Research Article: 2025 Vol: 29 Issue: 2

Applying green activity-based costing technology in environmental cost management / An applied study in a fertilizer factory in Basra

Issa Tawfeeq Issa Alnaser, Southern Technical University, Iraq

Murtadha Kadhim Afat Albazooni, University of Basrah, Iraq

Mohammed Qasim Yahya Alqureani, Southern Technical University, Iraq

Citation Information: Issa Alnaser, T. I. Afat Albazooni , K. M. Yahya Alqureani, Q. M., (2025). Applying Green Activity-Based Costing Technology In Environmental Cost Management / An Applied Study In A Fertilizer Factory In Basra. Academy of Accounting and Financial Studies Journal, 29(2), 1-10.

Abstract

The research aims to demonstrate the application of GABC technology in managing environmental costs through the information produced by this technology. To achieve this goal, an applied study method was used in the Southern Fertilizers Factory in Basra. The researchers reached a set of conclusions, the most important of which is that the application of the (GABC) technology has a major role in helping the company’s management to make the best decisions related to managing environmental costs through the information provided by this technology to reduce the environmental impact in addition to reducing costs, because environmental costs have become a high percentage of overhead costs, it is no longer possible to ignore information related to these costs.Thus, it will affect the company's profitability and, consequently, its market share compared to competitors, as well as the environment. The total environmental costs amounted to (5,129,346,000) dinars. Based on the results obtained, the researchers recommend applying GABC technology in fertilizer plants.

Keywords

Green activity-based costing, environmental cost management.

Introduction

Since the Industrial Revolution, problems of resource consumption and environmental pollution have been on the rise due to the development of manufacturing industries. Therefore, environmental issues have received widespread attention locally and globally, which has prompted a focus on studying and researching the causes of these problems in order to address them. As environmental costs represent a high percentage of total costs, traditional costing systems were unable to provide information about them. GABC technology emerged as a tool to help management make better decisions related to environmental issues based on the information it produced, which positively impacts the company's financial position and improves its environmental performance.

Research Problem

Due to the rapid changes, challenges and problems facing the environmental situation as a result of pollution resulting from industrial companies in all fields, specifically the petrochemical and fertilizer industries and the oil sector, where the pollution process is accompanied by costs called environmental costs, which requires accurately identifying green activities, or calculating indirect environmental costs. Therefore, the research problem can be formulated with the following question: (What is the role of applying the costing technique based on GA in managing environmental cost?).

Importance of the Research

1. The research gains its importance from the growing interest in environmental cost management and its impact on sustainability, as well as the importance of linking management with environmental cost management.

2. Providing information that enables management to make decisions focused on managing environmental costs to reduce them and minimize negative environmental impacts.

Research Objective

The research aims to demonstrate the role of applying GABC technology in accurately managing environmental costs, ensuring improved cost position and sustainable environmental performance of the company.

Research Hypothesis

Based on the problem, importance, and objective of the research, the research is based on the following main hypothesis:

H1: The application of green activity-based costing technology enhances the accurate management of environmental costs to reduce the negative environmental impact.

Previous Studies

1- A study (Jumaah & Mashkoor, 2023) entitled: (The Impact of GABC in Reducing Costs in the Oil Refinery in Southern Iraq)

The study aimed to reduction the impact of GABC technology on cost reduction. The study concluded that the information produced by this technology has an impact on cost reduction through the redistribution of indirect costs, including environmental costs.

2- A study (Abd-Allah & Abdlkadm, 2023) entitled: (Using GABC to measure cost and improve management decisions)

This study aimed to measure environmental costs more accurately using GABC and make better decisions. The study concluded that calculating environmental costs using GABC is is a useful accounting method that can track direct and indirect costs, in addition to tracking carbon taxes and measuring greenhouse gas emissions to reduce environmental problems. It is also useful in providing more accurate information about activities for making better decisions.

3- A study (Al Mashkoor, 2022) entitled: (The Impact of GABC and Green Supply Chain Practices on Environmental Performance of Oil Refineries in Iraq)

This study aimed to analyze the effects of GABC technology and green supply chain practices through environmental awareness on environmental performance. The study concluded that transparently tracking resources through GABC while reducing waste will increase profitability and improve companies' environmental performance. The researcher recommended incorporating additional supply chain practices and understanding how they impact environmental performance.

