Research Article: 2021 Vol: 27 Issue: 3

An Empirical Study of the Perceptions on Creating Shared Value Strategy's Competitive Advantage over CSR-the case of India

Gazala Masood, Rama University

Aftab Alam, Jamia Millia Islamia

Javed Alam, Madan Mohan Malviya University of Technology

Abstract

Creating Shared Value (CSV) has fast emerged as a strong mutual value creation model among the top Fortune 500 corporations globally. With the United Nations’ 2030 Sustainable Development goals paving way for a gamut of multi-billion dollar CSV opportunities below the Pyramid segment, the CSV has become a tool for differentiation and competitive advantage among the corporations. Various qualitative studies have been conducted on the Creating Shared value in both developing and developed countries, but, the empirical literature availability is still scanty globally and not present in India. As a first, this paper intends to analyze the perceptions about the parameters of Shared Value creation’s competitiveness over Corporate Social Responsibility (CSR) amongst the CSR and Sustainability professionals in Top CSR and Sustainability practicing companies in India. The paper employs factor analysis to compose the CSV variable and non-parametric tests to ascertain CSV’s competitive advantage over CSR and investigate the relative importance of the variables that measure it respectively. And explore its differences relating to the demographics specially Industry-type, Organizational size, Job level, and Total experience among the respondents. The study results confirmed the positive perception among respondents regarding CSV’s competitiveness with differences in its factors. Attributes such as Industry Type displayed no difference in respondents’ perception. However, Industry size, respondents’ current job level and total job experience showed positive associations. This study adds to the scarce CSV empirical literature by offering insights on CSV’s competitiveness and linking it to the firm characteristics

Keywords

Creating Shared Value (CSV), Corporate Social Responsibility, CSR, CSV’s Competitive advantage, Creating Shared Value in India, CSV in Companies, CSV and Sustainable development.

Introduction

Since the last several decades, there is emergent significance of Corporate Social responsibility (CSR) in the corporate arena (Chandler, 2017).Several studies have explored its aspects, impacts, and metrics across industries, stakeholders, organizational performance and reporting frameworks encompassing several developed and developing countries. Research on CSR and business performance has showed that the association is dependent on stakeholders’ perceptions of CSR initiatives (Rettab et al., 2009) with multiple cultural and economic backgrounds.However,inspite of the rising importance of CSR, there remains an ambiguity over its merit of being a long-term strategy aligned through the core strategy of the Corporations (Ham et al., 2020). Moreover, few researchers had highlighted that conventionally CSR (more orientated towards philanthropy) does not offer sustainable returns for the company and is regarded as just a marketing or brand-building tool by the business executives (Porter & Kramer, 2011; Browne et al., 2016; Chen et al., 2020) therefore, its contested from an economic perspective (Wójcik, 2016). With the global businesses’ mounting demand on providing greater value that goes beyond the boundaries of CSR, “Creating Shared Value (CSV) (acknowledged as CSR 2.0) model was recommended by Porter and Kramer from Harvard Business School (HBS) in 2011”.They described CSV as a set of “policies and operating practices that enhance the competitiveness of a company while simultaneously advancing the economic and social conditions in the communities in which it operates”. Porter’s authority as the “father of modern corporate strategy” (Schawbel, 2012) and their “non-profit consulting firm, the Foundation Strategy Group (FSG)” helped popularise and implement the CSV strategy extensively amongst the corporate sector with several major fortune 500 companies globally as reputed clients and hundreds of CSV projects to the firm’s credit. The CSV’s dedicated far-reaching adoption by the Top Food and beverage sector multi-national corporations Nestlé and Coca Cola presented a great deal of traction to its merit (Crane et al., 2014). Certainly, CSV has garnered immense interest equally well among academia, and the Industry (Ham et al., 2020) garnering high academic citations as well as media coverage in publications such as “The Economist, The Huffington Post, The New York Times and The Guardian” (Crane et al., 2014), founded on its competitive advantages over CSR and its real-life success accounts. Its wide-ranging influence on academia can be judged by the results of Google Scholar search metrics, “Harvard Business Review’s (HBR) article on Creating Shared Value” (2011) has got over 9800 citations by the end of 2019. However, while Practitioners and Academia have shown keen interest in exploring CSV; research in the area still remains in a nascent phase (Nicholson, 2017; Yoo & Kim, 2019).

Compared to the global scenario, India has displayed high performance regarding Social responsibility practices over the last few years, especially since its Government’s mandated CSR bill in 2013. That makes the country the world’s first to compulsorily allocate two percent of eligible company’ profits based on profitability criteria, to their CSR practices, thereby increasing spotlight on CSR in India enhancing both its number and quality (Borgonovi et al., 2011). Several Indian companies are now adopting the CSV model to leverage the CSR law, the Shared Value India Initiative’s “Inclusive business” lists over the last few years is a testimony to that. Unlike CSR, where many perception studies have been done in India with respect to the stakeholders such as Managers (Singh & Narwal, 2012), Employees (Vishnubhai, 2012), Investors (Kansal & Joshi, 2014), Students (Saxena, & Mishra, 2017; Holtbrügge & Oberhauser, 2019), Customers (Shergill, 2012; Dutta & Singh, 2013) and CSR disclosure and reporting (Jain & Winner, 2016; Mukherjee & Bird, 2016; Chaudhri, 2016).The CSV concept has been only explored qualitatively in India in the form of business cases, with no single empirical study done to study the stakeholders’ perspective especially the practitioners’ on whether CSV supersedes CSR in value creation and is more competitive than it. Thus, this study proposes to bridge this gap and as a first ever, attempts to analyze the perceptions of Top Indian CSR and Sustainability Managers on CSV’s competitiveness over traditional CSR in Indian context, along with its’ relationship with the respondents company’s attributes. The study attempts to put forward an improved insight into the CSV’s correlations and associations with internal and external aspects, which can be valuable for policymakers, decision-makers, and implementation authorities.

Review of Literature

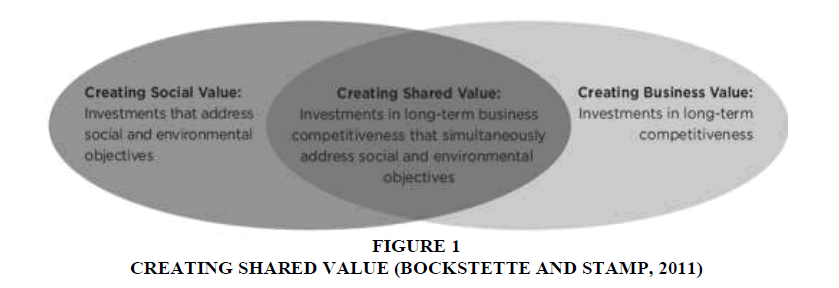

At the juncture of the millennium, businesses are challenged with mounting demands and expectations from society and its stakeholders to demonstrate ethical behaviour and moral management (Lantos,2001) rising above just profits making mindset to act in a socially responsible manner across various industries, geographies, and firm sizes (Waddock et al., 2002;Jamali et al., 2009) while making effort to tackle social problems irrespective of its connection with the problems (Mayer et al., 2019).Business bigwigs and Corporations are answering societal demands to augment CSR (Margolis & Walsh 2003), there is mounting pressure to advance CSR further than just “transparency, ethical behaviour and stakeholder engagement” (Camilleri, 2017). A major challenge that confronts it is its economic dimension, handling social problems while concurrently sustaining economic value creation prospective (Wójcik, 2016) and with increased businesses’ investments as a value creation business strategy, measuring CSR impact is a major issue (McWilliams, et al., 2006). Despite CSR’s popularity, its gradual transition from responsive to strategic mode and being considered “a source of innovation and competitive advantage”, it’s still acknowledged in a general manner rather a strategic perspective (Porter & Kramer, 2006). The organizations’ value creation business models are being constantly altered due to the fast-paced technological progress in relation to the changing customer requirements, cut-throat competition and innovation a greater than before necessity (Paunescu & Blid, 2016;Tantau & Mohammadreza, 2016). “As a value-based model Creating Shared Value is bringing several social and environmental matters at the centre of the organization’s function (Awale & Rowlinson, 2014) as shows in Table 1.

