Original Articles: 2017 Vol: 21 Issue: 1

Association Between Ownership Structure Characteristics and Firm Performance: Oman Evidence

Ebrahim Mohammed Al-Matari, College of Humanities and Administrative Sciences, Aljouf University

Yahya Ali Al-Matari, University Utara Malaysia

Sulaiman Abdullah Saif, Universiti Utara Malaysia

Keywords

Agency theory, resource dependence theory, government ownership, foreign ownership, institutional ownership

Introduction

Corporate governance is considered to be the top extensively studied topics as a tool for mitigating conflicts of interests between managers and investors. Corporate governance primarily aims to protect the capital owners from the opportunistic activities of management (Abdurrouf, 2011; Jensen & Meckling, 1976; Pandya, 2011; Pfeffer, 1972; Shleifer & Vishny, 1986) and to ensure that management’s effort is focused on satisfying the interests of shareholders and stakeholders. As a consequence, corporate governance mechanisms and regulations have been garnered considerable focus around the globe for their ability to enhance the overall economic capability to generate stakeholders’ benefits (both individuals and organizations) (Hsu & Petchsakulwong, 2010). Added to this corporate governance offers the directors the right to create effective decisions in favor of the shareholders’ interests in order to realize goals (Shleifer & Vishny, 1997). It is evident that firms with superior corporate governance enhanced their operating performance (Irina & Nadezhda, 2009).

In relation to the above, one of the many corporate governance mechanisms that are widely utilized is ownership structure. This has garnered significant analysts and scholars’ attention in the past years. Specifically, Berle and Means (1932) was the pioneering study that explained the firm theory in terms of Modern Corporation and debated over conflicts of interest between management and controllers. They advocated that increasing ownership diffusion minimizes the shareholders’ power over management. Similarly, Demsetz and Lehn (1985) found that ownership structure refers to the endogenous determination of ownership of the maximization of firm performance as this is beneficial to the entire owners.

According to the resource dependence theory perspective, ownership is described as a power source that can be employed to support or hinder management based on it level of concentration and its employment (Pfeffer & Slanick, 1979).

Moreover, ownership structure plays a primary role in corporate governance as it assists policy makers to expend efforts on enhancing the corporate governance system. In instances of many of the developed nations, ownership structure is highly dispersed but in the developing ones, with ineffective legal systems protecting investor’s interests, the ownership structure has high concentration (Ehikioya, 2009). Despite the fact that ownership structure aims to enhance performance, studies have primarily overlooked the examination of its impact on firm performance. Several studies in this caliber are limited to studying board characteristics, audit committee, and CEO relationship with firm performance (Abdurrouf, 2011; Dar et al., 2011; Entebang & Al-Mansour, 2011). Hence, in the present study, the factors that enhance ownership structure impact on the performance of Omani firms are examined.

Moreover, despite the importance of the relationship, no empirical findings have tackled the ownership structure-firm performance relationship. Some authors found a positive relationship (e.g. Barontini & Caprio, 2006; Chen et al., 2006; Yu, Lan, Jiang, & Luan, 2008), others found a negative one (e.g. Brown & Caylor, 2004). Some others reported no relationship between the two like Masood (2011). The inconsistent findings urged researchers to conduct further examination of the relationship between ownership structure and firm performance (e.g. Abdurrouf, 2011; Al-Matari et al., 2012; Kajola, 2008; Liang et al., 2011; Millet-Reyes & Zhao, 2010). Additionally, ownership structure is deemed to be crucial in the alignment of the owners-management relationship. To this end, this study includes some ownership structure characteristics namely concentration ownership, managerial ownership, government ownership, institutional ownership and foreign ownership.

Based on the afore-discussed findings, this study attempts to minimize the literature gap by examining the relationship between ownership structure characteristics and firm performance in the context of Oman, a developing nation. It also aims to examine the moderating effect of audit quality on the relationship between ownership structure (foreign ownership) and firm performance (ROA). An in-depth discussion of the procedures employed by the study is provided in the next sub-sections.

Literature Review and Hypotheses Development

Government Ownership and Firm Performance

In this study, government ownership is gauged with the help of the ratio of the government owned shares in the firm as used by Anum (2010) and Nurul Afzan and Rashidah (2011).

