Research Article: 2019 Vol: 23 Issue: 5

Assessment of Credit risk Management of Saudi Banks

Ishtiaq Ahmad Bajwa, Imam AbdulRahman Bin Faisal University

Ali Murad Syed, Imam AbdulRahman Bin Faisal University

Adel Alaraifi, Imam AbdulRahman Bin Faisal University

Waleed Rafi, Imam AbdulRahman Bin Faisal University

Abstract

Banks are exposed to different types of risks, which can affect their financial performance and can even lead to failure of banks. The collapse of any bank is possible to happen due to the increase in non-performing loans which is a part of credit risk. Credit risk is one of the most significant risks that banks face, in view of granting credit is the main source of income for commercial banks. The research paper pursues to assess the credit risk of Saudi banks by doing financial ratio analysis from 2013-2017. Financial ratio analysis was conducted based on secondary data of 12 Saudi banks licenced by SAMA to find out the NPL/ total loans ratio, NPL/ total assets ratio, and Basel III Capital Standards ratios. Analysis showed that Saudi banks are in a good stage of Basel III implementation and have achieved more than the minimum requirements related to Common Equity Ratio, Tier I Capital Ratio, and Capital Adequacy Ratio regarding Basel III requirements. Saudi banks are also performing strong return of equity (ROE) measure and their financial performance is stable over the sample period of 5 years.

Keywords

Credit Risk Management, Basel III Capital Standards, ROE

Introduction

The banking sector has a great impact on the economy. It plays a critical role in granting credit facilities and its role is a catalyst for economic growth of any country. The stability of financial system depends on the performance of the banking industry of any country. A bank will face credit risk when the debtor does not fulfill his or her obligation as per the contract on due date or anytime. The banks are financial services providing companies and most of the bank’s services are related to credit, such as, loans, payment services, and cash management (Ahmad & Ahmad, 2004). Credit creation is the major revenue creating activity of the banks (Kargi, 2011) but at the same time it exposes banks to the credit risk. The banks are facing lot of uncertainties while performing their operations, leading to face different types of risks; either financial or non-financial. These risks make threats for banks and may create a negative impact on bank’s performance, profits, and reputation. Among other financial and non-financial risks faced by any bank, credit risk plays a significant role on the profitability of any bank and success of the banks depends on accurate measurement and efficient management of this risk to a greater extent than any other risks (Giesecke, 2004). The failure of any bank may arise due to the increase in nonperforming loans that contributes to credit risk. As per Vodová (2003) significant loss arises due to borrowers default on their loan repayment contribute to insolvency and banking crisis. Kolapo et al. (2012) and Kithinji (2010) argued that increase in non-performing loans severely reduces the profitability of the banks.

Banks consider as the largest financial institutions around the world, and they have a significant role in developing the economy, they offer capital for innovation, and infrastructure, and create job opportunities (Khan et al., 2015). However, banks are facing variety of risks when they are operating. So, they have to analyze and monitor these risks regularly. Altunba? & Marqués (2008) argued that banks have chance of facing large number of risk when they are operating; such as credit risk, liquidity risk, and operational risk, and other risks that could create threat for banks survival and success. Credit risk is one type of financial risks which arises due to possibility of loss in financial market because of the movement in financial variables (Philippe & Joseph, 1996). It’s basically the losses arise due to the creditors’ inability to repay the loan (Broll & Welzel, 2002). According to Buchory (2015) non-performing loans are the loans that are sub-standard and doubtful, and the NPL ratio indicates the bank’s management ability in managing loans provided by bank The higher ratio indicates worse loan management quality and increase possibility of bank’s troubled conditions.

If we look at Saudi banks, they are facing the problems of non-performing loans and are exposed to credit risk. A study by Abdelrahim & Sciences (2013) investigated the credit risk management of Saudi banks by measuring capital adequacy ratio, liquidity ratio and asset quality. Espinoza & Prasad (2010) discussed the NPLs for GCC banks over 1998-2008 period. Louhichi et al. (2016) explored the determinants of credit risk in the banking system with a focus toward the Islamic banking industry. As per author’s knowledge no study used NPLs to assess the credit risk of Saudi banks and assessed the standing of banks in implementation of Basel III regulations. This study fills this gap in literature by assessing the position of Saudi banks in Basel III implementation and also analyzing their position towards credit risk. This research ascertains the level Saudi banks exposed to credit risk by examining through financial ratio analysis. The research aims to answer two questions:

1. To what extent does Saudi banks expose to credit risk?

2. At what stage does Saudi banks stand regarding the implication of Basel III accord?

Literature Review

Credit risk consider as one of the oldest risks facing many financial intermediaries (Broll & Welzel, 2002). Recently, banks have increased their offering of monetary services to clients, due to many reasons; including the increased demand for venturing in entrepreneurship which influences people to develop small and medium ventures (Goplani, 2017) and because most of those individuals lack of money power to develop these enterprises, they head to borrow from banks and other financial institutions (HALDAR, 2017).

Tommaso Padoa- Schioppa1, a member of Executive Board of the European Central Bank, shared his thoughts while delivering a speech at the Centre for Financial Studies: “The banking industry has become significantly more competitive than in the past, and competition is likely to increase further.” This competition creates easier access to loan by customers since banks and other financial institutions are trying to overcome other competitors by providing attractive offers to customers (Nguyen et al., 2016). The problem started when the competition affects the strategies for providing loans; when banks started to lend credit to low creditworthy customers to overcome the competition (Chorafas, 1999). (Kargi, 2011) found that the main causes for bank’s credit risk related to weak credit standards, poor portfolio management, and lack of attention to economic, market and regulation changes.

Al-Tamimi & Al-Mazrooei (2007) and Boffey & Robson (1995) said that credit risk has significant influence on bank’s performance and has a major cause of bank failure; due to possibility of facing losses from NPLs. Muhamet & Arbana (2016) research statistical evidence showed that 98% of banks failure were due to incident related to three main factors; poor assets quality as a result of poor loans policies and noncompliance with the rules and guidelines and poor supervision.

