Research Article: 2021 Vol: 25 Issue: 1

Audit Decision: Interaction between Earnings Management and Audit Specialization

YULIUS KURNIA SUSANTO, Trisakti School of Management

ARYA PRADIPTA, Trisakti School of Management

STEPHANIE ESTHER, Trisakti School of Management

Abstract

This research is purposed to get emperical evidence about the interaction influence of earnings management and audit specialization on audit decision. The population of this research are all manufacturing companies consistently listed and active in Indonesia Stock Exchange from the year of 2016 to 2018. This research uses 86 samples of manufacturing companies selected through purposive sampling method resulting in 258 data to be analyzed using binary logistic regression. The result of this study indicates that the interaction between earnings management and audit specialization influence positive and significant on audit decision. Investors can make the auditor decision and auditor specialization as a consideration in investing. Auditor specialization can detect earnings management and auditors tend to give qualified opinion. The company's goal to do earnings management is to obtain an unqualified opinion. Audit specialization can reveal the existence of earnings management and the company obtains qualified opinions. The longer the client is the tendency of the auditor to give an unqualified opinion. Auditors are more likely to provide qualified opinions on companies that lose.

Keywords

Audit decision, earnings management, audit specialization, audit tenure

Introduction

In this era, Auditor have an important role in the presentment of company’s financial statement that have been issued in the public. So many people asking about the independency of auditors in maintain credibility to produce appropriate financial statement. Especially nowadays, several auditor from several Public Accountant Firm have a scandals when do the audit to the client’s financial statement.

Independence is the most important thing for the profession of an auditor, even many people said that the independence of an auditor is the backbone of the auditor’s profession. In this case, auditor independence affects auditor planning, procedures for gathering evidence, findings, judgments, credibility, and public trust in auditor opinion. An auditor must maintain his independence both in fact and appearance during (1) planning an audit to ensure that management does not affect the audit plan or the scope of the audit planned by the auditor; (2) the phase of collecting audit evidence to ensure that the auditor has access to all information, records, schedules and financial reports, without being limited by management; and (3) reporting of audit findings to ensure the auditor's judgment and opinion are independent without being influenced by management or a sense of loyalty to the company (Rezaee, 2009). To support this reason, the researcher have collected the data about one case of company that have problems with their audit opinion. The case is about Sunprima Nusantara Pembiayaan (SNP Finance). The important background was that the company failed to pay medium term notes (MTN) interest until the process of postponing the Debt Payment Obligation (PKPU). They have so much MTN that should be paid with the interests. The question is, why they can issued a lot MTN?

That’s because their audit opinion. The auditor from Public Accountant Firm Satrio, Bing Eny that have do audit for SNP Finance, Marlinna and Merliyana Syamsul public accountants had not fully complied with the Auditing Standards - Professional Standards of Public Accountants in the implementation of general audits of SNP Finance's financial statements for 2012-2016. This problems can affect to their MTN because they give unqualified audit opinion that can make SNP Finance possible to issued MTN but they can’t pay their MTN and the interests. This research have purpose to give users more knowledge about what factors that can effect more to the audit opinion. Besides that, researcher also discussed about what factors that trigger the auditor in issued wrong audit opinion like happened in case above.

This research is a development from previous research conducted by (Susanto & Pradipta, 2017). The researcher add moderating variable which is auditor specialization. The research problem of this research are whether there is the interaction influence of earnings management and audit specialization on audit decision.

This research is expected to give benefits and contributions to manager to increase the knowledge of management in increasing their firm value, to give the knowledge for investors to do their investment in the future so they can avoid making wrong decision, to increase the knowledge of Otoritas Jasa Keuangan about the firm value of firms listed in Indonesia Stock Exhange in performing their duty to control and monitor financial service activities in capital market, and to increase the knowledge of future researchers related to firm value so this research can become a reference for future studies (Garcia-Blandon & Argiles-Bosch, 2018).

