Research Article: 2020 Vol: 24 Issue: 3

An Empirical Analysis of The Impact of Credit Risk on The Financial Performance of South African Banks

Ephias Munangi, University of South Africa

Athenia Bongani Sibindi, University of South Africa

Abstract

The banking sector is an important industry that needs to be safeguarded, as its failure is bound to have negative knock-on effects on the economy at large. In this article we examine the impact of credit risk on the financial performance of 18 South African banks for the period 2008 to 2018. Panel data techniques, namely the pooled ordinary least squares (pooled OLS), fixed effects and random effects estimators were employed to test the relationship between credit risk and financial performance (proxied by non-performing loans (NPLs) and by return on assets (ROA) or return on equity (ROE) respectively). The results of the study documented that credit risk was negatively related to financial performance. Thus, the higher the incidence of non-performing loans, the lower the profitability of the bank. Secondly, the study documented that growth had a positive effect on financial performance. This indicates that productivity capacity is ameliorated through bank development. Thirdly, it was found that capital adequacy was positively related to financial performance. While a greater capital adequacy ratio may instil confidence of stakeholders in a bank, making it competitive, to the contrary a high capital base may be perceived as lack of initiative and tying up resources which could have yielded better returns in alternative investments. Fourthly, the study did not find any conclusive relationship between size and financial performance. Lastly, the study found that bank leverage and financial performance were negatively related. The implications of the findings are that at a micro-level, banks should observe prudent and stringent credit policies in-order to limit the incidence of non-performing loans. At a macro-level, regulators must enhance supervision in order to ensure that banks manage their credit risk according to the regulations thereby minimising the risk of bank failure.

Keywords

Return on Assets, Return on Equity, Financial Performance, Credit Risk, Non- Performing Loans, Banks, South Africa.

Introduction

The heart of any financial system lies in the banking sector. Yet, credit risk continues to be a problem in South African banking system. This is further exacerbated since if credit risk is not managed and monitored may lead to bank failure (Makri & Papadatos, 2013). Belligerent granting of credit was found to be the pre-eminent driver of loan default (Rahman & Hai, 2017). There has been low economic growth in South Africa, which elevates credit risks and negatively affects the profitability of banks. The volatile worldwide, political and economic environment demands greater management acumen in the credit environment to contribute to the financial performance of banks.

A poor performing economy leaves people heavily mired in debt and defaulting leading to bank failure, since credit is an immense component of the financial soundness of banks. Therefore, effective oversight of non-performing loans is imperative to boost bank performance and offer guidance on economic efficiency. Profitability of banks is threatened by the growth of non-performing loans, due to absence of risk management (Haneef et al., 2012). However, financial performance of banks can be vastly improved if risks are managed (Alexiou & Sofoklis, 2009). Credit risk evaluation is important, as it helps put measures in place to anticipate, avoid, and prevent defaults from occurring (Bruni et al., 2014).

Empirical research lends clarity to the nexus that exists between credit risks and performance of banks. Extensive research is necessary to establish whether banks are failing to perform financially due to lack of effective credit risk management (Kargi, 2011). Loans are germane to credit risk exposure of banks. Hence, the analysis of the trend during the period 2008 to 2018 under investigation is salient, since loans must be managed for a bank to survive and stay profitable (Abbas et al. 2014). Non-performing loans and challenges with the loan quality can put South Africa’s financial stability at risk and at the same time hinder economic growth (Nikolaidou & Vogiazas, 2014). Credit risk management alleviates the effect of nonperforming loans to circumvent collapse of banks, which lead to lower economic growth and higher unemployment, which was approximately at 29% in South Africa in 2019 (STATSSA, 2019). High unemployment rates in developing countries contribute to inability to settle debts.

The primary objective of the study is to establish the impact of credit risk on financial performance of banks in South Africa. Secondly, it is to establish whether financial performance varies with the growth of South African banks. Thirdly, it is to establish the relationship between financial performance and capital adequacy of banks in the Republic. The fourth objective is to determine if the financial performance of South African banks varies with bank size. Lastly, it is to establish the relationship between bank leverage and financial performance of South African banks.

The study will contribute to literature on the relationship between bank credit risk and financial performance which is scant. Resource allocation will be enhanced, as well as the return from the risks taken, thereby improving performance. Financial performance is a measure of good use of scarce resources to create and maximise those profits (Ally, 2013). When risks are well-managed in banks, bank failures will be eradicated and there will be a stable economy in South Africa (Jaseviciene & Valiuliene, 2013). A well-structured banking system leads to a sound financial system which then results in an improved economy for the country. There remains little published work on the topic (Tarawneh, 2006).

The remainder of the paper is arranged as follows: the next section reviews the literature on the nexus between credit risk and financial performance of South African banks. The following section then describes the research methodology. The section that follows presents the empirical findings. The last section then concludes the paper and discusses the implications of the findings.

Review of Related Literature

The granting of credit entails uncertainty, because the future is unknown and future risks are unknowable (Furedi, 2009). Credit risk is the risk of default, the extent of fluctuations in debt instruments and derivatives valuation which varies and depends on the creditworthiness of borrowers (Lopez & Saidenberg, 2005). Credit risk must be identified, measured, monitored, and managed so as to ensure that the credit risks on loans are properly priced to acquire the set targets of returns from the information obtained during loan documentation (Kithinji, 2010). Credit risk is a notable financial risk, which has to be cautiously monitored and supervised so as to reduce default rate (Noomen & Abbes, 2018). General lack of a monitoring process on credit records, which includes not following up after banks give credit, and instability of governance are contributors of increased credit risk in banks. It is essential for any bank as a lender to continuously monitor the borrower’s ability to repay the debt (Addae-korankye, 2014). When debts are repaid, the level of non-performing loans diminishes and profitability increases.

Risk management involves assessing credit worthiness, which is the first step in the loan approval process (Shahom, 2004). Banks conduct an extensive financial and non-financial analysis as part of credit risk assessment and focus on creditworthy clients to reduce borrowers who will default (Mileris, 2015). The history of repayments on borrowed amounts and the balance sheet of the borrower play an important part in the assessment of credit worthiness. The predicted ability to repay loans in the assessment of creditworthiness is equally important and it can be ascertained through cash flow projections, which can show expected returns on investments (Nguta & Huka, 2013). Banks have an enormous social responsibility to deny credit to borrowers with a high probability of default (Ljubi?, Pavlovi?, & Milan?i?, 2015). Credit management is crucial, as failure to have quality loans and credit-worthy customers leads to an increase of default risk, which will strongly affect the performance, growth and survival of banks (Mirach, 2010).

