Research Article: 2022 Vol: 25 Issue: 1S

Accounting Skill and Industry Needs as Veritable Tool for Sustainable Small and Medium Scale Enterprises

Okewale JA, Department of Accounting, Faculty of Administration and Management Sciences, Olabisi Onabanjo University, Ago-Iwoye

Makinde KO, Department of Accounting, Faculty of Administration and Management Sciences, Olabisi Onabanjo University, Ago-Iwoye

Olusola OO, Department of Business Education, College of Vocational and Education, Tai Solarin University of Education

Sotunde OA, Registry, Federal University of Agriculture, Abeokuta

Citation Information: Okewale, J.A., Makinde, K.O., Olusola, O.O., & Sotunde, O.A. (2022). Accounting skill and industry needs as veritable tool for sustainable small and medium scale enterprises. Journal of Entrepreneurship Education, 25(S1).

Abstract

This study was embarked upon as the contribution of Accounting field towards sustainable Small and Medium Scale Enterprises (SMEs), using Ogun State as a pilot study. The sample size for the study was based on all of the registered small and medium scale enterprises (SMEs) in Ogun State, comprising Two thousand, four hundred and sixty-five (2,465) and Accounting Educators (AEs) selected across one each of the Federal, State and Private Universities in Ogun State. The Taro Yamme’s (1967) formulae was used to randomly select three hundred and forty-four (344) SME owners, while Senior lecturers and above were selected as the respondents for Accounting Educators. A self-designed 5-points Likert rating scale Questionnaire was designed for the study and administered to respondents via Google Form software. The Pearson Product Moment Correlation Coefficient (PPMCC) technique alongside t-test was used to analyse the gathered data. The results revealed that all of the Accounting Skills, such as the Management Accounting Information Skills (MAIS); Pricing Policy Skills (PPS); Budgeting, Risk and Uncertainty Skills (BRUS); and General Business Related Skills (GBRS) are very much important and needed by the SME owners for the sustainability of their enterprises, while Other Accounting Skills (OAS) that include Business Law, Financial Accounting, Taxation, and Tax Matters, Financial Management, and Auditing & Ethics are least important to the SME operations. The study therefore concluded that Management Accounting Information Skills was statically significant to be the skills needed by SME owners, thus, should be greatly emphasized in universities, while also taking into cognizance the needs of SME/small business accounting in the teaching-learning process.

Keywords

Accounting Skills, Management Accounting Information Skills (MAIS), Sustainable Small and Medium Scale Enterprises, Industry needs.

Introduction

The United Nations came about the Sustainable Development Goals (SDGs) in other to transform the world while protecting the earth, it is a call for poor, rich, and middle-income countries to build economic growth and address a range of social needs, hence the goals are grouped into 17 cogent areas in which country member of the United Nations must achieve by the year 2030, that is ten (10) years to this time. Among the 17 listed goals, Goal 4 focuses on quality education, for this study; it refers to the skills that are to be acquired by Accountants to understand how SME operates and how to make financial decisions to be able to meet the objective of the business, which is to maintain a sustained profit.

Thus, in 2017, a National Survey carried out by the National Bureau of Statistics (NBS) and SMEDAN on Micro, Small and Medium Enterprises (MSMEs) which covers enterprises in Nigeria employing below 200 persons in all the 36 States of the Federation and FCT, revealed the outcome that, the total number of MSMEs as at December 2017 stood at 41,543,028, which consist of: micro enterprises - MEs: 41, 469,947 (or 99.8 percent), small and medium enterprises - SMEs: 73,081 (or 0.2 percent). This survey also includes the five (5) major economic sectors viz: Wholesale/Retail trade (42.3 percent), Agriculture (20.9 percent), Other Services (13.1 percent), Manufacturing (9.0 percent), and Accommodation & Food Services (5.7 percent). Together, these account for about 91.0 percent of all MSMEs. With a total employment contribution of 59,647,954 persons, including owners, in December 2017 (equal to 86.3 percent of the national workforce), MEs alone contributed a whopping 95.1 percent but with innately weaker capacity for jobs creation at 1.37 persons per entity (compared with 39.5 persons for SMEs).

The overall objective was to reduce poverty through wealth and job creation, within the overall goal of facilitating socio-economic transformation. This highlighted the need for accurate and reliable data on which to backstop planning for the subsector, which was incidentally one of the challenges SMEDAN inherited at inception. Also, the initial effort at addressing this challenge produced only limited results. It was this state of affairs that eventually led to the commencement of the strategic partnership, in 2010, with the National Bureau of Statistics (NBS) - the apex Agency saddled with responsibility for producing socio-economic statistics in Nigeria (MSMEs National Survey, 2017).

The Nature of Accounting Skills for Sustainable SMEs Development

Michael & Chigozie (2014) posited that Accounting is the language of business that tells the owners/managers and other stakeholders of the business what is happening in the business. Its nature is to provide information to a wide range of interest groups and ultimately shows how a business has been managed for a period- whether successfully managed or otherwise. Osuala (2009) cited by Michael & Chigozie (2014), asserted that the knowledge of fundamental accounting skills is very important for the survivability of any business. Lack in the possession of these fundamental accounting skills by SMEs, or rather Accountants constitutes challenges such that, the chances of survival of the business are slim and the probability of imminent failure/collapse becomes high. Hence every small and medium scale enterprises should strive to acquire and possess these fundamental skills. Furthermore, Onoh (2014) stated that fundamental accounting skills are those competencies in basic accounting required by a person to function competently, confidently, and successfully in the process of carrying out one’s function of recording daily business transactions (Oyesode, 1998; Pulka et al., 2017; Yamane, 1967).

Book-keeping, bargaining, determining labor costs, simple budgeting, keeping of accurate receipts, sales records skills in keeping reliable records, work in progress records, invoices, cheque payments, keeping customers’ records and goods inventory constitutes some the skills. Others may include skills in good credit facility practices, cash sales, and prudent financial and working capital management amongst others. Management of money demands that the SME owner/manager must need to plan for all his future need for funds, plan for the most economical way of acquiring funds from different sources and be able to also plan for the most efficient way of putting to use acquired money from friends, family members, banks and other sources.

Statement of the Problem

The current global business climate change is becoming worrisome as it simply very different from that of the past. Business organizations operate in an environment surrounded by national and international, social, and political activities. Therefore, changes in the business environment demand corresponding change in the educational system and process, as well noted by Mohammad & Salvador (2007). However, the fact that should be particularly noted is that there has been little or no research addressing how necessary Accounting Skills can address the needs of these SMEs as encapsulated from these authors: Casner-Lotto & Benner (2006); Jackson (2009); Khan & Martínez (2011); McQuaid & Lindsay (2005); Washer (2007); Waweru (2010); Pittaway & Edwards (2012); Koç (2015).

Research Questions

From the above-stated problem, the following research questions would be formulated:

1. What are the special accounting skills or competencies that Nigerian industries (SMEs) demand from accounting graduates?

2. What are the stakeholders’ perceptions of the role of ICT and accounting software as determinants for sustainable SMEs?

Aim and Objectives of the Study

This study aims to assess and provide the accounting skills especially in the area of Management Accounting Information System relevant for sustainable Small and Medium Scale Enterprises (SMEs) as contributions to SME growth from the perspective of accounting. This shall therefore lead to the following specific objectives:

1. To examine and compare the special accounting competency skills demanded by SME operators with what is been offered in universities; and

2. To analyze stakeholders perception of the effect of ICT and accounting software on SME business operations and how it has improved their performances.

