Research Article: 2018 Vol: 22 Issue: 1

An Investigation of Macroeconomic Determinants of FDI Inflows In Bangladesh

Haider Mahmood, Prince Sattam bin Abdulaziz University

Keywords

FDI Inflows, Co-integration, Income, Democracy.

Introduction

The countries with a good history of smooth economic and social sectors are desired by foreign countries for long term investment to be benefited with profit maximization. FDI may claim as an important factor for the developing nations to grow. In the past two decades, FDI by the external Transnational Corporation (TNC) is becoming a prime source of the finance for underdeveloped economies. FDI is generally conceptualizing homogenous flows of capital through which countries earn more profit.

FDI may come up in number of forms. The foreign firm invests in home country by providing the capital to install a new asset, like a production plant, building and machinery, etc. Capital investments are aimed at expansion of operation level, replacement of worn out or outdated assets. Further, renewal might involve rebuilding, retrofitting or overhauling an existing asset. FDI by host country in form of capital investment has intention to increase the home country firms’ profits and productions.

In the further categories of FDI, merger or accusation of the firms in home country is a very famous and active kind of investment especially if the previously public operated firms are going to be privatized. In mergers or accusations, the countries involved their personal interest to do business transactions. An acquiring enterprise of host country purchases the target enterprise of home country. On the other hand, joint ventures create a partnership between the home and host countries for mutual benefits and it is also a common form of FDI. It is similar to partnership where the home and host countries’ enterprises share in the profits and losses. It generally formed for a specific purpose and may not continue for unlimited period. In addition, a contract term also brings inflow of FDI by signing a contract among firms of home and host countries like franchises, licenses, etc. Franchising is a business model in which the innovator (franchisor) allows to use his reputation and goodwill to franchisee.

Financial investments affect the country at micro as well as macro level. Financial investments and onward reinvestment of funds lead to develop an economy which may be considered as most desirous and demanding activity for up-to-date capitalistic economies. FDI is hallmark and a debating issue of today’s developing countries. Insufficient domestic resources can be termed as object gap. The existence of such capital gaps appreciates the inflows of FDI which can modernize the economy by bridging the foreign technology, management techniques and production processes gaps. Hence, FDI helps to close ‘object gap’ and may improve the income and living standards of the economy.

There can be number of determinants which may attract the FDI inflows. Further, a lower level of FDI may keep the pace of progress of developing countries at a slower speed. Many researchers have laid a focus on this topic and conclude widespread researches to crack the notion of the topic from various countries perspective in different period of time by considering a number of variables. In a pioneer study, de Mello (1997) suggests some supply-sided factors instead of demand-sided factors of FDI inflows. A firm is targeting a low cost of production to raise her profit. Therefore, it transfers its some of production process or a whole production process to those countries where the cost of human resource, cost of transportation and cost of other resources are relatively low. The trend of FDI may be influenced by a number of variables including demand and supply-sided factors. The present paper is particularly focusing on the macroeconomic factors. An interesting fact has been observed that 40% of the total FDI of the whole world has been received by developing economies. The reason of this fact might be claimed that developing nations are relatively less affected by the global financial crises and recessions. But, Bangladesh could attract a very low level of FDI till now. Therefore, this is extremely important to explore the factors of FDI inflows in Bangladesh to highlight the major reasons for a low level of FDI.

Literature Review

There are numerous researches on finding the causes of FDI inflows. For example, Majeed and Ahmad (2008) investigate this issue for twenty-three developing economies and find that cheap labour is the most important cause of FDI inflows. Further, they find that increasing urbanization helps a lot in attracting FDI. Therefore, they conclude that both demand-sided and supply-sided factors, which may increase the profitability of firms, are important in attracting FDI. Chowdhry and Mavrotas (2006) conduct an innovative study to test the traces of causality in FDI and GDP of Chile, Malaysia and Thailand for a period 1969-2000. They find bidirectional causality between FDI and GDP. Hsiao and Shen (2003) examine this relationship and find that GDP is affecting the FDI inflows. Therefore, GDP is proved as a significant and optimistic indicator of FDI flows in host country. Further, they also find the two way relationship between FDI and GDP as well. Schneider and Frey (1985) have identified that economic factors are more important for a democratic country to attract the FDI inflows. In the empirical exercise, they find that income per capita and secondary education has positive effects on FDI. Further, balance of payments deficit, wage cost and inflation have negative effects on FDI. Therefore, high inflation rates, wage cost and balance of payments deficit in developing countries are resulted in lesser FDI inflows.