Auditor Quality on Earnings Management and Audit Decision

Audit quality is a factor that influences audit opinion because of its ability to detect and report false financial statements or manipulation of material financial statements (Arens et al., 2017) defines the quality of the audit to mean how well an audit detects and report material misstatements in financial statements, the detection aspects are a reflection of auditor competence, while reporting is a reflection of ethics or auditor integrity, particularly independence. Industry specialization could be gained by repetition of audit tasks in same settings and therefore people assume that auditor or public accountant firm that auditing a large part of a particular industry demonstrate their expertise (Balsam et al., 2003).

Companies that make earnings management is likely to get unqualified opinion (Susanto & Pradipta, 2017). Researchers Johl et al. (2007) and Abolverdi & Kheradmand (2017) indicated that earnings management is an indicator in providing audit opinion. Earnings management negatively affects audit opinion (Hosseini & Abdoli, 2012). But another researcher indicates that earnings management have no significant effect on audit opinion (Rusmanto & Djamil, 2014).

Firms that are audited by the big four KAP are likely to get unqualified opinions (Susanto & Pradipta, 2017). Others research by Bartov et al. (2000) and Johl et al. (2007) also support that research by explaining that the high auditor's quality, the company will get a qualified opinion than the Non Big Four KAP. But Omidfar & Moradi (2015) said that the most Bg Four provides unqualified audit opinion because they have made selection for their client.

H1: The interaction between earnings management and auditor specialization has influence on likelihood qualified opinion.

Audit Tenure

Audit tenure is the agreed period of engagement between the auditor and client. Based on Minister of Finance Regulation No. 17 / PMK.01 / 2008 on the grounds that in order to maintain the quality of auditors, the government restricts the period of providing public accounting services, namely for 6 (six) consecutive financial years. Although the actual tenure audit will not affect audit quality if the auditor can maintain his professionalism, but the Government still has to regulate the regulation so that emotional closeness that is too long due to long tenure between the auditor and the client will not result in quality disruption (Hartadi, 2009).

Companies that have long been clients are likely to get unqualified opinions (Susanto & Pradipta, 2017). Siregar et al. (2012) states that the government regulation concerning audit tenure which was originally 5 years and can be extended to no limit. Research by Blandón & Bosch (2013) state that companies with a qualified opinion will have relatively shorter tenure. Audit tenure negatively affects the audit opinion especially qualified audit opinion because the tenure may result in the auditor failing to provide required audit opinion.

Firm Size

Firm Size is the scale at which the company can classified in size based on total assets, log size, stock market value, etc. The size of the company is considered to affect the value of a company because based on the size classification, it can affect the ease or difficulty of the company in obtaining funding sources both from outside and within the company (Siahaan, 2013).

According to Siahaan, The larger a company, the greater control it has in dealing with economic competition so that large companies usually have a lower risk compared to small companies. This is the reason many investors prefer to invest in large companies compared to small companies. Besides that, usually larger company have more complete information that investors need in investing decision.

Large companies are likely to get a qualified opinion (Susanto & Pradipta, 2017). Research by Blandón & Bosch (2013) state that companies with a qualified opinion are relatively small companies. While Hosseini & Abdoli (2012) indicate that the firm size a positive effect on audit opinion. Big companies tend to get a qualified opinion.

Leverage

Leverage is the ratio of debt with company assets. Companies that have a debt level greater than their total assets will face the danger of bankruptcy because of the large possibility that the company cannot pay its debts and can result in the company being taken over by another company to pay its debts (Susanto, 2009).

Leverage have no significant effect on qualified opinion (Susanto & Pradipta, 2017). Companies with a qualified opinion have relatively high leverage levels Blandón & Bosch (2013) Firms with high leverage can make KAP tend to provide qualified opinion related to risk in paying the debt.