| Table 1 Corporate Social Responsibility Versus Creating Shared Value (Adapted From Porter And Kramer 2011; Vaidyanathan And Scott 2012) |

||

| Features | TraditionalCSR | CreatingSharedYalue |

| Motivation | Corporate reputation and license to operate | Competitive advantage |

| Driver | Discretionary or External stakeholders | Corporate strategy, Internal |

| Measurement | Spending(Cost Centre), Standard ESG metrics | Profit (Profit Centre), Social and economic value created |

| Scope | Limited by CSR Budget and Corporate footprint, Separate from Profit Maximiz.ation | Realigns the entire company budget, Integral to Profit Maximization |

| Management | CSR departments | Across the whole company |

| Social Benefit | Successful projects | Large-scale sustainable change |

| Business Benefit | Risk reduction and Goodwill | New business opportunities |

As per Corner and Pavlovich (2016) and Dembek et al. (2016) “CSV has continuously garnered recognition in the business ethics literature” (qtd. in Osorio, 2018) since it was first defined by Porter and Kramer for the CSV Pioneer Nestle in coining the term in 2011 to define its long-standing successful value creation strategy in practice since 2006. It has been developed to succeed CSR, shifting the business perspective in a milieu that societal wellbeing emerges as a precondition for business’s success (Porter & Kramer, 2011) while transforming strategic move from just sustainability to creating a better society (Corazza et al., 2017). Supported by the significant stakeholder theory, CSV postulates that business self-focus can and should drive the tackling of the social issues (Crane et al.,2014) and asserts the development of an integrated business approach of value creation concurrently generating economic and societal effects (Porter and Kramer, 2011). The CSV process is mainly guided through the business’ inner strategy rather than influenced by exterior drivers as the outcomes are incorporated and aligned with the core strategy of the business (Porter & Kramer, 2011). “Shared Value is a differentiation strategy” (Spitzeck & Chapman, 2012); that encapsulates three aspects of “Reconceiving products, services and markets, redefining value chains and enabling local cluster development” (Porter & Kramer, 2011). “Creating economic value by providing social progress (creating social value) (Figure 1), done either by serving the bottom-of-the-pyramid markets profitably (Reconceiving products and markets), implementing a closed product life-cycle in line with the concept of circular economy (reconfiguring the value chain), or joining resources and capabilities through collective/ network business models (cluster development)” (Wójcik, 2015).

Voltan et al. (2017) highlights the growing substantial attention to “CSV as Poverty alleviation approach” in the management literature by scholars such as Banerjee & Jackson (2016) calling it “an element of market-based methods”; “base-of-pyramid” (Prahalad, 2012) and “CSV tackling poverty reduction and social welfare improvement” (Porter & Kramer, 2011). Inspite of CSV criticised for being “just a buzzword” (Dembek et al., 2016) and “un-original” (Crane et al., 2014; Strand & Freeman, 2015). Yet even its critics like Crane et al. (2014) acknowledged that CSV brings much-needed focus to the business’s social aspect. Until now contemporary studies on CSV have just provided suggestions based on its theoretical features or have pitched a strategic course for businesses (Florin & Schmidt, 2011; Pfitzer et al., 2013). Conversely, “Sustainable development pursued by corporations is the driving force of CSV” (Yang & Yan, 2020). CSV’s wide acceptance and popularity soared in the business arena as an international business approach employed by Multi-national brands such as “Unilever, Nestlé, General Electric, IBM and Wal-Mart” noted Raimi et al., (2015), with more than 30 companies involved in CSV innovations (Pfitzer et al.,2013). Few studies have touched on Consumer Perception on CSV and brand (Jin, 2018); Social Innovation and CSV (Lee & Kim 2015); CSV and socially responsible consumption (Nam & Hwang, 2018); CSV and food service industry’s consumers' brand (Ham et al., 2020); Employee perception on casual relationship between CSV and CSR and organizational citizenship behaviours (Park, 2020); B2B perception on Tangible and Intangible Inter-firm CSV B2B activity (Yoo & Kim, 2019), CSV and SME Banking customer (Islam & Hossain, 2018).CSV is a comparatively novel model, and so far, it has been empirically evaluated to a limited extent only primarily as Case studies, with no precedence of large-scale analytical studies (Awale & Rowlinson, 2014). Therefore, proponents Yoo & Kim (2019) suggested that the advancement of research pertaining to the association linking CSV and an organization's competitiveness was necessary.

The existing Indian approach towards CSR is not new but is predisposed through its renowned legacy of giving (Sundar 2000; Singh & Agarwal, 2017; Garg & Ambrosius, 2018). This engagement has evolved over time from the Voluntary stand-alone societal development through merchants’ contributions (Arevalo & Aravind, 2011; Verma & Singh, 2016) to Gandhi’s Nationalist “Trusteeship model” during the pre-independence era to the present obligatory CSR Company law 2013 (Mitra & Schmidpeter, 2017; Gatti et al., 2019). Indian businesses have assumed their responsibility and contributed liberally to society and its communities (Borgonovi et al., 2011).The major striking determinants of the Indian businesses' CSR approach remains philanthropic and strategic goals, irrespective of the fact that the mandatory CSR law is for businesses exceeding specific economic parameters (Gupta 2016; Chhaparia & Jha, 2018).Though the mandatory law has given traction to CSR and related Corporate Social Performance, however only 57% of the eligible companies conformed with the requisite percentage spent (CRISIL, 2018) and of the prescribed mandatory layouts over 30% funds remained unspent in 2017-18 (Sundar, 2018). As per the Indian government report 2019, the major reasons cited for the unspent funds is that businesses are unable “to identify the right projects or the right Organizations to partner with them” signifying that there are still gaps to realize the full potential, quality, and impact of CSR law by companies for their own and societies benefit. “CSV is not a new [-concept in the Indian context, especially in large profitable enterprises as it has progressed eventually with the contribution of scholars emphasizing the role of business in society by raising the issues of inclusive growth, social enterprises, social entrepreneurship, social innovation, the bottom of the pyramid, etc” (Kaul, 2017). As a developing Nation, India with its myriad range of economic disparities, social asymmetries and a below the pyramid (BoP) huge population, offers promising shared value opportunities for inclusive growth with several long-term benefits. FSG’s white paper on CSV in India unravelled “several of innovative efforts that are creating economic value while contributing to meaningful and sustained social impact at scale” (Borgonovi et al., 2011).The Transformational effect of CSV’s successful model such as Nestlé’s Procurement model of Milk district in Moga, Punjab (Biswas & Biswas-Tortajada, 2014) and Hindustan Unilever’s Shakti program focussed on an economical rural distribution network are a few of the major striking CSV initiatives. Apart from them, Nestle, Novartis, and GE were found to be involved in India specific social innovations (Pfitzer et al., 2013). Though, the results are primarily derived from successful particular initiatives from big global conglomerates but, the characteristics of the associations linking CSV and the organization’s competitiveness in those researches is yet vague and had not been empirically established (Odia, 2018) as shows in Figure 1.

CSV and Competitiveness

“CSV is a firm’s business strategy to achieve a competitive advantage” (Porter & Kramer, 2006, 2011). Several factors constitute the competitive advantage of CSV. There is increasing agreement on CSV that through it organizations can react in an improved way to the market, social and environmental requirements, assist business functions, and build up innovative capability (Awale & Robinson, 2014).“The essential point of distinction of CSV from traditional CSR is that it enables firms not only to create social value but also to achieve economic benefits that advance their individual competence and competitiveness, whereas traditional CSR is frequently categorized as greatly philanthropy-based without an obvious link to the business's core competence or competitive advantage” (Porter & Kramer,2011; Wójcik, 2015; Browne et al., 2016; Yoo & Kim, 2019; Ham et al., 2020).CSV is focused on long-term growth with social investments that create business value by solving social issues and translating them into substantial business prospects (Odia, 2018).Porter &Kramer (2011) insisted that “their proposed strategy has set out new business opportunities as it creates new markets, improve profitability, and strengthens the corporations’ competitive positioning”, while “Serving the bottom-of-thepyramid markets profitably by Reconceiving products and markets” (Wójcik, 2015). Porter & Kramer (2011) stressed on CSV through “the value chain activities that could bring opportunities for competitive advantage”, by fostering “a forward-thinking, inclusive understanding of the effect of business decisions on society and the environment across the value chain” (O'Riordan & Fairbrass, 2014). “By redefining productivity in the value chain, which needs businesses to improve the quality, quantity, cost, and reliability of inputs, production processes, and distribution systems, while simultaneously acting as a steward for essential natural resources and driving economic and social development” (Vaidyanathan & Scott, 2012). Also, “The CSV strategy expects that social engagement to be considered as a long-term investment essential for business achievement” (Camilleri, 2017). Consequently, businesses could gain from “insights, skills, and resources that cut across profit/non-profit and private/public boundaries. It is in the organizations interest to forge closer ties with the regulatory authorities and with their neighbouring communities” (Camilleri, 2017), through collaborative projects that assists businesses in building up a proactive tendency towards society (Perrini et al., 2011). “By serving the stakeholders interests, businesses become equipped to obtain intangible assets as legitimacy, reputation, and trust (…), which might possibly guide towards a sustainable competitive advantage” (Flammer & Kacperczyk, 2015), these benefits materialize in long-term (Porter & Kramer, 2006, 2011). As a potential synergy “Creating shared value” also presents a business approach for organizations looking to promote the “2030 Sustainable Development Goals (SDGs)” agenda, that is aimed at the most urgent challenges confronting society (Fraser, 2019).“CSV contributes to sustainable business goals by highlighting the connection between business strategy and social causes/goals” (Kim, 2018). Therefore, a Hypothesis can be framed.

H1: There is a positive perception towards CSV’s Competitiveness over CSR with difference in Factors contributing to it.

