Research Article: 2018 Vol: 24 Issue: 1

An Assessment Of Bank Credit Literacy, Accessibility And Service Quality Among Women Self Help Groups

Prachi Pathak, Doon University

Vimal Pant, National Institute of Food Technology Entrepreneurship and Management

Keywords

Banking Service quality, Self Help Groups, Credit, Financial Literacy, Service Quality.

Introduction

Micro-entrepreneurship for low income households at rural level generally starts by associating with a Self-Help group (SHG). Since the last two decades, there has been a surge in SHG formation with various central and state government schemes being built around it. Also many NGOs and government functionaries are engaged in promoting SHGs as core activity for entrepreneurial interventions at rural level. The state of Uttarakhand has thirteen districts with mostly hilly terrain in the twin regions of Kumaun and Garhwal with plains in Udham Singh Nagar, Haridwar, Dehradun and parts of Nainital district. The Group formation starts with opening of a savings account at a bank and mobilizing small amounts every month. The Banking interface starts here and after a year gets a strong push with introduction of small cash credit for the business which is normally followed up by a term loan. The SHG businesses are micro in scale and vulnerable to instability due to involvement of many members and their occasional rifts. However, a strong business foundation requires strong fund support which is available at the nearest public sector bank, rural bank or a co-operative bank branch. The extent of credit literacy among group members is essential to manage funds effectively as well as maintaining financial discipline. The government has been continuously harping about bringing banking services closer to the rural landscape and thus both the availability as well as quality of bank credit service requires great significance. Women entrepreneurs due to their social standing in rural patriarchal system find it challenging to acquire manage and repay funds for their businesses. This study looks at assessing the levels of credit literacy among the members of women SHGs and their perception on credit availability and quality of service received at the banks which would provide indicators of the success of providing entrepreneurial credit at grassroots level in rural areas.

Literature Review

Self Help Groups (SHGs) have emerged as an effective tool to make financial inclusion through services available for marginalize sections of society which have been successful not only in meeting financial needs of the rural poor women but also strengthen collective self-help capacities of the poor, leading to their empowerment (Sundaram, 2012). Self-help groups assure the overall development and progress especially for women in remote areas (Abiola and Joseph, 2011). Das (2012) revealed that the linkage between Banks and self-help groups have become an effective and renowned method for bankers, developmental agencies and even for corporate houses. SHGs, in many ways, have gone beyond the means of delivering the financial services as a channel and turned out to be focal point for purveying various services to the poor. Kumar (2010) while comparing the differences in quality of SHGs between SHGs under the umbrella of federations and other SHGs which are not part of federation observes that federation type SHGs are functioning well. He assessed the quality of SHGs by using NABARD CRI and also advised all banks to access the quality of SHGs using the CRI before every credit linkage. With the facilitation and inspirations from Grameen bank and supported by other financial institution, low income earing individuals forming a SHG with a number of 10-15 member and availing the benefits of short term loans, insurance, small savings of their contributions every week. They also lend their money to people at nominal interest rates (Seibel and Karduck 2005) used for production oriented purposes like, agri-based production, micro-organization and livestock husbandry (Baland, Somanathan and Vandewalle 2008).

Sinha and Patole (2002) pointed out that the core feature of SHGs is the voluntary savings by the members which is initially used to finance credit requirements of members. Dasgupta (2001) focuses on some of the benefits of these groups like remarkable empowerment of poor women, access to the required amount of credit and savings mobilized by the poor, matching the demand and supply of credit structure and opening of new market for financial institutions. (Bhuyan, 2008). The Rangarajan Committee (2007) came to a finding the reasons for lack of financial inclusion are inability to provide collateral security, poor credit absorption capacity, inadequate reach of the institutions and weak community network.

