Research Article: 2022 Vol: 26 Issue: 5S

An Analysis of Managerial Skills on Banking Sector Performance in Zimbabwe (2010-2019)

Mukarati. J., Midlands State University

Abel. S., Midlands State University

Mutenheri. E., Midlands State University

Le Roux. P., Nelson Mandela University

Citation Information: Mukarati, J., Abel, S., Mutenheri, E., & Le Roux, P. (2022). An analysis of managerial skills on banking sector performance in Zimbabwe (2010-2019). Academy of Accounting and Financial Studies Journal, 26(S5), 1-12.

Abstract

This study analyses the relationship between managerial skills and performance of commercial banks in Zimbabwe and managerial skill characteristics namely the level of education, years of experience and gender composition. The study also examined the substitution possibilities between a manager's level of education and years of experience in relation to bank performance. The hypotheses of the study were that a positive relationship exists between managerial skill characteristics and return asset and that there are substitution possibilities between years of experience and education level. Using a fixed effect model to analyze the relation between managerial skills and profitability among banks listed on the Zimbabwe stock exchange and the key findings of the study was that there exist substitution possibilities between managers’ level of education and years of experience in relation to bank performance. The results encourage banks in Zimbabwe to monitor and evaluate these factors for improvement to enable the sustainability of banks and industry for economic growth. The banking sector was recommended to invest in analysis of gender composition on performance as part of corporate governance issues. The study also suggested further research into a comparative study on the effects of managerial skills on all financial institutions to improve operational performance. The overall performance of non-banking financial institutions may be focused in future in order to improve the profitability of the financial sector as a whole.

Keywords

Managerial Skills, Bank Performance, Fixed Effect Model.

Introduction

Management education and banking performance have been a topic of increased interest in both academic and popular literature with a number of empirical literature establishing the importance of education in explaining the difference in bank performance. These researches were motivated by the assumption that managers have a strategic role to play in the performance of a bank given the symbolic power that they exercise on decision making and key operations of a bank with these changes and importance of certain educational background of managers to organizational strategies. Managers who have completed their postgraduate degree may not necessarily be able to provide the bank with a performance advantage. Most empirical studies confirm a positive relationship between education and bank performance as employees with specialized knowledge possess special capabilities.

Empirical works on education and bank performance is inconclusive and most empirical studies focused on the short run effect of the relationship with few studies having dealt with the long run relationship at entrepreneurial level. In spite of a general agreement that management skills influence bank’s performance, empirical findings remain divided and have provided little evidence to support which managerial/behavioral characteristics, educational background or managers’ attributes are essential for bank performance.

Thus, it becomes critical to provide country specific insights as to how educational backgrounds of managers are likely to affect banking sector performance in Zimbabwe. Particularly, we are going to examine whether there is any causal relationship between managerial skills and bank performance. This leaves us with the question of whether managerial education really matters to enhance bank performance given today’s challenges in the business world.

Given that the financial system in most developing countries is dominated by commercial banks and that the performance of the banking sector has repercussions across the length and breadth of the economy, an analysis in this study focused on the commercial banks and managerial skills were measured by assessing a manager education level, years of experience and gender composition. The banking sector in Zimbabwe have continued to revolutionise its operation through the adoption of technological innovation which lead to improvements in communication and data processing. The main objective of these improvements are to give the institutions opportunities to raise productive efficiency. Bank consolidated movement were witnessed in the financial sector with the hope of increasing efficiency. Though investigating the relationship between managerial skills and banking sector performance is not completely new in the area of research, country specific studies need to be carried to bring consensus in this area.

Specifically focusing on the education major of the managers and the performance of the banks listed on the Zimbabwe stock exchange, this study aims to find out whether there exists any significant and causal relationship between managerial skills and bank turnover which is a proxy of performance. This study seeks to analyze whether managerial education is important to enable the success of the manager in achieving a better bank performance. While focused on managers’ educational background, this thesis acknowledges and control for variables such as proportion of gender in management, capital to equity and bank size which are critical in influencing bank performance (Park et al., 1999).

