Research Article: 2022 Vol: 26 Issue: 2

Application of Principal Component Analysis to Facilitate Financial Statement Analysis: An Automobile Industry Case

Neha Puri, Amity University Uttar Pradesh

Harjit Singh, Amity University Uttar Pradesh

Amlan Chakrabarti, University of Calcutta

Deepak Tandon, International Management Institute (IMI)

Citation Information: Puri, N., Singh, H., Chakrabarti, A., & Tandon, D. (2022). Application of principal component analysis to facilitate financial statement analysis: an automobile industry case. Academy of Accounting and Financial Studies Journal, 26(2), 1-17.

Abstract

Purpose: After becoming the fourth largest auto maker in 2019 with nine percent annual growth rate and adding twenty-six million vehicles annually to its fleet, of which five million are shipped overseas. Around 2025, India is expected to be the third largest car market in terms of volume. The momentum will be maintained by rising middle-class income and a young population. Electric cars are also becoming more popular as a means of reducing pollution. Considering industry preparedness, Indian Government intend to develop India as a center of global manufacturing. Experts opine that India could be an aggressive leader in share mobility by 2029. The present study assesses the role played by key auto makers vis-à-vis financial performance of the Indian Automobile Industry. Consequently, a novel construction of principal components by periodicity of key financial ratios has been analyzed, in order to reduce the computational cost for their calculation, although increasing the accuracy. In 2018, India became the world's fourth largest car market, with sales up 8.3% year on year to 3.99 million vehicles. In 2018, it was the seventh-largest commercial vehicle manufacturer. An assessment of the three giants' financial success in this field is also essential. Fully understanding how many ratios can better be used with no loss of details, however, is complicated. The paper is about discussing this problem. Design/methodology/approach: Based on the financial statements of 14 companies, including TVS Motors, Mahindra & Mahindra Ltd., Maruti Suzuki India Ltd., Hindustan Motors, Ashok Leyland Ltd., Bajaj Auto Ltd., Tata Motors Ltd., and Eicher, a total of five financial ratios were calculated, including face value, sales turnover, fixed assets, total non-current assets, total current assets, and total assets value. Findings: At the end of the paper, the authors discuss how financial performance can be assessed using just five ratios rather than an expensive study of a large number of ratios that can be difficult to comprehend. The writers may utilise a few to represent the others with little loss of information because the ratios are all connected because they derive from the same statements. Originality/value: This study will benefit many stakeholders that are interested in each company's financial success by providing a faster approach to assess performance. It will also aid people who handle financial reporting in selecting the ratios that are important in representing their company's success. The application of PCA results in unbiased ratios that are particularly useful in evaluating performance.

Keyword

Performance Analysis, Financial Ratios, Principal Component Analysis, Financial Statements, Automobile Industry.

JEL Classification Code

M41; G15.

Introduction

Incomplete information may lead to improper decisions taken by the investors. To make them aware of the accurate financial information, it is relevant to formulate financial statements that demonstrate the future opportunities and risk undertaken in the investment alternatives. The company’s financial statements indicate the past financial strength, current worth and future course of action. Financial statements are being used to gather the company’s financial information worldwide. Financial statement information is valuable because it reduces uncertainty about a company's future profitability or economic health, or because it provides evidence about the quality of its management, its ability to meet its obligations under supply agreements or labour contracts, or other aspects of the company's operations (Revsine, 2018). Financial statements act as an effective tool to answer the stakeholder’s doubts such as How firm’s profitability will enhance? How customer’s satisfaction attained? How was the new manufacturing plant financed? How funds allocated for growth and expansion of the business? Financial statements hold answer to the above mentioned questions. The analysis of the financial statements is formulated with the applications of financial ratios.

Financial Statements allows to use financial report to identify the company’s strength and weakness. Financial Statement analysis is the process of using the relationship among a company’s financial statement numbers to gain insight into its operations. In today’s scenario cause-of-change analysis, common size statements, trend statements, and financial ratios are effective tools for understanding how a company has progressed over a certain period of time and to gather information about future aspect of the company (Rao, 1964). Financial ratios provide potent tool for the financial analyst to track company’s financial performance/position over a period of time, for making better comparability, understandability and to report compliance with the accounting standards (Costa et al., 2012). Financial Reporting Conceptual Framework acknowledges about the likely seekers of financial reports (for instance, management, creditors, regulators and other members from the public). The Conceptual framework are developed to provide guidance on the key issues, such as objectives, qualitative characteristics, definitions and recognition criteria. The users of the financial statements may demand for General Purpose Financial Statement or Specific Purpose Financial Statements depending on their requirements. General Purpose Financial Statement can be used by an array of beneficiary & groups for many purposes. But, in case of Specific Purpose Financial Statements, they are prepared to cater the specific requirement of the users. Financial analysis uses general-purpose financial statements that include the following:

1. Statement of Financial Position

2. Statement of Profit and loss & other comprehensive incomes

3. Statement of change in Equity

4. Statement of Cash Flows

5. Notes including a summary of significant account, policies and explanatory material

For effective economic and business decisions, financial statement analysis is applied as an analytical tool to financial statements. Financial statement analysis depends on one or more of the four building blocks such as liquidity & efficiency, profitability, solvency and market prospects. These building blocks cover aspects of financial performance or position of the company in Figure 1.