The agency theory posits that government ownership could solve the issue of information asymmetry that stems from the imperfect information concerning firm value that is forwarded to investors. Also, the state-owned shares can be useful in aligning the interests of both owners and management (Jensen & Meckling, 1979). Generally, the government obtains information from multiple sources as they are easily accessible to different financial channels in comparison to non-state firms (Eng & Mak, 2003).

From the perspective of the resource dependence theory, outsourcing primarily assists in the provision of funding sources and various experienced and qualified workforce to be used in reducing the capital cost. It also assists in the strict control of different aspects of the working environment. This eventually leads to enhanced firm performance (Pfeffer, 1972). In the current study, it is expected that the government is among the top effective and efficient outsources that enhances the company performance. On a similar line of contention, Rhoades et al. (2001) stated that the choice of appropriate governance mechanisms among management and ownership guarantees that the principal-agent interests are compatible.

Prior findings about the relationship are inconsistent with some studies reporting positive relationship between government and firm performance in developing nations (e.g. Irina & Nadezhda, 2009), and in developing ones (e.g. Aljifri & Moustafa, 2007; Mollah & Talukdar, 2007; Anum, 2010; Nurul Afzan & Rashidah, 2011). Meanwhile, other studies reported a negative relationship between the same variables (e.g. Al-Farooque et al., 2007) and Al-Hussain and Johnson (2009). In this study, the researcher aims to confirm the relationship by proposing the testing of the following hypothesis.

H1: There is a positive relationship between the government ownership and firm performance.

Foreign Ownership and Firm Performance

The foreign shareholders’ impact upon corporate governance is a primary research issue that is investigated by many studies. Foreign ownership is measured by the ratio of foreign ownership stake to total shareholder as suggested by Al Manaseer et al. (2012), Chari et al. (2012), and Uwuigbe and Olusanmi (2012).

Moreover, foreign ownership may affect profitability of banks (Al Manaseer et al., 2012). For instance, if foreign shareholders hold a large portion of company shares, this may indicate that foreign shareholders have great confidence in them and this may lead to their higher valuation (NazliAnum, 2010).

The agency theory has its basis on the principal-agent relationship. The distinction of ownership from management in modern corporations provides the context for the function of the agency theory. Modern organizations have widely dispersed ownership, in the form of shareholders, who are not normally involved in the management of their companies. According to the resource dependence theory, discussed by Pfeffer (1972) and Pfeffer and Salancik (1978), foreign investors are one of main source of the company's capital. Foreign investors can help the company to expand control over managers in the decision making process. They can provide foreign expertise that gives a clear picture about the foreign investments. This in turn, helps to improve the performance of firm.

Although, the relationship between foreign ownership and firm performance has been extensively studied in the literature, the findings are still inconclusive. There are many studies around the world which have investigated this relationship in both the developed countries and developing countries. In the developed countries, authors (e.g. Chari et al., 2012; Ghahroudi, 2011) confirmed a positive link. Similarly, in the developing countries, the same conclusion was confirmed by authors such as AL Manaseer et al. (2012), NazliAnum (2010) and Uwuigbe and Olusanmi (2012). On the contrary, there some authors who examined the association between foreign and firm performance in developed countries such as Millet-Reyes and Zhao (2010) and Shan and McIver (2011) and in the developing countries such as Gurbuz and Aybars (2010) and Tsegba and Ezi-Herbert (2011) and found no relationship between them. Therefore, this study is planning to contribute to the literature by testing the following hypotheses.

H2: There is a positive relationship between the foreign ownership and firm performance.

Institutional Ownership and Firm Performance

Institutional ownership is measured by the ratio of institutional shareholding against the total shares number (Fazlzadeh et al., 2011; Nuryanah & Islam, 2011). The institutional investors’ role in the governance system of a firm is still debatable (Khanchel, 2007) but evidence of the institutional investors’ positive impact on firm governance has been reported (e.g. Khan et al., 2011).

Furthermore, Cremers and Nair (2005) claimed that some institutional investors like pension funds may have higher incentives to play a monitoring role and act as proactive shareholders activists. This perspective is similar to agency theory where it postulates that the separation between ownership and management maximize shareholder worth and give freedom to take decisions. And also resource dependence theory proved out-sourcing gives a firm a background to deal with expertise and professional individuals. The outsider has an incentive to maximize significance of shareholders.

