Research Article: 2020 Vol: 24 Issue: 2

Analysis of Retail Investment Behavior in Indonesian Stock Market

Fajri Adrianto, Universitas Andalas

Masyhuri Hamidi, Universitas Andalas

Keywords

Investor Behavior, Active Strategy, Passive Strategy, Investment Decision.

Introduction

The "Yuk Nabung Saham (YNS)" campaign launched by the Indonesian Financial Services Authority, called OJK, since 12 November 2015 aims to attract more domestic investors to invest on the Indonesian Stock Exchange (IDX). It is motivated by the low number of domestic investors registered on the IDX. Hence, low funds from domestic investors have put foreign investor as the primary market mover as those foreign investors are predominately in the Indonesian stock market. OJK and IDX attempt to attract Indonesians by providing any convenience for new retail investors like low minimum deposit (only a hundred thousand rupiahs or about USD 6.75), and fewer document requirements. This campaign is also supported by an increasing number of issuers from 619 companies in 2018 to 649 at the end of July 2019 (OJK, 2019). Indeed, that increase provides benefits to retail investors because it is more convenient for investors to diversify their portfolio. Although Koesrindartoto et al. (2020) find that institutional investors tend to determine trading/ market activities, retail investors show their increasing role in the Indonesian market. Even in the French market, during the crisis, retail investors prefer to invest in the stock, suggesting that their contributions are more relevant to add liquidity (Barrot et al., 2016). Since IDX uses information technology, investors are allowed to make transactions by themselves, even without discussing with their brokers. They are more independent in buying and selling stocks. However, more independent could affect the wrong decision in selecting stocks. There could be emotional preferences instead of rationality. Nofsinger (2018) states that retail investors are influenced by psychology. They tend to follow the market by selling their securities when the market drops and buying securities when the market goes up.

The campaign has improved trading volume and values due to a large number of new domestic investors. The daily trading volume (values) rose from 12.43 billion shares (Rp8.53 trillion) to 15.43 billion shares (Rp9.81 trillion) at the end of July 2019. The increase of this liquidity provides convenience for investors, including retail investors in selling and buying stocks. Based on the trading value, the role of domestic investors since the year 2015 has already been higher than that of foreign investors, where at the end of 2018, domestic investor contribution reached 63.03%. This proves the more critical role of local investors, including retail investors. Those retail investors are more important in trading activities. By giving some conveniences in process and trading have made the market to be more attractive. Restrictions for retail investors only induce lower trading volume in the financial market (Heimer & Simsek, 2019). Hence, IDX has given less restriction to retail investors to increase the role of these investors not only as price taker, but also price maker.

In fact, the stock is still an advanced investment for the Indonesian citizens, where they think that this investment requires excellent skills in selection and trading. But with the massive YNS campaigns that reach all provinces in Indonesia, many people are interested in opening a stock account. This is mostly motivated by their expectation to get higher returns or want to join a particular investor community, such as the Indonesia Stock Exchange Gallery (GIBEI) regardless of their knowledge about stocks. In fact, the financial literacy of Indonesian society is still relatively low. In literature, an advanced investment like the stock is usually held by investors who have higher financial literacy (Bellofatto et al., 2018). Investors in the emerging market tend to herd market condition, especially when the market is in bull and bear position (Li et al. 2016). Their trading frequency is also related to financial advice received form their investment advisors (Tauni et al., 2018).

Our brief discussion with a local investment bank staff, many retail investors, especially those young investors, are not active in transactions. Some of them, even, only ever trade less than five times after a year having a stock account. We expect that retail investor’s behavior is still influenced by their limited literacy and demographic factors. Their behavior is relatively different from institutional investors. They are responsible for their own money and could be more conservative in trading, suggesting that they are concerned more with risks. They have limited money to do market diversification. Therefore, they just choose limited stocks. We hypothesize that investment strategy or decision made by retail investors is influenced by demographical characteristics of investors (supported by Fong et al., 2020).