Shah and Masood (2003) investigate the causes of FDI inflows in Pakistan by applying co-integration technique on a time period 1960-2000. The authors have considered the real economic fundamentals related to FDI. In their empirical findings, highly significant coefficients for cost of capital, tariff and expenditure on transport and communication are signalling for greater public sector role in attracting FDI in Pakistan. Nawaz et al. (2012) find that extreme fluctuations in the exchange rates are caused by dictatorship and turmoil of democracy which have strongly negatively impacted the FDI inflows in Pakistan through this severe exchange rate volatility. The consequences of volatility of exchange rate are high cost of production and high inflation rate. Therefore, foreign investors feel reluctant to invest in Pakistan.

In a relationship of FDI and democracy, Jensen (2003) explains the impact of federalism on FDI. He argues that TNC primarily prefers political benefits of investing along with economic benefits. A country might be considered to be more credible and trustworthy in the presence of federalism. So, investors are attracted to these countries because of low political risk there. He conducts empirical analysis for 114 countries and corroborates that countries with more democracy receive more FDI inflows because these are supposed to be more credible for their local and international commitments. Li and Resnick (2003) argue that established democracy and host government’s established policies may attract the foreign investors. But if government provides fewer incentives to the foreign investors then it may hinder the FDI inflows. They discuss that democratic countries may gain their credibility in eyes of foreign investors by providing political and legislative stability. In the empirical testing of FDI and democracy relationship for 52 countries, they find that higher level of democracy increases FDI inflows but if we consider property rights with democracy. But, higher level of democracy with improper property rights protection reduces FDI inflows. Therefore, higher level of democracy accompanied by property rights can only attract the FDI inflows. Mahmood (2016) investigates the determinants of bilateral FDI inflows of Pakistan from twenty-four countries by using a time period of 1985-2014. He finds positive influences of income and volume of trade on FDI inflows in long and short runs through panel co-integration technique. Further, a positive impact of democracy has also been found in short run.

Since this study is featured to investigate the determinants of FDI inflows for a developing economy of Bangladesh. It is thought-provoking to highlight that what are the factors which have been leading in attracting FDI in Bangladesh? The literature discussed above have highlighted the importance of some macroeconomic and political indicators i.e., income levels, trade, inflation and democracy. Utilizing these factors, this study is going contribute in the FDI literature of Bangladesh by finding the macroeconomic and political determinants of FDI inflows.

Methodology

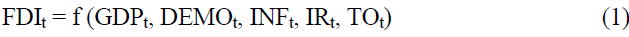

Published literature has highlighted many important factors, at micro and macro level, of FDI inflows. However, this paper focuses only on the major macroeconomic and political indicators and proposes the following model:

In equation 1, dependent variable is FDI inflows of Bangladesh. On the right hand side of equation 1, Bangladesh’s GDP, democracy, inflation rate, interest rate and trade openness are taken as independent variables respectively. Time series for a period of 1975-2015 are utilized for estimation. The increasing institutional quality through democracy index can have positive influence on the trends of FDI. Therefore, it is expected to have positive impact on the FDI inflows. GDP is proxy for the demand condition and income level of a country which may support the FDI inflows by providing greater market for the investments. Therefore, increasing GDP is expected to attract more FDI and it could have positive influence on the inflows of FDI. In the relationship of inflation and FDI inflows, inflation can harm the profitability of investment by increasing cost of production. On the other hand, it can also attract the greater FDI if inflation is demand pull and it can provide more profits to foreign investors. However, the exact relation is an empirical question and need to be tested. The increasing interest rate can attract more portfolio investment and it can have positive influence in the inflows of FDI as well. Lastly, the influence of trade openness can have positive influence on FDI inflows if openness policy is attract for foreign investors to sell their product in the international market with lesser trade restrictions. But, it can have negative effect if increasing openness is increasing competition for the foreign investors. Therefore, we can hypothesize the both positive/negative relationship in FDI inflows and trade openness and the exact relationship could only be corroborated with empirical exercise.

