Research Article: 2021 Vol: 24 Issue: 6S

Accounting Registration for E-Commerce Operations and Its Impact on Reliability of Accounting Information (Field Study in Pharmaceutical Industry Sector in Jordan)

Aiman Mahmoud Abu Hamour, Al-Balqa Applied University

Khalid Nasser Alzubi, Al-Balqa Applied University

Saher Mohamad Mahmud Adous, Al-Balqa Applied University

Nour Hussien Yousef Alrahamneh, Al-Balqa Applied University

Abstract

The study aimed to identify the impact of the accounting registration of electronic commerce operations on the reliability of accounting information in pharmaceutical industry sector in Jordan. The study community is one of the 14 pharmaceutical industries companies operating in Jordan and a company operating in the pharmaceutical industry in Jordan and registered with the Pharmacists Syndicate either the companies were public joint stock or limited liability company, while the sample consisted of (121) respondents from financial managers, heads of accounting departments, and accountants working in these companies. The study found that there is an effect of the accounting measurement of e-commerce operations with variables (recognition of revenue, revenue acquisition, and revenue ability to verify, revenue verification) on the reliability of accounting information in companies operating in the pharmaceutical industry in Jordan. The study recommended checking the companies ’ability to perform revenue recognition and accounting registration treatments in the e-commerce operations so that they are compatible with the changes and developments in the use of technologies compatible with international accounting standards.

Keywords

Accounting Registration, E-commerce, Reliability of Accounting Information, Pharmaceutical Industry Sector in Jordan

Introduction

The concept of e-commerce is concerned with managing the commercial activities and processes of products (goods and services) through their transfer via the Internet or similar technical systems. These activities meet the needs of consumers at the right price, time and place (Schneider & Perry, 2017).

E-commerce operations involve ways and methods that explain the method of selling, buying or exchanging products and information through communication networks, including the international information network (Internet) in the conclusion of commercial deals, whether within the country or between several different countries. This is done using an electronic medium and means of payment and contracting e. Also, data and documents read by a computer are transferred in forms governed by specific criteria from one organization to another, such as invoices and purchase orders through private networks (Abdul-Azim, 2016).

In order for Accounting Information to become reliable, it is subject to many characteristics, most notably the verifiability of information, understanding, impartiality, truthfulness in expression, representation, predictability, re-evaluation, and appropriate timing. As well as the decisions taken by investors and based on that information comes within the efforts made by companies operating in the Jordanian pharmaceutical sector to keep pace with the dynamic developments related to the accounting registration of e-commerce operations.

The Problem of the Study

E-commerce has witnessed many rapid developments that have led economists and legal professionals to think seriously about how to keep pace with this rapid development in the spread of electronic commerce with legislative rules that are still within its traditional framework. Therefore, the interest of the competent accounting organizations and the professional committees emanating from them has increased to make more efforts in developing theoretical frameworks for financial accounting and accounting registration processes related to the subject of accounting registration for e-commerce operations. It issued several standards that clarify how and when revenue is recognized. It continued to follow up on developments in the business environment that may affect these operations in order to amend the relevant controls in line with these developments (Al-Hayali, 2015).

Since Jordan is one of the countries that apply international accounting standards and in light of the expansion of e-commerce. The revenues resulting from this trade face many accounting registration and recognition problems, which are concentrated in linking Accounting Registration for E-commerce Operations and Accounting Information Reliability in companies operating in the pharmaceutical industry in Jordan, which is witnessing very large developments that forced it to deal with the issue of accounting registration for e-commerce operations. To achieve this purpose, the researcher will try to answer the following questions:

1- What are the estimates of the study sample members of the level of application of Accounting Registration for E-commerce Operations in companies operating in the pharmaceutical industry in Jordan?

2- What are the estimations of the study sample members of the level of Accounting Information Reliability in companies operating in the pharmaceutical industry in Jordan?

Objectives of the Study

The study aims to identify the impact of Accounting Registration for E-commerce Operations (revenue recognition, revenue acquisition, revenue verifiability, revenue realization) on Accounting Information Reliability in companies operating in the pharmaceutical industry in Jordan.

The Importance of Study

The importance of this study from a scientific point of view is the importance of e-commerce as it is a technological development that helps its users to achieve great profits compared to traditional commerce. In practice, this study gains its importance from the role that e-commerce plays in the business environment, which is a fundamental pillar of the economies of the world. Since Accounting Registration for E-commerce Operations affects the Reliability of Accounting Information, it is considered a basis for making many decisions in the company, so knowing the accounting registration in the light of the e-commerce environment is an important necessity and trying to solve the problems associated with e-commerce operations.

Hypotheses of the Study

The researcher formulated the following main null hypothesis: There is no effect of the accounting recording of e-commerce operations represented by (revenue recognition, revenue acquisition, verifiability of revenue, revenue realization) on Accounting Information Reliability in companies operating in the pharmaceutical industry in Jordan. The following hypotheses emanate from it:

First hypothesis: There is no effect of revenue recognition in e-commerce operations on Accounting Information Reliability in companies operating in the pharmaceutical industry in Jordan.

Second hypothesis: There is no effect of revenue acquisition in e-commerce operations on Accounting Information Reliability in companies operating in the pharmaceutical industry in Jordan.

Third hypothesis: There is no effect of verifiability of revenue in e-commerce operations on Reliability+Accounting Information in companies operating in the pharmaceutical industry in Jordan.

