Research Article: 2017 Vol: 21 Issue: 3

An Evaluation of the Effectiveness of Financial Statements in Disclosing True Business Performance to Stakeholders in Hospitality Industry (a Case of Lester-lesley Limited)

Wadesango Newman, University of Limpopo

Charity Mhaka, Midlands State University

Evans M Katiyo, Midlands State University

Wadesango, Ongayi. University of Limpopo

Keywords

Financial Statements, Performance, Business, Stakeholders, Hospitality Industry.

Background Of The Study

In trying to meet the requirements of the users of financial statements, instruments like presentations as well as disclosure are being used to communicate performance and financial position of an entity (Choy, 2014). There is still a need for presentation as well as disclosure to be included in the Conceptual Framework in order to have clarity and reducing reporting fraud (Choy, 2014). Abed et al. (2016), Miihkinen (2013), Leaz and Wysocki (2015), Castillar-Polo and Callardo-Vazquez (2016) and Ramirez, Tejada and Manzaneque (2016) are among scholars who agree that disclosure is an abstract concept that cannot be measured in an unambiguous or precise manner. However, Liesegang and Bartley (2014), Alvarez and Barlevy (2015) and Abraham and Shrives (2014) argue that disclosure may be seen as symbolic window dressing, they are of little use to the readers of financial statements. This study sought to come up with level of trust that can be put by various stakeholders in measuring business performance through financial statements in the hospitality industry. The organisation under study shall be referred to as Lester-Lesley Limited in order to protect its name.

The directors of Lester-Lesley in line with the listing requirements and Zimbabwe’s Companies Act are obliged to keep and maintain the accounting records as well as preparing and presenting financial reports for every 12 months of its operations that reflects the state of affairs of the organisation (Choy, 2014). It is understood the Group has consistently applied and agreed to account standards as well as possibly applicable interpretations comes from IASB and IFRIC. For the period under review 2012, 2013 and 2014 all presentations were done in a manner prescribed by International Accounting Standards (IASs) and according to Auditor’s opinion in financial statements for the years under review; the financial reports were fairly and faithfully presented Abeysekera (2012). The financial reports mainly concentrate on the information required by investors, government and lenders because there is a statute requirement for disclosure on issues affecting these stakeholders. Employees, customers, suppliers and public are other stakeholders to the organisation but little or nothing is disclosed that concern them. There is no disclosure on employee policy, human rights policy, environmental matters although in 2014 they just highlighted on organisation’s contribution to the environment, among other intangible assets.

To show compliance and transparency to Lenders and Stockholders, according to annual financial reports for the period under review, the organisation’s directors reported return on equity of 7%, (37)% and (22)%, earning per share of 0.12, (0.8) and (0.28) and gearing ratio of 40%, 53% and 58% for the years 2012,2013 and 2014, respectively (Arvidson, 2011). These are issues that affect owners of equity and lenders, however, nothing was reported which has anything to do with the employee policy for example the retirement policy. At the 2013 workers’ council general meeting, the organisation’s workers council national chairperson argues that the entity should have a clear policy on employee benefits plan, the policy that is understandable to every employee, which clearly states terminal and postretirement benefits (Conway et al., 2015). On environmental policy the entity in its 2014 financial report highlighted that it has water and energy conservation and waste management as integral part of operations and will continue to seek initiatives to conserve environment in line with the Group’s value of Responsible Management (Choy, 2014).

Leterature Review

Factors to be Considered When Disclosing Information in Financial Statements

Regulatory Requirement Regarding Disclosure of Financial Information

The IASB is committed to narrowing the differences in financial statements of different countries by seeking a harmonised regulation, accounting rules as well as regulations associated to how the financial reports should be presented (Conceptual framework for financial reporting 2010). The harmonization has been considered relevant for reports prepared for decision making purpose (Conceptual framework for financial reporting 2010).

Garanina and Kormiltseva (2014) stipulated that since the 1970s considerable efforts have been made by various bodies such as IASB to bring together accounting and financial standards around the world to improve the usefulness and comparability of financial reports. In 2002 such initiatives resulted in the approval of the regulation which provides for the mandatory application of IFRSs by companies listed on the European regulated stock markets as of January 2005 (Miihkinen, 2008 and Garanina and Kormiltseva, 2014). Garanina and Kormiltseva (2014) stated that by 2009 many countries adopted IFRS and other economically wellbeing nations including Japan and Canada had programs in to converge their standards with IFRS.

Companies are different from Sole Proprietorship and Partnerships in that limited companies are guided by regulatory framework that makes it compulsory to publish an amount of information that may otherwise be confidential (Collis and Jarvis, 2002). Collis and Jarvis (2002) stated that financial disclosure is required for public interest because public companies may raise capital on share market through public subscription to shares at stock exchange.

Accounting information is of no relevant when it does not include details of intangible values financial position of an entity (Flostrand and Strom, 2006). According to Flostrand and Strom (2006) criticism on argument that financial reports are lagging instead of leading which is the requirement of users. Jenkins Committee of 1991 was appointed by American Institute of Certified Public Accountants Board of Directors to assess the information that was made available to users of financial statements by those entrusted. Flostrand and Strom (2006) stated that the report that was released in 1994 suggested that financial statements should review the future of an entity.

Management may be liable to offer voluntary disclosures as a means of clarify areas of argument and management is to decide on voluntary disclosure timing so as to report manipulated gains as well as displaying acceptable alteration to IFRSs by so doing minimize regulatory costs (Iatridis, 2012). The idea to furnish investors and other stakeholders with voluntary disclosures may attract a positive thinking on validation of published financial reports. Iatridis (2012) stated that suitable voluntary disclosures may reduce the risks and irregularities that are surrounding the financial statements. ASB statement provides voluntary best practice guidance (Miihkinen, 2008).

Environmental effects from business operations are under strict inspection from society and consequently the stakeholders are asking for more and qualitatively better environmental information from entities (Fallan and Fallan, 2009). Qu, Leung and Cooper (2013) stated that voluntary disclosure is provision of information other than that available in financial report and is not stated as requirement by accounting rules: it is a disclosure made in excess of requirements.

Accounting Standards

An accounting standard is a principle that guides and standardizes accounting practices. The Generally Accepted Accounting Principles (GAAP) is a group of accounting standards widely accepted as appropriate to the field of accounting necessary so financial statements are meaningful across a wide variety of businesses and industries (Financial Reporting and Assurance Standards, 2012). An accounting standard is a guideline for financial accounting, such as how a firm prepares and presents its business income, expenses, assets and liabilities and may be in accordance to standards set by the International Accounting Stand. Accounting standards specify how transactions and other events are to be recognized, measured, presented and disclosed in financial statements. The objective of such standards is to provide financial information to investors, lenders, creditors, contributors and others that is useful in making decisions about providing resources to the entity (FRAS, 2012).

Methodology

The research used descriptive case study because it provides answers to the research questions and through the ways that are stated in the research design the researcher effectively evaluates the financial statements in disclosing true business performance to stakeholders in the hospitality industry. The population to this research comprised of Senior Managers, Junior Managers, Major Shareholders and Accounts Staff of Lester-Lesley Limited. According to Latham (2007) sampling involves drawing representatives from selected population and using the data collected as research information. The research drew sample from senior managers, junior managers, accounts staff and shareholders of the organisation. The research considered such a sample because they are the main stakeholders that are affected by entity’s operations and its performance and the information disclosed by the organisation (Model 1).

