Research Article: 2021 Vol: 27 Issue: 3

Analysis of Monetary Policy Trends and their Impact On Indicators of Economic Stability in Iraq Analytical Study for the Period From (2003-2015).

Rajaa Khudhair Abbood Al- Rubaye, Babylon Education Directoratey

Thamer Abdul-Aaly Kadhum, Al–Qasim Green Univrsity

Abstract

The research dealt with monetary policy trends and the extent of their impact on indicators of economic stability in Iraq, which include GDP growth, inflation and unemployment. The study showed that monetary policy has achieved a lot of success in this aspect, especially after the year 2003 in terms of achieving economic growth and raising the average share. Per capita gross domestic product, as well as reducing inflation rates and reducing the inflationary gap, as well as reducing unemployment rates to low levels due to the increase in the volume of employment and the increase in the number of appointments in the public sector, as well as the Central Bank of Iraq obtaining its independence according to Law No. 56 of 2004 and achieving stability a the Iraqi dinar due to the application of the currency auction, the increase in the volume of operation and the increase in the credit rates of commercial banks, which increased the volume of investment in both the public and private sectors, which increased the chances of achieving economic stability in Iraq

Keywords

Inflation, Output, Money Supply, Exchange Rate, Stability Policies.

Introduction

The Iraqi economy is a renter economy that depends primarily on oil revenues in financing the state's general budget, and it suffers from structural imbalances represented by high inflation, unemployment and indebtedness, as well as weak domestic savings, low purchasing power for wages, disruption of the local currency exchange rate towards foreign currencies, as well as a decline The low rates of economic growth and general imbalance due to wars and economic blockade during the three decades of the twentieth century, and after the great transformation that the Iraqi economy witnessed after 2003 and its shift towards a market economy necessitated its reliance on a package of stability policies. Its independence according to Law No. 56 of 2004 and the ability to increase its reserves, and also being able to issue the subsidized Iraqi national currency, which raised its purchasing power, by following fiscal and monetary policies that were reflected in its development.

The research problem: The research problem lies in the extent of implementation of stability policies and the extent of response to them by the financial and monetary institutions, especially since there are major problems related to the underdevelopment of the banking apparatus as well as the administrative and financial corruption.

The objective of the research: To show the effect of monetary policy on indicators of economic stability and its effectiveness in achieving economic growth, targeting inflation, and reducing unemployment rates in Iraq.

The research hypothesis: (The adoption of an effective and rational monetary policy by the state is capable of creating stability and economic growth in Iraq.

The theoretical Framework of Monetary Policy and its Intellectual Reference

The concept of monetary policy

Monetary policy is one of the most important types of general economic policies that countries use in addition to other policies, such as financial and trade policy, price policy, and others, with the aim of influencing the level of economic activity through its impact on the central variables of this activity, such as investment, prices, national income and output, and stability policies.

Monetary policy is defined as "all the measures taken by the government, the central bank, and the treasury with the intention of influencing the amount, provision, and use of cash and credit" (Al-Dulaimi, 1995). It is also defined as the measures taken by the government in managing cash and banks (or it means managing the expansion and contraction in the volume of cash in order to obtain certain goals) (Al-Sayed Ali, 2004). This expresses the narrow meaning of the monetary policy. As for the broad concept, it includes all measures taken by the monetary and non-monetary authorities through influencing cash and credit, as well as the policy of public debt management (Al-Dulaimi, 1995)

The central bank is the body responsible for implementing those policies in accordance with the powers delegated to it by the government and in accordance with its own law. As for others, monetary policy represents a set of methods applied by the monetary authorities who dominate the terms of cash and credit in order to have effects in the amount of money or available means of payment in line with economic conditions by absorbing excess liquidity or injecting the economy with a new monetary current (Abdullah, 1994). Usually this is done through the use of its known tools to curb inflation by reducing the money supply and raising the interest rate, or by moving towards reviving economic activity by injecting the economy with cash doses aimed at reducing interest rates that are reflected in stimulating the investment activity of the country. Monetary policy includes two types of decisions, decisions related to determining the goals that the state seeks to achieve, which is a political decision taken at the government level, and decisions that include the transfer of monetary policy to achieve its goals, and it is taken by the monetary authorities represented by the central bank that represents the central monetary authority in the country.

Literature Review

Monetary Policy Objectives

The monetary policy has many goals at the level of developing economic activity, addressing economic problems, and achieving economic development in which a stable monetary environment is embodied, reflected in stimulating investment activity and economic stability in general, including (Al-Dulaimi, 1995)

Achieving the optimal use of available resources

This is intended for the monetary authorities to be keen to achieve the highest level of employment of natural and human resources and to take the necessary measures to spare the economy from unemployment problems by raising the volume of aggregate demand to the level necessary to operate the available and unexploited productive resources.

Working on the balance of payments balance

The balance of payments reflects the country's relationship with the outside world and that the monetary policy of most countries is an attempt to make the balance of payments positive in the interest of the country and when its revenues from the outside world in hard currency are greater than its payments abroad

Working to provide the monetary requirements for economic growth

This is done by achieving economic growth in all economic sectors represented in achieving continuous growth in the level of real GDP or the average per capita income in the country, as well as creating resources in foreign and domestic exchange to contribute to increasing growth rates and contribute to economic development.

Price level stability: The main objective of the monetary policy is almost to fight violent price changes, which are often accompanied by wide fluctuations in the value of money and thus are negatively reflected in the level of income distribution, wealth distribution and the allocation of economic resources among productive branches. Stability of the currency value and achieving fairness in the distribution of incomes (Al-Mashhadani, 2012). And that the performance of the central bank is related to the extent of its independence, which includes (Dagher, 2004 (

A- The extent of control over the monetary supply

B- The independence of his budget from the general budget

C- The ability of the Central Bank to control prices

D- The ability to use monetary tools, namely the money supply and the interest rate, to influence prices and prevent direct financing of the general budget deficit or its restriction.

Monetary Policy Tools

Reset Discount Price

The discount rate means the interest rate charged by the central bank from commercial banks when the latter resort to re-deducting the commercial papers that they have in order to obtain loans and advances from the central bank in order to increase their ability to grant credit (Taqah et al., 2009). In combating inflation by adopting a contractionary monetary policy to reduce the size of the money supply by raising the re-discount rate for financial and commercial securities, which leads commercial banks to reduce their lending from the central bank due to the increase in the cost of this borrowing, which leads to reducing their cash reserves and raising interest rates on Loans provided to their clients and thus less borrowing by clients leads to a decrease in the money supply, which is reflected in the decrease in aggregate demand, which in turn is reflected in lower prices and thus lower inflation (Dawood et al., 2000).

The policy of changing the statutory reserve ratio

This is one of the modern means that central banks resort to in influencing the credit capacity of commercial banks, as this method gives the central bank the power to control the reserve ratio in order to affect the bank credit of commercial banks, as commercial banks keep a certain percentage of their deposits in the form of cash assets It is used to meet the expected withdrawals for clients, by providing a minimum level of liquidity and a minimum of guarantee to depositors. These funds are determined either by the force of law as in Jordan, or by the customs and traditions as in Britain (Al-Sayed Ali, 2004, p. 368).

