Research Article: 2018 Vol: 22 Issue: 5

Affection of Tax on Jordan Islamic Bank Accounting Disclosure

Abdullah Ibrahim Nazal, Zarqa University

Abstract

Purpose: This paper aims to find Jordan tax effects on disclosure accounting of Jordan Islamic Bank by comparing between Jordan Islamic Bank service cycle cost after tax and Traditional Banks service cycle cost after tax, also comparing between accounting data by choices of IFRS, tax law, and Islamic rules accounting.

Methodology: The methodology of this paper is comparative descriptive analysis depending on horizontal financial analysis and historically comparing study between Jordan Islamic Bank’s financial annual reports, Jordan Center Bank annual reports and Jordan Financial Market’s annual report also it depends theoretically on studies discussion.

Findings: The author finds that Jordan tax impacts of Jordan Islamic Bank accounting disclosure. It is affected by income tax as Traditional Bank but it is affected by sales tax, transfer owning tax and affected directly by economic sectors taxes than Traditional Banks. Jordan Islamic Bank uses IFRS choices and tax law choices to reduce tax. It uses depreciation, assets loss, employees’ expenses, and Morabaha buying installments certification to get financial leverage, therefore, its accounting disclosure loose the Islamic rules of accounting data based on market value. Its accounting disclosure had weakness point and strength point.

Originality/Value: It explains the weakness of financial tables’ disclosure in Jordan Islamic Bank as result to face tax by traditional ways than Islamic rules of accounting. It helps government to understand impact of tax on the bank weakness.

Keywords

Jordan Islamic Bank, Tax, Disclosure, Service Cycle, Profitability.

Introduction

The International Financial Reporting Standards (IFRS) are set of international standards of impact financial statements. IFRS are issued by the International Accounting Standards Board (IASB). IFRS were established as result to get a common accounting language in order to understand business and accounts from one company to another and from country to another. It rules the Islamic Banks financial statements and Traditional Banks financial statements in Jordan and other countries.

Based on IFRS, ways of accounting Islamic Banks is the same as Traditional Bank. Jordan Islamic Bank as any Islamic Banks asks for suitable tax as Traditional Banks. Traditional Banks have short steps dealing with loan interest contract. It gives customer loan and gets interest or it gets loan to give interest. Islamic Banks have long dealing steps. It faces increasing of buying tax. It buys product with sale tax and owns it by buying transfer owning tax then it sells these products to customers with sales tax and transfer owning tax. Jordan government accepts cost of sales tax and transfers owning tax without frequently buying from the bank as solution but cost of tax still increases customer cost. Customer buying sales tax, transfer owning tax, and government fees for contract with the bank. Increasing of cost by taxes types reduces Islamic Banks competition ability (Qatar Financial Center Authority, 2013).

Jordan Islamic Bank has produce goods by owns industries companies and services companies. The major problem of reducing profitability in 2016 comes as result to tax and fees at time of producing goods which increase costs of producing. Arab NGO Network for Development (ANND) showed repercussions of tax policies in Jordan. It explained that: “in Jordan, the tax burden is estimated at about 25% of GDP while income tax revenues do not exceed 4% of GDP due to high tax evasion” (Arab NGO Network for Development, 2017).

Dealers need to get disclosure in order to support the bank. Supporting increases by increasing loans from shareholders, depositors, and buying by delay cash or installment. Every supporter must be sure that the bank will increase profit after supporting.

Problem Statement

The problem statement aims to find the tax effects on Jordan Islamic Bank accounting disclosure. Its returns come from different resources as working, selling, leasing, and sharing in producing companies. In spite of different returns between Islamic Bank and Traditional Bank it has to obligate IFRS. There is need to explain different tax impacts on Jordan Islamic Bank disclosure. The questions of the problem statement:

1. Is Jordan tax regulation impacts on Jordan Islamic Bank accounting disclosure?

2. Do the Jordan taxes types’ impacting service cycle cost in Jordan Islamic Bank than Traditional Bank?

3. Are there Jordan economic sectors taxes impact service cycle cost in Jordan Islamic Bank?

4. Does the increasing income tax meet increasing revenue in Jordan Islamic Bank?

5. Does Jordan Islamic Bank choose traditional accounting ways to reduce Jordan income tax effect?

6. Is Jordan Islamic Bank choosing depreciation, assets loss, employees cost, and financial leverage to reduce Jordan income tax effect?

7. Is accounting data chosen by IFRS and Tax law Islamic rules disclosure application?

8. What is the weakness point and the strength point of accounting disclosure in Jordan Islamic Bank based on tax effect?

The Objectives

This paper has objectives to find the result as follow:

1. To explore Jordan tax effect on Jordan Islamic Bank accounting disclosure.

2. To compare Jordan taxes types’ impact service cycle cost between Jordan Islamic Bank and Traditional Bank.

3. To find Jordan economic sectors taxes effect on service cycle cost in Jordan Islamic Bank.

4. To find whether increasing income tax meet increasing revenue in Jordan Islamic Bank or not.

5. To find whether Jordan Islamic Bank chooses traditional accounting ways to reduce Jordan income tax effect.

6. To find whether Jordan Islamic Bank chooses depreciation, assets loss, employees cost, and financial leverage to reduce Jordan income tax effect.

7. To explain effect of choosing accounting data by IFRS and tax law on Islamic rules disclosure application.

8. To explain the weakness point and the strength point of accounting disclosure in Jordan Islamic Bank based on tax affection.

