Research Article: 2023 Vol: 27 Issue: 5

Antecedents and Innovative Outcomes of Financial Technology Adoption of the Banking Industry: A Strategic View

Fekri Shawtri, Community College of Qatar

Ibrahim Hussien Musa Magboul, Community College of Qatar

Citation Information: Shawtri, F., & Magboul, I.H.M. (2023). Antecedents and innovative outcomes of financial technology adoption of the banking industry: a strategic view. Academy of Accounting and Financial Studies Journal, 27(5), 1-14.

Abstract

The financial industry has been strongly influenced by digitalization in the past few years due to the emergence of financial technology (fintech), with many financial service providers adopting fintech. The development of fintech systems has bought a radical change to the financial industry by providing opportunities for the creation of new services and business models and poses challenges to traditional financial service providers. Thus, fintech has become subject to attention and research among practitioners and scholars. Based on technology adoption extant literature, this study aims to validate structural relationships that incorporate four external antecedents and three innovation outcomes into one model. Several hypotheses are suggested based on the model as the basis for future survey work to investigate the various aspects of fintech adoption. A survey was conducted from 126 observations deploying AMOS to validate the study model. Four out of seven antecedents were supported by data while three were not. Surprisingly, fintech adoption has a significant positive effect on all innovation outcomes, namely process innovation, product innovation, and innovation capability. This study could contribute to research in the areas of information systems and finance. It also benefits researchers and practitioners of Fintech technologies.

Keywords

Financial Technology, Adoption, Antecedents, Outcomes, Innovation, Banking Industry, Qatar.

Introduction

Business organizations are increasingly relying on Financial Technology (Fintech) as a means to help accomplish tasks in a turbulent environment (Zhang et al., 2018; Siyal et al., 2019; Singh et al., 2020). The potential benefits of fintech systems as tools for advancing business and society at large are widely recognized (Hasan et al., 2021). However, it is not well known among many researchers that there are differences in the adoption of fintech between developed and developing countries, despite currently fintech systems being extensively studied (Okoli & Tewari, 2020; Hasan & Ashfaq, 2021).

Many studies argue that the pay-off from investment in fintech cannot be effective and efficient because the end adoption remains low (Hornuf et al., 2021). Furthermore, a deeper understanding of the antecedents of Fintech in organizations is needed, particularly when these systems are not providing the expected return on investment (Douglas & Grinberg, 2016; Kalmykova & Ryabova, 2016; Hua et al., 2019). Despite a considerable portion of revenue on fintech by organizations, still, the payoff from the investment is debatable (Almulla & Aljughaiman, 2021). However, the financial industry is of great importance to society and in the daily lives of people worldwide (Gomber et al., 2017; Milian et al., 2019). Financial industries are investing in Fintech to facilitate moving to more technology-driven business processes (Micu & Micu, 2016; Berkmen et al., 2019). Occasionally, the financial industry in Qatar is frequently cited as being one of the fastest-growing in the Gulf zone.

Based on the prior discussion of the empirical research on Fintech, a model, which includes antecedents that affect adoption as well as the innovative outcomes that are affected by the subsequent fintech adoption, is explored, to use the knowledge captured to enhance Fintech among employees in the four listed big banks in Qatar where a marked lack of research on Fintech is observed. The remainder of this paper is organized as follows. Section 2 discusses the literature review. Section 3 provides the proposed research model and its associated hypotheses. Next, Section 4 describes the research method which includes an assessment of the goodness of the structural model, and this is followed by the analysis of the results in Section 5. Section 6 discusses the key findings while section 7 includes the implications. Lastly in section 8, some suggested future work and limitations of this study are presented.

Literature Review

The financial industry has witnessed a rapid revolution in the technologies to serve the wide spectrum of clientele (Wonglimpiyarat, 2018). The notable term of financial technology or what is well- termed, as Fintech is the major trend and advancement information technologies, which shapes the operations of the banking industry. A fintech is a tool that utilizes that computer programs and algorithms to perform various financial and banking services (Ozili, 2018). According to Thakor (2019) Fintech involves the utilization of technology to deliver more efficient and enhanced financial services. The reason behind this revolutionary trend is the need to reduce the intermediation mediation costs that would help to boost the financial sector performance and hence the economy (Thakor, 2019).

The major theories that justify the evolution and adoption of new technology and information system are the innovation and diffusion theory of Roger (1983), the Theory of Reasoned Action (Fishbein & Ajzen, 1975), and the Technology Adoption Model of (Davis, 1986). The integration of these theories and the inclusion of contextual antecedents in the field of adoption is the recent strand in the literature (Hameed et al., 2012). According to Shaikh & Karjaluoto (2015), the current literature on the adoption of technologies including mobile banking largely depends on the TAM and its modifications. Various research conducted studies to explore the determinants of the adoption of technologies (Yen & Wu, 2016). Prior research has addition variables to complement TAM original variables to expand and gain a solid understanding in predicting the acceptance rate of a novel technology (Pantano & Di Pietro, 2012; Liébana-Cabanillas et al., 2017; Siyal et al., 2019). Poong et al. (2017) lend support to the feasibility of TAM in technology adoption and fintech is not an exception.

