Research Article: 2021 Vol: 25 Issue: 3

An Empirical Investigation of the Role of Small Businesses in Economic Growth and Poverty Alleviation in North-Western Nigeria

Sunday Elijah, Federal University Gusau

Muhammad Usaini, Federal University Gusau

Abstract

This article empirically investigates the role of SME in economic growth and poverty alleviation in north-western Nigeria from 1987-2017 using time series data of Kano state, Nigeria and employing the ARDL approach. This study found that the variables of interest all together played important roles in influencing economic growth (GDP) in Kano state. Turnover of SME return and the turnover on SME employment are negative and significant while the turnover of SME loan depicted it is significant and positive. In general, the study’s findings are in harmony with the views of past studies; hence, we resolved that the results of the estimates of our ARDL are reliable and valid. Results of the empirical test found link between SME, economic growth, and poverty alleviation, from our results, the turnover of SME loan is significant and positive which contributes to GDP and alleviate poverty. The recommendations from this study are - a). The government should emphasize on the promotion of SME because they assist in alleviation of poverty. b) SME should pursue and maintain enough funds at the lowest rate of interest for its business smooth operations. c) Government should protect the SMEs by banning or placing tariff increase for the goods and services produced by SMEs in other to protect them as they are still infants. d) There is the need to maintain reasonable family size by SME operators because large family can have negative effect on income.

Keywords

Economic Growth, Small Business, Poverty Alleviation, North-Western Nigeria.

Introduction

The role of small businesses in economic growth and poverty alleviation in least developed countries (LDC) is of vital concern to policy makers, academics, laymen and managers. Alleviation of poverty is a wider socioeconomic creativity as it was shown by Millennium Development Goals that was adopted by members states of United Nations, SMEs play vital parts in the procedure because they employ, sell to or could be formed by the people living in the poor countries (Maksimov et al., 2017). According to some studies (Ilegbinosa & Jumbo, 2015; Iromaka, 2006; Racheal & Uju, 2018), SME have made countless contributions in Nigeria towards eradicating poverty. SME are viewed as the economic growth engine of any country’s development. The primary merit of the SME is that it has the power to employ at a low cost of capital. The labour strength of SME is considerable higher compared to large enterprises. Besides its potentials of growth and vital roles in value chains and manufacturing, they are wide-spread in Nigeria and they have multiple effects on creation of job, wealth creation, alleviation of poverty, reduction in disparities of income and income redistribution. After the 1986 economic reform, SME are perceived as the key to the growth of Nigeria, reducing unemployment and alleviation of poverty in the nation. Hence, there is the need to encourage SME in developing nations like Nigeria because since it brings countless distribution of wealth and income, employment, economic self-dependence, entrepreneurial development among others, it means there is need to focus on it. The main reason of SAP and NEEDS that were introduced in 1986 and 2000 respectively were to indoctrinate genuine spirit of entrepreneurship in people’s mind in other to prepare people towards wealth creation via SMEs (Fasua, 2006; Oduntan, 2014). SMEs are the backbones of many communities across United States most especially in Philadelphia. SMEs account for majority of the jobs for the residents, giving supports to livelihood of households for tens of thousands in neighborhoods in Philadelphia and other places (Merrick & Howard, 2020; Osemene et al., 2017). According to Osemene et al., (2017) and Eniola (2014) Nigeria’s SME account for greater than 95% of the productive activities, they employ more than 70% of the labour force and they have the power to generate up-to 70% of the GDP. According to Racheal & Uju (2018), SMEs had been estimated that it employed 22% of Nigeria’s adult population, because of the role of SME in growth and development of different economies, SMEs have suitably been mentioned to be known as “the growth-engine” and the catalyst of any country’s socio-economic transformation. In addition, the SMEs constitute more than 90% of the business operations and it contributes to more than 50% of the country’s total opportunities of employment and GDP. According to Manzoor et al. (2019), SMEs are actually easy to start, they need less capital, they generate greater employment opportunities and produces the commodities which meets local demand at the same time some contribute to export earnings.

Theoretically, one of the motivations for this study was the authors were inspired by seminal work of Prahalad (2004) who investigated the roles of marketing to people that are poor, and later following its improvements by Karnani (2007) who focuses on the poor that are the producers. The latter is vital due to the fact that it discusses openings to the poor to raise their real incomes via employment (Abdullahi et al., 2019; Maksimov et al., 2017; Smith & Pezeshkan, 2013). The poor people need not just the steady employment, but they also need reasonable earnings that will put them directly above poverty line (Habib & Zurawicki, 2010; Karnani, 2007; Maksimov et al., 2017). According to Micah et al. (2015), findings have revealed that more-than 3/4 of North’s population live under poverty. Likewise, it was estimated that the 3 geo-political zones of the northern-Nigeria which are north central, north east and northwest have 67%, 71.2% and 72.2% respectively of their populace facing the poverty scourge. The implication is that the people are denied the access to the quality of life and they have tendency to have negative chances of life to get outcomes that are undesirable. It might be said that poverty is having a lot of implications for continued society’s survival. The noticeable implication is possibilities of criminal tendencies for the people faced with the problem. According to studies (Maksimov et al., 2017; Narayan-Parker & Patel, 2000) 60,000 of the poor people clearly specified that rising income from their business or earned wages in their employments was the most supportive in running away from poverty.