Liquidity

Liquidity is a ratio that refers to a company's ability to settle its liability (Zimon, 2020). A good company is if it can complete its short-term liabilities on time. Companies that are able to settle liability obligations on time are referred to as companies that are in a liquid state. While companies that cannot complete their short-term liabilities in a timely manner, the company will face uncertainty in the course of the business .

Liquidity is the ability of a company to settle its financial obligations by changing assets into cash or doing other things with the aim of earning cash to settle its obligations. Whether or not a company's liquidity can be seen from its ability to complete its short-term financial obligations. If the company has difficulty in completing short-term obligations, it will make the company lose the opportunity to take advantage of such discounts obtained from a faster period of time in paying off its obligations. But if the company does not have the ability to settle its obligations, it will cause problems that will lead to the sale of forced investments and other assets at lower prices and, in its worst form, become bankruptcy and bankruptcy (Subramanyam, 2014).

Liquidity have no significant effect on qualified opinion (Susanto & Pradipta, 2017). Research by Blandón & Bosch (2013) state that the higher the liquidity of the company the higher the chances of the company getting an unqualified opinion. The lower the liquidity of a company indicates a small opportunity for the company to meet its short-term liabilities. The smaller the company's opportunity to meet its shortterm obligations, the greater the chances of the company getting a qualified audit opinion. The higher the liquidity of the company the higher the chances of the company getting an unqualified opinion.

Inventory

Inventories are investments made by companies for the purpose of obtaining returns in the form of profits through sales to customers (Zimon, 2019). Inventory levels in many companies are very guarded, because they assume if the available inventory is inadequate then the sales volume will go down and not reach the sales target itself. But excess inventory will also cause several problems such as the costs of storage, insurance, taxes, obsolescence, and physical damage. In addition, if the company provides too much inventory, it will also cause a large amount of funds which can actually be used for other more profitable things (Subramanyam, 2014)

Inventory have no significant effect on qualified opinion (Susanto & Pradipta, 2017). Research by Blandón & Bosch (2013) states that the higher the inventory the higher the possibility of the company receiving a qualified opinion. The high inventory indicates that the company is less efficient in operational activities. The higher the inventory the higher the possibility of the company receiving a qualified opinion.

Losses

Losses is a decrease in net assets of the company that arose due to unexpected events (Subramanyam, 2014). Losses can be caused by two things, the first because the amount of the load is higher than the income and the second because of the misstatement that causes the company suffered losses in its financial statements.

Companies that experience loss are likely to get a qualified opinion (Susanto & Pradipta, 2017). Research by Blandón & Bosch (2013) states that the higher the loss is the higher the probability of a company receiving a qualified opinion. Losses can be caused by two things, the first because the amount of the load is higher than the income and the second because of the misstatement that causes the company suffered losses in its financial statements. Such misstatements can cause the company to get a qualified opinion (Arens et al., 2017).

Methods

The population of this research is all manufacturing companies listed and actived in Indonesia Stock Exchange from 2016 to 2018. The sampling technique of this research is purposive sampling. Sample selection procedure is shown in Table 1.

| Table 1 Sample Selection Procedure | ||

| Criteria Description | Total Companies | Total Data |

| Manufacturing companies consistently listed in IDX from the year 2016 to 2018 | 166 | 498 |

| Manufacturing companies which do not publish financial statement ended as of 31st December | (4) | (12) |

| Manufacturing companies which do not consistently use IDR currency in the financial statement. | (61) | (183) |

| Manufacturing companies which the share is not active | (15) | (45) |

| Total Sample | 86 | 258 |

Audit decision according to accounting dictionary (Ardiyos, 2007) is a report given by a registered public accountant as a result of its assessment of the fairness of the financial statements presented by the company. Qualified opinion was measured using dummy variables, value 0 for unqualified opinion, 1 another unqualified opinion (Blandon & Bosch, 2013). If the auditor provides an unqualified opinion then the audit opinion is clear. Conversely, if the auditor provides qualified opinion such as going concern, litigation, asset realizing then the audit opinion is unclear.

