Research Article: 2023 Vol: 27 Issue: 1S

Antecedents towards Stock Market Participation in South Africa

Noxolo Eileen Mazibuko, Nelson Mandela University

Chantal Rootman, Nelson Mandela University

Wise Mbewe, Nelson Mandela University

Citation Information: Mazibuko, N.E., Rootman, C., & Mbewe, W. (2023). Antecedents towards stock market participation in South Africa. Academy of Accounting and Financial Studies Journal, 27(S1), 1-18.

Abstract

South Africa has a highly sophisticated financial sector that contributes significantly to the economy, and the stock market forms part of this. The Johannesburg Stock Exchange (JSE) has gained the interest of some South Africans, however, there appears to be apathy and inertia when it comes to actual stock market participation by South African consumers. The primary objective of this study was to identify the antecedents of stock market participation in South Africa. By identifying antecedents, opportunities could be created to increase stock market participation (investment), to ultimately ensure economic growth for the South African economy. In the empirical investigation of the study, a convenience sample of 295 respondents was employed to gather consumers’ perceptions. A structured questionnaire was used and data was analysed quantitatively. The empirical results showed statistically significant relationships between all the selected antecedent variables and stock market participation. Demographic characteristics, financial literacy, financial risk tolerance, communication and consumer trust influence stock market participation. The study contributes by providing practical recommendations to role players in the financial services industry in order to increase stock market participation and ultimately gain the benefits thereof, also for the broader economy.

Keywords

Consumer Behaviour, Financial Services Providers (FSPs), Shares, Stock Market Participation.

Introduction

The structure and dynamics of South African households and families have significantly changed, and do not present uniform characteristics (Sooryamoorthy & Makhoba, 2016). These changes have affected overall consumer perceptions of products/services’ price, quality and value. Relating to the financial services industry, investor perceptions and behaviour should therefore be studied to create financial products/services suitable for various customer types and needs. The economic growth of a country depends on the existence of a well-developed financial system and institutions (Allen et al., 2017). Understanding consumer behaviour should, therefore, be a fundamental function of Financial Services Providers (FSPs) such as banks, insurance companies and stockbrokers.

Consumer behaviour has always been an area of interest to marketing professionals (Arun et al., 2019). Consumer behaviour focuses on how individuals make decisions to spend their available time, money and effort on consumption-related items. Omotoyinbo et al. (2017) conclude that consumer behaviour models provide a frame of reference for solving problems, and the implication is that, since consumers are at the centre of all marketing programmes, practitioners should understand consumers’ views, preferences, feelings, motives and suggestions. The knowledge of consumer behaviour helps marketers understand the selection of products, services and brands, and how consumers are influenced by their environment, reference and peer groups, family, and salespersons (Arun et al., 2019). Specifically, consumer behaviour is influenced by aspects related to cultural, social, personal and psychological factors (Arun et al., 2019). Furthermore, marketers should understand that the consumer’s decision-making process (Stankevich, 2017) steps that ultimately lead to a purchase or a non-purchase.

Changes in consumer behaviour influence the actions of role players in the financial services industry. Al-Khalifah (2018) highlights that FSPs are experiencing unprecedented change as new technologies, customer expectations, regulations and competitive pressures are forcing them to continuously learn and adapt. Financial markets are changing, have more complex financial products, and therefore there is a large range of products consumers must choose from (Lusardi, 2019). According to Lusardi (2019), the way consumers make decisions about their financial investments has revolutionised.

Previous consumer behaviour and decision-making studies within the field of financial services focused on consumer attitudes, the impact of digitalisation (Pousttchi & Dehnert, 2018) and use of applications (Karjaluoto et al., 2019). It is, however, important to turn investigations towards consumer behaviour related to stock market participation. Mugableh (2021) emphasises that it is vital to launch policies that encourage investment and promote stock market development. For this reason, FSPs need to know as much as possible about their consumers to attract more stock market participants.

Klagge & Zademach (2018) assert that over the past few decades the world stock markets have surged, and emerging markets have accounted for a large amount of this boom. As at 2017, there were 66 exchanges part of the Sustainable Stock Exchanges Initiative (SSEI) (Klagge & Zademach 2018). According to the African Securities Exchanges Association (AESA, 2021), there are currently 25 stock markets in 37 African countries. As revealed by Buthelezi (2021), while South Africa's stock exchange remains dominant on the continent, smaller exchanges are leapfrogging ahead in terms of incentives and technology to attract investors. For example, consumers in Rwanda can buy and sell securities using their mobile devices and the Malawian Stock Exchange launched a WhatsApp portal to distribute information (Buthelezi, 2021).

Since stock markets are key drivers of economic growth, play a fundamental role in the economic development of countries, and because South Africa’s stock exchange needs to stay abreast of changes, it is critical to investigate aspects related to it. A country’s stock market plays a crucial role in the growth of industry and trade, which eventually affects the economy (Mugableh, 2021), especially those of developing countries. Studies mentioned in Kuffour & Adu (2019) argue that a well performing stock market is characterised by increasing participation. The financial sector of a country, which includes stock market aspects, needs to identify factors which can be adapted to effectively influence stock market participation by consumers. Thus, the focus of this study is on enhancing consumer behaviour in the form of stock market participation in South Africa to improve the welfare of society and to boost the economy.

Problem Statement

According to Batuo et al. (2018), financial development and financial liberalisation have positive effects on, and thus diminishes, financial instability. The authors also reveal that economic growth reduces financial instability (Batuo et al., 2018). Guru & Yadav (2019) indicate that stock market development also stimulates the economic growth of developing countries.

South Africa has a highly sophisticated financial services industry that contributes significantly to the economy. The JSE is currently ranked the 17th largest stock exchange in the world by market capitalisation and is the largest exchange on the African continent (Sustainable Stock Exchanges Initiative 2021). However, South Africa has one of the lowest savings rates in the world (Lings & Netshitenzhe, 2020) and this affects investments, also on the stock exchange. Gross savings as a percentage of Gross Domestic Product (GDP) was at 14.79% in 2020 (South Africa – Gross Savings, 2020), whereas the household saving rate in South Africa decreased to 0.30% during early 2021 (CEIC, 2021; Statistics SA, 2021). According to Ribaj & Mexhuani (2021), in developing countries the correlation between savings and economic growth is clear. Deposits have a significant positive impact on economic growth, because savings stimulate investment, production as well as employment, and consequently generate greater sustainable economic growth (Ribaj & Mexhuani, 2021). According to the South African Savings Institute (SASI, 2014), the stock market helps the economy to generate more savings and sustainable investments. The link between the development of a strong savings culture and economic growth is of fundamental importance to a developing country. In this respect, attracting participants to the stock exchange could be an imperative strategy.

In contrast, while the Johannesburg Stock Exchange (JSE) has managed to arouse the interest of many South Africans, there appears to be apathy and inertia when it comes to actual stock market participation. Consumers are often uncomfortable dealing with financial decisions and even decide to avoid these (Park & Sela, 2018). Stock market non-participation is considered a “puzzle” in microeconomics and finance literature, because it is not easy to explain why many consumers, despite high stock returns, do not own equities/shares (Campbell 2006; Snijder, 2021). Furthermore, the research findings of Shi, Li, Shen and Ma (2021) reveal that transaction costs and complex tax issues related to stock market participation result in consumers’ low motivation to purchase shares.