It is worthy to know that there are only few studies that were conducted in developing country like Nigeria and Kano (north-western Nigeria) in particular on role of small businesses in economic growth and poverty alleviation, also, the few studies conducted had contradictory and inconsistent findings, which created room for further study. In addition, only little attention is given to SME as they are being left in the hands of the individuals for them to start and run the SMEs. Worthy of note is that the issues that are relating to SMEs development is now important in most of the third world countries development. No country has ever developed without the appreciable contributions from SME sector of the country. The effectiveness and performance of SME is for it as the instruments of economic growth and development hence, assisting in decreasing incidence of poverty is of concern to this study. Looking at the present situation of Nigeria, it depicts that SMEs should be given more encouragement and consideration. Therefore, there is the immense need to investigate the role of small businesses in economic growth and poverty alleviation in Kano (north-western Nigeria). The remaining part of the paper is: section two deals with the survey of literatures which considers the literature review, the third section considers the methodology and model specification, the fourth section deals with results and discussion. Lastly, the fifth section deals with the conclusion and policy recommendations.

Survey of Literatures

According to Micah et al. (2015), the investigation of the associationship between the small scale businesses, growth and the poverty alleviation is the growing aspect of concentration. In addition, it is commonly decided and documented that the small businesses are having active and positive role in alleviation of poverty. Frederick (2013) observed the sector of SME plays a role that is critical in the economy. The support of the SME as the industry of support assist in strengthening of the large industries. The development of SME happens to be the future candidates of the large industries, the reason is almost all large enterprises are having the experience of commencing its business as SME. The roles played by SME have been noticed as vital in every country worldwide. SME is been considered as a train for the growth and reduction of poverty for its nations through job creation and income for its individuals.

Gebremariam et al. (2004) empirically investigated the critical role of the SME in growth and poverty reduction in West Virginia. They employed OLS and 2SLS regression, they observed a positive associationship exists between the small businesses and economic growth. There exist strong inverse associationship also existing between incidence of poverty, small businesses and the economic growth. Therefore, the results founds the connections between the small businesses, economic growth, and incidence of poverty. Beck, Demirguc-Kunt & Levine (2005) explored the associationship between relative size of SME, growth and poverty reduction employing a new data-base on share of the SME in entire manufacturing labour-force. Employing 45 countries as the sample, the study found a positive and strong association between the importance of the SMEs and the GDP per capita growth. The concerned data do not confidently support that SME exercise causal impact on the growth. In addition, the study found evidence that the SME alleviate poverty or decrease the inequality of income.

Ilegbinosa & Jumbo (2015) empirically examine the SME and economic growth of Nigeria from 1970-2012, SMEs benefits to any economy are simply noticeable. They include – job creation, increase outputs of services and goods that are produced in the economy and provide the means for reduction of income disparities among others. The paper polled eighty-four SME for the primary data collection with the statistical records from 1975-2012 as its secondary data. OLS, co-integration and error correction approach was employed to estimate the study’s data collected for the study’s period. The variables of interest employed included GDP as the dependent variable while finance available to SME, inflation rate and interest rate are the independent variables. The outcome of the study observed that the finance available to SME have positive relationship with the economic growth whereas inflation rate and interest rate disclosed a positive and negative influences on the economic growth respectively. Therefore, the study resolved that the independent variables played vital roles in determining impact of SME on economic growth in Nigeria. They recommended the Government of Nigeria to organize national enterprise forum that will focus on contribution of SME in the objective of national development. State or Federal Ministries of Industries should collaborate with the National Association of SME to work out the strategies for annual report of SME operating in the country and the Government should try to adopt policies to maintain favorable low rate of commercial bank borrowing so as to accelerate the high investments in the small, medium and large-scaled businesses, and subsequently contribute to significant economic growth in the long-run.

Micah et al. (2015) discussed that the challenges faced by Nigeria is poverty and different studies have showed that more than three quarter of Nigeria’s populace are living below the poverty line. It is against this backdrops that they examined the roles of SME in making better the economic status of the traders that are engaged in the sector. They adopted Lewis’ Culture of Poverty and Neoliberal theory and they employed cross-sectional survey design. 200 respondents were the sample size employed for the quantitative analysis. Majority of the respondents (64%) were male and the married were 52%. There were 13.5% of traders that designated their status as buoyant before their involvement in SME. A minimum of 14% of the concerned traders said they were buoyant in terms of economic status consequent upon their engagement in SME. There were 92% of the concerned traders that stated that SME are stable and profitable income source for their survivals. The qualitative data depicted that taxes, electricity, access to loan with the security of properties and lives were the major challenges which hindered SME growth in the area of study. SME had empowered traders to provide for their basic necessities and lived above the poverty line. SME is one of the major employers of youth and had remained the sustenance for family support and the means of obtaining positive chances of life. Nigeria should improve on viable roads construction, provision of facilities for loan and improve the electricity supply. This could assist to make SME competitive, sustainable and attractive to combat poverty and youth unemployment.

Maksimov et al. (2017) observed that alleviation of poverty in least developed nations (LDN) needed raising the level of income of the LDN workers. The study sees the poor to be the producers and explore the drivers of wages of the higher employee. They concentrated on SME because SME are one of the chief drivers of growth, employment and alleviation of poverty in these nations. To pay for higher wages, the SME need to increase its organizational efficiency. They debated that in LDNs, characterized through the substantial official constraints, SME could improve it efficiencies either through internalizing the inefficient formal institutions or through taking the advantage of institutional enablers that are established not just by the local government but also the non-governmental, international, social or non-profit enterprises that is set up around the globe. In 1,273 SMEs as a sample from 7 LDN across Asia, Middle East and Africa, they found support for mediated-model, where the SME with the higher exports, female ownership or government contracts achieve the higher organizational efficiency which in-turn do pay the higher employee wages. Strongest occur for the firms owned by female and exporting firms the weakest, whereas the direct associationship to the wages are the strongest to exporting SME. The data supported the idea that the SME with government contracts happens to be more efficient in transaction with the other constituents in business environment, the ones that have higher export are having a broad base of sources of efficiency and those with the female ownerships are specifically expert in exploiting the local business and the societal relationships.