We examined some research questions related to retail investment behavior in choosing stocks and trading behavior. First, we investigate the relationship between financial literacy and investment behavior. Van Rooij et al. (2011) find that people with low financial literacy are less likely to choose investment assets with high risk like stocks. However, the YNS campaign has attracted many new retail investors to invest in the stock market regardless of their financial literacy, as long as they can earn higher returns as campaigned by IDX and brokerage firms. There are few studies that examine the relationship between financial literacy and investment behavior. Knowledge distinguishes between informed and uninformed investors, where investors with good literacy will be more rational in making investment decisions compared to uninformed investors. The latter are more likely to conduct herding behavior (Jalilvand et al., 2018). To the best of our knowledge, there has been no specific study on the influence of the literacy of the investment behavior of the retail investor of YNS. Lower financial literacy is related to bad financial planning such retirement planning (Lusardi & Mitchell, 2007). The relationship of financial literacy and investor characteristics with stock selection is under-explored. Previous studies highlight the relationships between those variables and investment types chosen by investors. They do not explicitly examine stock types.

This paper analyses the relationship between financial literacy and stock choices for retail investors who are mostly less advised in making investment decision. Our main conjecture is that investors with high financial literacy are more likely to choose less risky stocks. Their literacy in money and capital market terms, also their literacy in financial terms such as time value of money and interest rates could lead them to prefer less risky assets because they know that stock market is efficient. The traditional view of investment is that market is efficient where investors are rational in their investment decision. The rational argument suggests that stock price fully reflect all available information in public.

Our next research question is whether investor risk profile determines the investment behavior. Low-risk tolerance investors may choose a passive strategy instead of an active one. However, we have a counter-argument where those low-risk tolerance investors may be more active in reconstructing their portfolio with lower risk stocks. They may choose stocks with lower price deviation like blue-chips stocks.

There are an influx of studies on the influence of demographic factors, including families against investment decisions (Gao, 2015). Thus, the marital status of an investor is expected to have a relationship with investor behavior in choosing investment type. However, to the best of our knowledge, there is a limited study investigating the relationship between retail investor characteristics, financial literacy, and retail investor behavior in Indonesia as representative of emerging stock market which have many young investors with limited funds.

According to Almenberg & Dreber (2015), investment behavior is related to gender. They find that male investors are more likely to participate in the stock market. This is due to their higher risk profile. Male investors are usually identified to be more active in trading activities due to their more confidence (Barber & Odean, 2001). In behavioural finance literature, male investors are more confident in making an investment decision (Bailey et al., 2011). Their confidence leads to trade more in stock. So, our study examines whether the investment behaviour of retail investors varies across male and female investors.

Education is an essential factor in investor behaviour. McCannon (2014) performed an experiment how education affects social preference. He finds that an educated person is more independent and wealthier. That finding can be concluded that educated investors are more likely to be more active. Educational background also influences the literacy of investors on financial and investment. Higher educated investors are expected to more literate since they have more time in educational institutions to acquire knowledge.

We then investigate whether investment behaviour is varied based on investor experience. The concept of learning by doing could be absorbed by investors after experiencing in trading and investment. We expect that investors will learn from their experiences in stock trading. They may be more active when they know how to choose good stocks. On the other hand, they could take passive strategy when they know that stock price is efficient where it is a bit impossible to earn short-term abnormal returns.

We also analyze the relationship between investor wealth and their trading and investment behaviour. We expect that investor wealth is also related to their behaviour, including how to choose stocks. Wealth that can be proxied by investor income influences investor behaviour (Kallunki et al., 2018). Our study hypothesizes that wealthier investors tend to trade frequently since they have a higher chance to top-up their fund. More funds have higher opportunities to trade. However, in contrast, wealthier investors may take passive trading because they usually have other investment assets.

Our paper consists of background that explains our research background and research questions. We then have section 2 for literature review, followed by section 3 that explains research methodology. Our result is discussed in section 4. The conclusion will be in section 5.

Literature Review

Bellofatto et al. (2018) investigate the relationship between financial literacy and investment behavior. They find that high financial literate investors are more active in trading. Those investors build their portfolio with fewer securities, suggesting diversified. The results are motivated by the results that those investors are more confident in trade. They are also smarter than those low financial literate investors in choosing investment asset where they hold more complicated investment such as option and warrant. According to investment performance, high literate investors can earn higher returns. Higher financial literacy also boosts investor confidence in making an investment decision.

In terms of risk profile, investors who have a higher risk profile can affect market volatility. Zhou et al. (2019) investigate the relationship between the uncertainty avoidance index and market volatility. They find that in the market with lower uncertainty avoidance index (Barber & Odean, 2000), suggesting higher risk profile, trading activities are more volatile than that are in the market with a higher index. That empirical finding suggests that investors preferences toward risk determine how investors make an investment decision in choosing stocks, building a portfolio, and choosing active/passive strategy. Huber et al. (2019) also confirm the relationship between risk preferences and investment decision.