Kipngetich & Muturi (2015) found that credit risk has a positive relationship with financial performance of the bank. And when Poudel (2012) explored the most factor effecting the banks financial performance, he found that the most factor was the default rate. Noman (2015) study found that credit risk has an effect on profitability of Bangladesh banks. Aduda & Gitonga (2011) found that credit risk management effect the profitability of the bank at a reasonable level. DeYoung & Torna (2013) found that credit risk plays an important part in the bank stability.

A report (2018) published by SAMA2 on Saudi Banking Sector indicates that the banking sector continues to grow with a margin of 2.2% per year with total loan amounting to as much as 73.5% of the overall sector's capital. As Saudi Arabian Monetary Authority (SAMA), the central bank of the Kingdom of Saudi Arabia, has a strong interest in promoting safety and improving efficiency of the operations of the financial institutions, and to help banks and other financial institutions to mitigate credit risk, responsible lending principles has been issued which must be followed by them. One of significant goals of the principles is to ensure the fairness and competitiveness among creditors and to insure they have effective and efficient procedures and mechanisms. The principles enforce banks to adopt clear and scientific methods and criteria with performing the best practices to evaluate the creditworthiness of the consumer and his ability to repay in a reasonable manner, considering all basic expenses. And the principle indicate that creditors must reject all finance request if it doesn’t obtain that the consumer will be able to repay, or if the deductible ratios are not consistent with what the principle specified. These principles would help banks to cut NPL ratios and increase the financial stability of the bank.

Credit risk has an effect on bank’s financial stability by affecting the distance of an individual bank regarding insolvency and failure (Beck, 2008). According to the Basel Accord, main indicators of bank financial stability are capital adequacy, and asset quality (Beck & Demirguc-Kunt, 2009). And the measurements of bank stability based on (NPL) ratio (Ahamed & Mallick, 2015; Beck & Demirguc-Kunt, 2009; Nthambi, 2015; Rao & Ghosh, 2008). In 1974 Basel Committee on Banking Supervision (BCBS) established to improve the quality of banking supervision worldwide to achieve banking financial stability (BCBS, 2015). Basel I established in 1988 to introduce the concept of risk weighted assets (RWA), enforce minimum capital requirements of 8 %, and capital to RWA of 4 % (Blundell-Wignall & Atkinson, 2010; Goodhart, 2011). Then, Basel II established to emphasize the minimum required capital to RWA of 4 %, and give the incentives for greater use of the process of securitization (Blundell-Wignall & Atkinson, 2010). In 2010, Basel III accepted to be applied from 2013 till 2019 and suggested to increase Tier 1 capital ratio from 4 % to 6 %, to increase Equity to RWA from 2% to 4.5 %, to maintain capital buffer by more than 2.5% of capital, during period of stress when capital adequacy ratio are less than 7% dividend and bouncers cannot be distributed, and during the period of excessive credit growth counter-cyclical buffer of 0 to 2.5 % must be applied (Slovik & Cournède, 2011).

Based on Shanthi (2017) research, Basel III has been issued to ensure the financial stability during economic downturn. Bano (2018) did analysis of Pakistani banks find that Basel III has a positive and significant impact on bank performance. Applying Basel III provides many opportunities not only for banks but also for economic development (Bano, 2018). Implementation of Basel III has influence on macroeconomic productivity such as GDP, and have the benefit to ensure the financial stability during crisis and economic downturn (Aosaki, 2013). On the other hand, in order to fulfill the requirements of Basel III, volume of banks’ credit lending may decrease or the borrowers charging rate will increase; which ultimately result in reducing the capability of some borrowers to take loans from banks. This will lead to reduce the expenditure and then the volume of investment; which leads to decreasing economic productivity. And the drop of economic productivity would decrease credit lending (Aosaki, 2013).

Saudi banking sector consists of 12 Saudi banks licenced by SAMA for the period of 2011-20173. The research represents the level of credit risk that Saudi banks are exposing, through financial ratio analysis. The objective of this research paper is to conduct financial ratio analysis of Saudi banks, to find out at what level Saudi banks exposed to credit risk and at what stage does Saudi banks stand regarding the implication of Basel III accord? The purpose of this research is to ascertain to what extent Saudi banks exposed to credit risk. Secondary data sources will be used to serve the purpose.

From 2011 Saudi Arabia was standing at the most advanced stage in term of Basel III adoption, it was standing in the third stage, meaning that the final regulations regarding Basel III was published and sent to eligible participants. While most of European countries at that time were standing in the second stage, meaning that their draft regulation was published. And US was in the first stage, since its draft regulation has not yet been published (Allen, Carletti, & Marquez, 2011). And based on SAMA’s announcement (2017), all Saudi banks have fulfilled the capital adequacy ratio requirements by Basel III accord, and have even increased the required rate at many stages closer to be the double and this is before decision is binding on all international banks by the end of 2019.

Data Collection and Methodology

The research adopted ratio analysis design to answer the research questions. The sample consists of all 12 Saudi banks which licensed by SAMA. Data is collected for the period between 2013 and 2017 (Table 1). The data collection was done through using secondary resources including Bloomberg, financial statements, and financial stability reports. Financial data from these resources was used to calculate and to evaluate the credit risk management of Saudi banks, and specifically finding NPL/ Total loans ratio, NPL/ Total Assets ratio, Common Equity Ratio, Tier 1 Capital ratio, and Capital Adequacy ratio. Financial data from the resources was used to calculate and to evaluate the credit risk management of Saudi banks, by analyzing the data to find NPL/ Total loans ratio, NPL/ Total Assets ratio, Common Equity Ratio, Tier 1 Capital ratio, and Capital Adequacy ratio.