Key areas to be researched to improve the savings levels and ultimately economic growth in South Africa, are the various aspects linked to consumer behaviour relating to stock market participation among the country’s citizens. Thus, the question guiding this study is:

What are the antecedents of stock market participation in South Africa?

Research Objectives

The primary objective of this study is to investigate consumer behaviour regarding stock market participation in South Africa by identifying the antecedents of stock market participation. Identifying these relationships could create opportunities to increase stock market participation (investment), to ultimately ensure economic growth for the South African economy.

Literature Overview

Progress has been made in studying and understanding consumer decision-making in a state of risk and uncertainty, including as part of financial markets and stock markets. Family members and systems influence individuals’ financial decisions (Kim et al., 2017). Furthermore, consumers’ personalities influence their financial decisions. For example, incremental theorists prefer riskier investments (Rai & Lin, 2019). Thampathy & Krishnan (2014) concur that a range of psychological factors influence consumer buying behaviour relating to stock markets. Literature on financial decision-making outlines how financial behaviours and psychosocial factors are determinants of financial well-being (Greenberg, 2019). This study adds to the research field by considering stock market consumer behaviour in South Africa.

Consumer Behaviour in the form of Stock Market Participation

Stankevich (2017) mentions that consumer behaviour and the consumer decision-making process has become an important topic in marketing. According to Lamb et al. (2016), consumer behaviour is how consumers make purchase decisions and how they use and analyse factors regarding the purchase of goods or services.

FSPs should predict the consumer (investment) behaviour and preferences of customers to formulate marketing and strategic decisions as well as to present suitable investment portfolios to customers (Mak & Ip, 2017). Sometimes it is difficult to explain investors’ behaviour (Piwowarski et al., 2019). Mak & Ip (2017) mention that individual investors are becoming more cautious towards investments which makes it difficult for FSPs to formulate marketing strategies. In other words, consumer behaviour influences how FSPs market financial products and services.

Since consumers make decisions about many financial products and services, it is important that they choose those that meet their financial needs (Ozili, 2018). Households with less exposure to the importance of financial planning are less likely to spend time and effort on improving their investment decisions (Chien & Morris, 2017). Fan (2021) also states that financial capability is positively associated with advice-seeking behaviour, and short- and long-term desired financial behaviours. Financial decisions, and one’s level of financial literacy to make these decisions, impact investment decisions, how family can be supported and retirement (Kumari, 2020; Umadevi et al., 2019). According to Chien & Morris (2017), good financial decision-making could help households hedge against income risks and to achieve a better life. Thus, investment decisions effect the welfare of households.

Sivaramakrishnan et al. (2017) maintain that stock market participation is an important economic activity for a country and its citizens. In this study, stock market participation refers to the degree to which consumers invest at least a portion of their wealth in shares listed on the stock exchange. Understanding stock market participation decisions made by households is important to both academic researchers and policymakers (Chien & Morris, 2017). Therefore, this study proposes selected (based on literature) antecedents of stock market participation, and the study sets out to test these in the South African market.

Demographic Characteristics

According to Kotler & Armstrong (2014), demography refers to the size, as well as the territorial distribution and composition of a country’s population which can be segmented based on citizen characteristics such as gender, age, race, family, religion, education, occupation and social class. Information on these aspects are useful for firms during the process of segmenting and catering for markets (Schiffman & Kanuk, 2015). Lamb et al. (2016) maintain that demographic characteristics are strongly related to consumer buyer behaviour.

Almenberg & Dreber (2015) reveal that men and women have different attitudes and decision-making behaviour towards participating in the stock market, with women more reluctant to participate in the stock market. Furthermore, men showed a higher stock market participation rate than women (Almenberg & Dreber, 2015). On the other hand, Cole et al. (2014) found that there is a positive relationship between reported investment income and participation in equity markets. This implies that the demographic characteristic of income influences stock market participation. The research findings of Cole et al. (2014) reveal that better-educated individuals exhibit behaviours that are associated with increased savings and better financial management, namely through greater financial market participation, increased equity ownership, higher credit scores and fewer instances of negative investment earnings. Shi et al. (2021) also confirm that characteristics such as age, gender, marital status, population size, demographic structure, education level, income level, and wealth status influence stock market participation.

Financial Literacy

OECD (2014), cited in Stolper & Walter (2017), define financial literacy as knowledge and understanding of financial concepts and risks, and the skills, motivation and confidence to apply such knowledge and understanding in order to make effective decisions across a range of financial contexts, to improve the financial well-being of individuals and society, and to enable participation in economic life.

Financial literacy is a significant predictor of individuals’ saving habits (Matemane, 2018). Lower savings and over-indebtedness can often be attributed to lower levels of financial literacy (Matemane, 2018). In addition, Kadoya et al. (2017) find that a lack of financial literacy is the reason behind consumer reluctance to participate in the stock market. Balloch et al. (2015) concur that, although there are different consumer behavioural traits that explain the level of stock market investments, the lack of financial understanding takes on a prevailing role. Mouna & Anis (2017) find that individuals with a low level of financial literacy are less likely to invest in the stock market. Hence, illiterate people tend to shy away from financial markets because they have little knowledge of shares.

Furthermore, financial literacy is a key driver in developing a robust savings culture and has important implications for FSPs endeavouring to stimulate individuals to invest (Bankseta, 2017). A study by Sivaramakrishnan et al. (2017) shows that financial literacy significantly influences investors’ intention to invest, and ultimately their actual investment behaviour.

Investment Risk Factors

Nesticò et al. (2018:1) define risk as the possibility of an unfortunate event; the potential occurrence of negative consequences arising from an incident; or the set of consequences deriving from an activity and its associated uncertainties. Furthermore, risk can be defined as a combination of the probability of an occurring event and the severity of its consequences (Nesticò et al., 2018). According to Pompian (2015), the level of risk that consumers are willing to undertake is not the same, and it depends largely on their personal attitudes to risk.

Investment risk refers to the chance that an asset’s value will decrease (Botha et al., 2015). Therefore, investment risk factors can be referred to as those probabilities of occurrence of losses relative to the expected returns on investments (Jordan et al., 2012; Nesticò et al., 2018). A consumer’s attitude to risk describes the level of risk a consumer is willing to take on for a particular investment, taking into account the consumer’s circumstances. In addition, Sarkar & Sahu (2018) suggest that the perception of risk is a function of the objective characteristic of the considered shares and the subjective characteristic of the investor. The degree of risk aversion is the extent to which a consumer is willing to choose a risky high-return investment in comparison to a possible low-return investment. Garman & Forgue (2017) maintain that the knowledge of financial risk tolerance as well as determining willingness and capacity to take on risk is an integral part of a consumer’s financial planning. Risk tolerance has an impact on consumers’ investment decisions, and it is relevant when considering long-term financial goals (Reddy & Mahapatra, 2017).

