Research Article: 2020 Vol: 24 Issue: 6

An Investigation of The Determinants of Capital Structure and The Effects of Credit Rating on Capital Structure: Evidence from A Panel Data Analysis in UK Market

Riyad Al-Hindawi, Institute of Banking Studies in Jordan

Abstract

The Objective of the study is to investigate the determinants of capital structure in the UK for the period 2012-2017 and the impact of credit rating on capital structure. The study employs a panel data of 138 firms, of which 69 are credit rated and the remaining are non-rated. The study uses a static model in order to investigate the determinants of capital structure and the effects of credit ratings on leverage. The results show that, as a category, firms with a credit rating use more debt than non-rated firms. However, within the categories, the results suggest that the level of firms’ credit ratings is negatively related to leverage.

Keywords

Capital Structure, Leverage, Credit Rating and UK Market.

JEL Classifications Code:

G32

Introduction

The aim of this paper is twofold: first, to investigate the empirical evidence of the determinants of capital structure in the UK market during the period 2012-2017. Second, to investigate the effects of credit ratings on capital structure. The study develops a static model based on the previous studies of the determinants of capital structure. The model includes two kinds of variables. First, the capital structure determinants. Second, the variables that proxy for the firms’ credit ratings.

The contribution of the study arises from the following: Most of the previous studies that addressed the capital structure mixture have been examined using US market data. Hence, it is important to investigate capital structure theories in other developed markets such as the UK market. The study discusses the reasons why credit ratings may be relevant for managers in the capital structure decision process. In addition, the study empirically investigates the effects of credit ratings on the financial gearing in the UK market. Moreover, in terms of the effect of credit ratings on capital structure, the study extends the works of Kisgen (2006, 2009); Graham & Harvey (2001); and Shivdasani & Zenner (2005). It is worth noting that little prior research has addressed the relationship between the credit rating and financial gearing. Moreover, the research in this area has been done using data from the US market There appears to be no study that has investigated the effects of credit ratings on financial gearing in the UK market. Hence, it is important to investigate this issue in the UK market. In addition, the study investigates how the effects of credit rating on financial complement the existing capital structure theories.

The study organized as follows. The literature review will be discussed in section (2). Section (3) explains the methodology of the study. Section (4) discusses the results of estimating the models and its discussion.

The Literature Review

Capital Structure Theories

Since the seminal work of Modigliani & Miller (1958), researchers have continued to investigate how firms finance their projects. Modigliani & Miller (1958) argue the firm’s value is independent of its financial structure under certain assumptions However, Modigliani and Miller (1963) contend that due to the deduction of interest payments from the firm’s taxable earnings, the capital structure mix is relevant to a firm’s value.

It has been argued that several theories have been proposed to explain the capital structure question Barclay & Smith (1999) and Harris & Raviv (1991). This section gives a brief explanation of the capital structure theories. The study discusses four theories of capital structure. These are the tax-approach theory, the agency theory, the pecking order theory and the target capital structure theory.

The tax-approach theory suggests that the main reason of using debt relative to equity is the existence of tax-shield caused by using debt rather than equity (DeAnglo & Masulis, 1980; Miller, 1986). This is attributed to the deduction of interest on debt from the firm’s taxable earnings (DeAnglo & Masulis, 1980; and Miller, 1986). DeAnglo & Masulis (1980) argue that, ceteris paribus, as the corporate tax rate is raised, the firm will substitute debt for equity financing. They claim that firms subject to lower corporate tax rates employ less debt in their capital structures. DeAnglo & Masulis (1980) predict a positive relationship between the effective corporation tax rates and leverage. Lymer & Oats (2006) argue that the marginal rate of tax is the rate of tax which is due of the taxpayer earns ?1 more than its current income. Ashton (1989) argues that the UK tax system differs from the US system and that its relevance to the practice of UK financial decisions is nonexistent. Ashton (1989) contends that the tax advantage of debt is less under the UK tax system than it is under the US classical system. He claims that this is because of the tax imputation system in which the gross dividend can be offset against the firm’s corporation tax liability. Thus, it is predicted to find lower levels of debt in the UK than in the US. Panno (2003) argues that the tax deductibility of interest affects all firms in the same way at given point in time, and cannot therefore explain cross-sectional differences between firms.

Agency theory is another theory proposed to explain the capital structure mix. This theory was proposed by Jensen & Meckling (1976). According to the agency costs theory, a firm’s capital structure is determined by minimizing agency costs, i.e., costs related to conflicts of interests between various groups, which have claims on the firm’s resources. The agency theory suggests that the driving force behind financing projects by debt is the resolution of the agency conflicts and, in the long run, by tax advantages (Jensen, 1986). This implies that when firms make their financing decision, they evaluate the advantages that may arise from the resolution of the conflicts between managers, shareholders and from long–run tax shields. Jensen (1986) points out that since debt commits the firm to pay out cash, it reduces the amount of free cash available to managers to engage in the type of pursuits that managers want, which are not in the interests of shareholders. Harvey et al. (2004), argued that the incremental benefit of debt is concentrated in firms with high expected managerial agency costs that are also most likely to have overinvestment problems resulting from high levels of assets in place or limited future growth opportunities. Singh & Davidson (2003), found that leverage in large firms that is relatively related to agency cost measure.

The pecking order theory of capital structure is an application of the asymmetric theory. This theory is proposed by Myers (1984) based on the works of Myers & Majluf (1984). Myers (1984) argues that firms finance their projects by using internal resources first, then through using debt, and finally, by issuing equity as the last resort. It has been argued that in the pecking order theory, the attraction of interest tax-shield and the threat of financial distress are assumed to be of second order. The pecking order theory suggest that a change in debt levels happens when there is an imbalance between internal cash flow, net of dividends, and real investment opportunities (Shyam-Sunder & Myers, 1999). Shyam-Sunder & Myers (1999) contend that changes in debt ratios are driven by the need for external funds, not by any attempt to reach an optimal capital structure. Myers (1984) points out that in the pecking order theory, firms take “the path of least resistance” and choose what then appears to be the low-cost financing instrument, which is debt. Frank & Goyal (2003) contend that the pecking order theory implies that financing the deficit should wipe out the effects of other variables. Myers (2001) argues that when the firm can issue either debt or equity to finance its new investment, debt has the prior claim on assets and earnings; equity is the residual claim; thus, investing in debt is less exposed to errors in valuing the firm.