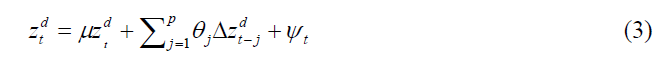

Most of macroeconomic series may have unit root problem. For this purpose, we utilize the DF-GLS test offered by Elliot et al. (1996). This test follows the de-trending series procedure which has better ability to determine the series to be stationary or not. The de-trending procedure is as follows:

z may carry any variable for unit root analysis. Once series (z) is detrended with (2), we may apply usual Augmented Dickey Fuller (ADF) test as follows:

This test utilizes the same t-distribution suggested by usual ADF test. A rejection of null hypothesis μ= 0 would certify the fact of stationarity in a series. Equation (3) can further be extended by incorporating the time element in the analysis to test series with time trend. Further, the test of the equation (3) would be applied on the levels and differences of variables to verify the stationarity of all variables in our model (1).

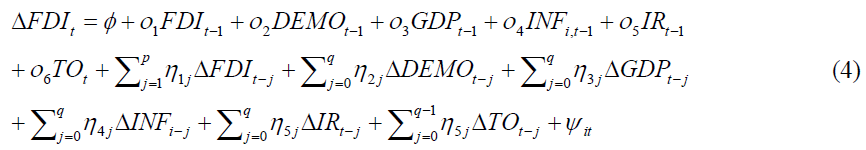

Further, ARDL co-integration of Pesaran et al. (2001) is chosen, for its superiority of efficiency in mix order of integration, for regression analysis. ARDL is presented in equation (4). It will be used to find the long as well as short run estimates.

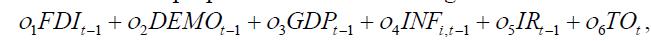

The purpose of including the first lag of level variables,  in the equation (4) is to apply the bound test with null hypothesis of,

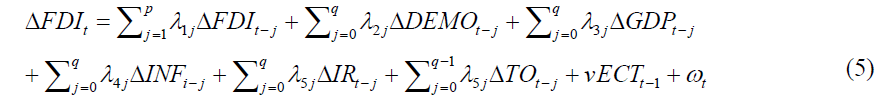

in the equation (4) is to apply the bound test with null hypothesis of,  to test the presence of cointegration in (4). The presence of long run relationship is pre-condition for any further analysis afterwards. Once we establish the long run relationship in (4), we can calculate the effects of our independent variables on FDI inflows by normalizing the coefficients of lagged independent variables normalize by coefficient of lagged dependent variable. Further, the lag lengths are captured in the differenced variables to find the optimum lag length in (4) through AIC, to correct the endogeneity issue and to estimate the robust and reliable results from (4). After testing co-integration, short run results can also be estimated with the Error Correction (EC) model by including the ECTt-1 term in equation (4) by the following way:

to test the presence of cointegration in (4). The presence of long run relationship is pre-condition for any further analysis afterwards. Once we establish the long run relationship in (4), we can calculate the effects of our independent variables on FDI inflows by normalizing the coefficients of lagged independent variables normalize by coefficient of lagged dependent variable. Further, the lag lengths are captured in the differenced variables to find the optimum lag length in (4) through AIC, to correct the endogeneity issue and to estimate the robust and reliable results from (4). After testing co-integration, short run results can also be estimated with the Error Correction (EC) model by including the ECTt-1 term in equation (4) by the following way:

In equation (5), v is the coefficients of ECTt-1 to conclude the possible presence of short run relations in the model. The negative and significant coefficients may be claimed for an evidence of short run relationship. Further, coefficients of lagged differenced variables may utilize for the discussions of short run impacts.