| Table 1 Basel III Stages and Time Arrangements | |||||||

| 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | |

| Minimum (Common Equity capital ratio) | 3.5% | 4.0% | 4.5% | 4.5% | 4.5% | 4.5% | 4.5% |

| Capital Conservation Buffer | - | - | - | 0.625% | 1.25% | 1.875% | 2.5% |

| Minimum (Common Equity capital ratio) plus (Capital Conservation Buffer) | 3.5% | 4.0% | 4.5% | 5.125% | 5.75% | 6.375% | 7.0% |

| Minimum (Tier 1 Capital) | 4.5% | 5.5% | 6.0% | 6.0% | 6.0% | 6.0% | 6.0% |

| Minimum (Capital Adequacy ratio) | 8.0% | 8.0% | 8.0% | 8.0% | 8.0% | 8.0% | 8.0% |

| Minimum (Capital Adequacy ratio) plus (Capital Conservation Buffer) | 8.0% | 8.0% | 8.0% | 8.625% | 9.25 | 9.875% | 10.5% |

Analysis and Discussion

Saudi Banks NPL Amounts

During the period of 2013-2017 the average NPL amount of 12 Saudi Banks was 1,398.8 million (Table 2-3).

| Table 2 Descriptive Statistics of “Saudi Banks" NPL Amount 2013 - 2017 | ||||

| Million SR | Mean | Std. Dev. | Min | Max |

| NPL Amount | 1,398.8 | 1019.65 | 302.5 | 4,769.0 |

| Table 3 Saudi Banks NPL Amounts 2013-2017 | |||||

| Million SR | 2013 | 2014 | 2015 | 2016 | 2017 |

| RJHI AB | 3,007.7 | 2,655.7 | 3,266.9 | 2,867.6 | 1,770.2 |

| ALAWWAL AB | 738.6 | 841.6 | 824.2 | 1,655.5 | 1,985.6 |

| ALINMA AB | 302.5 | 350.3 | 428.8 | 545.6 | 814.0 |

| ARNB AB | 1,003.6 | 1,095.2 | 1,229.6 | 1,006.7 | 1,400.5 |

| ALBI AB | 460.9 | 430.7 | 514.8 | 507.1 | 532.2 |

| BJAZ AB | 429.4 | 369.9 | 355.3 | 484.0 | 504.4 |

| BSFR AB | 1,517.4 | 1,182.5 | 1,129.7 | 1,706.9 | 3,422.0 |

| NCB AB | 2,919.4 | 2,851.3 | 3,681.9 | 3,925.5 | 4,769.0 |

| RIBL AB | 1,264.5 | 1,049.9 | 1,358.7 | 1,158.0 | 1,412.2 |

| SAMBA AB | 2,011.6 | 1,659.7 | 1,113.8 | 1,076.2 | 1,127.3 |

| SABB AB | 1,525.3 | 1,494.9 | 1,517.3 | 1,655.5 | 1,893.5 |

| SIBC AB | 395.0 | 436.4 | 447.6 | 1,069.6 | 773.1 |

| Total | 17,588.86 | 16,432.16 | 17,883.70 | 19,674.31 | 22,421.01 |

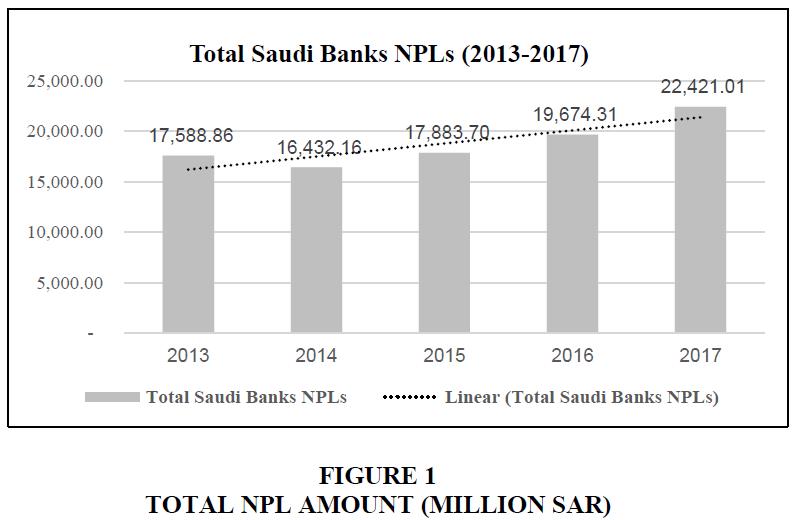

In 2013, total NPLs for Saudi banks was 17,588 million, 17% of the NPLs amount was contributed by Al Rajhi Bank, and 16% by National Commercial Bank, and the lowest NPL amount was by Saudi Investment Bank and Alinma Bank of 2.25% and 1.72% respectively. Finally, in 2017 Saudi banks get the highest NPL amount during the last five years to become 22,421 million. National Commercial Bank and Banque Saudi Fransi have the highest amount by 21% and 15% respectively (Figure 1).

