Original Articles: 2017 Vol: 21 Issue: 1

Attitude Towards Money: Mediation to Money Management

Sheela Devi D. Sundarasen, Prince Sultan University

Muhammad Sabbir Rahman, North South University Dhaka

Keywords

Money Management, Parental norms, Perceived Financial Literacy, Attitude towards Money and Structural Equation Modeling

Introduction

In this age of a fast-paced global economy, where young adults are drowned by the temptation of a flamboyant lifestyle, an individual’s money management approach is critical to obtaining financial freedom. Young adults face crucial predicaments and are antagonized with sophisticated financial decisions at every stage of their life cycle. Equally faltering is the fact that they are monetarily burdened with enormous student mortgages due to escalating educational cost, unsettled credit cards and elevated household debts due to high cost of living and lifestyle pressure, escalating housing and motor vehicle loans, and mounting medical bills for parents. These may hinder their accumulation of wealth right from the onset of their adulthood. The importance of money management has been documented in extant literature but inadequate attention has been given to the young adults’ ‘attitude towards money’ as a mediating factor. An individual’s ‘attitude towards money’ is an important factor in shaping the manner in which they manage their finances. Thus, this study attempts to revisit the money management issue using ‘attitude towards money’ as the central concern since there is a gap in exploring this important topic from the said perspective. This will form the main motivation and contribution of the study.

Money management is an amalgamation of individuals’ aptitude to realize, analyses, handle, and communicate personal finance issues towards their financial wellbeing (Vitt and Anderson, 2001; Atkinson and Messy, 2012, OECD Working Paper 15). As widely documented, financial literacy has great impacts on money management; illiteracy on the key essentials of financial concepts contribute to the absence of planning for retirement, speculative practices in the stock market, ridiculous borrowing practices etc. (Lusardi, 2008a, NBER Working Paper 14084).Equally important is the role of parents (Ivan and Dickson, 2008; Clarke et al., 2005; Dennis and Migliaccio, 1997; Neul and Drabman, 2001; Shim et al. 2010; Shim et al. 2009; Xiao et al. 2007) as it also affects an individual’s attitude and ability to manage their finances. Attitude towards money is assumed as a critical part in endeavors for an individual to enhance their monetary education and prosperity (Edwards et al., 2007). Since diverse recognitions about money affects the degree of money related information and practices of people(Norvilitis et al., 2006; Roberts and Jones, 2001), money attitude also impacts the self-direction of individuals (Burgess, 2005) and demonstrates as an enhancement to financial information seeking on money related matters (Edwards et al., 2007). Sundarasen et al., (2014) aptly stated that financial literacy, money management and wealth optimization is a ‘cradle to grave’ process, whereby individuals need to be educated and guided at every stage of their life-cycle, so as to ensure minimization of financial mistakes and experience financial freedom at the earliest possible stage of their life.

This study distinguishes itself by examining the mediating role of ‘attitude towards money’ on the relationship between perceived financial literacy and parental role on money management of young adults in a developing country. An issue of contention with regard to the selection of the variables is the fact that most academic work on this area has been undertaken in developed countries and any conclusion derived from those studies cannot be imputed automatically to all other countries due to social and cultural factors. Since this study is based on young adults, perceived financial literacy and parental role is deemed as two major factors that will have an impact on money management and also in terms of shaping a young adult’s attitude towards money. In that context, the contribution of this study is twofold; first, a revisit on the impact of perceived financial literacy, parental norms and attitude towards money on the money management will be examined. Second, an analysis is on the mediating role of ‘attitude towards money’ on the relationship between parental norms and perceived financial literacy on money management will be undertaken. To achieve the above objectives, data is collected via questionnaire from young adults, represented by postgraduate students in both private and public institution of higher learning. Structural Equation Modeling (SEM) analysis is applied to establish the causal relationship between the constructs on the proposed model.

Based on the empirical evidence, the main contribution of this study is the fact that ‘attitude towards money’ is a full mediator between parental norms and money management but the reverse is documented for perceived financial literacy and money management. Additionally, the results also indicate that parental norms, perceived financial literacy and ‘attitude towards money’ play a significant role on money management. The outcome of this study signals the importance on the execution of knowledge and awareness of financial planning among young adults. It should be taken as an ultimate and major task by parents, educational agents and government as it has great impact on money management. Knowledge and awareness of young adults’ perception towards money and money management is of decisive importance to a country as financially independent and stabile young adults are the backbones to long-term economic stability. If appropriate financial planning and money management becomes widespread in a society, economic growth will be motivated (Case and Fair, 1999) and consequently, social problems arising from poverty would be reduced, if not eliminated (Boon et al., 2011). The results of this study are envisioned to shed light amongst young adults, right at the onset of their career in terms of their financial decision-making.

The remainder of this paper is organized as follows. Section2 provides an overview of previous works in this field, whilst in Section 3, Research Design and Methodology is developed and a framework is proposed. Section 4 analyses and discusses the results. Section 5 concludes, with limitation and future research.

Hypotheses Development

As stated above, a young adult’s money management is very much influenced by the extent of financial literacy, parental guidance and attitude towards money. This section starts with the extant literature associated to the relevance of each variable on money management and concludes with the conceptual model and hypotheses.

Money Management Money management can be considered as an amalgamation of individuals’ aptitude to realize, analyze, handle, and communicate personal finance issues towards their financial wellbeing (Vitt and Anderson, 2001;Atkinson and Messy, 2012, OECD Working Paper 15).It embraces budgeting, spending, saving and investing (Murdy and Rush, 1995) and the absence of it could have adversarial effects on individuals’ wealth(Knight and Knight, 2000). In this context, wealth comprises of savings accounts, employer-backed retirement arrangements, insurance policies, real estate and other monetary assets, (Guiso et al., 2002;Campbell 2006;Van Rooij et al., 2007).