According to Afsharha (2014), risk aversion plays a significant role in stock market participation. Lee et al. (2015) concur that risk aversion levels have significant and negative effects on stock market expectations. The study by Lee et al. (2015) shows that there are significant interactions between stock market expectations and risk aversion levels as well as notable negative effects of risk views on stock market participation. In a study by Sivaramakrishnan et al. (2017:818) where risk avoidance formed part of a variable labelled “attitude to investment behaviour”, it was found that this aspect has a negative impact on consumers’ intention to invest in equity markets. Lin & Lu (2015) found that passive investors exhibit a lower risk tolerance than active investors. This suggests that active investors, as well as those investing in shares, are possibly more willing to tolerate risk.

Communication

The term communication is seen as a relational state where there is a “pattern of interconnections” (Sillars & Vangelisti, 2018; Vangelisti & Perlman, 2018). In the field of business, communication is defined as the tool that marketers and businesses use to share information to attract consumers so that they respond in a desired way (Schiffman & Kanuk, 2015). Lamb et al. (2016) concur that communication is the effort to understand and communicate clearly with customers. Schiffman & Kanuk (2015) further argue that communication can evoke emotions that can put consumers in a receptive frame of mind, and can be used to encourage purchasing.

According to Standard Bank (2016), unlike with consumer goods, the process and decision to invest in shares on the stock market relies on the advice of financial advisers/planners and stockbrokers. Although buyers of financial products such as shares may make investment decisions in shares rationally, they analyse the information in the market (Pompian, 2015:4). Thampatty & Krishnan’s (2014) study established, however, that misconceptions regarding the stock market, thus inaccurate communication and how it is understood, are a hindrance to participation in stock market investments. A study by Sivaramakrishnan et al. (2017:836) also suggests that, in terms of stock market participation, the effect of risk avoidance can be mitigated by better communication. According to Duttagupta et al. (2021), there are two ways through which social interaction occurs in the market – word-of-mouth helps with the transfer of information among people, and the other relates to the enjoyment that people get by discussing market trends. Duttagupta et al. (2021:454) further maintain that word-of-mouth helps investors understand what is happening in the market and assists them to act according to market situations. This shows that communication might play a role in the degree of consumers’ investments.

It has also been determined that social communication plays a positive role in influencing and multiplying stock market participation (Gao et al., 2019). A study by Park & Sela (2018) provides implications for financial product and service communication, since consumers often find financial decisions difficult to undertake. These studies suggest that communication from FSPs, which can ensure consumer awareness and eliminate misconceptions, could increase stock market participation. Since communication is a key part of firm-customer relationships and other marketing tools, the finding by Hoque et al. (2018) that relationship marketing and informative advertising determine consumers’ behavioural intentions in financial services, supports the proposed relevance of communication in this study.

Consumer Trust

Lin et al. (2014:39) refer to trust as one party’s psychological expectations that another party will not engage in opportunistic behaviours. It is also the willingness of a party to be vulnerable to the actions of another party. According to Calvet et al. (2009) cited in Sivaramakrishnan, et al. (2017), trust is a relatively stable individual trait that can explain the persistent reluctance or inclination to invest in risky assets. Pappas (2017) maintains that trust is based on the buyer’s expectations that the seller will not have an opportunistic attitude and take advantage of the situation, but will behave in a dependable, ethical and socially appropriate manner, fulfilling commitments despite the buyer’s vulnerability and dependence. Trust influences buying intention positively (Nosi et al., 2021). Che et al. (2017) concur and maintain that trust is a key factor in determining consumer purchase decisions. However, Wei et al. (2018), cited in Fan et al. (2021), found that lack of trust creates doubt in consumers and negatively affects their purchase intentions.

Various scholars generally refer to the trust expressed by a consumer in a commercial environment as consumer trust (Fan et al., 2021). In this study, consumer trust is referred to as expectations or positive impressions to secure benefits (Krot & Lewicka, 2012; Pappas, 2017; Hawlitschek et al., 2018), due to sound, honest and correct advice as well as information from FSPs and markets.

In reference to e-finance services, a study by Zhou et al. (2018) confirmed the positive relationship between trust and continuance intention. Therefore, since investment intention predicts actual investments in the stock market (Sivaramakrishnan et al., 2017), the effect of trust on stock market participation in South Africa is worth investigating. Previous research suggests that trust plays an important role in an individual's decision to participate in stock markets. However, Calvet et al. (2009), cited in Sivaramakrishnan et al. (2017), suggest that trust does not vary in people across wealth levels, thus, it can explain why even the wealthy show limited participation in the equity markets. Giannetti & Wang (2016) provide evidence that stock market participation decreases following corporate financial scandals and fraud, all of which result in a lack of consumer trust.

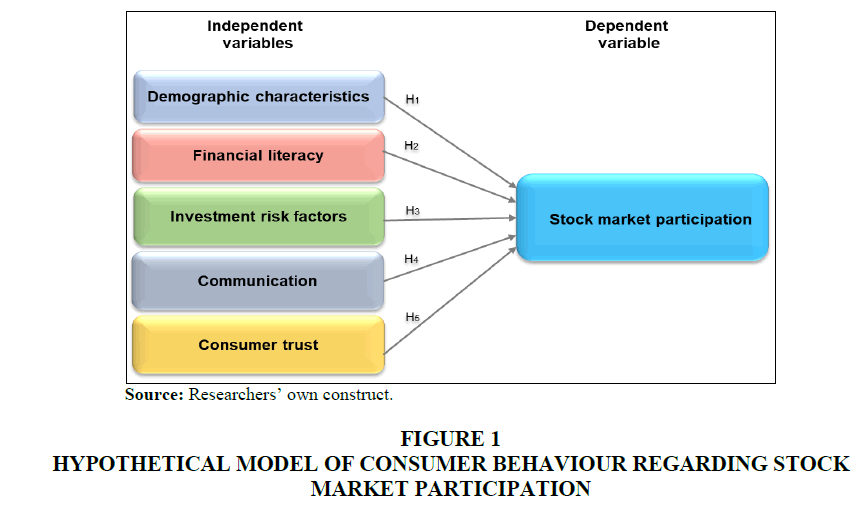

Hypothetical Model

Based on the literature review, the study proposes the hypothetical model presented in Figure 1, showing the possible antecedents of Stock market participation.

Based on the earlier literature, in this study it is proposed that demographic characteristics such as gender, age, income level, social class, education level as well as family or household structure and size influence South African consumers’ participation in the stock market:

H1: There is a significant relationship between Demographic characteristics and consumer Stock market participation.

The argument identified from the literature, that financial literacy influence behaviour in terms of purchasing shares, led to the hypothesis that:

H2: There is a significant relationship between Financial literacy and consumer Stock market participation.

From the literature it is evident that consumers’ attitudes toward risk and risk aversion in the investment context is also linked to their behaviour, and thus stock market participation. It is hypothesised that:

H3: There is a significant relationship between Investment risk factors and consumer Stock market participation.

Based on the literature that suggest that communication, both in terms of word-of mouth and firm marketing, is relevant in the investment context, it is hypothesised that:

H4: There is a significant relationship between Communication and consumer Stock market participation.

Literature revealed the link between trust and stock market participation. Based on the arguments showing a link between trust and potential investments made by consumers, it is hypothesised that:

H5: There is a significant relationship between Consumer trust and consumer Stock market participation.

