Research Article: 2018 Vol: 22 Issue: 3

Adoption of Mobile Money Services and the Performance of Small and Medium Enterprises in Zimbabwe

Reginald Masocha, University of Limpopo

Obey Dzomonda, University of Limpopo

Abstract

This study focused on investigating the drivers of the adoption of mobile money services and the subsequent performance of Small and Medium Enterprises (SMEs) in Zimbabwe. This contribution used the quantitative research method with a descriptive research design. 160 SMEs participated in the survey and data was collected through the use of self-administered questionnaire in a survey. Participants in the study were selected owner/ managers of SMEs in the rural places in Zimbabwe sampled using the convenience sampling technique. The data was collected between September-November 2017. Data analysis included descriptive statistics, exploratory factor analysis (EFA), confirmatory factor analysis (CFA) and structural equation modelling (SEM). SEM was used to test hypotheses and the results indicated that benefits of mobile money and challenges in traditional financial services influenced firm adoption of mobile money services. Conclusively, the study established that subsequent adoption of mobile money services has an influence on the performance of SMEs.

Keywords

Mobile Money Services, Performance, SMEs, Eco Cash, Zimbabwe.

Introduction

The critical role played by Small and medium enterprises (SMEs) as catalysts for overall economic performance is widely accepted and documented (Ngek, 2014). According to the World Bank (2016), SMEs play a pivotal role towards sustainable development. Hence, the strategy to focus on supporting SMEs will uplift the economies of developing countries such as Zimbabwe confronted with a plethora of socio-economic problems (Ayandibu & Houghton, 2017). It is important to define SMEs to deal with issues of inclusion and exclusion in this study. Dada (2014) proffer that there is no universally acceptable definition for SMEs. Studies such as Mahembe (2011) & Wiese (2014) allude that SMEs can be defined based on an economic and a statistical definition. According Zindiye, Chiliya & Masocha (2012), in Zimbabwe a SME is defined as a registered company which employ not more than 100 employees and with an annual turnover of not more than 8,30,000 US dollars. Ramukumba (2014) indicates that SMEs in developing countries have become effective tools for development due to their potential to improve income distribution, create new employment, reduce poverty and facilitate export growth. Zindiye, Chiliya & Masocha (2012) identify SMEs as the engine for economic growth in Zimbabwe as they contribute over 50% towards the country’s gross domestic product (GDP).

Notwithstanding their potential to immensely contribute to the economy, SMEs in Zimbabwe are still faced with a plethora of challenges that hinder their growth (Kwaramba, 2017). On that note, the needs of SMEs are not well catered by most banks. SMEs mostly fill in gaps left by large businesses by targeting the unsaved needs of the low income group of customers (Ngaruiya, Bosire & Kamau, 2014). Alas, the majority of the customers of SMEs fall in the unbanked category (Ngaruiya, Bosire & Kamau, 2014). Wambari (2009) indicates that in various developing countries 9 out of 10 people have no bank account. Statistics show that 12 million of the Zimbabwean populace live in rural areas. Unfortunately, 70 percent of the Zimbabwean populace fall in the unbanked category (Kufandirimbwa et al., 2013). This retards the growth of SMEs since it’s difficult to process electronic transactions such as payments and transfers with their customers.

Mobile money transfer facilities have come as a panacea to a plethora of liquidity problems facing SMEs (Aron, Meullbauer & Sebudde, 2015). This service originated from Kenya but with the inception of Eco Cash in Zimbabwe, this service has been adopted and used at an increasing rate. Many sectors and different stakeholders point the importance of this service as convenient, time saving, cost effective and efficient (Onyango et al., 2014). With the inception of Eco Cash in Zimbabwe, mobile money services completely changed the game on how business is conducted. There is a paucity of empirical studies about mobile money in Zimbabwe. As such, a study of this nature is poised to immensely contribute towards understanding of this concept from the Zimbabwean backdrop. Related studies have been carried out in Kenya where mobile money services originated. Therefore, this study seeks to investigate the drivers of mobile money services adoption and the subsequent impact on performance of SMEs in Zimbabwe.