Osemene et al. (2017) examined that SME are the mechanisms that are propelling the economic growth and development hence, reducing poverty in lots of countries worldwide. In spite accounting for greater than 95% of the productive activities, the SME contribution to Nigeria’s GDP is less than 10%. Poverty rate and unemployment remains high in the nation. It is because of this that they focus on Kwara state, Nigeria to investigate how the SME contributed to alleviation and reduction of poverty. They employed primary data by administration of questionnaire from 100 SMEs as a sample. They employed probit regression to shed lights on impact of generated income by the owners of SME on the alleviation of poverty in Nigeria. The outcomes of the regression analysis showed that generated income by the owners of SME strongly impact on alleviation of poverty in Kwara state, Nigeria. They, hence, recommended the SMEs owners should maintain and seek enough funds at lower rate of interest for their businesses smooth operations.

Manzoor et al. (2019) discussed that the primary objective for the formation of South-Asian Association of regional Cooperation (SAARC) was to work collectively towards slow economic growth, eradication of poverty, sectors of education and deprived health. In its 12th SAARC Summit, it was declared that eradication of poverty is the key area of concentration and the SAARC nations will try their best in other to reduce all kinds of poverty through the assistance of any likely strategy. Their study’s main objective was to investigate the development of agenda for eradication of poverty in SAARC nations via SME development because it will be short-cut remedy for mitigating poverty. 20% of the poorest income holder as a percentage of the GDP have been employed as proxy of poverty in SAARC. SME development have been estimated through the SME shares in the respective countries GDP. Panel dataset from 1990-2015 was developed, fixed effect approach (FEA) and techniques of regression equation were employed to estimate the data observed. The results of FEA happens to be misleading. The regression equation for the countries were employed for the empirical analysis. The outcomes have found that there are 3 primary factors that are key in poverty reduction in the SAARC: SMEs growth, openness to trade and the social-sector development.

Usaini et al. (2020) empirically investigated the small businesses critical-roles in the economic development and reduction of poverty in the northwest of Nigeria. The study found a positive associationship existing between the small enterprises and economic growth in their analysis of OLS regression. There also exist clear associationship between the incidence of poverty, small business and the economic growth. The study’s empirical results, therefore, established the connections between the small business, economic growth and the incidence of poverty.

On the contrary, Beck et al. (2003) examine the relationship existing between relative size of SME, growth and poverty by employing the new data-base on share of the SME labour in the total-manufacturing labour-force. Employing 76 countries as samples, they found a strong associationship between importance of the SMEs and the GDP per capita growth. The associationship although, not robust for controlling for the simultaneity bias. Therefore, while the large SME sector is the characteristics of the economies that are successful, the data was unable to support hypothesis that the SMEs exercise causal impact on growth. In addition, the study found no indication or sign that the SMEs have reduced poverty. Lastly, the study found competent evidence that the total business-environment is facing both small and large firms as it is measured by ease of the firm exit and entry, contract enforcement and sound property rights – influences the economic growth.

In a different study, Beck & Demirgüç-Kunt (2004) explored relationship existing between the size of SME, growth and the poverty reduction, the study observed that a new outcome found no support to the existing widely belief that the SME promotes higher growth and it lower poverty. However, it provides some support to the view that business environment quality facing all these firms, small and large influences the economic growth.

Frederick (2013) disclosed the SME is seen as a hub for income generation for most of the urban dwellers without formal employment payment. In the case of Tanzania, entry to SME is mostly not an issue. One could start SME in any place at any time. Although, this formal sector development had been greatly characterized with 2 parallel phenomena that may be contradictory in terms of character. First, is the growing politicization effort that is encouraging people to engage in SME. Second, is the parallel rise in different events which are suggesting bureaucratic hurdles and prevalence of crime that affect SME and the counter reactions from the small trades; while the second could be characterized by the constant feuds and tension between urban authorities and small traders. Picturing on findings of research, they challenge possibility of poverty reduction in Tanzania employing the strategy for developing SME in situation where there exist bureaucratic hurdles and increasing petty crime level. It was debated and concluded that when the present controversial and intricate scenario surrounding SME are not reversed, SME development is going to be on the slippery slope. Choices that are recommended to tame the problem are – developing the discourse portfolio existing between the bureaucratic authority and the small traders, and the authorities that are formulating the policies could promote the development of SME.

Methodology and Model Specification

Empirical model

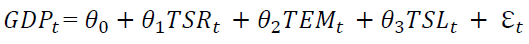

To investigate the role of small businesses in economic growth and poverty alleviation, this study used time series data starting from 1987-2017 employing data from Kano State in north-western Nigeria. The time period was chosen because of data availability, the data where sourced from National Bureau of Statistics (NBS) of Nigeria, with our data at our disposal, we used the ARDL bounds testing approach. This paper had followed the models used by (Gebremariam et al., 2004; Usaini et al., 2020). This study’s functional form of the model is:

GDP= f (TSR, TEM, TSL) (1)

The model in Equation (1) depicts that GDP is the function of TSR (Turnover of SME Return) and its control variables like TEM (Turnover on SME Employment) and TSL (Turnover of SME Loan). The model of Equation (1) is specified in its econometric form and becomes:

(2)

(2)

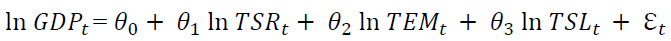

Taking the natural logarithm on both side of Equation (2), it will become:

(3)

(3)

Where: GDP is the gross domestic product, TSR is the turnover of SME return, TEM is the turnover on SME employment and TSL is the turnover of SME loan. θ1 - θ3 and ?t are coefficients of the explanatory variables and the Gaussian error term respectively.