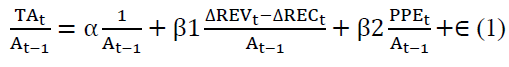

Earnings management is defined as a management disclosure with full intervention to the financial reporting process to external parties, with the intent of obtaining personal benefits. Earnings management is measured by Discretionary Accruals (Susanto, Pirzada, & Adrianne, 2019). Discretionary accruals were calculated using the following formula (Susanto, Pradipta, & Cecilia, 2019:

Where TA total accruals (Inct– OCFt), At-1 prior total assets, ΔREVt change in net operating revenues, ΔRECt change in net receivables, PPEt gross property, plant and equipment, error term also known as discretionary or abnormal accruals, Inct income before extraordinary items and discontinued operations, OCFt operating cash flow.

Auditor Industry Specialization is measured using dummy variables. Score 1 if auditor industry specialist (15 per cent market share) exists in auditee’s industry, 0 otherwise. Auditor size is measured using dummy variables (Adeyemi et al., 2012). Score 1 represents KAP Big Four, while score 0 represents other than Big Four KAP; where the Big Four KAP is Deloitte Touche Tomatsu, PricewaterhouseCoopers, Ernst & Young, KPMG.

Audit tenure is the length of time the auditor has conducted an examination of a company (Rahmina & Agoes, 2014). Research in Indonesia related to tenure audit continues to grow one of them. Siregar et al. (2012) states that the government regulation concerning audit tenure which was originally 5 years and can be extended to no limit. Blandón & Bosch (2013) state that companies with a qualified opinion will have relatively shorter tenure. The longer the company becomes KAP client, the less independence of KAP. This can make KAPAudit tenure is the length of time the auditor has conducted an examination of a company (Rahmina & Agoes, 2014). Research in Indonesia related to tenure audit continues to grow one of them. Siregar et al. (2012) states that the government regulation concerning audit tenure which was originally 5 years and can be extended to no limit. Blandón & Bosch (2013) state that companies with a qualified opinion will have relatively shorter tenure. The longer the company becomes KAP client, the less independence of KAP. This can make KAP more likely to provide unqualified opinion on companies that have long been clients. Tenure audits are measured using a log of the number of years in which the company has been audited by the same registered public accountant.

Firm size is a scale that can classify the size of the company in various ways including total assets, log size, or stock market value. Firm size is measured from the average log of total asset value at the end of the year. Leverage is the use of debt financing to increase revenue (Subramanyam, 2014). Leverage is measured from total liabilities divided by total equity which are both based on book value. Liquidity is the ratio used to evaluate a company's ability to meet its short-term capability (Subramanyam, 2014). Liquidity is measured by dividing the company's total cash by the total liabilities of the company. Inventory is an item owned by the company to be sold as part of the company's business operations (Subramanyam, 2014). Inventory are measured by dividing the company's inventory at the end of the period by the total assets of the company at the end of the period. The loss is a decrease in net assets of a company that arises from circumstances or unexpected events (Subramanyam, 2014). Losses using dummy variables, value 1 representing companies that suffered losses and 0 others. Hypothesis testing uses binary logistic regression.

Results and Discussion

Descriptive statistics and hypothesis test result can be seen in following table:

The test result of the interaction between earnings management and auditor industry specialization has significance level of 0,071 which is below 0,10. This means that Ha is accepted. Auditor industry specialization is as moderating the relation between earnings management and audit decision. The result of the interaction between earnings management and auditor size has significance level of 0,895 which is above 0,05. This means that auditor size is not moderating the relation between earnings management and audit decision. It means that whether the auditor size is big four or non-big four, will not affect the relation between earnings management and auditor’s decision in issued the audit opinion in Table 2 & 3.