Fourth hypothesis: There is no effect of revenue generation in e-commerce operations on Accounting Information Reliability in companies operating in the pharmaceutical industry in Jordan.

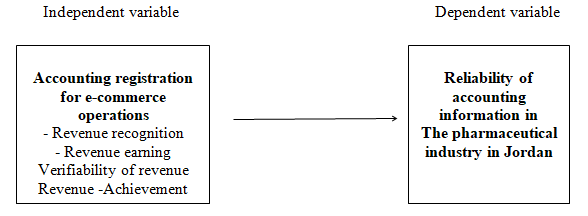

The study Model

The following Figure No (1) illustrates the study model:

Figure 1: Study Model

Source: The model was prepared by the researcher based on the references and studies received later.

Procedural Definitions of Terms

Accounting registration: It is the process through which companies operating in the pharmaceutical industry in Jordan determine the values associated with all the basic elements and components included in the company’s financial statements. The concepts related to accounting registration are determined by the presence of specific assumptions on which the measurement processes of these values depend.

Accounting Information Reliability: It is the characteristics that must be characterized by Accounting Information or the rules to be adopted by companies operating in the pharmaceutical industry in Jordan, in order to assess the level of Accounting Information Reliability, so that defining the set of characteristics related to Accounting Information will help those in charge of Setting accounting standards, and assisting officials when preparing financial statements in evaluating Accounting Information.

The Limits of the Study

The limits of the study were as follows:

1- Spatial limits: The application of this study is limited to companies operating in the pharmaceutical industry in Jordan.

2- Human limits: The researcher chose a sample of financial managers, heads of accounting departments and accountants working in these companies.

3- Temporal limits: This study was completed during the period between October 2019 and February 2020.

Study Approach

The descriptive and analytical approaches were used by referring to books, periodicals and research published in refereed scientific journals, conferences and previous relevant literature. On the analytical side, a questionnaire was prepared as a tool for collecting the necessary data to test the hypotheses of the study. A comprehensive survey was conducted for companies operating in the pharmaceutical industry in Jordan to show how Accounting Registration for E-commerce Operations is and its impact on Accounting Information Reliability in companies operating in the pharmaceutical industry in Jordan.

Study Community and Sample

The study population consists of all companies operating in the pharmaceutical industry in Jordan, numbering (15) companies registered with the Pharmacists Syndicate, whether they are public joint stock companies or joint stock companies with limited liability, according to the annual report of the Amman Stock Exchange, for the year 2019. These companies are: (a pharmaceutical company Hikma, Al-Ram Pharmaceutical Industries, Jordan River Pharmaceutical Industries, Amman Pharmaceutical Industries, Arab Pharmaceutical Industries Company (AVICO), Jordan Pharmaceutical Production and Industry Public Shareholding Company, United Pharmaceutical Manufacturing Company, International Drug Company, Jordanian Swedish Company for Medical Products and Sterilization, The Arab Company for Pharmaceutical Industry and Industrial Supplies (Acdima), New Irbid Pharmaceutical Industries, Middle East Pharmaceutical Industries, Arab Center for Pharmaceutical and Chemical Industries, Dar Al Dawa Group of Companies). As for the sample, due to the smallness of the study population, a comprehensive survey was adopted and questionnaires were distributed at a rate of (10) questionnaires in each of these companies, as the number of distributed questionnaires reached (140) questionnaires. The researcher retrieved (121) questionnaires at a rate of (86.4%) of the total distributed questionnaires, and they were adopted for statistical analysis.

Data Collection Sources

The data collection for this study was carried out through two sources: primary sources, by adopting a questionnaire. And secondary sources, by referring to specialized accounting books and research published in relevant Arab and foreign journals.

Data Collection Tool, Validity and Reliability

The researcher designed a questionnaire that covered the hypotheses of the study and according to the five-point Likert scale. The validity was tested by presenting the questionnaire to the experienced and specialized accountancy professors to judge its validity as a tool for data collection. Stability test was also performed using Cronbach's alpha coefficient. The degree of reliability of this questionnaire according to Cronbach's alpha standard reached (84.9%), and this is appropriate in such tests in order to adopt the results of this study (Malhotra, 2018). As for the limits that I adopted to comment on the arithmetic mean, the researcher has identified three levels of importance (low level, medium level, and high level) based on the following equation: (Sekaran, 2015).

Category Length=(Maximum Alternative - Minimum Alternative)/Number of Levels

(5-1)/3=4/3=1.33. Thus, the levels are as follows:

- Low approval level from (1)- less than (2.33).

- Average approval level from (2.34) - (3.67).

- A high level of approval from (3.68) to (5).

Statistical Processing

Statistical methods were used within the Statistical Program for Social Sciences (SPSS), such as arithmetic mean and simple and multiple linear regression analysis.

Previous Studies

The study of Lee & Whang (2011) which concluded that companies are applying the basic principles and ideas of e-commerce in highly effective ways and that the Internet is one of the main tools in information technology that allowed companies to create creative solutions that contributed to raising the ability to adopt the core principles of e-commerce.

The study of Nafokh's (2011) examined the impact of e-commerce on the audit profession and demonstrated current knowledge in e-commerce auditing. The results showed a positive and significant relationship for e-commerce and the requirements for practicing external auditing in audit offices in Jordan.

The study of Ronald (2012) that aimed at determining the extent to which American companies apply the principle of revenue recognition and disclosure of financial statements. The study concluded that disclosure by American companies is still weak, especially with regard to revenue.