The literature of Fintech modelling for the adoption and usage purposes are still at early stages and few studies have been conducted, although it foundation rooted in the TAM as the main technology acceptance research model (for instance, Ryu, 2018; Hu et al., 2019; Razzaque et al., 2020). In the study of Ryu (2018), the perceived benefits and risks of Fintech's usage have been explored and evaluated. Additional risk types that involve legal risks and operational risks were also investigated. The results find support for the effects of the legal risk on the Fintech adoptions although the findings indicate the negative effects. On contrary, the Fintech adoption is affected by convenience significantly and positively. In a different contextual setting, Hu et al. (2019) examine the use of Fintech among active customers. Their findings substantiate that trust is a major factor that influences the trend among the customers to adopt fintech. The traditional factor of TAM like perceived ease of use was not significant in fintech adoption.

Razzaque et al. (2020) also explored the fintech adoption in the banking sector in Bahrain. The results indicate that perceived benefits and risks are considered as the main determinant of the adoptions. However, the users believe that perceived benefit is more important than perceived risk. The results are consistent with Ryu’s (2018) in many aspects including the perceived benefits, risks, and convenience Hu et al. (2019) provide evidence that is not consistent with (Razzaque et al., 2020).

An extension also has been carried out to include the outcome in the model. Mahmood & Soon (1991) extracted a comprehensive model from the literature to measure the potential impact of IT on strategic organizational variables. Similarly, Chen & Tsou (2007) examined the impact of IT adoption on product innovation and process innovation. A positive relationship between IT adoption and innovation practices was found. In a different perspective, adopting IT through user behaviors by Venkatesh et al. (2003) was explored. Also, Jitpaiboon et al. (2005) believe that technology adoption research should be heavily looked into IT adoption instead of focusing on a simple investigation of dependent variables. This is the major motivation of this paper.

On a different focus, fintech benefits should be investigated. The importance of the antecedents has been overlooked in the new studies of fintech. It is of significance to specify factors that justify why people continue to use Fintech. Studies have identified the main drivers influencing user behavioral intentions in the technology adoption literature (Zhou, 2013; Ryu, 2018; Hu et al., 2019). However, no studies have covered both antecedents and innovation outcomes in the adoption of Fintech. Furthermore, while there is a need to understand the Fintech adoption, there has been little attempt to fill the gap.

Building on the above few studies, it is crucial to determine the main antecedents and the innovation outcomes factors that drive the financial technology adoption and fill the void of the prior research. Thus, this study proposed an extension of the TAM by adding adequate antecedents and innovation outcomes to predict the adoption of Fintech within organizations.

Research Model and Hypotheses Support

The expectations from using Fintech have created a significant challenge in its adoption concerning the planning of technology acceptance and usage within organizations. Since current research on Fintech is fragmented with limited theoretical grounding (Cai, 2018), this study advances the use of technology acceptance frameworks to propose a theoretical model of antecedents and innovation outcomes of Fintech adoption. The study has delineated the pertinent antecedents influencing the adoption of Fintech. In addition, while a considerable amount of research effort addresses the field of financial services and the banking sector, only a few empirical studies have addressed the Fintech industry (Zavolokina et al., 2016).

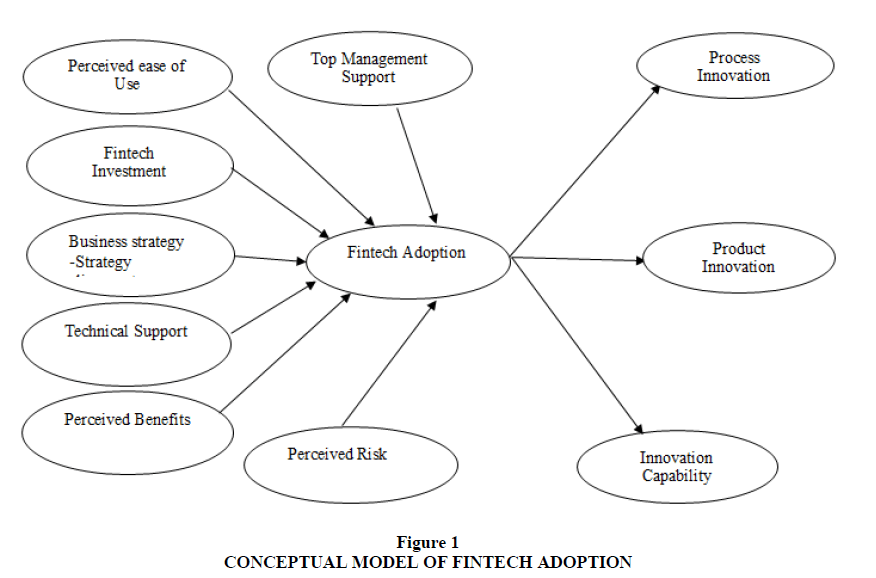

There are ten variables in this model. The first part of the model includes seven antecedents of Fintech adoption (H1-H7). The second part of the model consists of the Fintech adoption construct (Davis, 1989). The third part includes innovation outcomes, namely process innovation with three hypotheses (H8–H10) Figure 1 and Table 1.

|

||||||||||||||||||||||||||||||||||||||||||||||||

Method

The purpose of this study is to investigate the antecedents and innovative outcomes of Fintech adoption of the banking industry in Qatar. This is a cross-sectional quantitative study. The population for this study comprises employees of the big four listed banks in Qatar who are currently active in these banks. However, the target employees of these banks are largely familiar with fintech applications due to the nature of their jobs across bank departments. A purposive sampling technique was deployed. In designing the questionnaire, a thorough prior literature review search was performed, and the questionnaires related to technology adoption are identified. As a pre-test, a total of three experts were involved in the item refining process. A pilot study was conducted before the actual data collection to test the item measurements in the study model to confirm the reliability and validity of the measurement items as well as the clarity of the questionnaire. Since most of the variables in the conceptual model have already been studied in the extant studies, therefore, their measurement constructs and associated measures existed. The questionnaire was consisted of four sections to respectively cover general information, the antecedents, Fintech adoption, and innovation outcomes.