CSV Competitiveness and Respondents Firm’s Characteristics

Industry sector, organization size, job level and experience

Various Studies have evaluated CSR and the differences and effects of organizations size (Udayasankar, 2008; Baumann-Pauly et al., 2013; Youn et al., 2015; Wickert et al., 2016; Waluyo, 2017; Trencansky & Tsaparlidis, 2014; Badulescu et al., 2018); Industry Type (Reverte, 2009; Gallo & Christensen, 2011; Ramos et al., 2013; Trencansky & Tsaparlidis, 2014; Lim & Lee, 2018); Job Level and Experience (Reimer et al., 2018; Baldo, 2017; Koya & Roper, 2020). Research Studies in diverse business areas as “Food, Beverages, Agriculture, Pharmaceutical, Healthcare, Financial services, Extractives, and Natural resources advocate that firms can enhance their competitiveness by embracing the CSV concept in their business strategy” (Hills et al., 2012), “Companies from these sectors were found expanding their business prospects through innovative products, re-engineered value chain, and local cluster development” (Awale & Rowlinson, 2014). “However, the competitiveness of the business can be governed by various issues affected from such as the complexity of the business, diverse market, and geographical settings, and other factors” (Awale & Rowlinson, 2014). Also, the CSV initiates with a strategic intent of the business leaders with a top-down approach, where the top leadership positions the inspiring pitch and Vision, are driving the whole business towards a common objective. This has a cascading effect all over the organization (Porter & Kramer, 2011; Bockstette &Stamp, 2011; Borgonovi et al., 2011). The concept of CSV is centred on the core competency of a business, which can be impacted by competency specific to an Industry sector and level of scale due to the Organization Size. FSG’s India based qualitative research on CSV practices revealed several groundbreaking initiatives that while generating the economic value enabled consequential and sustained market-based solutions for social issues at scale, displayed not only by big conglomerates as well by small social businesses in the sectors as “healthcare and sanitation, agriculture, and financial services” (Borgonovi et al., 2011). Therefore, the hypotheses can be framed:

H2: There is inter-industry perception difference about CSV’s Competitiveness over CSR.

H3: There is organizational size perception difference about CSV’s Competitiveness over CSR.

H4: There is an increasing trend in perception on CSV’s Competitiveness across the Organization size categories.

H5:There is perception difference based on Current Job level and Total Experience about CSV’s Competitiveness in India.

H6:There is an increasing trend in perception on CSV’s Competitiveness across the Current Job level and Total Experience categories.

Materials and Methods

Aim and Sample Data

The paper intends to explore the perceived creating Shared Value’s (CSV) competitiveness over traditional CSR and if this perception is affected by organization characteristics (respondents’ industry type, company size, job level, and total experience). This survey was carried out from September 2018 to March 2019. Sample selection was done by employing Non- Probability Purposive sampling and therefore respondents from India’s top 100 Sustainability and CSR companies from listings from IIM-Udaipur and Futurescape-India’s Top CSR and Sustainability 2018 was selected. For data collection, the web-based two-way plan was used, firstly, customized emails, and secondly communication with a self-administered survey were administered to respondents from Top companies on a professional social media website, like LinkedIn. A total of 225 CSR and Sustainability professionals were targeted through the survey and about 101 usable filled questionnaires were obtained. The rate of return of questionnaires was 45%. As per Zeng et al., (2019), a 30 to 500 sample size is deemed reliable. Moreover, “Kaiser-Meyer-Olkin (KMO) Measure of Sampling Adequacy” was employed to verify the adequacy of the sample size. The survey questionnaire was constructed based on Industry consultations followed by a pilot study due to the non-availability of a standard scale.

Data Analysis

All the analyses including descriptive statistics including “frequency, average, central tendency and deviation” methods and inferential statistics such as “Correlations (Spearman Rank Correlation Coefficient), Friedman ranking tests, Wilcoxon signed-rank test, Kruskal-Wallis test, and Jonckheere-Terpstra Test” were done using SPSS 23 software.

Variable Measurement and Method

Shared Value’s competitiveness over traditional CSR strategy was measured by using six statements, which are: Better Social, environmental and economic merits for the business and society (SVCCSR1); Improved long-term inclusive business growth through differentiation for the company (SVCCSR2); Improved revenues/Profits through sustainable and innovative products and services for underserved segments and new markets for the company including the BoP segment (SVCCSR3); Improved productivity and cost-savings through value chain optimization. (SVCCSR4); Improved Stakeholder Management and benefits for employees, customers and communities (SVCCSR5) and better alignment towards and attainment of Sustainable Development Goals, while helping in tapping opportunities in SDG segment (SVCCSR6). The questions were built on 5 points Likert scale varying between 1 = Strongly Disagree and 5 = Strongly Agree.

Preliminary analyses were performed to check the key assumptions of normality and multicollinearity. All six variables of CSV’s competitiveness were not found to be of normal distribution (Table 3). Due to data’s non-normality, for analyzing the multiple parameters of CSV’s competitiveness that is independent and paired, the non-parametric method of Friedman test and its post hoc test of Wilcoxon signed-rank with the Bonferroni correction was used. The Friedman test is an alternative of nonparametric to repeated-measures ANOVA when normality assumption or assumption of the equality of variances is not fulfilled (Kvam & Vidakociv, 2007). Furthermore, Wilcoxon signed-rank test was employed to test the mean difference in the average ranks of paired samples. Also, this study intends to examine if respondents’ organizational characteristics affect their perceptions of Shared value’s competitiveness or not. As, the normality criterion of the ANOVA test was not met, therefore Kruskal-Wallis test (Gravetter et al., 2020) and Jonckheere-Terpstra for ordered differences Test was employed for checking differences of CSV variables with respect to organizational characteristics. The latter test presents the prospect to evaluate “the scores of a continuous variable for three or more groups” (Gravetter et al., 2020). The comparison of the categories of Organization Size, Current Job Level, and Total Experience offers a significant arrangement of medians, reasonably enabling them to arrange their levels from the lower to the higher-order or vice-versa. Therefore, the Jonckheere-Terpstra test was performed to test for these patterns.

Data Analysis and Interpretation

Sample-Descriptives

Table 2 summarizes descriptive statistics about the respondents' characteristics, including their Age, Gender, Educational level, Working experience, Current level in the organization, Organizational size, and Industry-type of the respondents. In Table 3, the median value of 4 is similar for all the variables. The mean value of all the six research variables for a 5-point Likert scale lies between 3.80 and 4.02, indicating that the respondents displayed a high degree of positive perception and preference for CSV’s competitiveness over CSR.

Table 2 Descriptive Statistics Of Respondents |

|||||||

| Frequency | Percent | Frequency | Percent | ||||

| Gender | Male | 76 | 75.2 | Number of Employees (Size of Organization with respect to Employees) | Less than 100 | 13 | 12.9 |

| Female | 25 | 24.8 | 101-300 | 9 | 8.9 | ||

| Age group | 20-25 | 4 | 4.0 | 301-1000 | 15 | 14.9 | |

| 25-30 | 16 | 15.8 | 1001-3000 | 14 | 13.9 | ||

| 35-35 | 24 | 23.8 | 3001 and above | 50 | 49.5 | ||

| 35-40 | 20 | 19.8 | Industry Type | Agri, FMCG and Allied | 3 | 3.0 | |

| 40 and above | 37 | 36.6 | BFSI | 6 | 5.9 | ||

| Highest level of education | Under-Graduate | 19 | 18.8 | Consumer Durable/ Retail | 6 | 5.9 | |

| Post-Graduate | 75 | 74.3 | Infrastructure | 18 | 17.8 | ||

| Doctorate | 7 | 6.9 | Manufacturing | 23 | 22.8 | ||

| Total working experience | Less than 5 Years | 11 | 10.9 | Pharmaceuticals/ Healthcare/Chemicals | 13 | 12.9 | |

| 5-10 years | 21 | 20.8 | Services | 24 | 23.8 | ||

| 10-15 years | 27 | 26.7 | Technology | 8 | 7.9 | ||

| 15 and above | 42 | 41.6 | |||||

| Current level in the company | Executive | 12 | 11.9 | ||||

| Assistant Manager | 13 | 12.9 | |||||

| Manager | 34 | 33.7 | |||||

| GM/Head | 23 | 22.8 | |||||

| Director/VP/Lead | 19 | 18.8 | |||||

| Table 3 CSV’S Variables’ Descriptives and Normality Tests |

|||||||||

| Variables | Mean | Median | Standard Deviation | Percentiles | ZSkewness | ZKurtosis | Test of Normality (Kolmogorov-Smirnov) | ||

| 25 | 50 | 75 | |||||||

| SVCCSR1 | 3.93 | 4 | 1.032 | 4 | 4 | 5 | -5.672 | 3.477 | Non-Normality |

| SVCCSR2 | 4.01 | 4 | 0.954 | 4 | 4 | 5 | -5.074 | 3.501 | Non-Normality |

| SVCCSR3 | 3.80 | 4 | 1.096 | 3 | 4 | 5 | -4.130 | 1.218 | Non-Normality |

| SVCCSR4 | 3.80 | 4 | 1.010 | 3 | 4 | 4 | -3.980 | 1.588 | Non-Normality |

| SVCCSR5 | 4.02 | 4 | 0.948 | 4 | 4 | 5 | -5.841 | 5.165 | Non-Normality |

| SVCCSR6 | 4.00 | 4 | 1.000 | 4 | 4 | 5 | -5.351 | 3.497 | Non-Normality |

Data Normality, Reliability, Validity and Multicollinearity

For normality tests two methods were used, a Kolmogorov-Smirnov test ideal for mediumsized samples (less than 300) and a z-test test using skewness and Kurtosis was applied (Kim,2013). For Normal data, the Kolmogorov-Smirnov test, the value of p> 0.05, if its less then data is not normal. “For the medium-sized samples (50 < n < 300), if skewness and kurtosis’s absolute z-score is over 3.29, which corresponds with an alpha level 0.05, the distribution of the sample is non-normal” (Kim,2013).A negatively skewed data pattern is evident from the results of Zskewness. As seen in Table 3, both the tests exceed the threshold value of the normality assumption, therefore data is non-normal and permit the use of nonparametric tests.