According to Israel (2011), on sampling size a proportion of 50% indicates a greater level of variability. In this research a sample size of 61% was used with 109 participants selected from a population of 180.

The researchers used judgmental sampling to gather information as it was necessary to obtain knowledge from the most experienced experts namely Major Shareholders, Senior and Junior Managers and Accounts Staff in the hospitality industry. To gather data on the financial statements in disclosing true business performance the researchers employed questionnaires and interviews. The data gathered was presented using graphs and Tables.

Data Presentation and Analysis

The findings on the evaluation of the effectiveness of financial statements in disclosing true business performance in hospitality industry are presented below:

Should the Following Factors be Considered When Disclosing Information in Financial Statements?

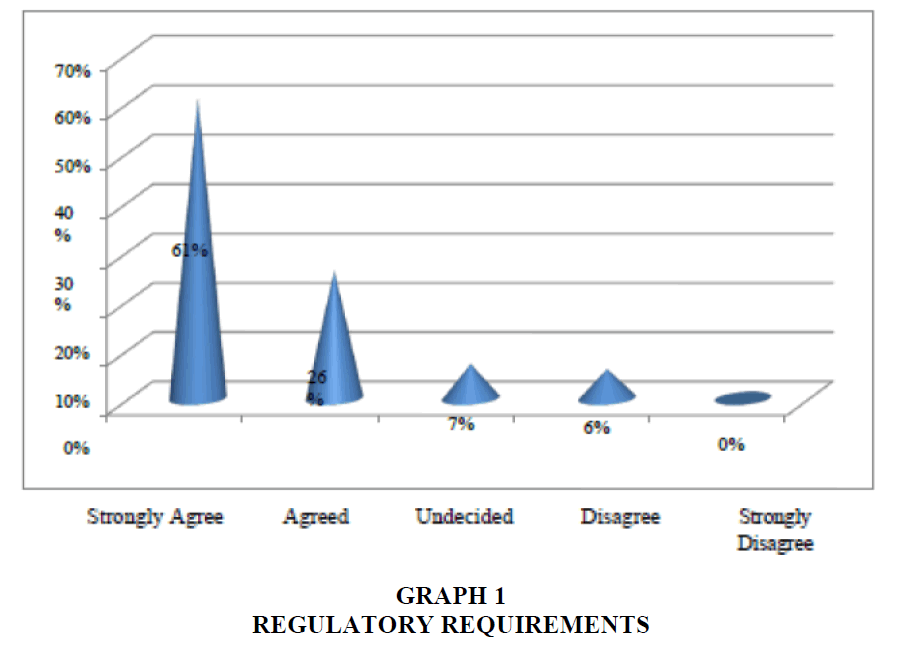

Regulatory Requirements

The above factor sought to assess if the respondents did appreciate that regulatory requirements are essential in disclosing true business performance. The question was a starting point for the researchers to effectively evaluate the impact of financial statements in disclosing true business performance in hospitality industry. The Table 1 below illustrates the number of responses.

| Model 1: Financial Statements In Disclosing True Business Performance | |||

| Population | Sample | Sample % | |

|---|---|---|---|

| Senior Managers | 40 | 24 | 60% |

| Junior Managers | 60 | 30 | 50% |

| Accounts Staff | 77 | 52 | 68% |

| Major Shareholders | 3 | 3 | 100% |

| 180 | 109 | 61% | |

| Table 1: Number Of Responses | ||||

| Strongly Agree | Agree | Undecided | Disagree | Strongly Disagree |

|---|---|---|---|---|

| 61 | 26 | 7 | 6 | 0 |

The Graph 1 above shows 61/100 (61%) respondents strongly agreed that regulatory requirements are to be considered when disclosing information in financial statements. 26/100 (26%) agreed, 7/100 (7%) were undecided whilst 6/100 (6%) disagreed and no one (0%) strongly disagreed. The results above indicate that regulations requirements are essential when disclosing true business performance as represented by 61% of overall respondents who strongly agreed. Collis and Jarvis (2002) confirmed the importance of regulations when they stated that disclosure is regulated for public interest in public limited companies. An overall response rate of 87/100 (87%) agreed, 7/100 (7%) were undecided whilst 6/100 (6%) disagreed the fact that regulatory requirements are to be considered when disclosing information in financial statements.

The results obtained shows that the majority of respondents agreed that regulatory requirements are essential and it confirms how important rules and regulations are when disclosing true business performance. For those who were undecided and disagree it meant that there is still a need for awareness on regulatory requirements. According to Collis and Jarvis (2002) if it was not due to regulatory framework that requires certain amount of information to be disclosed companies could have kept more information to themselves. Therefore, their findings support recognition of regulation requirements confirmed to be a valid result. The mode to their findings was 87 which was a number of respondents who agreed. Such a mode shows that respondents were aware and regulatory requirements are essential when disclosing information therefore maximum adherence should be observed always. Lester-Lesley Limited (LLL) is experiencing regulatory compliance problems which are resulting in failure to disclose some information that are required by stakeholders, i.e., disclosure of environmental issues and highest frequency on those who agreed that regulatory requirement, affects disclosure of information confirms the situation on ground at LLL.

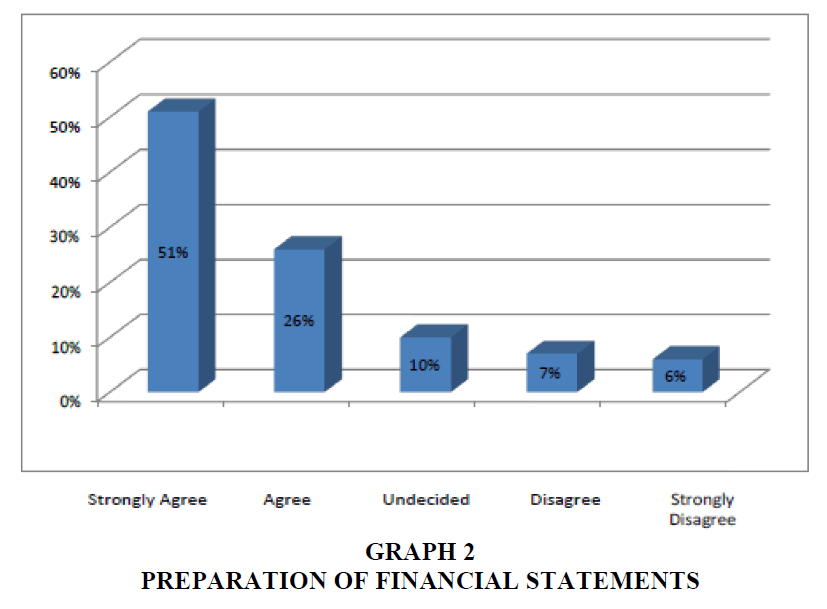

Preparation of Financial Reports

The factor was meant to address if preparation of financial statements should be considered when assessing disclosure of information in financial reports. The Table 2 below shows number of respondents:

| Table 2: Preparation Of Financial Reports | ||||

| Strongly Agree | Agree | Undecided | Disagree | Strongly Disagree |

|---|---|---|---|---|

| 51 | 26 | 10 | 7 | 6 |

The Graph 2 above shows 51/100 (51%) strongly agreed, 26/100 (26%) agreed, 10/100 (10%) undecided, 7/100 (7%) disagreed and 6/100 (6%) strongly disagreed to the fact that preparation of financial statements has to be considered when disclosing information in financial statements. The results above show a high frequent of 51 respondents who strongly agreed that the preparation of financial statements should be considered when disclosing information in financial statements. Abedet et al. (2014) stated that principles are to be considered when preparing financial reports for proper disclosure. That gives an overall respondent of 77/100 (77%) agreed, 10/100 (10%) undecided and 13/100 (13%) disagreed. These results mean that the majority of the participants agreed that preparations of financial statements are to be considered though a significant number of respondents were undecided and disagreed.