Over the decades, financial security on retirement arrangements is a universal foremost concern and has dominated almost all aspects of human lives in one way or another. This is apparent in the move from defined benefit (DB) to defined contribution (DC) plans, which means that workforces in the present day will have to make wise decisions in managing their wealth, vis-à-vis to retirement and pension wealth(Lusardi, 2008a, NBER Working Paper 14084).Determination of saving choices are challenging as individuals need to accumulate evidence and make projections; from social welfare and retirement fund to interest rates and

price rise projections, to mention a few (Lusardi, 2008a, NBER Working Paper 14084).Literature documents the absence of effective money management as the primary driver of rising budgetary constraints(Lea et al., 1995;Lunt and Livingstone 1992;Murdy and Rush, 1995;Ranyard and Craig, 1995;Walker, 1996). A structured and comprehensive long-term planning should be able to enhance money management and lessen the probability of financial debts (Lunt and Livingstone, 1992; Ranyard and Craig, 1995). Moreover, financial education, budgeting, saving and investment may help towards enhancing money and wealth management.

Therefore, financial literacy and proper money management can have noteworthy ramifications on financial performance: individuals with low money related education are less inclined to gather fortune and upgrade riches viably (Stango and Zinman, 2007, Working Paper, Mimeo, Dartmouth College; Hilgert et al., 2003; Lusardi et al., 2009, NBER Working Paper 15352).The long term implication of money management is predominantly to elevate investment in wealth for future, particularly for retirement, thus it is closely secured to retirement organizing and retirement assets possessions (Lusardi et al., 2010; Behrman et al., 2010, NBER Working Paper 16452).

Contrasting to the above, Carsky et al., (1984) and Knight and Knight,(2000) refuted to the conjecture that financial literacy enhances money management. Their investigation documented that mindfulness on money related education have not adequately enhanced money management. This is very disconcerting on the grounds that creating operational and suitable methodologies to inspire effective budgetary practices to eliminate the undesirable impacts of financial debts may be affected by the absence of legitimate money management. To this end, we intend to further explore on the significant influences towards better money and wealth management among young adults.

Perceived Financial Literacy

Hogarth and Hilgert (2002)refers ‘financial literacy’ as an ‘understanding of finance and the ability to utilize it to make sound personal financial decision’. This will result in the financial well-being of individuals. Adequate indulgent on ‘financial literacy’ and what it entails are fundamental in today’s fast-paced and volatile global environment. Similarly, financial education refers to the mastery of finance related knowledge and expertise essential to undertake daily transactions and wealth accumulation investments. It empowers people to utilize learning, and use the knowledge to administer their own finances and ensure long lasting financial security for themselves and their families. It will also give individuals the ability to understand the basic financial products that people deal with in their everyday lives, which can considerably affect their economic situation and welfare. These information and abilities are essential to handle financial encounters and judgments in daily life, such as managing the allowances, maintaining a bank account, investing and saving (Kotlikoff and Bernheim, 2001; Johnson and Sherraden, 2007). Formal financial education is believed to play a vital role in financial literacy (Bernheim et al., 2001;Varcoe et al., 2005) and it is important to equip oneself with this knowledge of financial literacy at an early stage of one’s life as it creates the foundation for future financial behavior and security(Beverly and Burkhalter, 2005; Martin and Oliva, 2001). Therefore, understanding the extent of financial literacy level of the young is particularly imperative when observed from the viewpoint that financial knowledge and expertise developed early in life as it generates an underpinning for impending financial conduct and happiness (Beverly and Burkhalter, 2005; Martin and Oliva, 2001).

It is widely documented that a positive connotation exists between financial literacy and all behaviors related to financial decision-making. Financial literacy is largely linked to the saving habits and portfolio decision. For example, people with low monetary education are more inclined to face issues with financial obligation(Lusardi and Tufano, 2009, NBER Working Paper 14808), less likely to take an interest in value ventures(Van Rooij et al., 2007;Christelis et al., 2010), less credible to pick performing trust funds with lower expenses(Hastings and Tejeda-Ashton, 2008, NBER Working Paper 14538), less inclined to aggregate and oversee riches successfully (Stango and Zinman, 2007, Working Paper, Mimeo, Dartmouth College; Hilgert et al., 2003), and less inclined to antedate retirement(Lusardi and Mitchell, 2006, NBER Working Paper 17075;2007;2009, NBER Working Paper 15350). It is irrefutable that financial literacy is an imperative part of sound financial decision making, and many youngsters wish they had more money related information(Lusardi et al., 2009, NBER Working Paper 15352). The ultimate goal of being financially literate is to educate consumers so that they can make appropriate decisions and be responsible for them, assess their current financial situation and manage their finances in such a way as not to be a burden to their families or society. Linking financial literacy and personal financial behavior have shown positive correlation in most researches (Bernheim et al, 1997, NBER Working Paper 6085; Hogarth and Hilgert, 2002; Hilgert et al., 2003; Courchane and Zorn, 2005; Lusardi and Mitchell, 2007; Lusardi, 2008b, OECD Working Paper 18).

Financial literacy at the macro-level warrants that the nation is sufficiently equipped to manage with the regular monetary situations and dealings in the marketplace. A financially

knowledgeable and cultured citizen is highly competent in handling money and is adept to managing his own/family budget, including managing financial assets and obligations pertaining to a shift in life-long attainments. Low levels of financial literacy can deliver problematic monetary choices, which, in the total, can yield low levels of prosperity by making it challenging for patrons to encounter their financial requirements essential for living.