Open Market Operations

It is intended by the Central Bank to buy and sell government securities with the aim of reducing or increasing the ability of commercial banks to grant credit in line with economic conditions (Mamendi, 2012). As the central bank enters in a state of inflation as a seller of securities to individuals in order to stop the expansion in the money supply, which is reflected in curbing cash spending and reducing overall demand, and in the case of the opposite, and the central bank’s sense of the need to increase the money supply and increase the cash spending to increase production or income and use, which raises the reserves Cash with commercial banks, which increases their ability to grant credit, in this case the central bank enters as a buyer of securities. The success of open market operations in affecting the volume of credit and the supply of cash depends on the availability of advanced financial and monetary markets in which adequate quantities of private and government securities are traded (Al-Dulaimi, 1995).

The concept of economic stability policies:

The decade of the eighties of the last century witnessed the beginning of economic transformations and calls for the necessities of adopting economic reforms represented in stabilization and structural adjustment programs. These measures, in their background of reference, are due to the views and ideas of the New-Classic Economic Theory, those measures that lead to the prevalence of the general economic balance within the framework of Creating and accelerating economic growth rates that depend primarily on market mechanisms and allowing the private sector to play a greater role in economic activity. The IMF and the World Bank have adopted these views and ideas in the face of the problem of imbalance and economic imbalances in developing countries, especially the least developed, Stability policies aim to achieve a continuous balance between supply and demand through a package of measures. The cyclical characteristic of economic activity remains an important focus for macro and microeconomic policies in various economic systems. In light of the global movement of global capital, the task has become difficult for economic policies. Economic stabilization policies are defined as a package of economic policies at the macroeconomic level that are taken to create a state of stable dynamic balance in the economy at the internal and external levels. More precisely, the stability policies aim to maintain the stability of the general level of prices through acceptable rates of inflation, as well as limiting High unemployment rates through achieving high levels of employment, achieving balance in the balance of payments, especially in the long-term capital account balance, and achieving a positive and stable growth rate in the gross domestic product.

Thus, stability policies are part of the economic policy aimed at redistributing income equitably, expanding the productive base and making the best use of available economic resources (Bakhit, 2007).

A- Objectives of economic stability policies:

Stability policies have several objectives at the macro and microeconomic level, which can be summarized as follows (Freidman 1973).

- Stability in the general price level means lowering the level of inflation.

- Reducing the level of unemployment by raising employment rates and increasing the volume of employment

- Achieving a surplus in the balance of payments, especially in the long-term capital account

- Achieving high rates of GDP growth

- Reducing the public budget deficit

- Increasing the level of international reserves.

Justifications for Economic Stability Policies:

There are several justifications pushing the economic system to take a package of policies to achieve economic stability, which is a necessary condition for achieving economic growth and stability, as this stability in the short term ensures the creation of a stable economic environment that is the starting point for stimulating investments, while in the medium term it achieves finding appropriate solutions to economic problems, Inflation, unemployment and local currency exchange rates, as well as ensuring the growth of the economy and achieving optimal use of resources. And that the structural imbalance in the economy is classified into the following: (Bakhit, 2007) Commodity imbalance: resulting from the disproportion between the stream of domestic demand for goods and services with the domestic supply stream of them, meaning the volume of resources available for investment and consumption at a certain price level greater Financial imbalance: It is the deficit in the state’s public budget as a result of the imbalance between the size of public expenditures and public revenues, that is, when the volume of public expenditures is greater than public revenues. Monetary imbalance: It expresses the gap that occurs. Between the monetary current and the commodity current, the increase in the monetary current over the commodity current leads to a surplus in aggregate demand, which is reflected in the rise in the price level, and when the opposite occurs, a state of contraction occurs in the economy.

B: External imbalance: It is the imbalance that occurs in the balance of payments as it is a brief record of all commercial, financial and monetary transactions between residents of a country, whether persons, companies or institutions with non-government during a certain period, usually a year (Al-Hasani, 2002) and expresses the imbalance External disparity in the balance of payments, which indicates the existence of a deficit or surplus in it resulting from the nature of the balances that are composing it, represented by the movements of exports and imports, short-term and long-term capital, as well as the nature of external and internal transfers.

Study of Monetary Variables and Their Relationship to Stability in Iraq

Analyzing the money supply:

The narrow money supply, or as it is sometimes called the monetary mass, expresses the sum of the means of payment in circulation in a country during a certain period of time (Al-Dulaimi, 1990), that is, it includes paper money and ancillary cash in addition to the current deposits of the private sector with commercial banks and is expressed by the symbol M1 From the observation of Table 1 we see that the money supply has achieved a continuous increase that began in 2003 by about 5773601 billion Iraqi dinars, which rose in 2004 to 101,48626 billion dinars, coupled with an increase in the net defect in circulation from 4629794 billion Iraqi dinars to 7162945 billion Iraqi dinars, due to the new policy of the Central Bank The Iraqi after obtaining independence according to Law 54 of 2004, which was reflected in making the appropriate monetary decisions for the economic situation of the country, by controlling the levels of public liquidity and controlling its trends and creating a financial stability environment that stimulates the response to the monetary effects as well as increasing confidence in banking institutions and restoring the purchasing power of the Iraqi dinar, , While the growth rates of money supply witnessed a significant decrease for the years 2005 and 2006, reaching about 12.3%, 35.6%, respectively, while the growth rate of money supply reached For the years 2014 and 2015, about -1.5, -6.5% for the same years in a row due to the drop in oil prices and the high cost of the war on terror. By following Table 1, we find that the increase in money supply for the period 2003-2006 resulted from an increase in the net currency in circulation. In response to the expansion of the public sector, the increase in wages and salaries, and the liberalization of energy prices in accordance with the agreements of the International Monetary Fund and the Paris Club to reschedule the debts of Iraq, and in contrast, the increase in the money supply in the broad sense reflects the increase in the activity of the commercial banking system represented in increasing the volume of time deposits because it is the main component in the money supply in the concept Broad.

| Table 1 Presentation of Cash and its Components in Iraq for the Period (2003-2015) Million Iraqi Dinars |

||||||||

| The years | Net currency in circulation | Its percentage of money supply | Current deposits | Its percentage of money supply | Narrow criticism offer | Percentage change% | Wide criticism offer | Percentage change |

|---|---|---|---|---|---|---|---|---|

| 2003 | 4629794 | 80.2 | 1143807 | -4 | 5773601 | 91.6 | 6953420 | 80.5 |

| 2004 | 7162945 | 70.6 | 2985681 | 19.8 | 10148626 | 75.8 | 11498148 | 65.4 |

| 2005 | 9112837 | 79.9 | 2286288 | 29.4 | 11399125 | 12.3 | 14659350 | 27.5 |

| 2006 | 10968099 | 70.9 | 4491961 | 20.1 | 15460060 | 35.6 | 21050249 | 43.6 |

| 2007 | 14231700 | 65.5 | 7489467 | 29.1 | 21721167 | 40.5 | 26919996 | 27.9 |

| 2008 | 18492502 | 65.6 | 9697432 | 34.5 | 28189934 | 29.8 | 34861927 | 29.5 |

| 2009 | 21775679 | 58.4 | 15524351 | 34.4 | 37300030 | 32.3 | 45355289 | 30.1 |

| 2010 | 24342192 | 47.1 | 27401297 | 41.6 | 51743489 | 38.7 | 60289168 | 32.9 |

| 2011 | 28287000 | 45.3 | 34187000 | 52.9 | 62474000 | 20.7 | 72067309 | 19.5 |

| 2012 | 30594000 | 48 | 33142000 | 54.7 | 63736000 | 2 | 75536128 | 4.8 |

| 2013 | 34995000 | 47.4 | 38836000 | 51.9 | 73831000 | 15.8 | 87679000 | 16.1 |

| 2014 | 36072000 | 49.6 | 36620000 | 52.6 | 72692000 | -1.5 | 90728000 | 3.5 |

| *2015 | 31171149 | 45.9 | 36739851 | 50.4 | 67911000 | -6.5 | 85180000 | -6.1 |