The Statement of the Hypotheses

The hypotheses of the study were stated in a tentative null form as follows:

H1: There is no difference between the mean score of owners of SMEs' opinion on the accounting skills needed for sustainable SMEs and the Accounting Educators' (AEs) view on the Institutions Course Competencies.

H2: There is no significant difference between the mean scores of the responses of owners of SMEs on the effect of accounting software on their business operations.

Literature Review

Accounting Skill and Sustainable SMEs in Nigeria

Nigeria is faced with a lot of developmental challenges and Business education is seen as a tool for ameliorating these challenges. This explains why the United Nations Education, Scientific and Cultural Organization (UNESCO) in Olateju (2010), promotes the adoption of vocational and technical education (VTE). Business education is a component of VTE. Writers such as Iheanacho (2006); Ojajuni (2010); Onwuchekwa (2010); and Gidado (2011) have suggested ways for attaining sustainable development through the adoption of Business education, particularly in developing countries like Nigeria. These are discussed under the following sub-headings:

Socio-Economic Development

Every country desires to develop. To this end, Nigeria is not an exception. As viewed by Iheanacho (2006), Nigeria has not been able to progress like the Asian Tigers, namely South Korea, Malaysia, Singapore, Indonesia, etc. and economic giants like Taiwan, China, and Japan, because she is yet to adopt Technical and Business education (TBED) as her instrument for socio-economic development. Furthermore, he stated that TBED can take Nigeria to the promised land by transforming her into a producer of secondary goods, a producer rather than a mere consumer nation, an active exporter as opposed to the present status of the active importer as well as manufacturer and not an assembler of automobiles. He is of the position that all these would bring about an improved standard of living which is an indicator of national development.

Entrepreneurial Development

Business Education equips and empowers entrepreneurs with skills that will bring to business success. According to Ojajuni (2010), VTE to whom Business education is a subset equips its recipients with skills that would lead to proper scanning of the environment which is among the characteristics of entrepreneurs. Furthermore, Gidado (2011) pointed out that Entrepreneurship Education which is a basic component of the Business education curriculum stimulates people to bear risks. According to Gidado (2011), Business education also equips its recipients with managerial skills which will lead to business success. These imply that business education has the potentials for solving some of Nigeria’s developmental challenges such as unemployment and poverty. This follows that through the income which the employment opportunities will generate; people will be able to get income to be used in ameliorating their levels of poverty.

Production of Competent Skilled Manpower

Business education can lead to the production of competent manpower needed for development. It was reported by Onwuchekwa (2010) that through its Employment and Training Act of 1973, Britain addressed its manpower needs with the use of technical/ vocational education and training (TVET) to whom Business education is a subset. He also pointed out that developed countries emphasize the need for skilled manpower necessary for economic securities. This according to him is among the objectives of vocational and technical education. This means that Business education should be highly encouraged in Nigeria by creating awareness regarding its relevance in bringing about development. Through this; would help in addressing the problem of acute shortage of skilled manpower bedevilling the country.

Sustainable Development Goal 4 – Quality Education: The Basic Targets to be achieved by the year 2030

Education enables upward socioeconomic mobility and is a key to escaping poverty. For this study, some of the SDG targets that directly relates to this study are highlighted below:

Target 4.3 - By 2030, African countries would ensure equal access for all women and men to affordable and quality technical, vocational and tertiary education, including university.

Target 4.4 - By 2030, African countries would have substantially increased the number of youth and adults who have relevant skills, including technical and vocational skills, for employment, decent jobs, and entrepreneurship.

Target 4.7 - By 2030, ensure that all learners acquire the knowledge and skills needed to promote sustainable development, including, among others, through education for sustainable development and sustainable lifestyles, human rights, gender equality, promotion of a culture of peace and non-violence, global citizenship and appreciation of cultural diversity and culture’s contribution to sustainable development.

Theoretical Review - The Knowledge-Based Theory and Dynamic Capabilities Theory

The knowledge-based theory considers knowledge as the most strategically significant resource of a firm. It was first developed by Penrose as a Resource-Based View (RBV) in 1959. However, it was later modified by other scholars, including Wernerfelt, Barney, and Conner (Carla, 2006). The Proponents of knowledge-based theory asserted that the resource-based view does not go far enough. Particularly, knowledge is treated as a generic resource by RBV, instead of possessing special characteristics. Therefore, it does not distinguish between different types of knowledge-based capabilities. The proponents of knowledge-based theory posit that knowledge is embedded and carried through multiple entities including organizational policies, routines, documents, and employees to include accountants).

According to Ikujiro & Hirotaka (1995), the term, ‘Dynamic Capabilities’ was first introduced in a working paper in 1989 and was influenced by Gary Hamel organization’s multinational strategy research which resulted in Core Competences of the Corporation. Helfat (2007) distinguished Dynamic capabilities from operational capabilities like the capacity of an organization to purposefully create, modify, or improve its resource base. Dynamic capabilities framework assumes that core competencies existing within an organization should be used for the improvement of their short-term competitiveness. This implies stretching the use of available resources including accounting skills at the disposal of a firm for short-term competition. Improvements in successive short-terms will, in turn, build long-term competitive advantage. That is the convergent point of the theory with this study. Core competence in accounting knowledge and skill could improve SMEs' accounting skills, performance, and hence, competitiveness. Therefore, it may serve as one of the improvement strategies for sustainable SMEs.

ICT and Accounting Software

IT knowledge and skills refer to the acquisition of relevant knowledge and skills in the application of computers and telecommunication equipment to store, retrieve, transmit and manipulate data. Researchers over the years after a comprehensive review of studies regarding the importance of integration of information technology (IT) knowledge and skills have taken a stand on the importance of integration of IT knowledge and skills in accounting curriculum while few others believe that integration is not an assurance that accounting graduates would create value in their workplace in the future thereby meeting the expectation of their employers.

Also, Ogundana et al. (2015) posited that Accounting software packages refer to intangible products. They are a type of application software that records and processes accounting transactions within functional modules such as accounts payable, accounts receivable, payroll, and trial balance. They include Peachtree, Quickbook, Lotus 123, Super calc, etc. A study by Wessels (2007) cited by Ogundana et al. (2015) of the information and communication technology (ICT) education offered to account students at South African universities revealed that students had limited exposure to the use of accounting software packages thereby affecting their ability to add value to organizations they find themselves. This, therefore, is an indication that accounting software can influence the sustainability of SMEs in Nigeria, although studies are limited in this area, thus this current study aims to add to knowledge the relevance of ICT and accounting software to the sustainability of SMEs activities.

Previous Empirical Studies

In a study conducted by Njoku & Nwosu (2002) on the Role of Business education in sustaining small scale businesses for national development, 30 enterprises and 185 respondents comprising of 35 employers and 150 employees were randomly selected in Imo State. The data collected were analyzed using frequency, percentage scores, and ranking. The study revealed that the owners used trial and error in managing their businesses which could lead to a high rate of business failure, and they are interested in cheap labour. In the same vein, it identified poor accounting and communication skills, lack of co-operation, lack of initiative, lack of tactfulness, dishonesty, lack of patience, poor filing habit, frequent fraud, inability to produce mailable letters, and the inability of the employees to charm customers as the constraints to effective management. The study concluded that the recruitment of experts in business education will make small-scale businesses contribute to national development (Nonaka & Takeuchi, 1995; Ikem et al., 2012; Curado, 2006; Abbasi, 2011; French & Coppage, 2003).

