Research Article: 2019 Vol: 25 Issue: 2

An Evaluation of the Effectiveness of Presumptive Tax Administration On Revenue Collection By Zimra A Case Study of the Cottage Industry In Harare (2011-2018)

Wadesango Newman, University of Limpopo

Denford, University of Limpopo

Sitcha, Midlands State University

Abstract

The research focused on the evaluation of the effectiveness of Presumptive tax administration on revenue collection. The researchers observed that there is little contribution that is collected from the presumptive tax to an extent that it can act as a stand-alone tax head and as a result Zimbabwe Revenue Authority (ZIMRA) has been missing its revenue targets for the past eight years from 2011 to 2018. A mixed method approach was used to gather data through the use of questionnaires and interviews. A sample size of 50 people was used (25 ZIMRA SCO employees and 25 cottage industry operators that consist of the furniture manufacturer, metal fabrication and upholstery operators). The research findings revealed that the effectiveness of presumptive tax administration was affected by the high tax rates that were imposed by the ministry of finance relative to the income levels that the cottage industry earn on a monthly basis, high levels of corruption and the political interference that occur. The research recommend that the authorities should lower the presumptive tax rates by taking into consideration the general economic environment, include the relevant stakeholders in the setting up of the tax rates for the cottage industry, embark on registering the informal sector operators through mobile units in the areas of operation for the informal sector operators.

Keywords

Effectiveness, Presumptive Tax Administration, Revenue Collection, ZIMRA.

Introduction

Economic challenges have resulted in the shrinking of the tax base in Zimbabwe as highlighted by ZIMRA (2014). According to Sikwila, et al. (2016), the general decline in economic activity due to poor economic policies and other factors resulted in closure of many companies and retrenchment of many workers as capacity utilization dwindled to lowest leading to the reduction of revenue from taxation. This is also supported by Kadzere & Bonga (2013) who highlighted that the liquidity crunch, fall of prices of commodities in global markets and poor performance of agriculture has resulted in this current economic meltdown. Dube & Casale (2016) point out that the period 2008 to 2016 reports suggest that more than 75% of the formal companies were closed. Nyamwanza et al. (2014) concluded that this to a larger extent has a telling effect on government revenue and projects.

As a result, the Zimbabwean economy has a large number of informal sector operators as they attempt to fill the gap that is left by large companies which have succumbed to economic challenges as indicated by Zivanai et al. (2016). According to Nyamwanza et al. (2014) the informal sector has become the major employer in the country but the majority of these informal sectors are not registered for tax and other purposes. ZIMCODD (2014) state that despite the informal economy being able to manage to fill the void that was left by the large companies, the same cannot be said in terms of providing for the revenue gap and hence the county is losing out the potential revenue from the informal sector.

Taxation in Zimbabwe and in other countries forms the basis of government funding. Tapera (2017) defines tax as money that is paid to the government compulsorily and without any direct return value to the tax payer. Zivanai et al. (2016) assert that there are different types of taxes that are paid by the citizens to ZIMRA on behalf of the government of Zimbabwe which include Value Added Tax (VAT), Pay as you earn (PAYE), Corporate Tax, Customs and Excise Duty, Capital Gains Tax, Presumptive Tax, Carbon Tax and Mining Royalties. ZIMCODD (2014) stated that in Zimbabwe a number of taxes are levied on citizens and the tax is mainly used for financing national and local government projects. Chukwuma & Efeeloo (2017) point out that the taxes that are collected act as a fiscal tool for controlling the economy.

In a bid to raise the much needed revenue, the government of Zimbabwe pursued to expand its tax net by integrating the growing informal sector into the tax net as noted by Utaumire et al. (2013). However how to tax the informal economy remains a pressing question. In its pursuit to increase tax collection, the Zimbabwe Revenue Authority (ZIMRA) opted for the presumptive tax system in certain types of business in 2005 as indicated by Wadesango and Mhaka (2017). According to Utaumire et al. (2013) presumptive tax was further enforced in 2011 to broaden the revenue base in view of the increasing informal business activity. Musarirambi (2013) defines presumptive tax as the tax which involves the indirect means to ascertain tax liability, which is different from the usual roles based on the taxpayer’s account.

Literature Review

According to Utaumire et al. (2013) presumptive tax was introduced in order to capture informal business that have remained outside the tax net and also lessen the burden on the formal sector. According to the Income Tax Act Section 36C the presumptive tax mainly targets small scale traders including cross boarder traders, transport operators, small scale miners, restaurant operators, flea markets, hair saloon operators and the cottage industry. This was necessary because SMEs activity constitute 70% of the economic activity and that their contribution is more than 60% of the country’s GDP as indicated by the Ministry of Finance (2013). ZIMRA (2018) pointed out that the cottage industry operators include those in the furniture making or upholstery trade, metal fabrication and any other cottage industry that the Minister may by notice in a statutory instrument may prescribe. Examples of operators in the cottage industry are those who manufacture furniture in Glen View Area 8 in Harare.

Mhlanga (2018) stated that the method of presumptive tax in Zimbabwe is based on the rates that are postulated by the Ministry which means that even if the business makes a loss, it is obliged to pay the tax payable that is stipulated. The cottage industry operators are required to pay an amount of $300.00 per quarter as presumptive tax as noted by Kamuteku (2016). According to Zimbabwe Independent (2014) the informal sector operators are required to pay presumptive tax every quarter by the 10th of January, April, July and October. Different countries in developed countries use different methods to collect revenue from the informal sector businesses. Joshi et al. (2013) assert that in Ethiopia the informal firms are required to pay a presumptive tax on income based on turnover as well as a 2 per cent tax on turnover instead of VAT. They further stated that Tanzania charges a presumptive tax which is proportionate to turnover, with those who do not keep records are obliged to pay larger amounts and Ghana operates a flat rate of turnover tax of 3% for the small firms.