Previous Studies

Alshirah et al. (2016) explained the negative effect of income tax on small and medium enterprises in Jordan because it increases costs. Al hadidi (2017) found that Jordan tax evasion impact tax revenues to establish projects. In 2016, Tax evasion was equal 1.5 JD billion while tax revenues were equal 3.828 JD billion. Al sheikh et al. (2016) explained the need to understand tax accounting in Jordan because there are many factors impact tax evasion as companies’ size, and employees’ numbers. Alawneh (2017) explained that Jordan debts has positive relation with tax, therefore, government has to use ways as Islamic Bank Sukuk to reduce deficient. Bashayerh and Oran (2016) found that tax effort has negative reduction on agriculture and mining sectors which impact Jordan GDP also tax has many changes. Bawaneh (2017) there is problem of mechanism tax collection comes from estimated tax by self-judgment. There is need for suitable tax forming. Qatar Financial Centre Authority (2013) explained needing of reducing tax in Islamic Banks to meet Traditional Bank because it applies the same accounting rules of IFRS and Islamic face problem of get back part of buying tax or adds part of tax after Jordan adjusted tax. The changing will have impact results next year. It affects disclosure of the current year increasing profit or reducing profit because of tax changing.

These studies show Jordan tax change and its impact dealing with companies and Islamic Banks which needs more disclosure.

The previous studies found that Jordan tax has negative effect on Islamic Banks and its companies because of increases cost than Traditional Banks and impact negatively estimated profit because of tax changing. This study shows previous studies results practically through case study. This study is deferent than previous studies because it adds comparison between IFRS choices and Islamic rules accounting data in order to find the gap between them and explains the gap effect on Jordan Islamic Bank accounting disclosure.

Comparing Jordan Taxes Types’ Affection On Cost Of Service Cycle In Jordan Islamic Bank And Traditional Bank

By comparing between tax impacts operation service in Jordan Islamic Bank and Traditional Banks, There are similar factors obligate the same tax and fees beside income tax, on other hand, there are different factors that increase tax more than Traditional Bank in Jordan.

Tax impacts banking finance services sector by increasing customers cost than other sectors. This comes as result of the government stapes and fees which is equal 1.3% from contract price amount. Completion between Islamic Bank and Traditional Bank is depending on Islamic motion than reducing margin profit to meet interest on loan service in Traditional Bank. Increasing cost of Islamic Bank financial services by installments comes as result to effect by tax types. Traditional Banks just sell loan to get income tax but Islamic Bank will buy goods or buildings and sell it to customers, therefore, it impacts by sales tax and transfer owning tax also and after owning building, there is other tax as building tax and knowledge tax.

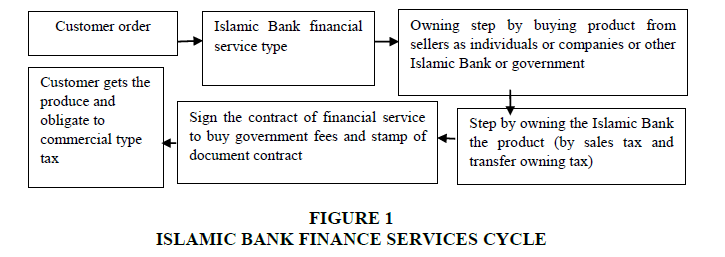

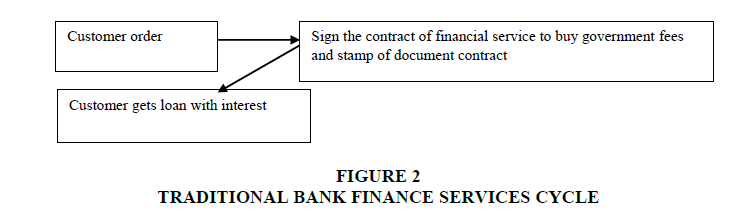

The finance services cycle in Islamic Banks is selling, sharing, Ijarah Tamwilia (leasingsell). It is impacted by tax on different sectors producing (Figures 1 & 2).

The cycle is impacted by tax affection on economic sectors. Product cost is increased by sales tax and transfer owing tax which is different from sector to another. Practically, Islamic Bank financial services are impacted by producer buying all taxes and fees and cost to get profit also it is impacted by Islamic Bank taxes, costs, and profits.

Tax law gives Traditional Banks benefit to reduce tax income by reducing loan interest to get financial leverage, also dealing in Traditional Banks is fixed by loan services with interest which is not impacted by many tax types. Companies and Islamic Banking sell real products as cars, building, and machines in many steps than Traditional Banks.

Jordan Taxes’ Impacts Cost Of Ijarah Tamwilia Service Cycle In Jordan Islamic Bank

Ijarah Tamwilia service cycle is an example. Jordan Islamic Bank Ijarah Tamwilia cycle is affected by different types of taxes than in Traditional Bank. Tax increases on Islamic Banks more than Traditional Bank because Ijarah Tamwilia (lease and sell) service obligates customers to by yearly building tax based on commercial type.

Practically case study, Ijarah Tamwilia service in Jordanian Islamic Bank contract no: (2012/500) was faced problem of unexpected taxes after 4 years.

The customer surprised as result to unexpected tax because he thinks that taxes are the responsibility of the bank as owner on other hand the government obligates tax on flat with high tax because it considers flats which owned by bank is commercial type which is more than residential type. Practically, after four years the customer will buy the following taxes and fees.

1. The customer was bought (3500) JD tax in order to transfer owning from seller to the bank after customer signed contract in 2012.

2. 639.360 to buy taxes.

3. Fines on flat based on Table 1.

| Table 1 Taxes Of Customer Contract No (1012/500) In 31/8/2018 |

|||||

| Tax type | Tax amount | Last tax | Last fines | Courage discount | Net taxes and fines |

| building tax | 96 JD | 288 JD | 57.600 JD | 0 | 441.600 JD |

| Knowledge Tax | 19.20 JD | 57.6 JD | 5.760 JD | 0 | 82.560 JD |

| The contribution of sewage | 28.80 JD | 86.400 JD | 0 | 0 | 115.200 JD |

| All amount | 144 JD | 432 JD | 63.360 | 0 | 639.360 JD |

Source: (Nazal, 2016) depend on Tax document of the customer up to contract no (2012/500) from 2012- 2016.