Saudi NPL/ Total Loans Ratio

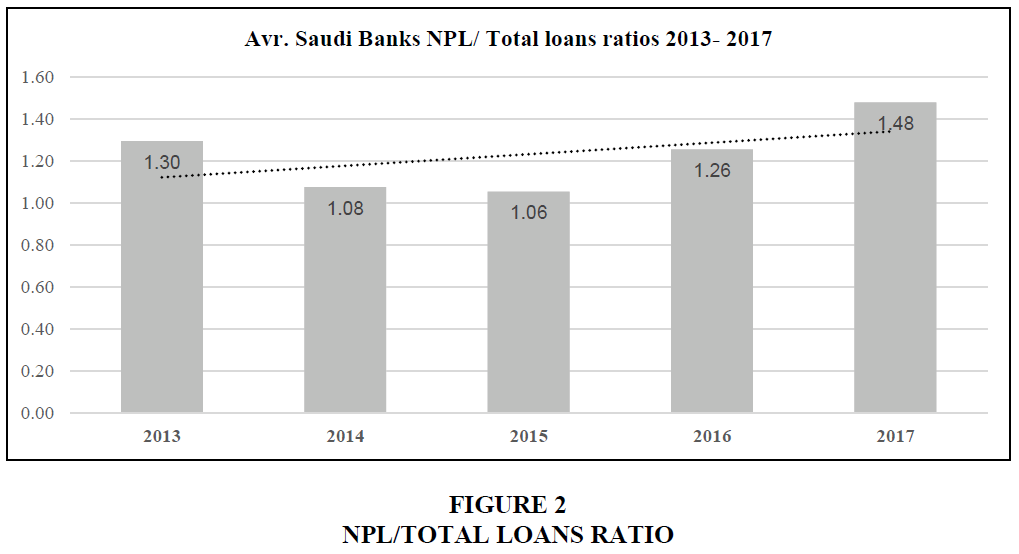

NPL/ Total loan ratio which considered as the main measure of asset quality across the banking system, slightly increased in 2017 (Table 4), the ratio recorded an average of 1.48%t in 2017 compared to 1.26% in 2016. The financial stability report of SAMA 2017 says that the increase in the NPL ratio of the aggregate banking system appears to originate from exposure to the corporate sector, while the NPL Ratio is weighed down by the retail sector. If we compare 5 previous 5 years 2017 recorded the highest ratio.

| Table 4 Descriptive Statistics of “Saudi Banks" NPL/ Total Loans 2013 - 2017 | ||||

| Mean | Std. Dev. | Min | Max | |

| NPL/ Total loans | 1.23 | 0.45 | 0.65 | 2.99 |

The results showed Table 5 that in 2016 Saudi British Bank, Bank AlBilad, National Commercial Bank, Saudi Investment Bank, and Alawwal Bank have higher than average NPL/ Total loans ratio, the percentage recorded at 1.34, 1.36, 1.51, 1.75 and 2.21 respectively while all other banks have lower than average. In 2017, when the average NPL/ Total loans ratio was 1.48, Saudi British Bank, National Commercial Bank, Banque Saudi Fransi, and Alawwal Bank were above average of NPL/ Total loans, the percentage was 1.57, 1.86, 2.73, and 2.99 respectively while for all other Saudi banks the ratio is below average.

| Table 5 Saudi Banks NPL/Total Loans | |||||

| 2013 | 2014 | 2015 | 2016 | 2017 | |

| RJHI AB | 1.57 | 1.26 | 1.51 | 1.24 | 0.74 |

| ALAWWAL AB | 1.35 | 1.27 | 1.06 | 2.21 | 2.99 |

| ALINMA AB | 0.67 | 0.65 | 0.75 | 0.77 | 1.02 |

| ARNB AB | 1.11 | 1.03 | 1.04 | 0.85 | 1.2 |

| ALBI AB | 1.9 | 1.48 | 1.47 | 1.36 | 1.19 |

| BJAZ AB | 1.2 | 0.88 | 0.83 | 1.13 | 1.25 |

| BSFR AB | 1.34 | 0.99 | 0.9 | 1.29 | 2.73 |

| NCB AB | 1.52 | 1.26 | 1.42 | 1.51 | 1.86 |

| RIBL AB | 0.95 | 0.77 | 0.92 | 0.8 | 1 |

| SAMBA AB | 1.73 | 1.31 | 0.84 | 0.85 | 0.94 |

| SABB AB | 1.41 | 1.27 | 1.18 | 1.34 | 1.57 |

| SIBC AB | 0.82 | 0.75 | 0.73 | 1.75 | 1.27 |

| Average | 1.3 | 1.08 | 1.06 | 1.26 | 1.48 |

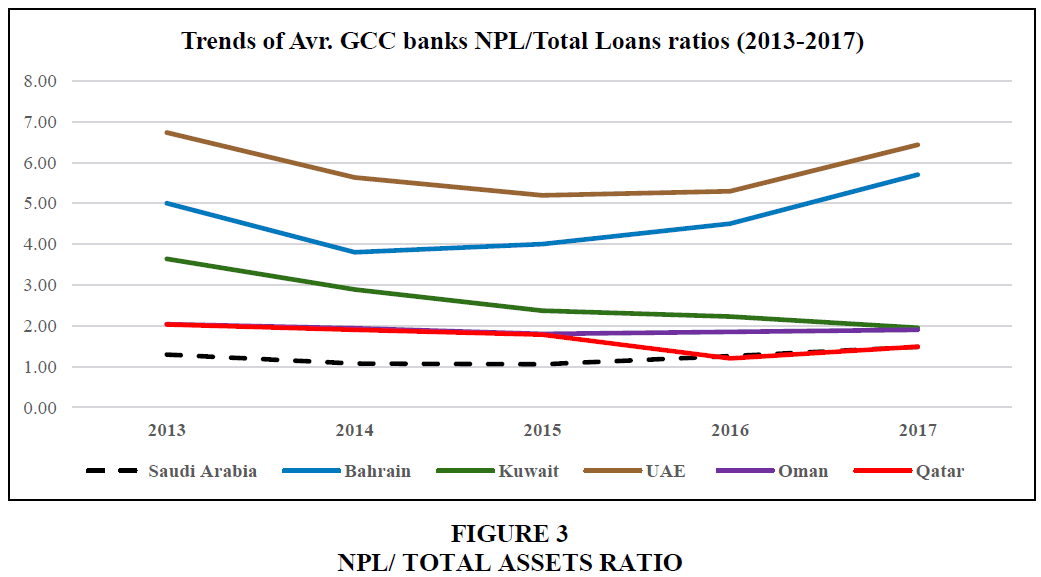

Figure 2 represents the NPL/ Total loan ratios of Saudi Banks compared to other GCC countries. The results showed that there is significant variation in the ratio between the countries; Saudi Arabia, Kuwait, Oman, and Qatar have ratios less than 2% while UAE and Bahrain have ratios of about 6 percent. The graph shows that Saudi banks are also performing very well as compared to GCC banks in terms of NPL/Total loans ratio.

If we look at world-wide data4 of NPLS/Total Loans of world banks, the ratio stands at 3.45% in 2017 which was 4.09% in 2013. This shows (Figure 3) that Saudi banks’ NPL/Total Assets ratio is quite low as compared to world’s banks.