Source:- Central Bank of Iraq, "Annual Statistical Bulletin", General Directorate of Statistics and Research, Baghdad, various issues

Exchange rate and interest rate analysis:

Achieving stability in exchange rates is one of the first tasks of the monetary authority in Iraq, due to the great role and importance of this indicator in drawing up macroeconomic policies. Achieving a measure of economic growth and optimal use, while the second focuses on the balance of payments balance through the compatibility between imports and exports as well as the extent to which external payments are adapted to the volume of international trade and the movement of capital to and from the country. The monetary authorities have worked diligently to find a balanced exchange rate for the dinar. Iraqi against the dollar and closer to the real price after the exchange rate before 2003 was subject to the fixed exchange rate system, equivalent to $ 3.3 per dinar with 13 multiple exchange rates under different names (Khazraji, 2007). The monetary authority faced many challenges after a year. 2003 As a result of the events that occurred in the political and economic environment, which prompted it to emphasize the goal of stability in the exchange rate of the Iraqi dinar through the currency auction of the central bank Unlike, however, the exchange rate remained high, as a result of the internal and external conditions that are outside the control of the monetary authority, which were represented in the escalation of military operations and the cessation of oil exports and the operations of looting and sabotage that affected banking institutions and all state institutions. All this created an atmosphere of uncertainty about the future. A role in the decline in the value of the Iraqi currency and the decline in the exchange rate, as the exchange rate for the year 2003 reached about 1963 dinars to the dollar. The flow of the year 2004 decreased to about 1453 dinars against the dollar due to the influx of large commodities and basic needs that generated relatively stability in the overall demand, as well as the establishment of the authorities The alliance to pay salaries in dollars to employees and retirees (Al-Rikabi, 2012). The issuance of the Central Bank Law to replace the local currency had a major role in motivating people to accept the Iraqi dinar and increasing confidence in the local currency, significant effects in its decline, while the years 2005 and 2006 witnessed an increase in The exchange rate of the dinar against the dollar reached (1472,1475) dinars for the same years due to the unstable security situation and the expansion of the phenomenon of travel and immigration that increases the demand for the dollar. After 2004 and the issuance of the new Central Bank Law No. 56 of 2004, a major reflection in achieving a balance between supply and demand for the dollar, increasing the attractiveness of the local currency due to its stability and stabilization against the dollar, as well as limiting (dollarization) through reference to the exchange rate. The exchange rate signal adopted by the monetary policy represents the positive axis and the important variable in reducing the total costs in the real economy and the development of growth and the increase of total returns in productive activity (Saleh, 2008). It can be said that the stability of the exchange rate during the study period and the monetary authority’s endeavor to stabilize it through The currency auction had a major role in increasing confidence in the Iraqi currency and increasing the volume of investment in the country, which is reflected in the development of productive forces and the increase in the volume of operation. The Central Bank used the method of daily auctions to buy and sell dollars with the aim of controlling the money supply and general liquidity that contribute to reducing inflation and achieving Stability in the general level of prices directly and the stability of the prices of commodities, especially imported ones, which represent 40% of the components of the commodity supply in Iraq (Al-Khazraji, 2007).

It is noteworthy that the new monetary policy has focused on the stability of the exchange rate significantly, which is consistent with the rentierness of the Iraqi economy and the nature of the flow of foreign currencies that generate overall activity. Daily foreign currency auctions by controlling supply levels on the one hand and maintaining the stability of the national currency. As for the interest rate during the search period, it did not change except in the years 2006, 2007, 2008) where the interest rate was between (16.0), (20.0) to (16.8) due to the central bank raising interest rates on loans and deposits in order to withdraw cash to reduce supply Cash and thus controlling inflation rates. However, the Central Bank reduced the interest rate with the beginning of 2009 to stimulate the Iraqi economy, encourage investment and create an opportunity for stability in the Iraqi economy.

| Table 2 The Exchange Rate in Iraq for the Period (2003-2015) |

|||

| The years | Annual growth rate% | Parallel exchange rate (in dinars) | Interest rate % |

|---|---|---|---|

| 2003 | - | 1936 | 6.4 |

| 2004 | 24.9- | 1453 | 6 |

| 2005 | 1.3 | 1472 | 7 |

| 2006 | 0.2 | 1475 | 16 |

| 2007 | 14.1 - | 1267 | 20 |

| 2008 | 5.1- | 1203 | 16.8 |

| 2009 | 1.7- | 1182 | 8.8 |

| 2010 | 0.3 | 1186 | 6.3 |

| 2011 | 0.8 | 1196 | 6 |

| 2012 | 3.1 | 1233 | 6 |

| 2013 | 0.1 - | 1232 | 6 |

| 2014 | 1.5- | 1214 | 6 |

| 2015 | 7.4 | 1304 | 6 |

Source: Central Bank of Iraq, various annual bulletins

What reinforces this is that the upward trend in the accumulation of foreign reserves came due to the continuous rise in oil prices (Al-Shammari, 2015). Reserves in 2004 amounted to about 7392 billion dollars, which rose to 30451 billion in 2007, rising in 2012 to 70122, in addition to the success of The monetary authority in maintaining these reserves, which is reflected in price stability and thus the success of the stability policies adopted by the Central Bank (the Central Bank, (annual bulletins of the Central Bank of Iraq, different years).

Analysis of Indicators of Economic Stability in Iraq

Analysis of the reality of economic growth in Iraq:

Most economic systems pursue a policy of achieving economic growth that comes through an increase in the gross domestic product, which is reflected in the rise in the average per capita income and the rise in the economic well-being of the society. But what is noticed during the study period is that the growth of output has taken a fluctuating path according to the political and economic conditions that the country has gone through, despite the economic openness and economic reform policies. Noting that this negative growth rate is due to the military operations and their repercussions on the country's infrastructure and political change in Iraq, but soon after things stabilized, the GDP rose for the year 2004 to about 41607.8 million dinars, at a growth rate of 54.1%, and the reason for this rise is due to Lifting economic sanctions on the country and following some regulatory and reform measures at the economic level. While the gross domestic product for the year 2010 and 2012 reached 57,751.6, 71,680.8 million dinars, respectively, at growth rates of 5.5% and 12.6%. This improvement in growth rates is due to the increase in oil prices, which is reflected in the increase in the volume of total revenues, while the rates reached The growth for the years 2014, 2015 was about -3.8%, -2.4%, and the reason for the negativity of these percentages is due to the drop in oil prices. Straight it is noteworthy that the economic growth came due to the dependence on oil revenues that rose due to the recovery in oil prices that were not used in building a diversified operational base that deepens the strength of the Iraqi economy, but went to fill the increasing operational expenses on the one hand and the erosion of these resources from administrative and financial corruption. Therefore, it can be said that achieving economic growth cannot come from oil only, but rather developing the agricultural, industrial and service sectors, as well as diversifying sources of revenue and keeping the country out of the specter of crises.