Diouf & Hebb (2016) find that the retail investors' behaviour is determined by their demographic background and social values believed by investors, especially for choosing SRI investment. Male investor behaviour differs from female investors. For example, male investors are more active than a female investor in trading due to their more confident in making an investment decision (Tauni et al., 2017). However, portfolios formed by male investors are underperformed by portfolios constructed by female investors (Barber & Odean, 2001). Furthermore, male investors distinguish themselves in choosing non-financial constraints in investment. Adam & Shauki (2014) find that male investors tend to be less socially responsible in investment than female investors.

Education is also crucial in determining stock investment behaviour. Educated investors hold more stocks and more active in trading (Bellofatto et al., 2018). Informed investors are expected to be more conscious and extraversion, which lead to prefer to be active in trading (Tauni et al., 2017). Education is related to how investors behave with information acquisition and investment decision. Park et al. (2019) find that unique information can affect how investors trade and form the portfolio. For instance, retail investors are more likely to take sort position before the announcement of monetary information. Educated investors are concerned with fundamental information before making an investment decision. According to Choi et al. (2010), MBA students are more concerned with primary information reported in prospectus than those college students.

Then, investment behaviour is also related to investor wealth. Deaves et al. (2006) conclude that wealthier investors are more confident in making an investment decision. They are even overconfidence. He also suggests that wealthier investors are more concerned with fundamental information of firms. However, that overconfidence makes investors act as a trader. Investors who frequently trade their investment security erode their future wealth (Brad M Barber & Odean, 2000).

Investment experience is a matter in how investors behave in investment. Their experience is related to convenience in choosing security assets. Agnew & Szykman (2010) investigate the relationship between investment experience and investment decision. They argue that investment experience increases investment financial literacy. Literate investors lead to confidence in making an investment choice.

Higher portfolio values mean a higher probability to diversify into more stocks. Investors who have higher amount of investment portfolio potentially to choose more stocks in their portfolio. Portfolio values are related to how investors distribute their wealth to various security such as stocks and bonds (Clements & Silvennoinen, 2013). Tekçe et al. (2016) are more complicated in examining retail investor characteristics relationship with behavioural bias. They find that familiarity bias is more likely performed male, younger investors, investors with lower portfolio value, and investors in low income, low education regions. Those investors are more confident in doing trading but resulting lower return that investor who have representativeness heuristic.

Methodology

We survey 100 retail investors who live in West Sumatera, Indonesia. We collaborate with Indonesia Stock Exchange Galleries (GIBEI) to connect us with respondents. Since we intend to have respondents with various characteristics, we also collaborate with some investment banks in West Sumatera. Therefore, we have respondents from various background.

Investor behaviour is explained by several variables, including stock choice preferences, trading frequencies and portfolio behaviours. Trading frequency represents active/ passive behaviour where investors who have higher trading frequencies care categorized as active investors, vice versa. For more details, investor behaviour is explained by several variables, including:

1. Investors likelihood to choose blue-chips stock where it is a dummy variable. It is valued one if they are more likely to put blue-chips stocks as their first choice when bidding a stock, zero otherwise.

2. Investors preference in choosing state-owned enterprises (SEO) stocks. It is valued one if they choose SEO stock as their first preference, zero otherwise.

3. Investors preference in choosing under a thousand-rupiah stock. It is valued one if they prefer to select under a thousand stocks when selecting stocks for their portfolio, zero otherwise.

4. Investors preferences in selecting dividend/ gained stocks for their portfolio. It is valued one if they preferred to choose dividend/ gained stocks in selecting stocks, zero otherwise.

5. A number of stocks owned by investors in their portfolio, representing their investment diversification.

6. A number of monthly trading taken investors, representing whether they are either active or passive investors.

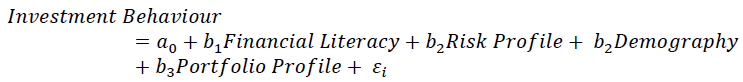

We then construct our research model using the following equation:

Financial Literacy is measured by adopted financial literacy question used by OJK, in which we ask respondents several questions in finance, including time value of money, capital market, money market, etc. This variable is the percentage score of their literacy about financial questions, scored 0 to 100. The risk profile is investor risk preference where we have ten scales, starting from very less risk tolerance investor scored 1 to high-risk tolerance scored 10. Demography variables include gender, monthly income, and education. Meanwhile, for portfolio profile we use investment duration and portfolio values to proxy investment profile of retail investors.

