Research Article: 2018 Vol: 22 Issue: 5

Accounting Standards: The Lessons From Small And Medium Enterprises

Nuramalia Hasanah, Universitas Negeri Jakarta

Ratna Anggraini, Universitas Negeri Jakarta

Unggul Purwohedi, Universitas Negeri Jakarta

Abstract

Financial accounting standards non-public accountability (SAK ETAP) is a standard created to improve the quality of SMEs financial statements in generating accounting information. Accounting information can help SMEs in making important decisions, identify business development, and manage finances so as to achieve more success. However, many SMEs have not been able to make a proper financial report in accordance with applicable standards. This study aims to determine the implementation of SAK ETAP in the SMEs sector. This study used primary data from questionnaires which distributed to owners of SMEs in the Ciomas, Bogor. The research sample consists of 113 owners. The research is quantitative research using simpe desciptive analysis which to know the perception of business owners in SMEs sector about: accounting recording, financial reporting routine, constraint in accounting recording and how to increase accounting knowledge for SMEs by descriptive method. This study analyzed the data obtained to find out more about the implementation of SAK ETAP in SMEs. This study found that SMEs business people agree that the implementation of SAK ETAP will be easy and beneficial for their business. Training will be able to skillfully record these transactions and be adjust to their needs.

Keywords

SMEs, SAK ETAP, Financial Reporting.

Introduction

SMEs (small and medium enterprises) constitute a vital sector in terms of economic growth and development. The important role of SMEs in Indonesia is proven by the fact that, in the last five years, the contribution of SMEs to Gross Domestic Product has always been above 50% and the employment rate is always above 90% (Business Review, 2016). However, the current business development has resulted in an increasing number of capital needs for most SMEs, so that they can no longer expect capital from their own savings to expand their business, but have to rely on loans from third parties. In order to obtain capital from credit channeling banks, there is a requirement for SME owners to make accounting information available in the form of financial statements outlining their business activities. In addition, accounting information can assist owners of SMEs in making important decisions, identifying business development, and managing their finances to achieve more success.

The main problem for SMEs with regard to the development of capital is that proper financial management requires good accounting skills. However, many SMEs have not been able to produce the financial reports required by the banks, so they experience difficulties in obtaining additional capital for their business. Yenni (2014) reports that only 22.5% of SMEs have financial statements and 87.8% prepare financial reports inappropriately. The neglect of financial management has an impact that is not clearly visible, but will indirectly reduce the chances of success of SMEs in the future.

Most SMEs focus solely on making profit without giving thought to whether the success of their business is sustainable. For that reason, SMEs require accounting reports that can be used to manage various transactions (Irwan, 2011). According Rudiantoro and Siregar (2011), SMEs do not implement or use proper accounting information in their business. Moreover, the business scale of an SME can also affect its ability to produce financial reports. The smaller the business scale of an SME, the less likely its owners are to be concerned about the financial statement. Such owners assume that financial statements are not required for small businesses because so few accounts arise from their business activities. SMEs lack understanding and need to be taught about the importance of the financial statements of a business. SME bookkeeping systems are generally very simple and tend to ignore the rules of financial administration standards (default). However, accurate and standard financial statements will assist SMEs greatly in their business development, both in quantitative and qualitative ways.

Based on these circumstances, this study aims to answer the following research questions: What is the perception of the owners of SMEs with regard to the existing accounting standards? The set of accounting standards under investigation is SAK ETAP (Entity without Public Accountability Standards), which is intended to be used by business entities that do not have public accountability, such as SMEs. Specifically, this study has the objective of exploring in more detail the financial reporting of SMEs and the perception of business actors in the SME sector with regard to SAK ETAP. Thus, this study is expected to contribute to the existing literature by providing an initial description of the implementation of accounting standards, in particular SAK ETAP, in the SME sector.