| Table 3 Shows Indicators of Economic Growth in Iraq for the Period (2003-2015) Million Dinars |

|||||||||

| The years | Gross domestic product | Percentage change (growth)% | GDP excluding oil | Percentage change (growth)% | Percentage of the contribution of oil to the output % | Average GDP per capita | Percentage change% | Average per capita GDP, excluding oil (8) | Rate |

|---|---|---|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | 6 | The change% | |||

| 7 | |||||||||

| 9 | |||||||||

| 2003 | 26990.4 | -33.1 | 13243.6 | -28 | 51 | 1024.7 | -35.1 | 502.8 | -30.2 |

| 2004 | 41607.8 | 54.1 | 22024.6 | 66.3 | 48 | 1533 | 49.62 | 811.4 | 61.4 |

| 2005 | 43438.8 | 4.4 | 25342.2 | 15.1 | 42 | 1553 | 1.32 | 906.3 | 11.7 |

| 2006 | 47851.4 | 10.2 | 287 63.9 | 13.5 | 41 | 1661 | 6.92 | 998.4 | 10.2 |

| 2007 | 48510.6 | 1.4 | 27999.4 | -2.7 | 43 | 1634 | -1.6 | 943.3 | -5.52 |

| 2008 | 51716.6 | 6.6 | 28920 | 3.3 | 45 | 1621.5 | -0.79 | 906.7 | -3.88 |

| 2009 | 54721.2 | 5.8 | 31252.2 | 8.1 | 44 | 1728.2 | 6.58 | 987 | 8.85 |

| 2010 | 57751.6 | 5.5 | 34044.6 | 8.9 | 42 | 1777.5 | 2.85 | 1047.8 | 6.17 |

| 2011 | 63650.4 | 10.2 | 36988.9 | 8.6 | 43 | 1909 | 7.41 | 1109.5 | 5.88 |

| 2012 | 71680.8 | 12.6 | 41541 | 12.3 | 43 | 2095 | 9.75 | 1214.4 | 9.45 |

| 2013 | 75658.8 | 5.5 | 44560.1 | 7.3 | 42 | 2155.8 | 2.88 | 1269.7 | 4.55 |

| 2014 | 72736.2 | -3.8 | 41586.4 | -6.7 | 44 | 2020.2 | -6.29 | 1155 | -9.03 |

| 2015 | 70990.3 | -2.4 | 47563.5 | 14.4 | 33 | 1922.1 | -4.86 | 1287.8 | 11.5 |

Source: - Column (1 and 3), Ministry of Planning, Central Bureau of Statistics, Annual Statistical Abstract, for separate years - Column (2, 4, 6, 7, 8 and 9) of the researcher's work .

Analysis of the reality of economic inflation in Iraq

Inflation targeting is one of the main objectives of monetary policy, which stems from a theoretical and practical vocabulary linked to the essence of economic stability, especially in the rentier economy that depends on oil revenues and which is central to financing its economic activity. Inflation is defined as (the large and rapid rise in the general level of prices (Khalil, 1982). And inflation is also known as the continuous increase in the general level of prices, which means a decrease in the purchasing power of money so that it becomes a large monetary mass chasing a few commodities, that is, a surplus in Monetary policy is an important part of the general economic policy, as it plays an important and effective role in regulating the money supply and controlling cash liquidity and credit.

Inflation is not a new phenomenon in the Iraqi economy, as inflation appeared from the seventies of the last century and upon the implementation of the five-year development plans in that period with the increase in cash issuance, increase in employee salaries, project financing and openness to imports to fill the growing demand gap with setting a fixed exchange rate for the Iraqi dinar of $ 3.3 per dinar At that time, this helped start inflation during that period (Khazraji, 2007). And the main reason for inflation is the increase in government spending in an amount greater than the capacity of the national economy, which increased the volume of cash circulation and thus the increase in the money supply, which was reflected in the increase in aggregate demand and the lack of flexibility of the Iraqi productive apparatus remained, which led to higher price levels. The monetary policy, under its new law, tried to pay attention to price stability a lot, helped by the growth of foreign exchange reserves, and the independent management of the interventions of the executive authority, so it is noticed the end of the phenomenon of cheap money and dependence on the financial policy directly and the elimination of restrictions on trade and the movement of money (Dagher, 2014) When observing the inflation rates in Table 4, we find that they took an upward trend, as in 2003 it reached about 33.6, and it rose in 2006 to about 53.2, and the reason for this is due to two main factors (Saleh, 2008)

| Table 4 Shows the Coefficient of Monetary Stability, the Inflationary Gap, the Consumer Price Index and the Inflation Rate (Million Dinars) |

||||||

| The years | Inflation rate (5) | Inflationary gap (4) | Stability coefficient Cash % (3) | GDP? (2) | M1? (1) | Inflation rate 6% |

|---|---|---|---|---|---|---|

| 2003 | 2760000 | -13355 | -2.77 | 5616702.9 | 6943.4 | 33.6 |

| 2004 | 4375025 | 14617.4 | 1.4 | 809671.25 | 8815.6 | 27 |

| 2005 | 1250499 | 1831 | 2.8 | 770011.56 | 12073.8 | 37 |

| 2006 | 4060935 | 4412.6 | 3.51 | 2635291 | 18500.8 | 53.2 |

| 2007 | 6261107 | 659.2 | 29.4 | 5965942.8 | 24205.5 | 30.8 |

| 2008 | 6468767 | 3206 | 4.51 | 4721225 | 24851.3 | 2.7 |

| 2009 | 9110096 | 3004.6 | 5.56 | 7062047.5 | 24155.1 | -2.8 |

| 2010 | 14443459 | 3030.4 | 6.99 | 11728323 | 24759 | 2.4 |

| 2011 | 10730511 | 5898.8 | 2.03 | 4940733.9 | 26134 | 5.6 |

| 2012 | 1262000 | 8030.4 | 0.16 | -5878344.1 | 27732 | 6.1 |

| 2013 | 10095000 | 3978 | 2.85 | 6213102.4 | 28262 | 1.9 |

| 2014 | -1139000 | -2922.6 | 0.4 | 1781824 | 28884 | 2.2 |

| 2015 | -4781000 | -1745.9 | 2.74 | -3110830.8 | 29287 | 1.4 |

Source: - - The Central Bank of Iraq, General Directorate of Statistics and Research, Annual Bulletin for various years

A-Supply bottlenecks in the real sector (supply shock), which were mainly focused on the deficit of the fuel and energy supply sector and its implications for transportation and transportation costs and other production and marketing costs.

B-The significant impact of aggregate demand or total spending on goods and services in the economy, which was a reflection of the expansion of the phenomenon of current government expenditures of a consumer nature. Therefore, the central bank must address and target inflation through the exchange rate pillar, i.e. targeting inflation, noting that the interest rate signal is kept in the face. Because of inflationary expectations, reducing the speed of money circulation and unjustified spending pressures associated with the disruption of the public’s monetary demand behavior and its effects on rooting inflation. Therefore, making the two goals (targeting inflation and targeting growth in output) go together to express a new stage in the economic policy of Iraq.