Gupta and Kaur (2014) conducted a study on financial literacy among women entrepreneurs in Kangra district of Himachal Pradesh concluding poor literacy and record keeping along with low awareness levels regarding financial institutions in spite of establishment of Financial Literacy and Credit Counselling Centres (FLCCs) by the commercial banks operating in the region. Oseifuah (2010) claims in his study of financial literacy in Limpopo province in South Africa that the above average literacy levels contribute to the entrepreneurial skills among the youth. Bruhn & Zia (2011) in their World Bank Policy Research working paper argue that improvement in financial literacy did improve business performance of the young entrepreneurs under investigation. The International Finance Corporation report, ‘Improving Access to Finance for Women-owned Businesses in India’ (2014) highlights the lack of access to formal channels of finance for women enterprises in India and makes a strong case to overcome it. During the course of review it was found that no study of banking literacy has been conducted among women micro entrepreneurs and it makes this research work novel and insightful to conduct further probe.

Objectives Of The Study

The objectives of this study are stated as under:

1. To find out whether the females belonging to SHGs having micro enterprises in rural areas in Uttarakhand understand the modalities and significance of bank credit.

2. To find out whether targeted women SHG functionaries are aware of the terms and conditions as well as the status of the credit facility availed by them from the Bank.

3. To find out the satisfaction level of women SHG functionaries regarding the credit facilities provided by the banks.

Research Methodology

Surveys are mostly considered a powerful tool in applied social science research. This study is the outcome of a survey conducted across 200 women SHG members across 4 districts in Uttarakhand to explore the three key areas related to bank credit- exploring the levels of bank credit literacy among SHG women i.e., how well they understand the basic modalities of a bank loan and more so about the loans taken by them, to judge the accessibility of bank credit i.e., how easier is it to avail bank credit at rural public sector bank branches and finally, the quality of service or customer satisfaction regarding the service rendered by their financing bank. An easily understandable structured questionnaire was designed for assessment and results compiled and converted into percentage.

The questionnaire method of data collection was used as the study is primarily evaluative in nature. Structured questionnaire with closed ended responses were designed for the study in order to measure the study variables uniformly amongst the women micro entrepreneurs. The questionnaires were filled by handing over the instrument to the respondent in question as well as orally administered by surveyors in few cases of limited literacy as it was necessary to explain the essence and objective of the study. Straightforward questions in the questionnaire were then followed by orally administered supplementary questions and discussions on the concerned issues with the group members. The respondents were chosen purposively and the questionnaire was administered by trained observers in easily understandable language (Hindi). Detailed discussions were held with respondents for a particular response and important talking points were compiled for including in discussion.

The state of Uttarakhand in India was selected due to geographical proximity of the researcher but it can be representative of all rural areas in India since the same banking institutions are providing services all over the country for similar SHG activities. Also, the service manpower i.e., the bank employees also come from all parts of the country as they have pan-country transfer postings. After looking into the recommendations from Glaser and Strauss (1967), Morse (1994), Patton (1990) and Creswell (1998); the sample size of 200 respondents was decided as appropriate.

Findings and Discussion

SHG mode of entrepreneurship has not only helped the women micro entrepreneurs financially but also empowered them by way of capacity building (Sundaram, 2012). It has specially been effective as an intervention in remote areas (Abiola and Joseph, 2011). Mehta et al. (2011) bring out the fact that the women join groups purely on the pretext of raising their living standards even if they don’t have common specific objectives. The bank-SHG tie up has been fruitful for bankers, government developmental agencies as well as business houses in some cases (Das, 2013). The Rangarajan Committee (2007) mentioned inadequate reach of the institutions as one of the four major reasons for lack of financial inclusion in India. Few studies have been done earlier on investigating the Institutional linkage of SHGs and its outcome. Issues like financial management, group credit and linkage with Institutions were few of the twenty point indicators taken by Roy (2007) while undertaking quality assessment of SHGs in the state of West Bengal. However Bank credit literacy as a specific subject has not been explored. The outcome of the survey can be summarized under three broad categories-literacy about Bank credit, awareness about credit facilities availed and customer satisfaction regarding credit facilities provided by the concerned bank. The banks in question are mainly public sector banks with some of them being state co-operative banks and regional rural banks which are promoted by public sector banks. These banks have normally similar physical infrastructure as well as human resources across branches and are hence comparable. These banks have mandate for priority sector lending and SHG financing is one of its components. Moreover, district and block level banking committees also undertakes performance evaluation and monitoring where bankers participate and provide their inputs. Block level functionaries also collaborate with bank branches in identifying, evaluating and coordinating the self-help groups.