Literature Review

Micro, Small and Medium Enterprises and Their Financial Reporting Issues

Republic of Indonesia Act No. 20 of 2008 on SMEs Articles 1 (1)-(3) provides definitions of the terms micro, small, and medium enterprises. A micro business is a productive enterprise owned by an individual and/or an individual business entity fulfilling the criteria of micro business as stipulated in this law. According to this act, a small-scale business is a standalone productive economic enterprise undertaken by an individual or entrepreneur who is not a subsidiary, is not owned or controlled by a company branch, and is not a direct or indirect part of a medium business or a large enterprise.

Warren et al. (2009) defined a financial statement as a report prepared for accounting users after transactions are recorded and summarized. Meanwhile, according to Kieso et al. (2012), a financial statement is one of the main means by which companies communicate financial information to people outside the company. This report details the profits and losses made by the company. The financial statement provided by a company is an indicator its success, and serves as an important reference for users, assisting them in making decisions. A financial statement provides information on profitability, risk, and cash flow time, all of which will affect the expectations of the interested parties. These periodic reports are prepared in accordance with generally accepted accounting principles relating to the financial status of individuals, associations or business organizations, and comprise a statement of financial position, income statements, retained earning statements, cash flow statements and notes to the financial statements.

According to SAK ETAP (2009), the standard is intended for the use of entities that:

1. Have no significant public accountability.

2. Publish general purpose financial statements for external users (those who are not directly involved in business management, such as creditors, and credit rating agencies).

Most SMEs only record the amount of money received and expended, the amount of goods bought and sold, and the amount receivable/debt. Research conducted by Putra and Kurniawati (2012) shows that SMEs are restricted in preparing financial statements due to a lack of capable human resources in the field of accounting and the lack of time allocated for preparation. Realistically, it is not feasible for many SMEs to employ someone specifically to do the bookkeeping and to prepare financial statements because this would necessitate an increase in spending in order to pay the salaries of the accounting personnel.

Narsa et al. (2012) found that SMEs which produce good financial reports in accordance with SAK ETAP develop faster than SMEs which do not produce financial reports, even if the latter were established at the same time or, in some cases, earlier than the former. Rudiantoro and Siregar (2012) shows that the implementation of SAK ETAP in order to improve the quality of financial statements still faces obstacles because SME entrepreneurs do not fully understand this standard. Nedsal et al. (2014), who conducted research in Depok and the surrounding areas, stated that SMEs in various regions of Indonesia experience several similar problems and so proposed that solutions and approaches to improve the accountability of SMEs be provided in the form of an accounting process manual based on SAK ETAP that is "User Friendly" and may be used systematically by SMEs managers.

Tarmizi (2013) measured the implementation of SAK ETAP using three indicators, accountability, objectives, and completeness of information. Supadmi (2015) analyzed the implementation of SAK ETAP using six indicators adopted from SAK ETAP. These were:

1. Assets and liabilities are in accordance with SAK ETAP.

2. Assets and liabilities not authorized by SAK ETAP.

3. Items previously used under Indonesian GAAP are re classified into SAK ETAP.

4. The amount of recognized assets and liabilities are in accordance with SAK ETAP.

5. The assistance of SAK ETAP in controls the company's entry and exit.

6. The convenience provided by SAK ETAP in presenting the company's financial statements.

Aims

This study has the objective to explore the practise and perception of MSMEs with regard to SAK ETAP.

Methods

The research employs a quantitative approach with simple descriptive analysis in order to explore the perception of business owners in the SME sector regarding: accounting recording, financial reporting routines, constraints in accounting recording, and how to increase accounting knowledge in SMEs. The data are collected through surveys distributed to owners of SMEs in the Bogor city area. SMEs in the city of Bogor have been centralized so as to facilitate the search data. In addition, SMEs in Bogor City are constrained when applying for capital from banks, leading to problems in financial reporting. The research was conducted in Bogor District, encompassing the Ciomas, Ciapus, Ciherang and Dermaga areas. The population studied is SMEs in Bogor City and there are 113 samples.

Primary data is collected by distributing questionnaires to be filled by respondents. Any incomplete questionnaires will not be included in the analysis stage. In order to gather data on the financial reporting of SMEs, researchers will visit the SMEs and collect the questionnaires. Respondents are chosen using a non-probability convenience sampling technique.

