Research Article: 2020 Vol: 24 Issue: 6

Analyze The Influence of Asian Regional Share Price Index on The Joint Share Price Index In Indonesia

Petrus Peleng Roreng, Jeferson Belopadang

FEB Universitas Kristen Indonesia Paulus Makassar

Abstract

In this paper, the researcher study and analyze the effect of the Asian regional stock price index on the composite stock price index in the Indonesian stock exchange empirically. The independent variables used in this study are Singapore Straits Times Price Index (STI), Kuala Lumpur Composite Index (KLCI), Shanghai Stock Exchange (SSE), Nikkei 225 Index (N225), Hang Seng Index (HSI), dan Korea Composite Stock Price Index (KOSPI). In contrast, the dependent variable used is the Composite Stock Price Index in the Indonesia Stock Exchange. The results found that KLCI had a significant and positive effect on the IHSG. In contrast, STI, SSE, HSI, and KOSPI had a positive but not significant impact on the IHSG and N225 had a negative and insignificant effect on the IHSG. In addition, the R Square value is 28.6%. That means that other variables outside the model explained 71.4%.

Keywords

Singapore Straits Times Price Index, Kuala Lumpur Composite Index, Shanghai Stock Exchange, Hang Seng Index, Korea Composite Stock Price Index.

Introduction

The Indonesian capital market through the Bursa Efek Indonesia (BEI) or Indonesia Stock Exchange (IDX)) is an integral part of the global stock exchange activities. Also, usually for stock exchanges that are close to their location, they often have the same investors (Mansur, 2005). The phenomenon that occurs due to globalization and Indonesia as one of the countries in the Asian region has opened a stock market for foreign investors investing in the Asian area. Therefore, a change in one stock exchange will also affect other countries' exchanges in this case, usually the more significant transactions against the smaller ones.

The capital market in Indonesia has undergone significant changes due to technological changes and globalization. The Indonesian capital market has been integrated with the world capital market (Karim et al., 2009). As a result, the risk and return of shares internationally and movements in the capital market are not only caused by domestic factors, but also by changes in share prices in world capital markets. The capital market is also integrated if two separate markets have the same movements and have movements in between their indexes (Click & Plummer, 2003 & Eddy, 2020).

The purpose of this study was to determine and analyze the effect of the Singapore Straits Times Price Index (STI), the Kuala Lumpur Composite Index (KLCI), the Shanghai Stock Exchange (SSE) Index, the Nikkei 225 Index (N225), and the Hang Seng Index (HSI). ), and the Korea Composite Stock Price Index (KOSPI) simultaneously or partially against the Composite Stock Price Index (IHSG) in Indonesia.

Literature Review

Before 2007, two stock exchanges in Indonesia obtained securities trading business licenses from Bapepam, namely the Bursa Efek Jakarta (BEJ) or the Jakarta Stock Exchange (JSX), and Bursa Efek Surabaya (BES) or the Surabaya Stock Exchange (SSX). On November 30, 2007, JSX and SSX were merged and changed their name to the Indonesia Stock Exchange (IDX) and started operations on December 1, 2007.

An index number is a number that is used as a means of comparing two or more of the same activities for different periods and is expressed in per cent (Iqbal, 2013). The basis for consideration is, among others, if the number of listed company shares held by the public (free float) is relatively small. At the same time, the market capitalization is large enough, so changes in the listed company's share price have the potential to affect the fairness of the IHSG movement. The basis for giving weight to the weighted IHSG calculation is determined by the size of influence on the shares. For stocks that have a significant role in influencing the market, will be given considerable weight. On the other hand, stocks that have little influence will be given a small load. In determining the size of the weight is influenced by the size of the number of shares registered by the issuer (Widoatmodjo, 2000, Muh. F, 2020).

Straits Times Index or STI is a stock market index based on capitalization on the Singapore Stock Exchange. The Straits Times Index is used to record and monitor daily changes of the 30 largest companies in the Singapore stock market and as a critical indicator of market performance in Singapore. The Straits Times Index was founded on January 10, 2008, as a continuation of the Straits Times Industrial Index (www.straitstimes.com) (Samsul, 2008).

In July 2009, the Kuala Lumpur Stock Exchange or KLSE was changed to FTSE BM KLCI as the basis for measuring the Malaysian capital market. KLSE was introduced in 1986. It also was used as an indicator of the performance of the Malaysian stock market and economy. In this Index, there are 30 of the most liquid companies on the Malaysian stock exchange. The base value of this Index is 100, which has been established since January 1977 (www.ftse.com).