The target capital structure theory suggests that firms have a long-run target capital structure. The target capital structure theory argues that firms use debt or equity or both in order to move toward their target capital structure. Marsh (1982) argues that a firm’s choice of financing instrument relies on the difference between the firms’ current and target debt ratios. It has been argued that the overall capital structure target is a function of bankruptcy risk, and the tax benefits (Marsh, 1982). According to the static-trade-off theory, the firm sets a target of debt–to-value ratio (target capital structure) and gradually it moves towards it, and that the firm changes equity for debt, or debt for equity until the value of the firm is maximized (Myers, 1984; Cai & Ghosh (2003) argue that by assuming that the goal of the firm is to maximize the value of the firm, when a firm’s capital structure is different from the optimal capital structure, then the firm tries to “correct” it. Hence, when a firm’s gearing is below the firm’s optimal gearing ratio, the firm adjusts its gearing upward, and when a firm’s gearing is above the firm’s optimal gearing ratio, the firm decreases its debt level. Hovakimian et al. (2004) conclude that firms that follow a dynamic trade-off strategy select the amounts of new debt and equity so that the deviation from the target induced by accumulation of earnings and losses is offset and the resulting debt ratio is close to the target.

The Impact of Credit Rating on Capital Structure

It has been argued that the interest in credit rating services has significantly increased over the past three decades (Cantor, 1994). Regulators, banks and bondholders, pension fund trustees and other fiduciary agents have made increasing use of ratings in their decisions. Consequently, the use and the impact of credit rating on the securities market has grown significantly, and increasingly act as benchmarks or creditworthiness standards, far beyond their initial purpose (Gonzalez, 2004). Furthermore, White (2001) argues that the proposals by the Bank of International Settlement (BIS) to include borrower’s credit ratings in assessment of the capital adequacy of banks’ capital have highlighted general interest in the credit rating industry. The importance of credit rating to capital structure decision-making has been recently recognized. The literature on the impact of credit ratings on the capital structure mixture is quite limited. It is worth mentioning that the first research that found such evidence is Graham & Harvey (2001). Graham & Harvey (2001) found that credit rating is the second important factor on deciding the financial policy. Kisgen (2006, 2009) found that credit rating influences the capital structure decisions. Gonzalez (2004) argues that achieving a desired rating is frequently incorporated into corporate goals and represents an integral part of the financing strategy of companies. Bancel & Mitto (2002) replicate Graham and Harvey’s (2001) approach, using survey from European countries; and found that credit rating is the second important factor influencing the debt policy.

Kisgen (2009) mention many reasons behind the idea that credit ratings are likely to affect capital structure decisions. First, the regulatory effects: several regulations that affect financial institutions and other intermediaries are directly tied to credit ratings. As a result, although a firm itself may not have higher risk of default, it may be required to pay a higher interest rate on its debt merely as a result of its credit rating. Second, the market segmentation: bonds are categorized by their credit ratings. Third, the third party relationship: credit ratings may materially influence relationships with third parties, including the employees of the company, suppliers to the company, or clients of the company. Fourth, the pooling effects: credit ratings supply information to firm’s stakeholders relating to the quality of a company beyond what is discernable from publicity available information. Firms are likely to be pooled with other companies in the same rating group. As a result, all companies within the same rating category would be evaluated as having similar default probabilities and associated yield spreads for their bonds. Fifth, the ratings triggers: firms may be concerned about credit ratings since triggers may exist for changes in ratings (for example, bond covenants may be directly tied to the credit rating of the firm, forcing certain actions to be taken by the firm, given a downgrade that may be costly).

Kisgen (2009) examines how credit rating complements the current capital structure theories, especially the trade-off and the pecking order theories. Kisgen (2009) argues that credit rating and capital structure hypotheses state that a credit rating change has a discrete cost/benefit. If this cost is material, managers will balance that cost against the costs and benefits implied by the trade-off theory. In certain cases, the costs associated with a change in credit rating may then result in different capital structure behavior than the trade-off theory alone. In other cases, the trade-off theory factors may outweigh the credit rating considerations. Kisgen (2006) argues that the trade-off and credit rating effects together imply firms will balance the traditional trade-off benefits of higher leverage against the traditional benefits of lower leverage and those discrete credit rating benefits of lower leverage. Kisgen (2009) suggests that assuming that for some level of leverage both credit rating and capital structure hypotheses and pecking order effects are material, a firm faces a trade-off between the costs of issuing equity versus the discrete cost associated with a potential change in credit rating. He points out that this conflict exists most strongly for firms that are near a change in rating, near to an upgrade as well as a downgrade.

Shivdasani & Zenner (2005) contend that there is crucial debate about benefits and the costs of more or less leverage and the corresponding credit rating. Shivdasani & Zenner (2005) suggest that highly rated firms face a question of whether they should use their financial flexibility to lever up and buy back shares. On the other hand, low-rated firms take financing strategies that keep or strengthen their credit rating.

Kisgen (2006) argues that firms exhibit behavior consistent with targeting minimum ratings; following rating downgrades, firms undertake significantly greater leverage reducing capital market activity to regain their target rating, while upgraded firms do not undertake more or less leverage reducing activity. This effect is most pronounced at ratings near the investment grade/speculative distinction. Shivdasani & Zenner (2005) claim that a highly levered firm at the edge of investment-grade can ill afford to take the chance that it might be downgraded. They argue that such a firm cannot afford an unexpected increase in interest rates, which will result in decline in its cash flow. Steeman (2002) argues that firms’ level of debt is an indicator of the inherent credit risk (the firms’ risk of default). He claims that debt levels can be linked to a certain credit rating, the higher the leverage, the lower the credit rating, and the better the business position the more leverage is acceptable. Heine and Harbus (2002) claim that when a firm’s cash flows are strong, debt is likely to pay back to a level consistent with the firm’s target credit rating. If firm’s cash flows are not enough, management is likely to increase its leverage ratio to move to a temporarily higher level (corresponding to a lower “fallback” rating ) in order to finance investment.