Results

A quantitative research with simple descriptive analysis is employed in analysing the data. This involves conducting a survey to describe the financial reporting of SMEs and analyzing the frequency distribution of respondents with regard to age, age of business, and instruments studied. The 113 respondents were divided into three business categories, namely, micro entity: 55 respondents (49%), small entity: 50 respondents (44%), and medium entity: 8 respondents (7%). The respondents in this study are dominated by men (92.93%); only 7.07% are women. Education is categorized into elementary, junior high, high school, diploma, and undergraduate levels. The results of this study concerning the education level of respondents are quite diverse. Ownership of small and medium enterprises in the city of Bogor is dominated by high school graduates (41.41%). This study categorizes the educational backgrounds of SMEs owners into accounting/economics, engineering, law, and other (encompassing various backgrounds). The most common educational background is the varied category; it is possible that SMEs do not implement SAK ETAP because only 20.41% of owners come from an accounting/economics educational background.

Description Of Research Results

What are SME Owners’ Perceptions of the Accounting Standards?

Based on the results of the questionnaire, events and conditions pertaining to SMEs are classified according to their subject. The data is explained using the descriptive approach. In order to answer the proposed research question, this study surveyed the respondents on various topics.

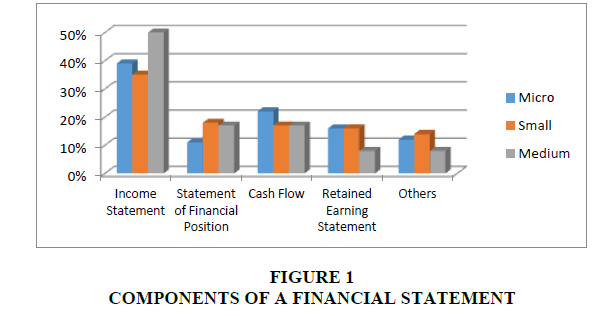

Components of a financial statement

Responses given by owners of SMEs to questions about the importance of the components of financial statements made by the company can be seen in Figure 1. The data shows that, among the five components of the financial statements of respondents, owners of SMEs assume that the income statement is the most important report to be made, perhaps because it informs them of the progress of their business in terms of profits and losses. The results show that 39% of micro enterprise owners, 35% of small business owners and 50% medium businesses consider income statements to be important. After that, the order of importance of financial statement components differs for each size of business. According to micro business owners, the order of importance is: income statement, statement of cash flows, retained earning statement, and statement of financial position. Meanwhile small and medium enterprises rank the importance of financial statements components as follows: income statement, statement of financial position, cash flow statement, and retained earning statement. This means that small and medium enterprises have the same perception of the components of financial statements and may adjust these to the applicable accounting standards in similar ways.

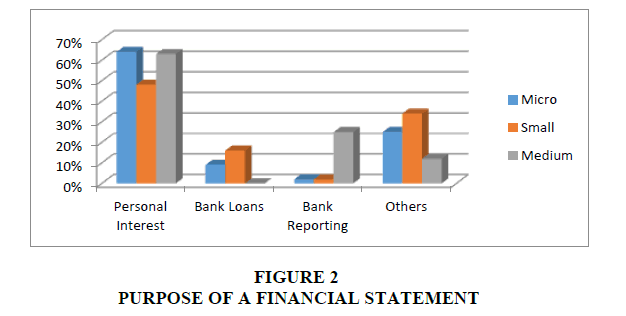

Purpose of a financial statement

Figure 2 shows the responses of SME owners to questions about the purpose of financial statements.

As shown in Figure 2, the most common purpose of financial statements cited by SME owners is personal interest; this response is given by 64% of micro enterprises, 48% of small enterprises, and medium enterprises 63%. The second most significant purpose cited by SME owners are responses falling into the “other” category. These results show that SME owners cannot separate their personal interests and business interests, so it is reasonable that the financial records of MSMEs remain simple in appearance. Third parties who provide loans to SMEs, especially banks, usually demand that standardized financial statements be created in accordance with the applicable procedures.