| Table 2 Descriptive Statistics Test Result | |||||

| Variables | N | Minimum | Maximum | Mean | Std. Deviation |

| AO | 258 | 0 | 1 | 0,36 | 0,482 |

| EM | 258 | -1,011562 | 0,815154 | 0,00375744 | 0,116619333 |

| AS | 258 | 0 | 1 | 0,43 | 0,497 |

| AIS | 258 | 0 | 1 | 0,25 | 0,435 |

| TENURE | 258 | 0,00000 | 1,041393 | 0,32585892 | 0,238970139 |

| SIZE | 258 | 10,950984 | 14,537456 | 12,36877768 | 0,705094003 |

| LEVERAGE | 258 | -5,285088 | 11,097933 | 1,16144572 | 1,726258785 |

| LIQ | 258 | 0,033705 | 8,637842 | 2,23196775 | 1,652874707 |

| INV | 258 | 0,002450 | 0,617720 | 0,20528140 | 0,136390254 |

| LOSS | 258 | 0 | 1 | 0,21 | 0,408 |

| Table 3 Test Result | ||

| Variable | Coefficient | Significance |

| (Constant) | 0,374 | 0,603 |

| EM | -0,324 | 0,390 |

| AIS | -0,004 | 0,959 |

| AS | -,099 | 0,190 |

| EM*AIS | 2,000 | 0,071 |

| EM*AS | 0,068 | 0,895 |

| TENURE | -0,410 | 0,002 |

| SIZE | 0,011 | 0,856 |

| LEVERAGE | 0,002 | 0,924 |

| LIQ | -0,002 | 0,918 |

| INV | -0,058 | 0,802 |

| LOSS | 0,217 | 0,007 |

Source: Data Output SPSS

The test result of audit tenure has significance level of 0,002 which is below 0,05. Audit tenure has influence on auditor decision. The longer a client, the auditor tends to give an unqualified opinion. This result probably occurs because the auditor will have an emotional bond to the client that will lead to feelings of loyalty to the client so that the skepticism and independence of the auditor will be replaced with loyalty in giving unqualified opinions.

The test result of firm size has significance level of 0,856 which is above 0,05. Firm size has no influence on audit decision. The test result of leverage has significance level of 0,924 which is above 0,05. Leverage has no influence on audit decision. The test result of liquidity has significance level of 0,918 which is above 0,05. Liquidity has no influence on audit decision. The test result of inventory has significance level of 0,802 which is above 0,05. This means that the inventory amount has no influence on audit decision. The test result of loss has significance value of 0,007, which is below 0,05. This means that losses has an influence on audit decision. Companies that suffered loss can get more attention from the auditors because they need to know how that company can suffer from losses.

Conclusion

Based on the results and discussion of this research can be concluded that auditor specialization has influence to relation between earnings management and audit decision. Audit tenure and loss has influence to audit decision. Meanwhile, firm size, leverage, liquidity, inventory have no influence to audit decision. Investors can make the auditor decision and auditor specialization as a consideration in investing. Auditor specialization can detect earnings management and auditors tend to give qualified opinion.

The limitation of this research are: the sample used is only 86 manufacturing companies that is listed in Indonesia Stock Exchange. The research period is only 3 years from 2016 to 2018. The variable used is only 6 independent variables and 1 moderating variables where there are still many variables that could be examined. The recommendation for the next researchers are: use more sample for the next research and extend the research period by more than 3 years. The next researcher is also expected to use or add other variables which can influence audit decision. The next researcher can focus the audit decision to the specific opinion like unqualified audit opinion or qualified audit opinion.

References

- Abolverdi, Z., & Kheradmand, A. (2017). A Survey of the Relationship between Earnings Management and Qualified Auditor Opinion in Tehran Stock Exchange. International Journal of Economics and Financial Issues, 7(2), 723-729.

- Adeyemi, S.B., Dabor, E.L., & Okpala, O. (2012). Factors Affecting Audit Quality in Nigeria. International Journal of Business and Social Science. 3(20), 198-209.