Hamza et al. (2015) surveyed 300 SMEs located in the Northern Region of Ghana; using descriptive and inferential statistics, the researchers demonstrated that SMEs' financial performance was positively correlated with efficiency in inventory management. They also pointed out that, there was a need for managers of SMEs to embrace efficient stock management practices as a strategy for improving their financial performance and survival in that currently uncertain business environment. Concluding from the foregoing, over-reliance on short-term borrowing, the volatility of cash and profit positions are some of the core necessities for applying basic accounting practices such as inventory, credit, debit, and cash management among SMEs.

On the relevance of the accountant to SMEs, the Association of Certified Chartered Accountants (ACCA) has carried out several pieces of research to empirically investigate the particular circumstances where the accountants are relevant. ACCA research report No.18, which indicates the potential role of the profession in supporting small businesses (Chittenden et al., 1990; Odugbemi & Oyesiku, 2000; Ekwe & Abuka, 2014).

Still, on the relevance of the accountants’ advice, researches are in accords that accountants’ advice proves useful. However, there is disaccord as to the effects of their advice on the business. Accountants are of the most-used professional support providers (Atkinson & Hurstifield, 2003; Jay & Scheper, 2003; Nwokike, 2013). Surprisingly, Accountants’ advices are not related to any of the performance measures (Jay & Scheper, 2003).

Obamuyi (2007) cited by Ohachosim (2012) in the paper titled “An exploratory study of loan delinquency among small and medium enterprises (SME) in the Ondo State of Nigeria” maintained that the lending practices towards SMEs are not different from those for large enterprises. The paper went further to state some standard criteria to assess the creditworthiness of borrowers as follows; financial strength, profitability, track record, relations and payment records with other banks, business risks, and collateral securities. All the above criteria cannot be good assessments without adequate accounting. It is because of the deficiency in the record-keeping of SME that compels the banks to insist on collateral as a “must for SME.”

Devi & Smith (2010) study concluded that because accountants have not noticed the need for them to acquire a peculiar mind-set towards SMEs, that Accountants are not used as supposed by the SMEs. It is, therefore, reasonable for the accountant and accounting educators to prepare for the emerging tasks. As Ohachosim (2012) put it, there is a need to increase time with the SME, and also there is a need to bring down the level of interaction to be compatible with the level of SME- operators.

Conceptual Framework and Variable Relationships

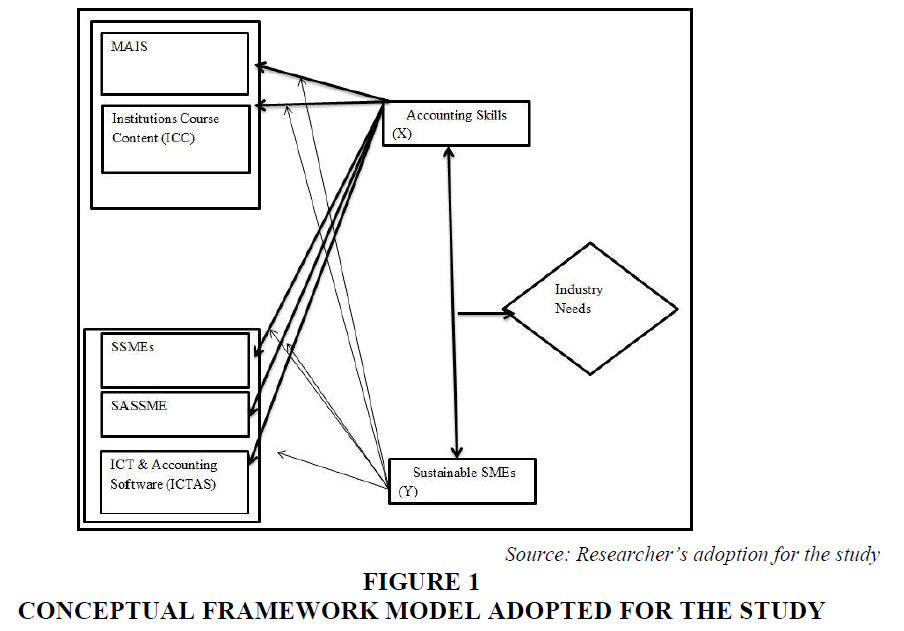

The underpinning framework adopted for the study is illustrated below in Figure 1.

The framework is made up of Management Accounting Information Skills (MAIS), Institutions Course Contents (ICC), and Industry needs (IN) are categorized under current competencies in accounting as independent variables (X), Sustainable characteristics of SMEs (SSMEs), Special Accounting Skills for SMEs (SASSME), and ICT & Accounting Software (ICTAS) are categorized under the Sustainable SMEs as dependent variable (Y), while industry needs are regarded as the moderating variable. Therefore, this work is built on Resource Base View. That is, the resources/competencies/capabilities are to help the firm to attain a competitive advantage and also sustained performance. According to RBV, the firm’s resources/competencies/capabilities of firms hold some qualities that make them have value, rare, imperfectly imitable, and not substitutable resources. The resources of a firm are divided into two; these are material resources and non-material (human/knowledge) resources.

Summary of Literature Review/Gap

It is obvious from the pieces of literature reviewed that the place of industry needs in an accounting skill is central to the performance or otherwise of the accounting educators. This study seeks to address these gaps that are, the accounting skills needed by the small and medium scale enterprises to come up with a set of potential skills that affect the adoption of small and medium scale enterprises and a set of potential supporting activities to influence economic development in Nigeria.

In summary, the gaps identified are in three areas these include empirical, contextual and theoretical gaps, these are further explained below:

1. Empirical Gaps: Less than 27% of the literature on industry needs and accounting skills are qualitative, which means that they are just based on reviews without any empirical investigation to support their findings that were based on their conclusions. The authors include Richard et al., (2019); Buba et al., (2018); Aremu & Adeyemi, (2011); Nishat, (2011); Nwobu et al., (2015).

2. Contextual Gaps: The majority, 45.1% of the literature reviewed showed that SME owners must acquire some basic fundamental accounting skills. This study, however, intends to fill the gap in the aspect of ‘decision-making skills’ by the SME operators, that is, it may not be necessary for the SME operators to acquire fundamental accounting skills, but the skill to decide the accounting information or advice provided by the accountant who has acquired necessary skills for the sustenance of SME activities. The following are the authors that contributed to this area, Okafor & Daferigbe (2019); Okoye et al., (2017); Kehinde et al., (2016); Ogundana et al., (2015); Seda, (2015); Obiamaka, (2015); Nwoha, (2006); Michael & Chigozie, (2014); Mba & Cletus, (2014); Mohammed & Salvador, (2007) and Okoli, (2011).

3. Theoretical Gap: Only 5% of the literature reviewed was able to provide some elements of theory on industry needs and accounting skills for sustainable SMEs. Thus, this study intends to fill this gap by providing the necessary teaching-learning theories that are to be adopted in the classroom by accounting educators in other to impact the necessary accounting skills needed by the industry (SMEs) for sustained entrepreneurial activities. This is intended to go in line with the Resources-Based View (RBV) theory, which states that knowledge is the basic resources of a firm that wishes to continually improve its performance to a sustainable realm. Silva, 2018; Nelson, 2010 were some of the authors that contributed to the theory.