The most important feature of the current research is a new addition to the GABC technique, but in a different field, which is managing environmental costs for the purpose of controlling them, reducing the negative environmental impact, and creating a better climate

Theoretical Framework

Green Activity Based Costing (GABC)

Traditional systems have been subject to much criticism due to the poor allocation of indirect costs to the cost object. Therefore, the activity-based costing (ABC) system emerged to overcome these criticisms and allocate indirect costs more accurately. Horngren (2021) states that it is one of the best tools for improving the cost accounting system, starting with identifying activities as indirect cost centers and then allocating the costs of these activities to cost targets (Datar & Rajan, 2021). However, with the increasing number of problems and pollution caused by factories, introducing some modifications to the ABC system will achieve management goals better. These modifications were proposed by the US Environmental Protection Agency (USEPA), Traditional cost drivers have been supported by drivers related to emissions from production processes.These modifications are a positive step towards supporting management decisions through optimal use of available resources and energy conservation (Marinho Neto et al., 2018). GABC is a method for calculating environmental costs by identifying the activities that consume these costs and measuring them within the framework of environmental cost accounting, then accurately including the cost of the resources consumed in the activity, and finally allocating the final activity costs to products or services through cost drivers (Huang & Yanhua, 2015). Most of the GABC steps are compatible with the ABC system, with one difference: the former helps measure cost savings resulting from reducing the cost of raw materials during the recycling and reuse period, as well as measuring environmental costs (Abd-Allah & Abdlkadm, 2023). As for (Jumaah), she defined it as one of the modern management accounting techniques, which measures the cost of the product more accurately by identifying and measuring the hidden environmental costs with the total costs, and distributing the indirect environmental costs more fairly and accurately to green activities using the appropriate resource drive and then allocating the cost of these activitiesto the products based on the amount of the drive consumed by these activities(Jumaah et al., 2025). This technique also provides more detailed information not only for pricing decisions but also for measuring and evaluating the company’s performance and thus provides an opportunity for top management to reduce costs and support prevention and pollution prevention activities (Jumaah & Mashkoor, 2023).

Environmental Costs and Their Importance

Accounting thought views environmental costs as helping companies prepare reports that benefit internal and external parties by applying the principle of disclosure to preserve national wealth and achieve economic efficiency (Ahmed, 2017: 25). Therefore, environmental costs are defined as the economic sacrifices that companies spend in order to protect the environment from the effects of environmental pollution caused by their industrial activities (Al-Zamli & Al-Ajaibi, 2021). As defined by Cohen, it is the costs of activities and supplies to use this information in making administrative policy so as to help mitigate the tax effects of activities (Cohen & Santhakumar, 2007). As defined by Cohen, it is the cost of activities and supplies, and this information is used in administrative policymaking to help reduction the tax consequences of activities (Cohen & Santhakumar, 2007). With the increase in environmental problems, the costs related to them have increased significantly, so it has become necessary to provide accurate information about these costs, as their importance stems from the importance of the benefits achieved by the condition of preserving the rights of future generations, in addition to creating opportunities to reduce costs and improve the company’s performance to continue its work in a competitive market (Almashkor & others, 2023: 3206). It is noted from the above that the importance of measuring and disclosing these environmental costs is complemented by using a costing technique such as the (GABC) technique, which identifies and measures these costs accurately and clearly to be the basic foundation upon which management builds appropriate future decisions. Environmental cost management is the process of identifying, analyzing, and evaluating the costs associated with the environmental impacts of an organization's or project's activities. This type of management aims to minimize environmental impact and minimize associated financial costs by making sustainable strategic decisions that consider the environment while maintaining economic feasibility.

Third: Steps for applying the GABC

The steps for applying the technology are as follows: (Jumaah & Mashkoor, 2023)

1. Determine the cost objective and production quantity.

2. Calculating direct economic costs.

3. Set green activities.

4. Calculating indirect environmental costs.

5. Determine cost drives and activity drives.

6. Allocate indirect costs to green activities.

7. Calculate green activity costs.

8. Allocate green activity costs to cost objective.

9. Combine direct and indirect product costs.

10. Benefits of Green Activity-Based Costing

(Antic, et al., 2021), (Hsieh et al., 2020), and (Oncioiu et al., 2019) identified the benefits of GABC:

1. Identifying and measuring environmental costs.

2. Allocating environmental costs to cost drivers

3. Costs are more realistic through allocation and careful control.(Almashkor & others, 2023:35)

4. Improving the decision-making process.

5. Achieve a higher competitive advantage by reducing environmental costs.

The Role of GABC in Managing Environmental Costs

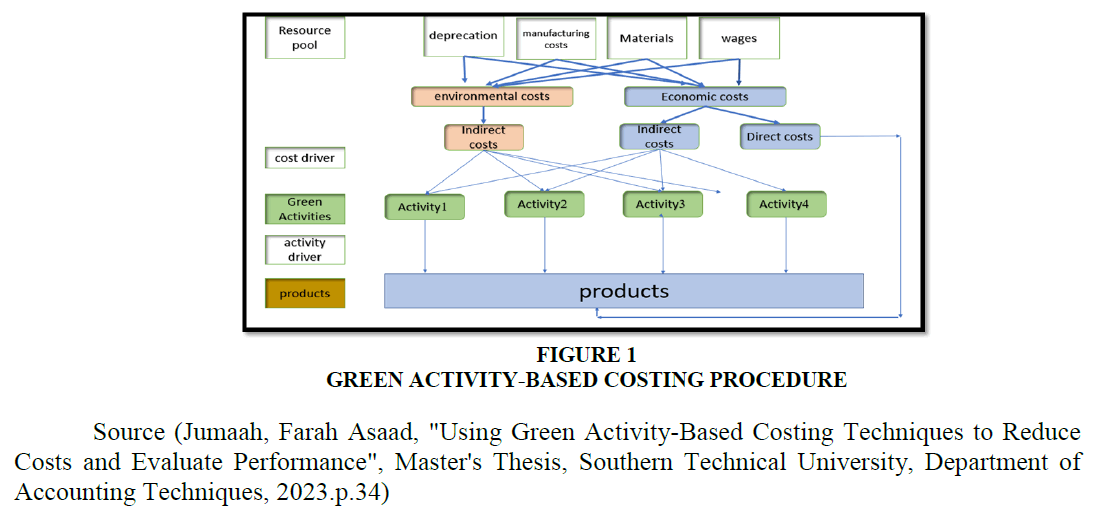

ABC cannot track externalities and their costs, such as greenhouse gas emissions, so it must be developed to help companies manage environmental costs. Based on the principle that what cannot be measured cannot be managed. The GABC technique can help management fill this gap by identifying environmental costs according to their type and relationship to the cost objective, which are usually hidden within overhaed costs, and then allocating them to activities based on a cause-and-effect relationship, and then to the cost objective according to each product and the amount of its benefit from those green activities (Abd-Allah & Abdlkadm, 2023). Green is a term that refers to activities that have both economic and environmental dimensions, because the word green does not only mean environmental, but rather it is a metaphorical expression that refers to everything that has a relationship with the environment and the economy, whether it has a positive or negative environmental impact. The process of accurately identifying and measuring environmental costs will have a significant impact on making decisions related to environmental economic feasibility, because increased pollution and the lack of optimal use of resources means inefficient operational processes. In addition, decisions to design a green product are based on accurate information about the impact of the elements from which the product is made and the places of waste, and thus will also have a role in strengthening the control element to achieve environmental quality, which has become the most important pillar of competition (Abdul Rahman & Ismail, 2014). (Mashkoor et al., 2023) explained that the application of GABC is a useful solution solution to avoid disadvantages of previous costing systems (Mashkoor et al., 2023), and Figure 1 shows the procedural diagram of the GABC technique and its role in managing environmental costs through the information it produces (Juma, 2023: 34):

The Practical Framework

An Overview of the Research Sample Company

The company was established on 12/2/1969 under the name of the General Company for Fertilizers Industry in Basra, with a nominal capital of 12 million dinars. The year 1971 witnessed the production of urea through a small production unit in (Abu Flus, southern Iraq) with a design production capacity of 50 thousand tons annually. In 1977, the capacity of the first plant was expanded by establishing a second plant to produce urea fertilizer at a cost of 32 million dinars and a design capacity of 130 tons per day of urea and 800 tons per day of ammonia. On 1/10/1978, a large plant was established to produce urea fertilizer in the Khor Al-Zubair fertilizer complex, which consists of two production lines with a design capacity of 1600 tons per day for each line of urea and 1000 tons per day of ammonia at a cost of 192 million dinars. On 2/24/1979, all the plants were merged. The two companies were merged to form the General Company for Fertilizers Industry/ Southern Region. The plant produces urea fertilizer, which is a final product that covers 60% of the local need, in addition to producing desalinated water (RO) for the production process requirements. The surplus is to meet the needs of the residential area adjacent to the plant. It also produces water vapor and ammonia gas as components of the production process. The surplus is released into the air, causing many environmental problems that affect the health of living organisms.