The financial sector in Zimbabwe faced myopia of challenges due to macroeconomic instabilities and as such improving bank performance to build resilience is crucial for survival. As such financial companies have initiated a number of strategies with a view to equip management with the necessary skills. The objective of these strategies if to enable the banks to adapt in this dynamic economic environment and key among them is the education of the company management. The increased desire for performance has led to a number of companies’ managers seeking to uplift themselves academically.

Although previous studies have presented strong evidence that managerial skill is a major determinant of productivity and efficiency differences among firms, there have been a limited number of studies of this relationship from a financial institution perspective. Thus, the impact of education on company performance is still inconclusive with a review of the literature on the nature of the relationship between managerial skill and bank performance provides contradicting results. Certo investigated the contribution of education and the findings were that the level of education is significant in giving optimum decision and the same conclusion was found by Kokeno & Mutuvi who concluded that education has positive and significant effect on bank performance.

Darmadi found out that educational qualification of board members does matter on bank performance, a result which is opposed by studies by Gottesman & Morey (2010) who found no significant influence of education on bank performance. However, these empirical studies did not review the aspect of the type of academic qualification and how the educational major would impact bank performance. In this instance, there is need for a country specific study which sought to answer the research question: Does managerial skills affect bank performance among commercial banks in Zimbabwe?

Theoretical Framework

There are several volumes of theoretical work trying to understand the managerial education-performance link. The common and widely applied theory which forms the basis of this study is the Human capital theory by Becker which suggests that a bank can profit from the cognitive and productivity ability of an individual derived from the individual’s stock of experience, education and skills. According to this theory the level of education determined the marginal productivity of labor which tend to influence the bank’s earnings as the theory proposes a positive managerial education-performance link (Chames et al., 1994).

Studies of the effect of managerial skills have grown since the germination of human capital and business literature. These empirical studies define managerial skills as the organizational resources, which can deal with upcoming challenges, development of organizational planning, and lead the firm’s operations by utilizing the organizational recourses. The main important dimensions for managerial skills are management education, experience, gender composition and administrative skills Smith. These dimensions are considered important for planning the strategies, directing the organizational strategies, supervising the team in upcoming challenges, building the networking, distribution channels, and decision-making.

Theoretical Perspectives

The role and importance of managerial skills has been studied by scholars of different disciples such as law, economics, finance, sociology, strategic management and organisation theory Kiel & Nicholson. The extant literature has primarily focussed on the characteristics of the managers in affecting organisational performance Fama & Jensen. Meanwhile, some scholars have also paid attention to other issues such as ownership. CEO turnover and compensation Lausten in affecting firm performance. This section reviews four major theoretical perspectives of boards and governance mechanisms that are considered relevant for this study that is., the human capital theory, agency theory, stewardship theory, resource dependence theory and stakeholder theory (Akhtar, 2003; Yao & Han, 2007).

The Human Capital Theory

Production in the banking industry involves the use of intermediate inputs, which take part in the production of final or semi-final outputs. Bank performance depends upon the way it produces outputs from inputs. According to Rossi & Ruzzier productivity means the firm’s ability to produce an output at a minimum cost and to achieve that minimum cost the firm must produce the maximum output given its inputs (technical efficiency) and choose the appropriate input mix given the relative price of its inputs (allocative efficiency) (Kebede, 2001).

The human capital theory has been viewed as a source of value in effective organisation Thomas & Diez and with the emergence of knowledge- based economies, knowledge, skills and abilities are viewed as an invisible asset for sustainable organisation Wright. Thus continued education is critical for organisations to maintain competitiveness, hence as such organisations have emphasise more on knowledge acquisition Debrulle & Maes. The organisation relies on employees’ skills and knowledge for increased organisational performance. McConnell stated that a more educated, better-trained person is capable of supplying a larger amount of useful productive effort. As such, organisation relies on employee’s skills and knowledge for value creation in organisation. According to the human capita theory, different level of education and training contribute to different level of wages and salaries. The theory viewed employees as an invaluable asset and to invest in education and training led to significant gains in business competitive advantage and sustainability (Belliveau et al., 1996; Wagenvoort & Schure, 2005).