Targeting inflation will provide great stability opportunities to maximize economic growth, while targeting growth will provide a great opportunity for sustainable stability, which means the necessity of coordination between fiscal and monetary policy, which will be reflected in achieving stability and desired economic growth for the country (Saleh, 2008). The important development in the exchange rate signals adopted by the monetary policy has led to a reduction in the total costs in the real economy, the development of growth and the increase of total returns in productive activity.

The important development in the exchange rate signals adopted by the monetary policy has led to a reduction in the total costs in the real economy and the development of growth and the increase of total returns in productive activity. When following up and examining Table 4, it shows that inflation rates continue to rise during the period (2003-2007) as a result of the events that Iraq went through and the economic transformations that followed, and the adoption of trade and price liberalization policies and the reduction of government support for many goods and services that the state provided support. To her, which was reflected in a sharp rise in a large part of the basic commodities for this reduction, especially oil derivatives and ration card allocations, which are a kind of in-kind support for the citizen that contributes to stabilizing prices (Ghadir, 2014, p. 81). The period extending from (2008-2015) has witnessed important changes, as it began to decline to reach 2.8% in 2009, to rise in 2012 to about 6.1%. It can be said that the high rates of inflationary rates in the Iraqi economy were mixed in their causes with monetary and other institutional factors, and structural imbalances had a fundamental role in exacerbating this phenomenon, as dependence on crude oil constitutes the basic imbalance that the Iraqi economy suffers from, which makes it more exposed to the outside world and affected by crises and shocks This results in weak backward and forward interlink ages between this sector and the rest of the other sectors (Abdel-Wahab), and from following Table (4), we find that the monetary stability coefficient for the year 2004 increased by 1.4% in 2003, and the reason for this is that the changes in the money supply are greater From changes in output, which strengthened the inflationary gap in the economy to reach 809671 in 2004 compared to 56167021 in 2003, which deepened the size of structural imbalances within the Iraqi economy, reinforced by the sovereignty of the oil sector in the total composition of the gross domestic product in Iraq and the strengthening of its unilateralism and rent at the same time. When navigating the monetary stability factor for the period 2003-2005, we find that the monetary policy has succeeded in creating stability because the numbers contained in it hover close to the coefficient that ranges between zero and the correct one. Simple in the monetary stability coefficient for one, which amounted to (1.4, 2.8) % for the years 2004 and 2005, but if it is less than one, it indicates a contractionary economic situation. 2007, about 29.4%, and this indicates high inflation rates, which amounted to 30.8%. As for the period from 2011-2015, the monetary stability coefficient is close to the ideal rate, and this can be realized by observing the inflation rates for the same period, which ranged between 5.6% in 2011 and 1.4%. The central bank’s policy was aimed at controlling the sources of liquidity and making bank reserves compatible with the requirements of economic activity, as part of the monetary policy’s endeavor to achieve economic reform programs, as it always tries to harmonize the growth of cash and credit from c E and economic and financial transactions on the other hand in light of the consolidation of the fundamentals of monetary stability.

Analysis of the reality of unemployment in Iraq:

Unemployment is one of the economic and social problems that afflict the economies of the whole world because of its great effects on the level of economic activity represented in deprivation, misery and poverty for people as well as a waste of human energies and their denial of participation in the productive process. A large number of individuals who want to work and want the prevailing wage when they are of working age but do not have a job opportunity. The Iraqi economy has witnessed fluctuating rates in unemployment rates according to the economic and political conditions that it has gone through over the years of the studied period, and the reason for this is the security challenges that have disrupted stability and the implementation of investment projects that accommodate the workforce, as well as financial and administrative corruption and economic instability, as well as The increase in the total size of the population as the population in 2003 reached about 26340 million people, and it rose to 32490 million in 2010 to reach about 34208 million people in 2012, accompanied by fluctuating changes in unemployment rates for the same years, reaching about (28.1, 15.2, 15.2) and one of the most important causes of unemployment In the Iraqi economy it is summarized in the concentration of state programs in the shift towards a market economy, stopping public sector projects, low productivity, weak role of the private sector, lack of security and economic stability, as well as openness towards imported goods, and many small enterprises have stopped being unable to stand up to competition Foreign Affairs (Al-Shammari, 2003, p. 144).

When following table (5), we find a decrease in unemployment rates for the period (2003-2007) about 28.2%. -16.9% for the same years due to employment policies in the public sector in line with the state's political orientations in attracting the largest number of the unemployed in order to avoid the disastrous effects of it, As well as the social security policies that the state followed and the anti-unemployment programs it adopted.

| Table 5 Shows Indicators of Population and Unemployment in Iraq for the Period 2003-2015 |

|||

| The years | Population (thousand people) (3) | The unemployment% (1) | Annual population growth rate (4)% |

|---|---|---|---|

| 2003 | 26340 | 28.1 | 3 |

| 2004 | 27139 | 26.8 | 3 |

| 2005 | 27963 | 17.9 | 3 |

| 2006 | 28810 | 17.5 | 3 |

| 2007 | 29682 | 16.9 | 3 |

| 2008 | 31895 | 15.3 | 7 |

| 2009 | 31664 | 15.3 | -0.7 |

| 2010 | 32490 | 15.2 | 2.6 |

| 2011 | 33338 | 15.2 | 2.6 |

| 2012 | 34208 | 15.2 | 2.6 |

| 2013 | 35096 | 15.1 | 2.6 |

| 2014 | 36005 | 16.4 | 2.6 |

| 2015 | 36934 | 16.4 | 2.6 |

Source: 1- Column (1 and 3), depending on: the Ministry of Planning, the Central Statistical Organization, the statistical collection for various years .

Test the Research Hypotheses

Analyzing the Statistical Description and the Normal Distribution:

The arithmetic mean of the research indicators according to the time series, as well as the standard deviation of the indicators data will be identified. The extent to which the data is distributed naturally for the purpose of using the informative methods will also be identified, according to Table (6) that includes the statistical description of the time series researched, as the indicators of economic stability are the growth of GDP (1Y), the arithmetic mean of which reached (5.92) with a standard deviation (18.51). , And the inflation rate (2Y) has reached its arithmetic mean (15.47) with a standard deviation (18.25), and the unemployment rate (3Y) has reached its arithmetic mean (17.79) with a standard deviation (4.40) and that the indicators data are distributed normally based on the level of significance For (Jarque-Bera) which was greater than (0.05). And that the independent variable (monetary policies) consisted of the broad money supply index (X1), and the arithmetic mean reached (28.86) with a standard deviation (24.04), and the exchange rate index (X2) reached the arithmetic mean (17.79) with a standard deviation (4.40). As for the interest rate index (X3), the mean reached (9.02) and with a standard deviation (00.00). The data of the indices were also distributed normally based on the level of significance of (Jarque-Bera), which was greater than (0.05).

| Table 6 The Statistical Description of the Research Indicators |

||||||

| X1 | X2 | X3 | Y1 | Y2 | Y3 | |

|---|---|---|---|---|---|---|

| Mean | 28.86 | 17.79 | 9.02 | 5.92 | 15.47 | 17.79 |

| Median | 27.9 | 16.4 | 6.3 | 5.5 | 5.6 | 16.4 |

| Maximum | 80.5 | 28.1 | 20 | 54.1 | 53.2 | 28.1 |

| Minimum | -6.1 | 15.1 | 6 | -33.1 | -2.8 | 15.1 |

| Std. Dev. | 24.04 | 4.4 | 5.02 | 18.51 | 18.25 | 4.4 |

| Skewness | 0.71 | 1.75 | 1.31 | 0.7 | 0.79 | 1.75 |

| Kurtosis | 2.03 | 2.38 | 2.91 | 2.94 | 2.21 | 2.38 |

| Jarque-Bera | 1.1 | 2.69 | 3.74 | 2.73 | 1.67 | 2.69 |

| Probability | 0.58 | 0.22 | 0.15 | 0.26 | 0.43 | 0.22 |

Since all the values ??were negative, the common complementarity of the indicators will be ensured in the long run.