1. Liquidity and efficiency- This describes about the organization’s financial ability to meet its short term obligations and to efficiently generate revenue from routine operations.

2. Solvency refers to a company's capacity to pay long-term obligations while also generating future income.

3. Profitability - A company's capacity to offer incentives to attract and retain investors.

4. Market prospects—the firm's capacity to elicit favorable market expectations.

Literature Review

The success and failure of the organisation depends upon the difference in accounting/ financial information from year to year. Four key accounting variables namely; Performance variables, Liquidity Variables, Leverage Variables and growth were ascertained (Taylor, 1986) to analyse the financial performance of the firm. Principal Component Analysis has proven the evidences for analysing the market and diversifying the risk. The findings obtained exhibited the best portfolio returns and possibility of controlled risk generated (Pasini, 2017). Financial development played a key role in the growth and prosperity of the economy. The author described about the adoption of various financial market variables in relation to financial institutions (Johnston, 2014). The combination is mandate, to understand the country’s financial worth. Results drawn from principal component analysis (PCA) emphasised on financial development (Lenka, 2015). However, the study investigated the introduction in Egypt, Nepal and Sri Lanka of public sector accounting reforms. Data reviews and semi-structured interviews with public officials, government accountants and members of specialist accounting bodies are also used to derive evidence for the study (Adhikari et al., 2019).

Financial Ratios is the best indicator for the organisational financial performance. Principal Component Analysis has been significantly adopted to assess the financial performance of three China based telecom companies (Yusheng, 2019). The quantitative information derived from the financial statements act as a tool for evaluating the economic decisions taken over a given period or financial reporting period (Abraham, 2004; Bhargava, 2017; Schönbohm, 2013). Principal Component analysis (PCA) has been adopted to examine the financial ratios selection in two Malaysia’s Industry (Yap, 2013). Similarly, a study conducted to analyze the Muscat Securities Market profitability indicated positive results between size, working capital, financial assets, growth, and the profitability of 17 listed companies listed in Muscat Market Securities (Samman, 2015). The company’s financial performance depends on the financial achievement of the company. Financial Ratios such as liquidity, profitability, leverage, solvency, and efficiency were used as an indicator for financial performance (Fatihudin, 2018). The quality of the financial statements assessed for the firms depends on the agreement of International Financial Reporting Standards (IFRS) or US GAAP. The study compared the disclosure quality scores resulting from the annual reports of the firm. Moreover, the authors had relied on timeliness, relevance and conservatism as the measurement to calculate the earnings of the firm (Daske, 2006). The aim of this paper was to examine how the World Bank has used accounting rhetoric/languages to express development discourses at various periods of global capitalism through the case analysis of development projects in Sri Lanka and development studies released from 1978 to 2006 (Jayasinghe & Uddin, 2019).

Principal Component Analysis as a black box was widely used to understand the data. The author adopted the variance and the goal on the basis of measurement noise, rotation, redundancy and covariance matrix to identify the slope of best fit (Shlens, 2005). The authors studied the accounting research literature based on Fair Value Accounting. The study focused on the extensive analysis of fair value analysis in the period of financial crisis. The relationship between Fair Value Accounting & Financial Crisis was examined (Menicucci & Paolucci, 2016). The derivation of revenue/profit go hand in hand with the financial stability of the firm. The author adopted different dictionaries to indicate the financial results such as Loughran and McDonald dictionary adopted for analyzing profitability. The article represented financial ratios as an indicator for measuring profitability of US firms as well as linguistic indicators were compared in the study (Hájek, 2017).

De Zoysa, (2010) acknowleges the peception of the usefulness of the annual reports through a questionnaire survey regarding emerging markets in Sri Lanka. The information taken from the annual reports helped in knowing the key factors for making business decisions such as buying, selling or holding of shares. The identification of principal component of the financial statements acknowleged by the authors that was reported in the list of the Romanian Listed Companies was considered as a research study. From the period of 2006-11, the research study aimed to identify the principal components of various financial statements. The results dawn from the study compared the finnacial performance with the market value of the company (Istratea, 2015). In the similar study conducted by (Wang, 2014), the principal coponent analysis was conducted for ‘Shanghai stock exchange 50 index’ to explore its principal components. The utility of cross sectional or panel data was emphasized to understand the functional principal component analysis (FPCA). The author examined the profitability aspect of Kirkuk company. The data for the present and past performances of the company was collected through secondary sources. Analysis of financial statements was done on the basis of financial ratios from the year 2005 to 2011. The results indicated ‘insignificant relationships between profitability with asset regulated and assets utilization’ (Ahmed, 2018).

