Research Article: 2020 Vol: 19 Issue: 3

An Assessment of Bank Customers Intention to Use Internet Banking: The Role of Service Quality and Perceived Security

Eke Vincent Ikechukwu, Federal Polytechnic Bauchi

H.B. Singhry, Abubakar Tafawa Balewa University

Abstract

Keywords

Behavioural intention, Effort expectancy, Internet banking, Performance expectancy, Reliability, Security, Social influence.

Introduction

Innovations and developments are increasingly becoming manifest in strong competitive markets. During the last two decades, banking industry has witnessed many innovations in products, processes and procedures. These innovations in banking have gained more prominence in context of economic significance and satisfaction of customers. Internet banking service (IBS) is one such innovation in banking which has controlled two important parameters: time and distance (Bashir & Madhavaiah, 2015). Internet banking can be defined as a facility that allows customers of a financial institution to conduct financial transactions on a secured website operated by the institution, which can be a retail or virtual bank, credit union or building society (Ali, Mazen, Maged & Alan, 2015). The benefits of internet banking include enabling customers to send or transfer money, pay bills online, access online products, rates and services, make deposits and offer 24-hour customer assistance desk. As a result, Internet banking leads to customer satisfaction, bank profitability and performance. Even though, there has been considerable rate of growth of non-cash payments globally and the internet has become highly fashionable, developing countries are still struggling hard to catch up with their counterparts in the developed countries.

The Nigerian economy is characterized by huge amount of money in circulation, thus majority of its transactions are cash based (Sanusi, 2011). This is an indication of a slow adoption of non-cash payment system in Nigeria. In 2019, the Central Bank of Nigeria (CBN) equally reiterated its commitment to cashless policy by introducing charges on every bank cash transaction. Against this backdrop, the Central Bank of Nigeria (CBN) is launching Payment Service Banks (PSBs) to make banking services available to over 60 million financially excluded Nigerians by 2020. Earlier reports released in 2008 by the National Space Research and Development Agency (NSRDA), only 2% (about 2.4 million) of Nigerians over 140 million populations actively use the internet (Mohammed & Siba, 2009). Nigeria has performed dismally low in internet usage generally: and so performance in internet banking cannot be an exception. Nigeria arguably has the highest number of unbanked and underserved population compared to other countries across the globe (Uduk, 2019). The Central Bank of Nigeria (CBN, 2008) recognizes that internet banking service is still at the cradle stage of development in Nigeria. Odumeru (2012) asserted that developing countries such as Nigeria are lagging behind in internet banking service operations, and customers’ acceptance of internet banking has not yet reached the expected level.

One of the fundamental issues affecting the implementation of internet banking among most financial institutions until today is about the acceptance of banking transaction among the users (Hassanuddin et al., 2015). Generating a greater understanding of consumer behavioural responses continue to be primary concern for marketing researchers (Malhotra & McCort, 2015) This is reflected in the frequency and rigor with which researchers have explored and modelled the antecedents of the behavioural intentions of consumers (Venkatesh et al., 2016). Reliability dimension of service quality is an important determinant of customers’ intention to use service products. For example, in Nigeria, there is a high degree of customer complaints of poor internet connectivity, increasing threat by account hackers, high charges and sometimes, poor service recovery efforts when customers have problems (Nwogu and Odoh, 2015).

Security is a significant concern and a primary deterrent to use technology- based services. Trust, risk and security in particular should be critical additional variables to consider in measuring technology acceptance, especially as they relate to payment and privacy related research (Kanokkarn, & Tipparat, 2018). To accept that technology-based services like internet banking has gained acceptance in a developing country like Nigeria, the security concerns of Nigerian customers should be properly measured. Service providers should be seen to maintaining the confidentiality of operation, refrain from sharing personal information and ensuring a good level of security for the customers’ information.

Previous studies that explored the influence or the antecedents of behavioural intentions were more focused on other service sectors different from retail banking (Santonen, 2007). For example, tourism/restaurant (Hutchinson et al., 2009; Ladhari, 2009) and airline (Saha & Theingi, 2009). Furthermore, the search and review of related literature revealed that most of the studies conducted on internet banking were in countries like the USA, the UK, Spain and Malaysia, with few empirical studies on the subject conducted in developing countries like Nigeria (Nwachukwu, 2013). Given the difference in orientation, economy, social conditions and cultural values among consumers across the nations, it is presumed that the behavioural responses of consumers in developing countries like Nigeria will be different from those of other developed countries like the USA, UK and China. In light of the few and limited studies on the determinants of customers’ behavioural intention to use internet banking in Nigeria, security issues and reliability of technology-based services as it affects customers behavioural intention to use of internet banking services of commercial banks in developing countries such as Nigeria, this study attempts to fill the observed gap.

Literature Review and Hypotheses Development

Internet banking can be defined as a facility that allows customers of a financial institution to conduct financial transaction on a secured website operated by the institution, which can be a retail or virtual bank, credit union or building society (Shumaila & Mirella, 2015). It can also be defined as a facility provided by banking and financial institution that enables the user to execute bank related transactions through Internet (Nwogu and Odoh, 2015). Internet Banking Services is the customers’ ability to access their bank accounts and complete all their banking transactions through bank websites without the need for a physical presence in physical places of the bank. Nigeria as a country has joined the League of Nations embracing the technology, however, the adoption is low (Odumeru, 2012, and Nwogu and Odoh, 2015). Most Banks in Nigeria have deployed it in their mainstream operation but the acceptability by customers has not been clearly verified. The Central Bank of Nigeria on the other hand as the apex financial institution in the Country has also champion a cashless economy, which has led to a renewed interest in this wonderful but security- threatened technology.

Theoretical Framework of the Study

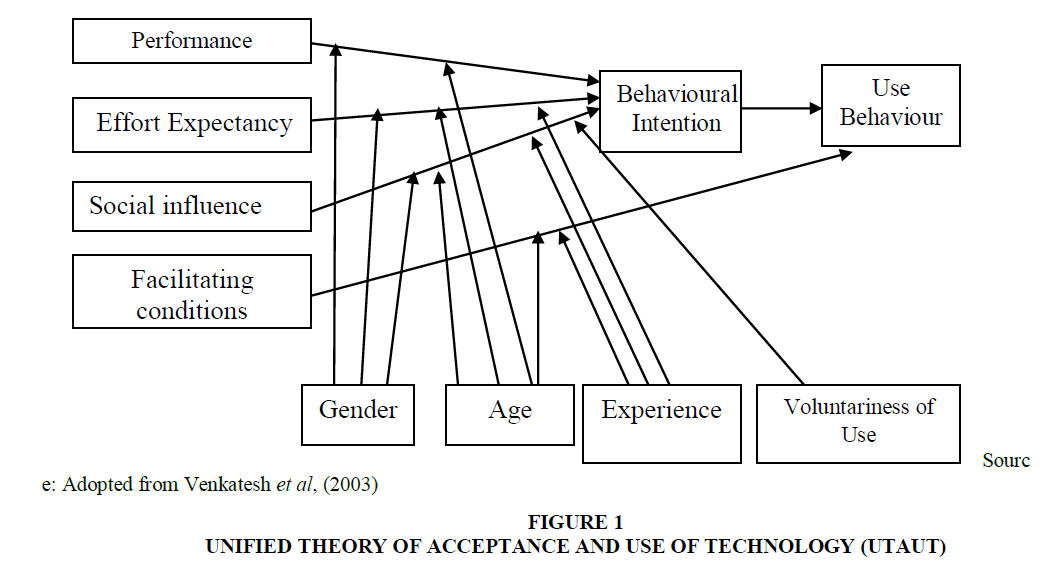

This study is guided by the Unified Theory of Acceptance and Use of Technology (UTAUT) developed by Venkatesh, Morris, Davis, and Davis (2003). The field of information technology acceptance research in general has yielded numerous, competing models, each differing in recognized acceptance determinants at the time of Venkatesh et al. (2003) seminal research study. They then focused on eight prominent models: (a) the theory of reasoned action; TRA (b) the technology acceptance model; TAM (c) the motivational model; (d) the theory of planned behavior; TPB (e) a combined model using the technology acceptance model and the theory of planned behavior; (f) the PC utilization model; (g) the innovation diffusion theory; IDT and (h) social cognitive theory SCT. The quantitative study resulted in the development and empirically validated UTAUT, bringing together the eight predominant models into one theoretical framework.