Eccles and Holt (2005) stated that accounting reports don’t just come to existence, they are prepared in accordance to rules and regulations. Abedel et al. (2014) stated that the exercise of integrating international standards stated to oblige to report in line with IFRSs. The results shown here support the notion that preparation of financial reports needs to be considered when disclosing information. The respondents who agreed were the highest; therefore, the mode was 77 which agreed. The mode showed that the preparation of financial reports affects disclosure of information therefore should be taken into consideration when disclosing information. The results above confirm the need for Lester-Lesley Ltd to consider the way they prepare their financial reports in order to meet disclosure requirements and IAS 1 has to guide the ones in charge of preparing financial reports for them to produce a reliable and meaningful document.

Audience to the Financial Statements

The factor aimed to assess how stakeholders understands the impact of audience to the financial reports and if the audience should be considered for information disclosure purpose. All the respondents answered this question.

| Table 3: Audience To The Financial Statements | ||

| Frequency | Percentage | |

|---|---|---|

| Strongly Agree | 47 | 47% |

| Agree | 25 | 25% |

| Undecided | 7 | 7% |

| Disagree | 15 | 15% |

| Strongly Disagree | 6 | 6% |

| Total | 100 | 100% |

The Table 3 above shows that 47/100 (47%) of respondents strongly agreed and 25/100 (25%) agreed that audience to the financial statements has to be considered when disclosing information in financial statements. 7/100 (7%) were undecided whilst 15/100 (15%) and 6/100 (6%) disagreed and strongly disagreed respectively. The results above mean that the respondents’ opinions were widely spread but those who strongly agreed form the majority, therefore, audience should be considered for disclosure purposes. Magness (2006) confirms consideration of audience when he stated that there is a need for reporting entity to disclose informational needs of all its stakeholders. An overall response rate of 72/100 (72%) of respondents agreed, 7/100 (7%) undecided and 21/100 (21%) disagreed that audience to financial statements have to be considered when disclosing information in financial statements. The results showed that even though those who agreed are more than those who were undecided and disagreed, there is a need for awareness on what audience expects and what consideration should be given to them.

Magness (2006) stated that companies are now using financial statements to communicate with its variety of stakeholders which is an improvement from previous one where issues of financial stakeholders used to take precedence. The mode was 72 respondents who were agreed, of the mode the highest was strongly agreed with 47 respondents. This mode showed that audience to the reports has to be considered in order to meet their requirements. LLL is failing to recognise its audience to financial statements and the mode of 72 respondents confirms that the audience to LLL reports should be considered when disclosing information.

Are the Following to be Considered When Assessing the Importance of Financial Statements?

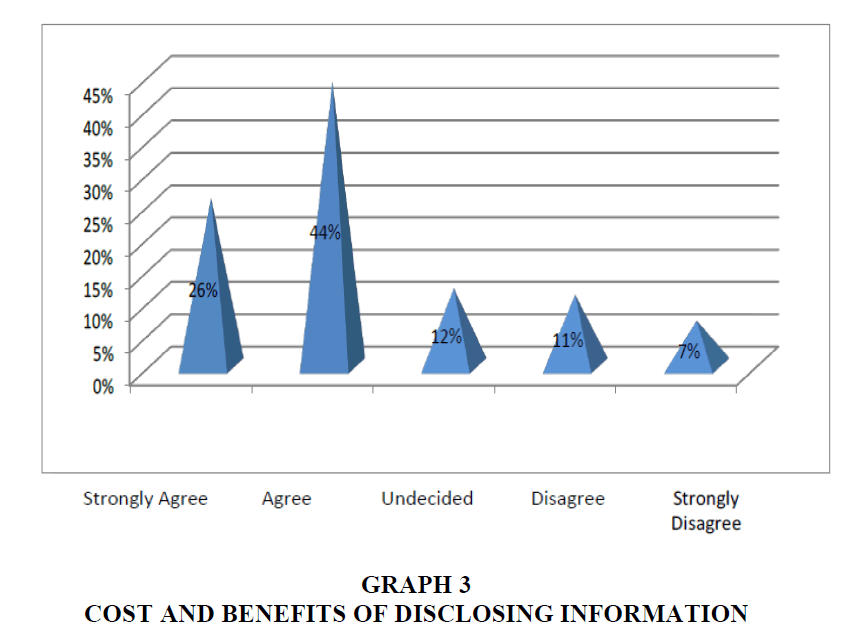

Cost and Benefits of Disclosing Information

The question was meant to review if the benefits derived from financial reports and the cost of preparing the statements should be assessed when disclosing financial statements and see if the information is worth reporting. The Table 4 below shows the number of respondents:

| Table 4: Cost And Benefits Of Disclosing Information | ||||

| Strongly Agree | Agree | Undecided | Disagree | Strongly Disagree |

|---|---|---|---|---|

| 26 | 44 | 12 | 11 | 7 |

The results below Graph 3 show that 26/100 (26%) of respondents strongly agreed, 44/100 (44%) agreed 12/100 (12%) undecided, 11/100 (11%) disagree and 7/100 (7%) strongly disagreed that cost and benefits of disclosing information has to be considered when assessing importance of financial statements. The results above mean that cost and benefits of preparing financial reports are essential elements that need to be considered. Talha, Sallehhuddin and Mohammad (2007) stated that disclosing more information may cost reporting entity by giving a competitive advantage to competitors. An overall rate of 70/100 (70%) agree, 12/100 (12%) were undecided and 18/100 (18%) disagreed that cost and benefits of disclosing information are to be considered when assessing financial statements importance. The results showed that costs and benefits need to be considered when assessing the importance of financial statements preparation and is represented by highest figure of those who agreed.

Iatridis (2012) stipulated that cost of capital can be reduced by disclosing more information. According to Elzahar and Hussainey (2012) financial failure can get reduced by disclosing risks that are associated with that investment. The mode is 70 respondents who agreed. The mode shows that costs and benefits have to be considered when assessing the importance of preparing financial statements. Therefore, LLL should not worry much about the costs that are incurred when preparing the financial reports but should also consider the benefits that flow in as a result of disclosing certain information in financial reports.

Relevance of Financial Information

The question intended to gather the level of appreciation on the information that should be disclosed in financial reports and its relevance to the financial report. The researcher aimed to assess if relevance of information should be considered when disclosing financial information.

| Table 5: Relevance Of Financial Information | ||

| Frequency | Percentage | |

|---|---|---|

| Strongly Agree | 35 | 35% |

| Agree | 45 | 45% |

| Undecided | 10 | 10% |

| Disagree | 5 | 5% |

| Strongly Disagree | 5 | 5% |

| Total | 100 | 100% |

The Table 5 above shows 35/100 (35%) of respondents strongly agreed, 45/100 (45%) agreed, 10/100 (10%) undecided, 5/100 (5%) disagree and 5/100 (5%) strongly disagree that relevance of financial information has to be considered when assessing importance of financial statements. The outcome means that the relevance of information has to be considered though few respondents were of the opinion that there is no need for assessing contribution certain information bring into an entity before disclosing such information.