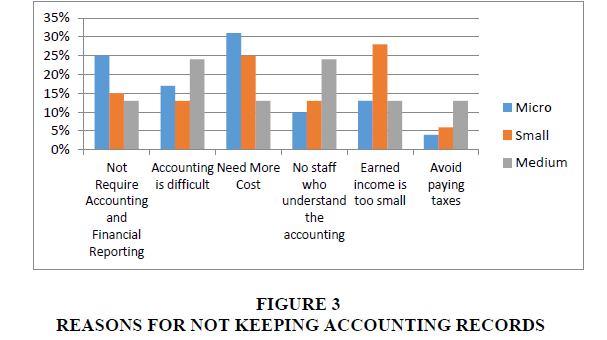

Reasons for not keeping accounting records

The next question concerns the reasons why SME owners do not keep accounting records. The respondents' answers can be seen in Figure 3.

The owners of SMEs cite various reasons for not keeping accounting records. The three most common responses from owners of micro, small and medium enterprises are as follows:

a. Micro enterprises: it costs more (31%); accounting and financial reporting are not required (25%); accounting is difficult/complicated (17%).

b. Small enterprises: income earned is too small (28%); it costs more (25%); accounting and financial reporting are not required (15%).

c. Medium enterprises: accounting is difficult/complicated (24%); no staffs understand accounting (24%); accounting and financial reporting are not required (13%).

In addition to the above reasons, there are other factors that prevent SMEs keeping accounting records, these are:

a. There is a presumption that the recording of transactions is not necessary and so, when implemented, it is a waste of time and energy.

b. There is a presumption that recording transactions is not very useful in supporting daily operational activities.

c. Business managers are more focused on the production activities of daily routine business management (eg goods shopping, taking care of the workforce, etc.) and take care of their trading transactions so that there is no time for recording.

d. SMEs owners have limited knowledge of how to keep financial records.

e. It is assumed that the complete recording of transactions will result in an increase in the amount of taxation to be paid.

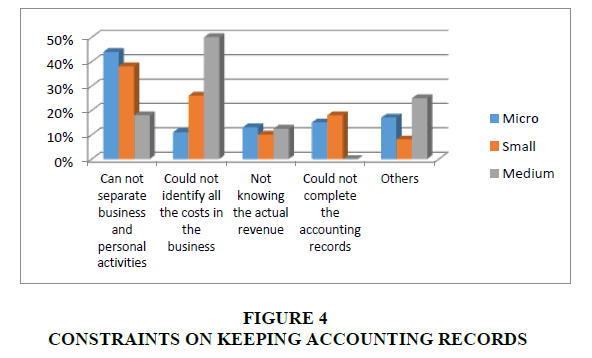

Constraints on keeping accounting records

The next question concerns the constraints on keeping accounting records. The answers of the respondents can be seen in Figure 4.

The SME owners give varied responses relating to the constraints on keeping accounting records. The three most common answers given by the owners of micro, small and medium enterprises are as follows:

a. Micro enterprises: cannot separate personal and business activities (44%); could not complete the accounting records (15%); do not know their real income (13%).

b. Small enterprises: cannot separate personal and business activities (44%); could not identify all the costs in the business (26%); could not complete the accounting records (18%).

c. Medium enterprises: could not identify all the costs in the business (50%); cannot separate personal and business activities (12.5%); do not know their real income (12.5%).