The theory consists of four core determinants and four moderators of behavioral intention and use behaviour (see Figure 1). The core determinants are: (a) performance expectancy; (b) social influence; (c) facilitating conditions; and (d) effort expectancy. The four moderators are: (a) age; (b) experience; (c) gender; and (d) voluntariness of use. The UTAUT was dubbed a useful tool for managers to evaluate the probability of success in implementing new technologies, to understand core determinants of acceptance and be proactive at intervening with appropriate action plans targeting users deemed less likely to adopt and use new technology systems (Venkatesh et al., 2003).

Research Framework and Hypotheses Development

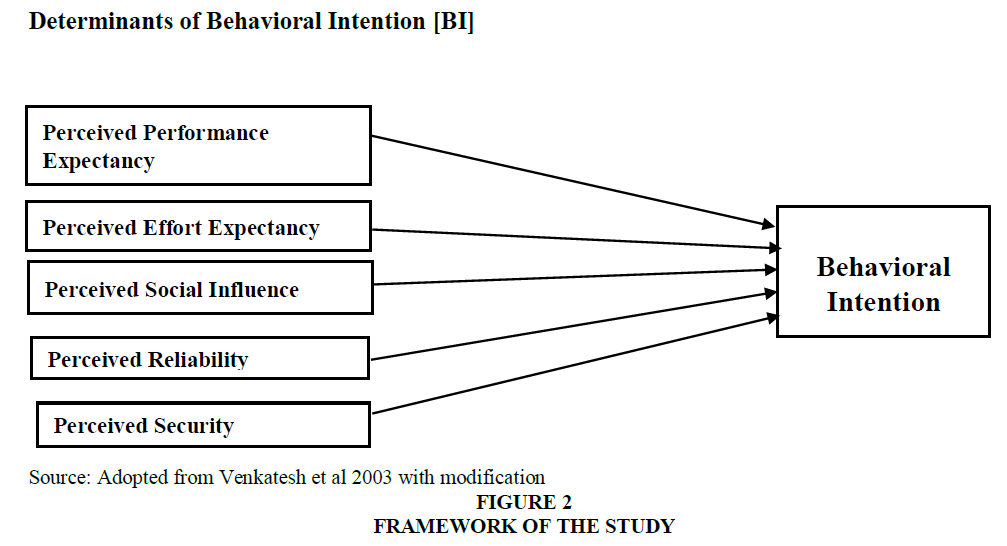

This study used the UTAUT framework to develop a research framework by introducing e-service quality variables of reliability and security to the UTAUT model of (Venkatesh, Morris, Davis, & Davis, 2003) (Figures 1 & 2).

Performance Expectancy (PE)

Performance Expectancy is defined in terms of utilities extracted by using technology-based service like internet banking such as saving time, money and effort, convenience of payment, fast response and service effectiveness (Venkatesh et al., 2016; Zhou et al., 2010). Previous studies found performance expectancy to have positive relationship with customers’ behavioural intention (Sharma, Singh, & Sharma, 2020; Merhi, Hone, and Tarhini, 2019; Alalwan, Dwivedi, Rana, and Algharabat, 2018; Venkatesh et al., 2016, Shin, 2009; and Chou et al., 2018). Users’ expectation on the performance of technology influences his intention to adopt the technology. Internet banking promises to be fast and portable media of financial transaction and the users’ perception of the delivery of those promises determine the success of this endeavour (Sarfaraz, 2017). One can argue that PE can have an important role in the technology acceptance of service products. It is logical for one to assume that Nigerian internet banking customers expect to attain gain in performing internet banking tasks. Performance expectancy is one of the factors that influences customers’ behavioural intention towards acceptance of service products (Venkatesh et al., 2016).

This is in line with Oh and Park (1996) who suggested that it is necessary to refine theories and methodology to be suitable to a specific situation. That given the difference in orientation, economy, social conditions and cultural values among consumers across the nation, it is presumed that the behavioural responses of consumer in developing countries will be different from those of other developed countries. In further confirmation of the finding, (Faqih & Jaradat, 2015; Liebana-Cabanillas et al., 2017) in their own findings, confirmed that performance expectancy is an important predictor of mobile commerce adoption intention. The study added that consumers opt for the mobile commerce services if they feel confidence on the usefulness of services. Thus, we formulate hypothesis one as follows:

H1: Performance expectancy has significant effect on the behavioural intention to use internet banking services in Nigeria.

Effort Expectancy (EE)

Effort Expectancy is the degree of ease associated with customers’ use of technology (Venkatesh et al., 2016). It is synonymous to perceived ease of use which has been noted to positively influence the behavioural intention to use technology (Venkatesh et al., 2016). For example, Lee (2009) and Yoon & Steege (2013) found perceived ease of use PEOU (similar to EE) to have an effect on behavioural intention but it was not the strongest predictor, similarly, Martins et al. (2014); Alalwan, Dwivedi, Rana, and Algharabat (2018); Merhi, Hone, and Tarhini (2019); and Sharma, Singh, & Sharma (2020) found that EE has a significant positive influence on behavioural intention. If the users found the internet banking services easy to use and do not require much effort, then they are more likely to adopt it. Effort expectancy is an important determinant of behavioural intention (Faqih & Jaradat, 2015). Experts in technology adoption models emphasized that user’s perception of ease of use determines the acceptance of the technology. Easy to use and requirement of less effort is one of the key reasons the users of internet Banking services adopt the technology. The service is expected to make their life easy by providing a user-friendly interface and quick set payment setups (Sarfaraz, 2017). In the context of this study, it is expected that if the users find internet banking services easy to use, then they are more likely to use and adopt it. On the contrary, if the users find the services to be difficult to use, then they are less likely to adopt it. Therefore, we hypothesized that:

H2: Effort expectancy has a significant effect on the behavioural intention to use internet banking services in Nigeria.

Social Influence (SI)

Social Influence is defined as “a person’s perception that most people who are important to him think he should or should not perform the behavior in question” (Ajzen, 1991). Although Davis (1989) omitted the SI construct from the original TAM due to theoretical and measurement problems, however SI was added later in TAM2 due to its importance in explaining the external influence of others on the behavior of an individual. Much of the empirical research in information systems found SI to be an important antecedent of behavioural intention BI (e.g. Venkatesh et al., 2003; Venkatesh & Zhang, 2010; Tarhini et al., 2013, 2014; Sharma, Singh, & Sharma, 2020) and in Internet Banking (e.g. Yousafzai et al., 2010; Kesharwani & Bisht, 2012). These studies empirically supported the direct positive relationship of SI on the customers’ intention to use the system. The rational is based on the fact that the consumers will be highly influenced by the uncertainty that will be created from an innovation such as online banking and this will force these consumers to interact with their social network to consult on their adoption decisions. This research assumes that the customers will be highly influenced by others (friends, family, co-workers and media). The rational is also based on the cultural index which is proposed by Hofstede (1990). In acceptance of technology, Saleh (2008) found that people are ready to adopt and accept certain behaviours just in order to impress the group he/she belongs to or because of their significant influence on the individual behavior. With the way people’s life are moulded around role models, public figures, sportsmen and celebrities, an encouragement by such important figures to use the system can motivate users to adopt the use of an information system (Taiwo et al., 2012). Nigerian society is multicultural in nature, diverse in many areas of life. It is necessary to investigate the impact of this diversity in influencing the behavioural intention to accept internet banking services. It is therefore, hypothesized in this study that:

H3: Social influence has a significant effect on the behavioural intention to use internet banking services in Nigeria

Security

Security refers to the protection of information and systems from unauthorized intrusions and is linked to the perceived risk that the customers may fear that an unauthorized party will gain access to their online account and their online transactions. It was defined by Salisbury et al. (2001), as the extent to which one believes that the World Wide Web is secured for transmitting sensitive information. Shin (2009) notes that perceived security is “the degree to which a customer believes that using a particular internet based services will be secure”. In turn, perceived security is expected to affect attitude and behavioural intentions directly. Several studies report a strong relationship between security and behavioural intentions. The majority of customers believe that internet banking lacks security, efficiency, ease of use, trust, and service quality (Zhao et al., 2010). Investigating the effect of security concern on behavioural intention to accept internet banking services among Nigerian public cannot be better than now. Previous empirical studies (e.g. Merhi, Hone, and Tarhini, 2019; Anouze, and Alamro, 2019; Juwaheer, Pudaruth, & Ramdin, 2012) found significant positive effect of perceived security on behavioural intention. This study therefore, postulates that:

H4: Security issues of internet banking services has a significant effect on the behavioural intention to use internet banking services in Nigeria

Reliability

Reliability is the ability to perform the promised service dependably and accurately (Parasuraman and Greenwood, 1998). It means that the organization must deliver what it promises its customers. Dorian (1996) has described some of the important attributes of reliability. One of these attributes is competence and another one is efficiency. Competence is defined as knowledge, skill and pride (Walker, Denver, and Ferguson, 2000). A measure of the competence of a service industry has been found to be reflected in how it handles its bills (Larkin, 1999). Customers want to do business with companies that keep their promises, particularly those concerning core service attributes. All banks need to be aware of customers’ expectations of reliability. Management has to work as a team with staff, to improve the level of service that their staff offers to their customers. Reliability is positively related to the use of internet banking and constitutes the most important features that customers seek in evaluating their internet banking service quality (Liao & Cheung, 2002). Similarly, there is a strong relationship between customers’ reliability on service provided and customers’ behavioural intention towards acceptance of the service (Kettinger & Lee, 2005). Reliability features of technology based products are essential to consumers’ use of such electronic channel (Liao & Cheung, 2002). The more reliable and secured consumer perceive internet banking to be; the more likely they will be to use it. Hossain and Leo (2009) found that reliability and ease of operations influence customer perception of internet banking. Consequently, we postulate that:

H5: Reliability has a significant effect on the behavioural intention to use internet banking service in Nigeria.

Methodology

The study adopted the survey research design which is a procedure in quantitative research that involves the administration of a survey or questionnaire to a small group of people (called the sample) to identify trends in attitudes, opinions, behaviours or characteristics of a large group of people (called the population). This study adopted inferential survey with the aim of establishing relationships between variables (Creswell, 2012). The population of the study was made up of the 256,340 (two hundred and fifty six thousand, three hundred and forty) customers who are enrolled in the internet banking platform from the seventeen banks operating in Bauchi and Gombe states. Based on the Krejcie and Morgan (1970) table for sample size determination, the sample size of 384 (three hundred and eighty –four) was determined. However, this is the minimum sample size required for the study and since there was no guarantee that there will be 100% response rate because of human behaviour and other factors, the sample size was increased by 30% to account for non-response bias/attrition (Saunders, Lewis, & Thornhill, 2016). Thus, 406 customers were used for the study. The convenience sampling technique was used in this study because a sampling frame could not be obtained from the banks. This is because most banks consider such information as secret and are not willing to reveal to any outsider.

A structured questionnaire was adapted from previous studies that measured the same variables. The study however, modified some items to suit the research context and the environment (Singhry, 2018). For service quality an electronic service quality (E-S-Q) instrument that has been extensively used to measure the quality of service delivered by internet banking, ATM, Websites and other online services developed by Parasuraman et al. (1988), Walker, Denver, and Ferguson (2000), Ladhari (2009) were used. While for the UTAUT variables (Performance expectancy, Effort expectancy and Social influence), the instrument developed by (Venkatesh et al., 2012), Yoon and Steege (2013) Tarhirin et al. (2013, 2014) Taiwo, Mahmood, and Downe (2012)) were used. For security, the instrument developed by Mohammad and Oorschot (2017), Bast (2011), Khalilzadeh et al. (2017) were used. For behavioural intention, the instrument developed by Ladhari (2009), and Santonen (2007) were used. These instruments are relevant to the study and have been tested for reliability.

The research instrument was administered to the target respondents using the personal method of questionnaire administration, with the help of some research assistants for collecting research data. These assistants were given allowances and gift items to motivate them for the desired commitment to ensure accurate data gathering. The Customer Relation Officers of the bank were used for the data collection since they have daily contacts with the customers of the bank. Convenience (Accidental) sampling techniques were used for distributing questionnaires to the respondents. The aim was to get some basic information quickly and cost efficiently (Singhry, 2018).

Validity and Reliability of Instrument

The validity of the research instrument was determined using both Exploratory Factor Analysis (EFA) and Confirmatory Factor Analysis (CFA). In EFA, principal component factor analysis with varimax rotation was used to detect the underlying dimensions. A summary of the output items and the rotated matrix is presented in Table 1. The rotation converged in six (6) iterations. The Kaiser-Meyer-Olkin (KMO) measure of sampling adequacy, which determines the extent to which data are appropriate for factor analyses, yielded a result of .949. A test statistic of .949 (df = 990, p < .001), provided strong evidence that factor analysis was applicable for data analysis in this research. Additionally underscoring the suitability of factor analysis are the results of Bartlett’s Test of Sphericity, which determines whether or not a relationship exists between the variables: if no relationship exists, then undertaking factor analysis is purposeless. An appropriate p-value, per Hinton, Brownlow, McMurray and Cozens (2004), should be < 0.05 when factor analysis is being considered. The p-value in this case is .000, which indicates that factor analysis presented as a highly relevant technique to employ for this research. In addition, the six (6) components extracted have a cumulative total variance explained of 66.682% which is greater than the threshold value of 50% (Hair et al., 2011) and the factor loadings were greater than 0.40, which was proposed as the threshold value by Hair, Black, Babin, Anderson, and Tatham (2006). The results showed that all of the items loaded on the specific factor they were intended to measure except four items in which one was under Reliability of Internet Banking (i.e., RIBS5); one item under behavioural intention (i.e. BI1); one item under Performance Expectancy (i.e. PE5) and one item under effort expectancy. These items otherwise known as nuisance items – were deleted. Thus, it can be said that, the EFA results demonstrate that unidimensionality is ensured.