The main objective of presumptive taxes is to simplify the tax administration process, collect revenue from the informal sector operators and educate them with the ultimate aim of including them into the ‘regular’ tax system. The was also supported by Iordachi & Tirlea (2016) who state that presumptive tax in Ukraine is considered as an instrument to facilitate the transfer of revenue from the shadow economy. Dube & Casale (2016) alluded the relevance of presumptive tax in the informal sector as the actual income are notoriously hard to monitor. Joshi et al. (2014) also suggested that the benefits that are derived from taxing the informal sector include revenue, growth and governance and it assist to sustain tax morale and tax compliance among larger firms. Wadesango & Wadesango (2016) further highlighted that the informal economy now denotes a source of tax revenue for the cash-strapped government.

Main Research Question

What is the effectiveness of presumptive tax administration by ZIMRA on revenue collection?

Research Objectives

1) To analyze the historical background of presumptive tax in Zimbabwe and other countries.

2) To analyze the methods that are used for the assessment and collection of presumptive tax.

3) To identify the challenges encountered in presumptive tax administration on revenue collection.

4) To identify measures ZIMRA can adopt and implement to improve presumptive tax administration.

5) To examine the performance of presumptive tax administration on revenue collection.

Research Methodology

The study adopted quantitative methodology. Mixed methods of research is the use of multiple methods of research that combines the use qualitative and quantitative data collection techniques. According to Creswell (2014) the mixed method is a method to inquiry that involves the collection of both qualitative and the quantitative data, integrating them and making use of distinctive designs that involve philosophical assumptions as well as the theoretical frameworks. In this study, the research sample consisted of two categories, the cottage industry operators and the tax officers, that is, 25 representing the cottage industry and 25 representing ZIMRA SCO workers. The sampling unit for the cottage industry consist of 8 metal fabrication operators, 8 upholstery operators and 9 furniture manufacturing entrepreneurs. The sampling unit for the tax officers consist of revenue specialist, SCO supervisors, middle managers and the top management from Zimbabwe Revenue Authority. Data was collected through questionnaires. Data analysis was aided by the use of Microsoft excel packages in analyzing the data collected from the respondents.

Justification Of The Adopted Research Approach

Most of the researches in this area of study have been conducted using the quantitative approach alone but in this study the researcher decided to us both qualitative and quantitative approaches (mixed method). According to Creswell (2014), the mixed method is a method to inquiry that involves the collection of both qualitative and the quantitative data, integrating them and making use of distinctive designs that involve philosophical assumptions as well as the theoretical frameworks. Creswell (2014) further states that the key assumption is that using both qualitative and quantitative techniques provides a more complete understanding of the problem under research than making use of a single approach alone. Qualitative method seeks to investigate how respondents interpret their own reality. Kumar (2013) asserts that the main focus of qualitative method is to understand, explore, explain, discover and clarify solutions, feelings, perceptions, attitudes, values, beliefs and experiences of a group of people. According to Creswell (2013) the qualitative interviews deals with the understanding, attitudes and views of individuals with regards to a particular problem. The researchers made use of interviews to ZIMRA managers in an effort to obtain a thorough insight into opinions of people, understanding and notions with regards to the effectiveness of presumptive tax administration on revenue collection.

Systematic Review

According to Pittaway et al. (2004) a high-quality systematic review is described as the most reliable source of evidence to guide practice. The purpose of a systematic review is to deliver a meticulous summary of all the available primary research in response to a research question. A systematic review uses all the existing research and is sometime called ‘secondary research’ (research on research). In this study, the researchers scrutinsed previous studies conducted by other researchers in the same area and some of them were brought back later in the discussion to refute or agree with the findings of the current study.

Results and Discussion

The section of the study illustrates the presentation, analysis as well as the interpretation of the collected data during the research study and it indicates the research results and findings obtained using the instruments that were discussed in the preceding sections. The presentation of data was done with the aid of the tables, graphs and pie charts. Descriptive analysis was done using Microsoft Excel to analyze data. Analysis of the presented information was done with an effort to come up with realistic conclusions concerning factors that contribute to the effectiveness of presumptive tax administration on revenue collection.

Questionnaire Response Rate

Questionnaires and interviews were the research instruments that were used in the study and therefore the response rate was analyzed as per technique used. Data was obtained from two sets of questionnaire, one for the cottage industry operators and the other from the ZIMRA employees Table 1.

| Table 1: Response Rate | ||||

| Level | Sample Size | Responded | Not Responded | Response Rate |

|---|---|---|---|---|

| ZIMRA SCO Employees | 25 | 24 | 1 | 96% |

| Cottage Industry Operator | 25 | 20 | 5 | 80% |

| Total | 50 | 44 | 6 | 88% |

ZIMRA Small Client Officer employees had a response rate of 96% which means that of the 25 questionnaires that were sent, 24 managed to respond whilst 1 did not respond. The cottage industry operators had a response rate of 80% as only 20 managed to respond whilst on 5 did not respond to the questionnaires. The overall response rate that the researcher got was 88% after administering questionnaires to the ZIMRA Small Client Office employees and the cottage industry operators which constitute 44 questionnaires responded whilst 12% of the questionnaires did not respond which is 6 questionnaires that were not responded.