The Shanghai Index is a widely followed domestic and foreign authoritative statistical index to measure the performance of the Chinese Capital Market. The Shangai Stock Exchange or the Shangai index is an index that contains the best 50 stocks in terms of liquidity and represents the stock market in Shanghai, China with a scientific and objective method (www.csindex.com.cn).

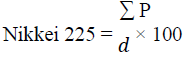

The Nikkei 225 is a stock market index calculated and published by the Japanese newspaper Nikkei Inc. The official name of the Nikkei 225 stock index is the Nikkei Stock Average. The Nikkei Stock Average or better known as the Nikkei 225 consists of 225 stocks on the Japanese stock market, namely the Tokyo Stock Exchange First Section, considering the weight of the industrial sector. For more than 60 years, Nikkei 225 index has been used as a barometer of the state of the Japanese economy. The Nikkei 225 is the main Index for Japanese equity market financial products that was founded in 1950. Daily calculations of the Nikkei 225 index started on September 7, 1950, by the daily Nihon Keizai Shimbun (Nikkei). At the same time, the Tokyo stock exchange uses the Nikkei 225 index as an adjustment to the TSE average price.

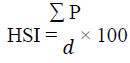

The Hang Seng Index is one of the composite stock indexes in the Hong Kong Stock Exchange (Stock Exchange of Hongkong Limited/SEHK) which includes the 33 largest company stocks in the SEHK and is the main indicator of market performance in Hong Kong, covering around 70% of the capitalization value. SEHK (www.wikipedia.com).

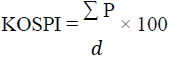

The KOSPI 200 covers the whole of 70% of the value of shares traded on the stock exchange and is a representation of the price of all shares in South Korea, such as the Dow Jones index in the US. The base value is set at 100 points as of January 3, 1990. It is calculated using the market capitalization method from its value/weight, and the dominance of one or more components which is relatively much larger than the other ingredients.

Research Methodology

The population and sample used in this study are the STI index, KLCI index, SSE index, Nikkei 225 index, HSI index, KOSPI index and IHSG for the period January 2014 to December 2017 (48 months). The research variables can be seen in Table 1.

| Table 1 Research Variables | |||

| Research Variable | Definition | Measurements | Scale |

| Singapore Straits Times Price Index (STI) (X1) |

An index used to measure the performance of the Singapore stock market |  |

Ration |

| Kuala Lumpur Composite Index (KLCI) (X2) |

An index used to measure the performance of the Malaysian stock market |  |

Ration |

| Shanghai Stock Exchange (SSE) (X3) |

An index used to measure the performance of the Chinese stock market |  |

Ration |

| Nikkei 225 Index (N225) (X4) |

An index used to measure the performance of the Japanese stock market |  |

Ration |

| Hang Seng Index (HSI) (X5) |

An index used to measure the performance of the Hong Kong stock market |  |

Ration |

| Korea Composite Stock Price Index (KOSPI) (X6) |

An index used to measure the performance of the South Korean stock market. |  |

Ration |

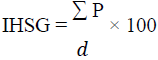

| Indeks Harga Saham Gabungan (IHSG) (Y) |

An index used to measure the performance of the Indonesian stock market |  |

Ration |

Data Analysis Technique

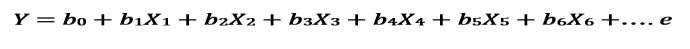

In analyzing the data, the researcher used the SPSS 23 program. The data analysis method used in this study was multiple regression analysis methods Anoraga & Pakarti (2003). This study uses multiple linear regression analysis to determine the effect of studied with variables on the Composite Stock Price Index (multiple linear regression method) or mutated as follows:

Where:

Y = Indeks Harga Saham Gabungan (composite stock price index) (IHSG)

b0-b6 = Regression Coefficient

X1 = Singapore Straits Times Price Index (STI)

X2 = Kuala Lumpur Composite Index (KLCI)

X3 = Shanghai Stock Exchange (SSE)

X4 = Nikkei 225 Index (N225)

X5 = Hang Seng Index (HIS)