Empirical li Gottesman & Morey (2010) test the CEO education background and performance link on a sample of 390 US firms. Educational background is defined by the type of degree and the school selection of the CEO. Performance is measured by Tobin’s Q. The study finds a significant link between both the type of degree and school selectivity with Tobin’s Q. Results are explained by citing the length of time that lapses between the attainment of formal education and becoming CEO. This time gap renders formal education irrelevant (Maxam et al., 2006; Mintzberg, 1996; Pfeffer & Fong, 2002).

Jalbert examine the level of education and school ranking of CEOs of large US firms during the period, 1997-2006. Performance is assessed by return on assets, return on equity and return on investment. The study shows that, while being undergraduate is essential to become CEO, a graduate degree is not. Accomplishment of undergraduate degree does not explain differences in return on assets and return on investment, but is significantly and positively related to return on investment. School rank is found to be associated with return on equity. Graduate school ranking is marginally significantly cause variations in return on assets. While undergraduate school ranking affects return on investment positively, graduate school ranking affects the variable negatively (Graham et al., 2005; Tang & Tseng, 2004).

King show that both level of education and school quality influence firm performance. A sample of 149 large US firms are studied during 1992 to 2011. Results show CEOs with an MBA have the ability to deliver better performance than their counterparts. MBA from a better-ranked school is found to results in CEOs assuming more risk and adopt innovative models of business to achieve better performance. The study concludes that management degree enhances CEOs’ ability to manage bigger and more complex banks and attain improved performance. Cheng evaluate if the managerial ability and bank strategy fit can influence the bank performance with a sample of 34285 bank-year observations from US listed banks during the period, 1992-2014. Along with other variables, they check if CEO with a management degree can impact performance. The results show a positive association with performance and a negative relationship with risk (Chevalier & Ellison, 1999; Jones, 1994).

In Europe, Morresi examines CEO education-performance relation with a sample of 612 banks of market capitalization of over one billion euros listed on stock exchanges of UK, France, Italy, Spain, Germany and Netherlands during 2006 to 2015. The level of education, quality of school, and study specialization of CEO are evaluated against the accounting and market related performance. The study finds that CEOs with a higher degree and from a better-ranked school do not boost performance. But, CEOs from top ranked schools are found to enhance long-term market performance (Gottesman & Morey, 2006). The study infers the CEO education helps to reduce information asymmetry problem. Lu & Zhang examine the CEO education-performance link with the data of Chinese publicly-listed banks from 2003 to 2012. After addressing the endogeneity in the CEO education variable with the instrumental variables of the college entry exam rate in China's different provinces in different years, the impacts of cultural revolution on CEO education, and the growth environment of the CEO, the authors find that excellent CEO education can significantly enhance bank value, but cannot significantly affect banks' accounting profitability and growth rate (Golec, 1996). These findings suggest that a CEO with high education background can enhance the expectation on the value of the bank from investors; however, CEO education may not help enhance performance in the short run (Frey & Detterman, 2004; Graham & Harvey, 2001; Palia, 2000).

Saidu investigates CEO education-performance association with a sample of 222 bank year observations relating to financial banks listed in Nigerian stock exchange over the period, 2011-2016. Results show CEO education is positively linked to all the three measures of performance employed by the study (Gonchve, 2005). While the association with return on assets is statistically significant, the association with the other two variables, stock price and return on equity are not statistically significant. Research that tests the CEO education-performance comes up with mixed results. Broadly, the empirical works employ four broad measures of CEO education, level, ranking, domestic or foreign and field of study. This study employs three of these measures namely, level, domestic or foreign and field of study. The study proposes the following hypotheses (Fiorentino et al., 2006).

H1: Bank managers with a higher educational level (postgraduate degree) outperform banks supervised by managers with an undergraduate degree.