As for the study of Al-Jabari's (2012), which aimed to identify the e-commerce environment and compare it with the traditional trade environment, and to know the adequacy of the conceptual framework of financial accounting to deal with that environment. It found a difference in the views of the study sample about the adequacy of the conceptual framework of financial accounting to deal with e-commerce operations.

The study of Al-Shukry’s (2012), which aimed to identify the impact of developing the performance of the external auditor in improving Accounting Information Reliability in light of the global financial crises.

And the study of Vantanasombut (2013) concluded that the most important factors affecting customers' interest are the factor of the establishment's possession of power and freedom in making its decisions and the factor of awareness of safety using technological development to ensure the security and reliability of accounting information available through Internet sites.

Makled (2015) concluded that e-commerce has become one of the most important external factors affecting the accounting information system. Consequently, the impact on the internal control structure is that this type of trade methods has problems, whether they affect the accounting registration or problems that are needed from control measures to give confidence and the possibility of reliability.

The study of Al-Maghraby (2016) that aimed to develop a proposed accounting framework in organizing the electronic disclosure process in light of the mechanisms of information technology governance in the Egyptian environment.

What Distinguishes the Current Study from Previous Studies?

By reviewing previous studies, it was found that they dealt with the issue of accounting in general in e-commerce in terms of recognizing the appropriateness of accounting policies for the e-commerce environment. As for the current study, it deals with an important aspect of companies' business at the present time, which is e-commerce, as it came to identify Accounting Registration for E-commerce Operations and its impact on Accounting Information Reliability on companies operating in the pharmaceutical industry in Jordan.

Theoretical Framework

E-commerce Concept

E-commerce is the process of exchanging electronic information, and the process of exchange takes place through electronic transmission between two computers using agreed systems in preparing information and devising practical applications between producers and users and employing them in an integrated process in the global market through the Internet (Al-Khuraiji, 2013).

Accounting Registration in Light of E-Commerce

Al-Jabari (2012) indicates that the concepts of accounting registration are determined by the presence of basic ingredients that include basic accounting assumptions and basic accounting principles. These assumptions depend on the processes by which these values and items are measured. It also defines the characteristics of the accounting recording process itself.

Accounting Measurement Procedures for Revenue in the Light of E-Commerce

Revenue is defined as all the inflows that lead to an increase in the size of the company's assets or a decrease in liabilities or both, resulting from the sale of products. Or it is those activities that result from the company's exercise of its main activity, which aims to achieve profits, and which are due to the increase in property rights. It also represents flows resulting from the use of the company's assets, such as rents and credit interests, and takes place during the fiscal year (Al-Sharif, 2019).

As for revenue recognition, it is a fundamental process used to enter or record a specific item in the company’s accounts and financial statements. This recognition process includes describing the item in words and numbers while entering the amounts in total in the reports and financial statements. As for the assets, liabilities or liabilities, the recognition does not include making a recording of the acquisition or maturity of the item in question, but it includes all subsequent changes to the item, including the process of removing the previously recognized item from the reports and financial statements (Fakhr, 2010).

According to the principle of revenue recognition, what governs this process is that revenue is recognized at the point of sale or actual delivery, and revenue may be recognized when the price of the goods is received, when it is produced, or after the point of sale or actual delivery. There are two basic conditions for revenue recognition: (Al-Hubaishi, 2007).

1- The revenues have already been realized or are verifiable.

2- That the revenues have been earned, as the revenues are earned when the economic unit does what it must do so that the revenues become actually realized, in the event that the revenue process is completed. Revenue recognition is represented by the operations that are based on proving the transactions in the company's accounting records, and they are recorded in the reports and financial statements. Earning revenue is if two basic conditions are met:

a. The sales have been delivered or actually submitted.

b. The existence of real exchange operations between the company and other parties.

In light of the previous presentation, the researcher concludes that the cases in which revenues are considered to be realized in companies operating in the pharmaceutical industry sector in Jordan are the following:

a- Revenue is realized after the sale of pharmaceutical products, such as selling in installments.

b- Earning revenues upon completion of the process of providing pharmaceutical products, such as an objective assessment of the selling price.

c- Revenues are realized during the process of providing pharmaceutical products whose presentation cycle takes more than one accounting period for several accounting periods.

d- The ability of revenues to be realized upon completion of the provision of pharmaceutical products, when they are provided according to the customer's request and their selling price is predetermined. The cost of providing pharmaceutical products can be determined when their selling price is competitively determined, and the entire pharmaceutical products can be sold in a short and short time without reducing the price of these products.

Accounting Information Reliability

Messier (2015) defines Accounting Information Reliability as the awareness of Accounting Information users that they can trust and rely on specific and disclosed information with the least possible degree of fear. It should be free from errors, bias and distortion, and in order to achieve confidence in this information, qualitative characteristics are required:

1- Verifiability and comprehension of information: It means the possibility of reaching the same results when two independent persons use the same methods of measurement and accounting disclosure. That is, the results reached by a particular person can be reached by another person provided that the same methods of measurement and disclosure are used. In order to achieve confidence in Accounting Information, the information must be verifiable and understandable (Al-Shirazi, 2014).

2- Impartiality of information: Information should be impartial, objective and free from bias, and to be able to give its users an accurate perception of reality without distortions or errors, to reach a certain result or a certain behavior. The information must also present truthful facts without omitting or selecting information for the benefit of a particular party (Kieso et al., 2015).

