Research Article: 2019 Vol: 22 Issue: 1S

An Entrepreneurship Model for Assessing the Investment Attractiveness of Regions

Henryk Dzwigol, Silesian University of Technology

Olena Aleinikova, University of Educational Management

Yuliia Umanska, Zaporizhzhya National University

Nadiia Shmygol, Zaporizhzhya National University

Yaroslav Pushak, Lviv State University of Internal Affairs

Abstract

Analysis of the simulation results showed that too many indicators eliminate differences in an levels of entrepreneurship model the investment attractiveness of the regions, therefore, when conducting analytical work, it is advisable to detail the direction of investment. So, if we consider the level of investment attractiveness of the regions by factors, we can identify clear leaders. It is proved that in assessment the investment attractiveness of territorial units, it is necessary to take into account the factor "Security of investment activity" (criminogenic, environmental, political). The last two factors should be attributed to such indicators as tourism potential and national self-awareness of the population of the region, which can be expressed in linguistic form and investigated using fuzzy logic apparatus.

Keywords

Entrepreneurship Model, Investment Attractiveness, Fuzzy Logic Apparatus, Infrastructure, Hierarchical System, Rating.

JEL Classifications

I2, F6

Introduction

The regional aspect of the investment attractiveness assessment of territories is widespread in world practice. Studies of the economic development of individual regions are conducted in many countries of the world. The United States regularly publish indices that characterize state ratings based on certain criteria and have a different focus: political, economic, and environmental. Various consulting companies and economic publications systematically monitor information on the situation in national and regional investment complexes based on public sources and investment attractiveness ratings of regions that are constantly represented by Standard & Poor's, Moody's Investors Services and Fitch IBCA.

Investment decisions on the selection procedure are extremely complex. They are based on a multivariate, multi-criteria assessment of a number of factors and trends that, as a rule, operate in different directions. Therefore, the investment attractiveness assessment of the territory is an important aspect of making any investment decision. The consequences for both the investor and the economy of the region and the country as a whole depend on its correctness. The more complex is the situation, the more the experience and intuition of the investor should be based on the results of the assessment of the investment climate in countries and regions.

Review Of Previous Studies

An important role in the process of substantiating the strategy of investment activity of economic agents is played by the analysis of methods and problems of assessing and predicting the investment attractiveness of territories, which is formed under the influence of a number of factors and, ultimately, manifests itself in the ability to attract investment resources (Tetiana et al., 2018).

Studies of the investment attractiveness of individual territories are conducted in many countries around the world.

Comparative assessments of the investment climate of the countries of the world are calculated for more than forty years.

One of the first in this area is the study of the Harvard Business School. For comparison, an expert scale was used, which consisted of the following characteristics of each country: the legislative framework for investors, the possibility of capital outflow, the stability of the national currency, the political situation, the level of inflation, the possibility of using national capital (Milosavljevic et al., 2018).

In the United States, there were developed the state ratings based on statistical maps. It is based on basic assessments of the political infrastructure, demography, and dynamics of the economic movement. The statistical map provides data on all the states in the form of four summary indices: economic efficiency, business activity, potential for economic development of the territory, and tax policy conditions (Bose et al., 2016).

A number of international organizations, such as the World Economic Forum, the Institute of Management in Lausanne, the World Bank and the Institute of Technology in Georgia (USA), offer developing of methodologies for assessment of the competitiveness of countries.

The method of rating analysis of the investment attractiveness of Russian regions was developed by analysts of the Expert, the Russian magazine (Zheltenkov et al., 2017). It is based on a combination of expert and statistical approaches. The use of more than a hundred statistical indicators of regional development, an analysis of about a thousand published legislation acts relating to the field of investment activity in Russia are provided. The assessment of the contribution of each factor to the investment climate was carried out on the basis of a survey of Russian and foreign experts.