The best approach to understanding credit risk and lessen the impact of non-performing loans is to analyse the financial performance of banks (Bhattarai, 2015). When banks issue credit there is uncertainty which surrounds the outcome on returns. Banks take risks and are rewarded well when borrowers do not default. Empirical evidence from previous studies show mixed results on the nexus between credit risk and financial performance at banks (Mushtaq, Ismail, & Hanif, 2013). Some studies revealed that those banks that tend to have more losses harbour a greater risk appetite (Khemraj & Pasha, 2013). In order for banks to monitor risk appetite and be in charge of credit risk, policies that ensure loans are accorded to those with the ability to pay back what they owe and minimise loan delinquency are essential (Karuri, 2014). Arguably, effective risk management would mitigate the high incidence of nonperforming loans which diminish profits (Aliu & Sahiti, 2016).

Sbârcea (2017) examined the levels of credit risks for banks which can be tolerable for performance to be acceptable. The study documented that profitability was high with ROE and ROA showing positive profitability trends and this motivated gravitation towards taking on greater risk. However, a closer monitoring of non-performing loans should forever be observed since non-performing loans represent a cost to banks which lowers profit and in many times linked with bank failures and financial crises which lead to economic turmoil (Khemraj & Pasha, 2013). This is because the credit system is destabilised as a consequence of default (Mirach, 2010). Therefore, it is logical for banks to accurately appraise applications for loans considering that banks flourish when they mitigate credit risks to acceptable levels. Prudent credit risk management helps to improve bank profitability and increase chances of survival of banks (Al-shakrchy, 2017).

Kargi (2011), investigated the impact of credit risk on the financial performance of Nigerian banks. Further, the study established that banks’ profitability is inversely influenced by the levels of loans and advances, non-performing loans and deposits. This therefore exposes them to great risk of illiquidity and distress. Credit risk management was observed to have a significant impact on the profitability of banks.

Another strand of studies has documented a negative relationship between credit risk and bank performance. A decrease in bank performance is observed when the level of credit risk goes up (see for instance; Kaaya & Pastory, 2013; Chimkono, Muturi, & Njeru, 2016). Extant studies support a negative relationship between credit risk and profitability (see for instance, Kolapo Ayeni, & OKE, 2012; Githaiga, 2015; Al-shakrchy, 2017; Sbârcea, 2017 and Seemule, Sinha & Ndlovu, 2017). Moreover, Saheb and Reddy (2018) examined nonperforming loans and established their negative outlook on performance of banks. They reasoned that banks must deal with non-performing loans in order to perform well through various strategies such as debt factoring. Peric and Konjusak (2017) also reported a negative relationship between return on assets (ROA) and non-performing loans. Credit risk was found to be a vital predictor of bank’s financial performance. In the same vein, Rasika and Sampath (2016), examined the impact credit risk has on financial performance of commercial banks in Sri Lanka and found that the return on equity was negatively related to non-performing loans. To the contrary Kithinji (2010) documented no relationship between non-performing loans and profitability, as the findings revealed that profitability of the banks were not influenced by nonperforming loans, suggesting that there were other variables at play to impact financial performance.

Munyai (2010) contended that high interest rates were the biggest problem during recession of 2007-08 even after the introduction of the National Credit Act which was signed into law by the President of South Africa in 2005. This caused over-indebtedness which ultimately led to default. An increase in interest rates makes repayment tough for borrowers (Wambui, 2013). Interest rate variations have financial stability implications, due to the fact that banks tend to accept higher risk exposure and have an increased risk appetite when interest rates are low, which in turn fuels inflation (González-aguado, 2014). Inflation does not discriminate and affects performance of all banks negatively regardless of size (Ifeacho & Ngalawa, 2014). An economy that is doing well is synonymous with improved bank performance and closely linked to growth (Kumar & Kavita, 2017). Petria et al (2015), refer to a similar study, which showed growth has a positive effect on bank profitability.

The lending growth strategy, if not carefully assessed, has a negative effect on profitability of banks (Siaw et al., 2014). Banks tend to become risk aggressive in efforts to attain more market share (Mishi et al., 2016). Growth at the expense of appropriate credit assessment puts in jeopardy the ability to pay loans. This affects even adequately capitalised banks. Motive to gain a competitive advantage over rivals is what leads to reckless lending in most instances (Dang, 2011). However, South African banks are underpinned by solid regulatory and legal framework, and operate in a highly competitive environment, which increases costs (Kumbirai & Webb, 2010). The greater the number of loans, the greater the credit risk which then erodes profitability. Fast credit growth not supported by economic growth can result in undesirable effects of both macro-economic and financial volatility (Peric & Konjusak, 2017). In some cases, banks need to raise more capital to sustain the growth strategy, and this presents the challenge which in turn affect returns of investors. Shareholder wealth is improved when the bank performs well, and credit controls are in place.

According to Musah (2017) liquidity is a very important driver for bank profitability. This view was also established by Dima (2011) who found that profitability was directly proportional to liquidity, in the sense that profits resultantly produce cash flow. Banks tend to perform poorly in times when gross domestic product (GDP) growth is low, and financial performance is good when GDP growth is high (Murerwa, 2015). There is a great demand for loans in favourable times, since the standard of living improves. The banking sector contributes more than 20% of the GDP in South Africa, where economic growth stabilises the ability of borrowers to repay debts (Ifeacho & Ngalawa, 2014).

Banks are liquid when the minimum capital requirements enable them to pay debts and depositors. When a bank is capitalised adequately, it seems to be more profitable (Dietrich & Wanzenried, 2009). Shareholders provide capital to a bank with ability to earn a profit, making it a worthwhile investment. Adequate capital instils confidence to all stakeholders and establishes a strong reputation (Armitage & Marston, 2008). Banks take less risk when facing liquid problems. Bigger adequately capitalised banks with the ability to settle obligations are more profitable and financially stable (Paleckova, 2016; Mahathanaseth & Tauer, 2014). Capital must be enough to cover any form of risks encountered, both expected and unexpected losses (Githaiga, 2015). Equity, solvency ratio, and internal capital are prime components to examine when evaluating capital adequacy, which is mostly favourable for profitable banks with low leverage (Klepczarek, 2015). A greater level of calculated risk is assumed by banks when there is assurance of sufficient capital and this minimises default risk.