Results and Discussion

Descriptive Analysis

Financial literacy scores of our respondents are shown in Table 1. The score is between 0 and 100, where 100 means that respondents can correctly answer all financial literacy questions. We find that the average financial literacy of respondents is 72.2 percent, suggesting below OJK standard (83 percent). We then analyze financial literacy based on respondents’ education background and risk profile. We report that financial literacy is higher for respondents who have higher education. The average score for retail investors who have a high-school background is 69.16 percent, while the average score for Diploma/ Bachelor/ Master Degree or higher is 72.73/71.72/85.71 percent, respectively.

| Table 1 Financial Literacy | ||||

| Financial Literacy | Mean (%) | Std. Dev. (%) | Min (%) | Max (%) |

| All | 72.10 | 20.52 | 0 | 100 |

| Risk Profile | ||||

| Low tolerance | 88.64 | 15.17 | 54.55 | 100 |

| Moderate tolerance | 66.90 | 23.16 | 0 | 100 |

| High tolerance | 75.76 | 14.65 | 27.27 | 100 |

| Education | ||||

| Senior High School | 69.16 | 22.86 | 0 | 100 |

| Diploma | 72.73 | 13.38 | 54.55 | 100 |

| Bachelor | 71.72 | 18.76 | 27.27 | 100 |

| Master’s degree or Higher | 85.71 | 12.70 | 63.64 | 100 |

| Age | ||||

| Below 25 | 70.35 | 20.50 | 0 | 100 |

| 25 – 29 | 68.83 | 20.23 | 27.27 | 81.82 |

| 30 – 34 | 95.46 | 6.43 | 90.91 | 100 |

| 35 – 39 | 93.18 | 13.64 | 72.73 | 100 |

| Above 39 | 84.85 | 52.48 | 81.82 | 90.91 |

Risk profile defines how retail investors prefer risk investment assets. We categorize the risk profile int three: low, moderate, and high-risk tolerance. We can see that low-risk tolerance investors have higher financial literacy score than those moderate and moderate risk profile. The score of low-risk tolerance investors is 88.64 percent, while the mean score for moderate and high tolerance investors are 66.9 and 75.76 percent, respectively. This suggests that top literate retail investors tend to be less tolerance with investment risk. Below 29-year-old investors have lower literacy than above 30-year-old investors. Average financial literacy score for 25 to 29 year-old investors is 68.83 percent while the scores for investor at age of 30 to 34 and 35 to 39 are 95.46 and 93.18, respectively.

Table 2 shows the descriptive statistic of financial literacy and risk profile across investor behaviors. Investors who prefer in choosing dividend stock are more literate in finance (72.392 percent) than those investors who ignore whether firms usually pay a dividend or not. We also find high profile investors are more likely to choose dividend stocks compared to low-risk profile investors. Interestingly, an investor who are preferred to collect gained stocks, on average, have higher financial literacy, 74.009 percent compared to only 66.669 percent for investors who said not considering previous gain earned by a stock. Such investors also have a higher risk profile.

| Table 2 Financial Literacy and Risk Profile for Investment Behaviour | ||||

| Literacy | Risk Profile | |||

| No | Yes | No | Yes | |

| Dividend Stock | 71.982% | 72.392% | 5.932 | 6.222 |

| Gained Stock | 66.669% | 74.099% | 5.630 | 6.151 |

| SOEs Stock | 70.055% | 74.213% | 6.098 | 5.918 |

| Under Rp 1,000 Stock | 78.148% | 65.532% | 6.058 | 5.958 |

| Bluechips Stock | 65.871% | 80.340% | 6.000 | 6.023 |

Choosing SOEs (State Owned Enterprises) behavior is also expected to be related to financial literacy and investor risk profile. Investors who prefer to choose SOEs stocks are more literate than their non-SOEs concerned investors counterparts. Those investors are relatively categorized lower risk-profile investors, suggesting that most of investors with lower risk profile tend to hold lower volatile stocks, as the main characteristics of Indonesia SOEs stocks.