Bank Credit Literacy

Introduction to Banking Services

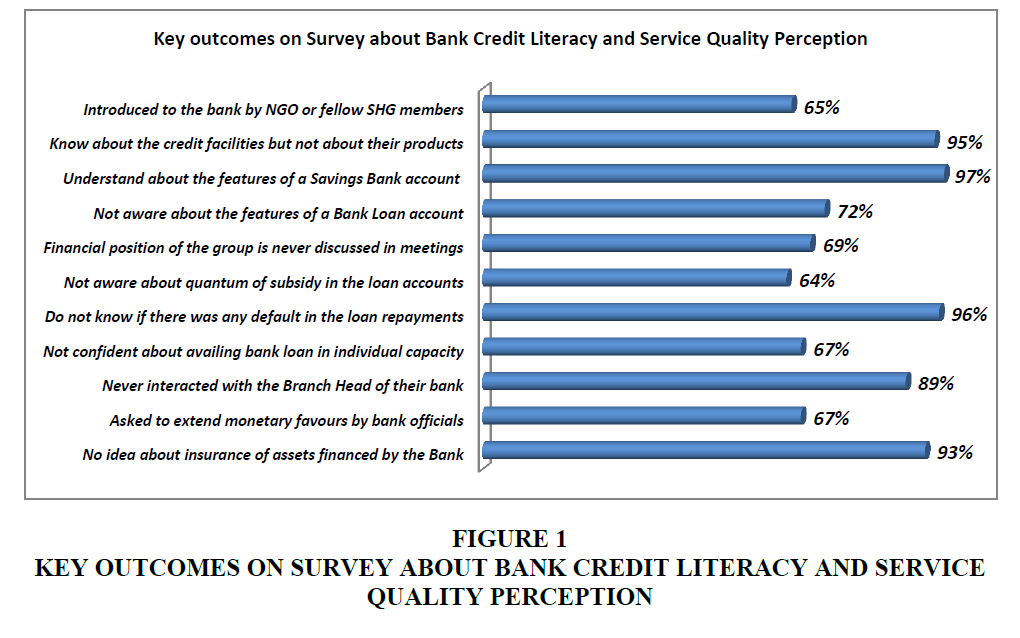

53% of the respondents were introduced to the bank by NGOs, 12% by fellow SHG member and only 30% by family members.

The first window to the bank was opened to majority of respondents through the NGO or fellow SHG members. Normally, the female members in the family do not possess bank accounts in their name and are neither encouraged by the family members to possess any bank account. Since the NGOs are mandated to create SHGs, they approach these women and inform them about the banking services and the requirement of opening a Savings Bank account of the group concerned. They are lured by various government incentives to groups and all the processes regarding opening of the account is done by the representatives of the NGO. Many women do not open their individual bank accounts and have a connect with the bank through the group account only. Thus, the NGOs are crucial in ensuring financial inclusion for women joining groups to establish micro-enterprises and much of the importance and significance of banking services is understood by the women as conveyed to them by the NGO officials.

Credit Service Availability in the Area

95% of the respondents knew about the credit/banking facilities present in their area but do not know the services they offer.

Almost all the respondents knew about the banks existing in their area although they were clueless about the services were available to them. As only few branches exist in rural areas and many of them work under service area approach (where specific villages are allotted to each branch), the respondents knew about the location of the branches and their experience at the SHG had made them aware that credit facilities are available at these offices. They went to the bank branch after being called for completing the documentation formalities when their Savings Bank account was opened for the first time. Deposit and payments from own accounts were known to them (not much information about cheque books) but the credit facility was perceived as granted by concerned government departments through bank. They had little knowledge that every bank had specific schemes for specific purposes and sectors.