Methodology

The descriptive Survey research design was seen as meeting the requirement for the study. As regards this research, the study was carried out in Ogun State, specifically, two (2) target groups, consisting of the Small and Medium Scale Enterprise operators in the purview of the sample selection and Universities in Ogun State.

The population for the study includes all the Small and Medium Scale Enterprises (SMEs) in Ogun State, Nigeria, comprising Two thousand, four hundred and sixty-five (2,465), operators as recorded by the SMEDAN National Survey of MSME (2017) to seek their opinion on the accounting skills considered necessary for the sustainability of their business. The population also involves all the Accounting Educators (AEs) working in Universities across Ogun State.

Sample and Sampling Techniques

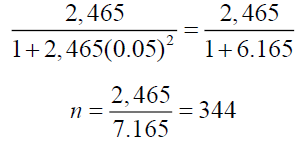

The sample for this study was based on all of the registered small and medium scale enterprises (SMEs) in Ogun State. The researcher made use of random sampling techniques to determine the sample size for the SME operators using Yaro Yamme’s (2006) formulae:

n = N

1 + N(e)2

Where n = Sample size

N = Population (Number of SMEs in Ogun State)

e = Margin of error

For instance, with a margin error of 5% and a population of 2,465 SMEs in Ogun State, sample size can be determined as thus;

Where N=2,465; e=5%; n =?

In addition to the above, the second group were Accounting Educators in the department of accounting of the Selected Universities (consisting of One Federal State and Private) to request for their accounting competency or course synopses, teaching styles or techniques, several lecturers in the department based on each level of lecturer, etc. for gathering data on the dependent otherwise called response variables (Y). The items of the research instruments were leverage on the studies of (Silva, 2018; Zack, 2003; Okoye et al., 2017; Ogundana et al., 2015; Anita, 2012; Zureigat, 2015; Michael & Chigozie, 2014; and Nwaigburu & Eneogwe, 2013). Finally, the rating scale used is as follows in Table 1:

| Table 1 Rating Scales for Questionnaire Administration | ||

| S/N | Attributes | Rating |

| 1. | To a Greater Extent | 5 points |

| 2. | To a Moderate Extent | 4 points |

| 3. | To a Small Extent | 3 points |

| 4 | To a Slight Extent | 2 points |

| 5 | Not at all | 1points |

Data Analytical Techniques

The data collected was analyzed using Statistical Packages for Service Solution (SPSS) version 23.0, using percentage mean, minimum, maximum, and standard deviation scores. In the same vein, the research questions were answered using the mean scores and standard deviations of the responses to each of the questionnaire items, as well as the grand mean for all the items in each of the sections. Any questionnaire item and grand mean whose mean score is 3.00 or above was accepted and those below 3.00 was rejected. This is because the mean score for the five-point rating scale is 3.00 (5+4+3+2+1=15÷5=3).

Furthermore, a t-test of significance was used for this study, as it is commonly used for the test of significance of the correlation coefficient obtained from the Pearson Product Moment Correlation Coefficient (PPMCC) technique. It is also used to test the significance of the simple Linear Regression Coefficient and the partial correlation coefficient obtained from the multiple regression analysis models.

Presentation of Results

The results obtained from the survey, the descriptive analyses as well as the inferential statistics are presented in this section. The electronic closed-ended questionnaires were administered via Google form platform to three hundred and forty-four (344) small and medium-scale business owners, however, only two hundred and ninety-six (296) responded to the questionnaire given a response rate of 86%. While the second group of respondents is the Accounting Educators (AEs) in the Universities that consisted of 48 lecturers across the Federal, State, and Private universities in Ogun State Nigeria.

Descriptive Statistical Analysis

Socio-Economic Characteristics of the Respondents

Table 2 shows that 50.7% of the respondents are SME owners/operators, while 44.3% are accountants working in the SME sector. The profile for the respondents’ age is as follows: For participants in the SME sectors, 6.8% of the respondents' ages less than 30 years, 24.7% ranges between 30 and 40 years, 10.1% of them are between 41 and 50 years of age while 12.5% ages between 51 and 60 years and above 60 years respectively. This implies that the majority of the participants in the SME sector were fully in their active age, 30 to 40 years of age. 43.9% of the SME’s gender was male and 31.1% constitute female. This implies that most of the participants for the survey were male. The result of the marital status for SME participants shows that 19.9% are single, 38.2 are married, 5.7% are divorced, and 12.5% are widow. It, therefore, implies that the majority of the participants are married which is an indication that the participants are matured and responsible to a reasonable extent.

Furthermore, the ethnic group of the majority of the participants in the SME sector is Yoruba with 24.0%, followed by Fulani with 14.5%, then Igbo and Hausa with 11.8% respective. It, therefore, concluded that the majority of the participants are Yoruba, this may be due to the scope of the study, which is limited to Ogun State that is majorly and densely populated with the Yorubas’. Table 2 also revealed the distribution of the SME participants religion to be 23.0% for Christians, 20.3% for those who practice Islam, 12.8% for the traditional faithful, 9.5% had no religion, and 10.8% of the SME respondents practice another religion such as the gray messages. From the foregoing, this result shows that the majority of the respondents for this study were Christian and Muslim faithful.