In the context of this study, perceived financial literacy is expected to have a positive impact on money management as young adults who are well equipped with these knowledge will be able to apply their knowledge in their daily financial transactions. This should ultimately avoid unwarranted financial baggage at the later years of their life and assist these young adults to achieve financial freedom. Thus, the following hypothesis will be tested:

H1 Perceived financial literacy has a positive impact on money management of young adults in a developing country.

Parental Norms

Parents are recognized as one of the prime socialization agents for adolescent and adults (Clarke et al., 2005;Rettig 1985)and financial related facts accumulations(Lyons et al., 2006). It is also widely documented that parents are persuasive in imparting money related education to their children (Ivan and Dickson, 2008; Clarke et al., 2005; Dennis and Migliaccio, 1997; Neul and Drabman, 2001; Shim et al. 2010; Shim et al. 2009; Xiao et al. 2007). A comprehensive study by Shim et al. (2009)concurs that adults who are confident with their transactions on financial choices tend to have sufficient guidance from their parents since childhood, in addition to formal financial literacy education from different sources. Similarly, Lyons et al.(2006)who undertook a study on high school and college students conjectured that almost 77% of the students turned towards and relied on their parents to provide them with the information on financial knowledge and proficiency.

Recent evidence suggests that an individual’s mother’s education has an impact on financial literacy, particularly if a respondent’s mother has university education. Respondents whose mothers were not deprived of university education had superior outlooks than those whose mothers advanced only from high school. This difference is statistically significant especially in terms of inflation, interest rates and risk diversification(Lusardi et al., 2009).Therefore, socialization agents, especially parents shoulder an essential slice in the money management exposure and administration of their off-springs. Parents who had ensured valuable financial behavior amongst youth were all the more strongly considered by their offspring’s as financial replicas. These adults eventually undertake financial activities conforming towards appropriate money management. Although money related abilities are being taught in formal instructive settings, research reveals a strong relationship between the home environment and individuals’ embracing of financial skills. The larger part of monetary learning that individuals’ hold is adapted through parent’s exhibition of financial knowledge (Clarke et al., 2005;Neul and Drabman, 2001;Shim et al., 2009).

This communication of parental guidance at early stages of one’s life coupled with the existence of financial education at school acts as a perfect blend and gives a solid establishment that could prompt better monetary conclusions. Parental impact, through primary exposures or deliberate education of cash management appears to be a critical variable in creating individuals’ money related believes and practices. Likewise, parental coaching in adolescence may be associated with financial expositions in adulthood. Thus, plans and systems that enhances parents monetary certainty, reading proficiency and energizing intergenerational considerations about financial issues may be an essential approach to enhance their off-springs’ eventual money related commitments and outcomes.

In the context of this study, parental norms (in addition to financial literacy) are conjectured as a critical element especially for young adults who have just started their journey into a new chapter of their life, i.e., working adults. The knowledge acquired fromtheir parents coupled with the manner their parents handled financial matters will definitely play a very important role in money management decision of these young adults. To further test on the impact of parental norm and money management among young adults, the following hypothesis is tested:

H2 Parental norms have a positive impact on money management of young adults in a developing country.

Attitude Towards Money

Though financial literacy and parental norms assume a key measure in impacting money management, this study conjectures that the attitude of an individual towards money is vital in creating any type of association. It is universally acknowledged that money is an influential instrument and motivator that shapes an individual's life. Money is acknowledged by certain people as a materialistic trifle, whilst others consider money as force, capacity to draw in companions and relationship. It is similarly acknowledged as an image of accomplishment and achievement, opportunity and security (Engelberg & Sjoberg, 2006; Mitchell & Mickel, 1999). Edwards et al., (2007) assumes attitude towards money as a critical part in endeavors for an individual to enhance financial information seeking on money related matters. The author also found that money attitudes were related to students’ openness with parents about their financial situation. These findings suggest that particular money attitudes could serve as a stimulus to an individual’s behavior in terms of attaining knowledge on financial matters in the same way that money attitudes influence other behavior. Since diverse acknowledgements about money affects the extent of money related information and practices of people (Norvilitis et al., 2006;Roberts and Jones, 2001), money attitude also impacts the self-direction of individuals, suggesting that those attitudes are likely to interact with self-directed behavior for security such as financial knowledge seeking (Burgess, 2005). Hong (2005) revealed a significant positive relationship between “good” attitudes toward money and the budgeting behavior among Korean adolescents. Similarly, Kim (2003) found that saving behavior as a tool for safety was significantly associated with money attitudes. Thus, those who have a positive attitude towards money will actively seek out money management knowledge as a way to enhance their skill set. The author also stated that, those who consider money as a thing to avoid might be reluctant to take active steps to learn about money matters. Thus, it is important to determine the ‘attitude towards money’ that young adults perceive and efforts should be taken to change their perceptions or attitudes. This will further enhance positive money management practices amongst them.