Research Methodology

Research Design

For the purpose of the study, a positivistic research philosophy was adopted (Maree et al., 2016). It is important to identify the antecedents of stock market participation, based on consumers’ perceptions and in their contexts. Therefore, a positivistic research philosophy is deemed most appropriate. The deductive approach to theory development is relevant since measurable data are collected to test specific hypotheses, based on literature, to assess the relationships between the variables of the study (Saunders et al., 2019:145; Engel & Schutt, 2014). For the purpose of the study, a mono method quantitative methodological choice was adopted. This is deemed appropriate since data was collected from a large sample to quantitatively test hypotheses (Creswell, 2014; Greener & Martelli, 2020; Kivunja & Kuyini, 2017). In addition, a survey strategy was adopted as people’s perceptions were gathered to explain the antecedents of stock market participation (Saunders et al., 2019). A cross sectional time horizon was applicable (Saunders et al., 2019) since the objective was not to monitor change over a time period, but rather to collect data from respondents regarding their stock market participation based on their context at a specified time.

Data Collection

In addition to secondary data collection for the literature review, for primary data collection full ethical clearance was obtained from the Nelson Mandela University (South Africa) Research Ethics Committee for Human participants (REC-H) and all aspects such as confidentiality, anonymity and voluntary participation were considered. The population of the study included all South African consumers located in four of the nine provinces, namely, Eastern Cape, Western Cape, KwaZulu-Natal and Gauteng, due to the researchers’ reach to FSPs. However, there was no sampling frame available. Therefore, non-probability sampling in the form of convenience and snowball sampling was appropriate for this study (Saunders, et al., 2019).

A self-administered, self-developed and structured questionnaire was used to gather data during 2019. A seven-point Likert-type scale was used to gather respondents’ level of agreement regarding aspects relating to the variables. A pilot study was conducted and minor editorial changes were made.

For the main study, hard copy questionnaires were distributed by the researchers and trained fieldworkers. A total of 725 questionnaires were distributed. The questionnaires received amounted to 510. Therefore, this study achieved an acceptable response rate of 70%. Incomplete questionnaires (215) were excluded from data capturing.

Data Analysis

Quantitative data analysis procedures were conducted by using Microsoft Excel and Statistica. Descriptive statistics were conducted to summarise the data, e.g. through calculating means, frequencies and standard deviations. Inferential statistics were conducted in four steps. Firstly, Exploratory Factor Analyses (EFA) were conducted to determine construct validity. Factor loadings of 0.5 and above were regarded as indicating valid factors (Hair et al., 2014). Secondly, Cronbach’s alpha coefficients were calculated, for the valid factors that emerged from the EFAs, to test the reliability of the measuring instrument. Cronbach’s alpha correlation coefficients greater than 0.7 were regarded as showing sufficient levels of reliability (Hair et al., 2014). Thirdly, Pearson’s Product Moment Correlations were calculated to determine the correlations, and the strength thereof, between variables (Asri et al., 2016). According to Asri et al. (2016), Pearson correlations range between -1.00 and +1.00 where a correlation of 1 indicates a perfect positive relationship, and a correlation of −1 indicates a perfect negative relationship. Finally, multiple regression analyses were used to accept or reject the proposed hypotheses, since it identified whether significant relationships exist between the independent and dependent variables (Saunders et al., 2019).

Empirical Results

Descriptive Statistics Relating to the Respondents

Fairly equally distributed, 51% of the respondents were male and 49% were female. The majority of the respondents (73%) were younger than 50 years. The same percentage attained a tertiary qualification and are subsequently employed; with 20% self-employed and only 7% who live on their retirement funding and/or inheritance.

Validity and Reliability Results

Table 1 shows the EFA results and Cronbach’s alpha coefficients.

Table 1 indicates that six factors resulted from the EFA, which coincides with the six factors that the hypothetical model suggested. However, based on the items that loaded, one factor’s name and conceptualisation changed. Eight of the ten items that were expected to measure ‘demographic characteristics’ loaded on a single factor. This means that respondents viewed these items as a single construct termed Demographic characteristics.

Three items which were intended to measure ‘financial literacy’ and one item related to ‘investment risk factors’ loaded onto the same factor. This item considered investing in shares with stable performances; and thus, shows that respondents regarded this as an indication of financial literacy. Since most items that loaded onto this factor are financial literacy-related, it is evident that respondents viewed these items as a single construct termed Financial literacy.

Table 1 also indicates that four items expected to measure the 'investment risk factors’ and ‘financial literacy’ variables loaded together onto one factor; and were not interpreted by respondents as expected. Respondents did not perceive ‘investment risk factors’ as a single, stand-alone construct but as a dimension rather to be termed ‘financial risk tolerance’, which consists of both investment risk and financial literacy aspects. The factor was labelled Financial risk tolerance since the items related to aspects linked to having financial information, knowledge and the ability to cope with financial loss.

Furthermore, the EFA reveals that five items that were expected to measure ‘communication’ and one item relating to ‘investment risk factors’ loaded onto a single factor. This single item loading here was justified as it also relates to communication by way of gathering perceptions on seeking information and understanding it. The respondents perceived these items as a single construct, Communication, since most items of this factor related to communication.

Table 1 shows that all ten items expected to measure ‘consumer trust’ and four of the items expected to measure ‘communication’ as well as one of the items expected to measure ‘investment risk factors’ loaded on one factor. The four communication-related items that loaded onto this factor all measured the degree by which respondents’ FSPs share information with them, thus, the trust element of the client-adviser relationship justifies these loadings onto this factor. The single investment risk-related item considered respondents’ trust that the market will always recover; therefore, its loading onto the factor which mainly covers the aspect of trust is understandable. Respondents viewed all these items as measures of a single construct, namely, Consumer trust, since the consumer trust items dominated this factor’s item loadings.

| Table 1 Summary Of Efa Results And Cronbach’s Alpha Coefficients |

||||

|---|---|---|---|---|

| Variable and abbreviation | Number of items accepted | Minimum loading | Maximum loading | Cronbach’s alpha |

| Demographic characteristics (DC) | 8 | 0.564 | 0.771 | 0.86 |

| Financial literacy (FL) | 4 | 0.521 | 0.769 | 0.71 |

| Financial risk tolerance (FRT) | 4 | 0.501 | 0.772 | 0.72 |

| Communication (CM) | 6 | 0.582 | 0.810 | 0.86 |

| Consumer trust (CT) | 15 | 0.502 | 0.780 | 0.92 |

| Stock market participation (SM) | 19 | 0.510 | 0.791 | 0.95 |

Source: Calculated from survey results

All ten items expected to measure ‘stock market participation’ as well as nine other items, anticipated to measure additional variables part of a larger study, loaded onto one factor. These nine items all related to value-adding investments and financial performance when investing in shares; therefore, the items’ link to, and their consequent loading with stock market participation items is clear. The respondents viewed these items as measures of a single construct termed Stock market participation, since most of the items linked to stock market participation.

As per Table 1, all factors were retained since each had more than three items. The minimum and maximum loadings show that the six factors’ range of item loadings were above the 0.5 cut-off value. In other words, the EFA results provided sufficient evidence of construct validity. In addition, Table 1 shows that all factors’ reliability was confirmed since each had a Cronbach’s alpha coefficient above the 0.7 cut-off value.