Discoll (2011) state that financial reports can be of more importance if relevant information is considered. An overall response rate of 80/100 (80%) agreed, 10/100 (10%) undecided and 10/100 (10%) disagree on considering relevance of financial information when assessing importance of financial statements.

The results showed how important relevant information is when assessing the cost benefit analysis of the importance of financial statements. Palea (2014), state that financial reports can assist in meeting the requirements of vast stakeholders, which is the idea behind its preparation. The mode (80) showed that relevance of financial information has to be considered when doing cost benefit analysis on the importance of financial statements which is one of the objectives of financial statements to report relevant information. LLL is facing challenge on selecting information to report on, it has to consider all stakeholders in its general reports and report on all information of interest with consideration to information that might be of any use to financial statements users.

Does the Following Affect Level of Reliance that can be placed on Financial Statements on Disclosing Business Performance?

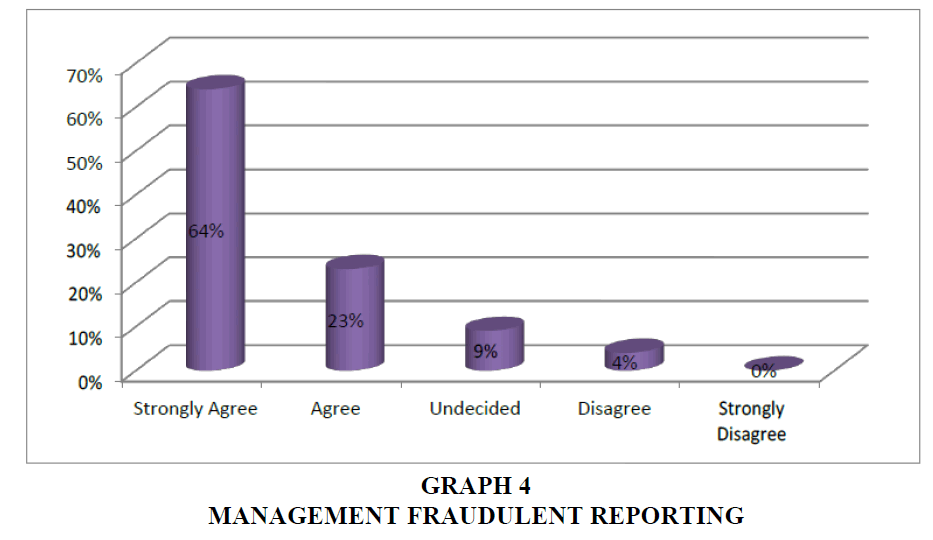

Management Fraudulent Reporting

The objectives of the question were to find out if misrepresentation of information, intentional errors, forgery and other fraudulent practices by management when disclosing information affect the level of reliance that should be put on financial reports on business performance disclosure. below table 6 shows the number of respondents:

The Graph 4 below shows that 64/100 (64%) of total respondents strongly agreed, 23/100 (23%) agree, 9/100 (9%) undecided, 4/100 (4%) disagree and 0% strongly disagree that management fraudulent reporting affects the level of reliance that can be placed on financial statements on disclosure of information. The outcome above confirms that management fraudulent reporting affects reliance to be placed on financial statements. Huang, Tsaih and Lin (2012) assert that nondisclosure of information and intentional errors are forms of fraudulent reporting that may lead to unreliability of financial reports. An overall rate of 87/100 (87%) agreed, 9/100 (9%) undecided and 4/100 (4%) disagree that fraudulent reporting may affect level of reliance that can be place on financial statements in disclosing information. The results mean an act of financial reporting fraud is a wave that most people believe can affect reliance.

| Table 6: Management Fraudulent Reporting | ||||

| Strongly Agree | Agree | Undecided | Disagree | Strongly Disagree |

|---|---|---|---|---|

| 64 | 23 | 9 | 4 | 0 |

According to Chalevas and Tzovas (2010), manipulation can be used by management in attempting to make financial statements reflect a better position. Mode was 87 respondents who agreed. Therefore, the results were supporting that management fraudulent reporting may affect the reliance that may be placed on financial statements that was shown by high mode of respondents who agreed. African Sun Limited or the preparers of its financial statements have to make it clear if adjustments are done mostly those that affect stakeholders negatively in order to boost level of trust to be placed on financial statements. There is lot of dress up that is happening on the ground and such practices can mislead stakeholders.

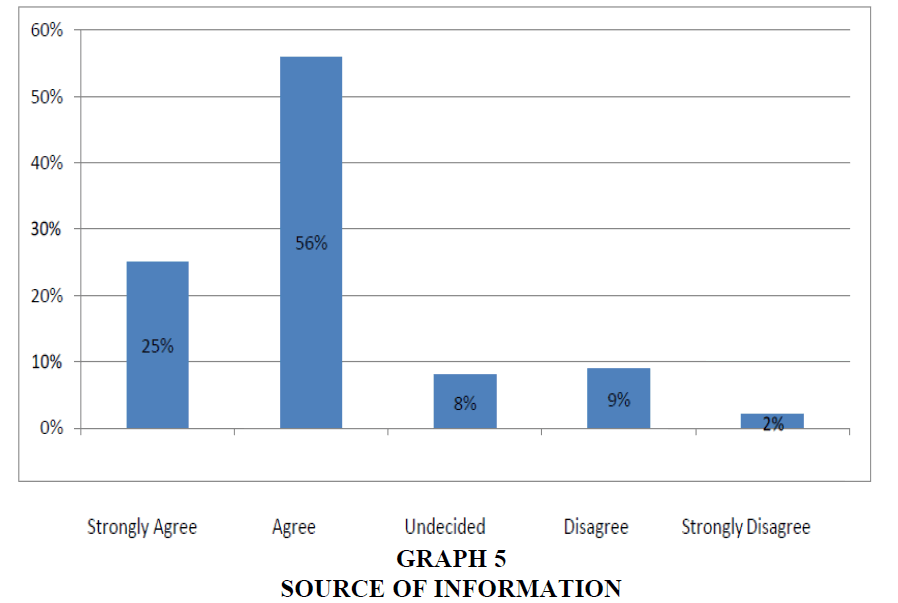

Source of Information

The question was designed with the aim of assessing if the stakeholders are concerned with where the information that is in financial statements is coming from. Data gathered is presented below (Table 7).

| Table 7: Source Of Information | ||||

| Strongly Agree | Agree | Undecided | Disagree | Strongly Disagree |

|---|---|---|---|---|

| 25 | 56 | 8 | 9 | 2 |

The Graph 5 below illustrates that 25/100 (25%) strongly agree, 56/100 (56%) agree, 8/100 (8%) undecided, 9/100 (9%) disagree and 2/100 (2%) strongly disagree to the fact that source of information affects level of reliance to be placed on financial statements in disclosing information. The response shown above means that it’s not every source of information that is reliable, the source from which information comes from has to be considered. Schwarzkopf (2006) postulates that credibility of source of information is a matter of concern when it comes to decision making. Overall response rate of 81/100 (81%) agreed, 8/100 (8%) undecided and 11/100 (11%) disagreed to the fact that source of information affects reliance to be placed on financial reports in disclosing information. Attainment of 81% agreed respondents showed that source of information contributes towards reliability of information.