Demographic Information from ZIMRA Respondents

The variables such as age, gender, educational qualification, work experience are viewed as important for the purpose of this study as it has a bearing in the effective understanding of presumptive tax administration on revenue collection.

Educational Qualification of ZIMRA Respondents

Respondents were asked their level of qualification in an effort to assess how data can be relied upon. Table 2 shows the level of qualification of ZIMRA respondents:

| Table 2: Zimra Qualification Level | ||

| Qualification | Respondents | Percentage |

|---|---|---|

| Certificate | ||

| Diploma | ||

| Degree | 14 | 58% |

| Master’s Degree | 8 | 33% |

| Professional Qualification | 2 | 8% |

| Total | 24 | 100% |

From the above Table 2 for ZIMRA level of qualification, 58% (14/24) of the respondents had their highest qualification being an undergraduate degree, 33% (8/24) had a master’s degree qualification and the remaining 8% (2/24) have got a professional Qualification being the highest level of qualification. The level of education within the authority by the respondents enhances reliability of the research findings. Thus the respondents can be assumed to have adequate knowledge about the presumptive tax administration operations based on their level of qualification.

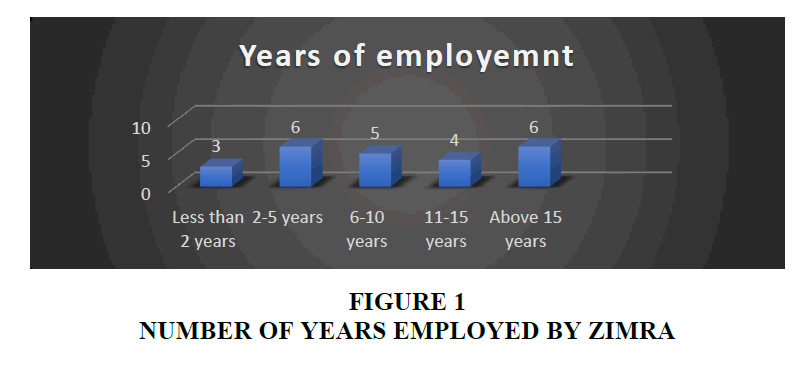

Number of years Employed by the Authority

The respondents were then asked the number of years that they have been employed by ZIMRA as well as the number of years that they have been working at their current work station. Figure 4 shows the number of years that the respondents have been employed by the Authority.

From Figure 1 below, the results show that the majority of the respondents are employed for a period of six years and beyond in the tax authority. This signifies the fact that the respondents have adequate knowledge on the establishment and enhancement of the presumptive taxation in Zimbabwe as well as the performance of the tax head relative to the overall revenue collections by the authority. Thus the information provided by these employees represents a true reflection of the status quo regarding presumptive taxation.

Historical Background of Presumptive Tax Administration on Revenue Collection

This research objective was to ascertain whether adequate research was done on the introduction of presumptive tax in Zimbabwe as well as to determine whether the presumptive tax legislative framework is clearly understood by the ZIMRA officers.

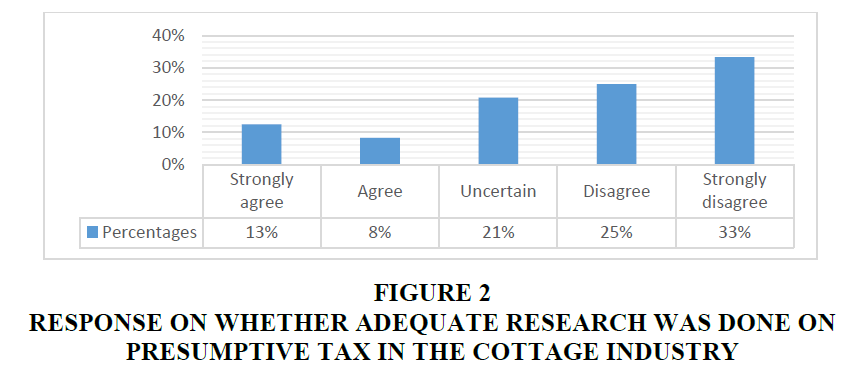

Was Adequate Research Done On Presumptive Tax in Zimbabwe in the Cottage Industry?

The objective sought to establish whether or not adequate research was done on presumptive tax in the cottage industry. The results of the research are show in Figure 2.

As denoted by Figure 2, the majority of the respondents 58% (14/24) of the respondents disagree on the fact that adequate was done on presumptive tax administration in the cottage industry which has a major impact on the revenue contribution from this sub-sector as denoted by Dube & Casale (2016). According to Dube & Casale (2016) unlike the transport industry, inadequate research was done on the profitability of the sub-sectors such as the cottage industry that were later added into the tax system.

The results which can be drawn from Figure 2 is that inadequate research was done on the presumptive tax in the cottage industry.