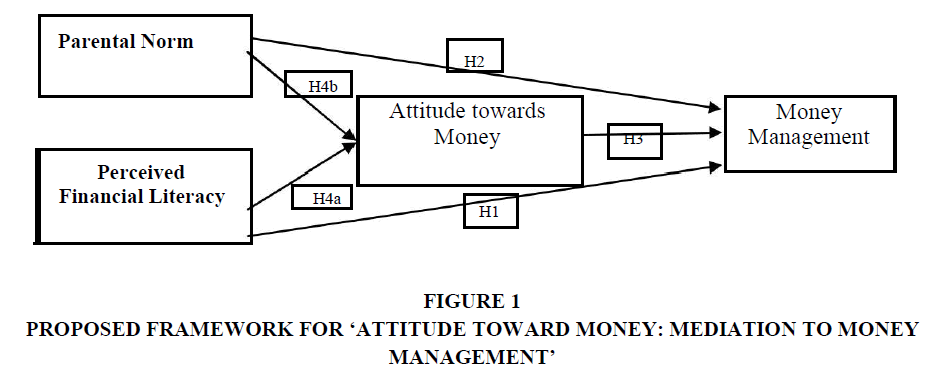

Since literature documents that disposition towards money forms one's conduct on monetary matters, this study conceptualizes that a young adult’s attitude towards money may adjust the relationship between perceived financial literacy and parental norms on money management. Though these young adults may be financially literate, their ‘attitude towards money’ may significantly affect the money management. Similarly, though parents embed the right conception about money management, an individual’s ‘attitude towards money’ may also alter the existing relationships. Thus, the current study is designed to address this gap in the research literature, i.e., the mediating effects of attitude towards money on the between perceived financial literacy and parental norms on money management. In that context, the following hypotheses are tested:

H3 Attitude towards money has a positive impact on money management of young adults in a developing country.

H4a Attitude towards money mediates the relationship between perceived financial literacy and money management of young adults in a developing country.

H4b Attitude towards money mediates the relationship between parental norms and money management of young adults in a developing country.

As stated from the onset, though several studies have been undertaken in this area but none have amalgamated the three respective research streams mentioned in the above review in the manner suggested by this study. One of the most vital discussions in the financial planning environment is concerning the factors that have impacts on financial decision- making and for that purposes, a new model is designed, which examines its relationship on money management. This paper will focus on the relevance of an individual’s ‘attitude towards money’ as a mediator between parental norms, financial literacy and money management. The following issues are addressed:

1. The impact of parental norms, financial literacy and ‘attitude towards money’ on money management.

2. The mediating role of ‘attitude towards money’ on the relationship between parental norms and financial literacy on money management

Research Design and Methodology

Characteristics of the Sample

This research tests the hypothesized model in Figure 1, by means of a sample of young adults, represented by working adults, who are part-time postgraduate students at several private and public universities. Students from the higher learning institutions were selected as they aptly represent the young adults who are currently facing numerous financial challenges in money management. Convenience sampling procedure is applied and data is collected via university campus intercept procedure; face to face survey method. Two hundred and twenty students were randomly selected to respond to the survey instruments, out of which only two hundred instruments were used (due to incompleteness) for further data analysis. Out of the total selected survey instruments, 60% of the respondents were female, whilst 40% of the respondents were male.

The age of the respondents ranged from 20 to 40 years old; 70% of the respondents were between 21 and 30years, 20% between 31 and 35 years and 10% of the respondents were above 35 years. Out of the total respondents, 60% of the respondents represent private higher learning institution and the remaining 40% of the respondents were from the public higher learning institutions. Majority of the respondents are employed (94%) with different private and public imited companies, whilst only 6% of the respondents were unemployed. In addition, most of the respondents (80%) are concerned about financial planning and money management. However the remaining 20% of the respondents are not aware of financial planning and money management. Majority of the respondents (48%) agreed that the media play an important role in creating the awareness on financial planning slogan among the young generation. Most of them (27%) agreed that family can play an important role in promoting the important aspects of financial planning among the young generation. The characteristics of our sample are reported in Table 1.

| Table 1: Characteristics Of The Sample | ||

| Characteristics | Frequency (N=200) | Percentage (100%) |

|---|---|---|

| Gender | ||

| Male | 80 | 40 |

| Female | 120 | 60 |

| Age | ||

| 21-30 Years | 140 | 70 |

| 31-35 Years | 40 | 20 |

| Above 35 Years | 20 | 10 |

| Marital status | ||

| Single | 156 | 76 |

| Married | 44 | 24 |

| Race | ||

| Malay | 56 | 28 |

| Chinese | 122 | 61 |

| Indian | 18 | 9 |

| Others | 4 | 2 |

| Monthly household income | ||

| Under RM2000 | 84 | 24 |

| RM2001-RM2999 | 48 | 42 |

| RM3000-RM4999 | 32 | 16 |

| RM5000 and Above | 36 | 18 |

| Parent’s academic Qualification | ||

| Non-Graduate | 82 | 41 |

| Graduate | 118 | 59 |

| Parents | ||

| Self-employed | 112 | 56 |

| Employed | 88 | 44 |

| Main source of financial | ||

| knowledge | ||

| Family | 74 | 37 |

| Media | 76 | 38 |

| Peers | 32 | 16 |

| School | 18 | 9 |

This research applies a 5 point Likert scale questionnaire (1=strongly disagree, 2=disagree, 3=neutral, 4=agree, 5=strongly agree).This study has adapted the following instruments which are used to measure money management, perceived financial literacy, parental norms and attitude towards money.

| Table 2: Construct Measurement Instruments | |

| Constructs | Instrument |

|---|---|

| Money management | Boon et al., (2011) |

| Perceived financial literacy | Boon et al., (2011) |

| Parental norms | Shim et al., (2010) |

| Attitude towards money | Tang’s Money Ethic’s Scale (1992) |

This research applies Structural Equation Modeling (SEM) analysis to establish the causal relations between the constructs on the proposed model. The proposed hypotheses are tested using the structural equation modeling (SEM) as this technique provides statistical inferences by assessing the relationships in the path diagram comprehensively (Hair, Tatham, et al. 2006).Confirmatory factor analysis (CFA) is performed to examine the constructs’ dimensionality (see Table 3) using AMOS 20 software, maximum likelihood estimation is applied to let the nonappearance of multivariate normality. Chi-square test, goodness-of-fit index (GFI), comparative fit index (CFI) and the root mean square error of approximation (RMSEA) is used to test the model fits (Hair, Tatham, et al. 2006).The factor loadings under each construct’s items demonstrate convergent validity( Table 2). This research also calculates the average variance extracted (AVE)(Fornell and Larcker 1981) to determine the discriminant validity of the constructs (Table 3).Comparable model fit indices were tested by using GFI, CFI, and the RMSEA (Hair, Tatham, et al. 2006). Finally, the calculation of direct effect, indirect effect and total effect is used to measure the mediation relationship.