The harmonization in accounting standards is utmost important to analyze the financial statements of the companies (Feroz et al., 2003). The author investigated on how the accounting standards can enhance the comparability of the financial statements. The results drawn emphasized on the consistency in the financial statements to enhance the profitability position of the company (Wang, 2014). Data envelopment analysis (DEA) was applied to analyze the firm’s financial performance on the basis of accounting ratios. The results revealed relationship between the deviances from the optimum DEA efficiency scores and the deviances from the optimum financial ratios. (Wieland, 2010) discussed about the approach to extract and exploit the financial statements from the prospective of the investors. The company’s value was an important instrument for financial & economic analysis (Vukoja et al., 2018) in Table 1.

| Table 1 Summary of Related Literature | |

| Authors | Financial Statements and Principal Component Analysis |

| Pasini, (2017) | Homogeneous stocks |

| Heterogeneous stock | |

| Principal Component Analysis | |

| Lenka, (2015) | Financial Development |

| Time Series | |

| Financial Development Index | |

| Financial Institutions | |

| Financial Market Variables | |

| Accounting Variables | |

| Taylor, (1986) | Capital Structure |

| Dividend | |

| Growth | |

| Cash Flow | |

| Accrual Accounting | |

| Financial Ratios | |

| Yusheng, (2019) | Principal Component Analysis |

| Financial Performance | |

| Customer Growth | |

| Management Efficiency | |

| Financial Statements | |

| Abraham, (2004); Bhargava, (2017); Schonbohm, (2013) | Quantitative Information |

| Accounting Standards | |

| Ben Chin-Fook Yap, (2013) | Financial Ratios |

| Cash Flow | |

| Factor Analysis | |

| Principal Component Analysis | |

| Samman, (2015) | Financial Performance |

| Profitability | |

| Financial Leverage | |

| Working Capital efficiency | |

| Didin Fatihudin, (2018) | Rate of returns |

| Profitability | |

| Firm Size | |

| Working Capital | |

| Financial Performance | |

| Financial Study | |

| Daske, (2006) | Cash Flow |

| Balance Sheet | |

| Fundamental Analysis | |

| Technical Analysis | |

| Menicucci & Paolucci, (2016) | Annual reports |

| Disclosure | |

| Information quality | |

| International Financial Reporting Standards | |

| Shlens, (2005) | Fair Value Accounting |

| Financial Crisis | |

| Pro-cyclicality | |

| Volatility | |

| Hájek, (2017) | Accounting research literature |

| Principal Component Analysis | |

| Measurement and Noise | |

| Covariance Matrix | |

| Non-Parametric analysis | |

| Financial ratio | |

| De Zoysa, (2010) | Financial Analysis |

| Topic Analysis | |

| Annual Reports | |

| Financial Results | |

| Financial Indicators | |

| Istratea (2015) | Financial reporting |

| Annual reports | |

| Emerging markets | |

| Decision-making | |

| High level of education | |

| Zhiliang Wang, (2014) | Financial reporting |

| Principal components | |

| Listed firms | |

| Bucharest Stock Exchange | |

| Yang, (2014) | International Financial Reporting Standard |

| Functional data analysis | |

| Curves classification | |

| Nonparametric analysis | |

| Functional depth analysis | |

| Campisi et al., (2019) | Financing |

| Financial statements | |

| Decision making | |

| International | |

| Chinese small to medium-sized enterprises (SMEs) | |

| Data envelopment analysis (DEA) | |

| Efficiency | |

| Ahmed, (2018) | Financial ratios analysis (FRA) |

| Knowledge Intensive Business Services (KIBS) | |

| Malmquist productivity index | |

| Performance measurement | |

| Financial Statements | |

| Feroz, (2003) | Ratios Analysis |

| Profitability | |

| Accounting | |

| Wieland, (2010) | Data Envelopment Analysis |

| Finance | |

| Earnings predictions | |

| Financial statement analysis | |

| Consensus recommendations | |

| Vukoja, Sunulahpašić, & Vukoja, (2018) | Abnormal returns |

| Sell side analysts | |

| Financial Analysis | |

| Liquidity | |

| Solvency | |

| Indebtedness | |

| Value of companies | |

| Methods of Assessment | |

| Valuation | |

| Adhikari et al., (2019) | Accrual accounting Diffusion Emerging economies International Public Sector Accounting Standards Public sector |

| Jayasinghe & Uddin, (2019) | Accounting rhetoric Accounting Technology Global Capitalism |

Objectives

To ascertain the firm’s financial performance in their annual reports, following research objectives have been formulated to test this hypothesis, the following research methodology was used:

1. To explore PCA on five financial ratios for Indian Automobile Industry.

2. To identify the factors that indicates the performance of automobile industry.

3. To analyze how the components are related to each other.

Methodology

Two models were utilized in several research on relationship analysis for financial ratios and financial statements. To begin, the study looked at the factors that influence industrial production in Oman. As a result, a sample of 17 industrial businesses registered on the Muscat securities market from 2006 to 2013 will be utilized (Beaver et al., 2012). The OLS Model's findings revealed a substantial and statistically significant link between productivity, firm size, production, fixed assets, and working capital. Comparing the profitability and efficiency of state-owned companies with private corporations is also a good idea (Al-Jafari & Al Samman, 2015; Jakob, 2017). Multiple regression was the second model used in several investigations. The second model adopted for various studies was multiple regression for analyzing the financial strength and weakness of the firm, profitability analysis and financial-economic analysis (Bhunia et al., 2011; Kofi-Akrofi, 2013; Buse et al., 2010). In the field of accounting, PCA has been adopted to examine and analyze the financial performance of the companies.