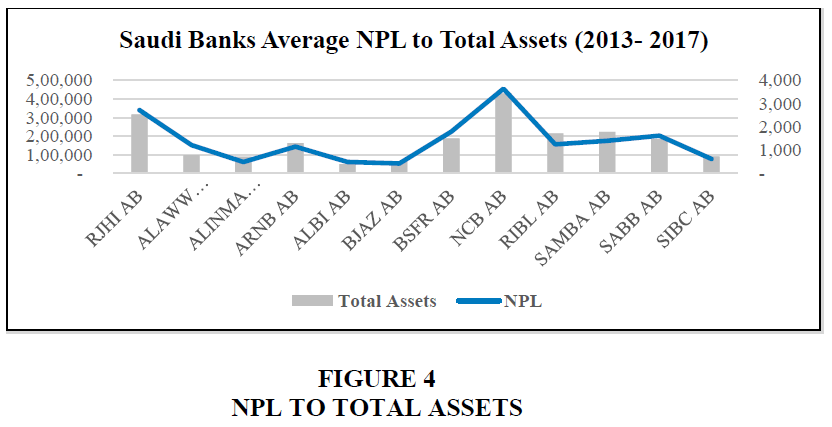

Average NPL/ Total Assets ratio of Saudi banks for the period of 2013- 2017 is 0.81%. The results showed that in 2014 and 2015 Saudi banks had a below average of NPL/ Total Assets ratio (Table 6-7). While in 2013, 2016 and 2017 Saudi banks were above average, and the main contributors of high NPL/ Total Assets ratio was Alawwal Bank, and Banque Saudi Fransi (Figure 4).

| Table 6 Descriptive Statistics of “Saudi Banks" NPL/ Total Assets 2013 - 2017 | ||||

| Mean | Std. Dev. | Min | Max | |

| NPL to Total Assets ratio | 0.81 | 0.31 | 0.43 | 1.99 |

| Table 7 Saudi Banks NPL/Total Assets 2013-2017 | |||||

| 2013 | 2014 | 2015 | 2016 | 2017 | |

| RJHI AB | 1.07 | 0.86 | 1.04 | 0.84 | 0.52 |

| ALAWWAL AB | 0.92 | 0.87 | 0.76 | 1.58 | 1.99 |

| ALINMA AB | 0.48 | 0.43 | 0.48 | 0.52 | 0.71 |

| ARNB AB | 0.73 | 0.67 | 0.72 | 0.59 | 0.82 |

| ALBI AB | 1.27 | 0.95 | 1.00 | 0.94 | 0.84 |

| BJAZ AB | 0.72 | 0.56 | 0.63 | 0.82 | 0.74 |

| BSFR AB | 0.89 | 0.63 | 0.61 | 0.84 | 1.77 |

| NCB AB | 0.77 | 0.66 | 1.02 | 1.08 | 1.27 |

| RIBL AB | 0.62 | 0.49 | 0.61 | 0.53 | 0.65 |

| SAMBA AB | 0.98 | 0.76 | 0.47 | 0.46 | 0.50 |

| SABB AB | 0.86 | 0.80 | 0.81 | 0.89 | 1.01 |

| SIBC AB | 0.49 | 0.47 | 0.48 | 1.15 | 0.82 |

| Average | 0.82 | 0.68 | 0.72 | 0.85 | 0.97 |

Saudi Basel III Capital Standards

Table 8 analysis indicates that Saudi banks have too much capital to absorb losses without risk of failure. Saudi Banks fulfill the minimum requirements of Basel III Accord by having more that 4.5% of common equity and more than 6% of tier 1 capital ratio. Moreover, Saudi banks analysis showed that all banks have high capital adequacy ratio meaning that banks are limiting their exposure to risk, and promoting stability and efficiency of the financial system. Based on SAMA’s announcement (2017), all Saudi banks have fulfilled the capital adequacy ratio requirements by Basel III accord, and have even increased the required rate at many stages closer to be the double and this is before decision is binding on all international banks by the end of 2019.

| Table 8 Descriptive Statistics of “Saudi Banks" Basel III Capital Standards 2013 - 2017 | |||||