| Constructs | χ2 | CR | df | GFI | CFI | RMSEA | AVE |

|---|---|---|---|---|---|---|---|

| Parental Norms | |||||||

| Perceived Financial | 8.49 | 0.89 | 0.00 | 0.95 | 0.94 | 0.05 | 0.63 |

| Literacy | 12.49 | 0.93 | 0.00 | 0.92 | 0.93 | 0.05 | 0.72 |

| Attitude towards Money | 12.09 | 0.89 | 0.00 | 0.95 | 0.94 | 0.05 | 0.63 |

| Money Management | 8.49 | 0.88 | 0.00 | 0.93 | 0.94 | 0.06 | 0.6 |

Data Analysis

The initial CFA model for all the constructs are adequate in achieving the acceptable model fit for further data analysis as shown in Table 3. According to Field,(2000); Stevens,(1992) and Hair, (2006), the importance of a loading provides little indication of the substantive significance of a variable to a factor, thus only factor loading with an absolute value of greater than 0.5 is acceptable. In this regard, all items are acceptable. The significant factor loadings demonstrate the adequate convergent validity of the constructs. According to Hair (2010), the Average Variance Extracted (AVE) less than 0.5 indicates that, on average, more inaccuracy remains in the items than variance explained by the latent factor structure executed on the measurements.

In addition, the results of the construct reliability (CR) also demonstrate adequate internal consistency of the measured variables (See table 3). It is concluded that the construct reliability of the constructs are supported since all composite reliabilities are more than 0.7 (Hair et al., 2010).

Table 3 shows that this model fits the sample data set and also meets the goodness-of-fit indices. Based on the results in Table 3, it is concluded that the model is valid for further analysis of the hypothesized effects (Hair, Tatham, et al. 2006).

Standardized path coefficient (β) is applied to check the effects of the proposed model (less than 0.10 = small effect; around 0.30= Medium effect; value more than 0.50 = large effects)(Cohen 1988). The final model of the associations is shown in Table 4. First, we established the association of parental norms, perceived financial literacy and attitude towards money on money management. The standardized path coefficients (β) support that all the relationship positively affects money management at a significant level (Table 4). Thus, this research accepts H1, H 2, and H3. The empirical results on Table 4 (Part A) support all 4 research hypotheses as follows:

| Table 4: Overall model fit statistics, path estimate and influence effects between the variables | |||||

| Overall ModelFit Statistic | StatisticValue | Path | PathEstimate | Significance | |

|---|---|---|---|---|---|

| P-value of test | 0.335 | Parental norm to Money Management | 0.782 | *** | |

| GFI | 0.946 | Perceived Financial Literacy to MoneyManagement | 0.827 | *** | |

| AGFI | 0.056 | ||||

| RMSEA | 0.952 | Attitude toward money to MoneyManagement | 0.583 | *** | |

Parental norms (β= 0.782, p=0.000) indicate a significant and positive relationship on Money Management; implying that parental norms have a positive influence on the money management of individuals. This is similar to the findings of Clark et al.(2005), Danes and Haberman (2007), Neul and Drabman (2001), and Shim et al. (2009). Their study documented that the larger part of monetary learning that individuals hold is adapted through parent’s exhibition of financial knowledge. Financial literacy is to a large extent associated with the financial experience as it unveils greater financial knowledge; parental involvement influence could be even more decisive because financial occurrences that arises within a family setting is expected to be more impactful. Role of parents from an infantry stage of an individual is imperative, so as to ensure that they are taught at every stage of their life on the importance of money management. This will mould individuals to be finance savvy and attain financial freedom in the later part of their lives.

Similarly, perceived financial literacy also has a significant and positive (β= 0.827, p=0.000) impact on money management. This concurs with the study byStango and Zinman,(2007), Working Paper, Mimeo, Dartmouth College;Hilgert et al., (2003); Lusardi et al., (2009), NBER Working Paper 15352, who have clearly documented that financial literacy plays a pivotal role in money management. Young adults with low levels of financial literacy are less probable to accumulate and manage wealth effectively. The final variable analyzed is ‘attitude towards money’. The research findings indicate that attitudes towards money has a significant and positive (β= 0.583, p=0.000) relationship with money management.

This is in line with the findings of Kim (2003), Hong (2005), Burgess (2005) and Edwards et al. (2007). Money attitude is seen as significantly related to spending patterns of college students, students’ openness with their parent on financial matters, a motivator to seek financial knowledge and a self-directed behavior for financial security. As for the mediation effects, which is the main contribution of this paper, the following explanation ensues. Attitudes towards money fully mediates the relationship between parental norms and money management (β=0.050, z= 0.703, p=0.753), thus the hypothesis is statistically supported by the results of the mediation test. It should be noted that there is a significantly positive relationship between parental norms and money management when attitudes towards money play a mediating role (Table 5). It is thus conjectured that the relationship goes through attitudes towards money to money management. The direct effect is only 0.050 while the indirect effect is 0.703, which confirms the full mediation of attitudes of money in this relationship. Thus, hypothesis H4ais accepted.