Kisgen (2009) proposes that firms for example are likely to target ratings around the change from investment grade to speculative grade (BBB- to BB+). He argues that this is due to the fact that a speculative grade rating forbids some investors from investing in a firm’s bonds, and increase capital charges for other investors (Cantor and Packer, 1997). Kisgen contends that ratings are also most prevalent around the change in rating from investment grade to speculative grade.

Methodology

Determinants of Capital Structure

It is worth noting that the determinants (the independent variables) of capital structure that are included in the model are based on the main theories of capital structure (the tax-shelter theory, the agency theory, and the asymmetric information theory). In addition, the variables included in the model are based on the previous empirical studies that investigated the determinants of capital structure (Jordan et al., 1998; Bevan & Danbolt, 2002, and 2004; Panno, 2003; and Ghosh & Cai, 2000). The determinants of capital structure that are included in the model are: Tax burden, Asset structure, Profitability, Size, and Age.

Tax Burden

The basic corporate profit tax treatment permits the deduction of interest payments in the calculation of taxable income. Thus, using debt in a firm’s capital mixture decreases its expected tax liability and increases its after-tax cash flow (Barclay & Smith, 1995). Taggart (1985) argues that corporate debt enjoys a net tax advantage when corporate tax rates exceed marginal personal tax rates. DeAnglo & Masulis (1980) predict a positive relationship between the effective corporation tax rates and leverage because of the benefit of debt financing resulting from the tax deductibility of interest from taxable earnings.

However, several studies related to the tax advantage of debt in the UK market have pointed out that the tax benefit of debt is quite limited. Ashton (1989) contends that the tax advantage of debt is less under the UK tax system than it is under the US system. Ashton (1989) argues that this is because of the tax imputation system, in which the tax on the gross dividend can be offset against the firm’s corporation tax liability. Thus, it is predicted to find lower levels of debt in the UK than in the US market.

The proposed hypothesis is:

H1: Other things being equal, leverage is positively related to firms’ tax burden.

The study uses the ratio of the firmi’s tax paid during yeart divided by the firmi’s profit before interest and tax during yeart as a measure of firmi’s tax burden.

Asset Structure (Tangibility)

It has been argued that the conflict between debt providers and stockholders will make lenders face the risk of moral hazard (Bevan and Danbolt, 2002, and 2004). Therefore, debt providers may demand collateral (using the firms’ fixed assets) to reduce the moral hazard problem (Titman and Wessels, 1988; Williamson, 1988; and Harris and Raviv, 1990). Mackie- Mason (1990) argues that, according to the moral hazard hypothesis, high tangible asset values should encourage debt issues by lowering the associated moral hazard costs.

Several studies have indicated reasons for using asset structure as a determinant of capital structure. Myers & Majluf (1984) conclude that issuing debt secured by property avoids the costs associated with issuing shares. For this reason, firms that have assets that can be used as collateral may be predicted to issue more debt at attraction rate as debt may be more readily available. Masulis (1976), and Jensen & Meckling (1976) contend that stockholders of leveraged firms are likely to invest sub-optimally to expropriate wealth from the firm’s bondholders. They suggest that this may cause a positive relationship between leverage ratios and the ability of firms to collateralise their debt. If the debt can be collateralised, the borrower is restrained or limited to use the funds for a specified project. Rajan & Zingales (1995) contend that the rationale underlying using tangibility as a determinant of capital structure is that fixed assets are easy to collateralize, and hence, they decrease the agency costs of debt.

The proposed hypothesis is:

H2: Other things being equal, leverage is positively related to firms’ asset structure (tangibility).

The study uses the ratio of firmi’s fixed assets to firmi’s total assets as a measure of tangibility.

Profitability

Modigliani & Miller (1963) point out that firms, in general, prefer debt to equity due to the tax deductibility of interest payments from taxable earnings. This indicates that highly profitable firms would prefer to issue debt instead of equity in order to benefit from tax shields. However, the pecking order theory predicts that firms will prefer internal to external capital sources. Thus, firms that have high levels of earnings will choose to finance investments with retained earnings rather than issuing debt (Myers, 1984; and Myers & Majluf, 1984).

The proposed hypothesis is:

H3: Other things being equal, leverage is negatively related to the firms’ profitability.

The study uses the ratio of the firmi’s earnings before interest, taxes, and depreciation (EBIT) divided by firmi’s book value of the assets as a measure of profitability.

Size

Many studies have pointed out that leverage ratios are related to the firm’s size. Chua & Mcconnel (1982) argue that this may be attributed to the direct bankruptcy costs, which appear to constitute a larger proportion of the firm’s value as that value decreases, and that large firms are in general more diversified and less inclined to bankruptcy. Titman & Wessels (1988) propose that the cost of issuing debt and equity is related to firm size. Hence, small firms pay much more than large ones to issue equity and long-term debt. Bevan & Danbolt (2002) point out that larger firms are, in general, credit rated. Hence, they have access to non-bank debt financing, which is likely to be unavailable to small firms. Bevan and Danbolt (2002) argue that the positive coefficient of size indicates that large firms are regarded as being ‘too big to fail’ and hence, they have better access to the debt.

The proposed hypothesis is:

H4: Other things being equal, leverage is positively related to firms’ size.

The study uses the firmi’s total assets as a measure of firm size.

Age

Peterson & Rajan (1994) show that leverage decreases with firm’s age, but it increases with firm’s size. A natural explanation for this observation is that young firms tend to be externally financed while older firms tend to accumulate retained earnings. Michaelas et al. (1999) claim that one implication of the pecking order is to find a negative relationship between firm’s age and its leverage. In general, young firms are externally financed, exhibiting higher debt levels compared to older firms that realise more profits and finance operations using accumulated internal sources (Chittenden et al., 1996).

The proposed hypothesis is:

H5: Other things being equal, leverage is negatively related to firms’ age.

The study uses the natural logarithm of companies’ age since incorporation to measure firms’ age.

Credit Ratings Variables

The study uses two variables to investigate the credit rating effect on the financial gearing. Mainly, the study explores two effects of credit rating on financial gearing. Firstly, the effects of firms being credit rated or non-rated on financial gearing. Secondly, the effect of different categories of credit ratings on financial gearing. The credit rating variables that are included in the main model are:

1. CRNR, is a dummy variable equal to one for rated firms, and zero for non-rated firms. The study employs this variable to investigate the effect of firms being credit rated or not on the financial gearing.