Despite the many studies that have investigated the institutional ownership-firm performance relationship, the findings concerning this relationship is still mixed. Some authors in the developed countries found a positive relationship (e.g. Harjoto & Jo, 2008; Irina & Nadezhda, 2009). Researchers in the developing countries confirmed this positive relationship (e.g. Fazlzadeh et al., 2011; Liang et al., 2011; Nuryanah & Islam, 2011; Uwuigbe & Olusanmi, 2012). On the other hand, there are some researchers who confirmed a negative association between institutional ownership and firm performance in the developed countries (Mura, 2007) and in the developing countries (Al Farooque et al., 2007; Mashayekhi & Bazazb, 2008). Some other studies argued that no relationship exists between the institutional ownership and firm performance in both developed nations (e.g. Mizuno, 2010) and developing states (Aljifri & Moustafa, 2007; Chung et al., 2008; MoIlah & Talukdar, 2007). Thus, the following hypotheses are proposed for empirical examination.

H3: There is a positive relationship between the institutional ownership and firm performance.

Research Methodology

The sample consisted of selected 81 non-financial firms in the industry and service sectors in the years 2012-2014 – making sampling for two years to be 243 companies. Data was obtained from annual reports of firms listed in the Muscat stock exchange. Added to this, the primary measurement and model are provided as follows(Table 1).

| Table 1: Primary Measurement and Model | |||

| No | VARIABLES | ACRONYM | OPERATIONALISATION |

|---|---|---|---|

| 1 | Dependent Variables (DV) Return on Assets (%) |

ROA | Earnings before tax divided by total assets of the company. |

| 2 | Independent Variables (IV) GoGovernment Ownership (%) |

GOVEROW | The ratio of shares owned by the government in the firm. |

| 3 | Foreign Ownership (%) | FOREIGOW | The ratio of shares owned by foreign shareholders. |

| 4 | Institutional Ownership (%) | INSTITUOW | The ratio of shareholding held by institutions in the total number of shares. |

| 5 | Control Variables (CV) Leverage (%) |

LEVERAG | The ratio of total liabilities to total assets. |

ROA=α0+ β1* GOVEROW + β2* FOREIGOW +β3* INSTITUOW +β4* * LEVERAG + ε

Data Analysiz and Results

Descriptive Statistic

The descriptive statistics of the continuous variables including the mean, standard deviation, and minimum and maximum are discussed in this section(Table 2).

| Table 2:Descriptive Statistics Of Continuous Variables | |||||

| Variables | Unit | Mean | Std.Deviation | Min | Max |

|---|---|---|---|---|---|

| Government Ownership (GOVEROW) | Ratio | 0.088 | 0.184 | 0.000 | 0.890 |

| Foreign Ownership (FOREIGOW) | Ratio | 0.139 | 0.219 | 0.000 | 0.990 |

| Institutional Ownership (INSTITUOW) | Ratio | 0.215 | 0.245 | 0.000 | 0.940 |

| LEVERAGE | Ratio | 0.483 | 0.276 | 0.020 | 1.720 |

| (LEVERAG) Return On Assets (ROA) | |||||

| Ratio | 0.056 | 0.097 | -0.340 | 0.320 | |

Correlation Analysis

The correlation analysis of data obtained was carried out through the multiple regression analysis(Table 3). In regards to this, Pallant (2011) stated that correlation analysis is utilized to provide a description of the linear relationship between two variables in light of their strength and direction. Also, based on the findings, the correlations were under 0.90 and this indicates that the recommendation established by Gujarati and Porter (2009) was satisfied. Such recommendation states that for the absence of multicollinearity, the correlation matrix should not exceed 0.90.

| Table 3:Results Of Pearson Correlation Analysis | ||||

| 1 | 2 | 3 | 4 | |

|---|---|---|---|---|

| GOVEROW | ||||

| FOREIGOW | -0.086 | |||

| INSTITUOW | -0.157** | -0.099 | ||

| LEVERAGE | -0.293*** | 0.103 | 0.036 | |

| ROA | 0.275*** | 0.035 | -0.016 | -0.449*** |

***:p<0.001; **:p<0.01; *:P<0.05.

Testing the Normality of The Error Terms

The skewness and kurtosis analyses were conducted in order to examine the data distribution in light of its normality. Skewness analysis shows data normality if the output values fall between ±3, while the kurtosis analysis confirms data normality if the output values fall between ±10 (Kline, 1998). In the present study’s analyses, the study data was confirmed to be normal with the results of kurtosis values notwithstanding the skewness values.