Literature Review

Jenkins (2008) defines mobile money as money accessed and used using a mobile phone. The study is grounded on the theory of Technology Acceptance Model. The theory of Technology Acceptance Model by Davies (1989) provides the basis to understand how users of a certain technology accept and make use of that particular technology. As cited by Davies (1989), the TAM tries to elucidate how several factors can affect users’ final decision to adopt and use a certain technology. Most importantly are perceived usefulness and perceived ease of use (Davies, 1989). According to Davies (1989), perceived usefulness means the extent to which an individual believes that a given technology will improve his or her job performance while ease of use means the degree to which one believes that adopting a certain technology will result in less effort applied to execute a certain activity. Perceived ease of use affects perceived usefulness directly in that if a technology results in no effort applied to do something, eventually that technology will become useful. Viehland & Leong (2007) indicate that these two factors have a bearing on the user’s behavioural intention to adopt and use a certain technology. The Technology Acceptance Model sets precedence to support the variables under consideration in this study. This theory is robust and has been used extensively in studies related to mobile money adoption and performance of SMEs recording above seven thousand citations (Boonsiritomachai & Pitchayadejanant, 2017).

Mobile Money Services

EcoCash is an innovative strategy introduced by Econet to enable its subscribers to complete simple financial transactions such as sending money to loved ones, buying prepaid airtime for you or other Econet subscribers and paying for goods and services. In Zimbabwe, the mobile money transactions process starts by a customer registering at any registered Eco Cash outlet. According to Simiyu & Oloko (2015), the process is complete when a customer receives an electronic account which connects directly to their SIM card and phone number. The mobile phone becomes a mobile wallet because customers can make transfers, payments and salary balance checks anywhere at any given time (Anurag, Tyagi & Raddi, 2009). According to Ngaruiya, Bosire & Kamau (2014), mobile money increases the speed and efficiency in the way financial transactions take place. Furthermore, it provides a saving platform for the rural populace without bank accounts (Kufandirimbwa et al., 2013). Mararo & Ngahu (2017) assert that mobile money transaction services are of outmost importance to SMEs because a transaction can be done even after hours as compared to banks which operate mostly from 8 to 4 PM.

Mobile Money Knowledge

The rate in which mobile money services are adopted hinges on the knowledge possessed by the users. According to Iliasov (2014) lack of knowledge is a serious barrier towards mobile money services adoption. Lack of knowledge and education inversely affects mobile money services adoption (FinMark Trust, 2016). Dzokoto & Appiah (2014) note that lack of knowledge is usually a common phenomenon among the poor. Hence, programmes designed to increase mobile money knowledge among users goes a long way in increasing mobile money services adoption by SMEs in Zimbabwe. The authors of this study are of the view that mobile money knowledge increases the rate of mobile money services adoption. From that backdrop, the following hypothesis is stated;

H1: Mobile money knowledge (MMK) positively influences mobile money (MMS) adoption by SMEs in Zimbabwe.

Perceived Mobile Money Benefits and Mobile Money Services

Narteh, Mahmoud & Amoh (2017) found that the level of adoption of mobile money services is positively related with perceived benefits associated with the adoption thereof. Lubua and Semlambo (2017) concur and indicate that users adopt mobile money because they perceive to realise financial gains. Lubua & Semlambo (2017) further remark that the mobile money services technology is adopted when users believe that they can make a business out of it. A study by Wamuyu (2014) asserts that mobile money services’ adoption has proliferated among users because it offers momentous benefits to the users. These benefits include, ease of use, convenience and its ability to cut costs. Similarly, Kikulwe, Fischer and Qaim (2015) indicate that there is a link between perceived benefits such as time saving and reduced transaction cost with intention to use mobile money services. The above discussion leads to the following hypothesis:

H2: perceived mobile money benefits (MMB) positively influence mobile money (MMS) adoption by SMEs in Zimbabwe.

Perceived Challenges and Mobile Money Services

Koloseni & Mandari (2017) are of the view that challenges such as fraud and poor service of the mobile money services system can cause users to be dissatisfied, hence the adoption rate will decline. Equally important is the issue of trust. Koloseni & Mandari (2017) argue that trust emerges as one of the worst challenges experienced by mobile money services users. A study Dzokoto & Appiah (2014) found out that a significant number of retail SMEs still prefer to transact in cash over mobile money services because they are scared of fraudulent incidences that may arise by the use thereof. Systems have to be put in place to improve users’ trust as it directly affects the adoption rate of mobile money services. However, the challenges that are associated with traditional financial systems seem to be improving the use of mobile money services. For instance, Baganzi & Lau (2017) argue that traditional financial services are associated with financial exclusion of the poor particularly in the developing countries like Zimbabwe, as well as inaccessibility as reviewed by the number of people with mobile money which outweighs the number of people with bank accounts. According to Rajiv, Stanley & Ishan (2015), the large proportion of the informal sector is often excluded by formal financial systems and in the middle of economic problems; the formal banking systems were associated with widespread mistrust. As such, it is not clear to what extent challenges in the financial systems contribute to the adoption of mobile services by SMEs in Zimbabwe. Thus, the following hypothesis is postulated:

H3; Perceived challenges in money transactions (MMC) positively influence mobile money (MMS) adoption by SMEs in Zimbabwe.

Mobile Money Services and Performance of SMEs

Simiyu & Oloko (2015) argue that the availability of mobile money transactions broaden the customer base of SMEs given the fact that majority of the rural populace now has access to a mobile phone. Furthermore, the accessibility, convenience and lower costs nature of mobile transactions has resulted in the growth of SMEs business activities especially in rural areas (Simiyu & Oloko, 2015). Nyaga & Okonga (2014) argue that mobile money transactions enhance the performance of SMEs. Kirui & Onyuma (2015) concur by citing that mobile money transactions easy the way in which payments and receipts are made. Kirui & Onyuma (2015) allude that mobile money transactions improve the performance of SMEs in that it is time saving, cost saving as well as flexible given that a transaction can be done anywhere at any given time. A plethora of studies agree that mobile money service usage improves the performance of SMEs in terms of sales growth, market share and profitability (Wanyonyi & Bwisa, 2013; Kirui & Onyuma, 2015; Mararo & Ngahu, 2017). Onyango et al. (2014) examined the nexus between mobile money services and the performance of small businesses in Kenya. The study reported a positive relationship between the use of mobile money services and the performance of small businesses in Kenya. Similarly, studies such as Nyaga & Okonga (2014) as well as Kirui & Onyuma (2015) found a significant positive association between mobile money usage and performance of SMEs using different sample groups. However, another strand of researchers reports an insignificant relationship between mobile money services and the performance of SMEs (Ngaruiya, Bosire & Kamau, 2014).

H4: Mobile money services (MMS) positively influence the performance (FP) of SMEs in Zimbabwe.

Research Methodology

This research embraced the quantitative approach and utilised a questionnaire as a research instrument to gather the data using a sample size of 160 SMEs from the various parts of Zimbabwe. The sample size was deemed appropriate for the use of SEM analytical approach as the rule of thumb has been the sample size in SEM should be 10 times the number of latent variables. In this case, with the research having five latent variables, the minimum sample size would be 50 observations. On the other hand, other researchers have disagreed that the use of the number of variables alone is not enough (Davcik, 2014; Westland, 2010; Nicolaou & Masoner, 2013). Sekaran & Bougie (2009) indicate that sample sizes that are between 30 and 500 are deemed proper for the majority of research. The questionnaire utilised constituted closed-ended questions in the form of 5-point Likert scales. The questionnaires were distributed personally and the convenience sampling technique was applied in the study because of its ease and flexibility. Initially a total of 300 questionnaires were distributed and only 160 were eventually returned yielding an effective response rate of 53%.

Data Analysis and Findings

Descriptive and inferential analyses were utilized in this study. Statistical Package for Social Sciences (SPSS) Version 24 was used for descriptive analysis. Table 1 below presents the information on the respondents’ demographics and the characteristics of the SMEs involved in the survey.