It has been argued that leverage is a key determinant of firms’ credit rating (Borde et al., 1994). Borde et al. (1994) claim that firms’ business risk can be affected by it leverage ratio. This is because leverage is likely to magnify corporate returns or losses. It could be argued that managers of highly leveraged companies will not voluntarily secure a better letter rating because a low rating is likely to exacerbate market uncertainties about their ability to fulfil their obligation. Consequently, it could be suggested that the higher the financial leverage, the greater the possible adverse influences of variations in underwriting performance and economic shocks on a firm’s capability to fulfil its obligations to policyholders and investors.

Amato & Furfine (2003) showed that leverage is inversely related to credit rating and is statistically significant. Doumpos & Pasiouras (2005) also found that leverage had a negative effect on credit ratings. Pottier (1998 and 1999) argue that a high financial leverage is negatively related to credit ratings. Adams et al., (2003) found that the likelihood of being rated is negatively related to leverage. Shin & Moore (2003) found that with few exceptions, leverage has significant adverse effects on ratings for all four agencies.

The proposed hypothesis is:

H6: Other things being equal, there is a negative relationship between leverage and the firm being credit rated.

I. CRO is a discrete variable to describe firms’ credit ratings. CRO equals 14 for firms that have (AA+) rating (the highest credit rating in the sample), 13 for firms that have (AA) rating… 1 for firms that have (B-) rating (the lowest credit rating in the sample). The study employs CRO variable to investigate the effect of different credit ratings categories on financial gearing.

Shivdasani & Zenner (2005) contend that there is crucial debate about the benefits and the costs of more or a less leverage and the corresponding credit rating. Shivdasani & Zenner (2005) suggest that highly rated firms face the question of whether they should use their financial flexibility to lever up and buy back shares. On the other hand, low-rated firms need to employ financing strategies that help them keep or even strengthen their credit rating.

It has been argued that the trade-off theory predicts that profitable firms generate a lot of profits and so should issue debt to reduce their corporate income taxes. However, in practice, it is likely that the most profitable firms have high credit ratings and low leverage ratios. Shivdasani & Zenner (2005) suggest that the pecking order theory can explain that behaviour. They argue that firms prefer to use internal cash flows to make new investments instead of going to external capital markets. Furthermore, profitable firms generate more than enough cash to meet their investment needs. Hence, there is no obvious reason to raise capital. Thus, these firms are likely to work with decreased leverage (Shivdasani & Zenner, 2005). Kisgen (2009) argues that an implication of discrete benefits of higher ratings levels in the context of the trade-off theory is that a firm’s optimal leverage can be lower than the optimal leverage implied by traditional trade-off factors alone. Firms may choose a lower leverage to obtain the discrete benefits associated with a higher credit rating.

Steeman (2002) contends that firms should be concerned about the influence of using debt. He claims that an increase of debt is likely to lead to a deterioration of the credit rating. However, Steeman (2002) contends that the issuance of equity is generally having a positive impact on the credit rating.

The proposed hypothesis is:

H7: Other things being equal, leverage is negatively related to a firm’s credit rating.

Capital Structure Measures

Bevan & Danbolt (2002) point out that prior research has indicated that both level of gearing and determinants of gearing vary significantly depending on the definition of gearing adopted. Bevan and Danbolt (2002) results illustrate that there have been significant changes in the influence of each of their dependent variables upon various debt measures. Rajan & Zingales (1995) claim that the most relevant measure of debt levels depends on the goal of the analysis.

It could be argued that although the financial literature provides information about the variables that influence capital structure, and the nature of that influence, there is no indication of the appropriate functional form of the relationship. Empirical work has used either leverage (debt/ (debt + equity)) or gearing (debt/equity). It has been argued that the previous two measures are often used indiscriminately as a measure of capital structure. The formula for leverage ensures that the measure is constrained within the range 0 to 1, while that for gearing ensures non-negative values. Both measures have zero as the limit that signifies the absence of debt (Jordan et al., 1998).

Therefore, the study uses two measures of leverage (total debt):

2. TDTA: equals the firmi’s total debt divided by its total assets.

3. LTDE: equals the natural logarithm of the firmi’s total debt divided by its total share equity.

Data and Sample

The sample of the study is composed of two kinds of data. First, the firms’ financial information over the period 2012-2017. The source of this data is the OSIRIS database. The set of financial information included in the study is taken from the firms’ financial statements during the period 2012-2017. Second, the firms’ credit ratings. The source of this data is the Standard and Poor’s long-term credit rating for the period 2012-2017.

The reasons for choosing this period are: The financial data and the credit rating for the period 2012-2017 are updated for the UK market and not included in the previous studies, especially after the financial crisis and its effect on British companies. Hence, this gives the opportunity to update the empirical evidence of capital structure decision making and the impact of credit rating on financial gearing in the UK market.

Following the previous studies related to investigating the capital structure mixture and the credit ratings firms that operate in the financial sector (banks, insurance and investment firms) are excluded (Shyam-Surnder & Myers, 1999; Frank & Goyal, 2003; Rajan & Zingales, 1995; and Kisgen, 2006). Moreover, all the firms engaged in merger during the period of the study are excluded from the sample (Shyam-Sunder & Myers, 1999). The study includes only firms whose financial statements are available on the Osiris database. Firms with missing observations for any variable and for any year in the models are included in the sample. Finally, the sample includes only the firms that are listed in the London Stock Market. The initial sample is a set of all the firms for which credit ratings are available on Standard and Poor's ratings for the UK market during the period 2012-2017. After taking into consideration the previous criteria, this restricted the rated-firms sample to 69 credit-rated firms over the period 1999-2005. Due to the fact that one of the aims of the study is to investigate the effects of credit rating on the capital structure between rated and non-rated companies, the study adds a set of non-rated firms to the 69 credit rated firms. Therefore, we selected 69 non-rated firms, using simple random sampling technique, out of the whole firms (1866 firms) available on Osiris database using a random number generator in order to match the rated firms sample with non-rated sample. This makes the whole sample consist of 138 firms over the period 2012-2017 (The sample is a pooled sample for the period 1999-2005). The study uses the SIC classification for the firms’ industry classification. Eight sectors are represented in the sample. Table 1 explains the distribution of the industries of the sample.