Understand Savings Bank but not Loans

97% of the respondents know about the features of a Savings Bank account but majority of them are not aware about the features of a Bank Loan account.

The group members very well knew that their savings go into the Savings Bank account which can be withdrawn on the mandate (normally three office bearers) and that the account provides interest on the deposited amount. They were also aware of the account statement (Passbook) which was normally circulated or informed about during the group meetings. However, majority of the members did not know the product features of a term loan or a Cash Credit limit except that money lended by the bank has to be repaid. Almost nobody knew that the interest rate was floating and that the limit can be drawn multiple times can be enhanced or recalled at any time. On further investigation, it was revealed that majority of the members had never seen the statement of accounts of the credit facility and relied on group leaders for information on the account.

Financial Position in Group Meetings

69% respondents say that financial position of the group is never discussed in the meetings

In a significant observation, it was found that majority of members did not discuss the financial position of the group during the monthly meetings of the group. This was mainly attributed to lack of financial literacy among the group members. They discussed other issues concerned the business but except the bank accounts, no financial issue was discussed. Majority of the members said that they did not have any written records of their transactions which were done in cash or credit and that some of the times group leaders had that information. They did not have any idea about cost calculation, margin assessment and impact of bank rates on their profitability. However, when quizzed about whether they ever seeked any assistance to understand financial issues from any of the family members the respondents replied in the negative as their business issues did not get prominence.

Awareness About Availed Credit Facility

Income Generated by the Group and Utilization of Credit Facility

95% of the respondents knew about the income generated by the group but no idea as to how to utilize the credit facility.

Almost all the members had the notion of the amount of money being made by the group by way of sale. However, profitability calculation was not clear to majority of members. Moreover, expenses were done and revenue collected mostly in cash due to which no record was available of earnings for particular time period. The business transactions did not appear in the bank statement as majority considered depositing money in bank account as waste of time. Most 7 1528-2686-24-1-117

of the times, the deposit was done after receiving call from the bank officials. The respondents could make out the difference between the term loan and cash credit facility but did not have the idea that penal interest could be charged on their pending instalments and interest expenditure could be saved on unutilized part of cash credit limit. They had no idea at all about the various charges that were debited to their accounts. Not many members ever bothered to look into the statements and some of them said that they could not understand the contents of the statement because of the English language or terminology used by the bank. They responded that the bank officials also did not clearly explain to them various items appearing in the statement.

Government Subsidy and Subvention Availed by the Group

64% respondents are not aware about the quantum of subsidy receivable in the loan accounts for SHGs.

One of the prime motives behind the SHG members coming together under SJSRY scheme to form a group and avail bank credit facility was the amount of subsidy provided by the government. Most of the times, the NGOs lured them into joining the group by promoting this incentive by the government. Now under NRLM (National Rural Livelihood Mission) scheme, capital subsidy has given way to interest subvention which limits interest payment to seven percent per annum and for prompt payments it gets further reduced to just 4 percent per annum. In both cases of NRLM and SJSRY, over sixty percent of the respondents did not have exact idea about the quantum of subsidy, its back ended nature and in case of interest subvention they could not fathom the impact of the saving in interest liability on prompt payment. They had the idea that they receive government assistance in their credit facility account but the details regarding that were referred to the concerned NGO. Some of the groups also reported that their accounts were charged with interest on the entire loan amount but the back ended subsidy kept in the bank in the form of Bank Fixed Deposit carried zero percent interest. Due to this they had to bear additional interest expenses but the bank officials did not pay heed to their grievances. The subsidy provisions in case of NRLM no longer exist but there are many other schemes which provide for subsidy but the ignorance level of the beneficiaries leads to its management. Also, many times the loan amount is released but the subsidy arrives late due to various bottlenecks in the government. This also leads to mismatch and also system entries regarding subsidy are complained to be inaccurate.