X6 = Korea Composite Stock Price Index (KOSPI)

e = Error

Results and Discussion

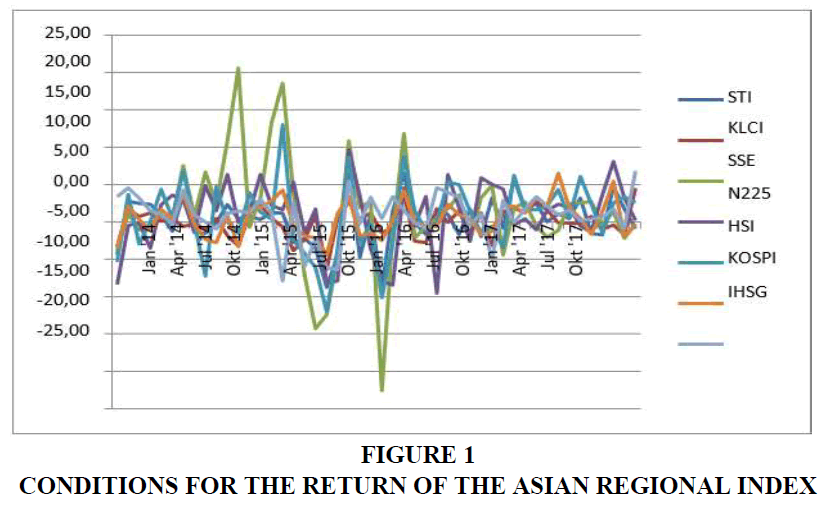

Description of Data on Conditions of Return of the Asian Regional Stock Price Index (Table 2).

| Table 2 Descriptive Statistics | |||||||

| STI | KLCI | SSE | N225 | HSI | KOSPI | IHSG | |

| Average | 0,20 | -0,06 | 1,20 | 0,80 | 0,63 | 0,45 | 0,88 |

| Max | 7,43 | 4,60 | 20,57 | 9,75 | 12,98 | 6,44 | 6,78 |

| Min | -8,80 | -6,41 | -22,65 | -9,63 | -12,04 | -4,37 | -7,83 |

| Std. Deviation | 3,30 | 2,00 | 7,34 | 4,62 | 4,79 | 2,42 | 2,96 |

Based on Figure 1 above, it obtained an overview of the fluctuation in the value of the Asian regional stock price index during the period 2014-2017. In the fourth quarter of 2014, the pattern of fluctuations in the Asian local stock price index shows a random variation marked by very extreme resistant points and support points. And that fluctuation (volatility) is evident in the SSE stock price index, wherein the picture above, the resistance point and support point of the SSE index is in an extensive range, this is reinforced by the most considerable SSE standard deviation value of 7.34.

Regression Test (F-Test)

Based on Table 3, the Fcount value is 2.471, while the Ftable is 2.46 with the numerator df 6- 1 = 5, the denominator df 44-6 = 38 and the significant level α = 0.05 so that Fcount> Ftable (2.471> 2.46) with a significance value smaller than 0.05 (0.041 <0.05). Thus, it can be interpreted that H0 is rejected and H1 is accepted, which means the Singapore Straits Times Price Index (STI), Kuala Lumpur Composite Index (KLCI), Shanghai Stock Exchange (SSE), Nikkei 225 Index (N225), Hang Seng Index (HSI). And the Korea Composite Stock Price Index (KOSPI) simultaneously has a significant effect on the Composite Stock Price Index in Indonesia (IHSG) for the 2014-2017 period.

| Table 3 Simultaneous Test Results | ||||||

| Model | Sum of Squares | df | Mean Square | F | Sig. | |

| 1 | Regression | 88,803 | 6 | 14,800 | 2,471 | ,041b |

| Residual | 221,594 | 37 | 5,989 | |||

| Total | 310,397 | 43 | ||||

| a. Dependent Variable: IHSG b. Predictors: (Constant), KOSPI, SSE, KLCI, N225, STI, HSI |

||||||

Partial Test (t-test)

Based on Table 4, it shows that only the Kuala Lumpur Composite Index (KLCI) has a significant effect on the Composite Stock Price Index in Indonesia (IHSG) for the 2014-2017 period because the KLCI significance value is less than 0.05 (0.026 <0.05). In the STI, SSE, N225, HSI and KOSPI variables the significance value is more significant than 0.05 so that it can be ascertained that these variables do not have a significant effect on the Composite Stock Price Index in Indonesia (IHSG) for the 2014-2017 period.