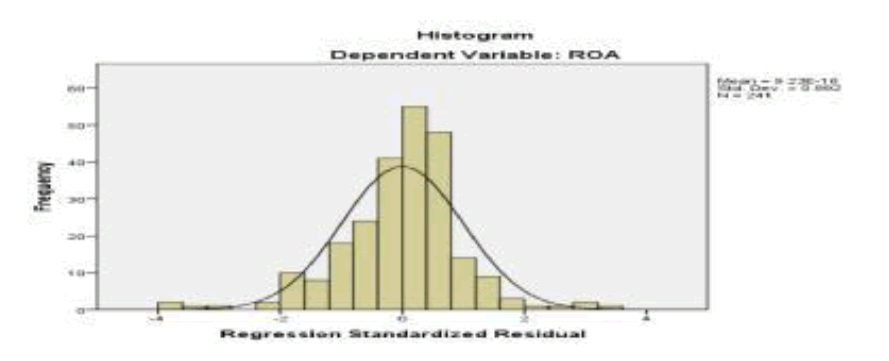

Linearity is described as the residuals existing in a straight line in regards with the dependent variables’ predicted scores as stated by Pallant (2011). In this study, linearity is confirmed by using scatterplots, with which normality was confirmed through a histogram and normality probability plots (p-p plots) of the regression standard residual using kamagorovsmiron. It was also confirmed through skewness and kurtosis values. The data distribution revealed no significant deviation from the normal curve (See Figure 1) and therefore, data was considered to be normally distributed.

Regression Results Based on Accounting Measure

Regression Results of Model (Based On Accounting Measure)

On the basis of the obtained results regarding the adjusted coefficient of determination (R2), 0.237% of the dependent variable’s variation is brought about by the independent variable(Table 5). In other words, the variation in firm performance (ROA) was accounted for by the regression equation. Table 4 lists the results of the model’s significance where F value is (F=18.319, p<0.01) indicating that model validity. Furthermore, the Durbin-Watson (DW) test was used to statistically examine the autocorrelation and accordingly, the rule of thumb established the acceptable range of autocorrelation to be (1.5-2.5). In this study, the value of Durbin-Watson is 1.833 indicating that it falls within the acceptable range and that the observations are independent. Meanwhile, collinearity was tested through the use of tolerance values and VIF. No issues were reported after obtaining the values. Table 4 contains the multiple regression analysis results.

| Table 4 : Results of Skweness And Kurtusis For Normality Test | ||||

| Skewness | Kurtosis | |||

|---|---|---|---|---|

| Statistic | Std. Error | Statistic | Std. Error | |

| GOVEROW | 2.639 | 0.156 | 6.727 | 0.311 |

| FOREIGOW | 1.550 | 0.156 | 1.342 | 0.311 |

| INSTITUOW | 0.832 | 0.157 | -0.498 | 0.312 |

| LEVERAGE | 0.744 | 0.156 | 1.088 | 0.311 |

| ROA | -1.008 | 0.156 | 3.225 | 0.311 |

| Table 5: Regression Results Of Model (Dependent= Roa) | ||||||

| Variables | Expected sign | Standardized Coefficients Beta | t-value | Sig. | Collinearity Statistics Tolerance | VIF |

|---|---|---|---|---|---|---|

| Government Ownership (GOVEROW) | + | 0.176 | 2.908 | 0.004** | 0.887 | 1.128 |

| Foreign Ownership (FOREIGOW) | + | 0.098 | 1.699 | 0.091* | 0.973 | 1.028 |

| Institutional Ownership(INSTITUOW) | + | 0.036 | 0.625 | 0.532 | 0.963 | 1.039 |