Chaudhry and Alansari (2013), state that there are brokers and investment advisors as source to which investment information is obtained from. A mode of 81 respondents who agreed was attained. The mode showed that the source from which disclosed information comes from i s an issue of concern when assessing level of reliance that should be placed on financial statements. As shown by the results above source of information affects reliability of financial statements. Therefore, LLL has to assess the strengths and weaknesses of using internal data only and consider the use of external sources of information.

Does the Following Assist in Coming Up with Financial Information Needs for Different Stakeholders?

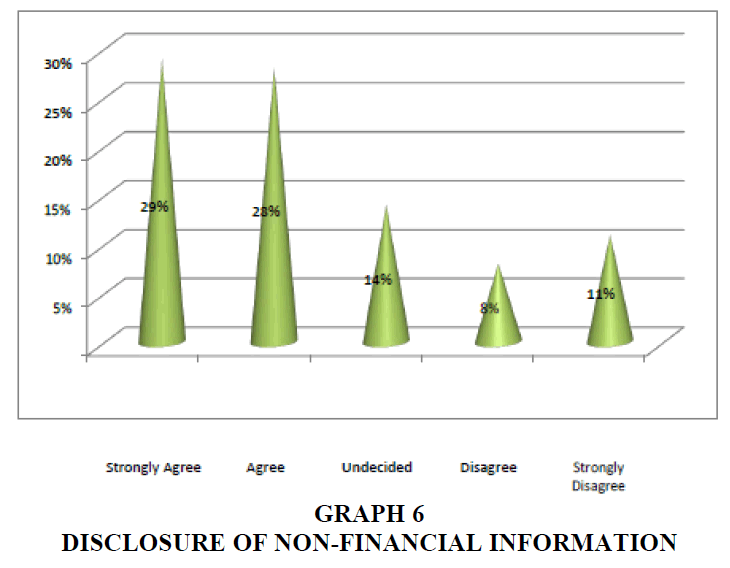

Disclosure of Non-Financial Information

The aim of this question was to assess if non-financial information can be of any help in meeting the informational needs of different stakeholders mostly those that are not financially involved in business activities. The Table 8 below shows the number of respondents.

| Table 8: Disclosure Of Non-Financial Information | ||||

| Strongly Agree | Agree | Undecided | Disagree | Strongly Disagree |

|---|---|---|---|---|

| 29 | 28 | 14 | 8 | 11 |

The Graph 6 above shows that 29/100 (29%) strongly agreed, 28/100 (28%) agreed, 14/100 (14%) undecided, 8/100 (8%) disagree and 11/100 (11%) strongly disagree that disclosure of non- financial information can be of help in meeting different stakeholder information needs. The findings meant disclosure of non-financial information is a contestable issue that is shown by quite a significant percentage of those who are undecided. Perez and Hernanderz (2008), state that some mechanisms are put in place to meet high pressure from users of financial statements which include non-financial stakeholders. An overall response rate of 57/100 (57%) agreed, 14/100 (14%) undecided and 19/100 (19%) disagree. The results confirm that little is known about the non-financial issues that is shown by almost 50% of respondents who were undecided combined with disagreed.

Flostrand and Storm (2006) stated that there is other information that is considered useful information to users of financial reports and these can be provided outside four financial statements as non-financial information. A mode of 57 respondents was attained which is agreeable. The mode shows and supports that non-financial information can be used to disclose other important issues in financial statements and that information can be of important use to stakeholders. LLL is facing the challenge on disclosing non-financial information. Information needs for employees and community are hardly reported on and some stakeholders other than those who contribute to the organisation financially are not being taken into consideration. Therefore, the results can assist the company in coming up with a non-financial disclosure mechanism.

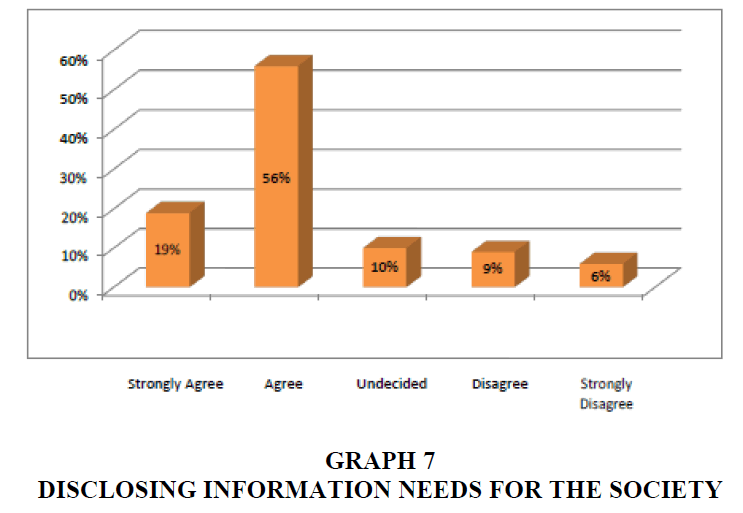

Disclosing Information Needs for the Society

The question was meant to find if disclosure of informational needs for the society in which the entity operates can be of any assistance in meeting the informational needs of different stakeholders with emphasis on public informational needs. The Table 9 below shows the number of respondents.

| Table 9: Disclosing Information Needs For The Society | ||||

| Strongly Agree | Agree | Undecided | Disagree | Strongly Disagree |

|---|---|---|---|---|

| 19 | 56 | 10 | 9 | 6 |

The Graph 7 above shows that 19/100 (19%) strongly agreed, 56/100 (56%) agreed, 10/100 (10%) undecided, 9/100 (9%) disagreed and 6/100 (6%) strongly disagreed that disclosing information needs for society may assist in coming up with financial information needs for different stakeholders. The results shown above confirm that information that affects the community in which firm operates is of concern in order to meet information requirements of various stakeholders. Chiang (2010) state that companies may get affected by the environment matters that arise from the societies in which they operate. Overall response rate of 75/100 (75%) agreed, 10/100 (10%) undecided and 15/100 (15%) disagreed. An overall percentage of 75% meant that the respondents are of the opinion that the societal information affects informational needs of various stakeholders. It is impossible to use voluntary disclosure instruments when monitoring public products.

Negash (2012) asserts that sustainable report is there to give a breakdown on the effects of entity’s operations on environment. Mode was 75 respondents agreeable. This mode confirms that disclosing information on society can be of assistance in meeting stakeholders’ information needs. There are no disclosures at L L L on societal needs i.e. the environment issues. The company is failing to disclose on what they are giving back to the communities in which the entity operates.