Description of Variables in the Model

Dependent variable

The primary concern and dependent variable that is focused on in this study is economic growth (GDP), it has been used in different studies (Ilegbinosa & Jumbo, 2015; Usaini et al., 2020). The annual data for GDP of Kano state Nigeria was used for this study for the estimation of the model. GDP at the price of purchaser is the summation of the gross value added from the entire residents’ manufacturers/producers plus any taxes to products and minus the subsidies that are not included in the products value. Usually it is calculated depreciation of the fabricated deduction or degradation and or depletion of natural resources.

Independent variables

Turnover of SME Return (TSR): The turnover of SME return is one of the independent variables used in this study, it have been used in a study by (Usaini et al., 2020). It is the revenue of the SME which is summed. Annual data of turnover of SME return for Kano state, Nigeria was employed in this study for the estimation of the model.

Turnover on SME Employment (TEM): The turnover of SME employment is another variable employed in this study. It is the incomings employment recruited by SME. It has been used in different studies (Gebremariam et al., 2004; Usaini et al., 2020). This study employed annual data for turnover on SME employment of kano state, Nigeria for its estimation of the model.

Turnover of SME Loan (TSL): The last variable used as one of the independent variables is the turnover of SME loan. It is the incomings of finance or loans giving to SME either from different sources or not. The annual data for turnover of SME loan for Kano state, Nigeria was used to estimate the model. Turnover of SME loan have been used in different studies (Ilegbinosa & Jumbo, 2015; Usaini et al., 2020).

Estimation Method

The study used ARDL approach by Pesaran et al. (2001) and observed ARDL by some studies (Elijah & Musa, 2019a; Elijah, 2019; Elijah & Musa, 2019b; Guza et al., 2018) for the estimation of our model in other to estimate both our long and short run relationship between our variables of interest because we are using time series data among other reasons which will be highlighted under results and discussion.

Descriptive Statistics, Unit Root and Cointegration Tests

For this study to start the main estimation of ARDL, the descriptive statistics, correlation matrix and unit root test will be estimated. They are conducted to enable us check our series normality so as to avoid strong dependence, to be aware of the degree of relationship between all the actual series and it is imperative to also do the unit root test so as to assess the order of integration for the concerned variables. The concerned variables are expected to be the combinations of I(0) and I(1), but none of the variables of concern should be I(2), the tests are for this unit root will be for Augmented Dickey Fuller (ADF) and Phillips-Perron (PP), after their estimations, we would be able to know whether our series concerned are fit and suitable for the estimation of ARDL approach.

Results and Discussion

Table 1 shows the descriptive statistics of Kano state, north-western Nigeria for GDP and its explanatory variables during the years under consideration from 1987-2017. Furthermore, the GDP for kano has a mean of 1,376,090, it is ranging from 1,063,633 to 1,768,972 with a standard deviation of 199,560. The turnover of SME return has a standard deviation of 303,899.7, it is ranging from 221,128 to 1,073,059 and has a mean of 690,966.8. The turnover on SME employment is having a mean of 3,671.29, a standard deviation of 1,507.492 and it is ranging from 1,694 to 5,910. Lastly the turnover of SME loan is having a standard deviation of 5.441, ranging from 51 to 71.4 with a mean of 64.439. Similarly, our variables of interest are normally distributed, and the reason is because the values of probabilities as shown by the Jacque-Bera, they are all greater than the normal statistical significance levels. This suggested that the concept of null hypothesis in our sequences of this study are normally distributed which could not be rejected, in other words, our series or sequences are distributed normally. These outcomes were also additionally confirmed by the skewness and kurtosis values of our series. The GDP and turnover on SME employment are skewed positively while turnover of SME return and turnover of SME loan are skewed negatively. Variables of interest like GDP, turnover of SME return, and turnover of SME employment are platykurtic whereas turnover on SME loan is leptokurtic because their values are more than three.

| Table 1 Descriptive Statistics | ||||

| GDP | TSR | TEM | TSL | |

| Mean | 1376090 | 690966.8 | 3671.290 | 64.439 |

| Median | 1363731 | 751006.0 | 3154.000 | 64.600 |

| Maximum | 1768972 | 1073059 | 5910.000 | 71.400 |

| Minimum | 1063633 | 221128.0 | 1694.000 | 51.000 |

| Std. Dev. | 199560 | 303899.7 | 1507.492 | 5.441 |

| Skewness | 0.068 | -0.369 | 0.430 | -0.766 |

| Kurtosis | 2.328 | 1.671 | 1.717 | 3.273 |

| Jarque-Bera | 0.608 | 2.987 | 3.082 | 3.132 |

| Probability | 0.738 | 0.225 | 0.214 | 0.209 |

| Sum | 42658783 | 21419971 | 110710.0 | 1997.600 |

| Sum Sq. Dev. | 1.19E+12 | 2.77E+12 | 68175988 | 887.974 |

| Observations | 31 | 31 | 31 | 31 |

GDP is the gross domestic product, TSR is the turnover of SME return, TEM is the turnover on SME employment and TSL is the turnover on SME loan.