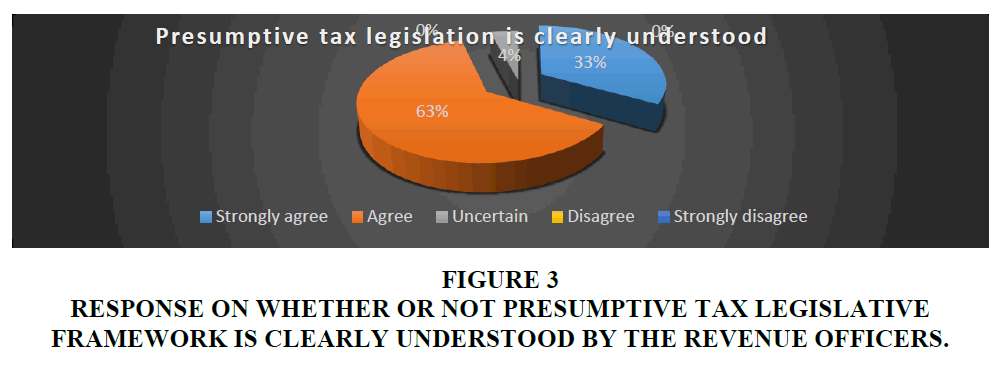

The Presumptive Tax Legislative Framework

The question was posed to establish whether or not the presumptive legislative framework is clearly understood by the revenue officers or revenue specialists. The results of the research are shown in Figure 3.

Figure 3:Response on whether or not presumptive tax legislative framework is clearly understood by the revenue officers.

From Figure 4 above, the majority of the respondents from the research findings, that is, 96% (23/24) are of the opinion that the presumptive tax legislative framework is clearly understood by the revenue officers in ZIMRA. It can be concluded that the ZIMRA revenue officers clearly understand the presumptive tax legislative framework.

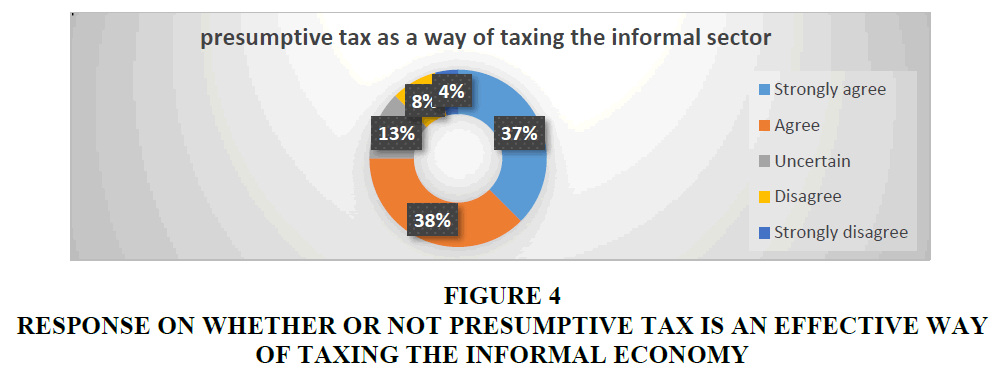

The Presumptive Tax is an Effective Way of Taxing the Informal

The questions sought to determine whether or not presumptive tax is an effective way of taxing the informal economy. The results of the research findings are shown on Figure 4.

Figure 4:Response On Whether Or Not Presumptive Tax Is An Effective Way Of Taxing The Informal Economy.

From Figure 4 above, 37% (9/24) strongly agree that the presumptive tax is an effective way of taxing the informal sector, 38% (9/24) agree on the fact, 13% (3/24) were not certain of the above fact, 8% (2/24) disagree that presumptive tax is an effective way of taxing the informal sector whilst only 4 % strongly disagree on the above cited fact. The majority of the ZIMRA officials agree on the stated fact, 75% (18/24) as they believe that the most effective way of obtaining the revenue from the informal sector is through presumptive tax. Since the presumptive tax ascertain the tax liability which differs from that which is determined by the accounting record (Musarirambi, 2013). Presumptive tax based on amounts established by the government provide an effective mechanism for informal sector taxation. It can be concluded that from the research findings, presumptive tax is an effective way of taxing the informal economy.

The Following are the Challenges that are Being Encountered on Presumptive Tax Administration on Revenue Collection

The research objective was to ascertain the challenges that are encountered in the presumptive tax administration by ZIMRA in the cottage industry.

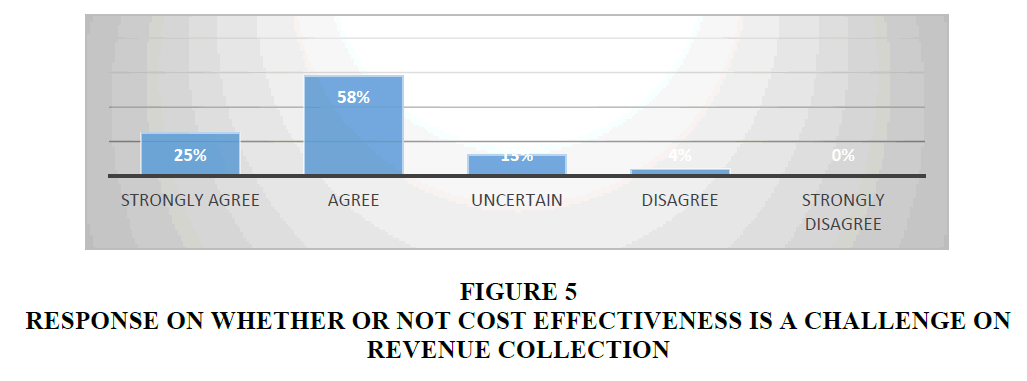

Cost Effectiveness

The question sought to determine whether or not if it is cost effective to collect presumptive tax from the informal sector operators. The results of the findings were shown in Figure 5 below.

From Figure 5 above, 25% (6/24) of the respondents strongly agree, 58% (14/24) of the respondents agree, 13% (3/24) remain uncertain and 4% (1/24) disagree that cost effectiveness tends to be a challenge on collecting revenue from the informal sector. In total 79% (20/24) of the respondents agree that the cost effectiveness analysis is a challenge in collecting revenue from the informal sector operators. The same is supported by Tanui (2016) who state that the administrative cost for the informal sector operators can offset it potential benefits. This is also supported by Joshi et al. (2013) who state that collecting taxes from the informal sector enterprises is a demanding task and it is poorly rewarding. From the research findings, it can be concluded that the cost effectiveness is a challenge when collecting revenue from the informal sector enterprises.