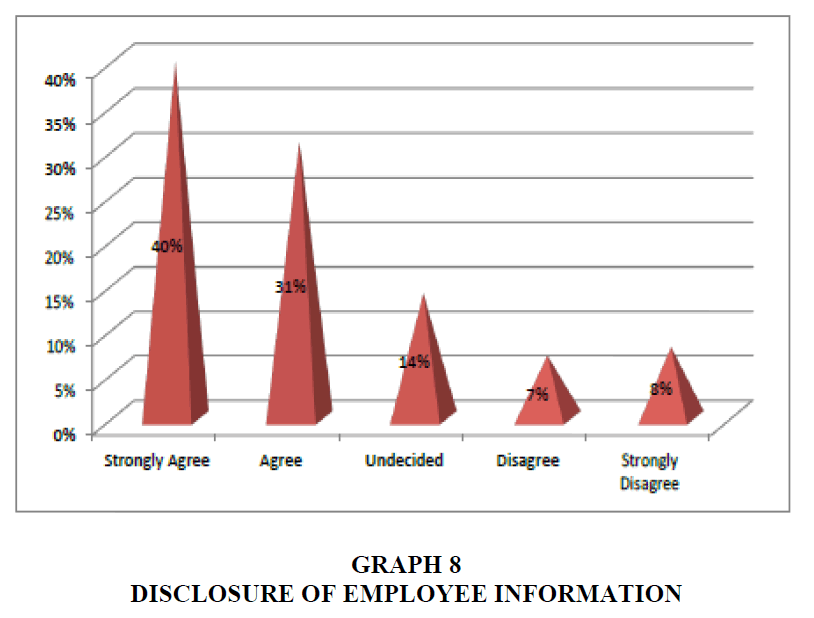

Disclosure of Employee Information

The researcher decided to ask this question as there is little that is done in line with employee information needs, issues pertaining employees are less dealt with in financial reports. The Table 10 below shows the number of respondents.

| Table 10: Disclosure Of Employee Information | ||||

| Strongly Agree | Agree | Undecided | Disagree | Strongly Disagree |

|---|---|---|---|---|

| 40 | 31 | 14 | 7 | 8 |

The Graph 8 above shows 40/100 (40%) strongly agreed, 31/100 (31%) agreed, 14/100 (14%) undecided, 8/100 (8%) strongly disagree and 7/100 (7%) disagree on disclosure of employee information as a way that may assist in coming up with financial information needs for different stakeholders. The results mean that respondents are supporting that employee informational need are vital in contributing towards disclosure of information for various stakeholders. Bellou (2007) also stated that certain employee information must be availed to them in line with the relationship that exists between them and employees. An overall response rate of 71/100 (71%) agreed, 14/100 (14%) undecided and 15/100 (15%) disagreed the fact that disclosure of employee information needs may assist in coming up with information needs of different stakeholders and that can be vital for disclosure of true business performance. Komissarov (2014) stated that less has been disclosed on pension policies in both government and business at all levels. Agree constitute 71 of respondents and is the mode. The mode confirms that disclosure of employee information can assist in coming up with the information needs of different stakeholders. LLL discloses nothing on the employee issues the results here confirms the importance of disclosing employee issues in financial statements. LLL has no defined policy on employees, i.e., on pension and postretirement benefits.

Does the Following Get Affected by Neglecting Other Stakeholders’ Needs When Presenting Information?

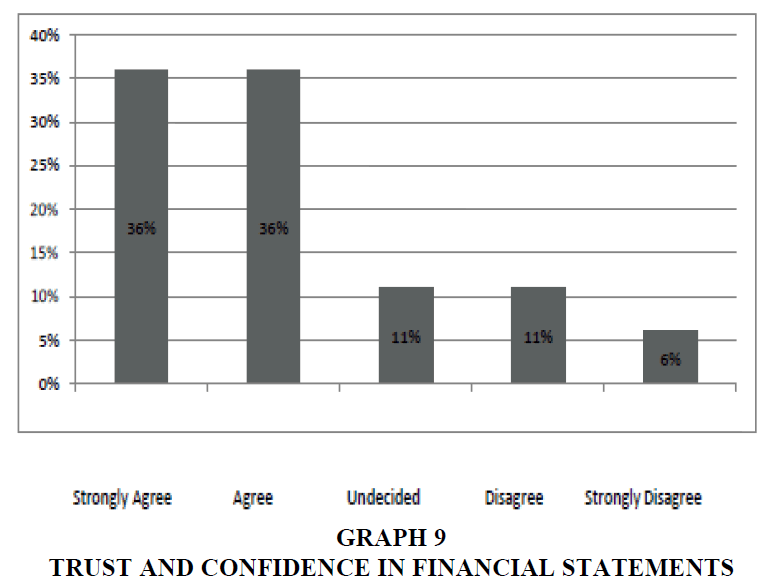

Trust and Confidence in Financial Statements

The researchers aimed to assess the effects of neglecting other stakeholder informational needs in financial reports by asking if trust and confidence levels on financial reports will remain the same even if other stakeholder needs are not taken into account. The Table 11 shows the number of respondents.

| Table 11: Trust And Confidence In Financial Statements | ||||

| Strongly Agree | Agree | Undecided | Disagree | Strongly Disagree |

|---|---|---|---|---|

| 36 | 36 | 11 | 11 | 6 |

The Graph 9 above shows that 36/100 (36%) strongly agreed, 36/100 (36%) agreed, 11/100 (11%) undecided, 6/100 (6%) strongly disagree and 11/100 (11%) disagreed that trust and confidence in financial statements may be affected by neglecting other stakeholders needs. The outcome above means that there was no dominating response since agreed and strongly agreed both attained a 36%. Tonkiss (2009) stated that trust and confidence are the pillars for economy to function. A response rate of 72/100 (72%) agreed, 11/100 (11%) undecided and 17/100 (17%) disagreed.

The results shown above confirm that the entity may lose trust and confidence when it neglects other stakeholders. Rezaee (2004) stated that public trust and confidence has been worn out due to fraudulent reporting in high profiled entities. The mode was 72 respondents who agreed and it was evenly distributed between strongly agreed and agreed. The mode confirms that trust and confidence in entity’s financial statements may be affected by neglecting other stakeholders when disclosing information. Lester-Lesley Ltd. is neglecting stakeholders as a result of that they are failing to meet informational needs requirements of these stakeholders and the issue are affecting negatively on organisation’s trustworthiness.

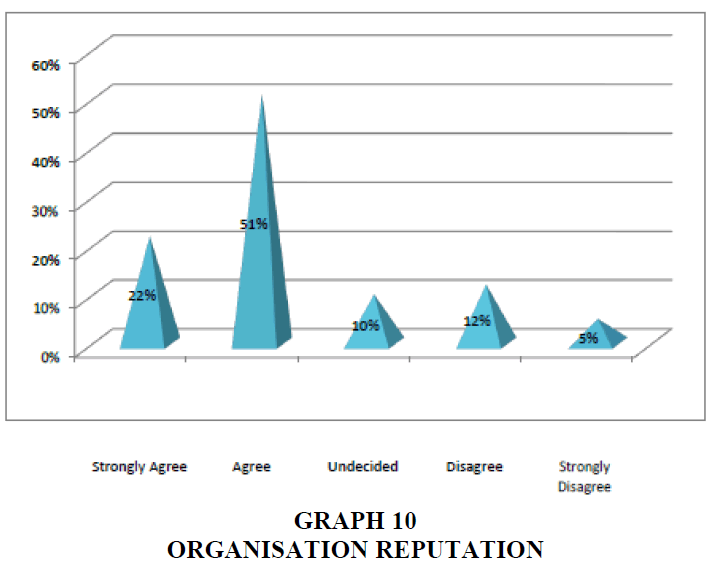

Organisation Reputation

This question sought to address the effects of neglecting other stakeholders’ informational needs on the organisation’s reputation. The researchers wanted to establish if the reputation of the organisation can be affected by failure to disclose other stakeholder needs. The Table 12 below shows number of respondents:

| Table 12: Organisation Reputation | ||||

| Strongly Agree | Agree | Undecided | Disagree | Strongly Disagree |

|---|---|---|---|---|

| 22 | 51 | 10 | 12 | 5 |

The Graph 10 above shows that 22/100 (22%) strongly agreed, 51/100 (51%) agreed, 10/100 (10%) undecided, 12/100 (12%) disagreed and 5/100 (5%) strongly disagreed that organisation’s reputation may be affected by neglecting other stakeholders needs when presenting information. The results shown illustrate that reputation comes as a result of good relationship between an entity and its stakeholders. According to Bebbington, Larrinaga and Moneva (2008), each entity has a reputation that is different from the other organisation and depends on how it interacts with its stakeholders. An overall of 73/100 (73%) agreed, 10/100 (10%) undecided and 17/100 (17%) disagreed to the fact that neglecting other stakeholders may affect reputation of the organisation. The overall results show that those who agreed constitute the majority and this means reputation of an organisation may be affected by neglecting other stakeholder’s needs.

| Model 2: Interview Response Rate | ||

| Scheduled Interviews | 5 | 100% |

| Administered Interviews | 4 | 75% |

Respondents’ Views

Q1. What are the Factors to be Considered When Disclosing Information in Financial Statements?