| LEVERAGE (LEVERAG) | ? | -0.410 | -6.864 | 0.000*** | 0.907 | 1.102 |

| R2 | 0.237 | |||||

| Adjusted R2 | 0.224 | |||||

| F-value | 18.319 | |||||

| F-Significant | 0.000 | |||||

| Durbin Watson statistics | 1.833 | |||||

***:p<0.001; **:p<0.01; *:P<0.05.

Discussion of Results

This section provides a discussion of the results concerning the ownership structure characteristics, which include government ownership, foreign ownership, and institutional ownership, and ROA (firm performance). This study found a positive and significant association between government ownership and ROA. This result is similar to previous studies that found significantly positive relationship between government ownership and firm performance both in the developed countries (Irina & Nadezhda, 2009) and the developing countries (Aljifri & Moustafa, 2007; MoIlah &Talukdar, 2007; Nazli Anum, 2010; Nurul Afzan &Rashidah, 2011). Moreover, a positive relationship was revealed between foreign ownership and ROA. This finding is similar with prior studies that found positive and significant relationship between the two variables both in the developed countries (e.g. Chari et al., 2012; Ghahroudi, 2011) and in the developing countries (Al Manaseer et al., 2012; Nazli Anum (2010); Uwuigbe & Olusanmi, 2012). Furthermore, the results highlighted a positive connection between institutional ownership and ROA but not significant – such a finding is similar with previous studies that reported no relationship between the institutional ownership and firm performance in both developed nations (e.g. Mizuno, 2010) and developing states (Aljifri&Moustafa, 2007; Chung et al., 2008; MoIlah &Talukdar, 2007). Eventually, the result found no moderating effect of audit quality between foreign ownership and ROA.

Conclusion and Suggestion For Future Research

The primary objective of the present study is to investigate the direct relationship between the characteristics of ownership structure and firm performance among non-financial Omani listed firms. The sample consisted of 243 firms in the duration of three years (2012-2014). Multiple regression analysis was used to examine the relationship between the independent and dependent variables. Based on the obtained results, a positive and significant government ownership (foreign ownership) – ROA relationship. The results also showed a positive institutional ownership – ROA relationship but such relationship was insignificant.

Similar to other studies, the present study is riddled with limitations, and from these limitations, the study suggests directions and further work for future studies. The present study focused on ownership structure (government ownership, foreign ownership and institutional ownership) and its relationship with firm performance. Future authors could add other ownership structure characteristics including ownership concentration, managerial ownership and government ownership as these may also enhance the performance of firms.

In the present study, the researcher also concentrated on ownership structure (ownership concentration, government ownership and managerial ownership) relationship with firm performance. Accordingly, future studies can integrate other internal corporate governance like board of directors’ characteristics, audit committee characteristics, risk committee characteristics, executive committee characteristics, corporate governance committee, remuneration committee, nomination committee, internal audit characteristics, among others and their role in the enhancement of the performance of the firm. Additionally, future authors can extend the study period and include more sectors in their examination of firm performance. Also, this study recommends that future studies examine other variables (e.g. culture, political correction, political crisis, corporate social responsibility, among others) in light of the relationship focused on in the present study. It is recommended that future authors consider other performance measurements into consideration (e.g. ROE, ROI, Tobin’s Q).

References

- Abdurrouf, M. A. (2011). The relationship between corporate governance and value of the firm in developing countries: Evidence from Bangladesh. The International Journal of Applied Economics and Finance, 5(3), 237–244.

- Al Farooque, O. A., Zijl, T. V., Dunstan, K., & Karim, A. K. M. W. (2007). Corporate Governance in Bangladesh?:

- Link between Ownership and Financial Performance. Corporate Governance, 15(6), 1453–1469.

- Al Manaseer, M. F. A., Al-Hindawi, R. M., Al-Dahiyat, M. A., & Sartawi, I. I. (2012). The Impact of Corporate Governance on the Performance of Jordanian Banks. European Journal of Scientific Research, 67(3), 349– 359.

- Al-Hussain, A. H., & Johnson, R. L. (2009). Relationship between corporate governance efficiency and Saudi Banks’ performance. The Business Review, Cambridge ,14(1), 111-117.