Table 1 explains tax effect on Ijarah Tamwilia service cycle. It increase cost as result to the follow fees:

1. There are fees of Center Bank commission on contract amount=1% after signing the contract.

2. There are fees of government documenting stamp on contract amount=0.3% after signing the contract.

By comparing between choices of financing buying flat, Customer takes loan from Islamic Bank Ijarah Tamwilia service or gets loan from Traditional Bank with interest or buys from the building industry company by delaying installment. The best way is to buy from building Industry Company is to avoid increasing of margin profits on customer cost also to avoid transfer owning tax from seller to the bank and after buying installments the bank will transfer owning to customer after buying fees. Also customer will reduce building tax yearly from commercial type to be residential type.

Increasing Jordan Islamic Bank costs in Ijarah Tamwilia, and increasing costs of sharing in producing by owning companies in different sectors comes as result to tax impact.

Jordan Taxes Types Impacts Jordan Islamic Bank Sharing In Companies

Cost of service cycle in Jordan Islamic Bank is affected by tax than Traditional Bank because it by Jordan Taxes as producer or goods sellers.

Jordan Islamic Bank tries to reduce cost of products by owning companies. It reduces margin profit amount by direct selling products directly from its companies. The traditional way shows margin profit of producer plus margin profit of the bank. Jordan Islamic Bank distributed shares owning in companies is shown in Table 2.

| Table 2 Distributed Jordan Islamic Bank Owning Shares In Companies |

|

| The companies that Jordan Islamic Bank owning | Jordan Islamic Bank Percentage of sharing owning in company |

| Al-Samaha for Finance and Investment | 100% |

| • Technical Applications for the Future | 100% |

| Sanabel Al Khair Financial Investments | 100% |

| • Age Schools | 99.4% |

| • Al-Samaha Real Estate | 98.7% |

| • Arabian Metal Pipes Manufacturing | 49.458% |

| • Jordan for the Production of Medicines | 44.167% |

| • Islamic insurance | 41.667% |

| • Industrial Agricultural Business | 40.129% |

| Al Amin Investment | 38.074% |

| • Jordan International Trade Center | 31.413% |

| • Global Chemical Industries | 30.7% |

| • Jordanian Chemical Industries | 22.539% |

| • Zarqa for Education and Investment | 22.497% |

| • National Cable and Wire Industry | 21.007% |

| • Methaq Real Estate Investments | 19.949% |

| Petra Education | 15.263% |

| • Modern Global Vegetable Oils | 10% |

| • Arabia for the Manufacture of Pesticides and Veterinary Medicines | 9.277% |

| • Jordanian Press and Publishing | 4.749% |

| • Jordan Press Foundation | 2.265% |

| • Jordanian Electricity | 2.149% |

| • Arab Center for Pharmaceutical Industries | 2% |

| • The dimensions of Jordan and the UAE for commercial investment | 1.775% |

| • International Islamic Classification Agency | 1.52% |

| • Al Baraka Islamic Bank BSC (Closed) | 0.2042% |

Sources: Based on Mubasher web of Jordan Islamic Bank shares details 11/6/2018.

It owns in different economic sectors and affected by increasing costs of producing as result to tax revenue in general budget.

Practically, Jordan Islamic Bank own shares in some companies in different economic sectors to meet its investing services. It impacts by tax. Jordan Islamic Bank shows loss of assets as way to reduce income tax (Table 3).

| Table 3 Assets Loss In Jordan Islamic Bank During 2010-2017 |

|

| Year | Jordan Islamic Bank assets loss |

| 2010 | 0.147 |

| 2011 | 0.555 |

| 2012 | 0.191 |

| 2013 | 0 |

| 2014 | 0.4 |

| 2015 | 0.2 |

| 2016 | 1.6 |

| 2017 | 0 |

Source: Annual reports in Jordan Islamic Bank.

Jordan Islamic Bank is affected by income tax as Traditional Banks; also it is impacted by other types of tax. It tries to reduce costs by sharing in producing companies but practically its sharing is affected by income tax, sales tax, transfer owning tax, and other fees. Tax increases its services cost than Traditional Bank services cost. Jordan Islamic Bank understands increasing cost of their services on customers; therefore, it shares in companies. Sharing is way to reduce cost of marketing or selling but it cannot reduce tax cost.

Cost Of Jordan Islamic Bank Service Cycle Is Affected By Economic Sectors Different Tax Types

Government obligates the highest income tax on banking sector which was between 45%- 30% and obligates other different tax types on Islamic Banks based on real dealing with services and goods within its service cycle of selling, leasing, sharing in companies.

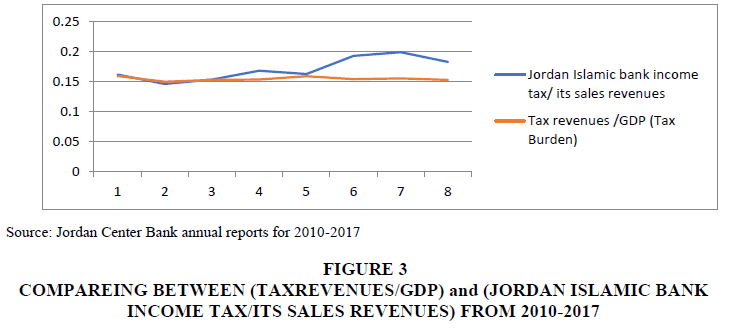

By comparing between two ratios which are:

1. Tax revenue/GDP.

2. Jordan Islamic Bank income tax/its sales revenues.

Table 4 shows Jordan Islamic Bank by high income tax.

| Table 4 Compareing Between (Taxrevenues/Gdp) And (Jordan Islamic Bank Income Tax/ Its Sales Revenues) From 2010-2017 |

||

| Year | Tax revenues/GDP (Tax Burden) | Jordan Islamic Bank income tax/its sales revenues |

| 2010 | 0.159151 | 0.16156 |

| 2011 | 0.149546 | 0.14578 |

| 2012 | 0.152576 | 0.153125 |

| 2013 | 0.153131 | 0.167959 |

| 2014 | 0.158709 | 0.162489 |

| 2015 | 0.15381 | 0.192708 |

| 2016 | 0.155013 | 0.198662 |

| 2017 | 0.152679 | 0.182437 |

Source: Jordan Center Bank annual reports for 2010-2017.