The first principal component brings together the X-variables with the greatest variation across all conceivable combinations. This initial component absorbs a large portion of the variance in the given data. The second one, too, takes the maximum residual variance in the data under the constraint that the correlation between the first and second variables is zero. This continues until the “ith” component, which will account for the last variation not accounted for by the extra components if its correlation with the other components is ‘0'. The independence of the variable being utilised is created by this requirement. The following basic equation is calculated using eigenvectors as the coefficient in principal component estimation (Yhip & Alagheband, 2020).

Y1=eˆ11ZX1+eˆ12ZX2+eˆ13ZX3+...+eˆ1iZXi,

Y2=eˆ21ZX1+eˆ22ZX2+eˆ23ZX3+...+eˆ2iZXi,

Yi=eˆi1ZX1+eˆi2ZX2+eˆi3ZX3+...+eˆiiZXi,

where Y is the principal component; eˆ the eigenvector; ZX the standardized value of the ratios used.

Variables

A total of 5 accounting ratios that are used in most literature in accounting and are deemed to be the most significant measures of profitability and liquidity. A part of the financial ratios key variables considered for the study are Sales Turnover, Fixed Assets, Total Current Assets, Total Non-Current Assets, Total Assets and Face value of the firms. This list, however, is not exhaustive; it has the ability to cover more ratios. Some of the ratios differ from the ones by Taylor, (1986) as they are more relevant to automobile industry as used in previous studies. Annexure I exhibits the list of ratios and the variables considered for the study.

The value indicated that as here estimate of reliability, increased the fraction of a test score attributable to error decreased. Reliability Table 2 shows that the Cronbach’s Alpha value is 0.81 which is quite high and it could be concluded that the measurement scale pertaining to the implementation scale is reliable to collect the data. The minimum value of scale to be reliable, is 0.70. Therefore, the data obtained from the secondary source is said to be reliable.

| Table 2 Reliability | |

| Reliability Statistics | |

| Cronbach's Alpha | Number of Items |

| 0.81 | 11 |

Data

PCA gives down a strategy for condensing a huge data set into a manageable size in order to reveal the often hidden, basic shape that is sometimes underlying by it. PCA is a multivariate approach for analyzing a data table in which observations are defined by many inter-correlated quantitative dependent variables in Table 3. Its objective is to extract the most significant information from a document. Its goal is to extract the important information from the statistical data to represent it as a set of new orthogonal variables called principal components, and to display the pattern of similarity between the observations and of the variables as points in spot maps (Mishra et al., 2017).

| Table 3 Prominent Studies Depicting Adoption of PCA in Various Facets of Finance | |||

| S.No | Author | Area/ Sector | Description |

| 1 | Mishra et al., (2017) | Application of PCA | PCA is a multivariate approach for analyzing a data table in which observations are defined by many inter-correlated quantitative dependent variables. |

| 2 | Rao, (1964) | Application of PCA in applied research | The research paper describes about the various interpretations of principal components in the surveying of multivariate statistical technique. |

| 3 | Johnston, (2014) | Encyclopedia of Quality of Life and Well-Being Research | The utility of Principal Component Analysis helps to identify the general patterns from the large data sets. |

| 4 | Olivieri, (2018) | Principal Component Analysis. In: Introduction to Multivariate Calibration | Analysis is provided in sample discrimination and in the development of inverse calibration models using full spectral information. |

| 5 | Frieden, (1991) | Principal Components Analysis. In: Probability, Statistical Optics, and Data Testing. | Principal Component analysis is closely related to linear regression and addresses how to fit many sets of data with thw minimum number of curves. |

| 6 | Costa et al., (2012) | Exploring the efficiency of Italian social cooperatives by descriptive and principal component analysis | The article evaluated the efficiency and profitability of the social cooperative with the adoption of principal component analysis to economic and financial indexes. |

| 7 | Yhip, (2020) | Financial Statement Analysis. In: The Practice of Lending | The research paper provided the credit analyst with information to calculate the ratios, which are usually grouped into four categories: profitability, asset utilization and efficiency, liquidity, and debt and solvency. |

| 8 | Beaver et al., (2012) | Do differences in financial reporting attributes impair the predictive ability of financial ratios for bankruptcy? | The study explored the effect of cross-sectional and time-series differences in financial reporting attributes on the predictive ability of financial ratios related to bankruptcy. |

From FY 2010 to FY 2019, the data used in the study was gathered from the company's website. The financial statement was evaluated with Statistical Software for Social Sciences 25, and the final coefficients for each key element were measured with Microsoft Excel 16. For the various ratios with different units of measurement, standardized data was utilized instead of the original data. The raw data are used, then a PCA will tend to give emphasis to variables that have relatively higher variances than those that have lower variances. The financial data has been obtained from the secondary data, taken from the company’s annual financial reports as presented on their websites and also from trusted journals and websites Table 4.