| Table 5: Path Estimate And Influence Effects Between The Variables | ||||

| No | Path | Direct Effect | Indirect Effect | Total Effect |

|---|---|---|---|---|

| 1 | Parental Norms to Attitudes towards Money | 0.723 | - | 0.723 |

| 2 | Parental Norms to Money Management | 0.050 | 0.703 | 0.753*** |

| 5 | Perceived Financial Literacy to Attitudes | 0.572 | - | 0.572 |

| towards Money | ||||

| 6 | Perceived Financial Literacy to Money | 0.540 | 0.224 | 0.764*** |

| Management | ||||

Finally, the hypothesis that explains the mediation effects of attitude towards money between perceived financial literacy and money management is also significant. However, the mediation effect here is partial, and not full (Table 5). Perceived financial literacy has substantial direct effect on money management rather than indirect effect. Therefore, hypothesis H4b is rejected. This is an interesting finding as it indicates that financial literacy has a standalone effect and not mediated by the attitude towards money, unlike parental norms. It also indicates on the extreme importance of financial literacy in the financial planning and money management landscape for young adults in an emerging country. All stakeholders should deliberate further in ensuring that financial literacy reaches all level of society and at every stage of their life-cycle.

Conclusion, Implication and Future Research

This paper empirically investigates the roles of parental norms and perceived financial literacy on the money management of young adults and the relevance of an individual’s ‘attitude towards money’ as a mediator in the abovementioned relationship. Close-ended questionnaires were used to conduct a survey among the young adults in Malaysia. These young adults are represented by the postgraduate students currently studying at both private and public universities. The results from this study indicate that parental norms, perceived financial literacy and attitude towards money play a significant role on money management. Most importantly, it is documented that ‘attitude towards money’ is a full mediator between parental norms and money management but is not a full mediator for the relationship between perceived financial literacy and money management. This highlights on the ultimate importance of financial literacy in the money management of young adults. In summary, all hypotheses are supported, with the exception of H4b as shown in Table 6. Though financial literacy has been widely propagated in the developed countries, it is a relatively new area of emphasis in the developing countries due to the absence and ignorance on the awareness of the antecedents to a proper money management programme among young adults. The factors explored in this paper have strong impacts on the financial decision-making and money management; thus it is envisioned that parents play a central role in imparting and implanting the importance of financial literacy, money attitude and money management amongst young adults as this would assist the young adults’ endeavor in long-term life-changing financial decisions. Since attitude towards money has been identified as an important mediator in the money management journey, due consideration should be given in instilling and conserving the ‘correct believe system’ about money among these young adults.

| Table 6: Summary Of The Hypotheses Results | ||

| No | Hypotheses | Accepted/Rejected |

|---|---|---|

| H1 | Parental norms play a significant role on money management | Accepted |

| H2 | Perceived financial literacy plays a significant role on money management | Accepted |

| H3 | Attitude towards money play a significant role on money management | Accepted |

| H4a | Attitude towards money mediates the relationship between parental normsand money management | Accepted |

| H4b | Attitude towards money mediates the relationship between perceivedfinancial literacy and money management | Rejected |

`

Parents and all other socialization agents, i.e., peers, educational institutions, colleagues, employers etc. should take a pivotal role in embedding appropriate attitudes towards money on these young adults. If an adequate level of financial literacy and appropriate attitude towards money is imparted to all young adults at every stage of their life cycle, proper financial planning and money management can be executed and it will become widespread in a society. This will contribute towards economic growth (Case and Fair, 1999) and consequently, social problems arising from poverty could be reduced, if not eliminated (Boon et al., 2011).

Limitation of this study may include the relatively small sample size. A larger dataset, representing a diverse population and a comparison with other countries is much desired. The presence of a number of underlying differences between countries in terms of social, cultural and economic factors may have significant impact on an individual’s ‘attitude toward money’ and money management, thus warranting a comparative study. Future research could also investigate and measure a more extensive and diverse set of questions as presented in the Financial Literacy and Education Commission Research and Evaluation Working Group (2011). Finally, since this study measures financial literacy from a subjective perspective, it is recommended that a more objective approach be adopted in determining financial literacy in future research as it may give a more comprehensive dimension to it.

References

- Ameriks, J., Caplin, A & Leahy, J. (2002). Wealth Accumulation and the Propensity to Plan. NBER Working Paper on Aging and Health. No. 8920.

- Atkinson, A & Messy, F. (2012). Measuring Financial Literacy: Results of the OECD / International Network on Financial Education (INFE) Pilot Study. OECD Working Papers on Finance, Insurance and Private Pensions. No. 15. OECD Publishing. http://dx.doi.org/10.1787/5k9csfs90fr4-en

- Behrman, J.R., Mitchel, O.S., Soo, C., & Bravo, D. (2010). Financial Literacy, Schooling, and Wealth Accumulation. NBER Working Paper on Economics of Aging. No. 16452.

- Bernheim, B.D, Garrett, D.M & Maki, D.M. (2001). Education and saving: The long-term effects of high school financial curriculum mandates. Journal of Public Economics, 80(3), 435-465.

- Bernheim, B.D., Garrett, D.M.,& Maki, D.M. (1997). Education and saving: The long-term effects of high school financial curriculum mandates. NBER Working Paper on Aging and Public Economics. No. 6085.

- Bernheim, B.D. (1995). Do households appreciate their financial vulnerabilities? An analysis of actions, perceptions, and public policy in Tax policy and Economic Growth. American Council for Capital Formation, Washington, D.C. 3:11-13.

- Bernheim, B.D. (1998). Financial Illiteracy, Education and Retirement Saving in Living with Defined Contribution Pensions, edited by Mitchell SO and Schieber S. Philadelphia: University of Pennsylvania Press:38-68.