| Table 1 Industry Classification for Credit Rated and Non-Rated Firms | ||

| Industry Classification SIC | Total number of Firms | Number of rated firms |

| Mining and Quarrying | 4 | 3 |

| Manufacturing | 60 | 27 |

| Electricity, Gas and Water Supply | 10 | 7 |

| Construction | 4 | 2 |

| Wholesale and Retail Trade | 17 | 8 |

| Hotels and Restaurants | 5 | 2 |

| Transport, Storage and Communication | 12 | 9 |

| Business Activities | 26 | 11 |

| Total | 138 | 69 |

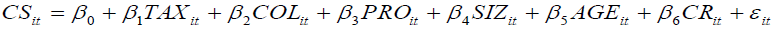

The Model

The study employs the below model to investigate the determinants of capital structure and the effects of credit rating on capital structure:

Where:

CSit: is a measure of firms’ capital structure measure.

β0: is the intercept.

TAXit: is the measure of the firm’s tax burden. It equals the ratio of firmi’s tax paid during yeart divided by its profit before interest and tax.

COLit: is the measure of the assets structure (tangibility). It equals the ratio of firmi’s total fixed assets divided by its total assets in yeart.

PROit: is the measure of profitability. It equals the ratio of firmi’s earnings before interest and tax in yeart divided by its total assets.

SIZEit: is the measure of the firm’s size. It equals the firmi’s total assets in yeart.

AGEit: is the firmi’s age. It equals the natural logarithm of firmi’s age since incorporation.

CRit: is the credit rating variable. The study uses three proxies to indicate credit ratings, CRNR, and CRO.

εit: is the error term.

Descriptive Statistics

In this section the descriptive statistics are reported for the sample.

The descriptive statistics in Tables 2 indicate the following:

| Table 2 Descriptive Statistics for the Credit Rated Firms | ||||

| Credit rated firms | Non-rated firms | |||

| Dependent Variable | Mean | Std. Dev | Mean | Std. Dev |

| TDTA | 0.322 | 0.197 | 0.244 | 0.166 |

| TDE | 0.794 | 7.105 | 0.635 | 1.122 |

| LTDE | -0.355 | 1.172 | -0.925 | 1.292 |

| TAX | 0.191 | 0.132 | 0.170 | 0.134 |

| COL | 0.633 | 0.196 | 0.519 | 0.246 |

| PROF | 0.143 | 0.0921 | 0.0867 | 0.304 |

| AGE | 50.75 | 40.85 | 41.4 | 28.95 |

| LOGAGE | 3.449 | 1.12 | 3.45 | 0.781 |

| TA (? 000) | 11,991,873.8 | 2,554,354 | 487,138.6 | 119,731 |

| CRO | 8.89 | 2.417 | - | - |

| Number of Firms | 69 | 69 | ||

1. All the mean values of the financial gearing measures ratios for the rated firms are higher for credit rated firms than for non-rated firms. This might be explained by the higher profitability (PROF) of credit rated firms compared with non-rated firms. DeAnglo & Masulis (1980) argue that highly profitable firms would prefer to raise debt instead of equity in order to benefit from the tax benefits. In addition, the higher leverage of credit rated firms may be explained by the higher ratios of tangibility.

2. The mean value of the tangibility variable (COL) is higher for credit rated firms than non-rated firms. This indicates that credit rated firms invest more in fixed assets compared with non-rated firms. In addition, this supports the idea that credit rated firms have more fixed assets to pledge the debt.

3. The mean value of the profitability (PRO) indicates that credit rated firms are more profitable than non-rated firms. This is may be attributed to the higher investment in fixed assets compared with nonrated.

4. Credit rated firms are older than non-rated firms (younger). The mean age of rated firms is 50.75 years, while it is 41.4 year for non-rated firms.

5. Credit rated firms are larger than non-rated firms. Credit rated firms have more total assets than nonrated firms.

6. The mean credit rating for credit rated firms is (8.89). This means that the mean credit ratings for the sample is (A-) for the period 2012-2017.

The Empirical Results and Discussion

The Model is estimated using panel data analysis over the period 2012-2017. It is worth noting that in order to test for multicollinearity, we use the variance inflation factor (VIF). It has been argued that as a rule of thumb, if the VIF of the variable exceeds 10, that variable is said to be highly collinear (Gujarati, 2003, p 362). The VIF for the variables included in the model are between (1.015-1.374) which indicates that the model does not suffer from any multicollinearity problems. Gujarati (2003) argues that the assumptions of the pooled sample, that the intercept and the slope coefficients are constant across time and firms and the error term captures differences over time, are highly restrictive. Therefore, despite its simplicity, the pooled regression model may distort the true picture of the relationship between the dependent and independent variables. The study investigates whether using panel data analysis is better than pooling the data. Furthermore, the study aims to investigate whether the fixed effects model or the random effects model is more suitable. Therefore, the model is tested using panel data analyses.

Investigation of the Determinants of Capital Structure

The results presented in Table 3 indicate that the Lagrange Multiplier test suggests that using panel analysis is more suitable than pooled on both dependent variables. The Hausman test implies that the fixed effect model is preferable than random model when using LTDE, while a random effect model is preferable to the fixed effect model when using TDTA.

| Table 3 Panel Analysis Diagnostic Results | ||

| Dependent Variable | LTDE | TDTA |

| Lagrange Multiplier test | 360.67 (0.000) |

783.4 (0.000) |

| Hausman test | 16.07 (0.007) |

4.0 (0.55) |

Table 4 shows the results of using panel analysis of the model for the determinants of capital structure in UK market for the period 2012-2017 (without credit rating variables). The coefficient of the tax variable in all models is negatively related to the leverage measures. This is not consistent with the proposed hypothesis. Furthermore, the tax variable is statistically significant. The negative result is consistent with Ashton’s (1989, 1991) arguments that the UK tax system differs from the US system. Ashton (1989 and 1990) contends that the relevance of tax-shield of using debt to the practice of the UK financial is non-existent or if it exists, it is likely to be quite small. In addition, the negative sign of tax supports Miller’s (1977) hypothesis that debt has no net tax benefits (Fama & French, 1998). This result is in line with several previous studies in the UK market (Michaelas et al., 1999; Jordan et al., 1998). Jordan et al. (1998) attributed the negative sign to the average amount of tax paid during the sample period influences the average level of debt during the period simply as the result of the effect on retained earnings. The collateral variable is positively related to leverage and statistically significant in the models using LTDE. However, it is not statistically significant when using TDTA as dependent variables. This supports the proposed hypothesis. This result is consistent with the results of Bradely et al. (1984); Titman & Wessels (1988); Rajan & Zingales (1995); Michaelas et al. (1999); Jordan et al. (1998) and Gosh & Cai (2000). This indicates that collateral reduces the risk of adverse selection and moral hazard that result from the conflict of interest between debt providers and stockholders (Bevan & Danbolt, 2002).