According to De Kort and Vermeulen, managers with high degrees tend to perform better compared to their counterparts as there seem to be a positive relationship between managerial education and turnover as measure of bank performance. It is hypothesized that managers with a graduate degree tend to be more productive compared to managers without graduate degrees.

H2: Banks supervised with managers with more experience show better bank profitability than banks which are controlled by less experienced managers.

The empirical literature on how effective the managers with more experience in delivering higher performance are mixed and in most of these studies highest level of experience is used as a proxy for innovation and strategic decision making (Gascon & Adenso-Diaz, 1997). Because of this, it is believed that bank performance is positively related to management experience (Hardle & Jeong, 2005). However, Lindorff & Jonson examined the association between management skills on shareholder return and found no significant relationship (Burt, 1992). They conclude that management skills may not offer relevant competencies at the CEO level. CEOs with management skills will provide a rich source of innovative ideas to develop policy initiation with analytical depth and rigour necessary for strategic decision Westphal & Milto. This shows the importance of experienced managers for delivering improved bank performance Smith. Since experience is viewed as important for bank performance, companies with highly experienced managers will perform better than those with less experience terature (Deary, 2004; Stefanou & Saxena, 1988).

Methodology

To analyse the impact of managerial skills on bank sector performance, data was collected from ZSE listed banks for the period 2010-2019. The study sample comprised of 6 banks and secondary data was taken from selected companies annual reports for the study period. The financial sector was chosen because of its significant decline in contribution to GDP (from 10% to 4.1%) between 2000 and 2021. The purpose of this study is to understand the impact of managerial skills on banking sector performance and therefore based on a sectorial case study will give in-depth analysis and understanding of the process (Berger, 1995 Spong et al., 1995).

Definition of Variables

Bank performance

Return on asset (ROA) which is the ratio of net income-to-the book value of assets, and bank profitability were used to measure bank performance. Bank performance may be largely influenced by skills of the managers (Chung & Pruitt, 1994; Podpiera & Podpiera, 2005).

Return on Assets

For the purpose of the study, return on assets (ROA) was used as a measure of bank profitability. ROA is an indicator of what management has accomplished with the given resources (assets). ROA has been used in many studies on firm performance. ROA is directly related to management’s ability to efficiently utilise corporate assets, which ultimately belong to shareholders. A lower return on assets will indicate inefficiency. ROA is considered a robust measure of firm performance and accordingly ROA was adopted in this study as a measure of bank profitability (Barker & Mueller, 2002; Gallacher, 2001).

Profit before tax is a measure that looks at a company's profits before the company has to pay corporate income tax. It essentially is all of a company's profits without the consideration of any taxes. Profit before tax can be found on the income statement as operating profit minus interest (Dechev, 1999; Kamath & Meier, 2006).

Variables of the Study

The Table 1 below shows the variables for the study which guided the researcher.

| Table 1 Variables of the Study | ||

| Variables | Definition | Measurement |

| Dependent Variable: ROA PBT |

Return on Asset Profit before Tax |

Ratio of operating income to total assets Value of profit before tax |

| Independent variables: EDU GE EXC |

Managerial Level of Education Proportion of female managers Years of managerial experience |

Number of managers who possessed a postgraduate degree qualifications Number of managers who are female an index of years of managerial experience |

| Control Variables: EQK BSIZE |

Equity capital Bank size |

fraction of equity-to-total assets Natural log of total bank assets |

Econometric Models

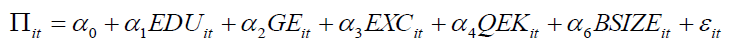

To examine the effect of managerial characteristics on bank performance using a bankyear unit of analysis, a fixed effect was applied. The model was chosen because it allows for the controlling of all time invariant omitted variables and to estimate a number of additional parameters (Imai, 2003). This methodology allows researchers to examine variations among cross-sectional units simultaneously with variations within individual units over time (Gaur & Gaur, 2006). It assumes that regression parameters do not change over time and do not differ between various cross-sectional units, enhancing the reliability of the coefficient estimate (Sathye, 2003). Thus, a fixed effect regression model was applied to examine the relationship between the variables (Oberholzer & Van Der Westhuizen, 2004). The model, comprising the vector variables was specified by the algebraic representation of equation:

Where Πit : is the bank performance measured by the dependent variables which are return on assets and profit before tax for financial year t, a is a constant, EDUit is the level of education for financial year t, : EXCit is the number of years of managerial experience for financial year t, GE is the proportion of female managers to total number of managers for financial year t, : QEKit are represented by the value of equity to total assets ratio for financial year t, : BSIZEit is total bank assets for financial year t and PBT is profit before tax for financial year t.. The possibility of substitution between the level of education and the years of experience was computed by determining whether a positive linear relationship exists between the two variables and hence the substitution possibilities (Finkelstein & Hambrick, 1996).

T:time period (2010- 2019)

α :Regression coefficients

ε :Error term

Results

Correlation Analysis

The Spearman correlation coefficient was applied to examine the relation between managerial educations, experience and bank performance in terms of return on asset. The null hypothesis assume that return on asset and managerial skills were independent. Two variables can be perfectly related, but if the relationship is not linear, Pearson's correlation coefficient is not an appropriate statistic for measuring their association. Pearson correlation test was thus conducted and the findings presented in Table 2 below. The null hypothesis was the nonexistence of correlation between technical efficiency and managerial skills (H0: p = 0).

| Table 2 Correlation Test | ||

| VARIABLE | CORELATION COEFFICIENT | DECISION |

| MANAGERIAL EDUCATION | 0.3799*** (0.0065) |

Reject H0 |

| MANAGERIAL EXPERIENCE | -0.2579*** (0.0706) |

Reject H0 |

The results finding with a correlation coefficient of 0.3799 between education and return on assets showed a moderate relation between these two variables. This implied that managers with a postgraduate qualification are more likes to contribute to bank performance. However, there seem to be a weak negative relation between managerial experience and return on asset with a correlation coefficient of -0.2579 (Fethi & Jackson, 2000).

Regression Results

The model equations were subjected to F-test to establish whether these variables were jointly significant. The F-test yielded a statistic of 5,056 (0.000) for the model where profit before tax was the dependent variable and 5.7738 (0.000) where return on asset was used as the dependent variable. The values of the F-statistics were statistically significant implying the existence of a linear relationship in both equations. An R-squared of 0.669 showed that about 66.95% of the variations in bank profit before tax can be explained by variation in the independent variables while around 56.5% of the variation in bank return on asset can be explained by variations in the independent variables in the study in Table 3.

| Table 3 Regression Results | ||

| Variable | Dependent variable PBT | Dependent variable ROA |

| Constant | 0.112 (0.92) |

-3.007 (0.04) |

| Education | -3.528*** (0.0071) |

-3.645 (0.1336) |

| Gender | 16.88*** | 14.375*** (0.0003) |

| Experience | 0.064*** (0.0030) |

-0.0648* (0.0942) |

| Equity to capital | 0.10865 (0.928) |

0.56001 (0.7127) |

| Bank size | 0.1353** (0.013) |

0.2901*** (0.0033) |

| Durban Watson | 2.523 | 1.328 |

| R-squared | 0.669 | 0.565 |

| F-statistic | 5.056 (0.0005) |

5.7738 (0.0000) |

Hypothesis 1 predicted that managerial education is positively associated with bank performance. The coefficient on education is negative and significant (β=-3.528; p<0.010). This coefficient remains negative in the model involving bank profit before tax. Thus Hypothesis 1 is not supported. Hypothesis 2 predicted that managerial experience is positively associated with bank performance. The positive signed coefficient (β=0.064, p<0.001) on experience supported the hypothesis but the hypothesis was rejected in the second model (β=-0.0648, p<0.10). Hypothesis 3 predicted that the proportion of female in management is positively associated with bank performance. The positive signed coefficient (β=16.88, p<0.001) on gender composition supported the hypothesis.