| Table 4 Hasil UJI Parsial | |||||||

| Model | Unstandardized Coefficients | Standardized Coefficients | t | Sig. | Information | ||

| B | Std. Error | Beta | |||||

| 1 | (Constant) | ,917 | ,393 | 2,333 | ,025 | ||

| STI | ,014 | ,204 | ,015 | ,069 | ,945 | H0 Received H1 Rejected | |

| KLCI | ,520 | ,224 | ,361 | 2,317 | ,026 | H0 Rejected H1 Received | |

| SSE | ,138 | ,095 | ,254 | 1,445 | ,157 | H0 Received H1 Rejected | |

| N225 | -,068 | ,100 | -,111 | -,686 | ,497 | H0 Received H1 Rejected | |

| HSI | ,016 | ,150 | ,023 | ,107 | ,915 | H0 Received H1 Rejected | |

| KOSPI | ,151 | ,226 | ,123 | ,668 | ,508 | H0 Received H1 Rejected | |

| a. Dependent Variable: IHSG | |||||||

Multiple Linear Regression Equation Analysis

Based on Table 3 above, a multiple regression equation can be prepared as follows:

IHSG = 0,917 + 0,014 STI + 0,520 KLCI + 0,138 SSE – 0,068 N225 + 0,016 HSI + 0,151 KOSPI

Determination Coefficient Test (R2)

Based on Table 5 it shows that the value of the coefficient of determination or Adjusted R Square is 0.170 or 17%. This figure shows that 17% of the IHSG variable can be explained by the STI, KLCI, SSE, N225, HSI, and KOSPI variables. While the remaining 83% is explained by other variables outside the model contained in this study.

| Table 5 Determination Coefficient | ||||

| Model | R | R Square | Adjusted R Square | Std. Error of the Estimate |

| 1 | ,535a | ,286 | ,170 | 2,44725 |

| a. Predictors: (Constant), KOSPI, SSE, KLCI, N225, STI, HSI b. Dependent Variable: IHSG |

||||

Discussion

Based on regression analysis simultaneously, the six Asian regional stock price indices have a significant effect on the Composite Stock Price Index in Indonesia (IHSG) on the Indonesia Stock Exchange. From this estimate, the Fstatistic value is 2.471 with a significant level of 0.041 (sig. <0.05), so that H0 is rejected. This means that simultaneously the Asian regional stock price index has a significant influence on the IHSG. Thus the hypothesis which states "It is suspected that the Asian regional stock price index had a significant effect on the Composite Stock Price Index in Indonesia in 2014-2017" is accepted. Another factor that encourages linkages between the Asian regional stock price index is the era of financial and non-financial globalization. The Indonesian Stock Exchange (IDX) is no exception, and it has also been affected by globalization, has been integrated with several exchanges in other countries, so that the future of the IDX is also determined by the prospects for the global stock market. Theoretically, this empirical finding is also in accordance with the Contagion Effect Theory that the economic conditions of a country will affect the economic conditions of other countries.

Index Effect STI to IHSG

Based on the partial test calculation, the comparison between tcount and ttable is H0 accepted, because of tcount (0.069) <ttable (2.026) with a significance value of more than 0.05 (0.069> 0.05). From the results of testing these hypotheses, it is concluded that there is no partially significant effect between the Asian regional stock price index as measured by the STI (X1) on the IHSG (Y). The results of this study are not in accordance with the Contagion Effect Theory, which states that the economic conditions of a country will affect the economic conditions of other countries. That means that the STI index does not have a significant effect on the IHSG because the market is more responsive to foreign market movements that are more influential, such as the KLCI and regional economic developments. These results are in line with the results of research by Mandasari & Wahyuanti (2013) and Khajar (2011); Sunariyah. 2011 which conclude that the STI index partially does not have a significant effect on the IHSG index in Indonesia. However, the results of this study contradict the research results of Utama & Artini (2015); Hidayah (2012) and Kasim (2010) which conclude that the STI index partially has a significant effect on the IHSG index in Indonesia.

Index Effect KLCI to IHSG

Based on the partial test calculation obtained from the comparison of tcount with ttable is H0 rejected because ttable (2.026) <tcount (2.317) the significance value is less than 0.05 (0.026 <0.05). From the results of testing these hypotheses, it is concluded that there is a partially significant effect between the Asian regional stock price index as measured by KLCI (X2) on the IHSG (Y). The results of this study are in accordance with the Contagion Effect Theory, which states that the economic conditions of a country will affect the economic conditions of other countries. That is presumably because the local market is only a follower of a more dominant market. Thus, Malaysia’s influence on Indonesia is beneficial in the sense that Malaysia is not a threat to Indonesia so that favourable market conditions in Malaysia become a positive sentiment for market movements in Indonesia. The results of this study are in line with the research of Nurul Hidayah (2012) and Muhammad Yunus Kasim (2010) who conclude that the KLCI index partially has a significant effect on the IHSG index in Indonesia.