| Table 1 Respondents Demographics And Sme Characteristics |

|||

| Variables | Category | Freq | (%) |

| Gender | Male | 107 | 66.9 |

| Female | 53 | 33.1 | |

| Age (Years) | Below 20 | 6 | 3.8 |

| 20-30 | 57 | 35.6 | |

| 31-40 | 67 | 41.9 | |

| 41-50 | 28 | 17.5 | |

| Above50 | 2 | 1.3 | |

| Education | Primary | 25 | 15.6 |

| Ordinary | 60 | 37.5 | |

| Advanced | 45 | 28.1 | |

| Diploma | 21 | 13.1 | |

| Degree | 9 | 5.6 | |

| Industry sector | Retail | 62 | 38.8 |

| Service | 92 | 57.5 | |

| Manufacturing | 4 | 2.5 | |

| Other | 2 | 1.3 | |

| No. of employees | 5 and Below | 9 | 5.6 |

| 6-10 | 99 | 61.9 | |

| 11-20 | 48 | 30.0 | |

| 21-50 | 4 | 2.5 | |

| Business Age (Years) | Below | 2 | 1.3 |

| 1-5 | 77 | 48.1 | |

| 6-10 | 61 | 38.1 | |

| 11-15 | 18 | 11.3 | |

| 15 and above | 2 | 1.3 | |

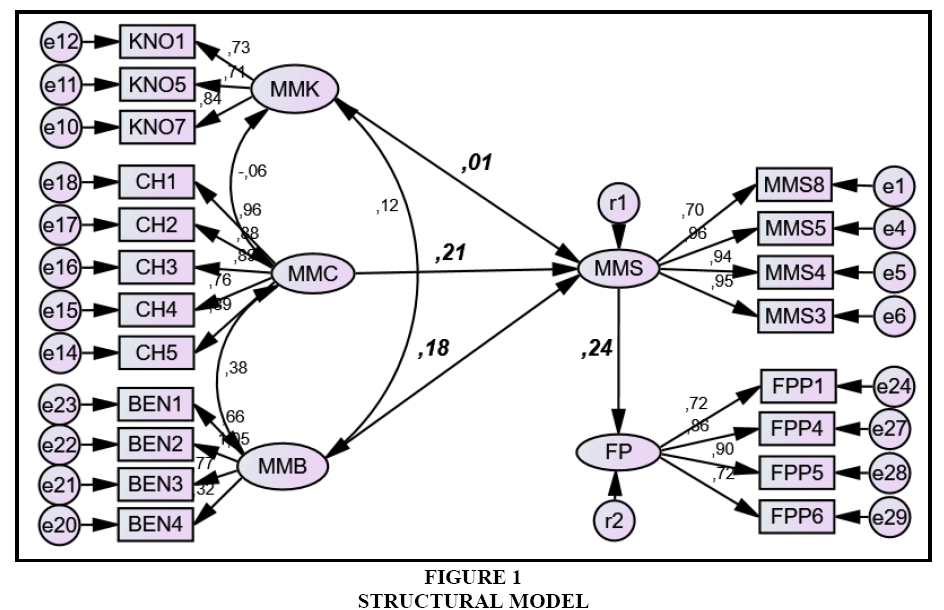

Assessment of unidimensionality was ascertained through exploratory factor analysis (EFA) and the results of factor loadings are outlined in Table 2 with all items reflecting significantly high loadings of above 0.50 (Mishra, 2015). The principal component analysis was utilized as the extraction method and the varimax rotation was used since the data was regarded to be orthogonal. Some of the items from the questionnaire that did not load perfectly on one construct were dropped for further analysis. The remaining items which were finally included in the model are as shown in Figure 1 and Table 2. For the measurement model, a confirmatory factor analysis (CFA) was conducted simultaneously with the assessment for validity and reliability. Cronbach’s coefficient alpha (CRα) greater than 0.7, Composite Reliability (CR) and Average Variance Extracted (AVE) were used to ascertain reliability in the study. The values for CR ranged between 0.805 and 0.945 which were above the threshold of 0.80. On the other hand, validity is divided into two: convergent and discriminant validity. Convergent validity was measured using factor loadings and AVE values and discriminant validity was measured using AVE value versus shared variance and Inter-Construct Correlation Matrix.

| Table 2 Measurement Model, Validity And Reliability |

||||||||||||

| Construct | Item | SFLs | CRα | CR | AVE | Mean | SD | Inter-Construct Correlation Matrix & Square root AVE | ||||

