletenetska, S., & Pylypenko, O. (2019). Model for forming of optimal credit portfolio of commercial bank. Journal of Management Information and Decision Sciences, 22(4), 501-506.

- Hilorme, T., Sokolova, L., Portna, O., Lysiak, L., & Boretskaya, N. (2019). The model of evaluation of the renewable energy resources development under conditions of efficient energy consumption. Proceedings of the 33rd International Business Information Management Association Conference, IBIMA 2019: Education Excellence and Innovation Management through Vision 2020. pp. 7514-7526.

- Hilorme, T., Sokolova, L., Portna, O., Lysiak, L., & Boretskaya, N. (2019). Smart grid concept as a perspective for the development of Ukrainian energy platform. IBIMA Business Review, Retrieved from https://ibimapublishing.com/articles/IBIMABR/2019/923814/

- Tetiana, H., Chernysh O., Levchenko, ?., Semenenko, ?., & Mykhailichenko H. (2019). Strategic solutions for the implementation of innovation projects. Academy of Strategic Management Journal, 18(1).