Index Effect SSE to IHSG

Based on the partial test calculation obtained from the comparison of tcount with ttable is H0 accepted, because of tcount (1.445) <ttable (2.026) with a significance value of more than 0.05 (0.157> 0.05). From the results of this hypothesis testing, the conclusion is that there is no partially significant effect between the Asian regional stock price index as measured by SSE (X3) on the IHSG (Y). The results of this study are not in accordance with the Contagion Effect Theory, which states that the economic conditions of a country will affect the economic conditions of other countries. The reason for the insignificance of SSE to the IHSG is because China does not invest much in shares, but in investments, one of which is in the infrastructure sector, for example investing in the construction of toll roads, reservoirs, and hydropower plants in West Java. Thus, it shows that the ups and downs of the SSE Index do not have a significant effect on the IHSG Index. The results of this study are in line with the research of Mie & Agustina (2014).

Index Effect N225 to IHSG

Based on the partial test calculation, the comparison between tcount and ttable is H0 accepted, because of ttable (-2.026) <-tcount (-0.686) with a significance value of more than 0.05 (0.497> 0.05). From the results of this hypothesis testing, it is concluded that there is no partially significant effect between the Asian regional stock price index as measured by N225 (X4) on the IHSG (Y). The results of this study are not in accordance with the Contagion Effect Theory, which states that the economic conditions of a country will affect the economic conditions of other countries. This is due to the behaviour of Japanese investors who invest more in the real sector than the financial industry so that the behaviour of investors in the Indonesian capital market does not have a significant effect on the rate of IHSG in Indonesia. The results of this study are in line with the research of Utama & Artini (2015); Mie & Agustina (2014); Khajar (2011) who state that the N225 Index partially has no significant effect on the IHSG index. However, the results of this study contradict the results of research by Wahyuni et al. (2014); Mandasari & Wahyuanti (2013) and Mansur (2005) is precisely that stated that the N225 Index partially has a significant effect on the IHSG index.

Index Effect HSI to IHSG

Based on the partial test calculation, the comparison of tcount to ttable is H0 accepted, because of tcount (0.107) <ttable (2.026) with a significance value of more than 0.05 (0.915> 0.05). From the results of testing these hypotheses, it is concluded that there is no partially significant effect between the Asian regional stock price index as measured by the HSI (X5) on the IHSG (Y). The results of this study are not in accordance with the Contagion Effect Theory, which states that the economic conditions of a country will affect the economic conditions of other countries. This happens because the ownership of securities or shares, especially the ownership of Hong Kong investors for shares in Indonesia is very small so that the actions taken by Hong Kong investors both in the Indonesian capital market and in the Hong Kong capital market itself have no significant impact in moving the Indonesian stock market so that changes in the behavior of the stock price index HSI in Hong Kong is not a catalyst or strong sentiment towards the behavior of the IHSG in Indonesia. This result is in line with the research results of Mandasari & Wahyuanti (2013); Kasim (2010); and Mansur (2005) concludes that the HSI index partially does not have a significant effect on the IHSG index in Indonesia. However, the results of this study contradict the results of research by Seputro (2012) and Khajar (2011), which conclude that the HSI index partially has a significant effect on the IHSG index in Indonesia.

Index Effect KOSPI to IHSG

Based on the partial test calculation, the comparison between tcount and ttable is H0 accepted, because of tcount (0.668) <ttable (2.026) with a significance value of more than 0.05 (0.508> 0.05). From the results of testing this hypothesis, it is concluded that there is no partially significant effect between the Asian regional stock price index as measured by the KOSPI (X6) on the IHSG (Y). The results of this study are not in accordance with the Contagion Effect Theory, which states that the economic conditions of a country will affect the economic conditions of other countries. That happens because the economic conditions in South Korea are still unstable due to geopolitical tensions that occur on the Korean Peninsula with North Korea. Also, North Korea has repeatedly flown missiles as an act of provocation or resistance against South Korea as a result of making market players afraid so that it makes the Korean economy is unstable. This economic instability has prevented market players in Indonesia from using the Korean market as a benchmark for investment in the stock market. This result is in line with the results of research by Khajar, (2011); Bae (1995), which concludes that the KOSPI index partially has no significant effect on the IHSG index in Indonesia. However, the results of this study contradict the results of research by Wahyuni et al. (2014) and Mansur (2005) concludes that the KOSPI index partially has a significant effect on the IHSG index in Indonesia.