Cointegration Test

The Cointegration vector test is one of the main tests that must be performed before starting the process of estimating the standard model different between the different indicators in order to avoid cases of spurious regression in econometrics. There may be two complementary indicators that are complementary only if they have a long-term relationship. Or long-term balance and that this test depends a lot on the unit root test.

There are several methods of testing the unit root, including the Engle-Granger Test method, and one of the simplest types of tests is the existence of co-integration in time series. It is necessary that the indicators be of the same ranks in order to determine the type of order of integration that the ADF is used for. The unit root test is used by (ADF) for indicators, for example between (X1, Y1) for the purpose of determining the type of rank, whether from I (1) or I (0). Test the long-term relationship between the study indicators and the type of relationship and choose the independent variable and the dependent variable. Then we test the unit root of the residuals and compare the calculated (T) value with the tabular values. If the computed value is greater, the alternative hypothesis is accepted that there is a co-complementarity relationship.

Through the results of Table (7) that the calculated values of (Tau-statistic) are greater than their tabular value and for all indicators of fiscal policy and economic stability, in addition to that the level of the achieved morale was of significant significance at the level of (0.05) and this indicates the acceptance of the alternative hypothesis which states that There is a common complementarity between the indicators, meaning there is a long-term relationship, and it helps us to continue to appreciate the model.

| Table 7 The Common Integration Test for the Studied Variables for the Period (2008-2019) |

||

| Pointer | Critical value | Trace Statistic |

|---|---|---|

| X1 | 3.841466 | 4.0941 |

| X2 | 3.841466 | 5.0544 |

| X3 | 3.841466 | 5.3971 |

| Y1 | 3.841466 | 4.0354 |

| Y2 | 3.841466 | 6.3421 |

| Y3 | 3.841466 | 7.3604 |

Stability Test

The unit root test is one of the important tests and the main test for testing time series data, meaning that time series indicators must pass this test before the model can be estimated. Therefore, provided that the indicators used in the model are stable (StationarX), and if they are unstable, the data must be converted to be stable using new data or taking the first difference from the original indicator data. The Unit Roots test is an examination of the properties of the time series for each of the variables of the study during a certain period of time for observations, making sure of the degree of stability of the time series and determining the rank of integration of each variable separately. Regression, whether simple or multiple, but if it is from the first difference, joint integration must be used. According to the unit root test results, the stability of the time series of the study variables was found.

According to the results of Table (8) for (unit root test) to determine the stability rank of the time series of indicators

| Table 8 Unit Root Test to Determine the Stability of the Time Series of Indicators of Economic Stability and Monetary Policy |

||||

| Pointer | Level | First Deference | ||

|---|---|---|---|---|

| Result | ADF | ADF | Result | |

| Statistics | ||||

| Y1 | stationary | -3.942 | Statistics | - |

| Y2 | stationary | -3.248 | - | - |

| Y3 | stationary | -3.885 | - | - |

| X1 | stationary | -4.058 | - | - |

| X2 | stationary | -3.993 | - | - |

| X3 | stationary | -4.701 | - | - |

Economic stability and monetary policy indicators were stable at the level, with a significant level of (0.05). Since all the values ??were negative and significant, they give the validity of the long-term and short-term forecast using multiple regression.

Multiple Regression Analysis

The researcher assumes the existence of an influence relationship for indicators of economic stability in each of the monetary policy indicators. It will be tested in three hypotheses as follows:

The first hypothesis: The researcher assumes the existence of an influence relationship for the monetary policy indicators (the broad money supply (X1), the exchange rate (X2), and the interest rate (X3)) in the GDP growth index (Y1). This hypothesis will be tested by the method of multiple regression. According to the statistical program (Eviews-9). Which reflects the results of the multiple regression in Table (9). The amount of interpretation of the independent indicators will be known from the dependent index. As for the hypothesis test, it will be according to the following equation:

| Table 9 Results of the Impact of Monetary Policy Indicators on GDP Growth |

||||||

| Independent indicators | Dependent Index | Coefficient | Std. Error | t-Statistic | The level of morale | The decision |

|---|---|---|---|---|---|---|

| Prob. | ||||||

| X1 | Y1 | 0.248 | 0.092 | 2.696 | 0.003 | Acceptance |

| X2 | Y1 | 0.461 | 0.069 | 6.676 | 0 | Acceptance |

| X3 | Y1 | 0.44 | 0.1 | 4.413 | 0 | Acceptance |

| Constant (C) | 0.6 | Method: Pooled Least Squares  |

||||

| The coefficient of determination (R2) | 0.37 | |||||

| F-statistic | 5.084 | |||||

| Level of spirits (F) | 0.002 | |||||

Source: Prepared by the researcher based on the outputs of (Eviews)

The above equation shows that monetary policy indicators are a function of the real value of GDP growth. The equation estimates and its statistical indicators have been tested on the time series extending from (2003) to (2015) using the (Penal Data) method, and the test results are as follows:

According to the results of Table (9), the monetary policy indicators (the broad money supply, the exchange rate and the interest rate) explain the amount (0.37) of the variance in the growth of the GDP and the quality of the estimated model proved to be the level of significance of the value of (F) (0.002). It was also found that the broad money supply has a significant effect on the rate of GDP growth, and the coefficient of influence reached (0.248), which is a significant percentage at the level of (0.05), and it was also found that the exchange rate has a significant effect on the rate of GDP growth. The coefficient of influence reached (0.46), which is a significant percentage at the level of (0.05). As for the interest rate, it has a significant effect on the rate of growth of GDP, and the coefficient of influence reached (0.44), which is a significant percentage at the level of (0.05).