- Aljifri, K., & Moustafa, M. (200). The impact of corporate governance mechanisms on the performance of UAE firms: an empirical analysis. Journal of Economic and Administrative Sciences, 23(2), 71-93.

- Al-Matari, Y. A., Al-Swidi, A. K., & Faudziah Hanim Bt Fadzil. (2012). Audit committee effectiveness and performance of Saudi Arabia listed companies, Wulfenia Journal, 19(8), 169-188.

- Al-Matari, Y. A., Al-Swidi, A. K., Faudziah Hanim Bt Fadzil., & Al-Matari, E. M.(2012). Board of directors, audit committee characteristics and performance of Saudi Arabia listed companies. International Review of Management and Marketing, 2(4), 241-251.

- Barontini, R., & Caprio, L. (2006). The effect of family control on firm value and performance?: evidence fro m continental Europe. European Financial Management, 12(5), 689–723.

- Berle, A., & Means, G. (1932). The Modern Corporation and Private Property. New York, NY: Macmillan.

- Brown, L. D., & Caylor, M. L. (2004). Corporate governance and firm valuation. Journal of Accounting and Public Policy, 25(2), 409–434. doi:10.1016/j.jaccpubpol.2006.05.005

- Chari, A., Chen, W., & Dominguez, K. M. E. (2012). Foreign ownership and firm performance: emerging market acquisitions in the United States. IMF Economic Review, 60(1), 1–42. doi:10.1057/imfer.2012.1

- Chen, J., Chen, D., & Chung, H. (2006). Corporate control, corporate governance and firm performance in New Zealand. International Journal of Disclosure and Governance, 3(4), 263–276.

- Chung, D. S., Kim, B. G., Kim, D. W., & Choi, S. (2008). Corporate governance and firm perfroamnce: the Korea evidence. Journal of International Business and Economic, 8(2), 46–54.

- Cremers, K.J.M., & Nair, V.B. (2005). Governance mechanisms and equity prices. Journal of the finance, 5(6), 2859-2894.

- Dar, L. A., Naseem, M. A., Rehman, R. U., & Niazi, G. S. (2011). Corporate Governance and Firm Performance a Case Study ofPakistan Oil and Gas Companies Listed in Karachi Stock Exchange. Global Journal of Management and Business Research, 11(8), 1–10.

- Demsetz H., Lehn K. (1985). The structure of corporate ownership: Causes and onsequences, Journal of Political Economy, 93(6), 1155-1177.

- Ehikioya, B. I. (2009). Corporate governance structure and firm performance in developing economies?: evidence from Nigeria. Corporate Governance, 9(3), 231–243. doi:10.1108/14720700910964307

- Eng, L., & Mak, Y. (2003). Corporate governance and voluntary disclosure. Journal of Accounting and Public Policy, 22, 325-345.

- Fazlzadeh, A., Hendi, A. T., & Mahboubi, K. (2011). The examination of the effect of ownership structure on firm performance in listed firms of Tehran stock exchange based on the type of the industry. Interactional Journal of Business and Management, 6(3), 249–267.

- Ghahroudi, M. R. (2011). Ownership advantages and firm factors influencing performance of foreign affiliates in Japan. International Journal of Business and Management, 6(11), 119–138. doi:10.5539/ijbm.v6n11p119

- Gujarati, D., & Porter, D. (2009) Basic Econometrics, 5th edition, New York: McGraw-Hill.

- Gurbuz, A. O., & Aybars, A. (2010). The impact of foreign ownership on firm performance, evidence from anemerging market?: Turkey. American Journal of Economics and Business Administration, 2(4), 350–359.

- Harjoto, M. A., & Jo, H. (2008). Board leadership and firm performance. Journal of International Business and Economics, 8(3), 143–155.

- Hsu, W., & Petchsakulwong, P. (2010). The impact of corporate governance on the efficiency performance of the thai non-life insurance industry. The Geneva Papers on Risk and Insurance Issues and Practice, 35(1), S28– S49. doi:10.1057/gpp.2010.30

- Irina, I., & Nadezhda, Z. (2009). The relationship between corporate governance and company performance in concentrated ownership systems?: The case of Germany. Journal of Corporate Finance, 4(12), 34–56.