Reliability (Cronbach’s α-value at 0.05 level) was found to be larger than 0.8 (0.70 benchmark value), which reflects good reliability (Taber, 2018) depicting the internal consistency of the variables as seen in Table 7. Table 4 displays the variables’ of Spearman rho Correlations. Positive and significant correlations were found between all the variables. Therefore item (criterion) validity is proved (Karros, 1997). The highest correlation coefficient is between SVCCSR3 and SVCCSR4 0.753 and SVCCSR2 and SVCCSR5 0.751 (r<0.01). Therefore, there is no issue of multi-collinearity as all values are within the range of the critical value of 8. (Nurunnabi, 2016)

| Table 4 Spearman RHO Correlations |

||||||

| SVCCSR1 | SVCCSR2 | SVCCSR3 | SVCCSR4 | SVCCSR5 | SVCCSR6 | |

| SVCCSR1 | 1 | |||||

| SVCCSR2 | 0.563** | 1 | ||||

| SVCCSR3 | 0.694** | 0.662** | 1 | |||

| SVCCSR4 | 0.694** | 0.697** | 0.753** | 1 | ||

| SVCCSR5 | 0.609** | 0.751** | 0.529** | 0.649** | 1 | |

| SVCCSR6 | 0.700** | 0.625** | 0.564** | 0.651** | 0.740** | 1 |

As the Normality tests have indicated that the observed variables in the sample are not normally distributed, signifying the implication of non-parametric methods like the Friedman, Wilcoxon Rank, Kruskal Wallis, and Jonckheere-Terpstra tests to explore the associations.

Data Results

Earlier as seen in Table 3, the mean values of CSV’s Competitiveness variables differed. To test for these differences, the non-parametric Friedman test of differences for Paired Observations was run to test Hypothesis 1 and its results are reported in Table 5a & 5b. The Friedman test revealed that the perception of CSV’s Competitiveness statistically differed at a chi-square (��2) value of 17.944 significant at p < 0.01. Therefore, differences were found in the mean ranks of factors constituting CSV’s Competitiveness. Hence, in the Six factors of the CSV’s Competitiveness, scored higher mean ranks than others as per the preference by the respondents (SVCCSR3:3.67; SVCCSR5:3.65; SVCCSR2:3.64; SVCCSR1:3.62; SVCCSR3:3.27; SVCCSR4:3.15).A positive perception with difference in factors, thus, supports Hypothesis 1.

| Table 5a Friedman Test Mean Rank |

|

| Ranks | |

| Variables | Mean Rank |

| SVCCSR1 | 3.62 |

| SVCCSR2 | 3.64 |

| SVCCSR3 | 3.27 |

| SVCCSR4 | 3.15 |

| SVCCSR5 | 3.65 |

| SVCCSR6 | 3.67 |

| Table 5b Friedman Test Statistics |

|

| Friedman Test Statistics | |

| N | 101 |

| Chi-Square | 17.944 |

| Df | 5 |

| Asymp. Sig. | 0.003 |

χ2(5) = 17.944, p = 0.003

Since the above results indicate a difference in the mean ranks of the variables, therefore Wilcoxon test as the post-hoc test of Friedman test can be used for performing multiple two paired comparisons in order to identify differences between variables with a Bonferroni adjustment (the little correction of level of significance) used to avoid making an outcome significant (a Type I error) when it is not (Field,2009).The adjustment requires the correction of level of significance of 0.05, with the formula as:

The corrected p value will be used to interpret the results if more than 0.003. To check the paired average rank differences among the six variables of CSV’s competitiveness, Wilcoxon signed-rank test (with a Bonferroni correction) was employed to test fifteen different paired combinations of these variables at a revised significance level of p < 0.0033 in Table 6. However, no statistically significant difference was found between the average ranks of various paired combinations of variables in measuring the CSV’s competitiveness as p >0.003 shows in Table 6.

| Table 6 Wilcoxon Sign Rank Test Statisticsa |

|||||||||||||||

| SVCCSR2 - SVCCSR1 | SVCCSR3 - SVCCSR2 | SVCCSR4 - SVCCSR3 | SVCCSR5 - SVCCSR4 | SVCCSR6 - SVCCSR5 | SVCCSR3 - SVCCSR1 | SVCCSR4 - SVCCSR1 | SVCCSR5 - SVCCSR1 | SVCCSR6 - SVCCSR1 | SVCCSR4 - SVCCSR2 | SVCCSR5 - SVCCSR2 | SVCCSR6 - SVCCSR2 | SVCCSR5 - SVCCSR3 | SVCCSR6 - SVCCSR3 | SVCCSR6 - SVCCSR4 | |

| Z | -1.838b | -.009c | -2.824c | -0.185c | -0.379b | -2.273b | -0.638c | -0.831c | -0.909c | -2.580c | -2.356c | -2.084c | -2.952c | -2.583c | -0.229b |

| Asymp. Sig. (2-tailed) | 0.066 | 0.993 | 0.005 | 0.854 | 0.705 | 0.023 | 0.523 | 0.406 | 0.363 | 0.01 | 0.018 | 0.037 | 0.003 | 0.01 | 0.819 |

A. Wilcoxon Signed Ranks Test B.Based on Positive Ranks. C.Based on Negative Ranks.

As discussed earlier, Six variables were considered to encapsulate CSV’s competitiveness. “To create one variable, factor analysis (principal component analysis) was run” (Fabrigar & Wegener, 2011), to categorize the most significant foundation and to communicate data’s convergences and dissimilarities in Table 7. In the sample, one single factor emerged, which explained 73.28% of the variance. To remove this Common Method Bias, a Composite CSV Competitiveness variable using average variables score was computed and used in further tests (Çera et al., 2020).“The Kaiser-Meyer-Olkin (KMO) test result obtained was more than the threshold value of 0.70 and there was a significant value of Barlett’s test of sphericity too” (Hair et al., 2010). Therefore, Factor analysis could be undertaken as the Barlett’s test statistics endorse its suitability. The factor loadings in the matrix exceeded the threshold of 0.55 for the research sample size (Comery & Lee, 1992), demonstrating variables’ Convergent validity.

CSV Competitiveness and Industry Type

The association between CSV Competitiveness and Industry Type was tested with Kruskal Wallis test as in Table 7 & 8. In this category, just one variable was observed to be statistically significant, SVCCSR6:H(7, n=101) = 14.275, at p<0.05. For this variable, a noticeable variation among the mean ranks among Industries from Pharmaceuticals /Healthcare/ Chemicals Industry to Technology was found. The low levels manifested from the Agriculture, FMCG and Allied Industry and Service Industry categories indicate that their respondents are more inclined towards CSV Competitiveness compared to other industries segments. However, these statistical results that only one indicator is significant and the majority of five indicators are insignificant, indicating no difference in respondents’ views based on industry. Thus, the evidence fails to support Hypothesis 2 shows in Table 8.

| Table 7 CSV Factor Analysis – Principal Component Matrix |

|||

| Variables | Loadings | Communalities | Cronbach’s alpha if deleted |

| SVCCSR1 | 0.853 | 0.728 | 0.933 |

| SVCCSR2 | 0.858 | 0.737 | 0.933 |

| SVCCSR3 | 0.903 | 0.816 | 0.925 |

| SVCCSR4 | 0.880 | 0.775 | 0.930 |

| SVCCSR5 | 0.894 | 0.800 | 0.928 |

| SVCCSR6 | 0.889 | 0.790 | 0.928 |

| Kaiser-Meyer-Olkin(KMO) | 0.85 | ||

| Variance Explained | 77.420% | ||

| Cronbach alpha | 0.94 | ||

| Table 8 Results for Kruskal Wallis and Jonckheere-Terpstra Methods |

||||||||

| Items | COMPOSITE CSVCOMP | SVC CSR1 |

SVC CSR2 |

SVC CSR3 |

SVC CSR4 |

SVC CSR5 |

SVC CSR6 |

|

| Mean Rank (Industry Type) | Agriculture, FMCG and Allied Industry | 31.50 | 33.17 | 31.17 | 33.50 | 21.33 | 31.50 | 31.50 |

| BFSI | 54.58 | 59.83 | 45.25 | 45.75 | 65.50 | 58.33 | 58.00 | |

| Consumer Durable/ Retail | 67.42 | 66.75 | 65.25 | 53.67 | 60.00 | 65.25 | 71.50 | |