3- Honesty in expression and representation: This means that the information should contain the attribute of honest representation so that it can be relied upon, and that honest representation does not mean a degree of 100% conformity, but rather a high degree of conformity (Kieso et al., 2015).

4- Predictability: Information forecasting means giving strong indications about the future of companies under normal conditions. The more powerful and close to reality these indicators are, the more appropriate they are because they allow their users to monitor future performance and know deviations, their positions and causes, and then treat them (Schroeder et al., 2016).

5- Feedback (the ability to re-evaluate): Users of Accounting Information should have the ability to make comparisons of the company's financial statements to determine trends in the financial position in performance and changes in the financial position, i.e., the availability of regression in the information provided by the system. This leads to the improvement and development of the quality of Accounting Information outputs in the future (Al-Shirazi, 2014).

6- Appropriate timing: any timely provision of its users on the grounds that it loses its value if it is not available at the time of need. Thus, the timely delivery of information to decision makers enables them to achieve the greatest benefit from the information (Schroeder et al., 2016).

From the above, the researcher concludes that Accounting Information Reliability is a feature that varies according to the person or entity associated with it. Accounting Information Reliability provided by the management of companies operating in the pharmaceutical industry in Jordan is completely different from Accounting Information Reliability, or the opinion provided by the auditor. Thus, it can be said that Accounting Information Reliability takes one of the following forms:

1- The ability of Accounting Information subject to audit to influence the decisions of its users on the grounds that they possess a degree of awareness of the honesty and integrity of the auditor's opinion of the information.

2- The information auditor's reputation in terms of the degree of his commitment to professional and ethical standards.

Analysis of the Results of the Field Study and Testing of Hypotheses

First: Characteristics of the Study Sample Members

| Table 1 Characteristics of The Study Sample Members |

|||

|---|---|---|---|

| Variables | Categories | Frequency | Percent |

| Academic qualification | Diploma | 14 | 11.6 |

| Bachelor's | 88 | 72.7 | |

| Master's | 18 | 14.9 | |

| PhD | 1 | 0.8 | |

| Total | 121 | 100% | |

| Years of Experience | less than 5 years | 13 | 10.7 |

| 5 years Less than 10 years | 54 | 44.7 | |

| 10 years Less than 15 years | 35 | 28.9 | |

| More than 15 years | 19 | 15.7 | |

| Total | 121 | 100% | |

| Job title | Financial Manager | 9 | 7.5 |

| Head of Accounting Department | 11 | 9.9 | |

| Accountant | 101 | 83.6 | |

| Total | 121 | 100% | |

It is evident from the analysis that:

1- The largest percentage of educational attainment levels is holders of a bachelor's degree, and they constituted (72.7%). It was followed by the percentage of master's degree holders with a rate of (14.9%) in second place. Diploma holders accounted for (11.6%), while for PhD holders it constituted (0.8%). It is clear that most of the sample members have an academic qualification above a bachelor's degree.

2- The experience of the highest percentage of the study sample is concentrated in the recurring category (5 years, less than 10 years), and they constituted 44.7%, then the recurring category (10 years, less than 15 years), which constituted 28.9%, then the recurring category (more than 15 years) and made up 15.7%. Finally, the recurring category (less than 5 years) accounted for 10.7%. This is an indication that the experience possessed by the sample is appropriate and qualifies them to carry out the duties dictated to them by the nature of the work, whose effects are reflected on Accounting Information Reliability.

3- Those whose job titles are accountant are the highest, constituting (83.6%) of the study sample, followed by (9.9%) of their job titles, head of the accounting department, while their job titles are financial manager (7.5%). These results give an indication of a normal distribution for the study sample, as the largest numbers are accountants.

Second: The Descriptive Statistics Results

Results Related to the First Question

| Table 2 Arithmetic Averages and Standard Deviations of The Revenue Recognition Variable in E-Commerce Operations |

|||||

|---|---|---|---|---|---|

| No. | Paragraphs | M | S.D | Lmp. | Rank |

| 1 | There is confidence in handling revenue recognition in e-commerce applications | 3.89 | 0.792 | High | 2 |

| 2 | There is the ability to deal with the problems of recognizing revenue arising from the use of assets such as rents and interest credits | 3.71 | 0.836 | High | 3 |

| 3 | The company has qualified, scientifically and practically qualified staff to deal with revenues in e-commerce applications | 3.57 | 0.902 | Medium | 4 |

| 4 | Revenue recognition treatments in accordance with accounting standards are consistent with international trade applications | 3.92 | 0.798 | High | 1 |

| 5 | Accountants have the knowledge of recording or entering an item in the accounts for the financial statements | 3.55 | 0.902 | Medium | 5 |

| 6 | The company is keen to apply revenue recognition rules in e-commerce applications | 3.54 | 0.885 | Medium | 6 |

| Total The Revenue Recognition | 3.69 | Medium | |||

This question states that: What are the estimates of the study sample members for the level of Accounting Registration for E-commerce Operations application in companies operating in the pharmaceutical industry in Jordan? The results were as shown in the analysis.