Equity, customer savings, and foreign funds are the three principal sources of how banks finance granting credit (Cichorska, 2014). The balance sheet section of a bank’s financial statements usually has a greater amount of debt compared to equity, where being highly leveraged means more risk (Maré & Sanderson, 2017). Having more debt on the capital structure is deleterious insofar as long-term solvency is concerned, not having the ability to settle cash obligations when required (Dima, 2011). Shareholders can influence the leverage position of the banks through the provision of capital (Zamore et al., 2018). A banks’ ability to earn returns above the cost of capital is cardinal in attempts to maximise shareholders wealth (de Wet & Hall, 2004). Therefore, an optimal capital structure according to the trade-off theory is desirable, namely one that will reduce the weighted average cost of capital (WACC) of the bank and improve profits (Vries & Erasmus, 2012).

Lower capital ratios have been found to push leverage higher together with risk and borrowing costs of banks (Akbas, 2013). High leverage indicates that banks are financed more through debt. Noomen and Abbes (2018) are of the view that leverage does not influence credit risk. However, the higher the debt the greater the risk of ending up with total liabilities exceeding total assets, thus being insolvent. Solvency risk is deemed to be a catalyst for bank failure (Samuels, 2014).

A number of studies have established a positive relationship between credit risk and financial performance of banks. Among others, Boahene et al. (2012) documented a positive relation between credit risk indicators of non-performing loans on the financial performance of banks. Further, Alshatti (2015), examined the effect of credit risk management on financial performance of Jordanian commercial banks and found a positive relationship between nonperforming loans and banks’ financial performance. Alshatti (2015), concluded that capital adequacy ratio had no effect on the profitability of banks as measured by ROE. Leverage, however, was found to negatively contribute towards banks’ profitability.

A number of existing studies have established on the one hand a negative relationship of capital adequacy with return on assets, while on the other hand a positive relationship has been established between capital adequacy and return on equity (Ifeacho & Ngalawa, 2014). On the other hand, Lipunga (2014) states that capital adequacy had no significant impact on ROA. When measured by ROA, no effect of capital adequacy ratio was found on the financial performance of banks (Alshatti, 2015). Nyoka (2019) found a direct correlation between bank capital and profitability. A negative nexus between leverage ratio and profitability is reported in some studies (Shah & Khan, 2017). Tan (2016) contended that a high ROA with low ROE finding is attributable to low leverage in banks. Kohlscheen, Murcia and Contreras (2018), shared a similar view, emphasising the dependence of shocks on profitability and leverage. Value creation is low for banks that are highly leveraged, with more debt in the capital structure (Kumar, 2014). The debt reduces the leeway for losses.

Bank size is a specific internal variable, which affects profitability differently among banks (Ongore & Kusa, 2013). As the bank size increases, so does the ability to earn more money. Generally, the bigger the bank, the greater the profits, and the higher its performance (Ferrouhi, 2017). There are contrasting views on whether bank size affects the banks’ performance (Murerwa, 2015; Mehrjardi, 2012). No conclusive results have been found on the correlation between bank size and profitability, except for the fact that economies or diseconomies of scale is a huge factor (Kusi et al., 2017). On the one hand, bank size has been found to be positively related with profitability (Flamini et al., 2009 ; Paleckova, 2016 and Kusi et al., 2017). were also of the same view and reported that the relationship between bank size and bank profitability was positive. Similarly, Nataraja et al. (2018) corroborated this finding and documented a direct correlation between return on assets (ROA) and bank size. On the other hand, a number of studies documented that credit risk and return on equity (ROE) was negatively related to bank size. Ally (2013) found a negative impact of bank size on the return on assets.

Research Methodology

Research Design

A correlation research design is adopted for this research. This non-experimental descriptive design is chosen as it provides how two or more variables are related to one another, what they share or have in common, while at the same time, predicting a particular outcome based on certain information provided (Salkind, 2012). The use of a numerical index called the correlation coefficient will measure the strength of the relationship between the variables. The aim is to have few errors from the analysis of data and provide adequate accurate and reliable information. Conclusions were based on deductive arguments since data was analysed with apriori expectations which started with theories and ended with conclusions. Approach is aimed to test if theories are correct. Numerical research or data was collected and was converted into useable statistics.

Sample Description and Data sources

The target population for this study was made up of South African banks with full financial statements operating between the periods from 2008 to 2018. The sample comprised of 18 banks as reported in Table 1. The study made use of secondary data extracted from the Bureau van Dijk Orbis: Bank Focus database. The study used a balanced panel data research design. The data extracted were the full financial statements of the sample under consideration, that is, through the non-probability purposive sampling technique (Etikan, Musa, & Alkassim, 2016). The data collected from the financial statements of banks was analysed through descriptive statistics, correlation matrix and panel regression models.

| Table 1 Sample of Banks | ||

| 1 | ABSA | Financial services group offering personal and business banking, credit cards, corporate and investment banking, wealth and investment management. |

| 2 | AFRICAN BANK | Retail bank that offers financial products and services |

| 3 | ALBARAKA | A world leader in Islamic banking |

| 4 | BIDVEST | Market leaders in foreign exchange and offer a full suite of banking and financial services to individuals and businesses |

| 5 | CAPITEC | Financing retail bank |

| 6 | DEVELOPMENT BANK OF SOUTH AFRICA | Development finance institution owned by the government |

| 7 | FIRST RAND | Financial services provider |

| 8 | GBS MUTUAL BANK | Financial services provider and a registered credit provider |

| 9 | GRINDROD | Commercial financial institution |

| 10 | GROBANK | Business, Agribusiness and Alliance banking |

| 11 | HABIB OVERSEAS BANK | Commercial bank |

| 12 | HBZ BANK | Business, personal, Islamic, trade finance and services |

| 13 | INVESTEC | Specialist banking and asset management group |

| 14 | MERCANTILE | Provides products and services in retail banking, corporate finance, asset management, equity brokerage and security |

| 15 | NEDBANK | Wholesale and retail banking, insurance, asset management and wealth management |