| Table 2 Socio-Demographic Distributions of the Respondents | ||

| Small and Medium Scale Enterprises (SMEs) | ||

| SME Respondents | Freq. | Percentage |

| SME Owners | 150 | 50.7 |

| Accountant in the SME sector | 131 | 44.3 |

| Missing System | 15 | 5.1 |

| Total | 296 | 100.0 |

| Respondents Age | ||

| <30 years | 20 | 6.8 |

| 30-40 years | 73 | 24.7 |

| 41-50 years | 30 | 10.1 |

| 51-60 years | 37 | 12.5 |

| >60years | 37 | 12.5 |

| Missing System | 99 | 33.4 |

| Total | 296 | 100.0 |

| Gender | ||

| Male | 130 | 43.9 |

| Female | 92 | 31.1 |

| Missing System | 74 | 25.0 |

| Total | 296 | 100.0 |

| Marital Status | ||

| Single | 59 | 19.9 |

| Married | 113 | 38.2 |

| Divorced | 17 | 5.7 |

| Widowed | 37 | 12.5 |

| Missing System | 70 | 23.6 |

| Total | 296 | 100.0 |

| Respondents Ethnic Group | ||

| Yoruba | 71 | 24.0 |

| Igbo | 35 | 11.8 |

| Fulani | 43 | 14.5 |

| Hausa | 35 | 11.8 |

| Others | 40 | 13.5 |

| Missing System | 72 | 24.3 |

| Total | 296 | 100.0 |

| Respondents Religion | ||

| Christianity | 68 | 23.0 |

| Islam | 60 | 20.3 |

| Traditional | 38 | 12.8 |

| No Religion | 28 | 9.5 |

| Others | 32 | 10.8 |

| Missing System | 70 | 23.6 |

| Total | 296 | 100.0 |

| Highest Educational Level Attained | ||

| Primary | 26 | 8.8 |

| Secondary | 40 | 13.5 |

| Technical | 68 | 23.0 |

| Tertiary | 55 | 18.6 |

| Others | 45 | 15.2 |

| System | 62 | 20.9 |

| Total | 296 | 100.0 |

| Major Occupation before establishing the enterprise | ||

| Trader | 98 | 33.1 |

| Civil Servant | 54 | 18.2 |

| Farmer | 31 | 10.5 |

| System | 113 | 38.2 |

| Total | 296 | 100.0 |

| Years spent in the occupation before establishing the enterprise | ||

| <10 years | 71 | 24.0 |

| 10-15 years | 54 | 18.2 |

| 16-20 years | 43 | 14.5 |

| 21-25 years | 25 | 8.4 |

| >25 years | 41 | 13.9 |

| Missing System | 62 | 20.9 |

| Total | 296 | 100.0 |

The majority 23.0% of the SME respondents had Technical education, followed by Tertiary education with 18.6%, other educational levels, 15.2%, this includes certificate, diploma courses, apprenticeship amongst others, secondary education 13.5% while 8.8% of the SME respondents had primary education. This, therefore, implies that the majority of SME respondents in Ogun State had Technical education, which invariably implies that this category of people dominates the SME industry in Ogun State. For the major occupation of the SME owners before the establishment of the enterprise, 33.1% of them were majorly traders, 18.2% are Civil Servants, while 10.5% are farmers. This implies that those who are already in the business arena have the potentials of expanding SME activities, thus, the experience of the little/petty trading engaged by the respondents can never be ruled out in the development of entrepreneurial skills, which serves as motivation to increase their capacity to a Small scale enterprise in the study area.

Consequently, the years spent by the SME respondents in their major occupations before establishing the enterprise then follows; 24.0% of the SME worked less than 10years, 18.2% worked between 10 and 15years, 14.5% worked between 16 and 20years, 8.4% worked between 21 and 25years and 13.9% of the SME respondents worked above 25years before establishing the enterprise. Thus, however, the majority of the SME respondents worked less than 10years, these findings then implies that, majority of the SME respondents who are already into trading or probably petty traders only spent an average of 10 years in such trading before expanding it to a small scale enterprise.

Presentation of Results According to Research Questions

Research Question 1: What are the Special Accounting Skills or Competencies that Nigerian Industries (SMEs) Demand from Accounting Graduates?

This research question was put forward to examine and compare the special accounting competency skills demanded by SME operators with what is been offered in Universities.

Table 3 below shows the summarized views of the SME respondents on the level of importance they attached to each of the accounting skills as well as the extent to which the accounting skills are been taught in Universities were revealed by the Accounting Educators (AEs).

| Table 3 Summary of Accounting Skills Needed for Sustainable SMES and the Extent to Which the Skills are Taught in Universities | ||||||||||

| Accounting Skills | Important Skills for sustainable SMEs in Ogun State (N=296) | The extent to which accounting skills are been offered in Universities (N=48 Accounting Educators) | ||||||||

| Not Important (%) | Least Important (%) | Somewhat Important (%) | Very Important (%) | Greatly Important (%) | Not at all (%) | To a Slight Extent (%) | To a Small Extent (%) | To a Moderate Extent (%) | To a Greater Extent (%) | |

| Management Accounting Information Skills (MAIS) | 37(11.5) | 47(15.7) | 50(16.7) | 55(18.5) | 64(21.6) | 5(11.1) | 9(10.0) | 9(17.9) | 20(41.7) | 16(32.3) |

| Pricing Policy Skills (PPS) | 39(13.2) | 44(13.6) | 40(13.5) | 53(17.8) | 47(15.9) | 4(8.3) | 4(8.3) | 7(14.6) | 26(53.7) | 17(35.2) |

| Budgeting, Risk and Uncertainty Skills (BRUS) | 43(13.9) | 47(17.0) | 48(18.2) | 62(21.0) | 39(13.9) | 2(3.5) | (4.15) | 5(10.4) | 19(40.3) | 18(38.2) |

| Other Accounting Skills (OAS) | 29(9.8) | 45(15.2) | 37(12.6) | 44(15.0) | 42(14.6) | 4(8.3) | - | 3(6.7) | 21(43.3) | 22(46.7) |

| General Business Related Skills (GBRS) | 44(14.9) | 50(17.0) | 46(14.5) | 57(19.3) | 45(17.3) | 1(2.8) | 1(8.3) | 4(9.3) | 26(54.6) | 15(30.5) |

See appendix for the accounting skills

The Management Accounting Information Skills (MAIS), that comprises Management Control Skills; Accounting information Skills; Decision-making process skills; product costing skills; cost estimation skill; planning for cost reduction skill; determining target costing skill and determining product life cycle skill shows that majority 64(21.6%) of the SME respondents reported that the skills are greatly important for the sustainability of their business. While on the other hand, the aggregate of 20(41.7%) of the AEs' views shows that the MAISs are taught to a moderate extent in the universities. It, therefore, concludes that the Management Accounting Information Skills (MAISs) are greatly important for sustainable SMEs and hence, were moderately taught in the University.

53(17.8%) of the SME respondents revealed that the Pricing Policy Skills (PPSs) are very much important for their business. The aggregate score for these skills is 53(17.8%) which shows that the PPSs are very much important for SME businesses. On the other hand, the aggregate score shows 26(53.7%), which implies that the Pricing Policy Skills were taught at a moderate level in the university. The skills include Skills in the quantitative and qualitative decision; estimation of contribution margin; estimation of cost-Volume-Profit analysis; making or buy decision; determining pricing policy; inventory (stock) control with discounts, amongst others.

The aggregate of 62(21.0%) of the statement shows that the Budgeting, Risk and Uncertainty Skills (BRUSs) are very much important for the SMEs' growth in Ogun State, the aggregate of 19(40.3%) shows that the Budgeting, Risk, and Uncertainty Skills (BRUS) were taught to a moderate extent in the universities surveyed for this study. These BRUS skills include Budgeting and Budgetary control; budget preparation skills; ability to compute cash budget; project investment appraisal skills; asset replacement decision skills; ability to forecast working capital skills, etc.

The aggregate of the score Other Accounting Skills (OAS) such as the skill on business law, financial accounting, taxation and tax matters, financial management as well as auditing and ethics skills is 45(15.2%), this, therefore, shows that the Other accountings are least important to the SME business. While on the other hand, 22(46.7%) of the AEs indicated that the skills are taught to a greater extent. See appendix I for the skills

For the General Business Related Skills (GBRSs), that comprises Human resources management skills, business and administration skill, corporate planning skill, business strategy skill, business research, etc., 57(19.3%) reported that the skills are very important, This implies that these skills are very important for the continuous growth of SMEs as revealed by the majority of the SME respondents, While on the other hand, the aggregate of the 26(54.6%) of the AEs views, shows that the GBRSs are taught to a moderate extent in the universities. It is therefore concluded that the General Business Related Skills (GBRSs) are very important for sustainable SMEs in Ogun State and hence, were moderately taught in the University.

Overall, it is concluded that all of the skills are very much important and needed by the SME owners; also, the OAS is the least important to the SME operations. However, all of the skills are taught to a moderate extent in universities including the MAIS that is greatly important for sustainable SME operations, whereas, the OAS that is least important to SMEs are taught to a greater extent in the Universities in Ogun State. This implies that there is a shift in the focus of accounting competencies of the SME needs. Where the accounting skills majorly and greatly needed for sustainable SMEs are not giving major attention but rather a moderate level of competencies, while the least needed accounting skills are giving greater attention.