Analysis

Assessment of the Measurement Model

First, we tested convergent validity which is the degree to which multiple items measuring the same concept agree. As suggested by Hair et al. (2010) we used the factor loadings, composite reliability and average variance extracted to assess convergence validity. The loadings for all items exceeded the recommended value of 0.5 (Hair et al., 2010). Composite reliability values (see Table 2), which depict the degree to which the construct indicators indicate the latent construct ranged from 0.808 to 0.938 which exceeded the recommended value of 0.7 (Hair et al., 2010). The average variance extracted, which reflects the overall amount of variance in the indicators accounted for by the latent construct, was in the range of 0.548 and 0.747 which exceeded the recommended value of 0.5 (Hair et al., 2010).

| Table 2 Factors Loading, Composite Reliability And Average Variance Explained Of The Variables |

||||

|---|---|---|---|---|

| Code | Loading | CR | AVE | |

| Innovation Capability | Cap3 | 0.711 | 0.870 | 0.573 |

| Cap4 | 0.771 | |||

| Cap5 | 0.764 | |||

| Cap8 | 0.762 | |||

| Cap10 | 0.774 | |||

| Product Innovation | Product3 | 0.918 | 0.898 | 0.747 |

| Product2 | 0.829 | |||

| Product1 | 0.843 | |||

| Process Innovation | Process6 | 0.825 | 0.798 | 0.569 |

| Process2 | 0.733 | |||

| Process1 | 0.699 | |||

| Fintech Adoption | FINTEH3 | 0.744 | 0.866 | 0.684 |

| FINTEH2 | 0.834 | |||

| FINTEH1 | 0.896 | |||

| Perceived Risk | PRisk8 | 0.753 | 0.933 | 0.637 |

| PRisk7 | 0.775 | |||

| PRisk6 | 0.684 | |||

| PRisk5 | 0.796 | |||

| PRisk4 | 0.839 | |||

| PRisk3 | 0.855 | |||

| PRisk2 | 0.879 | |||

| PRisk1 | 0.787 | |||

| Perceived Benefits | PB1 | 0.827 | 0.938 | 0.656 |

| PB2 | 0.769 | |||

| PB3 | 0.75 | |||

| PB4 | 0.865 | |||

| PB5 | 0.882 | |||

| PB6 | 0.845 | |||

| PB7 | 0.821 | |||

| PB9 | 0.704 | |||

| Technical Support | TS6 | 0.81 | 0.909 | 0.625 |

| TS5 | 0.811 | |||

| TS4 | 0.829 | |||

| TS3 | 0.703 | |||

| TS2 | 0.738 | |||

| TS1 | 0.842 | |||

| Perceived ease of Use | PEoU6 | 0.816 | 0.893 | 0.627 |

| PEoU5 | 0.74 | |||

| PEoU4 | 0.812 | |||

| PEoU3 | 0.867 | |||

| PEoU2 | 0.716 | |||

| Fintech Investment | ITINF4 | 0.752 | 0.784 | 0.548 |

| ITINF3 | 0.739 | |||

| ITINF1 | 0.73 | |||

| Business strategy -Strategy alignment | TRA4 | 0.758 | 0.836 | 0.630 |

| TRA2 | 0.842 | |||

| TRA1 | 0.78 | |||

| Top Management Support | TMS5 | 0.677 | 0.808 | 0.684 |

| TMS4 | 0.954 | |||

* Notes: CR, composite reliability; a, Cronbach’s alpha; AVE, average variance extracted; same items were deleted due to low loadings.

Discriminant Validity of constructs

Next, we proceeded to test the discriminant validity. Discriminant validity is the extent to which the measures are not a reflection of some other variables and is indicated by the low correlations between the measure of interest and the measures of other constructs (Cheung & Lee, 2010). Discriminant validity can be examined by comparing the squared correlations between constructs and the average variance extracted for a construct (Fornell & Larcker, 1981).

As shown in Table 2 , the squared correlations for each construct is less than the average variance extracted by the indicators measuring that construct indicating adequate discriminant validity. In total, the measurement model demonstrated adequate convergent validity and discriminant validity Table 3.