Data Analysis

Table 1 presents DF-GLS results and shows a mix order of integration. FDIt, GDPt, INFt and TOt are non-stationary at their levels but are stationary after first differencing. Further, DEMOt and IRt are stationary at levels. But, we can proceed for regression analysis as ARDL is efficient in presence of mix order of integration.

| Table 1: Df-Gls Test | ||||

| Variables | At Level | Differenced | ||

|---|---|---|---|---|

| C | C & T | C | C & T | |

| FDIt | 0.8547 (1) | -1.9629 (1) | -1.9172 (1)** | -3.5365 (0)*** |

| DEMOt | -6.2541 (1)*** | -5.9874 (1)*** | -- | -- |

| GDPt | -0.8457 (1) | -1.5478 (1) | -2.9874 (0)*** | -4.1541 (0)*** |

| INFt | -0.8745 (1) | -2.5418 (1) | -5.5478*** (0)* | -6.5416 (0)*** |

| IRt | -3.2541 (2)*** | -4.8745 (1)*** | -- | -- |

| TOt | -1.2541 (1) | -1.6541 (1) | -7.9491 (0)*** | -8.7753 (0)*** |

Table 2 shows regression results from ARDL methodology. Our estimated model has long run relationship as F-value from bound test is higher than critical values at 5% significance level. Further, our estimated model is out any diagnostic issue as all tests are showing p-values larger than 0.1 and CUSUM test also shows the stability of estimated parameters.

| Table 2: Ardl Results | ||||

| Variable | Coefficients | S.E. | t-stat | Prob. |

|---|---|---|---|---|

| Long Run Results | ||||

| DEMOt | 0.5416 | 0.2143 | 2.5269 | 0.0266 |

| GDPt | 0.0370 | 0.0120 | 3.0865 | 0.0094 |

| INFt | 6.1628 | 4.3362 | 1.4212 | 0.1807 |

| IRt | 0.1958 | 0.05087 | 3.8487 | 0.0023 |

| TOt | -0.8905 | 0.2241 | -3.9729 | 0.0018 |

| C | -36.2031 | 8.2793 | -4.3727 | 0.0009 |

| Short Run Results | ||||

| ?DEMOt | 0.1213 | 0.1614 | 0.7515 | 0.7562 |

| ?DEMOt-1 | -0.2289 | 0.1639 | -1.3965 | 0.1983 |

| ?GDPt | 0.0876 | 0.0744 | 1.1786 | 0.2614 |

| ?GDPt-1 | 0.1487 | 0.0827 | 1.7973 | 0.0975 |

| ?INFt | 1.5954 | 1.5881 | 1.0046 | 0.3127 |

| ?IRt | -0.3570 | -0.1903 | 1.8789 | 0.0843 |

| ?TOt | -0.9779 | 0.1792 | -5.4561 | 0.0001 |

| F- Value (lower-upper bound values) | 4.0143 | 10% (2.08-3) |

5% (2.39-3.38) |

1% (3.06-4.15) |

| Heteroscedasticity | 0.5296 | 0.8718 | ||

| Serial Correlation | 0.2299 | 0.7986 | ||

| Normality | 1.6071 | 0.4477 | ||

| CUSUM Stability | Stable parameters | |||

In the impact analysis, democracy is positively affecting FDI in Bangladesh in long run but its short run result is insignificant. It proofs that political stability might be remained helpful in raising FDI inflows and vice versa. But most of developing countries, like Bangladesh, are facing political instability and weak institutional quality. A positive impact of democracy variable on the FDI inflows in Bangladesh is corroborating this fact that weak quality of institutions is responsible for low level of FDI in Bangladesh. Further, GDP is positively determined the FDI inflows in long and short runs. GDP is representing the demand side condition for FDI inflows as higher income may attract higher demand for product and in turn investments. The market size or income of Bangladesh has been remained effective in the supporting FDI activities in Bangladesh. GDP of Bangladesh is also growing over time and it is catching more FDI inflows consequently. Inflation is neither beneficial nor harmful for FDI inflows as it is showing insignificant effects both in long and short runs. Interest rate is showing a negative influence on FDI inflows in short run. A higher interest rate may be creating a cost push effect on the investment decision and FDI inflows are decreasing due to low profits of investments as advocated by de Mello (1997). He explains that investing firms are showing cost reducing behavior to increase the profits of their investments. On the other hand, interest rate is showing a positive influence on FDI inflows in the long run. In that period, higher interest rate may win higher inwards capital flights due to showing higher expected returns and this situation is also showing a sound monetary policy for FDI inflows. Lastly, trade openness is becoming a barrier for FDI inflows as it has negative effects on FDI inflows both in long and short runs. This is an amazing result as this negative relationship is proving the substitution effect between FDI and trade. It means that higher FDI inflows are due to reduction in demand for imports as imports’ substitutes can be delivered by foreign investors. Alternatively, it can also be claimed that higher trade in Bangladesh is closing the doors and opportunities for foreign investors to invest because of increasing foreign competition of imported products in the local market.