| Table 4 Estimation the Model of the Determinants of Capital Structure Using Panel Analysis | ||

| Dependent Variable | LTDE Fixed Effect |

TDTA Random Effect |

| Intercept | - | 0.4 (0.00) |

| TAX | - 1.441 (0.002) |

-0.1 (0.01) |

| COL | 2.281 (0.000) |

0.05 (0.27) |

| PROF | -0.486 (0.508) |

0.05 (0.53) |

| TA | -0.13 E-7 (0.004) |

0.1 E-8 (0.02) |

| LAGE | -0.673 (0.017) |

- 0.04 (0.01) |

| R2 | 0.73 | 0.08 |

| N | 621 | 648 |

In addition, this result indicates that firms that have assets that can be used as collateral issue more secured debt than firms without collaterals (Myers & Majluf, 1984). Profitability variable is not statistically significant with both capital structure measures. Firm’s size is negatively related to all measures of leverage and statistically significant. The negative sign contradicts the proposed hypothesis. This result is in line with Rajan & Zingales (1995) and Titman & Wessels (1988). Rajan & Zingales (1995) argue that the negative sign of size variable may be attributed to the fact that the informational asymmetries between insiders in a firm and the capital markets are lower for large firms. Therefore, large firms should be more capable of issuing informationally sensitive securities like equity, and should on the basis of this have lower debt. The age variable is statistically significant. It is negatively related to leverage, which supports the proposed hypothesis. This indicates that older firms use less debt compared to younger firms. This might be attributed to the fact that older firms are likely to have internal resources such as retained earnings. On the other hand, younger firms rely more on external financing resources. This result supports the pecking order theory (Michaelas et al., 1998). Furthermore, this result is consistent with Peterson & Rajan (1994) and Michaelas et al. (1999).

Investigating the Effect of Credit Rating on Capital Structure

Investigating the Effect of Being Credit Rated on Capital Structure

The results presented in Table 5 indicate that using panel analysis is more suitable than using pooled analysis when using both LTDE and TDTA. The Hausman test implies that the random effects model is preferable to the fixed effects model for both dependent variables (LTDE and TDTA).

| Table 5 Panel Data Diagnostic Results | ||

| Dependent Variable | LTDE | TDTA |

| Lagrange Multiplier test | 644.1 (0.00) |

761.8 (0.00) |

| Hausman test | 6.3 (0.39) |

5.1 (0.53) |

Table 6 shows that including the CRNR variable into the model has not resulted in any significant change in the signs and significance of the variables in the previous model presented in Table 6. The results shows that Tax is significant and negatively related to LTDE and TDTA. Profitability is not significant with both measures. Size is negatively related to LTDE and TDTA and significant. Firm age is negatively related and significant with LTDE and TDTA. The dummy variable for rated and non-rated firms (CRNR) is positively related to LTDE and TDTA and statistically significant. This against the proposed hypothesis and indicate that credit rated firms use more debt compared with non-rated firms. This result is in line with Graham et al. (1998). The dummy variable for credit rated and non-rated firms (CRNR) is significantly positively related to leverage. This result against the proposed hypothesis. The positive sign of CRNR is in line with Graham et al. (1998). The positive sign of CRNR may be attributed to the higher profitability (PROF) of credit rated firms compared with non-rated firms. DeAnglo & Masulis (1980) argue that highly profitable firms would prefer to raise debt instead of equity in order to benefit from the tax benefits. In addition, the higher leverage of credit rated firms may be explained by the higher ratios of tangibility (COL) of credit rated firms compared with nonrated firms. Myers (1977) argues that firms that have fixed assets, which can be used as collateral, may be predicted to issue more debt at attraction rate as debt may be more readily available. In addition, Ganguin & Bilardello (2005) argue that the appropriate amount of leveraging for a company at a particular level of credit quality is more a matter of evaluating asset quality (tangibility). Ganguin & Bilardello (2005) contend that high quality, stable assetsthose with highly certain values and cash generation-can be leveraged more than assets of questionable value and cash flow.

| Table 6 Estimating Model Using Random Effect Model | ||

| Dependent Variable | LTDE | TDTA |

| Intercept | 1.3 (0.01) |

0.4 (0.00) |

| TAX | -0.9 (0.01) |

-0.1 (0.01) |

| COL | 1.9 (0.00) |

0.04 (0.38) |

| PROF | -1.0 (0.12) |

0.03 (0.72) |

| TA | -0.7 E-8 (0.04) |

- 0.1 E-8 (0.00) |

| LAGE | -0.2 (0.1) |

- 0.04 (0.00) |

| CRNR | 0.4 (0.00) |

0.08 (0.00) |

| R2 | 0.13 | 0.13 |

| N | 644 | 648 |

The results are for the period 2012-2017. Figures in brackets and in bold below the coefficient are the probabilities of significance.