| 16 | SASFIN | Financial products and services focus on the needs of entrepreneurs, corporates, institutions, and high-net worth individuals. |

| 17 | STANDARD BANK | A universal bank and full-service financial group offering transactional banking, saving, borrowing, lending, investment, insurance, risk management, wealth management and advisory services. |

| 18 | VBS MUTUAL BANK | A specialist corporate finance and retail bank |

Panel data techniques were employed to control for heterogeneity due to the different nature, complexity and size of the banks. Specifically, a static model was specified to test the relationships. Fixed Effects and Random Effects models are both useful to study the dynamics of cross-sectional data and control over unobserved time-invariant heterogeneity in crosssectional models (Arellano & Bonhomme, 2009). To ensure that the estimated results were reliable, diagnostic tests were also conducted on the estimated models. The applied Chow test on the pooled OLS model was first to discern whether fixed effects were valid. The Breusch Pagan (1980) LM test was the second test conducted to establish whether random effects were present. If the random effects were detected, then, the Hausman test was useful to discern the choice of the preferred estimator between the RE and FE estimators. Next, the modified Wald test was employed to test for group-wise heteroscedasticity. It is an important test to avoid standard errors being biased. The Pesaran (2004) CD test was conducted last for cross sectional dependence. Possibly cross-sectional dependence is inherent from banks depending on each other for funding through interbank market activities.

Model Specification

This study adapted a static panel data model. Return on Assets (ROA) and Return on Equity (ROE) for robustness, were used as dependent variables to proxy profitability. The independent variable, credit risk, was also measured by the ratio of non-performing loan to total loan and advance ratio (NPLR) as well as non-performing loans to total equity (NPLE) to test the robustness of the results. The rest of the variables are defined in Table 2.

| Table 2 Variable Definition | ||||

| Variable | Formula | Previous studies with similar approach | Findings | Expected sign |

| Dependent Variables | ||||

| Return on Equity (ROE) |  |

(Ifeacho & Ngalawa, 2014b) (Sbârcea, 2017) (Nataraja et al., 2018) |

Credit risk has significant impact on ROE | Negative |

| Return on Assets (R.O.A) |  |

(Alshatti, 2015a) (Saeed & Zahid, 2016) (Ongore & Kusa, 2013) |

Positive relationship of NPLR and financial performance | Negative |

| Independent Variables | ||||

| Non-Performing Loans Ratio (NPLR) |  |

(Abbas et al., 2014) (Nduku, 2013) (Chimkono et al., 2016) (Al-shakrchy, 2017) |

Non-performing loans affect the bank performance negatively | Negative / Positive |

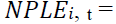

| NPLs to total equity (NPLE) |  |

(Rahman & Hai, 2017) | Non-performing loans adversely affects financial performance | Negative / Positive |

| Control Variables | ||||

| Size | Logarithm of Total Assets | (Boahene, Dasah, & Agyei, 2012) (Petria et al., 2015) (Shah & Khan, 2017) |

Size significantly affects profitability | Positive |

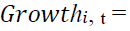

| Growth | Growth rate of Total Assets / Sales | (Chipeta, Wolmarans, & Vermaak, 2012) | Growth firms increase profitability to the firms | Positive |

| Leverage | Total Debt / Total Assets | (Jasevi?ien?, Povilaitis, & Vidzbelyt?, 2013) (Klepczarek, 2015) |

Highly leveraged firms perform better | Positive |

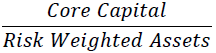

| Capital Adequacy Ratio (CAR) |  |

(Dreca, 2013) (Echekoba, Egbunike, & Kasie, 2014) (Aspal & Nazneen, 2014) |

ROA has a negative effect on CAR, while ROE is positively related with CAR | Positive |

The following static panel data models were specified as follows:

Where:  Return on Assets for bank i at time t ;

Return on Assets for bank i at time t ; Return on Equity for bank i at time t ;

Return on Equity for bank i at time t ;  Non-performing Loans Ratio for bank i at time t ;

Non-performing Loans Ratio for bank i at time t ; Nonperforming Loans to Equity for bank i at time t ;

Nonperforming Loans to Equity for bank i at time t ;  Growth for bank i at time t

Growth for bank i at time t Size for bank i at time t ;

Size for bank i at time t ; Leverage for bank i at time t ;

Leverage for bank i at time t ; Capital Adequacy Ratio for bank i at time t ;

Capital Adequacy Ratio for bank i at time t ;  = slope parameter;

= slope parameter; group-specific constant term that embodies all the observable effects ;

group-specific constant term that embodies all the observable effects ;  composite error term that also takes care of other explanatory variables that equally determine non-performing loans but were not included in the model.

composite error term that also takes care of other explanatory variables that equally determine non-performing loans but were not included in the model.

Equations (1) and (2) were estimated using the pooled regression model (Ordinary Least Squares [OLS]), Fixed Effects Model (FEM) and Random Effects Model (REM). Preestimation tests were conducted to establish that the estimated models were stable and not misspecified. Diagnostic tests were conducted to decide on the best estimator to run the model.

Empirical Findings

Descriptive Statistics

The summary statistics that present the measures of central tendency and normality are presented in Table 3. The results documented that the sample average bank financial performance of South African banks proxied by ROA was roughly minus 5 percent for the period under review. The minimum recorded ROE was as low as roughly minus 390%, while the best performing South African bank recorded a return on equity of about 224% for its shareholders. The results showed that most of the South African banks have a higher ROE more than ROA. The mean non-performing loan ratio (NPLR) of all banks over the test period was 0.0546. This suggests that banks could not collect 5.46% of every loan advanced. The standard deviation recorded based on non-performing loan ratio (NPLR) was 0.1014.