| 1 | 2 | 3 | 4 | 5 | ||||||||

| 1. MMS | MMS3 | 0.946 | 0.936 | 0.939 | 0.798 | 3.41 | 1.006 | 0.893 | ||||

| MMS4 | 0.942 | 3.51 | 0.958 | |||||||||

| MMS5 | 0.960 | 3.46 | 0.931 | |||||||||

| MMS8 | 0.700 | 3.90 | 0.877 | |||||||||

| 2. MMK | KNO1 | 0.726 | 0.792 | 0.805 | 0.582 | 4.22 | 0.579 | 0.02 | 0.763 | |||

| KNO5 | 0.713 | 3.98 | 0.441 | |||||||||

| KNO7 | 0.843 | 4.21 | 0.635 | |||||||||

| 3. MMC | CH1 | 0.965 | 0.792 | 0.945 | 0.775 | 3.85 | 0.540 | 0.28 | -0.06 | 0.880 | ||

| CH2 | 0.884 | 3.83 | 0.556 | |||||||||

| CH3 | 0.893 | 3.83 | 0.556 | |||||||||

| CH4 | 0.762 | 4.04 | 0.608 | |||||||||

| CH5 | 0.886 | 3.75 | 0.593 | |||||||||

| 4. MMB | BEN1 | 0.660 | 0.769 | 0.819 | 0.562 | 3.81 | 0.508 | 0.26 | 0.13 | 0.37 | 0.750 | |

| BEN2 | 1.053 | 3.96 | 0.370 | |||||||||

| BEN3 | 0.775 | 3.92 | 0.448 | |||||||||

| BEN4 | 0.325 | 3.89 | 0.448 | |||||||||

| 5. FPP | FPP1 | 0.718 | 0.873 | 0.878 | 0.645 | 2.09 | 0.565 | 0.24 | 0.16 | 0.06 | 0.05 | 0.803 |

| FPP4 | 0.864 | 2.24 | 0.639 | |||||||||

| FPP5 | 0.895 | 2.22 | 0.670 | |||||||||

| FPP6 | 0.720 | 2.27 | 0.742 | |||||||||

For convergent validity, as indicated in Table 2, all the factor loadings were above the recommended cut-off value of 0.50 (Hair et al., 2010). The AVE values were all above the cut-off value of 0.50 (Bagozzi & Yi, 1988; Hair et al., 2010) as they ranged between 0.562 and 0.798, thus indicating satisfactory convergent validity in the model. The results also satisfied discriminant validity assessments as indicated by AVE value versus shared variance which was measured by the square root of AVEs compared with inter-construct correlations. The results showed that all the square root of AVEs (Table 2 values in italics diagonally) were greater than their respective inter-construct correlations (Mishra, 2015). The Inter-Construct Correlation Matrix also showed satisfactory discriminant validity as all the values were below the threshold value of r=0.80 ranging between -0.06 and 0.37. Discriminant validity which is also termed divergent validity pertains to the lack of strong correlation between concepts or measurements that are intended to be unrelated (Bryman & Bell, 2011).

Furthermore, the CFA model reviewed acceptable fit (χ2=104.125, χ2/df=2.215, p<0.01, tucker-lewis index (TLI)=0.972, confirmatory fit index (CFI)=0.972, root mean square error of approximation(RMSEA)=0.097). Besides the chi-square being significant, which is habitually susceptible to sample sizes above 200 (Bagozzi & Yi, 1988; Hair et al., 2010), the rest of the statistics fell within acceptable ranges. Figure 1 constitutes the structural model results for the purposes of hypothesis testing. Herein, the goodness-of-fit indices show suggestion of acceptable model fitness to the data, regardless of the chi-square being significant (χ2/df=364.259, χ2/df=2.215, p<0.01, CFI=0.939, TLI=0.908, RMR=0.067, RMSEA0.097). As indicated earlier, the chi-square is subjective to large sample sizes of above 200.

Structural Equation Modelling (SEM) was conducted for hypothesis testing under inferential analysis utilising Analysis of Moment Structures (AMOS Version 24.0). SEM is a multivariate technique which is an alternative to multiple regression analysis (Hoyle, 2011). SEM is considered more superior since it can simultaneously test a series of dependence relationships between variables (Cooper & Schindler, 2011). SEM followed a two-staged approach, namely, measurement model and structural model.