This finding, however, supported Okoye (2017) findings that the presence of financial experts boosts the performance of SMEs. This finding also lends credence and support to Okafor & Daferighe (2019) that the application of accounting practices regardless of how simple it may appear is significant to the overall well-being of SMEs. Hence, necessary skills, most especially the MAIS are very much important and needed for the sustenance of SMEs in Ogun State.

Research Question 2: What are the Stakeholders’ Perceptions of the Role of ICT and Accounting Software as Determinants for Sustainable SMEs?

This research question was put forward to analyze stakeholders’, that is, SME owners' perception of the effect of ICT and accounting software on SME business operations and how it has improved their performances.

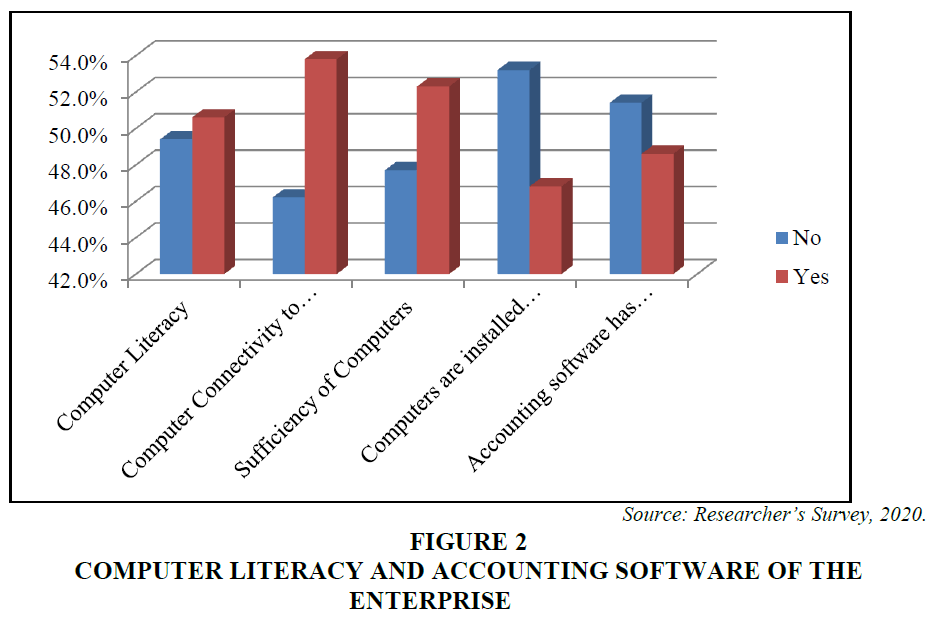

Figure 2 below shows that 115(49.4%) of the respondents indicated that their accountants, as well as the employees, are computer literate while 118(50.6%) of the respondents indicated that their employees and especially the accountants are not computer literate and had accounting software packages, like Sage, Tally, QuickBooks, etc. experience. 108(46.22%) of the SME respondents indicated that the computers are not connected with accounting operations of the enterprise, but rather connected to secretarial duties, while 126(53.8%) of the respondents indicated that the computers are connected to the accounting operations of the enterprise. 103(47.7%) of the respondents indicated that the computers are not sufficient for use, while 113(52.3%) of the respondents indicated that the computers are sufficient for use.

Furthermore, 118(53.2%) of the respondents indicated that the computers were not installed with accounting software, while 104(46.8%) of the respondents indicated that the computers were installed with accounting software, like Sage50, Tally, QuickBooks amongst others. Also, 107(51.4%) of the respondents indicated that the accounting software has not influenced their business profit, while 101(48.6%) of them indicated that the accounting software has influenced their business profits.

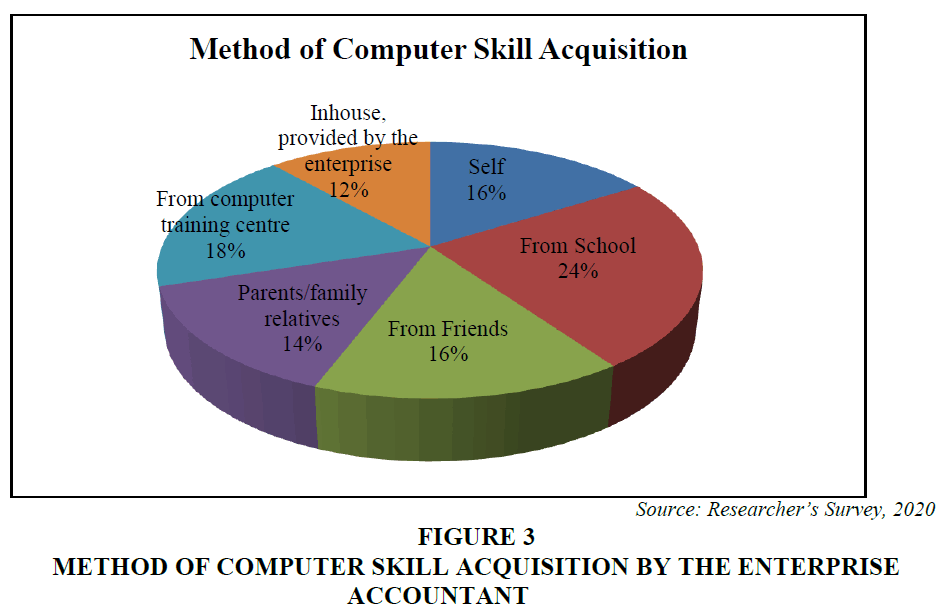

Figure 3 below revealed the method by which computer skills are acquired by SME employees, in particular, the accountants. 36(16.1%) of the respondents indicated that the employees acquired computer skills by themselves, 54(24.1%) indicated that the computer skills were acquired from school, 35(15.6%) indicated that the computer skills are acquired from friends, 32(14.3%) indicated that computer skills are acquired through the assistance of parents/family relatives, 41(18.3%) of the respondents indicated that the computer skills are from computer training centres, while 26 (11.6%) indicated that the computer skills are acquired through in-house training provided by the enterprise. It is therefore concluded that the majority of the employee enterprise acquired their computer skills from school.

Table 4 below shows the analysis of ICT and accounting software's role in the sustenance of SMEs in Ogun State. 63(30.0%) of the respondents indicated that Sage was recommended by the accountant for the accounting operations of the enterprise, by 56(28.0%) of the enterprise are currently using Sage, 71(33.8%) of the respondents indicated that QuickBooks was recommended, but 77(38.5%) of them are currently using QuickBooks, while 76(36.2%) of the respondents indicated that Tally was recommended by the accountant for the enterprise accounting operations, but only 67(33.5%) of them are currently using Tally. It is therefore concluded that Tally was majorly and commonly used by the SMEs and therefore recommended by the accountants of the SMEs. However, the majority of the enterprise is currently using QuickBooks, this implies that the SME owners are conversant and probably prefer Quick books not minding the recommendation of their accountants.