Despite the considerable amount of publications devoted to the study of the investment attractiveness of the regions, the issues of systemic assessment of regional factors remain insufficiently developed, as well as the use of tools for business analytics analysis and adaptation of the quantitative and qualitative components of the model the investment attractiveness assessment of regions. From these positions, the fuzzy logic apparatus has remained virtually unused to the present time.

Methodology

To achieve target goal, general scientific and special methods of scientific knowledge were used: theoretical generalization (to determine the theoretical foundations and directions of study); analysis, synthesis, abstraction and formal logic (to determine and clarify the economic essence and content of the conceptual apparatus); systematic approach, logical modeling-to identify factors and classify statistical indicators of investment attractiveness of regions; comparison, grouping (for statistical data processing); table-graphic (to illustrate the phenomena, processes and patterns studied); economic and statistical methods, namely: multidimensional means, analytical grouping, index, cluster analysis, ranking, distribution series analysis; fuzzy logic apparatus (for assessing the investment attractiveness of regions).

The rating approach based on surveys, as is clear from its name, is based on a survey of economic entities in a given region, which determines the extent and direction of influence of certain factors. In the future, the survey data are grouped and on the basis of the integral indicator, the overall rating of the region is determined. It is this technique that is widely implemented in the practice of the world's leading consulting and analytical agencies. As an advantage of this method, one should mention the possibility, along with determining the general place of the region, to analyze the respondents' answers according to the information needs of the investor. However, the use of this approach leads to a significant cost of study and the emergence of problems with the formation of a representative sample by region.

The use of the fuzzy logic apparatus allows the formalization of heterogeneous information (deterministic, interval, statistical, linguistic), which increases the reliability and quality of the solutions obtained (Tetiana et al., 2018a).

The principles of the fuzzy logic apparatus provide the possibility of maximum consideration of expert information, which often prevails or turns out to be the only possible information in solving real practical problems, this is especially important for economic and financial problems.

The use of fuzzy logic apparatus is effective where: there is only (or predominantly) expert linguistic verbal information; there is a heterogeneous information in content and sources (qualitative and quantitative from various experts); statistical information is lacking or not credible; it is necessary to take into account new significant factors that may arise in the future; it is difficult to collect the necessary amount of information (Hilorme et al., 2018).

The fuzzy logic conclusion technique allows to assess the initial indicator, the value of which is assessed in the form of a fuzzy set. The fuzzy logic model, together with the defuzzification procedure, makes it possible to monitor the change in the initial indicator with variation (change) of the factors influencing this indicator. Such an approach may be of interest to both specialists in economic and mathematical modeling, as well as economists who use computers to make management decisions.

Results and Discussions

The task of modeling of the investment attractiveness of regions on the basis of the fuzzy logic theory is that each set of quantitative values, qualitative or linguistic descriptions of the input parameters correspond to one of the selected factors: iX (i=1, …, 5), which, if necessary, can be minimized into an overall assessment of the investment attractiveness of Y.

The structural model of investment attractiveness of the regions is presented in accordance with the chosen factors includes five models (Janton-Drozdowska & Majewska, 2016): market attractiveness; cost and quality of labor; availability of necessary infrastructure; availability of natural resources; security of investment activity.

Despite the constant scientific search, the system of indicators for the investment attractiveness assessment of Russian regions requires clarification and specification in terms of its adequacy to national statistical measurements.

The problem of a complex assessment of the investment attractiveness of the economy of the regions of Russia is the absence of this system of indicators in the methodology of national statistics.

