Research Article: 2019 Vol: 23 Issue: 2

Accounting of Transactions In Electronic Money: International Trends

Viera Bartosova, University of Zilina

Vladislav V. Pshenichnikov, Voronezh State Agrarian University

Ganna Ievtushenko, V.N. Karazin Kharkiv National University

Laura Petrova, Odessa National Polytechnic University

Petro Ovchar, National University of Bioresources and Natural Resources Use

Abstract

The globalization conditions for the emergence and development of electronic money in a defined subject plane and related to these tendencies and challenges for analysis and audit are revealed. The analysis of globalization changes suggests the need to improve accounting approaches for new money transactions, modern methods of appraisal of work, in particular banks with them, as well as attention to the development of the activity of auditors, who should evaluate and verify the work with modern payment instruments and tools. It is substantiated that proper economic analysis and qualitative audit of transactions in electronic money can not be carried out without proper information provision of cash flow on the basis of the appropriate procedure of accounting of transactions. To this end, an order has been developed that solves the issue of providing information security analysis and audit of electronic money.

Keywords

Electronic Money, Information Support, Taxonomy, Electronic Vouchers, XBRL Technology.

JEL Classifications

M21, O16

Introduction

An important function of modern banking institutions is the capital turnover. On the one hand, this is explained by the role of banks in ensuring the financial and economic security of the state, and, on the other hand, by the social significance of money.

The general complex of tasks in the field of capital turnover is determined by the monetary policy of the state, taking into account the trends of the world and domestic economy and, in particular, the banking system.

The reduction of the money supply outside the banking system, which requires the use of effective instruments to counter the withdrawal of funds from the banking sector, is among the main areas of monetary policy.

It is about introduction of convenient, reliable and safe ways of payment of goods and services by the population without the use of cash.

The technical and organizational capacity of banks to emit, distribute and secure the electronic money system is unequivocal, as modern technologies and its availability are maintained at the proper level in the modern financial and credit business. It updates the issue of proper accounting and auditing of electronic money transactions, as well as analysis of its turnover and functioning for the purpose of efficient management of the banking institution, in particular its liquidity, on which the solvency of the population and, therefore, users (owners) of electronic money depend directly.

Review Of Previous Studies

Today, all forms of modern money do not actually have its own cost, but they have only value. Such an affirmation is most fully applicable to electronic money. This is due to the fact that banknotes and coins are not made from precious metals, but theoretically have its own cost in terms of its production expenses, but this cost is not commensurate with its real value the quantity of goods that can be purchased for them (Assenmacher et al., 2018). The cost of cashless money can be spoken in the context of its turnover and sale and purchase in the financial market, but it reflects its market price as a financial product, and not the nature of its cost as a “product” (Drobyazko et al., 2019). The purchasing power of electronic money is as absolute as cash and non-cash.

And the growth of commodity prices has the same effect on its depreciation as in other forms of money.

Hilorme et al., 2019 distinguish the functions of money depending on its form and degree of performance of functions of the means of circulation and payment, the degree of value, means of accumulation, social relations.

Berentsen & Schar (2018) indicate that with the emergence of non-cash and electronic money, they lost the traditional subject-sensory form and became a virtual reality, and its use completes the process of its evolution.

In support of Stiglitz (2017), however, we note that electronic money issued by different issuers is heterogeneous, which also distinguishes them from cash. The author, among other things, identifies the notion of electronic money with digital, thus emphasizing the technological component of this payment instrument.

In studies of Maurer et al. (2018) there are also some provisions that, in our opinion, are controversial: money theory researchers mistakenly consider bank accounts as the place for storing electronic money, as well as that, when emitting electronic money, entries are made on a non-financially issued issue account. If we take into account the last statement, then in this approach to the emission of electronic money in the country there would be an artificial increase in money supply, which, in turn, provoked unjustified inflation (Garbowski et al., 2019).

Taking into account that electronic money is not emitted in the form of banknotes and coins and is a liability of other than the state, such as the central bank, entities, its issuers, as well as the fact that the provision of electronic money is stored in lending organizations on accounts, electronic money has signs of non-cash funds and perform the same functions, in particular, the payment method (Kahn & Wong, 2019). Indirectly, it can also be said about the common features of non-cash and electronic money when it comes to the type of media on which they are stored electronic.

Methodology

The methodological and theoretical basis of the research is the fundamental provisions of the institutional theory, the scientific works of leading scientists on economic theory, accounting, analysis and audit, cybernetics, mathematics, computer science and philosophy.