| Table 4 ICT And Accounting Software as Determinants for Sustainable SMES | ||

| Variables | Frequency | Percentage (%) |

| Which of the accounting software was recommended by the Accountant? | ||

| Sage | 63 | 30.0 |

| Quick Books | 71 | 33.8 |

| Tally | 76 | 36.2 |

| Total | 210 | 100.0 |

| Which of the accounting software is currently used by the enterprise? | ||

| Sage | 56 | 28.0 |

| Quick Books | 77 | 38.5 |

| Tally | 67 | 33.5 |

| Total | 200 | 100.0 |

| How would you rate SME development in Nigeria with ICT | ||

| Don't Know | 61 | 25.5 |

| Low | 66 | 27.6 |

| Moderate | 52 | 21.8 |

| High | 60 | 25.1 |

| Total | 239 | 100.0 |

| How would you rate your enterprise performance compared with your competitors | ||

| Don't Know | 46 | 19.2 |

| Low | 41 | 17.2 |

| Moderate | 67 | 28.0 |

| High | 85 | 35.6 |

| Total | 239 | 100.0 |

| How efficient is your enterprise concerning the inclusion of accounting software in your enterprise operations | ||

| Don't Know | 33 | 15.3 |

| Low | 50 | 23.1 |

| Moderate | 59 | 27.3 |

| High | 74 | 34.3 |

| Total | 216 | 100.0 |

Table 4 also shows the distribution of respondents’ opinions on the role of ICT and sustainable SME development in the study area. The SME respondents were asked to rate SME development in Nigeria about the usage of accounting software, 61(25.5%) of them believed that they don’t know, 66(27.6%) of the respondents believed that SME development in Nigeria to accounting software is low, 52(21.8%) of the respondents believed that SME development is moderate, 60(25.1%) believed that the SME development is high with accounting software. Thus, going by the aggregate of 66(27.6%) of the respondents, it, therefore, concluded that SME development concerning using accounting software is low. Respondents were also asked to rate their enterprise performance compared with their competitors. 46(19.2%) of the respondents claimed that they do not know, this may probably due to their limited knowledge to engage in business research, 41(17.2%) claimed that their enterprise performance is low compared to their competitors, 67(28.0%) claimed that their enterprise performance is moderate compared to their competitors while 85(35.6%) of the respondents claimed that their enterprise performed higher than their competitors. Finally, the respondents were equally asked to indicate how efficient s their enterprise concerning the inclusion of accounting software in their accounting operations. 33(15.3%) of the respondents claimed that they do not know how efficient is their enterprise about the inclusion of accounting software in their business operations, 50(23.1%) of them claimed that the efficiency level of their enterprise is low, 67(28.0%) claimed that their enterprise efficiency level is moderate, while 74(34.3%) claimed that the efficiency level of their enterprise is high to the inclusion of accounting software to their business operations. This, therefore, concluded that the inclusion of accounting software to SME business operations has resulted in their high level of efficiency in Ogun state as revealed by the majority of the respondents, 74(34.3%).

This finding was in agreement with Ogundana et al. (2015) that the integration of ICT (accounting software packages and IT knowledge) into accounting curriculum would help accounting graduates fulfil the responsibility of adding value to business organizations, in this case, contribute to the sustenance of SMEs in Ogun State in particular and Nigeria in general. This finding also gives credit to the findings of Qasim (2015) where computer skills were found to be significantly important amongst the skills needed for accounting graduates as enumerated by Saudi employers.

Test of Hypotheses

The hypotheses that were formulated for the study were tested using the t-test and Pearson monument correlation coefficient statistical analysis. The hypotheses were tested at a 0.05 level of significance and a grand mean of 3.0.

Test of Hypothesis One

H1: There is no difference between the mean score of owners of SMEs' opinion on the accounting skills needed for sustainable SMEs and the Accounting Educators' (AEs) opinion on the institutions accounting course competencies.

Tables 5 shows the paired sample correlation test conducted to measure the relation of the accounting skills needed for sustainable SMEs and the level at which the skills are been taught in the universities coded as the Institution Course Competencies (ICC).

| Table 5 Paired Samples Correlations | ||||

| Accounting Skills | N | Correlation | Sig. | |

| Pair 1 | SME_Management Accounting Information Skill (MAIS) & ICC_MAIS | 45 | 0.487 | 0.001 |

| Pair 2 | SME_Pricing Policy Skill (PPS) & ICC_PPS | 45 | 0.767 | 0.000 |

| Pair 3 | SME_Budgeting, Risk and uncertainty Skill (BRUS) & ICC_BRUS | 35 | 0.542 | 0.001 |

| Pair 4 | SME_Other Accounting Skills (OAS) & ICC_OAS | 20 | -0.063 | 0.792 |

| Pair 5 | SME_General Business Related Skills (GBRS) & ICC_GBRS | 45 | 0.172 | 0.257 |

Table 5 revealed that all of the skills are positively correlated and significant at p ≤ 0.05, except the Other Accounting Skills (OAS) that is strongly negative, and insignificant at p ≤ 0.05 while also the General Business Related Skills (GBRS) has a positive weak correlation and not significant at p ≤ 0.05. This however implies that there is no difference in the mean scores between the Management Accounting Information Skills (MAIS), Pricing Policy Skills (PPS), and Budgeting, Risk, and Uncertainty Skills (BRUS).

Thus, the study fails to accept the null hypothesis that there is no difference between the mean score of owners of SMEs' opinion on the accounting skills needed for sustainable SMEs and the Accounting Educators' (AEs) opinion on the institutions accounting course competencies. The practical implication is that the accounting skills needed for sustainable SMEs for MAIS include Management Control Skills; Accounting information Skills; Decision-making process skills; product costing skills; cost estimation skill; planning for cost reduction skill; determining target costing skill and determining product life cycle skill are moderately and correlational taught in universities, while skills such as the Pricing Policy Skills (PPS), Budgeting, Risk and uncertainty Skills (BRUS), Other Accounting Skills (OAS) and General Business Related Skills (GBRS) are not highly emphasized and taught at the universities.

Test of Hypothesis Two

H2: There is no significant difference between the mean scores of the responses of owners of SMEs on the effect of accounting software on their business operations.

Table 6 shows the result of the one-sample t-test that was carried out to measure the statistical evidence of the hypothesis. The table indicates that all of the listed effects of accounting software are significant but only that computers are connected to the enterprise operations gave a positive t-value of 2.669 but insignificant at p ≤ 0.05, while others have negative t-values. this implies that the effect of accounting software are not seen or probably not measured by the SME owners due to lack of importance attached to the accounting software by SME managers, however, there is no enough evidence to accept or reject the null hypothesis that there is no difference between the mean scores of the responses of owners of SMEs on the effect of accounting software on their business operations.

| Table 6 One-Sample Test | ||||

| Effect of Accounting Software on SMEs operations in Ogun State | Test Value=3 | |||

| t | df | Sig.(2-tailed) | Mean Difference | |

| The Accountants of the enterprise are Computer literate | -75.968 | 232 | 0.000 | -2.494 |

| The computers are connected to the Accounting Operations of the Enterprise | 2.669 | 223 | 0.008 | 0.295 |

| The computers are sufficient for use | -75.371 | 233 | 0.000 | -2.462 |

| The computers are installed with accounting software, such as Tally, Quick book, etc. | -72.714 | 215 | 0.000 | -2.477 |

| The accounting software has influenced the persistent increase in Profit of my business | -75.418 | 221 | 0.000 | -2.532 |

| ICT has improve SMSE Industries development in Nigeria | -72.383 | 207 | 0.000 | -2.514 |

| Accounting software has increased the efficiency of my enterprise concerning my business operations. | -16.718 | 209 | 0.000 | -0.938 |

Summary

This study assesses the accounting skills needed by industries, using Small and Medium Scale Enterprises (SMEs) in Ogun State, Nigeria as a case study. Due to the need to develop sustainable accounting required for accounting careers that will produce graduates who meet dynamic changes of business organizations' requirements and the achievement of sustainable Development Goals (SDG) of the United Nation (UN), specifically Goal 4 – quality education and Goal 8 – Economic growth, the research study was conducted to investigate and address the gap between accounting competencies, sustainable SMEs and business requirements to be achieved by the year 2030.