Jordan Islamic Bank buys income tax based on its sales revenues more than general budget tax revenues based on GDP because income tax in banking sector is the highest type (Figure 3).

Figure 3: Compareing Between (Taxrevenues/Gdp) And (Jordan Islamic Bank Income Tax/Its Sales Revenues) From 2010-2017

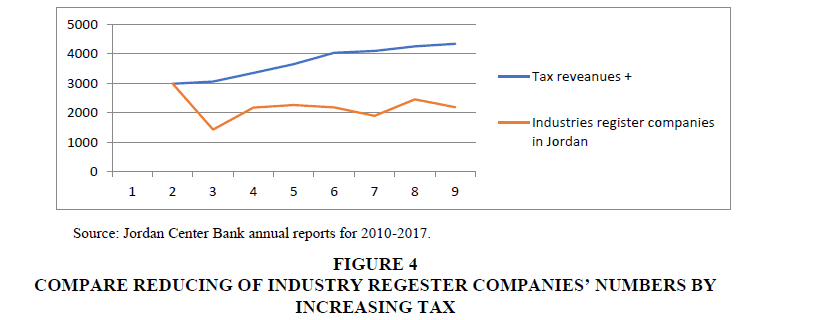

Jordan Islamic Bank deals with products as services and goods; therefore, it is affected by different tax types in economic sectors. It is impacted by Income tax and other tax types. In generally, Tax was reason to increase cost and some companies get in clears (Table 5 and Figures 4-6).

| Table 5 Discuss Changing Of Companies’ Regester Numbers In Jordan Economic Sectors Between 2015-2016 |

|||

| Companies Registers in Jordan Economic Sectors | 2015 | 2016 | Discuss the Changing |

| All companies registers in economic activities as Agriculture companies. | Numbers:720 Capital: 12.5 (million) |

Numbers:810 Capital: 15.5 (million) |

Increased this mean there is chance to make profit and chance to avoid tax risk than other sectors. |

| All companies registers in economic activities as Industry companies. | Numbers: 891 Capital: 49.1 (million) |

Numbers: 2,455 Capital: 42.1 (million) |

Increased numbers of companies but the capital is reduced. There is transfer of capital or loss of capital. Growth depends on expected new companies. |

| All companies registers in economic activities as Building companies. | Numbers: 148 Capital: 7.7 (million) |

Numbers: 121 Capital: 5.2 (million) |

Reduced there is losing of this sector growth. |

| All companies registers in economic activities as Commercial companies. | Numbers: 1,356 Capital: 22.3 (million) |

Numbers:1,374 Capital: 20.5 (million) |

Increased numbers but there is reduced of capital. There is transfer of capital or loss of capital. Growth depends on expected new companies. |

| All companies register in economic activities as Services companies. | Numbers: 2,222 Capital: 67.4 (million) |

Numbers: 2,301 Capital: 44.1 (million) |

Increased number with reduced capital. There is transfer of capital or loss of capital. Growth depends on expected new companies. |

Sources: Jordan Center Bank annual report, 2016 and Jordan financial market annual report, 2016.

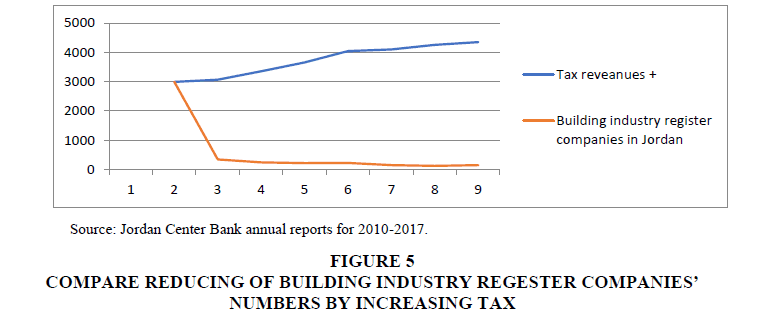

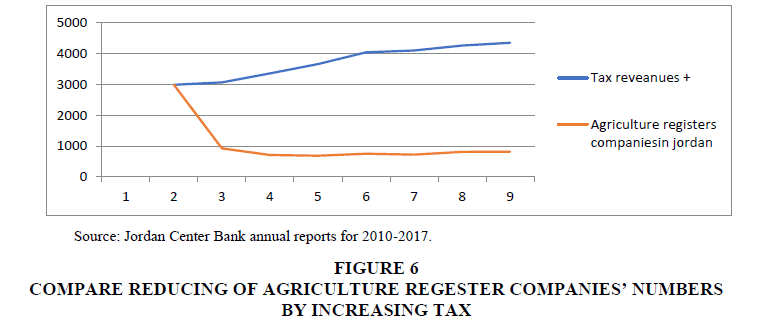

There is increasing of tax revenue in general budget from 2010-2017 in spite of reducing in industries registers companies’ numbers.

There is increasing of tax revenue in general budget from 2010-2017 in spite of reducing in building industries registers companies’ numbers.

There is increasing of tax revenue in general budget from 2010-2017 in spite of reducing in agriculture registers companies’ numbers.

Jordan Islamic Bank Choosing Ifrs And Tax Law Accounting Data To Reduce Jordan Income Tax

Jordan Islamic Bank tries to face tax risk impact on its investing to protect aims of shareholders, employee, and supporters. It tries to increase its net profit. It uses traditional ways of accounting based on IFRS which is shown in Jordan Islamic Bank annual reports.