| Table 3 Measurement Model Demonstrated Adequate Convergent Validity And Discriminant Validity |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| TMS | TRA | ITINF | PEoU | TS | PB | PRisk | FINTEH | Process | Product | Cap | |

| TMS | 0.827 | ||||||||||

| TRA | -0.108 | 0.794 | |||||||||

| ITINF | -0.125 | 0.802*** | 0.74 | ||||||||

| PEoU | -0.146 | 0.801*** | 0.804*** | 0.792 | |||||||

| TS | -0.135 | 0.741*** | 0.802*** | 0.827*** | 0.79 | ||||||

| PB | -0.16 | 0.701*** | 0.762*** | 0.756*** | 0.797*** | 0.81 | |||||

| PRisk | -0.034 | 0.622*** | 0.575*** | 0.667*** | 0.668*** | 0.764*** | 0.798 | ||||

| FINTEH | -0.033 | 0.666*** | 0.599*** | 0.672*** | 0.727*** | 0.770*** | 0.873*** | 0.827 | |||

| Process | -0.025 | 0.773*** | 0.744*** | 0.813*** | 0.792*** | 0.864*** | 0.918*** | 0.886*** | 0.754 | ||

| Product | -0.003 | 0.663*** | 0.577*** | 0.696*** | 0.620*** | 0.732*** | 0.793*** | 0.739*** | 0.911*** | 0.864 | |

| Cap | -0.229* | -0.273* | -0.071 | -0.179† | -0.154 | -0.215* | -0.250* | -0.204† | -0.267* | -0.240* | 0.757 |

Assessment of the Structural Model

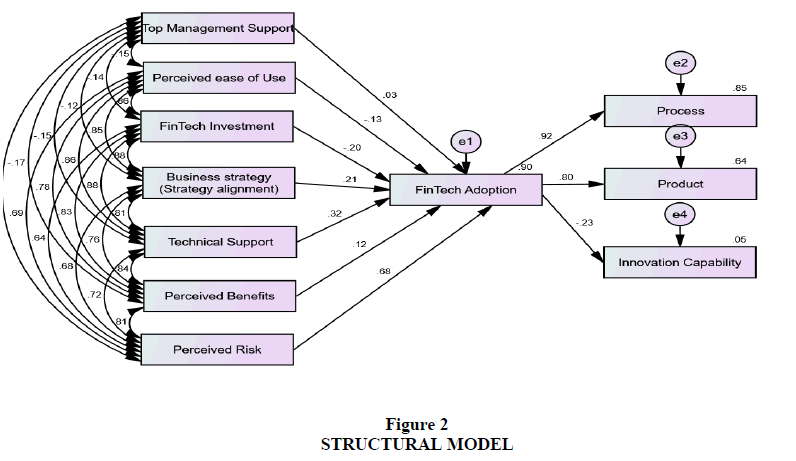

We then evaluated the structural model to test the hypotheses. As shown in Figure 2 and Table 4.

| Table 4 Test The Hypotheses |

|||||||

|---|---|---|---|---|---|---|---|

| Estimate | S.E. | C.R. | P | Decision | |||

| FINTEH | <--- | TMS | 0.03 | 0.027 | 0.988 | 0.323 | Not supported |

| FINTEH | <--- | PEoU | -0.132 | 0.095 | -1.927 | 0.054 | Not supported |

| FINTEH | <--- | ITINV | -0.203 | 0.123 | -2.396 | 0.017 | Supported |

| FINTEH | <--- | BIT | 0.211 | 0.084 | 3.073 | 0.002 | Supported |

| FINTEH | <--- | TS | 0.321 | 0.08 | 4.351 | *** | Supported |

| FINTEH | <--- | PB | 0.116 | 0.075 | 1.628 | 0.103 | Not supported |

| FINTEH | <--- | PRisk | 0.679 | 0.06 | 12.427 | *** | Supported |

| Process | <--- | FINTEH | 0.924 | 0.027 | 26.745 | *** | Supported |

| Product | <--- | FINTEH | 0.799 | 0.052 | 14.753 | *** | Supported |

| Cap | <--- | FINTEH | -0.23 | 0.076 | -2.62 | 0.009 | Supported |

Discussion of the Main Findings

The result of this study is congruent with extant studies reporting that top management support plays a critical part in enabling the organization to respond dynamically to changes in business positioning and management problems (Hasan et al., 2021). The extent of management support is not only known as the direction and resources provided but also the understanding strategically the application adoption. In consentient with previous studies (Haderi et al., 2018), this hypothesis was not supported by the data from employees of the banking sector in Qatar. One possible explanation is that proper support from the top management for fintech shows the importance of using fintech in their operation as a strategic and competitive resource not merely at an operational level.

Perceived ease of use is positively related to fintech adoption (Kim & Kim, 2018). This indicates when the fintech systems are easy to use, the banks' employees will be more willing to get involved and know the system and its features as the use of fintech is relatively easy to use (Hamid et al., 2016). However, this hypothesis was not supported by the data from the responses of the employees of the banking industry in Qatar. One explanation is that even current employees in the banking sector demand intelligent and easy-to-use financial services systems, the amount of training is not matching the subsequent fintech adoption. However, fintech adoption depends on a reasonable level of knowledge and IT skills among individuals within banks. Conversely, without fundamental training skills, employees are unable to cope with the advent of fintech applications. Business–IT alignment is significant to fintech, in line with numerous past findings (Tallon & Kraemer, 2007; El-Telbany & Elragal, 2014), showing that the possibility of smooth interaction among management staff and fintech-oriented staff is a critical factor in the development of a fintech strategy that is aligned with business strategy. Organizations with greater alignment are more likely to take advantage of the potential opportunities available through fintech applications usage. Hence, the findings in this research confirm that higher levels of alignment between business plans and IT plans to result in higher levels of fintech adoption.