The results of the structural model as illustrated in Figure 1 are shown in Table 3. The results obtained failed to support H1, which indicated that mobile money knowledge (MMK) positively influence mobile money (MMS) adoption by SMEs (β=0.015, p=0.865). However, the results of SEM supported H2, which stated that perceived mobile money benefits (MMB) positively influence mobile money (MMS) adoption by SMEs (β=0.181, p=0.024). The findings of this study are consistent with similar existing studies. Narteh, Mahmoud & Amoh (2017) found that the level of adoption of mobile money services is positively related with perceived benefits associated with the adoption thereof. Lubua & Semlambo (2017) concur that users adopt mobile money because they perceive to realise financial gains. A positive relationship was also established between perceived challenges in money transactions (MMC) positively influence mobile money (MMS) adoption (β=0.207, p=0.017), in support of H3. In line with these findings, Rajiv, Stanley & Ishan (2015) report that the large proportion of the informal sector is often excluded by formal financial systems and in the middle of economic problems banks do not trust SMEs and the informal sector. This automatically led SMEs to adopt mobile money services as an alternative. Finally, in relation to H4, the study established a positive relationship between mobile money services (MMS) and the performance (FP) of SMEs (β=0.240, p=0.006). The findings are in agreement with similar studies (Nyaga & Okonga, 2013; Onyango et al., 2014; Kirui & Onyuma, 2015). Kirui & Onyuma (2015) allude that mobile money transactions improve the performance of SMEs in that it is time saving, cost saving as well as flexible given that a transaction can be done anywhere at any given time. However, the results of this study are in disagreement with a study by Ngaruiya, Bosire & Kamau (2014) which found an insignificant relationship between mobile money services and the performance of SMEs.

| Table 3 Results Of Sem Hypotheses Testing |

||||||||

| Hypothesised Relationship | Standardised Regression Weight (β) | S.E. | C.R. | P | Supported/Not supported | |||

| H1 | MMS | <--- | MMK | 0.015 | 0.098 | 0.170 | 0.865 | Not Supported |

| H2 | MMS | <--- | MMB | 0.181 | 0.126 | 2.262 | 0.024 | Supported |

| H3 | MMS | <--- | MMC | 0.207 | 0.116 | 2.383 | 0.017 | Supported |

| H4 | FP | <--- | MMS | 0.240 | 0.058 | 2.56 | 0.006 | Supported |

Conclusion

Based on the results of structural equation modelling technique, the study revealed the antecedents of mobile money services their influence on the adoption of mobile money services by SMEs in Zimbabwe. Furthermore, the study examined the relationship between the general adoptions of mobile money services on the performance of these SMEs. Of the identified antecedents the study obtained that the level of mobile money knowledge did not have a significant impact on the adoption of mobile money services by SMEs in Zimbabwe. Although positive, the relationship was weak. This suggests that SMEs had adequate knowledge of the available services which has seized to be a motivator for the adoption and everyone is expected to have the knowledge of the services available on Eco cash. On the contrary, the study established that mobile money benefits and challenges in money transactions have a significant influence as drivers of adoption of mobile money services by SMEs.

Firstly, benefits provided by mobile money such as versatility, cost saving, time consumption and user-friendliness are deemed essential in the adoption of mobile money services. Thus, the more the perceived benefits encapsulated in mobile money services the more SMEs are expected to adopt. On the other hand, given a myriad of challenges in relation to financial transactions and banking sectors in Zimbabwe, mobile money has appeared as an option to the traditional banking systems. Consistently, the relationship between challenges in financial transactions has been identified. The implications of this study to latent research are that an additional perspective to understanding the spread of mobile money services is added. Thus, the research supports latent literature through consistent findings that conclude that mobile money services are preferred to traditional banking services due to the challenges associated with traditional financial services and the additional benefits needed by businesses. Subsequently, this has a positive influence on the performance of SMEs. As such, mobile money services can be a cost-effective option for small businesses that are weakened in several points. Given the crucial role played by mobile money services in solving the liquidity crisis in Zimbabwe, the government should put support structures and an enabling environment for mobile money services to flourish. There is need for the government to ensure that the technological infrastructure is conducive especially in the rural areas. Through investments in internet access such as wireless activities particularly at business centres where most SMEs operate from, the usage of mobile money can widely expand. Furthermore, the government can intervene into the usage of mobile money by ensuring that mobile network providers are charging fees that are convenient for the usage of mobile money service thereby creating a positive environment for the SMEs. However, this study had a limitation that it was cross sectional, it could have yielded different results if it was longitudinal where data was collected for a minimum of 3 years. Future research is needed to establish the impact of specific typology of financial services as well as the SMEs’ characteristics on the adoption of mobile money services. Further research can be conducted to determine the external variables that are influencing the adoption of mobile money services in developing countries.