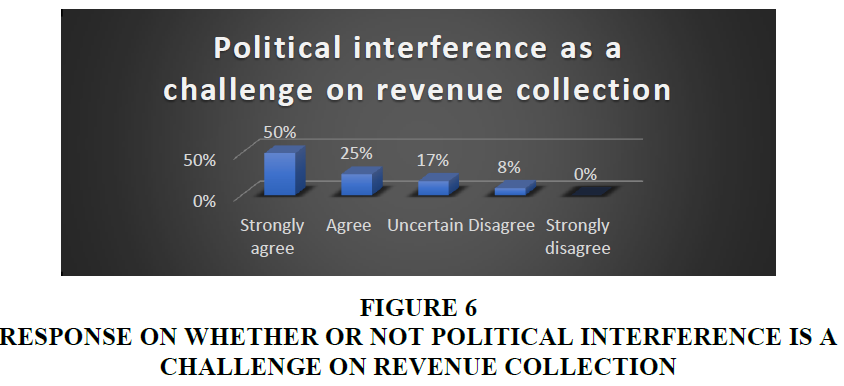

Political Interference

The objective of the question was to establish whether or not the political interference as a challenge on revenue collection. The results findings are shown in Figure 6.

From Figure 6 above, 50% (12/24) of the respondents strongly agree that political interference is a challenge on revenue collection, 25% (6/24) of the respondents agree, 17% (4/24) remain uncertain and 8%(2/24) of the respondents disagree. In total, 75% of the respondents agree that politicians normally interfere in the ways that revenue officers execute their duties. The research findings from the respondents is also supported by Dube and Casale (2017) who were of the opinion that some sectors in the informal sector are escaping the tax net and it appeared to be politically motivated. Munjeyi et al. (2017) also highlighted that the informal sector operators that had connection to a higher political officer tend to be immune from tax.

This can be concluded that the political interference is a challenge on revenue collection from the informal sector operators.

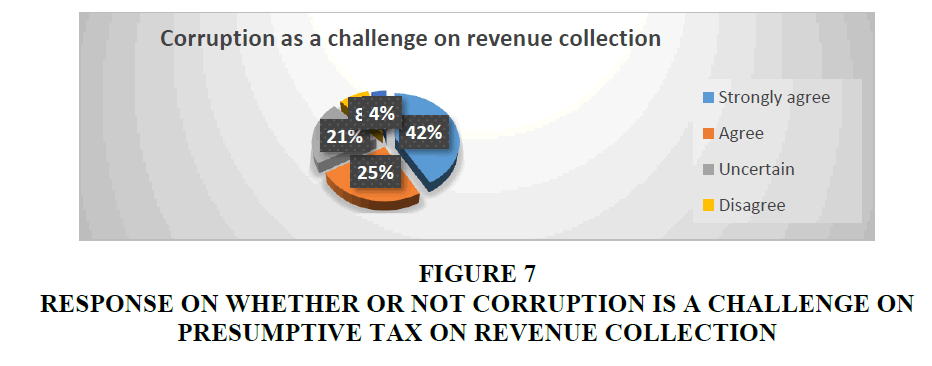

Corruption

The question sought to ascertain whether or not corruption as a challenge on presumptive tax revenue collection. The results of the research findings are shown in Figure 7.

Figure 7:Response On Whether Or Not Corruption Is A Challenge On Presumptive Tax On Revenue Collection.

With reference to Figure 7 above, 42% strongly agree, 25% agree, 21% are uncertain, 8% disagree and 4% strongly disagree. Of the 12% (3/24) who disagree, they are of the view that the ZIMRA revenue officers are professionals who exercise highest level of professional behavior when executing their duties and as such are not involved in corruption practices. They are of the view that they pose high levels of integrity.

However, the majority of the respondents 67% (16/24) agreed the view that there is rampant corruption in the way the revenue officers collect presumptive taxes in the informal sector. This finding that corruption is a challenge in revenue collection is supported by Nyamwanza et al. (2014) who pointed out that the corrupt practices compromises the ability of tax authorities to collect enough revenue for the national fiscus. From the research findings, it can be concluded that corruption is a challenge of collecting revenue from the cottage industry operators.

Unavailability of Information

The question seeks to establish whether the unavailability of information is a challenge on revenue collection. The results of the findings were shown in Table 3.

| Table 3: Responses On Whether Or Not Unavailability Of Information Affect Revenue Collection From The Informal Sector | |||||

| Strongly agree | Agree | Uncertain | Disagree | Strongly disagree | |

|---|---|---|---|---|---|

| Response | 14 | 4 | 4 | 0 | 2 |

| Percentages | 58% | 17% | 17% | 0% | 8% |

From Table 3 above, 58% (14/24) of the respondents strongly agree, 17% (4/24) of the respondents agree, 17% (4/24) of the respondents are uncertain and 8% (2/24) of the respondents strongly disagree that unavailability of information is a challenge on revenue collection from the informal sector. In total, 75% (18/24) of the respondents agree that the unavailability of information is a challenge of collecting revenue from the informal sector. The research finding is supported by Zuriat (2016) who state that the Uganda Revenue Authority established that the lack of a database for the informal sector is a challenge for taxing the informal economy. It can be concluded from the research findings that the unavailability of information is a challenge when collecting revenue from the informal sector.