In terms of investor’s behavior in choosing cheap stocks, this behavior is related to lower financial literacy and lower risk profile. Then, investors who prefer to collect blue-chips stocks, on average, have higher financial literacy than those investors who ignore blue-chips status. Former is, on average, have 80.340 percent score, higher that later investors who have 65.871 percent score for their financial literacy.

Table 3 shows the average monthly trading frequency of respondents. Most of our respondents have less frequent trading. 68 percent of them trade less than five times per month, suggesting that our respondents are more likely to be passive. Only 13 percent of them trade more than ten times per month.

| Table 3 Monthly Trading Frequency | |

| Monthly Trading Frequency (Times) | Percent |

| <5 | 68 |

| 5-9 | 19 |

| 10 - 14 | 4 |

| 15 - 19 | 6 |

| 20 - 24 | 1 |

| 25 - 29 | 1 |

| >29 | 1 |

Table 4 reports the number of stocks owned by respondents in their portfolio and average monthly top-up frequency. On average, they have about two stocks in their average, suggesting less diversified by respondents. They may have fund constraints to diversify their money on some stocks. The maximum number of stocks held by respondents is 11stocks, and some investors only hold one stock in their account. Top-up fund illustrates the consistency of investors to invest in stock market. Our survey shows that retail investors, on average, add their money to stock account 2–3 times per month.

| Table 4 Number of Stocks in Portfolio | ||||

| Variable | Mean | Std. Dev. | Min | Max |

| Number of Stocks in Portfolio | 2.33 | 1.67 | 1 | 11 |

| Average Top-Up Fund Freq per Month | 2.49 | 1.087 | 1 | 5 |

Main Estimation

We initially test the relationship between financial literacy & investor characteristics and how investors behave in choosing stock types. Table 2 reports the results of that relationship. We consider some investor characteristics, including Risk Profile, Demographics (Male, Monthly Income, and Education), and portfolio profile. First, we report the determining variables that influence the behavior of investor in selecting blue-chips stocks. We find positive coefficient on Financial Literacy, 3.788 significant at 5 percent level, indicating that retail investors who have higher scores on financial literacy are more likely to collect blue-chips stocks than that of less literate investors. This implies that good literate investors have knowledge to recognize firms with good fundamental data, as the main characteristic of blue-chips stocks.

We find no relationship between demographical characteristics and the likelihood of retail investors in choosing blue-chips stocks. This result implies that there is no preference difference between male and female; higher and lower-income; and higher educated and lower educated investors in selecting blue-chips stocks.

The significant coefficient is reported for Portfolio Values where it is positively, 0.477 with z-value 2.27 significant at 5 percent level, related to the preference of investors in choosing blue-chips stocks. Investors with higher amount of portfolio values are more likely to select bluechips stocks that those investors with lower portfolio values (Tables 5-7).

| Table 5 Logit Regression Results of Relationship Between FIN Literacy and Characteristics | |||