Steps for applying the GABC technique in the General Company for Fertilizer Industry in Basra.

The researchers were briefed on the company’s cost accounting system. It was found that the company uses a traditional costing system (stage system) to calculate product costs. According to the system applied by the company, indirect manufacturing costs do not distinguish between environmental costs and other costs Table 1. This prompted the search for another technique, namely green activity-based costing, to meet this need and address the dynamic environmental requirements. The financial statements for 2019, approved by the Iraqi Board of Supreme Audit, were used Table 2.

| Table 1 Cost Target and Production Quantity | ||

| NO. | Products | Output quantity (Ton) |

| 1 | Water RO | 10,251,664 |

| 2 | Water steam | 6,471,360 |

| 3 | Ammonia | 190,344 |

| 4 | Urea | 267,952 |

| Total | 17,181,320 | |

| Table 2 Direct Economic Cost | |

| Products | Direct economic costs |

| Salaries and Wages | 8,161,908,677 |

| Commodity Requirements | 14,372,447,370 |

| Service Requirements | 50,193,500 |

| Depreciation | 371,189,008 |

| Total | 22,955,738,555 |

| (Cost of Waste of Chemicals) | 4974439000 |

| (Environment Department Salaries) | 88,857,000 |

| Total direct economic costs | 17,892,442,555 |

Determine the Cost Objective and Production Quantity

Determining Direct Economic Costs

Set green activities: The process of defining activities is one of the basic steps in GABC, and these activities are implicitly it economic activities and environmental activities because they will bear a portion of the indirect economic costs and indirect environmental costs Table 3 and Table 4 .

| Table 3 Indirect Environmental Costs | |

| Type of Cost | Indirect environmental costs |

| Environmental Department Salaries | 88,857,000 |

| Cost of Chemical Waste | 4,974,439,000 |

| Cost of Electricity Waste | 66,050,000 |

| Total Indirect Environmental Costs | 5,129,346,000 |

| Table 4 Indirect Economic Costs | |

| Type of cost | Indirect economic costs |

| Salaries and Wages | 40,532,681,346 |

| Commodity Inputs | 18,984,965,713 |

| Service Inputs | 3,411,752,797 |

| Depreciation | 5,979,242,135 |

| Total | 68,908,641,991 |

| (Electricity Waste Cost) | 66,050,000 |

| Total Indirect Costs | 68,842,591,991 |

The Researchers Classified the Green Company’s Activities into the Following Activities

1. Water desalination (RO) activity: Through this activity, water coming from the Al-Mahala plant located in Abu Al-Khaseeb is converted into pure water, free of impurities and sediments, using filters and tanks to which chemicals are added for the above purposes. Excess water is discharged into a canal on the sea.

2. Evaporation activity (Water steam): Through this activity, desalinated water (RO) is converted under high temperature and pressure via the steam boiler unit into water vapor, which is one of the components of the production process in the next stage.

3. Ammonia activity: This activity produces ammonia gas as a result of the reaction of hydrogen gas and nitrogen gas extracted from the atmosphere and natural gas. It is a colorless gas with a smell similar to rotten eggs. The outputs of this activity are ammonia gas and carbon dioxide gas

4. Urea activity: Through this activity, urea fertilizer is produced, which is the main product resulting from the reaction of ammonia gas with carbon dioxide gas under extreme heat and pressure. This activity is accompanied by the release of many steams and gases that are released into the atmosphere.

Calculating Indirect Environmental and Economic Costs

Identifying Cost Drivers and Activity Drivers

Production quantities were relied on as a driving factor for cost.

Allocating Indirect Costs to Green Activities

Environmental costs were allocated to green activities based on production volumes because the fertilizer plant lacked the necessary metrics to quantify the impact of these pollutants the calculation mechanism is as follows:

Desalination activity = (total indirect environmental costs / total production quantities) × Desalination activity production quantity

= (5,129,346,000/17,181,320) × 10,251,664 tons

= 3,060,552,491 dinars per ton

And also for the rest of the activities….