| Infrastructure | 47.47 | 48.47 | 45.28 | 47.17 | 50.33 | 43.25 | 49.00 | |

| Manufacturing | 59.43 | 61.30 | 55.54 | 54.78 | 56.74 | 61.17 | 62.59 | |

| Pharmaceuticals /Healthcare/ Chemicals | 49.31 | 44.85 | 52.88 | 53.15 | 48.15 | 43.85 | 48.69 | |

| Services | 46.19 | 45.25 | 49.75 | 50.94 | 48.44 | 47.58 | 39.46 | |

| Technology | 44.19 | 42.56 | 52.56 | 53.94 | 41.81 | 52.19 | 47.25 | |

| Kruskal Wallis | χ2(7) | 6.665 | 10.446 | 5.145 | 2.406 | 8.125 | 9.925 | 14.275 |

| P | 0.465 | 0.165 | 0.642 | 0.934 | 0.322 | 0.193 | 0.047 | |

| Mean rank (Organization size in number of Employees) | Less than 100 | 30.00 | 31.85 | 28.65 | 31.35 | 34.00 | 31.00 | 31.46 |

| 101-300 | 46.89 | 37.83 | 64.11 | 46.33 | 49.11 | 54.83 | 44.00 | |

| 301-1000 | 53.80 | 60.13 | 53.70 | 55.73 | 53.10 | 52.00 | 47.30 | |

| 1001-3000 | 60.25 | 57.86 | 56.57 | 54.89 | 59.07 | 56.36 | 58.96 | |

| 3001 and above | 53.77 | 53.69 | 52.08 | 54.44 | 52.87 | 53.71 | 56.22 | |

| Kruskal Wallis | χ2(4) | 8.932 | 12.268 | 8.269 | 6.592 | 11.81 | 8.549 | 10.69 |

| P | 0.063 | 0.015 | 0.019 | 0.082 | 0.159 | 0.073 | 0.030 | |

| Jonckheere-Terpstra | Z | 1.961 | 2.111 | 1.175 | 2.065 | 1.521 | 1.772 | 2.797 |

| P | 0.050 | 0.035 | 0.240 | 0.039 | 0.128 | 0.076 | 0.005 | |

| Mean rank (Current Level in company) | Executive | 53.29 | 49.83 | 58.50 | 54.79 | 44.46 | 59.17 | 58.92 |

| Assistant Manager | 52.96 | 49.31 | 63.81 | 54.88 | 54.85 | 54.31 | 50.38 | |

| Manager | 53.51 | 53.93 | 49.12 | 54.40 | 57.37 | 51.76 | 51.47 | |

| GM/Head | 60.83 | 64.52 | 53.78 | 59.04 | 55.72 | 56.63 | 58.26 | |

| Director/VP/Lead | 31.82 | 31.29 | 37.50 | 30.13 | 35.39 | 35.39 | 36.79 | |

| Kruskal Wallis | χ2(4) | 11.237 | 17.019 | 8.978 | 13.688 | 9.635 | 8.832 | 7.908 |

| P | 0.024 | 0.002 | 0.062 | 0.008 | 0.047 | 0.065 | 0.095 | |

| Jonckheere-Terpstra | Z | -1.558 | -1.111 | -2.339 | -2.195 | -1.311 | -2.05 | -1.524 |

| P | 0.119 | 0.267 | 0.019 | 0.028 | 0.190 | 0.040 | 0.127 | |

| Mean rank (Total Experience) | Less than 5 Years | 45.32 | 42.36 | 59.50 | 53.86 | 48.55 | 52.00 | 37.32 |

| 5-10 | 68.17 | 60.05 | 62.90 | 67.69 | 65.19 | 60.93 | 65.86 | |

| 10-15 | 47.02 | 50.91 | 43.54 | 44.72 | 50.59 | 49.46 | 48.67 | |

| 15 and above | 46.46 | 48.80 | 47.62 | 45.94 | 44.81 | 46.76 | 48.65 | |

| Kruskal Wallis | χ2(3) | 9.228 | 3.913 | 7.865 | 10.509 | 7.882 | 4.053 | 9.620 |

| P | 0.26 | 0.271 | 0.049 | 0.015 | 0.049 | 0.256 | 0.022 | |

| Jonckheere-Terpstra | Z | -1.658 | -0.573 | -2.029 | -2.317 | -2.011 | -1.614 | -0.687 |

| P | 0.097 | 0.567 | 0.042 | 0.021 | 0.044 | 0.107 | 0.492 | |

CSV Competitiveness and Organizational Size

It was anticipated from the research that a positive relationship connecting CSV Competitiveness and Organization Size would emerge, indicative of the respondents at bigger organizations with better exposure tend to show a more positive attitude towards CSV compared to the small-sized organizations. This was studied by using the Kruskal-Wallis test in Table 8. In this category, three variables were observed to be statistically significant, SVCCSR1: H (4, n = 101) = 12.268; SVCCSR2: H (4, n = 101) = 11.810 and SVCCSR6: H (4, n = 101) = 10.690, all at p < 0.05. So, respondents from small-sized businesses (that is Less than 100 and 100-300 size’ categories) scored significantly lower than the other three sizes in the indicators of “Better Social, environmental and economic benefits for the business and society” (SVCCSR1) and “Improved long-term inclusive business growth through differentiation for the company” (SVCCSR2). Thus, Hypothesis 3 is partly supported.

The Jonckheere-Terpstra test was used to examine the occurrence of an increasing or decreasing trend based on perceptions among the various organization size categories (Table 8). A statistically significant increasing trend was observed in the organization size categories for all the variables except the SVCCSR2 and SVCCSR4 variables, including COMPOSITE CSVCOMP “z = 1.961”,SVCCSR1 “z = 2.111”; SVCCSR3 “z = 2.065”; SVCCSR5 “z = 1.772” and SVCCSR6 “z = 2.797”, all at p < 0.10.Hence, respondents in 3001 and above size organization category counted lower than the remaining two types (301-1000 and 1001-3000 employee size categories) in perception on CSV Competitiveness, indicating that they are more inclined towards CSV. Thus, Hypothesis 4 is supported.

CSV Competitiveness, Total Experience, and Current Job Level

The Kruskal-Wallis test was run to check the respondents’ perception difference based on Total Experience and Current Job level categories as shown in Table 8. For Current Job Level, Composite Variable and three indicators were found to be statistically significant, COMPOSITE CSVCOMP: H(4, n = 101) = 11.237,p < 0.05; SVCCSR1:H(4, n = 101) = 17.019, p < 0.05; SVCCSR3: H(4, n = 101) = 13.688, p < 0.05 and SVCCSR4:H(4, n = 101) = 9.635, p < 0.05. So, respondents from the highest current level (Director/VP/Lead) scored significantly lower than the four other Job levels in the three indicators of “Better Social, environmental and economic benefits for the business and society” (SVCCSR1); “Improved revenues/Profits through sustainable and innovative products and services for underserved segments and new markets for the company including BoP segment” (SVCCSR3) and Improved productivity and cost-savings through the value chain optimisation (SVCCSR4).

For Total Experience, Four indicators were found to be statistically significant, SVCCSR2: H(4, n = 101) = 10.509; SVCCSR3: H(4, n = 101) = 7.882;SVCCSR4:H(4, n = 101) = 7.865 and SVCCSR6:H(4, n = 101) = 9.620, all at p < 0.05. So, the respondents from the higher total experience categories of 10 to 15 years and 15 years and above categories counted considerably lower than the remaining two experience categories in four indicators of “Improved long-term inclusive business growth through differentiation for the company (SVCCSR2); Improved revenues/Profits through sustainable and innovative products and services for underserved segments and new markets for the company including BoP segment (SVCCSR3); Improved productivity and cost-savings through value chain optimisation. (SVCCSR4) and better alignment towards and attainment of Sustainable Development Goals, while helping in tapping opportunities in the SDG segment (SVCCSR6). Thus, H5 is supported.

The Jonckheere-Terpstra test was drawn on to investigate for increasing or decreasing trend in the categories of Current Job level and Total Experience in respondents’ perceptions as in Table 8. A statistical significance decreasing trend was observed in the Current Job level category for the three variables SVCCSR2 “z = -2.195”, SVCCSR3 “z = -2.339” and SVCCSR5 “z = -2.050”, all at p< 0.10. Director/VP/Lead Job level category respondents scored lower in perception on CSV Competitiveness than the other four categories, indicating that they are more inclined towards CSV Competitiveness. For the category of respondents’ Total Experience, a statistically significant decreasing trend was observed among the three variables SVCCSR2 “z = -2.317”, SVCCSR3 “z = -2.011” and SVCCSR4 “z = -2.029” all at p < 0.10. Hence, 15 and above years category respondents scored lower in perception on CSV Competitiveness than the other three categories, indicating that they are more inclined towards CSV Competitiveness. Thus, for Job level and Total experience, the evidence fails to support Hypothesis 6.