Arithmetic Means and Standard Deviations of the Revenue Recognition Variable in E-Commerce Operations

The analysis shows that the arithmetic mean of the revenue recognition variable in e-commerce operations was (3.584), with a high degree of importance. It was found that the most important statements were those that stated that “revenue recognition treatments in accordance with accounting standards are consistent with international trade applications,” with an arithmetic mean of (3.88) and a high degree of importance. E-commerce” ranked last, with a mean of (3.54), with a medium degree of importance.

| Table 3Arithmetic Averages and Standard Deviations of the Revenue-Acquisition Variable in E-Commerce Operations | |||||

|---|---|---|---|---|---|

| No. | Paragraphs | M | S.D | Lmp. | Rank |

| 1 | There are effective procedures for how to deal with revenue generation in e-commerce | 3.73 | 0.747 | High | 3 |

| 2 | The company is committed to applying the principle of revenue acquisition to determine the revenue for the period | 3.82 | 0.708 | High | 2 |

| 3 | Accountants have the knowledge of revenue earned when a company substantially accomplishes what it must accomplish to merit the revenue-generated benefits. | 3.91 | 0.769 | High | 1 |

| 4 | Companies are obligated to apply accepted accounting principles to deal with revenue acquisition in e-commerce applications | 3.65 | 0.906 | High | 4 |

| 5 | There are procedures to avoid fraud by companies while dealing with the earned revenue mechanism | 3.55 | 9590. | Medium | 6 |

| 6 | Accountants have the know-how and understanding in e-commerce applications in relation to cash claims for revenue to be considered earned | 3.60 | .9610 | Medium | 5 |

| Total The Revenue-Acquisition | 3.71 | High | |||

Arithmetic Means and Standard Deviations of the Revenue-Acquisition Variable in E-Commerce Operations

The analysis shows that the arithmetic average of the revenue-earning variable in e-commerce operations was (3.68), with a high degree of importance. And it turned out that the most important statements were "Accountants have knowledge of the revenues earned when the company essentially accomplishes what it must accomplish to deserve the benefits represented in the revenues" with a mean of (3.97) and a high degree and a high degree. It was found that the least important statements of this question are "there are procedures to avoid fraud by companies while dealing with the earned revenue mechanism", with a mean of 3.55, and a medium degree of importance.

| Table 4 Arithmetic Averages and Standard Deviations of The Verifiable Revenue Variable in E-Commerce Operations |

|||||

|---|---|---|---|---|---|

| No. | Paragraphs | M | S.D | Lmp. | Rank |

| 1 | The company is keen to tackle undocumented revenue recognition in the light of e-commerce | 3.55 | 0.800 | Medium | 6 |

| 2 | Accountants have the full knowledge of dealing with revenue and profits from profitable settlements of obligations | 3.84 | 0.847 | High | 1 |

| 3 | Developments in the world of e-commerce are followed to learn how to process verifiable revenue | 3.74 | 0.964 | High | 3 |

| 4 | The latest methods, administrative systems, technology and their applications on verifiable revenue in e-commerce applications are monitored | 3.78 | 0.799 | High | 2 |

| 5 | Accountants accept the idea of dealing with the verifiable revenue that e-commerce requires | 3.61 | 0.926 | Medium | 4 |

| 6 | The senior management monitors, follows up and evaluates the verifiable revenue in e-commerce applications | 3.64 | 0.994 | Medium | 4 |

| Total The Verifiable Revenue | 3.69 | High | |||

Arithmetic Means and Standard Deviations of the Verifiable Revenue Variable in E-Commerce Operations

The analysis shows that the arithmetic average of the verifiability of revenue variable in e-commerce operations reached (3.622), with a high degree of importance. It was found that the most important statements are "Accountants have full knowledge of dealing with revenue and profits from profitable settlements of obligations" in the first place, with an arithmetic mean (3.84) and a high degree of importance. It was found that the least important statements of this question read, "The Company is keen on addressing the recognition of undocumented revenues in the light of electronic commerce," and it ranked last, with a mean of (3.55), and a medium degree of importance.

| Table 5 Arithmetic Averages and Standard Deviations of the Revenue Realization Variable In E-Commerce Operations |

|||||

|---|---|---|---|---|---|

| No. | Paragraphs | M | S.D | Lmp. | Rank |

| 1 | Keeping abreast of the latest methods, administrative systems, technology and their applications on revenue generation processes | 3.73 | 0.783 | High | 2 |

| 2 | Recognize and formal proof of revenue realization at the date of sale in e-commerce applications | 3.81 | 0.875 | High | 1 |

| 3 | Any developments and developments in e-commerce operations with regard to revenue realization are monitored | 3.59 | 0.873 | Medium | 5 |

| 4 | Accountants have knowledge of the principle of revenue recognition when it is achieved in e-commerce applications | 3.65 | 0.883 | Medium | 3 |

| 5 | Accountants impose effective control over revenue generation in e-commerce applications | 3.58 | 0.873 | Medium | 6 |

| 6 | There is objectivity in revenue generation in e-commerce applications | 3.64 | 0.801 | Medium | 4 |

| Total The Revenue Realization | 3.66 | Medium | |||

Arithmetic Means and Standard Deviations of the Revenue Generation Variable in E-Commerce Operations

The analysis shows that the arithmetic average of the revenue realization variable in e-commerce operations was (3.66), with a medium degree of importance. It was found that the most important statements "are recognized and official proof of revenue is realized at the date of sale in electronic commerce applications" with a mean of (3.81), with a standard deviation of (0.875), and with a high degree of importance, and it was found that the least important statements were "Accountants impose control Effective on revenue generation in electronic commerce applications" with a mean of (3.58) and a medium degree of importance.