- Ardiyos. (2007). Kamus Besar Akutansi Inggris-Indonesia. Accessed April 8, 2019. https://www.belbuk.com/kamus-besar-akuntansi-p-55711.html.

- Arens, E., Beasley & Hogan. (2017). Auditing and Assurance Services. Pearson. Accessed April 8, 2019. https://www.pearson.com/us/higher-education/product/Arens-Auditing-and-Assurance-Services-16th-Edition/9780134065823.html.

- Bartov, E., Gul, F.A., & Tsui, J.S.L. (2000). Discretionary-Accruals Models and Audit Qualifications. Journal of Accounting and Economics.

- Garcia-Blandon, J., & Argiles-Bosch, J.M. (2018). Industry Specialization and Audit Quality: Evidence from Spain. International Journal of Auditing.

- Hartadi, B. (2017). The effect of Audit Fee, KAP Rotation, and Auditor's Reputation on Audit Quality in Indonesia Stock Exchange. EKUITAS (Jurnal Ekonomi Dan Keuangan), 16(1), 84-103.

- Hosseini, S.H., & Abdoli, M. (2012). Effect of Family Control and Board Structure on Earnings Management. International Research Journal of Finance and Economics.

- Johl, S., Jubb, C.A., & Houghton, K.A. (2007). Earnings Management and the Audit Opinion: Evidence from Malaysia. Managerial Auditing Journal, 22(7), 688-715.

- Omidfar, M., & Moradi, M. (2015). The Effects of Industry Specialization on Auditor’s Opinion in Iran. Mediterranean Journal of Social Sciences, 6(1), 399-408.

- Rahmina, L.Y., & Agoes, S. (2015). Influence of Auditor Independence, Audit Tenure, and Audit Fee on Audit Quality of Members of Capital Market Accountant Forum in Indonesia. Procedia - Social and Behavioral Sciences, 164, 324-331.

- Rezaee, Z. (2009). Corporate Governance and Ethics. John Wiley & Sons. https://books.google.co.id/books/about/Corporate_Governance_and_Ethics.html?id=i6LTA2WUtGMC&redir_esc=y.

- Rusmanto, T., & Djamil, A.B. (2014). The Effect of Earnings Management to Issuance of Audit Qualification Evidence from Indonesia. Journal of Business Studies Quarterly, 6(1).

- Siahaan, F. (2013). The Effect of Good Corporate Governance Mechanism, Leverage, and Firm Size on Firm Value. GSTF Journal on Business Review, 2(4), 137-142.

- Siregar, S.V., Amarullah, F., Wibowo, A., & Anggraita, V. (2012). Audit Tenure, Auditor Rotation, and Audit Quality: The Case of Indonesia. Asian Journal of Business and Accounting, 5(1), 55-74.

- Subramanyam, K. R. (2014). Financial Statement Analysis.

- Susanto, Y.K. (2009). Factors affecting acceptance of Going Concern Audit Opinions in Manufacturing Sector Public Companies. Jurnal Bisnis dan Akuntansi, 11(3), 156-174.

- Susanto, Y.K., & Pradipta, A. (2017). Corporate Governance and Audit Decision Making. Corporate Ownership and Control, 15(1), 381-386.

- Susanto, Y.K., Pradipta, A., & Cecilia, E. 2019. Earnings Management: ESOP and Corporate Governance. Academy of Accounting and Financial Studies Journal, 23(Spesial Issue 1).

- Susanto, Y.K., Pirzada K., & Adrianne S. 2019. Is tax aggressiveness an indicator of earnings management? Polish Journal of Management Studies, 20(2), 516-527.

- Zimon, G. 2019. The impact of quality management on inventories in commercial enterprises operating within group purchasing organizations. Problems and Perspectives in Management, 17(3), 362-369.

- Zimon, G. 2020. Issues of Financial Liquidity of Small and Medium-Sized Trading Companies: A Case Study from Poland. Entrepreneurship And Sustainability Issues, 8(1), 363-372.