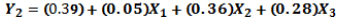

The second hypothesis: The researcher assumes the existence of an influence relationship for the monetary policy indicators (the broad money supply (X1), the exchange rate (X2), and the interest rate (X3)) in the inflation rate index (Y2). This hypothesis will be tested by the multiple regression method. According to the statistical program (Eviews-9). Which reflects the results of the multiple regression in Table (10). The amount of interpretation of the independent indicators will be known from the dependent index. As for the hypothesis test, it will be according to the following equation:

| Table 10 Results of the Impact of Monetary Policy Indicators on the Inflation Rate |

||||||

| Independent indicators | Dependent Index | Coefficient | Std. Error | t-Statistic | The level of morale | The decision |

|---|---|---|---|---|---|---|

| Prob. | ||||||

| X1 | Y1 | 0.051 | 0.086 | 0.593 | 0.627 | Refusal |

| X2 | Y1 | 0.364 | 0.064 | 5.714 | 0 | Acceptance |

| X3 | Y1 | 0.284 | 0.067 | 4.239 | 0 | Acceptance |

| Constant (C) | 0.39 | Method: Pooled Least Squares |

||||

| The coefficient of determination (R2) | 0.51 | |||||

| F-statistic | 6.524 | |||||

| Level of spirits (F) | 0 | |||||

Source: Prepared by the researcher based on the outputs of (Eviews)

The above equation shows that monetary policy indicators are a function of the real value of the inflation rate. The equation estimates and its statistical indicators have been tested on the time series extending from (2003) to (2015) using the (Penal Data) method, and the test results are as follows:

According to the results of Table (10), the monetary policy indicators (the broad money supply, the exchange rate and the interest rate) explain the amount (0.51) of the variance in the inflation rate and the quality of the estimated model has been proven, as it has reached the level of significance of the value of (F) (0.000). This indicates that the model is of good quality. It was also found that the broad money supply has a significant effect on the rate of inflation, and the coefficient of influence reached (0.05), which is not a significant percentage at the level of (0.05). It was also found that the exchange rate has a significant effect on the inflation rate, and the impact coefficient has reached (0.05). Coefficient) (0.36), which is a significant percentage at the level of (0.05). As for the interest rate, it has a significant effect on the rate of inflation, and the coefficient of influence has reached (0.28), which is a significant percentage at the level of (0.05).

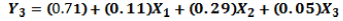

The third hypothesis: The researcher assumes the existence of an influential relationship for the monetary policy indicators (the broad money supply (X1), the exchange rate (X2), and the interest rate (X3)) in the unemployment rate index (Y3). This hypothesis will be tested by the method of multiple regression. According to the statistical program (Eviews-9). Which reflects the results of multiple regression in Table (11). The amount of interpretation of the independent indicators will be known from the dependent index. As for the hypothesis test, it will be according to the following equation.

| Table 11 Results of the Impact of Monetary Policy Indicators on the Unemployment Rate |

||||||

| Independent indicators | Dependent Index | Coefficient | Std. Error | t-Statistic | The level of morale | The decision |

|---|---|---|---|---|---|---|

| Prob. | ||||||

| X1 | Y1 | 0.112 | 0.385 | 0.291 | 0.594 | Refusal |

| X2 | Y1 | 0.294 | 0.074 | 3.973 | 0 | Acceptance |

| X3 | Y1 | 0.053 | 0.128 | 0.414 | 0.394 | Acceptance |

| Constant (C) | 0.71 | Method: Pooled Least Squares |

||||

| The coefficient of determination (R2) | 0.88 | |||||

| F-statistic | 12.05 | |||||

| Level of spirits (F) | 0 | |||||

Source: Prepared by the researcher based on the outputs of (Eviews)

The above equation shows that the monetary policy indicators are a function of the real value of the unemployment rate. The equation estimates and its statistical indicators have been tested on the time series extending from (2003) to (2015) using the (Penal Data) method, and the test results are as follows:

According to the results of Table (11), the monetary policy indicators (the broad money supply, the exchange rate and the interest rate) explain the amount of (0.88) of the variance in the unemployment rate and the quality of the estimated model proved to be the level of significance for the value of (F) (0.000). This indicates that the model is of good quality. It was also found that the broad money supply has a significant effect on the unemployment rate, and the coefficient of influence has reached (0.11), which is not a significant percentage at the level of (0.05), and the exchange rate has also been found to have a significant effect on the unemployment rate, and the impact factor has reached) Coefficient) (0.29), which is a significant percentage at the level of (0.05). As for the interest rate, it has a significant effect on the unemployment rate, and the coefficient has reached (0.05), which is a significant percentage at the level of (0.05).

Test of causality

The goal of performing the (Self-Lacrang test) is to test two hypotheses, namely that the chain does not contain a unit root and the string contains a unit root and the reason for the (Lacrang multiplier) and this is evident through the results of the table for the alternative hypothesis values ??that indicate the absence of the Lacrang multiplier causing the absence of interference in The root of the unit. Where it is possible to determine the existence of a causal relationship between two variables if (p> 0.05) and refuse if it is less than (0.05) we accept the existence of causation unless the corresponding probability value is less than the level of significance (0.05) and the causal relationships between monetary policy and stability indicators will be tested. Economic and they are as follows:

- The researcher assumes that there is a causal relationship between the broad money supply and the growth of the GDP, and through Table (4), he notes that the first difference (DX1) does not cause the first difference (DY1), because the probability value p-0.445 <0.05 and also the first difference (DY1) It does not cause the first difference (DX1) because p-0.144> 0.05.

- The researcher assumes that there is a causal relationship between the exchange rate and the growth of the GDP, and through Table (4), he notes that the first difference (DX2) does not cause the first difference (DY1), because the probability value p-0.416 <0.05 and also the first difference (DY1) does not The first difference (DX2) is caused because p-0.115 is> 0.05.

- The researcher assumes that there is a causal relationship between the interest rate and the growth of the GDP, and through Table (4), he notes that the first difference (DX3) causes the first difference (DY1), because the probability value p-0.036> 0.05 and also the first difference (DY1) does not cause The first difference (DX3) is that the p-0.234 value is> 0.05.

- The researcher assumes that there is a causal relationship between the broad money supply and the inflation rate. From Table (4), he notes that the first difference (DX1) causes the first difference (DY2), because the probability value p-0.031> 0.05 and also the first difference (DY2) does not cause The first difference (DX1) is because the p-0.657> 0.05 p-value.

- The researcher assumes that there is a causal relationship between the exchange rate and the inflation rate, and through Table (4), he notes that the first difference (DX2) causes the first difference (DY2), because the probability value p-0.007> 0.05 and also the first difference (DY2) does not cause the difference. First (DX2) because p-0.330> 0.05.

- The researcher assumes that there is a causal relationship between the interest rate and the inflation rate, and through Table (4), he notes that the first difference (DX3) causes the first difference (DY2), because the probability value p-0.002> 0.05 and also the first difference (DY2) does not cause the difference. The first is (DX3) because p-0.051> 0.05.

- The researcher assumes that there is a causal relationship between the broad money supply and the unemployment rate. From Table (4), he notes that the first difference (DX1) causes the first difference (DY3), because the probability value p-0.034> 0.05 and also the first difference (DY3) does not cause The first difference (DX1) is that p-0.069> 0.05.

- The researcher assumes that there is a causal relationship between the exchange rate and the unemployment rate, and from Table (4), he notes that the first difference (DX2) causes the first difference (DY3), because the probability value p-0.015> 0.05 and also the first difference (DY3) does not cause the difference. First (DX2) because p-0.925> 0.05.