Based on the EFA results (and the name change of one variable), the study’s revised hypotheses were stipulated as follows for further statistical analyses:

H1: There is a significant relationship between Demographic characteristics and consumer Stock market participation.

H2: There is a significant relationship between Financial literacy and consumer Stock market participation.

H3: There is a significant relationship between Financial risk tolerance and consumer Stock market participation.

H4: There is a significant relationship between Communication and consumer Stock market participation.

H5: There is a significant relationship between Consumer trust and consumer Stock market participation.

Descriptive statistics and correlations relating to the variables

Table 2 shows the study variables’ descriptive statistics and Pearson correlation results.

With regards to the means, Table 2 reveals that respondents disagreed with the statements of one variable, namely Financial risk tolerance (mean=3.07). This variable’s mean was also the lowest mean in the study’s results. Further, respondents were neutral regarding Customer satisfaction items (mean=4.04), which suggests that respondents were not adequately satisfied with their stock market participation and thus their share investment performances. All other means show that respondents were neutral towards agreeing with other variables’ items. Most agreements were with regards to Demographic characteristics, with the highest mean of 5.23. In terms of the overall standard deviation scores, the small standard deviations indicate minimal variation in respondents’ responses relating to the variables.

| Table 2 Descriptive Statistics And Pearson Correlations |

||||||||

|---|---|---|---|---|---|---|---|---|

| Variable | Mean | St. dev. | DC | FL | FRT | CM | CT | SM |

| DC | 5.23 | 0.82 | 1.000 | |||||

| FL | 4.79 | 0.71 | -0.236 | 1.000 | ||||

| FRT | 3.07 | 0.77 | 0.032 | -0.012 | 1.000 | |||

| CM | 5.20 | 0.84 | 0.338 | 0.038 | 0.182 | 1.000 | ||

| CT | 4.13 | 0.65 | 0.128 | 0.210 | 0.344 | 0.369 | 1.000 | |

| SM | 4.84 | 0.78 | 0.332 | 0.322 | 0.166 | 0.514 | 0.746 | 1.000 |

Source: Calculated from survey results.

In addition, Table 2 reveals the Pearson correlations relating to the 15 variable interactions. Of these correlations, 9 showed weak links (Pearson correlations between 0.1 and 0.3), 4 showed moderate links (Pearson correlations between 0.3 and 0.5) and 2 showed strong links (Pearson correlations above 0.5) between variables. Financial literary and Financial risk tolerance had the weakest correlation (-0.012). The strongest correlation is evident between Consumer trust and Stock market participation (0.746). Clearly, the element of trust plays an important role when respondents consider share investments.

Multiple Regression Results and Hypotheses Decisions

In this study, multiple regression analysis was performed to establish the influence of the independent variables on the intervening variable (see Table 3), to assess the hypothesised relationships.

This regression analysis revealed that all five independent variables have statistically significant relationships with Stock market participation. Specifically, Demographic characteristics (b=0.231, p<0.001), Financial literacy (b=0.266, p<0.001), Communication (b =0.197, p<0.001) and Consumer trust (b=0.741, p<0.001) are positively related to Stock market participation. This shows that respondents believe that their demographic characteristics, financial literacy, communication and trust in FSPs encourage them to participate in the stock market. In addition, Table 3 indicates that although Financial risk tolerance is significantly related to Stock market participation (b=-0.091, p<0.001), this relationship is negative. Interestingly, this indicates that if respondents’ risk tolerance increases, but they note that financial information is difficult to understand (items loaded onto this factor related to this aspect); this has a negative effect on their stock market participation. In total, the R2 of 0.711 shows that 71% of the variability in Stock market participation in the model is explained by the five independent variables. The highest T-value in Table 3, 22.231, shows that Consumer trust has the strongest significant relationship with Stock market participation. This confirms the Pearson correlation results. This means that if investors trust their FSPs, they are more likely to invest in shares listed on the stock exchange.

| Table 3 Regression Summary For Intervening Variable: Stock Market Participation (Sm) |

||||||||

|---|---|---|---|---|---|---|---|---|

| Parameter | Beta b* | Std. Error | B | Std. Error | T-value | P-value | ||

| DC | 0.240 | 0.026 | 0.231 | 0.025 | 9.092 | 0.001*** | ||

| FL | 0.239 | 0.026 | 0.266 | 0.028 | 9.360 | 0.001*** | ||

| FRT | -0.090 | 0.026 | 0.092 | 0.026 | -3.516 | 0.001*** | ||

| CM | 0.212 | 0.027 | 0.197 | 0.025 | 7.782 | 0.001*** | ||

| CT | 0.618 | 0.028 | 0.741 | 0.033 | 22.231 | 0.001*** | ||

| R | R2 | F | Std. Error of estimate P | |||||

| 84% | 0.71192104 | 249.10 | 0.70906311 p < .00000 | |||||

Source: Calculated from survey results.

Based on the regression results, since significant relationships exist between all the variables, all hypotheses were accepted.

Discussion, Managerial Implications and Recommendations

The hypothesis testing specifically revealed that if each of the variables are focused on by FSPs, stock market participation will increase.

Demographic Characteristics

FSPs need to consider demographic characteristics such as gender, level of income, level of education, and residential area when designing financial products. The results support the findings of (Shi et al., 2021). It is recommended that, when designing financial products to promote stock market participation, FSPs:

1. create an investment environment and policies that is supportive of gender equality to negate stereotypes that consider financial risk-taking as a male domain;

2. ensure that the language used is easy to understand and, where possible, it should be in the consumer’s mother tongue;

3. ensure that media platforms broadcasts target all different consumers.

4. ensure that products cater to consumers with different levels of income;

5. increase their geographic footprint so that products are accessible to a wider community; and

6. take into consideration consumers’ culture and household participation, for example through family-oriented products.

Financial Literacy

It is important for FSPs to ensure that effective financial literacy and investment initiatives are structured to help consumers know when and how to locate information in order for them to make sound financial decisions. In line with this study’s results, Mouna & Anis (2017) as well as Sivaramakrishnan et al. (2017) support the positive relationship between financial literacy and stock market participation. It is recommended that, when attempting to promote consumer participation in the stock market, FSPs:

1. provide information and create awareness that it is important for consumers to own shares so that they can benefit when on retirement.

2. provide consumers with adequate training on the differences between saving and investing in the stock market.

3. ensure that consumers understand that the core purpose of investing is to create long-term wealth.

Financial Risk Tolerance

A consumer’s willingness to take financial decisions in which the outcomes of the decisions are unknown and potentially costly, relates to the financial risk tolerance of the consumer. Although the conceptualisation of this study’s financial risk tolerance variable differed slightly from that of other studies, the results still relate to views of Afsharha (2014), Lee et al. (2015) as well as Sivaramakrishnan et al. (2017) that negatively linked risk aversion and stock market participation. Based on the results of the study, it seems as if consumers regard themselves and their family members as having limited knowledge regarding investments and cannot cope with financial loss resulting from stock market declines. Hence, it is imperative for the FSPs to understand that consumers do not have a clear idea of what the risks are regarding investments. It is recommended that FSPs:

1. follow, for stability and structure, the six steps of financial planning.