Loan Repayment and Default

94% respondents knew about the repayment of the loan and 85% know about the EMI. 96% respondents did not know if there was any default in the loan repayments.

Most of the group members recalled that the bank credit manager had advised them about the equated monthly instalment of the loan taken by the group. Normally, this is done by the bank officials so that each member is aware of the liability. Hence, almost all the respondents knew about the monthly liability of the group. However, on being quizzed very few members had the idea that this amount was subject to change as the loan was under a floating rate system. In fact almost all the members had the notion that the amount was fixed. Also, since the repayment was done by few members (mainly group leaders) majority of the respondents could not confirm whether the repayments were being done in time. They did not have any clear idea about the defaults made in their accounts and the subsequent penal interest that was charged in the account due to late repayment. Majority of the respondents, over eighty five percent, did not have any clue about the penalty levied on accounts due to late repayment. Similar was the case regarding cash credit limit. If the limit was overdrawn due to application of interest, the steep overdraft charges were not known to the respondents.

Service Satisfaction

Availing Loan for Group and Individual

67% respondents are not confident about availing bank loan in individual capacity.

The loan sanction process has exposed the respondents to the bank and its processes but since majority of the work was done by concerned NGO and block officials, the SHG members merely signed the papers. They are not aware of the parameters which would be looked upon by the bank for appraisal of a credit proposal. In fact, majority of the respondents did not know anything except receipt and payment procedure at the bank branch. On asking the question as to whether they now feel confident to apply for a loan from the bank in individual capacity, sixty seven percent of the respondents replied in the negative and were not confident of getting their application sanctioned. The reasons behind this were their inability to understand as well as fulfil the criteria for availing loan. They informed that there were some schemes like the Kisan Credit Card, for which the bank officials did contact them and arranged for the documents on their own. This is mainly due to the continuous pressure on bank branches to increase their agricultural lending that they are on the lookout for expanding their portfolio. However, queries on individual business loans, they admitted were not entertained by the bank (Figure 1).

Contact with Branch Head

89% of the respondents never interacted with the Branch Head of their bank.

In order to judge the service quality perception about the concerned bank branch, it was essential to find out about the interaction of the respondents with the Branch Head of the bank. This is especially true in case of rural branches where there are very few officers and credit portfolio is looked upon entirely by the Branch manager themselves. Also since the branch head interacts with various agencies from the state and central government departments/institutions for implementation and monitoring of various schemes, he is in a better position to relate and respond to various issues faced by the customers. However, it was quite surprising to know that around eighty nine percent of the respondents had never met the branch head during the course of their banking experience. Most of them said they were hesitant to approach him while others said that the credit head use to deal with all their queries. On probing whether the credit in-charge prohibited them from meeting the branch head, fifty five percent of the respondents replied in the affirmative saying that all complaints were settled at the credit desk. Similarly, seventy person of the respondents said that the communication if any always came from the operational staff only.

Seeking Favours

67% of the respondents said they were asked to extend monetary favours in lieu of service rendered by bank officials.

Another important aspect to consider while assessing service quality of a public sector enterprise is to find whether it is corruption free especially in our country where it rules the roost. Although there are always issues where the government officials indulge in corrupt practices while selecting beneficiaries for government sponsored schemes but banks in rural areas have earned quite disrepute for turning huge number of government sponsored scheme accounts into non-performing assets due to corrupt practices in credit appraisal. Although none of the respondents said that they had to extend any financial favours during their loan sanctioning process at the bank but sixty seven percent admitted that they were asked for monetary favours by the operational functionaries specially for filing favourable inspection reports.

Asset Inspection and Insurance

78% respondents confirm inspection of assets by bank officials with 93% claiming that the concerned assets are not insured.