The results found that there are deficiencies and a gap between the skills acquired in the offered accounting programmes in Universities and SMEs accounting skills requirements as highlighted below:

1. Majority of the SME owners in Ogun State had a minimum of Technical Education.

2. A major proportion of the SME owners' occupation before establishing the enterprise are traders, which means that those who are already in the business have the potential of expanding SME operations.

3. Majority of the SME owners who are into trading spent an average of 10 years in such trading before establishing the enterprise.

4. The study revealed that all of the accounting skills, Management Accounting Information Skills (MAIS); Pricing Policy Skills (PPS); Budgeting, Risk and Uncertainty Skills (BRUS); and General Business Related Skills (GBRS) are very much important and needed by the SME owners for the sustainability of their enterprises.

1. The Other Accounting Skills (OAS) that includes Business Law, Financial Accounting, Taxation, and Tax Matters, Financial Management, and Auditing & Ethics are least important to the SME operations.

2. All of these skills are taught to a moderate extent in universities including the MAIS (such as Management control skill, Accounting information skill, decision making process skill, Product costing skill, Cost estimation skill, Planning for cost reduction skill, Determining target costing, and Determining product life cycle.) that is greatly important for sustainable SME operations.

3. The OAS, which includes Business Law, Financial Accounting, Taxation, and Tax Matters, Financial Management, and Auditing & Ethics that is least important and/or needed by SME are greatly taught to a greater extent in the Universities.

4. Majority of the enterprise employees acquired their computer skills from school.

5. Tally was majorly and commonly used accounting software by the SMEs and therefore recommended by the accountants of the SMEs. However, the majority of the enterprise is currently using QuickBooks.

6. Majority of the SME respondents indicated that the inclusion of accounting software in SME business operations has resulted in their high level of efficiency in their business activities.

Conclusion

Based on the findings and discussion of this study, it was concluded as follows:

1. The accounting skills needed for sustainable SMEs for MAIS include Management Control Skills; Accounting information Skills; Decision-making process skills; product costing skills; cost estimation skill; planning for cost reduction skill; determining target costing skill and determining product life cycle skill, thus skills are moderately and correlational taught in universities, while skills such as the Pricing Policy Skills (PPS), Budgeting, Risk and uncertainty Skills (BRUS), Other Accounting Skills (OAS) and General Business Related Skills (GBRS) are not highly emphasized and taught in the universities; and

2. The effect of accounting software inclusion in SME business operations are not seen or probably not measured by the SME owners.

Policy Recommendations

1. Management Accounting Information Skills was statically significant to be the skills needed by SME owners, thus, should be greatly emphasized in universities. Also taking into cognizance the needs of SME/small business accounting in the teaching-learning process.

2. The inclusion of accounting software into the accounting curriculum would go a long way in preparing accounting graduates to tackle practical SME business challenges;

Contribution to Knowledge

This research has made contributions to the knowledge about the nature of the gap between accounting skills and industry requirements for sustainable SMEs in Ogun State.

Methodological Contributions

For the methodological contribution, the majority of previous studies reviewed, in the area of the accounting skills gaps, have applied a quantitative/qualitative method, mixed-method or multi-method approach to arrive at their sample size and techniques. However, based on this study's objectives, which aimed to explore and identify the competencies of accounting skills needed by SMEs in Ogun State, the researcher identified a qualitative approach, through closed-ended questionnaires by Google form platform. Significantly, this study is the first to apply a two-way approach of using SMEs and exploring Accounting Educators (AEs) Opinions on the accounting competencies of universities in Ogun State to investigate the skills needed for sustainable SME development in Ogun State. Furthermore, this study has:

1. Examined and compared the accounting needs of SMEs with what is been currently offered in universities; and

2. Analyzed stakeholders perception of the effect of ICT and accounting software on SME operations

The Study Limitations

This study like all others incurred the following limitations.

Firstly, this study did not cover all the universities in Ogun State that offer accounting courses. However, the universities that are included in this study represent one of the Federal, State, and Private Universities that offer accounting courses in Ogun State.

Secondly, the business sector's required skills cannot be misconstrued as been precisely determined through the research findings, since the sample of SME owners was limited and because of the difficulties to access a large proportion of small businesses in this sector.

Finally, the researcher faces challenges in data gathering simply because of the emergence of COVID 19 in March 2020. Therefore, some difficulties and obstacles were faced, by the researcher, in accessing the respondents both the SME owners and Accounting Educators.

Suggestions for Future Research Studies

1. In future research, internal and external factors, that could affect the job opportunities for accounting graduates in Nigeria, should be taken into consideration.

2. Although the study was conducted in Ogun State, it could be used as a starting point to investigate what happens in other similar business-related fields and other industries as well.

3. Further study will confirm if the acquisition of the relevant MAIS will improve accounting graduates’ job performance.

References

Abbasi, N. (2011). Competency Approach to Accounting Education: A Global View. The Metropolitan State University of Denver.

Casner-Lotto, J., & Barrington, L. (2006). Are they really ready to work? Employers' perspectives on the basic knowledge and applied skills of new entrants to the 21st century US workforce. Partnership for 21st Century Skills and Society for Human Resource Management. 1 Massachusetts Avenue NW Suite 700, Washington, DC 20001.

Curado, C. (2006). The knowledge based-view of the firm: From theoretical origins to future implications. Working Paper of Instituto Superior de Economia, e Gestāo, 8-11.

Helfat, C. (2007). Dynamic Capabilities: Understanding Strategic Change in Organizations. Oxford Blackwell, London.

Iheanacho, E.N.O. (2006). Technical and business education for socioeconomic and political stability in Nigeria. International Journal of Research in Education, 3(1), 164-168.

McQuaid, R.W., & Lindsay, C. (2005). The concept of employability. Urban Studies, 42(2), 197-219.

National Survey of Micro, Small and Medium Enterprises (2017).

Njoku, C.U., & Nwosu, A.N. (2002). Role of Business Education in sustaining small scale Businesses for national development. Business Education Journal, 3(5), 95-106.

Nwoha, C., (2006). Advanced financial Accounting. Enugu: Melfin Publishers.

Odugbemi, O.O., & Oyesiku, O.O. (2000). Research methods in the social and management science (Edn), Centre for Sandwich Programme (CESAP), Ogun State University, Ago-Iwoye.

Ojajuni, J. (2010). Relevance of technical vocational education and training (TVET) as an integral tool for entrepreneurship. COEASU Journal of Contemporary Issues, 3(1), 112-117.

Olateju, A.S.O. (2010). Improving the performance of metal work technology students at the technical colleges in Lagos state for manpower development for the realization of vision 2020. COEASU Journal of Contemporary Issue, 3(1), 255-263.

Osuala, E.C. (2009). Business and computer education. Enugu: Cheston Agency Limited.

Oyesode, S.A. (1998). Employment opportunities in business education by the 21st century. Functional education in Nigeria towards 2010 A.D and Beyond, Enugu; Cresco publishers.

Yamane, T. (1967). Statistics: An introductory analysis (2nd Edn). Harper and Row, New York.

Zack, M.H. (2003). Rethinking the knowledge-based organization. MIT Sloan Management Review, 44(4), 67-71.