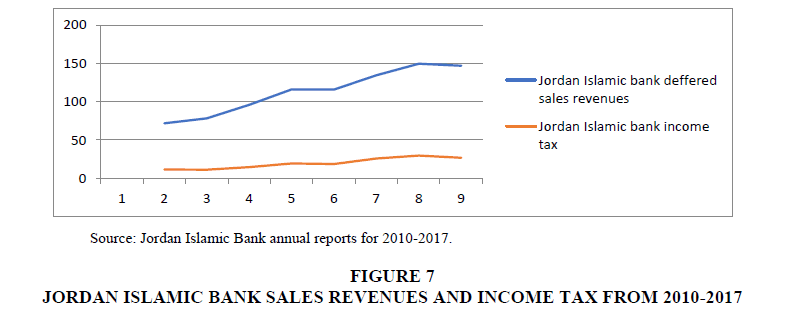

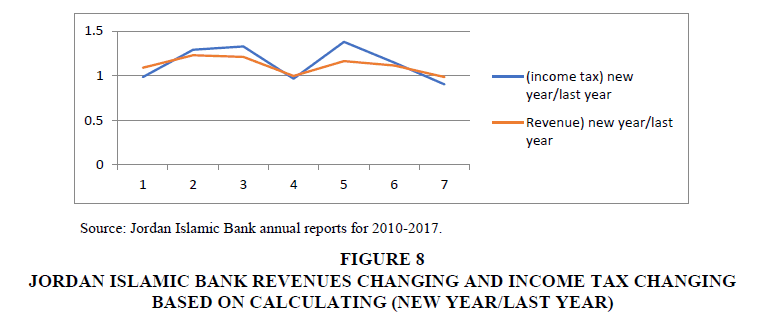

Jordan Islamic Bank buys Income tax. When Jordan Islamic Bank increases revenue it faces income tax increasing but this increasing is not equal to meet increasing of revenue (Table 6 and Figures 7 & 8).

Figure 8: Jordan Islamic Bank Revenues Changing And Income Tax Changing Based On Calculating (New Year/Last Year)

| Table 6 COMPARING CHANGING BETWEEN JORDAN ISLAMIC BANK REVENUES AND INCOME TAX |

||||

| Year | Jordan Islamic Bank Income Tax | (Income Tax) New Year/Last Year | Jordan Islamic Bank Sales Revenues | (Revenue) New Year/Last Year |

| 2010 | 11.6 | - | 71.8 | - |

| 2011 | 11.4 | 0.982759 | 78.2 | 1.0891365 |

| Reduce income tax after increase Jordan Islamic Bank revenue. | ||||

| 2012 | 14.7 | 1.289474 | 96 | 1.2276215 |

| Increase income tax after increase Jordan Islamic Bank revenue. | ||||

| 2013 | 19.5 | 1.326531 | 116.1 | 1.209375 |

| Increase income tax after increase Jordan Islamic Bank revenue. | ||||

| 2014 | 18.8 | 0.964103 | 115.7 | 0.9965547 |

| Reduce income tax after reduce Jordan Islamic Bank revenue. | ||||

| 2015 | 25.9 | 1.37766 | 134.4 | 1.1616249 |

| Increase income tax after increase Jordan Islamic Bank revenue. | ||||

| 2016 | 29.7 | 1.146718 | 149.5 | 1.1123512 |

| Increase income tax after increase Jordan Islamic Bank revenue. | ||||

| 2017 | 26.8 | 0.902357 | 146.9 | 0.9826087 |

| Reduce income tax after reduce Jordan Islamic Bank revenue. | ||||

Source: Jordan Center Bank annual reports for 2010-2017.

This Table shows time of study during 2012-2017. There was Increasing revenue in Jordan Islamic Bank and increasing income tax also reducing revenue was reducing income tax (Figures 7 & 8).

Increasing of Jordan Islamic Bank revenue was met increasing of income tax also reducing of its revenue was met reducing of income tax but increasing degree or decreasing degree is not correspond. And there is need to be explained.

Jordan Islamic Bank Choosing Depreciation, Assets Loss, Employees Cost And Financial Leverage To Reduce Jordan Income Tax Affection

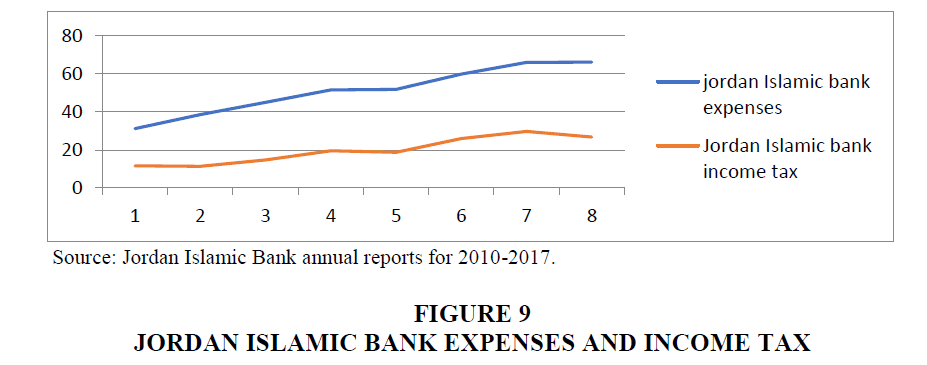

Increasing of Jordan Islamic Bank is not meeting the similar increasing of buying income tax. There are many factors impact the amount of buying income tax beside the impact of Jordan Islamic Bank revenue as expenses (Figure 9 and Table 7).

| Table 7 Comparing Jordan Islamic Changing Between Expenses And Income Tax |

||||

| Year | Jordan Islamic Bank Expenses | Jordan Islamic Bank Income Tax | Bank Income Tax/The Bank Expenses | Jordan Islamic Bank Revenue |

| 2010 | 31.17 | 11.6 | 0.372152711 | 71.8 |

| 2011 | 38.53 | 11.4 | 0.295873345 | 78.2 |

| After increasing expenses from 2010 to 2011 income tax was reduced in spite of increasing revenue. | ||||

| 2012 | 44.89 | 14.7 | 0.327467142 | 116.1 |

| After increasing expenses from 2011 to 2012 income tax was increased as result to increase revenue | ||||

| 2013 | 51.45 | 19.5 | 0.379008746 | 134.4 |

| After increasing expenses from 2012 to 2013 income tax was increased as result to increase revenue. | ||||

| 2014 | 51.75 | 18.8 | 0.363285024 | 146.9 |

| After increasing expenses from 2013 to 2014 income tax was reduced as result to increase revenue. | ||||

| 2015 | 59.79 | 25.9 | 0.433182806 | 78.2 |

| After increasing expenses from 2014 to 2015 income tax was increased in spite of reducing revenue. | ||||

| 2016 | 65.84 | 29.7 | 0.45109356 | 116.1 |

| After increase expenses from 2015to 2016 income tax was increased as result to increase revenue. | ||||

| 2017 | 66.03 | 26.8 | 0.405876117 | 134.4 |

| After increasing expenses from 2016 to 2017 income tax was reduced in spite of increasing revenue. | ||||

Source: Jordan islamic bank annual reports for 2010-2017.