| Table 4 Descriptive Statistics for Automobile Industry | ||||||

| Descriptive Statistics | ||||||

| N* | Minimum | Maximum | Mean | Std. Deviation | Variance | |

| Profit Before Interest And Tax Margin(%) | 141 | -978.14 | 72.69 | 0.5048 | 88.96043 | 7913.958 |

| Return On Capital Employed(%) | 141 | -396.63 | 200.47 | 19.0549 | 44.1642 | 1950.477 |

| Return On Net Worth(%) | 141 | -170.3 | 181.83 | 17.5088 | 32.15091 | 1033.681 |

| Current Ratio | 141 | 0.09 | 5.7 | 1.0151 | 0.63869 | 0.408 |

| Quick Ratio | 141 | 0.07 | 18.88 | 1.1387 | 2.20423 | 4.859 |

| Sales Turnover | 141 | 0 | 86020.3 | 17602.769 | 20722.6703 | 429429062.1 |

| Fixed Assets | 141 | 0 | 29702.78 | 4497.7896 | 6757.71806 | 45666753.43 |

| Total Non-Current Assets | 0 | 54124.7 | 9525.4901 | 14100.2736 | 198817716.8 | |

| Total Current Assets | 0 | 18071.06 | 4137.2779 | 4482.57429 | 20093472.28 | |

| Total Assets | 0 | 62931.8 | 13665.943 | 17975.1934 | 323107578.5 | |

| Face Value | 1 | 10 | 5.9645 | 3.83669 | 14.72 | |

| Valid N (listwise) | ||||||

* N= Number of data items

Results & Discussion

Table 5 shows the relations within the ratios and variables, which means we cannot have any ratio and variable that is independent from the other, hence, we cannot use these ratios in regression as independent variables. This means we need to create new variables using PCA that will be independent from each other.

| Table 5 Inter-Item Correlation Matrix for Indian Automobile Industry | |||||||||||||

| Correlation Matrix | |||||||||||||

| profit before interest and tax margin | return on capital employed | return on net worth | adjusted return on net worth | return on long term funds | current ratio | quick ratio | Sales Turnover | Fixed Assets | Total Non-Current Assets | Total Current Assets | Total Assets | ||

| Correlation | profit before interest and tax margin | 1.0000 | 0.016 | 0.03 | 0.065 | 0.137 | 0.275 | 0.183 | 0.173 | 0.116 | 0.144 | 0.213 | 0.166 |

| return on capital employed | 0.016 | 1.0000 | 0.003 | 0.328 | 0.434 | 0.005 | -0.022 | 0.101 | 0.012 | 0.029 | 0.09 | 0.045 | |

| return on net worth | 0.03 | 0.003 | 1.0000 | 0.675 | 0.681 | 0.013 | -0.014 | 0.077 | -0.002 | 0.022 | 0.076 | 0.037 | |

| adjusted return on net worth | 0.065 | 0.328 | 0.675 | 1.0000 | 0.919 | 0.078 | 0.03 | 0.139 | 0.088 | 0.095 | 0.142 | 0.11 | |

| return on long term funds | 0.137 | 0.434 | 0.681 | 0.919 | 1.0000 | -0.011 | -0.029 | 0.153 | 0.029 | 0.053 | 0.139 | 0.076 | |

| current ratio | 0.275 | 0.005 | 0.013 | 0.078 | -0.011 | 1.0000 | 0.494 | 0.07 | 0 | 0.067 | 0.21 | 0.105 | |

| quick ratio | 0.183 | -0.022 | -0.014 | 0.03 | -0.029 | 0.494 | 1.0000 | 0.229 | 0.16 | 0.247 | 0.402 | 0.294 | |

| Sales Turnover | 0.173 | 0.101 | 0.077 | 0.139 | 0.153 | 0.07 | 0.229 | 1.0000 | 0.839 | 0.915 | 0.89 | 0.94 | |

| Fixed Assets | 0.116 | 0.012 | -0.002 | 0.088 | 0.029 | 0 | 0.16 | 0.839 | 1.0000 | 0.933 | 0.795 | 0.93 | |

| Total Non-Current Assets | 0.144 | 0.029 | 0.022 | 0.095 | 0.053 | 0.067 | 0.247 | 0.915 | 0.933 | 1.0000 | 0.823 | 0.99 | |

| Total Current Assets | 0.213 | 0.09 | 0.076 | 0.142 | 0.139 | 0.21 | 0.402 | 0.89 | 0.795 | 0.823 | 1.0000 | 0.895 | |

| Total Assets | 0.166 | 0.045 | 0.037 | 0.11 | 0.076 | 0.105 | 0.294 | 0.94 | 0.93 | 0.99 | 0.895 | 1.0000 | |

The purpose of applying exploratory factor analysis is to find the essential structure of a relatively large set of variables. The factor analysis is a multivariate statistical method, which identifies the underlying factors on the correlation structure between the variables. The highly correlated variables are clubbed together to form a factor. The factor analysis with varix rotation was applied on the scale. The Kaiser-Meyer-Olin (KMO) Test and Bartlett's test Table 6, factor, and factor loadings are shown in Tables 6 & 7 below with necessary interpretations.