Conclusion

The results of this study indicate that the Asian regional stock index as measured by STI, KLCI, SSE, N225, HSI and KOSPI simultaneously affects the IHSG. Partially, only KLCI had a significant effect on the IHSG movement, while STI, SSE, N225, HSI, and KOSPI had no significant impact on the IHSG. The limitation of this study is that study only uses six variables and is just centred on the Asia Pacific. So, it does not reflect the conditions of the Asian regional Index. Against the IHSG in Indonesia and the period in this study is limited from 2014 to 2017.

Further works, it recommended having some variables. It will expect to be independent by using the composite stock index of other countries. By side that, the independent variables that have been used in this study such as the Thailand Stock Exchange (SET), the Taiwan Stock Exchange (TSEC), or the Bombay Stock Exchange (BSESN) so that you can see the effect of stock price indexes of other countries on the Index. Composite Stock Price in Indonesia and looking at other factors that have a significant impact on the Composite Stock Price Index in Indonesia. Further research can also increase the observation period to a decade or ten years to improve data distribution better. That has done to see a more diverse and representative result.

References

- Anoraga & Pakarti (2003). Pengantar Pasar Modal. Jakarta: Rineka Cipta.

- Bae, K.H. (1995). Market segmentation and time variation in the price of risk: Evidence on The Korean stock market. Pasific- Basin Jounal, 1-29.

- Buku Panduan Indeks Harga Saham (2010). Jakarta: BEI. Retrieved from https://www.idx.co.id/media/1481/buku-panduan-indeks-2010.pdf

- Click, R.W., & Plummer, M.G. (2003). Stock Market Integration in ASEAN after The Asian Financial Crisis. The International Cantre for the Study of East Asian Development, Kitakyushu, Japan.

- Eddy, Y., Susanto, S.J.F.X., Rustem, A.S., & Herningsih, A.T., (2020). Study of shared service implementation to develop a successful leadership business management system. Journal of Critical Reviews, 7(1), 267-271

- Iqbal, H.M. (2013). Principles of Material Material 2 (Inferential Statistics). Jakarta: Bumi Aksara.

- Karim, B.A., Majid, M.S.A., & Karim, S.A.A. (2009). Integration of Stock Markets Between Indonesia and Its Major Trading Partners. Gajah Mada International Journal of Business, 11(2).

- Kasim, M.Y. (2010). The effect of regional stock price index on the composite stock price index in the Indonesia stock exchange. Central Sulawesi Research and Development Media, 3(1), 27 –32.

- Khajar, I. (2011). The global stock exchange and its influence on the Indonesia stock exchange post-financial crisis 2008. Journal of EKOBIS,12(2), 153 – 167.

- Mandasari, N., & Wahyuanti, A. (2013). The effect of the foreign stock index on the JCI for investment decisions. Journal of Management Science & Research, 2(6).

- Mansur, M. (2005). The effect of the global stock exchange index on the composite Stock Price Index (IHSG) at the Jakarta Stock Exchange (BEJ) 2000-2002 Period. Sosiohumaniora, 7(3), 203-219.

- Mie, M., & Agustina. (2014). Analysis of the effect of the foreign composite stock price index on the Indonesian composite Stock Price Index. Journal of Micro-Political Economy Entrepreneurs, 4(2).

- Muh. F., Muhammad, R.P., Petrus, P.R., & Apriana T. (2020). Study of marketing management using IOT. Journal of Critical Reviews, 7(1), 294-297

- Samsul, M. (2008). Pasar Modal & Manajemen Portofolio. Jakarta: Erlangga.

- Seputro, H.Y. (2012). The Influence of SBI Interest Rates, Dow Jones Industrial Averages Index, Hang Seng Index, on the Indonesia Stock Exchange Composite Stock Price Index (IHSG). Journal of Economic Compilation, 4(1), 12- 26.

- Sunariyah. (2011). Introduction to Capital Market Knowledge (Sixth edition). Yogyakarta: YKPN School of Management.

- Utama, I.W.A.B., & Artini, L.G.S. (2015). The influence of the world stock index on the indonesia stock exchange composite Stock Price Index. Journal of Management, Business Strategy and Entrepreneurship, 9(66).

- Wahyuni, W., & Siti Khairani, C.D.W. (2014). The effect of the global stock price index on the movement of the composite Stock Price Index (IHSG) in the Indonesia Stock Exchange. Journal of STIE MDP.

- Widoatmodjo, S. (2000). Cara Sehat Investasi di Pasar Modal. Jakarta: PT Jurnalida Aksara Grafika.