Ratio of revenue changing from year to year is not similar to income tax changing from year to year. Income tax changing increased more than revenues changing in 2012, 2013, 2015, and 2016. This means that income tax is not fixed calculated. It had different way of calculating from year to year. Changing of income tax has reasons as follow:

1. Reduced tax from 45% in 2012 to 35% 2017.

2. Find accepted ways to reduce tax as depreciation, get finance leverage by Morabaha margin profit as interest in Traditional Bank.

3. Increase expenses as depreciations, employees’ expenses, and loss in asset.

There is relation between Jordan Islamic Bank expenses and Jordan Islamic Bank income tax (Figure 9).

Jordan Islamic Bank uses expenses to impact income tax. But this solution is not suitable every time because income tax is taken from profit after interest and expenses is one of the factors that impact income tax. When expenses were increased there must be high revenues.

Table 7 explains the changing between Jordan Islamic bank expenses and Income tax.

Practically, Jordan Islamic Bank tries to reduce tax by depreciations, employees’ expenses, and loss in assets but there was diffident impact. This difference comes as result to reduce tax from 45% in 2012 to 35% in 2017 (Table 8).

| Table 8 Comparing Jordan Islamic Bank Changing In Income Tax, Depreciation, Employee’ Expenses, And Assets Lose |

||||

| Year | Jordan Islamic Bank income tax | Jordan Islamic Bank Depreciation | Jordan Islamic Bank Employee Expenses | Jordan Islamic Bank Assets Loss |

| 2010 | 11.6 | 2.8 | 18.79 | 0.147 |

| 2011 | 11.4 | 3 | 23.77 | 0.555 |

| 2012 | 14.7 | 3.3 | 27.138 | 0.191 |

| 2013 | 19.5 | 3.87 | 31.16 | 0 |

| 2014 | 18.8 | 4.2 | 30.9 | 0.4 |

| 2015 | 25.9 | 6.67 | 32.45 | 0.2 |

| 2016 | 29.7 | 6.87 | 34.977 | 1.6 |

| 2017 | 26.8 | 6.6 | 37.39 | 0 |

Source: Jordan Islamic Bank annual reports for 2010-2017.

The table shows the three types impact increasing expenses to increase income tax. The Jordan Islamic Bank increase depreciation and expenses from 2011-2016 also it increase expenses of employee yearly.

Choosing Traditional Accounting Ways In Jordan Islamic Bank Impacts Islamic Rules Application

Zuhili (1997) explained Fiqh rules as standards to accept dealing between dealers. Every contract has conditions to accept dealer, accept acceptance satisfied, accept buying product, and accept price. Jordan Islamic Bank is affected by Islamic rules. Every service has Islamic rules to be accepted by Supervisory Islamic Board (SIB). When any service is not met Islamic rules, (SIB) will give general manager Fatwa to cancel the service. SIB has to give annual report beside external auditor to accept Jordan Islamic Bank services accounting (Jordan Islamic Bank Annual Reports, 2010-2017). Islamic rules are divided to accept service rules and accept service accounting. Jordan Islamic Bank managing is applies IFRS as law but SIB is just Fatwa to help dealing services with Islamic rules. Fatwa affect Islamic emotion dealing with customers.

SIB understands the basic contract of Jordan Islamic Bank organization by Islamic rules as sharing contract between shareholders to produce services and products. SIB has to analyze the sharing contract by Islamic rules and meet it is accept developing to accept the bank sharing. It considers shareholders sharing as big Musharakah contract. Al-Khiat (1995) explained that contract as sharing can include all type of contracts as selling and lease but Modarabah sharing cannot include sharing by Musharakah. This means there is division of contract types based on including other contracts as selling, lease, working, and Modarabah sharing.

Musharakah sharing is developed investing tool as company which is used by Islamic Banks (Shaikh, 2011). It can be shared between citizens, or companies, or between citizens and companies or between government and companies. Musharakah share value show the result of investing by Islamic rules. It is impacted by Fiqh limitation. This limitation depends on calculating profit and distributed profit also it depends on calculating loss and distributed loss.

The Fiqh rules will cancel the contract which is not ruled by profit and loss as in Islamic rules. It asks for fairness, therefore, it obligates to give shareholders returns based on the Islamic conditions. It is different than sharing in traditional company. Musharakah limitations are as follow:

A. Limits of share value by Fiqh are as follow:

1. Depend on market value by experts markets to give accept price fairly.

2. Does not calculate value based on depreciation.

3. Getting loan interest or giving loan interest is forbidden.

It impacts by two type of financing assets Sharing by Musharakah is obligating every shareholder to buy part of capital. Sharing by capital can be Sukuk or company. It has two cases as follow:

1. First case: Sharing investing depends only on finance by equity without liability. It is not buy by credit or get loan.

2. Second case: Its investing financed by equity and liability because it is buy by credit and get loan with its capital grantee.