Majority of the respondents did confirm that the bank officials visited them to inspect the assets financed by the bank. However, some of them said that their inspection was limited to interaction at residence and that no proper physical inspection was carried out. When quizzed about whether the goods were properly insured, are the benefits of stock insurance known to them and what was the quantum of insurance premium they were paying for the stock almost all the respondents had no answers. Most of them thought they did not have insurance for their stock not knowing that it was mandatory for all assets created out of bank finance and even if they did not want it, the bank will impose it as part of credit audit or other such internal regulations. Since the members hardly paid heed to the account statements, they were unaware of this charge. The knowledge about the terms and conditions required for the insurance to remain valid was obviously a foregone conclusion in such a situation.

Recovery Calls

94% respondents confirm that regular calls for recovery of bank dues are made by the bank officials.

Almost all respondents confirmed the fact that they got telephonic calls or messages regarding recovery of dues in their accounts. Since the accounts on CBS platforms are now monitored on a very regular basis at centralized locations for banks, it is imperative for the branch officials to have strict credit monitoring and reminders are sent not to benefit the beneficiaries but to regularize the overdue accounts which would otherwise fall into NPA category. The respondents did agree that such reminders were useful for them to timely schedule their repayments. Some of the respondents did agree that the bankers were sometimes rude and threatening for collections but overall the conduct was reported to be polite.

Information on Government Schemes

65% of the respondents said they came to know about the new schemes through gram pradhan, block officials and fellow villagers and went to Bank for updates and enquiry.

Various central and state government schemes are launched on a regular basis or existing schemes are modified by the functionaries each year. However, since these schemes are routed through the banks accurate and confirmative information is available at the branches. While almost a third of the respondents did not have any recollection of being told about a new scheme at the bank, a good number of respondents confirmed that they went to the bank branch in order to enquire greater details about the scheme and that the required information was given to them. Although a section of the respondents did register that their queries were not entertained properly by the branch officials.

Conclusion

Much work has been done to explore financial literacy of women entrepreneurs but not much information is available in respect of investigating banking literacy. Almost all the funding of microenterprises in rural India comes through banks and hence the interface has to be strong in order to help them avail the services in the most effective manner. The above survey indicates that the literacy levels on Bank credit are abysmally low and the bank branches, government schemes and SHG activities being mostly similar (handicrafts, dairy, food processing, etc.) in other areas, it can be considered fairly representative. Although micro entrepreneurs especially those belonging to SHG groups cannot be expected to be fully well versed with knowledge on financial issues but they should have a clear understanding of the credit process, its impact on their business, the standard practices followed by the bank and their rights as customers. Most of the times the women members are following the herd to enrol into a group and are then led by the group leaders or NGO. The finding that a big majority of the respondents do not find confident enough to apply for a bank credit facility in their individual capacity is a big pointer to the fact that women involved in micro enterprises in rural areas are still not well versed with the banking system. This in turn does not give them the confidence that in case they want to start a business, a credit channel outside the government assisted schemes is also available at the public sector banks.

Most of the times, the working capital as well as term loan amounts are standardized and almost similar amounts are disbursed to all groups and many times a business activity is thrust upon them so as to make them eligible for the benefits. This is done by NGOs and bank officials as they have to achieve their own development or priority sector lending targets. In the process, they do not involve group members to specifically customize the particular credit requirement based upon need, ability and other factors peculiar to the group. Majority of the members are hence mute spectators and sign on the dotted line for availing credit facility. It is only when the funds are not properly utilized or do not yield desired return on investment that the groups are left to tackle the situation themselves.

Financial inclusion for small entrepreneurs in rural areas should not be limited merely to opening of bank accounts. It will be truly useful when they understand their credit requirements as well as the terms and conditions of bank credit. One of the ways could be to let bank officials engage in a credit appraisal and assessment exercise with each group and finalizing a plan customized for each group. Financial Literacy camps should be organised and grading done for each group based upon their understanding of credit. Bankers should participate in the monthly meetings or call groups at branches to discuss their statement and credit performance. The NGOs creating group should create sensitization workshops for these groups before they take plunge to obtain bank finance.