The study hypothesized a positive relationship between managerial skill and bank performance based on the argument that managerial skill is one of the key inputs in the management decision making process. Results displayed in Table 3 shows that managerial experience, proportion of females in management and bank size are positive and statistically significant in influence the banking sector profit before tax yet the level of education on managers do have a significant but negative effect on bank profit. However, education did have a statistically significant effect on bank’s return on asset. Gender and bank size positive influence return on assets for the commercial banks under study. The study hypothesised a positive significant relationship between managerial skill characteristics and bank profit before tax based on the argument that that education and experience are key ingredients in decision making that can significantly contribute to increased bank profit. Managerial skills can enhance manager ability to make use of the information and quickly adjust to changing economic environment. The study findings found out that managerial education and experience are not important determinants of bank profit as the coefficients of both variables were negative but statistically significant.

The study findings showed the existence of substitution possibilities between managerial education and experience in relation to bank performance, a result in agreement with previous studies (Imai, 2003). However, these results were not consistent with previous studies that found positive significant relation between managerial skill characteristics and bank profit. Thus commercial banks should not expect increased profit though hiring managers with high education as it is the quality of education that matters. To the contrary, on bank return on asset, the result showed no significant relationship between managerial education and bank return on asset.

The two regression models on bank profit and return on bank assets showed a positive significant relationship between bank performance and the proportion of women in management. The study finding showed that an increase in the proportion of women in management increase both profit and bank return on assets. The results are consistent with Mathijis & Vrankan who indicated that more women in management lead to improvement in bank performance as women are deemed to be more efficient managers.

The study showed a positive and significant relationship between bank size and performance in terms of profit and return on assets. These findings were consistent with the general expectation of a significant (positive) relationship between bank performance and bank size as measured by the log of total assets. These results are supported by Sakina (2006) who found out that large banks are more profitable compared to small banks as highly capitalised banks tend to perform better compared to smaller banks.

Summary and Findings

The main objective of the study was to analyze the relationship between managerial skills and bank performance among commercial banks in Zimbabwe. The study hypothesized that there exist a significant positive significant relationship between managerial skills that is managerial education level and years of experience in relation to bank profit and return on assets. The empirical examination of the hypotheses developed from the conceptual framework presented in this study reveals a mixed set of results. Proportion of female in management was found to be positively associated with bank profitability, indicating value of gender diversity for the bank. Managerial experience was also found to be positively associated with bank return of asset but negatively associated with bank profit before tax. Managerial education was found to be negatively significant in affecting bank return on asset but was insignificant in influencing bank profit before tax.

The key findings of the study was that there exist substitution possibilities between managers level of education and years of experience in relation to bank performance, a result supported by previous studies (Viswanathan et al., 2000; Imai, 2003). The study also showed a positive significant relationship between bank performance and the proportion of women in management.

Further research is recommended in relation to bank inputs and characteristics apart from bank total assets. In addition, other alternative methods of estimation such as dynamic panel data analysis can be used combined with the fixed regression model to test the robustness of the results. Finally, the results encourage banks in Zimbabwe to monitor and evaluate these factors for improvement to enable the sustainability of banks and industry for economic growth.

Conclusion

Finally, the study has examined the impact of managerial characteristics variables on bank performance, and return on assets and profitability we used as proxy to bank profitability. It may be useful to re-examine matter using other market based performance variables average return on assets and Tobin’s Q and compare the relationship. This may be particularly useful in a fluctuating market and how firms change the managerial characteristics in response to change in bank performance.

Conclusively, the researcher believe that the theoretical framework and the findings of this research will stimulate scholars strategically, in bank performance and profitability and corporate governance in terms of gender composition, as well as practitioners, to examine the managerial characteristics from a theoretical perspectives.

References

Akhtar, M.H. (2003). A-efficiency Analysis of Commercial Banks in Pakistan: A Preliminary Investigation. A paper presented in Eighteenth Annual General Meeting & Conference of PSDE, Islamabad.

Indexed at, Google Scholar, Cross Ref

Barker, V.L., & Mueller, G.C. (2002). CEO Characteristics and Firm R&D Spending, Management Science, 48(6), 782-801.