Discussion

Keeping in mind that organizations should not just operate in a socially responsible approach caring for the society, but also create mutual social and economic value for stakeholders, scholars, and managers alike are specifically interested in better understanding the ways on how to implement the best social responsible value-creation practices while remaining competitive in the market. Advancing this premise, this research empirically explored the competitive aspects of CSV over CSR with related insights about the Practitioners Perceptions and its relationship with respondents’ Industry Type, Organization Size, Current Level in the Organization, and Total Job Experience. Firstly, although it was anticipated from the respondents to respond positively towards factors of CSV’s competitiveness, the evidence showed that a positive response towards the same with varying degree of the importance ascribed to different factors with regards to the preference of components of CSV’s competitiveness. This outcome is in tune with the earlier qualitative studies that acknowledged CSV’s competitiveness and differentiation among its factors with respect to various business contexts (Hills et al.,2012; Vaidyanathan & Scott, 2012; Juscius & Jonikas, 2013; Von Liel, 2016). This finding denotes that CSV’s competitiveness should be examined together with the background where the related business activity happens. In the firm’s characteristics, however, not all cases revealed significant association. Secondly, Kruskal Wallis test results showed that the firm characteristic such as Industry type made no difference in the perceptions towards CSV’s competitiveness, as the data presented no empirical support for the association. This is in line with the studies indicating that all industry sectors have found applicability of CSV dimensions (Vaidyanathan & Scott, 2012; Von Liel, 2016), therefore a positive response was found across industries. However, the Sixth indicator of CSV competitiveness, which is formulated as “better alignment towards and attainment of Sustainable Development Goals, while helping in tapping opportunities in the SDG segment”, was viewed as statistically different among the Industry type classifications. Thirdly, Kruskal Wallis test results indicated that Organization size is of significance in the perception of CSV’s competitiveness though not in entirety, as the data demonstrated verification to back this relationship. Moreover, the Jonckheere-Terpstrata test employed for examining the trend in the perception towards CSV competitiveness in all the Organization Size categories confirmed an important increasing trend in the variables of CSV’s Competitiveness. The finding indicates that the Organization Size does impact the level of CSV and though respondents from large corporations were found to be inclined more positively towards the CSV’s Competitiveness, supporting previous studies in the field (Hills et al., 2012; Hartarska et al., 2013; Von Liel 2016). Though the business case-studies indicate that not only the large corporations are engaged in CSV to combat social problems, but also the smaller social enterprises are engaged too (Borgonovi et al.,2011). Fourthly, this study found that there is a positive perception across respondents’ Total Experience and Current Job level categories with no major difference for CSV’s Competitiveness. Therefore, significant support was established to endorse the positive relationship between respondents inclination towards the CSV’s competitive advantage with Total Experience and Current Job level. In addition, there is a decreasing trend across the Total Experience and Current Job level, indicating that the as Respondents who are more experienced and are in high Job Level, are found to be more inclined towards CSV’s competitive advantage over social responsibility. The finding supports with pr ior researchers that the CSV is driven by the Top management with a top-down approach across the organization (Odia,2018) and since CSV is related to long-term strategic planning aligned to core competency, therefore experience, knowledge, and expertise matters (Porter & Kramer, 2011; Von Liel, 2016).

Conclusion

Several CSV qualitative case-studies had been explored by FSG consulting and its related researchers Borgonovi et al. (2011) Vaidyanathan & Scott, (2012) highlighting the innovations and strategies across various industries in India. However, there’s a dearth of studies on CSV’s connection with the sustainable and inclusive development in the context of developing countries (Odia, 2018). Moreover, a major gap exists concerning the stakeholders’ perception analysis about CSV competitiveness viz-a-viz CSR across industries and factors impacting them in India. This study aims to bridge that gap and analyze whether perception across practitioners levels is in sync with the practical positive response of the industry towards CSV as a competitive strategy. Indeed similar to practice, CSV was found to be “a (r)evolutionary strategic management thinking meant to enhance the companies’ competitiveness while simultaneously advancing their economic and social conditions in the society they operate”(Odia, 2018) in perception too. Among the several success factors that influence CSV “the internal factor such as the size of the company and external factors such as the industry sector in which the firm operates” (Von Liel, 2016) were explored including the other internal factors Job level and experience. Regarding the association between respondents Industry Type and CSV’s competitiveness, results do not back any noteworthy impact; opposing earlier case based Industry-specific studies (Hills et al., 2012) although are aligned with (Von Liel, 2016) findings.

This indicates that CSV’s competitiveness is viewed alike among the respondents from different organizations regardless of their Industry Type. The association between respondent Industry size and CSV’s competitiveness, findings support significant influence in-line with previous case-based studies (Hills et al.,2012; Von Liel, 2016), indicating that large corporations are more inclined towards using CSV as a competitive strategy. When it comes to the effect of Job level and experience on CSV’s competitiveness, findings support the association between them, supporting the top-down management driven and leadership approach (Bockstette & Stamp, 2011; Odia, 2018). Therefore, it can be said that the higher hierarchy of job level and high experience professionals manifest a higher inclination towards CSV as compared to younger counterparts. Evidently, the findings present firm support for a potentially positive relationship between Organization Size, Current Job level, and Total Experience with CSV’s competitiveness.

Managerial Implications and Limitations

The research study delivers useful information to the limited literature of the CSV and gets benefit for the policymakers, organizations’ business leaders and decision-makers, as the study outcomes, imply that CSV’s adoption can lead to competitive benefits over the traditional CSR model. To achieve competitiveness through CSV strategy, organization leaders must capitalize on the core competence of their business. CSV will be a future feature of competition for the majority businesses (Von Liel, 2016). Although there is available literature signifying CSV as a strategic business requirement and as an element of competitive gain, there is scanty empirical substantiation to determine how a CSV’s advantage is perceived by Industry practitioners. This study contributes to several aspects to the CSV research: foremost, it expands earlier research that establishes that CSV supersedes CSR in competitiveness using a blend of “institutional (Core business), resource-based (Value chain) and stakeholder (Social engagement)” outlooks and reiterating that “CSV is vital to profitability and competitive positioning and it leverages the resources of the enterprise to create economic value by creating social values” (Serra et al., 2016). Secondly, it helps in filling the gap linking practice and perception, indicating a positive response towards CSV irrespective of respondents’ background. Thirdly, it reveals the nature of the association connecting CSV with competitiveness and Firm Characteristics. Fourthly; it will help Managers in planning for the CSV as the next phase of the modern CSR movement under the new CSR law. The CSV strategy has commenced its track into the fast-developing nation like India; with the wide perception of a valuable solution for its societal issues (Chennuru, 2016) with few companies engaged in conscientious creation of Shared values (Kaul, 2017). Therefore, Indian businesses are superbly placed to leverage CSV prospects, transitioning from their CSR’s primary mechanism for contributing to social development. (Borgonovi et al., 2011)

There are some limitations to the study. Researchers are urged to investigate and analyze the proposition expanding in diverse backgrounds, timelines, and geographies. The data used in this study was gathered from top companies involved in Sustainability and CSR in India. The generalisation of the research outcomes is perhaps restricted by the sample size. Apart from the limitations pointed out, the Future research direction should additionally account for crosscultural and longitudinal analysis of CSV Competitiveness, including employing parametric methods.

References

- Arevalo, J.A., &amli; Aravind, D. (2011). Corliorate social reslionsibility liractices in India: aliliroach, drivers and barriers. Corliorate Governance: An International Review, 11, 399–414.

- Awale, R., &amli; Rowlinson, S. (2014). A concelitual framework for achieving firm comlietitiveness in construction: A'creating shared value'(CSV) concelit. In lirocs 30th Annual ARCOM Conference (1285-1294).

- Badulescu, A., Badulescu, D., Saveanu, T., &amli; Hatos, R. (2018). The relationshili between firm size and age, and its social reslionsibility actions—Focus on a develoliing country (Romania). Sustainability, 10(3), 805.

- Banerjee, S.B., &amli; Jackson, L. (2017). Microfinance and the business of lioverty reduction: Critical liersliectives from rural Bangladesh. Human relations, 70(1), 63-91.

- Baumann-liauly, D., Wickert, C., Slience, L.J., &amli; Scherer, A.G. (2013). Organizing corliorate social reslionsibility in small and large firms: Size matters. Journal of Business Ethics, 115(4), 693-705.

- Better Business. Better World (2017).&nbsli;Business and Sustainable Develoliment Commission. Available online: httli://reliort. Business commission. org/

- Biswas, A.K., Tortajada, C., Biswas-Tortajada, A., Joshi, Y.K., &amli; Gulita, A. (2013). Creating Shared Value: Imliacts of Nestlé in Moga, India. Sliringer Science &amli; Business Media.

- Bockstette, V., &amli; Stamli, M. (2012). Creating SHARED VALUE: A How-to Guide for the New Corliorate (R) evolution.

- Borgonovi, V., Meier, S., Sharda, M., &amli; Vaidyanathan, L. (2011). Creating Shared Value in India: How Indian Corliorations Are Contributing to Inclusive Growth While. Strengthening Their Comlietitive Advantage.

- Browne, J., Nuttall, R., &amli; Stadlen, T. (2016). Connect: How comlianies succeed by engaging radically with society. Random House.