Table 2 shows the explanatory variable test in the form of correlation matrix. The degree of their associationship are showed through the correlation coefficient amongst all the actual series is at maximum with some reasonable range. The range of the correlation coefficient are in their absolute values ranges from 0.026 – 0.287 which suggested that this study can safely conclude that there is no multi-collinearity issue among our series based on the rule of thumb (Prodan, 2013), this is because value in absolute terms are all less than 0.8 for rule of thumb (Prodan, 2013). With all these results at our disposal for the correlation, the results of our estimates will be reliable and valid.

| Table 2 Correlation Matrix | ||||

| Variable | GDP | TSR | TEM | TSL |

| GDP | 1.000 | |||

| TSR | 0.038 | 1.000 | ||

| TEM | 0.054 | -0.058 | 1.000 | |

| TSL | 0.142 | 0.287 | -0.026 | 1.000 |

GDP is the gross domestic product, TSR is the turnover of SME return, TEM is the turnover on SME employment and TSL is the turnover on SME loan.

This paper used the ARDL model by Pesaran et al., (2001), this method was used because of three primary reasons, they are: First, ARDL has the power to estimate both the short and long run relationships among the various variables of interest that do not have the same integration order as far as the variables of interest are all stationery at I(0), I(1) or both of them, although, none of variables of interest should be having I(2). Second, ARDL has the power to remove the issues associated to autocorrelation, and lastly, ARDL could be used for small sample size. In other to continue with this, the ADF (Dickey & Fuller, 1979), and the PP (Phillips & Perron, 1988) tests for the unit root was employed. The results for the ADP and PP tests are shown in Table 3.

| Table 3 Test of Unit Root | ||||

| Series | Augmented Dickey Fuller (ADF) | Phillips-Perron (PP) | ||

| No Trend | Trend | No Trend | Trend | |

| Level [I(0)] | ||||

| GDP | -2.064 | -2.757 | -1.909 | -2.743 |

| TSR | -1.125 | -1.661 | -1.172 | -1.661 |

| TEM | -1.338 | -1.213 | -1.528 | -1.409 |

| TSL | -3.4567** | -4.612*** | -3.432** | -4.960*** |

| First difference [I(1)] | ||||

| GDP | -5.271*** | -5.198*** | -6.755*** | -7.531*** |

| TSR | -5.223*** | -5.284*** | -5.223*** | -5.288*** |

| TEM | -5.233*** | -5.203*** | -5.247*** | -5.218*** |

| TSL | -5.340*** | -5.499*** | -5.481*** | -6.200*** |

GDP is the gross domestic product, TSR is the turnover of SME return, TEM is the turnover on SME employment and TSL is the turnover on SME loan.

Source: Computed with the use of E-view 11.

Focusing on Table 3, at level or at I(0), turnover on SME loan are integrated at both ADF and PP. Though, at the first difference or at I(1), all the variables of interest became stationery by using the methods of ADF and PP. Because our results for our tests of unit roots revealed integration order of I(1), it means there is the likelihood of long-run relationship among the variables. With these results at our disposal, the use of ARDL approach to investigate and search for the long-run association between GDP, turnover on SME return, turnover on employment and turnover on SME loan in Kano state, north-western Nigeria have been justified.