| Table 1 Rotated Component Matrix | ||||||

| Component | ||||||

| 1 | 2 | 3 | 4 | 5 | 6 | |

| Eigen Values | 18.655 | 3.715 | 2.439 | 2.262 | 1.662 | 1.273 |

| Percentage of Variance Explained | 41.457 | 8.256 | 5.419 | 5.027 | 3.694 | 2.829 |

| Cumulative % of Variance | 41.457 | 49.713 | 55.132 | 60.159 | 63.854 | 66.682 |

| Cronbach Alpha | .930 | .943 | .895 | .897 | .860 | .879 |

| IBS8 | .817 | |||||

| IBS10 | .806 | |||||

| IBS4 | .787 | |||||

| IBS9 | .764 | |||||

| IBS6 | .754 | |||||

| IBS5 | .746 | |||||

| IBS7 | .708 | |||||

| IBS3 | .655 | |||||

| IBS2 | .573 | .411 | ||||

| IBS1 | .492 | |||||

| RIBS5 | .468 | .458 | ||||

| BI7 | .780 | |||||

| BI8 | .779 | |||||

| BI9 | .770 | |||||

| BI6 | .750 | |||||

| BI10 | .735 | |||||

| BI5 | .692 | |||||

| BI3 | .678 | |||||

| BI4 | .653 | |||||

| BI2 | .563 | |||||

| SI2 | .793 | |||||

| SI5 | .784 | |||||

| SI6 | .710 | |||||

| SI4 | .709 | |||||

| SI3 | .697 | |||||

| SI1 | .669 | |||||

| BI1 | .445 | |||||

| PE1 | .768 | |||||

| PE3 | .749 | |||||

| PE4 | .718 | |||||

| PE2 | .702 | |||||

| PE6 | .604 | |||||

| EE3 | .487 | .457 | ||||

| RIBS3 | .824 | |||||

| RIBS2 | .749 | |||||

| RIBS1 | .738 | |||||

| RIBS4 | .403 | .546 | ||||

| RIBS6 | .436 | .512 | ||||

| PE5 | .445 | |||||

| EE6 | .752 | |||||

| EE7 | .619 | |||||

| EE5 | .612 | |||||

| EE2 | .420 | .588 | ||||

| EE1 | .565 | |||||

| EE4 | .543 | |||||

| Extraction Method: Principal Component Analysis. Rotation Method: Varimax with Kaiser Normalization. |

||||||

| a. Rotation converged in 6 iterations. b. Kaiser Meyer Olkin (KMO) Measure of Sampling Adequacy = .949 c. Bartlett’s Test of Sphericity Approx. Chi-Square = 14341.180; DF = 190; Sig. = .000 |

||||||

Reliability and Common Method Bias

The internal consistency or reliability of the refined scale was assessed by Cronbach’s alpha. In general, reliability coefficients of 0.70 are considered satisfactory (Nunnally, & Bernstein, 1994; Hejase and Hejase, 2013). The items reliability ranges between .860 and .943 which are all above the recommended threshold thereby suggesting good internal consistency. Furthermore, common method variance was assessed through Harmon’s one-factor test as recommended by Podsakoff and Organ (1986). As a rule of thumb, the test recommended that all components should account for less than 50% of the total variance explained. It was found that the six dimensions with initial eigenvalues greater than 1 (1.273-18.655), which accounted for 66.682% of the total variance explained. The first components accounted for 41.457%, which is lower than the recommended 50%. As no component has more than 50% of the total variance explained, common method bias was not suspected as an issue in this study.

Construct Validity

Confirmatory factor analysis (CFA) was performed based on the output of the exploratory factor analysis. The maximum likelihood estimation approach was used to establish the construct validity of the measurements. To establish construct validity, the indicators in the measurement model have to meet up the requirement for convergent and discriminant validity. Two approaches were used in construct validation. First, acceptable fitness indices were used and both measurement and structural models had good fitness indices (Bagozzi, 1993). In SEM, there is several Fitness Indices that reflect how fit is the model to the data at hand. However there is no agreement among researchers which fitness indexes to use. Hair et al. (1995, 2011) recommend the use of at least one fitness index from each category of model fit. The validation of the measurement model in CFA produced the fitness indices in Table 2. Although some of the index generally demonstrates lower levels in comparison to the other fit indices values higher than 0.90, values > 0.80 are considered to be also considered appropriate (Byrne, 2001).

| Table 2 Fit Indices | ||||

| Fit Index | Values Obtained | Recommended | Source | |

| Measurement | Structural | |||

| Root Mean Square Residual (RMR) | .066 | .066 | Closer to zero | Jöreskog and Sörbom (1981) |

| Goodness of Fit Index (GFI) | .813 | .813 | >0.90 | Tabachnick and Fidell (2013) |

| Comparative Fit Index (CFI) | .910 | .910 | >0.90 | Bentler (1990) |

| Tucker Lewis Index (TLI) | .901 | .901 | >0.90 | Garver and Mentzer (1999) |

| Normed Fit Index (NFI) | .863 | .863 | >0.90 | Bollen (1989) |

| Incremental Fit Index (IFI) | .910 | .910 | >0.90 | Bollen (1989) |

| Root Mean Square Error of Approximation (RMSEA) | .063 | .063 | <0.08 | Browne and Cudeck (1993) |

| ChiSq/df | 2.620 | 2.620 | <3.00 | Bollen (1989) |

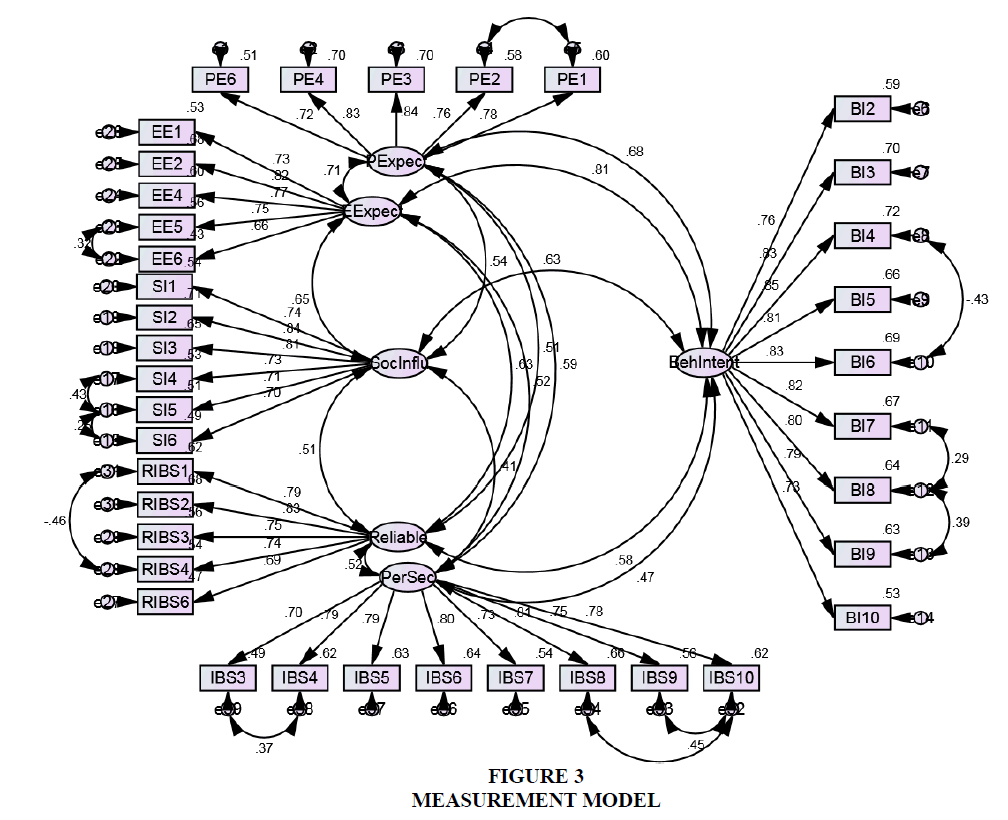

Secondly, to establish construct, validity, convergent and discriminant validity were examined. In EFA, a construct is considered to have convergent validity if its eigen value exceeds 1.0 (Hair et al., 1995). In addition, all the factor loadings must exceed the minimum value of 0.30. Table 1 presents the factor loading of the retained items on their underlying factors. It can be seen that all the loadings are quite high and their Eigen values exceeded the minimum criterion of 1. In confirmatory factor analysis, construct validity was also assessed based on the Fornell and Larcker criterian. A measurement model was developed and assessed as presented in Figure 3.