The general manager said the regulatory requirements are essential when disclosing information on financial statements and the intended use of financial reports has to be considered also. The chief financial controller emphasised on considering the requirements of standards and the intended use of the reports. The accountant stated that one should consider the intended users and their understanding of financial statements and the requirements of IFRSs. The accounts member of staff just said the regulatory requirements are vital when disclosing financial information in financial statements. Collis and Jarvis (2002) stated that companies are required by regulatory framework to make disclosures because they are required in public interest as large public companies are able to raise capital by offering shares to public.

The responses for this question confirmed or supported the findings from questionnaires where a mode of 87 respondents supported that regulatory requirements to the financial statements are among the factors to be considered when disclosing information in financial statements. In their response both participants mentioned regulatory requirements as a factor to be considered when disclosing information in financial statements. These results imply that Lester-Lesley Ltd. has to honour regulatory requirements when disclosing information; they should not disclose things that please them but disclosure should be in line with regulatory requirements.

Q2. How Reliable is Financial Statements on Disclosing Business Performance?

The chief financial controller said financial statements are reliable though they are surrounded with some anomalies, e.g. forgery and intentional errors. The general manager said financial statements are very reliable except for extreme cases where some relevant information is not disclosed. The accountant stated that one can rely on financial reports though things like forgery and dress-up may exist. Accounts staff member said financial statements are reliable though anomalies around reporting system may cause doubt. The results show that the respondents agreed that financial statements produce reliable information but viewed some anomalies that are associated with the preparers and the source of information. Huang, Tsaih and Lin (2012) stated that the idea of reporting is to enlighten stakeholders on the performance of organisation and contrary to that some anomalies may happen which involves the intentional misstatement or omission of material information.

On the questionnaire management fraudulent reporting and source of information were considered to be other factors that affect the level of reliance that can be placed on financial statements on disclosing true business performance. Forgery, intentional errors and other anomalies that surround financial statements are amongst the issues that are mentioned by interview respondents that may affect reliability of financial statements. Modes of 87 as well as 81 were attained on questionnaire respondents who agreed that management fraudulent reporting and source of information respectively affects reliability of disclosed information. To LLL these interview responses confirm how important the organisation needs to deal with a form of misrepresentation of facts.

Q3. Do the Benefits of Financial Statements Override Cost of Preparing them?

The general manager said he thinks the benefits derived outshine the costs because through financial statements stakeholders, e.g. investors will be able to analyse and if interesting invest in your organisation through scanning of financial statements. The financial controller said he thinks the financial statements are worth to be prepared though sometimes the cost seems to be significant. Accounts member of staff thinks that benefits and costs cancel each other. The accountant said the benefits are much visible as the entity may attract new investors using financial statements. Such results show the need for preparers to consider the cost and benefits of preparing financial reports and such consideration can assist in assessing if the information is worth being reported. Dumay and Lu (2010) is of suggestion that disclosure of information by organisation has benefits in particular creating trustworthiness and reducing information asymmetry.

On answering questionnaires on cost and benefits of disclosing information, respondents agreed that cost and benefits have to be considered when assessing the importance of preparing financial statements. Mode of 70 was attained on those who agreed that cost and benefits are worth to be considered for importance of financial statements assessment. And on responding to similar question, interviewees were satisfied that benefits of preparing financial reports outshine the costs of preparing them. Therefore, a consideration should always be given on cost and benefits of disclosing information. Preparers of organisation’s financial reports should view disclosure of information as a cost that does not attract benefits. LLL should do an assessment on the cost and benefits of disclosing information.

Q4. What are the Financial Information needs of an Entity’s Stakeholders?

The accountant said the stakeholders may need information on investments, going concern of an entity and information on non-financial items amongst others. The general manager said stakeholders need to be informed on issues that affect them or issues of interest to them e.g. the investors need to know the going concern of an entity. A member of accounts staff stated that stakeholders need to know if the entity is giving back to the society in which it operates. The chief financial controller said stakeholders are interested in things that affect them either financially or non-financial information. The findings confirm the importance of disclosing nonfinancial information. Negash (2012) outlined policy avenues for improving disclosure of environmental matters for the society. Komissarov (2014) stated that there is a need for disclosing employee issues since accounting for employee benefits has long been one of less transparent areas in financial statements. Sillanpaa et al. (2010) outlined that disclosing intellectual capitals is crucial because activities are based on them.

The interviews gave various information needs of an entity’s stakeholders which include non-financial information and financial information. The stakeholders are interested on investment information, going concern of an entity and other societal related issues. That is in support of the outcome on the questionnaires where the respondents supported that nonfinancial information and society related information can assist in meeting information needs for various stakeholders. Modes of 57 and 75 agreed respondents were attained in respect of disclosure of non-financial and societal information in financial statements.

Q5. What are the Effects of Neglecting Other Stakeholder Information Needs When Presenting Annual Financial Statements?

The general manager was of the sentiment that entity may lose great opportunities and trust can be lost through failure to recognise other stakeholders. Accounts member of staff said he thinks neglecting other stakeholder information needs affect reputation of an entity at large. The chief financial controller said entity may lose some of its stakeholders and trust and confidence may be eroded. The accountant was of the sentiment that the entity may lose, e.g. interested investors when they discover that the entity does not disclose investment issues in financial statements. The results show that neglecting other stakeholders’ informational needs contribute negatively to the overall organisation performance. Tonkiss (2009) stated that trust is the spinal cord of economics and trust and confidence are crucial to effective economic functioning. Samkin and Schneider (2010) stated that failure to gain legitimacy from stakeholder groups has serious implications for organisation.

The questionnaire respondents were of the view that organisation reputation, trust and confidence in financial statements may be affected by neglecting other stakeholders when presenting annual financial statements. Mode of 73 on reputation and 72 on trust and confidence were attained on agreed respondents. The interview respondents were also of the view that great opportunities and trust can be lost by failure to recognise other stakeholders to the financial statements. The findings enlightened LL on considering all its stakeholders for disclosure purposes to avoid the implications.