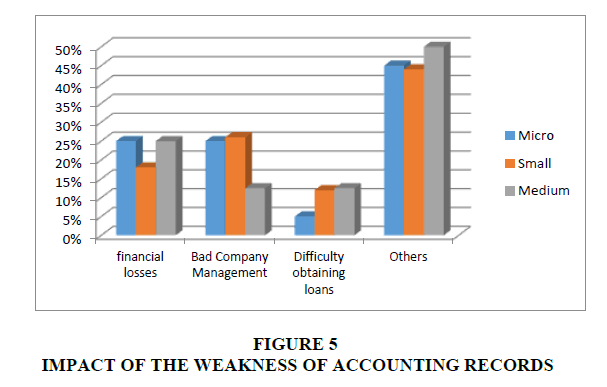

Impact of the weakness of accounting records

The next question put to the respondents concerns the form of the impact of weakness in keeping accounting records. The responses of the SME owners can be seen in the Figure 5. Respondents agreed that the weakness of accounting records has various impacts, with the responses of 45% of micro business owners, 44% of small business owners, and 50% of medium business owners falling into the “other” category. This shows that the owners of SMEs have not been able to identify the impacts of weakness in accounting records. As such, other factors need to be explored in order to understand the impact of weaknesses of accounting records for SMEs. Furthermore, the respondents’ answers indicate that the main impact of the weakness of accounting records is business losses, in the case of micro and medium enterprises, and bad company management, in the case of small enterprises.

The behavior of business management and financial administration of SMEs each show the same tendency: efforts are made to implement financial management in the form of financial transaction recording, but some transactions are still not recorded. Besides, not all SMEs are able to separate their business finances from their personal/family interests. However, most SMEs have been conducting the inventorization of financial evidence.

How to increase knowledge of accounting

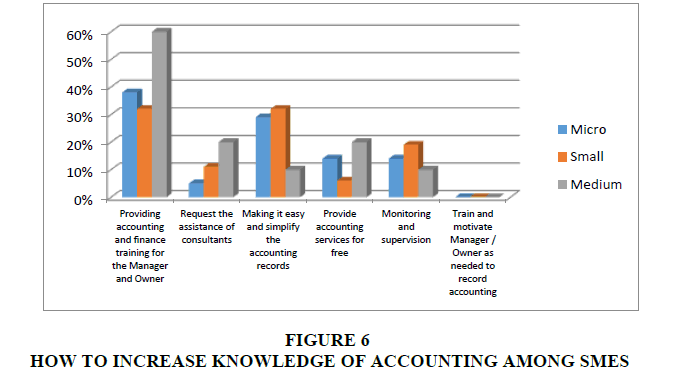

Respondents' answers relating to how to increase accounting knowledge among MSME owners can seen in Figure 6.

The results show that SME owners agree that the best way in which to improve accounting knowledge is by providing accounting and financial training to managers and owners. This method was endorsed by 38% of micro business owners, 32% of small business owners, and 60% of medium business owners. The three most common methods suggested by owners of micro, small and medium enterprises are as follows:

a. Micro enterprises: providing accounting and financial training for business managers and owners (38%); making easy and simplified accounting records (29%); providing free accounting services (14%).

b. Small enterprises: providing accounting and financial training for managers and owners (32%); making easy and simplified accounting records (32%); monitoring and supervision (19%).

c. Medium enterprises: providing accounting and financial training for managers and owners (60%); can not separate business and personal activities (12.5%), not knowing actual income (12.5%).

There is an indication that SME entrepreneurs do wish to carry out transaction recording, and it is expected that, through training, SMEs will be able to record these transactions skillfully and adjust financial statements to suit their needs.

Conclusion and Future Recommendation

The results of this research demonstrate that SME ownership is dominated by men, the most common education level of respondents is high school graduate, and the majority own small-scale businesses. The behavior of business management and financial administration of SMEs each show the same tendency: efforts are made to implement financial management in the form of financial transaction recording, but some transactions are still not recorded. Besides, not all SMEs are able to separate their business finances from their personal/family interests. Nevertheless, some SMEs have performed the inventorization of financial evidence. There is an indication or desire of the SME entity entrepreneurs to carry out transaction recording, and it is expected that the training will be able to skillfully record these transactions and be adjust to their needs.

This research only uses the criteria of making simple or complex financial statements to determine the sample. The researchers suggest that additional criteria be employed in sampling respondents for future research; these may include gender, age, and SMEs who receive credit from banks, among other factors. It is also recommended that different independent variable be added or used in place of the independent variable used in this study. Variables that may affect the implementation of SAK ETAP in SMEs include accounting training, corporate culture, and business sectors.