Convergent validity was evaluated based on recommendations by Fornell and Larcker (1981) and Hair Jr et al. (2013). First, item loading should be more than 0.70 and significance. Second, composite reliability of construct must be greater than 0.80. Third, average variance extracted (AVE) of all construct must be greater than 0.50. However, on the first condition, Hair et al. (2012) argue that items with factor loading above 0.4 should be retained if their deletion would affect content/construct validity and composite reliability. Results from Table 3 show that item loading of both constructs is between 0.659 and 0.848. Composite reliability of both constructs is between 0.864 and 0.943; average variance extracted (AVE) of both constructs is between 0.561 and 0.646. High composite reliabilities indicate that measurement items are valid and generalizable. Therefore, evidences of convergent validity exist.

| Table 3 Factor Loadings of Items On Constructs, AVE and Construct Reliability | ||||

| Constructs | Items | Factor Loadings | AVE | Construct Reliability |

| Performance Expectancy | PE6 | .716 | .619 | .890 |

| PE4 | .835 | |||

| PE3 | .837 | |||

| PE2 | .763 | |||

| PE1 | .775 | |||

| Effort Expectancy | EE6 | .659 | .561 | .864 |

| EE5 | .748 | |||

| EE4 | .774 | |||

| EE2 | .825 | |||

| EE1 | .730 | |||

| Social Influence | SI6 | .699 | .571 | .888 |

| SI5 | .712 | |||

| SI4 | .728 | |||

| SI3 | .806 | |||

| SI2 | .844 | |||

| SI1 | .735 | |||

| Reliability of Internet Banking Service | RIBS6 | .686 | .576 | .871 |

| RIBS4 | .738 | |||

| RIBS3 | .751 | |||

| RIBS2 | .826 | |||

| RIBS1 | .787 | |||

| Internet Banking Security | IBS10 | .785 | .596 | .922 |

| IBS9 | .751 | |||

| IBS8 | .814 | |||

| IBS7 | .734 | |||

| IBS6 | .801 | |||

| IBS5 | .795 | |||

| IBS4 | .786 | |||

| IBS3 | .703 | |||

| Behavioural Intention | BI2 | .765 | .646 | .943 |

| BI3 | .835 | |||

| BI4 | .848 | |||

| BI5 | .811 | |||

| BI6 | .832 | |||

| BI7 | .819 | |||

| BI8 | .800 | |||

| BI9 | .793 | |||

| BI10 | .726 | |||

Discriminant validity was assessed based on the criterion recommended by Fornell and Larcker (1981). The criterion states that the square root of the AVE for each construct must be larger than its correlations with all other constructs. In order words, the AVE should exceed the squared correlation with any other construct (Ali, Kim and Ryu, 2016; Hair et al., 2013). The bold values represented on the diagonal in Table 4 shows the square root of AVE for each construct, meanwhile the values shown at the upper triangle are the square of the correlation. The bold values represented on diagonal in Table 4 showed that the square root of AVE for each construct is greater than all the constructs’ correlations. Furthermore, values above the bold diagonal are the squared correlations of all the constructs and are less than all AVEs of the constructs. The values in the Table 4 provide evidence that each construct is empirically and statistically distinct from other constructs in the study, thus supporting discriminant validity and unidimensionality. It can be concluded that evidence of discriminant validity exists and all the constructs were distinct from each other.

| Table 4 Assessment of Discriminant Validity | |||||||||

| Constructs | 1 | 2 | 3 | 4 | 5 | 6 | 7 | AVE | CR |

| Performance Expectancy | .787 | .391 | .243 | .200 | .312 | .398 | .326 | .619 | .890 |

| Effort Expectancy | .625 | .749 | .310 | .318 | .256 | .531 | .486 | .561 | .864 |

| Social Influence | .493 | .557 | .756 | .201 | .211 | .333 | .263 | .571 | .888 |

| Reliability of Internet Banking | .447 | .564 | .448 | .759 | .291 | .295 | .334 | .576 | .871 |

| Internet Banking Security | .559 | .506 | .459 | .539 | .772 | .228 | .223 | .596 | .922 |

| Behavioural Intention | .631 | .729 | .577 | .543 | .478 | .804 | .623 | .646 | .943 |

Results and Discussion

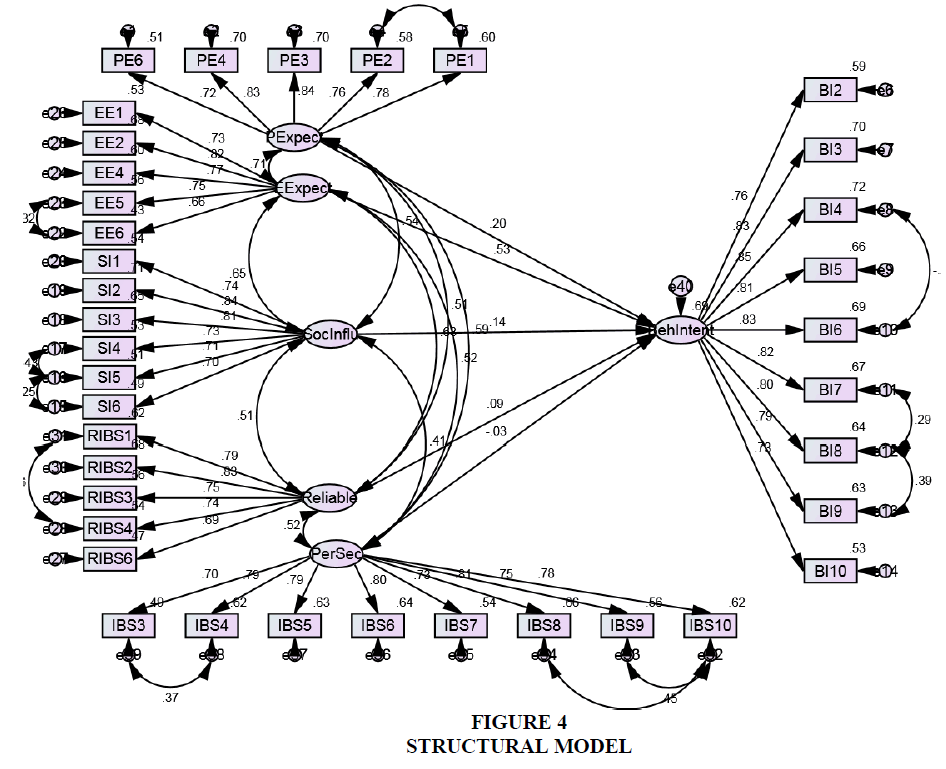

Structural Model Evaluation

The structural model of the study is presented in Figure 4. The figure indicates the relationship among PE, EE, SI, RIBS, IBS and BI. The results are subsequently organized in Table 5. Testing the structural model covers path coefficients (the strength and the sign of the theoretical relationships), hypotheses testing, and variance explained by the independent variables. Overall the validation of the structural model indicates a satisfactorily fitness indices as shown in Table 2. Table 4 provides the path coefficients while Figure 4 provides the validated structural model of the research framework.

The highest positive significant path relationship was between effort expectancy and behavioural intention (β=0.526, CR=7.057, p < .001) which was followed by performance expectancy and behavioural intention (β=0.201, CR=3.345, p < .001) while the least positive significant path relationship was between reliability and behavioural intention (β=0.079, CR=1.895, p < .001). Similarly, internet banking security reported negative but non-significant relationship with behavioural intention with path estimates of (β=-0.028, CR=-0.634, p >.05).