| Table 3 Summary Statistics | ||||||||

| Variable | Mean | Median | Standard Deviation | Min | Max | Skewness | Kurtosis | Number |

| NPLR | 0.0546 | 0.0312 | 0.1014 | -0.0176 | 0.9891 | 5.8331 | 46.1616 | 198 |

| NPLE | 0.1512 | 0.1367 | 1.1580 | -11.5666 | 3.993 | -6.6115 | 66.1007 | 198 |

| CAR | 0.1842 | 0.1468 | 0.0982 | -0.2000 | 0.5637 | 0.9592 | 5.1809 | 198 |

| ROA | -0.0455 | 0.0123 | 1.0273 | -14.4000 | 0.4373 | -13.8812 | 194.4825 | 198 |

| ROE | 0.1026 | 0.1268 | 0.3819 | -3.8754 | 2.2384 | -6.1926 | 73.2919 | 198 |

| SIZE | 10.0208 | 9.1650 | 2.6642 | 5.4400 | 14.6700 | 0.2472 | 1.7126 | 198 |

| GROWTH | 0.1481 | 0.0999 | 0.2351 | -0.5775 | 1.5189 | 2.5075 | 13.2837 | 198 |

| LEV | 0.8551 | 0.9019 | 0.1105 | 0.5254 | 1.1348 | -1.0389 | 3.5693 | 198 |

The highest non-performing loan ratio (NPLR) was 0.9891 and the lowest -0.0176. The mean non-performing loans to total equity (NPLE) of all the banks under the study was 0.1512. That translates to failure to collect 15.12% of every loan in relation to total equity. The standard deviation recorded based on non- performing loans to total equity (NPLE) was 1.1580. The highest non-performing loans to equity (NPLE) was 3.993 and the lowest -11.5666.

The results also documented that size variable had a mean logarithmic value of 10.0208, which equates to R22 489.41 in assets. The largest bank had a logarithmic value of 14.67, which equates to R2 350 174.17 in assets, and the smallest bank had an asset base of a logarithmic value of lowest 5.4400, which translates to R230.44 in assets. The capital adequacy ratio (CAR) for the sample of banks varied from 56.37% to minus 20.00%. And the mean of CAR is 18.42%. Furthermore, bank growth rate ranged from negative 57.75% to 151.89%, with an average value of 14.81%. The mean leverage rate was 85.51%, with the lowest recording at 52.54% and a highest of 113.48%. The standard deviation for leverage was 11.05%.

Initial Diagnostic Tests

In estimating both models, a number of diagnostic tests were implemented in-order to estimate a robust model. Tests were conducted for panel heterogeneity, heteroscedasticity, random effects, fixed effects-versus-random effects specification and lastly cross-sectional dependence. The tests confirmed the presence of fixed effects, heteroscedasticity and crosssectional dependence. As such, the study employed the Fixed Effects Driscoll and Kray with standard errors estimator, which controls for cross-sectional dependence and heteroscedasticity in estimating the models.

Panel Regression Results with Return on Assets (ROA) as the Dependent Variable

The regression output reported the pooled OLS and random effects (RE) estimation results for comparison. Analysis of the results was based on the fixed effects (FE) with Driscoll and Kray (1998) estimation results. The FE model is of good fit and is well specified. The Fstatistic value is 17.87 and is statistically significant at the 1% level of significance. The within R-squared correlation is at 0.2064. Firstly, the results of the study documented that financial performance and credit risk were negatively related.

Firstly, the results documented that credit risk is negatively related to financial performance. The Pooled OLS and Random Effects model estimation results documented that a 1% increase in the non-performing loan ratio would lead to a decline of roughly 490% in ROA of South African banks (Table 4). The Fixed Effects Driscoll and Kray estimator showed that a 1% increase in non-performing loan ratio would result in a highly significant 447.6% decline in ROA. However, the results were not robust as they were sensitive to the use of the credit risk variable employed. When, the non-performing loans-to-equity ratio was employed a positive relationship was established. The Fixed Effects Driscoll and Kray estimator documented that a 1% increase in non-performing loans to equity would result in a highly significant 14.35% increase in ROA.

| Table 4 Panel Regression Results With ROA as the Dependent Variable | |||

| Dependent Variable | Pooled OLS ROA | Random Effects ROA | Fixed Effects Driscoll and Kray (1981) standard errors ROA |

| NPLR | -4.868*** | -4.868*** | -4.476*** |

| (-7.31) | (-7.31) | (-5.03) | |

| NPLE | 0.076 | 0.076 | 0.143*** |

| -1.27 | -1.27 | -2.28 | |

| Growth | -0.015 | -0.015 | 0.321 |

| (-0.06) | (-0.06) | -1.14 | |

| Size | 0.015 | 0.015 | 0.012 |

| -0.61 | -0.61 | -0.24 | |

| CAR | 3.519*** | 3.519*** | 6.300*** |

| -4.55 | -4.55 | -5.65 | |

| LEV | 0.176 | 0.176 | -3.386*** |

| -0.26 | -0.26 | -3.15 | |

| Constant | -0.737 | -0.737 | 1.735 |

| (-1.03) | (-1.03) | -1.46 | |

| Number | 198 | 198 | 198 |

| Adjusted R2 | 0.2799 | 0.3018 | 0.2064 |

| F-statistic | 17.87*** | ||

Secondly, the results of the study did not establish a significant relationship between financial performance and growth, contrary to apriori expectations. The Pooled OLS and Random Effects estimation results documented though statistically insignificant result that a 1% increase in growth would lead to a 1.5% decline in ROA. Similarly, the Fixed Effects Driscoll and Kray estimator highlighted that a 1% increase in growth would result in a 32.1% increase in ROA, which is insignificant.

Thirdly, a positive relationship statistically significant relationship between financial performance and capital adequacy was proven. The Pooled OLS and Random Effects estimation results documented that a 1% increase in capital adequacy would lead to an increase of roughly 352% in ROA of South African banks. The result is highly significant at 1% level of significance. The Fixed Effects Driscoll and Kray estimator found that a 1% increase in capital adequacy ratio would result in a highly significant 630% increase in ROA.

Fourthly, the results of the study documented a positive relationship between bank size and financial performance. This is in-line with the apriori expectations. The Pooled OLS and Random Effects estimation results documented that a 1% increase in bank size would lead to an increase of 1.5% in ROA of South African banks. The result is, however, insignificant. The Fixed Effects Driscoll and Kray estimator revealed that a 1% increase in bank size would result in a 1.2% increase in ROA.

Fifthly, a negative relationship between bank leverage and financial performance was established. The reason could be that with increased leverage the higher the interest payments which diminish profitability. The Pooled OLS and Random Effects model estimation results reported that a 1% increase in bank leverage would result in a 17.6% increase in ROA. However, when using the Fixed Effects Driscoll and Kray estimator, of interest is that a 1% increase in bank leverage would result in a highly significant negative impact at 338.6% to ROA. The result is highly significant at the 1% level of significance.