The Allocation of Indirect Economic Costs is as Follows

• Desalination activity = Total indirect economic costs / Total production quantity × Production quantity of the activity

• = (68,842,591,991/17,181,320) × 10,251,664 tons = 41,076,653,131 dinars per ton

• Evaporation activity = (68,842,591,991/17,181,320) × 6,471,360 = 25,929,625,669 dinars per ton

• Ammonia activity = (68,842,591,991/17,181,320) × 190,344 = 762,675,646 dinars per ton

• Urea activity = (68,842,591,991/17,181,320) × 267,952 = 1,073,637,544 dinars per ton

Allocating Green Activity Costs to Products

In this step of the second stage of allocation, the costs of green activities are the same as the costs of products because each activity has only one product Table 5 and Table 6 .

| Table 5 Allocation of Indirect Environmental and Economic Costs to Green Activities | |||

| Cost Activity | Indirect environmental costs | Indirect economic costs | Total |

| Rate | 299 | 4,007 | |

| Water RO | 3,060,552,491 | 41,076,653,131 | 44,137,205,623 |

| Water steam | 1,931,972,894 | 25,929,625,669 | 27,861,598,564 |

| Ammonia | 56,825,682 | 762,675,646 | 819,501,328 |

| Urea | 79,994,932 | 1,073,637,544 | 1,153,632,476 |

| Total | 5,129,346,000 | 68,842,591,991 | 73,971,937,991 |

| Table 6 Allocating Green Activity Costs to Products | |||||

| Products And Item | Water RO | Water steam | Ammonia | Urea | Total |

| Quantity\ton | 10,251,664 | 6,471,360 | 190,344 | 267,952 | 17,181,320 |

| Direct economic costs | 10,675,973,046 | 6,739,204,965 | 198,222,202 | 279,042,342 | 17,892,442,555 |

| Indirect economic costs | 41,076,653,131 | 25,929,625,669 | 762,675,646 | 1,073,637,544 | 68,842,591,991 |

| Indirect environmental costs | 3,060,552,491 | 1,931,972,894 | 56,825,682 | 79,994,932 | 5,129,346,000 |

| Total | 54,813,178,669 | 34,600,803,529 | 1,017,723,531 | 1,432,674,818 | 91,864,380,546 |

Collecting Direct and Indirect Costs of Products

The final step is to collect all costs in Tables (2 and 5).

Based On The Information Produced By The Green Activity-Based Costing Technique, The Following Can Be Observed:

1. The technique achieved the hypothesis of more accurately identifying environmental costs for each product through the reallocation of indirect manufacturing costs, amounting to (5,129,346,000) dinars.

2. The environmental impact of green activities constitutes (6%), according to the equation below: Environmental Impact of Green Activities = (Environmental Costs / Total Costs) * 100% = (5,129,346,000 / 73,971,937,991) * 100% = 6%

3. The costing system applied in the factory does not show the amount of the cost of intermediate products, but rather it is cumulatively charged to the final product, which is urea fertilizer, while the costing technique based on green active determines the cost of intermediate and final products more accurately.

Accordingly, the following table shows the amount of difference between the cost of the final product according to the costing system applied in the factory and the cost according to the GABC technique: Table 7

| Table 7 The Cost Difference between Traditional Costing System and Technology | |||

| Item | Traditional costing systems (1) | GABC (2) | the difference |

| (1-2) | |||

| Water RO | / | 54,813,178,669 | -54,813,178,669 |

| Water steam | / | 34,600,803,529 | -34,600,803,529 |

| Ammonia | / | 1,017,723,531 | -1,017,723,531 |

| Urea | 109,056,464,000 | 1,432,674,818 | 107,623,789,182 |

| Total | 109,056,464,000 | 91,864,380,546 | 17,192,083,454 |

The cost of urea fertilizer according to the traditional cost system = the cost of one ton * 407,000 = 109,056,464,000 dinars

The table above shows that GABC technology has reduced the cost of urea fertilizer, enhancing its competitive position and profitability, in addition to helping management manage environmental costs.

Conclusions

The traditional costing system applied in the fertilizer plant does not identify indirect environmental costs and does not allocate them to products.

The application of GABC helped to more accurately allocate indirect costs, including environmental costs, thus determining the cost of each product based on its share of indirect environmental costs. It also provided management with information on the environmental costs of each activity. This reflects the amount of waste in chemicals, as well as the outputs of each stage of vapors and gases and their impact on the environment, which poses a risk that should be reconsidered.

GABC technology information helps management make decisions that reflect their results in managing environmental costs in the short and long term, ultimately creating a cleaner environment and reducing costs.

GABC technology provided a wealth of information that helps management perform its functions, including planning, control, and making the best decisions, particularly decisions related to environmental issues, in the best possible way, improving the company’s economic and environmental performance, producing environmentally friendly products, and ultimately strengthening its competitive position.