Results Related to the Second Question

It states: What are the estimations of the study sample members of the level of Accounting Information Reliability in companies operating in the pharmaceutical industry in Jordan? The results were as follows:

| Table 6 Arithmetic Averages and Standard Deviations of The Dependent Variable: Reliability of Accounting Information |

|||||

|---|---|---|---|---|---|

| No. | paragraphs | M | S.D | Lmp. | Rank |

| 1 | There is a congruence between the qualitative characteristics specified in the accounting system with those established by international accounting standards | 3.69 | .8560 | High | 4 |

| 2 | The accounting recording of e-commerce operations contributes to the timely delivery of information to decision makers | 3.82 | 0.785 | High | 1 |

| 3 | The accounting registration of e-commerce operations provides feedback that contributes to improving and developing the quality of information provided to decision makers | 3.65 | 0.861 | Medium | 6 |

| 4 | The accounting recording of e-commerce operations leads to the financial reports containing comparable information in order to facilitate the process of study, analysis, forecasting and decision-making. | 3.77 | 0.983 | High | 2 |

| 5 | The accounting recording of e-commerce operations helps contain the information with a predictive ability that helps to prepare plans and formulate future policies | 3.74 | 0.801 | High | 3 |

| 6 | The accounting recording of e-commerce operations contributes to making information impartial and unbiased | 3.61 | 0.891 | Medium | 7 |

| 7 | The accounting recording of e-commerce operations provides the ability to verify and verify reliable information | 3.66 | 0.868 | Medium | 5 |

| Total | 3.70 | High | |||

Arithmetic means and standard deviations of the dependent variable: Accounting Information Reliability

The analysis shows that the arithmetic mean of the dependent variable: Accounting Information Reliability reached (3.696), with a high degree of importance. It was found that the most important statements are "Accounting Registration for E-commerce Operations contributes to the delivery of information to decision makers in a timely manner" with an average of 3.98 and a high degree of importance. It was found that the least important statements of this question "Accounting Registration for E-commerce Operations contributes to making the information neutral and unbiased" with an arithmetic average of (3.58) and a medium degree of importance.

The Results of Testing the Hypotheses of the Study

| Table 7 Results of The Correlation Coefficients and Anova to Test The Significance of The Regression Model and the Coefficients |

|||||

|---|---|---|---|---|---|

| Model | Std. Error of the Estimate | Adjusted R Square | R Square | R | |

| 1 | 0.3291 | 0.339 | 0.555 | 0.745 | |

| Contrast Source | Sum of Squares | Mean Square | F | Sig. | |

| Regression | 9.711 | 2.427 | 8.581 | 0.000 | |

| Residual | 18.184 | 0.156 | |||

| Total | 21.083 | ||||

| Independent Variables/Coefficients | Standardized Coefficients | Unstandardized Coefficients | T | Sig. t | |

| Beta | Std. Error | B | |||

| Fixed Limit (3.002) | .416 | 3.001 | 5.921 | 0.000 | |

| revenue recognition | 0.319 | 184. | 0.195 | 3.945 | 0.003 |

| revenue gain | 0.297 | .149 | 0.249 | 4.611 | 0.000 |

| Verifiability of revenue | 0.255 | .146 | 0.314 | 5.710 | 0.002 |

| revenue verification | 0.341 | .159 | 0.210 | 4.519 | 0.001 |

The analysis shows that the value of the relationship between Accounting Registration for E-commerce Operations and Accounting Information Reliability has reached (0.745), which is a relatively high value and indicates a direct positive relationship. It is noted that the value of the coefficient of determination (2R) has reached (0.555%), which indicates that the Accounting Registration for E-commerce Operations variables are explained by the change or discrepancy in Accounting Information Reliability with the value of the mentioned percentage, and the modified (2R) value can be used, which It takes into account the number of independent variables, so that the percentage of the adjusted coefficient of determination becomes (0.339%), and the remaining value of the two percentages is due to other factors that affect Accounting Information Reliability.

As for the results of the analysis of variance ANOVA to test the significance of the regression model, the previous table (1) shows that the calculated F value reached (8.581), which is a statistically significant value because the value of the associated significance level reached (0.000) which is less than 0.05, which means that the main null hypothesis was rejected. And the acceptance of the alternative, which indicates that there is an impact of the accounting recording of e-commerce operations represented by (revenue recognition, revenue earning, revenue verifiability, Revenue -Achievement) on Accounting Information Reliability in companies operating in the pharmaceutical industry in Jordan.

The data in the same table (1) also indicate that the Accounting Registration for E-commerce Operations variables affect the dependent variable, which is Accounting Information Reliability, in companies operating in the pharmaceutical industry in Jordan. Therefore, hypotheses can be tested as follows:

Testing the First Hypothesis: It states that: There is no impact of revenue recognition in e-commerce operations on Accounting Information Reliability in companies operating in the pharmaceutical industry in Jordan. It is evident from Table (1) that the calculated t-value amounted to (3.945) with a significance level of (0.003). When comparing the value of the significance level with the value 0.05, it was found that the calculated significance level was lower, which indicates the rejection of the first zero hypothesis and thus the conclusion that there is an effect of revenue recognition in e-commerce operations on Accounting Information Reliability. The table also shows that the value of the standard parameter (Beta) has reached (0.319), which is a statistically significant value.