Table 9 explains Type of Islamic Banks sharing in general in order to show loan (liability) impact.

| Table 9 Sharing By Musharakah Balance Sheet |

|

| First case of sharing balance sheet | Second case of sharing balance sheet |

| Assets. | Assets. |

| Liability (Zero). | Liability (buying products with delay cash or installments). |

| Equity. | Equity. |

| Assets=equities. | Assets=equities+liabilities. |

| The sharing investing is limit finance by equities and there is no way to finance by liability. | The sharing investing service is possibility to get loan without interest to get operation leverage and financial leverage. |

Source: Created by author.

Second case of sharing is developed in Islamic Banks to add customers investing deposits in liabilities because. It owns by customer and the Islamic Bank will be applying Moudarabah sharing as manager not as owner.

B. Limits of share price by Fiqh accounting when equity divided to shares and every share has same profit and same lose:

1. Share price=Equity/Shares numbers.

2. Equity=(Assets value by market+net profit after tax)–(liabilities without interest+loss).

3. Assets value by market=Market value of fixed assets by market expert acceptance+Market value of current assets by market expert acceptance.

4. Liabilities without interest=buying things by credit as goods, machine, car, and building.

5. Net profit after tax is avoided deprecation and loan interest.

6. Every share in the sharing will get same return and same lose.

C. Limits of share price by Fiqh accounting when equity divided to shares and every share has not same profit but same lose.

1. Share price=Equity/Shares numbers.

2. Equity=(Assets value by market+net profit after tax)–(liabilities without interest+loss).

3. Assets value by market=Market value of fixed assets by market expert acceptance+Market value of current assets by market expert acceptance.

4. Liabilities without interest=buying things by credit as goods, machine, car, and building.

5. Net profit after tax is avoided deprecation and loan interest.

6. Every share has same lose.

7. Shares are classified based on distributed profit percentage as in the Table 10.

| Table 10 Distributed Profit Percentage Based On Sharing Contract Acceptance Of Distributing Sharers Profit Percentage |

|||||

| Accept common percentage of profit distributed between shareholders | Shares classified type | Share cost=capital of establishing sharing/shares numbers | Distributed profit based on every share type (+) | Distributed lose for every share regardless of its type (-) | Share price=(share cost-distributed lose+distributed profit) |

| Ex: 20% | A | Numbers | Profit*(percentage)/shares type Numbers | Lose/All shares=Same lose for every share | A type Price |

| Ex: 30% | B | Numbers | Profi*(percentage)/shares type Numbers | B type Price | |

| Ex: 50% | C | Numbers | Profit*(percentage)/shares type Numbers | C type Price | |

| Equal 100% | All shares numbers | ||||

Source: Created by author.

Islamic Banks in Jordan directs sharing based on ways to reduce tax as using depreciation and accounting policies but it does not give disclosure of assets as in Fiqh rule. Fiqh rules just evaluate assets by market price at time of evaluating. This will impact disclosure negatively because IFRS accept depreciation but Islamic rules not accept it. There is need to give other balance sheet and income statement without depreciation to meet Islamic rules.

Jordan Islamic Bank depends on fixed asset depreciation as cost of asset to reduce the amount of revenue that affected by income tax calculating (Table 11).

| Table 11 Fixed Asset Depreciation In Jordan Islamic Bank (Million) |

|

| Years | Depreciation of Fixed Assets Yearly |

| 2017 | 6.61 |

| 2016 | 6.87 |

| 2015 | 6.67 |

| 2014 | 4.25 |

| 2013 | 3.87 |

| 2012 | 3.32 |

| 2011 | 3.06 |

| 2010 | 2.80 |

| 2009 | 2.19 |

Sources: Jordan Islamic Bank annual reports from 201-2016.

Some Islamic Bank in Jordan as International Arab Islamic Bank and Jordan Islamic Bank try to get finance leverage by get profit of Morabaha service installments certified from sellers. When the bank buys goods by Morabaha service from other Islamic Bank with installments buying, it will get certified which shows the installment calculated based on the rule: (cost of goods+other costs as transport or documentation fees+margin of profit=the price).

Certified will explain the margin profit as interest of loan. Accepting tax law of Morabaha margin profit certified will give the buyer right to reduce margin profit as interest. It will reduce tax (Table 12).

| Table 12 Income Statement Financial Levarage Case In Jordan Islamic Bank |

||

| Income Statement | Case 1 | Case 2 |

| Returns | - | - |

| Costs (sales and operations) | - | - |

| Operation profit | - | - |

| Interest | Forbidden dealing that cause to cancel the contract. | Forbidden dealing that cause to cancel the contract but the bank has the certified of buying profit margin of Morabaha installments. |

| Net profit after interest | Zero. | Certified buying profit margin of Morabaha installments is accept in tax law as interest. |

| Tax from Net profit after interest | The bank cannot get finance leverage because there is no buying interest. | The bank can get finance leverage because there is no buying interest. |

| Net profit after tax | Net profit after tax will not increase because of financial leverage. | Net profit after tax will be increased because of financial leverage. |

Source: Created by author.

Practically, ways of facing tax developed the Islamic Bank services accounting. It impacts disclosure. Islamic Bank tries to find ways of reducing tax based on traditional acceptance ways as Traditional Bank. This is agreed by (Atma and Alzabi, 2014) studied. They found problem of discloser because leaders choose the suitable accounting policy based on their aims.

Jordan Islamic Bank tries to reduce tax by reduces sharing in Musharakah. It depends on working efforts or managing customers investing to get return. Working return increases expenses as salaries. It gets fixed return in spite of complexity tax increasing.

Some branches managers try to announce the profit over his target for next year. He delays the profit for next year. This way will reduce the real profit in current year. He uses the expect possibility to reduce tax as reason.

Weakness Point And The Strength Point For Accounting Disclosure In Jordan Islamic Bank Based On Tax Affection

There is strength point for accounting disclosure in Jordan Islamic Bank. It applies the IFRS to meet international unit of accounting data standards. It follows the center bank law and tax law as obligatory rules of accounting data. It reduces services cost by own companies as trader or producer to avoid cost of marketing commissions and own goods to meet the Islamic rule: “owning goods before selling goods”. It owns reserves and has insurances to cover loss. It gives working services without loan interest to give benefits and meet Traditional Bank service benefit. It uses accepted ways by tax law to reduce income tax by depreciation, assets loss, employees cost, and financial leverage therefore there the relation between income tax and Jordan Islamic Bank revenue is in the same direct but with reducing tax. These strength factors help the bank to get competition ability in Jordan. It is competing Islamic Banks in Jordan as International Islamic Arab Bank, Al Saf wa Bank, and Al-Rajhi Bank also It is competing Traditional Banks.