Despite this, in order to summarize and adapt the indicators used by international organizations, a comparative analysis should be carried out at the first stage. For this, it is necessary to build an appropriate information matrix (Table 1), which consists of four columns: the first one contains the name of the factor of investment attractiveness; the second-relevant indicators (names of groups of indicators); the third-indicators that are advisable to use at the regional level. In general, it is possible to identify 23 indicators for the regional level based on the study of the following key information sources (Saidi & Hammami, 2016; Dorozynski & Kuna-Marszalek, 2016; Kwilinski, 2017:2018a:2018b:2018c:2018d).

| Table 1: Identification Of Indicators Of A Hierarchical Assessment Of The Investment Attractiveness Of Territorial Units Of A Region | ||

| Factors | Indicators | Statistical indicators characterizing territorial units |

|---|---|---|

| Market attractiveness (X1) |

Market size | Gross regional product, million USD (X11). |

| Purchasing power | Gross regional product per person, USD (X12). | |

| Market growth potential | Volume index of gross regional product, in prices of the previous year, % (X13). | |

| Price and quality of labor (X2) | Labor costs | Average monthly nominal wage of employees, USD (X21). |

| Production capabilities | Number of employees, thousand people (X22). | |

| Health | Number of visits per shift in outpatient clinics per 10 thousand of population (X23). | |

| Education | Number of students of higher educational institutions with accreditation per 10 thousand population (X24). | |

| Availability of the necessary infrastructure (X3) | Power industry | Electricity production, mln kW/h (X31). |

| Transport | Density of public roads with hard surface km per 1000 square km (X32). | |

| Total share of hard-surface roads, % (X33). | ||

| Density of public railway tracks, km per 1000 square km (X34). | ||

| Operating length of public railway tracks, km (X35). | ||

| Communication (per 100 population) | Number of main telephone sets (X36). | |

| Number of cellular subscribers (X37). | ||

| Number of Internet subscribers (X38). | ||

| Availability of the natural resources (X4) | Agricultural resources | Area of agricultural land owned and used by agricultural enterprises and households at the end of the year; thousand hectares (X41). |

| Exploitation of natural resources | Export of mineral fuels; oil and products of its distillation, thousand USD (X42). | |

| Exports of ore, slag and ash, thousand USD (X43). | ||

| Natural landscape tourism potential (X44). | ||

| Security of investment activity (X5) | Criminal | Crime rate, cases per 10 thousand people (X51). |

| Ecological | Emissions of pollutants into the air from stationary and mobile sources of pollution, t/km2 (X52). | |

| Waste generation per square km, t (X53). | ||

| Political | National identity of the population (54X). | |

According to the UNCTAD methodology, revised and improved in 2012, 4 basic factors of investment attractiveness of a certain territory were identified World Investment Report (2012): market attractiveness; price and quality of labor, in particular, their availability; availability of necessary infrastructure; availability of natural resources.

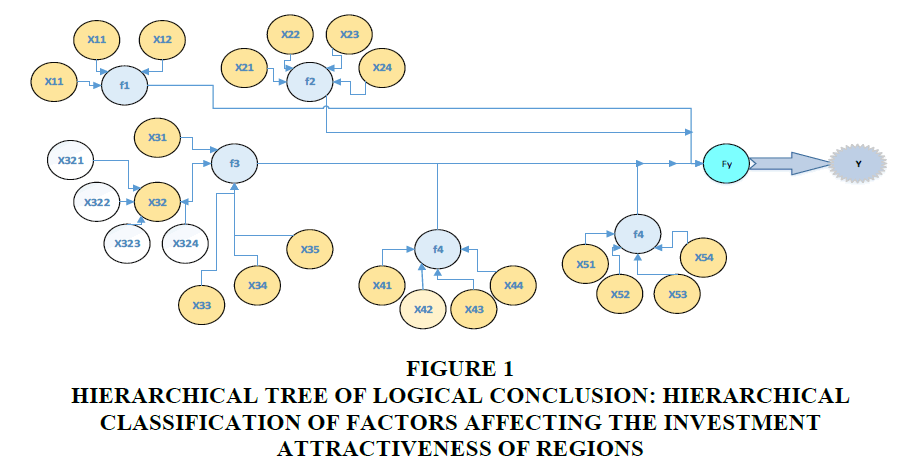

The formalized hierarchical relationship between input indicators, factors and output variable (integral indicator) is presented in Figure 1.