Testing the Second Hypothesis: It states that: There is no impact of revenue acquisition in e-commerce operations on Accounting Information Reliability in companies operating in the pharmaceutical industry in Jordan. It is evident from Table (1) that the calculated t-value amounted to (4,611) with a significance level of (0.000), and when comparing the value of the significance level with the value 0.05, it was found that the calculated significance level was lower, which indicates the rejection of the first zero hypothesis and thus the conclusion that there is an effect of revenue acquisition. In e-commerce operations on Accounting Information Reliability, the table also shows that the value of the standard parameter (Beta) has reached (0.297), which is a statistically significant value.

Testing the Third Hypothesis: It states that: There is no impact of verifiability of revenue in e-commerce operations on Accounting Information Reliability in companies operating in the pharmaceutical industry in Jordan. It is evident from Table (1) that the calculated t-value amounted to (5.710) with a significance level of (0.002) and when comparing the value of the significance level with the value 0.05, it was found that the calculated significance level was less, which indicates the rejection of the first zero hypothesis and thus the conclusion that there is an effect of verifiability of revenue In e-commerce operations on Accounting Information Reliability, the table also shows that the value of the standard parameter (Beta) has reached (0.255), which is a statistically significant value.

Testing the Fourth Hypothesis: It states: There is no impact of revenue Achievement in e-commerce operations on Accounting Information Reliability in companies operating in the pharmaceutical industry in Jordan. It is evident from Table (1) that the calculated t-value reached (4.519) with a significance level of (0.001). E-commerce operations on Accounting Information Reliability and the table show that the value of the standard parameter (Beta) has reached (0.341), which is a statistically significant value

Discussing the Results and Conclusion

It was found that there is an impact of the accounting measurement of e-commerce operations with variables (revenue recognition, revenue acquisition, verifiability of revenue, revenue Achievement) on Accounting Information Reliability in companies operating in the pharmaceutical industry in Jordan. It was found that Accounting Registration for E-commerce Operations contribute to the timely delivery of information to decision makers, and this measurement leads to the financial reports containing comparable information in order to facilitate the process of study, analysis, forecasting and decision-making, and it was found that there is a match between the qualitative characteristics specified in the accountant system with those established by international accounting standards. This result indicates the importance of the commitment of companies operating in the pharmaceutical industry in Jordan to the Accounting Registration for E-commerce Operations processes that make the financial statements able to provide timely delivery of information to decision makers, and because it leads to the financial reports containing comparable information in order to facilitate the study process analysis, forecasting and decision-making, and that the information contains a predictive ability to help prepare plans and formulate future policies.

The results showed that the arithmetic mean of the revenue recognition variable in e-commerce operations was of a high degree of importance. The companies are coordinating the accounting revenue recognition treatments in light of e-commerce applications with international accounting standards. It turns out that there is confidence in dealing with revenue recognition in e-commerce applications. And that there is the ability to deal with the problems of revenue recognition resulting from the use of the company's assets such as rents and credit interests, in addition to the fact that the company has an efficient, scientifically and practically qualified cadre to deal with revenues in e-commerce applications. This result confirms the importance of companies operating in the pharmaceutical industry in Jordan to develop the accounting system that links the company with its website on the Internet, and in a manner that complies with the accounting revenue treatments with those international accounting standards in light of e-commerce applications. The same applies to accounting registration processes when using techniques that are in line with relevant international accounting standards.

It was also found that the arithmetic mean of the revenue acquisition variable came with a high degree of importance. It turns out that companies have accountants who have knowledge of earned revenues when the company essentially accomplishes what it must accomplish to deserve the benefits represented in the revenues. It is also committed to applying the principle of revenue acquisition to determine the period's revenues. It was also found that companies have effective procedures for how to deal with revenue acquisition in e-commerce and are committed to applying accepted accounting principles to deal with revenue-earning operations in e-commerce applications. This means the importance of companies operating in the pharmaceutical industry in Jordan to measure the revenues earned when the company essentially accomplishes what it must accomplish to deserve the benefits represented in the revenues resulting from exchanging the provided service with elements similar in nature and the fair value of the services provided. And that revenue are recorded at the time of their recognition or inclusion in the income statement, and that revenues are recorded or recognized for all contracts concluded with customers, orally or in writing.

Finally, the results indicated a high level of importance for the verifiable revenue variable in e-commerce operations. It became clear that accountants have full knowledge of dealing with revenue and profits resulting from profitable settlements of obligations, and they have knowledge of verifiable monetary claims. In addition, it was found that accountants possess the necessary knowledge of verifiable revenue in e-commerce applications. This result imposes on the companies operating in the pharmaceutical industry in Jordan the need to deal with the revenue and profits resulting from profitable settlements of obligations and the accounting recording of the amount of those revenues and verifiable profits, since the correctness of the measurement is the result of the occurrence of the reciprocal process related to electronic commerce with external parties that deal with the company.

It was also found that the arithmetic average of the revenue realization variable in e-commerce operations was at a high degree. And it turns out that the official recognition and proof of revenue realization is done at the date of sale in e-commerce applications. The latest methods, administrative and control systems, technology and their applications on the processes of realizing these revenues are also kept abreast of. This result indicates the importance of companies operating in the pharmaceutical industry in Jordan acknowledging the realization of revenue at the date of sale in electronic commerce applications, and to keep pace with the latest methods, administrative systems and technology and their applications to revenue generation processes as a result of allowing others to use the company’s assets in return for revenue or return, with an emphasis on The company's keenness on the official proof of revenue and it is shown in its accounts, whether to form allocations for investment in shares or to provide reserves for losses that may occur by physical means that support the occurrence of the financial incident by providing evidence and accounting documents that are considered as sufficient physical evidence and written proof that supports and confirms the occurrence of the financial incident.