2. create an environment that enables consumers to get investment knowledge.

3. mitigate the impact of financial risk tolerance by incorporating insights from behavioural finance such as behavioural portfolio theory and outcome-based investment philosophy.

4. ensure that consumers understand and have skills to cope with financial loss resulting from a stock market decline (e.g. share values/prices decreasing).

Communication

It is important for FSPs to have the ability to comprehend the needs of the consumers and utilise the most effective media and messages. Gao et al. (2019) concur that communication plays an important role in increasing stock market participation. In order to communicate effectively with consumers to participate in the stock market, it is recommended that FSPs:

1. provide consumers with more information through different mass media sources.

2. provide consumers with relevant information through stockbrokers, financial advisers/planners, banks and other industry role players.

3. familiarise consumers with financial investment tools, such as unit trusts, bonds and retirement annuities.

4. frequently interact with consumers to increase the credibility of stock market information.

5. be available to attend to concerns and provide consumers regularly with information that can assist them to gain a basic understanding of the stock market.

Consumer Trust

FSPs are expected to provide and pass on accurate and useful stock market information to consumers. The study’s results correspond to the views of Giannetti & Wang (2016) who found that limited trust and fraudulent situations (where there can be no trust) hamper stock market participation. FSPs are expected to have the consumer’s best interests at heart regarding stock market matters. It is thus recommended that, when attempting to promote consumer trust towards stock market participation, FSPs:

1. implement customer engagement forums to build and foster trust relationships with consumers.

2. ensure consumer protection rules and regulations to drive consumer trust.

3. protect customer data and defend consumers against cybersecurity by establishing infrastructure, processes and procedures to prevent attacks or breaches.

4. ensure that there is transparency when discussing products and commissions charged.

5. listen to and consider consumer ideas and suggestions on stock market matters;

6. provide consumers with written documents regarding stock market matters, when necessary.

7. provide clarity to and reassure consumers regarding stock market recovery after declines.

Stock Market Participation

FSPs are required to adopt strategies that target consumers with different demographic characteristics. FSPs need to encourage consumers to participate in financial literacy and investment initiatives as this may also be instrumental in assisting them to be knowledgeable about investments and stock market matters as well as engaging more reluctant consumers. Although financial risk tolerance is significantly related to stock market participation, it is important for FSPs to create awareness for and encourage consumers to understand that the driver of stock market participation, or the decision to forego investing in shares, is risk aversion. The consumers feel that the effective use of communication and communication media are most likely to increase participation in the stock market. FSPs need to build a lasting trust relationship with consumers. To increase stock market participation, it is therefore recommended that FSPs:

1. encourage and guide consumers to buy and sell shares as and when it suits their circumstances.

2. ensure that consumers use information regarding share price changes and benefits of stock market participation.

3. ensure that consumers receive guidance and information regarding stock market matters relating to resignation and retirement.

4. assist consumers to understand tax implications resulting from stock market participation.

5. assist consumers to review the performance of their investments at due periods.

6. offer consumers value-creating investment options that are financially viable and stable in the long run.

Future Research and Final Conclusion

The shortcomings of this study include that due to time and cost constraints, the sample was selected in four of the nine provinces, and only quantitatively. Some respondents complained about the length of the questionnaire, however, trained fieldworkers assisted in overcoming this problem.

Since this study’s literature review stressed how debt impacts consumers’ savings, future studies can be conducted on the impact of consumer debt on stock market participation. Future research can also include an in-depth study on the influence of behavioural finance on stock market participation, since the literature review revealed how aspects of behavioural finance such as greed, fear and emotions impact consumers. Future studies could also investigate the impact of a Retail Distribution Review (RDR) on practice management in the financial services industry. Since RDR could enhance standards of professionalism, which is linked to consumer trust, there could be a positive impact on stock market participation, which shows that RDR research could be valuable. Comparative studies in other countries, African and other emerging economies, could prove valuable to increase stock market participation.

To conclude, this study investigated the antecedents of stock market participation in South Africa. Specifically, the empirical results confirmed that demographic characteristics, financial literacy, financial risk tolerance, communication and consumer trust are all significant antecedents of stock marketing participation. Although financial risk tolerance is significantly related to stock market participation, this relationship is negative. This implies that respondents believe that even if risk tolerance increases, if financial information is difficult to understand, it has a negative effect on stock market participation. All other variables need to increase in order to improve stock market participation. Stock market participation may result in positive financial benefits from and to South African consumers and improve the performance of the financial services industry. The study contributed to the industry, since role players can use the practical strategies suggested to encourage stock market participation.

References

African Securities Exchanges Association (AESA). (2021). Retrieved October 20, 2021, from https://african-exchanges.org/

Afsharha, M. (2014). Determinant elements of stock market participation among middle-aged individuals in northern Finland. Unpublished master’s dissertation, University of Oulu.

Al-Khalifah, A. (2018). The strategic stabilization of private banks and insurance company in the financial service sector. Journal of Humanities Insights, 2(4), 161-166.

Indexed at, Google Scholar, Cross Ref

Allen, F., Gu, X., & Kowalewski, O. (2017). Financial structure, economic growth and development. IESEG School of Management Working Paper Series, 2017-ACF-04: 1-69.

Almenberg, J., & Dreber, A. (2015). Gender, stock market participation and financial literacy. Economics Letters, 137, 140-142.

Indexed at, Google Scholar, Cross Ref

Arun, A., Sureshkumar, V., & Venkatesh, R. (2019). Purchasing motives for rural and urban consumers in buying personal hygiene products. Think India Journal, 22(10), 7748-7758.

Asri, M.N.M., Hashim, N.H., Desa, W.N.S.M., & Ismail, D. (2016). Pearson Product Moment Correlation (PPMC) and Principal Component Analysis (PCA) for objective comparison and source determination of unbranded black ballpoint pen inks. Australian Journal of Forensic Sciences, 50(4), 323-340.

Indexed at, Google Scholar, Cross Ref

Balloch, A., Nicolae, A., & Philip, D. (2015). Stock market literacy, trust, and participation. Review of Finance, 19(5), 1925-1963.

Indexed at, Google Scholar, Cross Ref

BANKSETA’s Annual Report South Africa (2017). Retrieved March 20, 2018, from https://www.bankseta.org.za

Batuo, M., Mlambo, K., & Asongu, S. (2018). Linkages between financial development, financial instability, financial liberalisation and economic growth in Africa. Research in International Business and Finance, 45, 168-179.

Indexed at, Google Scholar, Cross Ref

Botha, M., Rossini, L., Geach, W., Goodall, B., du Preez, L., & Rabenowitz, P. (2015). The South African Financial Planning Handbook. Durban: LexisNexis.

Buthelezi, L. (2021). Other African stock exchanges are doing great things – using WhatsApp, M-Pesa and tax breaks. Retrieved October 18, 2021, from news24.com/fin24/markets/other-african-stock-exchanges-are-doing-great-things-using-whatsapp-m-pesa-and-tax-break-20211013

Campbell, J. (2006). Household finance. Journal of Finance, 61, 1553-1604.