| Table 6 KMO and Bartlett’s Test | ||

| KMO and Bartlett's Test | ||

| Kaiser Meyer Olkin Measure of Sampling Adequacy | 0.716 | |

| Bartlett's Test of Sphericity | Approximate Chi-Square | 2575.886 |

| Df | 55 | |

| Sig. | 0.000 | |

| Table 7 Communalities | ||

| Communalities | ||

| Initial | Extraction | |

| Profit before interest and tax margin | 1 | 0.317 |

| adjusted return on net worth | 1 | 0.897 |

| return on long term funds | 1 | 0.944 |

| return on capital employed | 1 | 0.952 |

| return on net worth | 1 | 0.858 |

| current ratio | 1 | 0.734 |

| Quick ratio | 1 | 0.643 |

| Sales Turnover | 1 | 0.920 |

| Fixed Assets | 1 | 0.903 |

| Total Non-Current Assets | 1 | 0.955 |

| Total Current Assets | 1 | 0.875 |

| Total Assets | 1 | 0.989 |

| Extraction Method - Principal Component Analysis | ||

The result represents that KMO statistics is 0.716, which indicates the presence of sample is adequate (Frieden, 1991). The degree of common variance as per KMO value calculated is meritorious.

The Bartlett's Test of Sphericity is applied to test the null hypothesis that the correlation matrix is an identity matrix. An identity matrix, stands for a matrix in which all of the diagonal elements are zero. If the off diagonal values are zero, those variables are linearly independent. That means if all the off diagonal values are zero, there is no relationship between the variables. Bartlett’s test of Sphericity is significant if its associated probability is less than 0.05. The communality is the sum of the squared component loadings up to the number of components extracted as described in Table 7.

The extracted communalities of all variables are found to be larger than 0.5, indicating that the factor analysis used is appropriate for the investigation. The main component analysis is used to extract the components in the extraction procedure. It's based on the correlation matrix of the variables in question, and correlations often require a high sample size to be stable. In principal component analysis, the Eigenvalue of different components is calculated. The component is arranged in descending order and those components are considered whose Eigenvalue is greater than one. The result of Principal component applied on the latent factors is shown in Table 8 as below.

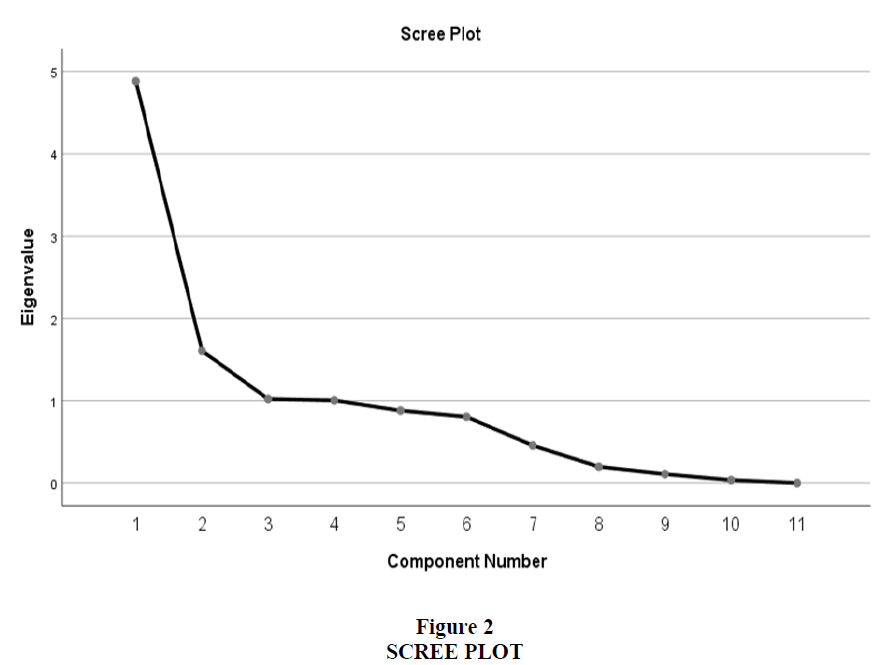

The analysis of the Table 8 depicts that based on extraction, only four components actually seem to be desirable as ‘variables’ in the automobile industry in place of the initial 11. These new variables are found to be not only independent but are more easily comparable than the initial variables we had (Olivieri, 2018). The first principal component covers the highest variation in the data with an initial eigenvalue of 4.883, which represent 44.395 percent of the variance. Three other components needed to, at least, get to 77.423 per cent of the variance, which is significant with least data being lost in the said analysis. This contradicts with the initial conclusion that was made on Indian Automobile companies, who used similar ratios but got four components at 64.8 per cent (Taylor, 1986).