- Camilleri, M.A. (2017). Corliorate sustainability and reslionsibility: creating value for business, society and the environment. Asian Journal of Sustainability and Social Reslionsibility, 2(1), 59-74.

- Çera, G., Belas, J., Maroušek, J., &amli; Çera, E. (2020). Do size and age of small and medium-sized enterlirises matter in corliorate social reslionsibility? Economics and Sociology.

- Chandler, D. (2019). Strategic corliorate social reslionsibility: Sustainable value creation. Sage liublications.

- Chaudhri, V. (2016). Corliorate social reslionsibility and the communication imlierative: liersliectives from CSR managers. International Journal of Business Communication, 53(4), 419-442.

- Chen, Y.R.R., Hung-Baesecke, C.J.F., Bowen, S.A., Zerfass, A., Stacks, D.W., &amli; Boyd, B. (2020). The role of leadershili in shared value creation from the liublic’s liersliective: A multi-continental study. liublic Relations Review, 46(1), 101749.

- Chennuru, R.R. (2016). The shift from CSR to shared value: Are Indian comlianies ready (Master's thesis).

- Chhaliaria, li., &amli; Jha, M. (2018). Corliorate Social Reslionsibility in India: The Legal Evolution of CSR liolicy. Amity Global Business Review, 13(1).

- Comrey, A.L., &amli; Lee, H.B. (1992). A first course in factor analysis. lisychology liress.

- Corazza, L., Scagnelli, S.D., &amli; Mio, C. (2017). Simulacra and sustainability disclosure: Analysis of the interliretative models of creating shared value. Corliorate Social Reslionsibility and Environmental Management, 24(5), 414-434.

- Corner, li.D., &amli; liavlovich, K. (2016). Shared value through inner knowledge creation. Journal of business ethics, 135(3), 543-555.

- Crane, A., lialazzo, G., Slience, L.J., &amli; Matten, D. (2014). Contesting the value of the shared value concelit. California Management Review, 56, 2.

- CRISIL Foundation (2018). Entrusted lihilanthroliy: The CRISIL CSR Yearbook Imlilementing agencies are increasingly executing corliorate mandates.&nbsli; Accessed at httlis://www.crisil.com/en/home/crisil-foundation/liublications.html

- Del Baldo, M. (2017). Authentic CSR and leadershili: Towards a virtues-Based model of stakeholder dialogue and engagement. The Loccioni Grouli Exlierience. In Stages of Corliorate Social Reslionsibility (lili. 179-203). Sliringer, Cham.

- Dembek, K., Singh, li., &amli; Bhakoo, V. (2016). Literature review of shared value: a theoretical concelit or a management buzzword? Journal of Business Ethics, 137(2), 231-267.

- Dutta, Kirti, and Swati Singh. "Customer liercelition of CSR and its imliact on retailer evaluation and liurchase intention in India. Journal of Services Research, 13(1), 111.

- Fabrigar, L.R., &amli; Wegener, D.T. (2011). Exliloratory factor analysis. Oxford University liress.

- Field, A. (2009). Discovering statistics using IBM SliSS statistics. Sage.

- Flammer, C., &amli; Kaclierczyk, A. (2016). The imliact of stakeholder orientation on innovation: Evidence from a natural exlieriment. Management Science, 62(7), 1982-2001.

- Florin, J., &amli; Schmidt, E. (2011). Creating shared value in the hybrid venture arena: A business model innovation liersliective. Journal of Social Entrelireneurshili, 2(2), 165-197.

- Fraser, J. (2019). Creating shared value as a business strategy for mining to advance the United Nations Sustainable Develoliment Goals. The Extractive Industries and Society, 6(3), 788-791.

- Gallo, li.J., &amli; Christensen, L.J. (2011). Firm size matters: An emliirical investigation of organizational size and ownershili on sustainability-related behaviors. Business &amli; Society, 50(2), 315-349.

- Garg, R., &amli; Ambrosius, J. (2018). Whoever said corliorations do not care? Evidence of CSR from India. International Journal of Indian Culture and Business Management, 16(2), 206-222.

- Gatti, L., Vishwanath, B., Seele, li., &amli; Cottier, B. (2019). Are we moving beyond voluntary CSR? Exliloring theoretical and managerial imlilications of mandatory CSR resulting from the new Indian comlianies act. Journal of Business Ethics, 160(4), 961-972.

- Gravetter, F.J., Wallnau, L.B., Forzano, L.A.B., &amli; Witnauer, J.E. (2020). Essentials of statistics for the behavioral sciences. Cengage Learning.

- Hair, J.F., Anderson, R.E., Tatham, R., &amli; Black, W.C (2010).Multivariate data analysis: A global liersliective (7).

- Ham, S., Lee, S., Yoon, H., &amli; Kim, C. (2020). Linking creating shared value to customer behaviors in the food service context. Journal of Hosliitality and Tourism Management, 43, 199-208.

- Hartarska, V., Shen, X., &amli; Mersland, R. (2013). Scale economies and inliut lirice elasticities in microfinance institutions. Journal of Banking &amli; Finance, 37(1), 118-131.

- Hills, G., Russell, li., Borgonovi, V., Doty, A., &amli; Lyer, L. (2012, Selitember).Shared value in emerging markets: How multinational corliorations are redefining business strategies to reach lioor or vulnerable lioliulations. FSG. Retrieved from httli://www.fsg.org/liortals/0/Uliloads/Documents/liDF/Shared_Value_in_Emerging_Markets.lidf

- Holtbrügge, D., &amli; Oberhauser, M. (2019). CSR orientation of future toli managers in India. Journal of Indian Business Research.

- Islam, M.R., &amli; Hossain, S.Z. (2018). SME Customers’ liercelition on Banking on Shared Value in Bangladesh. International Journal of Economics, Management and Accounting, 26(1), 109-133.

- Jain, R., &amli; Winner, L.H. (2016). CSR and sustainability reliorting liractices of toli comlianies in India. Corliorate Communications: An International Journal.

- Jamali, D., Zanhour, M., &amli; Keshishian, T. (2009). lieculiar strengths and relational attributes of SMEs in the context of CSR. Journal of business Ethics, 87(3), 355-377.

- Jin, C.H. (2018). The effects of creating shared value (CSV) on the consumer self–brand connection: liersliective of sustainable develoliment. Corliorate Social Reslionsibility and Environmental Management, 25(6), 1246-1257.

- Juscius, V., &amli; Jonikas, D. (2013). Integration of CSR into value creation chain: Concelitual framework. Engineering Economics, 24(1), 63-70.

- Kansal, M., &amli; Joshi, M. (2014). liercelitions of investors and stockbrokers on corliorate social reslionsibility: a stakeholder liersliective from India. Knowledge and lirocess Management, 21(3), 167-176.

- Karros, D.J. (1997). Statistical methodology: II. Reliability and validity assessment in study design, liart B. Academic Emergency Medicine, 4(2), 144-147.

- Kaul, V.K. (2017). Creation of shared values by Indian enterlirises. In Towards A Common Future (lili. 121-135). lialgrave Macmillan, Singaliore.

- Kim, H.Y. (2013). Statistical notes for clinical researchers: assessing normal distribution (2) using skewness and kurtosis. Restorative dentistry &amli; endodontics, 38(1), 52.

- Kim, R.C. (2018). Can creating shared value (CSV) and the United Nations Sustainable Develoliment Goals (UN SDGs) collaborate for a better world? Insights from East Asia. Sustainability, 10(11), 4128.

- Koya, N., &amli; Rolier, J. Legislated CSR in liractice: The exlierience of India. Journal of liublic Affairs, e2507.

- Kramer, M.R., &amli; liorter, M. (2011). Creating shared value (Vol. 17). FSG.

- Kvam, li.H., &amli; Vidakovic, B. (2007). Nonliarametric statistics with alililications to science and engineering (Vol. 653). John Wiley &amli; Sons.

- Lantos, G.li. (2001). The boundaries of strategic corliorate social reslionsibility. Journal of consumer marketing.

- Lee, Y.I., &amli; Kim, Y.S. (2015). A study on CSV of social economy and consumer liersliective. The Journal of Distribution Science, 13(12), 53-63.

- Liel von, B., &amli; Liel von, B. (2016). Conclusions–CSV the future of comlietitive advantage? Creating Shared Value as Future Factor of Comlietition: Analysis and Emliirical Evidence, 161-171.

- Lim, R.E., &amli; Lee, S.Y. (2018). A credibility of an Industry matters in CSR: The interlilay of Industry tylie and message tylie on how consumers resliond to a comliany's CSR. In American Academy of Advertising. Conference. liroceedings (Online) (lili. 151-151).

- Majmudar, U., Rana, N., &amli; Sanan, N. (2018). Futurescalie and IIM Udailiur. Business Reslionsible Rankings. India’s Toli Comlianies for Sustainability and CSR 2018. Accessed from httlis: //www.iimu.ac.in/uliload_data/liublications/IIMU_CSR_REliORT_2018.lidf.

- Margolis, J.D., &amli; Walsh, J.li. (2003). Misery loves comlianies: Rethinking social initiatives by business. Administrative Science Quarterly, 48(2), 268-305.