| Bluechips | SOE | Under 1,000 | |

| Financial Literacy | 3.788** (2.52) |

0.505 (0.47) |

-2.368 (-1.63) |

| Risk Profile | 0.097 (0.67) |

-0.0453 (-0.36) |

-0.152 (-0.94) |

| Male | -0.003 (-0.01) |

-0.0734 (-0.15) |

-0.674 (-1.21) |

| Monthly Income | -0.087 (-0.39) |

0.181 (0.95) |

0.0691 (0.31) |

| Education | 0.001 (0.00) |

-0.169 (-0.73) |

-0.211 (-0.72) |

| Investment Duration | 0.023 (0.16) |

-0.0199 (-0.15) |

-0.373* (-1.79) |

| Portfolio Values | 0.477** (2.27) |

0.197 (1.06) |

-0.521** (-2.12) |

| Constant | -4.662*** (-2.89) |

-0.481 (-0.42) |

5.049*** (2.86) |

| Pseudo R-squared | 0.1823 | 0.0317 | 0.2897 |

| Chi squared | 24.91*** | 4.393 | 40.11*** |

| ***, **, * significant at 1 percent, 5 percent, 10 percent | |||

| Table 6 Logit Regression on Stock Choices | ||

| Dividend Stock | Gained Stock | |

| Financial Literacy | 0.216 (0.18) |

2.262* (1.89) |

| Risk Profile | 0.103 (0.75) |

0.233 (1.54) |

| Male | 0.394 (0.71) |

0.309 (0.52) |

| Monthly Income | -0.168 (-0.77) |

-0.0763 (-0.37) |

| Education | 0.190 (0.75) |

-0.0602 (-0.23) |

| Investment Duration | -0.0440 (-0.27) |

-0.0198 (-0.13) |

| Portfolio Values | -0.0685 (-0.33) |

-0.132 (-0.66) |

| Constant | -1.906 (-1.48) |

-1.401 (-1.08) |

| Pseudo R-squared | 0.0196 | 0.0552 |

| Chi squared | 2.290 | 6.441 |

| ***, **, * significant at 1 percent, 5 percent, 10 percent | ||

| Table 7 OLS Regression on Diversification and Active Strategy Behaviour | ||

| Diversification | Monthly Trading | |

| Financial Literacy | 0.527 (0.62) |

0.383 (0.74) |

| Risk Profile | -0.006 (-0.06) |

-0.0256 (-0.42) |

| Male | 0.378 (0.96) |

0.204 (0.85) |

| Monthly Income | -0.0230 (-0.15) |

-0.170* (-1.88) |

| Education | 0.258 (1.41) |

0.0191 (0.17) |

| Investment Duration | -0.148 (-1.40) |

0.0182 (0.28) |

| Portfolio Values | 0.214 (1.50) |

0.356*** (4.07) |

| Constant | 0.824 (0.91) |

0.854 (1.55) |

| R-squared | 0.138 | 0.316 |

| F-Values | 2.10* | 6.06*** |

| ***, **, * significant at 1 percent, 5 percent, 10 percent | ||

We then examine the relationship between our explanatory variables and the likelihood of retail investors in selecting state-owned enterprises (SOE) stocks. We hypothesis that the preference of retail investor in choosing SOE stocks is varied across investors. However, we find that there is no relationship between financial literacy, demography and investment profile, and the preference of investors to collect SOE stocks. We argue that Indonesian SOE stocks are favoured all type of investors due to the popularity of SOEs in Indonesia. Most of SOEs are included in many positive and negative screening indices such as LQ45, Kompas 100, Jakarta Islamic Index, SRI Kehati dan others. Most of the investors, regardless of their literacy, demographic profile and investment profile, may prefer to bid those stock. Therefore, we find no relationship between those three variables and the preference of investors in selecting SOEs.

Another stock selection behavior we investigate is the retail investors in choosing stocks with under thousand-rupiah prices (Under 1,000). This behavior is essential to be analyzed since many retail investors have limited money in their portfolio, especially young investors. The latter sometimes have less than a million rupiah in their stock account. With that limited fund, we assume that investor could choose cheap stocks to build a portfolio. We find that financial literacy is not related to that behavior, shown by the insignificant coefficient on Financial Literacy. A similar result is also shown by the relationship between demographic background and that behavior, suggesting that the behavior does not depend on gender, income and education background. This behavior is varied across investment duration. Retail investors who have long experience in investment/ trading are less likely to invest under 1,000 stocks than those investors who have less experience in investment. The result is shown by the negative coefficient on Investment Duration, -0.373 significant at 10 percent level. A negative coefficient is also reported for Portfolio Values, -0.521 significant at 1 percent level, suggesting that the less likelihood of retail investors with a higher amount of portfolio value to collect under 1,000 stocks. They prefer to choose stocks with above a thousand in price. This implies that those investors prefer to buy stocks with strong fundamental since most of Indonesia stocks with higher price tend to have good fundamental performance.

We then examine the relationship between our variables and the preference of retail investors in choosing dividend and gained stocks. Dividend stock is defined as a stock that is routinely distributed dividend to its shareholders while gained stock is stock that is potentially earned capital gains based on historical data. The preference of choosing dividend stocks is not influenced by financial literacy, demographics, and investment profile, shown by insignificant coefficients on our independent variables. Meanwhile, financial literacy has a positive relationship with the likelihood of investors to select gained stocks. We find a positive coefficient on Financial Literacy, 2.262 significant at 10 percent level. The possibility of choosing firms with a historical capital gain is associated with financial literacy. Retail investors who are more likely to select gain stock than those who have low literacy ratings. This implies that investors with good financial literacy use the previous price movement in choosing stocks. With their good knowledge of finance, they can find firms that will earn higher gain in the future. There are no significant coefficients on other independent variables, suggesting that the behavior of investor in choosing gained stocks is not related to demography and investment profile.