References

- Anurag, S., Tyagi, R. & Raddi, S. (2009). Mobile payment 2.0: The next-generation model, in HSBC’s guide to cash, supply chain and treasury management in Asia Pacific. Ed. 178-183.

- Aron, J., Meullbauer, J. & Sebudde, R.K. (2015). Inflation forecasting models for Uganda: Is mobile money relevant? Centre for Economic Policy Research. Online available: https://www.sbs.ox.ac.uk/sites/default/files/research-projects/mobile-money/inflation-forecasting-16April.pdf

- Ayandibu, A.O. & Houghton, J. (2017). The role of small and medium scale enterprise in local economic development (LED). Journal of Business and Retail Management Research (JBRMR), 11(2), 133-139.

- Baganzi, R. & Lau, A.K.W. (2017). Examining trust and risk in mobile money acceptance in Uganda, Sustainability, 9, 1-22.

- Bagozzi, R.P. & Yi, Y. (1988). On the evaluation of structural equation models. Journal of the Academy of Marketing Science, 16(1), 74-94.

- Boonsiritomachai, W. & Pitchayadejanant, K. (2017). Determinants affecting mobile banking adoption by generation Y based on the unified theory of acceptance and use of technology model modified by the technology acceptance model concept. Kasetsart Journal of Social Sciences, 1-10.

- Bryman, A. & Bell, E. (2011). Research methodology: Business and management contexts. Oxford University Press, South Africa: Cape Town.

- Cooper, D.R. & Schindler, P. (2011). Business research methods. New York, USA: McGraw-Hill.

- Dada, R.M. (2014). Commercial banks’ credit and SMEs development in Nigeria: An empirical review. International Journal of Research, 1(8), 306-319.

- Davies, F. (1989). Perceived usefulness, perceived ease of use and user acceptance of information technology. MIS Quarterly, 13(3), 319-340.

- Dzokoto, V.A. & Appiah, E. (2014). Making sense of mobile money in urban Ghana: Personal, business, social and financial inclusion prospects. Online available: https://www.imtfi.uci.edu/files/docs/2014/dzkoto_final_report_feb2014.pdf. Accessed on March 04, 2018.

- FinMark Trust. (2016). The role of mobile money in financial inclusion in the SADC region. Online available at: https://www.finmark.org.za/wp-content/uploads/2016/12/mobile-money-and-financial-inclusion-in-sadc.pdf

- Hair, J.F., Black, W.C., Babin, B.J. & Anderson, R.E. (2010). Multivariate data analysis: A global perspective (7th Edn). Upper Saddle River, New Jersey: Pearson Education, Inc.

- Hoyle, R.H. (2011). Structural Equation Modelling for Social and Personality Psychology. UK, London: Sage Publications Inc.

- Iliasov, A. (2014). Barriers to mobile money adoption in Nigeria. Online available: http://finclusion.org/blog/barriers-to-mobile-money-adoption-in-nigeria.html

- Jenkins, B. (2008). Developing mobile money ecosystems. Washington, DC: International Finance Corporation and Harvard Kennedy School.

- Kikulwe, E., Fischer, E. & Qaim, M. (2015). Mobile money, smallholder farmers and household welfare in Kenya. PLoS One, 9(10), 2-19.

- Kirui, R.K. & Onyuma, S.O. (2015). Role of mobile money transactions on revenue of microbusiness in Kenya. European Journal of Business and Management, 7(36), 63-67.

- Koloseni, D. & Mandari, H. (2017). Why mobile money users keep increasing? Investigating the continuance usage of mobile money services in Tanzania. Journal of International Technology and Information Management, 26(2), 117-143.

- Kufandirimbwa, O., Zanamwe, N., Hapanyengwi, G. & Kabanda, G. (2013). Mobile money in Zimbabwe: Integrating mobile infrastructure and processes to organisation infrastructure and processes. Online Journal of Social Science Research, 2(2), 92-110.

- Kwaramba, N. (2017). The role and importance of key entrepreneurship development. Online available: https://www.theindependent.co.zw/2017/05/26/role-importance-key-entrepreneurship-development/

- Lubua, E.W. & Semlambo, A. (2017). The influence of the ease of use and perceived usefulness to the adoption of mobile money services in SMEs in Tanzania. Information Technologist (The), 14(2), 131-141.