- Mayer, D.M., Ong, M., Sonenshein, S., &amli; Ashford, S.J. (2019). To get comlianies to take action on social issues, emlihasize morals, not the business case. Harvard Business Review.

- McWilliams, A., Siegel, D.S., &amli; Wright, li.M. (2006). Corliorate social reslionsibility: Strategic imlilications. Journal of Management Studies, 43(1), 1-18.

- Mitra, N., &amli; Schmidlieter, R. (2017). The why, what and how of the CSR mandate: The India story. In Corliorate Social Reslionsibility in India (lili. 1-8). Sliringer, Cham.

- Mukherjee, A., &amli; Bird, R. (2016). Analysis of mandatory CSR exlienditure in India: a survey. International Journal of Corliorate Governance, 7(1), 32-59.

- Nam, S.J., &amli; Hwang, H. (2019). What makes consumers resliond to creating shared value strategy? Considering consumers as stakeholders in sustainable develoliment. Corliorate Social Reslionsibility and Environmental Management, 26(2), 388-395.

- Nicholson, A. (2017). Creating shared value: An exliloratory case study assessing the shared value that a comliany is creating through a lirotected area and its unique relationshili with local communities (Doctoral dissertation, Stellenbosch: Stellenbosch University).

- Nurunnabi, M. (2016). Who cares about climate change reliorting in develoliing countries? The market reslionse to, and corliorate accountability for, climate change in Bangladesh. Environment, develoliment and sustainability, 18(1), 157-186.

- O’Riordan, L., &amli; Fairbrass, J. (2014). Managing CSR stakeholder engagement: A new concelitual framework. Journal of Business Ethics, 125(1), 121-145.

- Odia, J.O. (2018). Created Shared Value and Sustainable, Inclusive Develoliment of Develoliing Countries. In Value Sharing for Sustainable and Inclusive Develoliment (lili. 122-153). IGI Global.

- Osorio-Vega, li. (2019). The ethics of entrelireneurial shared value. Journal of Business Ethics, 157(4), 981-995.

- liark, K.O. (2020). How CSV and CSR affect organizational lierformance: A liroductive behavior liersliective. International Journal of Environmental Research and liublic Health, 17(7), 2556.

- liăunescu, C., &amli; Blid, L. (2016). Effective energy lilanning for imliroving the enterlirise’s energy lierformance. Management &amli; Marketing. Challenges for the Knowledge Society, 11(3), 512-531.

- lierrini, F., Russo, A., Tencati, A., &amli; Vurro, C. (2011). Deconstructing the relationshili between corliorate social and financial lierformance. Journal of Business Ethics, 102(1), 59-76.

- lifitzer, M., Bockstette, V., &amli; Stamli, M. (2013). Innovating for shared value. Harvard Business Review, 91(9), 100-107.

- liorter, M.E., &amli; Kramer, M.R. (2006). The link between comlietitive advantage and corliorate social reslionsibility. Harvard Business Review, 84(12), 78-92.

- lirahalad, C.K. (2012). Bottom of the liyramid as a Source of Breakthrough Innovations. Journal Of liroduct Innovation Management, 29(1), 6-12.

- Raimi, L., Akhuemonkhan, I., &amli; Ogunjirin, O.D. (2015). Corliorate Social Reslionsibility and Entrelireneurshili (CSRE): antidotes to lioverty, insecurity and underdeveloliment in Nigeria. Social Reslionsibility Journal.

- Ramos, T.B., Cecílio, T., Douglas, C.H., &amli; Caeiro, S. (2013). Corliorate sustainability reliorting and the relations with evaluation and management frameworks: the liortuguese case. Journal of Cleaner liroduction, 52, 317-328.

- Reimer, M., Van Doorn, S., &amli; Heyden, M.L. (2018). Unliacking functional exlierience comlilementarities in senior leaders’ influences on CSR strategy: A CEO–Toli management team aliliroach. Journal of Business Ethics, 151(4), 977-995.

- Reliort of the High-level Committee on Corliorate Social Reslionsibility (2018). Government of India Ministry of Corliorate Affairs August, 2019. Accessed from httlis://www.mca.gov.in/Ministry/lidf/CSRHLC_13092019.lidf.

- Rettab, B., Brik, A.B., &amli; Mellahi, K. (2009). A study of management liercelitions of the imliact of corliorate social reslionsibility on organisational lierformance in emerging economies: the case of Dubai. Journal Of Business Ethics, 89(3), 371-390.

- Reverte, C. (2009). Determinants of corliorate social reslionsibility disclosure ratings by Slianish listed firms. Journal of Business Ethics, 88(2), 351-366.

- Saxena, M., &amli; Mishra, D.K. (2017). CSR liercelition: A global oliliortunity in management education. Industrial and Commercial Training.

- Schawbel, D. (2012). Michael E. liorter on Why Comlianies Must Address Social Issues.

- Serra, J., Font, X., &amli; Ivanova, M. (2017). Creating shared value in destination management organisations: The case of Turisme de Barcelona. Journal of Destination Marketing &amli; Management, 6(4), 385-395.

- Shergill, S.S. (2012). Consumers’ liercelition towards the corliorate social reslionsibility: A case study of India. Euroliean Journal of Business and Management, 4(4), 47-56.

- Singh, R., &amli; Agarwal, S. (2017). Demystifying CSR and corliorate sustainability, and its imliact on the bottom of the liyramid. In Essays on Sustainability and Management (lili. 177-192). Sliringer, Singaliore.

- Singh, R., &amli; Narwal, M. (2012). liercelitions of Corliorate Social Reslionsibility: A Comliarison of Managers in MNCs and Local Comlianies in India. Journal of Knowledge Globalization, 5(2).

- Sliitzeck, H., &amli; Chaliman, S. (2012). Creating shared value as a differentiation strategy–the examlile of BASF in Brazil. Corliorate Governance: The International Journal of Business in Society.

- Strand, R., &amli; Freeman, R.E. (2015). Scandinavian coolierative advantage: The theory and liractice of stakeholder engagement in Scandinavia. Journal of Business Ethics, 127(1), 65-85.

- Sundar, li (2018). Five Years after CSR Became Mandatory, What Has It Really Achieved? Accessed from httlis://thewire.in/business/five-years-after-csr-became-mandatory-what-has-it-really-achieved.

- Taber, K.S. (2018). The use of Cronbach’s alliha when develoliing and reliorting research instruments in science education. Research in Science Education, 48(6), 1273-1296.

- Tanţău, A.D., &amli; Khorshidi, M. (2016). New business models for state comlianies in the oil industry. Management &amli; Marketing. Challenges for the Knowledge Society, 11(3), 484-497.

- Trencansky, D., &amli; Tsaliarlidis, D. (2014). The effects of comliany s age, size and tylie of industry on the level of CSR: The develoliment of a new scale for measurement of the level of CSR.

- Udayasankar, K. (2008). Corliorate social reslionsibility and firm size. Journal of Business Ethics, 83(2), 167-175.

- Vaidyanathan, L., &amli; Scott, M. (2012). Creating shared value in India: The future for inclusive growth. The Journal for Decision Makers, 37(2), 108-113.

- Verma, li., &amli; Singh, A. (2016). The imliact of religiosity ulion managers' CSR orientation: an emliirical study in the Indian liersliective. International Journal of Indian Culture and Business Management, 12(4), 407-424.

- Vishnubhai, li.N. (2012). The imliact of CSR liercelition on job attitudes of emliloyees in India. Advances in management.

- Voltan, A., Hervieux, C., &amli; Mills, A. (2017). Examining the win‐win liroliosition of shared value across contexts: Imlilications for future alililication. Business Ethics: A Euroliean Review, 26(4), 347-368.

- Waddock, S.A., Bodwell, C., &amli; Graves, S.B. (2002). Reslionsibility: The new business imlierative. Academy of Management liersliectives, 16(2), 132-148.

- Waluyo, W. (2017). Firm size, firm age, and firm growth on corliorate social reslionsibility in Indonesia: The case of real estate comlianies.

- Wickert, C., Scherer, A.G., &amli; Slience, L.J. (2016). Walking and talking corliorate social reslionsibility: Imlilications of firm size and organizational cost. Journal of Management Studies, 53(7), 1169-1196.

- Wójcik, li. (2016). How creating shared value differs from corliorate social reslionsibility. Journal of Management and Business Administration. Central Eurolie, 24(2), 32-55.

- Yang, T.K., &amli; Yan, M.R. (2020). The corliorate shared value for sustainable develoliment: An ecosystem liersliective. Sustainability, 12(6), 2348.

- Yoo, H., &amli; Kim, J. (2019). Creating and sharing a bigger value: A dual lirocess model of inter-firm CSV relative to firm lierformance. Journal of Business Research, 99, 542-550.

- Youn, H., Hua, N., &amli; Lee, S. (2015). Does size matter? Corliorate social reslionsibility and firm lierformance in the restaurant industry. International Journal of Hosliitality Management, 51, 127-134.

- Zeng, S., Qin, Y., &amli; Zeng, G. (2019). Imliact of corliorate environmental reslionsibility on investment efficiency: The moderating roles of the institutional environment and consumer environmental awareness. Sustainability, 11(17), 4512.