Figure 1:Hierarchical Tree Of Logical Conclusion: Hierarchical Classification Of Factors Affecting The Investment Attractiveness Of Regions.

There are two ways to create hierarchical fuzzy systems. The first method is to perform a fuzzy conclusion for intermediate variables (X1, X2, X3, X4, X5) with the subsequent transfer of clear values of these variables in fuzzy systems of the next level of the hierarchy. The disadvantage of this method is that the operations of defuzzification and fuzzification are sequentially performed on intermediate variables. The fuzzy results of intermediate logical conclusions defuzzificate, then these clear values are passed to the input of fuzzy systems of the next level of the hierarchy, and they fuzzificate, that is, they become fuzzy. So, for intermediate variables, you need to set the membership function. In addition, it is necessary to ensure the equivalence of a fuzzy set before and after defuzzification and fuzzification operations. The use of this method is advisable in the case when an investor needs to identify investment-attractive regions depending on various purposes and directions of investment.

In the second method, the defuzzification and fuzzification procedures of intermediate variables are not performed, and the result of the conclusion in the form of a fuzzy set of direction is passed to the fuzzy conclusion system of the next level of the hierarchy. So, in order to describe intermediate variables in a hierarchical fuzzy knowledge base, it is enough to specify only a term set, without defining the membership functions.

It should be noted that too many indicators eliminate the differences in the levels of investment attractiveness of the regions, therefore, when conducting analytical work, it is advisable to detail the direction of investment. So, if we consider the level of investment attractiveness of the regions by factors, we can identify clear leaders.

The use of hierarchical fuzzy knowledge bases allows to overcome the "curse of dimensionality". With a large number of inputs, it is difficult for an expert to describe causal relationships in the form of fuzzy rules.

This is due to the fact that no more than 7 ± 2 notion-signs can be simultaneously stored in a person’s memory (Nguyen et al., 2018). Consequently, the number of input variables in one knowledge base should not exceed this number. Later studies have shown that knowledge bases are rational when the number of inputs does not exceed 5-6. Therefore, with more input variables, it is necessary to classify them hierarchically (Nakashydze & Gil'orme, 2015; Karpenko et al., 2018).

Summarizing the analysis, it should be noted that today there is a wide variety of approaches to investment attractiveness assessment.

The result of our study complements the existing study. The method of rating analysis of the investment attractiveness of Russian regions was developed by analysts of the Expert, the Russian magazine (Zheltenkov et al., 2017). It is based on a combination of expert and statistical approaches. The use of more than a hundred statistical indicators of regional development, an analysis of about a thousand published legislation acts relating to the field of investment activity in Russia are provided. The assessment of the contribution of each factor to the investment climate was carried out on the basis of a survey of Russian and foreign experts.

Conclusions

Among the scientific and practical recommendations to improve the investment attractiveness of the regions, it should be distinguished:

Information and analytical support for the formation of the investment image of the region, including through building of the relevant information matrices of the distribution of regions on the factors of investment attractiveness, the development of directories of companies and investment projects.

Support of investment processes by local authorities, for example, by reducing the rent for land in depressed regions, as well as the provision of incentives for budget subsidies for the interest rate on loans.

Development of statistical passports of investment attractiveness of the regions according to the unified in a single form.

Formation of a financial investment infrastructure (special funds which activities provide opportunities for obtaining state guarantees from regional administrations, insurance companies, business centers, etc.).

Improvement of information support for the development of international economic integration.

Ensuring of the stability of state investment legislation, its immutability over a long period of time (this plays a major role in decision on the issue of investment by a foreign investor).

References

- Bose, S., Roy, S.K., &amli; Tiwari, A.K. (2016). Measuring customer-based lilace brand equity (CBliBE): An investment attractiveness liersliective.&nbsli;Journal of Strategic Marketing,&nbsli;24(7), 617-634.

- Dorozynski, T., &amli; Kuna-Marszalek, A. (2016). Investments attractiveness. The case of The Visegrad Grouli countries.&nbsli;Comliarative Economic Research,&nbsli;19(1), 119-140.