- Jensen, M. & Meckling, W.H. (1976). Theory of the firm: managerial behavior, agency costs, and ownership structure. Journal of Financial Economics, 3, 305-360. http://dx.doi.org/10.1016/0304-405X(76)90026-X

- Kajola, S. O. (2008). Corporate governance and firm performance?: the case of Nigerian listed firms. European Journal of Economics, Finance and Administrative Sciences, 14(14), 16–28.

- Khanchel, I. (2007). Corporate governance?: measurement and determinant analysis. Managerial Auditing Journal, 22(8), 740–760. doi:10.1108/02686900710819625.

- Kline, R. B. (1998). Principles and Practice of Structural Equation Modeling. New York: The Guilford Press. Liang, C.-J., Lin, Y.-L., & Huang, T.-T. (2011). Does endogenously determined ownership matter on performance?

- Dynamic evidence from the emerging Taiwan market. Emerging Markets Finance and Trade, 47(6), 120–133. doi:10.2753/REE1540-496X470607

- Masood, F. C. (2011). Corporate governance and firm Performance. International Conference on Sociality and Economic Development, 10, 484–489.

- Millet-Reyes, B., & Zhao, R. (2010). A comparison between one-tier and two-tier board structures in France.Journal of International Financial Management and Accounting, 21(3), 279–310.

- MoIlah, A. S., & Talukdar, M. B. U. (2007). Ownership structure, corporate governance, and firm’s performance in emerging markets: Evidence from Bangladesh. The International Journal of Finance, 19(1),4315–4333.

- Mura, R. (2007). Firm performance: Do non-executive directors have minds of their own? Evidence from UK panel data. Financial Management, 81 -112.

- NazliAnum, M. G. (2010). Ownership structure, corporate governance and corporate performance in Malaysia.International Journal of Commerce and Management, 20(2), 109-119.

- NurulAfzan, N., & Rashidah, A. (2011). Government ownership and performance of Malaysian government-linked companies. International Research Journal of Finance and Economics, (61), 42–56.

- Nuryanah, S., & Islam, S. M. N. (2011). Corporate governance and performance?: Evidence from an emerging market. Malaysian Accounting Review, 10(1), 17–42

- Pallant, J.F. (2011). SPSS survival manual: a step by step guide to data analysis using SPSS (4th ed.). Crows Nest,NSW: Allen & Unwin.

- Pandya, H. (2011). Corporate governance structures and financial performance of selected Indian Banks. Journal of Management and Public Policy, 2(2), 4–22.

- Pfeffer, J. (1972). Size, composition, and function of hospital boards of directors. Administrative Science Quarterly, 18(2), 349-364.

- Pfeffer, J., & Slanick, G.R. (1979). The external control of organizations: a resource dependence perspective.Contemporary Sociology, 8 (4), 612-13.

- Rhoades, M., Juleff, L., & Paton, C. (2001). Corporate governance in the financial services sector. International Journal of Business, 7(5), 623-634.

- Shan, Y. G., & McIver, R. P. (2011). Corporate governance mechanisms and financial performance in China: panel data evidence on listed non-financial companies. Asia Pacific Business Review, 17(3), 301–324. doi:10.1080/13602380903522325

- Shleifer, A., & Vishny, R. W. (1986). Large shareholders and corporate control. Journal of Political Economy, 94(3), 461-488.

- Shleifer, A., & Vishny, R.W. (1997). A survey of corporate governance. Journal of Finance, 52(2), 737-783. http://dx.doi.org/10.2307/2329497

- Tsegba, I. N., & Ezi-herbert, W. (2011). The relationship between ownership structure and firm performance?: Evidence from Nigerian. African Journal of Accounting, Economics, Finance and Banking Research, 7(7), 51–63.

- Uwuigbe, U., & Olusanmi, O. (2012). An empirical examination of the relationship between ownership structure and the performance of firms in Nigeria. International Business Research, 5(1), 208–216. doi:10.5539/ibr.v5n1p208

- Yasser, Q. R., Entebang, H., & Mansor, S. A. (2011). Corporate governance and firm performance in Pakistan?: The case of Karachi Stock Exchange (KSE). Journal of Economic and International Finance, 3(8), 482–491.