Recommendations

The researcher presents a number of recommendations to companies operating in the pharmaceutical industry in Jordan as follows:

1- Verify the ability of companies to perform revenue recognition and accounting registration processes in e-commerce operations so that they are compatible with changes and developments in the use of techniques that are in line with international accounting standards.

2- Taking into account the accounting systems applied in companies through the study and analysis of these systems in order to ensure their ability to respond to international accounting standards in light of the expansion of electronic commerce.

3- Providing an efficient, scientifically and practically qualified cadre of accountants who possess the know-how and understanding to deal with the revenue generation resulting from dealing in e-commerce applications.

4- The commitment of companies to apply accepted accounting principles to deal with revenue-earning operations in e-commerce applications and to establish procedures to avoid fraud that may occur while dealing with the earned revenue mechanism.

5- Companies address the recognition of undocumented revenues required by electronic commerce and accountants accept the idea of dealing with verifiable revenue in light of this type of commerce.

6- Emphasizing on companies the necessity of following up on any developments and developments in e-commerce operations and imposing effective control over revenue generation in e-commerce applications.

References

- Al-Jabari, M., & Al-Sayed, A. (2012). “The adequacy of the theoretical framework for accounting in light of e-commerce operations”. PhD thesis, Arab Open Academy in Denmark, Faculty of Administration and Economics, Department of Accounting, Copenhagen, Denmark.

- Al-Hubaishi, W. (2007). “Abdul Aziz, the reality of the government accounting system in Yemen and the prospects for its development”. A master’s thesis, Faculty of Economics, Accounting Department, Damascus University: Syria.

- Al- Hayali, W. (2015). "Accounting Theory". Arab Academy Publications, Denmark.

- Al-Khuraiji, A.B.A. (2013). "E-commerce: Prospects and dimensions". Al-Rushd Library for Publishing, Distribution and Printing, Riyadh, Saudi Arabia.

- Al-Zaidi, W. (2014). "E-commerce via the Internet, the legal position". Dar Al-Manhaj for Publishing and Distribution, Jordan.

- Al-Sharif, O. (2019). "Principles of financial accounting". Dar Al-Masira for Publishing, Distribution and Printing, Amman: Jordan.

- Al-Shirazi, A.M. (2016). "Accounting theory". Dar Al Salasil for Publishing, Distribution and Printing, Kuwait.

- Al-Maghraby, M.M. (2016). “A proposed accounting framework in organizing the electronic disclosure process in light of the mechanisms of information technology governance in the Egyptian environment”. PhD thesis, Department of Accounting, Faculty of Commerce, Benha University, Egypt.

- Al-Wardat, K.A. (2016). Internal and external auditing. Al-Warraq Publishing and Distribution Corporation, Amman: Jordan.

- Alees, M., & Vasarhelyi, M. (2015). “The ‘now’ economy and the traditional accounting reporting model: opportunities and challenges for accounting information systems research. Bulletin for International of Fiscal Documentation, 50(11), 526- 530.

- Armstrong, G., & Kotler, P. (2016). Principle of marketing, E.d9, New Jersey: Prentice Hall, Inc.

- Cormier, D. (2014). The use of websites as disclosure platform for corporate performance. Journal of Management Accounting Research, 2(1), 151-178.

- Hamdi, A.A. (2016). “E-commerce”. publications of the Sadat Academy for Administrative Sciences, Cairo, Arab Republic of Egypt.

- Fakher, N. (2010). "An introduction to accounting". Tishreen University Publications, Syria.

- Kieso, D.E., Weygand, T., Jerrry, J., & Terry, D.W. (2015). Intermediate accounting. John Wiley and sons Inc, New York, USA.

- Lee, H.L., & Whang S.S. (2011). “E-Business & E-Commerce Integration”. Stanford university. Journal of Management Accounting Research, 2009, 21, 151-178.

- Mohsen, M. (2015). "Electronic commerce and its impact on accounting information systems". Journal of the Faculty of Commerce, Tanta University, 1(1), 51-63.

- Marwan, N. (2011). The impact of e-commerce on the practice of auditing in audit firms in Jordan. The Jordanian Journal of Business Administration, 2(1), 14-31.

- Malhotra, K.N. (2014). Marketing research. New Jersey. Saddle River: Pearson Prentice Hall.

- Messier, W. (2015). Auditing & assurance service. McGraw-Hill Companies, Boston.

- Muir, L., & Douglas, A. (2011). Advent of e- business concepts in legal services and its impact on the quality of services”. Managing Service Quality, 11(3), 9-35.

- Ronald, F. (2012). The fear of All Sums: CFO Survey, Internet Tax Freedom Act limits States. Accounting, 21(21), 190- 230.

- Schneider, G., & Perry, J. (2017). "E-Commerce". Boston: Course Technology.

- Sekaran, U. (2015). Research methods for business: A skill-building approach. John Wiley and Sons Inc, New York.

- Schroeder, R., Clark, M., & Katie, J. (2016). "Accounting Theory". Arabization of Al-Marikh Publishing and Distribution House, Riyadh, Saudi Arabia, 82-83.

- The annual report of the Amman Stock Exchange, for the year 2019.

- Vantanasombut, B. (2013). Information systems continuance intention of web-based applications customers: The case of line baking. Managing Service Quality, 11(3), 20-38.