Indexed at, Google Scholar, Cross Ref

Belliveau, M.A., O’Reilly, C.A., & Wade, J.B. (1996). Social Capital at the Top: Effects of Social Similarity and Status on CEO Compensation. Academy of Management Journal, 39(6), 1568-1593.

Indexed at, Google Scholar, Cross Ref

Berger, A.N. (1995). The Profit-Structure Relationship in Banking: Tests of Market Power and Efficient Structure Hypotheses. Journal of Money, Credit and Banking, 27, 404-431.

Indexed at, Google Scholar, Cross Ref

Burt, R.S. (1992). Structural Holes: The Social Structure of Competition, Cambridge, MA: Harvard University Press.

Chames, A., Cooper, W., Lewin, A.Y., & Seiford, L.M., (1994). Data Envelopment Analysis: Theory, Methodology and Applications. Kluwer Academic Publishers, Norwell, MA.

Indexed at, Google Scholar, Cross Ref

Chevalier, J., & Ellison, G. (1999). Are Some Mutual Fund Managers Better than Others? Cross-Sectional Patterns in Behavior and Performance. Journal of Finance, 54(3), 875-899.

Indexed at, Google Scholar, Cross Ref

Chung, K.H., & Pruitt, S.W. (1994). A Simple Approximation of Tobin’s q. Financial Management, 23(3), 70-74.

Indexed at, Google Scholar, Cross Ref

Deary, I.J. (2004). Intelligence: A Very Short Introduction, Oxford University Press.

Dechev, I. (1999). How Good are Business School Rankings?, Journal of Business, 72(2), 201-213.

Indexed at, Google Scholar, Cross Ref

Fethi, M., & Jackson, P. (2000). Evaluating the Technical Efficiency of Turkish Commercial Banks: An Application of DEA and TOBIT Analysis, University of Leicester.

Finkelstein, S., & Hambrick, D.C. (1996). Strategic Leadership: Top Executives and their Effects on Organizations, St. Paul, MN, West Publishing Company.

Fiorentino, E., Karmann, A., & Koetter, M. (2006). The cost efficiency of German banks: A comparison of SFA and DEA. Discussion Paper Series 2: Banking and Financial Studies, 10.

Indexed at, Google Scholar, Cross Ref

Frey, M.C., & Detterman, D.K. (2004). Scholastic Assessment or g? The Relationship between the Scholastic Assessment Test and General Cognitive Ability. Psychological Science, 15(6), 373-378.

Gallacher, M. (2001). Education as an Input in Agricultural Production. CEMA Working Papers 189, Universidad del CEMA.

Gascon, F., & Adenso-Diaz B. (1997). Linking and Weighting Efficiency Estimates with Stock Performance in Banking Firms. Wharton School Working Paper.

Golec, J.H. (1996). The Effects of Mutual Fund Managers Characteristics on their Portfolio Performance, Risk and Fees. Financial Services Review, 5(2), 133-148.

Indexed at, Google Scholar, Cross Ref

Gonchve, S.R. (2005). The role of financial institutions in the economic development of Malawi: Commercial Banks Perspective. Bunda College of Agriculture, University of Malawi, 67-68.

Gottesman, A., & Morey, M.R. (2006). Manager Education and Mutual Fund Performance. Journal of Empirical Finance, 13(2), 145-182.

Indexed at, Google Scholar, Cross Ref

Graham, J., Harvey, C., & Rajgopal, S. (2005). The Economic Implications of Corporate Financial Reporting, Duke University, Working paper.

Indexed at, Google Scholar, Cross Ref

Graham, J., & Harvey, C. (2001). The Theory and Practice of Corporate Finance: Evidence from the Field, Journal of Financial Economics, 60(2), 187-243.

Indexed at, Google Scholar, Cross Ref

Hardle, W., & Jeong, S. (2005). A onparametric Productivity Analysis. SFB 649 Discussion Paper 2005-013, Center for Applied Statistics and Economics, Humboldt-Universitat zu Berlin, Germany.