Moreover, this research supports the hypothesized relationship that technical support is positively related to fintech adoption. The findings are in line with many extant studies (Yolanda Masnita et al., 2019). Good-quality support can be achieved by providing fast answers to the technical and administrative problems encountered by the employees (Talukder, 2012; Wang et al., 2019). Fintech investment is significantly related to fintech adoption. This finding in line with previous studies (e.g. Demirguc-Kunt et al., 2017). One possible explanation is that the fintech investment is mostly directed toward and affects the operational and supportive activities rather than the strategic ones. This research also supports the hypothesized relationship that perceived benefits is positively related to fintech adoption. The findings are not in line with many extant studies. Fintech is influenced by behavioral beliefs. The benefits of Fintech usage might be considered behavioral (positive and negative) beliefs that determine attitudes and subsequent usage.

Perceived risk is posited to negatively affect the level of fintech adoption. The findings are in line with the results of previous studies (Nooriaiee & Pour, 2013; Chigada & Hirschfelder, 2017). Based on the supporting evidence, Ryu (2018) found that legal risk influenced the adoption negatively it is ascertained that perceived risk determines the attitude of an individual towards FinTech products and services. In addition, Fintech is hypothesized to positively affect the level of process innovation. The findings are in line with previous studies (Kim et al., 2016). Thus, banks can derive a benefit from available fintech systems to create new innovative processes that maintain customer relationships and strategic advantages by differentiating their offers from competing banks. Fintech is hypothesized to positively affect the level of product innovation. The findings are in line with (Chen & Tsou, 2007; Iman, 2018). Fintech was hypothesized to positively affect innovation capability. The findings are in line with many extant studies (xx), reflecting that effective fintech can improve bank performance in terms of quality, price, and delivery time of banking services. It can be argued that fintech by individual employees in the four big banks in Qatar probably enhances not only customer relationships but also determines the nature of the investment in the fintech system.

Implications of the Study

There are only a few studies that have been conducted on fintech in developing countries compared to developed countries (Tapanainen, 2020; Al-Nawayseh, 2020). Hence, the objective of this study was to examine the effect of antecedents and innovative outcomes of fintech adoption within the big four listed banks in Qatar that represent a developing country context. Despite a remarkable body of research, insights regarding the antecedents of fintech adoption, the structural interrelationships between antecedents, fintech adoption and the outcomes of adoption are lacking in the literature. So far, to the best of reserachers knowledge, there has been no research incorporating both antecedents and innovative outcomes of fintech into one integrated model.

The present study has theoretical implications by presenting evidence for how banks employees deal with fintech adoption. This study is positioned to provide insights and unique contributions to the fintech adoption literature by providing empirical evidence to support previous studies via further developing linkages among the antecedents and innovative outcomes of fintech adoption. This empirical support establishes a platform for an integrated theoretical framework for explaining and predicting fintech adoption. In addition, examining antecedents and innovative outcomes of fintech adoption is necessary for implementing a fintech adoption strategy. Knowing of the antecedents and innovative outcomes of fintech adoption enhance the ability of banks to predict stimulate greater adoption among their employees.

Implication to Practice

Taking the crucial role of fintech into consideration, it is inevitably important for organizations to understand the implications of the key findings of this research for practice. First, managers who grapple with the challenges of using information systems in their organizations can now gain the knowledge required to make their efforts and investments on these systems more efficient and effective. Moreover, there is a clear need for a commitment from top management to carefully support the role of the information system in their organizations. This cannot be only achieved through knowing the antecedents of fintech, but also through understanding the consequences of the subsequent fintech. Incorporating the antecedents and consequences gives researchers the means to deal with system adoption from a multidimensional perspective. Second, the results provide managerial insights on specific practices and interventions that enable fintech. The key antecedents and consequences of fintech revealed in this study can provide a theoretical lens for further understanding of how companies can stabilize and use their information systems efficiently and effectively. More specifically, the antecedents and consequences revealed can be integrated into several different models that seek to offer a more expansive view and understanding of fintech and its benefits. Thus, an examination of the key antecedents of fintech will enable practitioners to develop a wider variety of appropriate fintech strategies and, consequently, enhance the advantages of such fintech systems. For instance, the big four banks in Qatar could emphasize service innovation to retain both customers and employees. More resources for innovation capability initiatives are needed to identify market opportunities and design accordingly new banks products and services.

Limitations and Future Work

As with any study, many limitations must be considered when evaluating the results. First, the most obvious limitation involves the derivation of a sample for a study from a single banking industry within Doha, the capital city of Qatar; this limits generalization across other industries. The results obtained in this study are based on the responses from the big four listed banks in Qatar. However, generalizing the responses of a sample is not so simple. Accordingly, caution must be taken concerning the findings of this research until further testing can be made. Second, another limitation of this study is that this study uses cross-sectional analysis to examine antecedents and innovative outcomes of fintech adoption. It would be useful to conduct longitudinal research on the fintech technology adoption, antecedents, and innovative outcomes over time. Such future research would provide valuable insights into the influence of the dynamic interaction of antecedents and outcomes of such adoption over time and provide a more holistic view of the changes that take place at a variety of points in time regarding fintech adoption in different stages. Although this research has made significant contributions to the literature in fintech adoption, it is still limited to the fact that the deeper empirical understanding of fintech is lacking in extant studies. Future research could investigate fintech in different developing and developed countries to understand the cross-cultural effects on fintech adoption. More research is also required to identify additional antecedents that may affect fintech adoption, and of course some selected outcomes rather than merely innovative outcomes such as user performance.