Investigating the Effects of Firms’ Credit Ratings on Financial Gearing

The results presented in Table 7 shows again that panel analysis is preferred than pooled analysis. The Hausman test indicates that random effect model is more suitable when using LTDE as a dependent variable, while the fixed effects model is preferable than the random effects model when using TDTA as a measure of leverage.

| Table 7 Panel Data Diagnostic Results | ||

| Dependent Variable | LTDE | TDTA |

| Lagrange Multiplier test | 141.4 (0.000) |

314.4 (0.00) |

| Hausman test | 7.61 (0.268) |

16.2 (0.01) |

The results showed in Table 8 is that tax variable is negatively related to leverage and statistically significant when using LTDE as a measure of leverage. Asset structure is significant when using TDTA with negative sign, and not significant with LTDE. Profitability is not statistically significant. The size variable is significant with all leverage measures and negatively related. Firm age is not statistically significant with leverage. The CRO variable is statistically significant with financial gearing. Furthermore, it is negatively related to financial gearing, which is consistent with the proposed hypothesis. This indicates that the higher the credit ratings assigned to the firm, the lower the debt used. This implies that credit rated firms are concerned with their credit ratings. Moreover, credit rated firms are concerned about the disadvantageous effects of using more debt on their credit ratings. This result is consistent with the Kisgen (2006 and 2009) and Shivdasani & Zenner (2005) studies.

| Table 8 Estimating Model Using Panel Analysis | ||

| Dependent Variable | LTDE Random Effect |

TDTA Fixed Effect |

| Intercept | 2.856 (0.00) |

- |

| TAX | -2.330 (0.00) |

-0.5 (0.44) |

| COL | - 0.892 (0.12) |

- 0.4 (0.02) |

| PROF | - 0.607 (0.45) |

0.08 (0.61) |

| TA | -0.79 E-8 (0.01) |

- 0.1 E-8 (0.01) |

| LAGE | -0.142 (0.26) |

- 0.1 (0.17) |

| CRO | -0.157 (0.00) |

- 0.03 (0.00) |

| R2 | 0.20 | 0.87 |

| N | 289 | 292 |

The results are for the period 2012-2017. Figures in brackets and in bold below the coefficient are the probabilities of significance.

Conclusion

The study has achieved its main objectives. That is, we have investigated empirically the determinants of capital structure during the period 2012-2017 in the UK market. Furthermore, we have investigated the effect of credit rating on capital structure. In terms of the determinants of capital structure in the UK during the period 2012-2017, the results show that tax is significant determinant of capital structure in the UK when using pooled and panel analysis. However, tax variable is negatively related to leverage, which is against the proposed hypothesis. Moreover, the results show that asset structure is a significant factor in capital structure decision making, it is positively related to leverage. The study finds weak support for profitability as a determinant of capital structure. In addition, the study finds that firms’ size is statistically significant and negatively related to financial gearing. Furthermore, the study finds that firm age is a significant factor in determining the capital structure mix, it is negatively related to leverage. Concerning of the effect of credit rating on capital structure, the results show that credit rated firms use more debt than non-rated firms. In addition, the results show that firms’ specific credit ratings are negatively related to financial gearing. These results are in line with Kisgen (2006 and 2009) and Shivdasani & Zenner (2005).

A number of important observations are worth noting from this article. In general, the study gave a strong evidence of the effect of credit rating on financial gearing in the UK market. In addition, the study opens the door for further research in using the credit ratings of another credit rating agency (other than Standard and Poor’s). This would shed light on any difference between the effects of the different credit rating agencies on financial gearing. In addition, having established the importance of credit rating on capital structure decision in UK market, another possible line of research would be the effect of credit rating on debt choices. This would investigate whether firms prefer to use private or public debt.

References

- Adams, M., Burton, B., & Hardwick, P. (2003). the determinants of credit ratings in the United Kingdom insurance industry. Journal of Business Finance & Accounting, 30(3/4), pp. 539-572.

- Anis, A., & Shaha, F. (2020). Capital structure and financial performance: A Case of Saudi Petrochemical Industry. The Journal of Asian Finance, Economics and Business. 7(7). pp 105-112.

- Ashton, D.J. (1989). The cost of capital and the imputation tax system. Journal of Business Finance & Accounting, 16(1), pp. 75-88.

- Ashton, D.J. (1991). Corporate financial policy: American analytics and UK taxation. Journal of Business Finance & Accounting, 18(4), pp. 465-482.

- Bancel, F., & Mittoo, U.R. (2004). Cross-country determinants of capital structure choice: A survey of European firms. Financial Management, 33(4), 103-132.

- Barclay, M.J., & Smith J.R. (1995). The maturity structure of corporate debt. Journal of Finance, 50(2), 609-631.

- Benito, A. (2003). The capital structure decisions of firms: Is there a pecking order? Working Paper. Spain: Banco De Espana.

- Bevan, A.A., & Danbolt, J. (2002). Capital structure and its determinants in the UK – A decompositional analysis. Applied Financial Economics, 12(3), 159-170.

- Bevan, A.A., & Danbolt, J. (2004). Testing for inconsistencies in the estimation of UK capital structure determinants. Applied Financial Economics, 14(1), 55-66.

- Brounen, D., Jong, A.D., & Koedijk, K. (2005). Capital structure policies in Europe: Survey evidence. Journal of Banking and Finance. 30(5), 1409-1442.

- Cai, F., & Ghosh, A. (2003). Tests of capital structure theory: A binomial approach. Journal of business and economic studies, 9(2), 20-32.

- Cantor, R., & Packer, F. (1994). The credit rating industry. Quarterly Review (Federal Reserve Bank of New York), 19(2), 1.

- Chittenden, F., Hall, G., & Hutchinson, P. (1996). Small firm growth, access to capital markets and financial structure: Review of issues and an empirical investigation. Small Business Economics, 8(8), 59-67.

- Crutchley, C.E., & Hansen, R.S. (1989). A test of the agency theory of managerial ownership, corporate leverage, and corporate dividends. Financial Management (Financial Management Association), 18(4), 36-46.

- Deangelo, H., & Masulis, R.W. (1980). Optimal capital structure under corporate and personal taxation. Journal of Financial Economics, 8(1), 3-29.

- Fama, E.F., & French, K.R. (1998). Taxes, financing decisions, and firm value. Journal of Finance, 53(3), 819.

- Fama, E.F., & French, K.R. (2002). Testing trade-off and pecking order predictions about dividends and debt. Review of Financial Studies, 15(1), 1-33.

- Fama, E.F., & Miller, M.H. (1972). The Theory of Finance. Holt, Rinehart and Winston New York.

- Frank, M.Z., & Goyal, V.K. (2003). Testing the pecking order theory of capital structure. Journal of Financial Economics, 67(2), 217.

- Ganguin, B., & Bilardello, J. (2005). Fundamentals of Corporate Credit Analysis. McGraw-Hill/New York.