Table 5 revealed that hypotheses 1, 2, and 3 were supported at the 1% level of significance while hypothesis 4 was significant at 10% level of significance. However, hypothesis 5 was not supported. Specifically, the study revealed that performance expectancy has a significant positive effect on behavioural intention to use internet banking which is consistent with the previous studies by Venkatesh et al. (2016), and Chou et al. (2018), Alalwan, Dwivedi, Rana, and Algharabat, (2018) who found that performance expectancy has the highest co-efficient path weight among other constructs in its impact on customers’ behavioural intention. However, these findings contradict with the findings of Verkijika (2018) and Sumak, Polanic & Hericko (2010), who found that performance expectancy, has no direct effect on consumer behavioural intention.

| Table 5 Result of Hypotheses Testing | |||||||

| Paths | Unstd. Est. | Std. Est. | S.E. | C.R. | P | ||

| Performance Expectancy | → | Behavioural Intention | .182* | .201 | .054 | 3.345 | *** |

| Effort Expectancy | → | Behavioural Intention | .529* | .526 | .075 | 7.057 | *** |

| Social Influence | → | Behavioural Intention | .129* | .141 | .046 | 2.818 | .005 |

| Reliability | → | Behavioural Intention | .079*** | .094 | .041 | 1.895 | .058 |

| Security | → | Behavioural Intention | -.028 | -.029 | .044 | -.634 | .526 |

The study also found a significant positive effect of effort expectancy on behavioural intention to use internet banking which is in agreement with the result obtained by Alalwan, Dwivedi, Rana, and Algharabat (2018); Venkatesh et al. (2016); Martins et al. (2014), Tarhini et al. (2013), and Chou et al. (2018) who had found effort expectancy as a strong determinant of consumers’ behavioural intention. Similarly, the positive significant effect of social influence on behavioural intention was supported by the work of Venkatesh et al. (2003), Venkatesh and Zhhang (2010), Tarhini et al. (2014), Yousafzai et al. (2010), Kesharwani and Bisht (2012), Stavros and Anastasios (2017). However, unlike the finding of this study, Alalwan, Dwivedi, Rana, and Algharabat (2018), Birch and Irvine (2009) found no relationship between the two variables.

The test result of the fourth hypothesis show internet banking reliability to have significant positive effect on behavioural intention. This result is in congruence with the result obtained by Rahi, Ghani, and Ngah (2019) and Sharma, Govindaluri, and Al Balushi, (2015). Finally, internet banking security has no significant effect on behavioural intention to use internet banking. This finding is inconsistent with the result obtained by Pikkarainen, Pikkarainen, Karjaluoto and Pahnila (2004) which found a weak relationship between security and behavioual intention to use online banking services. Similarly, Juwaheer, Pudaruth, & Ramdin (2012); Merhi, Hone, and Tarhini (2019), Anouze, and Alamro (2019) found significant positive effect of perceived security on behavioural intention. Also in many banking studies conducted during the past years (Liao and Cheung, 2002) found an insignificant relationship between security and intention to use internet banking services. One would expect a significant relationship between internet bank security and behavioural intention to use internet banking services, going by several security issues surrounding internet based services, however, the researcher is of the opinion that majority of Nigerian bank customers are not majorly concerned about security issues of online transactions and because of the policy mandate for cashless economy in Nigeria.

Conclusion

The UTAUT theory employed in this work and the research findings, adequately explained the relationship among the variables in this study as follows: Performance expectancy, effort expectancy and social influence have significant causal relationship with customer behavioural intention to use internet banking services among Nigerian banking public. Customers’ positive behavioural intention is an indication of their acceptance of internet banking services. Surprisingly, however, much anticipated security issues threatening on line banking users and reliability, which is a functional quality measure in terms of dimensions of SERVQUAL have weak significant relationship with customers’ behavioural intention to use internet banking services. The researcher attribute this to the fact that in social sciences, the issue of variety in statistical significance is common because of complexity in human behaviour, more so, research environment can also contribute to mixed findings. It can be stated that the results of this study confirm that performance and effort expectancies, social influence, reliability and security measures are determinants of customers’ behavioural intention to accept internet banking services.

Implications of the Study

The results of the study provide sufficient evidence for confirming a significant causal relationship among the constructs. The findings were drawn based on the statistical results, and the practical recommendations were in turn, derived logically from the findings. In this section, managers are provided with practical recommendations in order to have more insight regarding the implication of customers’ behavioural intention on acceptance to use products.

The study provides empirical evidence that performance expectancy, effort expectancy, social influence and reliability to an extent, are significantly related to behavioural intention. This implies that Bank managers and policy makers should understand what influences the customers’ behavioural intention, hence positive intention leads to acceptance, and that bank managers must understand customers’ need/wants and deliver services that will match or exceed the actual experience with the needs in order to facilitate exchange. The internet banking service quality variable of reliability has a significant relationship with customers’ behavioural intention which implies that Nigerian banks need to pay attention to reliability features of their internet banking services to sustain customers’ relationship and loyalty. Central Bank of Nigeria (CBN) and other related regulatory agencies can also be guided by the result of this study in their decision making and policy formulation towards internet banking.

The model illustrates that consumers are likely to adopt the internet banking services if they are assured of the safety of transaction, they get expected performance and the system is user-friendly. Therefore, to make internet banking an integral part of daily life and the preferred means of handling transactions and purchase, banking organisation need to focus on minimizing the risks associated with the system and improve its safety and privacy. The second factor to consider is the promise of fast and flawless performance on the go. The system must be easy to use to engage a greater mass. Security features of internet banking should be adequately embedded to sustain safety and privacy.

Limitations of the Study and Future Research Directions

Although several contributions have been made in this study with regards to the antecedents of customers’ behavioural intention, there are also limitations that need to be addressed. First, difficulty in getting a sampling frame is considered as one of the major methodological limitations faced in this research. The inability to get the sampling frame resulted in the use of convenience sampling which is open to more bias than other probability sampling technique. Future research should therefore, employ probability sampling techniques so as to control for bias. Alternatively, research should take institutional customers as respondents (organisational level of analysis). It is expected that in this case, getting a sampling frame would not be a problem.

Secondly, this study was based on a cross-sectional strategy where data was collected in one period of time. This does not allow for a more in-depth study of behavioural intention to use internet banking. As such future research can consider using a longitudinal approach in which data collection will cover a long period of time. Furthermore, although this study did not aim to compare the customers from different regions in Nigeria, there could be some differences among the customers from different geographical locations. Due to the differences on ground of geographical location, it is recommended that future researchers on other sectors different from banking sector should conduct a national survey and compare the consumer behavioural responses among different geographical regions in Nigeria. In addition, future studies should also explore other types of bank such as micro-finance banks with the hope of uncovering different findings compared to those of retail banks. The indications are that other variables could also moderate or mediate the variable explored in this study. Hence, it is recommended that future research should investigate the mediating and moderating influence of other variables with regards to the variables employed in this analysis.

References

- Ajzen, I. (1991). The theory of planned behaviour. Organizational Behaviour and the Human Decision Process, 50, 179-211.

- Alalwan, A.A., Dwivedi, Y.K., Rana, N.P., & Algharabat, R. (2018). Examining factors influencing Jordanian customers’ intentions and adoption of internet banking: Extending UTAUT2 with risk. Journal of Retailing and Consumer Services, 40, 125-138.

- Ali, F., Kim, G.W., & Ryu, K. (2016). The effect of physical environment on passenger delight and satisfaction : Moderating effect of national identity. Tourism Management, 57, 213–224

- Ali, T., Mazen, E., Maged, A., & Alan, S. (2015). Extending the UTAUT model to understand the customers’ acceptance and use of internet banking in Lebanon. Journal of International Education in Business, 29(1), 234-240

- Anouze, A.L.M., & Alamro, A.S. (2019). Factors affecting intention to use e-banking in Jordan. International Journal of Bank Marketing, 38(1), 86-112.