Conclusion

This study empirically tested the relationships between the antecedents (top management support, perceived ease of use, training, business-IT -alignment, technical support, perceived benefits, and perceived risk) of fintech and the innovative outcomes of such subsequent adoption (process innovation, product innovation, innovation capability) among the employees in the big four listed banks in Qatar. Surprisingly, fintech adoption has a significant positive effect on all innovation outcomes. From the results of this study, it can be concluded that the antecedents and innovative outcomes of fintech are playing an important role in influencing banks employees’ adoption behavior. Consequently, the proposed modified model of fintech adoption provides a useful basis for future studies on fintech practices among banks. This model can now be adopted by researchers, managers, and banking and financial industries practitioners to suggest how they explicitly design and establish various technological policies investment decisions investment to develop a financial system that could facilitate the financial service and banking environment.

References

Aggarwal, H. (2010). Critical Success Factors in IT Alignment in the Public Sector Petroleum Industry of India. International Journal of Innovation, Management and Technology, 1(1), 56.

Al-Nawayseh, M.K. (2020). Fintech in COVID-19 and beyond: What factors are affecting customers' choice of FinTech applications?. Journal of Open Innovation: Technology, Market, and Complexity, 6(4), 1-15.

Indexed at, Google Scholar, Cross Ref

Al Shaar, E.M., Khattab, S.A., Alkaied, R.N., & Manna, A.Q. (2015). The effect of top management support on innovation: The mediating role of synergy between organizational structure and information technology. International Review of Management and Business Research, 4(2), 499.

Almulla, D., & Aljughaiman, A. A. (2021). Does financial technology matter? Evidence from an alternative banking system. Cogent Economics & Finance, 9(1), 1934978.

Indexed at, Google Scholar, Cross Ref

Berkmen, P., Beaton, M. K., Gershenson, M. D., del Granado, M. J. A., Ishi, K., Kim, M., ... & Rousset, M. M. V. (2019). FinTech in Latin America and the Caribbean: Stocktaking. International Monetary Fund.

Indexed at, Google Scholar, Cross Ref

Buchak, G., Matvos, G., Piskorski, T., & Seru, A. (2018). FinTech, regulatory arbitrage, and the rise of shadow banks. Journal of Financial Economics, 130(3), 453-483.

Indexed at, Google Scholar, Cross Ref

Cai, C.W. (2018). Disruption of financial intermediation by FinTech: a review on crowdfunding and blockchain. Accounting & Finance, 58(4), 965-992.

Indexed at, Google Scholar, Cross Ref

Calik, E., Calisir, F., & Cetinguc, B. (2017). Scale development for innovation capability measurement. Journal of Advanced Management Science, 5(2).

Indexed at, Google Scholar, Cross Ref

Chen, J. S., & Tsou, H. T. (2007). IT adoption for service innovation practices and competitive advantage: The case of financial firms. Information Research, 12(3), 314.

Indexed at, Google Scholar, Cross Ref

Chen, M. A., Wu, Q., & Yang, B. (2019). How Valuable Is FinTech Innovation? The Review of Financial Studies, 32(5), 2062-2106.

Indexed at, Google Scholar, Cross Ref

Chen, Z., Li, Y., Wu, Y., & Luo, J. (2017). The transition from traditional banking to mobile internet finance: an organizational innovation perspective-a comparative study of Citibank and ICBC. Financial Innovation, 3(1), 12.

Indexed at, Google Scholar, Cross Ref

Chigada, J. M., & Hirschfelder, B. (2017). Mobile banking in South Africa: A review and directions for future research. SA Journal of Information Management, 19(1), 37 1–9.

Indexed at, Google Scholar, Cross Ref

Davis, F. D. (1986). A technology adoption model for empirically testing new end-user information systems: Theory and results (Doctoral Dissertation, Massachusetts Institute of Technology, 1986). ADD 1986.

Demirguc-Kunt, A., Klapper, L., Singer, D., Ansar, S., & Hess, J. (2017). The Global Findex 10 Database: Measuring Financial Inclusion and the Fintech Revolution. 11 Washington DC, USA.

Indexed at, Google Scholar, Cross Ref

Douglas, J.L., & Grinberg, R. (2016). Old Wine in New Bottles: Bank Investments in FinTech Companies. Rev. Banking & Fin. L., 36, 667.

El-Telbany, O., & Elragal, A. (2014). Business-information systems strategies: a focus on misalignment. Procedia Technology, 16, 250-262.

Indexed at, Google Scholar, Cross Ref

Fazl?o?lu, B., Dalg?ç, B., & Yereli, A. B. (2019). The effect of innovation on productivity: evidence from Turkish manufacturing firms. Industry and Innovation, 26(4), 439-460.

Indexed at, Google Scholar, Cross Ref

Fornell, C., & Larcker, D.F. (1981). Evaluating structural equation models with unobservable variables and measurement error. Journal of Marketing Research, 48, 39-50.

Indexed at, Google Scholar, Cross Ref

Foroudi, P., Jin, Z., Gupta, S., Melewar, T.C., & Foroudi, M.M. (2016). Influence of innovation capability and customer experience on reputation and loyalty. Journal of Business Research, 69(11), 4882-4889.

Indexed at, Google Scholar, Cross Ref

Forsythe, S., Liu, C., Shannon, D., & Gardner, L. C. (2006). Development of a scale to measure the perceived benefits and risks of online shopping. Journal of Interactive Marketing, 20(2), 55-75.