Table 4 reports the relationship between our independent variables on diversification and monthly trading. Diversification refers to how retail investors spread their investment to some stocks instead of holding single or two stocks. This variable is measured by the number of stocks owned by investors in their portfolio. Our result shows that there are no significant coefficients on our independent variables. This implies that diversification is not explained by investor’s financial literacy, risk profile, demography and investment profile of retail investors.

Monthly trading represents whether a retail investor is active or passive. This variable is measured by the average number of trading in a month. We find a negative relationship between monthly trading and monthly income, suggesting that wealthier investors are less active than other investors. They may choose to invest for a longer period instead of taking trader position. However, investors who have a larger amount of portfolio values are more active. The result is contradictive with Monthly Income variable due to the fact that wealthier is guaranteed that they put more money on the stock portfolio. Meanwhile, active or passive behavior is not related to financial literacy, and risk profile, shown by insignificant coefficients on both variables.

Conclusion

Our research aims to investigate the relationship between financial literacy/risk profile/demographics/investment profiles with investment behavior. We survey 100 retail investors across West Sumatera who have own stock account. We find several important results that show retail investor behavior. The behavior in choosing blue-chips stock is influenced by financial literacy and portfolio values. Investors who have higher financial literacy are more likely to select blue-chips stocks compared to investors with lower financial literacy. Retail investors who have a higher amount of portfolio values are also more likely to choose blue-chips. Then, investor behavior in choosing SOE tocks is not distinguished by variability on our independent variables. We find that experienced investors are less likely to select under-thousand rupiah stocks than investors who have fewer experiences. Investors with higher amount portfolio values are less likely to invest on under a thousand-rupiah than those who have lower portfolio values.

We conclude that diversification is not related to our independent variables. Furthermore, monthly trading frequency is associated with investor wealth where they tend to bless active, suggesting that those wealthier investors focus on investment instead of short trading. Investors with higher portfolio values are more active than those who have lower portfolio values. The behaviour in choosing dividend stocks is not related to our independent variables. In terms of behaviour in choosing dividend and gained stocks, investors with higher financial literacy are more likely to pick gained stocks than those with lower financial literacy.

Acknowledgement

We thanks to dean of Faculty of Economics, Universitas Andalas, Dr. Harif Amali Rivai who have supported us by funding our research. We also thanks to the head of Management Department, Dr Verinita, for her support and feedback to our research.

References

- Adam, A.A., & Shauki, E.R. (2014). Socially responsible investment in Malaysia: behavioral framework in evaluating investors' decision making process. Journal of Cleaner Production, 80, 224-240.

- Anderson, A., Henker, J., & Owen, S. (2005). Limit order trading behavior and individual investor performance. The Journal of Behavioral Finance, 6(2), 71-89.

- Almenberg, J., & Dreber, A. (2015). Gender, stock market participation and financial literacy. Economics Letters, 137, 140-142.

- Bailey, W., Kumar, A., & Ng, D. (2011). Behavioral biases of mutual fund investors. Journal of Financial Economics, 102(1), 1-27.

- Barber, B.M., & Odean, T. (2001). Boys will be boys: Gender, overconfidence, and common stock investment. The Quarterly Journal of Economics, 116(1), 261-292.

- Barber, B.M., & Odean, T. (2000). Trading is hazardous to your wealth: The common stock investment performance of individual investors. The Journal of Finance, 55(2), 773-806.

- Barrot, J.N., Kaniel, R., & Sraer, D. (2016). Are retail traders compensated for providing liquidity? Journal of Financial Economics, 120(1), 146-168.

- Bellofatto, A., D’Hondt, C., & De Winne, R. (2018). Subjective financial literacy and retail investors’ behavior. Journal of Banking & Finance, 92, 168-181.

- Choi, J.J., Laibson, D., & Madrian, B. C. (2010). Why does the law of one price fail? An experiment on index mutual funds. The Review of Financial Studies, 23(4), 1405-1432.

- Clements, A., & Silvennoinen, A. (2013). Volatility timing: How best to forecast portfolio exposures. Journal of Empirical Finance, 24, 108-115.