| 2013 | 2014 | 2015 | 2016 | 2017 | |

| Common Equity Ratio (%) | |||||

| Mean | 14.7 | 13.9 | 14.2 | 14.8 | 15.4 |

| Std. Dev. | 4.99 | 3.54 | 2.87 | 2.37 | 2.51 |

| Min | 9.6 | 9.3 | 10.7 | 11.8 | 12.0 |

| Max | 26.7 | 22.2 | 20.7 | 18.3 | 19.6 |

| Tier I Capital Ratio (%) | |||||

| Mean | 16.4 | 16.0 | 15.9 | 17.0 | 17.8 |

| Std. Dev. | 4.23 | 3.91 | 3.01 | 2.64 | 2.33 |

| Min | 11.8 | 11.2 | 11.6 | 13.2 | 13.7 |

| Max | 28.0 | 26.0 | 22.0 | 21.8 | 22.2 |

| Capital Adequacy Ratio (%) | |||||

| Mean | 18.0 | 17.8 | 17.8 | 19.5 | 20.2 |

| Std. Dev. | 3.60 | 3.10 | 2.33 | 1.76 | 1.43 |

| Min | 15.0 | 14.0 | 15.5 | 16.5 | 17.6 |

| Max | 28.4 | 26.1 | 22.9 | 22.5 | 23.3 |

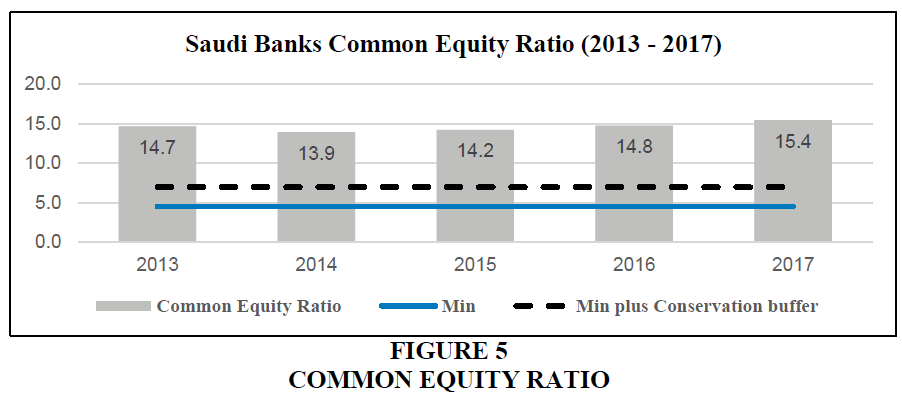

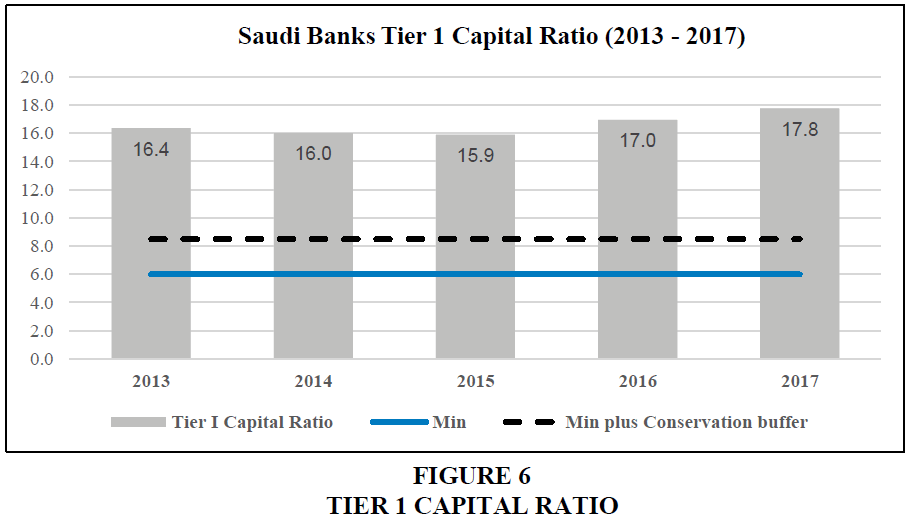

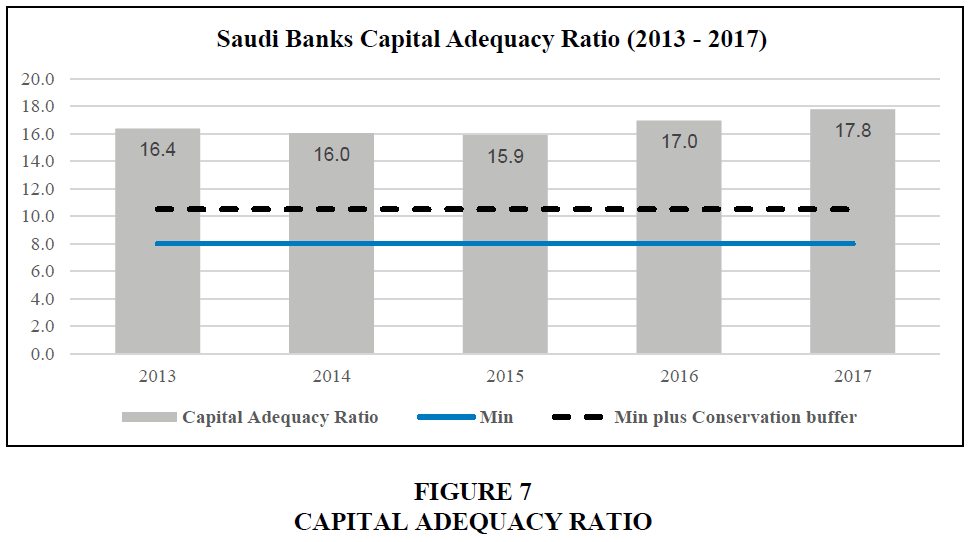

In 2017, the average capital adequacy ratio for all Saudi banks was 20.2% while the requirement is 10.5%. Al Rajhi Bank has the highest ratio of 23.3%, followed by Samba Financial Group with a capital adequacy ratio of 21.1%, then Saudi British Bank with a ratio of 21%. In the same year, Tier I Capital Ratio of all Saudi banks was 17.8% compared to 6% which required by Basel III accord. And the average Common Equity Ratio was 15.4% compared to the required 4.5% (Figure 5).

The analysis indicates that in all five years for the period (2013-2017), all banks well exceeded the requirements of Basel III accord. If we look at capital adequacy ratio of the world banks, the average value is 10.75% in 2017 which was 10.092% in 2013 (Figure 6-7).