References

- Adhy, P.H., & Kurniawati, E.P. (2012). Preparation of financial statements for small and medium enterprises (SMEs) standards-based entities without public accountability (SAK ETAP). Proceeding Call for Paper Science Week FEB-institution Lecturer.

- Bank Indonesia (2009). Study of minimum standards for financial reports and business plans for MSMEs. Directorate, Credit, Rural Banks and MSMEs.

- Firmansyah, R.A. (2013). Factors affecting the use of accounting information systems in small and medium enterprises in Malang. Scientific Journal of UB FEB Students, 2(2).

- Fuad., & Sitoresmi, L.D. (2013). Factors affecting the use of information administration of SMEs (Case study in KUB Sido Rukun Semarang). Diponegoro Journal of Accounting, 2(3), 1-13.

- Hasanah, N., & Anggraini, R. (2017). Accounting for standard perception in small medium enterprises: Case study in Indonesia. Advanced Science Letter, 23(11).

- http://br-online.co/kadin-kontribusi-umkm- to-pdb-sel--above 50-persen

- http://br-online.co/kadin-kontribusi-umkm- to-pdb-selalu-di-atas-50-persen

- https://bogorkab.bps.go.id/new/website/pdf-publikasi/Statistik-Daerah-Kabupaten-Bogor-2015.pdf

- Indonesian Institute of Accountants. (2009). Financial Accounting Standards for Entities without public accountants.

- Kessevan, P. (2012). Why SMEs ignore formal accounting systems? Entity concept explanation. Scientific Articles in International Conference on Applied and Management Sciences.

- Law of the Republic of Indonesia Number 20 Year 2008 on Micro, Small and Medium Enterprises. Retrieved from http://eng.kppu.go.id/newkppu/wp-content/uploads/LAW-OF-THE-REPUBLIC-OF-INDONESIA-20-OF-2008.pdf

- Neag, R. Masca, E., & Pascan, I. (2011). Actual aspects regarding the IFRS for SME opinion, debates, and future development. AnnalesUnivertsitasis Apulensis Series Economica, 11(1).

- Permatasari, R., & Setijawan, I. (2014). Perception analysis of ease of use and usability against public accounting accountability at cooperatives in Semarang. Journal of Business and Economics (JBE), 21(2), 163-175.

- Rizki, R., & Siregar, S.V. (2012). The quality of financial statements of SMEs and prospects of IFRS ETAP implementation. Journal of Accounting and Finance Indonesia, 9(1).

- Sisdiyantoro, K., & Minarni, E. (2014). Factors affecting implementation of SAK etap on cooperatives in tulungagung district. Journal of Tulungagung University BONOROWO, 2(1).

- Sixpria, N., Suhartati, T., & Warsini, T. (2014). Implementation in the process of accounting and financial statements on micro, small, and medium (SMEs). Journal of Accounting, Finance and Banking, 1(2).

- Solovida, G.T. (2010). Factors affecting the preparation and use of accounting information in small and medium enterprises in central Java. Social Sciences and Economics, 6(1).

- Supadmi, N., & Putu, I.G., & Ngr, A.P. (2015). Effect of perceived ease of use and use of the SAK ETAP implementation (Empirical Study on SMEs in North Denpasar). Journal of Accounting University of Udayana, 13(3).

- Tarmizi, R., & Bugawanti. N.L. (2013). The influence of perception of small and medium entrepreneurs to use SAK ETAP in the city of Bandar Lampung. JournalAccountance and Finance, 4(2).

- Teak, H., Bala, B., & Nisnoni, O. (2009). Growing small business habits preparing financial reports. Business Journal and Businessmen, 11(8).

- Tuti, R. (2014). Affecting factors for smes in developing understanding financial statements based on SAK ETAP. The 7th NCFB and Doctoral Colloquium. Faculty of Business and the Graduate UKWMS.