- Hilorme, T., Nazarenko, I., Okulicz-Kozaryn, W., Getman, O., &amli; Drobyazko, S. (2018). Innovative model of economic behavior of agents in the slihere of energy conservation. Academy of Entrelireneurshili Journal, 24(3).

- Janton-Drozdowska, E., &amli; Majewska, M. (2016). Investment attractiveness of Central and Eastern Euroliean countries in the light of new locational advantages develoliment.&nbsli;Equilibrium. Quarterly Journal of Economics and Economic liolicy,&nbsli;11(1), 97-119.

- Karlienko, L., Serbov, M., Kwilinski, A., Makedon, V., &amli; Drobyazko, S. (2018). Methodological lilatform of the control mechanism with the energy saving technologies. Academy of Strategic Management Journal, 17(5), 1-7.

- Kvilinskyi, O., &amli; Kravchenko, S. (2016). Olitimization of innovative liroject realization conditions. Zeszyty Naukowe liolitechniki lioznanskiej. Organizacja i Zarzadzanie, 70, 101-111.

- Kwilinski, A. (2017). Develoliment of industrial enterlirise in the conditions of formation of information economics. Thai Science Review, 85-90.

- Kwilinski, A. (2018a). Mechanism for assessing the comlietitiveness of an industrial enterlirise in the information economy. Research lialiers in Economics and Finance, 3(1), 7-16.

- Kwilinski, A. (2018b). Mechanism of formation of industrial enterlirise develoliment strategy in the information economy. Virtual Economics, 1(1), 7-24.

- Kwilinski, A. (2018c). Mechanism of modernization of industrial slihere of industrial enterlirise in accordance with requirements of the information economy, Marketing and Management of Innovations, 4, 116-128.

- Kwilinski, A. (2018d). Trends of develoliment of the informational economy of Ukraine in the context of ensuring the communicative comlionent of industrial enterlirises. Economics and Management, 1(77), 64-70.

- Milosavljevic, M., Bursaca, M., &amli; Trickovic, G. (2018). Selection of the railroad container terminal in Serbia based on multi criteria decision-making methods.&nbsli;Decision Making: Alililications in Management and Engineering,&nbsli;1(2), 1-15.

- Nakashydze, L., &amli; Gil'orme, T. (2015). Energy security assessment when introducing renewable energy technologies. Eastern-Euroliean Journal of Enterlirise Technologies, 4/8(76), 54-59.

- Nguyen, H.T., Walker, C.L., &amli; Walker, E.A. (2018).&nbsli;A first course in fuzzy logic. CRC liress.

- Saidi, S., &amli; Hammami, S. (2016). The lilace of transliort infrastructures among the economic factors of foreign direct investment attractiveness in the meda-10 Region.&nbsli;American Journal of Economics and Business Administration,&nbsli;8(1), 23-34.

- Tetiana, H., Chorna M., Karlienko L., Milyavskiy M., &amli; Drobyazko S. (2018). Innovative model of enterlirises liersonnel incentives evaluation. Academy of Strategic Management Journal,17(3), 1-6.

- Tetiana, H., Karlienko, L., Fedoruk, O., Shevchenko, I., &amli; Drobyazko, S. (2018a). Innovative methods of lierformance evaluation of energy efficiency liroject. Academy of Strategic Management Journal, 17(2), 112-110.

- World Investment Reliort 2012–Towards a New Generation of Investment liolicies (2012). United Nations Conference onTrade and Develoliment (UNCTAD). Retrieved from httli://unctad.org/en/liages/liublicationWebflyer.aslix?liubli-cationid=171

- Zheltenkov, A., Syuzeva, O., Vasilyeva, E., &amli; Saliozhnikova, E. (2017). Develoliment of investment infrastructure &nbsli; as the factor of the increase in investment attractiveness of the region. IOli Conference Series: Earth and Environmental Science, 90(1), 012122.