CEIC’s South Africa Gross Savings Rate. (2021). Retrieved October 22, 2021, from https://www.ceicdata.com/en/indicator/south-africa/gross-savings-rate

Che, J.W.S., Cheung, C.M.K., & Thadani, D.R. (2017). Consumer purchase decision in Instagram stores: The role of consumer trust. Presented to the 50th Hawaii International Conference on System Sciences, Hilton Waikoloa Village, Hawaii, USA, 24-33.

Indexed at, Google Scholar, Cross Ref

Chien, Y., & Morris, P. (2017). Stock market participation varies widely by State. The Regional Economist, Federal Reserve Bank of St. Louis, 25(3).

Cole, S., Paulson, A., & Shastry, G.K. (2014). Smart money? The effect of education on financial outcomes. The Review of Financial Studies, 27(7), 2022- 2051.

Indexed at, Google Scholar, Cross Ref

Creswell, J.W. (2014). Research design qualitative, quantitative and mixed methods approaches (Fourth Edition). Thousand Oaks: Sage.

Duttagupta, R.K., Agarwal, P., Mallareddy, S., & Veluchamy, R. (2021). Awareness of salaried employees towards investment portfolios. Presented to the International Conference on Business Research and Innovation (ICBRI), Management Development Institute Murshidabad e-book, 452-460.

Engel, R.J., & Schutt, R.K. (2014). Fundamentals of social work research. London: Sage.

Fan, L. (2021). A conceptual framework of financial advice-seeking and short- and long-term financial behaviors: An age comparison. Journal of Family and Economic Issues, 42, 90-112.

Indexed at, Google Scholar, Cross Ref

Fan, M., Ammah, V., Dakhan, S.A., Liu, R., Mingle, M.N., & Pu, Z. (2021). Critical factors of reacquainting consumer trust in e-commerce. Journal of Asian Finance, Economics and Business, 8(3), 0561-0573.

Indexed at, Google Scholar, Cross Ref

Gao, M., Meng, J., & Zhao, L. (2019). Income and social communication: The demographics of stock market participation. The World Economy, 42(7), 1931-2277.

Indexed at, Google Scholar, Cross Ref

Garman, E.T., & Forgue, R.E. (2017). Personal finance (Thirteenth Edition). Boston: Cengage.

Giannetti, M., & Wang, T.Y. (2016). Corporate scandals and household stock market participation. The Journal of Finance, 71(6), 2591-2636.

Indexed at, Google Scholar, Cross Ref

Greenberg, A.E. (2019). Financial decision making. Consumer Psychology Review, 2(1), 17-29.

Greener, S., & Martelli, J. (2020). An introduction to business research methods. The eBook company: Bookboon.

Guru, B.K., & Yadav, I.S. (2019). Financial development and economic growth: Panel evidence from BRICS. Journal of Economics, Financial and Administrative Science, 24(47), 113-126.

Indexed at, Google Scholar, Cross Ref

Hair, J.F., Black, W.W., Babin, B.I., & Anderson, R.E. (2014). Multivariate data analysis (Seventh Edition). New Jersey: Pearson.

Hawlitschek, F., Stofberg, N., Teubner, T., Tu, P., & Weinhardt, C. (2018). How corporate sharewashing practices undermine consumer trust. Sustainability, 10, 2638.

Indexed at, Google Scholar, Cross Ref

Hoque, M.E., Hashim, N.M.H.N., & Razzaque, M.A. (2018). Effects of communication and financial concerns on banking attitude-behaviour relations. The Service Industries Journal, 38(13-14), 1017-1042.

Indexed at, Google Scholar, Cross Ref

Jordan, B.D., Miller Jr, T.W., & Dolvin, S.D. (2012). Fundamentals of investments: Valuation and Management (Seventh Edition). New York: McGraw-Hill.

Kadoya, Y., Khan, M.S.R., & Rabbani, N. (2017). Does financial literacy affect stock market participation? Retrieved October 14, 2021, from https://ssrn.com/abstract=3056562

Indexed at, Google Scholar, Cross Ref

Karjaluoto, H., Shaikh, A.A., Saarijärvi, H., & Saraniemi, S. (2019). How perceived value drives the use of mobile financial services apps. International Journal of Information Management, 47, 252-261.

Indexed at, Google Scholar, Cross Ref

Kim, J., Gutter, M.S., & Spangler, T. (2017). Review of family financial decision making: Suggestions for future research and implications for financial education. Journal of Financial Counselling and Planning, 28(2), 253-267.

Indexed at, Google Scholar, Cross Ref

Kivunja, C., & Kuyini, A.B. (2017). Understanding and applying research paradigms in educational contexts. International Journal of Higher Education, 6(5), 26-41.

Indexed at, Google Scholar, Cross Ref

Klagge, B., & Zademach, H. (2018). International capital flows, stock markets, and uneven development: The case of Sub-Saharan Africa and the Sustainable Stock Exchanges Initiative (SSEI). De Gruyter, 62(2), 92-107.

Indexed at, Google Scholar, Cross Ref

Kotler, P.T., & Armstrong, G. (2014). Principles of marketing (Fifteenth Edition). Melbourne: Pearson.

Krot, K., & Lewicka, D. (2012). The importance of trust in manager-employee relationships. International Journal of Electronic Business Management, 10(3), 224-233.

Kuffour, S.A., & Adu, G. (2019). Financial literacy, trust and stock market participation in Ghana. Economics Literature, 1(2), 101-116.

Kumari, D.A.T. (2020). The impact of financial literacy on investment decisions: With special reference to undergraduates in Western Province, Sri Lanka. Asian Journal of Contemporary Education, 4(2), 110-126.

Indexed at, Google Scholar, Cross Ref

Lamb, C.W., Hair, J.F., McDaniel, C., Boshoff, C., & Terblanche, N.S. (2016). Marketing (Fifth Edition). Cape Town: Oxford University Press.

Lee, B., Rosenthal, L., Veld, C., & Veld-Merkoulova, Y. (2015). Stock market expectations and risk aversion of individual investors. International Review of Financial Analysis, 40, 122-131.

Indexed at, Google Scholar, Cross Ref

Lin, H., & Lu, H. (2015). Elucidating the association of sports lottery bettors’ socio-demographics, personality traits, risk tolerance and behavioural biases. Personality and Individual Differences, 73, 118-126.

Indexed at, Google Scholar, Cross Ref

Lin, J., Wang, B., Wang, N., & Lu, Y. (2014). Understanding the evolution of consumer trust in mobile commerce: a longitudinal study. Information Technology and Management, 15(1), 37-49.

Indexed at, Google Scholar, Cross Ref

Lings, K., & Netshitenzhe, N. (2020). SA’s low savings rate is stifling growth at the worst possible time. Retrieved October 22, 2021, from https://www.news24.com/fin24/opinion/opinion-sas-low-savings-rate-is-stifling-growth-at-the-worst-possible-time-20200725

Lusardi, A. (2019). Financial literacy and the need for financial education: Evidence and implications. Swiss Journal of Economics and Statistics, 155(1), 1-8.

Indexed at, Google Scholar, Cross Ref

Mak, M.K.Y., & Ip, W.H. (2017). An exploratory study of investment behaviour of investors. International Journal of Engineering Business Management, 9, 1-12.