Panel Regression Results with Return-on-Equity (ROE) as a Dependent Variable

For robustness checks, the estimation was conducted with ROE as the dependent variable. The regression output reported the pooled OLS and random effects (RE) estimation results for comparison. Analysis of the results is based on the fixed effects (FE) with Driscoll and Kray (1998) estimation results. The FE model is of good fit and is well specified. The Fstatistic value is 2.45 and is statistically significant at the 5% level of significance. The within R-squared correlation is at 0.0198.

Firstly, in testing the relationship between financial performance (proxied by ROE) and non-performing loan ratio, it was established that they are positively related. The Pooled OLS and Random Effects estimation results documented that a 1% increase in the non-performing loan ratio would lead to an increase of 0.2% in ROE of South African banks, though statistically insignificant (Table 5). The Fixed Effects Driscoll and Kray estimator showed that a 1% increase in non-performing loan ratio would result in a highly significant 104% increase in ROE. The result is highly significant at the 1% level of significance. However, the results were not robust and dependent on the credit risk measure employed.

| Table 5 Panel Regression Results With ROE as The Dependent Variable | |||

| Dependent Variable | Pooled OLS ROE | Random Effects ROE | Fixed Effects Driscoll and Kray (1981) standard errors ROE |

| NPLR | 0.002 | 0.002 | 1.040*** |

| -0.01 | -0.01 | -2.61 | |

| NPLE | -0.062** | -0.062** | -0.079 *** |

| (-2.41) | (-2.41) | (-2.78) | |

| Growth | 0.223* | 0.223* | 0.222* |

| -1.9 | -1.9 | -1.77 | |

| Size | 0.005 | 0.005 | -0.002 |

| -0.51 | -0.51 | (-0.08) | |

| CAR | -0.2309 | -0.2309 | -0.481 |

| (-0.69) | (-0.69) | (-0.96) | |

| LEV | 0.066 | 0.066 | -0.204 |

| -0.22 | -0.22 | (-0.42) | |

| constant | 0.01 | 0.01 | 0.306 |

| -0.03 | -0.03 | -0.58 | |

| Number | 198 | 198 | 198 |

| Adjusted R2 | 0.0272 | 0.0568 | 0.0198 |

| F-statistic | 2.45** | ||

A negative relationship was established when the non-performing loan-to-equity variable proxied credit risk.

Secondly, the research findings of the study established that financial performance and credit risk were positively related. According to the Pooled OLS and Random Effects estimation results, a 1% increase in growth would lead to a 22.3% increase in ROE of South African Banks. The result was statistically significant at the 10% level of significance. For inference, the Fixed Effects Driscoll and Kray estimator highlighted that a 1% increase in growth would result in a 22.2% increase in ROE and the results was statistically significant at the 10% level of significance.

Thirdly, the results of the study do not confirm any relationship between the financial performance and the capital adequacy ratio as all estimated results were statistically insignificant. Similarly, no conclusive evidence on the effect of bank size and bank leverage on financial performance of South African banks as the estimated results were statistically insignificant.

Conclusion

Credit risk is the major cause of many banking problems. This study examined the impact of credit risk on the financial performance of South African banks. Firstly, the study documented that on the one hand, bank financial performance (proxied by ROA) and credit risk (proxied by non-performing loans ratio) are negatively related and the result was highly statistically significant. Secondly, the study sought to establish whether there was a significant relationship between growth and financial performance of South African banks. A positive effect of growth on financial performance of banks was established. Thirdly, the study sought to test the relationship between financial performance and capital adequacy. When financial performance was proxied by ROA, a positive relationship was found to subsist. Fourthly, the findings of this study were inconclusive on relationship between size and the financial performance measures. Fifthly the study documented that bank leverage and ROA were negatively related.

Based on the findings from the empirical analysis, both monetary authorities and management of individual banks hold a sway in the overall financial performance of banks. Existing studies recommend that banks need to administer and concentrate more on effective credit risk management strategies. Banks’ rigorous credit evaluation in the lending process contributes towards the elucidation of an effective strategy that will not only limit banks’ exposure to credit risk but will improve banks performance and competitiveness. Nonperforming loans not only have a negative impact on the profitability of banks, but also affect the economy. As such, the South African regulatory authorities need to craft regulations that will lead to improved credit risk management and arrest the tide of increasing non-performing loans in banks. This will help secure the banking sector and the economy at large.

References

- Abbas, A., Zaidi, S.A.H., Ahmad, W., & Ashraf, R. (2014). Credit risk exposure and performance of banking sector of Pakistan. Journal of Basic and Applied Sciences, 4(3), 240-245.

- Addae-Korankye, A. (2014). Causes and control of loan default/delinquency in microfinance institutions in Ghana. American International Journal of Contemporary Research, 4(12), 36-45.

- Akbas. (2013). Determinants of bank profitability: An investigation of Turkish banking sector. Journal of Corporate Finance, 50, 158-179.

- Al-shakrchy, E.J. (2017). The impact of credit risk managing on bank profitability an empirical study during the pre-and post-subprime mortgage crisis: The case of Swedish commercial banks. Journal of Business and Finance, 3(1), 31-42.

- Alexiou, C., & Sofoklis, V. (2009). Determinants of bank profitability: Evidence from the Greek banking sector. Economic annals, 54(182), 93-118.

- Aliu, M., & Sahiti, A. (2016). The effect of credit risk management on banks profitability in Kosovo. European Journal of Economic Studies, (4), 492-515.

- Ally, Z. (2013). Comparative analysis of financial performance of commercial banks in Tanzania. Research Journal of Finance and Accounting, 4(19), 133–144.

- Alshatti. (2015). The effect of credit risk management on financial performance of the Jordanian commercial bank. Investment Management and Financial Innovations, 12(1), 338–345.

- Arellano, M., & Bonhomme, S. (2009). Robust priors in nonlinear panel data models. Econometrica, 77(2), 489–536.

- Armitage, S., & Marston, C. (2008). Corporate disclosure, cost of capital and reputation: Evidence from finance directors. British Accounting Review, 40(4), 314–336.

- Aspal, P., & Nazneen, A. (2014). An empirical analysis of capital adequacy in the indian private sector banks. American Journal of Research Communication, 2(11), 28–42.

- Bhattarai, Y. (2015). The effect of credit risk on the performance of Nepalese commercial banks. African Journal of Accounting, Auditing and Finance, 4(1), 81–87.