There is weakness point for accounting disclosure in Jordan Islamic Bank. It is impacted by Jordan Taxes than Traditional Banks because it works as trader or producer. There is possibility to impact by income tax and other tax as sales tax, transfer owning tax beside cost of storing and insurance. This will impact investing services cost increasing in Jordan Islamic Bank than Traditional Banks investing cost on other hand there is possibility risk of goods damage in Jordan Islamic Bank than Traditional Banks. Jordan Islamic Bank has to apply accounting Islamic rules in financial tables because it shows the fair value but applying IFRS and tax law will cause weakness of applying Islamic rules accounting as result to choice assets depreciation than assets market value. Evaluation Jordan Islamic Bank based on financial statements accounting data by IFRS and Tax law is not fairly as Islamic rules of accounting.

Jordan Islamic bank managing his asset based on tax impacts. When assets return is expected to buy high income tax, it reduces it or transfers it to customer or avoids dealing with this asset. Because of this impact the bank has idea to reduce sharing investing asset by working as manager to get commission. It accepts investing by customer’s capital and customer will buy part of the investing return as income tax but the bank will get his commission or managing return as expenses not as sharer to avoid income tax.

Conclutions And Recommendations

Jordan tax is affected by Jordan Islamic Bank accounting disclosure. Jordan taxes types’ impact increasing service cycle cost in Jordan Islamic Bank than Traditional Bank. Jordan economic sectors taxes are affected service cycle cost in Jordan Islamic Bank. Increasing of revenue meets increasing of income tax but Jordan Islamic bank reduce this increasing by choices of account based on IFRS and Tax Law. It uses choices of depreciation, assets loss, employees cost, and financial leverage to reduce Jordan income tax affection. Choices of accounting data is affected disclosure and cause weakness of applying Islamic rules of accounting therefore Jordan Islamic Bank disclosure had weakness point and strength point of accounting disclosure in Jordan based on tax affection. Searcher recommended to adjusted Jordan tax law in order to avoid Islamic bank disclosure and meet the fair value also to increase Islamic bank competition ability to improve economic sectors.

References

- Alawneh, A. (2017). The impact of public expenditure and public debt on taxes: A case study of Jordan. Accounting and Finance Research, 6(3), 10-23.

- Al-hadidi, E. (2017). Tax evasion in Jordan: Reality, causes, and result, research. Journal of Finance and Accounting, 8(12), 149-163.

- Al-Khiat, A. (1995). Company contracts. Dustore publishing, Amman, Jordan.

- Al sheikh, E. Al-adhun, M., Qasem, M., & Yusef, A. (2016). Factors affecting corporate tax evasion: Evidence from Jordan. International Journal for Innovation and Research, 4(6), 16-23.

- Al-shirah, A., Abdul Jabar, H., & Samsudin, R. (2016). Determinants of sales tax compliance in small and medium enterprises in Jordan: A call for empirical research. World Journal of Management and Behavioral Studies, 4(1), 41-46.

- Arab NGO Network for Development (ANND) (2017). Policy briefs: Repercussions of tax policies in the Arab region, Buirut, Lebanon. Retrieved from: www.annd.org

- Atma, M., & Alzabi, Z. (2014). The role of the audit profession in strengthening oversight and anti-corruption, Tenth International scientific conference professional. Magazine of Jordanian Society of Chartered Accountants, 99-100.

- Bashayerh, A., & Oran, A. (2016). Tax capacity and effort and economic implications: Evidence from Jordan. Jordan Journal of Economic Sciences, 3(2), 179-191.

- Bawaneh, S. (2017). Tax collection mechanism back to basic farming: The case of Jordan. International Journal of Business and Social Science, 8(12), 22-25.

- Central Bank of Jordan Annual Report. (2016). Retrieved from: www.cbj.gov.com

- Jordan Islamic Bank Annual Report. (2010). Retrieved from http://www.jordanislamicbank.com/sites/default/ files/Report2010.pdf

- Jordan Islamic Bank Annual Report. (2012). Retrieved from http://www.jordanislamicbank.com/sites/default/files/ anuual%202012.pdf

- Jordan Islamic Bank Annual Report. (2014). Retrieved from http://www.jordanislamicbank.com/sites/default/files/ anuual 2014(1).pdf

- Jordan Islamic Bank Annual Report. (2015). Retrieved from http://www.jordanislamicbank.com/sites/default/files/ report2015s2.pdf

- Jordan Islamic Bank Annual Report. (2016). Retrieved from http://www.jordanislamicbank.com/sites/default/files /IB_AnnualReport_2016_8_10_LOW.pdf 31/11/2017

- Jordan Financial Market Annual Report. (2016). Retrieved from https://www.ase.com.jo/en/node/536

- Nazal, A.I. (2016). Added value of Ijarah Tamwilia service in Jordanian islamic bank (Case study of contract no: 2012/500). Humanities and Social Sciences Letter, Pakistan, 5(1), 11.

- Qatar Financial Centre Authority. (2013). Cross border taxation of Islamic finance in the MENA region. Retrieved from http://www.qfc.qa/Admin/Resources/Resources/Cross%20border%20taxation%20of%20Islamic% 202013.pdf

- Shaikh, S.A. (2011). A critical analysis of Mudarabah & a new approach to equity financing in Islamic finance. Journal of Islamic Banking & Finance, International Association of Islamic Bank, Karachi, Pakistan, 28(3).

- Zuhili, W. (1997). Islamic jurisprudence and evidence. Dar al fker, Damascus, Syria (Part 4).