ARDL Bound Test

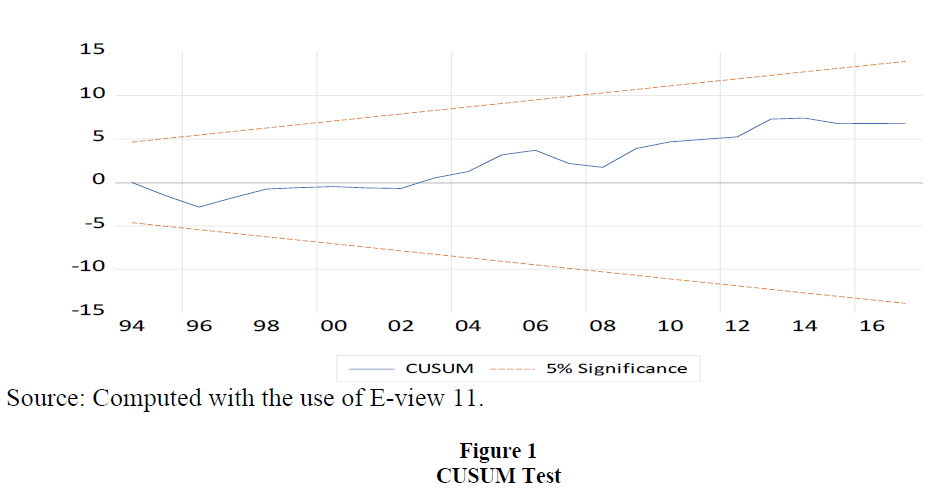

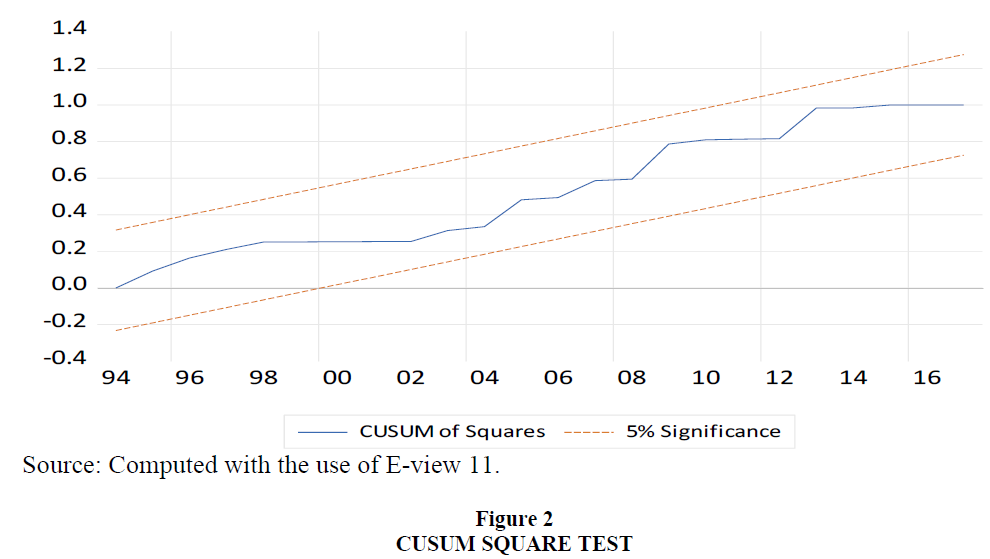

This study conducted the lag selection for the model and automatically the system selected lag 1, the results shows that optimal lag is ARDL (1, 0, 0, 0). In other to test, verify and know if the ARDL (1, 0, 0, 0) model has passed all the diagnostic checks, we conduct Breusch-Godfrey serial-correlation LM, CUSUM and CUSUM square tests. Table 4 shows the result of the Breusch-Godfrey serial-correlation LM test.

| Table 4 Breusch-Godfrey Serial Correlation LM Test | |||

| F-statistic | 0.109 | Prob. F(1,24) | 0.745 |

| Obs*R-squared | 0.135 | Prob. Chi-Square(1) | 0.713* |

Table 4 shows that our Probability value is 0.713 and because our p-value is more than 0.05, it means there is no serial correlation problem in this study’s ARDL model, and we are happy about it. Next, we conducted the stability test (CUSUM test) which is depicted by Figure 1. The outcome of the test of CUSUM depicted that our model for this study is stable because the blue color line fell within the bound area. What about our CUSUM square test?

Now we now estimate the CUSUM square test in other to check whether our residuals or our model for this study is stable. Its outcome is shown by Figure 2. The test of CUSUM square depicted that our residuals are stable, or our model is stable because our blue color line fell within the bound area.

Since our study have passed all the conducted diagnostic checks (depicted by Table 4, Figures 1 and 2), we have also identified the optimal lag [ARDL (1, 0, 0, 0)] for the ARDL bound test, our next step is to test for the long run relationship which can also be known as the bound test, the results are depicted by Table 5. Our Table 5 shows the F-test is 4.905 which is greater than or more than the critical values of the finite sample (n=30), the values which are 4.306 and 3.586 which are both significant at 5% and 10% respectively, which suggest there is long run cointegration relationships existing between gross domestic product, turnover of SME return, turnover on SME employment and turnover of SME loan.

| Table 5 The F-Bounds Test for Testing the Presence of the Long Run Cointegration Relationships | ||||

| Test Statistic | Value | Signif. | I(0) | I(1) |

| Asymptotic: n=1000 | ||||

| F-statistic | 4.905 | 10% | 2.37 | 3.2 |

| K | 3 | 5% | 2.79 | 3.67 |

| 2.5% | 3.15 | 4.08 | ||

| 1% | 3.65 | 4.66 | ||

| Actual Sample Size | 30 | Finite Sample: n=30 | ||

| 10% | 2.676 | 3.586* | ||

| 5% | 3.272 | 4.306** | ||

Source: Computed with the use of E-view 11.

From Table 6, all the variables (turnover of SME return, turnover on SME employment and turnover of SME loan) are the significant determinants of gross domestic product. Coefficient of turnover of SME return is negative and significant, this invalidated (Usaini et al., 2020). If our turnover of SME return increases by 1%, then gross domestic product tends to decrease by 0.017%. This means turnover on SME employment and turnover of SME loan plays important roles in allowing turnover of SME return in making the arrangement to decrease gross domestic product in Kano state, Nigeria. The coefficient of turnover on SME employment is negative and significant, this invalidated Gebremariam et al. (2004) and validated (Usaini et al., 2020). This implied that turnover of SME return and turnover of SME loan had played a significant aspect in allowing turnover on SME employment in making arrangement to decrease gross domestic product in Kano state, Nigeria. If our turnover on SME employment increases by 1% then our gross domestic product tends to decrease by 0.096%. The coefficient of our turnover of SME loan depicted it is significant and positive, this validated some studies (Ilegbinosa & Jumbo, 2015; Usaini et al., 2020). If our turnover of SME loan increases by 1% then the gross domestic product tends to increase by 0.092%. This implies that turnover of SME return and turnover on SME employment both have played critical roles that are important in allowing turnover of SME loan to make arrangement to increase the gross domestic product in Kano state, Nigeria. Turnover on SME employment is more responsive compared to turnover of SME return and turnover of SME loan because the elasticity of turnover on SME employment is higher. Results of the empirical test found link between SME, economic growth, and poverty alleviation and all these variables will inevitably alleviate poverty.

| Table 6 Long Run Coefficients Results | ||||

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

| LTSR | -0.017 | 0.142 | -0.119 | 0.006 |

| LTEM | -0.096 | 0.187 | -0.515 | 0.011 |

| LTSL | 0.092 | 1.021 | 0.090 | 0.029 |

| C | 14.792 | 4.454 | 3.321 | 0.003 |

Source: Computed with the use of E-view 11.