- Boahene, Dasah, & Agyei. (2012). Credit risk and profitability of selected banks in Ghana. Research Journal of Finance and Accounting, 3(7), 2222–2847.

- Bruni, M.E., Beraldi, P., & Iazzolino, G. (2014). Lending decisions under uncertainty: A DEA approach. International Journal of Production Research, 52(3), 766–775.

- Chimkono, E.E., Muturi, W., & Njeru, A.K. (2016). Effect on non-performing loans and other factors on performance of commercial banks in Malawi. International Journal of Economics, Commerce and Management, 4(2), 549-563.

- Chipeta, C., Wolmarans, H.P., & Vermaak, F.N.S (2012). Financial liberalisation and the dynamics of firm leverage in a transitional economy: Evidence from South Africa. South African Journal of Economic and Management Sciences, 15(2).

- Cichorska, J. (2014). Deleveraging in the Banking Sector. Journal of Economics & Management, 16, 5-15.

- Dang, U. (2011). The CAMEL rating system in banking supervision: A case study. Arcada University of Applied Sciences, International Business., 1–47.

- De Wet, J.D., & Hall, J.H. (2004). The relationship between EVA, MVA and leverage. Meditari: Research Journal of the School of Accounting Sciences, 12(1), 39-59.

- Dietrich, A., & Wanzenried, G. (2009, April). What determines the profitability of commercial banks? New evidence from Switzerland. In 12th conference of the Swiss society for financial market researches, Geneva (pp. 2-39).

- Dima, A.M. (2009). Credit Analysis. Risk Assessment and Management. Acedamy Publish. org.

- Dreca, N. (2013). Determinants of capital adequacy ratio in selected Bosnian banks. International symposium on econometrics, operations research and statistics/October 2014. 149–162.

- Echekoba, F.N., Egbunike, C.F., & Kasie, E.G. (2014). Determinants of bank profitability in Nigeria: Using camel rating model (2001-2010). International Journal of Economics and Finance, 6(12), 93–113.

- Etikan, I., Musa, S.A., & Alkassim, R.S. (2016). Comparison of Convenience Sampling and Purposive Sampling. 5(1), 1–4.

- Ferrouhi, E.M. (2017). Determinants of bank performance in a developing country: Evidence from Morocco. Organizations and Markets In Emerging Economies, 8(1), 118-129.

- Flamini, V., McDonald, C.A., & Schumacher, L. (2009). The determinants of commercial bank profitability in Sub-Saharan Africa. IMF Working Paper 09/15, 1–30.

- Furedi, F. (2009). Precautionary culture and the rise of possibilistic risk assessment. Erasmus Law Review, 02(02), 197–220.

- Githaiga, J.W. (2015). Effects of credit risk management on the financial performance of commercial banks in Kenya. Master Bus Adm Univ Nairobi, 8, 91-105.

- González-Aguado, C., & Suarez, J. (2015). Interest rates and credit risk. Journal of Money, Credit and Banking, 47(2-3), 445-480.

- Haneef, S., Riaz, T., Ramzan, M., Rana, M. A., Hafiz, M. I., & Karim, Y. (2012). Impact of risk management on non-performing loans and profitability of banking sector of Pakistan. International Journal of Business and Social Science, 3(7).

- Ifeacho, C., & Ngalawa, H. (2014). Performance Of The South African Banking Sector since 1994. The Journal of Applied Business Research, 30(4).

- Jasevi?ien?, F., Povilaitis, B., & Vidzbelyt?, S. (2013). Commercial banks performance 2008–2012. Business, Management and Education, 11(2), 189-208.

- Jaseviciene, F., & Valiuliene, V. (2013). Main risks in the Lithuanian banking sector: Analysis and evaluation. Vilnius : Vilniaus universiteto leidykla, 92(1), 97–120.

- Kaaya, D.I., & Pastory, D. (2013). Credit risk and commercial banks performance in Tanzania: A panel data analysis. Research Journal of Finance and Accounting, 4(16), 2222–2847.

- Kargi, H.S. (2011). Credit risk and the performance of Nigerian banks. Ahmadu Bello University, Zaria.

- Karuri, N.A. (2014). The relationship between interest rates and mortgage default rate among financial institutions in Kenya. Retrieved from http://erepository.uonbi.ac.ke/handle/11295/76789

- Khemraj, T., & Pasha, S. (2013). Determinants of non-performing loans in licensed commercial banks: Evidence from Sri Lanka. Asian Economic and Financial Review, 5(6), 868–882.

- Kithinji, A.M. (2010). Credit risk management and profitability of commercial banks in Kenya. School of Business, University of Nairobi, Nairobi.

- Klepczarek, E. (2015). Determinants of European banks' capital adequacy. Comparative Economic Research, 18(4), 81-98.

- Kohlscheen, E., Murcia, A., & Contreras, J. (2018). Determinants of bank profitability in emerging markets. Retrieved from https://www.bis.org/publ/work686.htm

- Kolapo, T.F., Ayeni, R.K., & OKE, M.O. (2012). Credit risk and commercial banks’ performance in Nigeria: A panel model approach. Australian Journal of Business and Management Research, 2(02), 31–38.

- Kumar, K., & Kavita, S. (2017). An analysis of the financial performance of Indian commercial banks. The IUP Journal of Bank Management, 16(1), 7-26

- Kumar, R. (2014). Determinants of value creation of GCC firms -An application of PLS SEM model. Asian Journal of Finance & Accounting, 7(1), 76.

- Kumbirai, M., & Webb, R. (2010). A financial ratio analysis of commercial bank performance in south Africa. African Review of Economics and Finance, 2(1), 30–53.

- Kusi, B.A., Gyeke-Dako, A., & Agbloyor, E.k,(2017). Bank profitability determination in income brackets in Africa: A shareholder versus stakeholder perspective. African Finance Journal, 19(2), 29–46.

- Lipunga, A. M. (2014). Determinants of Profitability of Listed Commercial Banks in Developing Countries?: Evidence from Malawi. Research Journal of Finance and Accounting, 5(6), 41–49.

- Ljubi?, M., Pavlovi?, V., & Milan?i?, S. (2015). The Impact of Credit Risk Assessment. Megatrend Revija ~ Megatrend Review, 12(3), 141–152.