- Deaves, R., Dine, C., & Horton, W. (2006). How are investment decisions made?. Task Force to Modernize Securities Legislation in Canada.

- Diouf, D., & Hebb, T. (2016). Exploring factors that influence social retail investors’ decisions: Evidence from Desjardins fund. Journal of Business Ethics, 134(1), 45-67.

- Fong, K., Krug, J.D., Leung, H., & Westerholm, J.P. (2020). Determinants of household broker choices and their impacts on performance. Journal of Banking & Finance, 112, 105573.

- Gao, M. (2015). Demographics, family/social interaction, and household finance. Economics Letters, 136, 194-196.

- Heimer, R., & Simsek, A. (2019). Should retail investors’ leverage be limited?. Journal of Financial Economics, 132(3), 1-21.

- Huber, J., Palan, S., & Zeisberger, S. (2019). Does investor risk perception drive asset prices in markets? Experimental evidence. Journal of Banking & Finance, 108, 105635.

- Jalilvand, A., Noroozabad, M.R., & Switzer, J. (2018). Informed and uninformed investors in Iran: Evidence from the Tehran Stock Exchange. Journal of Economics and Business, 95, 47-58.

- Kallunki, J., Kallunki, J.P., Nilsson, H., & Puhakka, M. (2018). Do an insider's wealth and income matter in the decision to engage in insider trading? Journal of Financial Economics, 130(1), 135-165.

- Koesrindartoto, D.P., Aaron, A., Yusgiantoro, I., Dharma, W.A., & Arroisi, A. (2020). Who moves the stock market in an emerging country–Institutional or retail investors? Research in International Business and Finance, 51, 101061.

- Li, Z., Wang, F., & Dong, X. (2016). Are all investment decisions to subscribe to new stocks mindless?: Investor heterogeneity and behavior in the process of subscribing to new stocks. China Journal of Accounting Research, 9(4), 283-304.

- Lusardi, A., & Mitchell, O.S. (2007). Baby boomer retirement security: The roles of planning, financial literacy, and housing wealth. Journal of Monetary Economics, 54(1), 205-224.

- McCannon, B.C. (2014). Finance education and social preferences: experimental evidence. Journal of Behavioral and Experimental Finance, 4, 57-62.

- Misra, R., Srivastava, S., & Banwet, D. K. (2019). Do religious and conscious investors make better economic decisions? Evidence from India. Journal of Behavioral and Experimental Finance, 22, 64-74.

- Nofsinger, J.R. (2018). The Psychology of Investing (6th ed.). New York and London: Routledge: Taylor & Francis Group.

- OJK. (2019). Capital market weekly statistics. July, 5th Week 2019.

- Park, K.W., Hong, D., & Oh, J.Y.J. (2019). Investor behavior around monetary policy announcements: Evidence from the Korean stock market. Finance Research Letters, 28, 355-362.

- Lahrech, N., Lahrech, A., & Boulaksil, Y. (2014). Transparency and performance in Islamic banking. International Journal of Islamic and Middle Eastern Finance and Management, 4(2), 116-130.

- Tauni, M.Z., Fang, H.X., & Iqbal, A. (2017). The role of financial advice and word-of-mouth communication on the association between investor personality and stock trading behavior: Evidence from Chinese stock market. Personality and Individual Differences, 108, 55-65.

- Tauni, M.Z., Majeed, M.A., Mirza, S.S., Yousaf, S., & Jebran, K. (2018). Moderating influence of advisor personality on the association between financial advice and investor stock trading behavior. International Journal of Bank Marketing, 36(5), 947-968.

- Tauni, M.Z., Fang, H., Mirza, S.S., Memon, Z.A., & Jebran, K. (2017). Do investor’s Big Five personality traits influence the association between information acquisition and stock trading behavior? China Finance Review International, 7(4), 450-477.

- Tekçe, B., Y?lmaz, N., & Bildik, R. (2016). What factors affect behavioral biases? Evidence from Turkish individual stock investors. Research in International Business and Finance, 37, 515-526.

- Van Rooij, M., Lusardi, A., & Alessie, R. (2011). Financial literacy and stock market participation. Journal of Financial Economics, 101(2), 449-472.

- Zhou, X., Cui, Y., Wu, S., & Wang, W. (2019). The influence of cultural distance on the volatility of the international stock market. Economic Modelling, 77, 289-300.