Indexed at, Google Scholar, Cross Ref

Maree, K., Creswell, J.W., Ebersohn, L., Eloff, I., Ferreira, R., Ivankova, N.V., Jansen, J.D., Niewenhuis, J., Pietersen, J., & Plano Clark, V.L. (2016). First steps in research (Second Edition). Pretoria: Van Schaik.

Matemane, M.R. (2018). Saving for tomorrow: Does the level of financial literacy in the South African working class matter. South African Business Review, 22(1), 1-21.

Indexed at, Google Scholar, Cross Ref

Mouna, A., & Anis, J. (2017). Financial literacy in Tunisia: Its determinants and its implications on investment behaviour. Research in International Business and Finance, 39(Part A), 568-577.

Indexed at, Google Scholar, Cross Ref

Mugableh, M.I. (2021). Causal links among stock market development determinants: Evidence from Jordan. The Journal of Asian Finance, Economics and Business, 8(5), 543-549.

Indexed at, Google Scholar, Cross Ref

Nesticò, A., He, S., De Mare, G., Benintendi, R., & Maselli, G. (2018). The ALARP principle in the cost-benefit analysis for the acceptability of investment risk. Sustainability, 10, 4668.

Indexed at, Google Scholar, Cross Ref

Nosi, C., Pucci, T., Melanthiou, Y., & Zanni, L. (2021). The influence of online and offline brand trust on consumer buying intention. EuroMed Journal of Business, EarlyCite, awaiting publication details.

Indexed at, Google Scholar, Cross Ref

Omotoyinbo, C., Worlu, R., & Ogunnaike, O. (2017). Consumer behaviour modelling: A myth or heuristic device? Perspectives of Innovations, Economics and Business, 17(2), 101-119.

Indexed at, Google Scholar, Cross Ref

Ozili, P.K. (2018). Impact of digital finance on financial inclusion and stability. Borsa Istanbul Review, 18(4), 329-340.

Indexed at, Google Scholar, Cross Ref

Pappas, N. (2017). Effect of marketing activities, benefits, risks, confusion due to over-choice, price, quality and consumer trust on online tourism purchasing. Journal of Marketing Communications, 23(2), 195-218.

Indexed at, Google Scholar, Cross Ref

Park, J.J., & Sela, A. (2018). Not my type: Why affective decision makers are reluctant to make financial decisions. Journal of Consumer Research, 45(2), 298-319.

Indexed at, Google Scholar, Cross Ref

Piwowarski, M., Biercewicz, K., & Borawski, M. (2019). Methods of examining the neuronal bases of financial decisions in W. Tarczy?ski & K. Nermend (Eds.), Effective Investments on Capital Markets. Springer Proceedings in Business and Economics, 351-368.

Indexed at, Google Scholar, Cross Ref

Pompian, M. (2015). Behavioural finance and wealth management. New Jersey: John Wiley & Sons.

Pousttchi, K., & Dehnert, M. (2018). Exploring the digitalization impact on consumer decision-making in retail banking. Electronic Markets, 28, 265-286.

Indexed at, Google Scholar, Cross Ref

Rai, D., & Lin, C.W. (2019). The influence of implicit self-theories on consumer financial decision making. Journal of Business Research, 95, 316-325.

Indexed at, Google Scholar, Cross Ref

Reddy, K.S., & Mahapatra, M.S. (2017). Risk tolerance, personal financial knowledge and demographic characteristics: Evidence from India. The Journal of Developing Areas, 51(3), 51-62.

Indexed at, Google Scholar, Cross Ref

Ribaj, A., & Mexhuani, F. (2021). The impact of savings on economic growth in a developing country (the case of Kosovo). Journal of Innovation and Entrepreneurship, 10(Article 1), 1-13.

Indexed at, Google Scholar, Cross Ref

Sarkar, A.K., & Sahu, T.N. (2018). Investment behaviour: Towards an individual-centred financial policy in developing economies (First Edition). London: Emerald Publishing Limited.

Saunders, M., Lewis, P., & Thornhill, A. (2019). Research methods for business students (Eighth Edition). London: Pearson.

Schiffman, L.G., & Kanuk, L.L. (2015). Consumer behaviour (Eleventh Global Edition). New Jersey: Pearson.

Shi, G.F., Li, M., Shen, T., & Ma, Y. (2021). The impact of medical insurance on household stock market participation: Evidence from China household finance survey. Frontiers in Public Health, 9(Article 710896), 1-10.

Indexed at, Google Scholar, Cross Ref

Sivaramakrishnan, S., Srivastava, M., & Rastogi, A. (2017). Attitudinal factors, financial literacy, and stock market participation. International Journal of Bank Marketing, 35(5), 818-841.

Indexed at, Google Scholar, Cross Ref

Snijder, W.B. (2021). The relationship between an individual's ability to evaluate probabilities and stock market participation. Unpublished master’s dissertation, University of Groningen.

Sooryamoorthy, R., & Makhoba, M. (2016). The family in modern South Africa: Insights from recent research. Journal of Comparative Family Studies, 47(3), 309-321.

Indexed at, Google Scholar, Cross Ref

South African Savings Institute’s (SASI) An overview of Savings in South Africa (2014). Retrieved December 2, 2019, from https://www.savingsinstitute.co.za/

Standard Bank’s Online Share Trading (2016). Retrieved April 20, 2019, from https://stockbroking.standardbank.co.za

Stankevich, A. (2017). Explaining the consumer decision-making process: Critical literature review. Journal of International Business Research and Marketing, 2(6), 7-14.

Indexed at, Google Scholar, Cross Ref

Statistics SA (2021). Retrieved October 22, 2021, from https://tradingeconomics.com/south-africa/personal-savings

Stolper, O.A., & Walter, A. (2017). Financial literacy, financial advice, and financial behaviour. Journal of Business Economics, 87, 581-643.

Indexed at, Google Scholar, Cross Ref

Sustainable Stock Exchanges Initiative Johannesburg Stock Exchange (2021). Retrieved October 22, 2021, from https://sseinitiative.org/stock-exchange/jse/

Thampathy, M., & Krishnan, M. (2014). A study on the perception of stock market investments among government employees in Calicut City. Asian Journal of Management Research, 4(3), 501-508.

Umadevi, K., Rupa, R., & Selvam, P.M. (2019). Influence of socio economic status of working women on financial decisions of their family with special reference to self-financing college teachers. International Journal of Research and Analytical Reviews, 6(1), 468-473.

Vangelisti, A.L., & Perlman, D. (Eds.) (2018). The Cambridge handbook of personal relationships (pp. 243-255). Cambridge University Press.

Zhou, W., Tsiga, Z., Li, B., Zheng, S., & Jiang, S. (2018). What influence users’ e-finance continuance intention? The moderating role of trust. Industrial Management & Data Systems, 118(8), 1647-1670.

Indexed at, Google Scholar, Cross Ref

Received: 21-Apr-2022, Manuscript No. AAFSJ-22-11826; Editor assigned: 23-Apr-2022, PreQC No. AAFSJ-22-11826(PQ); Reviewed: 07-May-2022, QC No. AAFSJ-22-11826; Revised: 19-Nov-2022, Manuscript No. AAFSJ-22-11826(R); Published: 26-Nov-2022