- Beverly, S.G.,&Burkhalter, E.K. (2005). Improving the financial literacy and practices of youths. Children & Schools. 27(2), 121-124.

- Boon, T.H., Yee, H.S., &Ting, H.W. (2011). Financial literacy and personal financial planning in Klang Valley, Malaysia. International Journal of Economics and Management. 5(1), 149-168.

- Brown, J.R., Ivkovic, Z., Smith, P.A., & Weisbenner, S. (2008). Neighbours matter: Causal community effects and stock market participation. The Journal of Finance. 63(3), 1509-1531.

- Burgess, S.M. (2005). The importance and motivational content of money attitudes: South Africans with living standards similar to those in industrialised Western countries. South African Journal of Psychology. 35(1), 106-126.

- Cameron, M.P., Calderwood, R., Cox, A., Lim, S., &Yamaoka, M. (2014). Factors associated with financial literacy among high school students in New Zealand. International Review of Economics Education. 16(Part A):12-21. doi: http://dx.doi.org/10.1016/j.iree.2014.07.006.

- Campbell, J.Y. (2006). Household finance. The Journal of Finance. 61(4), 1553-1604.

- Carsky, M.L., Lytton, R.H.,&McLaughlin, G.W. (1984). Changes in consumer competency and attitudes: Do student characteristics make a difference? Proceedings of the American Council on Consumer Interests, USA, 30, 166-173.

- Case, K.F.,& Fair, R.C. (1999). Principles of Economics (5th Edition). Prentice Hall. Upper Saddle River, New Jersey.

- Christelis, D., Jappelli, T.,& Padula, M. (2010). Cognitive abilities and portfolio choice. European Economic Review. 54(1), 18-38.

- Clarke MC, Heaton MB, Israelsen CL, & Eggett DL (2005). The acquisition of family financial roles and responsibilities. Family and Consumer Sciences Research Journal. 33 (4), 321-340.

- Cohen J (1988). Statistical Power Analysis for the Behavioral Sciences (2nd Edition). Routledge. Hillsdale, NJ. Courchane, M & Zorn P (2005). Consumer literacy and creditworthiness. Federal Reserve System Conference,

- Promises and Pitfalls: as consumer options multiply, who is being served and at what cost.

- Danes, Sharon M, &Heather, R & Haberman. (2007). Teen financial knowledge, self-efficacy, and behavior: A gendered view. Financial Counselling and Planning. 18(2), 48-60.

- Delfabbro P & Thrupp L (2003). The social determinants of youth gambling in South Australian adolescents.

- Journal of Adolescence. 26(3), 313-330.

- Dennis H & Migliaccio J (1997). Redefining retirement: The baby boomer challenge. Generations. 12(2), 45-50.

- Edwards R, Allen MW & Hayhoe CR (2007). Financial attitudes and family communication about students' finances: The role of sex differences. Communication Reports. 20(2), 90-100.

- Engelberg, E., & Sjoberg, L. (2006). Money attitudes and emotional intelligence. Journal of Applied Social Psychology, 36(8), 2027–2047.

- Field A (2000). Discovering Statistics using SPSS for Windows. Sage Publications, Inc. Thousand Oaks, CA, USA. Financial Literacy &Education Commission Research and Evaluation Working Group (2011).2012

- Research Priorities and Research Questions.Retrieved December15,2012.www.treasury.gov/resource

- Fornell C & Larcker DF (1981). Evaluating structural equation models with unobservable variables and measurement error. Journal of Marketing Research. 18(1), 39-50.

- Guiso L, Haliassos M & Jappelli T (2002). Household portfolios: MIT press.

- Hair JF, Black WC, Babin JB, &Anderson RE (2010). Multivariate Data Analysis: A global perspective (7th Edition). Pearson Education Inc. Upper Saddle River NJ.

- Hair JF, Tatham RL, Anderson RE, &Black WC (2006). Multivariate Data Analysis (6th Edition). Pearson Prentice Hall. Upper Saddle River, NJ.

- Hastings JS & Tejeda-Ashton L (2008). Financial Literacy, Information, and Demand Elasticity: Survey and Experimental Evidence from Mexico. NBER Working Paper on National Bureau of Economic Research. No. 14538.

- Hilgert MA, Hogarth JM &Beverly SG (2003). Household financial management: The connection between knowledge and behavior. Fed. Res. Bull. 89(2003), 309.

- Hogarth JM, & Hilgert MA (2002). Financial knowledge, experience and learning preferences: Preliminary results from a new survey on financial literacy. Consumer Interest Annual. 48(1), 1-7.59(1), 137-163.

- Ivan B &Dickson L (2008). Consumer economic socialization. Handbook of Consumer Finance Research. Springer New York 2008, 83-102.

- Johnson E &Sherraden MS (2007). From Financial Literacy to Financial Capability among Youth. Journal of Sociology & Social Welfare. 34(3), 119.

- Knight LG &Knight RA (2000). Counselling clients on credit. Journal of Accountancy. 189(2), 61-72.

- Kotlikoff L &Bernheim B (2001). Household Financial Planning and Financial Literacy. Essays on Saving, Bequests, Altruism, and Lifecycle Planning. MIT Press.

- Kretschmer T &Pike A (2010). Links between non-shared friendship experiences and adolescent siblings' differences in aspirations. Journal of Adolescence. 33(1), 101-110.

- Lea SEG, Webley P &Walker CM (1995). Psychological factors in consumer debt: Money management, economic socialization, and credit use. Journal of Economic Psychology. 16(4), 681-701.

- Lunt PK &Livingstone SM (1992). Mass Consumption and Personal Identity: Everyday Economic Experience:

- Open University Press. Buckingham. Philadelphia.