In order to achieve the goal of the study, the system of general philosophical, general scientific and special methods of cognition has been used. The dialectical method has been used to determine the place of electronic money in the theory of modern money for the purposes of accounting, analysis and audit, and to develop a methodology for auditing electronic money in banks. The system approach has been applied in processing the methods of accounting, analysis and audit of electronic money in banks as components of a holistic, organizational and economic mechanism of banking activity. The study of the evolution of money, analysis and audit has been carried out with a combination of historical, bibliographic and logical approaches. Using methods of analysis and synthesis, induction and deduction, statistical method gave the opportunity to develop tools and organizational approaches to economic analysis and audit of electronic money in banks. The research methodology is mainly based on the financial and economic information of banking institutions, which is explained by the need to solve problems in developing methods and justifying approaches to conducting economic analysis and audit of electronic money in banks. For the solution of the tasks, the following was used: positivism, as a direction of modern philosophy, which involves the presence and application of various scientific paradigms and theories within individual scientific disciplines; separate provisions of dialectical materialism; general methodological principles of the system approach; sociotechnical system approach; empirical method and method of idealization; method of scientific experiment and study in real conditions.

Results and Discussion

At the moment, banks are under some competitive pressure from other financial institutions, because if earlier banking business has used about 70% of the world's financial assets, today it controls only 30% (Hilorme et al., 2019). However, schemes for the electronic money turnover on a program basis are more complicated than those based on the use of cards. Using the Internet as a medium of turnover allows such electronic money to instantly cross the borders of the states, it is easy to exchange for electronic money from other issuers and for electronic money denominated in other currencies (Drobyazko, 2018).

Electronic money based on cards in which a built-in chip containing cash equivalent as a result of prepayment can be used not only as a carrier of electronic money but also as traditional payment cards for access to the holder's bank account.

Introducing a system of payment for goods using electronic money, goods purchased in this way can be cheaper by the same 2.5 - 5%, which will stimulate sales and will be beneficial for buyers, sellers and the electronic payment system as a whole (Hilorme et al., 2019). Considering that electronic money also claims to be a part of the money transfer market, it becomes quite obvious interest in this segment, when the exchange agent can deliver the addressee free for him and for the sender of funds.

Consequently, the acquisition of electronic money by users can be carried out as follows: through the cash desk of the bank the issuer of electronic money; by transferring non-cash funds in favor of the bank the issuer of electronic money; with the help of self-service machine to deposit the e-wallet; through agents for distributing electronic money; through agents for replenishing electronic devices; through agents for exchange transactions; through settlement agents who accept electronic money in exchange for cash or non-cash funds; through other banks that are members of the electronic money system and, accordingly, members of the payment system within which the bank operates issuer of electronic money.

In this case, the agents of deposit are business entities that provide users of means of electronic money deposit of e-wallet (electronic vouchers), and distribution agents are legal entities that distribute electronic money among users in exchange for cash or non-cash funds.

In order to consolidate the data by public authorities or the company's headquarters from geographically distributed subdivisions or other stakeholders using specialized software, which allows to faster process the necessary data and to present it to the desired user, the receiving information system should have data in the form in which it will be able to process them and give out the result.

One of the most popular ways to present data today is the XBRL technology, an expanding business reporting language. This is an open specification based on the XML language (Extensible Markup Language) that uses an identifier for each individual data element, rather than considering financial information as a block of text or a printed document or a table.

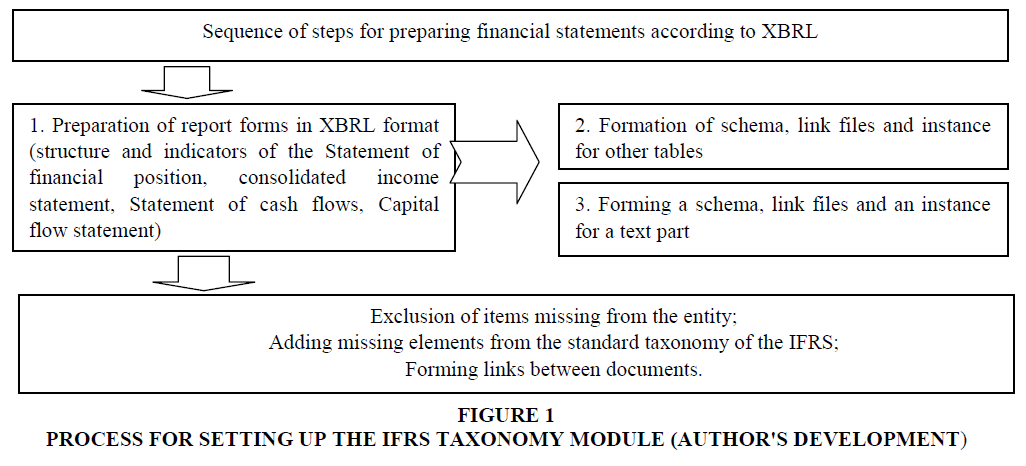

For this we draw attention to Figure 1, which presents in more detail the process of preparation of the module for work, namely describes exactly what changes need to be made.

Since the taxonomy covers all the data that can be reflected in the financial statements, there is a need for the company to add elements that may not be sufficient to fully disclose or remove them. This is done to ensure that the reports are concise and informative.

The acquisition of software is no less important in the preparation of such reporting. It should be noted that there is no program that automatically transmits XBRL text formatted reports.