| Table 8 Total Variance Explained | |||||||||

| Total Variance Explained | |||||||||

| Component | Initial Eigenvalues | Extraction Sums of Squared Loadings | Rotation Sums of Squared Loadings | ||||||

| Total | % of Variance | Cumulative % | Total | % of Variance | Cumulative % | Total | % of Variance | Cumulative % | |

| 1 | 4.883 | 44.395 | 44.395 | 4.883 | 44.395 | 44.395 | 4.7 | 42.726 | 42.726 |

| 2 | 1.608 | 14.62 | 59.015 | 1.608 | 14.62 | 59.015 | 1.786 | 16.233 | 58.959 |

| 3 | 1.021 | 9.278 | 68.294 | 1.021 | 9.278 | 68.294 | 1.019 | 9.261 | 68.22 |

| 4 | 1.004 | 9.129 | 77.423 | 1.004 | 9.129 | 77.423 | 1.012 | 9.203 | 77.423 |

| 5 | 0.881 | 8.005 | 85.428 | ||||||

| 6 | 0.805 | 7.315 | 92.743 | ||||||

| 7 | 0.457 | 4.158 | 96.901 | ||||||

| 8 | 0.197 | 1.793 | 98.694 | ||||||

| 9 | 0.108 | 0.984 | 99.678 | ||||||

| 10 | 0.035 | 0.322 | 100 | ||||||

| 11 | 2.81E-06 | 2.55E-05 | 100 | ||||||

| Extraction Method: Principal Component Analysis. | |||||||||

After applying Principal Component analysis, components are rotated using varimax. Varimax is the most widely used rotation technique. The calculated Eigen value of different components is shown in graphical presentation of Eigen value known as Scree plot in Figure 2.

Table 9 exhibits the list of the accounting ratios of the automobile companies.

| Table 9 List of Accounting Ratios /Variables | ||

| Ratio class | Ratio name | Formula/Explanation |

| Profitability ratios | 1. Profit Before Interest And Tax Margin(%) | Revenue minus expenses excluding tax and interest |

| 2. Return on capital employed | EBIT/ Total Assets – Total Current Liabilities | |

| 3. Return on Net worth | Net after-tax profits ÷ (Shareholder capital + Retained earnings) | |

| Liquidity ratios | 4. Current ratio | Current Assets/Current Liabilities |

| 5. Quick Ratio | Quick Assets/ Current Liabilities | |

| Sales Turnover | Sales Turnover is a measure for evaluating how much of its products or services a business sells within a defined period. | |

| Fixed Assets | Assets which are purchased for long-term use and are not likely to be converted quickly into cash, such as land, buildings, and equipment. | |

| Total Non-Current Assets | Noncurrent assets are a company's long-term investments for which the full value will not be realized within the accounting year. | |

| Total Current Assets | Total current assets are the aggregate amount of all cash, receivables, prepaid expenses, and inventory on an organization's balance sheet. | |

| Total Assets | Here total assets mean the total amount of assets owned by a person or an entity. The assets possess economic value and yield benefits over its useful life. | |

| Face value | Face value is a financial term used to describe the nominal or dollar value of a security, as stated by its issuer. | |

On the basis of factor loadings, the variables are categorized into four categories:

1. Return on assets and sales performance - PCA provide a consistent and reliable measure of managerial or operational efficiency of a firm. Sales performance is the best indicator for the procedure of business transaction of a business administrative typology.

2. Profitability Position - Financial Ratios such as profit before interest and tax margin, return on net worth, return on long term funds and adjusted return on net worth are useful in making business and economic decisions. This develops the conceptual framework for which events & transactions are accounted for, how to measure them and how it can be conversed to the stakeholders. This represents a fair and clear view of the financial reports of the firm.

3. Liquidity – Liquidity position of a firm can be evaluated with the help of analyzing firm’s current as well as quick ratio. This ratio depicts the cash readiness/ availability with the firm. It is important the firm should maintain high liquidity position so that the routine operations would not disturb.

4. Return on Capital employed - Financial statement users have different interests, which means that the implementation of fair value concept contributes to achieving the interests of only individual financial statement users, while the interests of other financial statement users have not been fulfilled.

This huge variation is supposed to be because of these data being focused on one industry, hence, reducing the differences in valuation and reports of numerous firms. The increased percentage means there is lesser data loss from the above four components and this allows for better analysis of the financial statements. Therefore, the PCA for the automobile industry, propose us to remain with four variables, Year 1–Year 4 whose calculation based on Table 10.