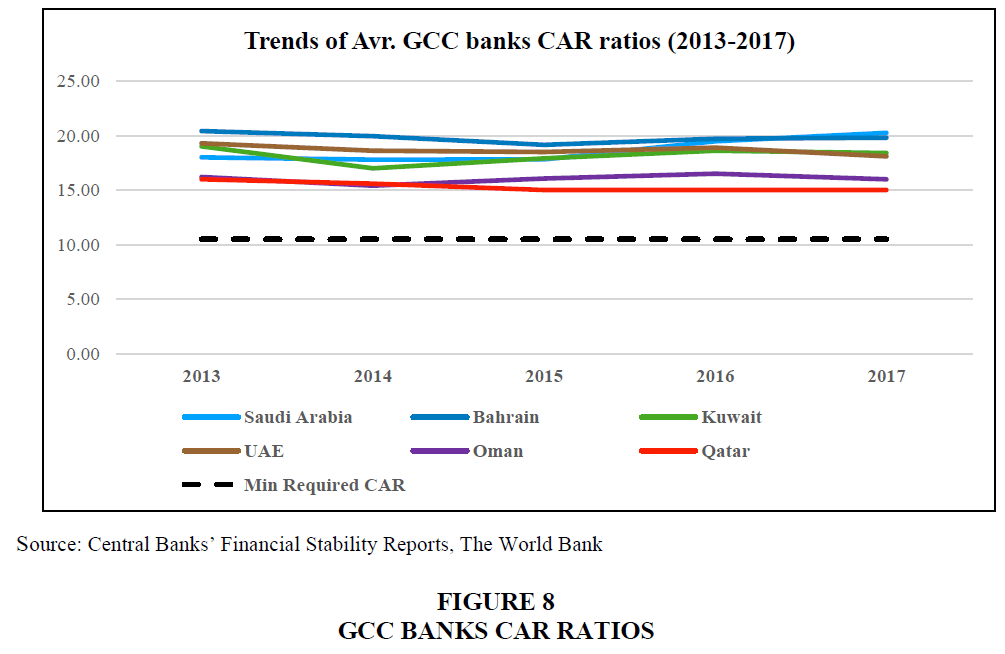

Figure 7 compare the CAR of Saudi Arabia with GCC countries. The results showed that Bahrain, Kuwait, UAE, Oman, and Qatar are fulfilling the CAR required by Basel III, and percentages are close to each other.

Figure 8 shows the Return on Equity (ROE) for GCC banks. The Table 9 shows that Saudi Banks have high ROE in GCC region. In fact, ROE of Saudi banks is second highest after Qatari banks in the GCC region over the last five years. This shows that that financial performance of Saudi banks is very good and in spite of having high capital reserve ratio.

| Table 9 GCC Banks' Return on Equity | ||||||

| Banks’ Return on Equity (%) | ||||||

| 20111 | 2012 | 2013 | 2014 | 2015 | 2016 | |

| Saudi Arabia | 14.8087 | 14.6111 | 14.7954 | 15.5176 | 14.8286 | 12.4745 |

| Qatar | 19.0348 | 16.624 | 15.7427 | 15.6418 | 15.066 | 13.7417 |

| UAE | 11.6209 | 12.1217 | 13.1398 | 14.5301 | 14.7648 | 11.8329s |

| Kuwait | 10.4946 | 9.48567 | 7.74191 | 8.90372 | 8.78818 | 8.46143 |

| Oman | 12.5356 | 13.4387 | 13.1298 | 12.3806 | 12.1863 | 10.189 |

| Bahrain | 8.8918 | 9.15353 | 11.0991 | 9.43152 | 9.42407 | 8.91668 |

The results indicated that NPL amounts of Saudi banks have increased to 22,421 million in 2017 from 2013 to 2017 and NCB and Banque Saudi Fransi are main contributors to this amount. The results also indicated that NPL to total loans ratio of Saudi banks has reached to 1.48% in 2017 and Alawaal Bank and Banque Saudi Fransi are having the highest ratio among all the Saudi banks. Saudi, Kuwaiti, Omani, and Qatari banks have NPL to total loans ratio less than 2% while UAE and Bahraini banks have ratios about 6%.

Considering NPL to total assets ratio of Saudi banks, it is having an average of 0.81% for the period from 2013 to 2017, which has increased to 0.97% in 2017 and Alawaal Bank and Banque Saudi Fransi are having the highest ratio among all the Saudi banks.

Saudi banks have fulfilled the capital requirements of Basel III by reaching more than the required ratios of Common equity, Tier 1 Capital, and Capital Adequacy ratio. If we compare it with GCC countries the results showed that all GCC countries have fulfilled the requirements of Basel III and the percentages are very close to each other. ROE of Saudi banks was 12.474% in 20165 which was 14.808% in 2011.

Conclusion

This study applied financial ratio analysis to analyze 12 Saudi banks. This study used secondary data collected from Bloomberg, financial statements and financial stability reports and all Saudi banks licensed by SAMA. Results of the study indicated that NPL/ Total loans ratio of Saudi banks of the period 2013 - 2017 has an average of 1.23% and Alawwal bank and Banque Saudi Fransi are having the highest ratio. The comparison of Saudi banks’ NPL/ Total loans ratio with GCC banks emphasis that there is significant variation on the NPL/ Total Loan ratios between these countries despite of several similarities in the economic structure between the countries. The result showed that Saudi, Omani, and Qatari banks have higher level of credit quality that UAE and Bahraini banks; since they have lower NPL/ Total loans ratios. NPL to total asset ratio for all Saudi banks has increased by 18.3% during the five years and Alawwal Bank and Banque Saudi Fransi are the main contributors for this increase. The results indicate that overall Saudi banks are performing well in NPLs but Alawwal bank and Banque Saudi Fransi have issues with NPLs.

Regarding the Basel III requirements which focus on reducing the banks’ ability to damage the economy by taking excessive risks, and promoting financial stability, the analysis showed that Saudi banks are in a very good stage and have achieved more than the minimum requirements related to Common Equity Ratio, Tier I Capital Ratio, and Capital Adequacy Ratio. ROE of Saudi banks is almost consistent over the last five years and shows good financial performance despite of keeping capital reserve requirements significantly higher than Basel III requirements.

End Note

1.https://www.ecb.europa.eu/press/key/date/2000/html/index.en.html

2.http://www.sama.gov.sa/en-US/EconomicReports/AnnualReport/Fifty%20Fourth%20Annual%20Report.pdf

3.http://www.sama.gov.sa/en-US/License/Pages/SaudiBanks.aspx

4.https://data.worldbank.org/indicator/fb.ast.nPer.Zs?end=2017&start=2010&view=chart

5.https://fred.stlouisfed.org/series/DDEI06SAA156NWDB

References

- Abdelrahim, K.E. (2013). Effectiveness of credit risk management of Saudi banks in the light of global financial crisis: A qualitative study. Asian Transactions on Basic and Applied Sciences, 3(2), 73-90.

- Aduda, J., & Gitonga, J. (2011). The relationship between credit risk management and profitability among the commercial banks in Kenya. Journal of Modern Accounting and Auditing, 7(9), 934.

- Ahamed, M., & Mallick, S. (2015). Corporate debt restructuring, bank competition and stability: Evidence from India. Retrieved from https://ifrogs.org/PDF/CONF_2015/sl_Ahamed_Mallick_2015.pdf

- Ahmad, N.H., & Ahmad, S.N. (2004). Key factors influencing credit risk of Islamic bank: A Malaysian case. The Journal of Muamalat and Islamic Finance Research, 1(1), 65-80.