| Table 4: Responses On Whether Or Not Formalization Of The Informal Sector Improves revenue collection | |||||

| Strongly agree | Agree | Uncertain | Disagree | Strongly disagree | |

|---|---|---|---|---|---|

| Response | 14 | 4 | 3 | 2 | 1 |

| Percentages | 58% | 17% | 13% | 8% | 4% |

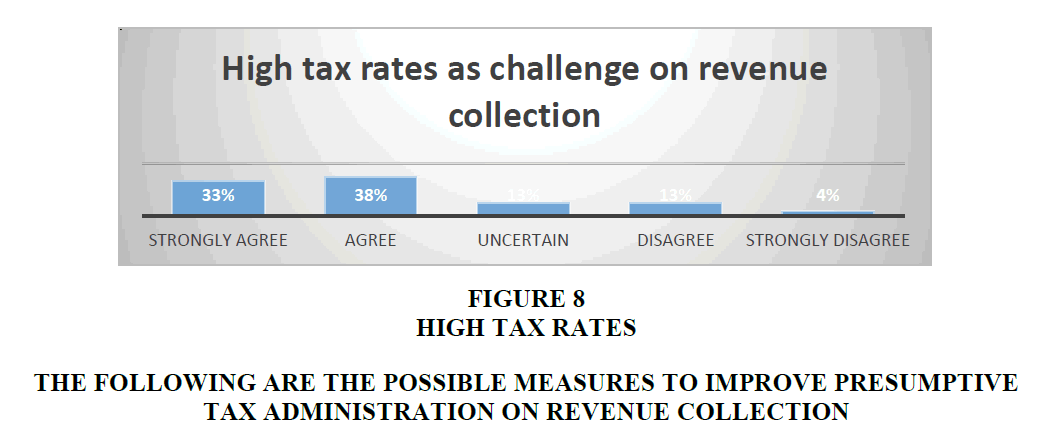

High Tax Rates

The question sought to establish whether high tax rates are a challenge on presumptive tax on revenue collection. The results of the research findings were shown in Figure 8.

Figure 8:The Following Are The Possible Measures To Improve Presumptive Tax Administration On Revenue Collection.

With reference to Figure 8 above the majority of the respondents agree that high presumptive tax rates are a challenge on revenue collection. In total 71% (17/24) of the respondents agree that high presumptive tax rates are a challenge on revenue collection. The same is supported by Sikwila et al. (2016) who state that the high marginal tax rates prevented the informal sector to comply and pay tax. Utaumire et al. (2013) also noted that the absence of involving the interested parties in determining the tax rates resulted in the resistance by the informal sector which becomes a challenge in generating revenue collection.

It can be concluded from the research findings that the high tax rates tend to be a challenge on revenue collection from the informal sector.

Review of the High Presumptive Tax Rate

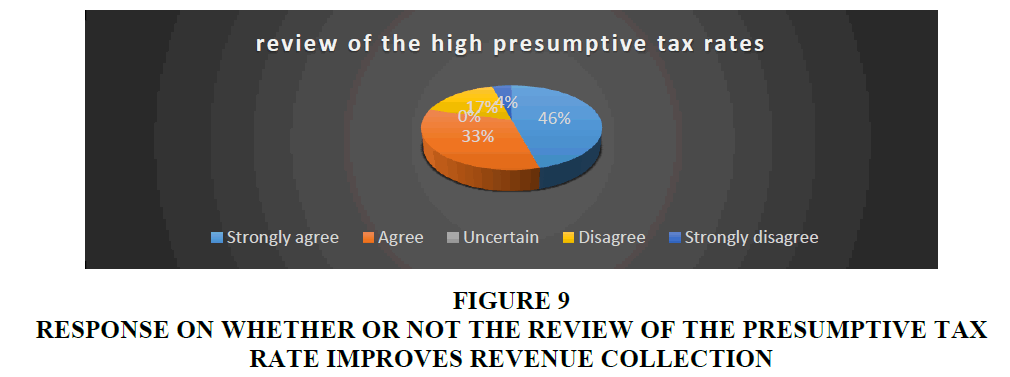

The research question sought to establish whether the review of the high presumptive tax rates improves revenue collection. The results of the research findings are shown in Figure 9.

Figure 9:Response On Whether Or Not The Review Of The Presumptive Tax Rate Improves Revenue Collection.

With reference to Figure 9 above, the majority of the respondents agree that the presumptive tax rates should be reviewed. In total the majority of the respondents 79% (19/24) agree that the review of the presumptive tax rates improves revenue collection. The same opinion is shared by Fursion & Lysko (2014) who state that the presumptive tax administrators should review the tax rates in line with the economic situation. Sikwila et al. (2016) also agreed on the above fact by pointing out that lower marginal tax rates may persuade the informal sector operators to comply and pay their presumptive taxes.

Thus it can be concluded that the review of the presumptive tax rates improves revenue collection from the informal sector.

Formalization of the Informal Sector

The research question sought to determine whether formalizing the informal sector will improve revenue collection. The result from the respondents were shown in Table 4 below.

With reference to Table 4 above, 58% (14/24) strongly agree, 17% (4/24) agree, 13% (3/24) are uncertain, 8% (2/24) disagree and 4% (1/24) strongly disagree. In total, 12 % of the respondents no not agree that formalization will increase revenue collection. This is supported by Utaumire et al. (2013) who state that there is no defined plan that will facilitate the informal sector enterprises to graduate into the informal economy. The majority of the respondents (75%) agree that formalization will improve revenue collection from the informal sector. This entails that they will be able to maintain their books of accounts and be able to file their tax returns once they are formalized. This will in-turn increase revenue collection in the informal sector. Joshi et al. (2014) supported the respondents by pointing out that formalization may stimulate growth in the informal sector.