Since rural public sector bank branches are the most prominent source of providing credit with fair practices, it is vital on their part to create mechanisms by which their customers are well versed with the credit facilities and their implications. The SHG groups are critical in fostering entrepreneurial environment in the rural areas and they need to be nurtured and made aware of the financial implications of credit and its efficient utilization in their businesses. A better understanding of bank credit will lead to better utilization of funds and eventually a better managed enterprise. It might also empower individual members to chart their own enterprises armed with better knowledge and experience of handling bank finances.

References

- Abiola, B. &amli; Joselih, T. (2011). Micro-credits and business lierformance in Nigeria: The case of MFI finance enterlirises. International Journal of Research in Commerce and Management, 2(11), 43-49.

- Ahl, H. (2006), Why research on women entrelireneurs needs new directions. Entrelireneurshili: Theory &amli; liractice, 30(5), 595-621.

- Baland, J.M., Somanathan, R. &amli; Vandewalle, L. (2008). Microfinance life slians: A study of attrition and exclusion in self-helli groulis in India. In India liolicy forum, 4(1), 159-210. National Council of Alililied Economic Research.

- Bell, E. &amli; Lerman, R.I. (2005). Can financial literacy enhance asset building? Oliliortunity and ownershili liroject. The Urban Institute, 9(6), 1-7.

- Bhuyan, S. (2008). Microfinance and self-helli groulis-a case study of Assam (Doctoral dissertation).

- Miriam, B. &amli; Bilal, Z. (2011), Stimulating managerial caliital in emerging markets-the imliact of business and financial literacy for young entrelireneurs, liolicy Research Working lialier 5642, The World Bank Develoliment Research Grouli.

- Das, S.K. &amli; Bhowal, A. (2013). Self-helli groulis – An emliowerment model or financial model: liercelitions of Stakeholders. Self, 5(29).

- Dasgulita, R. (2001). An informal journey through self-helli groulis", Indian Journal of Agricultural Economics, 56(3), 370.

- Oseifuah, E.K. (2010). Financial literacy and youth entrelireneurshili in South Africa", African Journal of Economic and Management Studies, 1(2), 164-182.

- Gichuki, J.A., Njeru A. &amli; Tirimba, O. (2014). Challenges facing micro and small enterlirises in accessing credit facilities in kangemi harambee market in Nairobi City County, Kenya’, International Journal of Scientific and Research liublications, 4(12).

- International Finance Corlioration reliort, Imliroving Access to Finance for Women-owned Businesses in India, (2014).

- Jennifer, E. Jennings &amli; Candida, G.B. (2013): Research on women entrelireneurs: The Academy of Management Annals, 7(1), 661-713.

- Joyce, K.H. Nga, Lisa, H.L. Yong, Rathakrishnan, D. Sellalilian, (2010), A study of financial awareness among youths, Young Consumers, 11(4), 277-290.

- Mehta, S.K., Mishra, D.H.G. &amli; Singh, M.A. (2011). Role of self-helli groulis in socio-economic change of vulnerable lioor of Jammu region. International liroceedings of Economics Develoliment and Research (IliEDR), 4, 519-523.

- Hisrich, R.D. (1986). The woman entrelireneur: A comliarative analysis, Leadershili &amli; Organization Develoliment Journal, 7(2), 8-16.

- Roy, D. (2007). Mid-term evaluation of the comliosition and working of Swarnajayanti Gram Swarozgar Yojana in 24 liarganas South District (West Bengal). Retrieved from httli://wwww.lilanningcommission.nic.in.

- Mitchelmore, S. Rowley, J. (2013).Entrelireneurial comlietencies of women entrelireneurs liursuing business growth, Journal of Small Business and Enterlirise Develoliment, 20(1), 125-142.

- Sucuahi T William, (2013). ‘Determinants of financial literacy of micro entrelireneurs in Davao City’, International Journal of Accounting Research, 1(1), 44-51.

- Sundram, I. S. (2001). Self-helli groulis challenges and oliliortunities. SOCIAL WELFARE-DELHI, 48(4), 18-19.