Furthermore, if there is shift in SME employment, it results in a change that will in-turn contribute to the change in incidence of poverty, when all other factors are still constant. However, a change in employment of SME would lead to change in the poverty level without essentially affecting GDP rate of growth. According to economic theory, an increase in the turnover of SME loan (that is, finance available to SME) would lead to a rise in the productive activities of SME. Therefore, an increase in the productive activities of SME would hence rise the total output of services and goods produced and will lead to increase in the position of GDP. Also, according to economic theory, a rise in the interest rate would discourage the SME from lending from the banks and therefore, decrease the level of the productive activities. Such decrease in productive activities would lead to decrease in the position of GDP. Lastly, when there is rise in the rate of inflation (continual increase in general prices of services and goods), it will boost SME to do more production and hence, an increase in the position of GDP.

LGDP is the logarithm of gross domestic product, LTSR is the logarithm of turnover of SME return, LTEM is the logarithm of turnover on SME employment, LTSL is the logarithm of turnover on SME loan and C is the constant. Source: Computed with the use of E-view 11.

From Table 7, it can be observed that it depicted the results of the short run coefficients. One out of the most exciting and interesting part of this outcome is that the result is negative, and the coefficient of the ECT lies in-between zero and one which is in line with theory, it also depict that there is the evidence of convergence to long run equilibrium. Our ECT is -0.3400, which means our model adjust at a speed of 34.00% back to its position of equilibrium. The adjustment for the convergence back to long run equilibrium takes about 2 years and 9 months (i.e. 1/34.00 X 100 = 2.9). In other words, if there is any disequilibrium, it takes 2 years and 9 months to go back to equilibrium.

| Table 7 Short Run Coefficients | ||||

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

| C | -5.04E-16 | 5.25E-16 | -0.960525 | 0.0000 |

| ECT(-1) | -0.340017 | 0.356017 | -0.955077 | 0.0000*** |

| D(LGDP) | 1.000000 | 5.84E-17 | 1.71E+16 | 0.0000 |

| D(LTSR) | 1.57E-19 | 1.70E-17 | 0.009229 | 0.0027 |

| D(LTEM) | -5.51E-19 | 2.06E-17 | -0.026744 | 0.0089 |

| D(LTSL) | 1.12E-17 | 6.70E-17 | 0.166349 | 0.0093 |

Source: Computed with the use of E-view 11.

Conclusion and Policy Recommendations

This article empirically investigated the role of SME in economic growth and poverty alleviation in north-western Nigeria from 1987-2017 using time series data of Kano state, Nigeria and employing ARDL approach. This study found that these variables all together played important roles in influencing economic growth (GDP) in Kano state. All the variables (turnover of SME return, turnover on SME employment and turnover of SME loan) are the significant determinants of economic growth (GDP). Turnover of SME return is negative and significant, the turnover on SME employment is negative and significant while the turnover of SME loan depicted it is significant and positive. Turnover on SME employment is more responsive compared to turnover of SME return and turnover of SME loan because the elasticity of turnover on SME employment is higher. In general, the study’s findings are in harmony with the views of past studies, hence, we resolved that the results of the estimates of our ARDL are reliable and valid. Results of the empirical test found link between SME, economic growth, and poverty alleviation and all these variables will inevitably alleviate poverty.

In addition, a change in SME employment leads to a change which in turn contribute to change in incidence of poverty when all other things remain constant. Though a change in SME’s employment would lead to change in the poverty without certainly affecting the growth rate of GDP. Theoretically, an increase in available finance to SME (turnover of SME loan) will lead to rise in the SMEs productive activities. Hence, an increase in SME production activities leads to the rise in total output of the produced services and goods which also lead to rise in GDP. Furthermore, theoretically, a rise in the rate of interest of getting loan is going to discourage SME from collecting loan from the financial institutions and hence decrease productive activities level. This decrease in productive activities leads to decrease in GDP. Finally, a rise in rate of inflation will inspire the SME to produce further thereby increases the GDP. The recommendations from this study are - a) The government should emphasize on the promotion of SME because they assist in alleviation of poverty. b) The SME forum should be organized by the government which will be satisfactory because it will focus on SMEs contribution to achieving its objectives, the State/Federal Ministry of industries should collaborate with SMEs association to work out strategies to assist the SMEs. c) SME should pursue and maintain enough funds at the lowest rate of interest for its business smooth operations. d) Nigeria Bank of Industry, Nigeria Agricultural and Cooperative Bank and the Nigeria Industrial Development Bank should kit up in the direction of helping SMEs. e) Data bank for SME should be opened by the government and SMEs in other to furnish prospective and potential SME investor. f) Government should protect the SMEs by banning or placing tariff increase for the goods and services produced by SMEs in other to protect them as they are still infants. g) There is the need to maintain reasonable family size by SME operators because large family can have negative effect on income.

Authors Contributions: S.E. and M.U. have both equally contributed in estimating and writing the original draft of this paper, they both revised the paper individually and collectively, while M. U. provided the data for this study.

Acknowledgements: Both authors are using this opportunity to appreciate and thank anonymous reviewers for their observations, corrections, addition of knowledge and comments that improved this paper significantly.

Conflicts of Interest: Both authors declare there is no conflict of interests.

References

- Abdullahi, A., Gimi, S.H., & Elijah, S. (2019). Banking sector integration and economic growth: Re-examination of the impact of financial integration on growth. https://www.researchgate.net/publication/340533482

- Beck, T., & Demirgüç-Kunt, A. (2004). SMEs, growth, and poverty.

- Beck, T., Demirgüç-Kunt, A., & Levine, R. (2003). Small and medium enterprises, growth, and poverty: Cross-country evidence. The World Bank. http://econ.worldbank.org.

- Beck, T., Demirguc-Kunt, A., & Levine, R. (2005). SMEs, Growth, and Poverty. Journal of Economic Growth, 10(3), 199–229. http://www.nber.org/papers/w11224

- Dickey, D.A., & Fuller, W.A. (1979). Distribution of the Estimators for Autoregressive Time Series with a Unit Root. Journal of the American Statistical Association, 74(366a), 427-431.