| Table 10 Component Matrix | ||||

| Component Matrixa | ||||

| Component | ||||

| 1 | 2 | 3 | 4 | |

| Face Value | -.400 | .306 | .104 | .188 |

| Profit Before Interest & Tax Margin (%) | .225 | .515 | .169 | -.027 |

| Return On Capital Employed (%) | .066 | -.021 | .769 | .586 |

| Return On Net Worth (%) | .056 | -.002 | .593 | -.788 |

| Current Ratio | .161 | .840 | -.011 | -.002 |

| Quick Ratio | .365 | .683 | -.161 | -.027 |

| Sales Turnover | .950 | -.104 | .066 | .014 |

| Fixed Assets | .921 | -.205 | -.072 | .028 |

| Total Non-Current Assets | .957 | -.110 | -.039 | .035 |

| Total Current Assets | .932 | .085 | .042 | -.003 |

| Total Assets | .984 | -.065 | -.020 | .027 |

| Extraction Method - Principal Component Analysis | ||||

| a. 4 components extracted. | ||||

Conclusion

Profit Before Interest and Tax Margin (percent), Return on Capital Employed (percent), Return on Net Worth (percent), Current Ratio & Quick Ratio are the main performance highlighters for the industry, according to the findings of PCA analysis conducted on five ratios over ten years for fourteen selected companies. Maintaining all of these will result in positive returns for the industry's shareholders. We cannot look at these factors in isolation as they are interrelated and are combined when assessing the overall performance of the industry as a whole or individual firms. Further, the combination of various ratios and six underlying variables is able to give significant conclusion about the industry in question and can therefore, effectively evaluate the operations of the firms.

Further Scope & Policy Recommendations

State-owned companies are frequently stated to be less lucrative and efficient than private corporations, according to (Jakob, 2017). A comparison can be made in a setting that includes both private and public companies. Further research can be undertaken to identify the elements of financial statements which can enhance the profitability of automobile industry. Extensive study of financial ratios of both public as well as private sector can be evaluated to understand the prospective of firm’s financial position. Cross country analysis can be appraised to visualize the performance of this sector around the globe, which may result in the formulation of strategies and policies.

| Annexure Exhibit 1 Rotated Component Matrix | ||||

| Particulars | Component | |||

| 1 | 2 | 3 | 4 | |

| Profit before interest & tax margin | 0.106 | 0.075 | 0.544 | 0.064 |

| Return on capital employed | 0.032 | 0.17 | 0.006 | 0.96 |

| Return on net worth | 0.011 | 0.895 | -0.004 | -0.237 |

| Adjusted return on net worth | 0.073 | 0.916 | 0.065 | 0.218 |

| Current ratio | -0.02 | 0.005 | 0.856 | -0.013 |

| Return on long term funds | 0.05 | 0.913 | 0.02 | 0.329 |

| Quick ratio | 0.202 | -0.043 | 0.772 | -0.064 |

| Sales Turnover | 0.949 | 0.082 | 0.094 | 0.063 |

| Fixed Assets | 0.95 | -0.004 | -0.011 | -0.017 |

| Total Non-Current Assets | 0.974 | 0.012 | 0.074 | -0.009 |

| Total Current Assets | 0.887 | 0.076 | 0.284 | 0.048 |

| Total Assets | 0.985 | 0.028 | 0.129 | 0.005 |

| Extraction Method - Principal Component Analysis | ||||

| Rotation Method - Varimax with Kaiser Normalization | ||||

| a. Rotation converged in four iterations. | ||||

References

Beaver, W.H., Correia, M., & McNichols, M.F. (2012). Do differences in financial reporting attributes impair the predictive ability of financial ratios for bankruptcy?. Review of Accounting Studies, 17(4), 969-1010.

Bhargava, P. (2017). Financial analysis of information and technology industry of India (a case study of Wipro Ltd and Infosys Ltd).

Campisi, D., Mancuso, P., Mastrodonato, S.L., & Morea, D. (2019). Efficiency assessment of knowledge intensive business services industry in Italy: Data envelopment analysis (DEA) and financial ratio analysis. Measuring Business Excellence, 23(4), 484-495.

De Zoysa, A., & Rudkin, K. (2010). An investigation of perceptions of company annual report users in Sri Lanka. International Journal of Emerging Markets, 5(2), 183–202.

Fatihudin, D. (2018). How measuring financial performance. International Journal of Civil Engineering and Technology (IJCIET), 9(6), 553-557. Retrieved from http://www.iaeme.com/ijciet/issues.asp?JType=IJCIET&VType=9&IType=6

Hájek, R.M. (2017). Comprehensive assessment of firm financial performance using financial ratios and linguistic analysis of annual reports. Journal of of International Studies, 10(4), 96-108.

Jakob, B. (2017). Performance in strategic sectors: A comparison of profitability and efficiency of state-owned enterprises and private corporations. The Park Place Economist, 25(1), 8.

Menicucci, E., & Paolucci, G. (2016). Fair value accounting and the financial crisis: a literature-based analysis. Journal of Financial Reporting and Accounting, 14(1), 49-71.

Pasini, G. (2017). Principal Component Analysis For Stock Portfolio Management. International Journal of Pure and Applied Mathematics, 115(1), 153-167.

Samman, M.K.J. (2015). Determinants of Profitability: Evidence from Industrial Companies Listed on Muscat Securities Market. Review of European Studies, 7(11).

Shlens, J. (2005). A Tutorial on Principal Component Analysis.

Taylor, S. L. (1986). Analysising Financial Statements: How many variables should we look at? JASSA, 1.

Wang, C. (2014). Accounting Standards Harmonization and Financial Statement Comparability: Evidence from Transnational Information Transfer. Journal of Accounting Research, 52(4), 955-992.

Wild, J. (2018). Financial Accounting Fundamentals (7th, Kindle Edition ed.). McGraw-Hill Higher Education.