Conclusion

It has been established that regulatory requirements regarding disclosure of financial information, preparation of financial statements and audience to financial statements were amongst the factors to be considered for information disclosure purpose. Most of the respondents agreed that these factors are to be considered when disclosing information. It also emerged through interview responses that regulatory requirements and the users of financial statements are amongst factors to be considered when disclosing information in financial statements. The research identified the cost and benefits of disclosing financial information, relevance of financial statements and significance of stakeholder groups as the factors to be considered when carrying out a cost benefit analysis on the importance of financial statements. Respondents were of the opinion that benefits derived from the financial statements outshine the costs of preparing them.

Recommendations

Voluntary Disclosure

The organisation should adopt voluntary disclosure in order to meet the requirements of other non-financial information needs and disclosure on intellectual capitals that are there for the organisation to reduce information asymmetry.

Use of Relevant Sources of Information

The organisation should consider both internal and external sources of information to meet stakeholder requirements.

Incorporating All Stakeholder Information Needs in Financial Reports

The organisation should always capture all stakeholders’ information requirements as a way of maintaining good reputation and boosting trust and stakeholders’ confidence. Failure to gain legitimacy from stakeholder groups has serious implications for organisations in that these groups may display apathy towards the attempts by organisations to manage and protect the environment (Samkin and Schneider 2010).

References

- Abed, S., Al-Najjar, B. & Roberts, C. (2016). Measuring annual report narratives disclosure: Empirical evidence from forward-looking information in the UK prior the financial crisis. Managerial Auditing Journal, 31(4), 23-34.

- Abeysekera, I. (2013). A template for integrated reporting. Journal of Intellectual Capital, 14(2), 227-245.

- Abraham, S. & Shrives, P.J. (2014). Improving the relevant factor disclosure in corporate annual reports. The British Accounting Review, 46, 91-107.

- Alvarez, F. & Barlevy, G. (2015). Mandatory disclosure and financial contagion, Working Paper 21328, National Bureau of Economics Research, Cambridge.

- Arvidsson, S. (2011). Disclosure of non-financial information in the annual report. Journal of Intellectual Capital, 12(2), 277-300.

- Beddington, J., Larrinaga, C. & Moneva, J.M. (2008). Corporate social reporting and reputation risk management. Accounting, Auditing and Accountability Journal, 21(3), 337-361.

- Bellou, V. (2007). Identifying employee’s perceptions on organisational obligations. International Journal of Public Sector Management, 20(7), 608-621.

- Castilla-Polo, F. & Gallardo-Vazquez, D. (2016). The main topic of research on disclosure of intangible assets: A critical review. Accounting, Auditing and Accountability Journal, 29(2), 323-356.

- Chalevas, C. & Tzovas, C. (2010). The effect of the mandatory adoption of corporate governance mechanisms on earnings manipulation, management effectiveness and firm financing. Managerial Finance, 36(3), 257-277.

- Chaudhry, A.S. & Alansari, H. (2013). Use of electric and digital information by investment professionals in Kuwait. Library Review, 63(3), 157-176.

- Chiang, C. (2010). Insights into current practices in auditing environmental matters. Managerial Auditing Journal, 25(9), 912-933.

- Choy, L.T. (2014). The strengths and weaknesses of research methodology comparison and complimentary between qualitative and quantitative approaches. IOSR Journal of Humanities and Social Science, 19(4), 99-104.

- Collis, J. & Jarvis, R. (2002). Financial information and the management of small private companies. Journal of Small Business and Enterprise Development, 9(2), 100-110.

- Conway, S.L., O’Keefe, P.A. & Hrasky, S.L. (2015). Legitimacy, accountability and impression management in NGOs: The Indian Ocean tsunami. Accounting, Auditing and Accountability Journal, 28(7), 1075-1098.

- Discoll, D.L. (2011). Introduction to primary research: Observation, surveys and interviews. Writing Spaces, Reading and Writing, 2(1), 32-43.

- Dumay, J.C. & Lu, J. (2010). Disclosing improvements in human capital: Comparing results to the rhetoric. Journal of Human Resource Costing and Accounting, 14(1), 70-77.

- Elzahar, H. & Hussainey, K. (2012). Determinants of narrative risk disclosures in UK interim reports. The Journal of Risk Finance, 13(2), 133-147.

- Fallan, E. & Fallan, L. (2009). Voluntarism versus regulation. Journal of Accounting and Organisational Change, 5(4), 473-489.

- Flostrand, P. & Strom, N. (2006). The valuation relevance of non-financial information. Management Research News, 29(9), 580-597.

- Garanina, T.A. & Kormiltseva, P.S. (2014). The effect of international financial reporting standards (IFRS) adoption on the value relevance of financial reporting: a case of Russia. In Accounting in Central and Eastern Europe.

- Huang, S.Y., Tsaih, R.H. & Lin, W.Y. (2012). Unsupervised neural networks approach for understanding fraudulent financial reporting. Industrial Management and Data Systems, 112(2), 224-244.

- Iatridis, G.E. (2012). Voluntary IFRS disclosure: Evidence from the transition from UK GAAP to IFRSs. Managerial Auditing Journal, 27(6), 573-597.

- Israel, G.D. (2011). Determining sample size. University of Florida, IFAS Extension.

- Kaminski, K.A., Wetzel, T.S. & Guan, L. (2004). Can financial ratios detect fraudulent financial reporting? Managerial Auditing Journal, 19(1), 15-28.

- Komissarov, S. (2014). Financial reporting and economic implications of statements of financial standards No 132® and No 158. Review of Accounting and Finance, 13(1), 88-103.

- Latham, B. (2007). Quantitative Research Methods Spring 2007, England 5377.

- Leuz, C. & Wysocki, P. (2015). The economics of disclosure and financial reporting regulation: Evidence and suggestions for IGM Working Paper No. 132. Booth Working Paper Series No.16-03.

- Liesegang, T.J. & Bartley, G.B. (2014). Towards transparency of financial disclosure. American Academy of Ophthalmology, Elsevier.

- Magness, V. (2006). Strategic posture, financial performance and environmental disclosure. Accounting, Auditing and Accountability Journal, 19(4), 540-563.

- Miihkinen, A. (2013). The usefulness of firm risk disclosures under different firm riskiness, investors interest and market conditions. Advanced in Accounting, Incorporating Advances in International Accounting, 29, 312-331.

- Negash, M. (2012). IFRS and environmental accounting. Management Research Review, 35(7), 577-601.

- Palea, V. (2014). Fair value accounting and its usefulness to financial statement users. Journal of Financial Reporting and Accounting, 12(2), 102-116.

- Qu, W., Leung, P. & Cooper, B. (2013). A study of voluntary disclosure of listed Chinese firms - A stakeholder perspective. Managerial Auditing Journal, 28(3), 261-294.

- Ramirez, Y., Tejada, A. & Manzaneque, M. (2016). The value of disclosing intellectual capital in Spanish Universities: A new challenge of our days. Journal of Organisational Change Management, 29(2), 45-56.

- Rezaee, Z. (2004). Restoring public trust in the accounting profession by developing anti-fraud education, programs and auditing. Managerial Auditing Journal, 19(1), 134-148.

- Samkin, T.A. & Schneider, A. (2010). Accountability narrative reporting and legitimation. Accounting, Auditing and Accountability Journal, 23(2), 256-289.

- Schwarzkopf, D.L. (2006). Investor’s attitudes towards source credibility. Managerial Auditing Journal, 22(1), 18-33.

- Sillanpaa, V. (2010). The role of intellectual capital in non-profit elderly care organisations. Journal of Intellectual Capital, 11(2), 107-122.

- Tonkiss, F. (2009). Trust, confidence.