- Allen, F., Carletti, E., & Marquez, R. (2011). Credit market competition and capital regulation. The Review of Financial Studies, 24(4), 983-1018.

- Altunba?, Y., & Marqués, D. (2008). Mergers and acquisitions and bank performance in Europe: The role of strategic similarities. Journal of economics and business, 60(3), 204-222.

- Aosaki, M. (2013). Implementation of Basel III: Economic Impacts and Policy Challenges in the United States, Japan, and the European Union: Walter H. Shorenstein Asia-Pacific Research Center, Freeman Spogli Institute.

- Bano, A. (2018). Basel III: Implementation and challenges faced by Pakistan’s banking industry. Grassroots, 51(2).

- Beck, T. (2008). Bank competition and financial stability: friends or foes?. The World Bank.

- Beck, T., & Demirguc-Kunt, A. (2009). Financial institutions and markets across countries and over time-data and analysis. The World Bank.

- Blundell-Wignall, A., & Atkinson, P. (2010). Thinking beyond basel III.OECD Journal: Financial Market Trends, 2010(1), 9-33.

- Boffey, R., & Robson, G.N. (1995). Bank credit risk management. Managerial Finance, 21(1), 66-78.

- Broll, U., & Welzel, P. (2002). Credit risk and credit derivatives in banking. Retrieved from http://webdoc.sub.gwdg.de/ebook/serien/lm/vwl_diskussionsreihe/228.pdf

- Buchory, H.A. (2015). Banking profitability: How does the credit risk and operational efficiency effect. Journal of Business and Management Sciences, 3(4), 118-123.

- Chorafas, D.N. (1999). Strategic planning and the quality of services in retail banking. In The Commercial Banking Handbook (77-100): Springer.

- DeYoung, R., & Torna, G. (2013). Nontraditional banking activities and bank failures during the financial crisis. Journal of Financial Intermediation, 22(3), 397-421.

- Espinoza, R.A., & Prasad, A. (2010). Nonperforming loans in the GCC banking system and their macroeconomic effects: International Monetary Fund.

- Giesecke, K. (2004). Credit risk modeling and valuation: An introduction. Available at SSRN 479323.

- Goodhart, C. (2011). The Basel Committee on Banking Supervision: A history of the early years 1974–1997: Cambridge University Press.

- Goplani, R. (2017). Service quality management in retail banking with reference to satisfaction and switching intentions of the customers. IUP Journal of Marketing Management, 16(4).

- HALDAR, A.K. (2017). Relative importance of servqual dimensions-A study on retail banking services of India post. CLEAR International Journal of Research in Commerce & Management, 8(7).

- Al-Tamimi, H.A., & Al-Mazrooei, F.M (2007). Banks' risk management: a comparison study of UAE national and foreign banks. The Journal of Risk Finance, 8(4), 394-409.

- Kargi, H.S. (2011). Credit risk and the performance of Nigerian banks. Ahmadu Bello University, Zaria.

- Khan, H., Khan, S., Saif, N., Khan, M.S., & Phil, F.U.M. (2015). A comparative study on job satisfaction among public and private banks employees. Gomal University Journal of Research [GUJR], 31(1).

- Kipngetich, S., & Muturi, W. (2015). Effect of credit risk management on financial performance of savings and credit co-operative society. The Strategic Journal of Business & Change Management, 2(44), 900-915.

- Kithinji, A.M. (2010). Credit risk management and profitability of commercial banks in Kenya. Retrieved from https://pdfs.semanticscholar.org/d8a8/004b0e27717dc89a2594a71a9128c54e4f7f.pdf

- Kolapo, T.F., Ayeni, R.K., & Oke, M.O. (2012). Credit risk and commercial bank's performance in Nigeria-A panel model approach. Australian journal of business and management research, 2(2), 31.

- Louhichi, A., & Boujelbene, Y. (2016). Credit risk, managerial behaviour and macroeconomic equilibrium within dual banking systems: interest-free vs. interest-based banking industries. Research in International Business and Finance, 38, 104-121.

- Muhamet, A., & Arbana, S. (2016). The effect of credit risk management on banks’ profitability in Kosovo. European Journal of Economic Studies, 4, 492-515.

- Nguyen, T.P.T., Nghiem, S.H., Roca, E., & Sharma, P. (2016). Bank reforms and efficiency in Vietnamese banks: evidence based on SFA and DEA. Applied Economics, 48(30), 2822-2835.

- Noman, A.H.M. (2015). An empirical investigation of the profitability of Islamic banks in Bangladesh. Global Journal of Management And Business Research, 15(4).

- Nthambi, E. (2015). Financial inclusion, bank stability, bank ownership and financial performance of commercial banks in Kenya. Unpublished MBA Project, University of Nairobi.

- Philippe, J., & Joseph, K.S. (1996). Financial Risk Management, Domestic and International Dimensions. Blackwell Business.

- Poudel, R.P.S. (2012). The impact of credit risk management on financial performance of commercial banks in Nepal. International Journal of arts and commerce, 1(5), 9-15.

- Rao, D.T., & Ghosh, P. (2008). Preparedness of Indian Banks in Managing Operational Risk. Economic and Political Weekly, 47-53.

- Shanthi, M. (2017). Mediating effect of social capital in the relationship between human resource management practices and innovative performance of private banks in Tricomalee district. Retrieved from http://www.digital.lib.esn.ac.lk/handle/123456789/3638

- Slovik, P., & Cournède, B. (2011). Macroeconomic impact of Basel III. Retrieved from https://www.oecd-ilibrary.org/docserver/5kghwnhkkjs8-en.pdf?expires=1571208260&id=id&accname=guest& checksum=47D78A953D9E5635C49F79A688A042EB

- Vodová, P. (2003). Credit risk as a cause of banking crises. Paper presented at the The Paper Prepared for the 5th International Conference Aidea Giovani, Milan. July.