Indexed at, Google Scholar, Cross Ref

Gartlan, J., & Shanks, G. (2007). The alignment of business and IT strategy in Australia. Australasian Journal of information systems, 14(2).

Gomber, P., Koch, J.A., & Siering, M. (2017). Digital Finance and FinTech: current research and future research directions. Journal of Business Economics, 87(5), 537-580.

Indexed at, Google Scholar, Cross Ref

Haddad, C., & Hornuf, L. (2019). The emergence of the global FinTech market: Economic and technological determinants. Small Business Economics, 53(1), 81-105.

Indexed at, Google Scholar, Cross Ref

Hair, J. F., Black, W.C., Babin, B.. J., Anderson, R. E. and Tatham, R. L. (2010). Multivariate Data Analysis (7th ed.). Upper Saddle River, Pearson Prentice Hall.

Hameed, M. A., Counsell, S., & Swift, S. (2012). A conceptual model for the process of IT innovation adoption in organizations. Journal of Engineering and Technology Management, 29(3), 358-390.

Indexed at, Google Scholar, Cross Ref

Hasan, R., Ashfaq, M., & Shao, L. (2021). Evaluating Drivers of Fintech Adoption in the Netherlands. Global Business Review.

Indexed at, Google Scholar, Cross Ref

He, Y., Chen, Q., & Kitkuakul, S. (2018). Regulatory focus and technology adoption: Perceived ease of use and usefulness as efficacy. Cogent Business & Management, 5(1), 1459006.

Indexed at, Google Scholar, Cross Ref

Hornuf, L., Klus, M.F., Lohwasser, T.S. et al. (2021). How do banks interact with fintech startups?. Small Bus Econ 57, 1505-1526.

Hu, Z., Ding, S., Li, S., Chen, L., & Yang, S. (2019). Adoption Intention of FinTech Services for Bank Users: An Empirical Examination with an Extended Technology Adoption Model. Symmetry, 11(3), 340.

Indexed at, Google Scholar, Cross Ref

Hua, X., Huang, Y., & Zheng, Y. (2019). Current practices, new insights, and emerging trends of financial technologies, Industrial Management & Data Systems, 119(7), 1401-1410.

Indexed at, Google Scholar, Cross Ref

Huang, L.K. (2015). Exploring factors affecting top management support of IT implementation: A stakeholder perspective in hospital. Journal of IT Management, 26(1), 31-45.

Iman, N. (2018). Assessing the dynamics of FinTech in Indonesia. Investment Management and Financial Innovations, 15(4), 296-303.

Indexed at, Google Scholar, Cross Ref

Kalmykova, E., & Ryabova, A. (2016). FinTech market development perspectives. In SHS Web of Conferences (28, 01051). EDP Sciences.

Indexed at, Google Scholar, Cross Ref

Kearns, G.S., & Lederer, A.L. (2004). The impact of industry contextual factors on IT focus and the use of IT for competitive advantage. Information & Management, 41(7), 899-919.

Indexed at, Google Scholar, Cross Ref

Kim, Y., Park, Y.J., & Choi, J. (2016). The Adoption of Mobile Payment Services for “FinTech”. International Journal of Applied Engineering Research, 11(2), 1058- 1061.

Lee, I., & Shin, Y. J. (2018). Fintech: Ecosystem, business models, investment decisions, and challenges. Business Horizons, 61(1), 35-46.

Indexed at, Google Scholar, Cross Ref

Li, Y., Spigt, R., & Swinkels, L. (2017). The impact of FinTech start-ups on incumbent retail banks’ share prices. Financial Innovation, 3(1), 26.

Indexed at, Google Scholar, Cross Ref

Ma, W. W. K., Andersson, R., & Streith, K. O. (2005). Examining user adoption of computer technology: An empirical study of student teachers. Journal of computer-assisted learning, 21(6), 387-395.

Indexed at, Google Scholar, Cross Ref

Marshall, B., Mills, R., & Olsen, D. (2008). The role of end-user training in technology adoption. Review of Business Information Systems (RBIS), 12(2), 1-8.

Indexed at, Google Scholar, Cross Ref

Micu, I., & Micu, A. (2016). Financial technology (FinTech) and its implementation on the Romanian non-banking capital market. Practical Application of Science, IV (2 (11)), 379-384.

Milian, E.Z., Spinola, M.D.M., & de Carvalho, M.M. (2019). Fintechs: A literature review and research agenda. Electronic Commerce Research and Applications, 34, 100833.

Indexed at, Google Scholar, Cross Ref

Pantano, E., & Di Pietro, L. (2012). Understanding consumer’s acceptance of technology-based innovations in retailing. Journal of Technology Management & Innovation, 7(4), 1-19.

Indexed at, Google Scholar, Cross Ref

Porter, M.E. (1987). From competitive advantage to corporate strategy. Harvard Business Review, 65(3), 43-59.

Indexed at, Google Scholar, Cross Ref

Okoli, T. T., & Tewari, D. D. (2020). An empirical assessment of probability rates for financial technology adoption among African economies: A multiple logistic regression approach. Asian Economic and Financial Review, 10(11), 1342-1355.

Indexed at, Google Scholar, Cross Ref

Rajapathirana, R.J., & Hui, Y. (2018). Relationship between innovation capability, innovation type, and firm performance. Journal of Innovation & Knowledge, 3(1), 44-55.