Conclusion

FDI inflows are major targets of developing nations to invite foreign exchange in the country and also to fill the saving-investment gap. This paper has been aimed at finding the macroeconomic and political determinants of FDI inflows in Bangladesh by using data of a period 1975-2015. The empirical exercise exerts that co-integration has been proved in the model. In the long run, GDP, democracy and interest rate are positively influencing the FDI inflows in the Bangladesh. But, the effect of inflation has been observed insignificant. Trade openness is creating a negative effect on the FDI inflows. Therefore, we can conclude that market size and interest rate, as indicator of monetary policy, are providing a healthy environment for the foreign investors to invest in Bangladesh. It may consequently attract a significant amount of FDI with a positive movement in the said variables. A positive relationship of democracy and FDI inflows does mean that a low level of democracy in Bangladesh is responsible for lower level of FDI inflows. Further, a negative relationship of trade openness and FDI inflows suggest that trade openness is harmful for FDI inflows. This result also corroborates that trade openness is competing the FDI inflows. Therefore, more openness in trade might be harmful for the FDI inflows. Based the results, this paper recommends the government of Bangladesh to improve the democracy conditions and economic growth to attract FDI inflows as both variables have positive effects on FDI inflows. Further, trade openness needs qualitative restrictions on the products which are locally manufactured by foreign investors in the Bangladesh.

References

- Chowdhry, A. & Mavrotas, G. (2006). FDI and growth: What causes what? The World Economy, 29(1), 42-58.

- De Mello, L.R. (1997). Foreign direct investment in developing countries and growth: A selective survey. Journal of Development Studies, 34(1), 1-34.

- Elliot, G., Rothenberg, T.J. & Stock, J.H. (1996). E?cient tests for an autoregressive unit root. Econometrica, 64, 813-836.

- Jensen, N.M. (2003). Democratic governance and multinational corporations: The political economy of foreign direct investment. International Organization, 57(3), 587-616.

- Li, Q. & Resnick, A. (2003). Reversal of fortunes: Democratic institutions and foreign direct investment inflows to developing countries. International Organization, 57(1), 175-211.

- Mahmood, H. (2016). Determinants of bilateral foreign direct investment inflows in Pakistan from major investing countries: A dynamic panel approach. Journal of Applied Economic Sciences, 11(7), 1471-1476.

- Majeed, M.T. & Ahmad, E. (2008). Human capital development and FDI in developing countries. Journal of Economics Cooperation, 29(3), 79-104.

- Nawaz, T., Khan, M.A., Shah, M.A.A. & Aleem, M. (2012). Impact of democratic/non democratic regimes on foreign direct investment in Pakistan: Pre and post. September 11, 2001 Scenarios. Pakistan Journal of Commerce and Social Sciences, 6(1), 67-82.

- Pesaran, M.H., Shin, Y. & Smith, R.J. (2001). Bounds testing approaches to the analysis of level relationships. Journal of Applied Econometrics, 16, 289-326.

- Schneider, F. & Frey, B.S., (1985). Economic and political determinants of foreign direct investment. World Development, 13(2), 161-175.

- Shah, Z. & Masood, Q.A. (2003). The determinants of foreign investment in Pakistan: An empirical investigation. The Pakistan Development Review, 42(4), 697-714.