- Mahembe, E. (2011). Literature review on small and medium enterprises' access to credit and support in South Africa. Online available at: http://www.ncr.org.za

- Mararo, M.W. & Ngahu, S. (2017). Influence of mobile money services on the growth of SME in Nakuru town, Kenya. Journal of Humanities and Social Science, 22(10), 64-72.

- Mishra, P. (2015). Business research methods. Oxford University Press, India: New Delhi.

- Narteh, B., Mahmoud, M.A. & Amoh, S. (2017). Customer behavioural intentions towards mobile money services adoption in Ghana. The Service Industries Journal, 37(7-8), 426-447.

- Ngaruiya, B., Bosire, M. & Kamau, S.M (2014). Effect of mobile money transactions on financial performance of small and medium enterprises in Nakuru Central Business District. Research Journal of Finance and Accounting, 5(12), 53-58.

- Ngek, N.B. (2014). Determining high quality SMEs that significantly contribute to SME growth: Regional evidence from South Africa. Problems and Perspectives in Management, 12(4), 253-264.

- Nyaga, K.M. & Okonga, B.M. (2014). Does mobile money services have an impact on SMEs performance in Naivasha? International Journal of Current Research, 6(10), 9394-9398.

- Onyango, R., Ongus, R., Awuor, F. & Nyamboga, C. (2014). Impact of adoption and use of mobile phone technology on the performance of micro and small enterprises in Kisii Municipality Kenya. World Journal of Computer Application and Technology, 2(2), 34-42.

- Rajiv, L., Stanley, R. & Ishan, S. (2015). Mobile Money Services-Design and Development for Financial Inclusion, Harvard Business School Working Papers, Online available: http://www.hbs.edu/faculty/Publication%20Files/15-083_e7db671b-12b2-47e7-9692-31808ee92bf1.pdf (accessed 03/03/2018).

- Ramukumba, T. (2014). Overcoming SMEs challenges through critical success factors: A case of SMEs in the Western Cape province, South Africa. Economic and Business Review for Central and South-Eastern Europe, 16(1), 19-38.

- Simiyu, C.N. & Oloko, M. (2015). Mobile money transfer and the growth of small and medium sized enterprises in Kenya: A case of Kisumu city, Kenya. International Journal of Economics, Commerce and Management, 3(5), 1056-1065.

- Viehland, D. & Leong, R.S.Y. (2007). Acceptance and use of mobile payments. ACIS 2007 Proceedings, 16. Available at: http://aisel.aisnet.org/acis2007/16

- Wambari, A. (2009). Mobile banking in developing countries (a case study on Kenya). Thesis, Vaasan Ammattikorkeakoulu University of Applied Sciences.

- Wamuyu, P.K. (2014). The role of contextual factors in the uptake and continuance of mobile money usage in Kenya. The Electronic Journal of Information Systems in Developing Countries, 64(1), 1-19.

- Wanyonyi, P.W. & Bwisa, H.M. (2013). Influence of mobile money transfer services on the performance of micro enterprises in Kitale municipality. International Journal of Academic Research in Business and Social Sciences, 3(5), 500-517.

- Wiese, J.S. (2014). Factors determining the sustainability of selected small and medium sized enterprises (Masters Dissertation), North West University, Potchefstroom, South Africa.

- World Bank. (2016). Entrepreneurs and small businesses spur economic growth and create jobs. Online available: http://www.worldbank.org/en/news/feature/2016/06/20/entrepreneurs-and-small-businesses-spur-economic-growth-and-create-jobs (accessed on 4 March 2018).

- Zindiye, S., Chiliya, N. & Masocha, R. (2012). The impact of government and other institutions' support on the performance of small and medium enterprises in the manufacturing sector in Harare, Zimbabwe. International Journal of Business Management & Economic Research, 3(6), 655-667.

- Davcik, N.S. (2014). The use and misuse of structural equation modelling in management research: A review and critique, Journal of Advances in Management Research, 11(1), 47-81.

- Sekaran, U. & Bougie, R. (2009). Research methods for business: A skill building approach. (5th Edn), West Sussex, UK. John Wiley & Sons Ltd.

- Westland, J.C. (2010). Lower bounds on sample size in structural equation modelling. Electronic Commerce Research and Applications, 9(6), 476-487.

- Nicolaou, A.I. & Masoner, M.M. (2013). Sample size requirements in structural equation models under standard conditions. International Journal of Accounting Information Systems 14, 256-274.