- Bagozzi, R.P. (1993). Assessing construct validity in personality research: Applications to measures of self-esteem. Journal of Research in Personality, 27(1), 49-87.

- Bashir, I., & Madhavaiah, C. (2015). Consumer attitude and behavioural intention towards Internet banking adoption in India. Journal of Indian Business Research, 7(1), 67-102.

- Bast, E. (2011). Exploring technology accetance aspects of an NFC enabled mobile shopping system: Perception of German grocery consumers. Auckland University of Technology.

- Bentler, P.M. (1990). Comparative fit indexes in structural models. Psychological bulletin, 107(2), 238.

- Birch, A., & Irvine, V. (2009). Preservice teachers’ acceptance of ICT integration in the classroom: applying the UTAUT model. Educational media international, 46(4), 295-315.

- Bollen, K.A. (1989). A new incremental fit index for general structural equation models. Sociological Methods & Research, 17(3), 303-316.

- Browne, M.W., & Cudeck, R. (1993). Alternative ways of assessing model fit. Sage focus editions, 154, 136-136.

- Byrne, B.M. (2001). Structural equation modeling with AMOS, EQS, and LISREL: Comparative approaches to testing for the factorial validity of a measuring instrument. International journal of testing, 1(1), 55-86.

- Central Bank of Nigeria (2008). Banking supervision annual report for the year ended 31st December 2008. Abuja: Central Bank of Nigeria. Retrieved from http://www.cenbank.org/

- Chou, Y.H.D., Li, T.Y.D., & Ho, C.T.B. (2018). Factors influencing the adoption of mobile commerce in Taiwan. International Journal of Mobile Communication, 16(2), 117-134.

- Creswell, J.W. (2012). Educational research: Planning, conducting, and evaluating quantitative and qualitative research (4th Ed.). Boston: Edwards Brothers.

- Davis, F.D. (1989). Perceived usefulness, perceived ease of use, and user acceptance of information technology. MIS quarterly, 319-340.

- Dorian, P. (1996). Intensive Customer Care. Sandton: Zebra Press.

- Faqih, K.M., & Jaradat, M.I.R.M. (2015). Assessing the moderating effect of gender difference and individualism- collectivism at individual-level on adoption of mobile commerce technology: TAM3 Perspective. Journal of Retailing and Consumer Services.22(2), 37-52.

- Fornell, C., & Larcker, D. F. (1981). Evaluating structural equation models with unobservable variables and measurement error. Journal of marketing research, 18(1), 39-50.

- Garver, M. S., & Mentzer, J. T. (1999). Logistics research methods: Employing structural equation modeling to test for construct validity. Journal of business logistics, 20(1), 33-47.

- Hair Jr, J.F., Hult, G.T.M., Ringle, C.M., & Sarstedt, M. (2013). A primer on partial least squares structural equation modeling (PLS-SEM): Sage Pubs.

- Hair, J.F., Hult, G.T.M ., Ringle, C.M & Sarstedt, M.A. (2017). Primer on Partial Least Squares Structural Equation Modeling(PLS-SEM), 2nd edition. Sage, Thousand Oaks.

- Hair, J.F., Ringle, C.M., & Sarstedt, M. (2011). PLS-SEM: Indeed a silver bullet. Journal of Marketing Theory and Practice, 19(2), 139–151.

- Hair, J.F., Sarstedt, M., Pieper, T.M., & Ringle, C.M. (2012). The use of partial least squares structural equation modeling in strategic management research: a review of past practices and recommendations for future applications. Long range planning, 45(5-6), 320-340.

- Hair, J., Black, B. Babin, B., Anderson, R. & Tatham, R. (2006). Multivariate data analysis (6th edition). Upper Saddle River, NJ: Prentice-Hall.

- Hair, J.F., Anderson, R.E., Tatham, R.L., Black, W.C., (1995). Multivariate Data Analysis, With Readings (fourth ed.). Englewood Cliffs, New Jersey: Prentice Hall.

- Hassanuddin, N.A., Zalinawati, A., Norudin, M., & Noor, H.H. (2015) Acceptance towards the use of Internet Banking services of Cooperative Bank. International Journal of Academic Research in Business and social sciences. 2 (3), 253-259

- Hejase, A.J., & Hejase, H.J. (2013). Research Methods: A Practical Approach for Business Students. 2nd Edition, Philadelphia, USA: Massadir Inc.

- Hinton, P.R., Brownlow, C., McMurray, I., & Cozens, B. (2004). Using SPSS to analyse questionnaires: Reliability. SPSS explained, 356-366.

- Hofstede, G. (1990). A Reply and Comment on Joginder P. Singh:'Managerial Culture and Work-related Values in India'. Organization Studies, 11(1), 103-106.

- Hossain, M., & Leo, S. (2009). Customer perception on service quality in retail banking in Middle East: the case of Qatar. International Journal of Islamic and Middle Eastern Finance and Management, 2(4), 338-350.

- Hutchinson, J., Lai, F., & Wang, Y. (2009). Understanding the relationships of quality, value, equity, satisfaction, and behavioural intentions among golf travelers. Tourism Management, 30, 298–308.

- Jöreskog, K.G., & Sörbom, D. (1981). LISREL 5: analysis of linear structural relationships by maximum likelihood and least squares methods;[user's guide]. University of Uppsala.

- Juwaheer, T.D., Pudaruth, S., & Ramdin, P. (2012). Factors influencing the adoption of internet banking: a case study of commercial banks in Mauritius. World Journal of Science, Technology and Sustainable Development, 9(3), 204-234.

- Kanokkarn, S.N., & Tipparat, L. (2018). Assessing the intentions to use internet banking: the role of perceived risk and trust as mediating factors. International Journal of Bank Marketing, https://doi.org/10.1108/IJBM-11-2018-0159.

- Kesharwani, A., & Bisht, S.S. (2012). The impact of trust and perceived risk on internet banking adoption in India: an extension of technology acceptance model. International Journal of Bank Marketing, 30 (4), .303-322.

- Kettinger, W.J., & Lee, C.C. (2005). Zones of tolerance: Alternative scales of measuring information systems service quality. MIS Quarterly, 29, 607-623

- Khalilzadeh, J., Ahmet B.O., & Anil, B.(2017) Security-related factors in extended UTAUT model for NFC based mobile payment in the restaurant industry. Computers in Human Behaviour, 24(2), 9-13.

- Krejcie, R.V., & Morgan, D.W. (1970). Determining sample size for research activities.

- Ladhari, R. (2009). Service quality, emotional satisfaction, and behavioural intentions: A study in the hotel industry. Managing Service quality. 19 (3), 308-331.

- Larkin, H. (1999). Programs to boost patient satisfaction pay off in many ways CEO say. AHA News 06/21/99, 35, 1.

- Lee, M .C (2009). Factors influencing the adoption of internet banking: an integration of TAM and TPB with perceived risk and perceived benefit. Electronic Commerce Research and Applications, 8 (3), 130-141.

- Liao, Z., & Cheung, M., (2002). Internet based e-banking and customer attitude: An empirical study. International Journal of Information & Management, 34(1), 283-295

- Liebana-Cabanillas, F., Marinkovic, V., & Kalinic, Z. (2017). A SEM-neural network approach for predicting antecedentts of m- commerce acceptance. International Journal of Information & Management, 48(8), 393-403.

- Malhotra, M.K., McCort, J.D. (2015). A cross-cultural comparison of behavioural intentions Models. International Marketing Review, 18(3), 235-69.