The calculation of IFRS reporting indicators can be done in Excel, but the most important condition is to create an XBRL-reporting file from these data.

IFRS taxonomy is a project within which indicators to be disclosed in accordance with IFRS are systematized and presented in electronic form. The main task of this project is to give the world the only format for electronic exchange of reports.

XBRL is an XML-based software language specially designed to automate business information requirements, such as preparing, exchanging and analyzing financial statements, reports and audit schedules. The use of XBRL language by businesses can have the following benefits: the ability of financial planners and users to save time significantly; will allow to customize reporting to meet the specific needs of users of information such as investors and analysts; can be adjusted in accordance with specific business requirements, even at the reporting level of individual organizations; increasing transparency, reducing the number of errors in reports.

It should be noted that XBRL reporting is as complete as a paper copy.

Recommendations

In the course of the study, it was found that massive use of electronic money is hampered by the following factors: lack of public confidence, low motivation and insufficiently developed relationships between issuers, users and businesses that charge for electronic money. Due to the use of accounting, economic analysis and audit methods, it was recommended to expand the information base for increasing public confidence in electronic money as a modern form of money.

Conclusion

Over the past few years, the globalization preconditions for the development of electronic money and the problems of analysis and audit deepening associated with these trends have clearly been distinguished. The introduction of international standards and approaches to understanding the economic and accounting nature of electronic money, as well as the use of modern approaches to auditing transactions with them, will increase confidence in this payment instrument. This is important in view of the expected massive introduction of electronic money calculations, taking into account the active development of interstate and interpersonal connections in the digital environment of the information society.

The issue of reporting financial statements according to the IFRS taxonomy is quite complicated and relevant in today's terms. More and more countries are moving to compiling financial statements in XBRL language, because it is quite convenient, informative and accessible to all users. The process of transition to this system requires the acquisition of special skills, through which the coverage of information is possible. In the light of the above, we can say that the process of transitioning to the compilation of financial statements in XBRL language is labor-intensive and cost-effective, but has a number of advantages that, in the end, give the enterprises future economic benefits.

In addition, this will increase the transparency of financial reporting. Financial transparency is the timely disclosure of the necessary information regarding the production and financial activity of the enterprise, as well as the practices of corporate governance. Successful implementation of XBRL can play a crucial role in highlighting reliable indicators that are of key importance to stakeholders. Consequently, sharing IFRS and XBRL will improve the quality of financial reporting, reducing costs and improving accuracy, as well as the ability to analyze information.

Today, XBRL is needed not only for financial institutions, but also for investors, banks, analysts and other users of financial reports. The more companies will provide information in the XBRL format, the greater will be the amount of competitive information available in an analytical form.

References

- Assenmacher, K., & Krogstrup, S. (2018). Monetary Policy with Negative Interest Rates: Decoupling Cash from Electronic Money. International Monetary Fund. Retrieved from https://www.imf.org/en/Publications/WP/Issues/2018/08/27/Monetary-Policy-with-Negative-Interest-Rates-Decoupling-Cash-from-Electronic-Money-46076

- Berentsen, A., & Schar, F. (2018). The case for central bank electronic money and the non-case for central bank cryptocurrencies. Retrieved from https://research.stlouisfed.org/publications/review/2018/02/13/the-case-for-central-bank-electronic-money-and-the-non-case-for-central-bank-cryptocurrencies

- Garbowski ?., Drobyazko S., Matveeva V., Kyiashko O., & Dmytrovska V. (2019). Financial Accounting of E-Business Enterprises. Academy of Accounting and Financial Studies Journal, 23(2).

- Drobyazko, S. (2018). Accounting management of enterprises’ own of in the conditions of legislative changes. Economics and Finance, 10, 4-11.

- Drobyazko, S., Hryhoruk, I., Pavlova, H., Volchanska, L., & Sergiychuk, S. (2019). Entrepreneurship Innovation Model for Telecommunications Enterprises. Journal of Entrepreneurship Education, 22(2).

- Hilorme, T., Shurpenkova, R., Kundrya-Vysotska, O., Sarakhman, O., & Lyzunova, O. (2019). Model of energy saving forecasting in entrepreneurship. Journal of Entrepreneurship Education, 22(1S).

- Hilorme, T., Zamazii, O., Judina, O., Korolenko, R., & Melnikova, Yu. (2019). Formation of risk mitigating strategies for the implementation of projects of energy saving technologies. Academy of Strategic Management Journal, 18(3).

- Kahn, C.M., & Wong, T.N. (2019). Should the central bank issue e-money? Money, 01-18.

- Maurer, B., Nelms, T.C., & Rea, S.C. (2018). ‘Bridges to cash’: Channelling agency in mobile money. In Linguistic and Material Intimacies of Cell Phones. Routledge.

- Stiglitz, J.E. (2017). Macro-economic management in an electronic credit/financial system (No. w23032). National Bureau of Economic Research. Retrieved from https://www.nber.org/papers/w23032