Recommendation

1. The Basra fertilizer plant can keep pace with industrial developments and update its accounting and costing systems to provide management with information that enables it to make better decisions, particularly regarding environmental cost management.

2. The potential for implementing GABC technology in the fertilizer plant is evident, as it is an effective way to utilize and invest the information it generates in managing environmental costs, achieving economic and environmental benefits, social outcomes, and achieving a greater competitive advantage.

3. Work to reduce environmental costs to minimize negative environmental impacts and create a better, more sustainable environment.

References

Abd-Allah, Hanan suhbat, Mohammed rady Abdlkadm, (2023)"Using on Green Activities Based Costs to Measure Costs and Improve Management Decisions",INTERNATIONAL JOURNAL OF RESEARCH IN SOCIAL SCIENCES & HUMANITIES, 13, 120-128, 10.37648/ijrssh.v13i01.011.

Indexed at, Google Scholar, Cross Ref

Abdul-Rahman, Ismail M, (2014)"Environmental Pollution Accounting", 1st ed., Al-Wafa,.

Al Mashkoor, I. A. (2022). The impact of green activity-based costing and green supply chain practices on environmental performance oil refineries in Iraq. International Journal of Economics and Finance Studies, 14(4), 96-113.

Al-Zamili, & Al-Ajaibi,(2021)"Activity-Based Environmental Cost Analysis and Its Role in Improving the Environmental Performance of Economic Units (An Applied Study on the Kufa Cement Plant)", Al-Muthanna Journal of Administrative and Economic Sciences, Volume 11, Issue 2, pp. 185-200, 2226-1419, 10.5213/6/2021-11/185-200,.

Antic, L., Stevanović, T., & Milenović, J. (2021). ENVIRONMENTAL ACTIVITY-BASED COSTING AS AN INSTRUMENT OF ENVIRONMENTAL MANAGEMENT ACCOUNTING. Economic Outlook/Ekonomski Pogledi, 23(1).

Indexed at, Google Scholar, Cross Ref

Cohen, M. A., & Santhakumar, V. (2007). Information disclosure as environmental regulation: A theoretical analysis. Environmental and Resource Economics, 37(3), 599-620.

Indexed at, Google Scholar, Cross Ref

Datar, S. M., & Rajan, M. V. (2021). Horngren's cost accounting. Pearson.

Hsieh, C. L., Tsai, W. H., & Chang, Y. C. (2020). Green activity-based costing production decision model for recycled paper. Energies, 13(10), 2413.

Indexed at, Google Scholar, Cross Ref

Huang, D., & Yanhua, P. A. N. (2015). On environmental cost accounting of cement enterprises. Int. Bus. Manage., 10(3), 74-82.

Jumaah, F. A., Alnaser, I. T. I., & Albazooni, M. K. A. (2025). The Accounting Strategy is a Goal to Achieve the Managerial Strategy Competitively: A case study. Manar Elsharq Journal for Management and Commerce Studies, 3(2), 41-56.

Jumaah &Farah Asaad, (2023)."Using Green Activity-Based Costing Techniques to Reduce Costs and Evaluate Performance", Master's Thesis, Southern Technical University, Department of Accounting Techniques,.

Marinho Neto, H. F., Agostinho, F., Almeida, C. M., Moreno García, R. R., & Giannetti, B. F. (2018). Activity-based costing using multicriteria drivers: an accounting proposal to boost companies toward sustainability. Frontiers in Energy Research, 6, 36.

Indexed at, Google Scholar, Cross Ref

Mashkoor, I. A. A., Ali, J. H., & Al Kanani, M. M. (2023). The Role of Green Activity-Based Costing in Achieving Sustainability Development: Evidence From Iraq. International Journal of Professional Business Review: Int. J. Prof. Bus. Rev., 8(4), 19.

Indexed at, Google Scholar, Cross Ref

Oncioiu, I., Căpuşneanu, S., Oprea Constantin, D. M., Türkeș, M. C., Topor, D. I., Bîlcan, F. R., & Petrescu, A. G. (2019). Improving the performance of entities in the mining industry by optimizing green business processes and emission inventories. Processes, 7(8), 543.

Indexed at, Google Scholar, Cross Ref

Received: 01-Apr-2025, Manuscript No. AAFSJ-25-15991; Editor assigned: 02-Apr-2025, Pre QC No. AAFSJ-25-15991(PQ); Reviewed: 16- Apr-2025, QC No. AAFSJ-25-15991; Revised: 21-Apr-2024, Manuscript No. AAFSJ-25-15991(R); Published: 28-Apr-2025