- Lopez, J., & Saidenberg, M. (2005). Evaluating credit risk models. Risk Management: Challenge and Opportunity, 24, 219–238.

- Mahathanaseth, I., & Tauer, L.W. (2014). Performance of Thailand banks after the 1997 East Asian financial crisis. Applied Economics, 46(30), 3763–3776.

- Makri, V., & Papadatos, K. (2014). How accounting information and macroeconomic environment determine credit risk? Evidence from Greece. International Journal of Economic Sciences and Applied Research, 7(1).

- Maré, E., & Sanderson, L.B. (2017). Banking regulations: An examination of the failure of African Bank using Merton's structural model. South African Journal of Science, 113(7-8), 1-7.

- Mehrjardi, M.S. (2012). Size and profitability of Banks in Kenya. Unpublished MBA Project, University of Nairobi.

- Mileris, R. (2015). The impact of economic downturn on banks’ loan portfolio profitability. Engineering Economics, 26(1), 12–22.

- Mirach, H. (2010). Credit Management. Education + Training, 20, 24–25.

- Mishi, Sibanda, & Tsegaye. (2016). Industry concentration and risk taking: Evidence from the South African banking sector. African Review of Economics & Finance, 8(2), 112–135.

- Munyai, P. (2010). Higher interest rates and over-indebtedness: A comparison of conventional and Islamic Banking. SA Merc LJ, 22(August), 405–416.

- Murerwa, C.B. (2015). Determinants of banks’ financial performance in developing economies: Evidence from kenyan commercial banks (Doctoral dissertation, United States International University-Africa).

- Musah, A. (2017). The impact of liquidity on profitability of commercial banks in Ghana. Asian Journal of Economic Modelling, 6(1), 21–36.

- Mushtaq, M., Ismail, A., & Hanif, R. (2015). Credit risk, capital adequacy and banks performance: An empirical evidence from Pakistan. International Journal of Financial Management, 5(1).

- Nataraja, N.S., Chilale, N.R., & Ganesh, L. (2018). Financial performance of private sector banks in India. Academy of Accounting and Financial Studies Journal, 22(2), 1–12.

- Nduku. (2013). The Effect of Capital Structure on the Financial Performance of Commercial Banks in Kenya. Unpublished Master of Business Administration Degree, University of Nairobi.

- Nguta, H., & Huka, S. (2013). Factors influencing loan repayment default in micro-finance institutions?: The experience of imenti north district, Kenya, International Journal of Applied Science and Technology 3(3), 80-84.

- Nikolaidou, E., & Vogiazas, S.D. (2014). Credit risk determinants for the bulgarian banking system. International Advances in Economic Research, 20(1), 87-102.

- Noomen, N., & Abbes, M.B. (2018). The determinants of credit risk management of islamic microfinance institutions. IUP Journal of Financial Risk Management, 15(1), 7–22.

- Nyoka, C. (2019). Bank capital and profitability: an empirical study of South African commercial banks. Comparative Economic Research. Central and Eastern Europe, 22(3), 99-116.

- Ongore, & Kusa. (2013). Determinants of Financial Performance of Commercial Banks in Kenya. International Journal of Economics and Financial Issues, 3(1), 237–252.

- Pale?ková, I. (2016). Determinants of the Profitability in the Czech Banking Industry. Acta VŠFS-ekonomické studie a analýzy, 10(2), 142-158.

- Peric, B.S., & Konjusak, N. (2017). How did rapid credit growth cause non-performing loans in the CEE Countries? South East European Journal of Economics and Business, 12(2), 73–84.

- Petria,N., Capraru, B., & Ihnatov, I. (2015). Determinants of banks’ profitability: Evidence from eu 27 banking systems. Procedia Economics and Finance, 20(15), 518–524.

- Rahman, M., & Hai, H. (2017). Factors affecting non-performing loan (npl) of private commercial banks in Bangladesh. Amity Global Business Review, 12(2), 7–14.

- Rasika, D.G.L., & Sampath, H.R. (2015). Impact of credit risk on financial performance of Sri Lankan commercial banks.

- Saeed, M.S., & Zahid, N. (2016). The impact of credit risk on profitability of the commercial banks. Journal of Business & Financial Affairs, 5(2), 2167-0234.

- Saheb, S.S., & Reddy, K.C. (2018). Credit risk management practices in banking sector in Ethiopia. International Journal of Current Research, 10(04), 68164–68174.

- Salkind, N.J. (2012). Exploring Research, 8th Edition. Pearson.

- Samuels, S. (2014). The challenges of the leverage ratio. 7, 231–239.

- Sbârcea, I.R. (2017). Credit risk versus performance in the romanian banking system. Studies in Business and Economics, 12(3), 171–180.

- Seemule, M., Sinha, N., & Ndlovu, T. (2017). Determinants of commercial banks ’ profitability in botswana?: An empirical analysis. IUP Journal of Bank Management, 16(2), 7–28.

- Shah, M.H., & Khan, S. (2017). Factors affecting commercial banks profitability in Pakistan. Journal of Business and Tourism, 3(1), 1–12.

- Shahom, D. (2004). Psychometric Creditworthiness Scoring for business loans. 1(19).

- Siaw, A., Ntiamoah, E., Oteng, E., & Opoku, B. (2014). An empirical analysis of the loan default rate of microfinance institutions. European Journal of Business and Management, 6(22), 12-17.

- STATSSA. (2019). Quarterly Labour Force Survey Q1:2014. Quarterly Labour Force Survey, PO211(May), 1–70.

- Tan. (2016). The impacts of risk and competition on bank profitability in China. Journal of International Financial Markets, Institutions and Money, 40, 85–110.

- Tarawneh, M. (2006). A comparison of financial performance in the banking sector: Some evidence from omani commercial banks. International Research Journal of Finance and Economics, 3(3), 101–112.

- Vries, A. De, & Erasmus, P.D. (2012). The influence of firm characteristics and economic factors on capital structures?: A comparison between book value and market value leverage. 21(3), 2–16.

- Wambui, N.S. (2013). The effect of interest rate volatility on mortgage default rate in Kenya. International Journal of Business, Humanities and Technology, 3(1).

- Zamore, S., Ohene Djan, K., Alon, I., & Hobdari, B. (2018). Credit risk research: Review and agenda. Emerging Markets Finance & Trade, 54(4), 811–835.