Indexed at, Google Scholar, Cross Ref

Razzaque, A., Cummings, R. T., Karolak, M., & Hamdan, A. (2020). The propensity to use FinTech: input from bankers in the Kingdom of Bahrain. Journal of Information & Knowledge Management, 19(01), 2040025.

Indexed at, Google Scholar, Cross Ref

Roy, S. K., Balaji, M. S., Kesharwani, A., & Sekhon, H. (2017). Predicting Internet banking adoption in India: A perceived risk perspective. Journal of Strategic Marketing, 25(5-6), 418-438.

Indexed at, Google Scholar, Cross Ref

Ryu, H.S. (2018). What makes users willing or hesitant to use Fintech? the moderating effect of user type. Industrial Management & Data Systems, 118(3), 541-569.

Indexed at, Google Scholar, Cross Ref

Ryu, H. S. (2018). Understanding the benefit and risk framework of FinTech adoption: comparison of early adopters and late adopters. In Proceedings of the 51st Hawaii International Conference on System Sciences.

Indexed at, Google Scholar, Cross Ref

Sabherwal, R., & Chan, Y.E. (2001). Alignment between business and IS strategies: A study of prospectors, analyzers, and defenders. Information Systems Research, 12(1), 11-33.

Indexed at, Google Scholar, Cross Ref

Sanders, J.L. & Linderman, J.K. (2014). Process management, innovation and efficiency performance”, Business Process Management Journal, 20(2), 335-358.

Indexed at, Google Scholar, Cross Ref

Shaydullina, V.K. (2018). Review of Institutional and Legal Issues for the Development of the FinTech Industry. European Research Studies, 21, 171.

Singh, S., Sahni, M.M., & Kovid, R.K. (2020). What drives FinTech adoption? A multi-method evaluation using an adapted technology acceptance model, Management Decision, 58(8), 1675-1697.

Indexed at, Google Scholar, Cross Ref

Siyal, A.W., Donghong, D., Umrani, W. A., Siyal, S., & Bhand, S. (2019). Predicting mobile banking acceptance and loyalty in Chinese bank customers. SAGE Open, 9(2), 1-21.

Indexed at, Google Scholar, Cross Ref

Sweis, R.J. (2010). The relationship between IT adoption and job satisfaction in contracting companies in Jordan. Journal of IT in Construction, 15, 44-63.

Szopi?ski, T.S. (2016). Factors affecting the adoption of online banking in Poland. Journal of Business Research, 69(11), 4763-4768.

Indexed at, Google Scholar, Cross Ref

Tallon, P. P., & Kraemer, K. L. (2007). Fact or fiction? A sensemaking perspective on the reality behind executives' perceptions of IT business value. Journal of Management Information Systems, 24(1), 13-54.

Indexed at, Google Scholar, Cross Ref

Talukder, M. (2012). Factors affecting the adoption of technological innovation by individual employees: An Australian study. Procedia-Social and Behavioral Sciences, 40, 52-57.

Indexed at, Google Scholar, Cross Ref

Tapanainen, T. (2020). Toward Fintech Adoption Framework for Developing Countries-A Literature Review based on the Stakeholder Perspective. Journal of Information Technology Applications and Management, 27(5), 1-22.

Wang, L., Luo, X., & Lee, F. (2019). Unveiling the interplay between blockchain and loyalty program participation: A qualitative approach based on Bubichain. International Journal of Information Management, 49, 397- 410.

Indexed at, Google Scholar, Cross Ref

Wang, W., Zhang, S., Su, Y., & Deng, X. (2019). An Empirical Analysis of the Factors Affecting the Adoption and Diffusion of GBTS in the Construction Market. Sustainability, 11(6), 1795.

Indexed at, Google Scholar, Cross Ref

Wonglimpiyarat, J. (2018). Challenges and dynamics of FinTech crowdfunding: An innovation system approach. The Journal of High Technology Management Research, 29(1), 98-108.

Indexed at, Google Scholar, Cross Ref

Yen, Y.S., & Wu, F.S. (2016). Predicting the adoption of mobile financial services: The impacts of perceived mobility and personal habit. Computers in Human Behavior, 65, 31-42.

Indexed at, Google Scholar, Cross Ref

Yusr, M.M. (2016). Innovation capability and its role in enhancing the relationship between TQM practices and innovation performance. Journal of Open Innovation: Technology, Market, and Complexity, 2(1), 6.

Indexed at, Google Scholar, Cross Ref

Zavolokina, L., Dolata, M., & Schwabe, G. (2016). The FinTech phenomenon: antecedents of financial innovation perceived by the popular press. Financial Innovation, 2(1), 1-16.

Indexed at, Google Scholar, Cross Ref

Zhang, Y., Weng, Q., & Zhu, N. (2018). The relationships between electronic banking adoption and its antecedents: A meta-analytic study of the role of national culture. International Journal of Information Management, 40, 76-87.

Indexed at, Google Scholar, Cross Ref

Received: 12-May-2023 Manuscript No. AAFSJ-23-13590; Editor assigned: 15-May-2023, PreQC No. AAFSJ-23-13590(PQ); Reviewed: 30-May-2023, QC No. AAFSJ-23-13590; Revised: 14-Jul-2023, Manuscript No. AAFSJ-23-13590(R); Published: 21-Jul-2023