From the research findings, it can be concluded that formalization may be an effective tool to improve revenue collection from the informal sector.

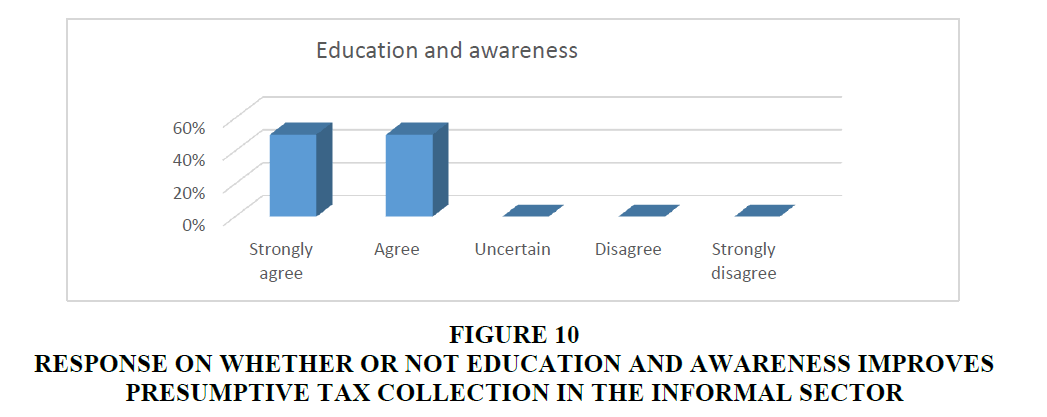

Education and Awareness

The research question sought to ascertain whether education and awareness improves the revenue collection. The results of the research findings are shown in Figure 10.

Figure 10:Response On Whether Or Not Education And Awareness Improves Presumptive Tax Collection In The Informal Sector.

From Figure 10 above, 50% (12/24) strongly agree and 50% (12/24) agree. This notion is also supported by Ebifuro et al. (2016) who pointed out that through education, the informal sector operators can be educated about the presumptive tax system and will be assisted to comply with the tax system.

From the findings, it can be concluded that education and awareness campaigns can be effective tools to improve presumptive tax collections in the informal sector.

Conclusions

The research focused on the evaluation of the effectiveness of presumptive tax administration on revenue collection by ZIMRA: A case study of the cottage industry in Harare. The researchers indicated that the authority is failing to effectively collect enough revenue from presumptive tax to an extent that it can be a stand-alone tax head. The study was a success as the researchers were able to effectively evaluate the effectiveness of presumptive tax administration on revenue collection and establish that the current presumptive tax system is not collecting enough revenue because of the political interference which is resulting in the revenue officers not being able to execute their duties properly as well as enforcing compliance in the cottage industry. Also the presumptive tax system is not effectively collecting revenue because the larger amount of what is collected is ending up in people’s pockets instead of the national purse due to high levels of corruption.

Implications Of The Study

The research study provides valuable literature review for future students of research in the same area. Also one of the managerial and policy implications is that ZIMRA will benefit immensely from the research study as they will likely adopt some of the recommendations to improve Presumptive Tax Administration on revenue collection.

Limitations

Confidentiality nature of the Zimbabwe Revenue Authority.

Considering the confidentiality nature of ZIMRA as a state controlled parastatal, access to information is considered private and confidential. The researchers need to seek authority from ZIMRA in order to access the information from the organization. This could be a mammoth task.

Recommendations

From the research findings, the research made the following recommendation:

ZIMRA should implement a tax system that will ensure the informal sector operators would graduate into the normal tax system after a certain period of time. They should educate the informal sector operators on the importance of record keeping and the potential benefits that arises when they are formalized.

References

- Chukwuma, LO., &amli; Efeeloo, N. (2017b). Boosting tax revenue in Nigeria: A reflection of revenue authority’s tax monitoring model. Research Journal of Finance and Accounting, 8(24), 2222-2847

- Creswell, J.W. (2014). Research Design: Qualitative, Quantitative and Mixed Aliliroach 4th Edition, Sage liublication: Los Angeles.

- Dube, G. (2014). Informal Sector Tax Administration in Zimbabwe, liublic Administration and Develoliment, DOI: 10.1002/liad.1673

- Dube, G., &amli; Casale, D. (2016). The imlilementation of Informal sector taxation: Evidence from Selected African countries. eJournal of Tax Research, 14(3), 601-623.

- Dube, G., &amli; Casale, D. (2017). Informal Sector Taxes and Equity: Evidence from liresumlitive Taxation in Zimbabwe, Develoliment liolicy Review.

- Ebifuro, O., Mienye, E., &amli; Odubo, TV. (2016). Alililication of GIS in Imliroving Tax Revenue from the Informal Sector in Bayelsa State, Nigeria. International Journal of Scientific and Research liublication, 6(8), 2250-3153.

- Fursin, A., &amli; Lysko, M. (2014). liathways reforms simlilified tax system for small enterlirises in Ukraine, From<www.zhu.edu.ua/journal-cliu/index/der > (Retrieved 5 May 2017)

- Gaddis, I. (2014). Who bears the burden? The distributive incidence of liresumlitive income tax in Tanzania. Washington DC, The World Bank.