- Lusardi A &Mitchell OS (2007a). Baby boomer retirement security: The roles of planning, financial literacy, and housing wealth. Journal of Monetary Economics. 54(1), 205-224.

- Lusardi A, Mitchell OS &Curto V (2010). Financial Literacy among the Young. Journal of Consumer Affairs. 44(2), 358-380.

- Lusardi A, Mitchell OS &Curto V (2009). Financial literacy among the young: Evidence and implications for consumer policy. NBER Working Paper. National Bureau of Economic Research. No. 15352.

- Lusardi A &Mitchell OS (2009). How ordinary consumers make complex economic decisions: Financial literacy and retirement readiness. NBER Working Paper. National Bureau of Economic Research. No. 15350.

- Lusardi A (2008a). Financial Literacy: An Essential Tool for Informed Consumer Choice? NBER Working Paper in National Bureau of Economic Research. No. 14084.

- Lusardi A (2008b). Increasing the Effectiveness of Financial Education in Workplace. CFS Working Paper.

- International Conference on Financial Education, U.S. Department of the Treasury and OECD. No.2008/18.

- Lusardi A &Mitchell OS (2006). Financial Literacy and Planning: Implications for Retirement Wellbeing. NBER Working Paper. Pension Research Council, Wharton School, University of Pennsylvania. No. 17078

- Lusardi A &Mitchell OS (2007b). Financial literacy and retirement preparedness: Evidence and implications for financial education. Business Economics. 42(1), 35-44.

- Lusardi A &Tufano P (2009). Debt literacy, financial experiences, and over indebtedness. NBER Working Paper.

- National Bureau of Economic Research. No. 14808.

- Lyons AC, Scherpf E &Roberts H (2006). Financial education and communication between parents and children.

- The Journal of Consumer Education. 23(2006), 64-76.

- Martin A &Oliva JC (2001). Teaching Children about Money: Applications of Social Learning and Cognitive Learning Developmental Theories. Journal of Family and Consumer Sciences: From Research to Practice. 93(2), 26-29.

- Masche JG (2010). Explanation of normative declines in parents' knowledge about their adolescent children. Journal of Adolescence. 33(2), 271-284.

- Mitchell, T. R., & Mickel, A. E. (1999). The meaning of money: an individual difference perspective. Academy of Management Review, 24(3), 568–578.

- Moore ES &Bowman GD (2006). Of friends and family: how do peers affect the development of intergenerational influences?. Advances in Consumer Research. 33, 536-542.

- Murdy S &Rush C (1995). College students and credit cards. Credit World. 83(5), 13-15.

- Neul SKT &Drabman RS (2001). A practical procedure for instituting a chore and allowance program for grade school children: Specific guidelines for clinicians. Child & Family Behavior Therapy. 23(4), 37-45.

- Norvilitis JM, Merwin MM, Osberg TM, Roehling PV, Young P, &Kamas MM (2006). Personality factors, money attitudes, financial knowledge, and credit-card debt in college students1. Journal of Applied Social Psychology. 36(6), 1395-1413.

- Osili UO &Paulson AL (2008). Institutions and financial development: Evidence from international migrants in the United States. The Review of Economics and Statistics. 90 (3), 498-517.

- Ranyard R &Craig G (1995). Evaluating and budgeting with instalment credit: An interview study. Journal of Economic Psychology. 16(3), 449-467.

- Rettig KD (1985). Consumer socialization in the family. Journal of Consumer Education. 3, 1-7.

- Roberts JA &Jones E (2001). Money attitudes, credit card use, and compulsive buying among American college students. Journal of Consumer Affairs. 35(2), 213-240.

- Shim S, Barber BL, Card NA, Xiao JJ, &Serido J (2010). Financial socialization of first-year college students: The roles of parents, work, and education. Journal of Youth and Adolescence. 39(12), 1457-1470.

- Shim S, Xiao JJ, Barber BL, &Lyons AC (2009). Pathways to life success: A conceptual model of financial well-being for young adults. Journal of Applied Developmental Psychology. 30(6), 708-723.

- Stango V &Zinman J (2007). Fuzzy math and red ink: when the opportunity cost of consumption is not what it seems. Working Paper. Mimeo, Dartmouth College.

- Stevens JP (1992). Applied Multivariate Statistics for the Social Sciences (2nd Edition). Hillsdale, NJ. Erlbaum. Sundarasen SDD, Rahman MS, Rajangam N, & Sellappan R (2014). ‘Cradle to Grave’ Financial Literacy Programs and Money Management. International Journal of Economics and Finance. 6(6), 240-246.

- Tang TL (1992). The meaning of money revisited. Journal of Organizational Behavior. 13 (2), 197-202.

- Van Rooij M, Lusardi A & Alessie R (2011). Financial literacy and stock market participation. Journal of Financial Economics. 101(2), 449-472.

- Varcoe KP, Martin A, Devitto Z, & Go C (2005). Using a financial education curriculum for teens. Journal of Financial Counseling and Planning. 16(1), 63-71.

- Vitt LA & Anderson C (2001). Personal finance and the rush to competence: Financial literacy education in the US: A national field study commissioned and supported by the Fannie Mae Foundation. ISFS, Institute for Socio - Financial Studies.

- Walker CM (1996). Financial management, coping and debt in households under financial strain. Journal of Economic Psychology. 17(6), 789-807.

- Xiao JJ, Shim S, Barber BL, & Lyons AC (2007). Academic success and well-being of college students: Financial behaviors matter. Technical Report. Tucson, AZ: University of Arizona, Take Charge America Institute for Consumer Financial Education and Research.