- Ghosh, A., Cai, F., & Li, W. (2000). The determinants of capital structure. American Business Review, 18, 129-132.

- Gonzalez, F. (2004). Market Dynamics Associated with Credit Ratings: A Literature Review. European Central Bank.

- Graham, J.R., & Harvey, C.R. (2001). The theory and practice of corporate finance: Evidence from the Field. Journal of Financial Economics, 60(2/3), 187-243.

- Gujarati, D.N. (2003). Basic Econometrics Fourth Edition. Gary Burky

- Harris, M., & Raviv, A. (1990). Capital structure and the informational role of debt. Journal of Finance, 45(2), 321-349.

- Harris, M., & Raviv, A. (1991). The theory of capital structure. Journal of Finance, 46(1), 297-355.

- Harvey, C.R., Lins, K.V., & Roper, A.H. (2004/10). The effect of capital structure when expected agency costs are extreme. Journal of Financial Economics, 74(1), 3-30.

- Heine, R., & Harbus, F. (2002). Toward a more complete model of optimal capital structure. Journal of Applied Corporate Finance, 15(1), 31.

- Hovakimian, A., Hovakimian, G., & Tehranian, H. (2004). Determinants of target capital structure: The case of dual debt and equity issues. Journal of Financial Economics, 71(3), 517.

- Jensen, M.C., & Meckling, W.H. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 3(4), 305-360.

- Jensen, M.C. (1986). Agency costs of free cash flow, corporate finance, and takeovers. American Economic Review, 76(2), 323.

- Jordan, J., Lowe, J., & Taylor, P. (1998). Strategy and financial policy in UK small firms. Journal of Business Finance & Accounting, 25(1/2), pp. 1-27.

- Kanakriyah, R. (2020). Dividend Policy and Companies’ Financial Performance. The Journal of Asian Finance, Economics and Business. 7 (10). pp.531-341.

- Kisgen, D. (2009). Do firms target credit ratings or leverage levels. Journal of Financial & Quantitative Analysis, 44(6). 1323-1344.

- Kisgen, D. (2006). Credit ratings and capital structure. Journal of Finance, 61(3). 1035-1072.

- Lasfer, M.A. (1995). Agency costs, taxes and debt: The UK evidence. European Financial Management, 1(3), 265.

- Leary, M.T., & Roberts, M.R. (2005). Do firms rebalance their capital structures? Journal of Finance, 60(6), 2575-2619.

- Lymer, A., & Oats, L. (2006). Taxation: Policy and Practice. 12th Edition. Fiscal Publication/Birmingham.

- Mackie-Mason, J.K. (1990). Do taxes affect corporate financing decisions? Journal of Finance, 45(5), 1471.

- Marsh, P. (1982). The choice between equity and debt: An empirical study. Journal of Finance, 37(1), 121.

- Masulis, R.W. (1980). The effects of capital structure change on security prices: A study of exchange offers. Journal of Financial Economics, 8(2), 139-178.

- Michaelas, N., & Chittenden, F. (1999). Financial policy and capital structure choice in U.K. SMEs: Empirical evidence from company panel. Small Business Economics, 12(2), 113.

- Miller, M.H. (1977). Debt and taxes. Journal of Finance, 32(2), 261.

- Modigliani, F., & Miller, M.H. (1958). The cost of capital, corporation finance and the theory of investment. The American Economic Review, 48(3), 261-297.

- Modigliani, F., & Miller, M.H. (1963). Corporate income taxes and the cost of capital: A correction. The American Economic Review, 53(3), 433-443.

- Myers, S.C., & Majluf, N.S. (1984). Corporate financing and investment decisions when firms have information that investors do not have. Journal of Financial Economics, 13(2), 187-221.

- Myers, S.C. (1984). The capital structure puzzle. Journal of Finance, 39(3), 575.

- Myers, S.C. (2001). Capital Structure. Journal of Economic Perspectives, 15(2), 81-102.

- Nayar, N., & Rozeff, M.S. (1994). Ratings, commercial paper, and equity returns. Journal of Finance, 49(4), 1431-1449.

- Ozkan, A. (2001). Determinants of capital structure and adjustment to long run target: evidence from UK company panel data. Journal of Business Finance & Accounting, 28(1/2), 175-198.

- Panno, A. (2003). An empirical investigation on the determinants of capital structure: The UK and Italian experience. Applied Financial Economics, 13(2), 97-112.

- Pottier, S.W., & Sommer, D.W. (1999). Property-liability insurer financial strength ratings: Differences across Rating Agencies. Journal of Risk & Insurance, 66(4), 621-642.

- Pottier, S.W. (1998). Life insurer financial distress, best's ratings and financial ratios. The Journal of risk and insurance, 65(2), 275-288.

- Rajan, R.G., & Zingales, L. (1995). What do we know about capital structure? Some evidence from international data. Journal of Finance, 50(5), 1421-1460.

- Shin, Y., & Moore, W. (2003). Explaining credit rating differences between Japanese and US agencies. Review of Financial Economics, 12(4), 327-344.

- Shivdasani, A., & Zenner, M. (2005). How to choose a capital structure: Navigating the debt-equity decision. Journal of Applied Corporate Finance, 17(1), 26-35.

- Shyam-sunder, L., & Myers, S.C. (1999). Testing static tradeoff against pecking order models of capital structure. Journal of Financial Economics, 51(2), 219-244.

- Singh, M., Davidson III, W.N., & Suchard, J., (2003). Corporate diversification strategies and capital structure. Quarterly Review of Economics & Finance, 43(1), 147.

- Steeman, M. (2002). Corporates and Credit Ratings. NIB Capital Bank.

- Sumani, S., & Ahmad, R. (2020). Reciprocal capital structure and liquidity policy: Implementation of corporate governance toward corporate performance. The Journal of Asian Finance, Economics and Business, 7(9), 85-93.

- Taggart JR. (1985). Effects of regulation on utility financing: Theory and evidence. Journal of Industrial Economics, 33(3), 257.

- Titman, S., & Wessels, R. (1988). The determinants of capital structure choice. Journal of Finance, 43(1), 1.

- WhitE, L.J. (2001). The Credit Rating Industry: An Industrial Organization Analysis. New York University Salomon Center.