Imai, Y., (2003). Walter Benjamin and John Dewey: The Structure of Difference Between Their Thoughts on Education. Journal of Philosophy of Education, 37(1), 109-125.

Indexed at, Google Scholar, Cross Ref

Jones, P. (1994). Are manufacturing workers really worth their pay?. Working Paper 94-12. Centre for the Study of African Economies, Oxford University.

Kamath, R., & Meier, H.H. (2006). Titled Positions in Finance in the United States: An Examination of the 1994-2003 Developments. Journal of Applied Finance, 16(1), 115-124.

Kebede, T.A. (2001). Farm Household Technical Efficiency: A Stochastic Frontier Analysis, a Study of Rice Producers in Mardi Watershed in the Western Development Region of Sepal. A Master’s Thesis Submitted to the Department of Economics and Social Sciences, Agricultural University of Norway.

Maxam, C.L., Nikbakht, E., Petrova, M., & Spieler, A.C. (2006). Managerial Characteristics and Hedge Fund Performance. Journal of Applied Finance, 16(2), 57-70.

Mintzberg, H. (1996). Ten Ideas Designed to Rile Everyone Who Cares About Management, Harvard Business Review, 74(4), 61-68.

Oberholzer, M., & Van Der Westhuizen, G. (2004). An empirical study on measuring efficiency and profitability of bank regions. Meditari Accountancy Research, 12(1), 165-178.

Indexed at, Google Scholar, Cross Ref

Palia, D. (2000). The Impact of Regulation on CEO Labor markets, Rand Journal of Economics, 31(1), 165-79.

Indexed at, Google Scholar, Cross Ref

Park, B.U., Simar, L., & Weiner, C. (1999). The FDH Estimator for Productivity Efficiency Scores: Asymptotic Properties. Econometric Theory, 16, 855-877.

Indexed at, Google Scholar, Cross Ref

Pfeffer, J., & Fong, C.T. (2002). The End of Business Schools? Less Success than Meets the Eye, Academy of Management Learning and Education, 1(1), 78-95.

Indexed at, Google Scholar, Cross Ref

Podpiera, A., & Podpiera, J. (2005). Deteriorating Cost Efficiency in Commercial Banks Signals an Increasing Risk of Failure. Working Papers, Czech National Bank, Research Department.

Sakina, L.S. (2006). An investigation on the X-efficiency of commercial banks in Kenya. University of Nairobi unpublished MBA thesis.

Sathye, M. (2003). Efficiency of Banks in a Developing Economy: The Case of India. European Journal of Operational Research, 148, 662-671.

Indexed at, Google Scholar, Cross Ref

Spong, K., Sullivan, R., & DeYoung, R. (1995). What makes a bank efficient? A look at financial characteristics, bank management and ownership structure. Federal Reserve Bank.

Stefanou, S.E., & Saxena, S. (1988). Education, experience and allocative efficiency: adual approach. American Journal of Agricultural Economics, 70(2), 338-45.

Indexed at, Google Scholar, Cross Ref

Tang, K.K., & Tseng, Y.P. (2004). Constructing a measure of Industry - Specific Human Capital using Tobin’s Q Theory. Economics Bulletin, 10(1), 1-7.

Wagenvoort, R., & Schure, P. (2005). A recursive thick frontier approach to estimating production efficiency Econometrics Working Paper EWP0503. European Investment Bank, Luxembourg & University of Victoria, Canada.

Yao, P., & Han, Z. (2007). Ownership Reform Foreign Competition and Efficiency of Chinese Commercial Banks: A Son Parametric Approach. China Policy Institute, University of Nottingham.

Indexed at, Google Scholar, Cross Ref

Received: 26-Nov-2021, Manuscript No. AAFSJ-21-10049; Editor assigned: 29-Nov-2021, PreQC No. AAFSJ-21-10049(PQ); Reviewed: 13-Dec-2021, QC No. AAFSJ-21-10049; Revised: 23-Mar-2022, Manuscript No. AAFSJ-21-10049(R); Published: 30-Mar-2022