- Elijah, S. (2019). An empirical analysis of the impact of bank credit on the manufacturing sector output in Nigeria (1986-2016). Journal of Economics Library, 5(4), 371-382. www.kspjournals.org

- Elijah, S., & Musa, A.B. (2019). Dynamic Impact of Trade Openness on the Economic Growth in Nigeria. International Journal of Engineering and Advanced Technology (IJEAT), 8(5C), 609-616. https://doi.org/10.35940/ijeat.E1087.0585C19

- Elijah, S., & Musa, A.B. (2019). Impact of trade liberalization on economic development in Nigeria based on ARDL approach. Asia Proceedings of Social Sciences, 4(1), 122-124.

- Eniola, A.A. (2014). The role of SME firm performance in Nigeria. Arabian Journal of Business and Management Review (OMAN Chapter), 3(12). https://platform.almanhal.com/Files/2/72781

- Fasua, K.O. (2006). Entrepreneurship theory, strategy and practice.

- Frederick, B. (2013). The Role of Small and Medium Enterprises in Economic Growth and Poverty Reduction in Temeke Municipal Council.

- Gebremariam, G.H., Gebremedhin, T.G., & Jackson, R.W. (2004). The role of small business in economic growth and poverty alleviation in West Virginia: An empirical analysis. https://ageconsearch.umn.edu/record/20290/files/sp04ge02.pdf

- Guza, G.M., Musa, A.B., & Elijah, S. (2018). Violent Crime and Unemployment in Nigeria: An ARDL Bound Test Cointegration. International Journal of Social Economics, 45(2), 340-356. http://readersinsight.net/JEI/article/view/1097

- Habib, M., & Zurawicki, L. (2010). The Bottom Of The Pyramid: Key Roles For Businesses. In Journal of Business & Economics Research, (8). https://clutejournals.com/index.php/JBER/article/view/716

- Ilegbinosa, I.A., & Jumbo, E. (2015). Small and Medium Scale Enterprises and Economic Growth in Nigeria: 1975-2012. International Journal of Business and Management, 10(3), 203-216. https://doi.org/10.5539/ijbm.v10n3p203

- Iromaka, C. (2006). Entrepreneurship in small business firms. Ikeja: G-Mag. Investments Ltd.

- Karnani, A. (2007). The mirage of marketing to the bottom of the pyramid: How the private sector can help alleviate poverty. California Management Review, 49(4), 90-111.

- Maksimov, V., Wang, S.L., & Luo, Y. (2017). Reducing poverty in the least developed countries: The role of small and medium enterprises. Journal of World Business, 52(2), 244-257. https://doi.org/10.1016/j.jwb.2016.12.007

- Manzoor, F., Wei, L., Nurunnabi, M., & Subhan, Q.A. (2019). Role of SME in Poverty Alleviation in SAARC Region via Panel Data Analysis. Sustainability, 11(22), 1-14. https://doi.org/10.3390/su11226480

- Merrick, C., & Howard, S.G. (2020). The Importance of Small Business and Entrepreneurship as Strategies to Alleviate Poverty in Philadelphia. Social Innovations Journal, 2. www.socialinnovationsjournal.org

- Micah, D.J., Idowu, O.A., & Orija, S.J. (2015). Poverty Alleviation in Nigeria?: What Is the Role of Small Scale Business?? Journal of Global Economics, Management and Business Research, 3(3), 128-138. www.ikpress.org

- Narayan-Parker, D., & Patel, R. (2000). Voices of the poor: Can anyone hear us? (1). World Bank Publications.

- Oduntan, K.O. (2014). The Role of Small and Medium Enterprises in Economic Development: The Nigerian Experience. In International Conference on Arts, Economics and Management, 75-78. https://doi.org/10.15242/ICEHM.ED0314038

- Osemene, O.F., Salman, R.T., & Kolawole, K.D. (2017). Impact of Small and Medium Scale Enterprises on Poverty Alleviation in Kwara State, Nigeria. The Pacific Journal of Science and Technology, 18(1). http://www.akamaiuniversity.us/PJST.htm

- Pesaran, M.H., Shin, Y., & Smith, R.J. (2001). Bounds testing approaches to the analysis of level relationships. Journal of Applied Econometrics, 16(3), 289-326. https://doi.org/10.1002/jae.616

- Phillips, P.C.B., & Perron, P. (1988). Testing for a unit root in time series regression. Biometrika, 75(2), 335-381. https://academic.oup.com/biomet/article-abstract/75/2/335/292919

- Prahalad, C.K. (2004). The fortune at the bottom of the pyramid: Eradicating poverty with profits.

- Prodan, I. (2013). The effect of weather on stock returns: A comparison between emerging and developed markets. Anchor Academic Publishing (aap_verlag).

- Racheal, J.A.C., & Uju, M. (2018). Role of smal & medium enterprises in poverty eradication in Nigeria. European Journal of Research and Reflection in Management Sciences, 6(2). www.idpublications.org

- Smith, A., & Pezeshkan, A. (2013). Which businesses actually help the global poor? South Asian Journal of Global Business Research, 2(1), 43-58. https://doi.org/10.1108/20454451311303284

- Usaini, M., Elijah, S., & Usaini, M. (2020). The Role of Small Business in Economic Growth and Poverty Alleviation in Nothwest Nigeria. International Journal of Accounting and Finance Studies, 3(1), 53-66. https://doi.org/10.22158/ijafs.v3n1p53