- Martins, C., Oliveira, T & Popovic, A. (2014). Understanding the Internet banking adoption: a unified theory of acceptance and use of technology and perceived risk application, International Journal of Information & Management, 39(2), 1-13

- Merhi, M., Hone, K., & Tarhini, A. (2019). A cross-cultural study of the intention to use mobile banking between Lebanese and British consumers: Extending UTAUT2 with security, privacy and trust. Technology in Society, 59, 101151.

- Mohammad, M. & Oorschot, P.V. (2017). Security and usability; The Gap in Real-world- online banking.

- Mohammed, S. K. & Siba, S.M. (2009). Service Quality Evaluation I internet Banking: An Empirical study in India. International Journal of Indian Culture and Business Management, 2(1), 12-19.

- Nunnally, J.C., & Bernstein, I. (1994). Psychometric theory (3 ed.). New York: McGraw-Hill.

- Nwachukwu, I. (2013). Retail banking: Banks going back to the basics? - Latest news, breaking news, business, finance analysis. Business Day. Retrieved from http://www.businessdayonlinSe.com/index

- Nwogu, E., & Odoh, M. (2015). Security Issues Annalysis on Online Banking Implementations in Nigeria. International Journal of Computer Science and Telecommunications, 6(1) 20-21.

- Odumeru, J.A. (2012). The acceptance of e-banking by customers in Nigeria. World Review of Business Research, 2(2), 62-74.

- Parasuraman, A., Zeithaml, V.A., & Berry, L.L. (1988). SERVQUAL: A multiple item scale for measuring consumer perceptions of service quality. Journal of Retailing, 64, (3), 12-40.

- Parasuraman, A., Zeithmal, V.A. & Berry, L.L. (1985). A conceptual model of service quality and its implications for future research. Journal of Marketing, 49 (4), 35-41.

- Parasuraman, R., & Greenwood, P.M. (1998). Selective attention in aging and dementia. In R. Parasuraman (Ed.). The attentive brain (pp461–487). The MIT Press.

- Pikkarainen, T., Pikkarainen, K., Karjaluoto, H., & Pahnila, S. (2004). Consumer acceptance of online banking: an extension of the technology acceptance model. Internet research, 14(3), 224-235.

- Podsakoff, P.M., & Organ, D.W. (1986). Self-reports in organizational research: Problems and prospects. Journal of management, 12(4), 531-544.

- Rahi, S., Ghani, M. A., & Ngah, A. H. (2019). Integration of unified theory of acceptance and use of technology in internet banking adoption setting: Evidence from Pakistan. Technology in Society, 58, 101120.

- Saha, G.C, & Theingi (2009). Service quality, satisfaction, and behavioural intentions: A study of low-cost airline carriers in Thailand. Managing Service quality, 19(3), 350-372

- Saleh, H.K. (2008), Computer self-efficacy of university faculty in Lebanon, Educational Technology Research and Development, 56(2), 229-240.

- Salisbury, W.D., Pearson, R.A., Pearson, A.W., & Miller, D.W. (2001). Perceived security and World Wide Web purchase intention. Industrial Management & Data Systems, 101(4), 165-177.

- Santonen, T. (2007). Price sensitivity as an indicator of customer defection in retail banking. International Journal of Bank Marketing, 25(1), 39-55

- Sanusi, S.L. (2011). Banks in nigeria and National economic development: Acritical review. Paper presented at the seminar on becoming an economic driver while applying banking regulations, Lagos.

- Sarfaraz, J. (2017). Unified Theory of Acceptance and Use of Technology (UTAUT) Model Mobile Banking. Journal of Internet Banking and Commerce, 22(3), 2-20

- Saunders, M., Lewis, P., & Thornhill, A. (2016). Research methods for business students (Vol. Seventh). Harlow: Pearson Education.

- Sharma, R., Singh, G., & Sharma, S. (2020). Modelling internet banking adoption in Fiji: A developing country perspective. International Journal of Information Management, 53, 102116.

- Sharma, S.K., Govindaluri, S.M., & Al Balushi, S.M. (2015). Predicting determinants of Internet banking adoption. Management Research Review, 38(7), 750-766.

- Shin, D.H. (2009). Towards an understanding of consumer acceptance of mobil wallet. Computers in Human Behaviour, 25(6), 1343-1354.

- Shumaila, Y., & Mirella, Y.(2015). Understanding customer specific factors underpining internet banking adoption. International Journal of Bank Marketing, 30(1), 78-81.

- Singhry, H. B. (2018). Research methods made easy. Bauchi-Nigeria: Greenleaf Publishing Company.

- Stavros, A.N & Anastasios, A.E.(2017). Mobile-based assessment: Investigating the factors that influence behavioural intention to use. International Journal of Computers & Education, 109(3), 56-73

- Sumak, B, Polancic, G, & Hericko, M. (2010). An Empirical Study of Virtual Learning Environment Adoption Using UTAUT. In proceedings of 2010 Second International Conference on Mobile, Hybrid, and Online Learning.

- Tabachnick, B.G., & Fidell, L.S. (2013). Using Multivariate Statistics (6th ed.). Boston: Person.

- Taiwo, A.A., Mahmood, A.K., & Downe, A.G. (2012). User acceptance of eGovernment: Integrating risk and trust dimensions with UTAUT model. In 2012 international conference on computer & information science (ICCIS), 1, 109-113.

- Tarhini, A., Hone, K. & Liu, X. (2013), Factors affecting students’ acceptance of e-learning environment in developing countries: a structural equation modeling approach. International Journal of Information and Education Technology, 3(1), 54-59.

- Tarhini, A., Hone, K., & Liu, X. (2014). The effects of individual differences on e-learning users’ behaviour in developing countries: A structural equation model. Computers in Human Behavior, 41, 153-163.

- Uduk, M. (2019). Lead paper presented at the Nigeria Stock Exchange (NSE) Data Workshop 2019.

- Venkatesh, V., & Zhang, X. (2010). Unified theory of acceptance and use of technology: US vs. China. Journal of global information technology management, 13(1), 5-27.

- Venkatesh, V., Morris, M. G., Davis, G. B., & Davis, F. D. (2003). User acceptance of information technology: Toward a unified view. MIS Quarterly, 27(3), 425–478.

- Venkatesh, V., Thong, J.Y.L., & Xu, X. (2016). Unified theory of acceptance and use of technology: A synthesis and the road ahead. Journal of the Association for Information Systems, 17(5), 328-376.

- Venkatesh, V., Thong, J.Y.L., & Xu, X. (2012). Consumer acceptance and use of information technology: extending the unified theory of acceptance and use of technology. MIS Quarterly, 36(1), 157-178.

- Verkijika, S.F. (2018) Factors influencing the adoption of mobile commerce application in Cameroon. Telematics and Informatics, 35(6), 1665-1674.

- Walker, K., Denver, P. & Ferguson, C. (2000). Managing key clients: securing the future of the Professional Services. Continum Publishers.

- Yoon, H.S & Steege, L.M.B. (2013). Development of a quantitative model of the impact of customers’ personality and perceptions on internet banking use, Computers in Human Behaviour, 29(3), 1133-1141.

- Yousafzai, S.Y., Foxall, G.R., & Pallister, J.G. (2010). Explaining internet banking behavior: theory of reasoned action, theory of planned behavior, or technology acceptance model? Journal of applied social psychology, 40(5), 1172-1202.

- Zhao, A.L., Koenig-Lewis, N., Hanmer- Lloyd, S. & Ward, P. (2010). Adoption of internet banking services in China: is it all about trust? International Journal of Bank Marketing, 28(1), 7-26.

- Zhou, T., Lu, Y., & Wang, B. (2010). Integrating TTF andUTAUT to explain mobile banking user adoption. Computers in Human Behaviur, 26(4), 760-767.