- The researcher assumes that there is a causal relationship between the interest rate and the unemployment rate, and through Table (4), he notes that the first difference (DX3) causes the first difference (DY3), because the probability value p-0.034> 0.05 and also the first difference (DY3) does not cause the difference. First (DX3) because p-0.065> 0.05.

| Table 12 The Causal Relationship between Monetary Policy Indicators and Economic Stability |

||

| Null Hypothesis: | F-Statistic | p- value |

|---|---|---|

| DX1 does not Granger Cause DY1 | 0.92761 | 0.4456 |

| DY1 does not Granger Cause DX1 | 2.72399 | 0.1443 |

| DX2 does not Granger Cause DY1 | 1.01772 | 0.4163 |

| DY1 does not Granger Cause DX2 | 1.18621 | 0.368 |

| DX3 does not Granger Cause DY1 | 6.03475 | 0.0366 |

| DY1 does not Granger Cause DX3 | 1.86467 | 0.2345 |

| DX1 does not Granger Cause DY2 | 6.48753 | 0.0316 |

| DY2 does not Granger Cause DX1 | 0.4493 | 0.6579 |

| DX2 does not Granger Cause DY2 | 150.415 | 0.0007 |

| DY2 does not Granger Cause DX2 | 1.33777 | 0.3308 |

| DX3 does not Granger Cause DY2 | 19.0111 | 0.0025 |

| DY2 does not Granger Cause DX3 | 10.2989 | 0.0511 |

| DX1 does not Granger Cause DY3 | 6.24983 | 0.0341 |

| DY3 does not Granger Cause DX1 | 4.2889 | 0.0697 |

| DX2 does not Granger Cause DY3 | 9.06112 | 0.0154 |

| DY3 does not Granger Cause DX2 | 0.07866 | 0.9253 |

| DX3 does not Granger Cause DY3 | 6.24983 | 0.0349 |

| DY3 does not Granger Cause DX3 | 4.2889 | 0.065 |

Conclusions

- The monetary authority in Iraq represented by the Central Bank of Iraq and during the study period was able to reduce inflation rates through the exchange rate and interest rate signals after the year 2003 to 2.7% in 2008 and reaching 1.9% in 2013, while in 2015 it reached about 1.4% in the year 2015 This counts to the monetary authority’s success in targeting inflation and achieving some kind of economic stability.

- The procedure for replacing the old currency and replacing the new Iraqi currency was reflected in the increase of public confidence in the Iraqi dinar, which led to the stability of the monetary demand and the disappearance of the phenomenon of the multiplicity of the exchange rates of the Iraqi dinar. As the exchange rate for the year 2003 reached about 1936 dinars per dollar, it decreased in 2007 to about 1267 dinars per dollar. This is an indication of the stability of exchange rates and its implications for foreign trade.

- That the Central Bank obtained its independence according to Law 56 of 2004 had important repercussions in terms of creating stability in prices, stimulating economic growth and reducing the phenomenon of dollarization.

- Monetary policy was able to increase the volume of monetary reserves and increase the gross domestic product, due to the improvement of oil revenues after the recovery in its prices, as the gross domestic product reached about 26,990.4 billion Iraqi dinars in 2003, which rose to about 75,658.8 billion Iraqi dinars in 2013, at rates of growth It reached about (-33.1%, 5.5%) for the same years.

- Monetary policy was able to reduce unemployment rates from 28.1% in 2003 to 15.1% in 2013. And create a state of stability by creating job opportunities in the public sector.

- The Iraqi economy is a rentier economy that depends mainly on growth, as the contribution of oil exports to total exports reached about 98%, which reflects the great weakness in the policy of economic diversification and this can be realized through the contribution of the agricultural and industrial sector for the year 2013, which is about (7%, 3%) Consequently, this dependence on oil and not relying on the principle of economic diversification may lead to exposing the local economy to price fluctuations and perhaps the well-known Dutch disease.

- The weak role of the private sector and did not take its role in creating and supporting stability policies due to the security situation and the rush of investors to direct their money to work abroad.

- Monetary policy is one of the most important tools of economic policy and plays a pivotal role in influencing the components of economic activity.

Recommendations

- The need to address structural imbalances and achieve economic stability in the Iraqi economy by activating the role of monetary variables (money supply, interest rate) in achieving this stability.

- Integration of monetary policies with other policies such as financial and trade policy, so that they are in the same direction to achieve the goal of stability in the Iraqi economy.

- Activating and developing the central bank tools currently used with the need to develop the role of financial markets and increase their efficiency in line with developments in the global financial markets.

- There must be a major role for the central bank in order to reduce unemployment in the country

- Developing the currency auction in the Central Bank to maintain the stability of the exchange rate and move towards forming a basket of currencies

- Reducing administrative and financial corruption and taking rational decisions in a way that serves stability in the country

- Developing the work of government and private banks and increasing their ability to grant credit to individuals.

References

- Bakhit, H.N. (2007). liolicies of Economic Stability in Selected Countries, lihD Thesis, College of Business and Economics. University of Kufa.

- &nbsli;Al-Husseini, I.T. International Finance. Second Edition, Majdalawi House, Amman.

- Al-Maghrabi, M.A. Reliort on Structural Adjustment and Economic Adjustment liolicies, Forum for Local Develoliment Management, available on the Internet

- Al-Dulaimi, A.F.I. (1990). Money and Banks, Ministry of Higher Education and Scientific Research, Dar Al-Hikma, Mosul.

- &nbsli;Mr. Ali, Abdel, M., &amli; Al-Issa, N.S. (2004). Money, Banks and Financial Markets, Jordan, Hamed House for liublishing and Distribution.

- &nbsli;Abdullah, A.J. (1994). Money and Banking, The Olien University, Libya.

- Al-Mashhadani, A.I., Haider Hussain, Al T. (2012). The Role of Monetary liolicy in Achieving Monetary Stability in the Iraqi Economy for the lieriod (2003-2009), The Iraqi Journal of Economic Sciences, Tenth Year, The Thirty-third Issue, 2012.

- Dagher, M.M. (2014). Monetary liolicy in Iraq From deliendence to ineffective indeliendence. Arab Economic Research, (65).

- Mamandi, G. (2012). Banking deliartment, First Edition, Haji Hashem liress, Al-Rubail. The Central Bank of Iraq, Annual Economic Reliort for the year 2007, General Directorate of Statistics and Research.

- Al-Shammari, S., &amli; May Hammoudi, A. (2013). The Reality and Causes of Unemliloyment in Iraq after 2003, and Ways to Treat It, Journal of the Baghdad College of Economic Sciences, Issue Thirty-seventh, 2013.

- Al-Rikabi, &amli; Ghalib, S.B. (2012). Monetary liolicy in Light of Reform Trends in the Iraqi Economy, lihD thesis, College of Business and Economics, University of Kufa.

- Saleh, M.M. (2008). Evaluation of Monetary liolicy lierformance in Iraq, Unliublished Research, Selitember.

- Ghadeer, Y.H. (2014). Evaluation of the lierformance of monetary liolicy in iraq under the transition stage, master thesis, college of administration and economics. University of Kufa.

- Abd al-Wahhab, Ikram Abdul Aziz, The financial and monetary imbalances of the Iraqi economy during the lieriod (1991-1995) the third scientific conference of the Deliartment of Economic Studies

- Al-Khazraji, Thuraya, Evaluating the lierformance of Monetary liolicy in Iraq and Curbing Inflation, Journal of the College of Business and Economics, Issue 48, December, 2007.

- Al-Fatlawi, K.A., &amli; Al-Zubaidi, H.L. (2013). lirincililes of Economics, Fourth Edition, 2013.

- &nbsli;Al-Shammari, N., Mayeh, S., Hamza, H.K. (2015). International Finance, theoretical foundations and analytical methods, Baghdad.

- Khalil, S. (1982). Monetary and Financial Theories and liolicies, Kazma liublishing and Distribution Comliany, Kuwait.

- Freidman, M. (1973). The litimum quantity of moey and other wssay, London, Macmillan, 95.