- Iordachi, V., &amli; Tirlea, M.R. (2016). Use of liresumlitive taxation in facilitating small business comliliance, Theoretical and Scientific Journal, 6(8), 52-67.

- Joshi, A., lirichard, W., &amli; Heady, C. (2013). Taxing the Informal Economy: Challenges, liossibilities and Remaining Questions, IDS Working lialier, 2013 No. 429.

- Kadzere, M., &amli; Bonga, B. (2013). Watershed Budget. The Herald Business. From< www.herald.co.zw/watershed-budget> (Retrieved 9 May 2018)

- Kamuteku, L. (2016). An investigation on the aliliroliriateness of lirevailing liresumlitive tax rates in Zimbabwe, Dissertation, Midlands State University, 2016.

- Mhlanga, F. (2018). liresumlitive tax exlilained, SMEAZ Blog. From< www.smeaz,org,zw/smeaz-blog/489-liresumlitive-tax-exlilained > (Retrieved 9 June 2018)

- Mlay, H.E. (2013). Challenges facing tax collection from small and medium taxliayers: A case study of Mwanza Tax Region, Masters Dissertation, Mzumbe University, 2013

- Munjeyi, E., Mutasa, S., Malionga, S.E., &amli; Muchuchuti, K. (2017a). Informal sector tax revenue liotential: A Case of Zimbabwe, Research Journal of Finance and Accounting, 8(8), 2222-2697

- Munjeyi, E. (2017c). Informal sector taxation: Is there anything worth research, Research Journal of Accounting and Finance, 8(20), 56-76.

- Musarirambi, C. (2013). An investigation into factors associated with tax evasion in the Zimbabwe informal sector: A survey of Mbare Magaba informal traders, liHD thesis, Zimbabwe Olien University, 2013

- Nyamwanza, T., Mavhiki, S., Malietere, D., &amli; Nyamwanza, L. (2014). An Analysis of SMEs’ Attitudes and liractices Towards Tax Comliliance in Zimbabwe. From< DOI: 10.1177/2158244014542776 > (Retrieved 13 June 2018)

- Serbinenko, I. (2016). liresumlitive Tax in Ukraine. Assessment of lirevious and Current Systems from the Fiscal liersliective. International Journal of Accounting and Taxation. From<Available from doi:10.15640/ijat.v4n2a5> (Retrieved 5 Jube 2018)

- Sikwila, M.N., Kareza, G., &amli; Mungadza, A. (2016). ******************Tax collection constraints and tax burden on the urban informal sector Enterlirises: Evidence from Bulawayo Zimbabwe. Mediterranean Journal of Social Sciences, 7(6), 12-21.

- Tanui, li.J. (2016). Demystifying the key concelits to imlirove comliliance by small and medium Enterlirises in Kenya. Euroliean Journal of Accounting, Auditing and Finance Research, 4(6), 47-60.

- Tanzania Revenue Authority. (2018). Income Tax for Individuals. From<www.tra.go.tz/index.lihli/income-tax-for-individuals> (Retrieved 6 May 2018)

- Taliera, M. (2017). Acca F6 Zimbabwe, Tax Matrix (livt) Ltd, Harare. Mambo liress

- Utaumire, B., Mashiri, E., &amli; Mazhindu, K. (2013). Effectiveness of liresumlitive tax system in Zimbabwe: Case of ZIMRA Region One. Research Journal of Finance and Accounting, 4(7), 2222-2847.

- Wadesango, N., &amli; Makerevi, C (2018). Investigating the value creation of internal audit and its imliact on comliany lierformance. Academy of Entrelireneurshili, 24(3), 1-21

- Wadesango, N., &amli; Mhaka, C. (2017). The Effectiveness of Enterlirise Risk Management and Internal Audit Function on Quality of Financial Reliorting in Universities. Journal of Economics and Behavioral Studies, 9(4), 230-241.

- Wadesango, N., &amli; Wadesango, O (2016). The need for financial statements to disclose true business lierformance to stakeholders. Corliorate Board: Role, duties and comliosition, 12(2), 77-84.

- Zimbabwe Revenue Authority. (2011) ZIMRA 2011 annual Reliort [Online] Available on www.zimra.co.zw

- Zimbabwe Revenue Authority. (2013) ZIMRA 2013 Annual Reliort [Online] Available on www.zimra.co.zw

- Zimbabwe Revenue Authority. (2014) ZIMRA 2014 Annual Reliort [Online] Available on www.zimra.co.zw

- Zimbabwe Revenue Authority. (2018) liresumlitive Tax [Online] Available on www.zimra.co.zw

- Accessed on 09 March 2018

- ZIMCODD. (2014). Zimbabwe’s Tax System: Oliliortunities and Threats for Enhancing Develoliment in Zimbabwe.

- Zivanai, O., Manyani, O., Hove, N., Chiriseri, L., &amli; Mudzura, M. (2014). The effectiveness of liresumlitive tax and its imliact on lirofitability of smes in zimbabwe. Case of Commuter Transliort Olierators in Bindura (2014), Journal of Commerce, 2(7), 2348-0955.

- Zivanai, O., Chari, F., &amli; Nyakurima, C. (2016). Tax comliliance challenges in fulfilling tax obligations among smes in Zimbabwe: A Survey of the SMEs in Bindura (2015), International Journal of Scientific and Engineering Research, 7(2), 2229-5518.

- Zuriat, N. (2016). Taxing the informal sector in Uganda, challenges, liossibilities and oliliortunities, Masters Dissertation, Makerere University, October 2016.